The British Virgin Islands Financial Services Commission (BVI FSC) is an offshore financial authority with almost the same level of scrutiny as in other offshore regulators, such as the Seychelles FSA and the Mauritius FSC.

The list below includes some of the top choices for those targeting BVI FSC-regulated brokerages.

| IFC MARKETS | |||

| instaforex | |||

| markets4you | |||

| 4 |  | Exness | ||

| 5 |  | easyMarkets | ||

| 6 |  | MultiBank | ||

| 7 |  | AVATRADE |

Trustpilot Ratings for BVI FSC Brokers

Trustpilot examines the user reviews and ratings, then approves them for brands. The ranking below is based on the scores submitted for brokers.

Broker Name | Trustpilot Rating | Number of Reviews |

27,305 | ||

AvaTrade | 11,821 | |

MultiBank | 1,662 | |

1,765 | ||

Markets4you | 111 | |

IFC Markets | 556 | |

InstaForex | 464 |

Spreads in Select Forex Brokers

Typically, top high-reputation brokers offer an option to trade with zero spreads. Here’s a list of minimum spreads in recommended options.

Broker Name | Min. Spread |

Exness | 0 Pips |

AvaTrade | 0 Pips |

0 Pips | |

Markets4you | 0.1 Pip |

JustMarkets | 0.1 Pip |

0.4 Pips | |

easyMarkets | 0.7 Pips |

Comparison of Non-Trading Fees and Costs in Brokers

The table in this section ranks the introduced brands based on the deposit, withdrawal, and inactivity costs charged by the brokers.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Exness | $0 | $0 | $0 |

JustMarkets | $0 | $0 | $5 Monthly |

Markets4you | $0 | $0 | $10 Monthly |

easyMarkets | $0 | $0 | 10% for a withdrawal ≥ USD 500 |

MultiBank | $0 | $0 | $60 Monthly |

InstaForex | $0 | $0 for USDT | €5 Monthly |

$0 on Credit/Debit Cards and Wire Transfers | $0 | $10 Monthly |

Tradable Instruments in DFSA Brokers

This section of the article is dedicated to the tradable assets’ variety in select DFSA-regulated brokers.

Broker Name | Number of Instruments |

MultiBank | 20,000+ |

AvaTrade | 1,250+ |

IFC Markets | 650+ |

340+ | |

Exness | 200+ |

150+ | |

JustMarkets | 90+ |

6 Top Brokers Regulated by BVI FSC

The following sections of this article review the six best options from the curated list for average traders. It examines account types, trading platforms, commissions, and other details.

Exness

Founded in 2008 by Petr Valov and Igor Lychagov, Exness has grown into a high-volume global broker, employing 2,100+ professionals across nearly 100 countries and processing over $4 trillion in monthly trading volume.

Operating through multiple regulated entities, Exness maintains oversight from authorities such as the Financial Services Commission (BVI), FCA, CySEC, FSCA, and others. Client funds are segregated, negative balance protection is enforced, and investor compensation varies by jurisdiction.

Exness offers five main account types, including Standard, Standard Cent, Pro, Raw Spread, and Zero, with minimum deposits starting from $10.

Trading costs are competitive, featuring spreads from 0.0 to 0.8 pips and commissions ranging between $0.2 and $3.5 per lot, depending on account structure. Furthermore, there is a Exness rebate program available for reduced costs.

The broker supports MT4, MT5, Exness Trade (mobile), and Exness Terminal (web), enabling access to Forex, indices, commodities, crypto CFDs, and stocks. Additional tools include copy trading, algorithmic strategies, VPS hosting, and 24/7 multilingual customer support.

Table of Specifics

Account Types | Standard, Standard Cent, pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Deposit | $10 |

Deposit Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Withdrawal Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Maximum Leverage | Unlimited (Subject to account) |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Exness Pros & Cons

Below is a concise overview of the broker’s key advantages and limitations to help assess its suitability. Consider these before going through with Exness registration.

