Forex trading in Germany and other European markets has been going through a strong growth with over $380B of average daily volume in 2025. The country has one of the most stringent financial authorities in the EU and the globe, that is the Federal Financial Supervisory Authority (BaFin).

A brokerage must have a license from FFSA or another top-tier European authority to operate in Germany.

If you are a resident of Germany, here are the best choices you have for trading in Forex.

| Vantage Markets | |||

| Pepperstone | |||

| Eightcap | |||

| 4 |  | FxPro | ||

| 5 |  | Tickmill | ||

| 6 |  | AvaTrade | ||

| 7 |  | ActivTrades | ||

| 8 |  | eToro | ||

| 9 |  | City Index | ||

| 10 |  | FXTM |

Forex Brokers in Germany with Highest Trustpilot Ratings

For a better perspective of the reputation and the quality of services of the mentioned brokers, look at the respective Trustpilot ratings.

Broker | Trustpilot Rating (out of 5) | Number of Reviews |

4.7 ⭐ | 11,468 | |

Vantage Markets | 4.5 ⭐ | 11,350 |

Pepperstone | 4.3 ⭐ | 3,195 |

eToro | 4.2 ⭐ | 29,859 |

4.2 ⭐ | 393 | |

4.1 ⭐ | 3,353 | |

ActivTrades | 3.9 ⭐ | 1,249 |

FxPro | 3.8 ⭐ | 862 |

Tickmill | 3.6 ⭐ | 1,050 |

FXTM | 2.6 ⭐ | 1,076 |

Germany Brokers Compared Based on Spreads

Usually, top brokers offer trading with lower spreads and commissions, and that is one of the reasons for their popularity. Always consider the costs when choosing a Forex brokerage since it directly affects profits.

The table below outlines the minimum spreads in select brokers.

Broker | Min. Spread |

Eightcap | 0 Pips |

0 Pips | |

0 Pips | |

VT Markets | 0 Pips |

Pepperstone | 0 Pips |

Interactive Brokers | 0 Pips |

D Prime | 0 Pips |

0 Pips | |

AvaTrade | 0 Pips |

eToro | 0.2 Pips |

How Much Are the Non-Trading Fees at the Brokers in Germany?

Here are some of the brokers with the least non-trading costs and fees in the Forex market.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Eightcap | $0 | $0 | No |

Pepperstone | $0 | $0 | No |

Fx Pro | $0 | $0 | Yes |

$0 | $0 | Yes | |

Tickmill | $0 | $0 | Yes |

$0 | $5 for USD Accounts | Yes | |

Saxo | $0 | 30 AUD for Manual WIthdrawal | No |

Interactive Brokers | $0 | Varies | No |

VT Markets | $0 | Varies | No |

AvaTrade | $0 | Varies | No |

Tradable Instruments of the Forex Brokers in Germany

The higher number of tradable instruments means more options and better diversity. The table below compares the most notable brokers in terms of trading symbols.

Broker | Number of Instruments |

Interactive Brokers | 4.9K+ |

Plus500 | 2.8K+ |

FxPro | 2.1K+ |

AvaTrade | 1.25K+ |

1.2K+ | |

ActivTrades | 1K+ |

1K+ | |

Eightcap | 800+ |

Tickmill | 600+ |

IronFX | 500+ |

Top 8 Best Forex Brokers for Germany

In the following sections, each broker will be introduced, considering the important factors for traders who reside in Germany.

Eightcap

Eightcap is a multi-regulated CFD and Forex broker operating under ASIC, FCA, CySEC, and SCB, giving it strong regulatory credibility for traders in Germany seeking oversight from top-tier authorities.

Founded in 2009 in Melbourne, the broker has expanded globally and now offers access to over 800 tradable instruments, including forex pairs, indices, commodities, metals, shares, and cryptocurrency CFDs, which is one of the most extensive crypto-derivatives selections among retail brokers.

Depending on jurisdiction, leverage can reach 1:500, although regulatory caps such as 1:30 apply in regions like the EU.

All accounts share the same minimum deposit of $100, margin call level of 80%, and stop-out level of 50%. We have a guide for Eightcap registration that you may check out if you have decided to open an account.

In terms of platforms, Eightcap supports MetaTrader 4, MetaTrader 5, and TradingView. The broker also integrates several advanced tools: Capitalise.ai for code-free automation, FlashTrader for rapid order execution and position sizing, and an AI-powered economic calendar for data-driven decision-making.

There is an Eightcap rebate program available that can be utilized to reduce costs and commissions while trading with this broker.

Eightcap Summary of Specifics

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:30 in EU |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

The broker has a set of benefits and drawbacks similar to any other options in the industry.

