Maverick Trading stands out as it operates with a profit split model, offering traders between 70% and 80% of their profits.

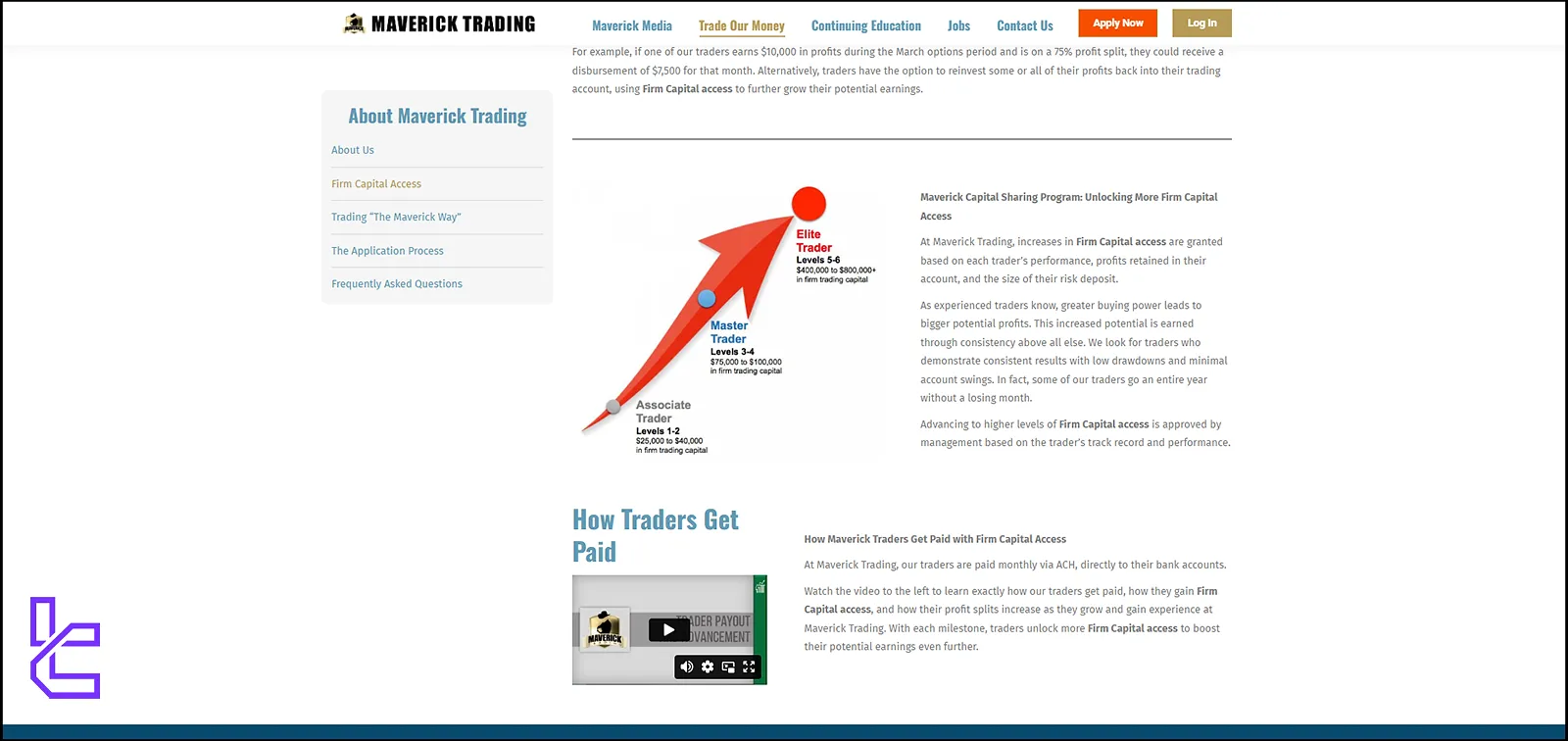

Traders start with capital between $25,000 and $40,000 at Levels 1-2, progressing to higher amounts at Levels 3-4 and 5-6, where the capital can reach $800,000.

Although specific payment methods are not listed, electronic fund transfers are likely used for profit disbursements.

Maverick Trading Company Overview

Founded in 1997, Maverick Trading is a proprietary trading firm that offers traders access to the company’s capital in exchange for a performance-based profit share. Rather than acting as a broker, Maverick functions as a capital allocator, funding qualified traders who pass a rigorous interview, training, and evaluation process.

The firm provides a performance-based path: after successful onboarding, traders contribute an initial at-risk deposit of $5,000 and receive access to a real account starting at $25,000. As they progress through the firm’s six qualification levels, traders can grow their capital access up to $800,000 and earn 70% to 80% of the profits they generate.