Pros | Cons |

Very low minimum deposit starting from $10 | Services restricted in several countries |

Tight spreads with multiple zero-spread accounts | No traditional bonuses or promotions |

Multi-regulated global structure including FSC BVI | Educational content less extensive than top peers |

Wide platform support (MT4, MT5, web & mobile) | Not all instruments available on every account type |

AvaTrade

AvaTrade is a globally established Forex and CFD broker operating since 2006, holding 9 regulatory licenses across major jurisdictions. Its regulatory coverage includes the BVI FSC, CySEC, ASIC, FSCA, ADGM, and the Central Bank of Ireland, reinforcing its international compliance framework.

Under the BVI FSC entity, AvaTrade offers flexible trading conditions for global clients, including leverage of up to 1:400, mandatory segregation of client funds, and negative balance protection. The broker applies clearly defined risk controls with a 25% margin call and 10% stop-out level.

AvaTrade supports a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, WebTrader, a proprietary mobile app, and AvaOptions for options trading. Clients can access over 1,250 instruments across Forex, stocks, indices, commodities, metals, and crypto CFDs.

With a $100 minimum deposit, AvaTrade supports multiple funding methods such as bank wire, credit/debit cards, Skrill, Neteller, WebMoney, and PayPal (region-dependent).

For a complete review on AvaTrade deposit/withdrawal methods, check out our article.

The broker operates a spread-based pricing model with no deposit or withdrawal commissions and provides 24/5 multilingual customer support. Here’a summary of the broker’s features.

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros & Cons

The following table summarizes AvaTrade’s key strengths and limitations to help traders assess its suitability among BVI FSC-regulated Forex brokers.

Pros | Cons |

Multi-jurisdiction regulation including BVI FSC | Inactivity fees after prolonged non-use |

Broad platform support (MT4, MT5, WebTrader, AvaOptions) | No PAMM or MAM account structure |

Clear risk controls with defined margin rules | 24/5 support instead of 24/7 |

Copy trading via AvaSocial & DupliTrade | Bonus availability depends on region |

MultiBank

MultiBank Group is a global Forex and CFD brokerage founded in 2005, with its headquarters positioned in Dubai and operational reach across regions such as Australia, Germany, Cyprus, and the UAE.

The brand combines institutional-style infrastructure with retail access, offering trading in Forex, metals, indices, shares, commodities, and crypto CFDs.

For international clients, the broker’s BVI FSC structure is part of a broader multi-jurisdiction framework that also includes regulators such as ASIC (416279), CySEC (430/23), SCA (UAE), and MAS (CMS101174).

MultiBank highlights client safeguards like segregated accounts, negative balance protection (entity-based), and $1,000,000 excess loss insurance per account.

MultiBank’s trading environment centers on MetaTrader 4, MetaTrader 5, and its proprietary MultiBank-Plus platform, with leverage reaching up to 1:500 under eligible entities. Pricing is promoted as commission-free, with spreads that can start from 0.0 pips on ECN-style conditions, depending on account type and instrument.

Account access can start with deposits as low as $50 in some setups, while the broker’s core account lineup (Standard/Pro/ECN) commonly begins from $200 for Standard and scales higher for Pro and ECN tiers.

MultiBank also lists 24/7 support, offers PAMM/MAM and social trading features, and restricts service in several jurisdictions (including the USA, UK, Iran, Russia, and North Korea). Look at the table below for specifics.

Account Types | Standard, Pro, ECN |

Regulating Authorities | FSAS, FSCM, VFS, TFG, MAS, FMA, FSC, CySEC, ESCA, CIMA, BAFIN, AUSTRAC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | credit or debit card, Bank Transfer, Crypto, SEPA |

Withdrawal Methods | Bank Wire, Credit Cards, Neteller |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MultiBank-Plus, MT4 Platform, MT5 Platform, Web Trader MT4 |

MultiBank Pros and Cons

The pros and cons below summarize MultiBank’s positioning in the Best BVI FSC Forex Brokers category, focusing on platform depth, regulatory footprint, and practical trading costs that matter when comparing global brokers. Learn about these before MultiBank registration.

