Most people use credit cards for small and big purchases online or in physical stores. Forex brokers are some of the online terminals that accept this payment method, which is mostly cheaper and faster than traditional bank transfers.

The list below includes 8 of the brokers with good reputations and suitable conditions that accept credit cards.

| VT Markets | |||

| PU Prime | |||

| NordFX | |||

| 4 |  | LiteFinance | ||

| 5 |  | BlackBull Markets | ||

| 6 |  | FxGlory | ||

| 7 |  | TMGM | ||

| 8 |  | XM |

Trustpilot Ratings for Brokers Accepting Credit Cards

The table in this section ranks the mentioned brokers based on the user scores submitted on the Trustpilot platform.

Broker Name | Trustpilot Score | Number of Reviews |

3,045 | ||

VT Markets | 2,246 | |

FxGlory | 65 | |

NordFX | 84 | |

TMGM | 832 | |

468 | ||

PU Prime | 1,768 | |

XM | 2,894 |

Forex Broker Fees in Credit Card Payments

In some occasions, broker transactions come with fees according to the used method. The table here lists the credit card fees for suggested brokers.

Broker Name | Deposit Fees | Withdrawal Fees |

$0 | $0 | |

FXCM | $0 | $0 |

City Index | $0 | $0 |

PU Prime | $0 | $0 |

Eightcap | $0 | $0 |

$0 | $0 | |

BlackBull Markets | $0 | $5 |

FxGlory | $0 | 5% for Under $300 |

Deposit/Withdrawal Duration through Credit Cards in Forex Brokers

This section examines the duration required for credit card transactions to take place in brokerages.

Broker Name | Deposit Duration | Withdrawal Duration |

NordFX | Instant | Instant |

Eightcap | Instant | 2–5 Business Days |

PU Prime | Instant | 2-3 business days, depending on the merchant |

Instant | 1 to 3 Working Days | |

VT Markets | Instant | 1-3 business days |

City Index | Instant | 3–5 working days |

FxPro | Instant | 10 Minutes - 1 Business Day |

Instant to 2 business days | 2-5 business days |

Minimum Amounts for Credit Card Deposits/Withdrawals

The table below ranks some of the best Forex brokers for credit card holders based on the minimum amount required for deposits and withdrawals.

Broker Name | Min. Deposit | Min. Withdrawal |

NordFX | $0 | $0 |

Eightcap | $0 | $0 |

$50 | $0 | |

BlackBull Markets | $50 | $5 |

$50 | $10 | |

VT Markets | $50 | $40 |

City Index | $100 | $100 |

Plus500 | $100 | $100 |

Top 6 Forex Brokers Accepting Credit Cards in Detail

In the following sections, each of the best 6 credit card brokers with high Trustpilot scores are introduced.

BlackBull Markets

BlackBull Markets is a multi-award-winning brokerage with 7 major industry awards, providing access to 26,000+ instruments across 6 asset classes. Founded in 2014, the broker focuses on ECN trading conditions with institutional-grade execution and broad market coverage.

Headquartered in New Zealand and registered as Black Bull Group Limited, the company was established by Michael Walker and Selwyn Loekman.

BlackBull Markets operates under multi-jurisdictional regulation, including the New Zealand FMA (Tier-1) and the Seychelles FSA (Tier-3), offering segregated client funds and negative balance protection.

From a trading-infrastructure perspective, BlackBull Markets delivers ECN Standard, ECN Prime, and ECN Institutional accounts with spreads starting from 0.0 pips. Traders can access MT4, MT5, cTrader, TradingView, and proprietary platforms such as BlackBull CopyTrader and BlackBull Invest.

Operational flexibility is another core strength. With $0 minimum deposit, leverage up to 1:500, and support for multiple base currencies, the broker accommodates both retail and professional traders. Payments are processed via cards, bank wires, crypto, and major e-wallets, supported by 24/7 multilingual customer service.

Remember that to access full features and functionalities, you must go through the BlackBull Markets verification. Here are the broker’s specifics.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FSA, FMA |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros & Cons

Before diving into the detailed strengths and weaknesses, it’s worth noting that BlackBull Markets positions itself as a high-performance ECN broker. Its offering balances institutional-level execution and platform diversity with regional limitations and a feature-rich environment that may feel complex for some traders.

