Cent accounts are for those who want to start with little investments, which usually include beginners. Some brokerages offer an option to open a cent/micro account with little to no differences to standard trading other than the minimum deposit requirement.

The shortlist in this article covers some of the best choices in the industry.

| exness | |||

| HFM | |||

| PUPrime | |||

| 4 |  | vt markets | ||

| 5 |  | TeleTrade | ||

| 6 |  | FIBOGROUP | ||

| 7 |  | D prime | ||

| 8 |  | IFC MARKETS |

Trustpilot Ratings in Cent Account Brokers

Traders and investors can submit their reviews and ratings about brokers on “Trustpilot”. The table below ranks nominated brokerages based on user scores.

Broker Name | Trustpilot Rating | Number of Reviews |

Exness | 27,426 | |

HFM | 3,209 | |

2,418 | ||

PU Prime | 3.8/5 ⭐ | 1,783 |

556 | ||

D Prime | 452 | |

Fibo Group | 16 | |

TeleTrade | 67 |

Minimum Spreads in Cent Account Forex Brokers

Spreads are considered one of the most significant factors when choosing a good Forex broker for any type of trader. The table below ranks mentioned brands based on this parameter.

Broker Name | Min. Spread |

0 Pips | |

0 Pips | |

VT Markets | 0 Pips |

PU Prime | 0 Pips |

IFC Markets | 0 Pips |

InstaForex | 0 Pips |

Ultima Markets | 0 Pips |

Markets4you | 0.1 Pip |

Other Account Types in Select Brokers

Some brokers provide more than one cent/micro account to traders. Here’s a demonstration of the account types in mentioned brokerages.

Broker Name | Account Types | Max. Leverage |

Exness | Standard, Standard Cent, pro, Raw Spread, Zero | Unlimited (Subject to account) |

VT Markets | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo | 1:500 |

Ultima Markets | Demo, Standard, ECN, Standard Cent, ECN Cent | 1:2000 |

Standard, Prime, ECN, Cent | 1:1000 | |

Cent, STP, ECN | 1:1000 | |

IFC Markets | Standard, Micro, ECN | 1:400 |

InstaForex | Insta.Standard, Insta.Eurica, Cent.Standard, and Cent Eurica | 1:1000 |

MTrading | M.Cent, M.Premium, M.Pro | 1:1000 |

Number of Tradable Instruments in Cent Brokers

This section of the comparisons lists the number of tradable assets available in brokers. A larger number enables more diverse investments.

Broker Name | Number of Instruments |

VT Markets | 1,000+ |

IFC Markets | 650+ |

500+ | |

InstaForex | 340+ |

Ultima Markets | 250+ |

Exness | 200+ |

MTrading | 130+ |

50+ |

Top 6 Forex Brokers with Cent Account Option

The following parts will review and introduce the brokers in more details considering important parameters.

Exness

Founded in 2008 by Petr Valov and Igor Lychagov, Exness has grown into a global multi-asset broker processing over $4 trillion in monthly trading volume. The company employs more than 2,100 professionals across nearly 100 countries, positioning itself as a major retail liquidity provider.

Exness operates through multiple regulated entities, including Exness (UK) Ltd. (FCA), Exness (Cy) Ltd. (CySEC), and Exness ZA (FSCA), alongside licenses from FSA Seychelles, FSC BVI, and CMA Kenya. Client funds are segregated, and negative balance protection is applied across jurisdictions.

For cent-account traders, the Standard Cent account stands out with a $10 minimum deposit, spreads from 0.3 pips, and no commission. It supports micro-position sizing (0.01 lot), making it suitable for strategy testing, capital scaling, and risk-controlled execution on MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Trading costs remain competitive across account types, with spreads ranging from 0.0 to 0.8 pips and commissions between $0.2 and $3.5 per lot on professional accounts. Furthermore, there is an Exness rebate program available for discounts.

Exness also offers unlimited leverage (subject to eligibility), fast crypto withdrawals, and execution via Market or Instant models.

