SeacrestFunded provides funding with a minimum price of $50 on 2 trading platforms [DXTrade, MatchTrade]. The funding can go up to $1M via the scaling program.

The company charges a $3 to $6 trading fee in the Forex and commodities markets.

SeacrestFunded Company Information

SeacrestFunded is a Hong Kong-based proprietary trading firm headquartered in Kowloon and registered under the name MyFunded Capital (HK) Ltd, with registration number 76252354. The registration address is Suite 1601, 16/F., AXA Tower, Landmark East, 100 How Ming Street, Kwun Tong, Kowloon, Hong Kong.

Also, the prop firm has another entity in Cyprus under the legal name MyFunded Capital Solutions Ltd with the registration number 76252354. This branch's registered address is Archiepiskopou Makariou III, 228 Agios Pavlos, 5th floor, 3030 Limassol, Cyprus.

Seacrest, formerly known as My Funded FX, has been operating since its inception in 2022. Led by CEO Matthew Leech, the company has quickly established itself as a player to watch in the prop trading space.

It's worth noting that during our latest investigation, we found out that Leech is no longer the CEO of the prop firm; he had been in that position before the rebrand.

Summary Table

As with the other review articles, we have prepared a table to show a summary of the firm's specifics:

Account currency | USD, EUR |

Minimum price | $50 |

Maximum leverage | 1:30 |

Maximum profit split | Up to 80% (90% with Add-on) |

Instruments | Forex, Metals, Indices, Crypto, Commodities |

Assets | 175+ |

Evaluation steps | Up to 2 steps |

Withdrawal methods | Credit/Debit card, crypto |

Maximum fund size | $100,000 (up to $1M through scaling) |

First profit target | 10-8-5% (subject to the account) |

Max. Daily loss | 5% |

Challenge time limit | No limits |

News trading | Yes (on some conditions) |

Maximum total drawdown | Up to 8% |

Trading platforms | DXTrade, MatchTrade |

Commission per round lot | From $0 |

Trustpilot score | 4.3 out of 5 |

Payout frequency | Every 2 Weeks |

Established country | Hong Kong |

Established year | 2022 |

Pros & Cons

Let's take a closer look at the advantages and potential drawbacks of trading with SeacrestFunded:

Benefits | Drawbacks |

Access to significant trading capital (up to $100,000) | Relatively new company (established in 2022) |

Decent 80% profit-sharing arrangement | Limited payment methods |

Flexible pricing structure with low-cost entry options | News trading restrictions for some accounts |

Scaling plan to increase account size based on performance | - |

Funding and Prices

SeacrestFunded offers a range of account sizes to suit different trader preferences and skill levels. Here's a breakdown of their funding options and pricing:

- Account Sizes: $5,000 to $100,000

- Pricing: $50 to $500 (excluding discounts if applicable)

- Profit Split: 80% for traders (90% add-on available)

- Maximum Scaling: $1 million

Here's a detailed table to investigate the price and funding size variety at the prop firm:

Funding Size | Plan Price (1/2 Step) |

$5K | $50 |

$10K | $100 |

$25K | $200 |

$50K | $300 |

$100K | $500 |

How to Register and Verify on SeacrestFunded

Getting started with this prop firm is the first thing you consider before trading on it. Here's a step-by-step guide to SeacrestFunded registration and verification.

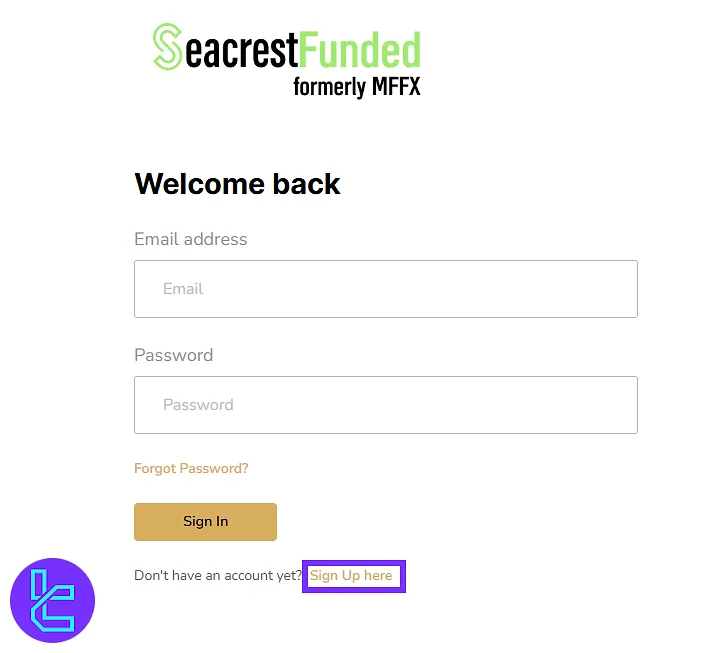

#1 Access the Registration Page

Start from the login section and click “Sign Up Here” to reach the account creation form.

