TEFS offers two funding models, including 1-Step and Instant, with account balances ranging from $2,000 to $460,000 and profit splits up to 90%. It supports 3,000+ trading instruments, including Forex, Futures, ETFs, and more, with a maximum leverage option of 1:16.

TEFS prop firm provides up to 6 hours of 1-on-1 personal coaching for instant-funded packages and up to 12 months of Live Trade Room subscriptions. It allows news trading and martingale strategies.

TEFS Prop Firm; Company Information and Key Details

Founded in 2017, TEFS (Trading Education & Funded Services) has established itself as a global leader in prop trading and trader education.

Operating under TEFS Marketing Management LLC (UAE) and its subsidiary TEF Systems Ltd (Cyprus), the company empowers traders across 100+ countries through real funding, expert coaching, and trusted trading programs.

Driven by innovation, TEFS combines education, live market access, and capital funding in one platform. With over 40,000 traders funded, 24/7 support, and a 100% funded model, the prop firm delivers transparency, fair payouts, and advanced trading tools.

- Founded: 2017, Dubai, UAE

- Global Reach: 100+ countries, 40,000+ funded traders

- Funding: Up to $460,000 with 90% profit share

- Education: 1,000+ hours of training, 1-on-1 coaching

- Assets: 3,000+ US stocks, ETFs, Forex, Crypto, Indices, Commodities

- Conditions: No time limits and fast secure payouts

TEFS Key Specifications

The platform offers a 90% profit share, instant funding up to $460K, and fast, secure payouts. Key specifications of TEFS prop firm:

Account Currency | USD |

Minimum Price | $55 |

Maximum Leverage | 1:16 |

Maximum Profit Split | Up to 90% |

Instruments | Forex, Metals, Indices, Crypto, Stocks, Futures, ETFs |

Assets | 3,000+ |

Evaluation Steps | 1-step, Instant |

Withdrawal Methods | Bank Transfer, USDT |

Maximum Fund Size | $460,000 |

First Profit Target | 10% |

Max. Daily Loss | 4% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | 6% |

Trading Platforms | Proprietary platform |

Commission | $7 per 1000 Share/CFDs |

Trustpilot Score | 4.6 / 5 |

Payout Frequency | Monthly |

Established Country | UAE |

TEFS Prop Firm Pros & Cons

Since 2017, TEFS has become one of the most trusted prop trading firms, supporting traders in 100+ countries with real funding, 1:1 coaching, and live trading rooms. Let’s check the firm’s advantages and disadvantages.

Pros | Cons |

Up to 90% profit share on earnings | Limited trading capital up to $460,000 |

Instant funding programs | Limited leverage offerings (up to 1:16) |

1:1 coaching with professional traders | - |

3000+ tradable assets including US stocks, FX & crypto | - |

Fast & secure payouts with no hidden fees | - |

24/7 support and educational resources | - |

With a global community of 40,000+ traders, TEFS continues to redefine prop trading by combining education, mentorship, and real capital access under transparent conditions.

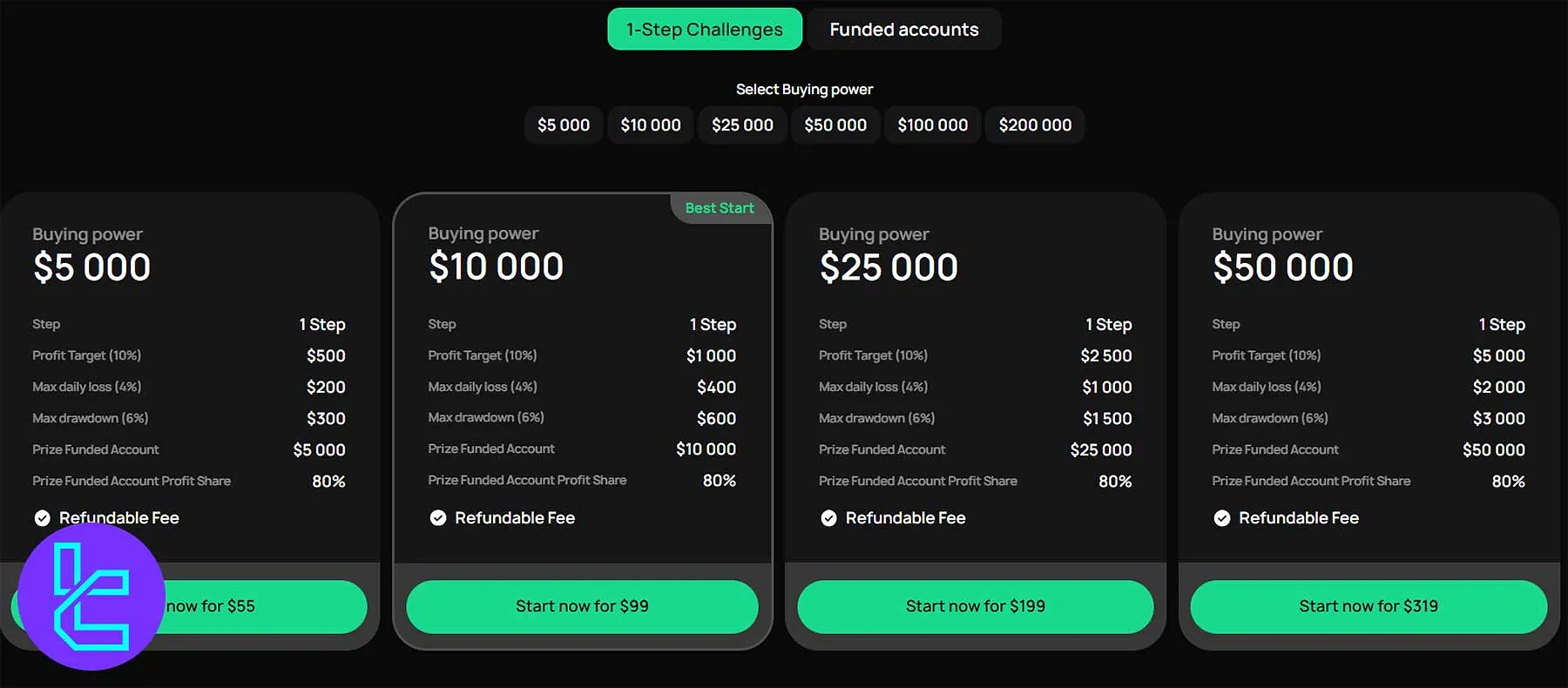

TEFS Funded Accounts and Challenges Pricing

TEFS offers a flexible funding structure through 1-Step Challenges and Funded Accounts, designed for traders at every level. With buying power ranging from $2,000 to $460,000, traders can choose between refundable challenge fees or direct access to funded capital.

Account Balance | 1-Step Challenge Price | Instant Funded Account Price |

$2,000 | - | $75 |

$5,000 | $55 | - |

$10,000 | $99 | - |

$12,500 | - | $445 |

$20,000 | - | $765 |

$25,000 | $199 | - |

$50,000 | $319 | - |

$66,000 | - | $2,485 |

$100,000 | $499 | - |

$130,000 | - | $4,945 |

$200,000 | $969 | - |

$210,000 | - | $7,975 |

$320,000 | - | N/A |

$460,000 | - | N/A |

TEFS Sign Up and Verification

The registration and verification process is designed to be simple, fast, and secure. In just six steps, traders can register, verify their identity, and access their funded trading dashboard.

TEFS supports global traders with seamless onboarding, social login options, and secure verification through Sumsub.

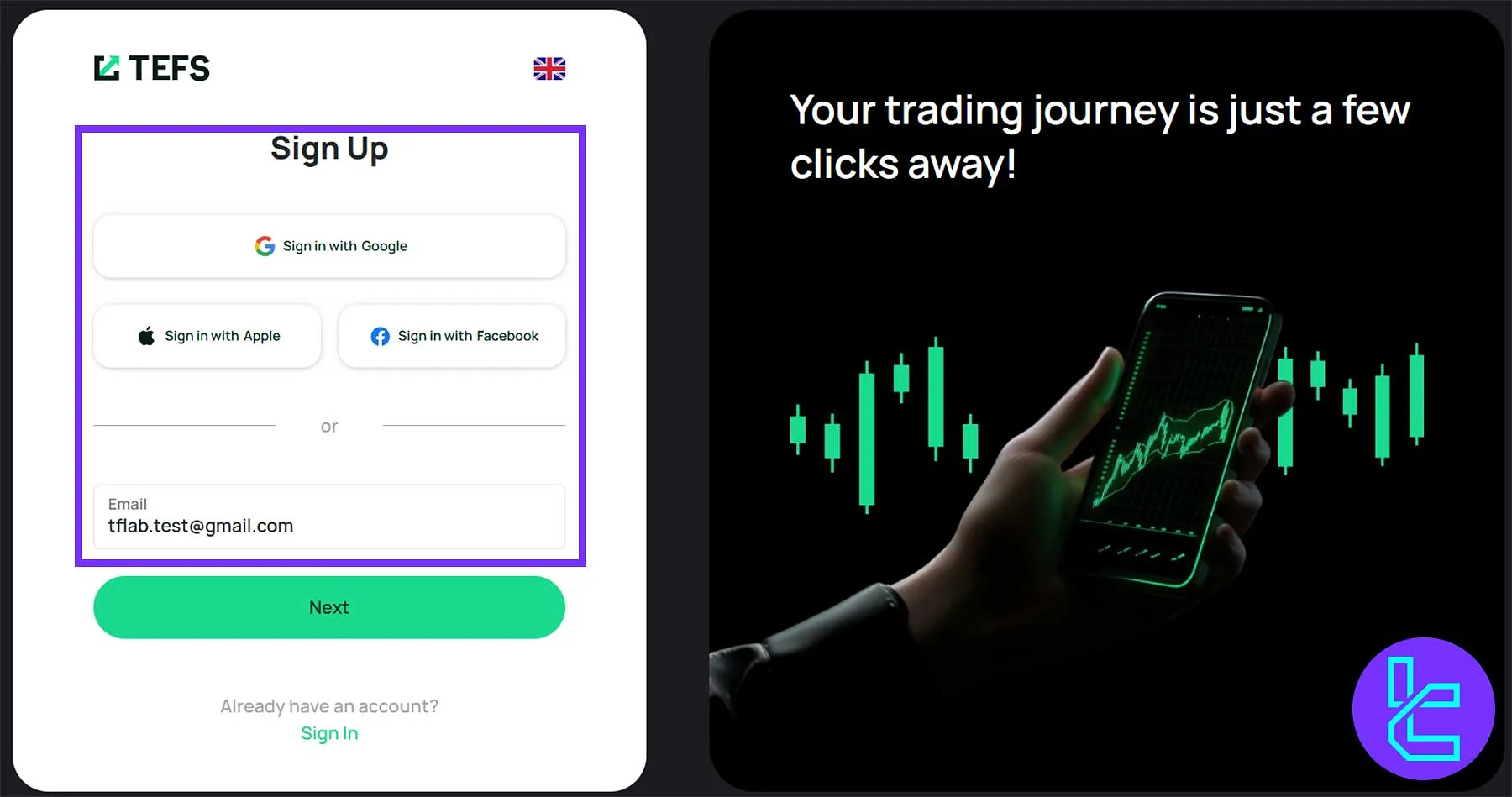

#1 Access Sign up Form

On the TEFS official website, navigate to the Login form and select the “Don’t have an account? Sign Up” option to initiate the registration process.

