Lux Trading Firm, with account sizes ranging from $50,000 to $10 million, caters to traders at all levels.

It features various instruments, including S&P 500, Hong Kong stocks, Oil, and BTC available on advanced platforms like MT5 and TradingView.

Lux Trading Firm’s flexibility includes the ability to hold positions during news events.

With a flexible evaluation process, no time limits, and up to 75% profit split, traders can focus on their strategies.

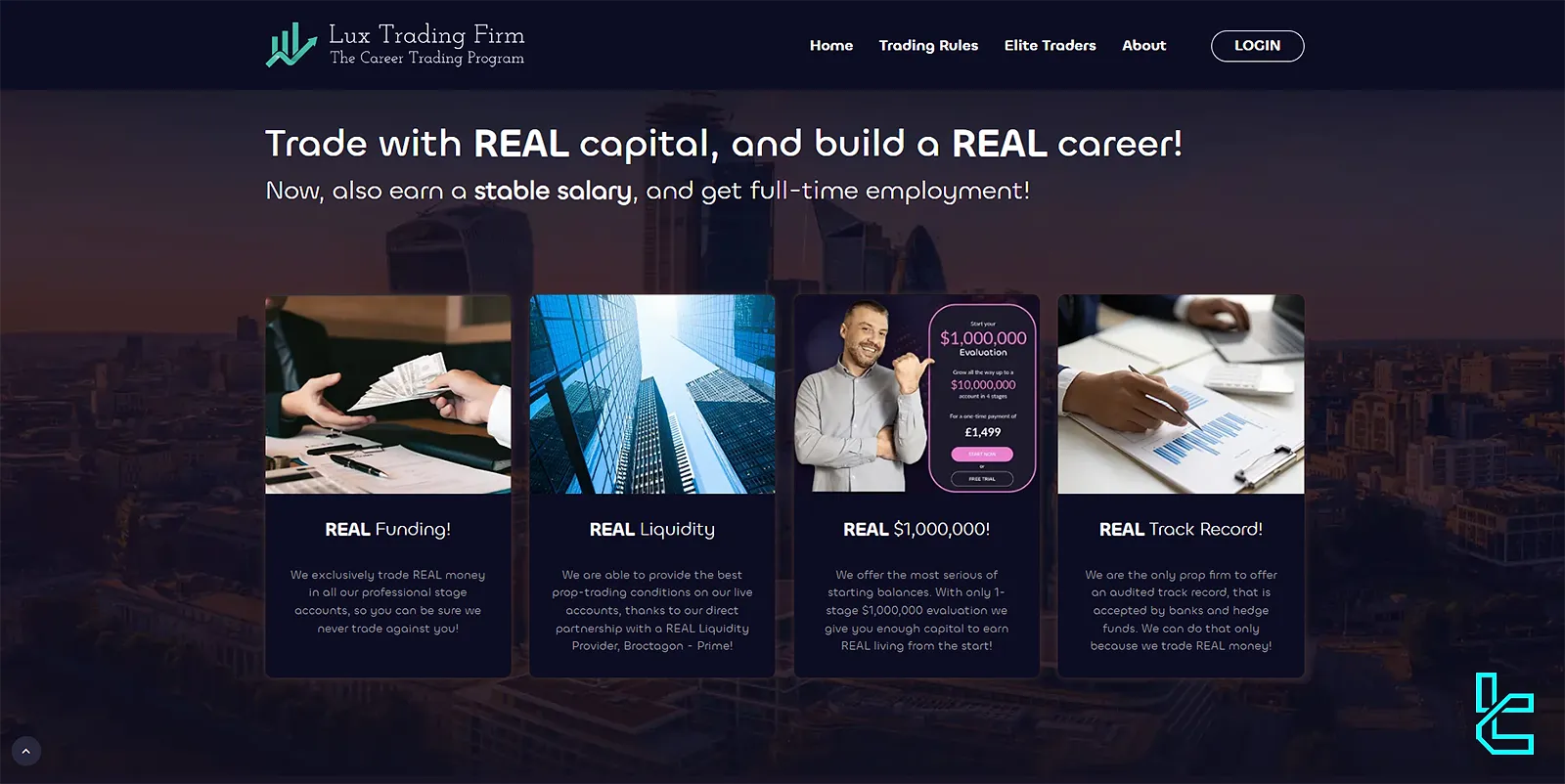

The Company Overview

Founded in 2020, Lux Trading Firm stands out in the crowded prop trading landscape with its innovative trader evaluation and funding approach. Here's a quick overview of what sets them apart:

