ThinkCapital prop firm is backed by the regulated broker ThinkMarkets, leveraging the exclusive ThinkTrader platform alongside integrations with TradingView and MetaTrader 5.

Since its launch in 2024, the firm offers three distinct funding models including called Lightning, Dual Step, and Nexus Challenge.

With capital offerings scaling from $5K up to $600K (and scalable to $1.5M), and a profit share of up to 90%, already served to 10,000+ traders.

ThinkCapital Company Information

ThinkCapital is a proprietary trading firm launched in 2024 as a subsidiary of ThinkMarkets, a globally regulated brokerage.

The firm operates out of 85 Great Portland Street, London, England, under the leadership of CEO Faizan Anees.

With a dedicated team of 11–50 employees, ThinkCapital has already onboarded over 10,000 traders and offers capital allocations of up to $600,000, which can be scaled up to $1.5 million through performance-based progression.

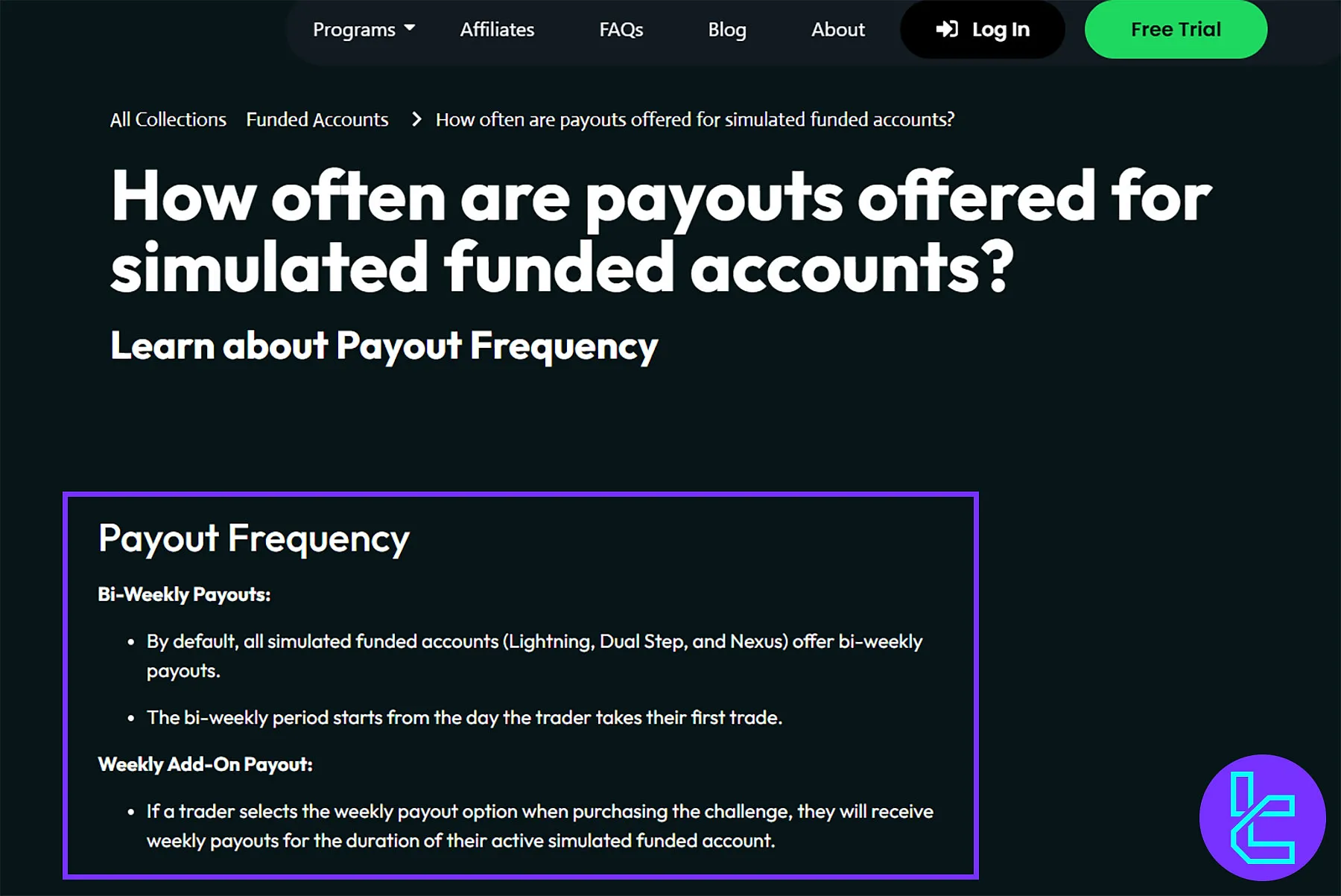

Payouts in ThinkCapital are processed every 14 days, and traders can earn up to 90% profit share. Quick facts of ThinkCapitalprop firm:

- Founded: 2024

- Headquarters: London, England

- CEO: Faizan Anees

- Employees: 11–50

- Platform: ThinkTrader (proprietary), TradingView

- Capital: $5K to $600K (scalable to $1.5M)

- Profit Split: Up to 90%

- Challenges: Lightning, Dual Step, Nexus

- Traders: 10,000+

- Payout Frequency: Every 14 days

- Prices: $39 to $1,099

ThinkCapital CEO

Faizan Anees is the CEO and co-founder of Think Capital and ThinkMarkets Group Holdings Ltd. With a strong background in financial services, he has driven the group’s global expansion since 2010, focusing on innovation and market growth.

- Co-founded TF Global Markets (UK) Ltd. and ThinkMarkets Group Holdings

- Former Co-CEO of Think Financial Group Holdings Ltd.

- Holds an undergraduate degree from DePaul University (2010)

- Experienced leader in fintech, trading technology, and business strategy

ThinkCapital Specifications

ThinkCapital offers a proprietary trading experience through its exclusive platform ThinkTrader, also integrated with TradingView and MetaTrader 5 (Platform 5).