#2 Provide Your Email or Use Social Login

Choose to sign up using Google, Apple, or Facebook for quick access, or manually enter your email address to continue with standard registration.

- One-click login via Google, Apple, or Facebook

- Email registration supported for all users

- Secure data encryption ensures user privacy

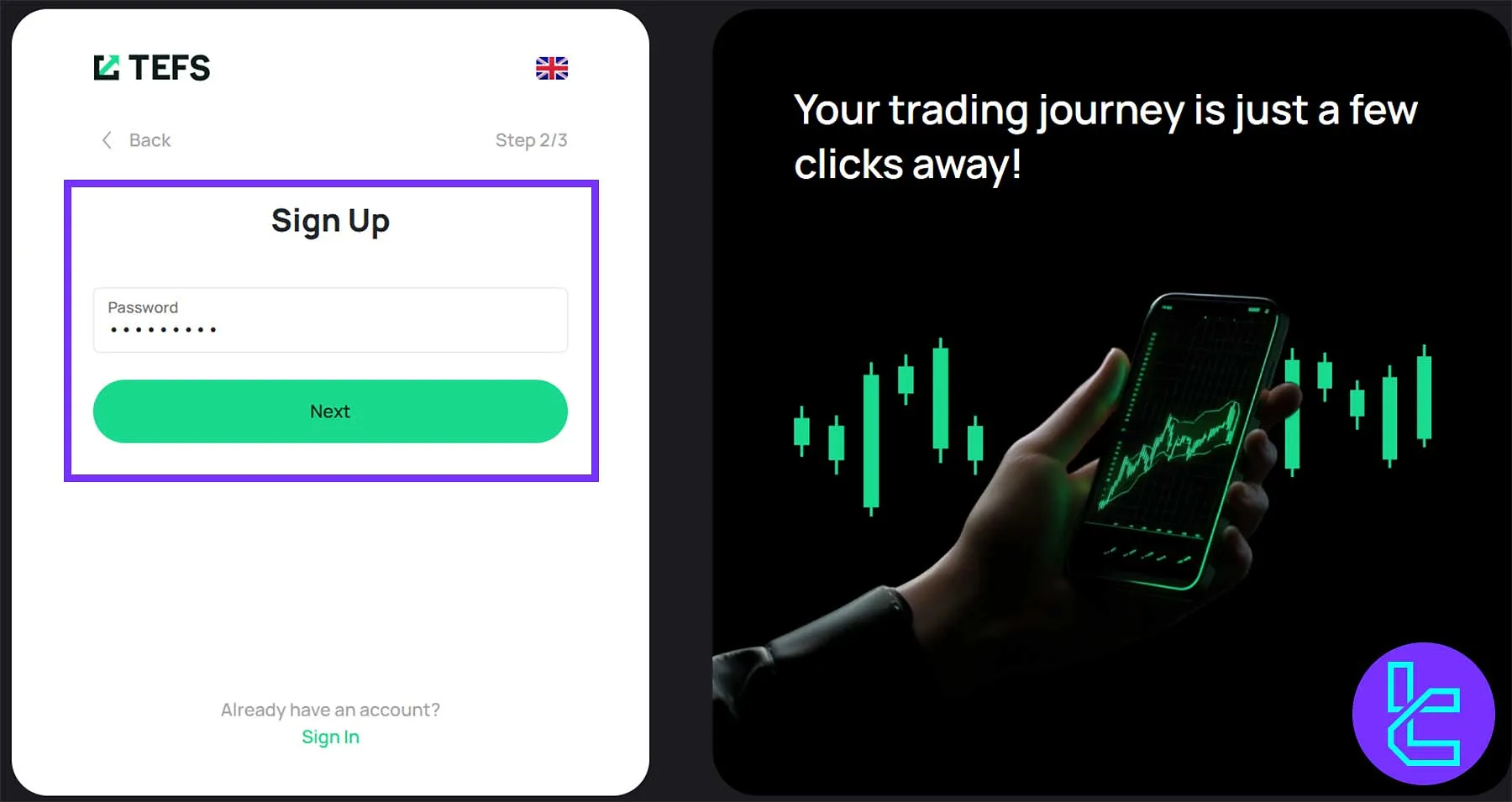

#3 Set a Password

Create a strong and secure password to protect your trading account. This step ensures only you can access your TEFS dashboard and trading tools.

- Use a mix of letters, numbers, and symbols;

- Keep your password confidential and unique;

- Minimum 8-character requirement for safety.

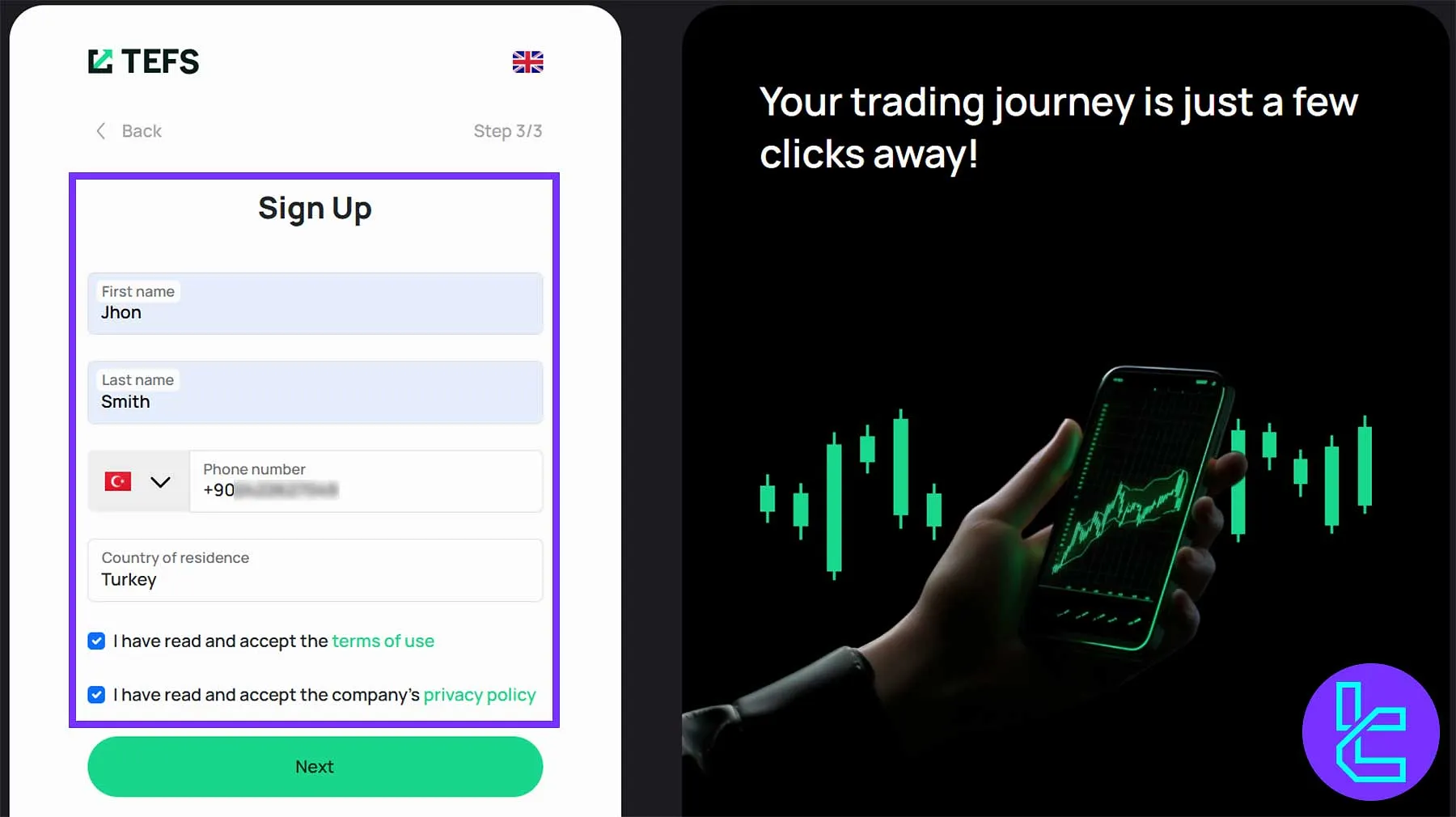

#4 Enter Personal Information

Complete your profile by entering the following information:

- First name

- Last name

- Phone number

- Country of residence

This ensures your account is verified under accurate and traceable details. Accept TEFS Terms of Use and Privacy Policy.

#5 Verify Your Email Address

After registration, TEFS sends a verification email to confirm your address. Click the verification link to activate your account and access the dashboard.

- Check your inbox or spam folder for the link;

- Click the “resend” option for verification if needed;

- Activation grants access to trading features and funding plans.

