Tradexprop offers funded accounts through 1-step, 2-step, and 0-step evaluations. Leverage options are up to 1:2 for Crypto and 1:50 for Forex and CFD Indices. It supports Rise, BTC, ETH, and USDC as withdrawal methods with a 30-day payout frequency.

Traders can access leverage options of up to 1:5 for Bitcoin and Ethereum through Tradexprop Crypto evaluation program with trading capital of up to $250K and fees ranging from $30 to $2,150. First profit target, max daily loss, and max drawdown on this program are 6%, 3%, and 9%, respectively.

Tradexprop; An Introduction to the Prop Firm

Forest Park FX LTD, located in Malaysia, operates the Tradexprop brand. The prop firm was founded in 2023 by Dixon Teo, CEO.

The company hosts over 2,000 traders and has paid them over $1.2 million. Monthly competitions, a real-time dashboard, and a profit split of up to 90% are some of the firm’s key features.

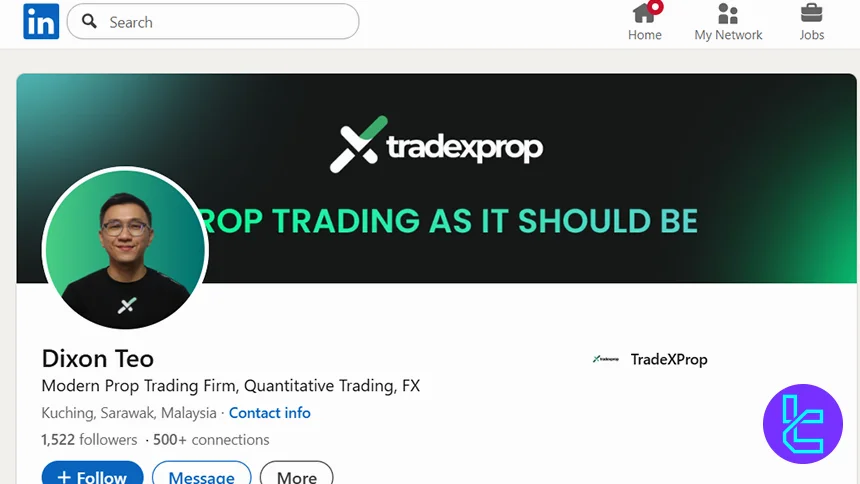

Tradexprop CEO

Dixon Teo, the CEO of Tradexprop, leads the firm from Kuching, Sarawak with a network of 1,522 followers and 500+ professional connections. With eight years of industry experience and a strong background in quantitative trading and fintech innovation, he shapes the strategic direction of Tradexprop and X Capital Group.

- As CEO of Tradexprop since 2023, he oversees a modern proprietary trading model focused on funding talent, advanced platforms, and trader empowerment;

- Founder of X Capital Group Sdn Bhd, a fintech firm developing quantitative trading systems across FX, CFDs, and soon equities and futures;

- Known for thought leadership through interviews and AMAs, where he discusses capital efficiency, market challenges, trader mindset, and the evolution of prop trading;

- Active in community-driven initiatives, including network-based earning models, early access programs, and trader education;

- Eight years of prior experience in the oil lubricant industry, strengthening his operational and marketing expertise.

Tradexprop Table of Specifications

The prop firm offers static drawdown and no minimum/maximum trading days. Let’s take a brief look at the Tradexprop offerings.

Account Currency | USD |

Minimum Price | $35 |

Maximum Leverage | 1:50 |

Maximum Profit Split | 90% |

Instruments | Forex, Metals, Commodities, Indices, Crypto |

Assets | 54 |

Evaluation Steps | 1-Step, 2-step, Instant Funding |

Withdrawal Methods | Rise, Crypto |

Maximum Fund Size | $400,000 |

First Profit Target | 6% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Yes (Condition: no position opening in a 3-minute window before or after a news event) |

Maximum Total Drawdown | 9% |

Trading Platforms | cTrader, DXtrade, MatchTrader |

Commission | 0.05% for the Crypto X account |

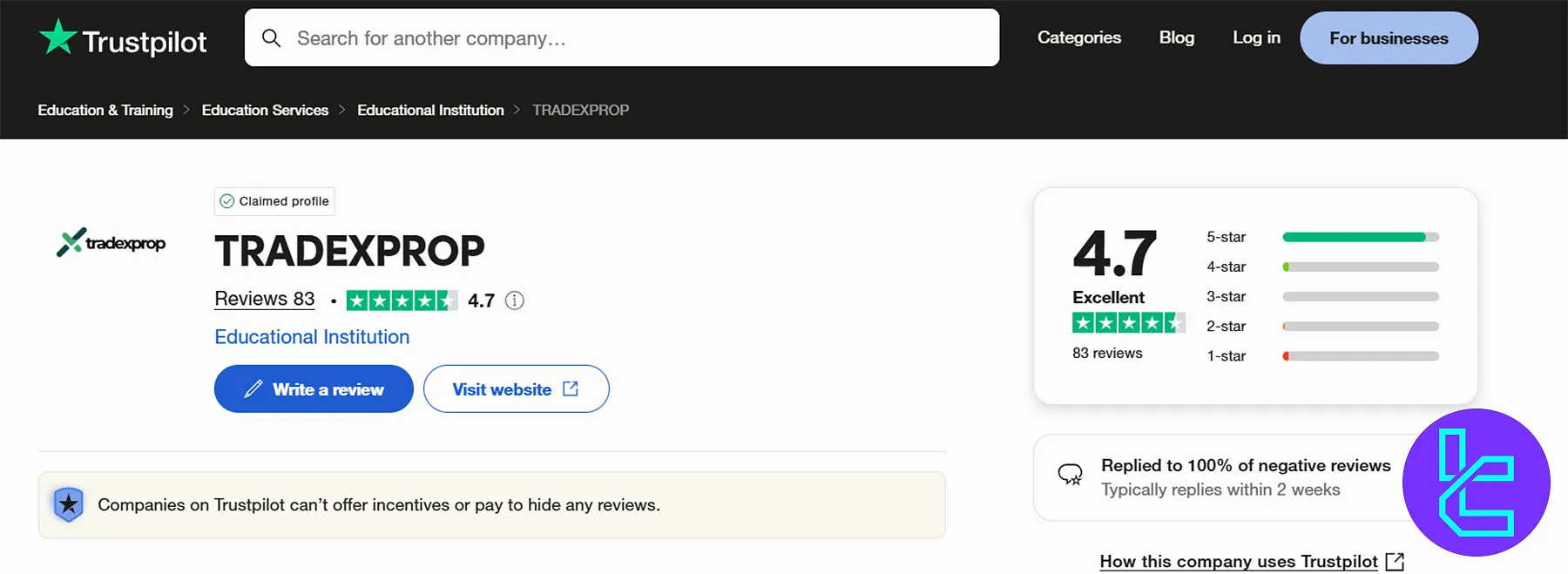

Trustpilot Score | 4.7 |

Payout Frequency | 30 Days |

Established Country | Malaysia |

Tradexprop Firm Pros & Cons

The company claims that it pays accumulated profits even after a breach, which is a positive aspect in this Tradexprop review. Let’s weigh the firm’s advantages against its disadvantages.