A competitive profit split of up to 90%, bi-weekly payouts, and scalability up to $1.5 are some of the features of ThinkCapital prop. Table below provides everything you need to know about this prop firm:

Account Currency | USD |

Minimum Price | $39 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Up to 90% |

Instruments | Forex, Commodities, Indices, and Cryptocurrencies |

Assets | 4000+ |

Evaluation Steps | 1 Step, 2 Step, 3 Step |

Withdrawal Methods | Crypto (USDT) and Credit Card (VISA, MasterCard, AMEX, Discover and JCB) |

Maximum Fund Size | $200,000 [Scaling Up to $1.5M] |

First Profit Target | Variable Based on the Challenge |

Max. Daily Loss | 4% |

Challenge Time Limit | 3 Days |

News Trading | Specified Limit |

Maximum Total Drawdown | 8% |

Trading Platforms | ThinkTrader, TradingView, Platform 5 (MetaTrader 5) |

Commission Per Round Lot | Not Specified |

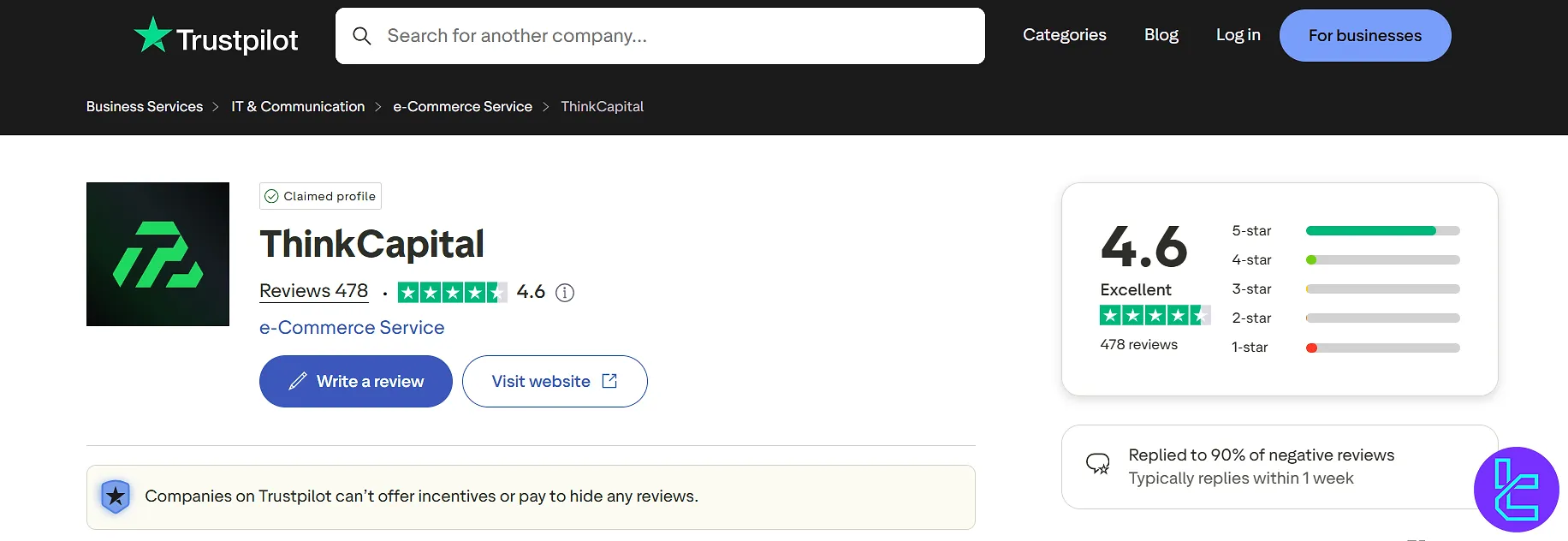

Trustpilot Score | 4.6 |

Payout Frequency | Bi-weekly |

Established Country | UK |

Established Year | 2024 |

What are the ThinkCapital Pros & Cons?

The firm is powered by ThinkMarkets and uses the exclusive ThinkTrader platform, ensuring robust execution and reliability.

However, its scaling model and advanced challenge options may require a deeper understanding of prop trading dynamics, especially for beginners. ThinkCapital advantages and disadvantages:

Pros | Cons |

Backed by regulated broker ThinkMarkets | May be complex for absolute beginners |

Offers up to 90% profit share | Pricing may be high on advanced challenges |

Three evaluation models to choose from | Limited educational content for newer traders |

Integrated with ThinkTrader, TradingView, and MT5 | - |

Bi-weekly payouts and scaling up to $1.5M | - |

Funding & Price in ThinkCapital

ThinkCapital offers three types of trading challengesLightning, Dual Step, andNexus each designed to match different trader skill levels and risk appetites.

The capital sizes range from $5,000 to $200,000, with the opportunity to scale up to $1.5 million through consistent performance. Prices start at just $39, depending on the chosen model and account size. ThinkCapital Challenge price table:

Account Size | Price in Lightning | Price on Dual Step | Price on Nexus |

$5000 | $59 | $59 | $39 |

$10000 | $99 | $99 | $79 |

$25000 | $199 | $199 | $139 |

$50000 | $299 | $299 | $199 |

$100000 | $499 | $499 | $349 |

$200000 | $1.099 | $1.099 | $749 |

How to Sign Up in ThinkCapital?

Getting funded with ThinkCapital is a four-step process. From selecting your preferred challenge to finalizing payment, the signup flow is intuitive and streamlined. Steps to Get Started:

- Choose your preferred challenge model

- Customize your account specifications and add-ons

- Fill in personal details

- Complete payment and start trading

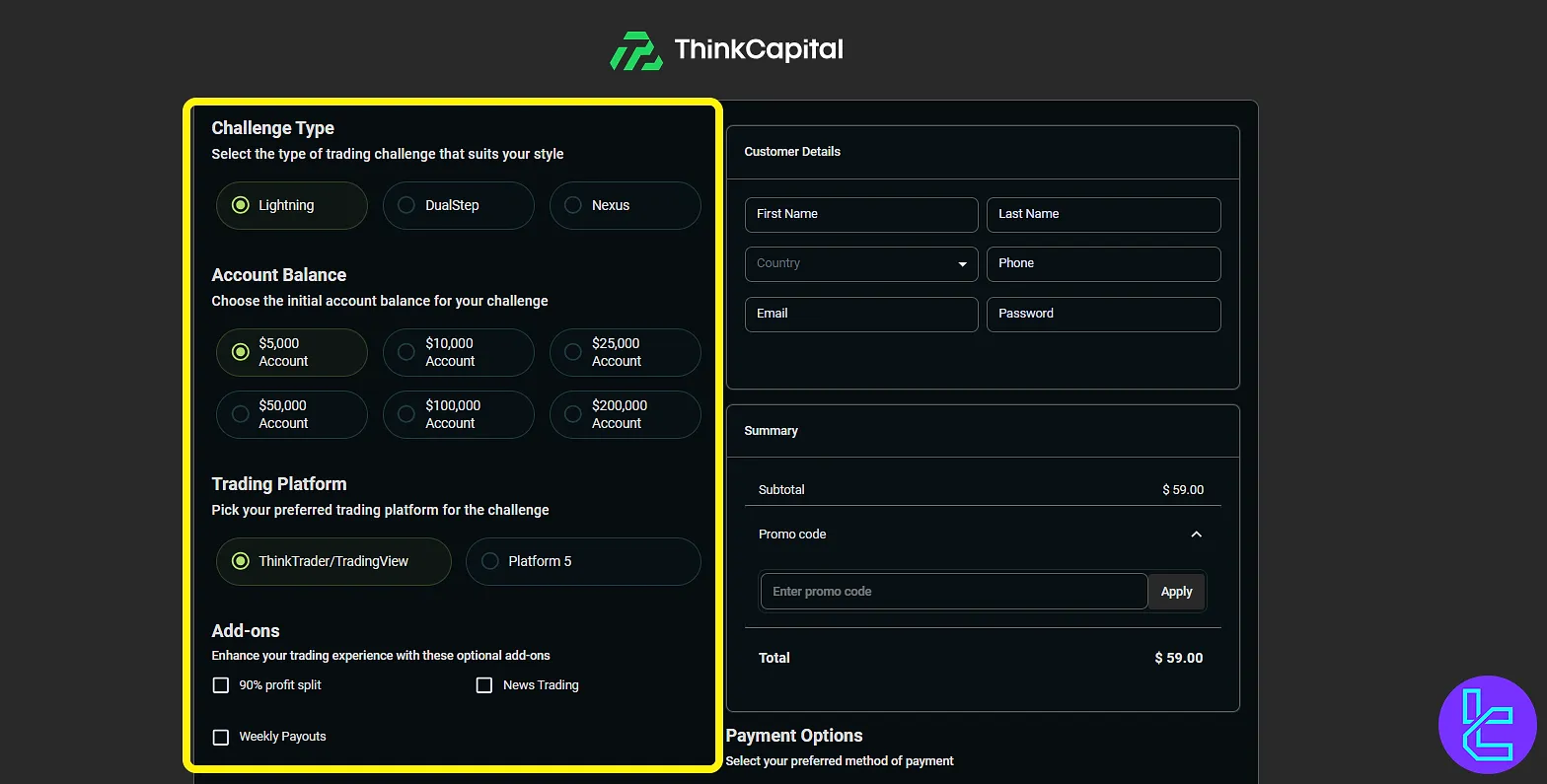

#1 Choose your preferred challenge model

To begin, head over to the official ThinkCapital website and click on the “Get Funded” button located on the homepage.

This action takes you directly to the challenge selection page, where you can compare evaluation models and pricing.

#2 Customize your account specifications and add-ons

After clicking “Get Funded,” you’ll be prompted to configure your account.

You can customize multiple parameters:

- Account Balance

- Trading Platform

- Add-ons including 90% profit share, news trading permission, weekly payouts

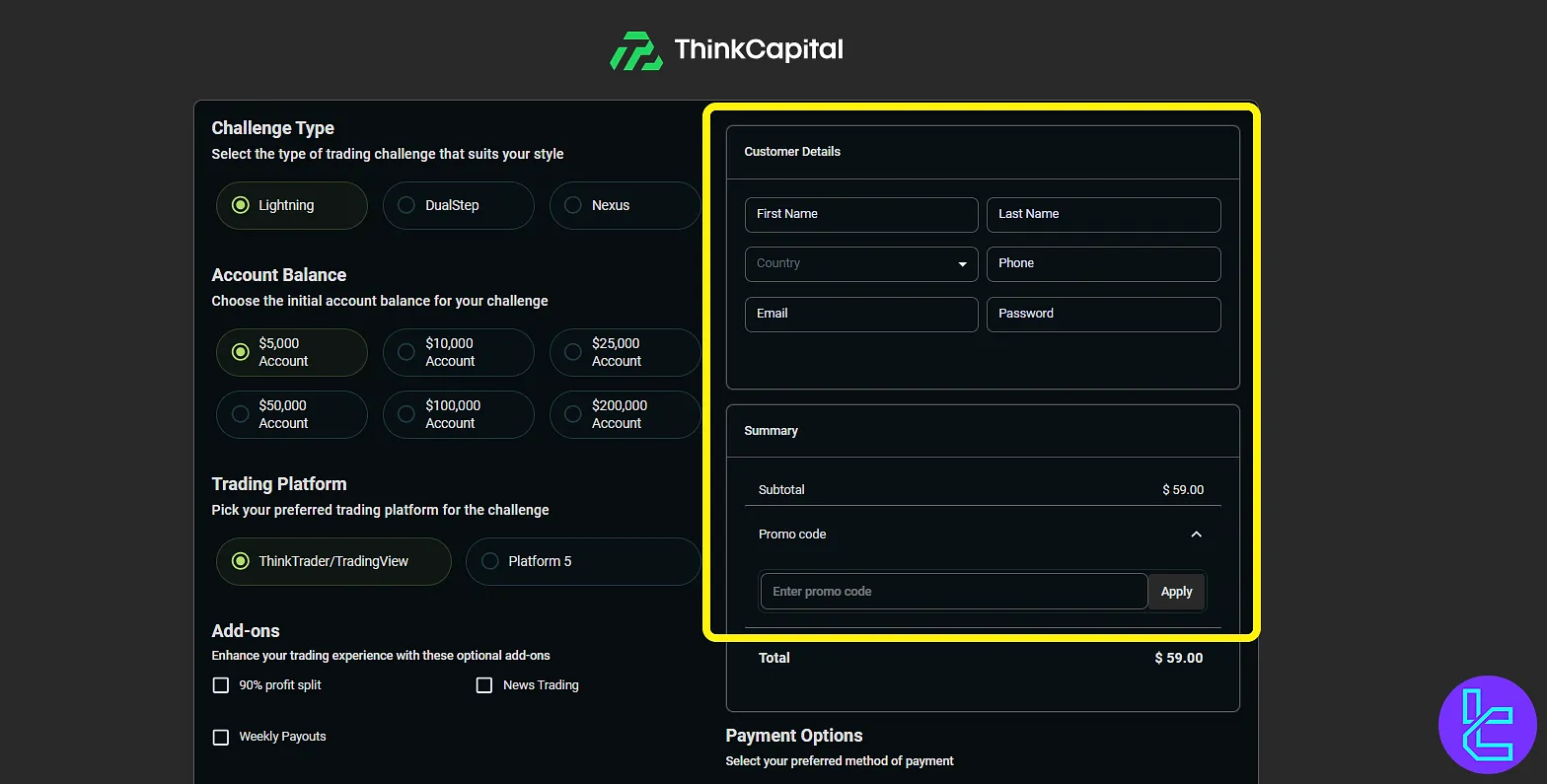

#3 Fill in personal details

Once your challenge is configured, ThinkCapital will ask for basic personal and account information.

