WeGetFunded is a prop firm with a minimum challenge fee of $79 and a profit split that is customizable between 80% and 90% options. Also, this company provides funding up to a whopping $4,000,000 through scaling. There are 2 evaluation models: Classic & Unlimited.

WeGetFunded prop firm offers bi-weekly payouts with a minimum withdrawal requirement of $100 through crypto (USDC) and bank transfer. The platform provides leverage options of up to 1:30 for gold/crypto and 1:100 for Forex.

Company Information Overview

WeGetFunded is a proprietary trading firm that facilitates funding for traders via challenges. Founded in 2023 by a team of over 80 seasoned traders as claimed by the company, this prop firm understands the challenges and aspirations of traders.

Based on the data found on the Google Maps platform, this prop firm is headquartered in DDP 24522, IFZA, Business Park, Dubai, United Arab Emirates.

WeGetFunded CEO

Valentin Pinault is the CEO of WeGetFunded, leading the company since April 2023. Based in Châteauroux, Centre-Val de Loire, France, Valentin has an extensive career spanning across insurance and entrepreneurship. He brings a vision of empowering traders through innovative funding solutions, driving the company's success with a focus on integrity and growth.

- CEO of WeGetFunded since 2023

- Gérant unique at SAS L’Imprévu since 2017

- Leadership experience at Groupama

- Background in finance, insurance, and business management

- Volunteer with Rotaract, fostering community engagement

Main Features and Specifics

To give you a clear picture of what the prop firm offers, here's a concise summary of its key features:

Account Currency | USD |

Minimum Price | €129 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 90% |

Instruments | Forex, Indices, Stocks, Crypto, Bonds, etc. |

Assets | Not Specified |

Evaluation Steps | 1-Step, 2-Step |

Withdrawal Methods | Bank Transfer, Crypto |

Maximum Fund Size | $4,000,000 Through Scaling |

First Profit Target | 8% |

Max. Daily Loss | From 5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | From 10% |

Trading Platforms | cTrader |

Commission Per Round Lot | Not Specified |

Trustpilot Score | 4.2/5 |

Payout Frequency | First Withdrawal is Accepted After Four Weeks Next Payouts Are Done Bi-weekly |

Established Country | United Arab Emirates |

Established Year | 2023 |

Advantages And Disadvantages

Like any trading opportunity, WeGetFunded comes with some significant pros and cons. Let's break them down:

Advantages | Disadvantages |

High Profit-Sharing Ratio (Up To 90%) | Quarterly Performance Reviews May Add Pressure |

Flexible Challenge Options | Limited Choice Of Trading Platforms |

Scaling Plan Up To $4 Million | Support is Only Available via Email |

Refund Of Challenge Costs Upon Success | - |

Funding & Price Range On WeGetFunded

WeGetFunded offers a range of funding options to suit different trader needs and experience levels. Here's an overview of their pricing and funding structure:

- Funding: From $10K to $400K for the initial balance, up to $4,000,000 via scaling

- Price: From €129 to €2,069 for classic and unlimited challenges

Account Balance | 1 Step Challenge | 2 Step Challenge |

$10K | €149 | €129 |

$25K | €229 | €199 |

$50K | €349 | €299 |

$100K | €579 | €499 |

$200K | €1129 | €979 |

$400K | €2069 | €1799 |

Account Registration and Identity Verification

To create a new trading account with the WeGetFunded prop firm, you can follow the steps below. WeGet Funded registration:

#1 Navigate to the Sign-Up Page

Visit the official WeGetFunded website and hit the “Register” button on the homepage to begin the process.