Specifics and Parameters

Account Types | Standard, Standard Cent, pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Deposit | $10 |

Deposit Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Withdrawal Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Maximum Leverage | Unlimited (Subject to account) |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Exness Pros & Cons

Exness combines low entry requirements with multi-jurisdiction regulation and flexible leverage, making it a strong candidate in the Best Cent Account Forex Brokers category. Below is a balanced overview of its strengths and limitations. Check them out before Exness registration.

Pros | Cons |

$10 minimum deposit for Standard Cent account | Educational materials less extensive than some competitors |

Multi-regulated (FCA, CySEC, FSCA, FSA, FSC, CMA) | Services restricted in several countries |

No deposit, withdrawal, or inactivity fees | Not all instruments available on every account type |

Spreads from 0.0 pips and scalable leverage options | No traditional deposit bonus programs |

HFM

Founded in 2010, HFM (formerly HotForex) serves over 2,500,000 live accounts across 27+ languages. The broker operates under multiple regulators, including Financial Conduct Authority (FCA 801701) and Cyprus Securities and Exchange Commission (CySEC 183/12), reinforcing its global compliance framework.

For traders seeking Cent Account Forex Brokers, HFM offers a Cent account with a $0 minimum deposit, micro-lot trading (0.01 lot), and leverage up to 1:2000 under specific entities. Spreads start from 1.2 pips, while Zero accounts provide floating spreads from 0.0 pips with commission.

You can check out the HFM rebate program for discount on trading costs.

HFM supports MT4, MT5, and its proprietary mobile app, alongside tools like Autochartist, VPS hosting, economic calendars, and SMS market alerts. Clients can fund accounts via wire transfer, cards, Skrill, Perfect Money, and crypto networks such as TRC-20 and ERC-20.

Security measures include segregated client funds and negative balance protection across regulated entities. Investor compensation varies by jurisdiction, with coverage up to €20,000 (ICF) under CySEC and £85,000 (FSCS) under FCA-regulated branches.

Table of Specifics

Account Types | Cent, Zero, Pro, Premium |

Regulating Authorities | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Deposit | From $0.00 |

Deposit Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Withdrawal Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

HFM Pros & Cons

The following section outlines HFM’s core advantages and potential drawbacks, helping cent account traders evaluate whether its regulatory depth, leverage flexibility, and asset diversity align with their trading strategy. Consider these if you are willing to go through HFM registration.

Pros | Cons |

Multi-regulated (FCA, CySEC, DFSA, FSCA, FSA) | Geo-restrictions in several countries |

Cent account with $0 minimum deposit | Inactivity fees after 6 months |

Leverage up to 1:2000 (entity-dependent) | Limited proprietary platform innovation |

Wide asset range (Forex, Stocks, ETFs, Crypto CFDs) | Mixed reviews regarding customer support quality |

VT Markets

VT Global Pty Ltd operates VT Markets as a multi-asset broker headquartered in Australia, facilitating over 30,000,000 trades monthly for 400,000+ active clients. The broker provides access to 1,000+ instruments across seven markets, positioning itself as a competitive choice among Best Cent Account Forex Brokers.

VT Markets offers four primary live accounts: Standard STP, RAW ECN, Cent STP, and Cent ECN. The Cent accounts enable micro-position sizing from 0.01 lot with a minimum deposit starting at $50, making them suitable for capital-controlled strategies and risk-calibrated trade execution.

Regulatory oversight includes the Australian Securities and Investments Commission (ASIC - 516246), Financial Sector Conduct Authority (FSCA - 50865), and the Financial Services Commission (FSC - GB23202269). Client fund segregation applies across entities, while leverage reaches up to 1:500 under non-ASIC jurisdictions.

Platform infrastructure centers on MetaTrader 4 and MetaTrader 5, supported by Webtrader+ and the VT Markets App. Spreads start from 0.0 pips on ECN accounts, with commissions from $6 per round turn, while Cent STP accounts provide spread-based pricing without commission charges.

You may visit our VT Markets dashboard page for a review on the broker’s interface. Here’s a summary of the broker’s specifics.

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros and Cons

VT Markets combines diversified asset coverage, flexible account structures, and multi-jurisdictional regulation. However, differences between regulatory entities, offshore leverage exposure, and the absence of excess loss insurance should be considered before VT Markets registration and selecting a Cent trading account.