- Real funding with live trading accounts, not just demo simulations

- Scalable account sizes from $50,000 up to a staggering $10,000,000

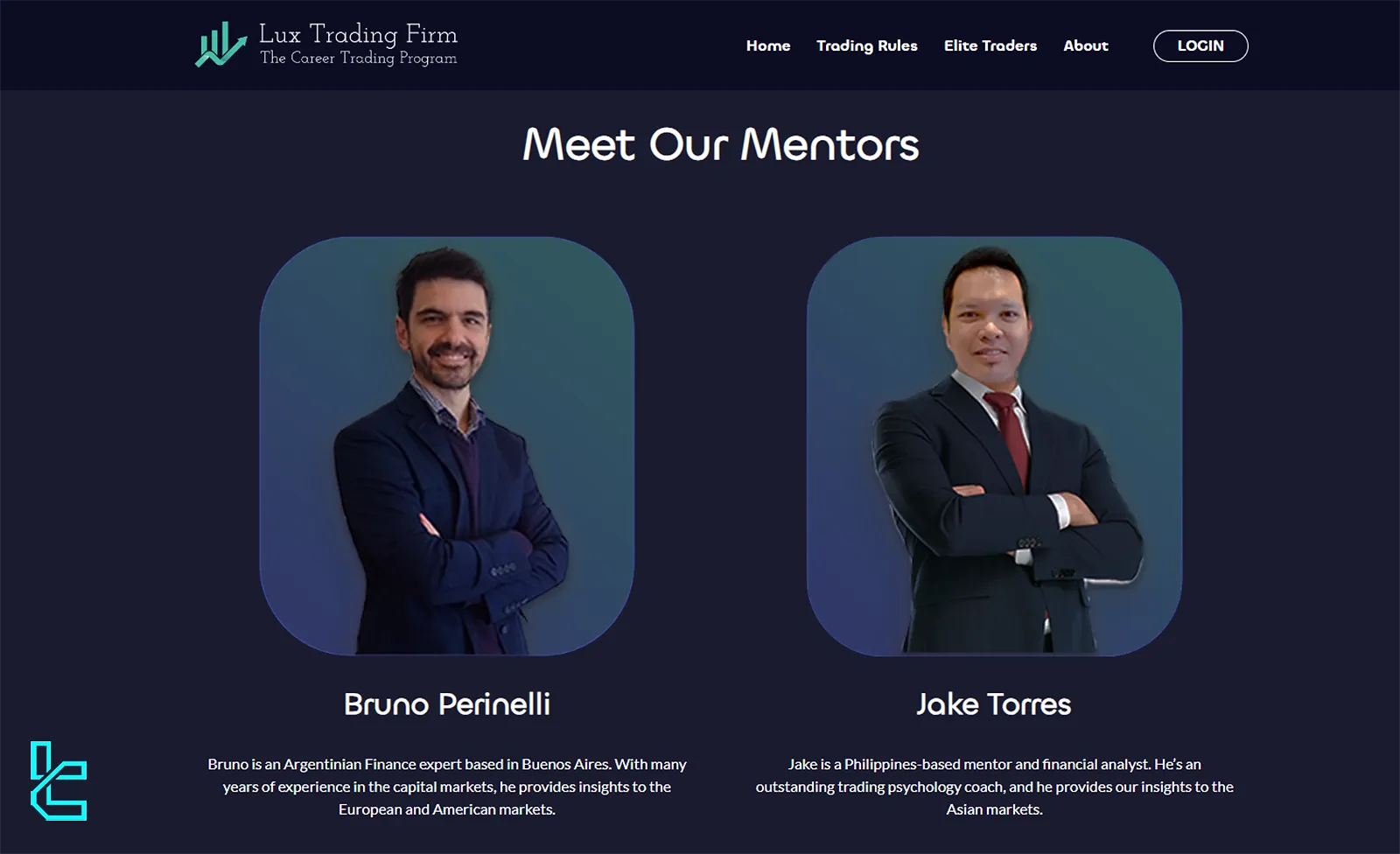

- Comprehensive support, including personalized mentorship and risk management

- An audited track record accepted by banks and hedge funds

Lux Trading Firm's commitment to providing traders with the tools and resources needed to succeed has made it a popular choice for novice and experienced traders looking to elevate their trading careers.

