SDF Prop began operating as an Iranian trading academy in 2017. In 2023, they decided to launch their prop firm. Currently, SDF Prop offers one challenge with two steps. The minimum challenge price is $25, and the maximum capital is $25000.

SDF Prop Firm Company Information

SDF Prop, short for Sarmaye Digital Funding, began its journey in 2017 as a trading education academy in Iran. After several years of community growth and training, the company transitioned into the prop trading space in 2023.

Operating on a two-step challenge model, the prop firm now offers funding options with up to 80% profit share, while applying risk parameters such as 5% daily and 10% overall drawdown limits. SDF Prop distributes payouts monthly, and has positioned itself as a digital capital funding platform for both Forex and crypto traders.

SDF Prop Summary of Specification

SDF Prop’s structure reflects a standard prop firm model, with an accessible entry point for aspiring traders.

While the platform does not currently offer multiple challenge types or instant funding, it simplifies the process with a 2-step evaluation and offers diverse capital packages. SDF Prop Specifications Overview:

Account Currency | USD |

Minimum Price | $25 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Up to 80% |

Instruments | Forex Pairs, Cryptocurrencies |

Assets | 250+ |

Evaluation Steps | 2 Step |

Withdrawal Methods | USDT, IRT |

Maximum Fund Size | $25000 |

First Profit Target | 10% |

Max. Daily Loss | 5% |

Challenge Time Limit | 30 Days in First Step, 60 Days in Second Step |

News Trading | Allowed |

Maximum Total Drawdown | 10% |

Trading Platforms | N/A |

Commission Per Round Lot | Not Specified |

Trustpilot Score | Now Available |

Payout Frequency | Monthly |

Established Country | UAE |

Established Year | 2023 |

The platform remains in development, with SDF Prop tools, journals, and trading calculators expected to be added in the future for better trader assistance.

What are the SDF Pros and Cons?

Like any proprietary trading firm, SDF Prop offers a mix of strengths and areas that need refinement.

It stands out with its monthly payout model, but certain aspects such as platform information or third-party reviews remain underdeveloped. SDF Prop strengths and weaknesses:

Pros | Cons |

Offers up to 80% profit share | No clear information on trading platforms |

250+ assets including forex & crypto | Verification issues in registration process |

Monthly payouts for funded traders | Lack of trust scores on external platforms |

Designed for both beginners and pros | No current bonus or discount programs |

SDF Prop’s minimalist challenge structure and accessible pricing attract attention, but some users may hesitate due to transparency gaps in areas like trading terminals and fee structure.

SDF Prop Fundings and Price

One of the most competitive aspects of SDF Prop is its affordable entry pricing, designed to accommodate retail traders. With capital offerings starting from $2,000 to $25,000, the firm allows traders to join at their preferred comfort level. SDF fundings and price:

Funding | Price |

$2,000 | $25 |

$5,000 | $54 |

$10,000 | $86 |

$25,000 | $144 |

How to Open an Account in SDF Prop Firm? Step-by-Step Guide

Creating an account with SDF Prop can be done in 3 steps. Here’s a breakdown of the registration steps to help you join SDF Prop and get started on your evaluation challenge:

- Click on the “Register” Button on the Main Page;

- Provide Information;

- Write Your Phone Number.

#1 Click on the “Register” Button on the Main Page

To begin your journey with SDF Prop, head over to the official website and find the “Register” button in the top navigation bar. This will direct you to a form that initiates the sign-up process.

There’s no need to pay initially—just create an account to browse the dashboard and available challenge options.

