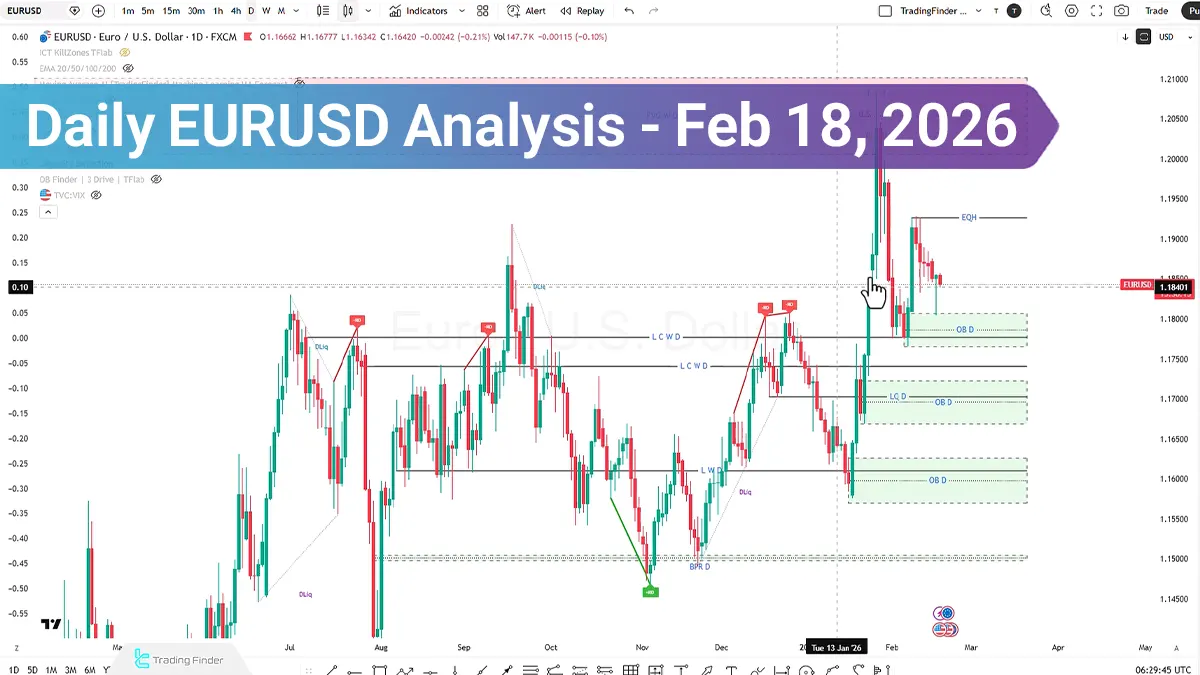

Key Points:

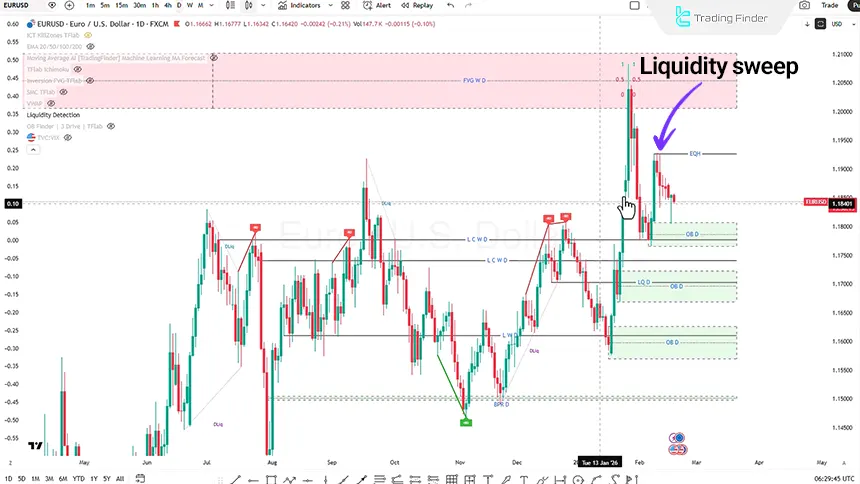

- Following an aggressive bearish move and sell-side liquidity sweep, price has shown a positive reaction to the daily order block and continues to maintain its bullish structure;

- The full retracement of the decline triggered by weak GDP data indicates continued bullish momentum and lack of price acceptance at lower levels;

- On the 4-hour time frame, the optimized FVG has been tested, and if sellers show weakness within the rejection block, the buy scenario targeting buy-side liquidity is reinforced;

- On the 1-hour time frame, the 1.1846$ level is a key short-term zone; price reaction around this area can determine the direction for the rest of the day;

- On the 15-minute time frame, the possibility of a limited pullback during the London session to complete liquidity objectives and then initiate a new bullish wave is is under consideration.

On February 18, 2026, the EURUSD pair, after an aggressive bearish move and sell-side liquidity sweep, reacts to the daily order block zone. Additionally, the overall market structure remains inclined toward the bullish scenario, although a limited short-term bearish correction is possible.

The $1.1846 level is identified as one of the key short-term zones, and price behavior around this range can determine the continuation path for the day.

Daily EURUSD Analysis on the 4-Hour Time Frame (H4)

On the 4-hour time frame, a short-term corrective scenario following the liquidity sweep is being considered. Under these conditions, price comes under selling pressure; simultaneously with the release of weaker-than-expected GDP data, the selling pressure intensifies.

However:

- The created drop is fully retraced;

- The bullish structure is reestablished;

- The Fair Value Gap zone is tested.

If selling pressure increases again, price may enter the rejection block range. Should a lower candle close occur within this area accompanied by weakening bearish momentum, it may be considered as a potential Buy entry opportunity.

EURUSD Analysis on the 1-Hour Time Frame (H1)

On the 1-hour time frame, contrary to the initial expectation of a rapid reaction to the order block, price first encounters stronger selling pressure and enters the Fair Value Gap (FVG).

Short-term scenario:

- Possibility of a limited bearish correction toward the 1-hour order block zone;

- Observation of a market character shift or break of structure.

EURUSD Analysis on the 15-Minute Time Frame (M15)

On the 15-minute time frame, using Kill Zones and examining price behavior across trading sessions:

- During the New York session, a bearish move forms with the nature of liquidity sweep and manipulation;

- The bullish move begins as a Distribution phase;

- During the Asia session, the market enters an Accumulation phase.

Additionally, during the London Session, price may initially move downward, enter the Fair Value Gap (FVG) zone, and then, with the formation of a Market Structure Shift on lower time frames and its confirmation on higher time frames, confirm the end of the bearish correction and the start of a new bullish wave.

It is also anticipated that price will return to the origin of its bullish move and, after completing the liquidity sweep process, continue the upward trend.

Conclusion

The EURUSD pair, after sweeping sell-side liquidity and reacting to the daily order block, has maintained its bullish structure. Furthermore, the absence of a close below the swing and the full retracement of the drop caused by GDP data indicate sustained bullish momentum.

In the short term, a limited correction is possible; however, unless the market structure experiences a decisive break, the primary focus remains on continuation toward buy-side liquidity and the BPR zone.