Specifications summary

Here is a comprehensive summary of what this prop firm brings to the table:

Account currency | USD |

Minimum price | £199 |

Maximum leverage | 1:30 |

Maximum profit split | 75% |

Instruments | FX, Indices, Energies, Metals, Equity, CFDs, Crypto |

Assets | EUR/USD, S&P 500, Oil, Gold, BTC, Tesla |

Evaluation steps | 1-step, 2-step |

Trading platform | MatchTrader, TradingView, MT5, Lux Trader |

Withdrawal methods | E-wallets, Bank Transfer, Credit/Debit Card |

Maximum fund size | $1,000,000 |

First profit target | 6% |

Max. daily loss | N/A |

Challenge time limit | No limits |

News trading | YES |

Maximum total drawdown | $60,000 for a $1M account |

Commission per round lot | Covered |

Trust pilot score | 4.1 out of 5 |

Payout frequency | Monthly |

Established country | UK |

Established year | 2020 |

Lux Trading Firm's specifications are designed for a wide range of traders, offering flexibility in account sizes and a generous profit split.

Pros & Cons associated with the Lux Trading Firm

To help you have a better perspective of the firm’s whole image, here is a table of pros and cons related to the Lux Trading Firm:

Advantages | Disadvantages |

Occasional Discounts | Limited educational resources |

Scalable accounts up to $10 million | Low Profit Split |

Personal mentorship | Limited track record |

The firm's relatively recent entry into the market also means its long-term stability is yet to be fully proven.

Funding & Pricing Structure

As with Prop Firms, Lux Trading Firm offers a range of account sizes to suit different traders of all levels:

Account Size | Cost | Profit Split |

$50K | £ 199 | 75% |

$200K | £ 449 | 75% |

$1,000,000 | £ 999 | 75% |

These one-time fees grant access to the firm's evaluation process. Upon successful completion, traders can manage natural capital with the potential to scale up to $10,000,000 over multiple stages.

Registration & Verification Process

Getting started with the firm is straightforward. Lux Trading registration:

#1 Visit the Lux Trading Firm

To initiate the account opening process, visit the Lux Trading Firm's official website. Once you're there, select your preferred account type and click the "Start Now" button.

#2 Complete the Registration Form

Now provide the following information:

- First name

- Last name

- Emal address

Then, confirm your email via the verification link sent to your inbox. In this step, traders are also required to verify their identity by uploading an ID card and a proof of address (utility bill or bank statement).

#3 Pay the Evaluation Fee

Pay the challenge price via the available methods to receive your account credentials and begin trading.

The firm’s Evaluation Steps

Lux trading prop firm’s evaluation process stands out for its simplicity and efficiency:

Account Size | Evaluation Stages | Profit Share/Fee Refund | Profit Target | Maximum Loss |

$50,000 | 2-step | 50% Fee Refund on evaluation stages / 75% on Live account | 6%, 4% | $3,000 |

$200,000 | 2-step | 50% Fee Refund on evaluation stages / 75% on Live account | 6%, 4% | $12,000 |

$1,000,000 | 1-step | 75% on Live account | 15% | $60,000 |

Lux Trading Firm offers substantial scaling potential across all account tiers, allowing successful traders to grow their capital to a maximum of $10,000,000.

- Funded traders can start with $50K, $200K, or $1M depending on the evaluation model they select;

- Scaling occurs progressively across 8 stages (for $50K), 6 stages (for $200K), or 3 stages (for $1M);

- Advancement to higher capital tiers is tied to meeting performance milestones, typically a 10% return threshold per stage;

- Throughout all stages of growth, the firm maintains a fixed profit-sharing ratio of 75% in favor of the trader;

Lux Trading Firm offers time-flexible evaluation challenges, allowing traders to complete their assessments without pressure from strict deadlines.

For the Two-Step Evaluation:

- Phase 1 requires at least 29 trading days (or 15 calendar days for swing traders);

- There is no maximum time limit to hit the 6% profit target;

- Phase 2 has no minimum or maximum trading day requirement; traders can proceed at their own pace to meet the 4% target.