These details are used to generate your account credentials and ensure smooth communication.

Required Information:

- First Name

- Last Name

- Country of Residence

- Phone Number

- Email Address

- Password (for your account)

- Promo Code (optional, e.g., WELCOME20 for discounts)

Make sure all information is accurate to avoid verification delays later in the process.

#4 Complete payment and start trading

In the final step, you'll select a payment method and finalize the purchase. ThinkCapital offers secure and fast payment processing through several options:

Available Payment Methods:

- Cryptocurrency: USDT (Tether)

- Credit/Debit Cards: VISA, MasterCard, AMEX, Discover, JCB

After successful payment, your account setup begins automatically, and you’ll receive platform login credentials via email within minutes.

ThinkCapital Trading Challenge Conditions

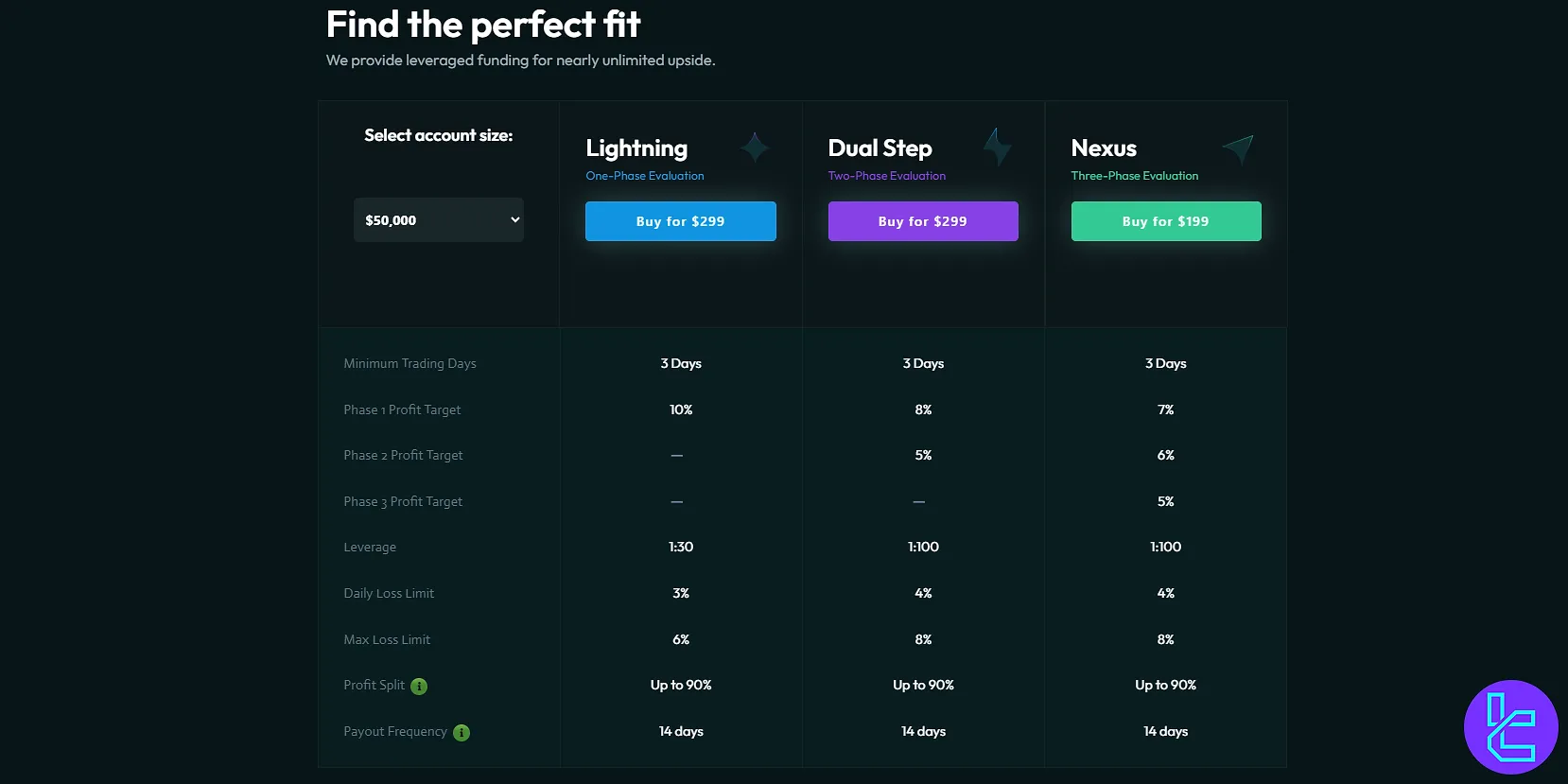

ThinkCapital structures its offerings around three trading models Lightning, Dual Step, and Nexus.

Each challenge comes with unique trading objectives, including daily and maximum drawdown rules, minimum trading days, and profit targets.

Traders must complete these challenges using only permitted strategies and within the defined timeframe to become eligible for a real funded account.

Beside all of these, you can see the specifics of the challenges in the table below:

Specifics | Lightning | Dual Step | Nexus |

Minimum Trading Days | 3 Days | 3 Days | 3 Days |

Phase 1 Profit Target | 10% | 8% | 7% |

Phase 2 Profit Target | - | 5% | 6% |

Phase 3 Profit Target | - | - | 5% |

Maximum Leverage | 1:30 | 1:100 | 1:100 |

Daily Loss Limit | 3% | 4% | 4% |

Max Loss Limit | 6% | 8% | 8% |

Profit Split | Up to 90% | Up to 90% | Up to 90% |

Payout Frequency | 14 days | 14 days | 14 days |

ThinkCapital Lightning Challenge

The Lightning Challenge is a fast-track proprietary trading evaluation designed for skilled traders seeking quick funding.

With a short 3-day minimum trading requirement and a competitive profit split, it offers one of the fastest paths to capital.