Pros | Cons |

Multi-jurisdiction oversight including BVI FSC, plus ASIC/CySEC/SCA/MAS entities | Restricted countries include the USA, UK, Iran, Russia, and others |

Platform choice: MT4, MT5, MultiBank-Plus | Educational and research content is limited vs. top research-led brokers |

Client protection features incl. segregated funds and up to $1M excess loss insurance | Inactivity fee reported (e.g., $60/month after a defined dormant period) |

High market depth with 20,000+ instruments (including large share-CFD catalog) | Higher entry thresholds on advanced tiers (e.g., Pro/ECN minimum deposits) |

easyMarkets

easyMarkets is a multi-asset Forex and CFD broker known for combining low entry requirements with advanced risk-management tools. With a minimum deposit of just $25 and commission-free pricing, the broker targets both new and experienced traders seeking cost-efficient market access.

Founded in 2001 and led by CEO Nikos Antoniades, easyMarkets operates through several regulated entities, including oversight from FSC BVI, CySEC, ASIC, FSCA, and FSA Seychelles.

This multi-jurisdiction structure allows flexible trading conditions while maintaining core compliance standards such as segregated funds and negative balance protection.

Under its FSC BVI entity, easyMarkets offers leverage of up to 1:2000, appealing to traders who require higher exposure than what EU-restricted environments allow. The broker supports Forex, indices, metals, commodities, cryptocurrencies, stocks, and options, covering more than 200 tradable instruments.

easyMarkets has also gained strong industry recognition, winning the “Best Forex/CFD Broker” award at the TradingView Broker Awards and the “Leading Broker of the Year” title at Forex Expo Dubai. Platform access includes MT4, MT5, TradingView, and a proprietary web and mobile platform featuring exclusive tools like dealCancellation and Freeze Rate.

If you are interested in making an investment, you may find our easyMarkets registration guide useful. The table below summarizes the broker’s details.

Account Types | easyMarkets Web/App and TradingView, MT4, MT5 |

Regulating Authorities | CySEC, ASIC, FSA, FSC, FSCA |

Minimum Deposit | $25 |

Deposit Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Withdrawal Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, TradingView, Proprietary platform |

easyMarkets Pros & Cons

Below is a concise overview of its main advantages and limitations to help traders assess its suitability.

Pros | Cons |

Regulated by multiple authorities including FSC BVI | Limited number of instruments versus some multi-asset brokers |

Commission-free trading with $25 minimum deposit | No copy trading or investment plans |

Unique risk tools (Guaranteed Stop Loss, dealCancellation) | Customer support limited to 24/5 |

Supports MT4, MT5, TradingView, and proprietary platform | Geo-restrictions in several regions |

Markets4you

Markets4you (formerly Forex4you) is a global online broker serving over 3 million trading accounts, supported by a team of 200+ professionals. The broker provides five live account types and a demo option, with entry-level access starting from just $1, positioning it as a low-barrier choice for retail traders.

Operated by E-Global Trade & Finance Group, Inc., Markets4you is regulated by the British Virgin Islands Financial Services Commission (BVI FSC). This Tier-3 regulatory framework allows flexible trading conditions, including leverage up to 1:4000, while catering to a global client base outside restricted jurisdictions.

A key feature is Share4you, Markets4you’s proprietary copy trading ecosystem, hosting 1,000+ strategy providers.

Traders can automatically replicate positions or manually follow selected leaders across Forex, indices, commodities, stocks, and crypto CFDs using MT4, MT5, or the broker’s proprietary platform.

The brand has earned 35+ international awards, including “Best Mobile Trading App Global” and “Best Forex Broker Southeast Asia”. Under the leadership of Marina Strausa, the company has strengthened its global profile through innovation and high-visibility partnerships, including collaboration with AB de Villiers.

