SFX Funded has scalable accounts up to $3,200,000. The firm offers various funding methods, including credit/debit cards, cryptos (BTC, ETH, LTC, TRON, MATIC, USDC), and PayPal.

Forex leverage is set at 1:30, commodities at 1:10, and cryptocurrencies at 1:2.

Traders can expect commission fees such as $4 per lot for Forex and commodities, with indices having $0.4 per lot and cryptocurrencies being commission-free.

SFX Funded Prop Firm Company Overview

Founded in 2024 and headquartered in Dubai, UAE, SFX Funded has quickly made a name for itself in the competitive world of prop trading. What sets this prop firm apart is its commitment to providing traders with realistic and achievable goals, coupled with generous profit-sharing arrangements.

SFX Funded CEO

Husam Samy, founder and CEO of SFX Global and SFX Funded, leads one of Dubai’s most innovative prop trading and education ecosystems. With over 8 years of Forex trading experience and a background in civil engineering and aviation, he blends technical precision with strategic market insight to empower traders worldwide.

- Professional Background: Former engineer and commercial pilot, now a global trading educator and prop firm leader;

- SFX Funded: Provides traders up to $3.2 million in trading capital with a two-step evaluation or instant funding option;

- SFX Global: Delivers elite trading education through the Forex Momentum Mastery program and the Currencies & Coffee community (3,500+ members);

- Vision: To democratize access to capital and education, merging fintech innovation with practical trading growth.

SFX Funded Prop Firm Specifications Summary

Let's break down the key specifications of SFX Funded's offerings:

Account Currency | USD |

Minimum Price | $29 |

Maximum Leverage | 1:30 |

Maximum Profit Split | 100% |

Instruments | Forex, Crypto, Commodities, Indices |

Assets | 80 |

Evaluation Steps | 1-step, 2-step, Instant |

Trading Platform | Match Trader |

Withdrawal Methods | Credit/Debit Cards, Crypto, Local Payments |

Maximum Fund Size | $3,200,000 |

First Profit Target | 5% |

Maximum Daily Loss | 4% |

Challenge Time Limit | Variable based on the funding program |

News Trading | YES |

Maximum Total Drawdown | 8% |

Commission | $4 per lot for FX & Commodities |

Trustpilot Score | 4.6 out of 5 |

Payout Frequency | Every 14 days |

Established Country | UAE |

Established Year | 2024 |

SFX Funded Prop Firm Pros & Cons

Like any trading platform, SFX Funded has its strengths and weaknesses. Let's examine them:

Pros | Cons |

Realistic trading objectives | No exclusive educational content |

Scalable account sizes | High challenge price on Instant Funding |

Flexible trading paces | Limited supported languages |

High profit splits up to 100% | No Telegram support |

Despite these minor drawbacks, SFX Funded's unique approach and competitive advantages make it a strong contender in the prop firm industry.

SFX Funded Prop Firm Funding & Price

SFX Funded has revised its funding programs, resulting in 4 distinct plans with different evaluation stages and pricing. The cheapest SFX Funded plan is the Ignite $5K account, which costs $29.

Account Balance | Rapid (1-Step) | Ignite (2-Step) | Ascend (2-Step) | Instant Funding |

$1,250 | - | - | - | $65 |

$2,000 | - | - | - | $90 |

$5,000 | - | $29 | - | $195 |

$7,500 | $55 | - | $79 | - |

$10,000 | - | $59 | - | $395 |

$15,000 | $89 | - | $129 | - |

$20,000 | - | - | - | $795 |

$25,000 | - | $109 | - | - |

$30,000 | $139 | - | $199 | - |

$40,000 | - | - | - | $1680 |

$50,000 | - | $199 | - | - |

$60,000 | $210 | - | $299 | - |

$100,000 | - | $359 | - | - |

$120,000 | $338 | - | $499 | - |

Note: At the time of writing this SFX Funded review, the firm offers default discounts, ranging from 30% to 50% on all challenges. (The prices above are without discounts)

SFX Funded Prop Firm Registration & Verification

To start trading with SFX Funded, users must go through a streamlined onboarding process tailored for accessing funded trading challenges. All registrations are processed digitally and comply with KYC regulations. Step-by-step guide to SFX Funded registration:

#1 Visit the Official SFX Funded Website

Navigate to the homepage to explore funding plans with different account sizes and challenge rules.

#2 Select Your Funding Model

Choose the evaluation program that matches your strategy, risk tolerance, and budget.

#3 Fill out the registration form

Provide basic information, including:

- Name

- Country

- Trading platform

#4 Submit payment

Pay the corresponding one-time challenge fee using supported methods (e.g., Bitcoin, Ethereum, Visa, Master Card, PayPal, etc.).

#5 Complete Identity Verification

After passing the challenge phase, to withdraw profits, you'll be required to provide supporting documents, including:

- Proof of ID: Passport or Driver's license

- Proof of Address: Utility bill or Bank statement

SFX Funded Prop Firm Evaluation Steps

SFX Funded offers four funding programs: 1-Step (Rapid), 2-Step (Ignite and Ascend), and Instant plans.

All programs offer scalable account sizes and profit splits based on trading performance, with successful traders potentially earning up to 100% of their profits.

Parameters | Rapid (1-Step) | Ignite (2-Step) | Ascend (2-Step) | Instant Funding |

Trading Period | 7 Days (on evaluation) | 30 Days (each evaluation step) | Unlimited | Unlimited |