Pros | Cons |

Cent STP and Cent ECN accounts available | No excess loss insurance |

ASIC, FSCA, and FSC regulatory coverage | Offshore entity offers higher risk exposure |

Spreads from 0.0 pips on ECN accounts | Withdrawal fees may apply |

1,000+ instruments across 7 markets | No 24/7 customer support |

PU Prime

Founded in 2016, PU Prime is a multi-asset Forex and CFD broker offering access to over 800 instruments across six asset classes, including Forex, indices, commodities, shares, ETFs, and bonds. With ECN/STP execution and spreads from 0.0 pips, it positions itself among competitive Cent account Forex brokers.

The broker offers four main account types, Standard, Prime, ECN, and Cent, with a minimum deposit starting from just $20. The Cent account allows micro-position trading (0.01 lots) and leverage up to 1:1000, making it suitable for strategy testing and small-capital risk management. To learn about the broker’s funding options, check out the PU Prime deposit and withdrawal page.

PU Prime operates under multiple regulatory entities, including ASIC (Australia, License No. 410681), FSCA (South Africa No. 52218), and offshore regulators such as FSA Seychelles and FSC Mauritius. Client funds are held in segregated accounts, and negative balance protection is applied across entities.

Trading is available via MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, and the proprietary PU Prime mobile app, which integrates copy trading and social trading features. Commission structures vary by account, with ECN fees from $1 per side per lot and zero-commission options for Standard and Cent accounts. The table below summarizes the broker’s details.

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

PU Prime Pros & Cons

Below is a balanced overview of PU Prime’s strengths and limitations, helping traders evaluate whether its Cent account conditions align with their capital size, trading frequency, and platform requirements. This part of the introduction is necessary especially for those willing to go through PU Prime registration.

Pros | Cons |

Low minimum deposit ($20 for Cent account) | Mixed user reviews on third-party platforms |

Leverage up to 1:1000 (offshore entities) | Not available to U.S. residents |

Multiple platforms (MT4, MT5, WebTrader, mobile app) | Offshore regulation for global clients |

Over 800 tradable instruments across 6 markets | Withdrawal fees may apply for repeated international transfers |

IFC Markets

Founded in 2006, IFC Markets is a multi-asset Forex and CFD broker serving over 210,000 clients globally. The company offers access to 650+ instruments across 9 markets, including Forex, stocks, ETFs, crypto futures, and synthetic assets.

The broker operates under the Labuan Financial Services Authority and the British Virgin Islands Financial Services Commission, maintaining segregated funds, negative balance protection, and professional indemnity insurance via Lloyd’s of London (Syndicate 4000).

IFC Markets supports Standard, Micro, and ECN accounts with a minimum deposit from $1 and leverage up to 1:400 (1:2000 under certain entities). ECN traders benefit from raw spreads starting at 0.0 pips with a 0.005% commission and a 10% stop-out level.

Trading is available via NetTradeX, MetaTrader 4, and MetaTrader 5. Its patented GeWorko Method enables the creation of Personal Composite Instruments (PCIs), while PAMM accounts and IFC Invest expand portfolio diversification options.

You can go to our IFC Markets dashboard page for a review of the broker’s user interface. Look at the table below for an overview of specifics.

Account Types | Standard, Micro, ECN |

Regulating Authorities | Labuan FSA, BVI FSC |

Minimum Deposit | $1 |

Deposit Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Local Transfer, Crypto, etc. |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Local Transfer, Crypto, etc. |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MT4, MT5, NetTradeX |

IFC Markets Pros & Cons

When evaluating IFC Markets, traders should weigh its ultra-low entry deposit, multi-platform flexibility, and patented trading innovations against regulatory tier differences and variable spreads on some major pairs. Below is a structured overview of its main advantages and limitations that must be considered before IFC Markets registration.

Pros | Cons |

Minimum deposit from $1 (Micro account) | No top-tier (FCA/ASIC) regulation |

650+ instruments across 9 markets | Higher spreads on some major FX pairs (Fixed accounts) |

Patented GeWorko portfolio creation method | Limited number of crypto CFDs compared to large exchanges |

ECN account with 0.0 pip spreads & 0.005% commission | Geo-restrictions (e.g., U.S., Russia) |

D Prime

D Prime Limited, established in 2014 and headquartered in Hong Kong, serves over 400,000 active clients with support from 1,000+ employees and 37,000 introducing brokers. The broker operates globally through offshore-regulated entities, positioning itself as a multi-asset provider with scalable trading infrastructure.