Pros | Cons |

Various trading platforms | No support for MetaTrader or TradingView |

Instant funding | Limited track record |

Crypto evaluation accounts | No refunds |

Generous profit split up to 90% | Limited support hours |

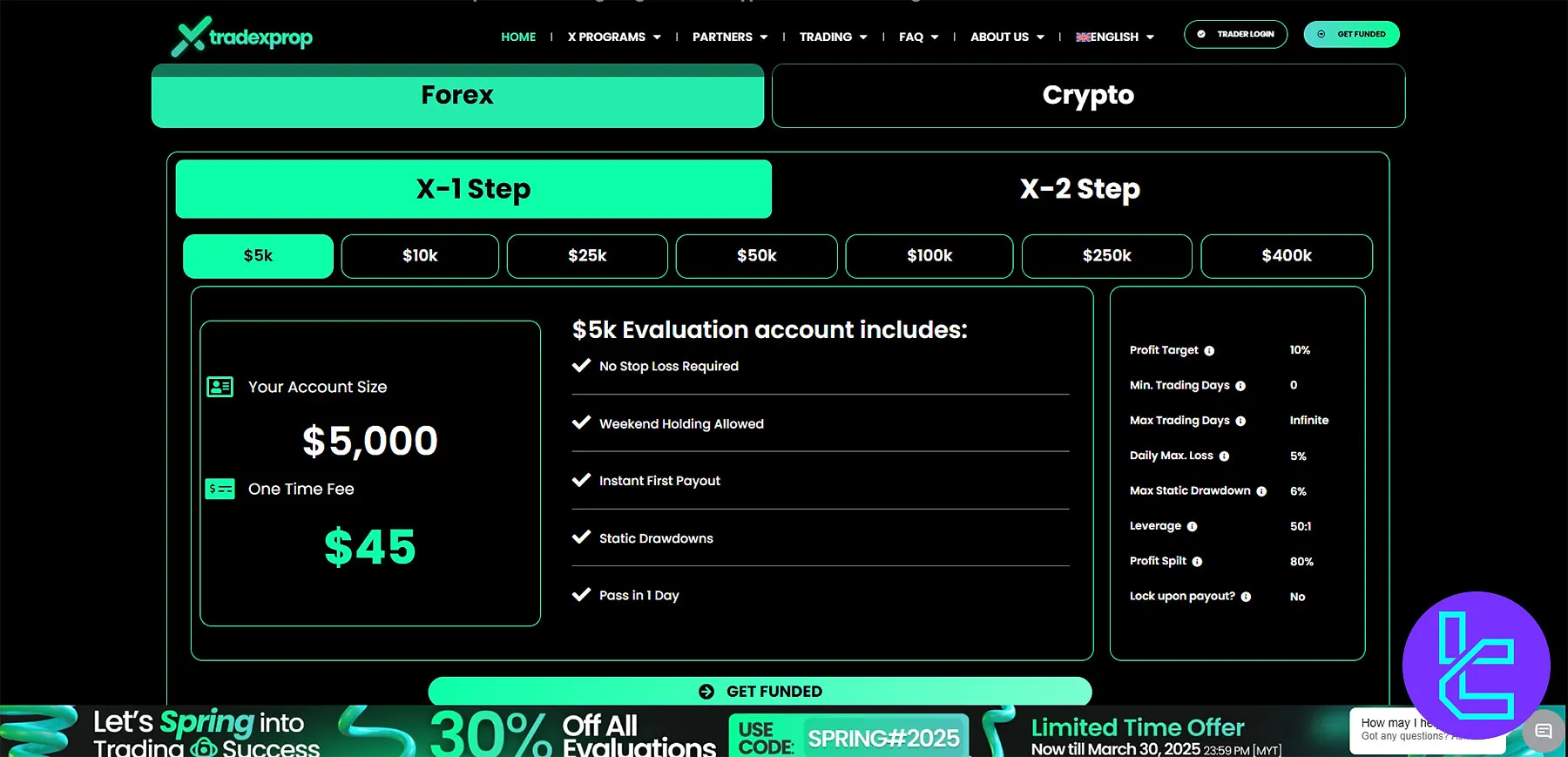

Challenge Prices

Tradexprop offers five types of funded accounts with different balancesandinitial fees to suit different trader needs and experience levels.

Account Balance | Forex X-1 Step | Forex X-2 Step | Crypto X-1 Step | Crypto X-2 Step | Instant Funded X |

$5K | $45 | $35 | $45 | $35 | $200 |

$10K | $85 | $75 | $95 | $80 | $400 |

$25K | $215 | $155 | $250 | $210 | $1,125 |

$50K | $395 | $285 | $525 | $430 | $2,500 |

$100K | $795 | $465 | $1,050 | $900 | $5,000 |

$250K | $2,155 | $1,350 | $2,150 | $2,000 | - |

$400K | $3,755 | $2,450 | - | - | - |

The prop firm offers a 30% discount on all evaluation plans at the time of writing this article, March 2025.

The company does not appear to offer any scaling programs for additional funding.