Max Daily Loss | 3% | 3% | 4% | 3% |

Max Drawdown | 4% | 8% | 8% | 6% |

Profit Target | 5% | 7% / 6% | 8% / 5% | None |

Leverage | 1:30 | 1:30 | 1:30 | 1:30 |

Payout Frequency | Bi-Weekly | Bi-Weekly | Bi-Weekly | Bi-Weekly |

Profit Split | Up to 100% | Up to 100% | Up to 100% | Up to 100% |

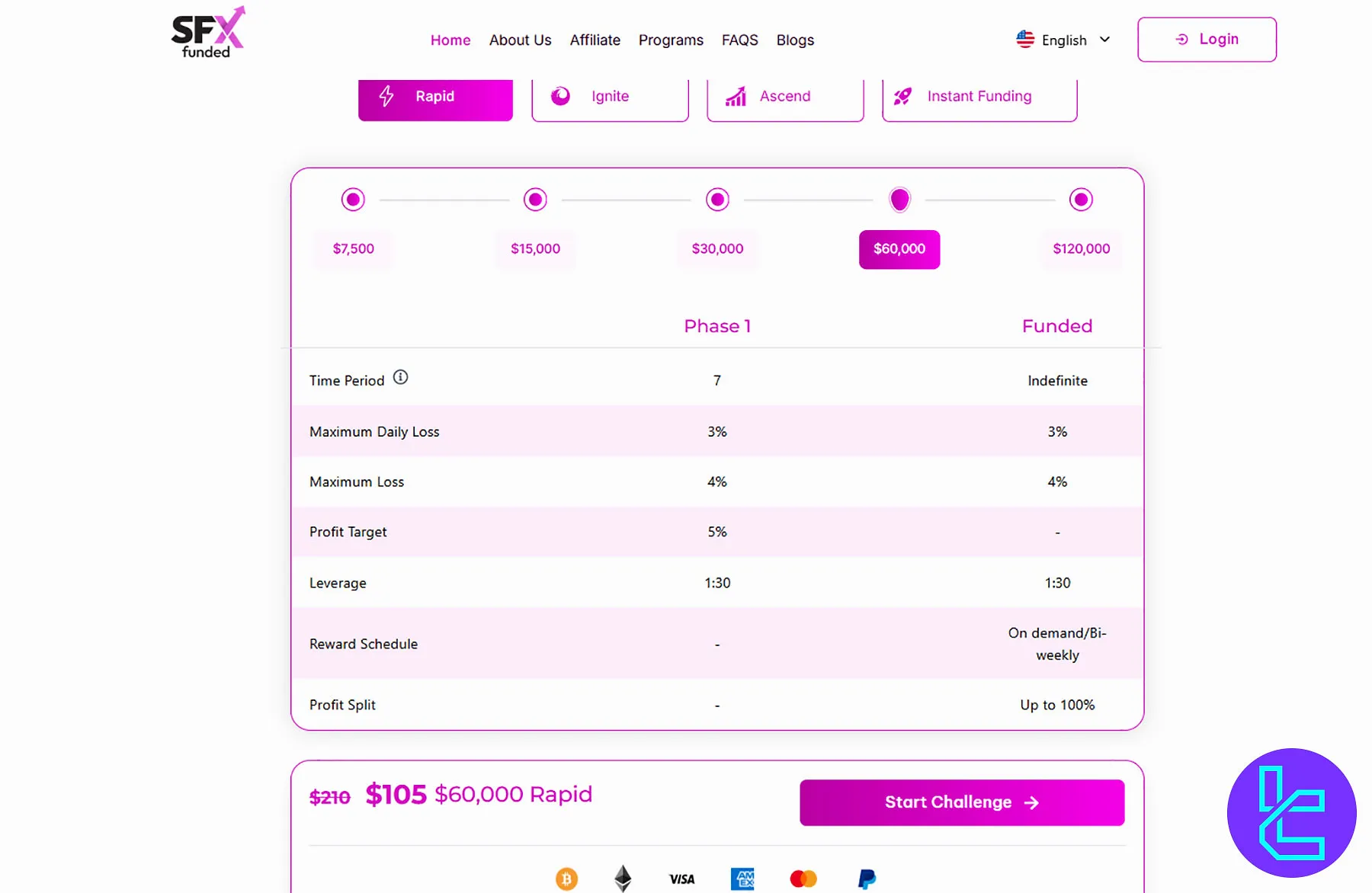

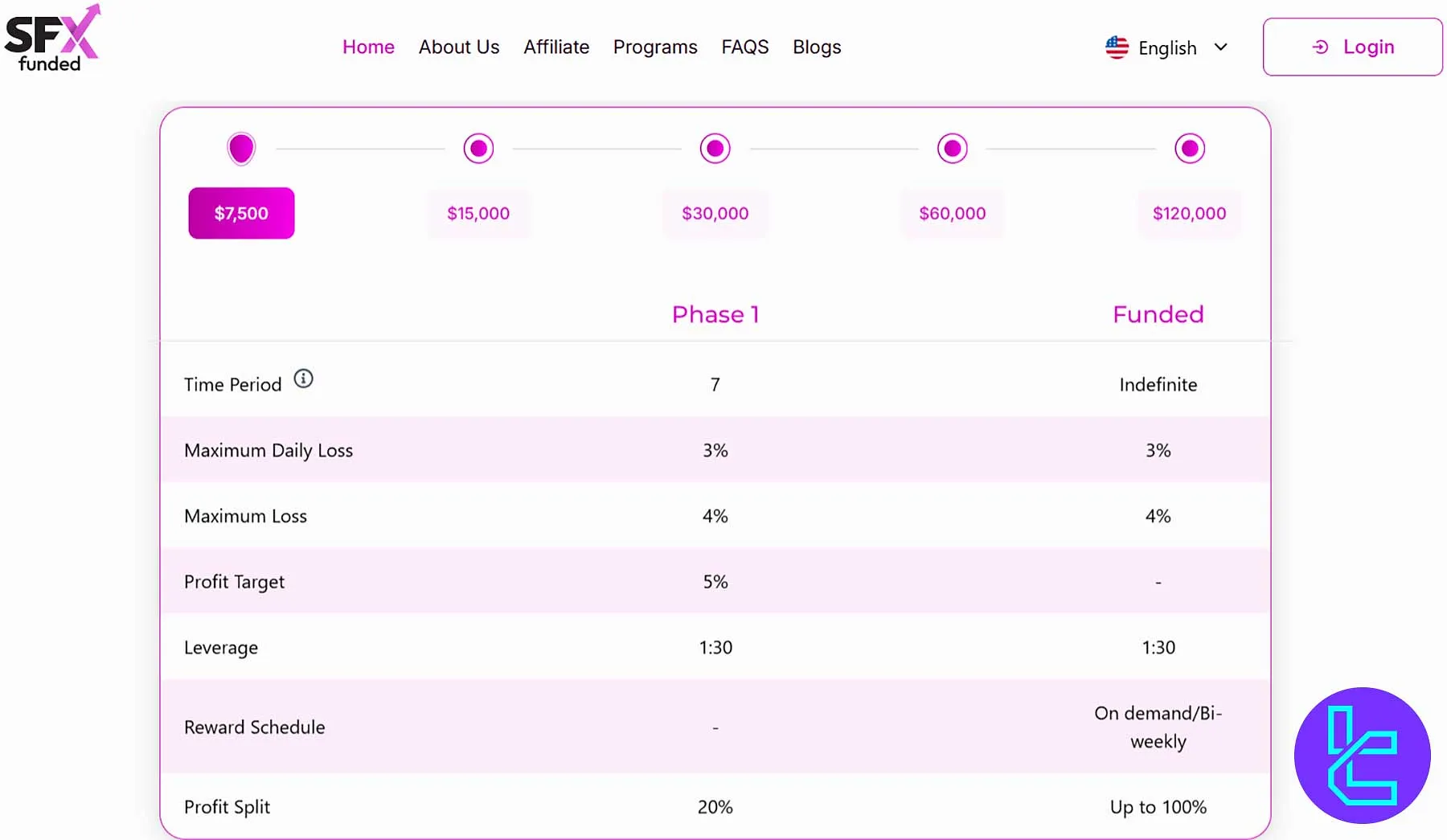

SFX Funded Rapid Challenge (1-Step Evaluation)

The Rapid Challenge offers traders the fastest route to funding, requiring only one evaluation phase completed within 7 days. It’s ideal for skilled traders seeking instant access to live accounts with minimal restrictions and high reward potential.

Trading Period | 7 Days (on evaluation) |

Max Daily Loss | 3% |

Max Drawdown | 4% |

Profit Target | 5% |

Leverage | 1:30 |

Payout Frequency | Bi-Weekly |

Profit Split | Up to 100% |

Traders who successfully complete this challenge gain immediate funding, making it perfect for those who value speed, skill, and efficiency.

SFX Funded Ignite Challenge (2-Step Evaluation)

The Ignite Challenge is a structured 2-phase program emphasizing strategy and consistency. Each phase lasts 30 days, testing traders’ discipline and adaptability while maintaining flexible risk limits and bi-weekly payout options.

Trading Period | 30 Days (each evaluation step) |

Max Daily Loss | 3% |

Max Drawdown | 8% |

Profit Target | 7% / 6% |

Leverage | 1:30 |

Payout Frequency | Bi-Weekly |

Profit Split | Up to 100% |

Designed for long-term profitability, the Ignite Challenge rewards steady performance with transparent evaluation metrics and rapid scaling opportunities.