For the One-Step Evaluation:

- The trader must complete at least 29 trading days (15 days for swing traders);

- There is no maximum duration to reach the required 15% profit target.

Lux Trading Firm bonuses and discounts

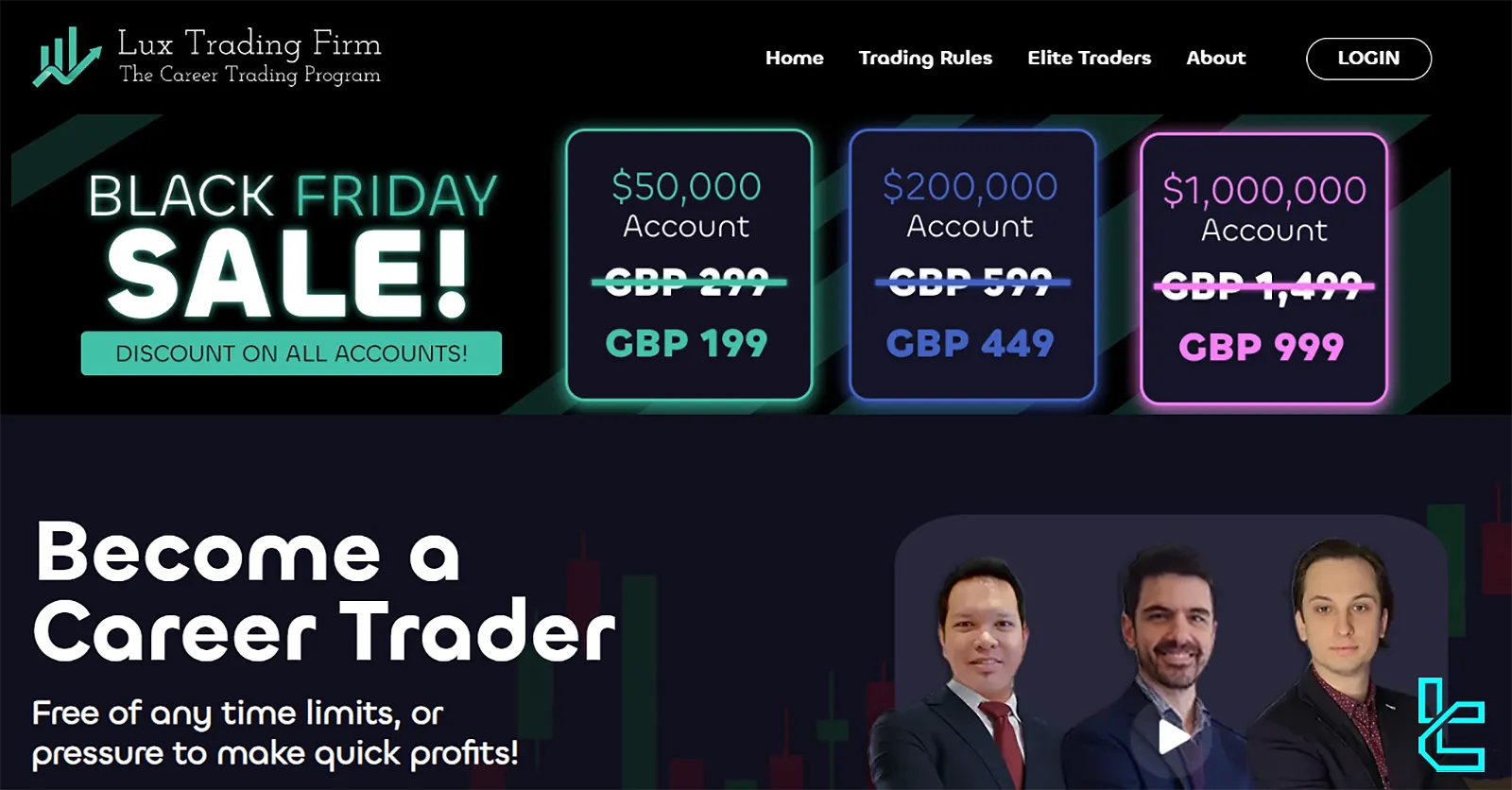

Lux Trading Firm occasionally offers fantastic Black Friday discounts across all account types, making it a great opportunity for traders to advance their trading journey with lower costs. The current discounted prices (November 2024) are as follows:

- $50,000 account: from GBP 299 to GBP 199

- $200,000 account: from GBP 599 to GBP 449

- $1,000,000 account: from GBP 1,499 to GBP 999

These limited-time discounts allow traders to access higher capital with significant savings, making Lux Trading Firm’s career trading program even more attractive and accessible.