Pros | Cons |

Ultra-fast ECN execution with spreads from 0.0 pips | Limited availability in certain regulated regions |

Access to 26,000+ instruments across global markets | Advanced platform ecosystem may overwhelm beginners |

Strong regulation via New Zealand FMA (Tier-1) | Institutional account requires high minimum capital |

Wide platform support (MT4, MT5, cTrader, TradingView) | No fixed-spread account option |

VT Markets

VT Markets is a multi-asset brokerage headquartered in Australia, facilitating over 30 million trades per month for more than 400,000 active traders worldwide. The broker provides access to 1,000+ instruments across seven markets, including forex, indices, shares, metals, and commodities.

From a regulatory perspective, VT Markets operates under multiple authorities, led by Australian Securities and Investments Commission (ASIC), alongside the Financial Sector Conduct Authority (FSCA) and Financial Services Commission Mauritius (FSC). Among these, ASIC oversight is considered the strongest in terms of client safeguards.

The broker offers four main account types; Standard STP, RAW ECN, Cent STP, and Cent ECN. With a minimum deposit from $50, base currencies such as USD, EUR, GBP, AUD, and CAD are supported, improving flexibility for international traders.

On the technology side, VT Markets supports MetaTrader 4, MetaTrader 5, WebTrader+, and a proprietary mobile app.

Features such as copy trading, PAMM accounts, negative balance protection, and leverage up to 1:500 (under non-ASIC entities) position the broker as a feature-rich choice for active and volume-driven traders. A VT Markets dashboard article is available for more details on the broker’s interface and features.

Specifics and Details

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros & Cons

Before going through the VT Markets registration, the following pros and cons summarize VT Markets’ overall strengths and limitations based on regulation, trading conditions, and platform coverage.

Pros | Cons |

Regulated by ASIC, FSCA, and FSC | ASIC entity limited to wholesale clients only |

Wide range of account types, including Cent and ECN | No excess loss insurance or compensation scheme |

Low minimum deposit starting from $50 | Offshore entities raise transparency concerns |

MT4 & MT5 support with copy trading and PAMM | Swap rates less competitive for long-term trading |

FXGlory

FXGlory is a forex broker established in 2011, known for offering extremely high leverage of up to 1:3000 and a $1 minimum deposit. The broker focuses on accessibility, making it possible for small-cap traders to enter the market with limited initial capital.

Headquartered in Saint Lucia, FXGlory operates without oversight from major regulatory authorities. While the broker emphasizes internal security measures such as data encryption and account protection, the absence of recognized regulation remains a defining characteristic of its risk profile.

FXGlory supports four account types; Standard, Premium, VIP, and CIP. Trading is available on MetaTrader 4 and MetaTrader 5, with micro-lot trading from 0.01 lots and commission-free execution across all accounts.

You can learn more about the broker’s different accounts through the FXGlory account types page.

In terms of markets, FXGlory provides access to Forex currency pairs, metals, and oil CFDs. The broker also offers features such as swap-free Islamic accounts, a 50% deposit bonus, hedging, VPS services on higher-tier accounts, and 24/7 customer support via multiple channels. The table below lists the specifics.

Account Types | Standard, Premium, VIP, CIP |

Regulating Authorities | None |

Minimum Deposit | $1 |

Deposit Methods | Wire Transfer, Credit/Debit Card, PayPal, NETELLER, Payza, Skrill, OKPAY, Webmoney, Sticpay, Perfect Money, CryptoCurrency, Zelle |

Withdrawal Methods | Wire Transfer, Credit/Debit Card, PayPal, NETELLER, Payza, Skrill, OKPAY, Webmoney, Sticpay, Perfect Money, CryptoCurrency, Zelle |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5 |

FXGlory Pros & Cons

It is worth noting that FXGlory’s trading conditions are attractive on paper, but its lack of regulatory backing and relatively narrow market coverage play a key role in its overall evaluation.