Minimum Trading Days | 3 Days |

Phase 1 Profit Target | 10% |

Phase 2 Profit Target | - |

Phase 3 Profit Target | - |

Maximum Leverage | 1:30 |

Daily Loss Limit | 3% |

Max Loss Limit | 6% |

Profit Split | Up to 90% |

Payout Frequency | 14 days |

ThinkCapital Dual Step Challenge

The DualStep Challenge is a structured two-phase evaluation built for traders who value a balanced risk-reward approach.

With higher leverage and attainable profit targets, it provides a clear path to securing a funded trading account.

Minimum Trading Days | 3 Days |

Phase 1 Profit Target | 8% |

Phase 2 Profit Target | 5% |

Phase 3 Profit Target | - |

Maximum Leverage | 1:100 |

Daily Loss Limit | 4% |

Max Loss Limit | 8% |

Profit Split | Up to 90% |

Payout Frequency | 14 days |

ThinkCapital Nexus Challenge

The Nexus Challenge is a comprehensive three-phase evaluation program for traders aiming for consistent performance.

With generous leverage and tiered profit targets, it rewards disciplined strategies and long-term trading consistency.

Minimum Trading Days | 3 Days |

Phase 1 Profit Target | 7% |

Phase 2 Profit Target | 6% |

Phase 3 Profit Target | 5% |

Maximum Leverage | 1:100 |

Daily Loss Limit | 4% |

Max Loss Limit | 8% |

Profit Split | Up to 90% |

Payout Frequency | 14 days |

Does ThinkCapital Offer Bonus & Discounts?

Traders can receive a 20% discount on their first challenge purchase by using the promo code “WELCOME20” during checkout.

This promotion applies across all challenge types [Lightning, Dual Step, and Nexus] and is valid for any account size.

It’s a part of ThinkCapital’s strategy to lower the entry barrier while still maintaining funding standards.

ThinkCapital Rules

ThinkCapital enforces a clear set of trading rules across all its challenge models and funded accounts. Key Compliance Guidelines for Traders on ThinkCapital:

- Use of Expert Advisors (EAs), high-frequency strategies, and latency arbitrage trading is prohibited due to market fairness and simulation abuse concerns;

- Copy trading, grid setups, and martingale-style progression are not allowed as they undermine responsible risk management;

- All forms of hedging across accounts or through group coordination are forbidden;

- Traders must refrain from engaging in trades around high-impact economic news events, particularly those marked with red folders on ForexFactory;

- Usage of VPNs or VPS is restricted and only permitted under predefined technical arrangements (i.e., ForexVPS);

- Exploiting platform bugs, delayed data, or the simulated trading structure itself can result in disqualification and forfeiture of profits;

- Gambling-like behavior, including punting or reckless speculation, directly violates ThinkCapital’s standards of professional trading conduct;

- ThinkCapital offers bi-weekly or weekly payouts with Rise, Crypto, and ThinkMarkets options, transparent fees, and regional eligibility rules.

Expert Advisors (EAs) and Algorithmic Tools

Deployment of automated trading tools, including Expert Advisors (EAs), is disallowed on any account type that does not explicitly support them.

These systems may execute high-volume or complex strategies without adhering to risk management rules, leading to distorted simulation results and potential platform instability.

ThinkCapital enforces firm restrictions on algorithmic activity to preserve fairness and simulation integrity.

Prohibited Trading Strategies

Some strategies are prohibited to use in ThinkCapital including copy trading, grid trading, latency arbitrage and etc.

Copy or Mirror Trading

ThinkCapital mandates that all trades originate from the trader’s own decisions.

Strategies such as copy trading, social trading, or mirror replication where trade execution is based on duplicating the actions of another party are not accepted under any account structure.

Grid Trading (including Reverse Grids)

Executing simultaneous buy and sell orders on the same asset with offsetting exposure commonly known as grid trading presents risk-free behavior incompatible with ThinkCapital’s simulation environment.

These strategies, often used to manipulate drawdowns or simulate profits, are banned due to their deviation from realistic market behavior.

Latency Arbitrage

Exploiting differences in data transmission speed between trading venues, a tactic known as latency arbitrage, is forbidden.

This technique relies on technological advantages rather than trading insight, violating the platform’s commitment to a level playing field.

High-Frequency Trading (HFT)

Strategies that involve ultra-fast trade execution through bots or HFT algorithms are not supported.

These approaches disrupt simulation fairness and often introduce unrealistic execution dynamics. Engagement in HFT leads to immediate account removal.

Martingale-Style Progression

Increasing trade size after each loss in an attempt to recover prior drawdowns known as martingale trading mirrors gambling behaviors and is not allowed.

This technique poses unacceptable risk and diverges from sustainable trading practices.

Gambling Behavior and Speculation

Trading activity that lacks risk controls or relies on random outcomes, often termed punting, is strictly off-limits.

ThinkCapital expects participants to follow structured, analytical, and risk-conscious strategies not speculative or reckless approaches. Violators may receive warnings, restrictions, or permanent bans.

Restrictions on News-Based Trading

Trading around significant macroeconomic announcements especially those flagged as “Red Folder” events on ForexFactory is disallowed on both Challenge and Funded accounts.

The enforcement window covers a 4-minute blackout: two minutes before and two minutes after the data release.

During this time:

- No new trades may be placed

- No pending orders may be executed

- Trades opened beforehand may remain active, but they cannot be closed or modified within the blackout window.

Engaging in any form of trading activity during these restricted periods will result in account suspension and forfeiture of all accumulated profits.

Hedging and Multi-Account Exposure

Hedging positions especially across different accounts or coordinating positions to neutralize exposure violates both ethical and operational standards at ThinkCapital.

The platform’s structure is built around authentic market participation, not risk-averse manipulation.

VPN and VPS Usage Policy

To protect the integrity of simulation data and maintain individual accountability, ThinkCapital generally prohibits the use of VPNs or VPSs for account access.

Exceptions are made only through approved services such as ForexVPS.

Conditions for permitted VPS use:

- The VPS must originate from ForexVPS;

- No shared access, group trading, or automation outside permitted challenge structures;

- Any behavior indicating shared account control or masked access routes will be flagged and reviewed.

Use of unauthorized remote tools may result in reclassification of trades, revoked privileges, or disqualification from the program.

ThinkCapital Payout Rules

Think Capital provides transparent and flexible payout rules for all funded accounts (Lightning, DualStep, Nexus). Traders can choose bi-weekly payouts by default or upgrade to weekly payouts, with multiple withdrawal methods including Rise, Crypto, and ThinkMarkets accounts.