Table of Specifics

Account Types | Classic Standard, Classic Fixed, Classic Pro, Cent Fixed, Cent Pro, Demo |

Regulating Authorities | BVI FSC |

Minimum Deposit | $1 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Transfer |

Maximum Leverage | 1:4000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Proprietary Platform |

Markets4you Pros & Cons

Below is a balanced overview of its main strengths and limitations to help traders assess whether its risk–reward profile aligns with their trading objectives.

Pros | Cons |

Extremely low minimum deposit ($1) | Regulated by a low-tier authority (BVI FSC) |

Very high leverage up to 1:4000 | No investor compensation scheme |

Copy trading via Share4you (1,000+ traders) | No negative balance protection |

Multiple platforms (MT4, MT5, proprietary) | Not available in several major regions |

IFC Markets

Founded in 2006, IFC Markets is a multi-asset Forex and CFD broker serving over 210,000 clients worldwide. The broker provides access to 650+ instruments across 9 markets, including Forex, indices, stocks, commodities, and crypto CFDs, with trading conditions designed for both retail and active traders.

From a regulatory standpoint, IFC Markets operates through multiple entities supervised by the BVI Financial Services Commission (BVI FSC) and the Labuan Financial Services Authority (Labuan FSA).

This structure allows global client access while enforcing safeguards such as segregated funds, negative balance protection, and professional indemnity insurance via Lloyd’s of London.

On the technology side, IFC Markets supports MetaTrader 4, MetaTrader 5, and its proprietary NetTradeX platform. The broker is particularly known for innovative tools like Synthetic Instruments, the Portfolio Quoting Method, and the U.S.-patented GeWorko Method, which enable advanced cross-asset trading strategies.

For a review of the broker’s user interface and software features, read our IFC Markets dashboard review.

Pricing is flexible across account types, with spreads from 0.0 pips on ECN accounts and a 0.005% commission on transaction volume. With a minimum deposit starting from just $1, leverage up to 1:2000 (entity-dependent), and PAMM-based investment options, IFC Markets caters to a wide spectrum of trading styles and capital levels.

Specifics and Parameters

Account Types | Standard, Micro, ECN |

Regulating Authorities | Labuan FSA, BVI FSC |

Minimum Deposit | $1 |

Deposit Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Local Transfer, Crypto, etc. |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Local Transfer, Crypto, etc. |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MT4, MT5, NetTradeX |

IFC Markets Pros & Cons

Overall, IFC Markets combines long-standing market presence, flexible entry requirements, and proprietary trading innovations. Before IFC Markets registration, take a look at this snapshot of the broker’s main strengths and limitations.

Pros | Cons |

Very low minimum deposit (from $1) | No top-tier Tier-1 regulation |

Wide range of platforms incl. MT4, MT5, NetTradeX | Spreads on some major pairs above industry leaders |

Innovative synthetic & portfolio-based instruments | Crypto offering smaller than some competitors |

ECN account with raw spreads from 0.0 pips | Service not available in certain regions (geo-restrictions) |

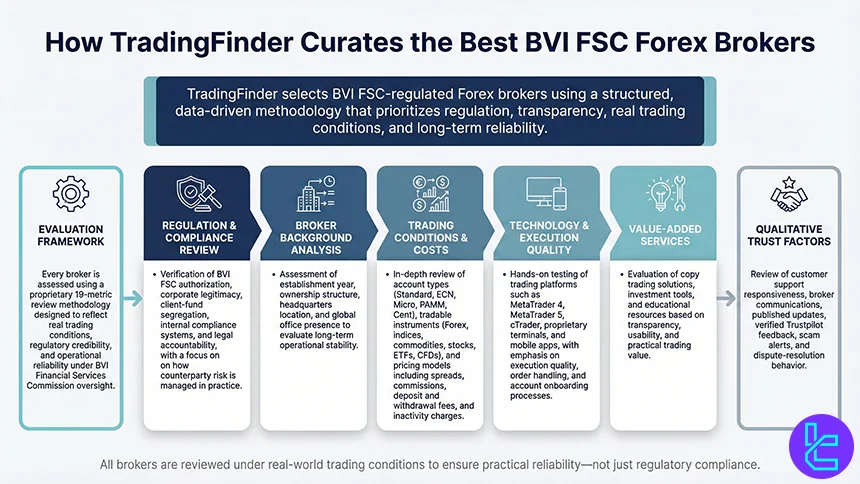

How Did We Curate the Brokers?