Doo Prime offers three account types, including Cent, STP, and ECN, with leverage up to 1:1000 under VFSC and FSC oversight. The Cent account requires no initial funding, while STP and ECN accounts start from $100, supporting maximum lot sizes of up to 100.

The broker provides access to 10,000+ instruments across Forex, stocks, indices, commodities, futures, and crypto CFDs. Trading is available via MetaTrader 4, MetaTrader 5, and its proprietary Doo Prime InTrade platform, with spreads from 0.0 pips on ECN accounts.

Additional features include PAMM, MAM, FOLLOWME, and copy trading solutions, plus swap-free accounts for Islamic traders. Deposits and withdrawals are commission-free internally, with support for bank transfers, cards, e-wallets, and crypto. Market execution (NDD) and 24/7 multilingual support enhance operational flexibility.

Table of Specifics and Details

Account Types | Cent, STP, ECN |

Regulating Authorities | VFSC, FSC |

Minimum Deposit | None |

Deposit Methods | Local bank Transfers, E-wallets, International Wire Transfers, Credit/Debit Card |

Withdrawal Methods | Local bank Transfers, E-wallets, International Wire Transfers, Credit/Debit Card |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Doo Prime InTrade |

D Prime Pros and Cons

Before D Prime registration, it is important to assess the broker’s strengths in leverage flexibility, account diversity, and platform access, alongside considerations such as offshore regulation tiers and limited top-tier oversight.

Pros | Cons |

Up to 1:1000 leverage on multiple accounts | No top-tier regulation (FCA, ASIC, etc.) |

10,000+ tradable instruments | Investor compensation scheme not available |

Cent account with no initial funding barrier | Education materials limited to registered users |

Supports MT4, MT5, and proprietary platform | Trust scores vary across review platforms |

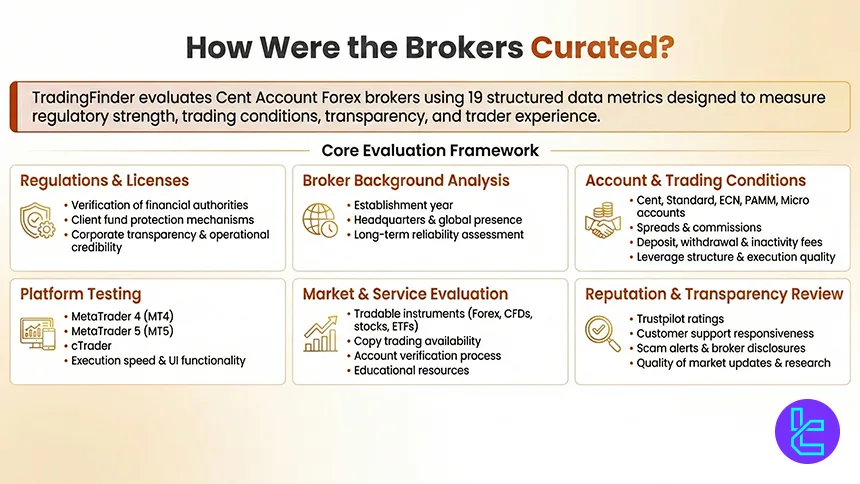

How Were The Brokers Curated?

Selecting the best cent account Forex brokers requires more than comparing minimum deposits or leverage ratios. At TradingFinder, our review methodology is built on 19 structured data metrics designed to assess regulatory strength, trading conditions, operational transparency, and overall trader experience.

This framework ensures objectivity, accuracy, and SEO-aligned entity evaluation.

We begin with Regulations and Licenses, verifying whether each forex broker operates under recognized financial authorities and provides client fund protection mechanisms. Broker background details such as establishment year, headquarters, global offices, and corporate transparency are analyzed to assess long-term reliability in the forex market.

Next, we evaluate Cent account features alongside account variety, including Standard, ECN, PAMM, and Micro accounts. Key performance indicators include spreads, commissions, deposit and withdrawal fees, inactivity charges, execution quality, and available leverage.

