Optimal Traders is a prop trading company with a minimum price of $29 for funding. The profit share goes up to 80%, and a leverage of up to 1:33 is available.

The challenge fees are paid via 6 methods [crypto, VISA, Mastercard, American Express, Discover, and JCB]. Optimal Traders prop firm offers various add-ons for a 90% profit share, payout frequency of 7 days, and EAs trading.

Company Overview

Optimal Traders is a prop firm headquartered in the bustling financial hub of Dubai, United Arab Emirates. Also, it has 2 other offices in the United Kingdom and Uzbekistan. Office Addresses:

- Headquarters: Dubai Silicon Oasis, DDP, Building A2, Dubai, United Arab Emirates

- UK Office: 67-169 Great Portland Street, 5th Floor, London, W1W 5PF

- Uzbekistan Office: 2 Muzrobot Street, Mirzo Ulugbek District, Tashkent

Optimal Traders CEO

Azlan Rana is the visionary CEO of Optimal Traders, a fast-growing prop-trading firm based in Dubai. Taking on the CEO role at just 22, he has become one of the youngest leaders in the proprietary trading industry. Azlan frequently shares trading insights and company updates on LinkedIn and X (formerly Twitter), engaging with the global trader community.

- Position: Chief Executive Officer (CEO) of Optimal Traders

- Industry: Proprietary trading and funding solutions

- Location: London, UK – a major hub for global prop trading

- Social Presence: Active on X (@AzlnOT) and LinkedIn

- Milestone: Appointed CEO at 22, a standout achievement in prop firm leadership

- Education: Graduate of Anglia Ruskin University

Summary Of Key Features

Here's a general overview of what Optimal Traders brings to the table:

Account Currency | USD |

Minimum Price | $29 |

Maximum Leverage | 1:33 |

Maximum Profit Split | 80% |

Instruments | Forex, Metals, Indices |

Assets | N/A |

Evaluation Steps | 1-Step, 2-Step |

Withdrawal Methods | Bank Wire, Crypto |

Maximum Fund Size | $6.5M |

First Profit Target | 7% |

Max. Daily Loss | 4% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | 8% |

Trading Platforms | MetaTrader 5 |

Commission Per Round Lot | $3 |

Trustpilot Score | 4.0 |

Payout Frequency | Bi-weekly |

Established Country | United Arab Emirates |

Established Year | 2023 |

Pros and Cons

Optimal Traders might be a good prop firm, but in order to make a balanced decision, you need to look at it from a balanced perspective. In the table below, we will take a look at Optimal Traders' advantages and disadvantages:

Pros | Cons |

High Capital Allocation (Up To $6.5M) | Limited Educational Resources Compared To Some Competitors |

No Time Limits On Trading Challenges | Limited Information On Scaling Opportunities |

Weekend Trading Allowed | No 24/7 Support Despite Their Claims |

How Is The Funding and Price Structure on Optimal Traders?

The company offers a range of funding options to suit different traders needs and budgets.

Here's a breakdown of their pricing and funding structure:

Account Size | 1-Step Standard | 1-Step Algo | 2-Step | 3-Step |

$5K | $89 | - | $29 | - |

$10K | $189 | $199 | $99 | $69 |

$25K | $289 | $319 | $159 | $119 |

$50K | $389 | $429 | $329 | $199 |

$100K | $589 | $649 | $509 | $369 |

$200K | $999 | $1,099 | $959 | $659 |

Optimal Traders Refund Policy

To activate your account and begin trading, you’ll need to select a suitable Assessment Program and pay the required Access Fee in full. Access to the Trading Platform is granted only after the Access Fee has been successfully processed.

Note: Once the Assessment Period begins, the Access Fee becomes non-refundable, unless otherwise required by applicable laws.

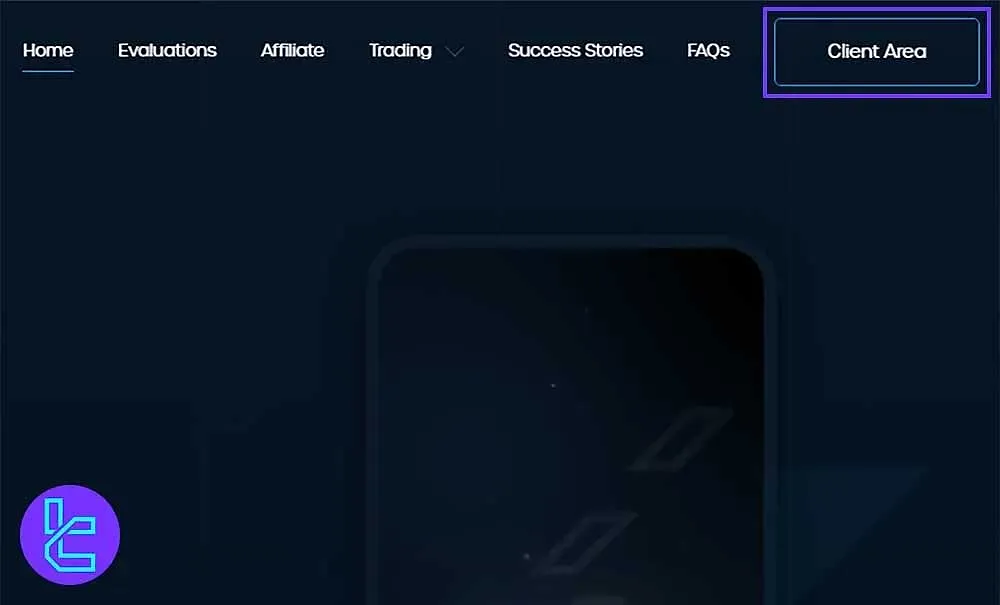

How To Register And Verify On Optimal Traders

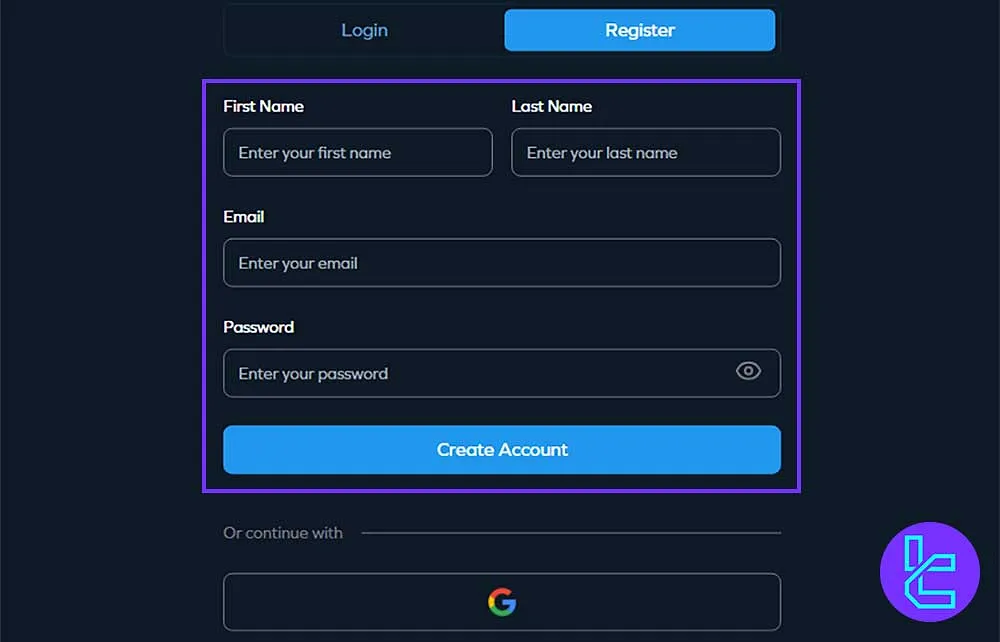

Creating your Optimal Traders account is fast and intuitive. Whether you choose to link your Google account or register manually, the process ensures access to your trading dashboard in minutes.

Manual sign-up only requires essential credentials, such as an email address, full name, and a secure password. Once the Optimal Traders registration is complete, you'll unlock the client dashboard and will be ready to explore evaluations, rules, and funded challenges.

#1 Navigate to the Registration Page

Head to the Optimal Traders website and:

- Click onClient Area;

- Select the Register tab to begin the process.

#2 Create Your Account

Select between Google or Email sign up. If you choose to proceed with email registration, the following details are required:

- First Name

- Last Name

- Email Address

- Strong Password (includes upper/lowercase letters, numbers, and symbols)

Finally, hit "Create Account" to complete the setup. Once done, your client dashboard will be instantly available across devices.

#3 Optimal Traders Verification

Now, you need to purchase a program. After passing the challenge, verify your account by submitting additional information and documents.

To complete the Optimal Traders verification process, navigate to the "Identity" menu through your client area, click "Get Verified", and upload proof of ID, including:

- Passport

- National ID card

- Driving license

Note: Document photos can only be uploaded via mobile devices. In the verification menu, you'll be prompted to scan a QR code to upload documents.

Remember to carefully review the trading rules and conditions before starting to ensure compliance throughout the evaluation process.

Evaluation Stages in Detail

Optimal Traders offers three main evaluation programs to provide the facility for traders with different mindsets. In this section, we will investigate each model in detail:

Features | 1-Step Standard | 1-Step Algo | 2-Step | 3-Step |

Trading Period | Unlimited | Unlimited | Unlimited | Unlimited |

Max Daily Loss | 3% | 4% | 4% | 4% |

Max Drawdown | 6% | 8% | 8% | 8% |

Profit Target | 10% | 10% | 8% / 5% | 7% / 6% / 5% |

Max Leverage | 1:33 | 1:33 | 1:33 | 1:33 |

Profit Split | 80% | Up to 80% | 80% | 80% |

EAs Allowed | No | Yes | Add-on | Add-on |

Traders can choose the program that best aligns with their trading style, risk tolerance, and experience level.