Choosing the Best BVI FSC-Regulated Forex Brokers requires far more than comparing spreads or leverage figures.

At TradingFinder, every broker featured in this article is evaluated using a 19-metric review methodology designed to reflect real trading conditions, regulatory credibility, and long-term reliability under British Virgin Islands Financial Services Commission oversight.

Regulation and licensing form the foundation of our analysis. We verify that each broker is authorized by the BVI FSC, assess corporate legitimacy, and review safeguards such as client-fund segregation and internal compliance structures.

While BVI regulation is considered offshore, our focus is on operational transparency, legal accountability, and how brokers mitigate counterparty risk in practice.

Beyond regulation, TradingFinder analysts examine core broker data, including establishment year, ownership structure, headquarters, and global office presence.

We then analyze account type diversity (Standard, ECN, Micro, PAMM, or Cent), tradable instruments (Forex pairs, indices, commodities, stocks, ETFs, and CFDs), and pricing models, covering spreads, commissions, deposit and withdrawal fees, and inactivity charges.

Trading infrastructure is tested hands-on. We review platforms such as MetaTrader 4, MetaTrader 5, cTrader, proprietary terminals, and mobile apps, alongside execution quality, order handling, and the full account-opening and verification process.

Copy trading, investment tools, and educational resources are assessed for transparency, usability, and real value.

Finally, qualitative factors complete the picture. We evaluate customer support responsiveness, broker communication channels, published infographics, updates, and verified user feedback from Trustpilot, alongside scam alerts and dispute-resolution behavior.

What is the BVI FSC?

The British Virgin Islands Financial Services Commission (BVI FSC) is the primary regulatory authority responsible for supervising financial services activities in the British Virgin Islands.

Established in 2001 under the Financial Services Commission Act, the BVI FSC operates as an autonomous statutory body with a mandate to regulate, monitor, and develop the jurisdiction’s financial services sector.

The BVI FSC oversees a wide range of entities, including forex and CFD brokers, investment businesses, mutual funds, trust and corporate service providers, insurance companies, and company incorporations.

Its regulatory framework is primarily based on legislation such as the Securities and Investment Business Act (SIBA), which governs brokers and investment firms operating from or registered in the BVI.

For forex brokers, the BVI FSC focuses on licensing, ongoing supervision, and compliance with core requirements such as minimum capital thresholds, internal controls, risk management procedures, and anti-money laundering (AML) and know-your-customer (KYC) standards.

Brokers are required to maintain proper records, submit periodic reports, and cooperate with regulatory inspections when requested.

Unlike Tier-1 regulators such as the FCA or ASIC, the BVI FSC does not impose strict leverage caps or operate a statutory investor compensation scheme. Instead, its regulatory approach emphasizes corporate governance, operational oversight, and legal registration within a recognized offshore financial center.

Due to these characteristics, BVI FSC regulation is commonly used by internationally focused brokers seeking operational flexibility while remaining subject to a formal regulatory authority.

Understanding the role and limitations of the BVI FSC is essential when assessing broker safety, risk exposure, and overall regulatory strength in the global forex market.

What are BVI FSC Advantages and Disadvantages?

Regulation by the British Virgin Islands Financial Services Commission offers a balance between formal regulatory oversight and operational flexibility. While it does not provide the same level of retail investor protection as Tier-1 authorities, it enables brokers to operate under a recognized legal framework with fewer trading restrictions, making it popular among globally focused forex brokers.