Pros | Cons |

Competitive Spreads | High minimum deposit |

Third-Party Platform Integration | Basic Educational Resources |

Strong Regulation | Platform Restrictions |

FxPro

FxPro is an established multi-regulated Forex and CFD broker founded in 2006 and operates under the supervision of the FCA, CySEC, FSCA, and the Securities Commission of the Bahamas.

Retail clients benefit from negative balance protection, segregated client funds, and a regulatory structure that aligns with European investor protection standards.

FxPro offers access to more than 2,100 financial instruments across Forex, indices, shares, metals, energies, cryptocurrencies, and futures.

German traders can choose from MT4, MT5, cTrader, and a proprietary mobile app. The average execution speed is under 12 milliseconds, which positions FxPro among the faster brokers in the industry.

Funding methods include bank transfer, Visa and Mastercard, PayPal, Skrill, and Neteller, with no additional fees in standard situations. FxPro also offers a dedicated copy trading service called FxPro CopyTrade that allows users to follow verified trading strategies on MT4 and MT5. For a comprehensive review of the broker's interface, visit our FxPro dashboard page.

Also, you can register your account through the FxPro rebate offer to trade with lower fees.

Summary of Specs

Account Types | Standard, Pro, Raw+, Elite |

Regulating Authorities | FCA, FSCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | 1:30 for European Clients |

Trading Platforms & Apps | MT4, MT5, cTrader, Web Trader, Mobile Appz |

FxPro Pros and Cons

Here's an outline of the important benefits and drawbacks of the broker.

Pros | Cons |

Variety of funding options | Doesn’t offer 24/7 customer support |

Competitive spreads and fast execution | High minimum deposit |

Multiple regulated entities | - |

Vantage Markets

Vantage Markets is an online Forex and CFD broker founded in 2009 and headquartered in Sydney, Australia, with a growing network of more than 30 offices worldwide. The company operates under several respected regulators, including ASIC in Australia, the FCA in the United Kingdom, the FSCA in South Africa, VFSC, and CIMA.

Clients at Vantage Markets can trade a broad range of instruments across Forex, indices, commodities, shares, and ETFs, with maximum leverage up to 1:30 for European standards.

Account options cover Standard STP, Standard Cent, Raw ECN, Pro ECN, and Swap Free accounts with a minimum deposit of only $20.

A Google score of 4.3 out of 5, 24-hour customer support, and frequent trading promotions further support Vantage Markets’ profile as a competitive choice for Germany-based traders who want a flexible and globally connected broker.

Here’s an overview of the broker’s features and products.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FSCA, VFSC, FCA, CIMA |

Minimum Deposit | $20 |

Deposit Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, and local payment options |

Withdrawal Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, and local payment options |

Maximum Leverage | 1:30 in EU |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, ProTrader, TradingView, proprietary application |

Vantage Markets Pros and Cons

Before going through with the Vantage Markets registration, check out the broker's advantages and disadvantages that are worth mentioning.

Pros | Cons |

Fast execution speeds | No proprietary desktop trading platform |

Advanced & popular trading platforms (MT4, MT5) | High minimum deposit for Pro ECN account |

Competitive spreads, especially on ECN accounts | - |

Supervised by Several High-ranking Authorities | - |

Pepperstone

Pepperstone has operated since 2010 and runs a regulated multi-entity structure that includes Pepperstone GmbH for Germany under BaFin oversight, with EdW compensation coverage up to 20,000 EUR.

It supports a broad CFD lineup across forex, indices, commodities, shares, crypto, and ETFs, alongside access to 10 base currencies, including EUR and CHF. Trading is available on MetaTrader 4, MetaTrader 5, cTrader, TradingView, and Pepperstone’s proprietary web and mobile platforms. The broker offers discounts through the TradingFinder Pepperstone rebate program.

The broker’s core account setup centers on Standard and Razor, with Razor targeting tighter pricing through raw spreads from 0.0 pips plus a per-side commission.

For opening an account, you can check out our guide for Pepperstone registration.

Risk controls include segregated client funds and negative balance protection, while order sizing ranges from 0.01 to 100 lots.

Pepperstone’s Specifics

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Deposit | $1 |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Maximum Leverage | 1:30 in EU |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Pepperstone Pros and Cons

The table below outlines the broker’s significant pros and cons.

Pros | Cons |

Deep liquidity | Limited access to the demo account |

Various options for trading platforms | - |

An extensive selection of tradable instruments across multiple asset classes | - |

Regulated by ASIC, CySEC, and several top-tier regulators | - |

City Index

City Index is a long-established Forex and CFD broker founded in London in 1983 and operating under the global StoneX Group. The broker provides access to more than 13,500 markets across Forex, indices, commodities, shares, bonds, and selected crypto CFDs, making it suitable for German traders seeking broad market coverage through a single platform.