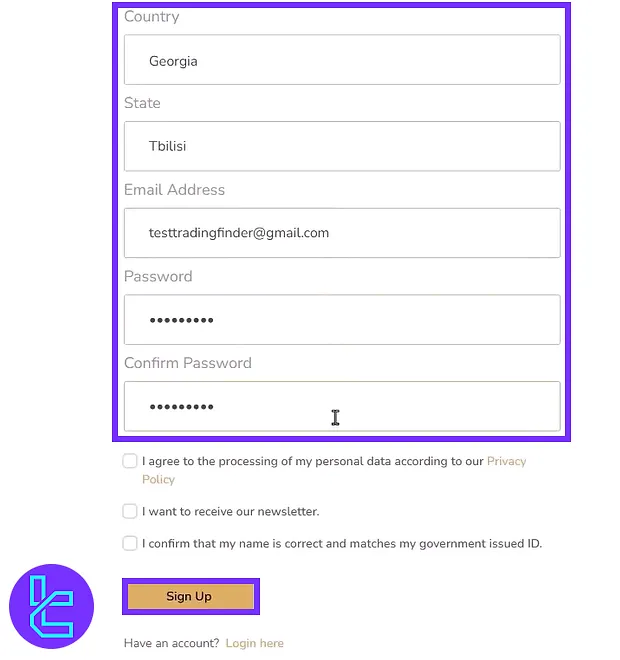

#2 Provide Personal Information

Complete the sign-up form by entering:

- Full name

- Email address

- Country of residence

Create a secure password and accept the terms, and click “Sign Up” to continue.

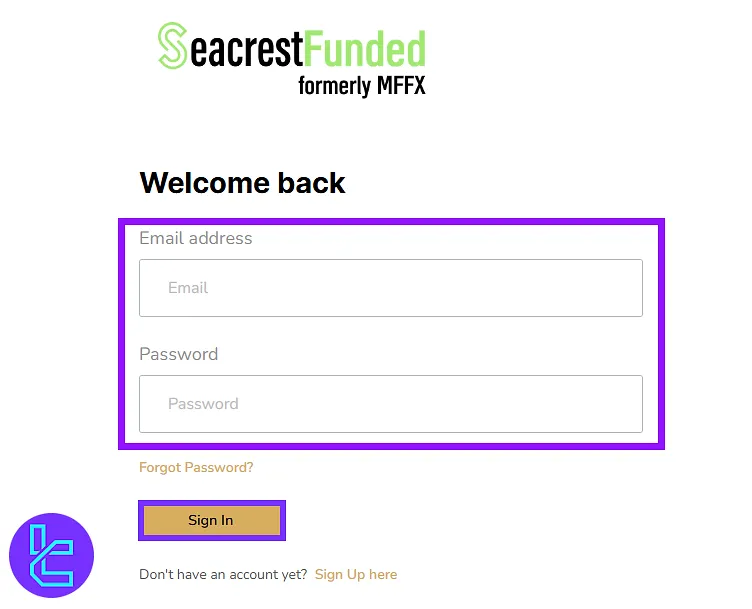

#3 Log In to the Dashboard

Return to the login page, use your new credentials, and access the SeacrestFunded dashboard, where you can manage accounts and explore funding programs instantly.

#4 Verify Your Account

For verification, first, you need to pass all the phases to get an eligible sim-funded account. Afterward, you need to prepare and submit the required documents for account verification.

