The Australian Securities and Exchange Commission is a top-tier financial regulatory entity that oversees Forex brokers in Australia.

Brokers regulated by this authority are reliable and offer up to 1:30 leverage, negative balance protection, up to $10,000 compensation for each client, and segregate client funds from operational funds.

| FP Markets | |||

| EightCap | |||

| Pepperstone | |||

| 4 |  | Vantage | ||

| 5 |  | easyMarkets | ||

| 6 |  | Exness | ||

| 7 |  | AvaTrade | ||

| 8 |  | XM Group |

Trustpilot Ratings of ASIC-Regulated Forex Brokers

The table below provides details of client reviews and rating of the best Forex brokers regulated by the Australian Securities and Exchange commission.

Broker | Trustpilot Rating | Number of Reviews |

FP Markets | 4.8/5 ⭐ | 9500+ |

Exness | 4.8/5 ⭐ | 27000+ |

AvaTrade | 4.8/5 ⭐ | 11500+ |

Vantage | 4.4/5 ⭐ | 11500+ |

4.2/5 ⭐ | 3000+ | |

easyMarkets | 4.1/5 ⭐ | 1500+ |

4.0/5 ⭐ | 3000+ | |

XM Group | 3500+ |

Minimum Spreads of Forex Brokers Licensed By ASIC

Traders who want to open an account with the top ASIC-regulated must consider the minimum spreads as it’s the most common trading cost in all account types.

Brokers | Minimum Spreads |

XM Group | 0.0 Pips |

CMC Markets | 0.0 Pips |

0.0 Pips | |

Pepperstone | 0.0 Pips |

IC Markets | 0.1 Pips |

Trade Nation | 0.6 Pips |

FXGlory | 0.7 pips |

easyMarkets | 0.7 pips |

Non-Trading Fees in Forex Brokers Regulated by ASIC

The table below allows you to see the non-trading fees (including deposit, withdrawal, and inactivity costs) in the best Forex brokers regulated by ASIC to have an estimation of your overall trading costs in this broker.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

$0 | $0 | $0 | |

$0 | $0 | $0 | |

OctaFX | $0 | $0 | $0 |

XM Group | $0 | $0 | $10 per month |

Plus500 | $0 | Varies | $10 |

IG Markets | Varies | Varies | $18 per month |

$0 | $0 | $50 | |

Admirals | $0 for most methods (0.9% for Skrill) | €10 (1 Free withdrawal per month) | €10 per month |

Number of Tradable Instruments in Forex Brokers Regulated by ASIC

The table below provides a comparison of the number of tradable instruments in the best brokers regulated by ASIC.

Broker | Number of Tradable Assets |

1400+ | |

Axi | 1000+ |

Pu Prime | 1000+ |

EightCap | 800+ |

OctaFX | 300+ |

275+ | |

Fusion Markets | 250+ |

NordFX | 100+ |

Top 8 Forex Brokers Regulated by ASIC

Traders residing in Australia and New Zealand can access a wide variety of CFD and Forex brokers allowing them to trade in over 8 different markets with leverage of up to1:30 under supervision of ASIC.

The following paragraphs offers a brief summary of the best available ASIC brokers that traders can choose from.

EightCap

Eightcap is a CFD and Forex broker established in 2009 in Melbourne, Australia, offering leveraged trading across six asset classes: Forex, commodities, metals, indices, shares, and cryptocurrencies.

The broker provides three main live account types: Standard, Raw, and TradingView, alongside a Demo account.

Spreads on Standard and TradingView accounts generally start from 1.0 pip, while the Raw account features spreads from 0 pip with a commission per traded lot. To reduce trading costs, use Eightcap rebate program from TradingFinder.

Regulatory oversight is a central aspect of Eightcap’s structure. The broker operates through multiple entities regulated by ASIC in Australia, the FCA in the United Kingdom, CySEC in Cyprus, and the SCB in The Bahamas.

Client protections vary by jurisdiction and may include segregated funds, negative balance protection, and investor compensation schemes such as FSCS or ICF, depending on the entity and client location.

Eightcap supports MetaTrader 4, MetaTrader 5, and TradingView, covering desktop, web, and mobile access.

