Key Points:

- After pulling back into the order block zone, Bitcoin reacted strongly and continued its bearish phase with a confirmed Break of Structure (BOS).

- Price positioning within the RSI oversold zone confirms sustained downside pressure and the dominance of negative momentum.

- On the 4-hour timeframe, a break below the $75,719 level may accelerate the bearish move, while a return to the BOS zone raises the possibility of a phase shift.

- On the 1-hour timeframe, a pullback toward the Pin Bar and order block zone provides conditions to evaluate a short-term bullish correction.

- Session structure on the 15-minute timeframe suggests that sell-side liquidity collection may support a limited short-term bullish fluctuation.

On February 1, 2026, Bitcoin showed a strong reaction after pulling back into the order block zone and continued its bearish phase following a confirmed market structure break.

Price consolidation within the bullish order block zone, combined with Relative Strength Index conditions, ties short-term scenarios to momentum behavior and structural dynamics.

Overall market sentiment remains dominated by fear, keeping the probability of a broader phase shift limited.

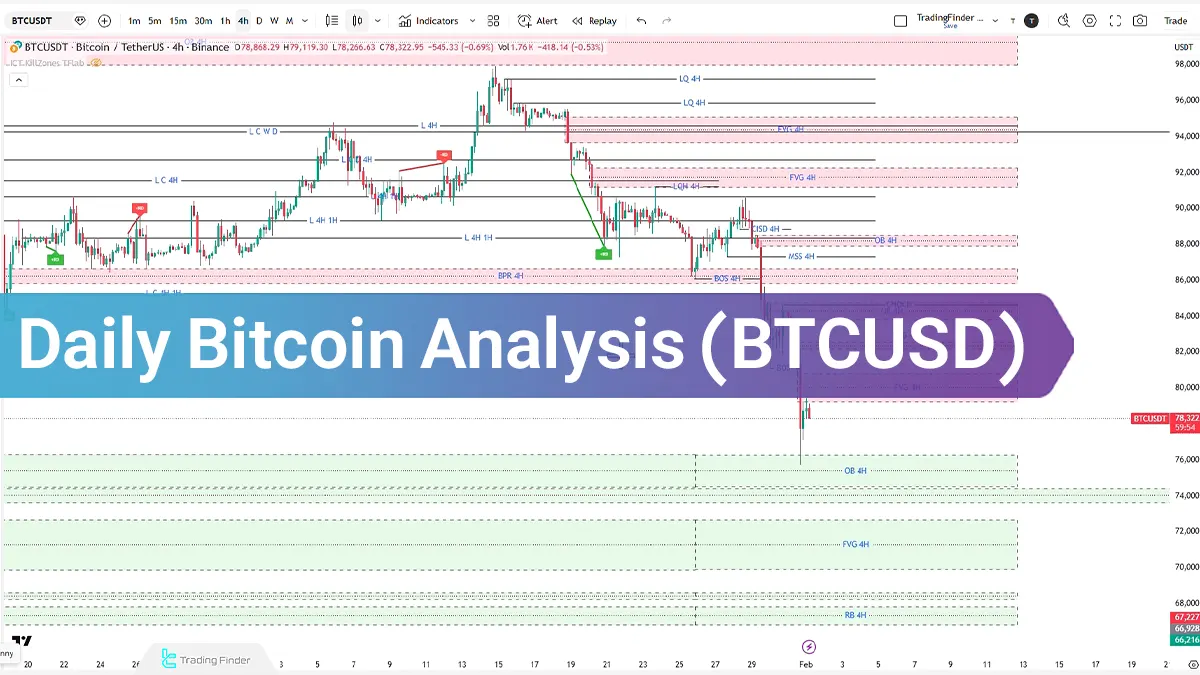

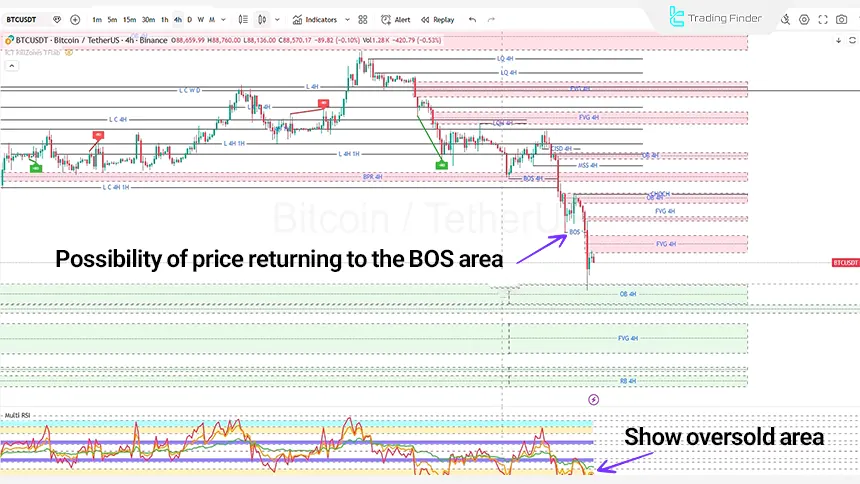

Bitcoin Analysis on the 4-Hour Timeframe (H4)

On the 4-hour timeframe, after pulling back into the Order Block zone, price recorded a significant reaction and continued its bearish path with a confirmed Break of Structure (BOS).

Relative Strength Index indicator readings indicate that price is positioned within a potential oversold zone, reflecting ongoing downside pressure in the market.

If bearish momentum increases and a downside displacement forms, price may continue lower by breaking the swing low at the $75,719 level.

Conversely, weakness in the bearish trend and a return toward the BOS zone could create conditions for a potential trend shift.

BTC Analysis on the 1-Hour Timeframe (H1)

On the 1-hour timeframe, weakness in the prior bullish structure is observed, with price pulling back toward the Pin Bar formation zone.

As a lower high forms and bearish pressure begins to weaken, an upside pullback accompanied by a bullish momentum candle may provide an opportunity to evaluate long positions.

In this scenario, the stop loss is positioned below the Pin Bar swing or behind the order block zone at the $74,466 level.

Additionally, 4-hour Fair Value Gap levels transferred to the 1-hour timeframe may act as upside price targets, extending toward the $82,225 level.

BTCUSD Analysis on the 15-Minute Timeframe (M15)

On the 15-minute timeframe, price action during the Asian session formed an Accumulation phase.

If a Manipulation move develops during the London session accompanied by sell-side liquidity collection, the market may transition into a Distribution phase during the New York session.

Note: Within this structure, targeting higher price levels becomes valid under a short-term active scenario.

Conclusion

Bitcoin analysis on February 1st indicates that market structure remains bearish, a view reinforced by Relative Strength Index readings.

Trading scenarios continue to depend on price reactions at order blocks, candle closing behavior, and momentum shifts.

As a result, until a valid break of key levels is confirmed, market focus remains on liquidity management and the continuation of downside pressure.