We directly test broker services on platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, reviewing trading apps, execution speed, and user interface functionality.

Our methodology also covers tradable instruments (Forex pairs, CFDs, stocks, ETFs), copy trading availability, account verification processes, and educational materials. We examine Trustpilot scores, customer support responsiveness, scam alerts, broker transparency, and the quality of infographics and news updates.

Finally, TradingFinder analysts, experienced in forex, crypto, and global financial markets, weight each metric based on its impact on trader capital protection and performance. This data-driven methodology ensures that every Cent Account broker featured in this ranking meets strict standards of compliance, cost-efficiency, and operational integrity.

What is a Cent Account?

A cent account in forex trading is a type of brokerage account where balances are displayed in cents instead of standard base currency units. For example, a $10 deposit appears as 1,000 cents in the trading platform. This structure allows traders to participate in real market conditions while committing significantly lower capital.

Cent Accounts are commonly offered on platforms such as MetaTrader 4 and MetaTrader 5, and they typically support micro-lot trading (0.01 lot or smaller). Because trade sizes are proportionally reduced, risk exposure per position is substantially lower compared to standard accounts.

These accounts are widely used by beginner traders who want to test live market execution without the psychological and financial pressure of large deposits. They are also useful for strategy testing, algorithm validation (Expert Advisors), and evaluating broker execution quality in real conditions rather than demo environments.

However, Cent Accounts may have certain limitations, such as higher spreads, restricted instrument selection, or capped leverage depending on the broker.

Despite these constraints, they remain a practical entry point for traders seeking low-risk exposure to real forex market dynamics.

What are The Pros and Cons of Trading with a Cent Account?

A Cent Account allows traders to operate in real forex market conditions while using significantly smaller capital. Since balances are denominated in cents, position sizes and risk exposure are proportionally reduced.

While this structure offers clear advantages for beginners and strategy testing, it also comes with structural limitations compared to Standard or ECN accounts.

Pros and Cons of Cent Accounts

Pros | Cons |

Traders can start with very small deposits, often $5–$20. | Many brokers apply wider spreads than on ECN or RAW accounts. |

Micro-lot trading limits potential losses per trade. | Some brokers restrict CFDs, stocks, or advanced assets. |

Unlike demo accounts, trades are executed in live environments. | Some Cent Accounts use market-maker models. |

Suitable for testing Expert Advisors on platforms like MetaTrader 4 and MetaTrader 5. | Smaller lot sizes limit absolute return amounts. |

In practice, Cent Accounts are primarily designed for beginner traders, low-risk experimentation, and psychological training. However, experienced or high-volume traders typically prefer Standard or ECN accounts for tighter spreads, deeper liquidity, and institutional-grade execution conditions.

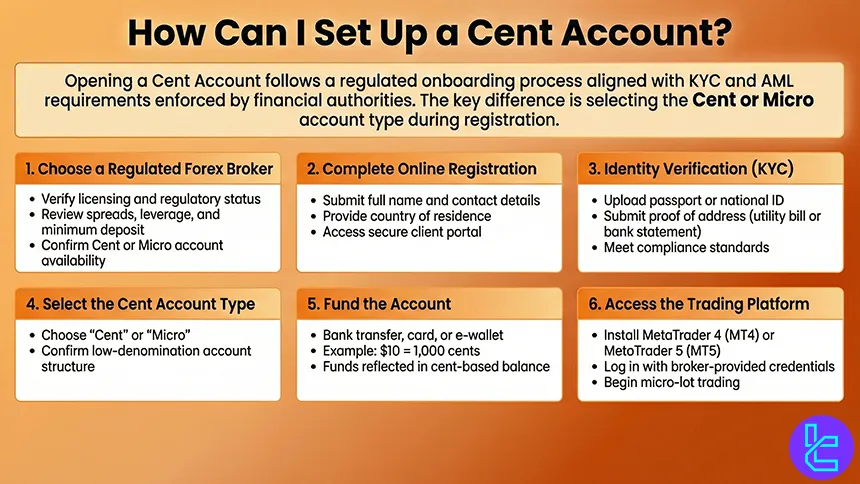

How Can I Set Up a Cent Account?