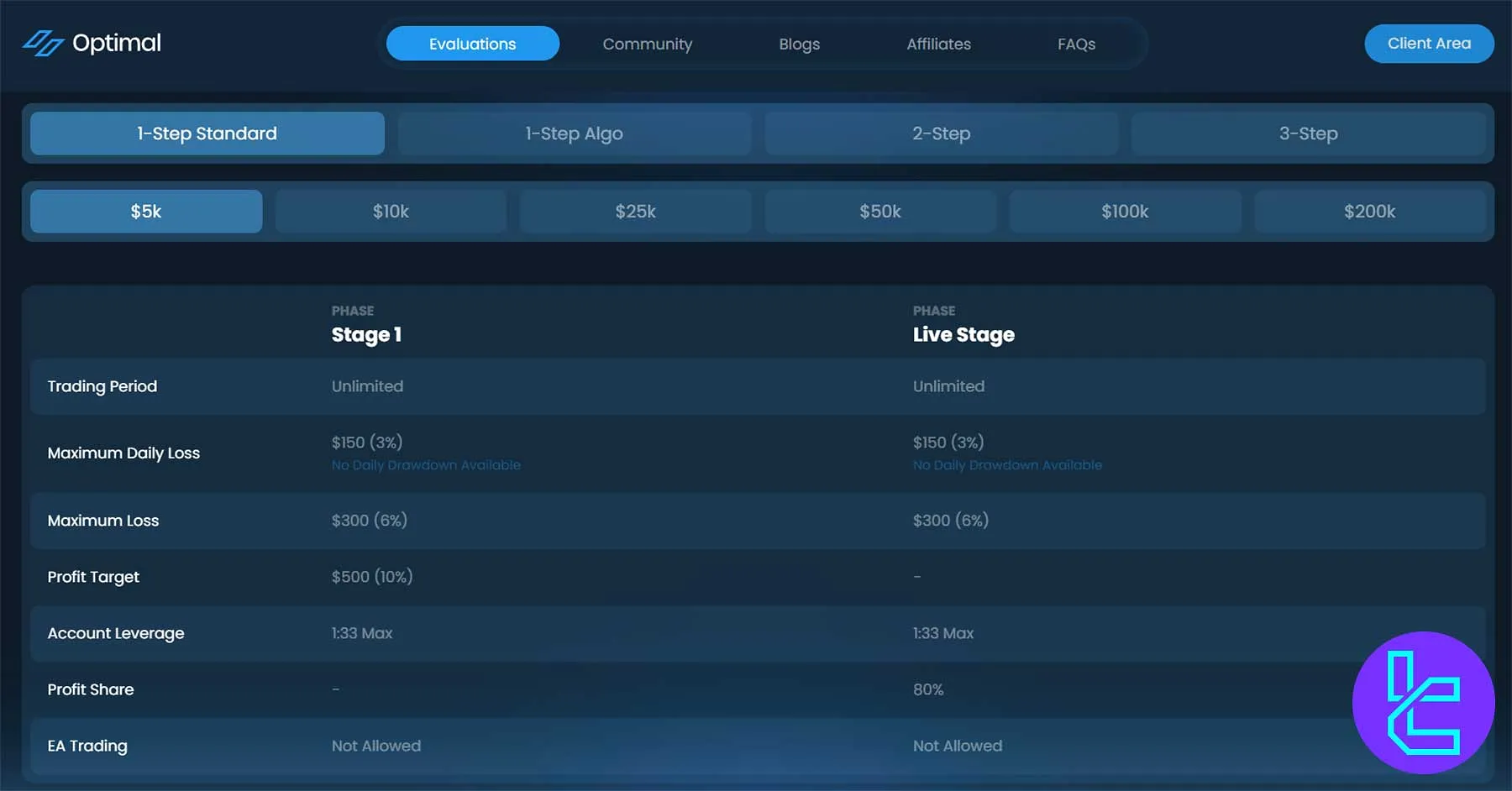

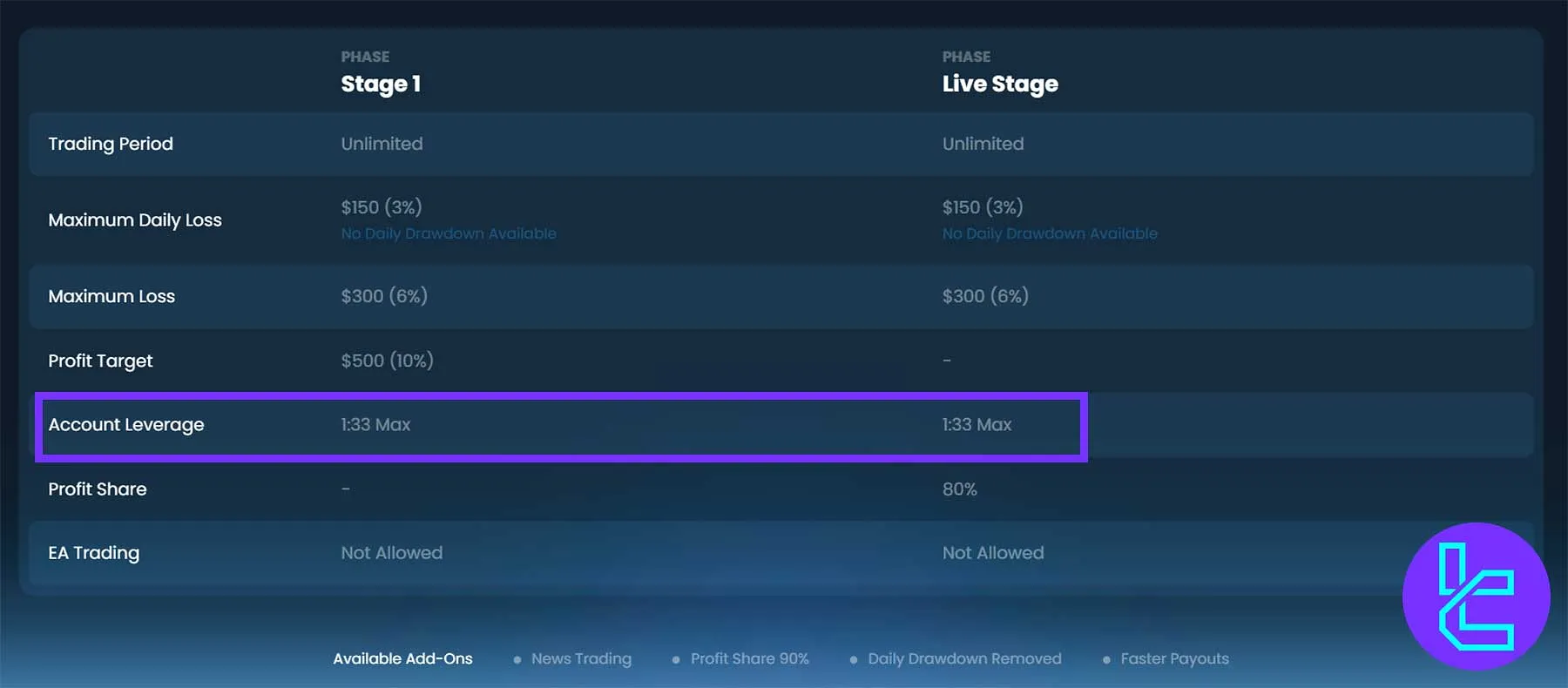

Optimal Traders 1-Step Standard Program

The 1-Step Standard Program is ideal for discretionary traders seeking fast funding with simple rules. It offers unlimited trading time, a 10% profit target, and a generous 80% profit share after passing the evaluation.

Feature | Stage 1 | Live Stage |

Trading Period | Unlimited | Unlimited |

Maximum Daily Loss | 3% | 3% |

Maximum Loss | 6% | 6% |

Profit Target | 10% | – |

Account Leverage | 1:33 Max | 1:33 Max |

Profit Share | – | 80% |

EA Trading | Not Allowed | Not Allowed |

This program is perfect for traders who want a single-phase challenge with no time pressure, clear risk parameters, and immediate access to profit splits upon passing. Its simplicity makes it an excellent starting point for new prop firm traders.

