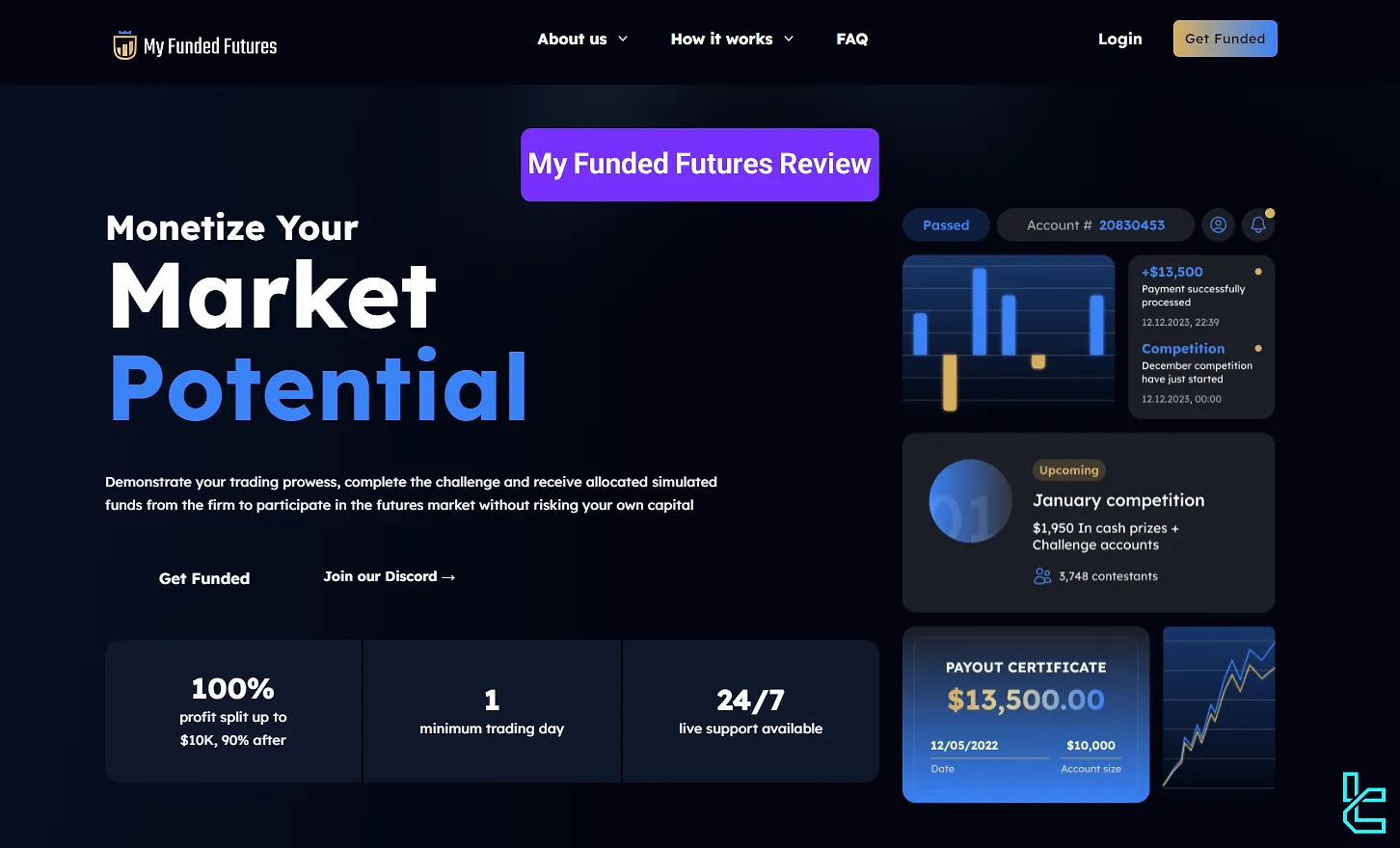

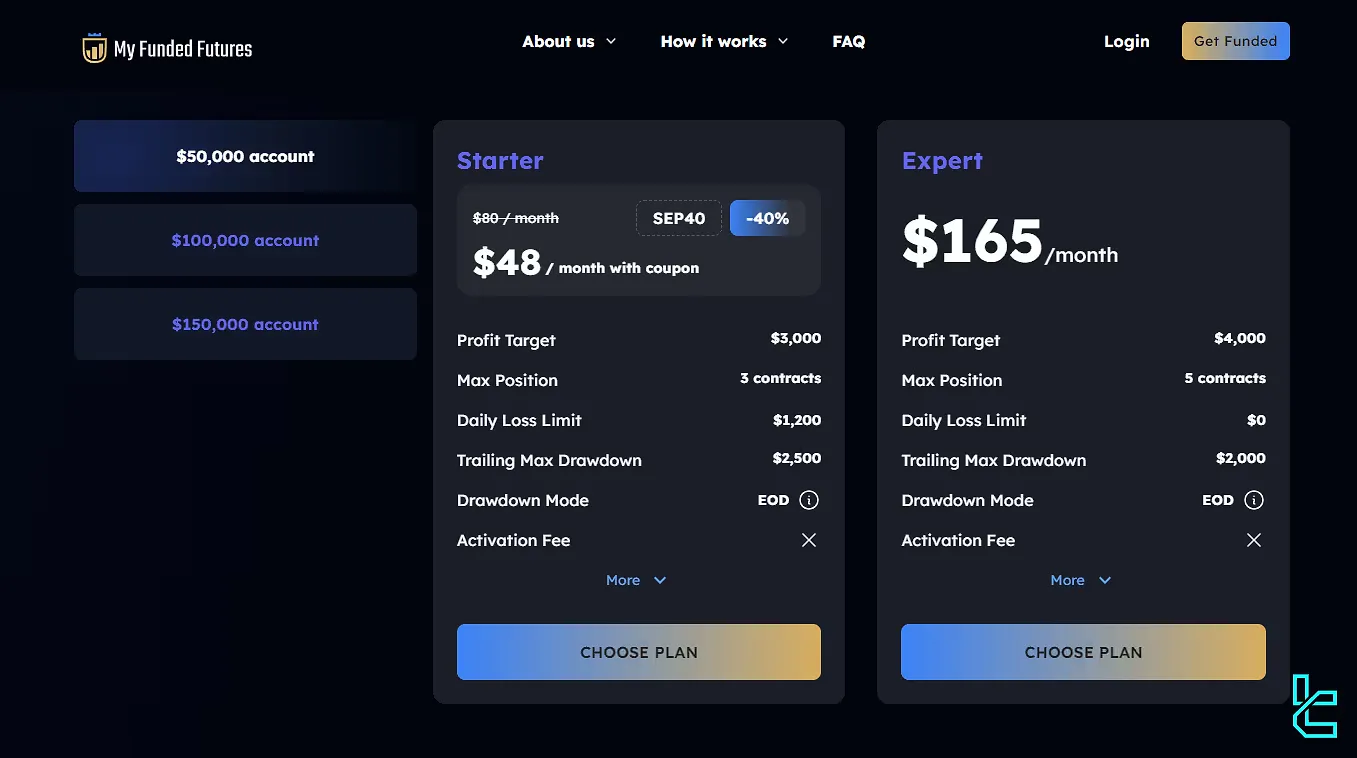

My Funded Futures is a prop firm with 3 account sizes [$50K, $100K, $150K,] each in two programs [Starter, Expert.] All these accounts are based on a 1-step evaluation.

The maximum daily loss in the starter program is 2.4%. The expert model doesn't have any limits on the mentioned parameter.

Company Information Overview

My Funded Futures is a prop trading firm founded in November 2023 and headquartered in Delaware, USA. This newcomer has quickly established itself as a formidable option for traders seeking funded accounts.

My Funded Futures stands out for its trader-friendly policies, including no daily loss limits for some accounts and positions allowed to be held overnight.

Summary of Specifications

In this section, we will have an overall look at the key specifics of the mentioned company. My Funded Futures Specifications Table:

Account Currency | USD |

Minimum Price | $48 |

Maximum Leverage | 1:1 |

Maximum Profit Split | 100% Up to $10K for the Initial Profit 90% for Next Profits |

Instruments | Futures |

Assets | Not Specified |

Evaluation Steps | 1 |

Withdrawal Methods | Riseworks |

Maximum Fund Size | $150K |

First Profit Target | 6% |

Max. Daily Loss | 2.4% for Starter 0% for Expert |

Challenge Time Limit | None |

News Trading | Prohibited |

Maximum Total Drawdown | From 3% |

Trading Platforms | NinjaTrader, Tradovate, TradingView, R | Trader Pro, Quantower, Sierra Chart |

Commission Per Round Lot | From $1.2 |

Trustpilot Score | 4.5/5 |

Payout Frequency | Bi-weekly |

Established Country | United States |

Established Year | 2023 |

Significant Pros and Cons

When considering My Funded Futures as your prop firm of choice, it's essential to weigh the advantages and disadvantages:

Pros | Cons |

Single-Step Evaluation Process Simplifies Qualification | Limited Track Record As A New Firm |

No Daily Loss Limits On Expert Plans | Automated Trading (EAs/Bots) is Prohibited. |

Rapid Payout Processing | - |

Competitive Profit Split | - |

Wide Range Of Futures Markets Available | - |

An Overview of the Funding & Price on My Funded Futures

The mentioned company offers a limited range of account sizes compared to the other prop firms. Here's an overview of their funding options:

- Fundings: From $50,000 to $150,000

- Price: From $48 to $375 (Monthly fee)

As mentioned above, the firm charges traders a monthly fee, not an entry price. The fees are higher on expert plans.

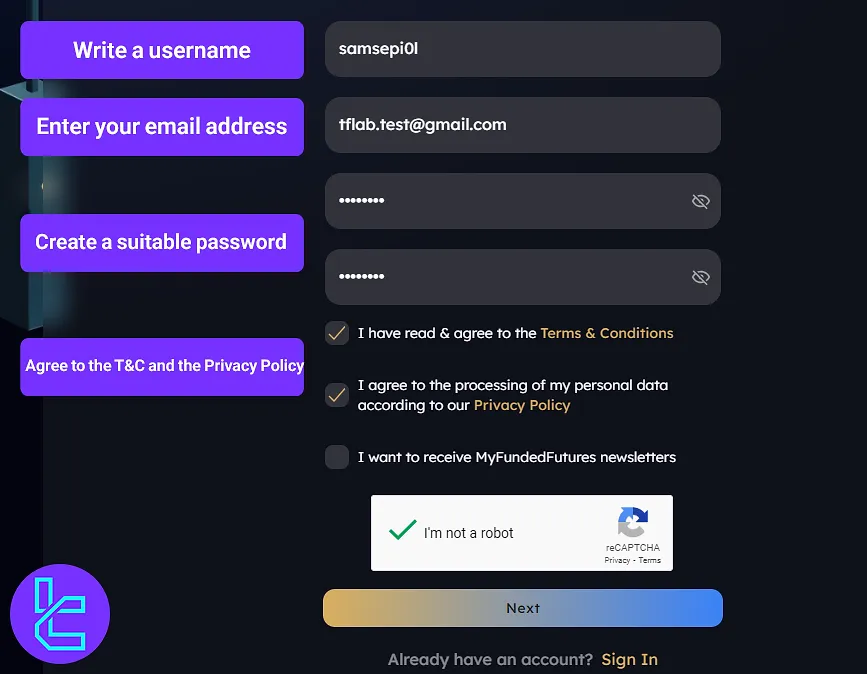

Step-by-Step Tutorial on Account Registration

Getting started with My Funded Futures is a simple process designed to get traders up and running quickly. Here's a step-by-step guide to My Funded Futures registration:

#1 Access the Official Website

Enter the My Funded Futures website on your preferred browser and click on the "Get Started" button.

#2 Fill Out the Registration Form

Provide the following information in the signup form:

- Username

- Password

Agree to the terms, and click on the "Next" option.

#3 Provide Personal Information

Complete your identity information by entering your full name, location details, and phone number, then click "Submit".

You can now buy a challenge and start trading on My Funded Futures accounts.

My Funded Futures Verification

To cash out your profits from the MFFU prop firm, upload the following documents:

- Proof of Identity: Passport, ID card, or driver's license

- Proof of Address: Bank statement or utility bill

If you need visual guidance on the My Funded Futures verification process, watch the video below.

Evaluation Phases

This prop firm takes only 1 step for traders' evaluation. Here's an overview of their evaluation phase:

Account Size | $50,000 | $100,000 | $150,000 | |||||

Challenge Type | Starter Plus | Expert | Starter | Eval To Live | Starter Plus | Expert | Starter Plus | Expert |

Profit Target | 6% | 8% | 6% | 6% | 6% | 8% | 6% | 8% |

Maximum Number of Positions | 3 Contracts | 5 Contracts | 3 Contracts | 3 Contracts | 6 Contracts | 10 Contracts | 9 Contracts | 15 Contracts |

Maximum Daily Loss | $0 | $0 | $1,200 | $0 | $0 | $0 | $0 | $0 |

Trailing Maximum Drawdown | $2,000 | $2,000 | $2,500 | $1,500 | $3,000 | $3,000 | $4,500 | $4,500 |

Does My Funded Futures Offer Any Bonuses And Promotions?