Maverick emphasizes professionalism and a long-term commitment. It avoids onboarding casual or inexperienced applicants by filtering for serious candidates through its interview and capital commitment model. This approach ensures only traders with discipline, strategy, and ambition are granted access to the firm's funds.

Specifications Summary

Maverick Trading offers a comprehensive prop trading program with the following specifications:

Account currency | USD |

Minimum price | N/A |

maximum leverage | 1:50 |

maximum profit split | 80% |

Instruments | N/A |

Assets | N/A |

evaluation steps | Level 1 to 6 |

Trading platform | N/A |

Withdrawal methods | N/A |

maximum fund size | $800,000 |

First profit target | N/A |

Max. daily loss | N/A |

Challenge time limit | N/A |

news trading | N/A |

Maximum total drawdown | N/A |

commission per round lot | N/A |

trust pilot score | 3.8 out of 5 |

payout frequency | N/A |

established country | United States |

established year | 1997 |

This structure allows traders to start with a significant amount of capital and scale up as they demonstrate consistent profitability while benefiting from the firm's resources and support.

Maverick Trading’s pros & cons

Like any trading opportunity, Maverick Trading comes with its own set of advantages and potential drawbacks:

Advantages | Disadvantages |

Access up to $800,000 in capital | Lower profit sharing compared to the rivals |

Well-structured funding levels | Stringent qualification process |

The suitability of Maverick Trading depends on individual trader goals, risk tolerance, and experience level. It may be particularly advantageous for newer traders seeking significant capital and comprehensive training.

Maverick Trading’s funding & price structure

Unlike many challenge-based prop firms, Maverick Trading follows a partner-capital model where traders are required to commit financially upfront. To begin, every trader must deposit an at-risk capital amount of $5,000. This serves two purposes: it acts as both skin in the game and a filter for serious applicants who are genuinely committed to long-term success.

In addition to the at-risk deposit, a separate membership fee is charged, though the exact amount is not publicly disclosed. During the initial evaluation phase, traders use their funds for practice and qualification. Upon successful completion, they are granted access to Maverick’s capital.

Maverick positions this financial commitment as a motivational tool, ensuring that only dedicated and performance-driven traders are admitted into the program. It’s essential to note that this model differs significantly from popular “no-risk” challenge-based prop firms and may not be suitable for everyone.

