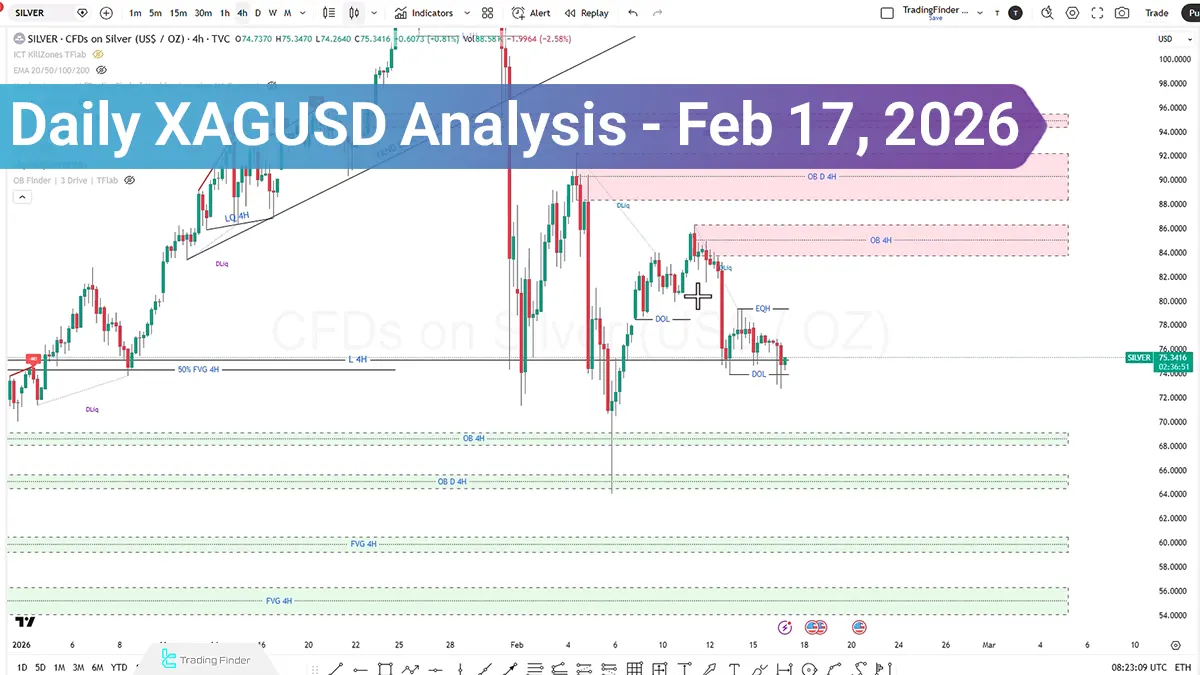

Key Points:

- After liquidity declined due to market holidays, silver entered a consolidation phase and in start of the trading week, a classic Liquidity Sweep and Stop Hunt happened;

- On the 4-hour timeframe, maintaining Higher Lows is the main condition for continuation of the bullish scenario; stabilization above the short-term structure can activate further upside;

- On the 1-hour timeframe, increasing bearish momentum accompanied by full-body candles and closes below support levels strengthens the scenario of a deeper correction;

- On the 15-minute timeframe, entry into an Order Block or Rejection Block accompanied by confirmation of a Market Structure Shift or CISD can create a lower-risk buying opportunity;

- The dominant scenario is currently bullish; however, any strong bearish Displacement could shift market balance in favor of sellers.

During yesterday’s trading session, the silver symbol faced a noticeable decline in liquidity due to U.S., Canadian, and Chinese market holidays and fluctuated within a ranging phase.

With the start of Tuesday’s trading day, selling pressure increased, and the price, after collecting Sell-Side Liquidity and executing a Stop Hunt move, advanced upward once again.

However, continued supply pressure has prevented bullish stabilization, and the short-term structure remains in a decision phase. The upcoming scenarios will depend on price behavior around liquidity zones and the manner of candle closes.

XAGUSD Analysis on the 4-Hour Timeframe (H4)

On the 4-hour timeframe, the market is entering a consolidation phase. With liquidity flow beginning on Tuesday, we first witnessed a move toward sell-side liquidity followed by a price rebound. This behavior indicates the collection of pending orders before a directional decision.

Based on the Price Action approach, if the market structure stabilizes while maintaining Higher Lows, the probability of continuation of the bullish trend remains. However, price reaction at key zones is critically important.

In the dominant scenario, if a bullish candle closes and price stabilizes above the short-term structure, the market focus can shift toward continuation of the upward move.

Silver Forex Analysis on the 1-Hour Timeframe (H1)

On the 1-hour timeframe, if selling pressure increases and the price is accompanied by a bearish Displacement move and strong candles, the probability of continuation of the downward trend will be reinforced.

In this situation, the market can activate lower levels as targets, and the short-term structure may enter a bearish phase.

The main criteria in this scenario:

- Increase in bearish momentum;

- Strong candle closes below support zones;

- Failure to form a bullish market structure shift.

XAGUSD Analysis on the 15-Minute Timeframe (M15)

On the 15-minute timeframe, using the ICT approach and reviewing the Kill Zone, liquidity behavior in the Asia session can be evaluated as follows:

- The primary move initially formed to the downside;

- Sell-side liquidity was collected;

- Price moved upward again;

- Then, with selling pressure and execution of a Stop Hunt, the short-term structure entered a decision phase.

If price enters the Order Block or Rejection Block zone and signs of seller weakness are observed, upon confirmation of a Market Shift Structure or Break of Structure, entry into a buy position becomes possible.

In this case:

- Stop loss should be placed behind the valid swing;

- The target should be the buy-side liquidity zone or the opposing Order Block.

Conclusion

Silver has entered a consolidation phase under reduced liquidity conditions, but with the start of trading flow, it is displaying classic liquidity collection and Stop Hunt behavior.

At present, relative dominance belongs to the bullish scenario, conditional upon maintaining structure and closing with a positive candle. However, any aggressive move and bearish displacement could shift the market path toward a deeper correction.

The main focus should be on price behavior at liquidity zones, the quality of candle closes, and the preservation or break of market structure.