Sure Leverage Funding offers a total of 7 accounts and challenges [1-Step, 2-Step, 3-Step, Instant, Instant Pro, EA, No Max DD] in funding sizes ranging from $5,000 to $200,000.

The maximum profit split available is 100%, with a $5 per round lot commission in trading.

Sure Leverage Funding Prop Firm Company Overview

This company is a prop firm under the legal name SureLeverage/ASAP Solutions FZ-LLC. Key Details:

- Founded Date: November 2023

- Headquarters: Compass Building, CO-WORKING FOAM0528, Al Shohada Road 10055, AL Hamra Industrial Zone-FZ, Ras Al Khaimah, United Arab Emirates

- Leadership: Led by CEO Sebastian Ness

- Trader Base: Serves over 10,000 traders globally

Sure Leverage Funding Review: Challenge rules, instruments, and more

Sure Leverage Funding Review: Challenge rules, instruments, and more

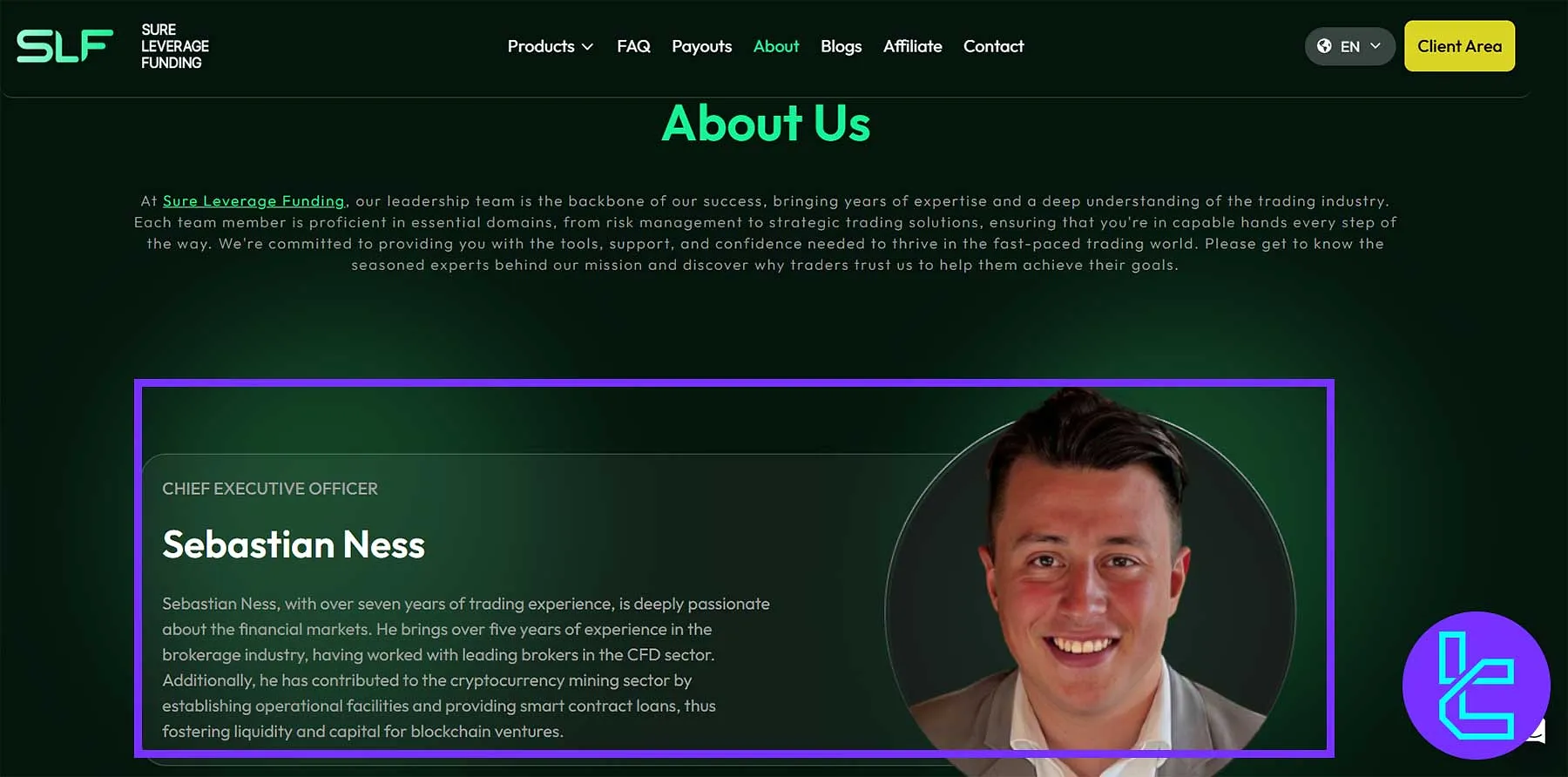

Sure Leverage Funding CEO

Sebastian Ness, the Chief Executive Officer of Sure Leverage Funding (SLF), brings over seven years of trading experience and more than five years in the brokerage sector, making him one of the driving forces behind SLF’s success. His leadership combines strategic insight with deep expertise in CFD trading and crypto finance.

- Over seven years of professional trading experience in financial markets

- Extensive five-year background in the brokerage and CFD industry with top-tier brokers

- Contributed to cryptocurrency mining by developing operational facilities and smart contract loan systems

- Focused on liquidity creation and blockchain capital management for innovative fintech ventures

Sure Leverage Funding Features and Specifics

Let's break down the key features that make Sure Leverage Funding a prop firm:

Account Currency | USD |

Minimum Price | $25 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 100% |

Instruments | Forex, commodities, crypto, Shares, and indices |

Assets | N/A |

Evaluation Steps | 1-Step, 2-Step, 3-Step, Instant Funding |

Withdrawal Methods | Credit/Debit Cards, Crypto, Rise Platform |

Maximum Fund Size | $400K |

First Profit Target | 5% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | 10% |

Trading Platforms | MetaTrader 5, MatchTrader, TradeLocker |

Commission Per Round Lot | $5 |

Trustpilot Score | 4.5/5 |

Payout Frequency | 14 Days, 30 Days |

Established Country | United Arab Emirates |

Established Year | 2023 |

Significant Benefits and Drawbacks

Every prop firm has its pros and cons. Here's an honest look at where Sure Leverage Funding shines and where it might fall short:

Benefits | Drawbacks |

Instant Funding Provided | Relatively Low Maximum Funding |

Profit Split Up to 100% | Limited Educational Resources |

No Trailing Drawdown Rules | - |

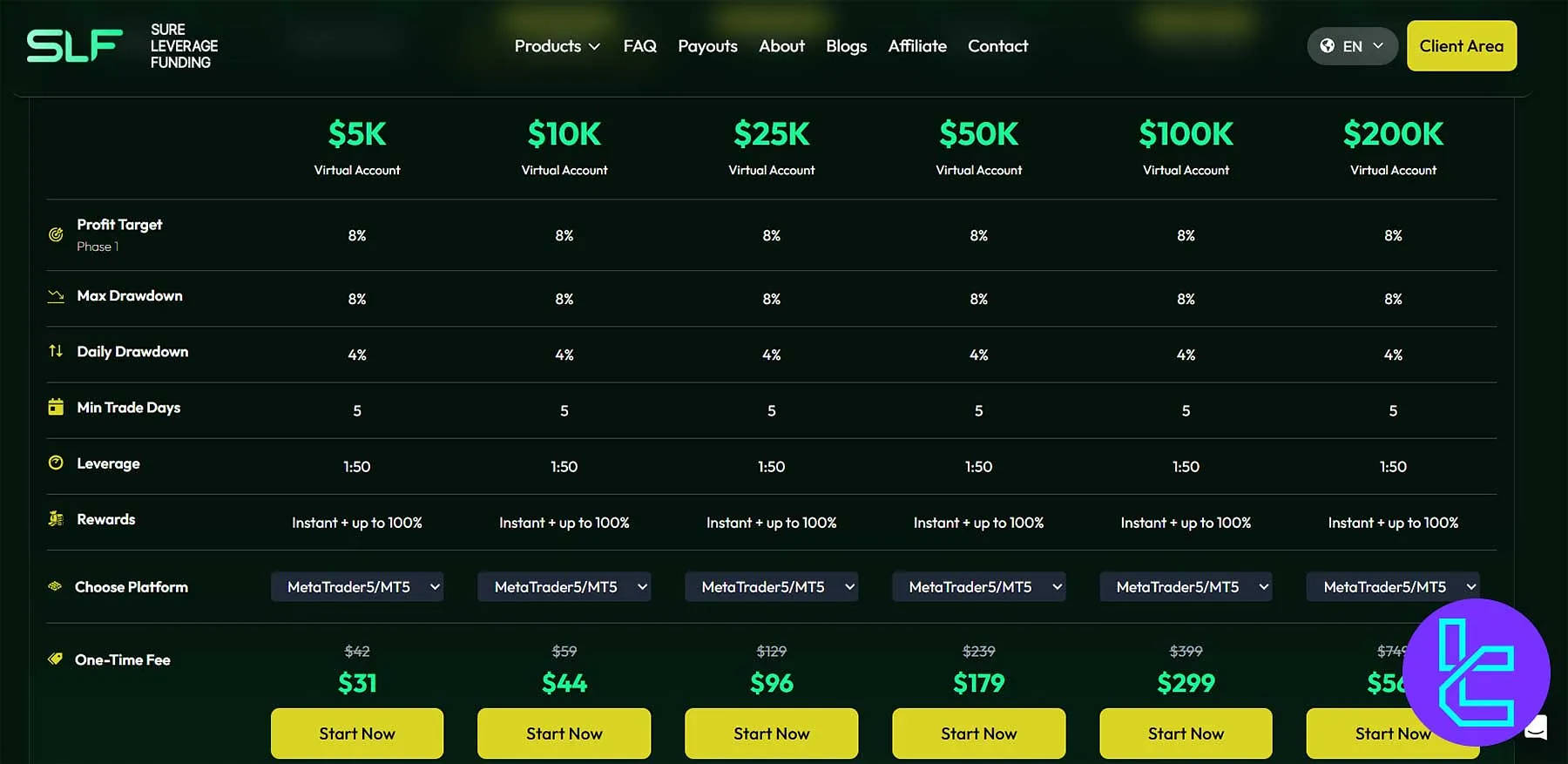

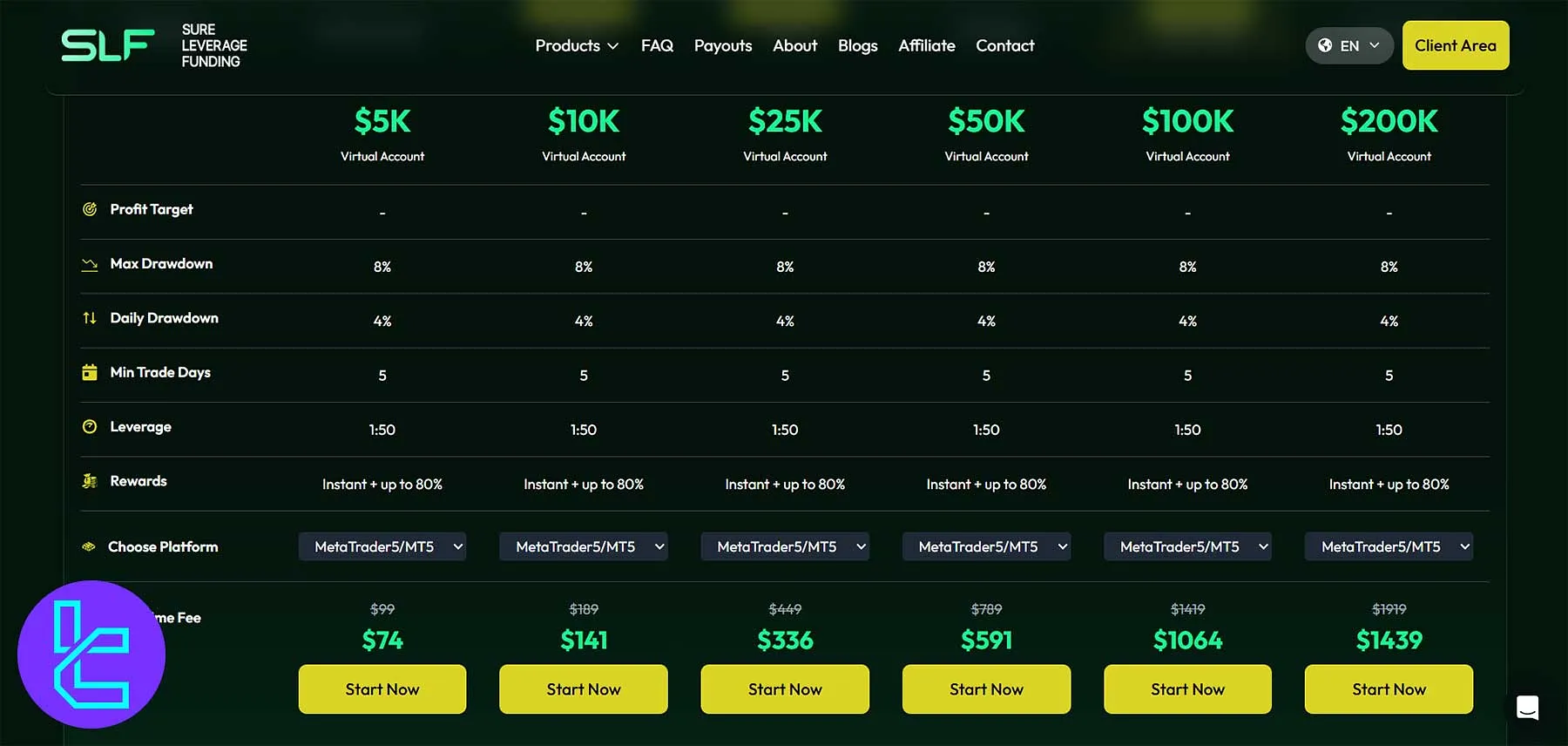

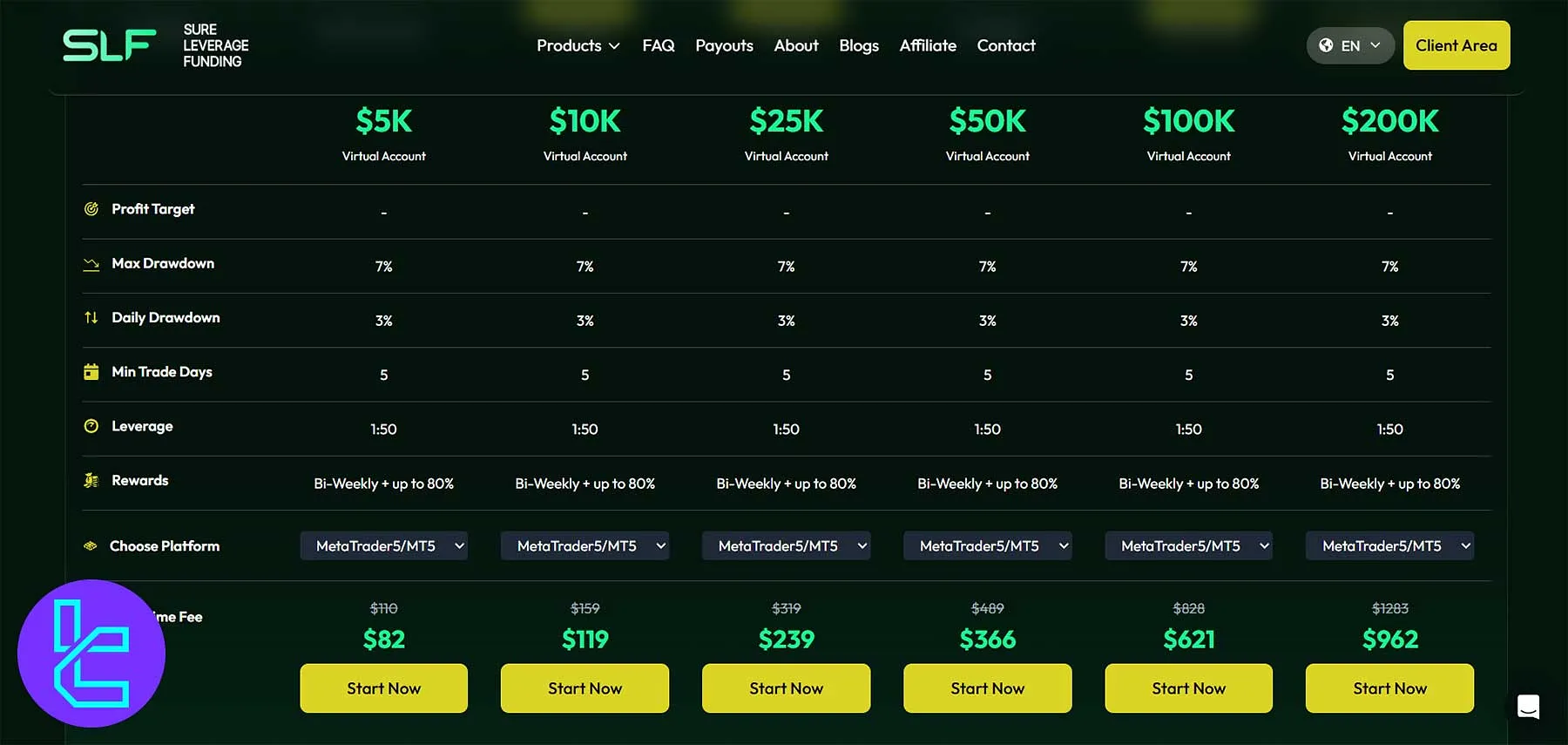

Challenge Sizes and Prices

Sure Leverage Funding offers a wide variety of challenge models with transparent, one-time fees based on account size and challenge type:

Funding | 1-Step | 2-Step | 3-Step | EA | Instant | Instant Pro | No Max DD |

$5K | $42 | $33 | $25 | $85 | $99 | $110 | $95 |

$10K | $59 | $40 | $49 | $185 | $189 | $159 | $135 |

$25K | $129 | $99 | $95 | $369 | $449 | $319 | $269 |

$50K | $239 | $199 | $159 | $515 | $789 | $489 | $415 |

$100K | $399 | $359 | $309 | $759 | $1,419 | $789 | - |

$200K | $749 | $659 | $579 | $1,359 | $1,919 | $1,222 | - |

These prices make Sure Leverage one of the more flexible and affordable prop firms in the mid-tier category, especially considering there are no recurring platform fees.

Note: At the time of writing this Sure Leverage Funding review, the prop firm offers its challenges with a default 30% discount (The prices above are the original fees before discount).

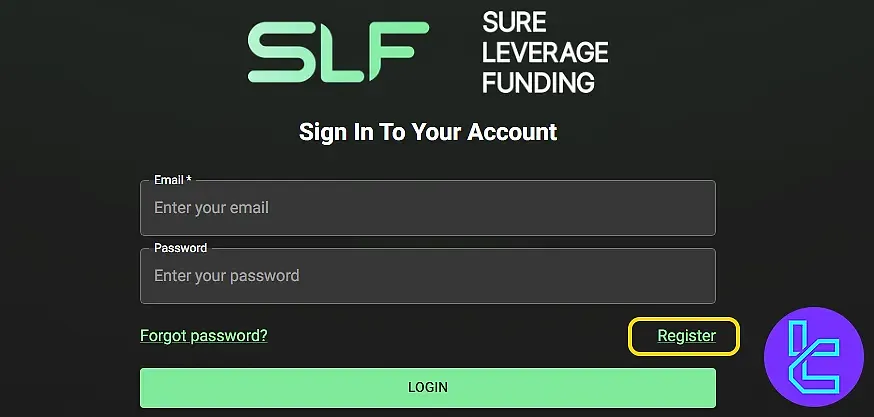

How To Sign Up and Verify on Sure Leverage Funding

The Sure Leverage Funding registration process takes just a few minutes and is required before purchasing any prop challenge. The process is fully digital and designed to give you access to your trader dashboard swiftly.

#1 Access the Dashboard

Start by visiting the Sure Leverage Funding official website. On the homepage, click “Dashboard”, then choose “Register” on the login page to begin.

#2 Complete the Registration Form

Fill in the application form with your information, including:

- First and last name

- Email address

- Password

- Country of residence

These basic details are essential for setting up your user profile.

#3 Finalize & Proceed to Platform

Once the form is submitted, your account is instantly created. There's no registration fee and no email verification required. After signing in, you can review the platform rules and start your evaluation or funded challenge.

#4 Complete Profile Verification

After account creation, head to your Profile section to input any additional personal details. Upload your verification documents, including:

- Proof of ID: Government-issued ID

- Proof of Address: Utility bill or Bank statement

Note that the verification procedure will not initiate until you've completed the evaluation phase successfully.