Trading is executed via market execution, with margin call and stop out levels set at 80% and 50%. The broker offers additional tools such as Capitalise.ai, FlashTrader, and an AI powered economic calendar.

Funding options include bank transfers, cards, e wallets, and cryptocurrencies after completing the Eightcap registration. All instruments are offered as CFDs, and crypto CFD access is restricted in certain regions.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Bank Transfer, Credit/Debit Cards (Visa, Mastercard), PayPal, Skrill, Neteller, Cryptocurrencies (BTC, ETH, USDT), Online Payment Systems |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, PayPal, Skrill, Neteller, Cryptocurrencies |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView |

Eightcap Pros and Cons

Here are the pros and cons you must consider before opening an account with this ASIC-regulated broker.

Pros | Cons |

Regulation by multiple authorities including ASIC, FCA, CySEC, and SCB | Crypto CFDs are not accessible to UK retail traders due to regulatory restrictions |

Support for MetaTrader 4, MetaTrader 5, and TradingView platforms | No passive investment options such as copy trading or PAMM accounts |

Competitive spreads on Raw account with market execution | Educational resources lack advanced structuring such as level-based learning paths |

Access to trading tools like Capitalise.ai and FlashTrader | - |

Exness

Exness is a global Forex and CFD broker launched in 2008 by Petr Valov and Igor Lychagov, operating under the EXNESS Group led by CEO Petr Valov.

The firm reports monthly trading volumes above $4 trillion and employs more than 2,100 staff across nearly 100 countries.

Exness runs multiple regulated entities, including oversight from FCA, CySEC, FSCA, CMA, FSC, FSA, ASIC, and CBCS, with client protections such as segregated funds and negative balance protection across listed entities.

Investor compensation can vary by jurisdiction, including FSCS coverage in the UK and ICF in Cyprus.

Trading access is built around Exness Trade (mobile), Exness Terminal (web), and MetaTrader 4 and MetaTrader 5, with both market execution and instant execution depending on instrument and account setup.

Enxess registration provides access to various account choices including Standard, Standard Cent, Pro, Raw Spread, and Zero, with minimum deposits starting from $10, while some professional style accounts commonly start from $200.

Spreads are stated from 0.0 to 0.8 pips, and commissions range from $0.2 to $3.5, with account specific models. Traders can earn cashback up to $112.5 via the Exness rebate program.

Exness dashboard offers copy trading via Social Trading and provides tools such as Exness VPS, economic calendar, and slippage rules.

Account Types | Standard, Standard Cent, Pro, Raw Spread, Zero, Demo |

Regulating Authorities | FCA, CySEC, FSCA, CMA, FSC, FSA, CBCS, ASIC |

Minimum Deposit | $10 |

Deposit Methods | Bank Cards, Skrill, Neteller, Perfect Money, SticPay |

Withdrawal Methods | Bank Cards, Skrill, Neteller, Perfect Money, SticPay |

Maximum Leverage | Unlimited (Subject to account conditions) |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Pros and Cons of Exness

The table below contains the advantages and disadvantages of trading with the Exness broker.

Pros | Cons |

Regulation by multiple authorities including FCA, CySEC, FSCA, CMA, FSC, FSA, and CBCS | Exness services are restricted in several jurisdictions such as Iran, Canada, Australia, France, and New Zealand |

Low minimum deposit starting from $10 on Standard and Standard Cent accounts | - |

Wide range of account models including Standard, Standard Cent, Pro, Raw Spread, and Zero | - |

Support for Exness Trade, Exness Terminal, MetaTrader 4, and MetaTrader 5 | - |

Pepperstone

Pepperstone is a multi-asset Forex and CFD broker founded in Melbourne in 2010. The company reports average daily trading volumes around $9.2B and a client base exceeding 400,000.

Account setup supports 10 base currencies including AUD, USD, GBP, JPY, EUR, CAD, CHF, NZD, SGD, and HKD, with order sizes typically ranging from 0.01 to 100 lots.

Leverage can reach 1:500 under eligible entities, while EU and UK frameworks apply lower caps.