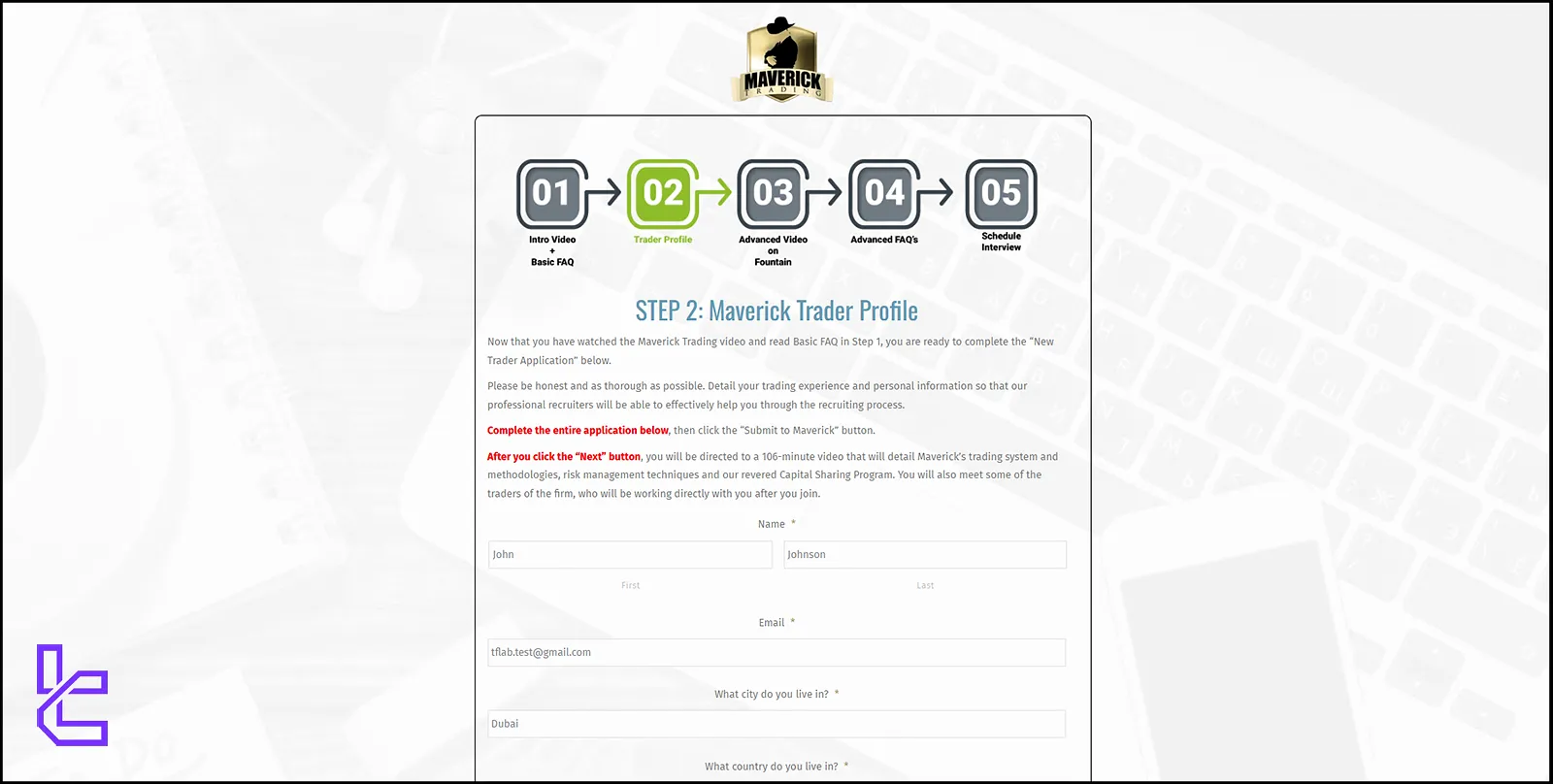

Registration & verification Process

Before beginning your journey on Maverick Trading, you must first open an account with this prop firm. Maverick Funding registration:

#1 Enter the Official Maverick Trading Website

Access the Maverick Trading website and click on the "Apply Now" button to begin the process.

#2 Complete Your Trader Profile and Schedule Interview

Now, follow the steps below to complete your application:

- Review FAQs: Applicants must thoroughly read the frequently asked questions to understand the firm's offerings and requirements;

- Complete Trader Profile: This step provides relevant information about your trading experience and goals;

- Watch Introductory Video: A comprehensive video introduces applicants to Maverick Trading's philosophy and operations;

- Schedule Interview: Qualified applicants are invited to schedule an interview with the recruiting team;

- Qualification Program: Upon acceptance, traders enter a comprehensive program to prepare them for live market success.

Maverick Trading emphasizes its commitment to diversity, respect, and transparency throughout this process, aiming to create a supportive environment for all traders.

Maverick Trading Prop Firm’s Evaluation Steps

Maverick Trading's evaluation process is structured to ensure traders are well-prepared for live market trading. The program consists of 3 primary levels:

Level | Requirements | Trading Capital |

Levels 1-2 (Associate Trader) | - Complete initial training modules and tests | $25,000 - $40,000 |

Levels 3-4 (Master Trader) | - Show consistent profitability | $75,000 - $100,000 |

Levels 5-6 (Elite Trader) | - Demonstrate exceptional trading skills and consistency | $400,000 - $800,000 |

This tiered structure encourages continuous improvement and rewards traders for their progress and success. It's worth noting that the maximum leverage in Maverick Trading funded accounts is 1:50.

Bonus offerings and discounts

While specific bonuses and discounts are not explicitly outlined on Maverick Trading's website, the firm offers several incentives for its traders:

- Performance-based Capital Increases: Traders can earn access to larger capital accounts by demonstrating consistent profitability;

- Higher Profit Splits: As traders progress through the levels, their profit share increases from 70% to 80%;

- Unique Performance Bonus: Traders who make the firm $7,000 receive a bonus.

These incentives are designed to align the interests of traders with those of the firm, encouraging long-term success and growth.

Maverick Trading Rules

Unfortunately, Maverick Trading doesn't specify what the trading rules and conditions are that it implements to encourage traders to perform safe trading practices.

Rules | Specification |

VPN or VPS Usage | N/A |

Hedging | N/A |

Expert Advisors (EA) | N/A |

Prohibited Strategies | N/A |

News Trading | N/A |

Trading platforms for trading on Maverick Trading

While the exact platforms are not specified, Maverick Trading emphasizes providing its traders with the necessary technological resources to succeed in today's evolving markets.

What instruments & symbols can I trade on MaverickTrading?

Maverick Trading offers trading opportunities across various financial instruments, including the Forex market. Although their website does not list specific symbols. Based on available information, traders can likely engage with:

- Stocks: Equity trading across major U.S. exchanges

- Options: Various option strategies on stocks and indices

- Forex: Currency pair trading through the Maverick FX division

- Futures: Possibly available, though not explicitly mentioned

- Cryptocurrencies: Mentioned as part of Maverick FX, specific offerings unclear

It's important to note that the available instruments may vary depending on the trader's level and qualifications within the firm.