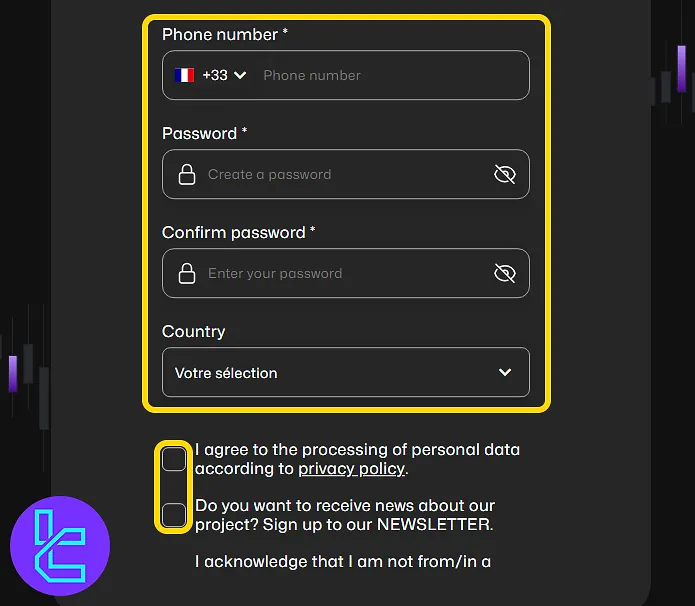

#2 Fill in Personal Information

Complete the form with your name, email, mobile number, password, residential address, country, and date of birth. Accept the terms before submitting.

#3 Confirm Your Email & Log In

Verify your email through the confirmation link sent to your inbox. Then log in with your credentials to access your trading dashboard.

#4 Verify Your Trading Account

After successfully passing the challenges, you must verify your trading account by completing the KYC process. The required documents include a proof of identity (such as a passport) and a proof of address (such as a utility bill).

Evaluation Stages and Program Specifics

WeGetFunded offers flexible evaluation programs tailored to different trader preferences. The 1-step and 2-step evaluations give traders the opportunity to prove their skills, with various drawdown limits, profit targets, and leverage options. Whether you're looking for a quick path to funding or a more gradual approach, WeGetFunded provides valuable conditions for aspiring traders.

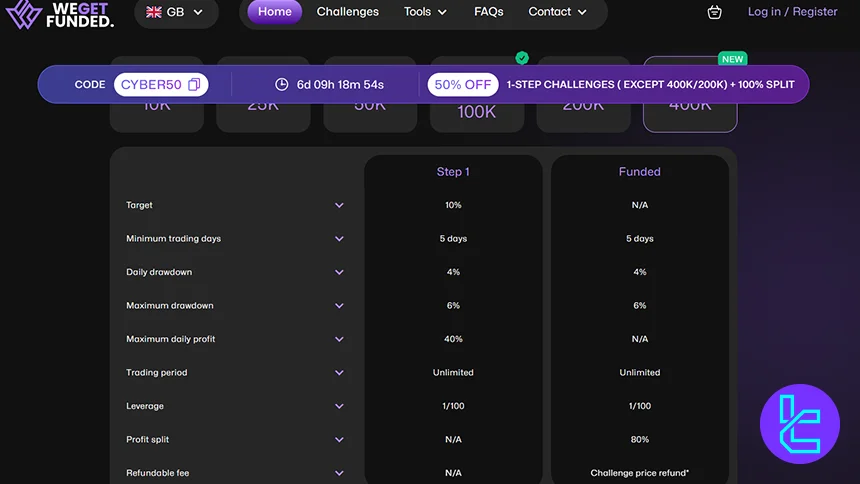

WeGetFunded 1 Stage Evaluation

For traders who want to get funded as soon as possible, the 1-step evaluation program is the best option.

Parameters | Step 1 |

Profit Target | 10% |

Minimum Trading Days | 5 Days |

Maximum Daily Drawdown | 4% |

Maximum Overall Drawdown | 6% |

Leverage | 1:100 |

Profit Split | 80/20 |

This streamlined challenge offers quick access to funding, ideal for traders who are ready to meet performance goals.

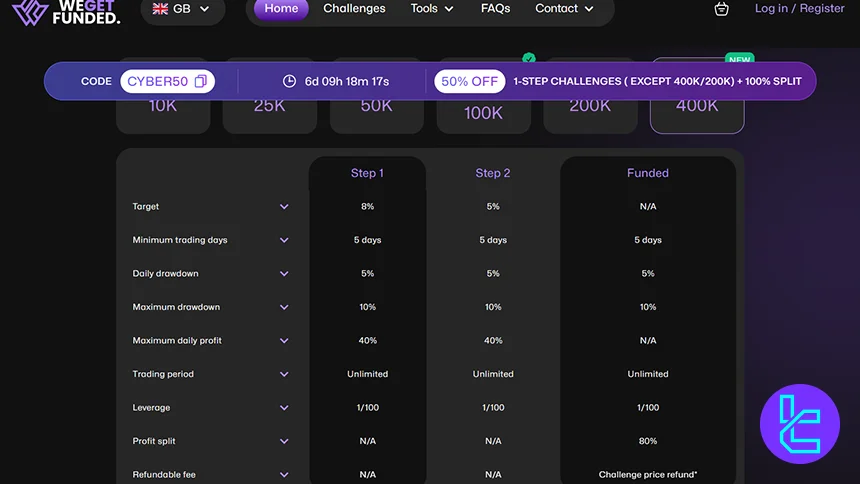

WeGetFunded 2-Step Evaluation

Traders who prefer a more gradual approach to trading find the 2-step evaluation a suitable option.