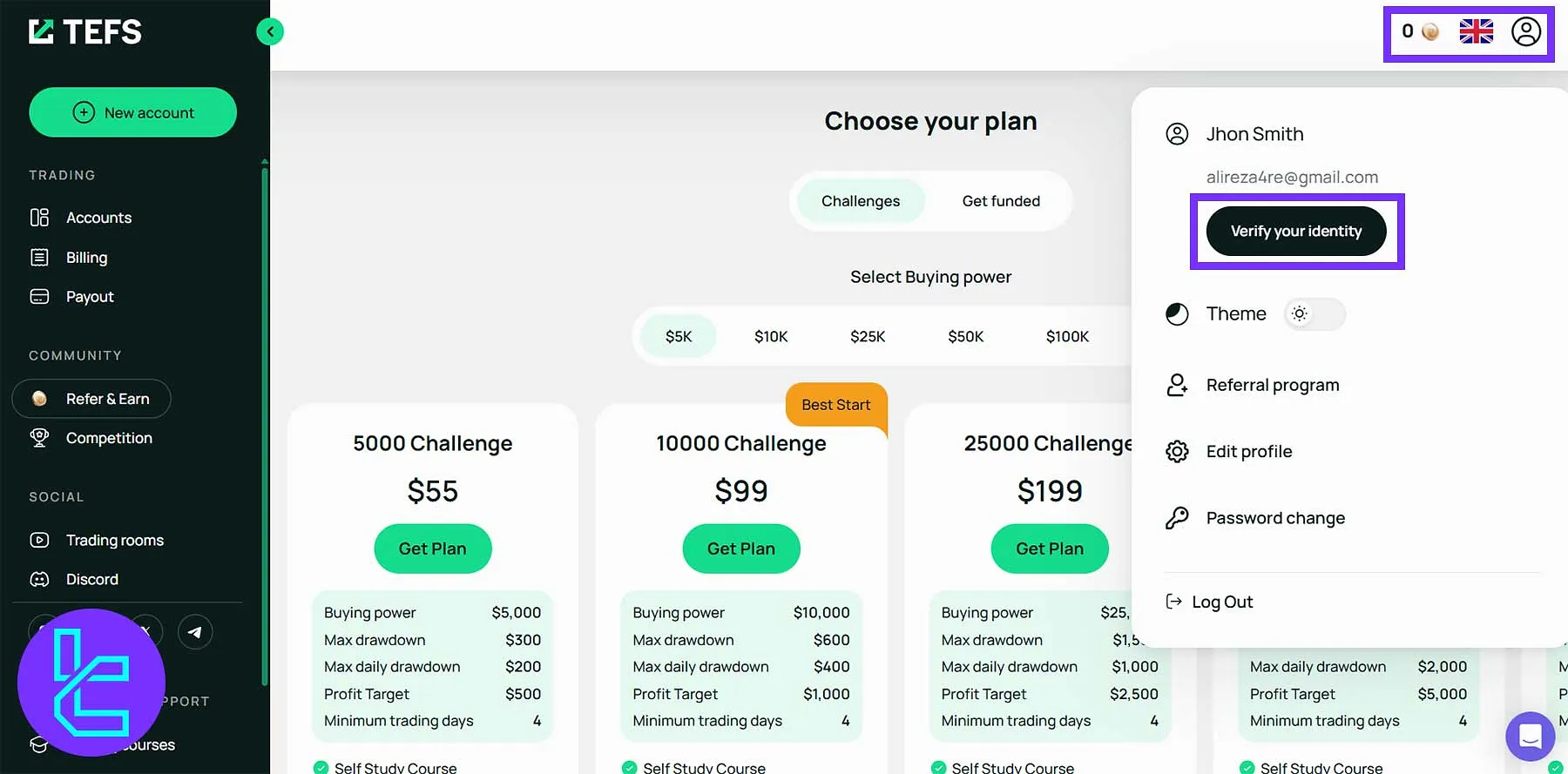

#6 Complete Identity Verification

Finalize your registration through Sumsub-powered verification. Upload supporting documents, including:

- Proof of ID: ID card, passport, or driver’s license

- Proof of Residence: Utility bill or bank statement

Also, you’ll need to complete a quick liveness check to confirm your identity.

TEFS Accounts Trading Conditions

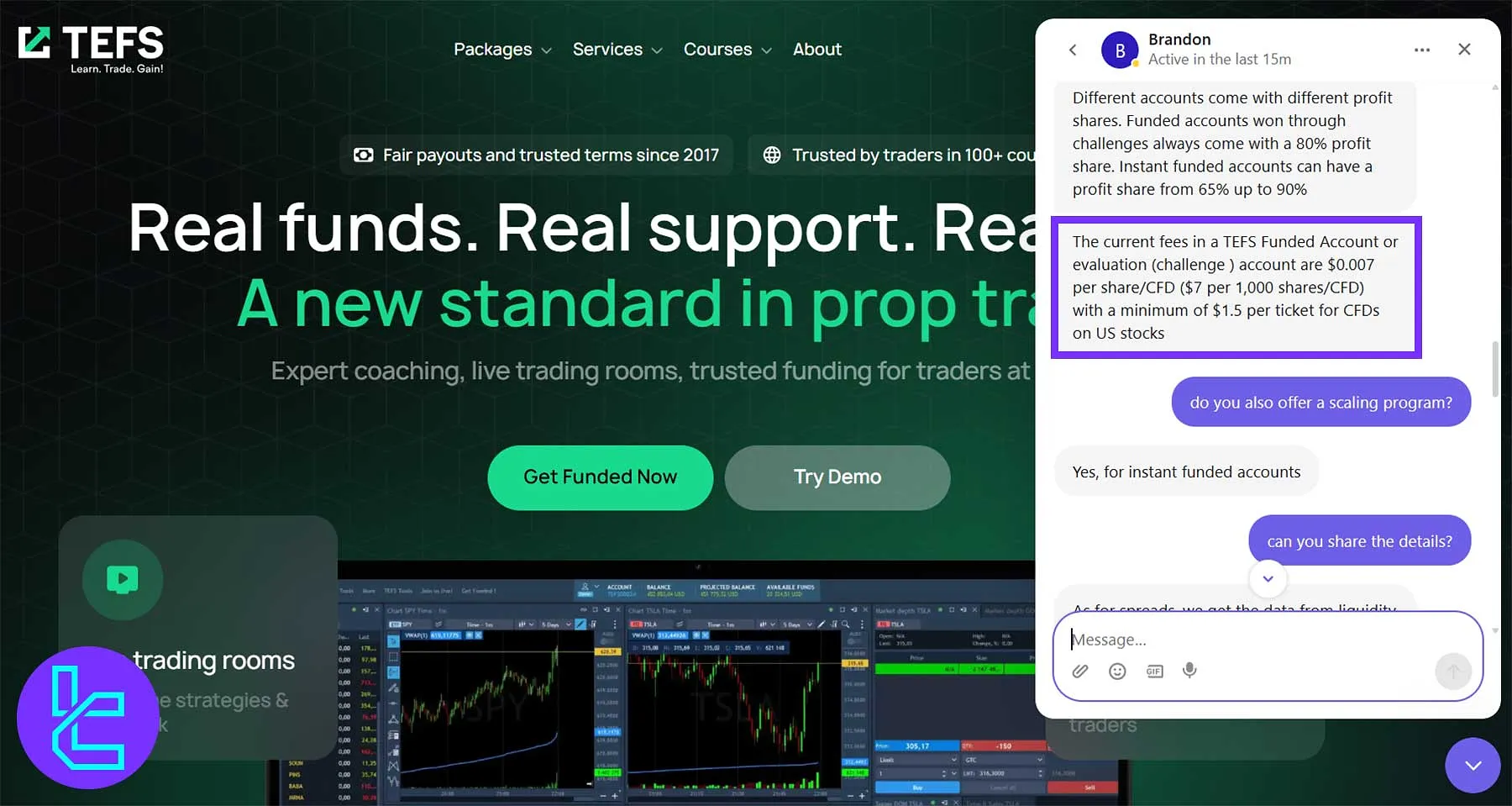

The prop firm offers two main funding models: 1-Step Challenge and Instant Funded. Both provide traders with flexible access to real capital, professional coaching, and transparent profit-sharing.

Challenge accounts are the affordable route to funding, while instant funding grants immediate trading access with tiered benefits.

Feature | 1-Step Challenge | Instant Funded |

Funding Access | After passing the challenge phase | Immediate upon purchase |

Profit Share | 80% | 65%–90% (based on plan) |

Daily Drawdown | 4% | None |

Total Drawdown | 6% | 5% |

Profit Target | 10% | None |

Time Limit | No | No |

Refundable Fee | Yes | No |

Payout Frequency | Monthly | Monthly |

Coaching & Courses | After funding | Included by tier |

TEFS 1-Step Challenge

The 1-Step Challenge program is ideal for traders seeking low-cost funding with a refundable entry fee. It offers a structured evaluation process with a clear 10% profit target, limited daily drawdowns, and an 80% profit share upon completion.

Buying Power | $5,000–$200,000 |

Profit Target | 10% |

Max Daily Loss | 4% |

Max Drawdown | 6% |

Step Count | 1 |

Profit Share (Funded) | 80% |

Refundable Fee | Yes |

Passing the challenge rewards traders with a free funded account of equivalent size. It’s a cost-effective way to secure real trading capital while learning disciplined risk management.

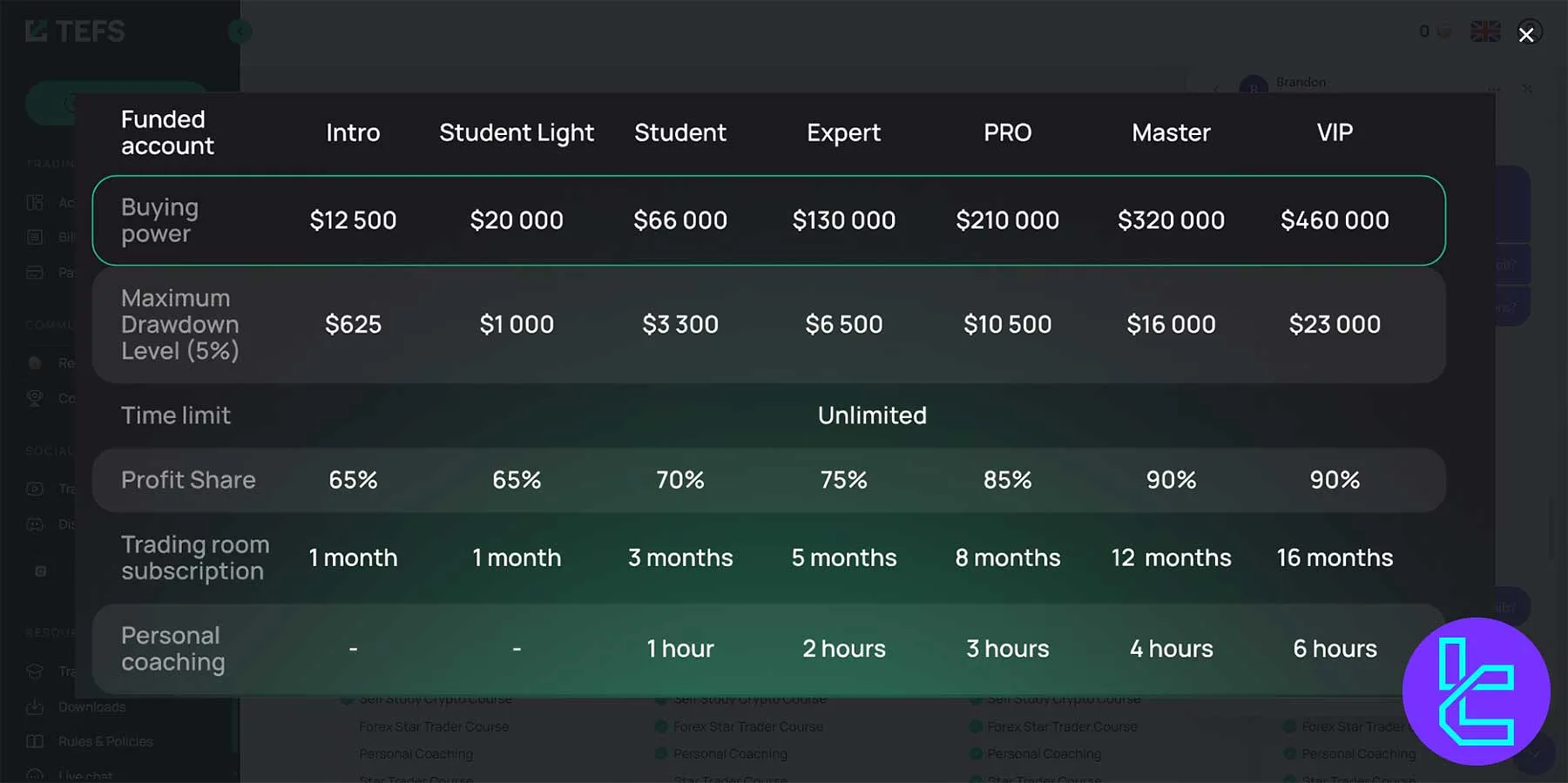

TEFS Instant Funded Accounts (Intro, Student, Expert, Pro)

The Instant Funded Accounts series provides immediate access to real capital, ranging from $2,000 to $460,000, with profit shares between 65% and 90%. Each plan includes educational tools, live trading rooms, and personal coaching.