Currently, this prop firm does not offer any specific bonuses or promotions, unlike those provided by Forex brokers. However, there are discount codes available:

- 40% off on Starter accounts with [SEP40]

- 10% off on reset fees for Starter plans with [ICT]

Note that the second one is unofficial, so it might not necessarily work. Check the official and third-party websites and resources to get the latest promo codes.

My Funded Futures Rules

Understanding My Funded Futures rules enables you to safeguard your account and prevent account termination for violating the platform's conditions.

- VPN and VPS Usage: No specific data on the website;

- Hedging: MFFU does not provide information regarding using Hedging strategies;

- Expert advisors: Fully automated trading systems, including AI, bots, and third-party automation tools (such as SignalStack), are banned;

- Gambling and Risk Strategies: Exploiting tight brackets or simulated market conditions to gain an unfair advantage is banned;

- News Trading: Utilizing strategies that exploit immediate news bursts, such as straddles or strangles, is strictly prohibited.

VPN and VPS Conditions

Although the website does not provide specific details about using VPNs or VPS, these tools are typically subject to certain restrictions in trading environments.

VPNs are generally used to mask a trader's IP address, but they can raise concerns if the geographical region of the IP address changes frequently. This could lead to doubts about external assistance during the challenge or live account phases.

Hedging

The website does not specify the firm’s policy on hedging. However, many prop firms restrict or prohibit hedging strategies during the challenge or live account phases due to concerns that it may be used to manipulate risk or artificially alter the trader's performance.

Typically, firms prefer traders to rely on real strategies that reflect actual trading abilities.

Expert Advisor

The use of fully automated trading systems, including Expert Advisors (EAs), AI, and trading bots (such as SignalStack), is prohibited during all phases of the challenge and live accounts.

This rule ensures that traders are relying on their skills and decision-making, rather than external automation tools that could distort their true trading capabilities.

Gambling and Risk Strategies

The following actions are banned in the My Funded Futures prop firm:

- Order Manipulation: Placing multiple limit orders at the same price to manipulate order fills is prohibited;

- Slippage & Bracket Exploitation: Exploiting tight brackets or simulated market conditions to gain an unfair advantage is banned;

- Copy Trading & Device Sharing: Traders must execute their own trades. Copy trading and using the same device as another trader is strictly prohibited.