Parameters | Step 1 | Step 2 |

Profit Target | 8% | 5% |

Minimum Trading Days | 5 Days | 5 Days |

Maximum Daily Drawdown | 5% | 5% |

Maximum Overall Drawdown | 10% | 10% |

Leverage | 1:100 | 1:100 |

The 2-step evaluation provides a balance between performance requirements and risk management for traders seeking gradual progression.

WeGetFunded Bonuses and Promotions

Based on our investigations, the company does not currently offer any specific bonuses or promotions. Prop firms occasionally offer discount codes through official or third-party sources; therefore, always check these sources for any promotions.

WeGetFunded Rules

Let's review all the trading conditions you must adhere to to avoid losing your account at the WeGetFunded prop firm. WeGetFunded rules:

- VPN and VPS Usage: Inform your account manager before using multiple IP addresses or a VPS to avoid security concerns

- Hedging: Allowed within risk management rules; abusive hedging may violate Terms of Use

- Expert Advisors (EAs): EAs and indicators are allowed with verification; certain strategies like high-frequency trading and arbitrage are prohibited

- Gambling and Risky Strategies: Emulators, arbitrage trading, scalping, grid trading, and copying other traders are strictly prohibited

- News Trading: Allowed during the challenge phase, but restrictions apply after obtaining a funded account based on the economic calendar

VPN and VPS Usage

While it is possible to trade from multiple IP addresses, it is advised that you inform your account manager before doing so. Using Virtual Private Servers (VPS) or connecting from multiple locations can trigger security and identity verification concerns.

To ensure the safety of your account, it is important to provide clear and transparent information about your current location. Always communicate any special circumstances with your account manager to avoid potential verification issues.

Hedging

Hedging is permitted at WeGetFunded as long as it adheres to the firm’s risk management policies. However, abusive hedging strategies, especially those that aim to manipulate trading conditions or circumvent the firm's rules, will be considered a violation of the Terms of Use.

Make sure your hedging strategies are implemented responsibly to avoid any penalties. If in doubt, reach out to support for clarification.

