The Egypt Financial Regulatory Authority (FRA), previously known as the Egyptian Financial Supervisory Authority (EFSA), is a relatively new financial body, starting in 2009. The department does not restrict brokers from foreign countries to provide services in the country.

For choosing the best broker as an Egypt-based trader, you should pay attention to the spreads, commissions, tradable instruments, account types, and other important factors based on your preferences.

| Tickmill | |||

| FXTM | |||

| D Prime | |||

| 4 |  | XM | ||

| 5 |  | OctaFX | ||

| 6 |  | HFM | ||

| 7 |  | Deriv | ||

| 8 |  | FBS |

Trustpilot Ratings for Forex Brokers in Egypt

Trustpilot is a reliable source for evaluating a brand’s performance and reputation based on user experience.

Broker Name | Trustpilot Rating (Out of 5) | Number of Reviews |

HFM | 4.6⭐ | 2,830 |

Deriv | 4.4⭐ | 69,319 |

FBS | 4.3⭐ | 8,009 |

4.0⭐ | 8,779 | |

Tickmill | 3.6⭐ | 1,057 |

XM | 3.5⭐ | 2,830 |

D Prime | 3.1⭐ | 460 |

2.6⭐ | 1,072 |

Low-Spread Trading in Forex Brokers for Egypt Residents

If you aim for low spreads in trading Forex symbols, here are some of the best options with high-quality services.

Broker Name | Min. Spread |

HFM | 0 Pips |

FxPro | 0 Pips |

0 Pips | |

0 Pips | |

VT Markets | 0 Pips |

TMGM | 0 Pips |

Deriv | 0.24 Pips |

XM | 0.6 Pips |

Egypt Forex Brokers with Fair Non-Trading Fees

Deposit/withdrawal commissions and inactivity fees are the most common non-trading costs in brokers. The table below mentions those with lower fees.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

D Prime | None | None | None |

None | None | $5 | |

Tickmill | None | None | $10 |

TMGM | None | None | $10 |

XM | None | None | $10 |

None | None | $25 | |

ATFX | None | 5 Units for Under 100 USD/EUR/GBP | $10 |

Alpari | Varies | Varies | $10 |

Brokers with High Number of Tradable Instruments for Egypt Traders

If the high diversity in tradable markets is important for you, then you should look into the list in this section.

Broker Name | Number of Instruments |

TMGM | 12,000+ |

D Prime | 10,000+ |

1,400+ | |

HFM | 1,000+ |

GO Markets | 1,000+ |

550+ | |

SwissQuote | 400+ |

easyMarkets | 200+ |

Top 6 Forex Brokers for Egypt-Based Traders

The next sections will be dedicated to digging into the details of each top broker for traders residing in Egypt considering the most important parameters.

Tickmill

Tickmill is a globally active Forex and CFD broker founded in 2014 and operating across more than 180 countries. The broker is regulated by multiple authorities, including the FCA, CySEC, FSA, FSCA, and LFSA, offering a layered regulatory structure that enhances transparency and fund protection.

Client funds are held in segregated accounts, with negative balance protection available across all major entities.

Tickmill provides access to Forex and key CFD markets with spreads starting from 0.0 pips and leverage of up to 1:1000 for non-European clients, which can be attractive for traders in Egypt seeking flexible margin conditions. Trading is conducted via MetaTrader 4 and MetaTrader 5, supporting fast execution under a no-dealing-desk model.

The broker offers Classic and Raw accounts with a minimum deposit of $100, supports Islamic swap-free accounts, and allows multiple base currencies. This structure suits cost-conscious and strategy-focused traders looking for efficient execution and clear pricing.

Summary of Specifics

Account Types | Classic, Raw |

Regulating Authorities | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Deposit | $100 |

Deposit Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Withdrawal Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Tickmill Pros and Cons

Knowing about the benefits and drawbacks gives you a fair perspective of the broker before going through the Tickmill registration.