Features | Intro Light | Intro | Student Light | Student | Expert | PRO | Master | VIP |

Buying Power | $2,000 | $12,500 | $20,000 | $66,000 | $130,000 | $210,000 | $320,000 | $460,000 |

Maximum Drawdown (5%) | $100 | $625 | $1,000 | $3,300 | $6,500 | $10,500 | $16,000 | $23,000 |

Time Limit | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

Profit Share | 65% | 65% | 65% | 70% | 75% | 85% | 90% | 90% |

Trading Room Subscription | 1 month | 1 month | 1 month | 3 months | 5 months | 8 months | 12 months | 16 months |

Personal Coaching | No | No | No | 1 hour | 2 hours | 3 hours | 4 hours | 6 hours |

Instant funding gives traders unlimited trading time, fast execution, and direct payouts. It’s ideal for professionals who want immediate access to capital without passing an evaluation phase.

Note: TEFS Master and VIP programs are not public packages; you can discuss the conditions of purchasing these packages with your account manager.

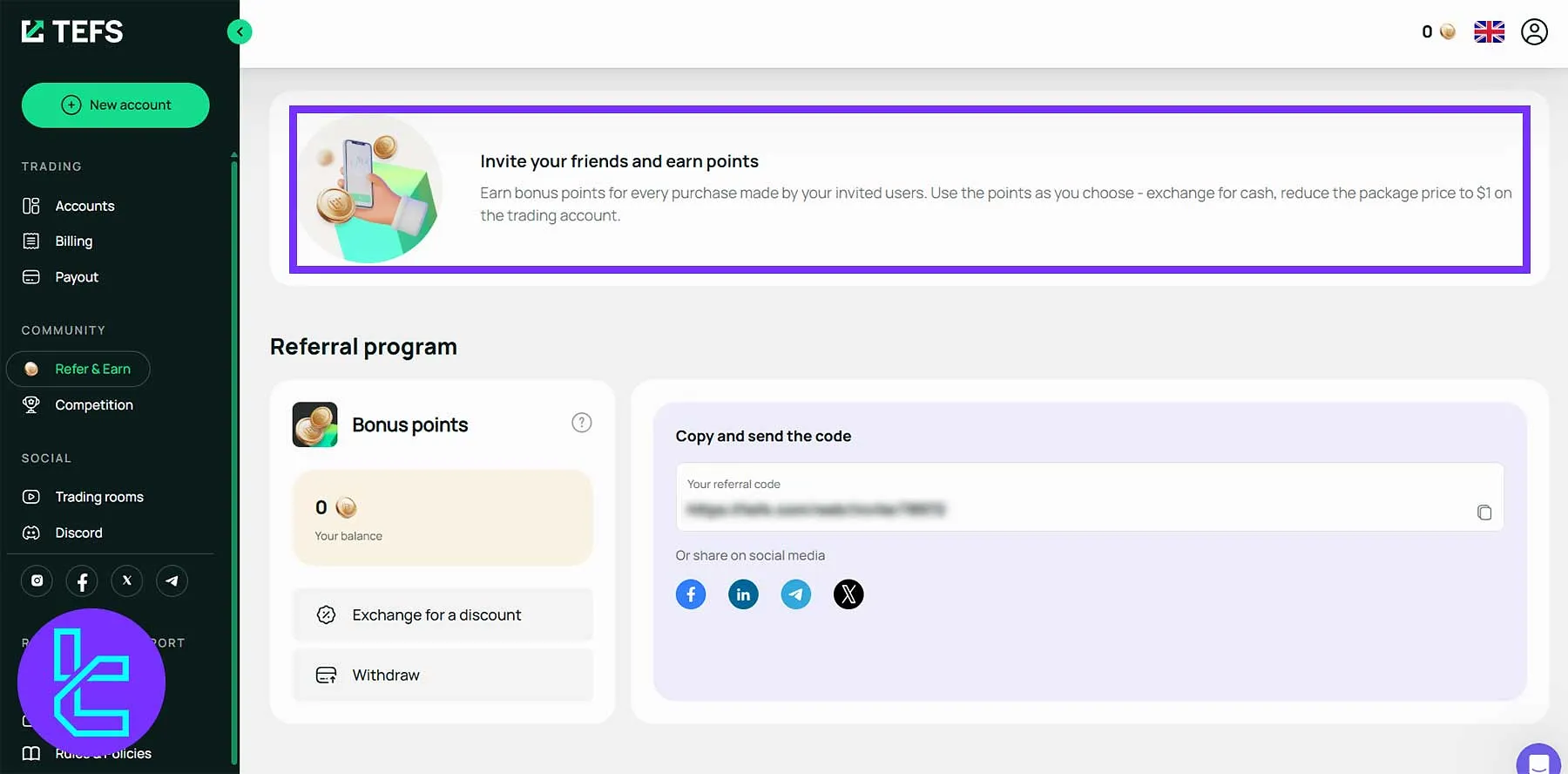

TEFS Promotions and Bonuses

TEFS rewards traders through ongoing promotions that enhance engagement and loyalty. From its Referral Program to Monthly Trading Competitions, TEFS offers both educational and financial incentives, including redeemable points, cash rewards, and access to funded accounts worth up to $16,500.

Feature | Referral Program | Monthly Competitions |

Reward Type | Bonus Points | Funded Packages & Cash Prizes |

Eligibility | All registered users | Registered TEFS traders |

Earning Criteria | Earn 1 point for every $10 spent by referred users | Compete for top rankings in trading performance |

Redemption / Benefit | Redeem points for discounts, cash, or exclusive rewards | Win funded accounts and cash prizes up to $16,500 |

Duration | Points valid for 12 months | Monthly recurring contests |

Limitations | No limit on the number of referrals | One entry per contest cycle |

TEFS Referral Program

The Referral Program allows traders to earn points for every friend they invite. Points can be redeemed for discounts or cash equivalents, making it a great way to grow your trading community and save on future plans.

- Earn 1 point for every $10 your referral spends;

- No limit on referrals or rewards;

- Points expire after 12 months;

- Redeem through your TEFS dashboard.

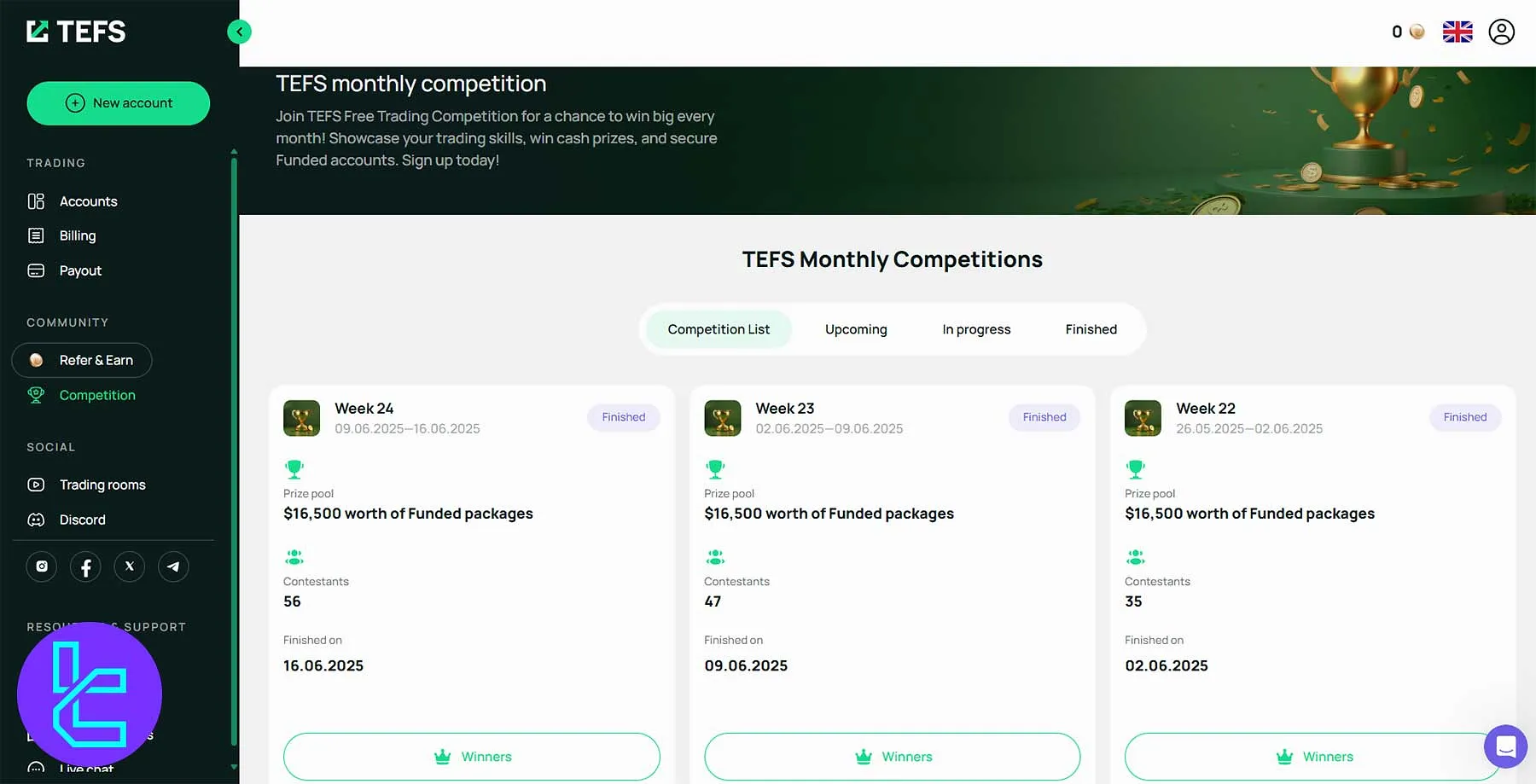

TEFS Monthly Competitions

The Monthly Trading Competition gives traders the chance to win big every month. Participants compete for $16,500 in funded packages, testing their trading strategies in real market conditions without financial risk.