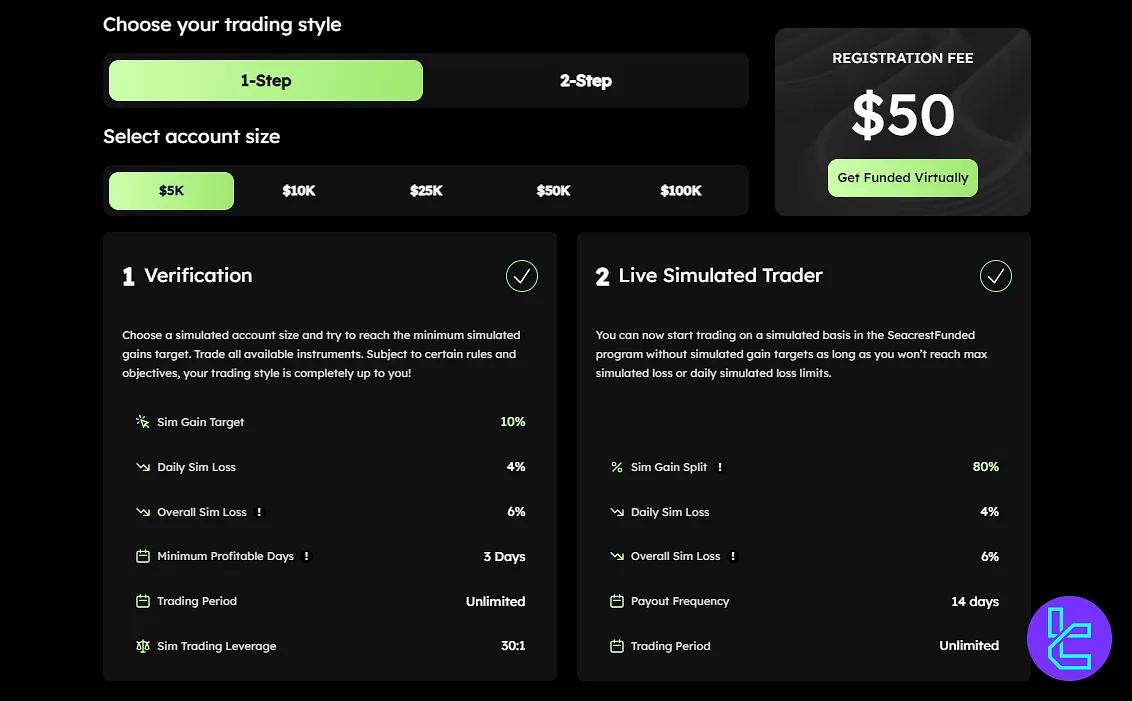

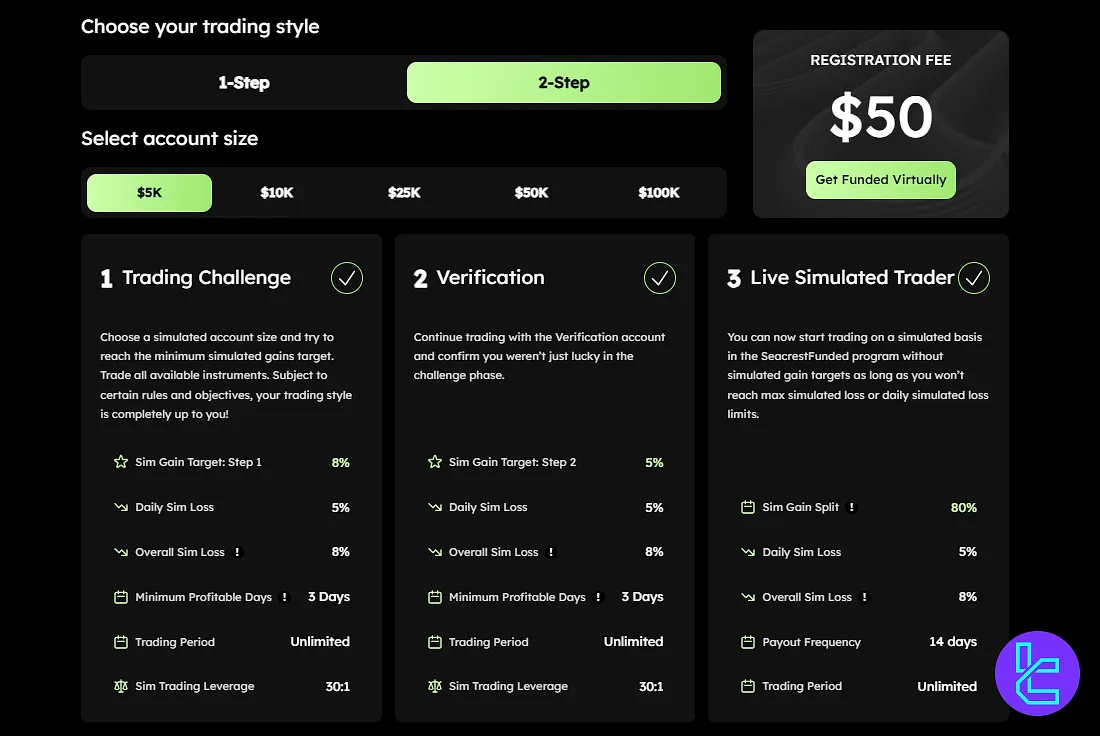

Evaluation Phases

SeacrestFunded offers a straightforward evaluation structure with only 2 models: 1-Step & 2-Step. In the table below, we will see a comparison of each model's features and specifications:

Specs | 1-step | 2-step |

Profit Target | 10% | 8-5% |

Max. Daily Loss | 4% | 5% |

Max. Total Drawdown | 6% | 8% |

Min. Profitable Days | 3 Days | 3 Days |

Profit Split | 80% | 80% |

Payout Frequency | 14 Days | 14 Days |

Key Points:

- No time limits on trading

- Scaling plan available after successful completion

1-Step

For quick access to funding from the prop firm, the one-stage evaluation program could be the better option. Here are the details:

Parameters | Numbers |

Profit Target | 10% |

Max. Daily Loss | 4% |

Max. Total Drawdown | 6% |

Min. Profitable Days | 3 Days |

Profit Split | 80% |

Payout Frequency | 14 Days |

2-Step

Those with less experience would find this plan easier because of its lower bars. Table of details:

Parameters | Numbers |

Profit Target | 8-5% |

Max. Daily Loss | 5% |

Max. Total Drawdown | 8% |

Min. Profitable Days | 3 Days |

Profit Split | 80% |

Payout Frequency | 14 Days |

Bonuses and Discounts

Some prop firms provide bonuses on signing up, depositing, and other conditions to attract new traders. Currently, SeacrestFunded does not offer any bonuses and promotions for traders.