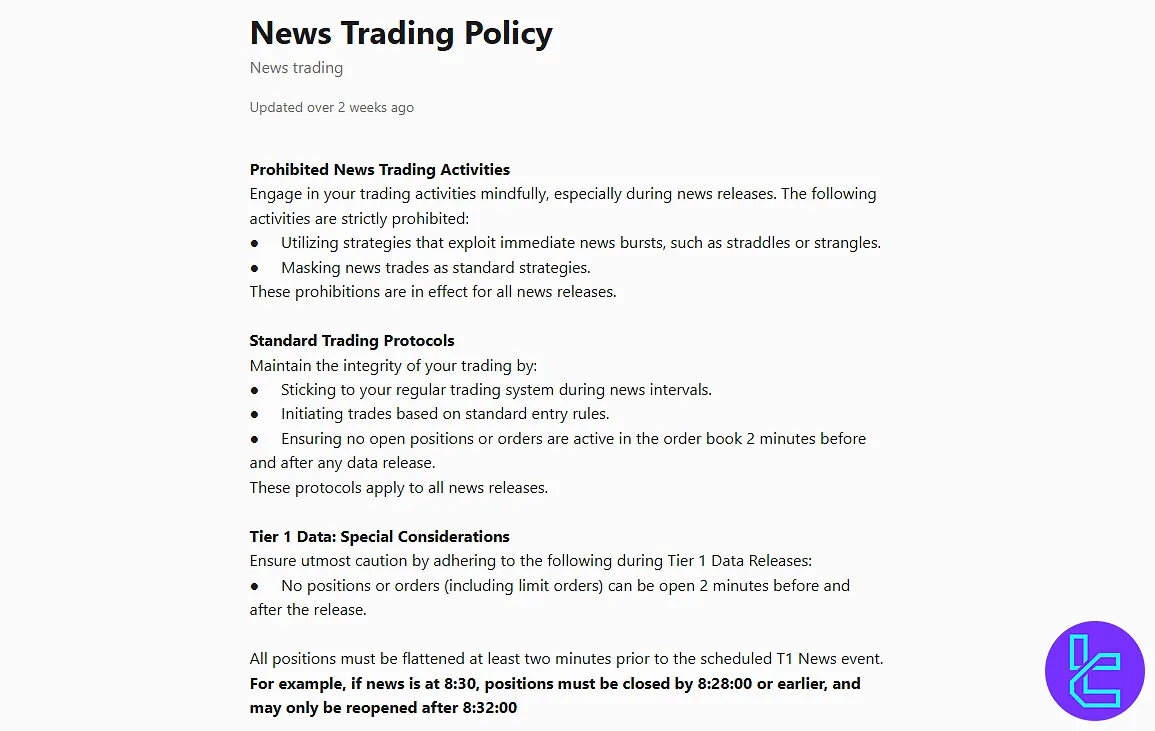

News Trading Policies

My Funded Futures has clear rules regarding news trading, which include:

- Prohibited Activities: Utilizing strategies that exploit immediate news bursts, such as straddles or strangles, is strictly prohibited. Masking news trades as standard trading strategies is not allowed. These prohibitions apply to all news releases;

- Standard Trading Protocols: Traders must adhere to their regular trading system during news intervals. Positions or orders cannot be active in the order book 2 minutes before or after any data release;

- Tier 1 Data: For Tier 1 Data releases, positions and orders must be closed at least two minutes before the release. For example, if news is at 8:30, positions must be closed by 8:28, and can only be reopened after 8:32.

Trading Platforms

My Funded Futures supports several popular trading platforms, catering to different trader preferences and styles. In this section, we will have a look at each one:

NinjaTrader:

- Advanced charting and analysis tools

- Customizable interface

- Ideal for experienced futures traders

- Accessible on Mac, Windows, and mobile operating systems

- Free simulations for learning the platform

Tradovate:

- Cloud-based platform

- User-friendly interface

- Suits traders looking for simplicity

TradingView:

- Comprehensive charting capabilities

- Various visual tools

- A large community of traders and analysts

- Attractive and modern interface

Other Supported Platforms:

- R | Trader Pro

- Quantower

- Sierra Chart

My Funded Futures ensures that traders can access robust, reliable platforms that can accommodate various trading strategies and preferences in the futures market.

Tradable Markets and Symbols

My Funded Futures offers a diverse range of tradable futures markets across major exchanges. Here's an overview of the important assets:

CME (Chicago Mercantile Exchange):

- E-mini S&P 500 (ES)

- E-mini Nasdaq-100 (NQ)

- Euro FX (6E)

CBOT (Chicago Board of Trade):

- 10 Year T-Note (ZN)

- Corn (ZC)

- Soybeans (ZS)

COMEX (Commodity Exchange):

- Gold (GC)

- Silver (SI)

- Copper (HG)

NYMEX (New York Mercantile Exchange):

- Crude Oil (CL)

- Natural Gas (NG)

- Heating Oil (HO)

My Funded Futures Prop Firm Payment Options Overview

This company has taken a typical approach to payouts. Actually, My Funded Futures works with Riseworks to process payouts. Options via Rise include:

- Crypto transfers

- Bank wire

- ACH payments

My Funded Futures offers a generous and well-structured payout policy designed to incentivize performance while maintaining capital stability.

All traders keep 100% of their first $10,000 in profits. Beyond that, a 90/10 split applies, with 90% going to the trader and 10% retained by the firm.

Payout frequency and conditions vary by plan:

- Starter: Withdrawals are possible after 5 winning days, with a minimum of $250. A 40% consistency rule applies; no single trade may contribute more than 40% of total profits;

- Starter Plus: Same withdrawal terms as Starter, but without consistency rules, offering more freedom;

- Expert: Biweekly payouts, minimum withdrawal $1,000.

The profit split on the Expert accounts is calculated based on the data below:

- First 45 days: 20% of net reserves withdrawable

- Days 46 to 90: 50%

- Beyond 90 days: 90%

This structure strikes a balance between early-stage earning potential and longer-term capital retention.

Commission & Fees in Trading

My Funded Futures operates on a commission-based model for futures trading. The costs vary based on the trading asset, but it starts from $0.56 per side.

Regarding inactivity fees, there've been no reports.