Its regulatory footprint spans several jurisdictions through different subsidiaries, including ASIC in Australia, FCA in the United Kingdom, CySEC in Cyprus, BaFin in Germany, DFSA in Dubai, CMA in Kenya, and SCB in The Bahamas.

Client protection features referenced across entities include segregated bank accounts and negative balance protection, alongside regional compensation schemes such as FSCS in the UK and ICF in the EU.

Trading access is built around MetaTrader 4, MetaTrader 5, cTrader, TradingView, and Pepperstone proprietary web and mobile platforms. All platforms are accessible after finalizing the Pepperstone registration.

Pricing is split between Standard and Razor accounts, with spreads starting from 0.0 pips on Razor and commission-based costs on some products. Traders can benefit from up to 12.857% commission reduction by joining the Pepperstone rebate program.

Pepperstone lists copy trading availability and provides 24/7 support via live chat, email, and phone, while availability and leverage settings can differ by country and entity.

Account Types | ASIC, FCA, CySEC, BaFin, DFSA, CMA, SCB |

Regulating Authorities | $1 |

Minimum Deposit | Apple Pay, Google Pay, Visa, Mastercard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Deposit Methods | Apple Pay, Google Pay, Visa, mastercard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Up to 1:500 (entity dependent) |

Maximum Leverage | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Pepperstone proprietary platform |

Trading Platforms & Apps | ASIC, FCA, CySEC, BaFin, DFSA, CMA, SCB |

Pepperstone Pros and Cons

The following table contains the advantages and disadvantages of trading with Pepperstone.

Pros | Cons |

Broad regulation coverage across ASIC, FCA, CySEC, BaFin, DFSA, CMA, and SCB | Leverage is materially restricted under FCA, CySEC, and BaFin entities, commonly capped at 1:30 for retail clients |

Platform choice includes MT4, MT5, cTrader, TradingView, and a proprietary platform | No PAMM account offering for managed allocation style investing |

Wide market coverage across Forex, indices, commodities, shares, crypto CFDs, and ETFs | Service availability is country dependent, with restrictions reported for regions such as the United States, Canada, Iran, and Japan |

Copy trading access via services like Signal Start, DupliTrade, and MetaTrader Signals | - |

AvaTrade Broker

AvaTrade is a multi-asset Forex and CFD broker that operates through a network of regulated entities across several regions.

The brand holds licenses linked to CBI in Ireland, CySEC in Cyprus, ASIC in Australia, FSCA in South Africa, JFSA in Japan, ADGM in Abu Dhabi, ISA in Israel, and BVI FSC, while also aligning with MiFID II requirements in Europe.

Traders must complete the AvaTrade verification process to comply with AML and KYC laws.

Client safeguards referenced in its framework include segregated accounts and negative balance protection, with compensation coverage available in specific jurisdictions, such as ICF up to €20,000 under EU aligned entities.

Trading access is delivered via MetaTrader 4, MetaTrader 5, AvaTrade WebTrader, a mobile app, and AvaOptions for options style strategies all available for download in the AvaTrade dashboard. AvaTrade supports markets including Forex, metals, commodities, indices, stocks, ETFs, and crypto CFDs, with execution described as instant.

Risk parameters in the provided data include a margin call level of 25% and a stop out level of 10%.

The minimum deposit is$100, and AvaTrade deposit and withdrawal methods include credit and debit cards, bank wire transfer, Skrill, Neteller, WebMoney, and PayPal, though method availability can vary by country.

AvaTrade also offers copy trading through DupliTrade and AvaSocial, plus an affiliate and referral program.

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | CBI, CySEC, ASIC, FSCA, JFSA, ADGM, ISA, BVI FSC, MiFID |

Minimum Deposit | $100 |

Deposit Methods | Credit or Debit Cards, Bank Wire Transfer, Skrill, Neteller, WebMoney, PayPal |

Withdrawal Methods | Credit or Debit Cards, Bank Wire Transfer, Skrill, Neteller, WebMoney, PayPal |

Maximum Leverage | Up to 1:400 (entity dependent) |

Trading Platforms & Apps | MeTaTrader 4, MetaTrader 5, WebTrader, Mobile App, AvaOptions |

AvaTrade Pros and Cons

Traders must know the following benefits and limitations of AvaTrade before opening an account with this broker.