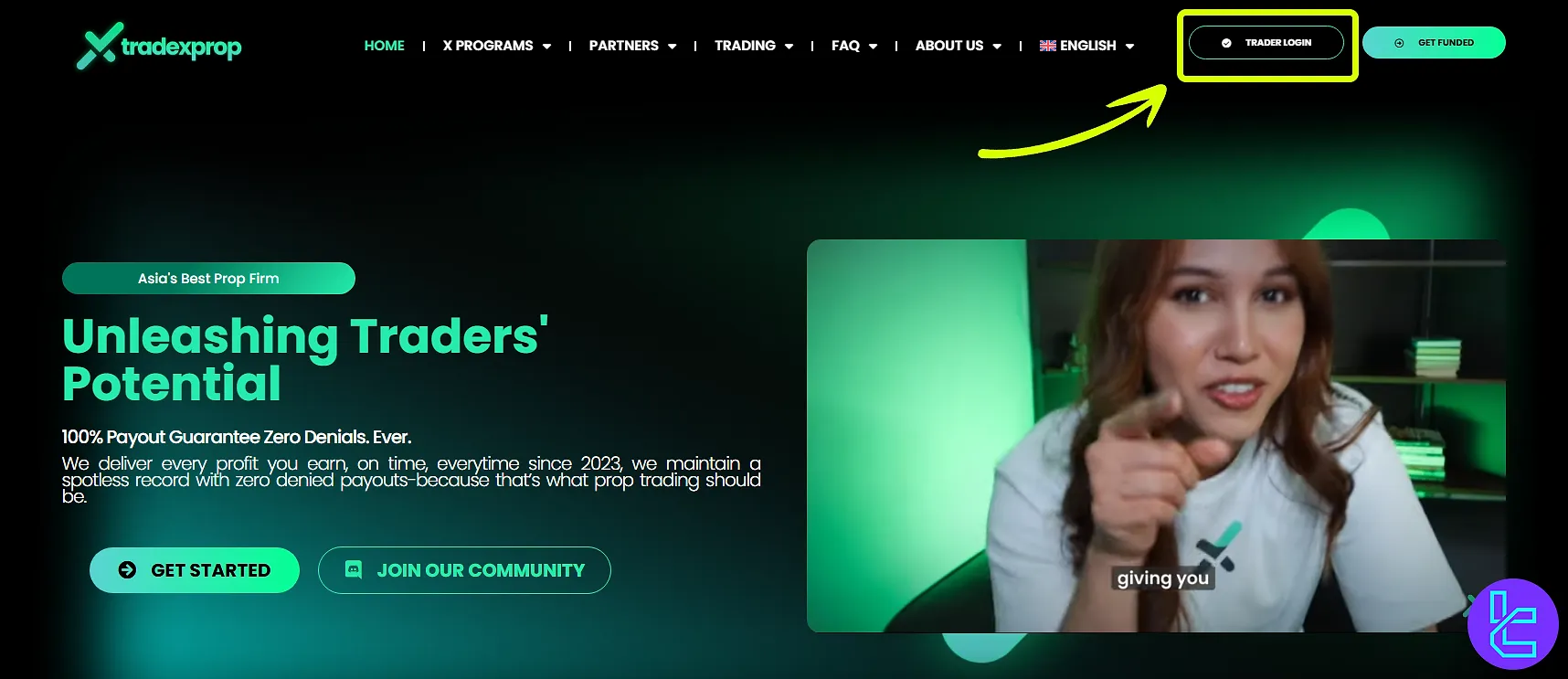

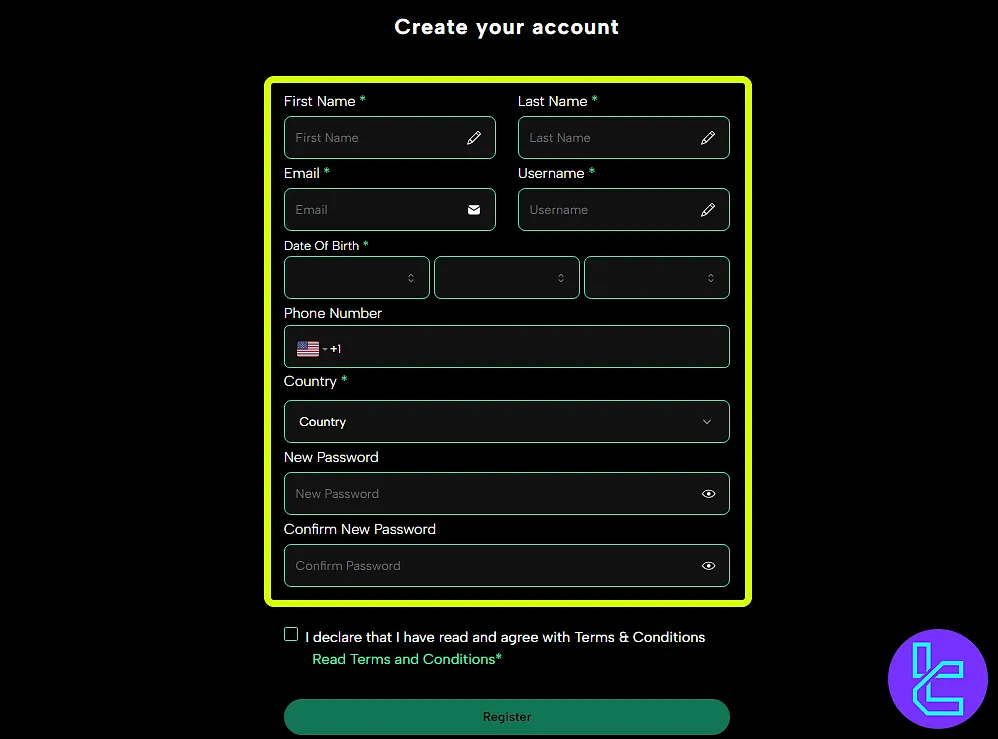

Account Opening and Verification on Tradexprop

You must be at least 18 years old to be eligible for a funded account on Tradexprop. The firm also requires successful traders to complete a KYC procedure after the evaluation phase.

#1 Visit the Official Website

Go to the prop's website and click “Trader Login” on the homepage to access the registration form.

#2 Fill Out the Account Form

Submit these pieces of information:

- Full name

- Username

- Date of birth

- Mobile number

- Country

Afterwards, set a secure password. Agree to the terms to proceed.

#3 Access Your Dashboard

Use your email and password to log in. Once inside, you can view available evaluation challenges and manage your prop account immediately.

#4 Verify Your Identity

When KYC becomes required, provide additional personal information, proof of ID, and proof of residence.