Pros | Cons |

Extremely high leverage up to 1:3000 | No regulation by major financial authorities |

Very low minimum deposit starting from $1 | Limited range of tradable instruments |

Multiple account types with commission-free trading | High withdrawal fees on several payment methods |

Support for MT4 and MT5 with micro-lot trading | No copy trading, PAMM, or investment programs |

NordFX

Founded in 2008, NordFX is a global forex and CFD broker serving over 1.7 million clients across 190 countries. With more than 16 years of operational history, the broker focuses on high-leverage trading, multi-asset access, and competitive pricing models tailored to active traders.

NordFX provides four main account types, which are MT4 Pro, MT4 Zero, MT5 Pro, and MT5 Zero, with spreads from 0.0 pips and maximum leverage up to 1:1000. A low $10 minimum deposit makes entry accessible, while Zero accounts cater to high-volume and scalping strategies. The NordFX deposit and withdrawal article is suggested if you want to learn about the payment methods.

Trading is conducted exclusively on MetaTrader 4 and MetaTrader 5, supporting Expert Advisors (EAs), automated trading, advanced charting, and copy-trading via MQL5. NordFX also offers PAMM accounts, enabling passive investment in managed trading strategies.

From a regulatory perspective, NordFX operates through multiple offshore entities in Saint Lucia, Seychelles, and Mauritius. While segregated funds and negative balance protection apply to some branches, the broker is not regulated by top-tier authorities, which places greater responsibility on traders’ risk management.

Features and Specifics

Account Types | MT4 Zero, MT4 Pro, MT5 Zero, MT5 Pro |

Regulating Authorities | Not regulated |

Minimum Deposit | $10 |

Deposit Methods | Bank wire transfer, Credit/debit cards, E-wallets, Cryptocurrencies |

Withdrawal Methods | Bank wire transfer, Credit/debit cards, E-wallets, Cryptocurrencies, Internal Transfer |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4 / MT5 |

NordFX Pros & Cons

NordFX combines high leverage, ultra-tight spreads, and flexible account structures with a broad range of markets. However, the lack of strong regulatory oversight and restricted availability in several regions are important considerations before the NordFX registration.

Pros | Cons |

Leverage up to 1:1000 for flexible margin strategies | No regulation from top-tier financial authorities |

Spreads from 0.0 pips on Zero accounts | Restricted access for US, EU, Canada, and several countries |

Supports MT4 & MT5 with EAs, copy trading, and VPS | No proprietary trading platform |

PAMM accounts for passive investment opportunities | Limited investor protection and no compensation scheme |

TMGM

TMGM, short for TradeMax Global Markets, is an Australian forex and CFD broker that began operations in 2013. The broker provides access to over 12,000 tradable instruments, covering forex, stocks, indices, commodities, energies, and cryptocurrencies across retail and professional trading environments. Also, there is a TMGM rebate program available for reduced costs in trading.

TMGM operates under a multi-entity regulatory structure. Its primary Australian arm, Trademax Australia Limited, is regulated by ASIC (Tier-1), enforcing segregated client funds and negative balance protection. Additional global entities are licensed by VFSC, FSC, and CMA (Tier-3), offering higher leverage with different investor safeguards.

From a trading perspective, TMGM supports EDGE/ECN and CLASSIC accounts, with spreads from 0.0 pips and commissions starting at $3.5 per lot. Traders can access MT4, MT5, IRESS, and the TMGM Mobile App, benefiting from ECN execution, deep liquidity, and average execution speeds under 30 milliseconds.

To learn about the TMGM dashboard, go to the designated webpage.

Beyond standard trading, TMGM integrates copy trading and social trading through its HUBx ecosystem and rewards program. Clients earn redeemable points per traded lot, while professional and institutional traders can access IRESS tiers with tailored commission structures and higher capital requirements.

For information on payment methods other than credit cards, check out our TMGM deposit and withdrawal methods article.

Summary of Specifics

Account Types | EDGE/ECN, CLASSIC |

Regulating Authorities | ASIC – Australia, VFSC – Vanuatu, CMA -Kenya, FSC-Mauritius, FSA - |

Minimum Deposit | $100 |

Deposit Methods | VISA, MasterCard, Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Union Pay, Fasapay, Crypto (USDT, USDC) |

Withdrawal Methods | Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Crypto (USDT, USDC) |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, IRESS, TMGM Mobile App |

TMGM Pros & Cons

TMGM’s strengths and limitations become clearer when its advantages and drawbacks are viewed side by side. The broker emphasizes regulation, execution quality, and product depth, while some structural and cost-related aspects may not suit all trading profiles. A balanced overview of pros and cons is outlined below.