Pros | Cons |

Broad regulatory coverage across CBI, CySEC, ASIC, FSCA, JFSA, ADGM, ISA, and BVI FSC | Inactivity fees may apply after 2 months with balance below $2,000, plus an annual administration fee after 12 months of inactivity |

Platform variety includes MT4, MT5, WebTrader, Mobile App, and AvaOptions | Customer support is listed as 24/5 rather than 24/7, which can matter during weekend market events in crypto CFDs |

Copy trading access via DupliTrade and AvaSocial | - |

Clear risk thresholds shown as 25% margin call and 10% stop out | - |

XM Group

XM Group is a multi-jurisdiction Forex and CFD broker founded in 2009, reporting more than 15 million clients and roughly 14 million trades per day.

The brand operates via several entities and offices, with a footprint that includes Cyprus, South Africa, Dubai, and Belize. Market access is delivered mainly through MetaTrader 4, MetaTrader 5, and the XM mobile app, positioning XM as a MetaTrader focused broker.

The product mix includes 55 plus currency pairs, commodities, indices, precious metals, shares, and cryptocurrencies, with an overall catalogue described as 1,400 plus CFDs and more than 1,200 stock CFDs.

Regulation is spread across multiple frameworks, including CySEC in Cyprus, FSCA in South Africa, DFSA in Dubai, FSC in Belize and Mauritius, ASIC in Australia and FSA in Seychelles.

These regulators require traders to complete the XM Group verification to comply with international laws.

In the Middle East, XM Financial Products Promotion L.L.C. is linked to SCA licensing for promotion activities, while Trading Point MENA Limited operates under DFSA license F003484 in Dubai.

Core trading conditions after completing the XM Group registration include a $5 minimum deposit for Standard and Ultra Low accounts, leverage up to 1:1000 under eligible entities, and minimum order sizes from 0.01 lot.

XM lists negative balance protection, hedging support, and MQL5 signal functionality, while investment style products such as PAMM are not offered in the XM Group dashboard.

Account Types | Standard, Ultra Low, Shares, Demo |

Regulating Authorities | CySEC, FSCA, DFSA, FSC (Belize), FSC (Mauritius), FSA (Seychelles), SCA (UAE promotion) |

Minimum Deposit | $5 |

Deposit Methods | Credit or Debit Cards, Bank Transfers, E wallet payments |

Withdrawal Methods | Credit or Debit Cards, Bank Transfers, E wallet payments |

Maximum Leverage | Up to 1:1000 (entity dependent) |

Trading Platforms & Apps | MT4, MT5, XM Mobile App |

Pros and Cons of XM Group

Traders must know the benefits and drawbacks of trading with the XM Group broker by checking the table below.

Pros | Cons |

Large CFD coverage including 55 plus FX pairs and 1,200 plus stock CFDs | Inactivity fees are referenced for dormant accounts, including a monthly $10 charge after a defined inactivity period |

Multiple regulatory entities across CySEC, FSCA, DFSA, FSC, and FSA | No investment account structures such as PAMM, and the Shares account has a notably higher minimum deposit of $10,000 |

Low entry threshold with $5 minimum deposit on key retail accounts | - |

MetaTrader ecosystem with MT4, MT5, and MQL5 signals | - |

easyMarkets

easyMarkets is a multi-asset Forex and CFD broker headquartered in Cyprus and led by CEO Nikos Antoniades.

The brand highlights industry recognition such as “Best Forex/CFD Broker” at the TradingView Awards 2023 and “Leading Broker of the Year” at Forex Expo Dubai 2024.

Trading is presented as commission free with a minimum deposit of $25, while leverage can reach 1:2000 under eligible international entities and is restricted to 1:30 for EU and Australian retail clients.

Regulatory coverage is split across several subsidiaries, including Easy Forex Trading Ltd under CySEC in Cyprus, easyMarkets Pty Ltd under ASIC in Australia, EF Worldwide Ltd under FSA Seychelles and FSC BVI, and EF Worldwide (PTY) Ltd under FSCA in South Africa.

Across these entities, the broker lists segregated funds and negative balance protection, with ICF coverage up to €20,000 under the CySEC entity.

