Key Points:

- After a short-term bullish correction and buy-side liquidity collection, the GBP/USD pair has returned to a bearish phase and resumed targeting lower levels;

- A negative price reaction to the Fair Value Gap (FVG) on the 4-hour timeframe reinforces ongoing selling pressure and validates the bearish scenario;

- Weekly support levels at $1.3592 and $1.3568 stand out as key areas for potential price reaction or temporary stabilization;

- On the 1-hour timeframe, bearish rejection from the $1.376 order block combined with increasing negative momentum raises the probability of reaching $1.3665 and $1.3642;

- Session-based price behavior, particularly interaction with Asian session high liquidity and distribution structure, defines the short-term GBP/USD path between continuation of the decline or a limited corrective move.

On February 3, 2026 Price action in the GBP/USD, unfolded in line with the expected scenario. A short-term bullish correction accompanied by buy-side liquidity collection was followed by a renewed return to thde bearish phase.

Subsequent targeting of draw-on liquiity was observed, with price stalling inside the Fair Value Gap zone.

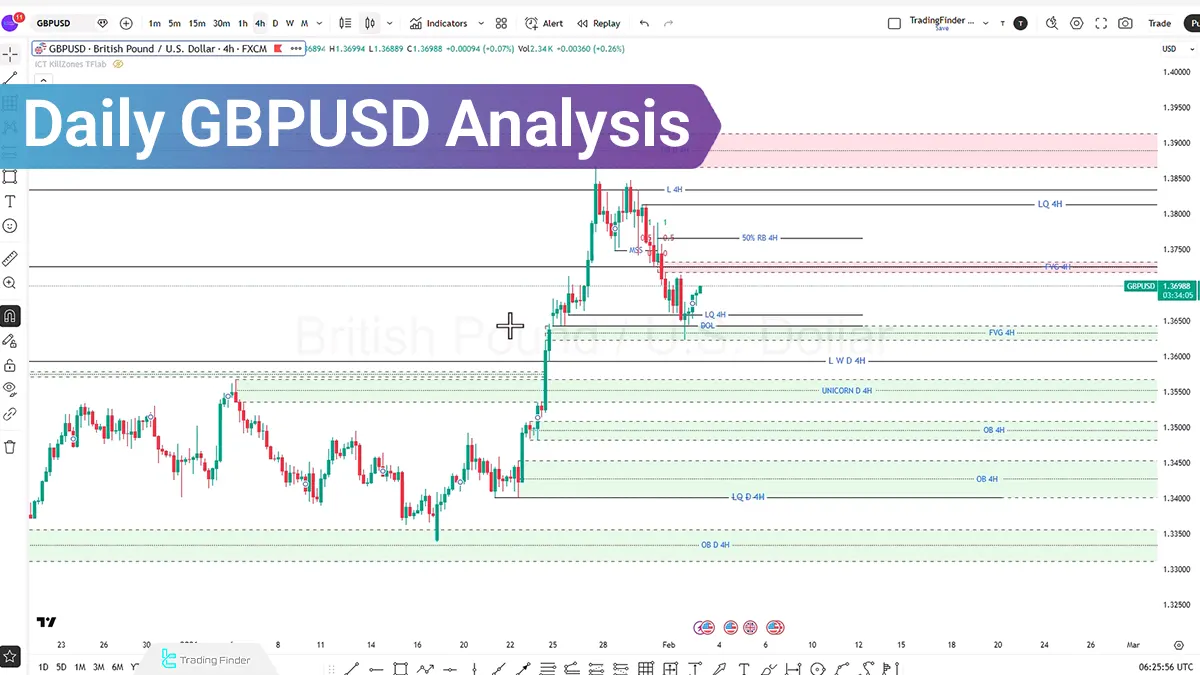

GBPUSD Analysis on the 4-Hour Timeframe (H4)

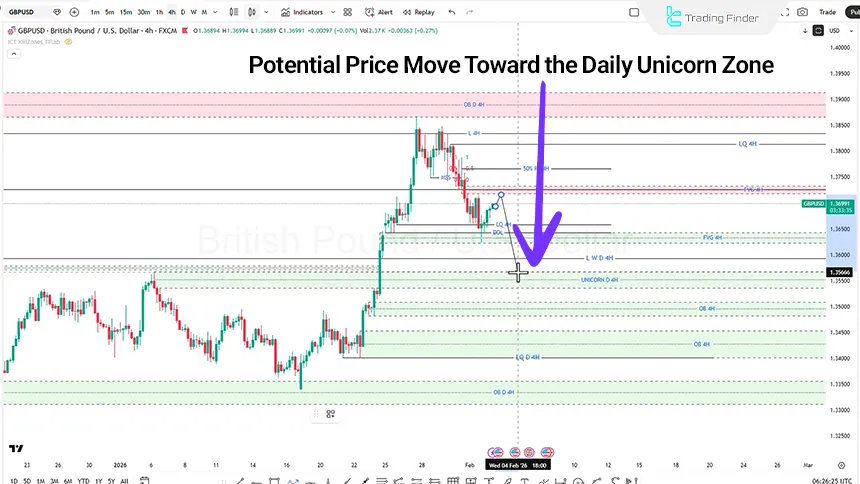

On the 4-hour timeframe, the current market structure shows signs of another short-term corrective move to the upside. Price entering the Fair Value Gap and reacting negatively from this zone highlights continuation of the bearish trend and activation of lower downside targets.

The first major weekly support level (daily- and H4-optimized) is located at $1.3592. The next support at $1.3568 aligns with the daily Unicorn zone (H4-optimized).

Recent ISM and PMI economic data were released above both previous and forecasted figures. While the US Dollar Index shows a short-term corrective pullback, continuation of its broader bullish move toward the $98.153 level remains valid.

GBPUSD Analysis on the 1-Hour Timeframe (H1)

On the 1-hour timeframe, the bearish price move following sell-side liquidity collection is accompanied by a Swing Failure Pattern (SFP) at the highs.

Price reaction to the $1.376 order block acts as a bearish rejection, keeping downside continuation likely.

Primary downside targets are located within the Fair Value Gap around $1.3665, with increasing bearish momentum opening the path toward the $1.3642 level.

This zone may serve as the foundation for a potential long setup, targeting the bearish order block near $1.3757.

Conversely, a confirmed close below the $1.3623 level accompanied by bearish displacement would validate continuation of the downtrend.

GBP/USD Analysis on the 15-Minute Timeframe (M15)

On the 15-minute timeframe, the initial scenario focused on an upward move to collect buy-side liquidity above the Asian session high. A close within the Asian session range suggested the potential for a distribution move during the New York session.

However, the distribution phase developed during the London session, while the New York session transitioned into consolidation.

In an alternative scenario, price moving higher during the London session and collecting prior-day buy-side liquidity remains in focus. Within this structure, the $1.3638 order block marks a key area for assessing bearish weakness.

Signs of weakness in this zone may support evaluating long entries with a risk-to-reward ratio of 1:1 or 1:2.

Conversely, a strong bearish move during the London session accompanied by momentum would keep downside continuation into the New York session and sell-side liquidity collection likely.

Conclusion

Price behavior in GBP/USD continues to reflect a dominant bearish structure accompanied by limited short-term corrective moves.

Buy-side liquidity collection and price reaction to the Fair Value Gap keep market focus on corrective scenarios within a broader downtrend.

Until price successfully reclaims key levels, the prevailing market path remains centered on downside targeting, order block reactions, and liquidity management.