City Index is regulated by tier-1 authorities, including the Financial Conduct Authority, Australian Securities and Investments Commission, and the Monetary Authority of Singapore, and offers segregated client funds and negative balance protection for retail traders.

Trading is commission-free, with spreads starting from 0.5 points on MT4, alongside access to the broker’s proprietary web platform and TradingView integration.

For traders in Germany, City Index supports EUR-denominated accounts, low minimum trade sizes from 0.01 lots, and professional account options with higher leverage eligibility. Its combination of strong regulation, deep liquidity, and platform flexibility positions City Index as a reliable Forex broker for experienced and multi-asset-focused traders.

Here’s a summary of the broker’s specifics.

Account Types | Classic, Platinum, VIP, Pro |

Regulating Authorities | FSA, ASIC, FCA, FINMA, MAS, SFC, JFSA |

Minimum Deposit | $0.0 |

Deposit Methods | Bank Wire |

Withdrawal Methods | Bank Wire |

Maximum Leverage | 1:30 in EU (1:66 for Professional accounts) |

Trading Platforms & Apps | Saxo Investor, SaxoTrader Go, SaxoTrader Pro |

City Index Pros and Cons

Before signing up and getting started with City Index, check out its advantages and disadvantages.

Pros | Cons |

Strong regulatory oversight | inactivity fees on dormant accounts |

Wide range of trading instruments (over 13,500) | High stock trading fees |

Competitive spreads | Web Trader has an old design and outdated design |

Comprehensive educational resources | - |

ActivTrades

ActivTrades is headquartered in London and has operated since 2001, with regulation led by the FCA in the UK. Client safeguards include FSCS protection up to GBP 85,000 and additional insurance of up to GBP 1,000,000 per client, alongside segregated funds and negative balance protection.

The broker offers forex and CFD access across shares, indices, commodities, ETFs, bonds, and cryptocurrencies, with retail leverage up to 1:30 and up to 1:400 for professional accounts.

Pricing is spread-based with floating spreads from 0.5 pips, and trade sizing starts from 0.01 lots with no minimum deposit requirement.

Platform coverage includes MT4, MT5, TradingView, and the proprietary ActivTrader suite. Customer support is available 24/5 via 3 channels [live chat, phone call, ticket]. If you already want to open an account, go through the ActivTrades registration tutorial.

Summary of Key Features

Account Types | Professional, Individual, Demo, Islamic |

Regulating Authorities | FCA, SCB, CMVM, BACEN, CVM |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, Credit/Debit Cards (Visa, MasterCard), E-Wallets (Skrill, Neteller), Local Payment Methods |

Withdrawal Methods | Bank Wire, Credit/Debit Cards (Visa, MasterCard), E-Wallets (Skrill, Neteller), Local Payment Methods |

Maximum Leverage | 1:30 in EU, 1:400 for Professional accounts |

Trading Platforms & Apps | MT4, MT5, ActivTrader, TradingView |

ActivTrades Pros and Cons

Knowing about the benefits and drawbacks is crucial when choosing a broker.

Pros | Cons |

Quick Executions with High Speed | No Social Trading and Copy Trading Features |

Robust Risk Management Tools | Limited Promotional Offers or Bonuses |

Competitive Spreads and Fees | - |

AvaTrade

AvaTrade operates as a multi-regulated brokerage with 9 regulatory licenses, including the Central Bank of Ireland, ASIC, CySEC, FSCA, and ADGM, while also aligning with MiFID standards for European coverage. Client safeguards include segregated accounts and negative balance protection across its regulated entities.

For trading access, AvaTrade supports forex and CFDs across metals, commodities, indices, stocks, and cryptocurrencies, with margin call and stop out levels set at 25% and 10%. An AvaTrade rebate program is available for discounts on fees and spreads.

Accounts are offered in Retail, Professional, Islamic, and Demo formats, and trading is available via MetaTrader 4, MetaTrader 5, AvaTrade WebTrader, and mobile apps, alongside AvaOptions for FX options workflows. You can read our AvaTrade dashboard review for detailed information about the broker's website interface and account management features.

Entry requirements start with a minimum deposit of $100, supported by six AvaTrade deposit/withdrawal options that are credit or debit cards, bank wire transfers, Skrill, Neteller, WebMoney, and PayPal.

AvaTrade also adds copy trading through DupliTrade and AvaSocial.

For any challenges and inquiries, customer support is provided 24/5 via live chat, email, and phone.

Table of Key Features

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA, JFSA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:30 in EU |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros and Cons

Here’s a demonstration of the benefits and drawbacks of trading with AvaTrade.