Tradexprop Evaluation Specs

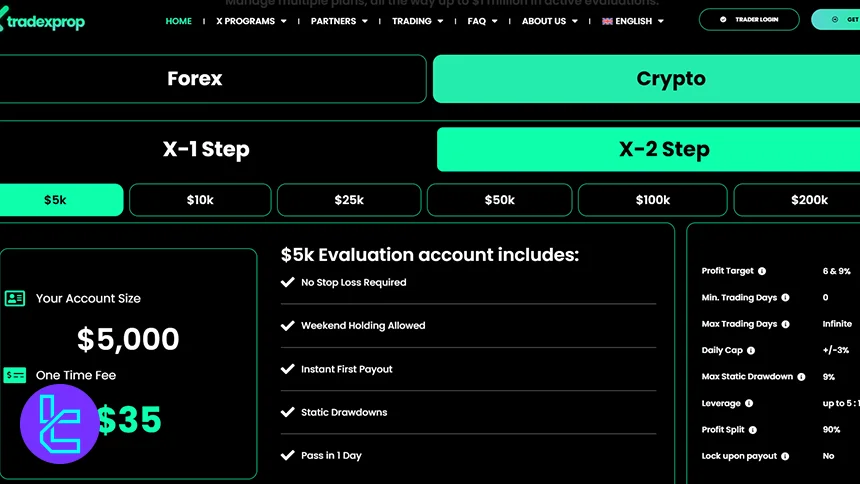

In addition to Instant Funded X accounts, the prop firm offers 1-step and 2-step challenges for the Forex market and Crypto, with various account sizes and tailored parameters.

Features | Forex X-1 Step | Forex X-2 Step | Crypto X-1 Step | Crypto X-2 Step | Instant Funded X |

Profit Target | 10% | 8% / 5% | 9% | 6% / 9% | N/A |

Profit Split | 80% | 80% | 90% | 90% | 80% / 90% |

Time Limit | None | None | None | None | None |

Max Daily Loss | 5% | 5% | +/-3% Daily Cap | +/-3% Daily Cap | 5% |

Max Drawdown | 6% Static | 8% Static | 6% Static | 9% Static | 8% Trailing |

Leverage | 1:50 | 1:50 | 1:5 | 1:5 | 1:50 |

Payout frequency | 30 Days | 30 Days | 30 Days | 30 Days | 30 Days |

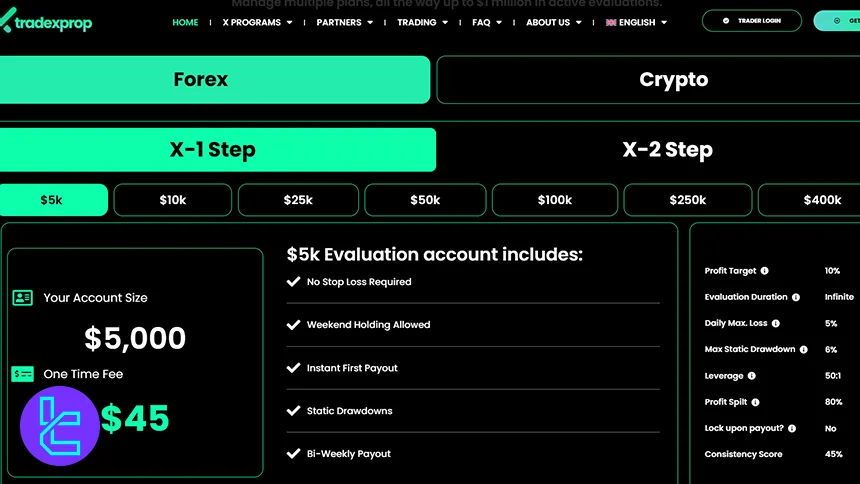

Tradexprop Forex X-1 Step

Tradexprop’s Forex X-1 Step challenge provides a straightforward, single-phase evaluation with no time restrictions, static drawdowns, and an 80% payout, ideal for traders who prefer simplicity and fast progression.

Profit Target | 10% |

Profit Split | 80% |

Max Daily Loss | 5% |

Max Drawdown | 6% static |

Time Limit | None |

Leverage | 1:50 |

Payout Frequency | 30 Days |

This plan is designed for traders who prefer direct, risk-controlled evaluation conditions with predictable payout cycles.

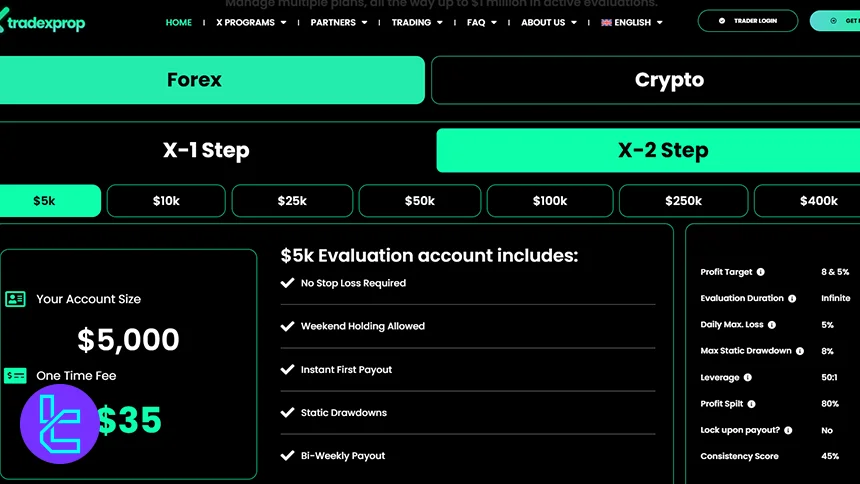

Tradexprop Forex X-2 Step

The Forex X-2 Step evaluation uses a two-phase structure with reduced profit targets of 8% and 5%, making it suitable for traders who want lower thresholds while maintaining a 5% max daily loss and static drawdowns.

Profit Target | 8% and 5% |

Profit Split | 80% |

Max Daily Loss | 5% |

Max Drawdown | 8% static |

Time Limit | None |

Leverage | 1:50 |

Payout Frequency | 30 Days |

This model supports traders who prefer a smoother evaluation curve combined with consistent payout frequency and stable risk parameters.