- Free to enter for all TEFS users

- Compete for funded accounts and cash prizes

- Weekly contests with visible leaderboards

- Winners announced after each round

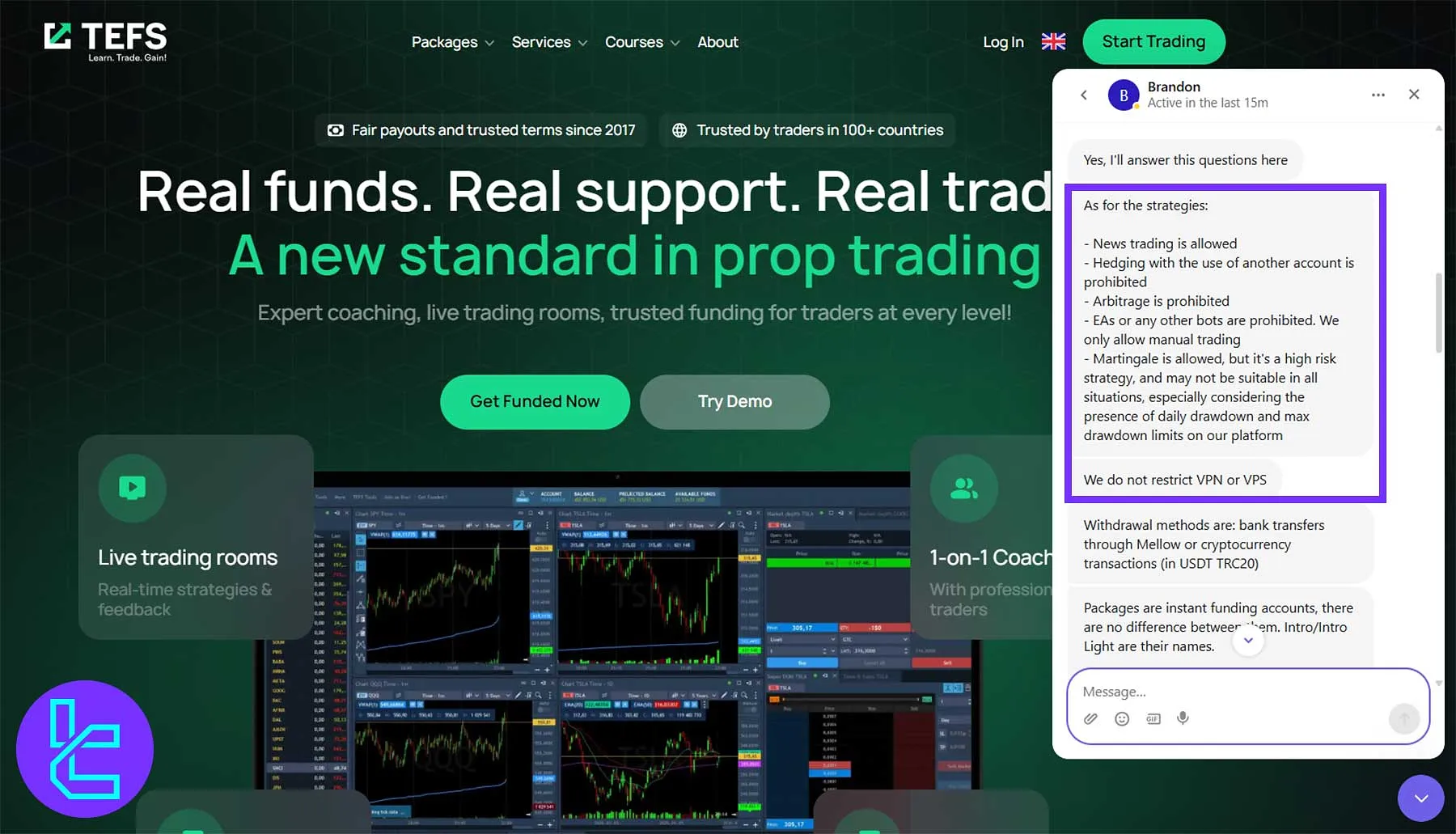

TEFS Prop Firm Rules

The prop firm operates with a transparent, trader-friendly rule framework designed to promote consistency, fairness, and long-term growth.

It supports manual trading strategies with flexible conditions while maintaining clear payout and compliance standards for all funded and challenge accounts. Summary of TEFS Rules

- VPN/VPS usage is fully allowed for flexibility and privacy;

- EAs and bots are prohibited; TEFS allows only manual trading;

- Hedging across multiple accounts is not permitted;

- Martingale strategies are allowed but carry high risk;

- Arbitrage is strictly prohibited;

- News trading is allowed;

- Profit split ranges from 65% to 90%, depending on account level and performance.

VPN/VPS Usage

Traders at TEFS can freely use VPN or VPS services to ensure stable connections, faster executions, and secure access from any location. There are no IP restrictions, allowing global accessibility.

Use of Expert Advisors (EAs)

TEFS enforces manual trading only, ensuring all trades reflect genuine trader skill and judgment. Automated systems, copy trading, or bots (EAs) are not permitted in any account type.

Hedging Policy

While internal hedging is allowed, cross-account hedging or opening offsetting positions across multiple TEFS accounts is not permitted. This rule maintains transparency and consistent performance evaluation.

- Cross-account hedging is prohibited;

- Internal single-account hedging is acceptable.

Martingale and Arbitrage Strategies

TEFS allows Martingale trading but warns traders of its high risk due to strict drawdown limits. Arbitrage strategies, however, are entirely banned to preserve fair trading conditions.

News Trading

Traders are welcome to capitalize on news-driven volatility at TEFS. The firm imposes no restrictions on trading during economic announcements or data releases. It’s ideal for short-term and high-volatility strategies.

You can utilize TradingFinder’s Economic Calendar to follow important financial events.

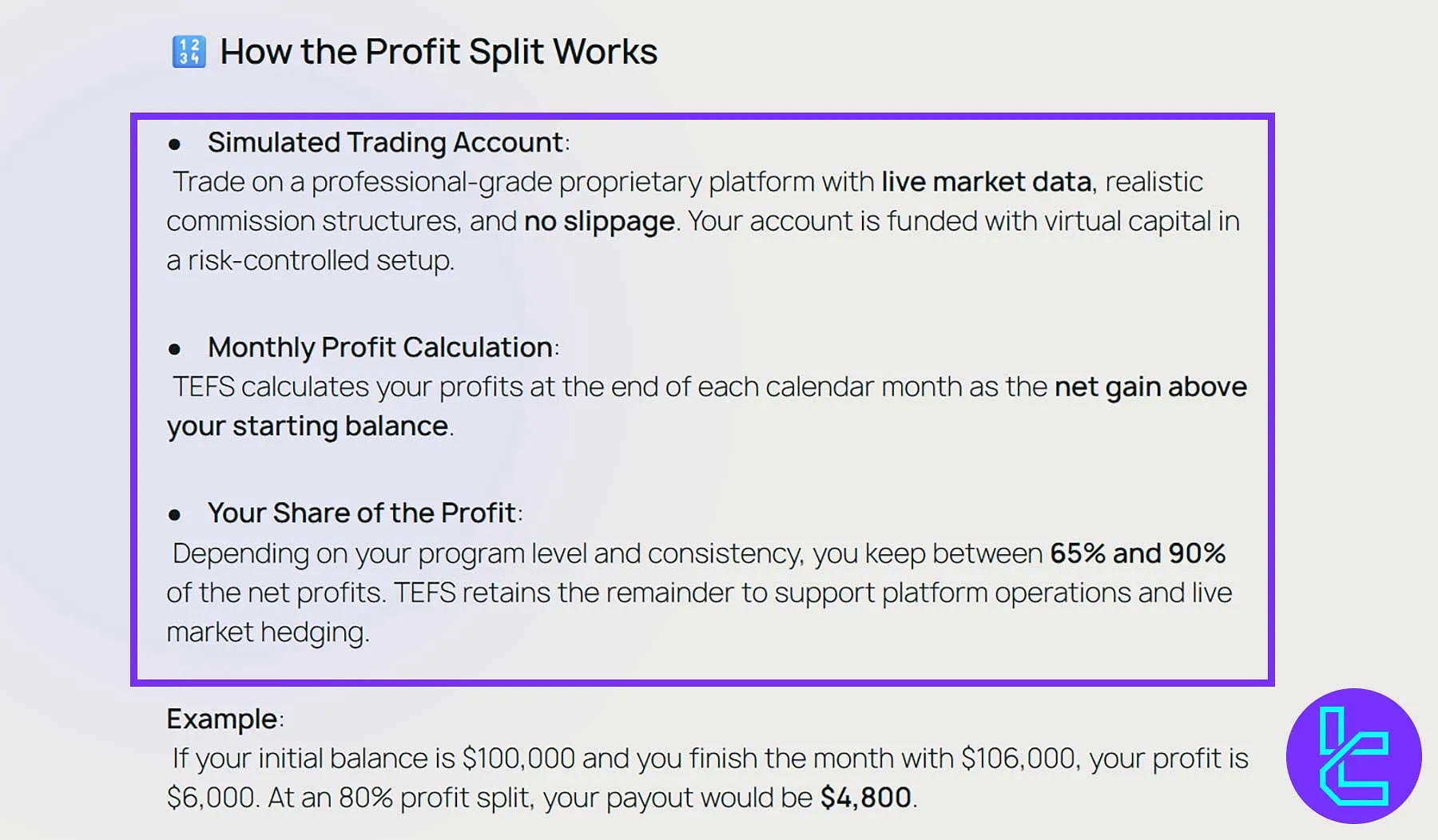

TEFS Payout Policy

The prop firm rewards traders through a transparent simulated profit-sharing model where traders earn real payouts from virtual trading. Profits are shared monthly, with payouts reaching up to 90% of net gains.

- Profit Split: 65%–90% based on performance and account type

- Payout Frequency: Processed monthly (by the 15th)