Pros | Cons |

Strong ASIC regulation with segregated funds | Inactivity fee after prolonged dormancy |

Over 12,000 tradable instruments | Limited diversity in retail account types |

Competitive ECN spreads and fast execution | Educational resources are relatively basic |

Copy trading, social trading, and rewards program | Offshore entities offer weaker investor protection |

LiteFinance

LiteFinance has operated since July2005, offering access to forex, stocks, metals, commodities, indices, and CFDs. The broker serves 3.01M+ clients and reports $24B average daily volume, reflecting long-term scale and liquidity across global markets.

Account choice is streamlined to CLASSIC and ECN. CLASSIC trades carry no commission with spreads from 1.8 points, while ECN provides zero-spread pricing with commissions (e.g., $5/lot on FX majors). Maximum leverage reaches 1:1000 under eligible entities.

Regulatory coverage varies by entity. CySEC (Tier-1) supervises the EU arm with ICF protection up to €20,000 and segregated funds, while the global entity is regulated by the Mauritius FSC (Tier-3), offering higher leverage and broad client eligibility.

Platforms include MT4, MT5, cTrader, and a proprietary mobile app, complemented by LiteFinance copy trading, PAMM, Islamic accounts, and frequent promotions. Support operates 24/5 in 15 languages, with offices in 15 countries.

To learn about the details of this broker’s funding options, including credit cards, visit the LiteFinance deposit/withdrawal methods page.

Broker Specifics

Account Types | CLASSIC, ECN |

Regulating Authorities | FSC |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, cTrader, Mobile App |

LiteFinance Pros & Cons

Below is a concise snapshot of strengths and limitations to help frame the detailed lists that follow.

Pros | Cons |

High leverage up to 1:1000 (eligible regions) | Limited account types (CLASSIC & ECN) |

ECN pricing with tight spreads and fast execution | No 24/7 customer support |

Broad platform lineup (MT4/MT5/cTrader/mobile) | Commission applies on ECN accounts |

Copy trading, PAMM, and frequent promotions | Tier-3 regulation for global entity |

How Have the Best Forex Brokers Accepting Credit Cards Been selected?

Choosing the Best Forex Brokers that Accept Credit Cards requires more than checking deposit speed or card availability. At TradingFinder, each broker is reviewed using a transparent, data-driven methodology designed to reflect real trading conditions and long-term reliability.

Our goal is to ensure that traders fund their accounts via credit cards with brokers that meet strict standards of security, cost efficiency, and performance.

TradingFinder analysts evaluate brokers based on 19 core metrics that directly affect trader capital and user experience. The process begins with regulations and licenses, verifying oversight by recognized financial authorities and the presence of client-fund protection mechanisms.

We then examine broker background data, including founding year, headquarters, and global office presence, to assess operational stability.

A major focus is placed on account type diversity, covering standard, ECN, micro, and managed structures, alongside the variety of tradable instruments such as forex pairs, CFDs, stocks, and ETFs. Since credit card users are sensitive to costs, commissions and fees, including card deposit charges, withdrawal costs, and inactivity fees, are analyzed through both official data and hands-on testing.

Our methodology also reviews deposit and withdrawal efficiency, trading platforms like MetaTrader 4, MetaTrader 5, and cTrader, plus mobile app performance. Factors such as account opening, KYC verification, copy trading availability, and customer support quality are carefully tested.

Finally, we incorporate Trustpilot scores, broker responsiveness, educational resources, infographics, alerts, and scam reports to form a balanced final rating. This structured approach ensures every credit-card-friendly forex broker featured on TradingFinder meets professional trading standards.

What Is a Credit Card?

A credit card is a widely used financial payment instrument that allows users to make purchases or deposits by borrowing funds from a card issuer up to a predefined credit limit. Instead of using existing funds, the cardholder repays the spent amount later, either in full or through installments, often with interest if the balance is not cleared within the billing cycle.