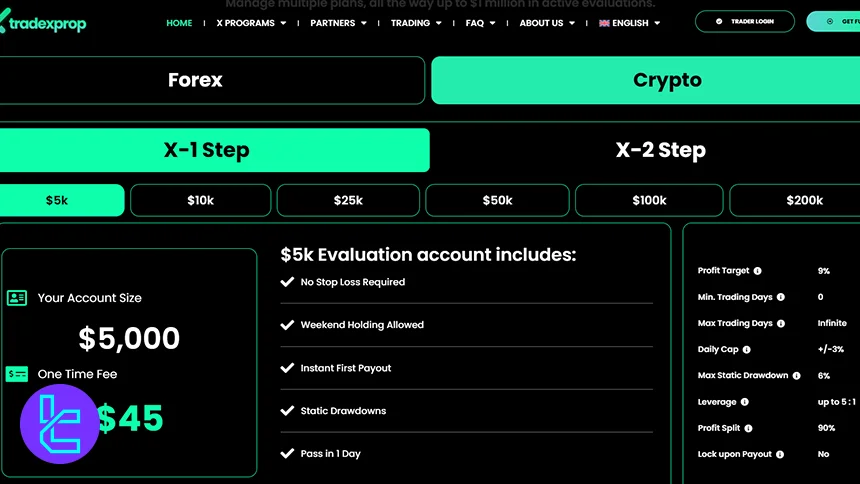

Tradexprop Crypto X-1 Step

Crypto X-1 Step offers a one-phase crypto evaluation featuring a 9% profit target, 6% static drawdown, a ±3% daily cap, and a superior 90% profit split for traders who thrive in digital-asset volatility.

Profit Target | 9% |

Profit Split | 90% |

Max Daily Loss | ±3% daily cap |

Max Drawdown | 6% static |

Time Limit | None |

Leverage | 1:5 |

Payout Frequency | 30 Days |

This format is ideal for crypto-focused traders seeking higher payouts with structured risk limits.

Tradexprop Crypto X-2 Step

Crypto X-2 Step includes a two-stage evaluation with 6% and 9% profit targets, a ±3% daily cap, and a premium 90% profit split, offering a high-potential path for systematic crypto traders.

Profit Target | 6% and 9% |

Profit Split | 90% |

Max Daily Loss | ±3% daily cap |

Max Drawdown | 9% static |

Time Limit | None |

Leverage | 1:5 |

Payout Frequency | 30 Days |

This challenge suits traders who want long-term consistency in crypto while enjoying an industry-leading payout structure.

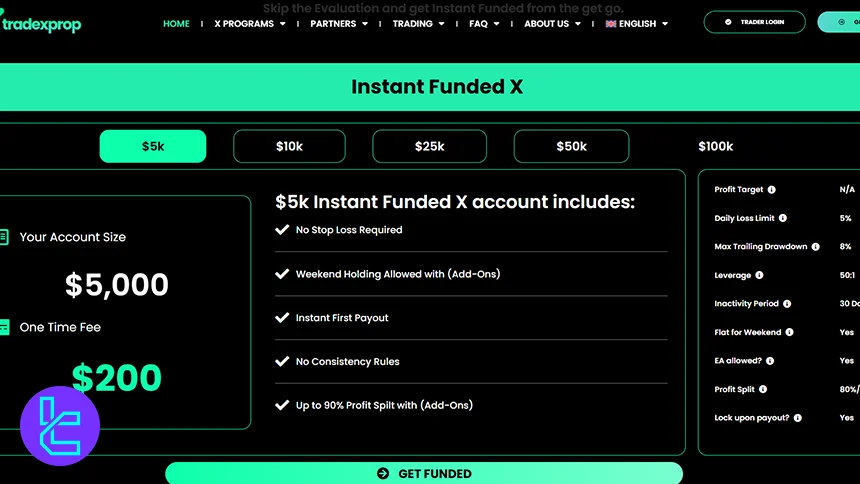

Tradexprop Instant Funded X

Instant Funded X provides immediate funded capital with no profit target, an 8% trailing drawdown, and up to 90% profit splits, designed for traders who want fast deployment without traditional evaluations.

Profit Target | N/A |

Profit Split | 80% / 90% |

Max Daily Loss | 5% |

Max Drawdown | 8% trailing |

Time Limit | None |

Leverage | 1:50 |

Payout Frequency | 30 Days |

This program is ideal for experienced traders wanting to start earning immediately while maintaining professional-grade risk controls.

Tradexprop Discount and Promotion

The firm frequently offers promotions to make its programs more accessible to traders. At the time of writing this Tradexprop review, the website offers three main promotions, including:

- Maximum drawdown upgrade from 5% to 8% (Code: IFX8)

- 10% discounts for all Instant Funded X accounts + free 90% profit split add-on

- Up to 10% recurring commissions for affiliates

Tradexprop Rules

Here are the trading rules that must be adhered to by traders. Tradexprop rules draw the guidelines around prohibited trading activities, accepted strategies, the use of VPN/VPS during trading, payouts, and many more.

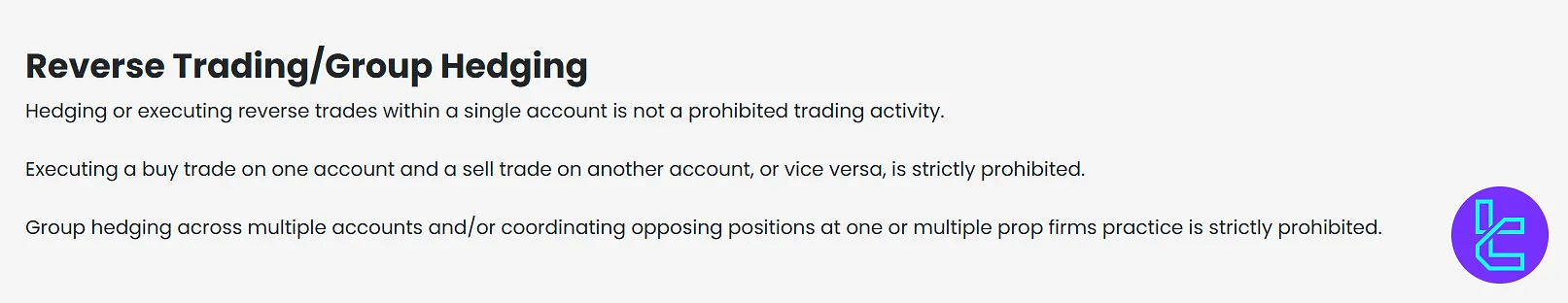

- Internal hedging within a single account is permitted;

- Group hedging and mirror trading across accounts or firms are strictly forbidden;

- Using arbitrage strategies between accounts is a direct breach of trading terms;

- News trading is restricted within a 3-minute window of key announcements;

VPN Usage

No formal policy has been disclosed regarding the use of VPNs.