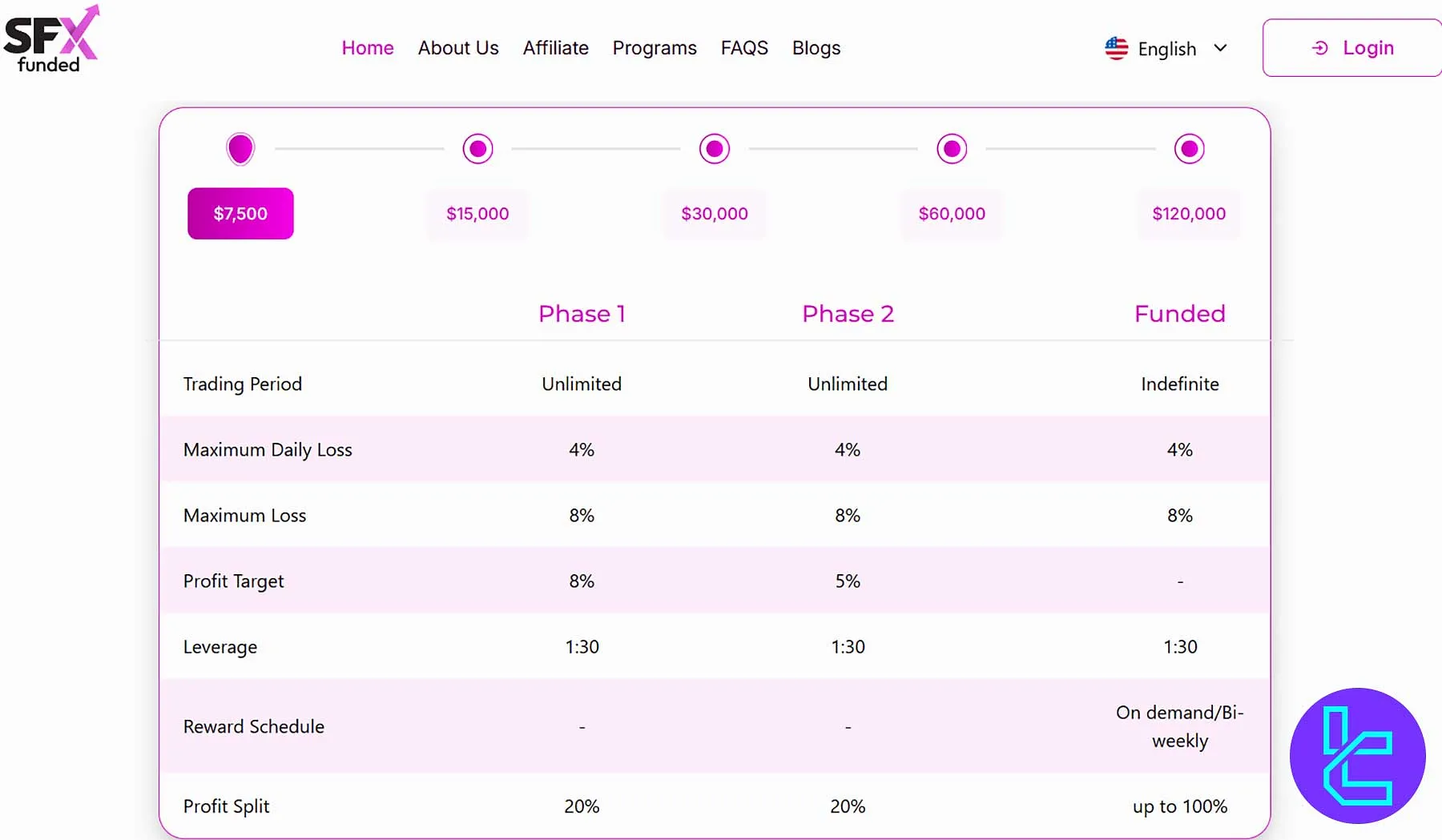

SFX Funded Ascend Challenge (2-Step Professional Plan)

The Ascend Challenge is tailored for professional traders aiming for growth with unlimited trading periods. It combines moderate risk parameters with a dual-phase model to ensure reliability and sustainable trading discipline.

Trading Period | Unlimited |

Max Daily Loss | 4% |

Max Drawdown | 8% |

Profit Target | 8% / 5% |

Leverage | 1:30 |

Payout Frequency | Bi-Weekly |

Profit Split | Up to 100% |

This program enables traders to scale confidently while demonstrating risk management and strategy mastery in real-market conditions.

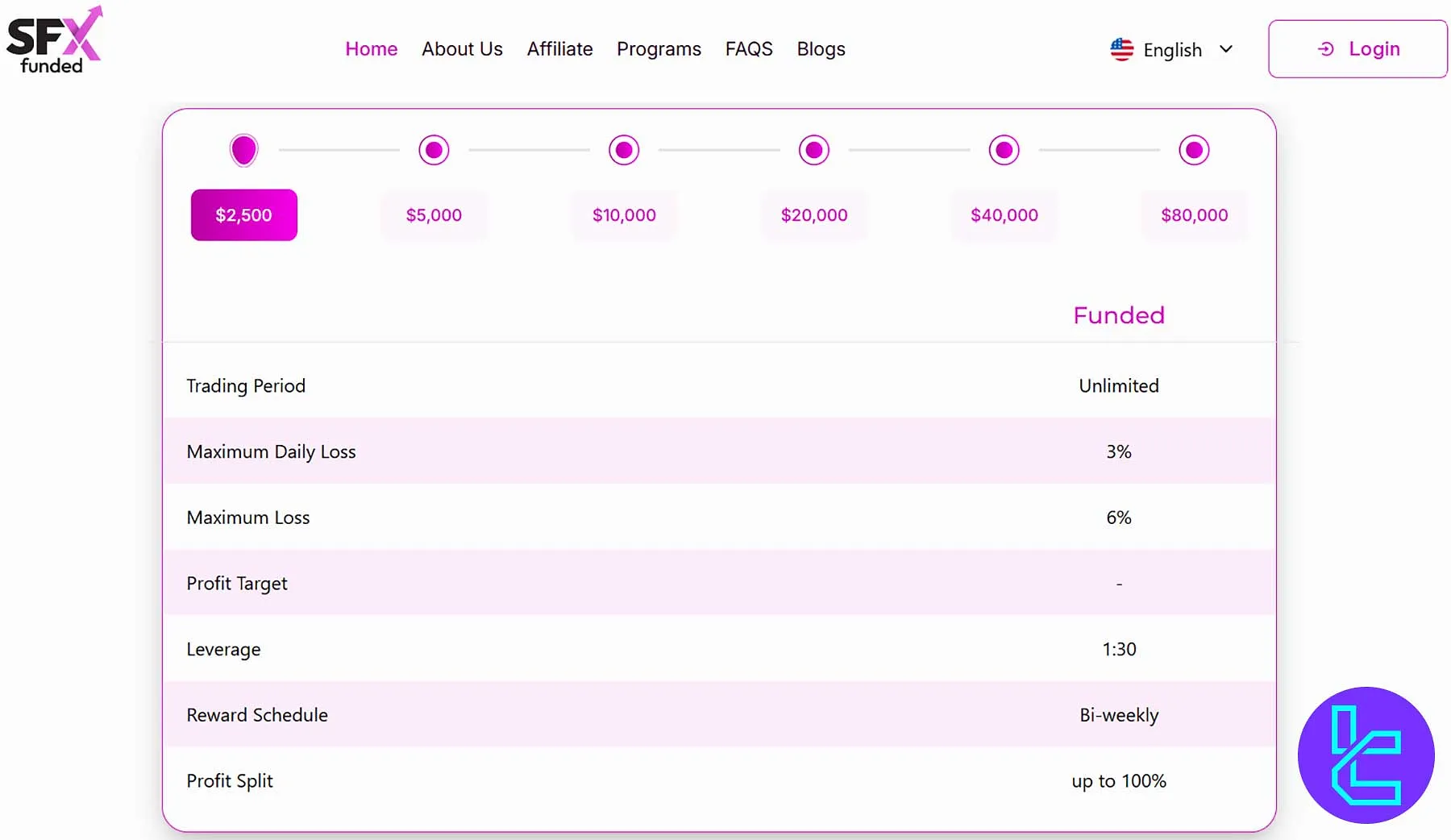

SFX Funded Instant Funding Program

The Instant Funding plan skips evaluations entirely, offering traders immediate access to live capital. With unlimited trading periods, balanced risk limits, and up to 100% profit share, it’s ideal for experienced traders ready to perform from day one.