Advantages | Disadvantages |

Recognized and established offshore regulator | No statutory investor compensation scheme |

Clear licensing framework under SIBA | Weaker investor protection compared to FCA or ASIC |

Greater flexibility in leverage offerings | No mandatory leverage caps for retail traders |

Lower compliance and operational costs for brokers | Limited direct intervention in client–broker disputes |

Suitable for international and non-EU clients | Less transparency requirements than Tier-1 regulators |

This contrast highlights why BVI FSC regulation is often viewed as a middle ground, that is, more structured than unregulated jurisdictions, but less restrictive than top-tier regulatory regimes.

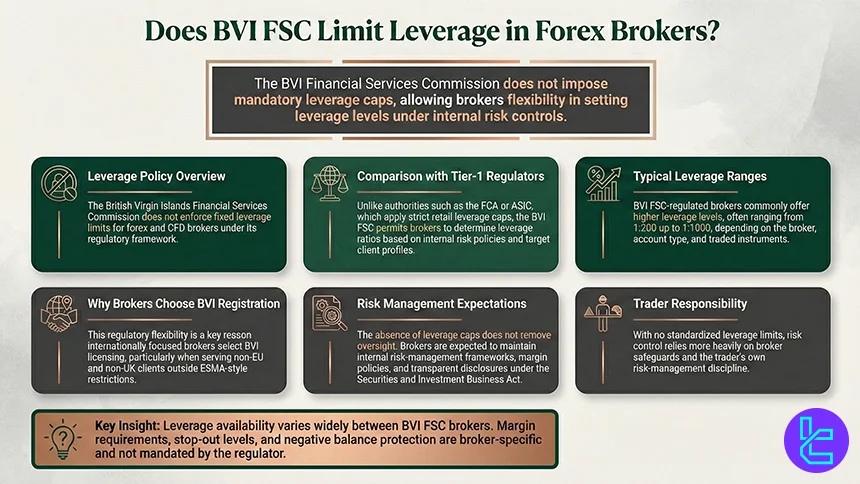

Does BVI FSC Limit Leverage in Brokers?

The British Virgin Islands Financial Services Commission does not impose mandatory leverage caps on forex and CFD brokers under its regulatory framework.

Unlike Tier-1 authorities such as the FCA or ASIC, which enforce strict leverage limits for retail traders, the BVI FSC allows brokers greater discretion in setting leverage ratios based on their internal risk policies and target markets.

As a result, BVI FSC-regulated brokers often offer higher leverage levels, commonly ranging from 1:200 up to 1:1000, depending on the broker, account type, and traded instruments.

This flexibility is one of the main reasons internationally oriented brokers choose BVI registration, particularly when serving non-EU and non-UK clients who are not subject to ESMA-style restrictions.

However, the absence of leverage limits does not mean a lack of oversight. Brokers are still expected to implement internal risk-management systems, margin policies, and disclosure practices in line with the Securities and Investment Business Act.

The responsibility for managing leverage-related risk therefore shifts more heavily toward the broker’s internal controls and the trader’s own risk management discipline.

In practice, leverage availability under BVI FSC regulation varies significantly between brokers. Traders should always review margin requirements, stop-out levels, and negative balance protection policies at the broker level, as these protections are not standardized or mandated by the BVI FSC itself.

What Are the BVI FSC Rules for Forex Brokers?

Forex brokers regulated by the BVI FSC must comply with a defined legal and supervisory framework, mainly established under the SIBA.