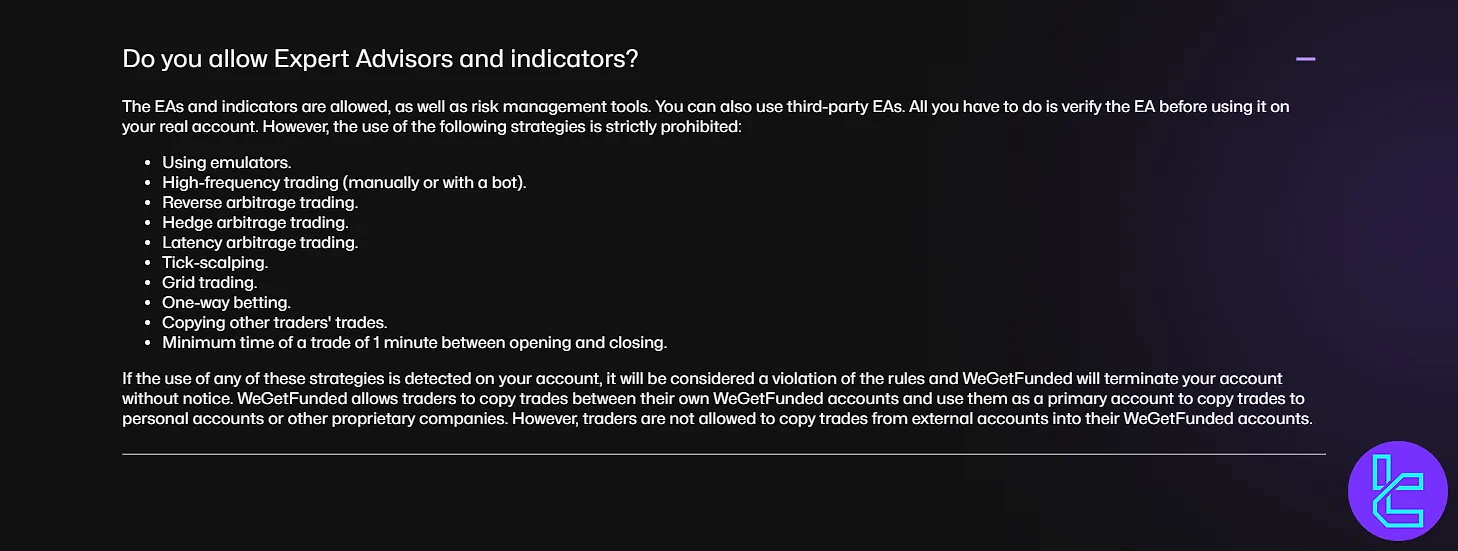

Expert Advisors (EAs) Usage

Expert Advisors and indicators are allowed, including third-party EAs, provided they are verified before being used on your live account. However, the following strategies are strictly prohibited:

- Emulators

- High-frequency trading, whether manual or bot-driven

- Reverse arbitrage trading

- Hedge arbitrage trading

- Latency arbitrage trading

- Tick-scalping

- Grid trading

- One-way betting

- Copying other traders' trades

A minimum trade time of one minute between opening and closing trades is required. If any of these prohibited strategies are detected on your account, WeGetFunded reserves the right to terminate your account without notice.

Additionally, copying trades from external accounts into your WeGetFunded account is not permitted, although copy trading between your own WeGetFunded accounts is allowed.

Gambling and Risky Strategies

The following trading practices are strictly forbidden:

- Emulators

- Reverse arbitrage trading

- Hedge arbitrage trading

- Tick-scalping

- Grid trading

- One-way betting

- Copying other traders' trades

News Trading Conditions

WeGetFunded allows news trading during the challenge phase. However, once a funded account is obtained, restrictions apply. You will be required to follow the economic calendar provided on the website and in your client area.

This calendar outlines when major economic events can be traded in an authorized manner, helping you to manage risk during volatile economic announcements.

These restrictions are in place to protect your capital by minimizing risks associated with economic events. The calendar will guide you on the best times to trade, ensuring optimal risk management and maximizing long-term success.

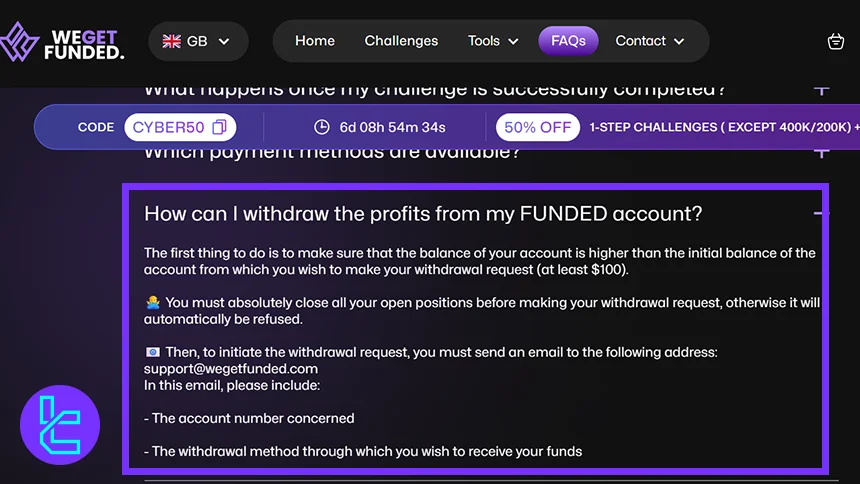

WeGetFunded Payout Policy

WeGetFunded offers a clear and structured payout process for funded traders. After meeting the withdrawal conditions, traders can easily request payouts, with profits distributed via bank transfers or cryptocurrencies. Withdrawals are processed swiftly, with clear instructions for a seamless experience.