Evaluation Overview and Challenge Details

Sure Leverage Funding features seven funding programs with evaluation steps from zero to three. Here are the conditions for SLF challenges:

Features | 1-Step | 2-Step | 3-Step | EA (1-Phase) | Instant | Instant Pro | No Max DD (1-Phase) |

| Profit Target | 8% | 10% / 5% | 5% / 5% / 5% | 6% | - | - | 6% |

| Max Drawdown | 8% | 10% | 6% | 8% | 8% | 7% | Phase 1 No Max DD Funded 6% |

| Max Daily Loss | 4% | 5% | 3% | 4% | 4% | 3% | 3% |

| Min Trade Days | 5 | 5 | 5 | 5 (Funded phase) | 5 | 5 | 5 |

| Time Limit | Unlimited | ||||||

| Consistency Rule | On Funded | On Funded | On Funded | 25% | Yes | 20% | 20% |

Max Leverage | 1:50 | 1:50 | 1:30 | Phase 1 1:100 Funded 1:50 | 1:50 | 1:50 | 1:50 |

Payout Frequency | Instant | Instant | Instant | 30 Days | Instant | 14 Days | 14 Days |

Profit Split | Up to 100% | 80% | 80% | 80% | Up to 80% | Up to 80% | 80% |

The variety of evaluation programs and their conditions enable traders to employ various trading strategies, from scalping to day trading. Here are the additional key points you must know about Sure Leverage Funding challenges:

- The EA program allows the use of Expert Advisors during the challenge phase only;

- The EA evaluation model is only accessible through the MT5 platform;

- The consistency rule indicates that the profits of a single trading day should not exceed a specific percentage of the accumulated account profits;

- 1-Step, 2-Step, and 3-Step programs impose the consistency rule on the funded phase;

- No Max DD program allows for withdrawals only on weekends.

SLF 1-Step Challenge

The 1-Step Challenge at Sure Leverage Funding provides traders with fast-track access to funded accounts while maintaining strong risk parameters. It’s ideal for skilled traders seeking quick payouts and unlimited trading time.

Profit Target | 8% |

Max Drawdown | 8% |

Max Daily Loss | 4% |

Minimum Trading Days | 5 |

Time Limit | Unlimited |

Consistency Rule | On Funded |

Max Leverage | 1:50 |

Payout Frequency | Instant |

Profit Split | Up to 100% |

This challenge allows traders to demonstrate profitability efficiently with instant profit withdrawals and no time restrictions.

Sure Leverage Funding 2-Step Challenge

The 2-Step Evaluation is designed for traders who prefer a structured assessment process with two distinct profit milestones. It balances flexibility, discipline, and generous trading conditions.

Profit Target | 10% / 5% |

Max Drawdown | 10% |

Max Daily Loss | 5% |

Minimum Trading Days | 5 |

Time Limit | Unlimited |

Consistency Rule | On Funded |

Max Leverage | 1:50 |

Payout Frequency | Instant |

Profit Split | 80% |

This evaluation is perfect for disciplined traders aiming for consistency and longevity in funded account performance.

SLF 3-Step Challenge

The 3-Step Challenge at SLF promotes progressive evaluation with three profit milestones and tighter drawdown limits, ideal for traders focusing on risk control and consistency.

Profit Target | 5% / 5% / 5% |

Max Drawdown | 6% |

Max Daily Loss | 3% |

Minimum Trading Days | 5 |

Time Limit | Unlimited |

Consistency Rule | On Funded |

Max Leverage | 1:30 |

Payout Frequency | Instant |

Profit Split | 80% |

This challenge rewards steady progress, making it a reliable route for traders who value sustainable growth.

Sure Leverage Funding EA (1-Phase) Challenge

The EA (1-Phase) challenge is tailored for algorithmic traders. It offers high leverage and flexible trading with both manual and EA-based systems.

Profit Target | 6% |

Max Drawdown | 8% |

Max Daily Loss | 4% |

Minimum Trading Days | 5 |

Time Limit | Unlimited |

Consistency Rule | 25% |

Max Leverage | Phase 1: 1:100 / Funded: 1:50 |

Payout Frequency | 30 Days |

Profit Split | 80% |

Ideal for traders automating strategies with EAs under a flexible evaluation system.

SLF Instant Challenge

The Instant Challenge allows immediate access to trading without an evaluation phase. It’s best suited for experienced traders ready to earn profits from day one.

Profit Target | None |

Max Drawdown | 8% |

Max Daily Loss | 4% |

Minimum Trading Days | 5 |

Time Limit | Unlimited |

Consistency Rule | Yes |

Max Leverage | 1:50 |

Payout Frequency | Instant |

Profit Split | Up to 80% |

A fast, direct funding solution for traders who want to skip evaluations and focus on live trading.

Sure Leverage Funding Instant Pro Challenge

The Instant Pro Challenge enhances the Instant model with improved payout terms and a bi-weekly schedule, giving professionals more control over their withdrawals.

Profit Target | None |

Max Drawdown | 7% |

Max Daily Loss | 3% |

Minimum Trading Days | 5 |

Time Limit | Unlimited |

Consistency Rule | 20% |

Max Leverage | 1:50 |

Payout Frequency | 14 Days |

Profit Split | 80% |

A premium challenge designed for seasoned traders seeking regular payouts and stable risk management.

SLF No Max DD (1-Phase) Challenge

The No Max DD Challenge gives traders more breathing room by removing maximum drawdown limits during the evaluation, while still applying risk rules in the funded phase.

Profit Target | 6% |

Max Drawdown | Phase 1: None / Funded: 6% |

Max Daily Loss | 3% |

Minimum Trading Days | 5 |

Time Limit | Unlimited |

Consistency Rule | 20% |

Max Leverage | 1:50 |

Payout Frequency | 14 Days |

Profit Split | 80% |

Perfect for traders who want maximum flexibility during evaluation while retaining realistic funded account conditions.

SLF Challenge Time Limits

Sure Leverage Funding imposes no time limits on its challenges, allowing traders to pass evaluations at their own pace.

Most models require a minimum of 5 trading days, though the “EA” challenge has no trading-day requirement in the evaluation phase and five days in the funded phase. This flexibility favors strategic traders who value discipline over speed.