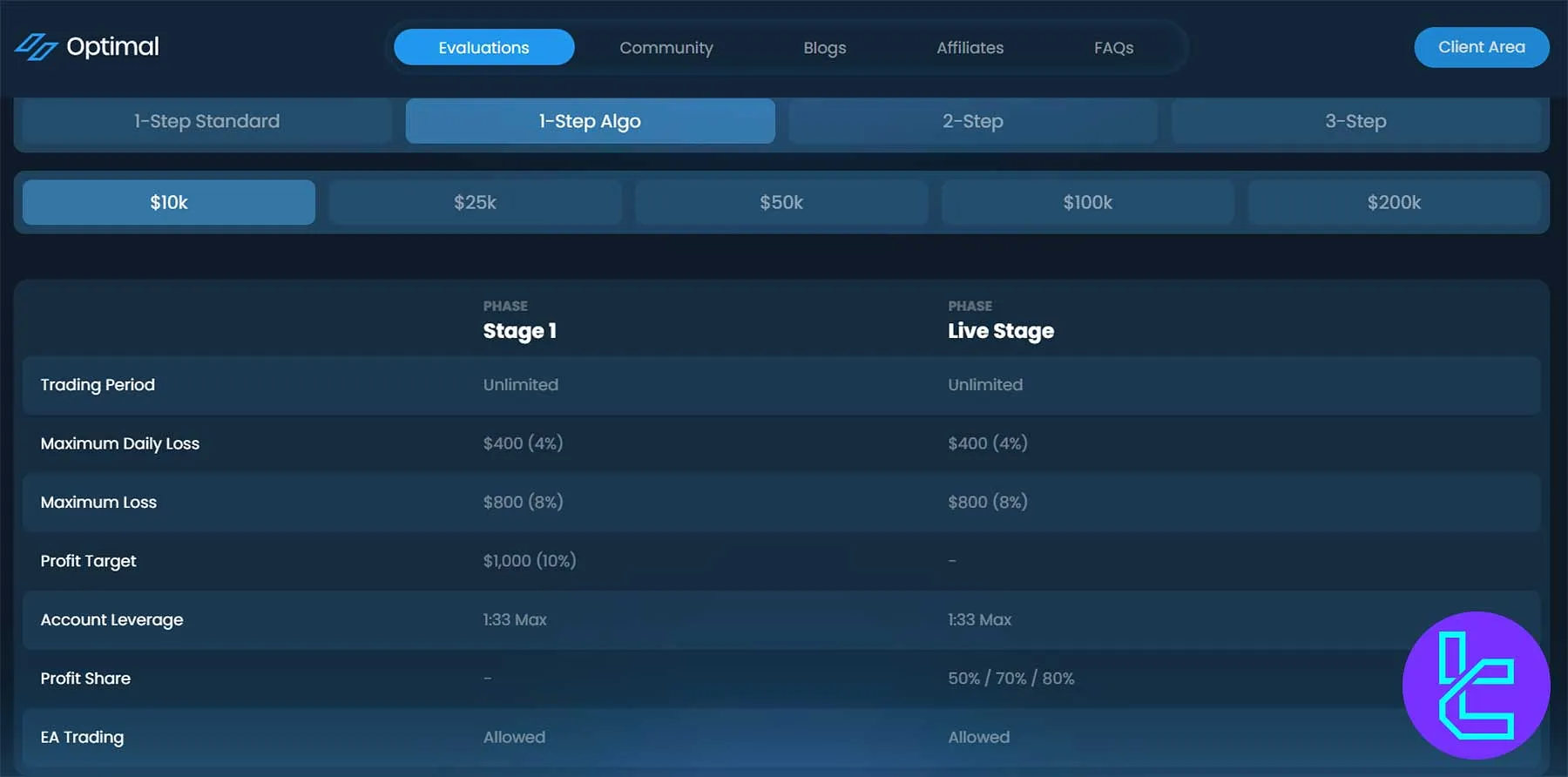

Optimal Traders 1-Step Algo Program

Designed for algo and EA traders, the 1-Step Algo Program allows automated strategies while keeping the same unlimited trading time and attractive profit splits of up to 80%.

Feature | Stage 1 | Live Stage |

Trading Period | Unlimited | Unlimited |

Maximum Daily Loss | 4% | 4% |

Maximum Loss | 8% | 8% |

Profit Target | 10% | – |

Account Leverage | 1:33 Max | 1:33 Max |

Profit Share | – | 50% / 70% / 80% |

EA Trading | Allowed | Allowed |

The 1-Step Algo Program gives algorithmic traders the freedom to test, refine, and scale their systems in a professional environment.

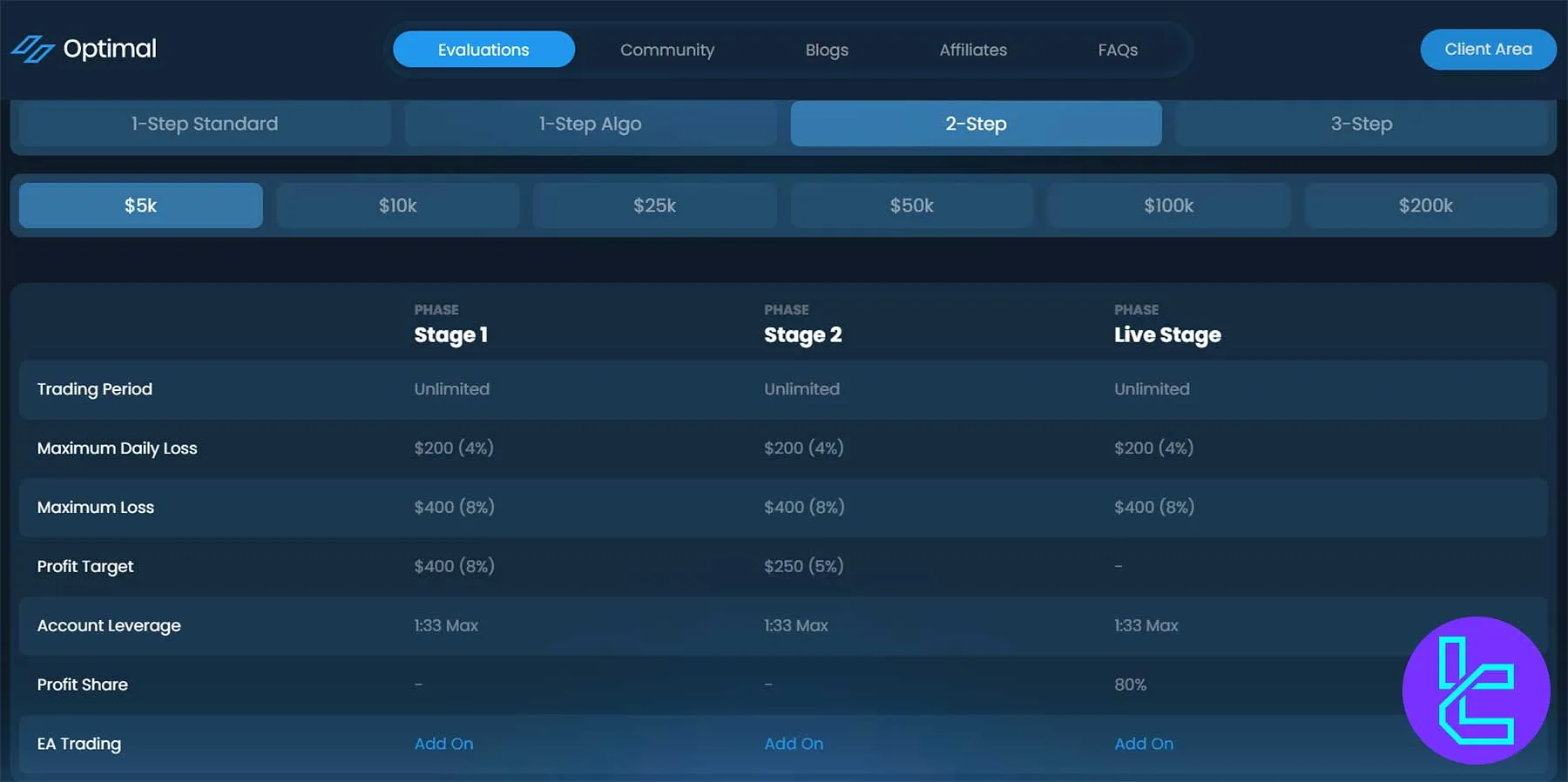

Optimal Traders 2-Step Program

This program features a two-stage evaluation process with lower profit targets per stage and optional EA trading. It balances risk control with funding accessibility for traders who prefer a gradual challenge.

Feature | Stage 1 | Stage 2 | Live Stage |

Trading Period | Unlimited | Unlimited | Unlimited |

Maximum Daily Loss | 4% | 4% | 4% |

Maximum Loss | 8% | 8% | 8% |

Profit Target | 8% | 5% | – |

Account Leverage | 1:33 Max | 1:33 Max | 1:33 Max |

Profit Share | – | – | 80% |

EA Trading | Add-On | Add-On | Add-On |

The 2-Step Program is great for traders seeking a balanced evaluation model with attainable profit targets and moderate risk exposure.