- Minimum Profit Threshold: $200–$400

- Maximum Payout: $15,000 per month

- Withdrawal Costs: No processing fees

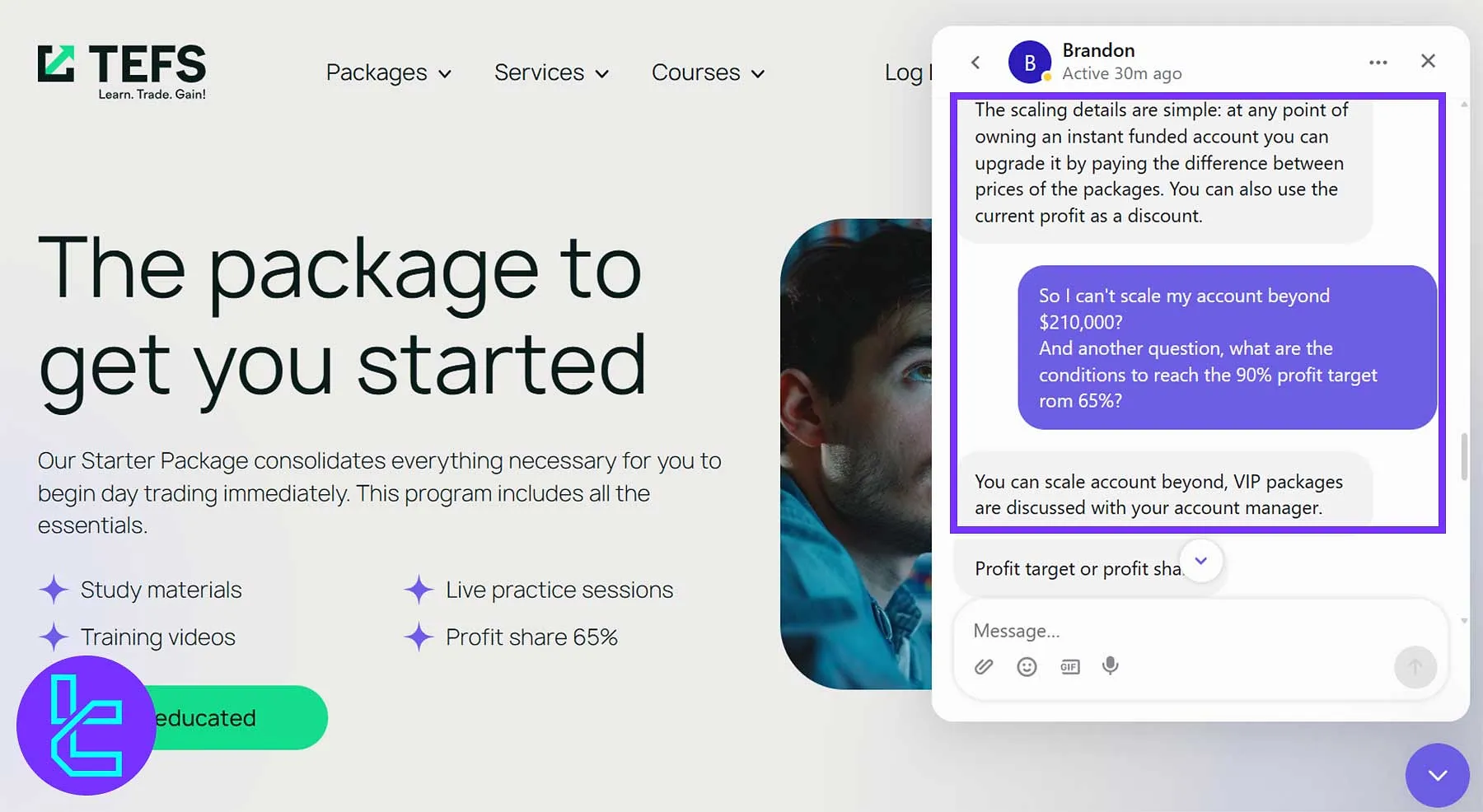

TEFS Prop Firm Scaling Program

The Scaling Program provides traders with a flexible way to grow their funded accounts without starting over. By paying only the price difference between packages, traders can instantly upgrade their account balance or even use current profits as a discount toward the upgrade.

- Instant upgrades available anytime by covering the price gap between account tiers;

- Profit-based discounts let traders scale without additional deposits;

- VIP packages and larger account sizes available through account manager consultation;

- Seamless transition without losing trading history or performance metrics;

- Ideal for consistent traders seeking to expand buying power responsibly.

TEFS Trading Platform

The TEFS Trading Platform delivers a professional-grade trading experience for funded and demo traders, providing real market data, advanced charting, technical analysis tools, and multi-asset execution.

Traders can access their login credentials directly from the “Accounts” tab in the client dashboard and trade instantly via web, Windows, android and iOS applications.

- Available as web-based, Windows desktop versions and mobile application for android and iOS;

- Credentials for login are accessible under the “Accounts” section of the dashboard;

- Supports trading on Forex, Stocks, Crypto, Futures, and Commodities;

- Real-time data, one-click trading, and fast execution;

- Comprehensive tools for portfolio tracking, open positions, and P&L monitoring.

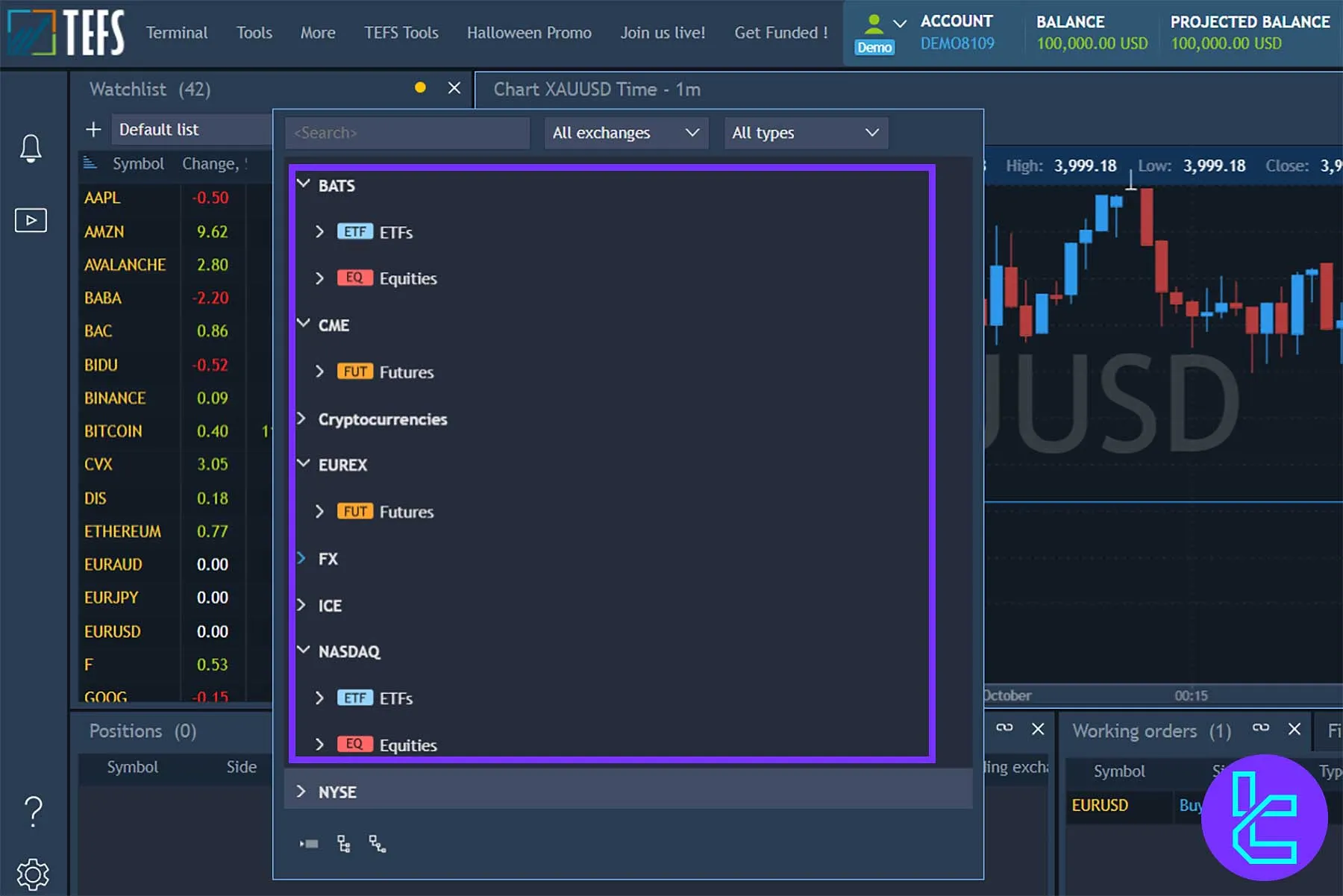

TEFS Markets and Trading Instruments

The prop firm grants access to over 3,000 global trading instruments, including US stock CFDs, Forex pairs, cryptocurrencies, metals, ETFs, and futures markets.

Traders can explore diverse markets across top exchanges, including CME, EUREX, NASDAQ, NYSE, BATS, and ICE, ensuring professional-level market exposure.

- US Stock CFDs: 2,300+ tradable equities across major U.S. exchanges

- Forex: 78 currency pairs with tight spreads and fast execution

- Crypto: 11 symbols, including Bitcoin, Ethereum, BNB, ADA, and XRP

- Metals: Trade Gold, Silver, Palladium, and Platinum

- Indices: Global indices

- ETFs & Futures: Access from leading global markets like CME, NASDAQ, and ICE

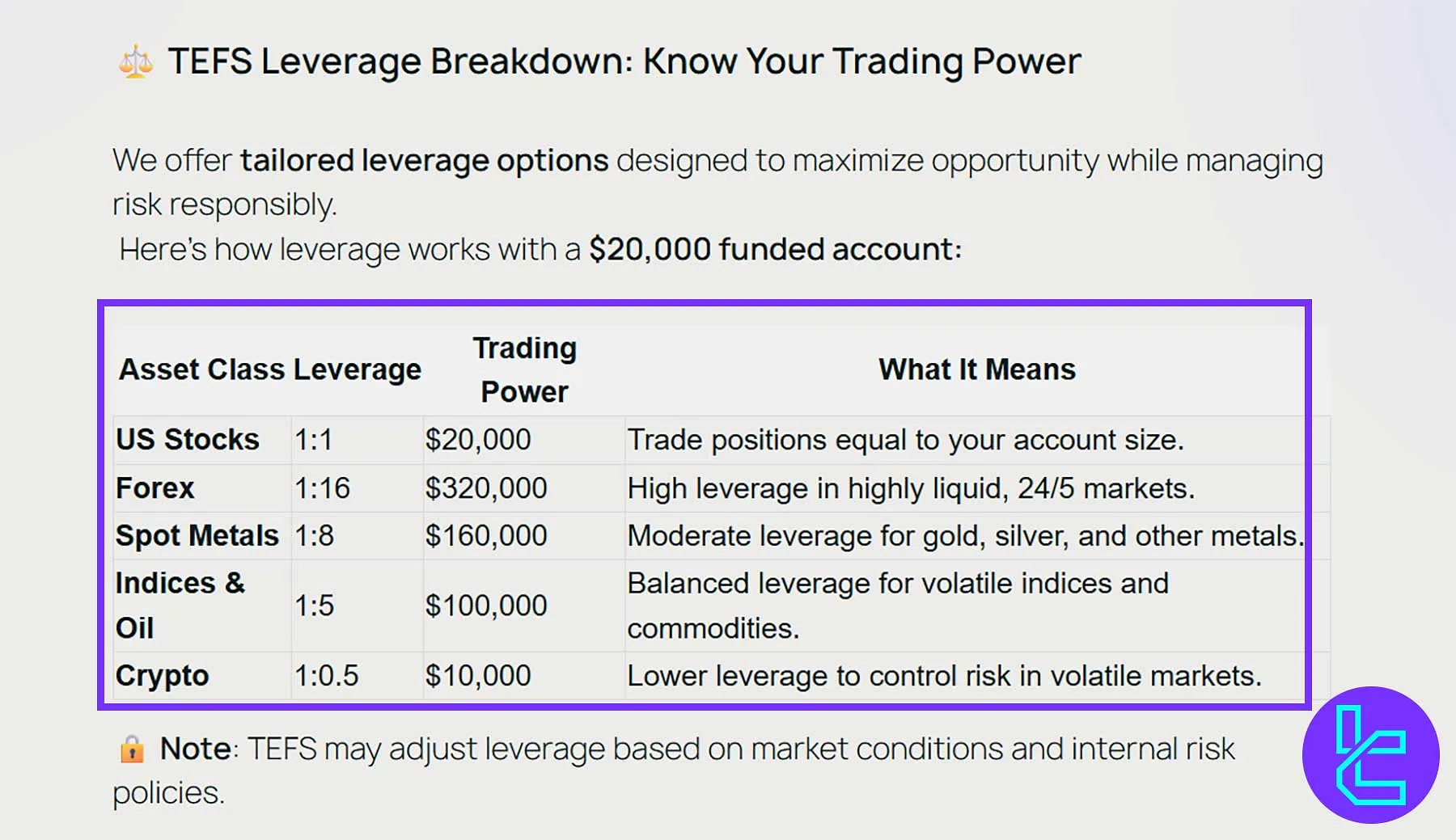

TEFS Prop Firm Leverage Offerings

The leverage system empowers traders to amplify their trading power responsibly. With tailored leverage across multiple asset classes, traders can control larger positions with smaller capital, turning funded accounts like the $20,000 package into access to over $320,000 in trading power.