However, there are discount codes available on third-party websites that could give you an edge in challenges. Here are some promo codes for the mentioned firm:

- TRUSTED10

- MFFX30

- MFFX10170

We do not know whether these codes work. Therefore, you should check them out for yourself. You can also check the official website and social media pages for occasional code releases.

SeacrestFunded Rules

The prop firm provides comprehensive resources regarding the rules that must be adhered to by traders:

- VPN/VPS: Allowed, but only with paid services. Device/IP sharing between accounts is strictly forbidden;

- Hedging: Simulated hedging within one demo account is allowed, but across multiple accounts or coordinated group hedging is prohibited;

- Expert Advisors (EA): EAs are not allowed on MT5 except via STT Social Trader Tools. Automated arbitrage, tick scalping, or bot exploitation is forbidden;

- Arbitrage: All forms of arbitrage (latency, one-leg, two-leg, etc.) are banned due to unfair advantage and misrepresentation of skill;

- News Trading: Allowed on Challenge Accounts but restricted on Live Simulated Accounts. Strict rules apply around high-impact (Red Folder) events, with profits removed if trades violate the 3-minute rule;

- Payouts: Seacrest Funded lets you request payouts every 14 days, processed within 12–72 hours, even on active accounts without disrupting trading.

VPN & VPS Usage

SeacrestFunded permits the use of VPNs and VPS services, provided they are paid solutions. These tools must not be used to circumvent trading restrictions or replicate prohibited strategies.

Under no circumstances should two traders access accounts from the same device or IP address, as this will link accounts under a single CID, resulting in termination.

Importantly, VPN/VPS services cannot be used to bypass restrictions on copy trading, group trading, or signal services. Any misuse will result in account failure and permanent termination.

Hedging Rules

- Permitted: Simulated hedging within a single demo account

- Prohibited: Opposite trades executed across multiple demo accounts, or coordinated group hedging where traders offset risk across firms to exploit program rules

Expert Advisors (EA) & Automation

EAs are banned on MT5, except when used via STT Social Trader Tools. Additionally, although copy trading is permitted, it is only allowed when it does not rely on an EA-based copier.

Martingale & Arbitrage Strategy

SeacrestFunded strictly prohibits all forms of arbitrage, including latency arbitrage, one-leg arbitrage, two-leg arbitrage, and any other manual or automated methods designed to exploit pricing inefficiencies or delays.

Latency arbitrage refers to taking advantage of time gaps between price feeds; one-leg arbitrage involves exploiting discrepancies in a single market without offsetting trades; and two-leg arbitrage means placing simultaneous offsetting positions across brokers or markets to profit from minor differences.

Traders who engage in such practices will face immediate disqualification, closure of all associated accounts, forfeiture of any earned profits or funding, and a permanent ban from all SeacrestFunded programs.