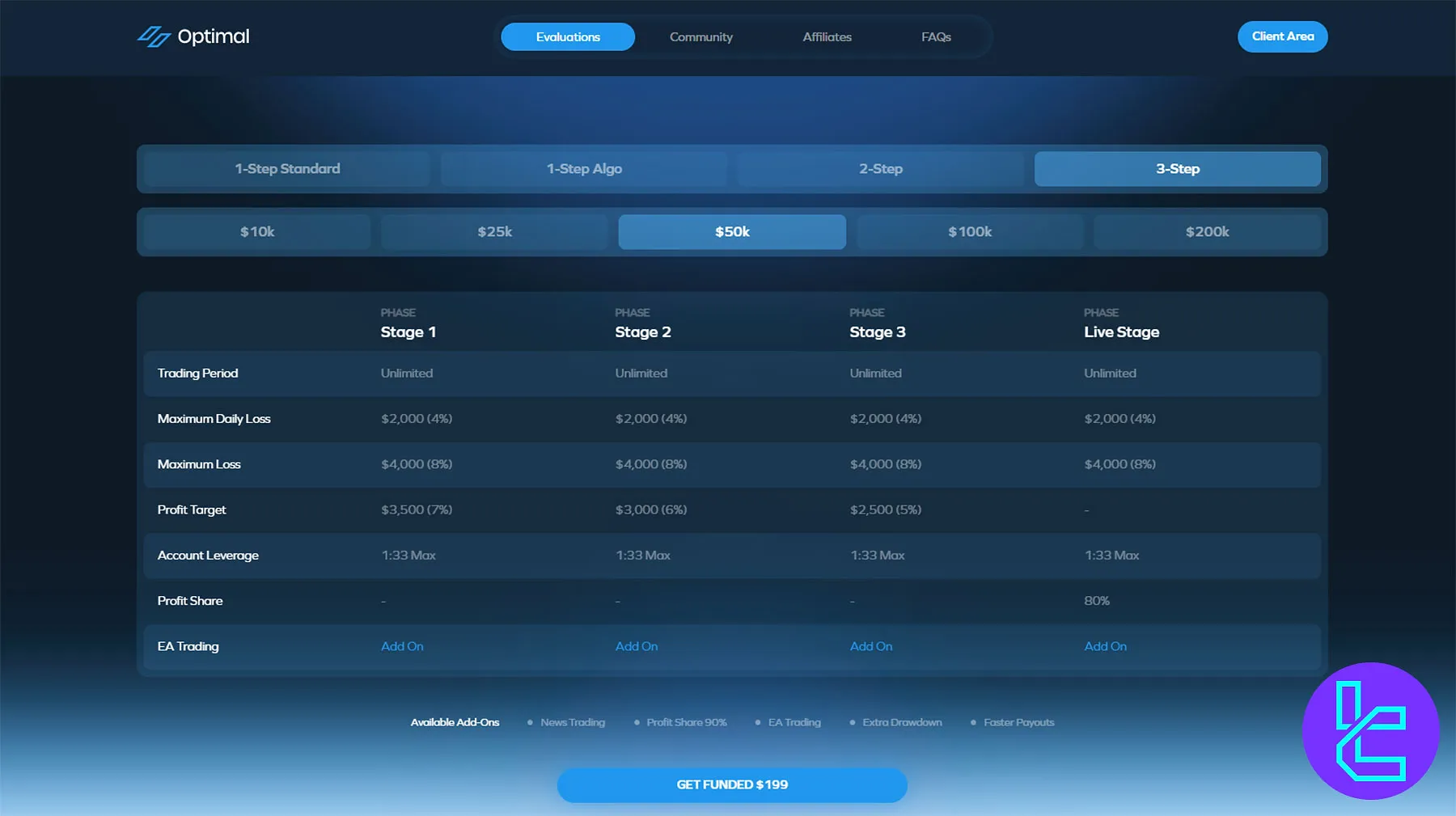

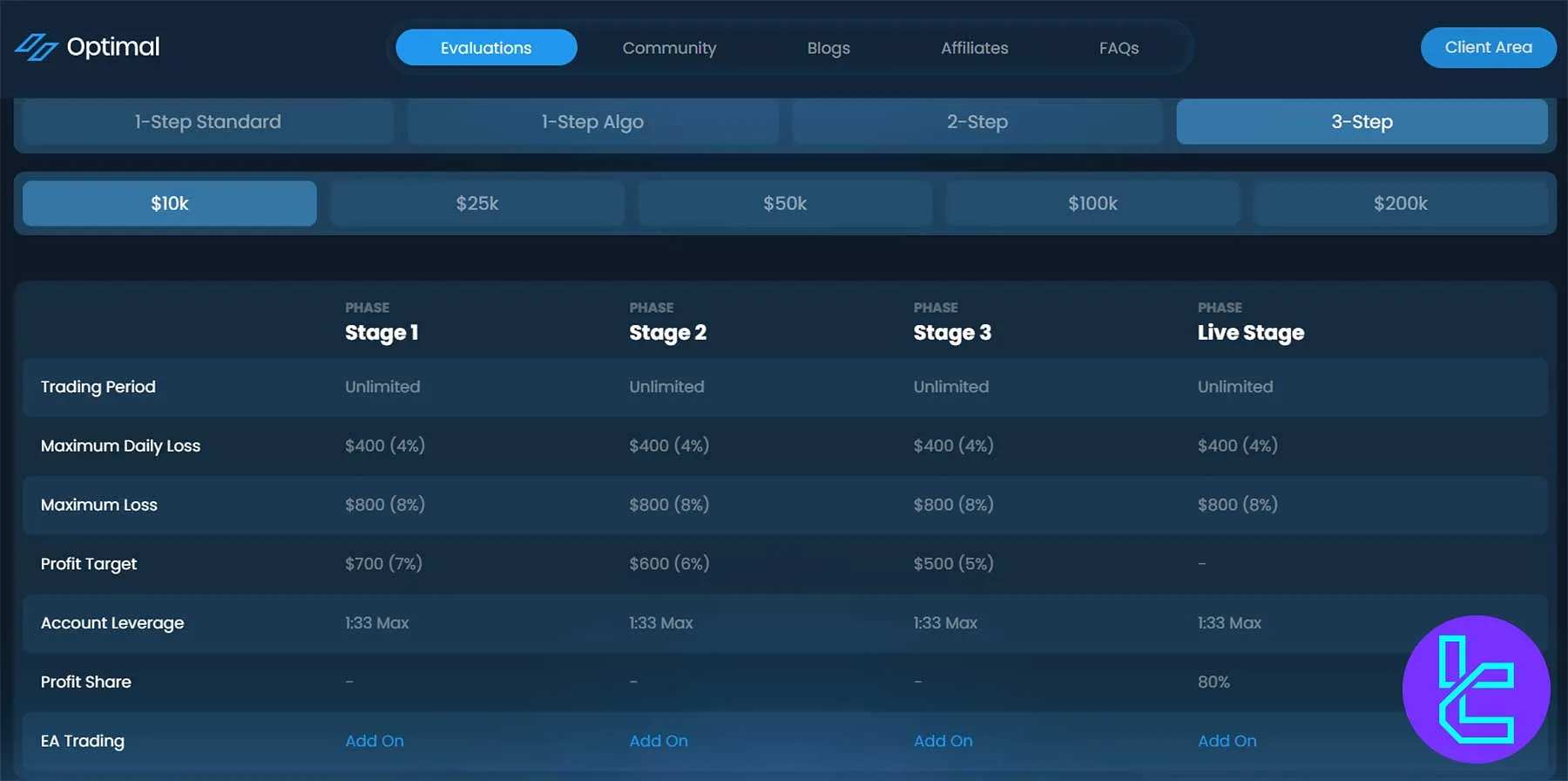

Optimal Traders 3-Step Program

The most comprehensive evaluation option, the 3-Step Program offers three progressive stages with gradually decreasing profit targets, ensuring consistency before traders access live funds.

Feature | Stage 1 | Stage 2 | Stage 3 | Live Stage |

Trading Period | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Daily Loss | 4% | 4% | 4% | 4% |

Maximum Loss | 8% | 8% | 8% | 8% |

Profit Target | 7% | 6% | 5% | – |

Account Leverage | 1:33 Max | 1:33 Max | 1:33 Max | 1:33 Max |

Profit Share | – | – | – | 80% |

EA Trading | Add-On | Add-On | Add-On | Add-On |

The 3-Step Program is ideal for traders who value long-term consistency and discipline, making it perfect for building robust strategies.

Optimal Traders Add-Ons

The prop firm offersup to five add-ons for its evaluation programs, allowing you to customize your trading experience by paying a higher challenge fee.

- 90% Profit Share: Increasing profit split from 80% to 90%

- News Trading: Allowing trading during news releases and high-impact events

- Faster Payouts: Reducing the payout frequency from 14 days to 7 days

- EA Trading: Enabling traders to utilize Expert Advisors (EAs)

- Extra Drawdown: Increasing daily loss limit from 4% to 5% and the maximum drawdown from 8% to 10%

Note: The 1-Step challenge comes with a special add-on offering the complete removal of the daily loss limit.

The availability of add-ons differs based on the challenge type. Optimal Traders add-ons:

Add-on | 1-Step Standard | 1-Step Algo | 2-Step | 3-Step |

News Trading | Yes | Yes | Yes | Yes |

90% Profit Share | Yes | No | Yes | Yes |

EA Trading | No | No | Yes | Yes |

Extra Drawdown | Daily drawdown removed | No | Yes | Yes |

Faster Payouts | Yes | No | Yes | Yes |

Bonuses and Promotions in Optimal Traders

As of the latest information available, the firm does not offer specific bonuses or promotions. This approach is similar to that of most other prop firms regarding bonuses. However, this might change in the future. Therefore, always check for any updates and changes.