Pros | Cons |

Regulated In Multiple Top-Tier Jurisdictions | Low Variety On Account Types |

Advanced Trading Platforms For Futures And Options | Relatively Low Amount Of Forex Pairs |

Educational Resources And Copy Trading Services | - |

Popular Trading Platforms Supported | - |

FXTM

FXTM, also known as ForexTime, is an international Forex and CFD broker established in 2011 and serving traders across more than 150 countries. The company operates under Exinity Limited and is currently regulated by the FSC of Mauritius, offering segregated client funds and a market execution model.

While its regulatory coverage is offshore-focused, FXTM remains accessible to traders in Egypt seeking high leverage and platform flexibility.

FXTM provides access to Forex, stocks, indices, commodities, metals, and cryptocurrencies, with leverage reaching up to 1:3000 for eligible clients. Trading is available through MetaTrader 4, MetaTrader 5, and the proprietary FXTM Trader App, supporting both desktop and mobile execution.

You can participate in the FXTM rebate program to save money on trading commissions and spreads.

The broker offers Advantage and Advantage Plus accounts with spreads from 0.0 pips and a minimum deposit of $200. Islamic swap-free accounts and copy trading via FXTM Invest are also available, making FXTM suitable for traders prioritizing leverage, platform choice, and diversified instruments.

Broker Specifics

Account Types | Advantage, Stocks Advantage, Advantage Plus |

Regulating Authorities | FSC |

Minimum Deposit | $200 |

Deposit Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Withdrawal Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, FXTM Trader App |

FXTM Pros and Cons

Before going through the FXTM registration and investing in the broker, be aware of its advantages and disadvantages.

Pros | Cons |

Wide Range of Trading Instruments | Improper Performance in The Regulatory |

Competitive Spreads and Low Commissions | Limited Cryptocurrency Offerings |

Advanced Trading Platforms (MT4, MT5) | Higher Minimum Deposits in Comparison with Other Brokers |

Excellent Educational Resources | No US Clients Accepted |

Multiple Account Types to Suit Different Traders | - |

D Prime

D Prime, formerly known as Doo Prime, is a multi-asset Forex and CFD broker established in 2014 and headquartered in Hong Kong. The broker operates through offshore-regulated entities under the VFSC and FSC, providing access to global markets for traders outside heavily restricted jurisdictions.

Client funds are segregated, and selected entities offer negative balance protection, although no top-tier regulatory licenses are in place.

D Prime supports Forex, indices, commodities, metals, cryptocurrencies, and securities, with over 10,000 tradable instruments available. Leverage can reach up to 1:1000, which may appeal to traders in Egypt seeking flexible margin conditions.

Trading is conducted via MetaTrader 4, MetaTrader 5, and the proprietary Doo Prime InTrade platform, using market execution.

The broker offers Cent, STP, and ECN accounts, with minimum deposits starting from $0 on Cent and $100 on STP and ECN accounts. Islamic swap-free options and copy trading solutions such as PAMM and FOLLOWME are also supported.

If you are interested in opening an account and giving the broker a chance, check out our D Prime registration guide.

D Prime Specifics

Account Types | Cent, STP, ECN |

Regulating Authorities | VFSC, FSC |

Minimum Deposit | None |

Deposit Methods | Local bank Transfers, E-wallets, International Wire Transfers, Credit/Debit Card |

Withdrawal Methods | Local bank Transfers, E-wallets, International Wire Transfers, Credit/Debit Card |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Doo Prime InTrade |

D Prime Pros and Cons

For an overview of D Prime’s benefits and drawbacks, look at the table below.

Benefits | Drawbacks |

Over 10,000 Tradable Instruments | No License from Any Top-Tier Authorities |

3 Different Account Types | Education Content Only for Registered Users |

24/7 Customer Support | - |

XM

XM Group is an international Forex and CFD broker founded in 2009, serving millions of clients across multiple regions through a network of regulated entities. The broker operates under authorities such as CySEC, FSCA, DFSA, FSC, and FSA, providing segregated client funds and negative balance protection across retail accounts.

This multi-jurisdiction structure supports transparency and operational stability for traders in Egypt seeking offshore access.