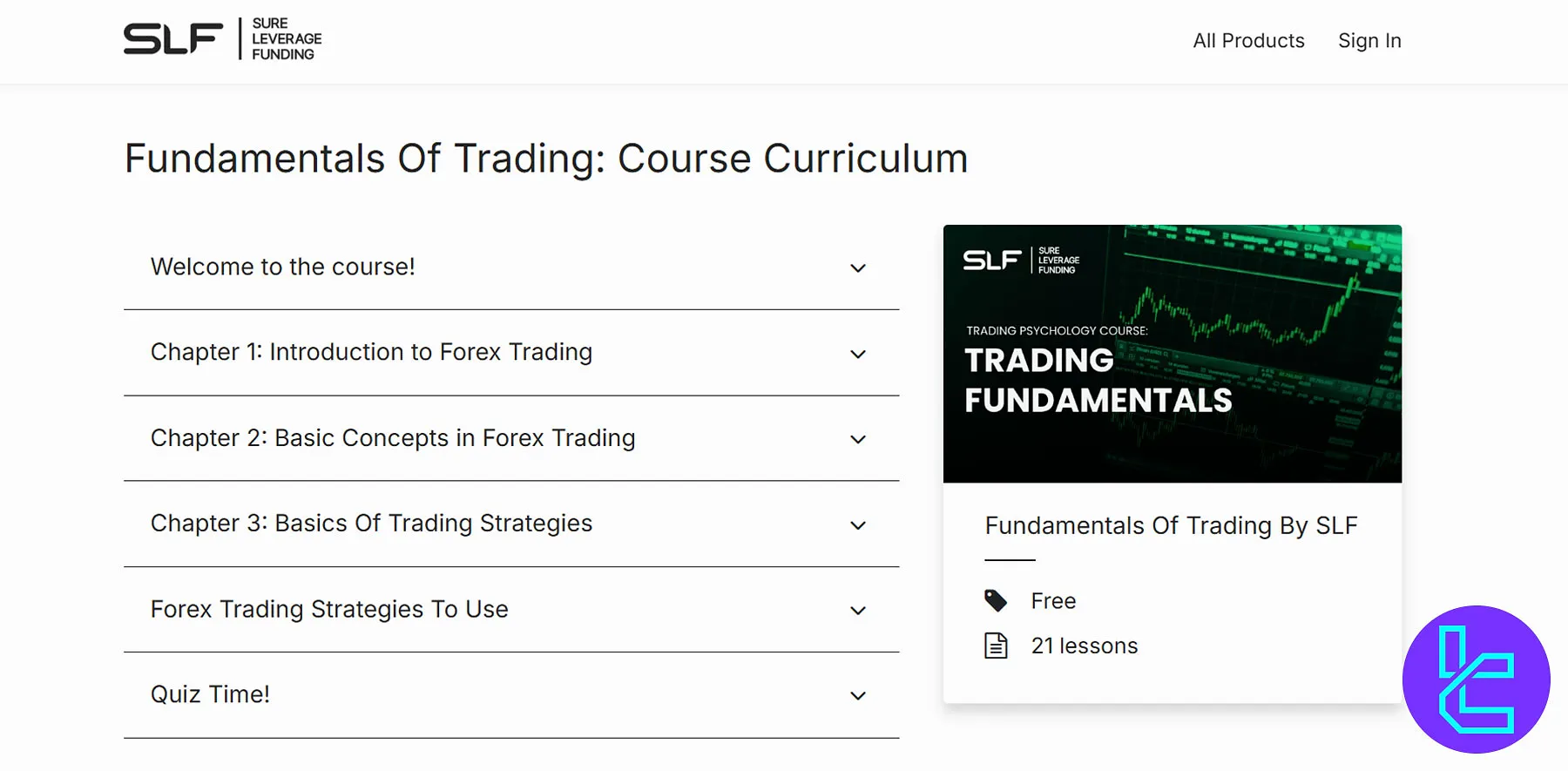

SLF Bonuses and Discounts

While the prop firm offers a default 30% discount on all its challenge fees, it also features seasonal PROM codes and bonus programs, including the Free $5K challenge giveaway with the following conditions:

- You must complete the prop firm's Forex market course;

- Over 1,000 challenges are available;

- The course activation fee is $5;

- The course includes 21 lessons and a final quize.

Sure Leverage Funding Trading Rules

In trading challenges, it's crucial to follow specific rules to maintain fairness and consistency. Various restrictions apply to prevent manipulative practices like VPN use, hedging, and risky trading strategies.

Understanding these Sure Leverage Funding rules helps traders navigate through challenges while ensuring compliance with platform standards. Below are the key guidelines to keep in mind during the evaluation and live phases:

- No use of VPN or VPS during challenges

- EA usage allowed only in the evaluation phase of the EA program

- No martingale or arbitrage strategies

- Restrictions on News-based trades

VPN and VPS Usage

Using Virtual Private Networks (VPNs) or Virtual Private Servers (VPSs) is strictly prohibited during the challenge and live account phases.

Traders must operate from a consistent IP address to ensure fairness and verify that no external assistance is being used.

Hedging

It is prohibited to hedge between accounts. This refers to using two separate trading accounts to open opposing positions on the same instrument, with identical lot sizes and at the same time. Such practices are not allowed and will lead to disqualification.

Expert Advisors (EA)

While Expert Advisors (EAs) are permitted in the evaluation phase for the EA challenge, they are strictly forbidden in any other challenge type. EAs and automated trading systems, including risk management tools, are not allowed in funded accounts.

Prohibited Trading Strategies

Certain trading practices are prohibited during the funded stage, including:

- Tick Scalping: Rapidly opening and closing positions to exploit small price changes

- High-Frequency Trading: Engaging in an excessive number of trades in a short time frame

- Latency and Reverse Arbitrage: Exploiting market delays or opening opposite positions across different accounts

- Martingale Strategy: Doubling positions after a loss with the expectation of recovering losses with the next trade

News Trading

News trading is disallowed during both the evaluation and live phases. Traders are restricted from opening or closing trades within a two-minute window before or after a significant news event release. Violations of this rule will result in disqualification from the challenge.

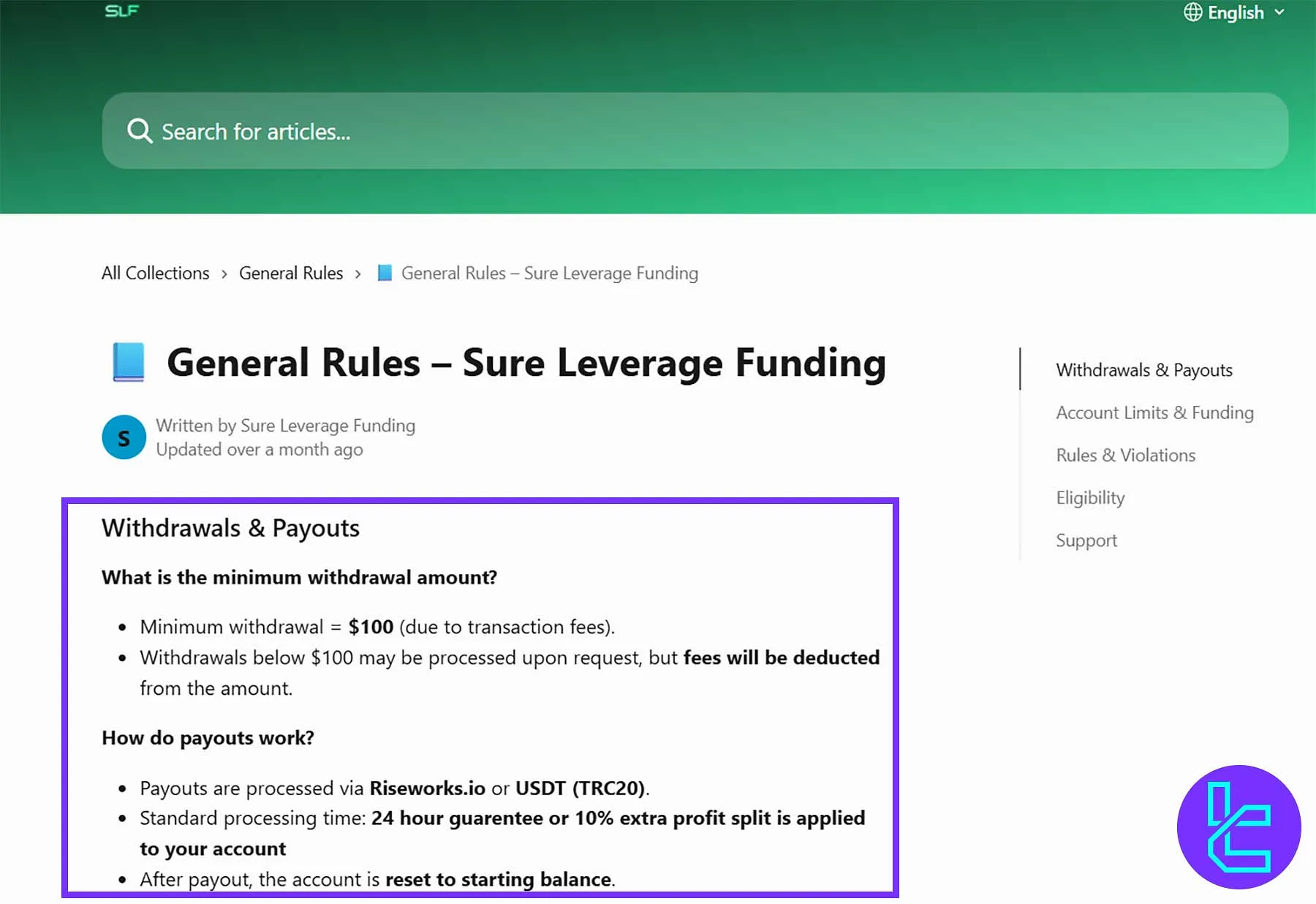

SLF Payout Rules

At Sure Leverage Funding (SLF), payout rules are designed for fairness, transparency, and rapid processing. Traders can withdraw profits securely through Riseworks.io or USDT (TRC20), with a 24-hour guarantee on payouts or an additional 10% profit split bonus if delays occur.