- Minimum Withdrawal: $100 or equivalent in your account balance

- Requirements: Close all open positions before submitting a request

- Request Method: Email to support@wegetfunded.com

- Processing Time: 48 hours after confirmation

- Payment Methods: Bank transfer (USD/EUR) or cryptocurrencies (USDC)

- Withdrawal Frequency: First payout after 30 days, subsequent payouts every 14 days

- Crypto Payments: Instant processing, bank transfers take up to 48 hours

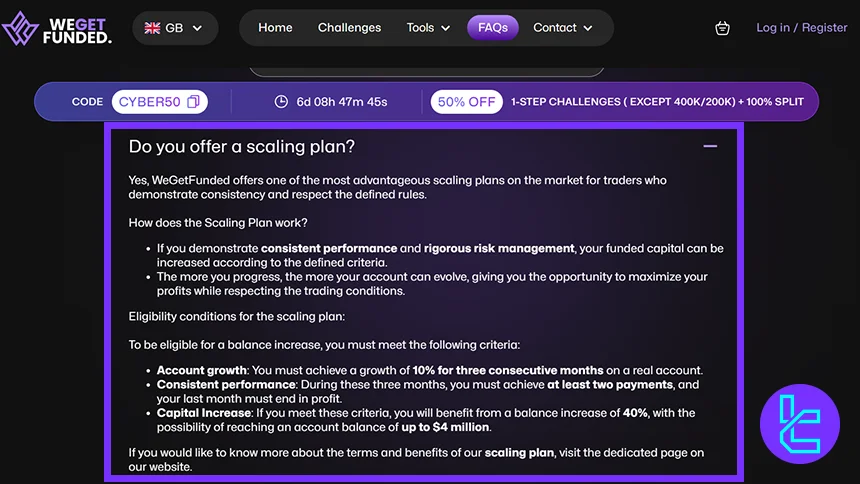

WeGetFunded Scaling Plan

WeGetFunded offers a unique scaling plan for traders who maintain consistent performance and adhere to the platform’s risk management rules. This program allows traders to increase their capital, potentially reaching up to $4 million, by demonstrating sustained success.

- Eligibility Criteria:

- 10% Account Growth: Achieve this over three consecutive months

- Consistent Performance: At least two payouts over three months, with the final month ending in profit

- Capital Increase: Eligible traders can receive a 40% increase in their balance

- Account Potential: Up to $4 million in total funding

Does WeGetFunded Offer Multiple Platforms?

WeGetFunded exclusively uses the cTrader platform, renowned for its advanced features and user-friendly interface. Here's why cTrader stands out:

- Low-latency execution for precise order placement

- Advanced charting tools and technical indicators

- Customizable interface to suit individual trading styles

- Algorithmic trading capabilities for those using EAs

- Mobile app for trading on the go

- Robust risk management features

However, some traders might prefer more platform options and find focusing on a sole choice a drawback.

Tradable Markets

WGF, like many other prop firms, offers a decent range of tradable instruments in different markets. In the list below, we will mention some of them:

- Forex

- Indices

- Stocks

- Cryptocurrencies

- Bonds

The company's website does not go into detail regarding this topic and only gives a general image of its offerings. It states that all available assets on the cTrader platform are accessible to WGF's clients.

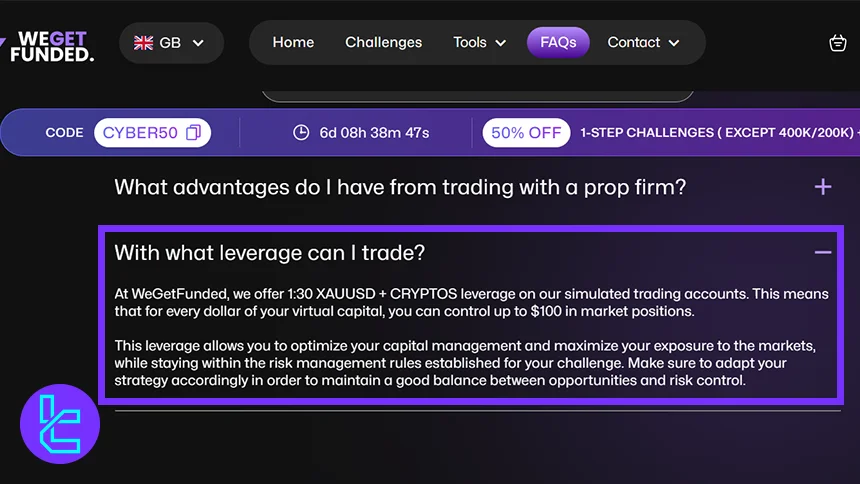

WeGetFunded Leverage Offerings

WeGetFunded offers competitive leverage ratios, allowing traders to manage their capital effectively while optimizing market exposure. With a leverage of up to 1:30 on XAUUSD and cryptocurrencies, traders can control up to $100 in market positions for every dollar of virtual capital.