Hedging & Reverse Trading

The firm draws a clear line between personal position management and coordinated abuse of the trading environment:

- Hedging or placing opposing trades within the same account (e.g., buying and selling the same instrument for risk offset) is allowed;

- Executing a long position on one account and a short position on another—whether within the same firm or across multiple firms—is a direct violation;

- Coordinated group hedging, including mirrored trading across several accounts or collective strategies involving opposing positions across firms, is strictly banned.

These activities compromise the integrity of the evaluation process and will result in immediate disqualification or account termination.

Expert Advisors (EAs)

There is currently no explicit information regarding the allowance or restriction of Expert Advisors (trading bots).

Arbitrage & Martingale Strategy

The firm enforces a strict zero-arbitrage policy; any attempt to exploit price discrepancies by linking an assessment account with another account—whether internal or through third-party firms—is strictly forbidden.

This includes latency arbitrage, signal replication, or cross-account strategy syncing.

No specific references to Martingale strategies are provided.

News Trading Policy

Trading around scheduled economic events is governed by a strict buffer window.

No positions may be opened within 3 minutes before or after a designated “News Event”. Trades executed within this 6-minute window are subject to disciplinary action, including:

- Forced closure of the position

- Removal of profits or losses (P&L) from the account

- Reduction of account leverage

- Immediate breach of account status

The definition of a “News Event” is determined solely by the firm, and decisions regarding news trading violations are made at its full discretion.

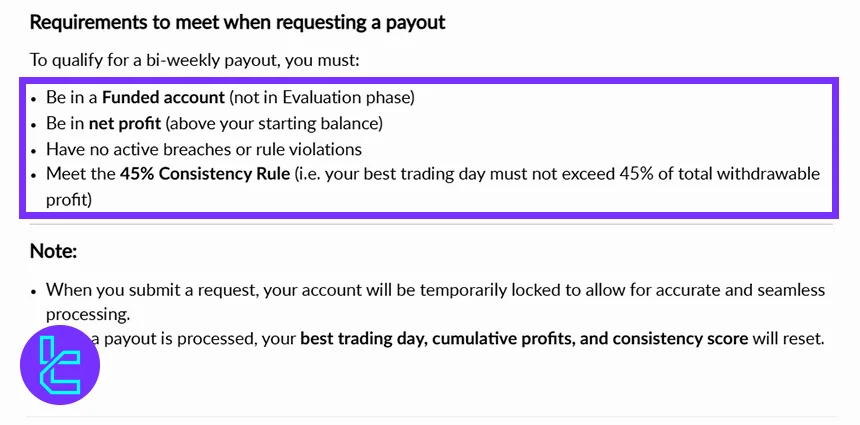

Tradexprop Payout Rules

Tradexprop provides a structured payout system designed for fast, secure, and transparent withdrawals.

Traders can request payouts every 14 days on eligible Forex funded accounts, with processing times of 1–2 working days and multiple withdrawal methods including Columis crypto and Rise.

- Before requesting a payout, accounts must be fully flat, with all trades closed and no new positions allowed until processing is complete;

- Withdrawals can be made through Columis (BTC, ETH, USDC – ERC-20 only) or Rise, depending on trader preference and account verification;

- Each method requires accurate wallet or account information, and traders must confirm via on-screen prompts;

- Bi-weekly payouts apply only to Forex Evaluation accounts created after April 16, 2025; Crypto and Instant Funding accounts remain on monthly cycles;

- Eligibility requires net profit, no breaches, and meeting the 45% Consistency Rule, with accounts temporarily locked during processing.