XM offers access to Forex, commodities, indices, shares, metals, and cryptocurrencies through MetaTrader 4 and MetaTrader 5.

Traders can benefit from leverage of up to 1:1000, with execution policies designed to reduce requotes and support fast order handling. Spreads start from around 0.6 pips, depending on account type and market conditions.

Also, an XM copy trading option is available for earning passive income besides trading profits.

With a minimum deposit of $5, Islamic swap-free accounts, and multiple base currencies, XM is well suited for Egyptian traders looking for low entry costs, flexible leverage, and a MetaTrader-focused trading environment.

The table below summarizes the broker’s details.

Account Types | Standard, Ultra Low, Shares |

Regulating Authorities | FSC Belize, CySEC Cyprus, FSCA South Africa, DFSA Dubai, FSC Mauritius, FSA Sechelles |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

XM Pros and Cons

Here are the broker’s noteworthy pros and cons at a glance that are essential to know before going through XM registration.

Pros | Cons |

Wide Range of Trading Instruments | Inactivity Fees |

Low Minimum Deposit | - |

Multiple Regulatory Licenses | - |

Negative Balance Protection | - |

OctaFX

OctaFX is a global Forex and CFD broker established in 2011 and headquartered in Saint Lucia, serving traders across more than 180 countries.

The broker operates under FSCA and MISA regulation, applies segregated client funds, and offers negative balance protection across its main entities. With over 40 million accounts opened, OctaFX has built a strong presence in emerging markets, including Egypt.

OctaFX provides access to Forex, indices, commodities, metals, stocks, and cryptocurrencies using an ECN-STP execution model.

Trading is available via MetaTrader 4, MetaTrader 5, and the proprietary OctaTrader platform, with floating spreads starting from 0.6 pips and no trading commissions. Leverage can reach up to 1:1000 for eligible non-EU clients.

To get familiar with the broker’s user interface, read our OctaFX dashboard review.

The broker requires a minimum deposit of $25, supports Islamic swap-free accounts by default, and offers copy trading through Octa Copy. These conditions make OctaFX suitable for Egyptian traders seeking low entry costs, high leverage, and commission-free pricing.

Summary of Features

Account Types | MT4, MT5, OctaTrader |

Regulating Authorities | FSCA, MISA |

Minimum Deposit | $25 |

Deposit Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Withdrawal Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, proprietary OctaTrader, and Copy trading app |

OctaFX Pros and Cons

Before going through with OctFX registration, learn about the broker’s strengths and weaknesses.

Pros | Cons |

Regulated in South Africa (FSCA) | Limited regulation compared to other top-tier brokers |

Competitive spreads starting from 0.6 pips | Limited range of tradable assets compared to some competitors |

No commissions on withdrawals | Regular changes in payment options |

High leverage up to 1:1000 | - |

Copy trading feature available | - |

HFM

HFM, is an international Forex and CFD broker founded in 2010 and operating through multiple regulated entities worldwide. The broker is supervised by authorities such as the FCA, CySEC, DFSA, FSCA, and FSA, offering segregated client funds and negative balance protection across its retail accounts.

This multi-entity regulatory structure provides operational stability and broad market access for traders in Egypt.

HFM offers trading in Forex, metals, indices, commodities, stocks, ETFs, bonds, and cryptocurrencies via MetaTrader 4, MetaTrader 5, and its proprietary mobile app.

To learn about the broker’s user interface and account management features, visit our HFM Dashboard page.

Leverage can reach up to 1:2000 for eligible non-European clients, with spreads starting from 0.0 pips on Zero accounts and commission-free pricing on most other account types. You can participate in the HFM rebate program to reduce commissions and spreads.

With a minimum deposit from $0, Islamic swap-free accounts, and multiple account structures including Cent, Pro, and Premium, HFM suits Egyptian traders seeking flexible leverage, low entry barriers, and diversified asset exposure.