Trading Period | Unlimited |

Max Daily Loss | 3% |

Max Drawdown | 6% |

Profit Target | None |

Leverage | 1:30 |

Payout Frequency | Bi-Weekly |

Profit Split | Up to 100% |

Perfect for seasoned traders, this program emphasizes trust and performance, providing instant access to trading capital without delay.

SFX Funded Profit Share

While the maximum profit split is 100%, it's only reachable through the prop firm's scaling program. SFX Funded starting profit share percentage:

- Rapid and Ascend: 80%

- Ignite: 75%

- Instant: 60%

SFX Funded On-Demand Payout

Ignite, Ascend, and Rapid Funded traders can request payment on demand for their first withdrawal. This allows for the first payout only after 3 trading days with the following conditions:

- Minimum profit of 3% is required;

- The profit split is 40%.

SFX Funded Challenge Time Limit

While the Ascend and Instant Funding programs have no time limit, the Rapid and Ignite programs have maximum durations of 7 days and 30 days, respectively.

Note that the time limit applies only to evaluation stages, and the figures mentioned are per step.

SFX Funded Prop Firm Bonuses and Discounts

At the time of writing this SFX Funded review, there is a default discount of 30% to 50% applied to all challenges. The firm also focuses on alternative incentives, such as a 15% commission-based affiliate program.

This affiliate program allows traders to earn a commission by referring new clients to the firm. Although it lacks the traditional bonuses that might reduce upfront costs for evaluations, this commission structure can create a steady income stream for those willing to promote the firm.

SFX Funded Trading Rules

The firm enforces strict policies on VPN use, hedging, Expert Advisors, Arbitrage strategies, and Martingale to ensure fairness and transparency.

Violations of the SFX Funded rules may lead to disqualification or account restrictions, maintaining the integrity of trader evaluations based on individual skills.

- VPNs and VPSs are prohibited to maintain location compliance and secure trade monitoring;

- Group hedging is banned to ensure fair evaluation of individual trader performance;

- Only self-developed EAs are allowed (No third-party and exploitative EAs);

- Martingale and arbitrage strategies are forbidden as they manipulate market conditions and risk management;

- News trading is restricted; no trades are allowed within 2 minutes before/after major news events.

SFX Funded Policy on VPN Usage

The use of VPNs (Virtual Private Networks) or VPSs (Virtual Private Servers) is strictly prohibited on all SFX Funded accounts. This policy ensures the integrity and security of trading operations.

A breach may result in immediate disqualification, permanent suspension, or loss of eligibility for future funded accounts.

If you are traveling and plan to use the platform, please notify the support team in advance of any IP address changes.

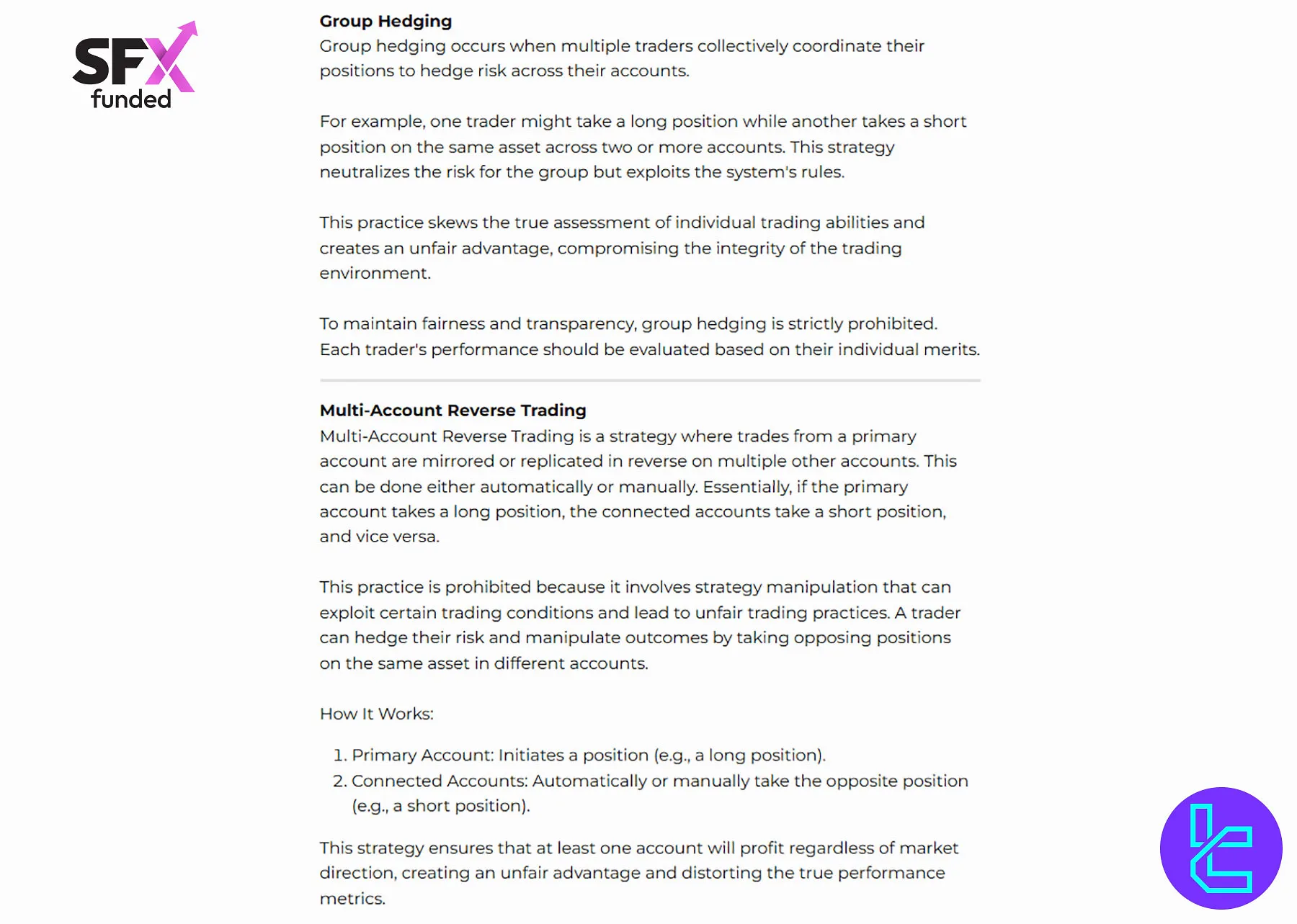

Hedging

Hedging and Group Hedging trades are not permitted in any SFX Funded accounts.

Group hedging occurs when multiple traders coordinate to hedge their positions across different accounts.

This tactic creates an unfair advantage by circumventing system rules and skews the true assessment of individual traders’ skills.

Expert Advisor (EA) Usage on SFX Funded

While Expert Advisors (EAs) are permitted as trade or risk managers, the use of third-party EAs is strictly prohibited.

Also, certain EAs that exploit specific market conditions are prohibited, such as

- Market Rollover Scalping EAs: These manipulate market conditions during rollover periods;

- News Scalping EAs: EAs that use rapid scalping techniques during major news events are not allowed;

- EAs Without Source Code Ownership: You must own the source code of the EAs used for transparency and integrity.

Martingale and Arbitrage Strategies

Both the Arbitrage and Martingale strategies are strictly prohibited. Martingale involves adding more positions when the price moves against the initial trade, with the aim of recovering losses when the price returns to the entry point.

Arbitrage involves exploiting price discrepancies for the same or similar assets across different exchanges. This practice is illegal and manipulative.

News Trading

News trading is permitted during the challenge phase, but it comes with strict restrictions. You cannot open or close trades within 2 minutes before or after any major news release, especially those categorized as "red-folder" events.

In case of violation, you'll get up to 2 warnings on Rapid accounts, and a single warning on Instant Funding accounts. If you repeat, you'll be disqualified.

There will be no compensation for trades executed during restricted news trading windows. Therefore, risk management is critical to avoid breaches of loss limits.

You can use TradingFinder's Economic Calendar to keep track of major economic news.