- Leverage on XAUUSD & Cryptos: 1:30

- Capital Efficiency: Control up to $100 for every $1 of virtual capital

- Risk Management: Stay within defined rules to balance risk and opportunity

- Flexibility: Adjust trading strategies based on leverage for optimal results

Which Options Are Available for Payments?

WeGetFunded understands the importance of flexible and secure payment options. They offer three main methods for deposits and withdrawals:

- Bank Transfer: Traditional and widely accessible

- Cryptocurrency: For those preferring cryptocurrency transactions

- Credit/Debit Card: Convenient payments for challenges

WeGetFunded Prop Firm Commissions And Costs

This prop firm tries to keep a competitive fee structure. Here's what you need to know:

- No hidden fees or commissions on trades

- One-time challenge fee (refunded upon first withdrawal after success)

- Standard spreads for all trades

However, there's no exact information regarding trading commissions and spreads. The firm only states that there are "exceptionally low commissions and ultra-competitive spreads." The lack of clear data can be considered a drawback.

Education and Tutorials

While WGF doesn't offer an extensive educational platform, they do provide some resources to support traders. This company's website consists of a FAQ section that Covers most common queries about their services. Also, there's a terminology of financial terms and words titled "Lexique".

You can also use TradingFinder's Forex education section to access comprehensive learning materials.

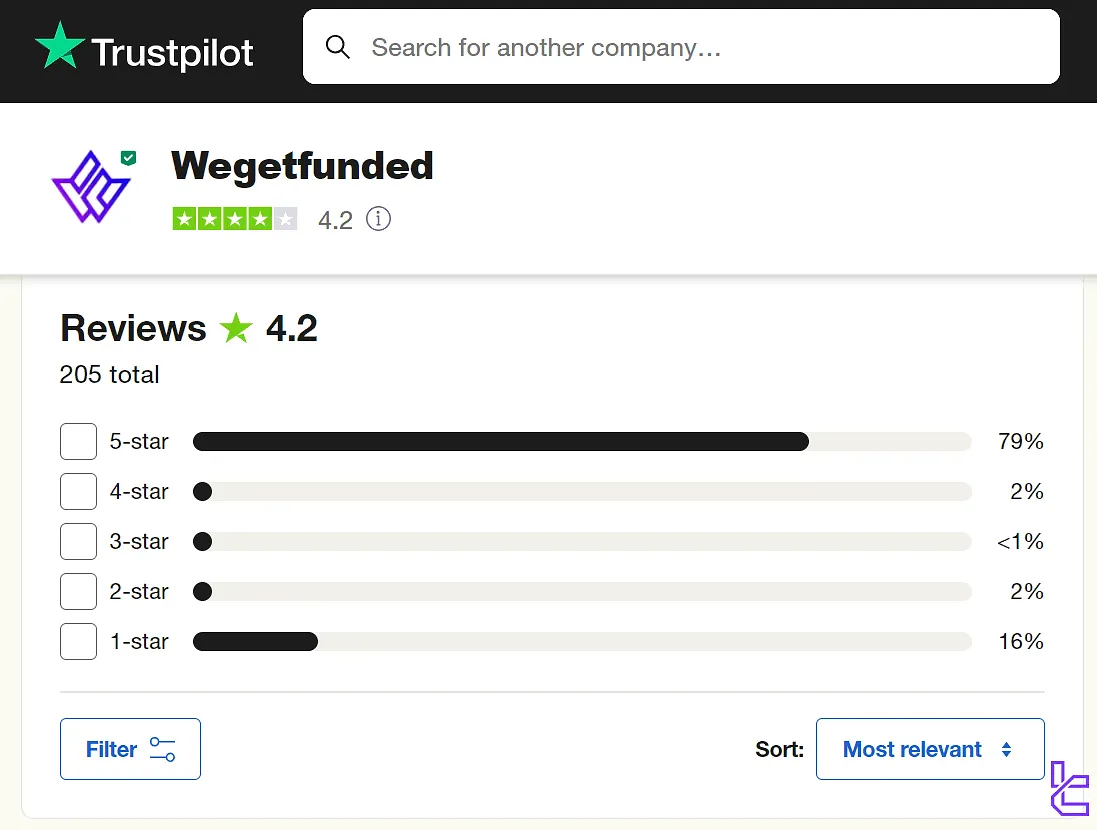

How Are The Trust Scores on Reputable Websites?