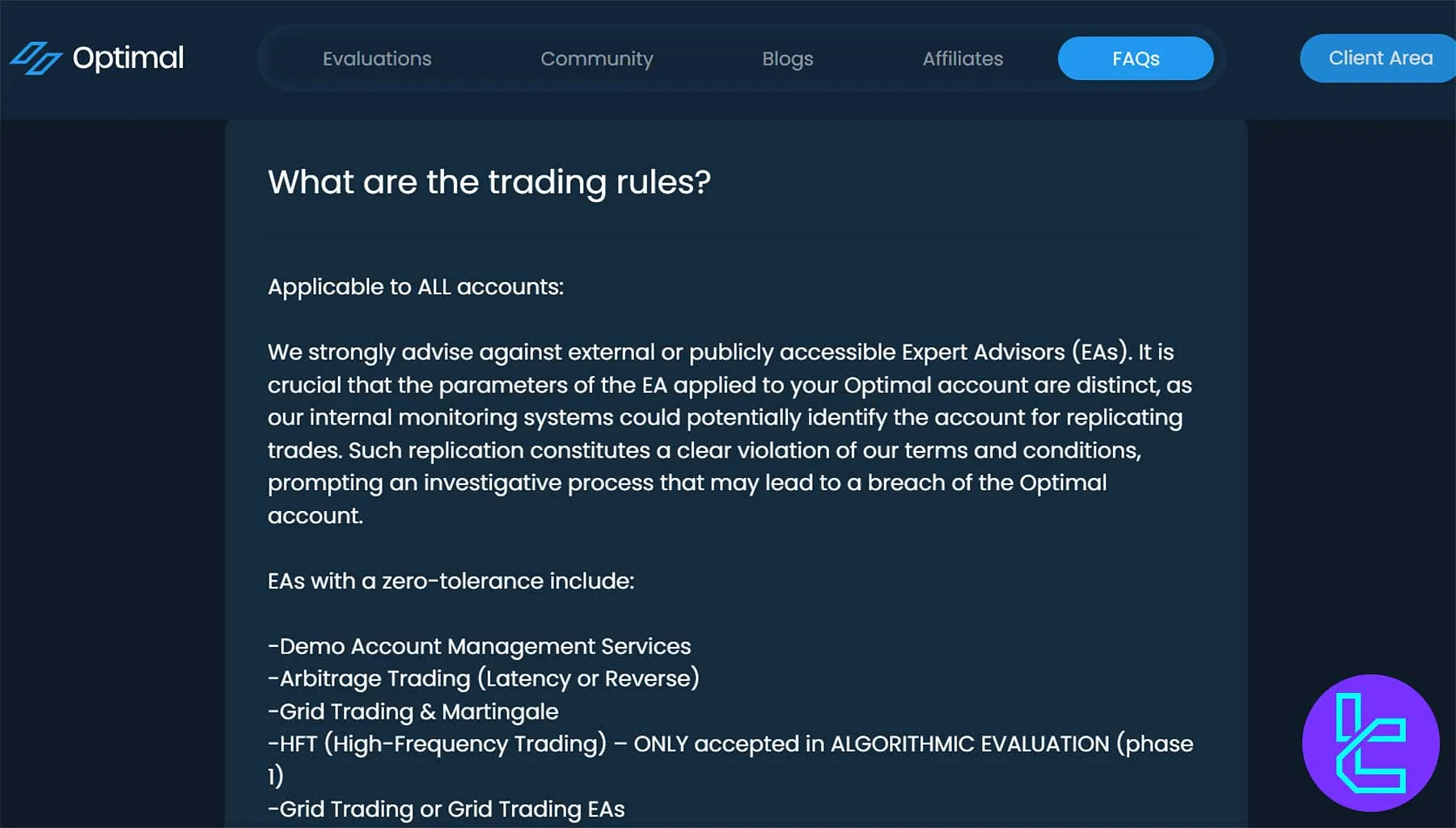

Optimal Traders Trading Rules

Traders must adhere to strict guidelines regarding VPN use, hedging, EAs, and news trading to ensure fair and compliant trading practices.

Violations of Optimal Traders rules may result in account restrictions or termination.

- VPN & IP: VPNs are allowed, but using them to bypass trading rules is prohibited. Changes in IP address require proof;

- Hedging: Risky strategies, including excessive margin and cross-account hedging, may lead to suspension;

- Expert Advisors (EAs): External EAs are prohibited, with specific types of trading banned;

- Martingale & Arbitrage: Strategies like martingale and arbitrage are not allowed; violations lead to deductions;

- News Trading: Restrictions apply to trading around red-folder news events; violations incur deductions;

- Payouts: Withdrawals are processed via bank transfers and crypto with thresholds of $100 and $50, respectively.

VPN Use & IP Address Policy

VPN and VPS services are permitted for trading activities; however, they cannot be used to bypass regulations related to:

- Copy trading

- Group trading

- Signal trading

If any violations are found as per our terms, accounts will be terminated. To prevent any issues with IP addresses, we recommend using a single device with a unique IP address throughout your trading.

Your IP address should match the geographical region for verification purposes. If a change in your IP address occurs, proof and reasoning for the change will be required.

Hedging in Optimal Traders

Aggressive trading methods that are deemed risky will undergo thorough reviews and may result in account suspension or termination.

Although there are no specific rules regarding maximum risk or consistency for all account types, high-risk trading, such as "all-in" positions or using excessive margin with minimal risk-reward ratios, will not be tolerated.

Trading behaviors that mimic gambling, such as mirror-hedging across different platforms or accounts, are strictly prohibited. This includes activities designed to profit from one account while incurring losses on another.

Such activities may lead to warnings, restrictions, or even permanent suspension from the firm's services.

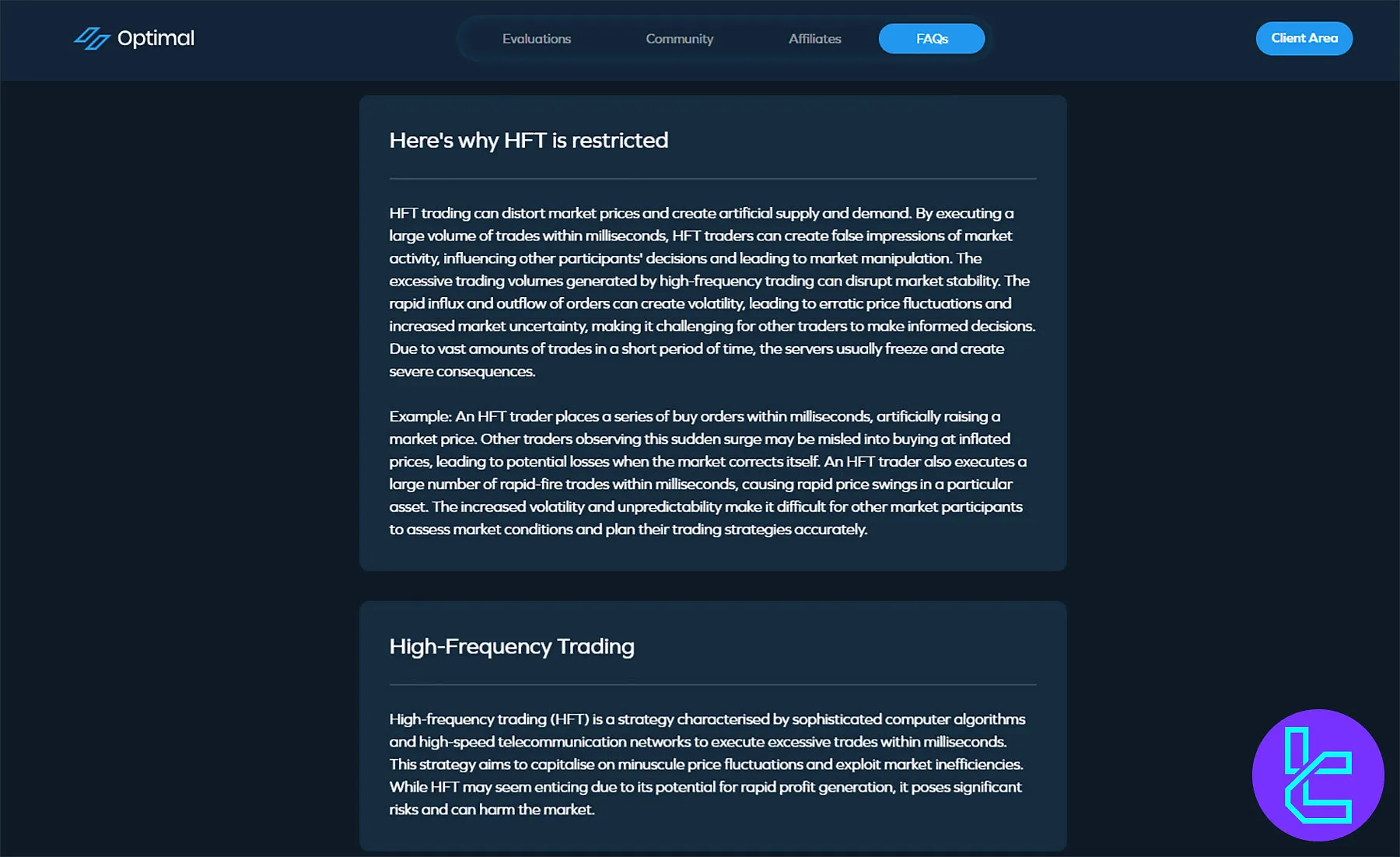

Expert Advisors (EAs)

We strongly advise against using external or publicly available Expert Advisors (EAs). Any attempts to replicate trades through EAs may result in a breach of our terms, triggering an investigation that could lead to account termination. Prohibited EAs:

- Arbitrage strategy (Latency/Reverse)

- Grid Trading & Martingale

- High-Frequency Trading (HFT)

These are all strictly prohibited in any of the trading phases.

Martingale and Arbitrage Strategies

Martingale strategy is where traders increase lot sizes after losing positions to try to recover losses. This approach is not allowed, and any breach will lead to trade deductions.

Any type of All-in gambling mentality and the following trading strategies will not be tolerated:

- Arbitrage

- Grid Trading

- Tick Scalping

News Trading

News trading is allowed, but only under specific conditions. Traders using news trading add-on are allowed to trade around news events, but there are restrictions if the news trading add-on is not enabled.

For such accounts, red folder news releases are restricted for 5 minutes before and after the news event.

Any trades executed during restricted news event windows will be subject to deductions if flagged.