Asset Class | Max Leverage |

Forex | 1:16 |

Stocks | 1:1 |

Metals | 1:8 |

Indices | 1:5 |

Crypto | 1:0.5 |

Built-in drawdown limits and stop-loss protections maintain safe trading environments.

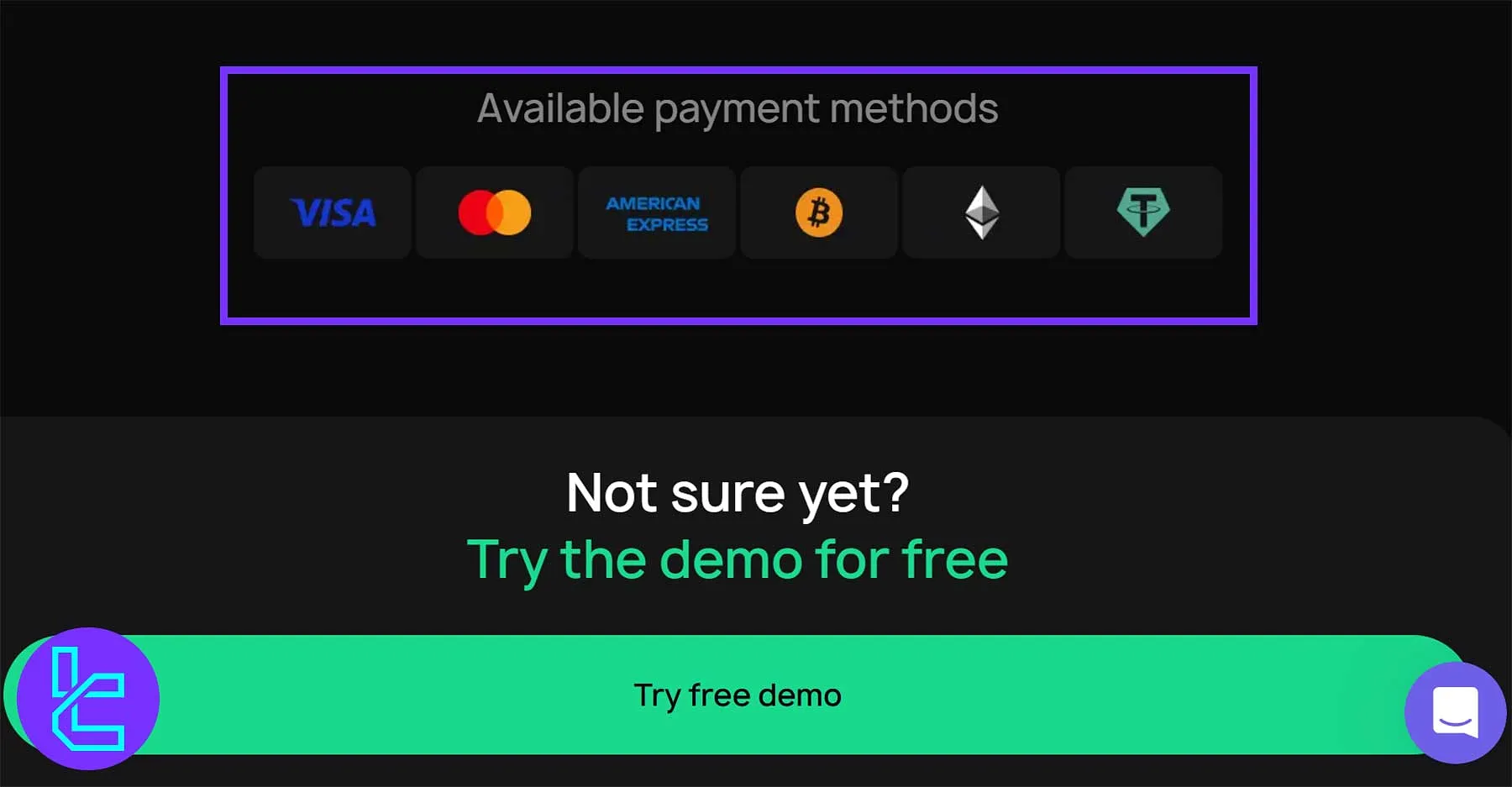

TEFS Payment and Payout Structure

The prop firm ensures smooth transactions for traders worldwide, offering multiple secure payment options and a transparent profit-sharing system.

Traders can earn up to 90% of their simulated profits and withdraw via bank transfer (Mellow) or cryptocurrencies (USDT TRC20), depending on preference and region.

- Accepted Payment Methods: Visa, Mastercard, American Express, Bitcoin, Ethereum, and Tether (USDT)

- Profit Split: Up to 90% of simulated profits paid in real funds

- Processing Schedule: Payouts processed monthly, on the 15th day

- Minimum Profit Requirements: $200 for Intro/Light, $400 for Standard

- Fees: No payout processing fees; TEFS covers wire transfer costs

- Limits: Up to $15,000 per calendar month

Note: Crypto transactions may incur blockchain network fees.

TEFS Trading Costs

Trading costs are designed for transparency and fairness, providing traders with institutional-grade pricing and real market data. With low per-share fees and raw spreads from liquidity providers, TEFS ensures a professional, cost-efficient trading experience for both Funded and Challenge account holders.

- Commission Rate: $0.007 per share or CFD (equivalent to $7 per 1,000 units)

- Minimum Fee: $1.5 per ticket for US stock CFDs

- Spreads: Sourced directly from liquidity providers without internal markups

- Pricing Structure: Real-time market conditions for accurate execution

- Platform Type: Same conditions apply for both funded and evaluation accounts

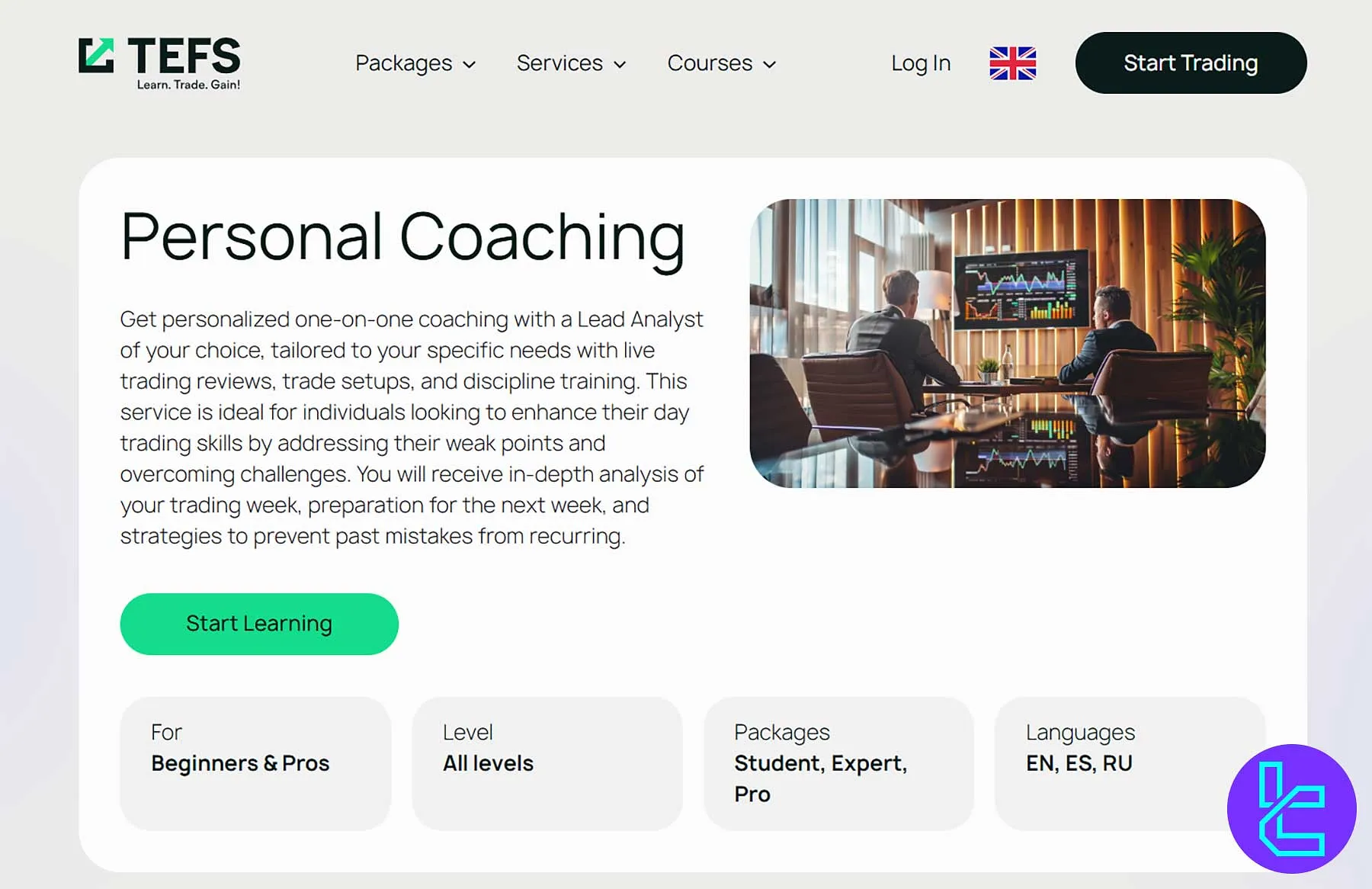

TEFS Prop Firm Educational Resources

The prop firm offers vast learning materials, providing structured, multilingual training for traders at every level. With nine specialized programs available in English, German, Spanish, and Russian.

TEFS combines practical demo accounts, self-study courses, coaching, and live trading rooms to turn aspiring traders into professionals.

- Demo Training Account: Practice in a risk-free environment with realistic analytics, Available in EN, ES, RU for Intro to Pro packages;

- Self-Study Day Trading Course: Covers trading fundamentals, chart analysis, and psychology for beginners (EN, DE, RU);

- Crypto Self-Study Course: Learn blockchain, crypto trading, and crypto fundamental analysis (EN, DE, RU);

- Forex Star Trader Course: Focus on forex and commodities, swing trading, and candlestick analysis;

- Star Trader Course: 15-hour professional training with mentoring and live sessions;

- Trading During Crisis Course: Teaches risk mitigation, VIX use, and crisis strategies;

- Risk Management Course: For advanced traders, covering expectancy, ratios, and discipline;

- Crypto Star Trader Course: Explains advanced strategies, chart tools, and crypto market psychology;

- Top Trader Course: Expert-level program focusing on institutional tactics and pivot-point indicators;

- Live Trading Room: Real-time trade calls and commentary from TEFS analysts;

- Personal Coaching: One-on-one sessions focusing on strategy, psychology, and consistency.