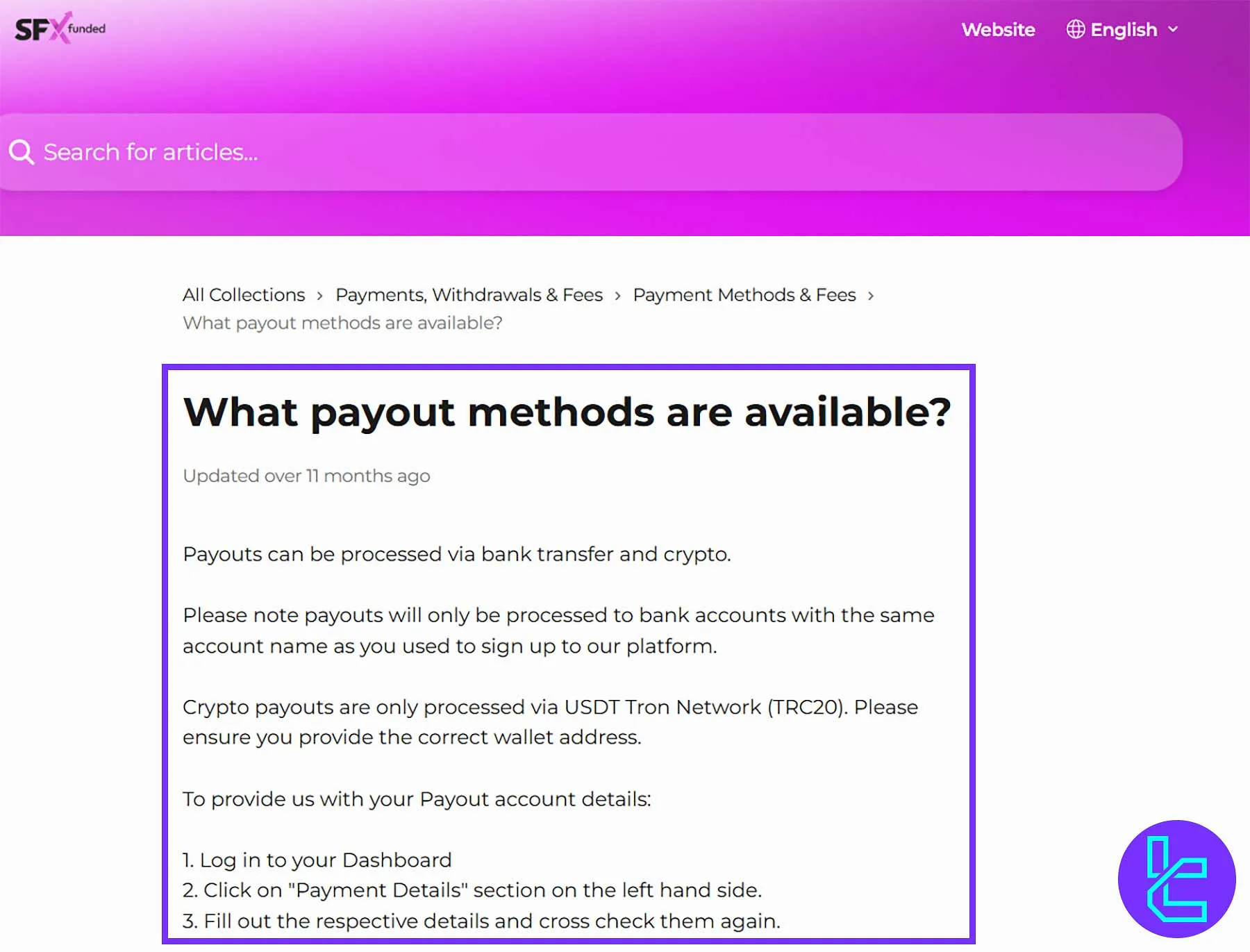

SFX Funded Payout Rules

SFX Funded provides one of the most trader-centric payout systems in the prop trading industry, offering profit splits from 65% to 100%, bi-weekly withdrawal options, and even on-demand payouts. The firm rewards consistent performance and transparency across all its funding programs.

- Profit Splits: Up to 100% in Rapid, Ignite, and Ascend Challenges, and up to 100% in Instant Funding accounts (starting at 65%). Payouts remain fixed until traders scale their accounts under official scaling rules;

- Payout Eligibility: Traders can request theirfirst payout after 21 business days, with bi-weekly withdrawals thereafter—provided they meet minimum trading day and profit thresholds (2–3%);

- On-Demand Payouts: Available after 3 trading days and a 3% profit, starting at a 40% split and upgrading to 80% after the first payout;

- Bonus Profit Share: Consistent traders earn a20% Challenge Phase Bonus after completing 5 successful funded payouts;

- Withdrawal Options: Bank transfer and USDT (TRC20), processed within 48 business hours to verified accounts only;

- Partial Withdrawals: Allowed above the 2% minimum threshold, following each plan’s payout schedule.