Credit cards are issued by banks and financial institutions in partnership with global payment networks such as “Visa” and “Mastercard”, enabling secure and near-instant transactions worldwide. In online trading, credit cards are commonly used to fund forex trading accounts due to their speed, convenience, and broad acceptance.

When used with forex brokers, credit cards allow traders to deposit capital quickly, often instantly, without relying on bank transfers or third-party wallets. However, credit card transactions may involve processing fees, cash-advance charges, or withdrawal limitations, depending on the broker and the card issuer’s policies.

From a forex trading perspective, credit cards are best suited for fast account funding rather than frequent withdrawals. Understanding how credit cards work, their cost structure, and their limitations is essential when choosing the best forex brokers that accept credit cards and managing trading capital efficiently.

Pros and Cons of Using Credit Cards

Using credit cards with forex brokers offers fast, convenient access to trading capital, making them popular among active traders. However, credit card funding also comes with specific cost, withdrawal, and risk considerations. Understanding both advantages and limitations helps traders choose suitable brokers and manage deposits responsibly.

Pros | Cons |

Instant or near-instant deposits | Higher deposit fees compared to bank transfers |

Widely accepted by top forex brokers | Withdrawals often restricted to original deposit amount |

Strong fraud protection and chargeback rights | Possible cash-advance fees from card issuers |

Easy to use without third-party wallets | Not ideal for frequent or large withdrawals |

Supported by global networks like Visa and Mastercard | Some brokers impose deposit limits on credit cards |

Do Credit Cards Come with Fees and Commissions?

Credit cards do come with fees and commissions, especially when they are used to fund forex trading accounts. While many brokers promote fast and convenient credit card deposits, the actual cost structure depends on both the forex broker and the card issuer.

From the broker’s side, credit card deposits may carry processing fees, typically ranging from low percentages to higher fixed-rate charges, depending on the broker’s liquidity providers and payment infrastructure. Some forex brokers absorb these costs to remain competitive, while others pass them directly to traders.

Withdrawals via credit cards are often more restricted and may include additional handling fees or limits tied to the original deposit amount.

On the card issuer’s side, banks may classify forex deposits as cash-like transactions, which can trigger cash-advance fees and immediate interest charges. These fees are imposed by the issuing bank, not the broker, and vary based on the card agreement. In addition, currency conversion fees can apply if the trading account currency differs from the card’s base currency.

Global payment networks such as Visa and Mastercard do not charge traders directly; instead, fees are determined by brokers and issuing banks operating on their networks.

For this reason, traders looking for the best forex brokers that accept credit cards should carefully review deposit terms, fee disclosures, and issuer policies to avoid unexpected costs and optimize overall trading expenses.

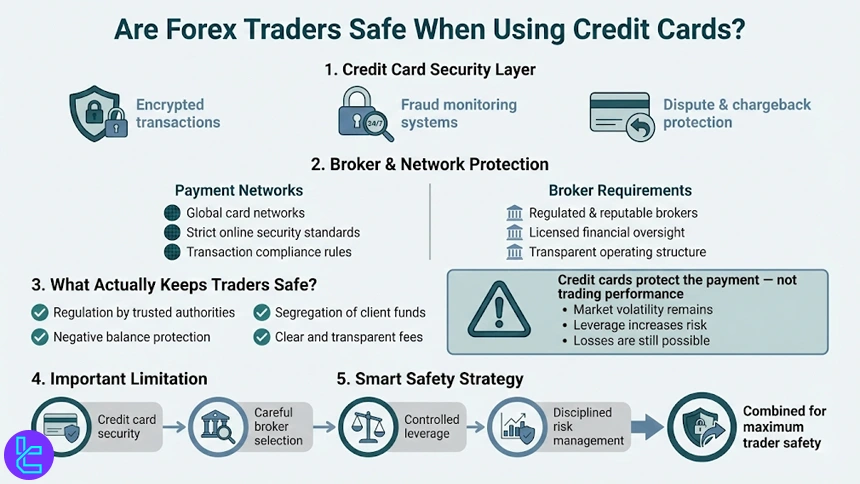

Are Forex Traders Safe When Using Credit Cards?