Pros | Cons |

Multiple Trading Platforms, Including MT4/MT5 | Limited Account Types Compared to Some Competitors |

Wide Range of Trading Instruments | - |

Well-regulated by 9 Financial Authorities | - |

eToro

eToro is an Israel-founded multi-asset broker established in 2007 and headquartered in Tel Aviv. For traders in Germany, eToro operates under its European entity, regulated by the Cyprus Securities and Exchange Commission, while also holding licenses from the Financial Conduct Authority and Australian Securities and Investments Commission, ensuring a strong multi-jurisdiction framework.

The broker focuses on a proprietary trading platform rather than MT4 or MT5, offering access to Forex, stocks, ETFs, indices, commodities, and cryptocurrencies. Retail clients in Germany trade Forex with leverage up to 1:30, while eligible professional clients can access leverage up to 1:400.

eToro’s core strength lies in its investment features, including CopyTrader, Smart Portfolios, and crypto staking, which allow traders to combine active trading with passive strategies.

With a low minimum deposit starting from $10, EUR-supported accounts, and a user-friendly web and mobile platform, eToro is particularly suited to German traders who value social trading, diversified exposure, and simplified portfolio management over traditional terminal-based execution.

Summary of Details and Offerings

Account Types | Personal, Professional, Corporate, Islamic |

Regulating Authorities | FCA, CySEC, MFSA, FSRA, ASIC, FSA, Gibraltar FSC |

Minimum Deposit | $10 |

Deposit Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Withdrawal Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Maximum Leverage | 1:30 for EU Retail Traders |

Trading Platforms & Apps | Proprietary App |

eToro Pros and Cons

Consider these important benefits and drawbacks before investing and going through the eToro registration.

Pros | Cons |

Proprietary Platform | No MT4/MT5 Support |

Innovative Social Trading Features | No Phone Call Option for Customer Service |

A Very Wide Range of Instruments | - |

Regulated in Multiple Jurisdictions | - |

How We Selected the Best Forex Brokers in Germany

Since German traders operate under strict regulatory standards, our Forex methodology framework prioritizes trust, compliance, and real-world performance.

Our analysts assess each broker using 19 core data metrics, covering every critical aspect of a brokerage’s operations. Regulation and licensing sit at the foundation of our methodology. We verify that brokers operate under reputable financial authorities and comply with investor protection standards applicable to German and EU traders.

Beyond regulation, we analyze the broker’s background, including company history, headquarters, and global presence. Account type diversity is another key factor, as German traders follow varied strategies ranging from retail Forex trading to ECN execution and copy trading.

We also examine the range of tradable instruments, ensuring access to major and minor currency pairs, CFDs, indices, commodities, and other markets.

Cost structure plays a major role in long-term profitability. Our team reviews spreads, commissions, non-trading fees, and deposit and withdrawal conditions through both documented data and hands-on testing. Trading platforms, such as MetaTrader 4, MetaTrader 5, cTrader, and mobile apps, are evaluated for stability, usability, and features.

Additional metrics include account opening and verification, copy trading services, customer support quality, educational resources, Trustpilot ratings, broker responsiveness, and scam or alert reports. We also consider transparency in updates, quality of infographics, and even sponsorship or charitable activities.