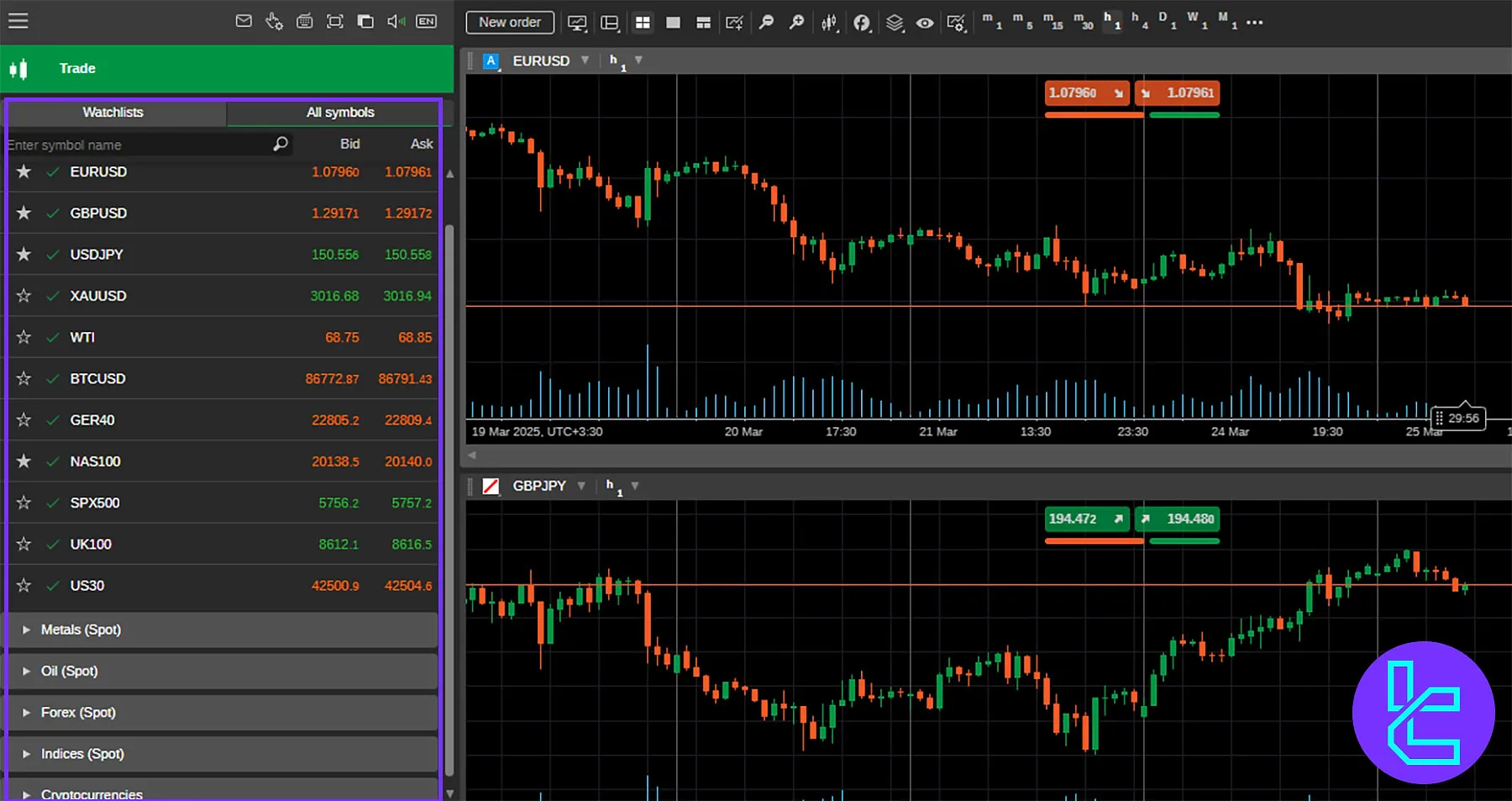

Available Trading Platforms on the Tradexprop Firm

The prop firm has partnered with Gooey Trade to provide access to three trading platforms: DXtrade, MatchTrade, and cTrader. However, the platforms' availability differs based on account type.

- Forex Evaluation / Instant Funded X: DXtrade, MatchTrader, and cTrader

- Cryptocurrency Evaluation: DXtrade

You can download the mobile versions of the platforms (except for DXtrade) from the links below:

Trading Markets on Tradexprop

The Crypto evaluation plan is designed specifically for trading digital assets. The firm offers access to 54 trading instruments and 5 asset classes, including the Forex market, through the Instant Funded X and Forex X programs, including:

- Forex Pairs: Major, minor, and exotic currency pairs

- CFD Indices: Including popular indices like S&P 500, NASDAQ, and US30

- Cryptocurrencies: Bitcoin, Ethereum, and other major cryptocurrencies

- Commodities: WTI and BRENT

- Metals: Gold, silver, and other precious metals

Please note that the availability of the mentioned assets may vary depending on the trading platform.

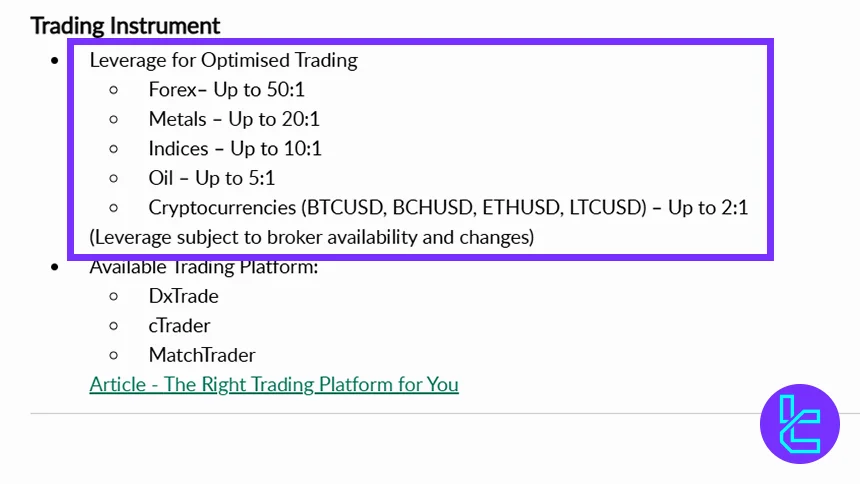

Tradexprop Leverage Offerings

Tradexprop provides structured leverage tiers across Forex, Crypto, and Instant Funding programs, giving traders up to 50:1 leverage depending on the asset class.

These offerings are designed to balance performance potential, volatility control, and evaluation stability across all program types.

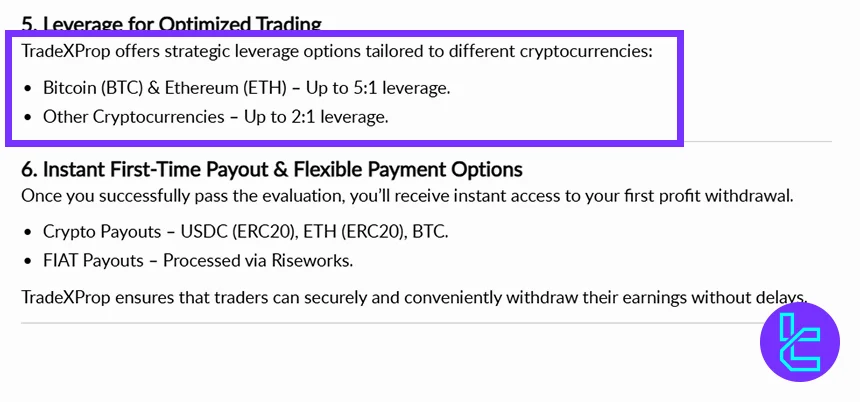

Tradexprop Crypto Evaluation Leverage

Tradexprop’s Crypto Evaluation program features conservative leverage designed for volatile digital assets, ensuring risk management remains stable across BTC, ETH, and alternative cryptocurrencies.

- Bitcoin (BTC) and Ethereum (ETH) offer leverage up to 5:1, allowing traders to capture directional moves without excessive exposure;

- All other cryptocurrencies are capped at 2:1 leverage, balancing opportunity with volatility protection;

- These tiers help maintain consistent risk profiles throughout the evaluation phase;

- Ideal for traders who rely on structured, disciplined crypto strategies.

Tradexprop Forex Evaluation Leverage

The Forex Evaluation program delivers one of Tradexprop’s broadest leverage structures, giving traders access to high-leverage instruments in major asset classes while maintaining strict drawdown control.

- Forex pairs offer up to 50:1 leverage for flexible execution and multi-timeframe strategies;

- Metals such as gold and silver trade with up to 20:1 leverage;

- Indices are capped at 10:1, providing controlled exposure to global market movements;

- Oil contracts operate at 5:1 leverage, while crypto pairs (BTCUSD, BCHUSD, ETHUSD, LTCUSD) are limited to 2:1.

Tradexprop Instant Funded X Leverage

The Instant Funded X program provides immediate-access leverage levels tailored to live capital conditions, enabling traders to deploy strategies without going through evaluations.