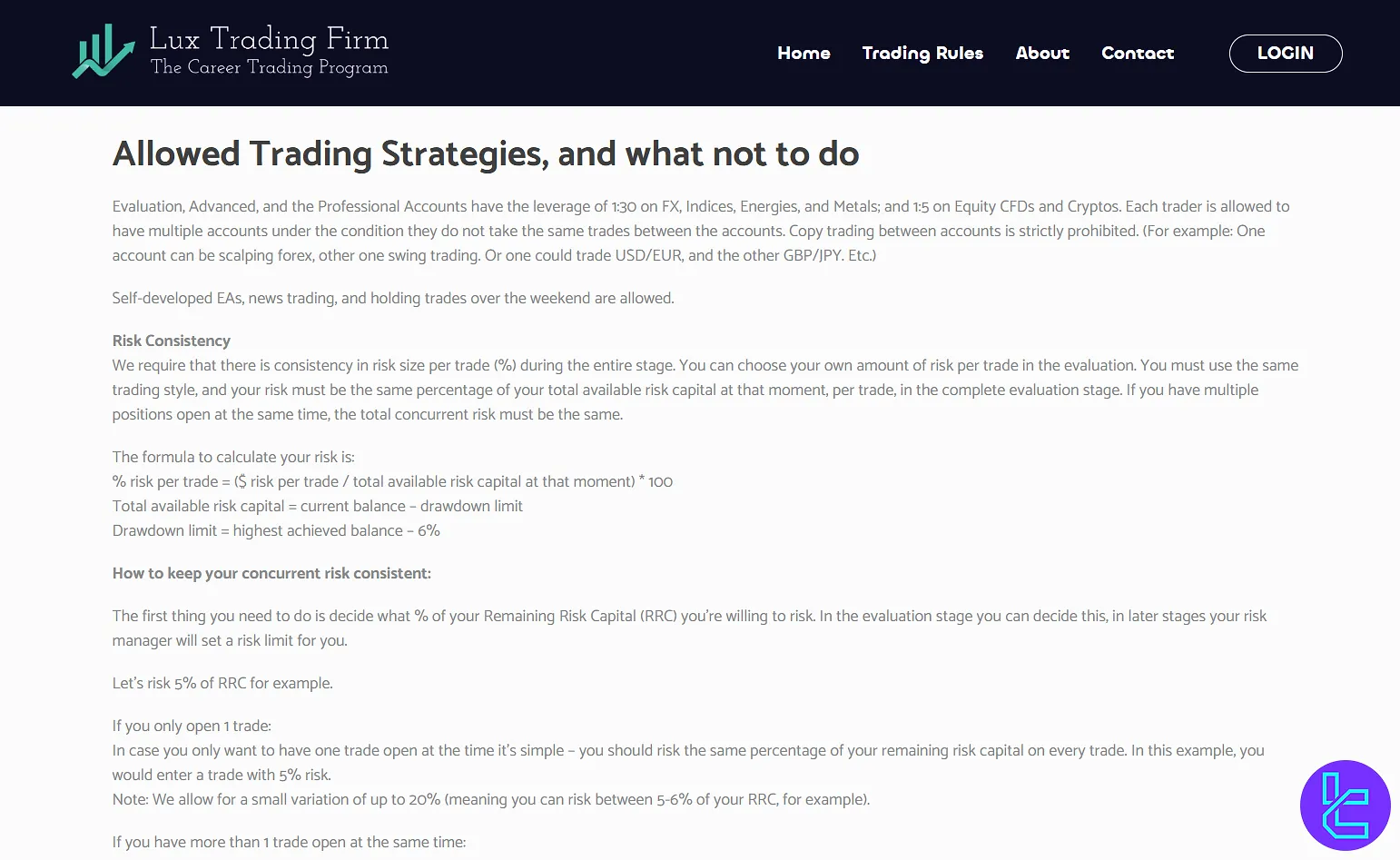

Lux Trading Firm Rules

Lux Trading Firm has clear rules on the allowed and prohibited things you can do during the evaluation and funded phase:

Rule Type | Status |

VPN and VPS | Allowed – No restriction |

Hedging Strategies | Allowed – No restriction |

Expert Advisors | Restricted – Subject to rules |

Gambling & High-Risk Strategies | Restricted – Subject to rules |

News trading | Restricted – Subject to rules |

Are Expert Advisors Allowed?