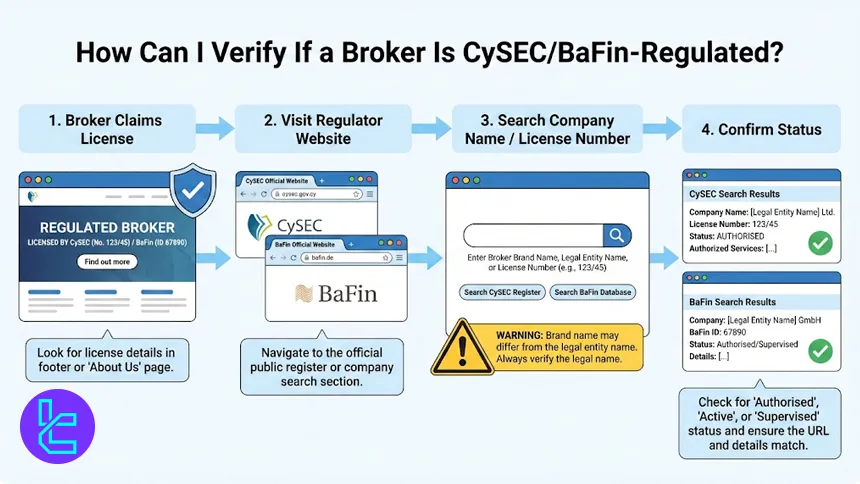

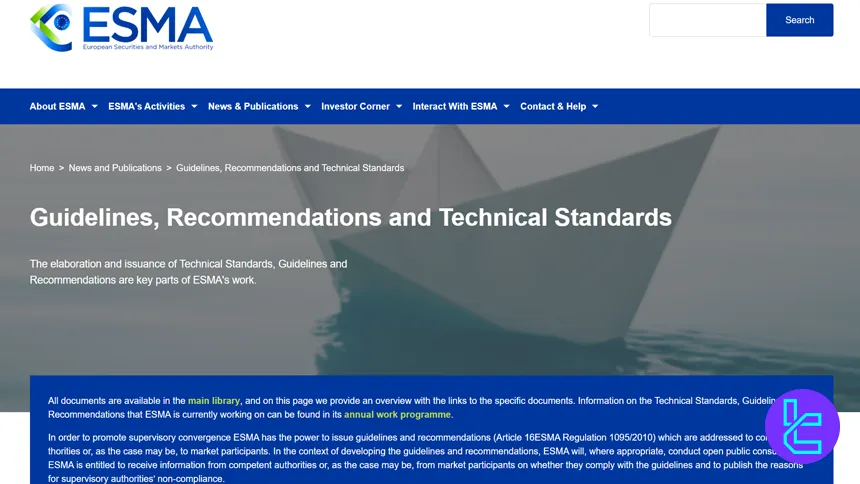

How Can I Verify If a Broker is CySEC/BaFin-Regulated?

Most of the brokers post a picture of the license, a number, or something else as a proof of being supervised by a financial authority.

However, you can never be too sure. To verify if a select brokerage or company is regulated by a certain organization such as ASIC, CySEC, BaFin, the UK FCA, etc., the first thing to do is visiting the authority’s website.

On the site, there is usually a search option, but it does not always work for finding registered companies. Try it first, and if you can’t find the chosen broker, look for an option called “database”, “entities”, “entries”, etc. and put the broker’s company name there.

Note that most times you will not get any results based on searching only the brand or trademark; you should type the registered name or the license number. Also, remember that every regulating authority is ranked in a specific tier.

You can check out the rankings via our TF score page.

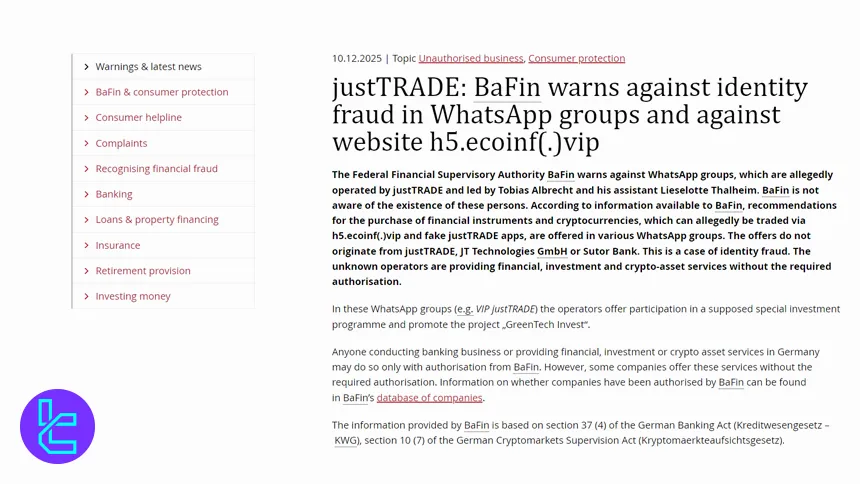

What Brokers Are on BaFin’s Warning Lists?

BaFin regularly issues public warnings about companies and websites offering financial and investment services, including unauthorized brokers and trading platforms, that lack the required banking or investment service permissions under German law.

Here are some of the most recently identified platforms and broker-like entities BaFin has warned consumers to avoid:

- broker(.)gmbh & broker.eu(.)com: BaFin explicitly warned that these websites were offering financial services without an official license;

- Graphene Brokerage LTD: Listed by BaFin as offering financial services without authorization;

- Various unlicensed online trading websites: BaFin warnings include platforms that operate numerous near-identical domains promoting trading services without oversight;

- Consumer warning platforms including green-vest.io, wisewealth.ai, dgtlfuture.com, titanwealth24.com, and others: Highlighted by BaFin as unlicensed investment/websites;

- Reports of WhatsApp-related scams posed to look like a known broker name: Another type of unauthorized activity singled out by BaFin.

Important Notes:

- BaFin does not maintain a single comprehensive “blacklist of brokers”, but it does publish individual warnings about specific entities offering financial services without authorization;

- These warnings are often updated multiple times per year as new unauthorized actors emerge;

- Trading with an entity on BaFin’s warning list can severely jeopardize your capital; these firms are not legally supervised, and clients lack regulatory protection.

To stay safe, always cross-reference a broker’s name and license status in the official BaFin register before depositing funds.