Platform access spans the proprietary easyMarkets Web and App, MetaTrader 4, MetaTrader 5, and TradingView, covering markets such as Forex, indices, metals, commodities, crypto, and stocks after completing easyMarkets registration.

Proprietary tools include dealCancellation, Freeze Rate, and guaranteed stop loss features, which are not uniformly available on MetaTrader 4 and MetaTrader 5.

Funding rails include cards, bank wire, Skrill, Neteller, and fast bank transfers, while availability, leverage, and product access can differ by jurisdiction and geo restrictions.

Account Types | easyMarkets Web/App and TradingView, MT4, MT5 |

Regulating Authorities | CySEC, ASIC, FSCA, FSA (Seychelles), FSC (BVI) |

Minimum Deposit | $25 |

Deposit Methods | Visa, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Withdrawal Methods | Visa, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Maximum Leverage | Up to 1:2000 (entity dependent) |

Trading Platforms & Apps | Proprietary platform, MT4, MT5, TradingView |

easyMarkets Pros and Cons

The following table contains the main benefits and limitations of trading with the easyMarkets.

Pros | Cons |

Multiple regulatory entities across CySEC, ASIC, FSCA, FSA Seychelles, and FSC BVI | Support hours are listed as 24/5 rather than 24/7 |

Proprietary risk tools such as dealCancellation, Freeze Rate, and free guaranteed stop loss | Geo restrictions apply, with limitations stated for regions such as the United States, parts of Canada, Israel, and multiple sanctioned jurisdictions |

Commission free pricing model with fixed and variable spread options | - |

Multi-platform access via proprietary apps, MT4, MT5, and TradingView | - |

How TradingFinder Chose the Best ASIC-Regulated Brokers?

The TradingFinder experts have evaluated over 200 Forex brokers and provided you with a list of the best options based on various factors.

Our team checked multiple principals alongside having ASIC regulation to ensure it provides you with trustworthy and reliable Forex brokerages.

Here is list of aspects that we’ve considered:

- Spreads

- Commission

- Customer support quality

- Range of assets

- Maximum leverage

- Variety of funding and withdrawal methods

- Passive income options

We have also considered our list of the best Forex brokers in Australia to create the current article.

What is ASIC?

The Australian Securities and Investments Commission (ASIC) is the primary regulator of Australia’s financial markets and financial services sector.

Established under the Australian Securities and Investments Commission Act 2001, ASIC operates as an independent Commonwealth authority with a mandate to support fair, orderly, and transparent markets.

Its regulatory scope covers companies, financial markets, and financial service providers involved in activities such as investing, superannuation, insurance, credit, and deposit taking.

ASIC is governed by a Commission made up of a Chair-person and appointed members who determine strategic priorities and oversee regulatory direction.

This regulatory authority also functions as the consumer credit regulator under the National Consumer Credit Protection Act 2009, licensing and monitoring banks, lenders, mortgage brokers, and other credit providers.

A core element of ASIC’s role is maintaining investor and consumer confidence. This is achieved through public education, transparency initiatives, and enforcement actions aimed at market participants and professional gatekeepers.

ASIC holds extensive statutory powers, including licensing financial service providers, maintaining public registers, setting regulatory rules, investigating misconduct, issuing infringement notices, and pursuing civil or criminal penalties where required.

Collectively, these responsibilities position ASIC as a central authority in safeguarding market integrity and financial stability in Australia.