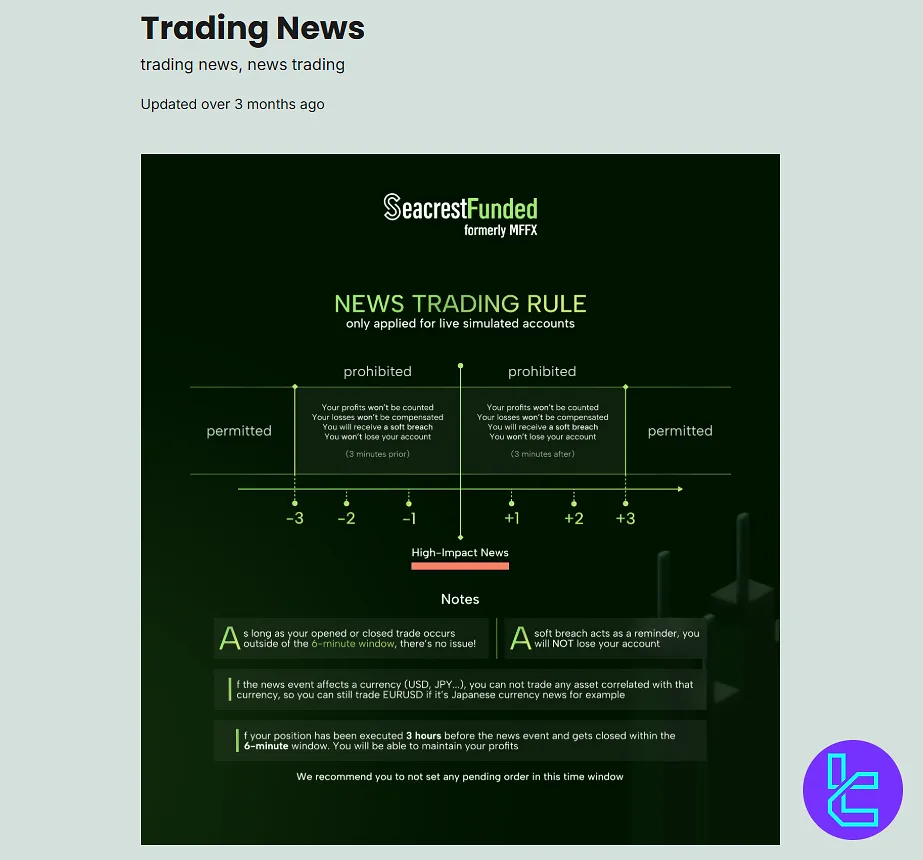

News Trading Restrictions

In SeacrestFunded, news trading is allowed during the Challenge phase but restricted on Live Simulated Accounts, unless the trader is participating in the special 2-Step News Plan. Any trade opened or closed within three minutes before or after a Red Folder event will have its profits removed.

If a position has been opened at least three hours prior to the news release and closed within the six-minute window following the event, the profits will remain valid. On the other hand, trades that are opened less than three hours before the news release and then closed during the restricted period will lose all associated profits.

Pending orders that are placed but not executed during the restricted window are not affected. Red Folder events, as listed on ForexFactory, cover high-impact announcements such as CPI, GDP, Non-Farm Payrolls, FOMC decisions, and central bank rate announcements.

These rules apply not only to major currency pairs like USD, EUR, GBP, CAD, AUD, NZD, CHF, and JPY but also to commodities and indices, including XAUUSD, USOIL, UKOIL, SPX, NAS, and DOW.

Payouts

SeacrestFunded allows traders to request payouts every 14 calendar days, starting from the first trade on a simulated prop account (excluding the first day).

Once the request is submitted, payouts are generally processed within 12 to 72 hours, ensuring traders receive their earnings promptly.

If a payout request is made during weekends or public holidays, it will be handled on the next business day. The minimum amount for payouts is $65.

Importantly, submitting a payout does not interrupt trading activities — traders can continue using the same account without waiting for the previous payout to complete.

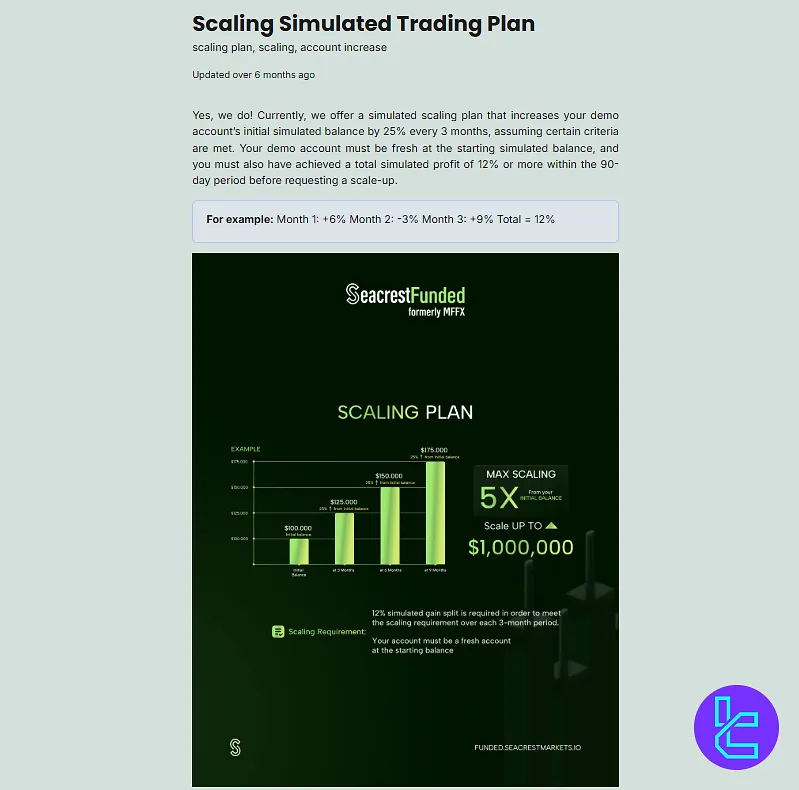

Simulated Account Scaling Plan

SeacrestFunded provides a simulated scaling program designed to expand a trader’s demo account balance gradually. Under this framework, the initial simulated balance can be increased by 25% every three months, provided that specific performance conditions are satisfied.

To qualify for a scale-up, the account must remain at its original starting balance, and the trader must record a cumulative simulated profit of at least 12% during the 90-day evaluation period. Once these criteria are met, traders may submit a formal request for scaling.

Illustrative example:

- Month 1: +6%

- Month 2: –3%

- Month 3: +9%

- Total: 12%

All scaling requests should be directed to fundedsupport@seacrestmarkets.io once eligibility requirements are fulfilled.