Trust is crucial in the prop trading industry, and WeGetFunded's Trustpilot scores reflect positively on their reputation:

- Overall rating is 4.2 out of 5 stars (based on over 200 reviews)

- Nearly 80% of reviews are 5-star ratings

WGF actively responds to negative reviews (+90% response rate), demonstrating its commitment to addressing customer concerns and maintaining service quality. However, there are no ratings and reviews on other credible websites.

Support Team Contact Channels and Working Hours

This is where WeGetFunded does a poor job. Most companies in various fields, including finance, provide 3 or more contact methods for customer services, but WGF only provides an email address: support@wegetfunded.com.

Besides, the team is not available 24/7, and the schedule is Monday to Friday, 8:00-20:00 (UTC+2). Support section in this prop firm is one of its most significant weaknesses.

Support Method | Availability |

Live Chat | No |

Yes (support@wegetfunded.com) | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

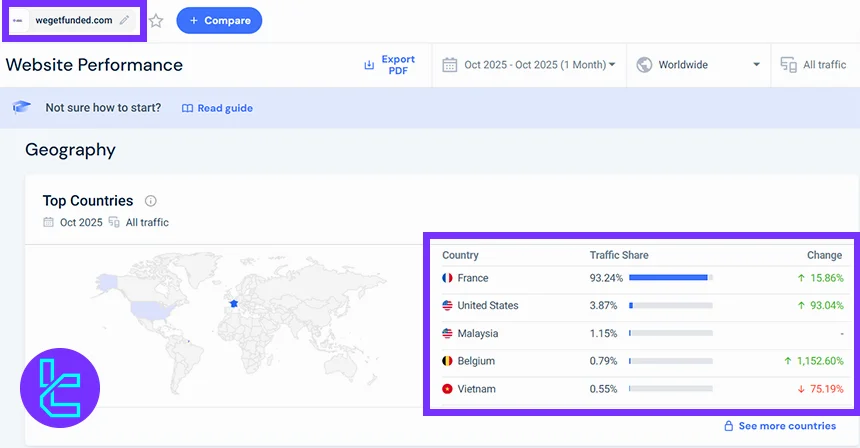

WeGetFunded Client Base

WeGetFunded is gaining significant traction worldwide, with the majority of its website traffic coming from France. The platform’s reach is expanding rapidly, with users from various regions participating in its trading challenges. Top Countries by Traffic:

- France: 93.24% (15.86% increase)

- United States: 3.87% (93.04% increase)

- Malaysia: 1.15%

- Belgium: 0.79% (1,152.60% increase)

- Vietnam: 0.55% (75.19% decrease)

WeGetFunded’s growing international footprint reflects its strong appeal to traders across multiple countries.

Social Media Accounts and Pages

WeGetFunded maintains an active presence on various social media platforms. You will find the links to the corresponding accounts here:

Social Media | Members/Subscribers |

5826 | |

1365 | |

77 | |

1620 | |

9766 | |

625 |

Following WeGetFunded on these platforms can provide valuable insights into their services, trading tips, and company updates.

WeGetFunded in Comparison with Other Prop Firms

Check the table below to understand the pros and cons of trading with WeGetFunded Prop Firm in comparison to other Prop Firms.

Parameters | WeGetFunded Prop Firm | |||

Minimum Challenge Price | $129 | $155 | $15 | €55 |

Maximum Fund Size | $4,000,000 | $400,000 | $100,000 | Infinite |

Evaluation steps | 1-Step, 2-Step | 2-phase | 1-Step, 2-Step | 2-Step |

Profit Share | 80% | Up to 90% | 100% | |

Max Daily Drawdown | 5% | 5% | 4% | 5% |

Max Drawdown | 10% | 10% | 8% | 8% |

First Profit Target | 8% | 10% | 8% | 10% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:75 | 1:100 |

Payout Frequency | Bi-weekly | Monthly | 10 Days | 14 Days |

Number of Trading Assets | N/A | N/A | 400+ | 150+ |

Trading Platforms | cTrader | MT4, MT5, cTrader, DXtrade | Match-Trader, cTrader | cTrader, DXTrade |

Expert Suggestions

WeGetFunded, a prop trading firm, offers a maximum leverage of 1:100 in the cTrader trading platform. The company has received a score of 4.2 out of 5 on the Trustpilot website. This rating is based on +200 reviews.

The firm enables payments via 3 main methods [bank transfer, crypto, credit/debit card] and provides its support services through email, Monday to Friday, 8:00 to 20:00 (UTC+2).