Is Forex Trading Legal for German Residents?

Forex trading is fully legal in Germany and operates within a well-defined regulatory framework designed to protect retail and professional traders. The German forex market is primarily overseen by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), which acts as the national financial regulator.

BaFin supervises forex brokers, enforces compliance standards, and ensures transparency across trading services offered to German residents.

In addition to local oversight, Germany is part of the European Union, meaning forex trading is also regulated under ESMA and MiFID II directives.

These regulations introduce strict rules on leverage, marketing practices, and risk disclosures.

German traders are legally allowed to open accounts with EU-licensed brokers, particularly those regulated by authorities such as BaFin or CySEC, as long as the broker complies with MiFID II passporting rules.

Note that trading with unregulated or offshore brokers, while not explicitly illegal, falls outside investor protection frameworks and carries higher legal and financial risks.

Leverage Cap for Forex Trading in Germany

Forex trading leverage in Germany is capped at a low level to reduce excessive risk for retail traders. As a member of the European Union.

For retail forex traders in Germany, the maximum allowed leverage levels are:

- 1:30 for major currency pairs (EUR/USD, GBP/USD, USD/JPY, etc.)

- 1:20 for non-major currency pairs, gold, and major indices

However, things are different for professional accounts; this type of trading account can have leverages of up to 1:400 or higher.

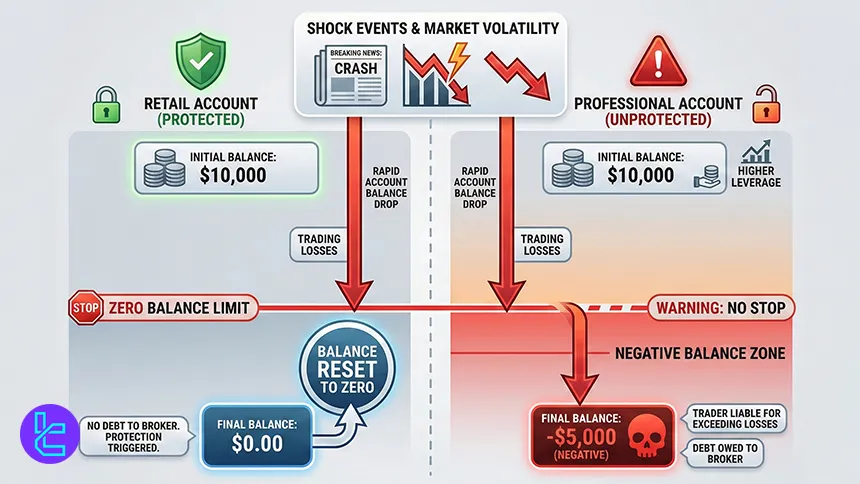

Do Forex Brokers in Germany Offer Negative Balance Protection?

Yes, negative balance protection is mandatory for retail forex traders in Germany. This requirement is enforced under ESMA regulations and incorporated into German financial law through BaFin and the MiFID II framework.

Negative balance protection means that if extreme market volatility, slippage, or gaps cause losses exceeding the account balance, the broker is legally obligated to reset the balance to zero. Traders are not liable for any deficit, even during high-impact events such as flash crashes, unexpected central bank decisions, or geopolitical shocks.

This protection applies to all retail accounts opened with brokers regulated by:

- BaFin (Germany)

- CySEC (Cyprus)

- Other EU authorities operating under MiFID II passporting

However, professional traders in Germany do not receive negative balance protection. Once a trader opts into professional status, they waive certain retail safeguards, including leverage limits and balance protection, in exchange for access to higher leverage and advanced trading conditions. This increases both potential returns and downside risk.

It is important to note that offshore or unregulated brokers may claim to offer negative balance protection voluntarily, but such promises are not enforceable under German or EU law.

For this reason, traders in Germany are strongly advised to use EU-regulated brokers to ensure full legal protection.

What Investor Protection Schemes Do Forex Brokers in Germany Offer?

Forex brokers operating legally in Germany are required to provide multiple layers of investor protection such as the negative balance protection, enforced under BaFin, MiFID II, and ESMA regulations. These protection schemes are designed to safeguard client funds, limit excessive risk, and ensure transparency in broker operations.

One of these protections is the segregation of client funds. German and EU-regulated brokers must keep client deposits in separate accounts from company operating funds. This prevents client money from being used for business expenses and protects traders if the broker faces financial difficulties.

German forex brokers are also part of statutory investor compensation schemes. Brokers regulated by BaFin participate in the Entschädigungseinrichtung der Wertpapierhandelsbanken (EdW), which covers eligible client claims up to €20,000 per person if a broker becomes insolvent.

EU-passported brokers, such as those regulated by CySEC, are covered by their local compensation funds, which typically offer similar protection limits under EU law.