Setting up a Cent Account follows a structured onboarding process similar to opening any live forex trading account. The main difference lies in selecting the Cent or Micro account type during registration. The process complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations enforced by financial authorities.

Step-by-Step Process to Open a Cent Account

- Choose a Regulated Forex Broker: Verify licensing, review trading conditions (spreads, leverage, minimum deposit), and confirm that a Cent Account is offered;

- Complete Online Registration: Submit personal details such as full name, email address, country of residence, and contact information through the broker’s secure client portal;

- Identity Verification (KYC): Upload identification documents (passport or national ID) and proof of address (utility bill or bank statement) to meet regulatory compliance requirements;

- Select the Cent Account Type: During account setup, choose “Cent”, “Micro”, or the broker’s equivalent low-denomination account option;

- Fund the Account: Deposit funds via supported methods such as bank transfer, debit/credit card, or e-wallets; for example, a $10 deposit will appear as 1,000 cents;

- Download and Access the Trading Platform: Install platforms like MetaTrader 4 or MetaTrader 5 and log in using the credentials provided by the broker.

Once activated, traders can execute micro-lot trades in live market conditions with proportionally reduced capital exposure.

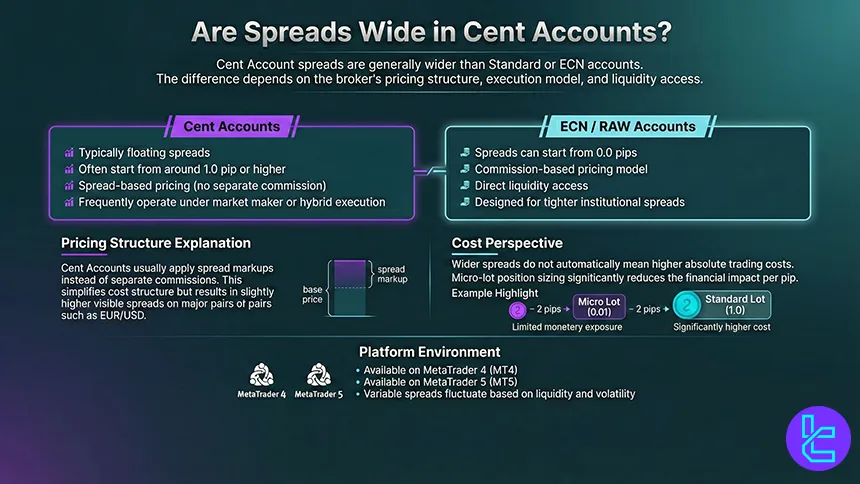

Are Spreads Wide in Cent Accounts?

Spreads in a Cent Account are generally wider compared to Standard or ECN accounts, but the exact difference depends on the broker’s pricing model and liquidity structure. Since Cent Accounts are primarily designed for low-capital traders, brokers often apply spread markups instead of charging separate commissions.

In many cases, Cent Accounts operate under a market maker or hybrid execution model. As a result, spreads on major currency pairs such as EUR/USD may be slightly higher than those offered on RAW or ECN accounts.

While ECN spreads can start from 0.0 pips with commission-based pricing, Cent Accounts typically feature floating spreads that begin from around 1.0 pip or higher.

However, the wider spread does not necessarily mean trading is expensive in absolute terms. Because position sizes are significantly smaller (micro lots), the monetary impact of each pip movement remains limited. For example, a 2-pip spread on a micro-lot trade represents a much smaller financial cost compared to the same spread on a standard lot.

Most Cent Accounts are available on platforms such as MetaTrader 4 and MetaTrader 5, where spreads remain variable and fluctuate based on market liquidity and volatility.

Overall, while spreads in Cent Accounts are typically wider than ECN accounts, they are proportionate to the account’s low-risk structure and intended use for beginner traders and strategy testing.

Do Cent Accounts Come with High Non-Trading Fees?

Cent Accounts do not inherently carry higher non-trading fees compared to other retail forex account types. Non-trading fees typically include deposit charges, withdrawal fees, currency conversion costs, and inactivity fees. These charges are determined by the broker’s overall fee structure rather than the specific account denomination.