- Payout Frequency: Bi-weekly by default | Optional weekly upgrade

- Withdrawal Methods: Rise, Crypto, or ThinkMarkets personal account (region-restricted)

- Processing Fee: $50 per Rise payout

- Eligibility: Country restrictions apply for ThinkMarkets account withdrawals

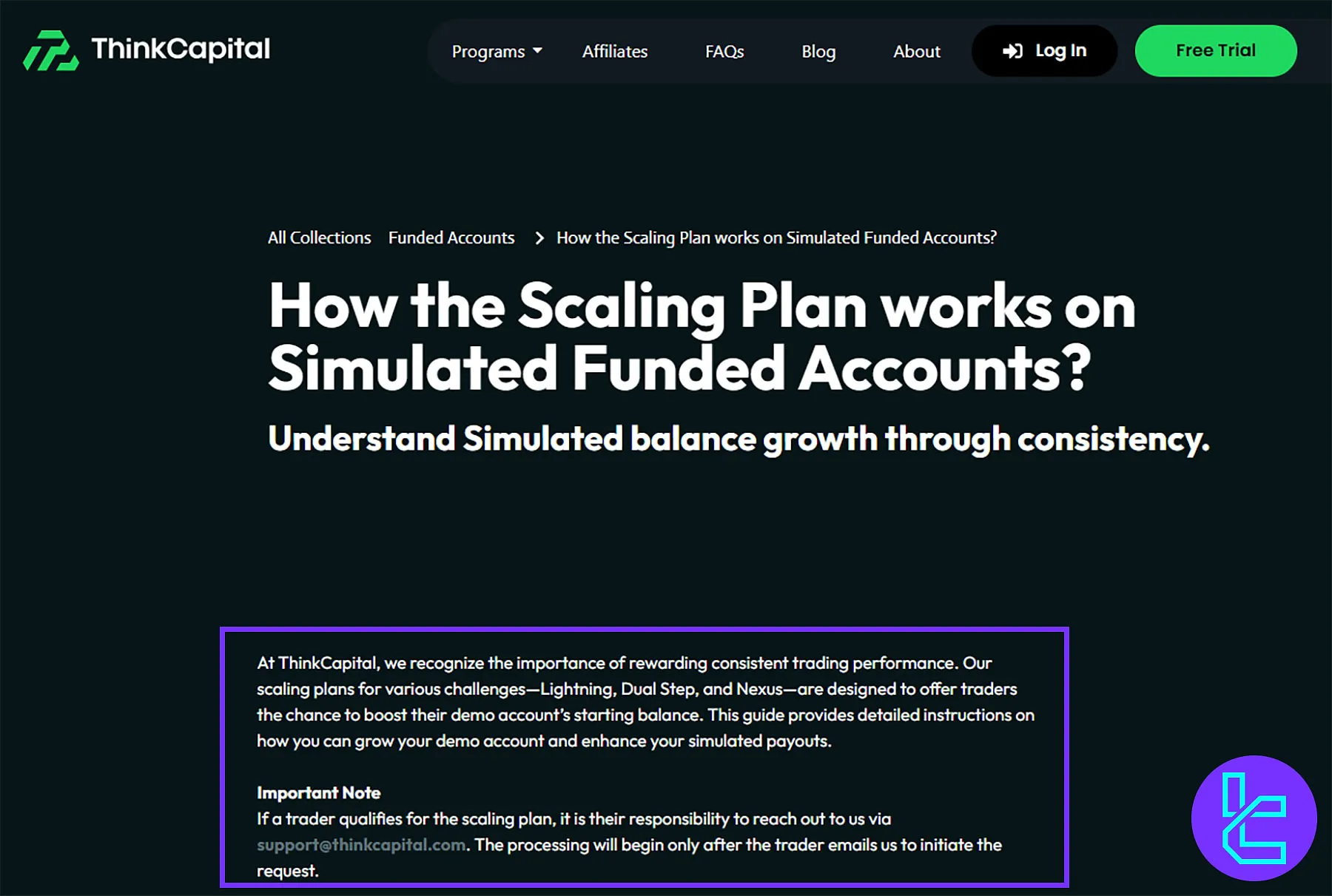

ThinkCapital Scaling Program

The prop firm offers a structured scaling program for its Lightning, DualStep, and Nexus challenges, allowing traders to grow their funded allocations up to $1M (MT5) or $1.5M (ThinkTrader) through consistent three-month trading performance and periodic reviews.

- Eligibility: 10% profit in three months (≈3.33% monthly)

- Scaling Increase: +20% of initial balance per event

- Review Cycle: Every 3 months with 3 withdrawals required

- Max Allocation: $1M (MT5) | $1.5M (ThinkTrader)

- Rules: No account splitting, merging, or platform switching

What Are the Trading Platforms of ThinkCapital?

ThinkCapital offers traders access to three trading platforms, allowing for flexible execution based on individual preference and trading style:

- ThinkTrader: A proprietary platform powered by ThinkMarkets, designed for speed, reliability, and advanced charting. It's deeply integrated with ThinkCapital's funding infrastructure;

- TradingView: Well-known for its customizable charts and scripting capabilities, TradingView integration enables seamless visual trading strategy development;

- MetaTrader 5 (Platform 5): A globally recognized multi-asset platform, MT5 is supported for algorithmic trading, custom indicators, and multi-device accessibility.

TradingFinder has developed a wide range of MT5 and TradingView indicators that you can use for free.

How Many Assets & Instruments Are Available on ThinkCapital?

ThinkCapital provides access to a broad range of trading instruments across multiple asset classes, allowing traders to diversify their strategies and take advantage of global market volatility. Available Asset Classes:

- Forex: Major, minor, and exotic currency pairs

- Cryptocurrencies: Popular pairs such as BTC/USD, ETH/USD, and others

- Commodities: Including gold, silver, crude oil, and more

- Indices: Global indices like S&P 500, NASDAQ, DAX, FTSE, etc.

All instruments are available on ThinkTrader, TradingView, and MT5 platforms, and offer tight spreads with minimal latency.