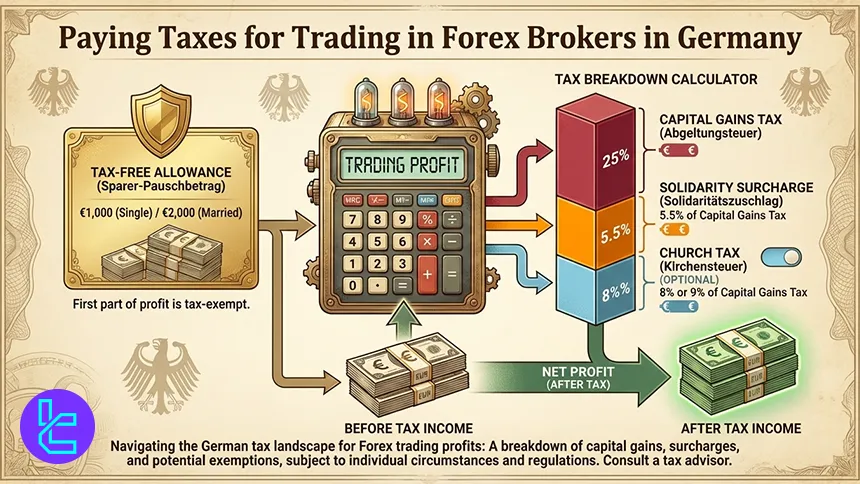

Should Traders Pay Tax for Forex Trading in Germany?

Profits generated from forex trading in Germany are taxable and fall under the country’s capital income taxation framework. For most retail traders, gains from forex CFDs and similar derivatives are classified as investment income and are subject to the flat capital gains tax.

The standard tax structure applied to forex trading profits in Germany includes:

- 25% capital gains tax

- 5% solidarity surcharge calculated on the tax amount

- Church tax, if applicable, depending on religious affiliation and the federal state

In practice, this brings the effective tax rate to approximately 26.375%, or slightly higher if the church tax applies.

German traders benefit from an annual tax-free allowance (Sparer-Pauschbetrag):

- €1,000 for single taxpayers

- €2,000 for married couples filing jointly

Only profits exceeding this threshold are taxable.

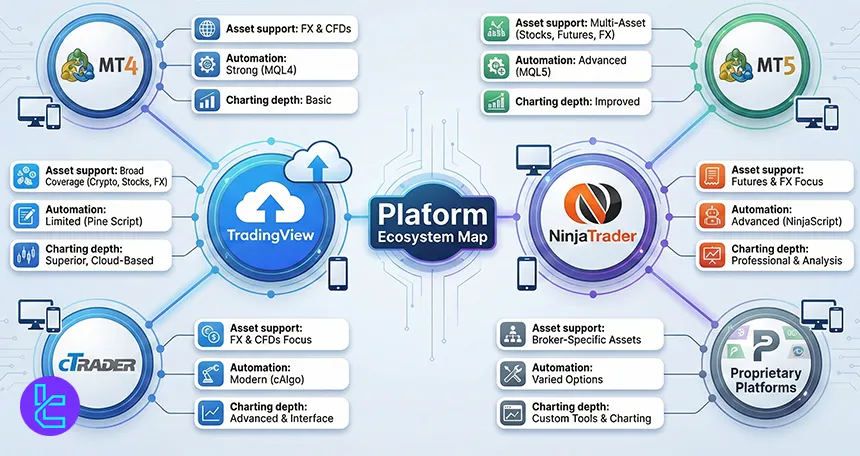

Which Trading Platforms are Available?

German forex traders have access to a wide range of professional trading platforms, offered by EU-regulated brokers in compliance with BaFin, MiFID II, and ESMA standards.

Platform availability is a key factor when choosing a broker, as it directly impacts execution quality, analysis capabilities, and overall trading efficiency.

The most widely used platforms in Germany are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Here are the MT4’s important specifics:

- Popular for forex-focused trading due to its stability

- Low resource usage

- Extensive ecosystem of indicators and Expert Advisors (EAs)

MT5 expands on this by offering additional features:

- More asset classes

- Advanced order types

- An integrated economic calendar

- Improved backtesting capabilities

Additionally, there are other popular choices among traders residing in Germany. cTrader Platform:

- Designed for ECN and STP trading environments

- Level II pricing and full market depth visibility

- Native support for algorithmic trading via cTrader Automate (cAlgo)

NinjaTrader Platform:

- Advanced platform primarily used for futures and forex trading

- Highly customizable charts and order-flow analysis tools

- Support for automated trading using NinjaScript (C#-based)

- Preferred by traders applying quantitative and systematic strategies

TradingView has also gained strong adoption among German traders. Many EU brokers now offer direct TradingView integration, allowing traders to execute orders directly from TradingView charts. Its strengths lie in advanced charting tools, cloud-based access, and a large community of analysts and scripts.