Most brokers offering Cent Accounts apply the same deposit and withdrawal policies used for Standard or Micro accounts. In many cases, deposits are free, while withdrawal fees depend on the payment provider (bank transfer, card processor, or e-wallet). Currency conversion fees may apply if the account base currency differs from the funding method.

Inactivity fees can be charged if an account remains dormant for a defined period, often between three to twelve months. This policy usually applies uniformly across all account types, including Cent Accounts. However, some brokers waive inactivity fees for low-balance accounts.

Cent Accounts available on platforms like MetaTrader 4 and MetaTrader 5 generally follow the broker’s standard fee schedule. Traders should review the broker’s terms and conditions carefully, as non-trading fees vary significantly across jurisdictions and regulatory frameworks.

Overall, Cent Accounts are not specifically associated with high non-trading fees, but total costs depend on the broker’s transparency and pricing policy.

Who Should Choose Cent Accounts in Brokers?

Cent Accounts are primarily designed for traders who want real market exposure with minimal financial risk. Because balances are denominated in cents and position sizes are reduced to micro-lots, they provide a practical environment for learning, testing, and refining trading strategies without committing substantial capital.

Beginner traders often choose Cent Accounts to transition from demo trading to live execution. Unlike demo environments, Cent Accounts involve real liquidity and market conditions, helping traders understand slippage, spread fluctuations, and execution speed on platforms like MetaTrader 4 and MetaTrader 5.

Algorithmic and EA users may also benefit from Cent Accounts. Developers frequently test Expert Advisors in live conditions with smaller lot sizes before deploying them on Standard or ECN accounts. This reduces capital exposure while validating performance metrics such as drawdown, execution accuracy, and order fill quality.

Low-capital traders who cannot meet the higher minimum deposits of Standard or ECN accounts may also find Cent Accounts suitable. With deposits often starting from $5 to $20, these accounts lower the entry barrier to the forex market.

However, Cent Accounts are generally not ideal for high-volume or professional traders seeking tight institutional spreads, deep liquidity, and commission-based pricing. For those participants, Standard or ECN account types typically offer more competitive trading conditions.

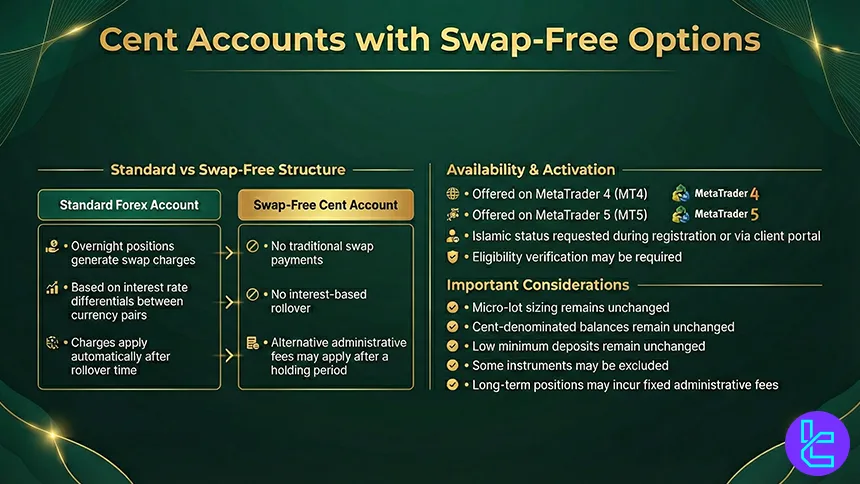

Cent Accounts with Swap-Free Options

Some forex brokers offer Cent Accounts with swap-free (Islamic) options, allowing traders to hold positions overnight without paying or receiving rollover interest. Swap-free structures are designed to comply with Shariah principles, which prohibit interest-based transactions.

In a standard forex account, overnight positions generate swap charges based on interest rate differentials between currency pairs. In a swap-free Cent Account, brokers typically remove these interest payments and may instead apply alternative administrative fees after a specified holding period.

Swap-free Cent Accounts are commonly available on platforms such as MetaTrader 4 and MetaTrader 5, where traders can request Islamic status during account registration or through the client portal. Brokers may require verification of eligibility before activating swap-free conditions.