HFM Specifics

Account Types | Cent, Zero, Pro, Premium |

Regulating Authorities | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Deposit | From $0.00 |

Deposit Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Withdrawal Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

HFM Pros and Cons

Before visiting the HFM registration page and opening an account, learn about its ups and downs.

Pros | Cons |

Multi-regulated | Geo-restrictions |

Wide range of trading instruments | Limited platform offerings |

Diverse account types | Technical issues |

Competitive spreads and leverage | Reports of poor customer support |

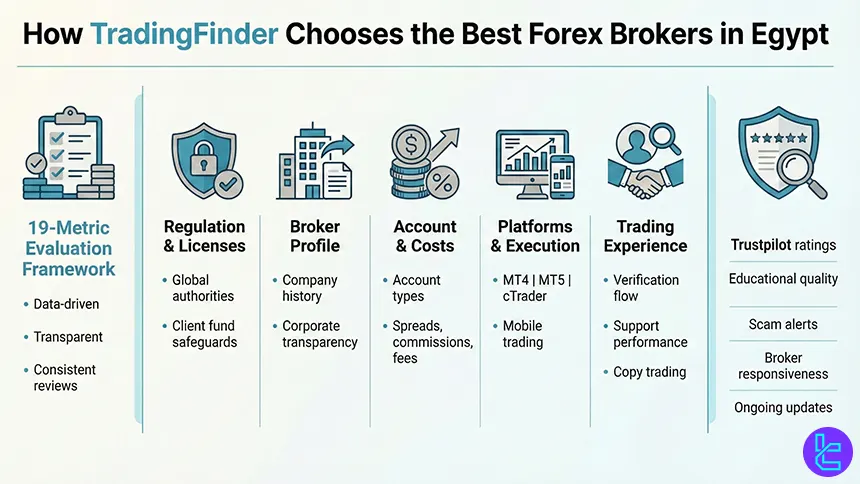

How Did We Choose the Best Forex Brokers for Egypt?

When compiling the Best Forex Brokers in Egypt, the evaluation process is built on a data-driven and transparent framework developed by TradingFinder. Choosing a forex broker is a high-stakes decision, as traders are placing real capital with international financial institutions.

For this reason, TradingFinder applies a 19-metric broker review methodology designed to assess not only surface-level features but also operational integrity, cost efficiency, and long-term reliability for Egypt-based traders.

The analysis begins with regulations and licenses, verifying whether brokers operate under reputable global authorities and maintain safeguards for client funds. This is followed by a detailed broker profile review, including establishment history, headquarters, and corporate transparency.

Equal importance is given to account type diversity, ensuring availability of Standard, ECN, Micro, PAMM, or copy trading accounts suitable for different trading styles.

TradingFinder also evaluates the range of tradable instruments, covering forex pairs, CFDs, indices, stocks, and ETFs, alongside a close inspection of commissions, spreads, non-trading fees, and withdrawal costs, as these directly affect net profitability. Trading platforms and apps such as MetaTrader 4, MetaTrader 5, cTrader, and mobile terminals are tested for execution quality and usability.

Additional metrics include deposit and withdrawal efficiency, account opening and verification flow, copy trading infrastructure, and customer support performance, assessed through real interactions and response-time tracking.

The methodology further incorporates educational materials, Trustpilot ratings, news transparency, infographic clarity, broker responsiveness, scam alerts, and even corporate social responsibility activities.

This structured approach ensures that every broker featured in this Egypt-focused guide meets practical, regulatory, and experiential standards aligned with active forex traders’ needs.

How Can I Verify if a Broker is Regulated?

Verifying a broker’s regulatory status is a critical step before opening a forex trading account, especially for traders based in Egypt who often use international platforms. The most reliable method is to cross-check the broker’s license directly with the official website of the financial regulator it claims to be supervised by.

Reputable authorities include the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and Australian Securities and Investments Commission (ASIC).

#1 Check the Broker’s Claimed Regulator on Official Websites

The first step in verifying a broker’s regulation is identifying which financial authority the broker claims to be licensed by. Always visit the official website of the regulator and search the broker’s name or license number in the public register.