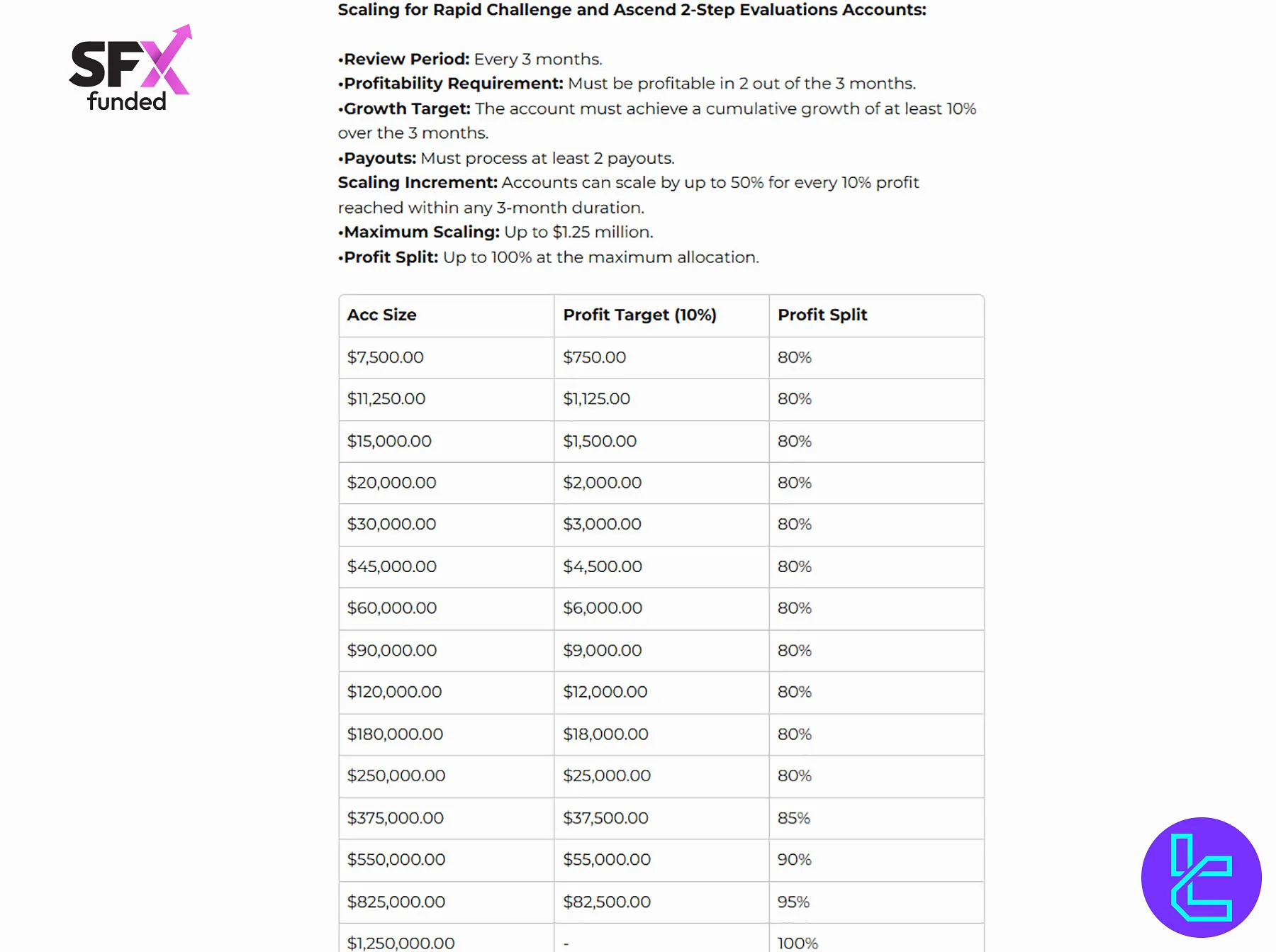

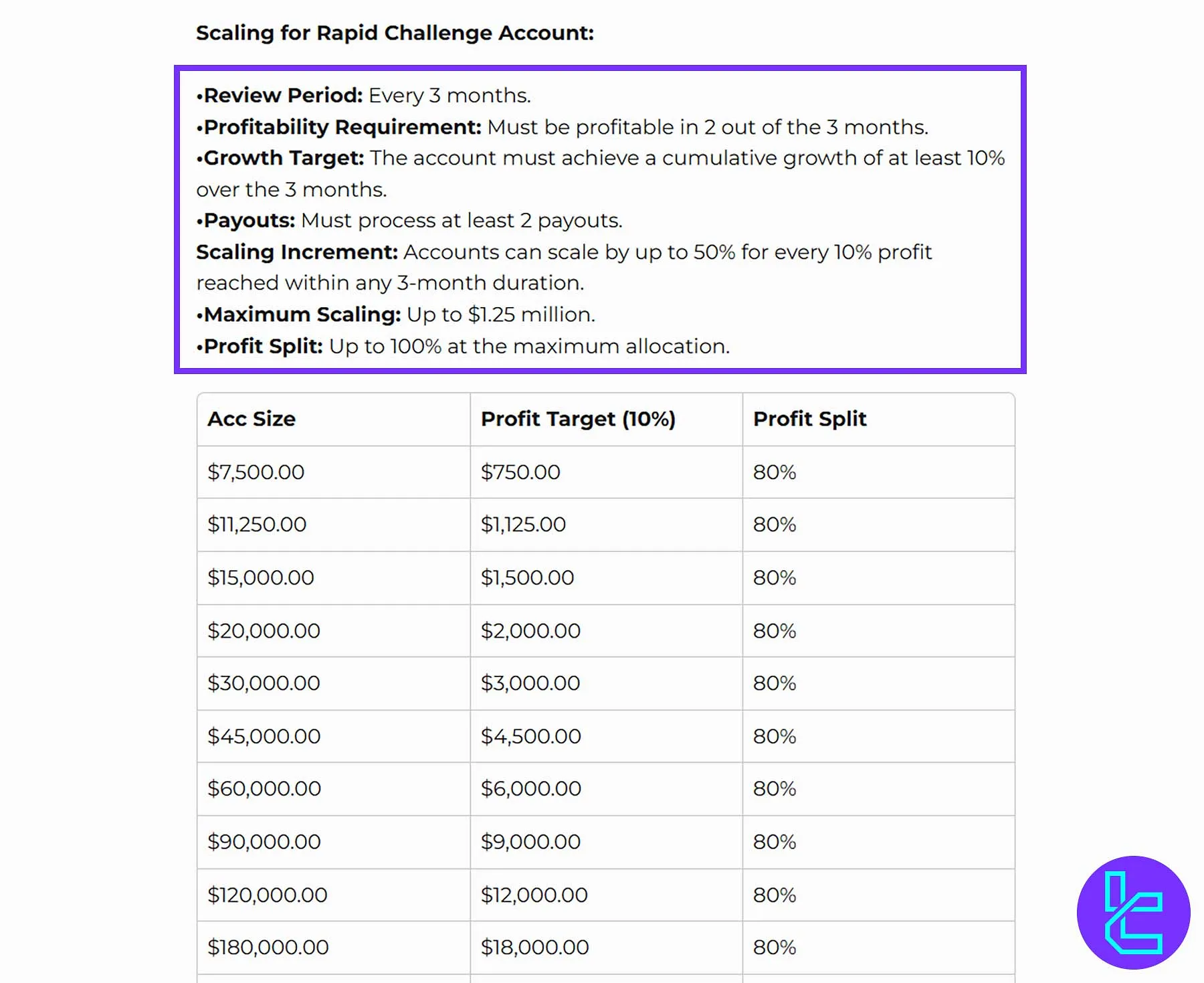

SFX Funded Scaling Program

While the prop firm allows scaling of Rapid, Ascend, and Ignite programs up to $1.25M, the Instant Funding account offers a significantly higher cap at $3.2M. To scale your SFX Funded account, you have to adher to the following rules:

- The review period is every 3 months;

- 2 out of 3 months must be profitable;

- A cumulative growth of 10% over the course of 3 months is required;

- You must withdraw profits at least 2 times

- Scaling is up to 150% of the starting balance in each step;

- The maximum fund allocation is $1.25M for Ascend, Ignite, and Rapid;

- The maximum fund allocation is $3.2M for Instant Funding;

- The profit share increases to 100% only after reaching the maximum scale size.

SFX Funded Prop Firm Trading Platforms

SFX Funded Prop Firm uses Match Trader as its primary trading platform, offering traders a range of features:

- Robust and user-friendly interface

- Advancedcharting tools

- Customizable layouts

- Real-time market data

- Seamless integration with various instruments (Forex, Commodities, Indices, Cryptocurrencies)

- Efficient strategy execution and position management

- Competitive features and reliable performance

While not as widely known as MetaTrader, Match Trader offers competitive features and reliable performance, making it a solid choice for SFX Funded’s traders.

What Instruments & Symbols Can I Trade on SFX Funded Prop Firm?

SFX-funded prop firms offer the following tradable instruments:

- Forex (FX)

- Commodities

- Indices

- Cryptocurrencies

This setup provides competitive pricing and flexible leverage for traders.