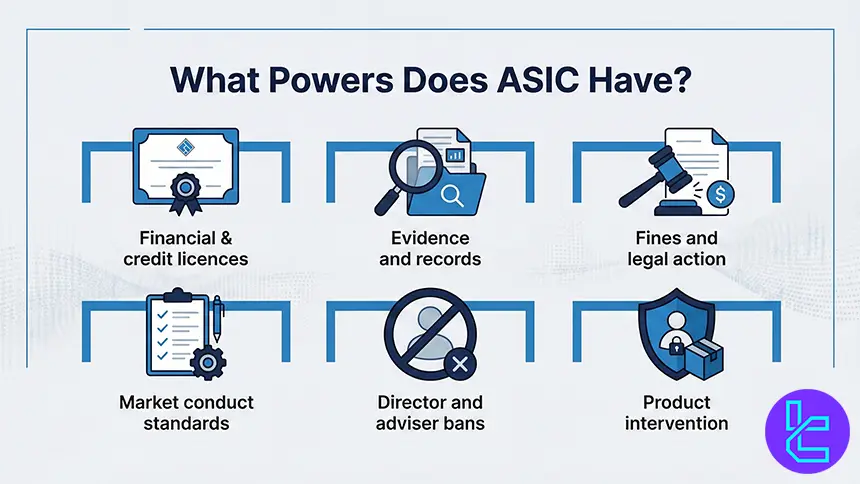

What Powers Does ASIC Have?

ASIC applies a structured enforcement framework to supervise financial markets, ensure compliance, and protect investors and consumers across Australia.

- Licensing Authority: ASIC grants and oversees Australian Financial Services Licences and credit licences to ensure only compliant firms operate;

- Investigative Authority: ASIC can investigate suspected misconduct by collecting evidence, requesting records, and examining individuals or entities;

- Enforcement Authority: The regulator may impose fines, suspend or cancel licences, and pursue civil or criminal proceedings when breaches are identified;

- Regulatory Rulemaking: ASIC sets and enforces standards for corporate governance, financial reporting, disclosure, and market conduct;

- Banning and Disqualification: ASIC can prohibit individuals from managing companies or providing financial services following serious misconduct;

- Consumer Protection Measures: The authority intervenes to curb misleading products, improve disclosure practices, and strengthen consumer safeguards.

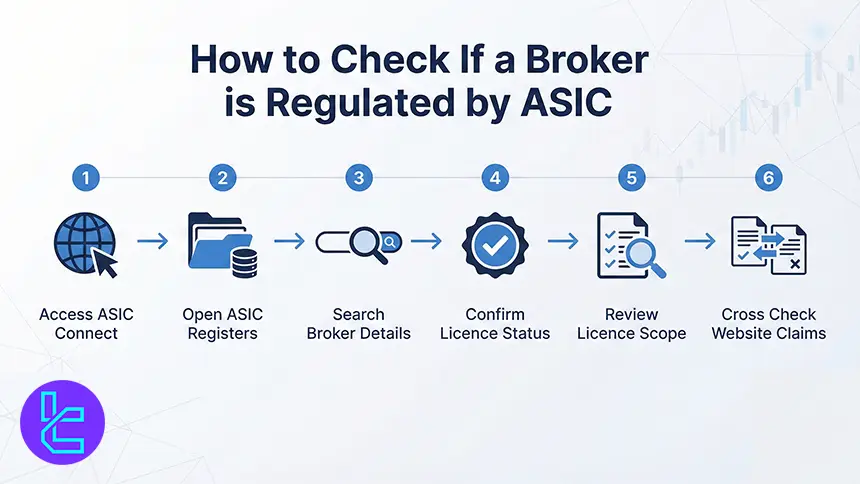

How can I Check If a Broker is Regulated by ASIC?

To verify whether a broker is regulated by ASIC, traders can rely on a clear and publicly accessible verification process provided by the Australian regulator.

- Access ASIC Connect: Visit the official ASIC Connect platform, which hosts all public regulatory registers;

- Open ASIC Registers: Select the option to search ASIC’s financial services registers to view authorised entities;

- Search Broker Details: Enter the broker’s legal name, trading name, or Australian Financial Services (AFS) licence number;

- Confirm Licence Status: Check that the record shows a status such as “Active” or “Registered,” indicating current ASIC authorization;

- Review Licence Scope: Examine permitted activities, conditions, and any disclosed enforcement or disciplinary actions;

- Cross Check Website Claims: Compare the licence number displayed on the broker’s official website with ASIC’s register to confirm consistency.

Rules Set by ASIC for Forex Brokers

ASIC-regulated brokers operate under a clearly defined compliance framework designed to protect investors and preserve market integrity.