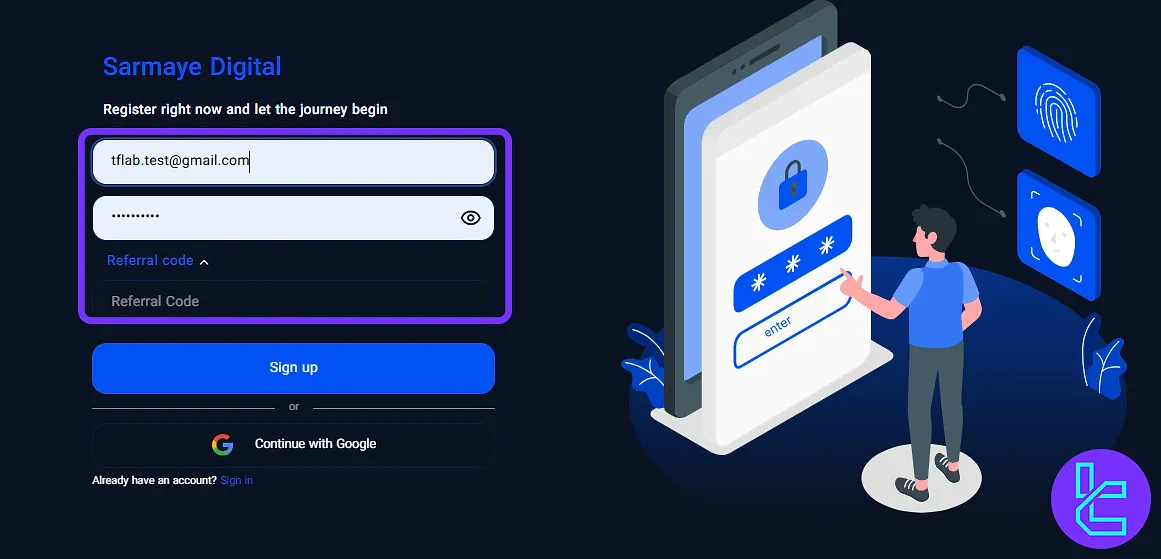

#2 Provide Information

The registration form asks for a few basic details:

- Email address

- Password

- Referral code (optional)

Note: Alternatively, users can sign up with their Google account for a quicker process.

#3 Write Your Phone Number

In this step, users are asked to enter their mobile number for verification purposes.

When entering the confirmation code, registration will be completed and you can buy your preferred plan.

SDF Prop Firm Challenges

SDF Prop utilizes a 2-step challenge model, similar to other leading prop trading firms, where traders must demonstrate discipline and profitability across two distinct evaluation stages.

The rules are transparent but flexible in terms of trading strategy, asset selection, and execution methods. While details on daily/weekly targets are not publicly available, the general structure aligns with standard industry practices. SDF Prop Firm challenge specifications:

Fundings | $2000 | $5000 | $10000 | $25000 |

Challenge Price | $25 | $54 | $86 | $144 |

Profit Target | 10% | 10% | 10% | 10% |

Maximum Daily Loss | 5% | 5% | 5% | 5% |

Maximum Overall Loss | 10% | 10% | 10% | 10% |

Minimum Trading Days | 5 Days | 5 Days | 5 Days | 5 Days |

Profit Share | 80% | 80% | 80% | 80% |

News Trading | Allowed | Allowed | Allowed | Allowed |

First Profit Withdrawal | 14 Days Later | 14 Days Later | 14 Days Later | 14 Days Later |

Bonus & Discounts

Currently, SDF Prop does not offer any bonus codes, seasonal promotions, or referral discounts. Traders must purchase the challenges at full price, with no incentives to reduce costs or encourage volume-based upgrades.

While this might be a drawback for some, it also reflects a transparent pricing model free of hidden conditions or limited-time offers. Users seeking bonus programs or referral incentives may consider watching the firm’s official channels for future announcements.

SDF Prop Rules

Aside from the basic rules of the challenges, including time, maximum daily, SDF Prop does not provide any additional information about the rules, such as hedging, the use of EA bots, and arbitrage trading.

The only common Prop Form rule mentioned on the company’s blog is news trading; users can trade news without any challenges.

SDF Prop Firm Trading Platforms

As of now, SDF Prop has not disclosed its trading platform partners or integrations. There is no official mention of MetaTrader 4, MetaTrader 5, cTrader, or web-based platforms on their website or documentation.

