XLTrade offers attractive 1-step and 2-step challenges for traders. With a maximum fund size of $3 million, XLTrade Prop firm provides ample scaling opportunities.

The firm sets a first profit target of 10%, allowing traders to measure their success effectively. With leverage of up to 1:500 and without commissions, XLTrade ensures traders benefit from competitive conditions.

The firm's global reach extends to over 160 countries, and it is supported by flexible payment options like Visa, MasterCard, Bank Wire, and Crypto.

XLTrade Prop Firm Company Overview

XLtrade, established in 2016 and headquartered in London, United Kingdom, is a prominent player in the proprietary trading (prop trading) industry.

Operated by Chimara Ltd, with its platform registered in the Virgin Islands, the prop firm offers traders access to substantial trading capital without requiring a significant personal investment.

This unique model has positioned XLTrade as a leading choice for both aspiring and professional traders, enabling them to enhance their trading capabilities on a larger scale.

XLTrade CEO

JJ Brookes leads XLTrade, an offshore prop trading firm known for providing funded trading accounts to a global investor base. Under his leadership, the firm positions itself as a performance-focused ecosystem built around accessibility, capital efficiency, and trader development.

- JJ Brookes serves as the active CEO, shaping XLTrade’s operational strategy and trader-funding framework;

- XLTrade operates as an offshore proprietary trading firm offering funded accounts tailored for Forex, indices, and commodities;

- The firm’s model emphasizes scalable capital, transparent evaluation conditions, and payout-driven incentives;

- Brookes’ public presence reinforces the brand’s positioning in the competitive prop-firm landscape, especially among new and mid-level traders.

XLTrade specifications summary

To provide a clearer picture of XLtrade's offerings, let's break down the prop firm's key specifications:

Account currency | USD |

Minimum price | $320 |

maximum leverage | 1:500 |

maximum profit split | %90 |

Instruments | Equity Indices, Stocks, Forex, Cryptos, Metals, Energy, Commodities |

Assets | EUR/USD, GBP/USD, USD/JPY, Tesla, NASDAQ, Gold, Silver, Oil |

evaluation steps | Step 1, Step 2 |

Trading platform | MetaTrader 5, WebTrader |

Withdrawal methods | Bank Wire, Crypto |

maximum fund size | $3M scaling |

First profit target | 10% |

Max. daily loss | - |

Challenge time limit | No limits |

News trading | Yes |

Maximum total drawdown | 10% |

commission per round lot | No |

Trustpilot score | 4.6 out of 5 |

Payout frequency | Weekly, Monthly |

established country | Virgin Islands |

established year | 2016 |

XLtrade's model is designed to attract serious traders with its high funding amounts and favorable profit-sharing terms. However, the lack of direct regulation and the high initial costs may cause some traders to pause.

XLTrade prop firm pros & cons

Let's weigh the advantages and disadvantages of trading with XLtrade:

Pros | Cons |

High funding amounts (up to $3 million scaling) | Lack of direct regulatory oversight |

Generous 90% profit split | Mixed customer reviews and transparency concerns |

Weekly payouts | Limited educational resources |

No profit limits or daily loss restrictions | - |

Use of the popular MT5 platform | - |

While XLTrade prop firm offers attractive terms for experienced traders, the high entry barriers and lack of transparency may deter some potential users.