Trading Platforms

SeacrestFunded utilizes 2 trading platforms for providing services to users. The firm's platforms are as follows:

- DXTrade: Available on Android, iOS, and web

- MatchTrade: Accessible through Android, iOS, and browsers

You can use either of these 2 for trading and passing challenges and phases on SeacrestFunded.

Available Instruments and Symbols

SeacrestFunded offers a decent range of tradable instruments via Seacrest Markets to suit various trading strategies:

- Forex Market: Significant and popular currency pairs

- Metals: Gold, Silver, Platinum, Palladium

- Commodities: Oil

- Indices: Major global indices

- Cryptocurrencies: Bitcoin, Bitcoin Cash, Litecoin, Ethereum

Overall, this firm offers more than 175 assets available for trading.

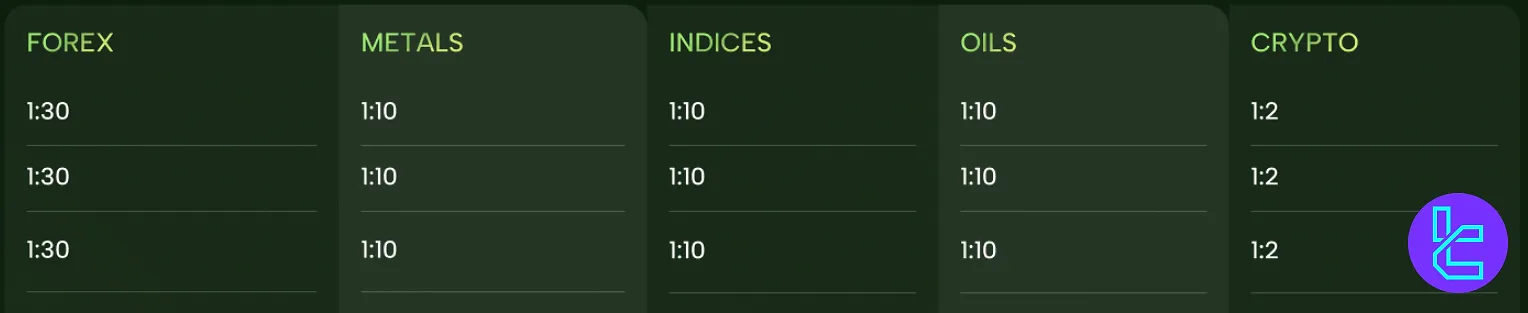

SeacrestFunded Leverage Details

SeacrestFunded provides traders with a flexible leverage structure. Here are the leverage limitations per the traded instrument:

- Forex: Up to 1:30

- Metals: Fixed at 1:10

- Indices: Offered at 1:10

- Oils: Maintained at 1:10

- Crypto: Limited to 1:2

The prop firm has set these restrictions to improve risk management among traders; however, some might find it unnecessary.

Payment Methods

SeacrestFunded does not support many options for payments and withdrawals, which is disappointing. Payment options available via the firm:

- Credit/Debit Cards (Visa, Mastercard, Discover)

- Cryptocurrencies

As we discussed, it doesn't even support bank transfers, which is a standard method among brokers and platforms.

Commission and Fees

In this section of the SeacrestFunded review, we will discuss the firm's commission structure. SeacrestFunded keeps costs at a reasonable level. You can see the details in the list below:

- Trading Commissions: $3-6 per standard lot for Forex and Commodities

- Indices and Cryptocurrencies: $0 commissions

- Withdrawal Fees: May vary depending on the chosen withdrawal method

Educational Resources and Materials

SeacrestFunded understands the importance of continuous learning in the trading world. They provide a range of educational resources to help traders improve their skills and increase their chances of success:

- Educational blog: In-depth articles on trading strategies and market analysis

- Video Tutorials: Step-by-step guides on platform usage and trading techniques

- FAQ Section: Comprehensive answers to common questions about the program

However, these resources are not vast and deep enough compared to some of the competitors.