Forex traders are generally safe when using credit cards, provided they trade with regulated and reputable brokers. Credit card payments benefit from advanced security layers such as encryption, fraud monitoring, and dispute resolution mechanisms, which add an extra level of protection compared to many alternative funding methods.

Most top-tier forex brokers partner with globally recognized payment networks, which enforce strict security standards and compliance rules for online transactions. These networks allow cardholders to request chargebacks in cases of unauthorized activity or proven misconduct, offering an important safety net for traders.

However, payment security alone is not enough. Trader safety largely depends on whether the broker is licensed by reputable financial authorities and applies measures such as segregation of client funds, negative balance protection, and transparent fee disclosure.

It is also important to note that credit cards protect the payment transaction, not trading losses. Market risk, leverage exposure, and poor risk management can still lead to capital loss regardless of the funding method. For optimal safety, traders should combine credit card protections with proper broker selection, cautious leverage use, and disciplined risk control strategies.

What Should I Do If My Money Does Not Appear After Making a Deposit Through a Credit Card in a Forex Broker?

If a credit card deposit does not reflect immediately in your forex trading account, the issue is usually procedural. While credit card deposits are often instant, short delays can occur due to verification checks, banking rules, or broker-side processing.

To resolve the issue efficiently, follow these steps:

- Check the transaction status with your card issuer: Log in to your online banking or card app and confirm that the transaction is marked as completed and not pending or reversed;

- Review the broker’s deposit processing time: Some forex brokers apply additional internal checks for credit card funding, especially for first-time deposits or large amounts;

- Verify account and card details: Ensure the credit card holder’s name matches the trading account name exactly, as mismatches can delay or block deposits;

- Confirm minimum and maximum deposit limits: Deposits outside the broker’s allowed range may be temporarily held or rejected;

- Check for currency conversion issues: If your card currency differs from the trading account currency, conversion delays or intermediary checks may apply;

- Contact broker customer support: Reach out to the broker’s support team and provide the transaction ID, deposit time, and amount for faster investigation.

How Can I Make a Deposit/Withdrawal to/from a Broker Through a Credit Card?

Depositing to or withdrawing funds from a forex broker using a credit card is a straightforward process, but it follows specific rules set by brokers, banks, and card networks. Below is a clear step-by-step overview of how both transactions usually work.

How to Make a Deposit via Credit Card:

- Log in to your broker’s client dashboard and navigate to the “Deposit” or “Funds” section;

- Select “Credit Card” as the payment method;

- Enter the deposit amount and choose your trading account currency;

- Provide card details, including card number, expiry date, and CVV;

- Complete verification steps, such as 3D Secure or one-time passcodes;

- Confirm the transaction, after which funds are usually credited instantly or within minutes.

How to Make a Withdrawal to a Credit Card:

- Access the “Withdrawal” section in your broker’s dashboard;

- Select “Credit Card” as the withdrawal method (only up to the deposited amount in most cases);

- Enter the withdrawal amount and submit the request;

- Wait for broker approval, which may take 1–3 business days;

- Allow bank processing time, as credited funds may take additional days to appear on your card statement.

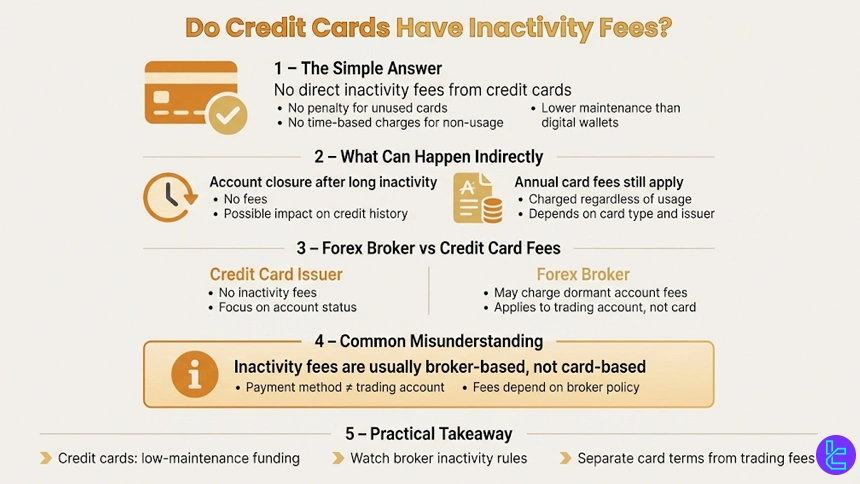

Do Credit Cards Have Inactivity Fees?