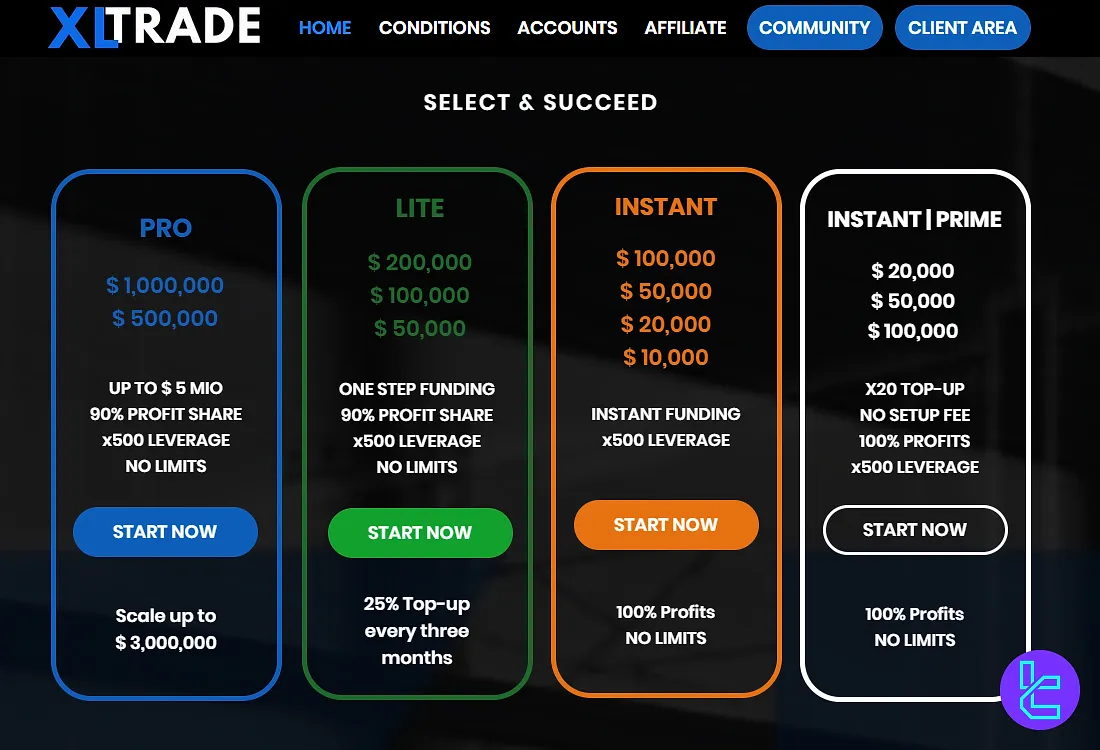

XLTrade funding & price

XLtrade's funding model is designed to cater to traders with various experience levels and capital requirements.

Here's a breakdown of their funding options:

Funding Size | Pro Price | Lite Price | Instant Price | Instant Prime Price |

$10,000 | - | - | $650 | - |

$20,000 | - | - | $1,250 | $1,000 |

$50,000 | - | $320 | $2,390 | $2,500 |

$100,000 | - | $790 | $4,590 | $5,000 |

$200,000 | - | $1,350 | - | - |

$500,000 | $2,490 | - | - | - |

$100,000 | $4,590 | - | - | - |

It's worth noting that while these funding amounts are substantial, the associated setup fees are non-trivial. Traders should consider their ability to meet the evaluation criteria before committing to these fees.

Note that XLTrade allows traders to scale up their funding size up to $3,000,000. Also, the initial fee paid for an account is fully refunded after success in the challenge by the trader.

XLTrade registration & verification Process

Joining XLTrade involves a straightforward process. The platform supports applicants from over 160 countries, but regional eligibility should be confirmed beforehand.

#1 Create Access Credentials

Begin by visiting the official XLTrade website. Click on “Start Now”, complete the signup form, and receive a password for Guest Access. This allows temporary entry to explore the platform and proceed with the next steps.

#2 Select Account Type and Make Payment

Choose your desired account type and specify the funding amount. You’ll be prompted to enter billing information and complete the payment securely.

#3 Verify Identity and Access Dashboard

Click on “Access Dashboard” to reach your personal trading portal. Navigate to the verification section to upload your proof of identity and proof of address—a standard KYC step to activate your account fully.

XLTrade Evaluation Steps

XLTrade employs 1-step and 2-step evaluation models for its various plans to assess traders' skills and risk management abilities.

The table below goes through all of the related details for each plan:

Parameters | PRO | LITE | INSTANT | INSTANT PRIME |

Profit Target | 10% per Step | 10% | N/A | N/A |

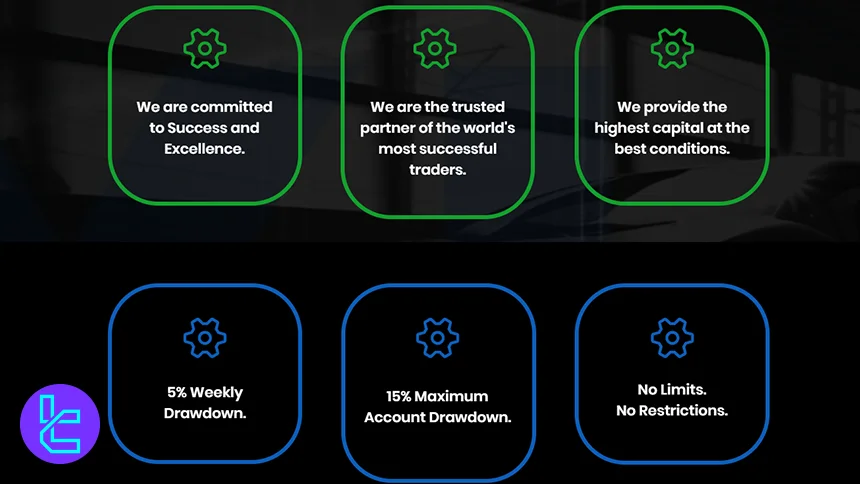

Max. Weekly Drawdown | 5% | 5% | 5% | 5% |

Max. Total Drawdown | 10% | 10% | 10% | 10% |

Profit Split | 90% | 90% | 100% | 100% |

Payout Frequency | Weekly | Weekly | Monthly | Monthly |

The absence of daily loss limits provides flexibility but requires traders to exercise strong self-discipline and risk-management skills.

XLTrade PRO Challenge

The PRO Challenge applies a structured multi-step model with a 10% profit target per step, ideal for traders who perform best under defined metrics and risk parameters.

Evaluation Model | 2-Step |

Profit Target | 10% per Step |

Max Weekly Drawdown | 5% |

Max Total Drawdown | 10% |

Profit Split | 90% |

Payout Frequency | Weekly |

XLTrade LITE Challenge

The LITE Challenge offers a simplified structure with a single 10% target, making it attractive for traders seeking quicker access to a funded account.

Evaluation Model | 1-Step |

Profit Target | 10% |

Max Weekly Drawdown | 5% |

Max Total Drawdown | 10% |

Profit Split | 90% |

Payout Frequency | Weekly |

XLTrade INSTANT Challenge

The INSTANT Challenge removes profit targets entirely, offering capital access without waiting for evaluation milestones.

Evaluation Model | Instant Access |

Profit Target | N/A |

Max Weekly Drawdown | 5% |

Max Total Drawdown | 10% |

Profit Split | 100% |

Payout Frequency | Monthly |

XLTrade INSTANT PRIME Challenge

INSTANT PRIME mirrors the INSTANT model but emphasizes a higher-tier experience with full capital access and premium payout conditions.

Evaluation Model | Instant Access |

Profit Target | N/A |

Max Weekly Drawdown | 5% |

Max Total Drawdown | 10% |

Profit Split | 100% |

Payout Frequency | Monthly |

XLTrade bonuses and discount offerings

XLTrade does not explicitly offer bonuses or promotional offers as part of its services. However, sometimes promo codes are found on the official or third-party sources.

XLTrade Rules

The prop firm's website does not reveal much information regarding this matter, but it states that news trading and the use of Expert Advisors (EAs) are allowed. Also, no strategies are restricted.

XLTrade Payout Policy

XLTrade provides a payout framework built for frequent withdrawals and high retention, allowing traders to keep 90% of all generated profits. Weekly payout access and multiple transfer channels position the firm as a flexible option for active earners.

- Traders retain 90% profit share, ensuring strong earning potential on funded accounts;

- Payouts can be requested every Friday, EOD, giving traders weekly access to their performance gains;

- Withdrawals are supported through bank wire and cryptocurrency, enabling fast, global-friendly transfers;

- Partial and full payout requests are allowed, offering flexible money-management options for different trading styles.

XLTrade trading platforms

XLTrade provides access to one of the most popular trading platforms, MetaTrader 5, and its WebTrader version in the Forex and CFD trading world.

MetaTrader 5 features:

- More advanced version of MT4

- Additional timeframes and order types

- Enhanced backtesting capabilities

- Access to a wider range of markets

XLtrade's provision of MT5 allows traders to choose the platform that best suits their trading style and needs. The support for automated trading is particularly noteworthy as it enables traders to implement and test complex strategies.

TradingFinder has developed various advanced MT5 indicators that you can use for free.

What instruments & symbols can I trade on XLTrade prop firm?