Only EAs developed by the trader themselves are permitted. Third-party EAs are not allowed as they do not reflect the trader’s skills. Additionally, the use of “Magic Keys” EAs is prohibited due to compatibility issues with Lux's risk management system.

Lux Trading Prohibited Strategies

Based on the latest data, here are the restricted strategies in the Lux Trading Firm:

- Account Sharing and Management: Account management is exclusive to the approved trader. No third party can manage or trade the account. Any breach of this rule will result in immediate disqualification;

- Arbitrage Trading: Engaging in arbitrage trading under any circumstances is prohibited. If traders exploit quote latency, they must report it to Lux immediately;

- Cheating through Small-Volume Trades: Using short-duration, small-volume trades solely to meet the required number of trading days is considered dishonest and may result in account suspension;

- Luck-Based Systems: Any strategy originating from gambling techniques, such as Martingale, is strictly forbidden. This includes relying on extreme strategies such as "all-in" bets and systems that do not employ proper stop-loss mechanisms;

- High-Risk Systems: Strategies that rely on large stop-losses, making it nearly impossible to recover from a single loss, are not allowed. Traders must use strategies that incorporate internationally accepted risk management standards;

- Grid Systems: While grid systems are not inherently bad, they conflict with Lux's risk consistency rules and are thus prohibited;

- High-Frequency Trading: Generating more than 2,500 server messages per day or using fully automated systems, such as robots and EAs that produce excessive trades, is forbidden. Violations will lead to account termination.

It's worth noting that copy trading is allowed in this prop firm.

News Trading Conditions

Traders are required to increase the stop-loss distance by 100% during high-impact news events to mitigate the risks posed by market volatility. This precaution helps to avoid exposure to significant market swings.

To prevent unnecessary risk, no stop-loss modifications can be made within 30 seconds before or after a news release. This ensures that the trader’s strategy remains intact without responding to sudden market movements caused by the news.

Traders are not permitted to place buy and sell stop orders around key news events in an attempt to capitalize on market volatility. These strategies are widely known and are ineffective in live trading environments, leading to automatic rejection of trades executed in this manner.