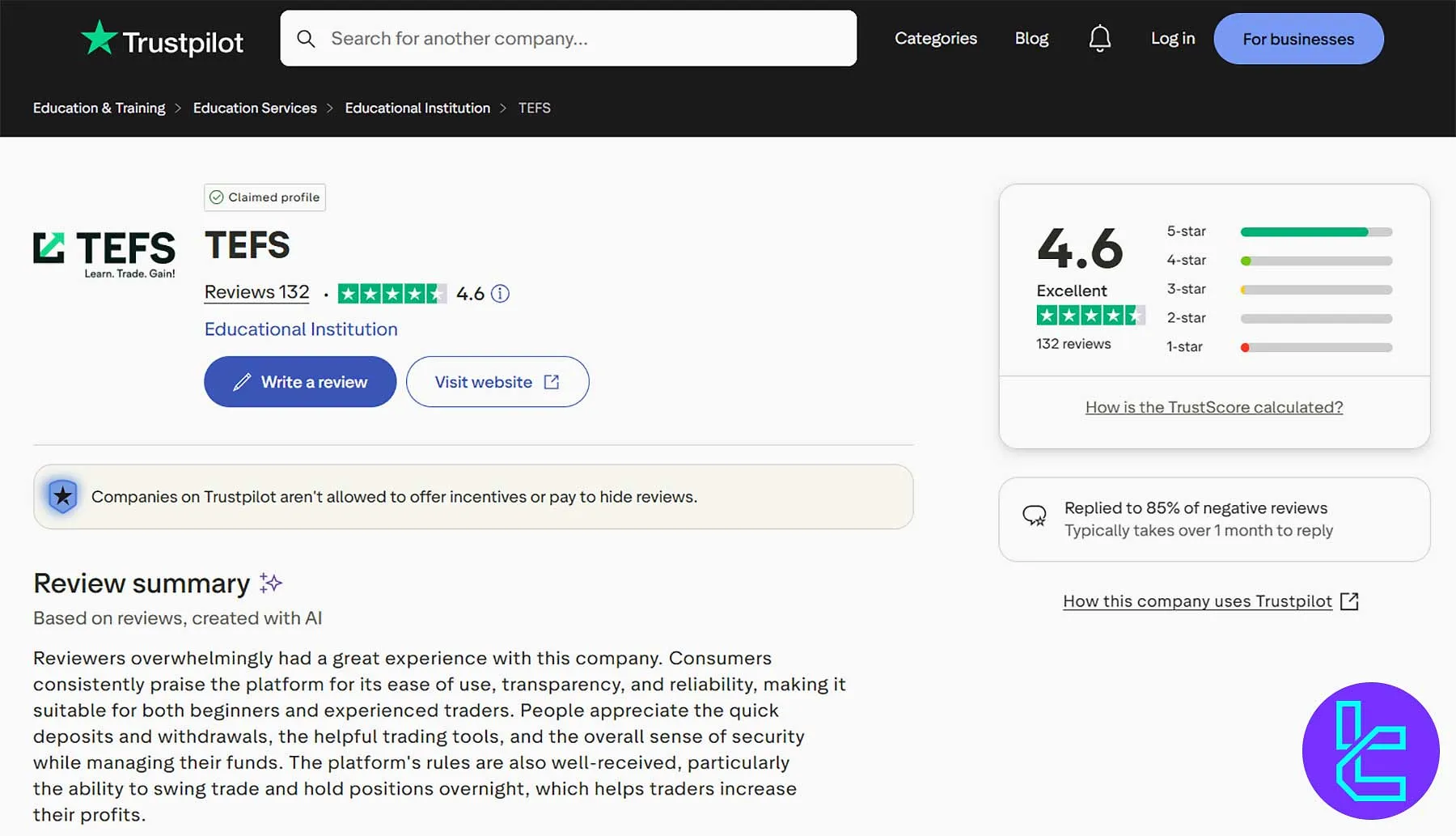

TEFS Trust Scores

The prop firm maintains strong online credibility, earning outstanding reviews from both users and independent trust analysis platforms. With a reputation for transparency, verified SSL security, and years of operation, TEFS is considered a safe and reliable prop trading environment by major review authorities.

The TEFS Trustpilot profile draws a picture of consistency in trustworthiness and customer satisfaction. Positive feedback highlights its transparency, fast withdrawals, and secure trading setup, while independent checks confirm website safety and legitimacy for traders worldwide.

- Trustpilot Rating: 4.6 out of 5 (based on 132 reviews)

- ScamAdviser Score: 100/100 (Verified SSL certificate and long-established domain)

TEFS Customer Support

The prop firm provides 24/7 support services through an online chat feature, available on the website. There are also other support methods, including:

Support Method | Availability |

Live Chat | Yes (On the official website) |

Yes (support@tefs.com) | |

Phone Call | Yes (+44 2039 578 535 / +1 646 357 8772 / +421 233 221 148) |

Discord | Yes |

Telegram | No |

Ticket | No |

FAQ | Yes |

Help Center | No |

Yes (+421 904 170 553) | |

Messenger | No |

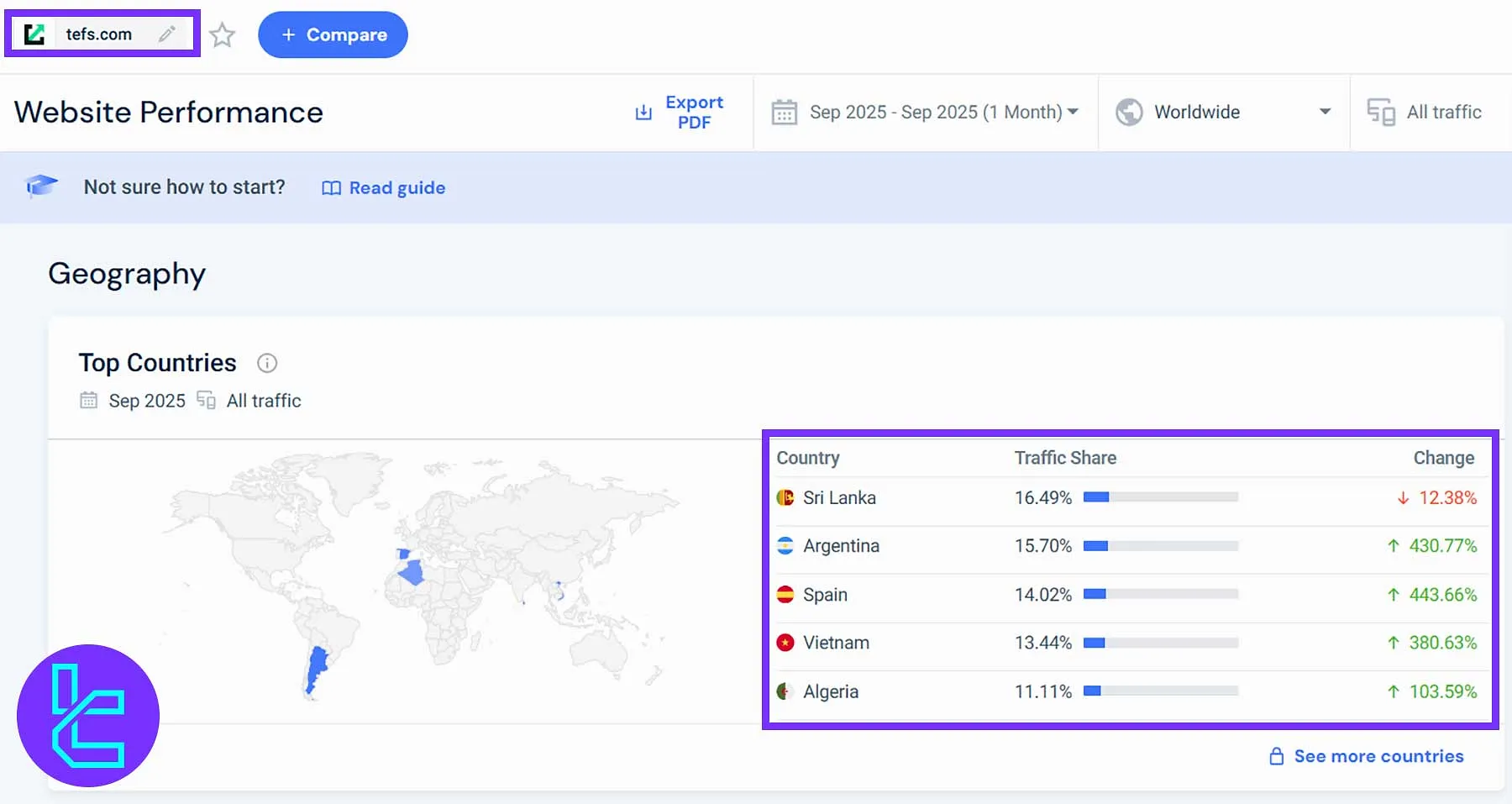

TEFS Client Base

TEFS continues to expand its global reach, attracting traders from multiple continents. As of September 2025, the prop firm reports a strong international audience led by emerging markets and a significant surge in engagement from Latin America, Europe, and Asia, according to the TEFS Similarweb profile.

TEFS’s client base showcases diverse participation, reflecting the firm’s growing appeal among both beginner and professional traders seeking funded opportunities in Forex, crypto, and equities across different regions.

- Sri Lanka: 49% of total traffic, showing steady retention despite a 12.38% dip

- Argentina: 70% share, marking a 430.77% surge in user activity

- Spain: 02% traffic share, up 443.66%, highlighting rapid European growth

- Vietnam: 44%, with a 380.63% increase, signaling rising Asian adoption

- Algeria: 11% share, with 103.59% growth in North Africa

TEFS Social Media

The prop firm maintains an active presence across multiple platforms to inform its client community about active promotions, ongoing events, platform upgrades, new features, challenges, discounts, and more.

Social Media | Members/Subscribers |

1500 | |

574 | |

78600 | |

78 | |

178 |

TEFS Prop Firm Comparison Table

Let’s see how TEFS stands in comparison with some of the most popular prop firms:

Parameters | TEFS Prop Firm | |||

Minimum Challenge Price | $55 | $13 | $39 | €55 |

Maximum Fund Size | $460,000 | $100,000 | $250,000 | Infinite |

Evaluation steps | Instant, 1-Step | Instant, 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step | 2-Step |

Profit Share | Up to 90% | 80% | 100% | 100% |

Max Daily Drawdown | 4% | 4% | 5% | 5% |

Max Drawdown | 6% | 8% | 10% | 8% |

First Profit Target | 10% | 8% | 5% | 10% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:16 | 1:75 | 1:100 | 1:100 |

Payout Frequency | Monthly | 10 Days | Bi-weekly | 14 Days |

Number of Trading Assets | 3,000+ | 400+ | 3000+ | 150+ |

Trading Platforms | Proprietary platform | Match-Trader, cTrader, MetaTrader 5 | Metatrader 5 | cTrader, DXTrade |

Expert Suggestion and Conclusion

TEFS provides access to funded accounts with a minimum withdrawal requirement of $200. It processes payouts through Mellow (bank transfer) and USDT, and supports payments via BTC, ETH, VISA, MasterCard, and American Express.

TEFS prop firm has a great Trustpilot score of 4.6 out of 5 and a 100/100 rating on ScamAdviser. Educational resources in English, Russian, Spanish, and German are among the advantages in this TEFS review, while the high $7 commission per 1,000 shares/CFDs is considered a downside.