- Forex instruments come with up to 50:1 leverage for maximum flexibility;

- Metals receive leverage up to 20:1, aligning with their market volatility;

- Indices allow traders up to 10:1 leverage, suitable for intraday and swing trading;

- Oil trades at up to 5:1 leverage, reflecting commodity volatility;

- Cryptocurrencies operate with up to 2:1 leverage depending on broker availability and liquidity conditions.

Deposit and Withdrawal Methods

In this Tradexprop review, we would like to note that the firm allows only one withdrawal request per 30 days, with the minimum being $100 or 1% of the account’s starting balance.

While payout methods include Bitcoin, Ethereum, and USDC for cryptocurrency and Rise for fiat, Tradexprop funding options are:

- Credit/Debit Cards: VISA, MasterCard, American Express, and JCB

- Crypto: Coinbase Commerce

- PayPal

Tradexprop Firm Trading Commissions

The firm charges no additional rates, and trading costs are the broker’s default fees. However, the exact amount is not disclosed on the website, except for the Crypto X evaluation, which comes with a 0.05% commission.

Educational Materials

The prop firm provides learning materials on various subjects, including Market Research, Trading Tips, Instruments, and Platforms, through its blog. Tradexprop has also made strategic partnerships to empower traders by offering a wide range of tools, such as:

- Traddictiv: Charts, forecasts, and trading ideas

- Traders Connect: Trade copying in the cloud with a 20-30ms average execution speed

- FX Replay: 100% web-based backtesting tool with access to TradingView

- SWIFT Journal: Automating trade journaling process

User Experience

There are 83 Tradexprop reviews on Trustpilot, mostly positive, resulting in an excellent score of 4.7 out of 5. While 95% of the comments are 5-star and 4-star, only 5% of the ratings on the Tradexprop Trustpilot profile are negative (1-star and 2-star).

Tradexprop Firm Customer Support

The firm provides live support Monday to Friday, from 9:00 AM to 9:00 PM (GMT+8). There are also several other ways to contact Tradexprop, including:

Support Method | Availability |

Live Chat | Yes |

Yes (support@Tradexprop.com) | |

Phone Call | Yes (+601126773345) |

Discord | Yes |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | Yes |

No | |

Messenger | No |

Tradexprop User Base

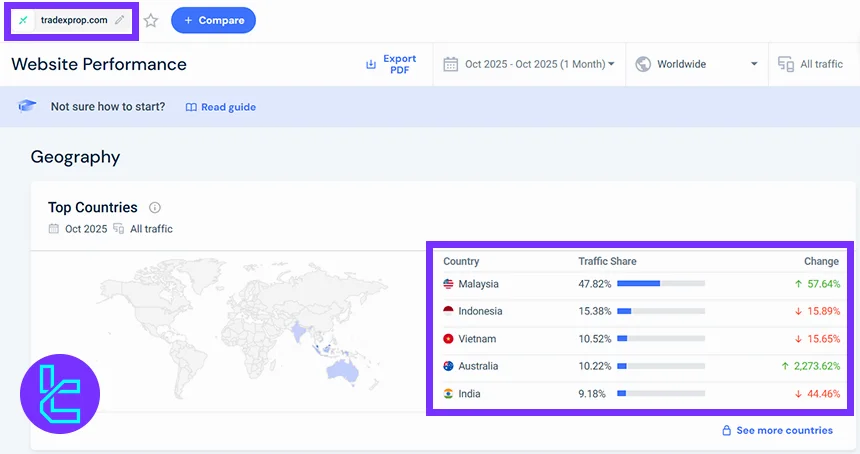

Tradexprop’s user base continues to expand across key Asia-Pacific markets, with Malaysia contributing 47.82% of total traffic in October 2025. Significant activity also comes from Indonesia, Vietnam, Australia, and India, highlighting the firm’s rapidly growing global trader community.

- Malaysia leads with 47.82% traffic share and a strong 57.64% growth surge, confirming its position as Tradexprop’s primary market;

- Indonesia accounts for 15.38% of users, though experiencing a 15.89% decline this cycle;

- Vietnam contributes 10.52%, reflecting a similar 15.65% dip but maintaining stable user activity;

- Australia shows remarkable expansion, rising by 2,273.62% to reach 10.22% traffic share;

- India records 9.18% of traffic, though down by 44.46%, remaining a notable emerging region.

These trends indicate Tradexprop’s strengthening presence in both Southeast Asia and Oceania, supported by rising interest in prop trading and accessible evaluation programs.

Tradexprop Social Media Handles

The firm has a community of 2,923 traders on Discord in addition to profiles on other social platforms. The prop firm shares news on its upcoming developments, trading competitions, promotional programs, new accounts, and many more via these profiles.

Social Media | Members/Subscribers |

980 | |

3566 | |

1184 | |

2923 | |

1580 |

How Tradexprop Performs in Comparison to Similar Examples

This table compares the reviewed prop firm to its main competitors:

Parameters | Tradexprop Firm | The 5ers Prop Firm | Breakout Prop Firm | BrightFunded Prop Firm |

Minimum Challenge Price | $35 | $39 | $50 | €55 |

Maximum Fund Size | $400,000 | $4,000,000 | $2,000,000 | Infinite |

Evaluation steps | 1-Step, 2-step, Instant Funding | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 2-Step |

Profit Share | 90% | 100% | 90% | 100% |

Max Daily Drawdown | 5% | 5% | 4% | 5% |

Max Drawdown | 9% | 10% | 6% | 8% |

First Profit Target | 6% | 5% | 5% | 10% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:50 | 1:100 | 1:5 | 1:100 |

Payout Frequency | 30 Days | Bi-weekly | Bi-weekly | 14 Days |

Number of Trading Assets | 54 | 3000+ | 100+ | 150+ |

Trading Platforms | cTrader, DXtrade, MatchTrader | Metatrader 5 | Proprietary platform | cTrader, DXTrade |

Expert Suggestions

Tradexprop provides access to 54 trading instruments across DXtrade, MatchTrader, and cTrader through a partnership with GooeyTrade. The Crypto X accounts come with a 0.05% commission. The prop firm has a score of 4.7/5 on Trustpilot.

Tradexprop prop firm supports bi-weekly payouts, Instant funding up to $100K, Crypto and Forex evaluations, and 1:20 leverage for gold trading. It requires adherence to the 45% consistency rule for payouts.