Educational Resources on My Funded Futures

The firm focuses primarily on providing trading capital and infrastructure, so it does not offer extensive resources for educational purposes. However, they offer these types of content:

- FAQ Section: Comprehensive answers to common questions about the evaluation process, rules, and account management

- YouTube Channel: Videos related to trading and financial markets

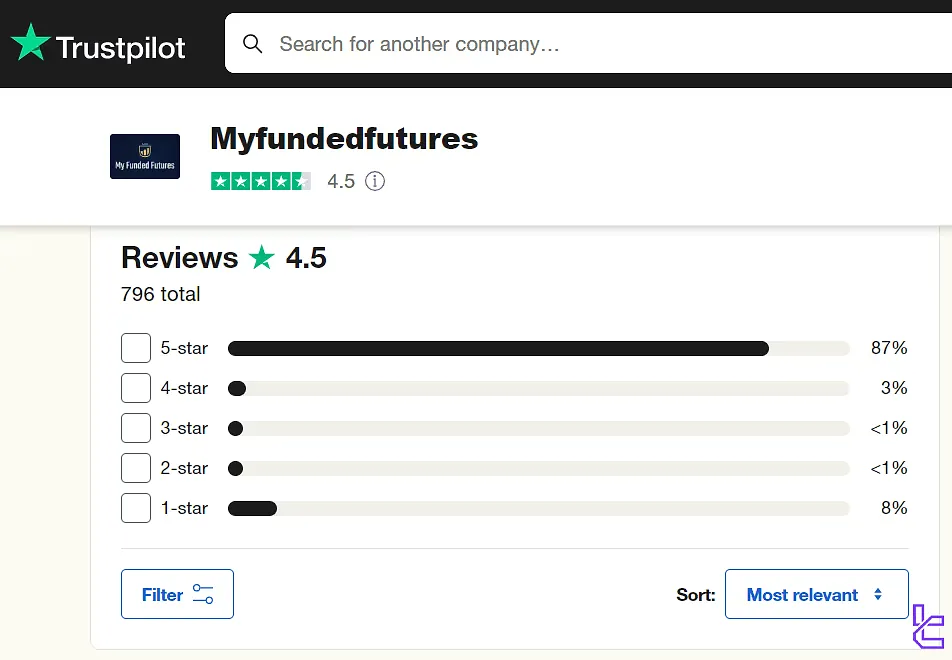

How Does My Funded Futures Perform in Terms of Trust Scores?

Trust is crucial in the prop trading industry, and the mentioned firm has worked to establish a positive reputation. In this section, we will review the company's score on Trustpilot:

- 4.5/5 stars

- More than 790 reviews

- Over 85% of the scores are 5-star

While My Funded Futures is a relatively new firm, its commitment to trader satisfaction has helped build trust within the trading community. As with any financial service, traders are encouraged to conduct their own due diligence.

Customer Support Services

My Funded Futures does not provide a dedicated support section on the website for unregistered users, and the only parts you can access are the live chat button and FAQ section.

This can be a drawback for the firm. They haven't even provided an email address for the support department in a clear form; we found it in the help center [support@myfundedfutures.com]. However, they claim the team is available 24/7.

Social Media Channels and Pages

My Funded Futures tries to post updates on various social media platforms to engage with traders and share valuable information. Social Pages:

- My Funded Futures Discord

- X (Formerly Twitter)

- Linked In

- You Tube

Comparing My Funded Futures with Other Props

To help you understand the pros and cons of trading with My Funded Futures prop firm, check the table below.

Parameters | My Funded Futures Prop Firm | |||

Minimum Challenge Price | $48 | $33 | $39 | $55 |

Maximum Fund Size | $150,000 | $400,000 | $250,000 | $200,000 |

Evaluation steps | 1-Step | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step, 3-Step | 1-phase, 2-phase |

Profit Share | 100% | 100% | 100% | 80% |

Max Daily Drawdown | 7% | 5% | 4% | |

Max Drawdown | 2.4% | 14% | 10% | 6% |

First Profit Target | 6% | 6% | 5% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:1 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Bi-weekly | Weekly | Bi-weekly | 2 Times a Month |

Number of Trading Assets | Not Specified | 40+ | 3000+ | 200+ |

Trading Platforms | NinjaTrader, Tradovate, TradingView, R | Trader Pro, Quantower, Sierra Chart | MetaTrader 5, Match Trader | Metatrader 5 | Metatrader 5, CFT Platform, and Crypto Futures |

Expert Opinion

My Funded Futures has obtained a 4.5/5 trust score on the Trustpilot website; more than 85% of the reviews are 5-star.

This futures-focused prop firm charges a variable commission for trading, starting from $0.56 per lot per side. Account prices start from $48.