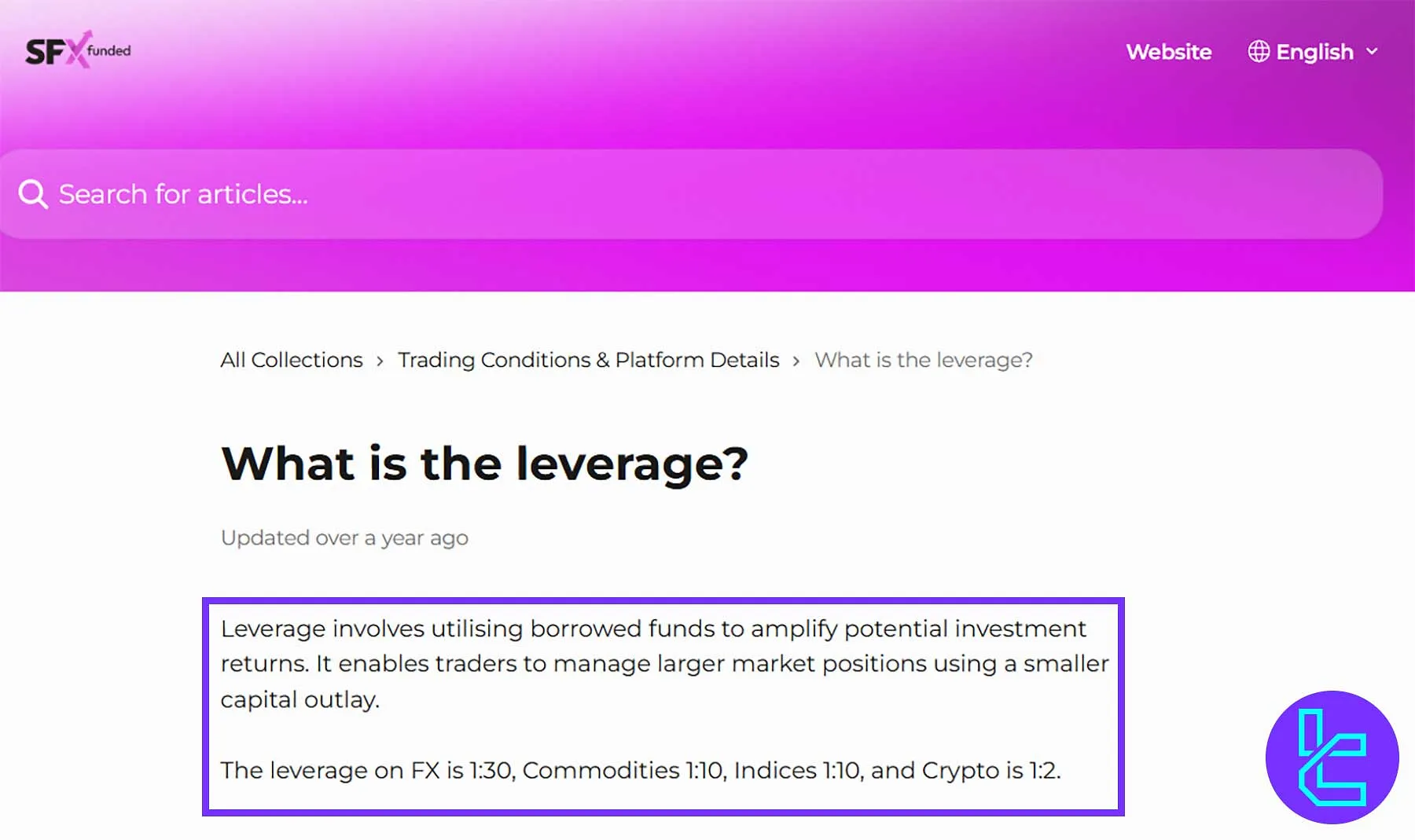

SFX Funded Leverage Offerings

SFX Funded provides traders with balanced and transparent leverage ratios across major asset classes, allowing both flexibility and control. By using leverage effectively, traders can access larger positions while maintaining responsible risk management aligned with global trading standards.

- Forex (FX): 1:30 leverage, ideal for active currency traders seeking precision and controlled exposure

- Commodities: 1:10 leverage, suitable for gold, oil, and other tangible assets with moderate volatility

- Indices: 1:10 leverage, enabling balanced exposure to global markets such as NASDAQ or S&P 500

- Cryptocurrency: 1:2 leverage, designed for high-risk digital asset trading with enhanced protection

These tailored leverage levels reflect SFX Funded’s focus on sustainable trading performance, ensuring every trader can scale safely and efficiently.

SFX Funded Prop Firm Payment Methods

SFX Funded supports various payment methods for deposits and withdrawals:

Region | Payment Methods |

Global | Credit/Debit Cards (Visa, Mastercard with 3D Secure), Cryptos (BTC, ETH, LTC, TRON, MATIC, USDC), PayPal |

South Africa | Card, EFT, Snapscan, Masterpass |

Rwanda | MTN, Airtel, All Banks |

Kenya | Card, M-PESA |

Ghana | Momo, Bank Transfer |

Nigeria | Card, Bank Transfer |

SFX Funded Prop Firm Commission & Costs

SFX Funded maintains a transparent fee structure:

Instrument | Leverage | Spreads | Commission |

Forex (FX) | 1:30 | Raw spreads | $4 per lot |

Commodities | 1:10 | Raw spreads | $4 per lot |

Indices | 1:10 | - | $0.4 per lot |

Cryptocurrencies | 1:2 | - | free |

It's important to note that while there are commission fees, the high profit splits (up to 100%) can offset these costs for successful traders.

Does SFX Funded Prop Firm Offer Vast Educational Resources?

SFX Funded Prop Firm offers limited educational resources but provides valuable learning opportunities through its simulated funded accounts. These accounts allow traders to practice and improve their skills in a real-world setting.

The firm also fosters a supportive community focused on growth and education, encouraging traders to share unique trading strategies and systems. This collaboration helps SFX enhance itsresearch and development of proprietary trading strategies, benefiting all traders on the platform.

You can check TradingFinder's Forex education section for free and comprehensive learning materials.

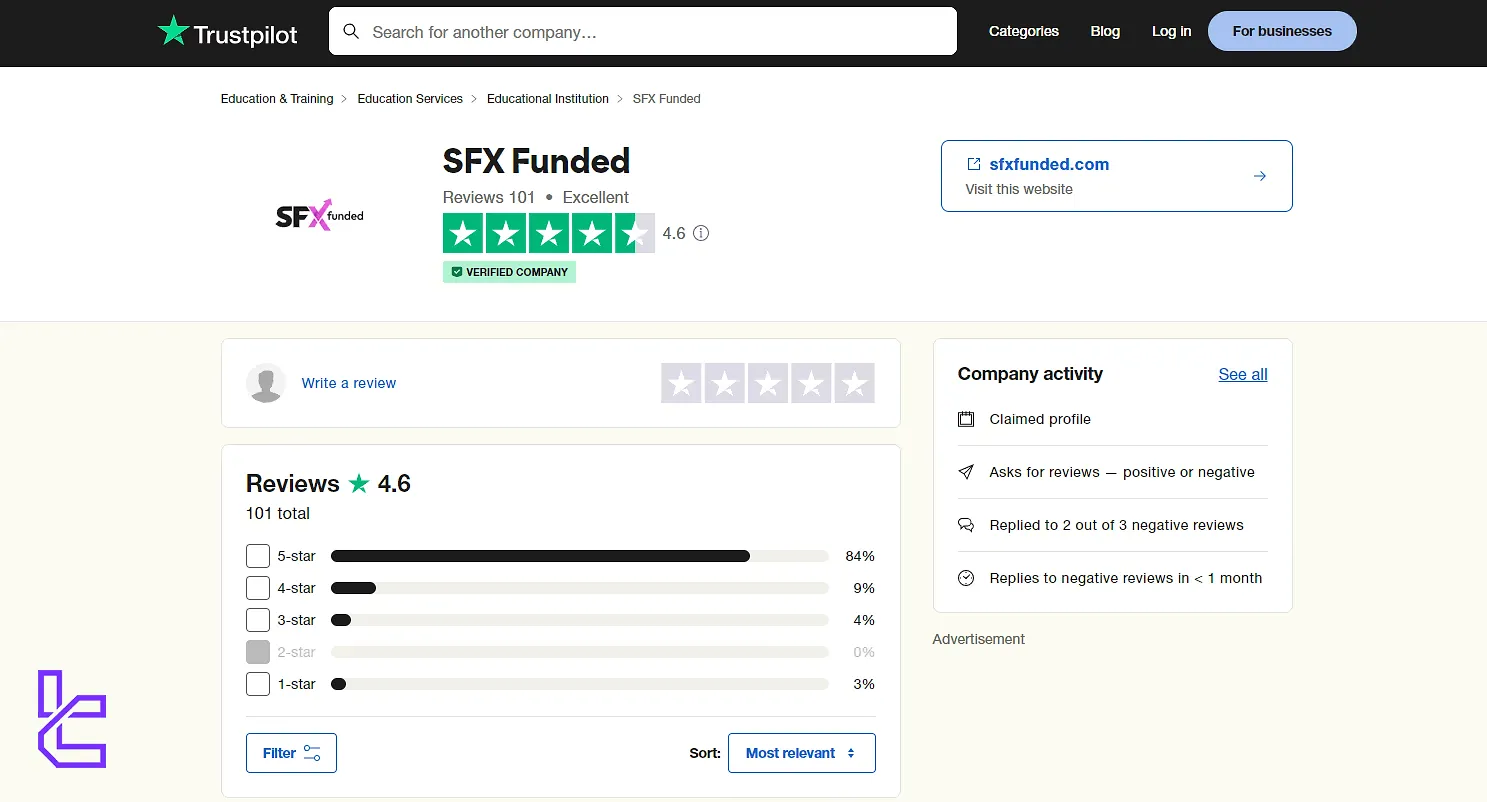

SFX Funded Prop Firm Trust Score on Trustpilot

The SFX Funded Trustpilot profile holds an excellent 4.6 out of 5 rating based on 101 comments, showcasing high levels of customer trust and satisfaction. Here is an abstract of what users say about the firm:

- Positive Review example: "Great experience with SFX Funded! Their 1-step evaluation is straightforward, and the profit-sharing is fantastic. Highly recommend!";

- Negative Review example: "The funding options are good, but they could improve their educational resources. Also, it took longer than expected to get a response to my support ticket".