#2 Verify the License Number and Legal Entity

A regulated broker must publish a license or registration number in its legal disclosure section. This number should exactly match the details shown on the regulator’s database, including the company name, authorization status, and registered address.

Any discrepancy between the broker’s website and the regulator’s records may indicate misrepresentation.

#3 Confirm You Are Trading Under the Regulated Subsidiary

Many international brokers operate multiple legal entities, including offshore companies with limited oversight. Even if a broker is regulated, traders must confirm that their account is opened under the licensed entity, not an unregulated offshore branch. This information is usually stated during the account-opening process or within the client agreement.

#4 Look for Regulatory Warnings and Independent Reviews

Checking official warning lists published by regulators is another essential step. In addition, platforms such as TradingFinder analyze regulatory claims, monitor compliance history, and highlight scam alerts or license suspensions. Using both regulator databases and independent reviews provides a more complete assessment of broker legitimacy.

Forex Trading Legality in Egypt

Forex trading in Egypt is not illegal, but it operates within a regulated and restrictive legal framework that traders must clearly understand.

The Egyptian financial system is primarily overseen by the Central Bank of Egypt (CBE), which regulates banking activities, foreign exchange flows, and cross-border currency transactions. However, the CBE does not issue retail forex trading licenses to online brokers.

At the same time, the Egyptian Financial Regulatory Authority (FRA) supervises non-banking financial markets such as securities, insurance, and capital market activities.

Retail online forex trading through international brokers does not fall under direct FRA authorization, which means there are currently no locally licensed forex brokers in Egypt.

As a result, Egyptian traders commonly access forex markets through international brokers regulated in jurisdictions such as the UK, EU, or Australia. While this practice is widely used, it exists in a legal gray area, meaning traders are responsible for choosing reputable, well-regulated offshore brokers and managing compliance risks themselves.

Importantly, trading forex for personal investment is not prohibited, but marketing or operating unlicensed brokerage services inside Egypt is restricted. For this reason, regulatory verification, broker transparency, and strong investor protection measures are especially critical for Egypt-based traders engaging in global forex markets.

Is There a Leverage Cap for Forex Trading in Egypt?

Egypt does not impose a specific domestic leverage cap for retail forex traders, mainly because online forex trading is not directly regulated by a local licensing authority. Since the Central Bank of Egypt does not supervise retail forex brokers, leverage limits are not defined under Egyptian financial law for individual traders.

In practice, leverage conditions for Egypt-based traders are determined by the regulatory jurisdiction of the broker, not by Egypt itself.

For example, brokers regulated under the European Securities and Markets Authority (ESMA) must apply a maximum leverage of 1:30 for major forex pairs for retail clients. Similarly, brokers overseen by the Financial Conduct Authority (FCA) enforce the same leverage restrictions.

By contrast, brokers regulated in offshore jurisdictions such as Seychelles, Mauritius, or St. Vincent and the Grenadines may offer significantly higher leverage, sometimes reaching 1:500 or more. While higher leverage can increase market exposure, it also amplifies downside risk, making risk management and margin control essential.

Platforms like TradingFinder factor leverage policies into their broker evaluations by balancing flexibility with regulatory safety. For Egypt-based traders, the key consideration is not just how high leverage can go, but which regulator enforces the leverage rules and what protections are attached to them.

Do Forex Brokers Employ Negative Balance Protection in Egypt?

Negative Balance Protection is not mandated by Egyptian financial law, as retail forex trading is not directly regulated by a domestic licensing authority. Since the Central Bank of Egypt does not supervise online Forex brokers, the availability of this protection depends entirely on the broker’s regulatory jurisdiction, not the trader’s location.

In practice, Egypt-based traders may encounter different levels of Negative Balance Protection depending on where the broker is regulated:

- Regulated under top-tier authorities such as the FCA or ESMA: These brokers are required to ensure clients cannot lose more than their deposited funds, even during extreme market volatility;

- Regulated under offshore jurisdictions: Negative Balance Protection may be optional, conditional, or entirely absent, and is often subject to internal broker policies rather than legal enforcement;

- Account-type dependent protection: Some brokers apply Negative Balance Protection only to retail accounts, excluding professional or high-leverage account structures.