- AFS Licensing Requirement: Brokers must hold a valid Australian Financial Services licence and continuously meet ASIC’s financial, operational, and competency standards;

- Segregation of Client Funds: Client money must be held in segregated trust accounts, fully separated from the broker’s operational capital;

- Mandatory Disclosure Rules: Brokers are required to provide transparent documentation, including a Product Disclosure Statement (PDS), outlining costs, features, and risks;

- Market Conduct Standards: Trading activities must comply with fair market practices, prohibiting manipulation, misleading promotions, and insider misconduct;

- Risk Disclosure for CFDs: Clear and prominent risk warnings must be issued, particularly for leveraged products such as CFDs;

- Financial Reporting and Audits: Regular financial statements and compliance reports must be submitted, with ASIC retaining audit authority;

- Dispute Resolution via AFCA: Brokers must be members of the Australian Financial Complaints Authority (AFCA) to handle client disputes externally;

- Ongoing Staff Competency: Representatives must receive continuous training to ensure advice and services remain accurate and compliant.

Tradable Instruments in the ASIC Regulated Brokers

ASIC-regulated brokers in Australia typically provide access to a broad, multi-asset trading environment built around leveraged and exchange-based instruments.

- Forex: Trading is available across major, minor, and exotic currency pairs such as EUR/USD, GBP/USD, and AUD/USD;

- CFD Instruments: Brokers commonly offer CFDs on shares, global indices like the S&P 500 and FTSE, commodities, and cryptocurrencies;

- Equities and Shares: Access may include direct share dealing or share CFDs covering domestic and international companies;

- Commodities: Precious metals such as gold and silver, alongside energy products like crude oil, are widely supported;

- Stock Indices: Traders can speculate on major global indices representing key equity markets;

- Cryptocurrencies: Popular digital assets are often available through CFD structures rather than direct ownership;

- Additional Products: Some brokers extend offerings to ETFs, ETNs, bonds, and government treasury instruments.

ASIC Regulated vs Unregulated Forex Brokers

The table below allows you to see what are the benefits of choosing an ASIC regulated broker instead of an unregulated broker.

Parameters | ASIC Regulated | Unregulated |

Application Fees | For corporate entities, the fee ranges from AU$3,721 to AU$5,025 when submitted online, and from AU$5,582 to AU$7,537 when lodged in paper form. | No fees |

Capital Requirement | Between AU$500,000 and AU$1,000,000 | No Requirements |

Application assessment timeframe | 6 Months or more | 0 days |

Physical presence required | Required | Not Required |

Corporate tax rates | 30% | Set by the Brokers region of stablishment |

Client funds segregation | Mandatory | Not Mandatory |

Investor protection scheme | For retail operations, the annual cost is AU$10,000 per company. | No schemes |

Leverage limit | Up to 1:30 | No limits |

ASIC vs Other Top-tier Regulatory Entities

Traders can check the table below to understand the differences between ASIC protection schemes, oversight, responsibilities, and capital requirements in comparison to those of other well-known regulatory bodies.

Parameter | ASIC (Australia) | CySEC (Cyprus) | FCA (UK) | MAS (Singapore) |

Minimum Capital Requirement | Between AU$500,000 and AU$1,000,000 | €750,000+ depending on firm type | £125,000–£730,000+ depending on model | $1 million SGD |

Client Fund Segregation | Required | Required | Required | Required |

Compensation Scheme | Investor Compensation Fund (AU$10,000) | Investor Compensation Fund (~€20,000) | FSCS (~£85,000) | No |

Leverage Limits | 1:30 | Set under MiFID (often 1:30 for retail in EU) | Retail max ~1:30 on majors | 1:30 |

Negative Balance Protection | Required | Often required | Required | Required |

Reporting & Audits | Ongoing financial reporting | Ongoing financial reporting | Ongoing reporting standard | Ongoing reporting standard |

Conclusion

Our review of the best Forex brokers regulated by ASIC showed us that Eightcap, Exness, Pepperstone, AvaTrade, XM Group, and easyMarkets are the best available options.

Having access to 1:30 leverage, various instruments in 5 markets, negative balance protection, reliable customer support, and low spreads are the main features of the brokers under oversight of ASIC.

All brokers have been evaluated based on the TradingFinder’s Forex methodology by considering various factors, including spreads, commissions, tradable instruments, leverage, customer support, etc.