SFX Funded Prop Firm Customer Support

SFX Funded Prop Firm offers multiple customer support channels:

Support Method | Availability |

Live Chat | No |

Yes (support@sfxfunded.com) | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

The firm aims to respond within 3 working days and recommends using one method for efficient handling. While they don't offer phone support, the available channels seem to adequately address most trader needs.

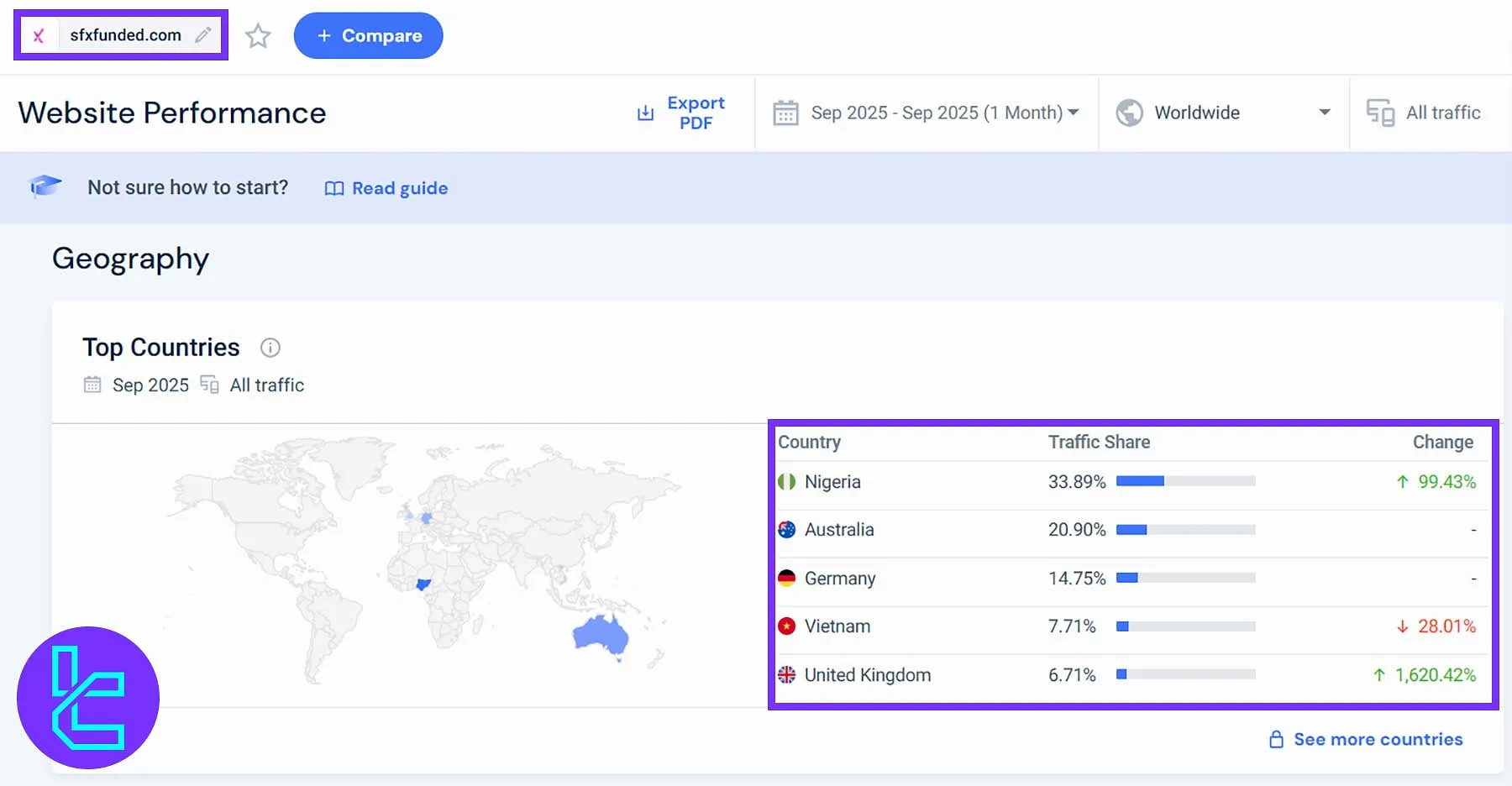

SFX Funded User Base

SFX Funded has established a rapidly growing global presence, with its platform attracting traders from over 20 countries. As of September 2025, the firm’s strongest user activity originates from Nigeria, Australia, and Germany, highlighting its appeal among both emerging and developed trading communities.

- Nigeria leads with 33.89% of total traffic, showcasing a 99.43% monthly growth, positioning it as the firm’s most active region;

- Australia follows with 20.90%, reflecting SFX Funded’s strong engagement among professional prop traders;

- Germany contributes 14.75%, supported by Europe’s established trading education market;

- Vietnam and the United Kingdom record 7.71% and 6.71%, with the UK showing a remarkable 1,620.42% surge in user traffic.

These metrics underscore SFX Funded’s expanding influence and reputation in the prop trading industry.

SFX Funded Prop Firm Social Media Channels

SFX Funded Prop Firm's social media channels include:

Social Media | Members/Subscribers |

510 | |

9796 | |

3900 | |

7686 |

Following these channels can provide traders with additional insights and keep them updated on the latest developments at SFX Funded.

SFX Funded Comparison Table

Let's compare SFX Funded's services with the top prop firms in the market:

Parameters | SFX Funded Prop Firm | Breakout Prop Firm | BrightFunded Prop Firm | Crypto Fund Trader Prop Firm |

Minimum Challenge Price | $29 | $50 | €55 | $55 |

Maximum Fund Size | $3,200,000 | $2,000,000 | Infinite | $200,000 |

Evaluation steps | 1-step, 2-step, Instant | 1-Step, 2-Step | 2-Step | 1-phase, 2-phase |

Profit Share | Up to 100% | 90% | 100% | 80% |

Max Daily Drawdown | 4% | 4% | 5% | 4% |

Max Drawdown | 8% | 6% | 8% | 6% |

First Profit Target | 5% | 5% | 10% | 8% |

Challenge Time Limit | Variable based on the funding program | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:30 | 1:5 | 1:100 | 1:100 |

Payout Frequency | 14 Days | Bi-weekly | 14 Days | 2 Times a Month |

Number of Trading Assets | 80 | 100+ | 150+ | 200+ |

Trading Platforms | Match Trader | Proprietary platform | cTrader, DXTrade | Metatrader 5, CFT Platform, Crypto Futures |

Expert Suggestions

SFX Funded’s high-profit splits, instant funding, lack of time limits for challenges, and lack of additional cryptocurrency commissions make SFX Funded a strong choice.

The profit target ranges from 5% to 8%, with a maximum daily loss of 3-4% and a maximum total drawdown of 4-8%.

Traders can benefit from scalable account sizes, competitive commissions, and fast payouts every 14 days.