Some brokers operating in Germany provide proprietary trading platforms alongside third-party solutions. These platforms are typically web-based, user-friendly, and designed for ease of access without software installation.

How Can I Choose the Best Forex Broker in Germany?

Selecting the best forex broker in Germany requires focus on regulation, trading conditions, and investor protection.

Regulatory authorization is the most significant factor. Reputable brokers serving German traders are either directly regulated by BaFin or operate under EU MiFID II passporting, commonly through authorities such as CySEC.

This ensures compliance with ESMA rules, including leverage caps, negative balance protection, and transparent risk disclosures. Using non-EU or offshore brokers places traders outside Germany’s legal protection framework.

Trading costs are another key consideration. Brokers should be evaluated based on spreads, commissions, and overnight swap fees. Some brokers offer commission-free accounts with wider spreads, while others provide RAW or ECN accounts with tighter spreads and fixed commissions.

Platform reliability and execution quality directly affect trade outcomes. The most competitive brokers in Germany typically support MetaTrader 4 (MT4), MetaTrader 5 (MT5), or TradingView, combined with fast execution speeds and minimal slippage.

Brokers should clearly disclose whether they operate under an STP/ECN or market-maker execution model.

Investor protection measures are required for retail traders. These include segregation of client funds, negative balance protection, and clearly defined margin call and stop-out levels. A broker’s ability to handle volatile market conditions transparently is a strong indicator of reliability.

Finally, account structure and operational convenience matter. The best brokers offer EUR-based accounts, flexible deposit and withdrawal methods, and multiple account types for retail and professional traders. Access to responsive customer support, ideally with German-language assistance, adds further value.

How Does Forex Trading in Germany Compare Against That in Other Countries?

Forex trading in Germany differs significantly from many other countries due to its strict regulatory environment and strong investor protection framework.

Compared to non-EU countries such as Kenya, South Africa, or offshore jurisdictions, Germany enforces lower leverage limits for retail traders.

While German traders are capped at 1:30 leverage on major forex pairs, traders in some non-EU regions may access leverage of 1:100, 1:200, or higher.

Here’s a comprehensive table comparing Forex trading in Germany against that in other regions:

Comparison Factor | Germany | |||

Primary Regulator | BaFin (Germany) under ESMA & MiFID II | Financial Sector Conduct Authority (FSCA) | Cyprus Securities and Exchange Commission (CySEC) under ESMA | Capital Markets Authority (CMA Kenya) |

Regulatory Framework | EU-wide MiFID II and ESMA compliance | National regulation under FSCA (non-EU) | EU-wide MiFID II and ESMA compliance | National regulation under CMA Kenya |

Retail Leverage Cap (Forex Majors) | 1:30 | Not strictly capped by FSCA; higher leverage commonly available | 1:30 | 1:400 |

Investor Protection Level | Very high | High | Very high | Moderate |

Negative Balance Protection | Mandatory | Commonly applied by brokers | Mandatory | Applied by many brokers |

Client Fund Segregation | Mandatory | Required under FSCA rules | Mandatory | Required under CMA rules |

Broker Transparency Requirements | Strict EU disclosure rules | Strong conduct and disclosure standards | Strict EU disclosure rules | Formal licensing and disclosure requirements |

Broker Availability | Broad access via EU passporting | Mix of FSCA-licensed and international brokers | Broad EU broker access via passporting | CMA-licensed local and international brokers |

Access to International Brokers | High (MiFID II passporting) | High (global brokers target ZA market) | Very high (EU passporting hub) | Moderate to high |

Typical Trading Platforms | MT4, MT5, cTrader, NinjaTrader, TradingView | MT4, MT5, cTrader, proprietary platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader (select brokers) |

Maximum Loss Protection | Cannot lose more than deposit | Often applied but entity-dependent | Cannot lose more than deposit | Often applied but broker-dependent |

Tax Treatment of Forex Profits | Subject to capital gains tax with limited loss offsets | Taxable under income or capital gains tax | Tax rules vary by residency | Tax obligations depend on Kenyan tax law |

Conclusion

Best Forex brokers in Germany offer trading services with leverage capped at 1:30 and licenses from top-tier financial authorities, such as the BaFin and CySEC. These brokerages, including Eightcap, FxPro, Pepperstone, etc. have negative balance protection enabled for retail traders.

Forex traders in Germany have access to a relatively safe trading space with EdW investor protection scheme; however, they must pay 25% capital gain tax on their profits made from trading.

You can learn about the factors and considerations we take into account while choosing brokers in our Forex methodology article.