Given the potential for sharp price gaps and rapid market moves, confirming this feature before opening an account is a key risk-control step rather than a secondary consideration.

Do Forex Traders in Egypt Have to Pay Taxes?

Forex taxation in Egypt is not governed by a dedicated, forex-specific tax framework, which often creates uncertainty for active traders. At present, there is no explicit law that directly targets retail forex trading profits, particularly when trading is conducted through international brokers. However, this does not automatically mean that profits are tax-free.

Tax matters in Egypt fall under the authority of the Egyptian Tax Authority, which applies income tax rules based on the nature, frequency, and source of earnings.

If forex trading is carried out regularly and resembles a professional or income-generating activity, profits may be classified as taxable income, especially when funds are transferred into local bank accounts. In contrast, occasional or passive trading activity is less likely to attract scrutiny, although this is not formally codified.

Another important factor is capital repatriation. While the Central Bank of Egypt does not prohibit Egyptians from trading with offshore forex brokers, inbound transfers of trading profits into Egypt may draw attention depending on transaction size, consistency, and declared income sources.

Forex brokers themselves do not withhold taxes on behalf of Egyptian clients, meaning all reporting responsibility rests with the trader.

Forex Trading in Egypt Compared to Other Regions

Forex trading in Egypt operates in a distinctly different regulatory environment compared to major global financial hubs. While trading is not illegal, Egypt lacks a dedicated domestic licensing framework for retail forex brokers, pushing traders toward internationally regulated platforms.

In contrast, regions such as the EU and Singapore apply structured oversight, leverage caps, and mandatory investor protections. Emerging markets like Thailand offer greater flexibility but fewer statutory safeguards.

The comparison below highlights how Egypt stands against selected jurisdictions in terms of regulation, leverage, protection standards, and overall trading conditions.

Comparison Factor | Egypt | |||

Primary Regulator | Financial Regulatory Authority (FRA) – no retail forex licensing | Autorité des Marchés Financiers (AMF) under ESMA | Monetary Authority of Singapore (MAS) | SEC Thailand & Bank of Thailand |

Regulatory Framework | No domestic retail forex framework; offshore access common | EU-wide MiFID II & ESMA | National framework under MAS (non-EU) | National oversight; limited retail forex licensing |

Retail Leverage Cap (Forex Majors) | No local cap; broker-dependent | 1:30 | ~1:20 | Not formally capped; broker-dependent |

Investor Protection Level | Moderate; depends on broker regulation | Very high | High | Moderate |

Negative Balance Protection | Not mandated; broker-dependent | Mandatory | Not mandatory; commonly offered | Not enforced; broker-dependent |

Client Fund Segregation | Depends on broker’s regulator | Mandatory | Mandatory | Depends on broker regulation |

Broker Transparency Requirements | Determined by offshore regulator | Strict EU disclosure rules | Strict capital & disclosure standards | Formal licensing & disclosure (limited scope) |

Broker Availability | International offshore brokers | Broad EU access via passporting | MAS-licensed local & global brokers | Local CMA/SEC entities & internationals |

Access to International Brokers | High | High | High | High |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader |

Maximum Loss Protection | Broker-dependent | Cannot lose more than deposit | Entity-dependent | Broker-dependent |

Tax Treatment of Forex Profits | Potentially taxable as income | Flat tax (PFU) or progressive | Often tax-free for retail investors | Taxed as personal income |

Conclusion

Egypt Forex traders do not face much scrutiny and regulatory restrictions; every broker from around the world can offer its services to Egypt-based clients. However, in such regions, more caution and research are advised.

HFM, Deriv, FBS, and OctaFX are some of the best choices for traders from Egypt with high Trustpilot ratings of over 4 out of 5 and fair commissions overall.

For a deepe breakdown of the full evaluation framework in curating the list of brokers, see our detailed Forex methodology.