- Minimum withdrawal amount: $100 (requests below this are processed with fees deducted);

- Processing time: Within 24 hours, or 10% extra profit if delayed;

- Payment methods: Riseworks.io or USDT (TRC20);

- Account reset: After every approved payout, the account returns to its starting balance;

- Denied payouts: If therisk team identifies soft breaches reducing profits to zero or below, payouts are denied, and the account resets.

SLF Scaling Plan

While the prop firm doesn't offer a structured scaling plan, it allows traders to have multiple accounts.

However, the condition is that the total funding must not exceed the maximum capital allocation of $400,000 per trader.

Trading Platforms and Terminals

SLF Traders have access to 3 of the most popular and robust trading platforms in the industry:

- MetaTrader 5: The industry-standard platform, offeringadvanced charting and automated trading capabilities

- MatchTrader: Modern interface with TradingView integration and multi-chart views

- TradeLocker: A newer visual platform optimized for on-chart SL/TP management and copy trading functionality

This variety allows traders to match their trading style with the platform that suits them best.

The discussed prop firm does not have MT5's license; therefore, it is called "Platform 5" throughout the firm's website.

TradingFinder has developed various MT5 indicators that you can employ for free.

What Instruments Are Available on Sure Leverage Funding?

This prop firm offers a decent range of tradable instruments in 5 markets, including:

- Forex major and exotic pairs

- Gold and Other Commodities

- Cryptocurrencies

- Shares

- Indices

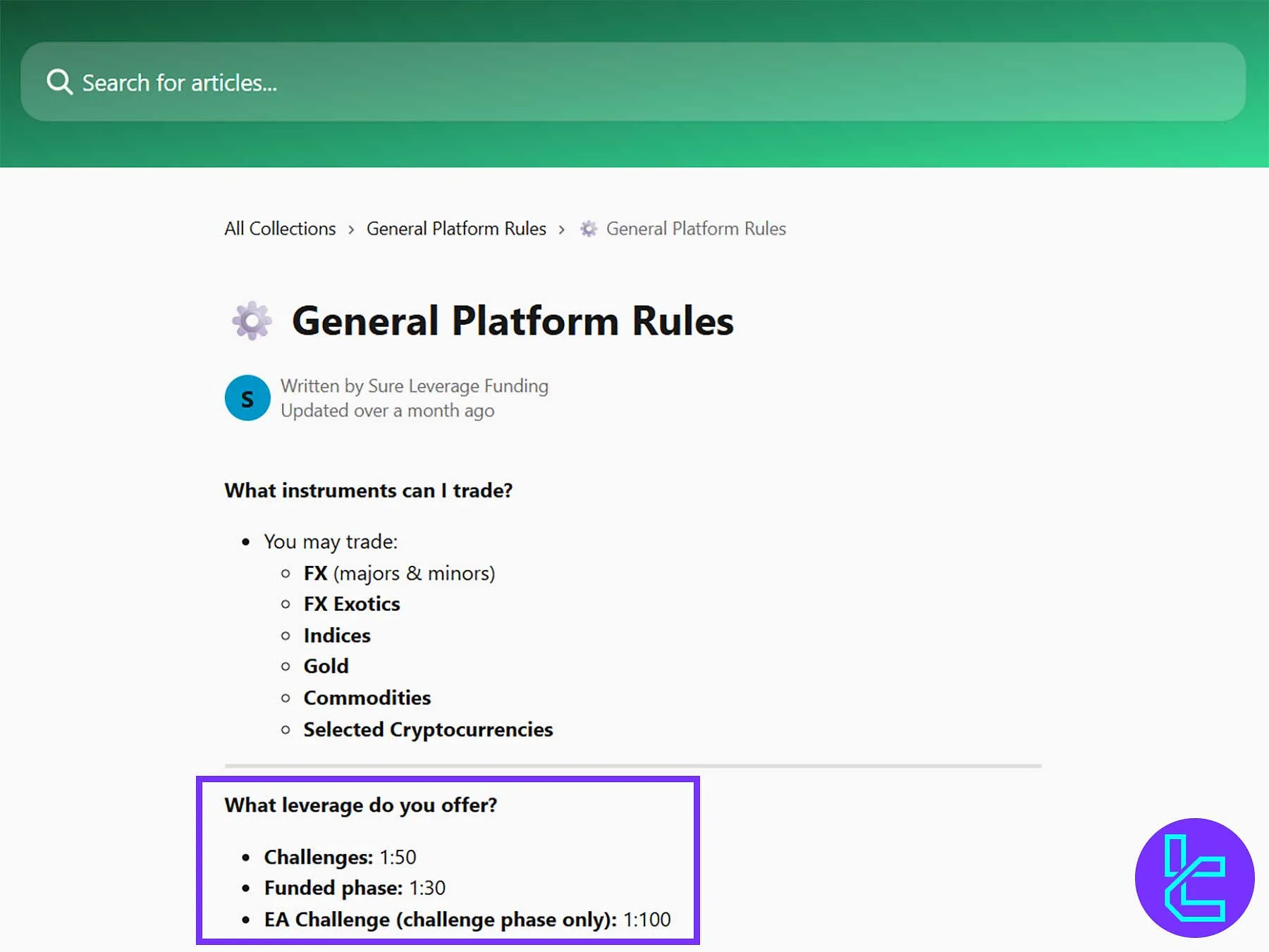

Sure Leverage Funding Leverage Offerings

SLF provides flexible and competitive leverage options tailored to various trading stages and account types. These ratios are designed to balance risk control and performance potential, giving traders the freedom to execute both short-term and long-term strategies across multiple financial markets.

- Standard Challenges: 1:50 leverage allows traders to manage capital efficiently while maintaining controlled exposure;

- Funded Phase: Leverage is adjusted to1:30, ensuring stable and sustainable trading after account funding;

- EA Challenge (1-Phase): Offers up to 1:100 leverage during the challenge phase, ideal for automated or high-frequency strategies.

Note: The 3-Step challenge offers leverage options of up to 1:30 even for the challenge phase.

Available Payment Methods

Paying for challenges and withdrawing profits is possible via 3 main options in SLF:

- Credit/Debit Cards: VISA/MasterCard

- Cryptocurrency: Bitcoin and ETH

- Rise Platform: Enabling payments via crypto transactions

Spreads and Commissions Structure

Sure Leverage Funding does not include much information regarding trading fees and commissions in its website.