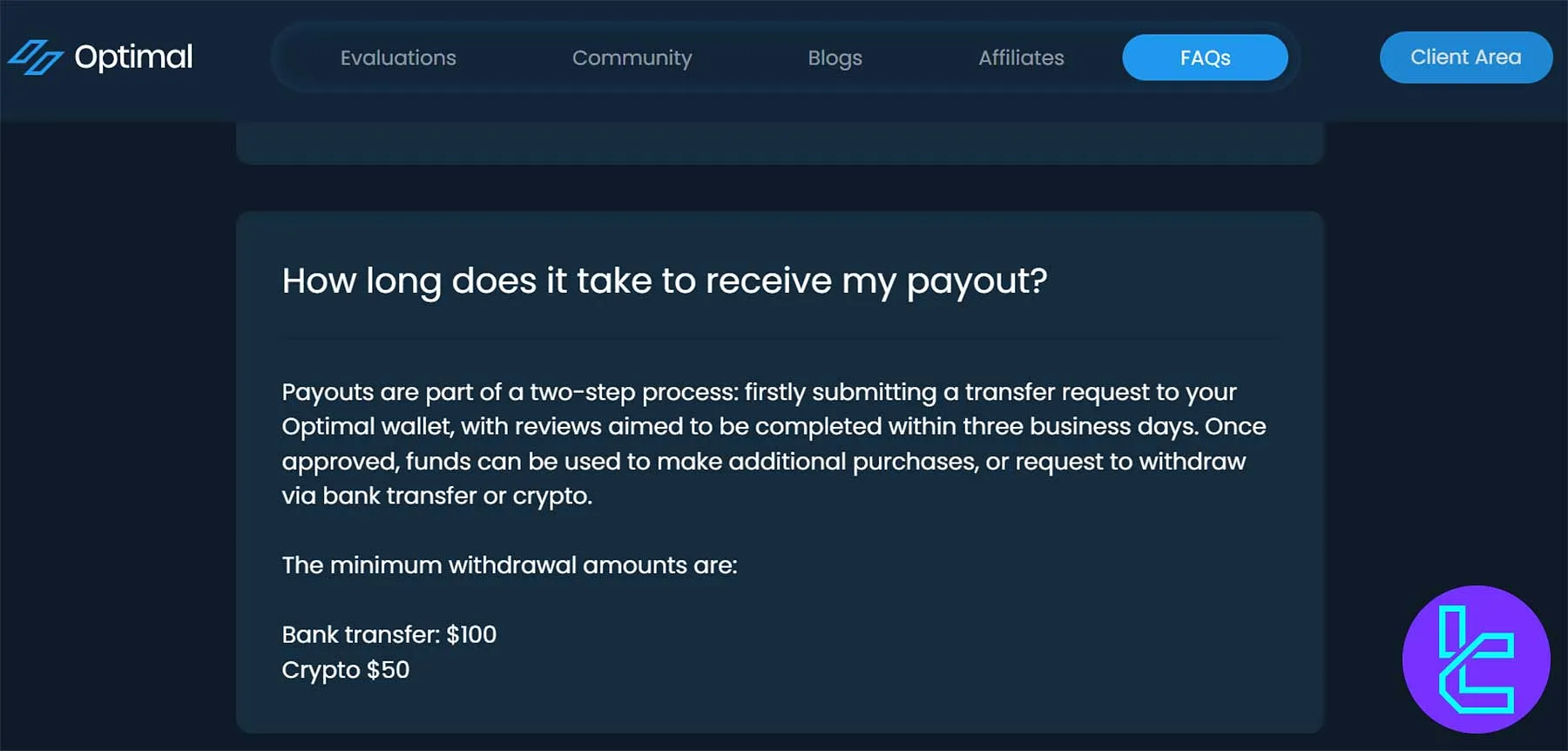

Optimal Traders Payout Policy

Optimal Traders ensures a smooth and transparent payout process, completing internal reviews within three business days. Traders can withdraw profits through bank transfer or cryptocurrency, with low minimum payout thresholds designed to make profit access fast and flexible.

- Processing Time: Reviews are completed within three business days before funds become available;

- Wallet Transfer: Payouts are first credited to the Optimal wallet before withdrawal;

- Withdrawal Methods: Bank transfer or cryptocurrency withdrawals supported;

- Minimums: $100 for bank transfers; $50 for crypto withdrawals;

- Flexibility: Funds can be used for additional purchases or trading challenges before withdrawing.

Optimal Traders Scaling Plan

The Optimal Trader Program features a dynamic account scaling model designed to reward consistent performance. Every time a trader achieves a 4% profit, their capital allocation increases by 25%, continuing this progression until reaching the maximum cap of $6.5 million.

Whether you start with a smaller or larger balance, the program offers a structured and transparent scaling roadmap tailored to each account size—empowering traders to grow steadily with their results.

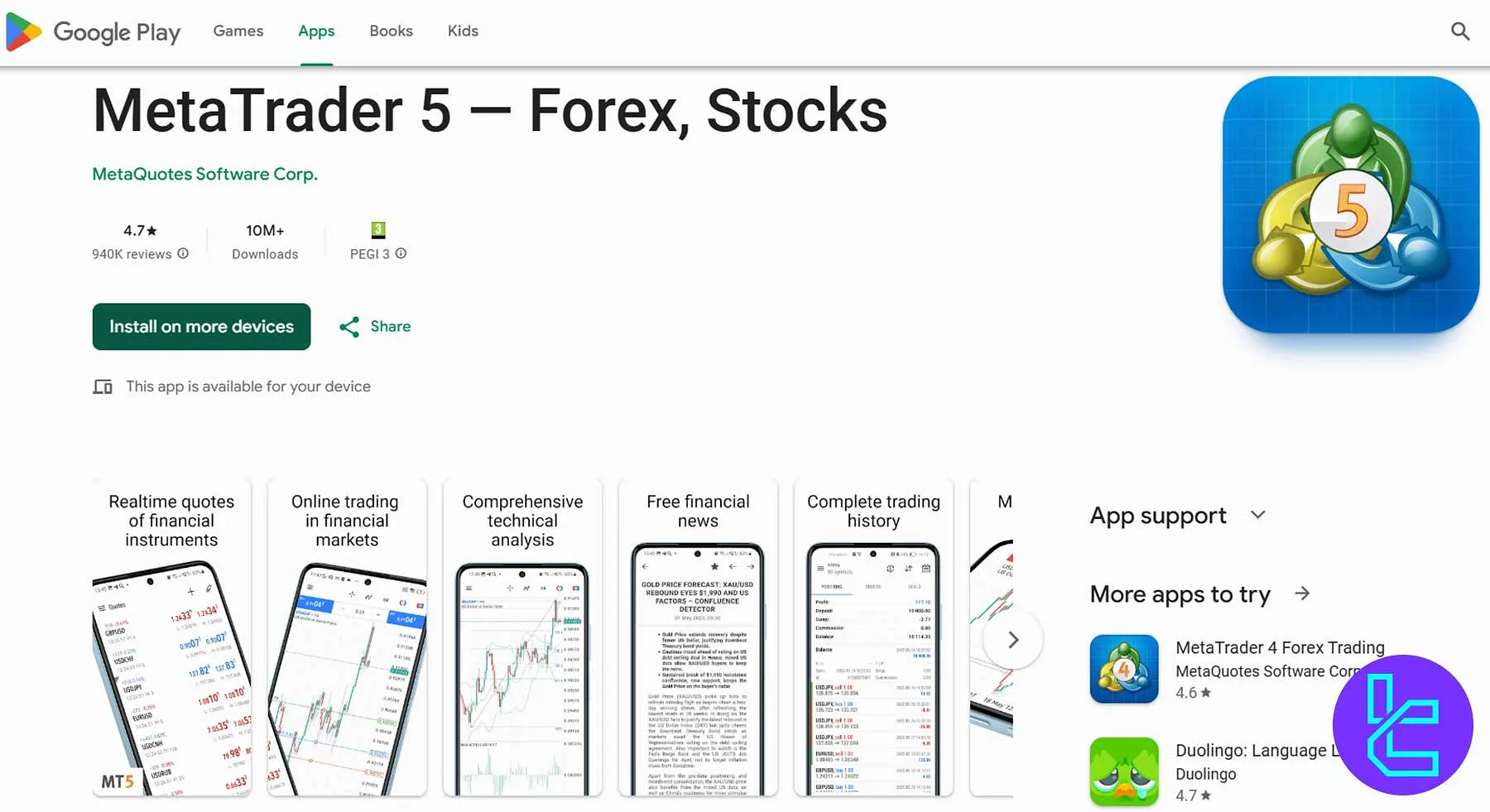

Trading Platform

Optimal Traders exclusively utilizes the MetaTrader 5 platform for its clients in passing evaluation. MT5 is a popular and much-used trading platform that offers:

- Advanced charting capabilities

- Access to multiple asset classes

- Custom indicators and Expert Advisors (EAs)

- Comprehensive strategy testing tools

- Depth of Market (DOM) functionality

- Multi-threaded strategy tester for EAs

- Built-in fundamental analysis tools

You can download MetaTrader 5 mobile from the Google Play Store and Apple App Store via the links below:

TradingFinder has developed a wide range of MT5 indicators that you can use for free.

Tradable Markets and Available Instruments

We investigated the website for any information and data related to the amount and variety of tradable assets in the prop firm and found nothing. The company does not reveal much information on its website, and this is a drawback.

It only hints that traders will gain access to the following asset classes:

- Forex market

- Metals

- Indices

Optimal Traders Leverage Offerings

Optimal Traders provides a consistent 1:33 leverage across all evaluation programs. This fixed leverage ensures balanced risk exposure, fair trading conditions, and scalable trading volume for both discretionary and algorithmic traders.

- Uniform Leverage: 1:33 across 1-Step Standard, 1-Step Algo, 2-Step, and 3-Step programs

- Risk Management: Designed to control drawdowns while maintaining trade flexibility

- Trader Friendly: Suitable for day traders, swing traders, and algorithmic strategies

- Consistency: Same leverage from evaluation phase to funded live account

What Options Do You Have For Payments on Optimal Traders?