In most cases, credit cards do not charge inactivity fees simply for being unused. Unlike some digital wallets or brokerage accounts, major credit card issuers do not penalize cardholders for not making transactions over a certain period. This makes credit cards a relatively low-maintenance funding option for forex traders who deposit only occasionally.

However, inactivity-related costs can appear indirectly. Some banks may close inactive credit card accounts after long periods of non-use, which can impact credit history rather than generate direct fees. Additionally, annual card fees, if applicable, continue to apply regardless of whether the card is actively used.

When credit cards are used with forex brokers, any inactivity fees are typically imposed by the broker, not the card issuer. These fees relate to dormant trading accounts rather than the payment method itself. For this reason, traders should clearly distinguish between credit card inactivity and forex account inactivity.

Do Forex Brokers Have to Be Regulated by Specific Authorities to Accept Credit Cards?

Yes, forex brokers generally must meet strict regulatory and compliance standards to accept credit card payments, although there is no single global authority that mandates this requirement.

In practice, reputable brokers that offer credit card deposits are usually regulated by well-known financial authorities, as card processors and banks require strong oversight before enabling card transactions.

Payment networks impose rigorous compliance rules on merchants, including forex brokers. To gain access to these networks, brokers typically need authorization from recognized regulators such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or comparable authorities in Europe and offshore jurisdictions.

These regulators enforce standards related to capital adequacy, client fund segregation, anti-money-laundering (AML), and know-your-customer (KYC) procedures.

Unregulated or loosely supervised brokers often struggle to maintain stable credit card processing. Even if card deposits are temporarily available, they may be withdrawn without notice due to compliance failures, chargeback risks, or banking restrictions.

How Does Credit Card Compare to Other Payment Methods?

Credit cards remain one of the most widely supported payment options among Forex brokers, offering instant deposits and broad global acceptance. Compared to e-wallets like Skrill, Neteller, and PayPal, credit cards usually provide higher deposit limits and stronger consumer protection through chargeback rights.

However, they may involve higher processing fees and are less flexible for withdrawals, which are often routed back to the original card or via bank transfer. The table below highlights the key differences traders typically consider when choosing between these payment methods.

Parameter | Skrill | Neteller | PayPal | WebMoney |

Broker Acceptance | Widely accepted by Forex brokers | Widely accepted, similar to Skrill | Moderate; fewer Forex brokers support it | Limited; region-specific |

Deposit Speed | Instant to a few minutes | Instant | Instant to same day | Instant |

Withdrawal Speed | Same day to 24 hours | Same day to 24 hours | Fast; bank withdrawals may take longer | Instant to same day |

Transaction Fees | Low to moderate; broker-dependent | Low to moderate | Moderate to high in some cases | Generally low |

Supported Currencies | 40+ fiat currencies | Multiple fiat currencies | 25+ fiat currencies | Digital WM units (WMZ, WME, etc.) |

Security & Compliance | Strong KYC, FCA-regulated provider | Strong KYC under Paysafe Group | High consumer protection, strong fraud control | Strong authentication, passport system |

Typical Forex Deposit Limits | Low minimums; broker-defined caps | Low minimums; flexible limits | Often higher minimums and limits | Low minimums; depends on WM type |

Regional Availability | Global, strong in EU & Asia | Global, strong in Forex-friendly regions | Global but broker-limited | Strong in Eastern Europe & CIS |

Conclusion

Credit card payments are popular and quick, but they might show their downsides when it comes to withdrawals. BlackBull Markets, VT Markets, FXGlory, and NordFX are some of the best Forex brokers offering credit cards with fair trading fees and various account types.

If you are willing to know about the parameters considered in curating the list of top brokers, check out our Forex methodology.