However, based on our chats with the support team, the prop firm charges $5 per standard lot in trading with raw spreads. There are no monthly fees for accounts; only an initial fee is charged.

To estimate a trade's outcome, use a forex profit calculator tool.

Educational Content and Materials

To be precise, Sure Leverage Funding does not provide any real educational resources to the traders; the only section that can help traders learn is the FAQ page, which is mostly about the prop firm's challenges, platforms, and other details.

Instead, you can go to our Forex education page for helpful articles in the financial world.

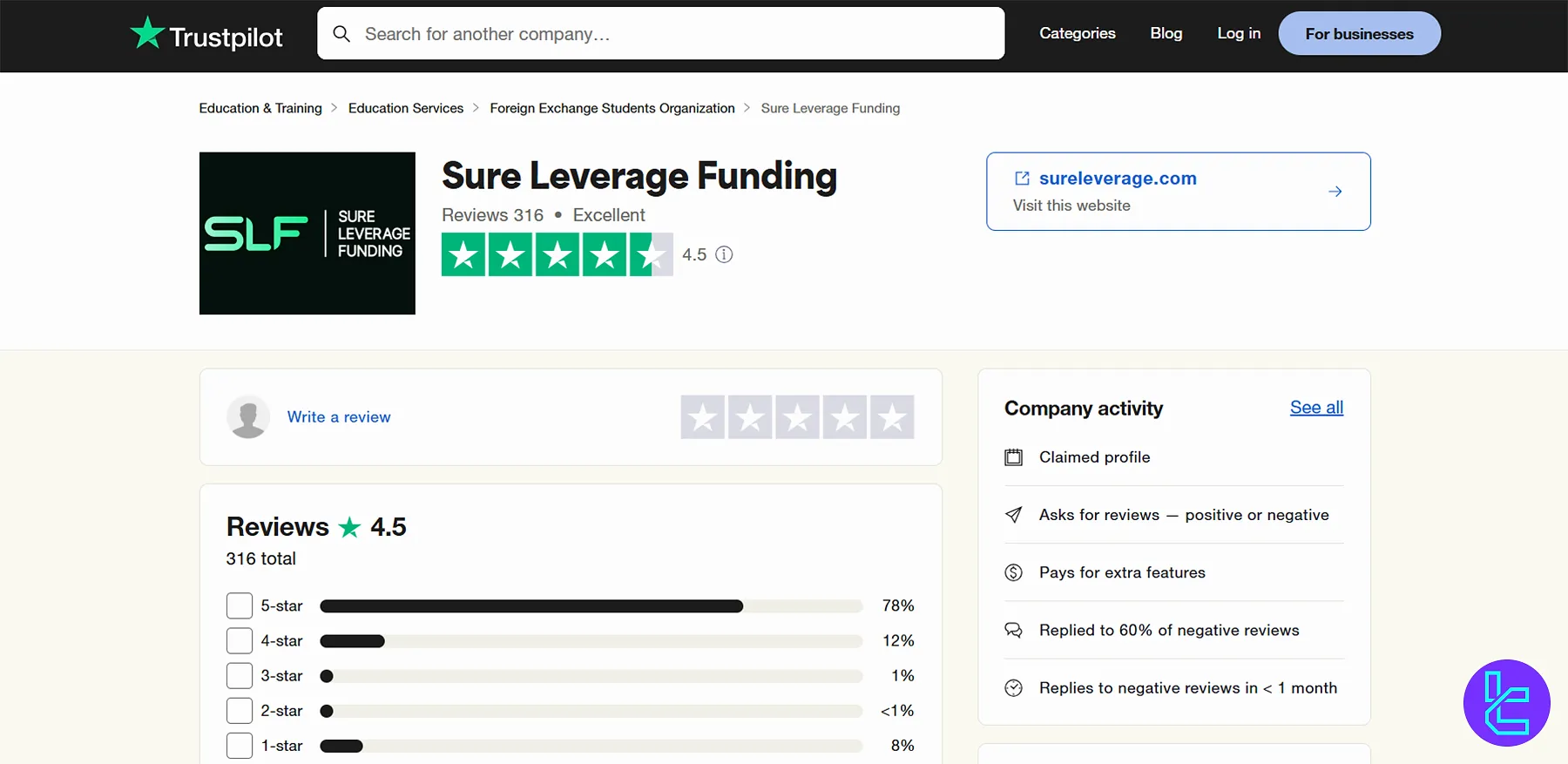

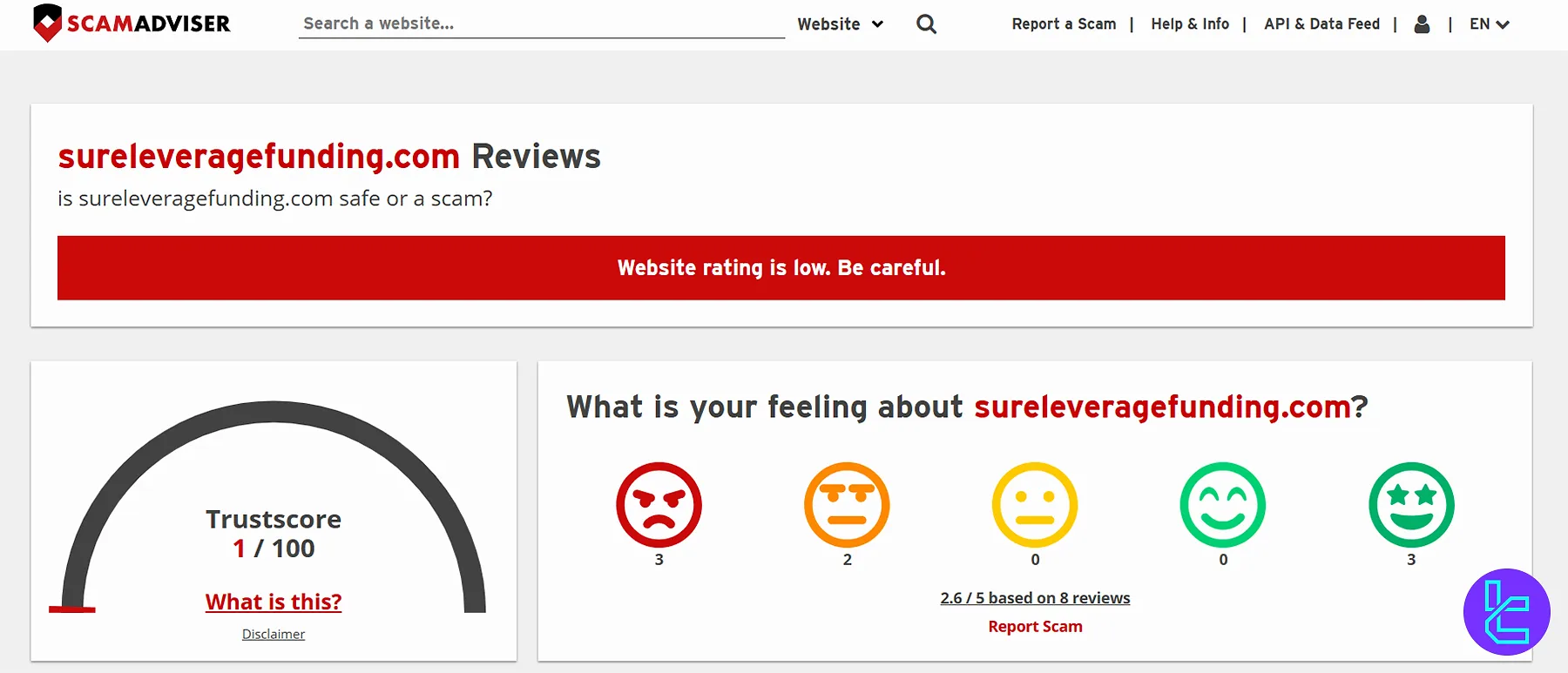

Trust Ratings and Scores

The SLF Trustpilot profile and ScamAdviser have an overall mixed tone. More Details:

- Trustpilot: 4.5/5 stars from over 310 reviews

- ScamAdviser: 1/100 Trustscore, 2.4/5 user review score (5+ reviews)

Sure Leverage Funding Support Contact Info and Schedule

Customer support services in the discussed prop firm are provided in 3 channels:

Support Method | Availablity |

Live Chat | Yes (On the official website) |

Yes (support@sureleverage.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes (Accessible through the "Contact" page of the site) |

FAQ | Yes |

Help Center | Yes |

No | |

Messenger | No |

Based on our investigations, the support agents are available 24/7.

Sure Leverage Funding User Base

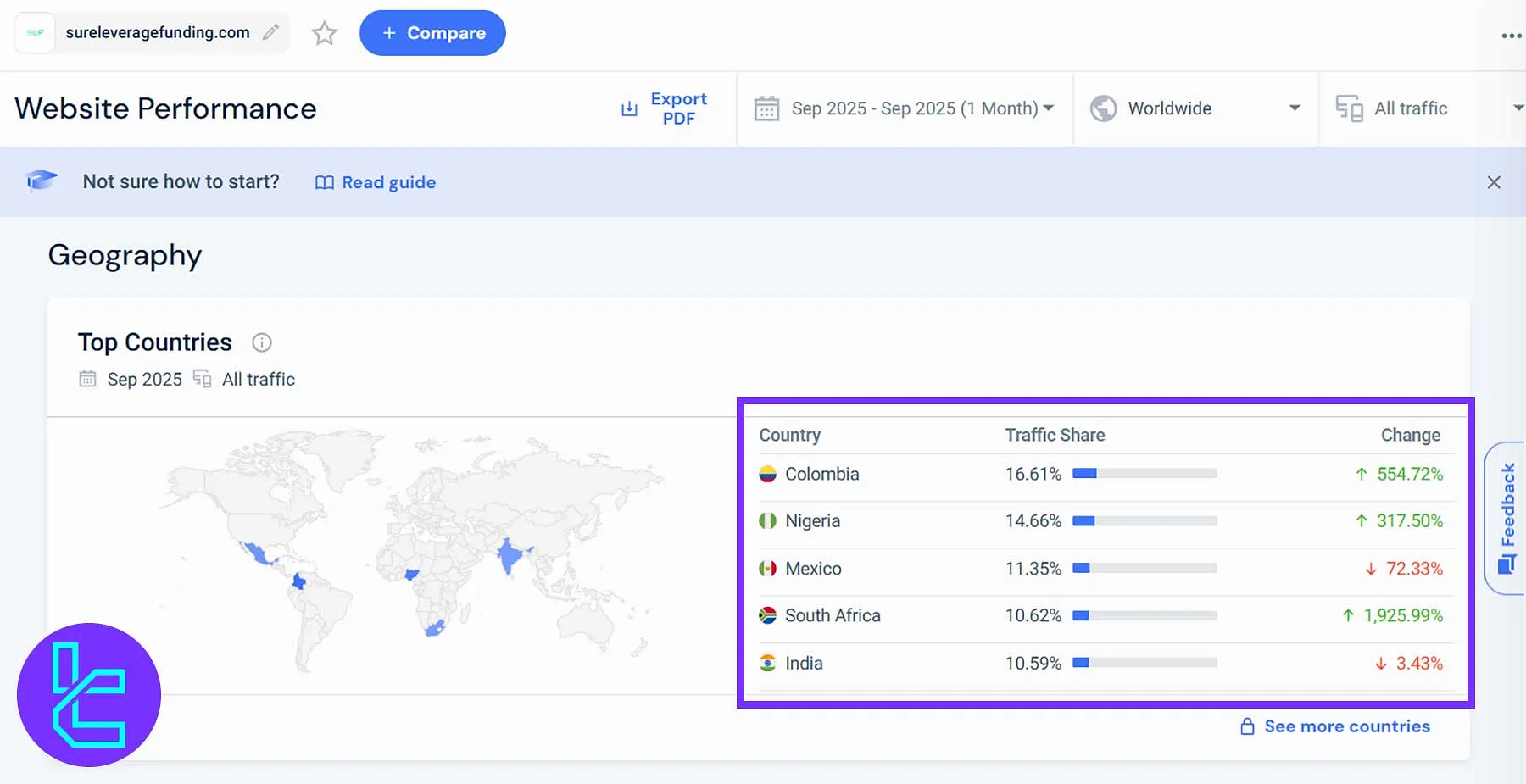

Sure Leverage Funding (SLF) has established a rapidly expanding global trading community, with strong user engagement across emerging and developed markets.

In September 2025, the platform recorded significant growth in visitor traffic from Colombia, Nigeria, Mexico, South Africa, and India, reflecting SLF’s increasing international presence and brand trust.

- Colombia: 16.61% of total visitors, marking an impressive 554.72% growth

- Nigeria: 14.66% share, rising by317.50%, showing high engagement from African traders

- Mexico: 11.35% share, maintaining steady traffic despite a 72.33% dip

- South Africa: 10.62% share, achieving remarkable 1,925.99% growth

- India: 10.59% share, with minimal change (-3.43%), indicating stable user activity

SLF Social Media Pages

Sure Leverage Funding maintains active profiles on 5 social media platforms, such as:

Social Media | Members/Subscribers |

5299 | |

9792 | |

14800 | |

1060 | |

170 |

Sure Leverage Funding Comparison Table

Let's check SLF features and services in comparison with top prop firms:

Parameters | Sure Leverage Funding Prop Firm | The5ers Prop Firm | Breakout Prop Firm | BrightFunded Prop Firm |

Minimum Challenge Price | $25 | $39 | $50 | €55 |

Maximum Fund Size | $200,000 | $250,000 | $2,000,000 | Infinite |

Evaluation steps | Instant, 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 2-Step |

Profit Share | Up to 100% | 100% | 90% | 100% |

Max Daily Drawdown | 5% | 5% | 4% | 5% |

Max Drawdown | 10% | 10% | 6% | 8% |

First Profit Target | 5% | 5% | 5% | 10% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:50 | 1:100 | 1:5 | 1:100 |

Payout Frequency | From daily | Bi-weekly | Bi-weekly | 14 Days |

Number of Trading Assets | N/A | 3000+ | 100+ | 150+ |

Trading Platforms | MetaTrader 5, MatchTrader, TradeLocker | Metatrader 5 | Proprietary platform | Proprietary platform |

Expert Suggestions

Sure Leverage Funding has enabled a maximum leverage of 1:100 in the evaluation phase of "EA" challenge, and 1:50 for other accounts and stages.

The company has received a 4.5 out of 5 score on Trustpilot, with 310+ reviews.