Based on our investigations, you can make payments for challenge fees via these methods and solutions:

- Cryptocurrencies

- Credit/debit cards (Mastercard/VISA)

- American Express

- Discover

- JCB

How Does Optimal Traders Payouts Work?

Getting paid is a simple two-step process designed for speed and flexibility.

- Submit a transfer request to move your funds into your Optimal Wallet;

- Once approved, you can initiate a withdrawal via bank transfer or cryptocurrency.

Note: All transfer requests are typically reviewed within three business days.

To ensure smooth processing, the following minimum thresholds apply:

- Bank Transfer Withdrawals: $100 minimum

- Cryptocurrency Withdrawals: $50 minimum

Commissions and Costs

Optimal Traders is recognized for offering some of the lowest trading commissions in the industry. By directly passing on the raw brokerage costs from Raze Markets, traders benefit from a highly transparent and cost-effective trading environment.

- Live Funded Accounts: A flat commission of $3 per side applies to trades on Forex, Metals, and Indices;

- Challenge Phases: All evaluation stages are completely commission-free, enabling traders to focus fully on performance without any added cost.

This commission model positions Optimal Traders as a top choice for serious traders seeking low-cost, high-transparency trading conditions.

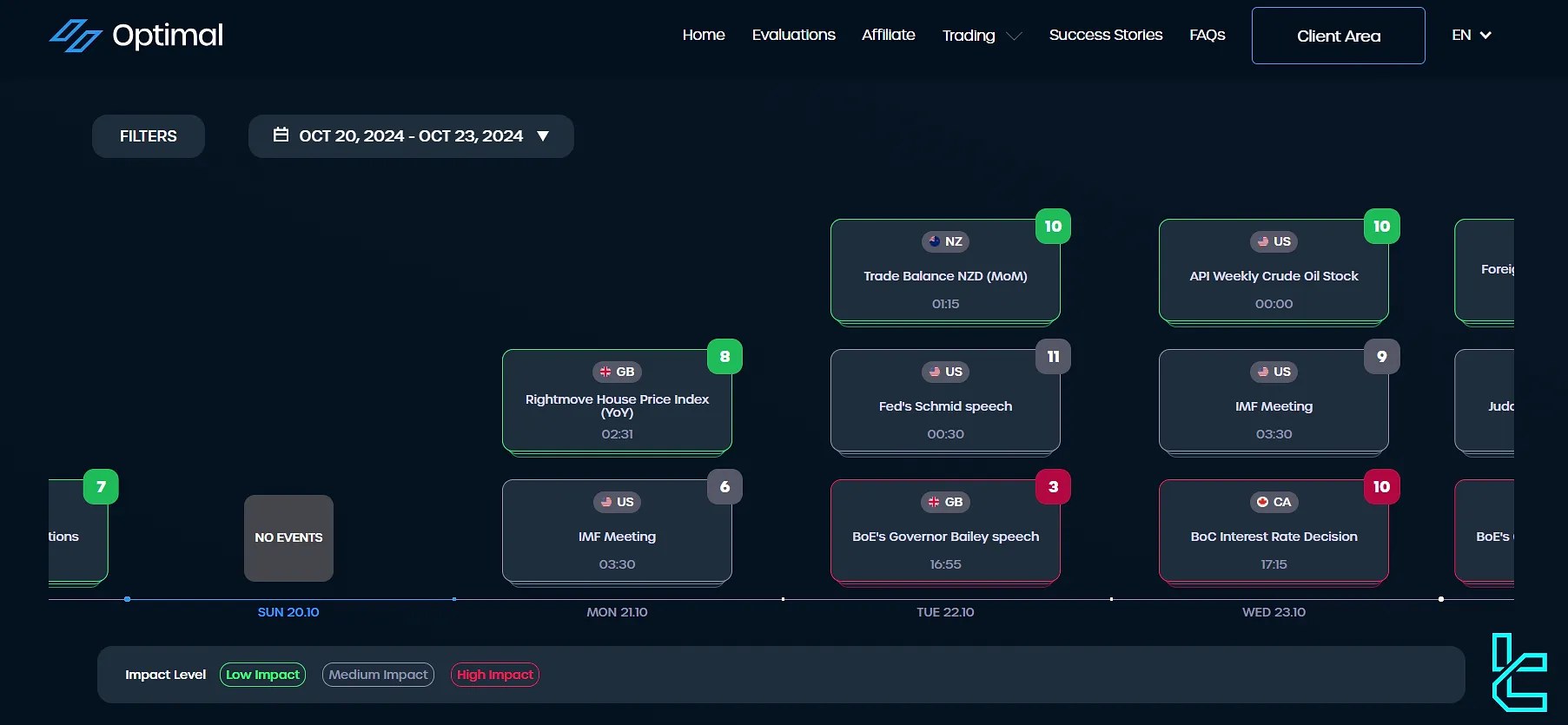

Are Comprehensive Education Resources Offered By Optimal Traders Prop Firm?

While the firm focuses primarily on providing trading opportunities, they do offer some educational resources:

- Blog: Regular articles covering market analysis, trading strategies, and platform tutorials

- FAQs: Answers to common questions about account types, trading rules, and platform features

- Economic Calendar: Up-to-date information on major economic events and their potential market impact

You can also use TradingFInder Forex education section for additional resources.

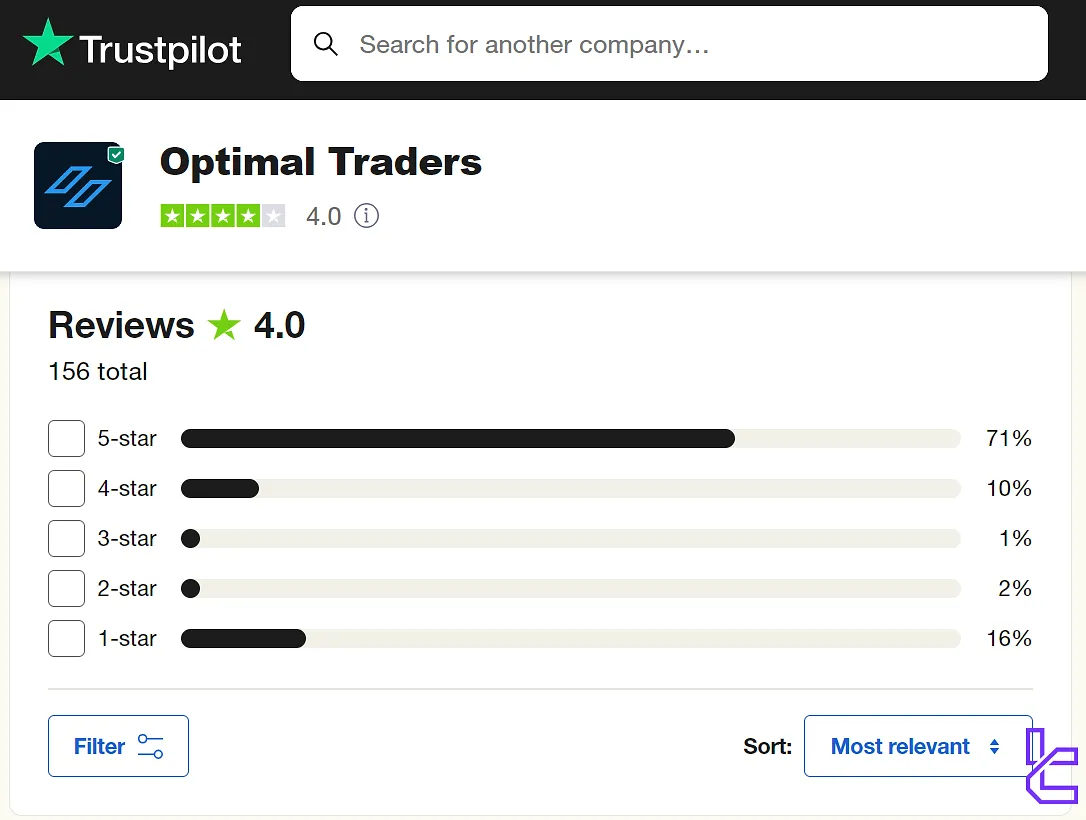

Trust Scores and Firm Evaluation on Platforms

The Optimal Traders Trustpilot profile has received a respectable score of 4.0 out of 5 stars, indicating generally positive feedback from users. Key Statistics:

- Over 150 reviews

- More than 70% of ratings are 5-star

- The firm asks for reviews, no matter positive or negative

- It has replied to 65%+ of negative comments

Overall, OT has achieved good results on the mentioned website. However, there are no reviews on other reputable platforms. This could be because of its short track record.