Key BVI FSC rules for forex brokers include:

- Licensing under SIBA: Brokers must obtain an Investment Business License before legally offering forex or CFD services from or through the British Virgin Islands;

- Minimum capital requirements: Licensed brokers are required to maintain a minimum level of paid-up capital, depending on the scope and nature of their regulated investment activities;

- Corporate presence and governance: Firms must be properly incorporated in the BVI, appoint directors and authorized representatives, and maintain adequate governance and internal control structures;

- AML and KYC compliance: Brokers must implement anti-money laundering and know-your-customer procedures aligned with international standards, including client verification and transaction monitoring;

- Record-keeping and reporting: Accurate financial and operational records must be maintained, with brokers obligated to submit reports or audited financial statements upon regulatory request;

- Risk management and internal controls: Brokers are expected to establish internal risk-management frameworks covering margin practices, operational risks, and client onboarding processes;

- Regulatory cooperation: Licensed firms must cooperate fully with BVI FSC inspections, information requests, and any supervisory or enforcement actions.

As with other offshore regulators, these rules focus on legal registration, governance, and compliance oversight rather than prescriptive retail-trader protections, making broker-level policies especially important for risk assessment.

How to Check a Broker’s BVI FSC Regulation

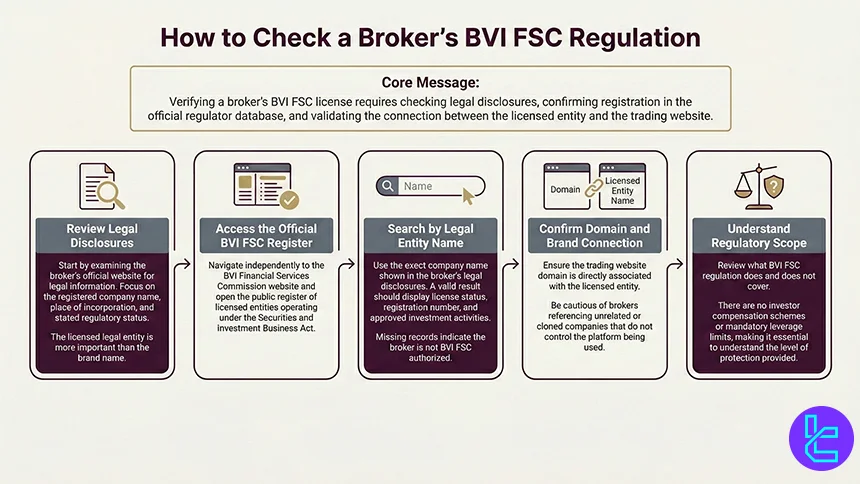

Verifying whether a broker is genuinely regulated by the British Virgin Islands Financial Services Commission (BVI FSC) is an essential step before opening a trading account. The process is straightforward, but it must be done carefully to avoid misleading or cloned regulatory claims.

Start by checking the broker’s legal disclosures on its official website. Reputable brokers clearly state their registered company name, place of incorporation, and regulatory status, usually in the footer, “Legal” section, or Terms and Conditions. The name of the licensed entity matters more than the brand name.

Next, visit the official BVI FSC website and access the public register of licensed entities. This register allows users to search for regulated companies operating under the Securities and Investment Business Act. Always navigate to the regulator’s website independently rather than using links provided by the broker.

Search the register using the exact legal company name listed on the broker’s website. A valid entry should confirm the firm’s license status, registration number, and permitted investment activities. If no matching record appears, the broker is not authorized by the BVI FSC.

It is also important to verify the domain and brand association. Some brokers operate multiple brands under one licensed entity, while others falsely reference a regulated company that is not connected to the trading website you are using. The trading domain should be clearly linked to the licensed firm.

Finally, review the scope and limitations of BVI FSC regulation. Confirm what protections are, and are not, provided, as BVI regulation does not include investor compensation schemes or mandatory leverage limits. This final step helps set realistic expectations about regulatory protection and risk exposure.

Are BVI FSC Brokers Allowed to Offer Crypto Trading Services?

Brokers regulated by the British Virgin Islands Financial Services Commission are allowed to offer crypto-related trading services, but the scope and regulatory treatment depend on how cryptocurrencies are provided and structured.

Under the BVI regulatory framework, most forex brokers offer cryptocurrencies as derivative products, such as crypto CFDs. In this model, traders speculate on the price movements of digital assets like Bitcoin or Ethereum without owning the underlying coins.