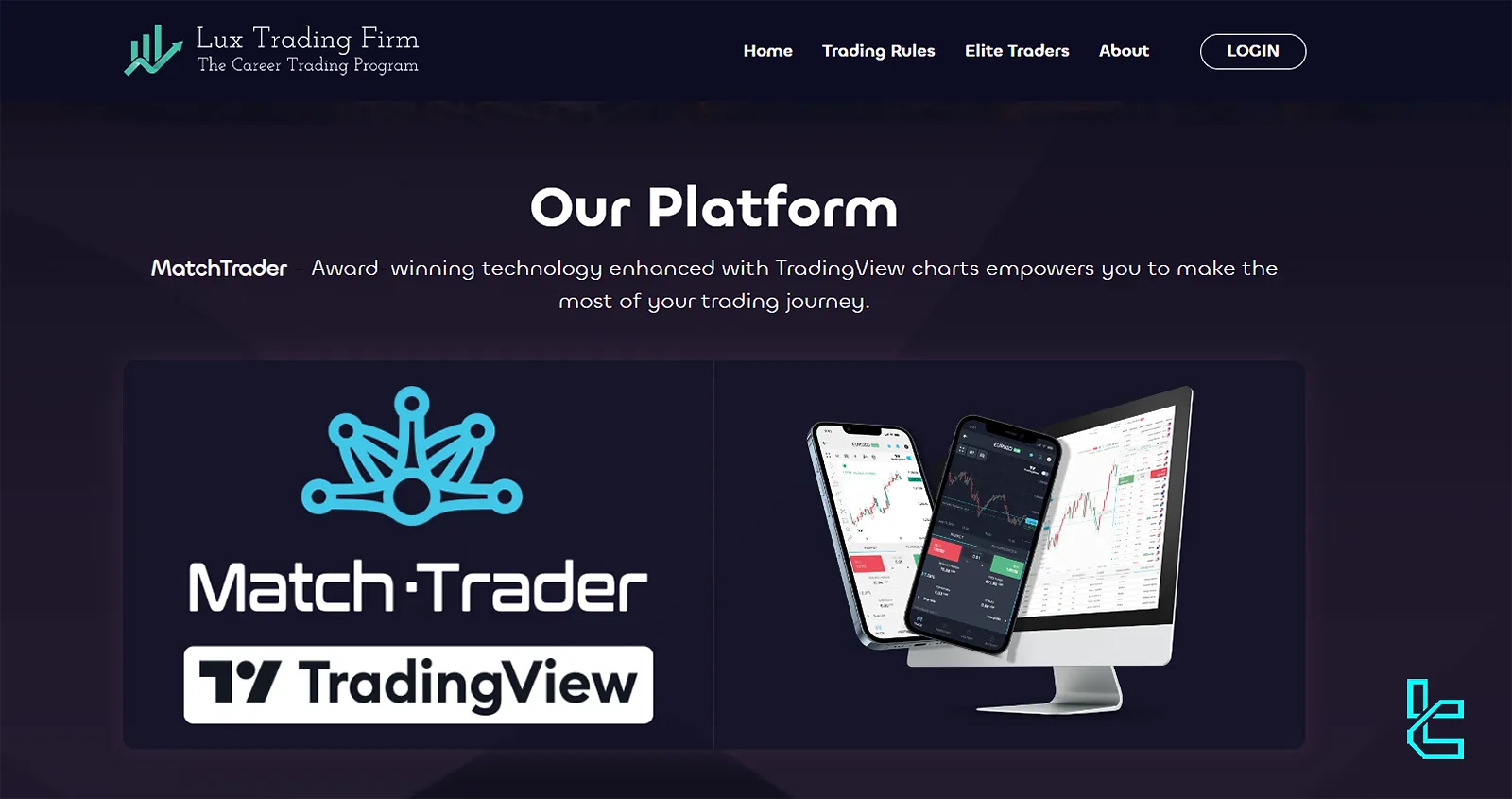

Lux Trading Firm’s trading platforms

The firm stands out in the prop trading world by offering a variety of advanced trading platforms to suit different trader preferences:

- MatchTrader: This award-winning platform is Lux Trading Firm's primary offering. It's known for its user-friendly interface and powerful features, making it suitable for any trader;

- TradingView: For those who prefer TradingView's advanced charting capabilities, Lux Trading Firm has seamlessly integrated it with MatchTrader;

- MetaTrader 5 (MT5): While not as prominently featured, the MetaTrader platform is available for traders who are more comfortable with this widely used platform;

- Lux Trader: the firm’s proprietary platform with Direct Market Access (DMA).

These platforms provide real-time trading on live accounts with no time limits to reach profit targets, allowing traders to develop their strategies without unnecessary pressure. You can check TradingFinder's exclusive MT5 indicators for more advanced tools.

What instruments & symbols can I trade on Lux Trading Firm?

The firm offers a diverse range of trading instruments, catering to various trading styles and preferences:

- Forex: Trade major, minor, and exotic currency pairs;

- Indices: Access popular indices like S&P 500, NASDAQ, and more

- Commodities: Trade metals, oil, gas, and other in-demand commodities

- Cryptocurrencies: Explore a wide selection of digital assets

- Stocks: Choose from over 250 US and Hong Kong stocks

- Bonds: Government bonds from powerful economies

Whether you're a forex enthusiast or interested in stock trading, Lux Trading Firm provides the instruments you need to implement your trading strategies effectively.

Lux Trading Firm’s Payment Methods

The firm understands the importance of convenient and secure payment options for its traders. They offer several methods to fund your account:

- Credit/Debit Cards: A quick and easy way to fund your account, accepted from major providers like Visa and Mastercard

- Cryptocurrencies: For those preferring digital currencies, Lux Trading Firm accepts various cryptocurrencies

The availability of crypto payments is particularly noteworthy, as it reflects Lux Trading Firm's adaptation to modern financial trends. Now let's review the payout structure in the Lux Trading Firm:

- Payouts are processed monthly;

- Traders must complete a minimum of 10 active trading days within a month to be eligible.