While the core trading mechanics, including micro-lot sizing, cent-denominated balances, and low minimum deposits, remain unchanged, traders should carefully review the broker’s swap-free policy. Some instruments may be excluded, and long-term holding strategies could incur fixed fees instead of traditional swaps.

Cent Accounts with swap-free options provide a structured solution for traders seeking low-capital access to the forex market while avoiding interest-based overnight charges.

What Instruments Are Available with Cent Accounts?

The range of instruments available in a Cent Account depends on the broker’s product offering and execution model. While these accounts are primarily designed for low-capital trading, many brokers still provide access to core forex and CFD markets under reduced lot sizes.

Most Cent Accounts include access to:

- Major, minor, and sometimes exotic Forex currency pairs

- CFDs on precious metals such as gold (XAU/USD) and silver (XAG/USD)

- CFDs on energy products like crude oil

- Select stock indices CFDs (e.g., US and European benchmarks)

- In some cases, limited cryptocurrency CFDs

However, compared to Standard or ECN accounts, the instrument list may be more restricted. Brokers often prioritize high-liquidity assets that are suitable for micro-lot execution and smaller account balances. Access to individual stocks, ETFs, or advanced derivative products may be unavailable or limited in Cent Accounts.

Cent Accounts typically operate on platforms such as MetaTrader 4 and MetaTrader 5, where contract specifications (lot size, margin requirements, leverage) are adjusted to reflect cent-denominated balances.

Before opening a Cent Account, traders should review the broker’s contract specifications page to confirm available instruments, leverage limits, and margin policies. Instrument availability ultimately depends on the broker’s liquidity providers, regulatory framework, and internal risk management structure.

Cent Accounts vs. Other Common Account Types

Cent accounts are structured for low-capital exposure, where balances are denominated in cents and trade sizes are reduced to micro lots. In contrast, Standard, ECN, and Pro accounts operate with full lot denominations and are designed for progressively tighter spreads, higher liquidity depth, and commission-based pricing models.

The table below compares the most important structural and cost-related parameters that differentiate these account types across major forex brokers.

Parameters | Cent Account | Standard Account | ECN Account | Pro Account |

Balance Denomination | Cents (e.g., $10 = 1,000 cents) | Base currency (USD, EUR, etc.) | Base currency | Base currency |

Typical Minimum Deposit | $0 - $50 | $50 - $200 | $100 - $500 | $200 - $1,000+ |

Lot Size Structure | Micro lots (0.01) or smaller | Standard & mini lots (0.01-1.0) | Raw lot sizes with direct liquidity | Standard lots, optimized execution |

Spreads (Major Pairs) | 1.0 - 2.0+ pips (floating) | 0.8 - 1.5 pips (floating) | 0.0 - 0.3 pips (raw) | 0.1 - 0.8 pips |

Commission Model | Usually spread-only | Usually spread-only | Commission per lot ($3-$7 RT typical) | Low or zero commission (broker-dependent) |

Execution Model | Market Maker / Hybrid | Market Maker / STP | True ECN / NDD | STP / Hybrid |

Max Leverage (Offshore) | 1:500 - 1:2000+ | 1:500 - 1:1000 | 1:200 - 1:500 | 1:200 - 1:500 |

Max Leverage (Tier-1 Reg.) | 1:30 | 1:30 | 1:30 | 1:30 |

Instrument Availability | Limited to core FX & CFDs | Full retail offering | Full offering with deeper liquidity | Full offering |

Target Trader Profile | Beginners, low-capital traders, EA testing | Retail traders | Scalpers, high-volume traders | Experienced discretionary traders |

Typical Stop-Out Level | 20% - 50% | 20% - 50% | 20% - 30% | 20% - 30% |

Slippage Sensitivity | Moderate | Moderate | Lower (direct liquidity access) | Lower |

Conclusion

Beginners and those intending to start with little investments in trading would find cent accounts a great feature in Forex brokers. These account types allow lower initial deposits as their main difference. Exness, HFM, VT Markets, and PU Prime appear as suitable choices for trading via micro accounts.

For details on the way we chose each broker, read our Forex methodology article.