These products fall under the Securities and Investment Business Act when structured as investment instruments and are commonly included within a broker’s licensed activities.

Some BVI FSC-regulated entities may also provide spot crypto trading or exchange-style services, but this typically requires additional compliance obligations, including enhanced AML and KYC controls. The BVI FSC has issued guidance recognizing virtual assets as a regulated activity when they involve investment business, custody, or transmission of client funds.

Unlike EU or UK regulators, the BVI FSC does not impose standardized leverage caps, product bans, or retail-specific crypto restrictions. This allows brokers to offer a broader range of crypto instruments and higher leverage, subject to their internal risk policies and disclosures.

However, BVI FSC regulation does not guarantee investor compensation or asset insurance for crypto trading. Traders should therefore review how client funds, digital assets, and margin risks are handled at the broker level, especially when trading high-volatility crypto products under an offshore regulatory framework.

Does BVI FSC Offer Any Investor Compensation Schemes?

The British Virgin Islands Financial Services Commission does not operate a statutory investor compensation scheme for retail traders.

Unlike regulators such as the FCA or CySEC, which require broker participation in formal compensation funds, BVI FSC regulation does not provide guaranteed reimbursement if a licensed broker becomes insolvent or fails to meet its financial obligations.

BVI FSC oversight focuses on licensing, corporate governance, and ongoing supervision under the Securities and Investment Business Act (SIBA), rather than on post-failure compensation mechanisms. As a result, traders do not benefit from predefined coverage limits or automatic claims processes tied to broker default.

Any form of client protection under BVI regulation is therefore broker-dependent. Some BVI FSC-regulated brokers voluntarily implement safeguards such as segregated client accounts, negative balance protection, or private insurance arrangements, but these measures are not mandated or standardized by the regulator.

For traders, this means that due diligence plays a critical role when selecting a BVI FSC-regulated broker.

Understanding how client funds are held, whether additional protections are offered, and how disputes or insolvency scenarios are handled at the broker level is essential when trading under a regulatory regime that does not include an investor compensation scheme.

BVI FSC in Comparison to Other Financial Regulators

The British Virgin Islands Financial Services Commission BVI FSC is commonly classified as a mid-tier offshore regulator, offering brokers operational flexibility with lighter capital and leverage constraints.

When compared with stricter authorities like the Financial Conduct Authority (UK) and the Australian Securities and Investments Commission, or the more structured offshore framework of the Financial Services Commission, BVI FSC places less emphasis on retail investor compensation and leverage caps.

This comparison highlights how regulatory depth, client protection, and compliance intensity vary across these jurisdictions.

Parameter | BVI FSC (British Virgin Islands) | FCA (UK) | ASIC (Australia) | FSC (Mauritius) |

Minimum Capital Requirement | Typically ~$100,000–$200,000 (varies by license) | £125,000–£730,000+ depending on model | Not strictly specified (risk-based capital) | ~$100,000+ depending on license class |

Client Fund Segregation | Required | Required | Required | Required |

Compensation Scheme | No statutory compensation fund | FSCS (up to ~£85,000) | No statutory compensation fund | No mandatory compensation scheme |

Leverage Limits | Not capped (often up to 1:500 or higher) | Retail max ~1:30 on majors | Retail up to ~1:30 | Commonly up to ~1:500 |

Negative Balance Protection | Not mandatory | Required | Common but not statutory | Not mandatory |

Reporting & Audits | Periodic reporting (lighter supervision) | Ongoing and strict reporting | Regular compliance reporting | Ongoing reporting (moderate oversight) |

Conclusion

Trading with the brokers regulated by the British Virgin Islands Financial Services Commission may be preferred by those who seek less limitations and restrictions, especially in terms of leverage. Exness, AvaTrade, MultiBank, and easyMarkets are some of the highly praised options with desirable conditions.

You may check out our Forex methodology to learn about our approach towards selecting and examining brokers.