Commission Structure & Costs

Understanding the costs and fee structure is crucial when it comes to choosing a prop firm. Lux Trading Firm's approach is straightforward:

- Challenge Fees: These one-time fees cover all costs associated with the evaluation process;

- Reset Fees: If you don't pass the challenge, you can reset your account for a fee.

Account Size | Reset Fee |

50k | £139 |

200k | £299 |

$1MM | £699 |

This transparent fee structure allows traders to focus on their strategies without worrying about unexpected costs. The challenge fees, while significant, are a one-time investment that can lead to substantial returns if you successfully pass the evaluation and start trading with a funded account.

Does Lux Trading Firm offer vast educational resources?

Lux Trading Firm's educational offerings are relatively limited compared to some of its rivals. However, they do provide the following:

- Personal Mentor: Each trader is assigned a personal mentor offering tailored guidance and support;

- Blog Posts: Basic educational content covering beginner, advanced, and expert-level topics.

While Lux trading prop firm may not offer as extensive a library of educational content, you can use the TradingFinder Forex education section to expand your knowledge base.

Lux Trading Firm’s Trust Scores on Trustpilot

Trustpilot reviews can provide valuable insights into a company's reputation. Lux Trading Firm has a solid rating of 4.1 out of 5 based on 649 reviews on Trustpilot (November 2024). Here's a breakdown of the feedback:

Positive Reviews (78%) | Negative Reviews |

Responsive customer service | 30-day withdrawal timeline (considered lengthy by some) |

Clear trading rules | Occasional reports of Inflated spread |

Effective tools | - |

It's worth noting that Lux Trading Firm actively responds to negative reviews, addressing concerns and explaining its policies. This level of engagement demonstrates a commitment to customer satisfaction and transparency.

Customer Support in the Lux trading prop firm

Effective customer support is crucial in today’s world of trading. In our case, the firm offers multiple channels for support:

- Trade Support: trading@LuxTradingFirm.com

- Tech Support: tech-support@LuxTradingFirm.com

- Sales Support: sales@LuxTradingFirm.com

- Phone: +44 20 7193 9534

- Live Chat

Lux Trading Firm has offices in multiple locations:

- London, UK (Marketing and Sales)

- Saint Lucia (Trading Desk)

- Montenegro and Dubai, UAE (Management)

This multi-channel approach ensures that traders can get help when they need it, whether it's for account-related issues, technical problems, or general inquiries. The presence of offices in different locations also suggests a global approach to customer service.

Social Media Channels

In today's digital age, a strong social media presence is crucial for fostering engagement and building community. Lux Trading Firm maintains active profiles on several platforms:

- Discord

- YouTube

- X (formerly Twitter)

By maintaining an active presence across these platforms, Lux Trading Firm demonstrates a commitment to trader engagement and transparent communication.

Comparing Lux Trading Firm with Other Props

To understand why Lux Trading Firm might be the right choice for you, check the comparison table below.

Parameters | Lux Trading Prop Firm | |||

Minimum Challenge Price | £199 | $39 | $67 | $100 |

Maximum Fund Size | $1,000,000 | $250,000 | $2,000,000 | $2,000,000 |

Evaluation steps | 1-step, 2-step | 1-Step, 2-Step, 3-Step | 1-phase, 2-phase, 3-phase | 1-Step, 2-Step |

Profit Share | 75% | 100% | Up to 90% | 100% |

Max Daily Drawdown | N/A | 5% | 4% | 5% |

Max Drawdown | 6% | 10% | 10% | 10% |

First Profit Target | 6% | 5% | 6% | 10% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:30 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Monthly | Bi-weekly | 14 Days | 7 Days |

Number of Trading Assets | N/A | 3000+ | N/A | N/A |

Trading Platforms | MatchTrader, TradingView, MT5, Lux Trader | Metatrader 5 | MatchTrader, Tradelocker, MT5 | DXTrade, Tradelocker, MT5 |

Expert suggestions

Lux Trading Firm’s prominent features include challenge prices starting at £139 for a 50k account and payouts being available in Credit/Debit Cards and Crypto.

While the fees and 30-day withdrawal timeline may be considerations, the firm’s transparency, 50% Fee Refund, and active customer support provide reassurance.