This lack of transparency may pose a concern for experienced traders who rely on specific platforms or EA trading strategy. While the firm’s local branding might indicate a simplified proprietary platform, this remains speculative until SDF Prop platform details are officially revealed.

How Many Assets are Available to Trade in SDF Prop?

SDF Prop provides access to over 250 tradeable instruments, spanning both forex market and cryptocurrency pairs. This asset selection positions the firm among the few that cater to multi-market traders.

Available Instruments Include:

- Major and Minor Forex Pairs

- Popular Crypto Assets

- Cross-Pairs and Exotic FX

The range is sufficient for both trend-based and mean-reversion strategies. However, the absence of detailed asset lists, spreads, or commission structure makes it difficult to assess the full competitiveness of these instruments.

What are the SDF Prop Fees?

No official information is currently available about trading fees, commissions, or spreads applied on SDF Prop accounts. The only available information about fees are the challenge prices, that we talked about in the previous stages.

Until clarified, users must assume trading costs are embedded in unknown spreads or applied on a per-account basis.

SDF Prop Educational Resources

While SDF Prop does not provide structured courses or masterclasses, it offers lightweight educational resources through its Help Center and Telegram channel. The focus is mostly on technical chart reviews, common trading tips, and Q&A threads for users during evaluations.

Key features of its education model:

- FAQ articles in the Help Center

- Telegram-based technical analysis of charts and community posts

This format suits traders who are already familiar with prop trading concepts, but it may fall short for absolute beginners seeking in-depth education or mentorship.

SDF Prop Firm Trust Scores

As of now, SDF Prop has not received any official trust scores from global review platforms such as Trustpilot or PropFirmMatch. This is likely due to its recent entry into the prop trading space and limited international exposure.

The absence of independent reviews makes it difficult to evaluate the user experience, funding reliability, or customer satisfaction levels.

As the firm matures and expands globally, its reputation across prop firm rating websites will likely become a critical factor for broader adoption.

SDF Prop Customer Support

SDF Prop offers multi-channel customer support, primarily targeting users in the MENA and Central Asia regions. The platform has adopted real-time communication tools to assist with registration, challenge questions, and payout clarifications.

Support Channels Include:

- Telegram

- Live Chat

While there is no mention of a 24/7 team or multilingual support, the firm’s responsiveness through Telegram and WhatsApp is relatively fast and informal—ideal for users familiar with these platforms.

SDF Prop on Social Media

SDF Prop maintains a presence on several social media platforms, focusing on both community engagement and trader education. These channels are used for announcements, chart analyses, and updates about rules or upcoming features.

SDF Prop active channels:

- Telegram

- X (Twitter)

- YouTube

Comparison of SDF with Other Prop Firms

To assess SDF Prop’s position in the global prop trading industry, the table below compares it with 3 popular competitors:

Parameters | SDF Prop | |||

Minimum Challenge Price | $25 | $49 | $32 | $100 |

Maximum Fund Size | $25000 | $1,500,000 | $4,000,000 | $2,000,000 |

Evaluation steps | 2-Step | 1-Step, 2-Step | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 80% | 90% | 95% | 100% |

Max Daily Drawdown | 5% | 4% | 5% | 5% |

Max Drawdown | 10% | 8% | 10% | 10% |

First Profit Target | 10% | 6% | 8% | 10% |

Challenge Time Limit | 30 Days in First Step, 60 Days in Second Step | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:125 | 1:100 | 1:100 |

Payout Frequency | Monthly | 14 Days | From 5 Days | 7 Days |

Number of Trading Assets | 250+ | 130 | 78 | N/A |

Trading Platforms | Not Specified | DXTrade, TradeLocker, cTrader | MT4, MT5, cTrader, MatchTarder | DXTrade, Tradelocker, MT5 |

While SDF Prop is more localized and limited in scale, its affordable entry, crypto support, and regional user base make it a rising competitor worth watching.

Conclusion

With its two-step challenge, flexible profit sharing [up to 80%], and monthly payout system, it offers up to $25000 capital to trade over 250 assets. To use SDF challenges, you must pay at least $25 and fly under the radar of 5% maximum daily loss.