Available Payment Methods

While specific payment methods are not detailed on Maverick Trading's website, we can infer some general information based on industry standards and the firm's structure:

- Profit Disbursement: Traders likely receive their share of profits (70-80%) through regular payouts, possibly monthly or quarterly;

- Electronic Transfers: Given the firm's global reach, electronic fund transfers are likely the primary payment method;

- Potential Fee Structure: Initial fees or deposits may be required, though these are not specified.

For the most accurate and up-to-date information on payment methods, prospective traders should contact Maverick Trading directly during the application process.

Commission & Cost in Detail

Maverick Trading's commission and cost structure are not explicitly detailed on their website, but we can infer some information based on their business model:

- No Traditional Commissions: Maverick likely doesn't charge traditional per-trade commissions as a prop firm;

- Profit Sharing: The firm takes 20-30% of profits as their primary form of compensation;

- Potential Initial Fees: Though not specified, there may be upfront costs for training or account setup;

- Technology Fees: The firm will likely cover costs for trading platforms and tools.

Maverick Trading's model aligns their interests with their traders, focusing on shared success rather than charging ongoing fees or commissions.

Does Maverick Trading offer vast educational resources?

Maverick Trading prop firm places a strong emphasis on education and trader development.

Maverick Trading's website features a "Continuing Education Resources for Traders" section that offers educational materials and resources designed to support traders in building their skills, mastering technical analysis, and staying informed about trading strategies.

It includes articles and insights aimed at helping traders enhance their knowledge and proficiency in market strategies.

This resource demonstrates Maverick Trading's commitment to ongoing trader education and development, providing a solid foundation for market success.

You can also check TradingFinder's Forex education section for additional learning materials.

MaverickTrading on Trustpilot

The Maverick Trading Trustpilot profile has a rating of 3.8 out of 5, indicating generally positive but mixed reviews. Key points from these reviews include:

- Comprehensive Training: Many reviewers praise the quality and depth of Maverick's educational resources;

- Supportive Staff: The firm's support team is often cited as helpful and responsive;

- Transparency: Some reviews mention the firm's clear communication and honest approach;

- Some Concerns: A few reviewers have expressed issues with fees or lack of communication in certain instances.

Overall, the Trustpilot score suggests that while Maverick Trading has many satisfied traders, there's room for improvement in some areas of their service.

Customer Support Team

Maverick Trading offers several channels for customer support:

- Contact Form: Available on their website for general inquiries

- Email Support: support@mavericktrading.com

The support team is available Monday through Friday, 6 am to 5 pm (local time). The firm emphasizes its commitment to helping traders succeed, encouraging prospective and current traders to ask questions and seek clarification.

Social media channels

Maverick Trading maintains an active presence on various social media platforms:

- X (formerly Twitter)

- Maverick Trading Facebook

These social media profiles serve as valuable resources for aspiring and current traders, providing market insights, educational content, and a glimpse into the Maverick Trading community. The prop firm also has a strong presence on famous platforms like CNBS and Yahoo finance to keep traders informed about the latest news and insights.

Maverick Trading in Comparison with Other Prop Firms

By comparing Maverick Trading's features with those of other well-known prop firms, traders can easily determine whether this prop firm is the right fit for them.

Parameter | Maverick Trading Prop Firm | |||

Minimum Challenge Price | N/A | $32 | $50 | $15 |

Maximum Fund Size | $800,000 | $4,000,000 | $2,000,000 | $100,000 |

Evaluation steps | Level 1 to 6 | 1-Step, 2-Step | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 80% | 95% | 90% | 85% |

Max Daily Drawdown | N/A | 5% | 4% | 4% |

Max Drawdown | N/A | 10% | 6% | 8% |

First Profit Target | N/A | 8% | 5% | 8% |

Challenge Time Limit | N/A | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:50 | 1:100 | 1:5 | 1:75 |

Payout Frequency | N/A | Varies | Bi-weekly | 10 Days |

Number of Trading Assets | N/A | 78 | 100+ | 400+ |

Trading Platforms | N/A | MT4, MT5, cTrader, MatchTarder | Proprietary platform | Match-Trader, cTrader |

Expert suggestions

Overall, Maverick Trading's emphasis on personalized trading plans (Associate, Master, and Elite Trader) and performance incentives, such as a bonus for traders who make the firm $7,000, demonstrates its commitment to helping traders grow.

The firm does not charge per-trade commissions but takes 20%-30% of the trader’s profits.

Also, Maverick Trading’s Trustpilot score of 3.8 out of 5 shows the platform’s relative reliability.