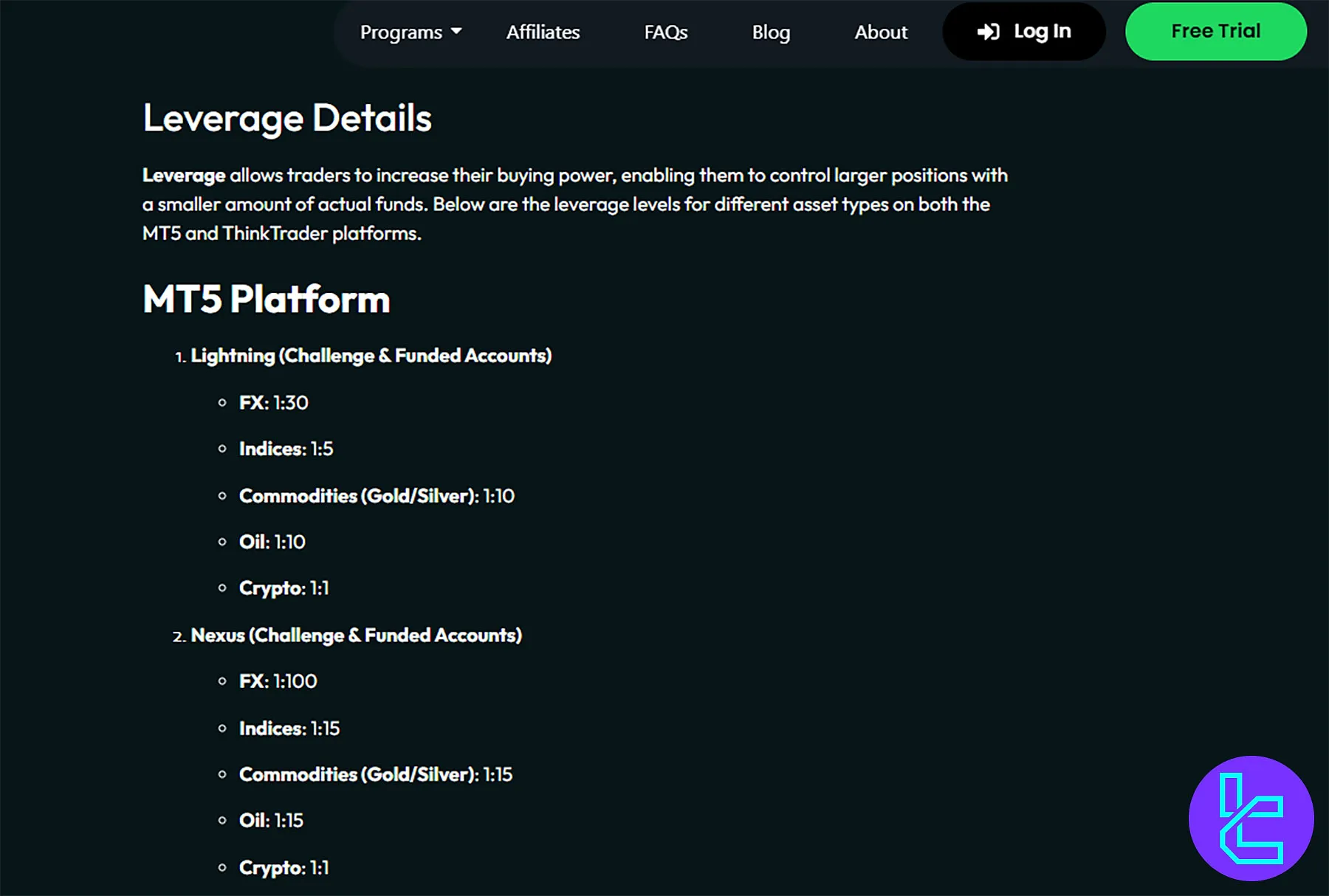

ThinkCapital Leverage Offerings

The prop firm delivers both static and dynamic leverage models across MT5 and ThinkTrader platforms, giving traders flexibility to optimize position sizing, margin usage, and risk exposure. Dynamic Leverage adjusts in real time, scaling leverage down as trade size increases.

- MT5 Lightning: FX 1:30 | Indices 1:5 | Gold/Silver 1:10 | Oil 1:10 | Crypto 1:1

- MT5 Nexus: FX 1:100 | Indices 1:15 | Gold/Silver 1:15 | Oil 1:15 | Crypto 1:1

- Dynamic Leverage (ThinkTrader & MT5 DualStep): Higher leverage for smaller trades, lower for larger trades for smarter margin control

ThinkCapital Fees

ThinkCapital maintains a transparent fee structure with clear guidelines on refunds, inactivity, and trading behavior.

There are no hidden fees, but traders must comply with specific conditions to maintain account eligibility and funding rights. Key Fee Policies:

- Challenge Fees: One-time payment based on selected model and account size (non-refundable after trading begins);

- Inactivity Rule:

- At least one trade must be placed every 30 days;

- If a funded trader in profit fails to trade within 30 days, the account is terminated and no payout is issued;

- Refunds:

- If you're unsatisfied and haven't started trading, you're eligible for a full refund with 14-Day Refund Guarantee;

- Traders who pass the challenge and complete their first payout are reimbursed for the original fee.

Does ThinkCapital Offer Educational Resources?

ThinkCapital provides basic educational materials to support traders throughout their journey, though the offering is more limited compared to education-focused firms. Educational Resources Available:

- Blog: Articles covering funding models, trading rules, and updates on platform features;

- FAQ Section: A detailed knowledge base explaining account setup, challenge rules, payments, and troubleshooting.

ThinkCapital Trust Scores

ThinkCapital has received strong trust ratings across major review platforms, indicating high customer satisfaction and a solid reputation within the prop trading community.

As a firm powered by ThinkMarkets, its credibility is reinforced by a regulated backing and reliable infrastructure.

- ThinkCapital Trustpilot: 6 out of 5, based on 470+ reviews. Users frequently praise the firm’s payout speed, customer support, and platform stability;

- ThinkCapital PropFirmMatch: 3 out of 5, from over 30 verified reviews. Traders highlight the variety of challenges and the transparency of rules as major advantages.

ThinkCapital Customer Services

ThinkCapital offers responsive and accessible customer support through live chat and an active Discord community.

The live chat is available directly on the official website, typically responding within minutes during working hours.

Meanwhile, the Discord server serves as a space for community interaction, updates, and direct access to support staff and moderators.

Traders can ask questions, share experiences, and get real-time assistance for technical or account-related issues.