XLTrade provides a wide selection of trading instruments, from the Forex market to indices, accommodating different trading styles and strategies:

Markets | Instruments |

Forex | EUR/USD, GBP/USD, USD/JPY , … |

Stocks | Various global stocks like US Stocks |

Indices | S&P 500, NASDAQ, FTSE 100 |

Commodities | Gold, Silver, Oil |

This wide selection of instruments allows traders to diversify their portfolios and exploit opportunities across different markets. However, it's crucial to note that the availability of specific symbols may vary, and traders should always check the current offerings and any associated trading conditions or restrictions.

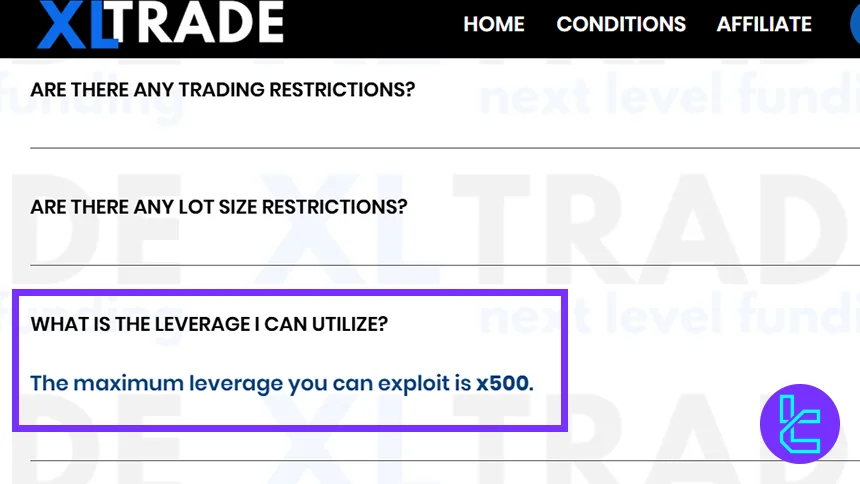

XLTrade Leverage Offerings

XLTrade empowers traders with a maximum leverage of x500, providing substantial flexibility in managing positions. This high leverage allows traders to maximize their potential returns while keeping risk parameters controlled under the firm’s guidelines.

- Maximum Leverage: Traders can access leverage up to x500, enhancing position sizes without excessive capital exposure;

- Leverage Flexibility: Suitable for various trading strategies, including day trading, swing trading, and long-term investments;

- Capital Efficiency: Enables traders to control larger positions with smaller capital outlay, ideal for maximizing potential returns on smaller accounts.

XLTrade payment methods

XLTrade offers several payment methods to accommodate traders from different regions:

Transaction Type | Payment Methods |

Withdrawals | Bank Wire, Crypto (Trader provides bank details or Crypto address) |

Deposits | Visa, Master Card, Bank Transfer, Crypto |

While XLTrade claims to offer various payment methods, the available options may depend on your location. It's advisable to check with their support team for the most up-to-date information on available payment methods in your region.

XLTrade commission & costs

Understanding the fee structure is crucial when considering a prop firm. Here's a breakdown of XLtrade's commission and costs:

Category | Details |

Trading Costs | No commissions, Spreads vary, Overnight swap fees may apply |

Withdrawal Fees | No fees by XLtrade, Third-party fees may apply |

Inactivity Fees | No clear info provided |

It's also worth noting that while XLTrade prop firm doesn't charge commissions, the spread costs can add up, especially for high-frequency traders.

When evaluating the overall value proposition, always consider the total cost of trading, including spreads.

Does XLTrade offer vast educational resources?

Unfortunately, XLTrade falls short in the area of educational resources.

Unlike many reputable prop firms and brokers that offer comprehensive educational materials, XLtrade's offerings in this department are quite limited. Instead, the firm has dedicated a section named Trader's Hub, where traders can join the community to seek help and ask advanced questions.

XLTrade Trust Scores on Review Websites

Trust scores and customer reviews play a crucial role in assessing the reliability of a prop firm. Let's examine XLtrade's standing on Trustpilot:

- XLtrade Trustpilot Score: 4.6/5 (based on 101 reviews as of 2023).

This score indicates a generally positive sentiment among reviewers. Key points from the reviews include:

Aspect | Positive | Negative |

Details | Efficient support, fair trading conditions, helpful staff | misunderstandings of trading rules, account termination complaints |

It's important to note that while the Trustpilot score is high, it contrasts with the lower rating on the Forex Peace Army (FPA) website. This discrepancy underscores the importance of consulting multiple sources when evaluating a prop firm's reputation.