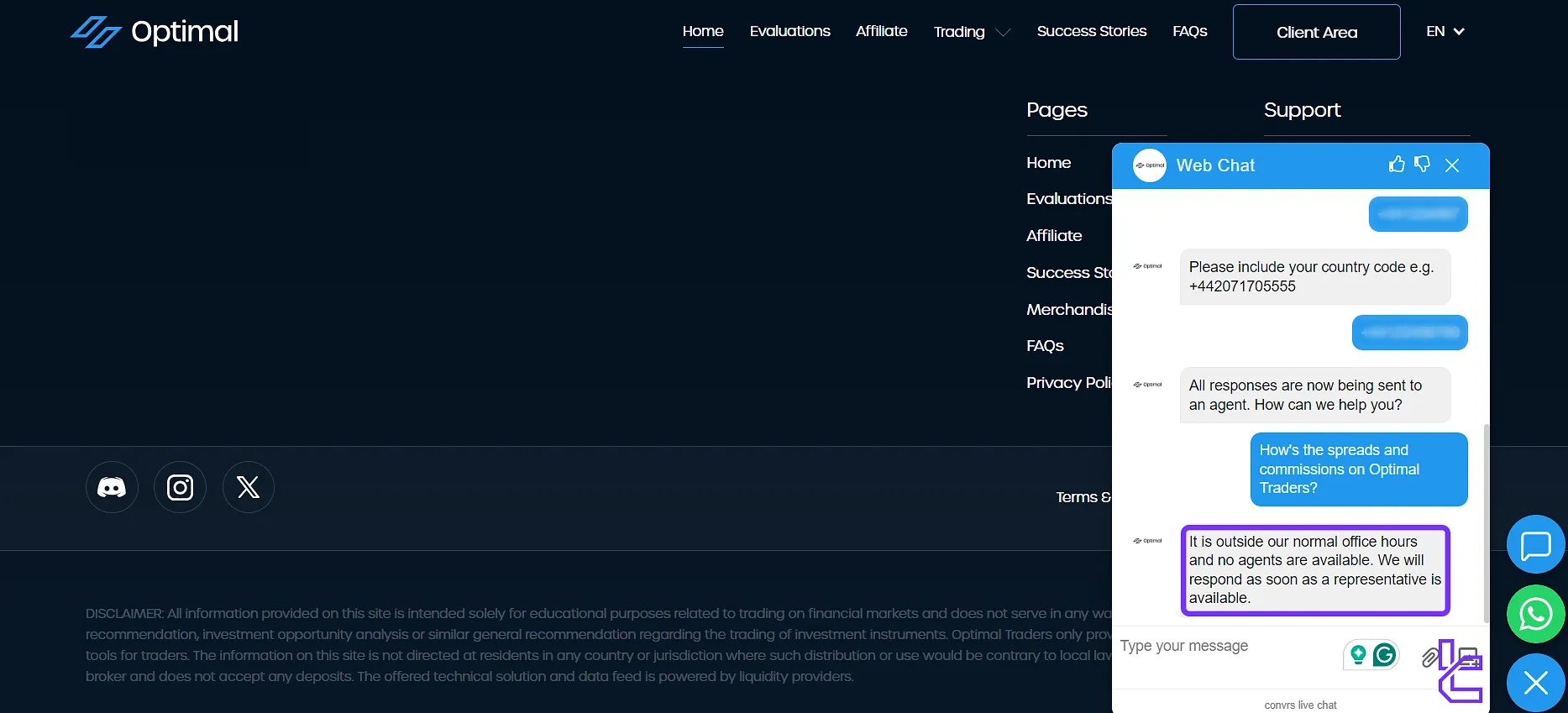

Customer Services; Contact Channels and Schedule

Usually, companies provide several contact channels for their support department. Support Channels in Optimal Traders:

Support Method | Availablity |

Live Chat | Yes (On the official website) |

Yes (support@optimal-traders.com) | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | No |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

The firm does not provide any phone support. It claims to offer services 24/7, but during our attempt to contact support via live chat, we got this reply:

Therefore, it appears that the company's claim is nothing more than what they have stated on their website. This is a major con in its quality of services.

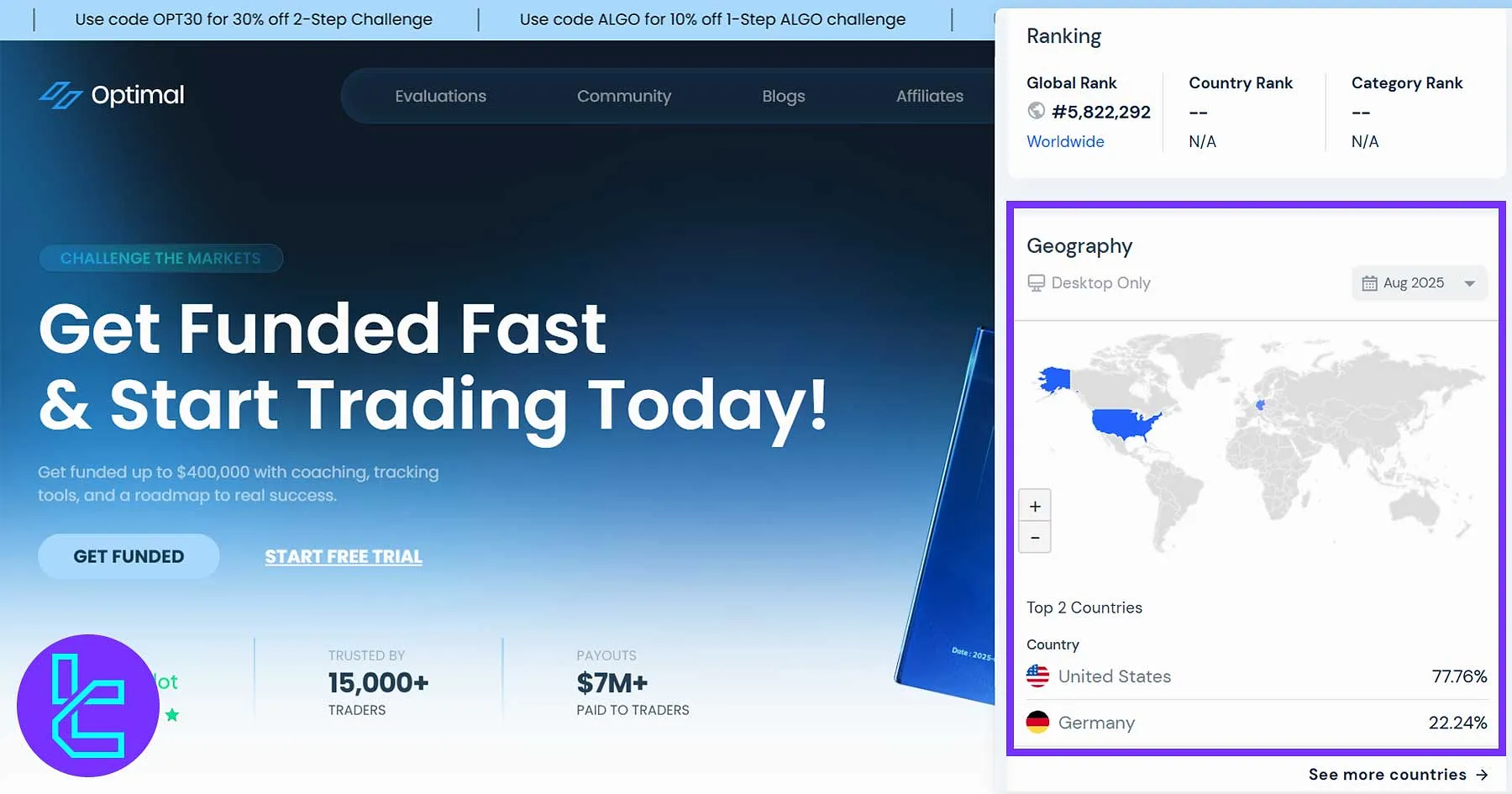

Optimal Traders User Base

Optimal Traders serves a global network of 15,000+ traders, paying out over $7M worldwide. Interestingly, despite US traders not being accepted, the platform records 77.76% of its traffic from the United States — a strong signal that many use VPNs or VPS solutions to access the site.

- Global Reach: Active traders from multiple regions, with Germany contributing 22.24% of traffic

- United States: Largest share of visits despite restrictions, likely via VPN/VPS usage

- Community Size: Trusted by over 15,000 traders globally

- European Presence: Germany leads among eligible users, reflecting strong EU engagement

- Future Plans: Dedicated solution for US traders expected in upcoming releases

Social Media Pages

Optimal Traders tries to post insights and updates on a few social network platforms. In the list below, we will provide links to each corresponding account:

Social Media | Members/Subscribers |

8,060 | |

9,121 | |

6,238 |

Optimal Traders vs Other Prop Firms

Let's check Optimal Traders' standing in the proprietary trading world in comparison with other prop firms:

Parameters | Optimal Traders Prop Firm | The5ers Prop Firm | BrightFunded Prop Firm | Crypto Fund Trader Prop Firm |

Minimum Challenge Price | $29 | $39 | €55 | $55 |

Maximum Fund Size | $6,500,00 | $250,000 | Infinite | $200,000 |

Evaluation steps | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step | 2-Step | 1-phase, 2-phase |

Profit Share | 80% | 100% | 100% | 80% |

Max Daily Drawdown | 4% | 5% | 5% | 4% |

Max Drawdown | 8% | 10% | 8% | 6% |

First Profit Target | 7% | 5% | 10% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | 5 Days |

Maximum Leverage | 1:33 | 1:100 | 1:100 | 1:100 |

Payout Frequency | 14 Days | Bi-weekly | 14 Days | 2 Times a Month |

Number of Trading Assets | N/A | 3000+ | 150+ | 200+ |

Trading Platforms | MetaTrader 5 | Metatrader 5 | Proprietary platform | Metatrader 5, CFT Platform and Crypto Futures |

Expert Suggestions

Optimal Traders, headquartered in Dubai, United Arab Emirates, has 2 additional offices in the United Kingdom and Uzbekistan. The company has received a 4/5 trust score on the Trustpilot platform.

MetaTrader 5 is the trading platform utilized by the prop firm. The first profit target in the 2-step Challenge is 8%.

Bi-weekly payouts, lack of a dedicated 24/7 support, limited trading instruments [Forex, Metals, Indices], and low Max leverage [up to 1:33] can be considered the drawbacks with Optimal Traders prop firm.