Support Method | Availablity |

Live Chat | Yes (On the official website) |

Yes (support@thinkcapital.com) | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | No |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

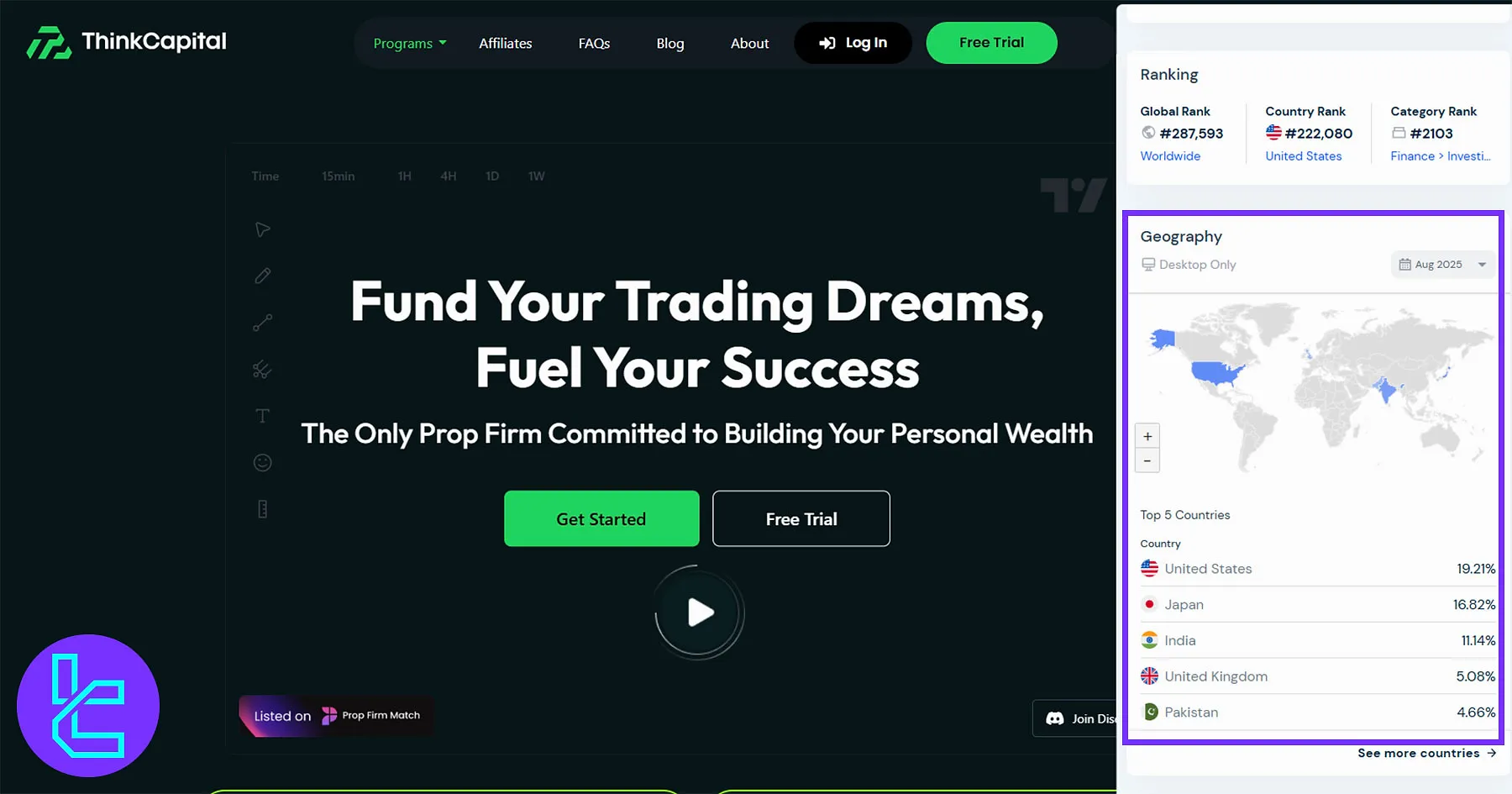

ThinkCapital User Base

The prop firmhas built a global community of traders, with strong adoption in North America, Asia, and Europe. Its platform attracts users seeking funded trading opportunities, making it a competitive player in the proprietary trading industry worldwide.

- Top Countries: United States (19.21%), Japan (16.82%), India (11.14%)

- Additional Markets: United Kingdom (5.08%), Pakistan (4.66%)

- Reach: Active presence across multiple continents, growing international user base

- Category Rank: #2103 in Finance – Investing niche (Aug 2025)

ThinkCapital on Social Media

ThinkCapital maintains an active presence across multiple social platforms, ensuring traders stay updated on the latest announcements, discounts, and trading insights.

These channels also serve as community hubs where traders can engage directly with the brand.

Official ThinkCapital Social Channels:

Social Media | Members/Subscribers |

7.4K | |

13.4K | |

12.3K | |

2.45K | |

16,258 | |

1,286 |

ThinkCapital Vs Other Prop Firms

ThinkCapital differentiates itself through its ThinkMarkets backing, exclusive ThinkTrader platform, and three-tier evaluation models.

Compared to other firms, it stands out in payout frequency, platform diversity, and scaling potential.

However, you can see the full comparison of this prop firm with other companies in the table below:

Parameters | ThinkCapital Prop Firm | |||

Minimum Challenge Price | $39 | $33 | $55 | $32 |

Maximum Fund Size | $200,000 [Scaling Up to $1.5M] | $400,000 | $200,000 | $4,000,000 |

Evaluation steps | 1 Step, 2 Step, 3 Step | 1-Step, 2-Step, 3-Step, Instant Funding | 1-phase, 2-phase | 1-Step, 2-Step |

Profit Share | 90% | 100% | 80% | 95% |

Max Daily Drawdown | 4% | 7% | 4% | 5% |

Max Drawdown | 8% | 14% | 6% | 10% |

First Profit Target | Variable Based on the Challenge | 6% | 8% | 8% |

Challenge Time Limit | 3 Days | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Bi-weekly | Weekly | 2 Times a Month | From 5 Days |

Number of Trading Assets | 4000+ | 40+ | 200+ | 78 |

Trading Platforms | ThinkTrader, TradingView, Platform 5 (MetaTrader 5) | MetaTrader 5, Match Trader | Metatrader 5, CFT Platform and Crypto Futures | MT4, MT5, cTrader, MatchTarder |

TF Expert Conclusion

ThinkCapital started its activity as a subsidiary to ThinkMarkets in 2024.

In less than a year, they exceed from 10000+ traders because of three challenge models, bi-weekly payouts, and scalable capital up to $1.5 million.