XLTrade prop firm customer support

Customer support is a critical aspect of any trading service. XLTrade offers several channels for customer support:

Support Method | Availability |

Live Chat | Yes |

No | |

Phone Call | Yes (+44 0 203 289 9020) |

Discord | No |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

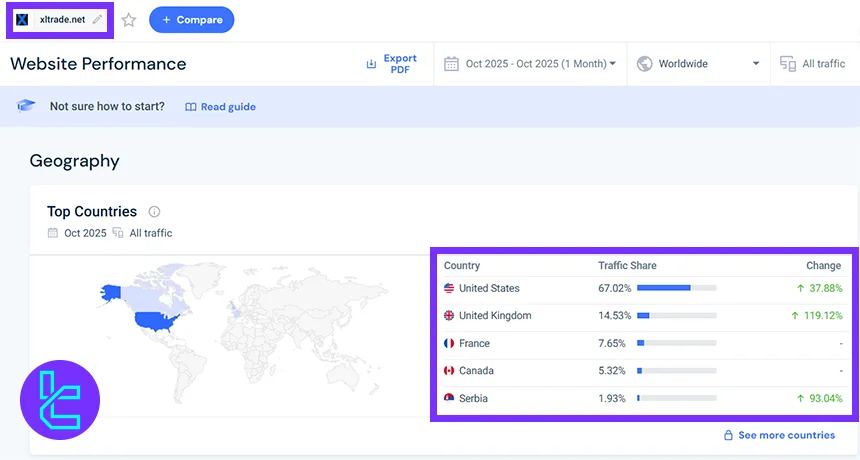

XLTrade User Base

XLTrade’s user base demonstrates robust global engagement, with a major portion of its traffic originating from key markets such as the United States, United Kingdom, and France. The platform has gained significant traction, reflecting its growing international reach and appeal within the trading community.

- United States: Dominates the user base, contributing 67.02% of total traffic, with a 37.88% increase in activity;

- United Kingdom: Accounts for 14.53% of traffic, showing a strong 119.12% growth;

- France: Attracts7.65% of users, with consistent engagement;

- Canada: Holds 5.32% of traffic, maintaining stable interest;

- Serbia: Emerging as a growing market, contributing 1.93%, with a 93.04% increase.

XLTrade social media channels

In today's digital age, a company's social media presence can provide valuable insights into its operations and customer engagement. XLTrade maintains a presence on some social media platforms:

Social Media | Members/Subscribers |

978 | |

1200 | |

780 | |

94 |

However, the overall social media engagement appears limited compared to other prop firms.

XLTrade Comparison with Other Prop Firms

Look at the table below for a comprehensive comparison between the reviewed prop firm and other players in the industry:

Parameters | XLTrade Prop Firm | BrightFunded Prop Firm | Maven Trading Prop Firm | The 5ers Prop Firm |

Minimum Challenge Price | $320 | €55 | $15 | $39 |

Maximum Fund Size | $3,000,000 | Infinite | $100,000 | $4,000,000 |

Evaluation steps | 1-Step, 2-Step | 2-Step | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step |

Profit Share | Up to 90% | 100% | 85% | 100% |

Max Daily Drawdown | N/A | 5% | 4% | 5% |

Max Drawdown | 10% | 8% | 8% | 10% |

First Profit Target | 10% | 10% | 8% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:500 | 1:100 | 1:75 | 1:100 |

Payout Frequency | Weekly, Monthly | 14 Days | 10 Days | Bi-weekly |

Number of Trading Assets | N/A | 150+ | 400+ | 3000+ |

Trading Platforms | MetaTrader 5, WebTrader | cTrader, DXTrade | Match-Trader, cTrader | Metatrader 5 |

Expert suggestions

In conclusion, XLTrade stands out with its low entry point starting at $320 and an appealing profit split of up to 90%.

The firm provides access to a wide range of trading instruments on popular platforms such as MetaTrader 5 and WebTrader.

While XLTrade prop firm may lack educational resources, its trading conditions, like 0 commission, bi-weekly payouts, and allowance for news trading, make it an attractive choice for prop traders.

Trustpilot reviews highlight the firm's efficient support, fair trading conditions, and helpful staff, earning it a score of 4.6/5 based on 101 reviews as of 2023.