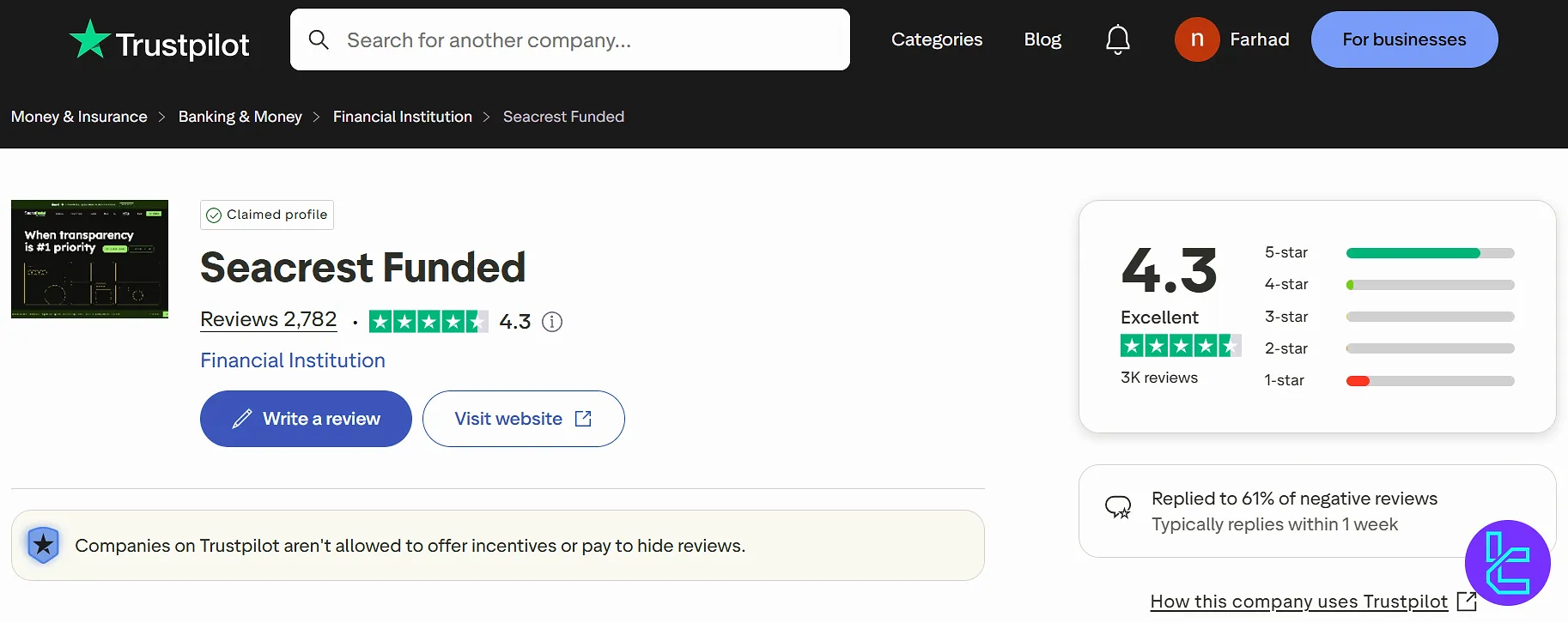

Trust Scores (Trustpilot)

Trust and reputation are crucial factors when choosing a prop firm. Let's look at how SeacrestFunded fares in terms of trust scores on Trustpilot as a reliable website:

- SeacrestFunded Trustpilot Rating: 4.3 out of 5 stars

- Number of Reviews: Over 2,700

- Key Praises: Fast payouts, transparent policies, helpful customer support

- Concerns: Some traders have expressed worries about recent changes to consistency rules

While SeacrestFunded is a relatively new company, established in 2022, they have quickly built a positive reputation in the industry. The high Trustpilot score suggests that many traders have had good experiences with the firm.

Support and Customer Services

Quality customer support is essential for any prop firm. Unfortunately, SeacrestFunded does not have a specific section for support on its website, and it is a significant drawback.

The only option for contacting the team is through the live chat button on the website. However, Response Time is generally quick, with many traders praising the responsiveness of the support team. Also, a decent FAQ section is available on the website.

Customer Support Summary Table:

Support Method | Availability |

Live Chat | Yes (Through the website) |

No | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | No |

FAQ | Yes (On the website) |

Help Center | No |

No | |

Messenger | No |

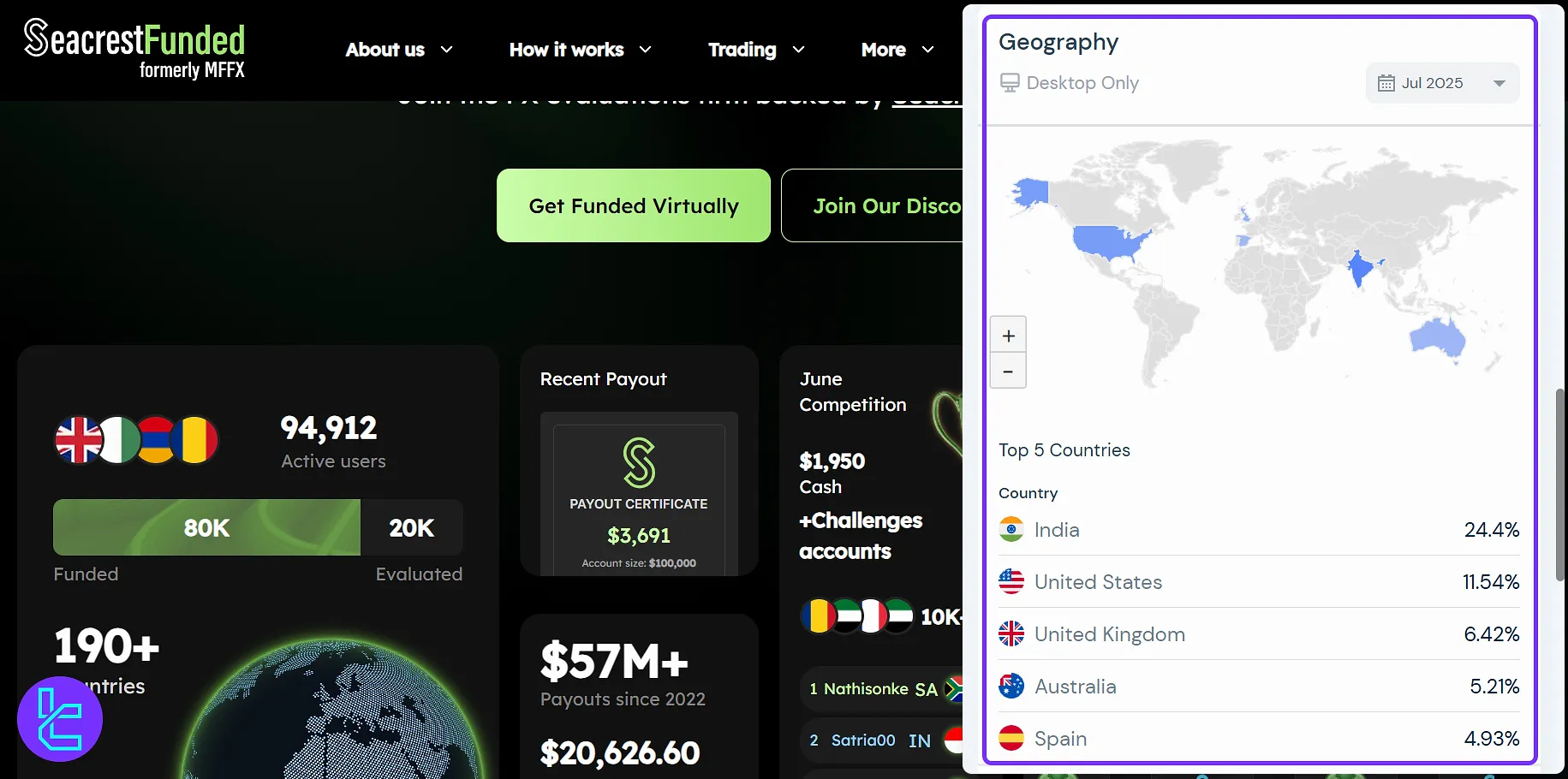

SeacrestFunded User Base Diversity Range

SeacrestFunded has built a global presence with nearly 95,000 active users across more than 190 countries, showcasing a highly diverse trader community.

Out of this base, 80,000 traders hold funded accounts, while 20,000 are in the evaluation phase, reflecting the firm’s wide appeal among different trading stages.

The platform’s user distribution also highlights its strong international footprint. According to the latest data (July 2025), the top five countries where SeacrestFunded users are most active include:

- India – 24.4% of the total user base

- United States – 11.54%

- United Kingdom – 6.42%

- Australia – 5.21%

- Spain – 4.93%

This diversity indicates that SeacrestFunded attracts traders from both emerging and established financial markets.

Social Media Channels

SeacrestFunded maintains an active presence on various social media platforms to engage with its trader community and share important updates. Here is a list of this firm's social media channels and pages:

Social Media | Members/Subscribers |

Over 32K | |

Over 22.6K | |

Over 34.2K | |

Over 31K |

Following SeacrestFunded on these platforms can help traders stay informed about the latest news, promotions, and educational opportunities offered by the firm.

SeacrestFunded in Comparison to Strong Contenders in the Industry

The prop firm isn't a bad choice when evaluated against some of the top prop firms:

Parameters | SeacrestFunded Prop Firm | Alpha Capital Group Prop Firm | Breakout Prop Firm | |

Minimum Challenge Price | $50 | $97 | $50 | $32 |

Maximum Fund Size | $1,000,000 | $200,000 | $2,000,000 | $4,000,000 |

Evaluation steps | 1-Step, 2-Step | 1-Step, 2-Step | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | Up to 80% (90% with Add-on) | 80% | 90% | 95% |

Max Daily Drawdown | 5% | 5% | 4% | 5% |

Max Drawdown | Up to 8% | 10% | 6% | 10% |

First Profit Target | 10-8-5% (subject to the account) | 5% | 5% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:30 | 1:100 | 1:5 | 1:100 |

Payout Frequency | Every 2 Weeks | Bi-weekly | Bi-weekly | From 5 Days |

Number of Trading Assets | 175+ | 40 | 100+ | 78 |

Trading Platforms | DXTrade, MatchTrade | MetaTrader 5, cTrader, Dxtrade | Proprietary platform | MT4, MT5, cTrader, MatchTarder |

Expert Suggestions

SeacrestFunded is headquartered in Hong Kong and led by CEO Matthew Leech. The company has channels on 7 social media platforms [Twitter, Facebook, Instagram, TikTok, YouTube, Telegram, Discord].

More than 2,700 users have given an average of 4.3/5 score to the company on the Trustpilot website.