Forex trading in Portuguese speaking area is a popular occupation with over $1.22 billion of average daily trading volumes in Portugal in 2025. The Securities Market Commission (CMVM) regulates the Forex trading space in the country.

However, Portugal is not the only region in the world with people speaking Portuguese; there are other countries from South America and Africa.

| City Index | |||

| AvaTrade | |||

| Tickmill | |||

| 4 |  | Global Prime | ||

| 5 |  | Pepperstone | ||

| 6 |  | Fusion Markets | ||

| 7 |  | eToro | ||

| 8 |  | IronFX |

Portuguese Speaking Area Brokers with Trustpilot Ratings

The list below ranks the mentioned Forex brokers based on the Trustpilot ratings, alongside demonstrating the number of reviews for each.

Broker Name | Trustpilot Rating | Number of Reviews |

4.8/5⭐️ | 5,566 | |

AvaTrade | 4.7/5⭐️ | 11,489 |

Global Prime | 4.7/5⭐️ | 385 |

Pepperstone | 4.3/5⭐️ | 3,194 |

4.2/5⭐️ | 393 | |

eToro | 4.2/5⭐️ | 29,872 |

Tickmill | 3.6/5⭐️ | 1,057 |

IronFX | 2.9/5⭐️ | 765 |

Minimum Spreads in Portuguese Speaking Area Brokers

You should always try to find the broker with the lowest costs and commissions possible among other options.

Broker Name | Min. Spreads |

FOREX.com | 0 Pips |

AvaTrade | 0 Pips |

Global Prime | 0 Pips |

0 Pips | |

eToro | 0 Pips |

tastytrade | 0 Pips |

0 Pips | |

IG | 0.6 Pips |

Non-Trading Fees in Select Forex Brokers for Portuguese Speaking Area

Non-trading fees make up the other part of costs in Forex trading, mainly involving deposit/withdrawals and inactivity periods.

Broker Name | Deposit Fees | Withdrawal Fees | Inactivity Fees |

Pepperstone | None | None | None |

None | None | None | |

IronFX | None | None | None |

FP Markets | None | None | None |

FOREX.com | None | None | €15 |

None | None | $10 | |

eToro | None | $5 | $10 |

tastytrade | None | Min. $5 | None |

Number of Tradable Assets in Portuguese Speaking Area Forex Brokers

Higher number of trading symbols in a broker allows for a wider range of investment variety, leading to higher diversity.

Broker Name | Number of Instruments |

FP Markets | 10,000+ |

6,000+ | |

XTB | 2,000+ |

AvaTrade | 1,250+ |

Pepperstone | 1,200+ |

FOREX.com | 1,000+ |

600+ | |

IronFX | 500+ |

Top 6 Forex Brokers in Portuguese Speaking Area

Six of the brokerages mentioned above will be introduced in more detail with a pros and cons summary for each in the sections below.

Fusion Markets

Fusion Markets is an Australia-based forex broker founded by Phil Horner and operated through Gleneagle Securities. The broker is regulated by ASIC and the VFSC, offering two regulatory entities with different leverage frameworks.

Client funds are held in segregated accounts at HSBC and National Australia Bank.

Fusion Markets provides access to forex and CFD markets through a multi-jurisdictional structure designed for international traders. The broker is positioned around low-cost trading. Forex spreads start from 0.0 pips on the Zero account with a fixed commission, while the Classic account offers commission-free pricing with spreads from 0.9 pips.

There is no minimum deposit requirement, which lowers entry barriers for traders in Portuguese speaking markets such as Brazil and Portugal. Maximum leverage reaches up to 1:500 under the offshore entity and 1:30 under ASIC regulation.

Fusion Markets supports MetaTrader 4, MetaTrader 5, TradingView, and cTrader. Additional services include copy trading, MAM accounts, VPS access, and multi-currency funding options. Here’s a table demonstrating the broker’s specifics.

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller, etc. |

Withdrawal Methods | PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros and Cons

The table below provides a summary of the broker’s advantages and disadvantages that are worth knowing before going through the Fusion Markets registration.

Pros | Cons |

Ultra-low trading costs | Limited range of educational resources |

No minimum Deposit | No proprietary trading platform |

Zero deposit fees | Relatively new broker (launched in 2019) |

Regulated by VFSC and ASIC | Limited financial instruments |

Copy trading capabilities through Fusion+ | Lack of investor protection fund |

Sponsored VPS program | - |

A full package of trading platforms (MT4, MT5, cTrader, TradingView) | - |

AvaTrade

AvaTrade is a globally licensed forex and CFD broker operating under nine regulatory authorities, including the Central Bank of Ireland, ASIC Australia, CySEC, FSCA South Africa, FSA Japan, and ADGM Abu Dhabi.

The broker follows MiFID II rules in Europe and offers segregated client accounts across all regulated entities. Retail clients are subject to margin call and stop-out levels of 25% and 10%, depending on jurisdiction.

AvaTrade accepts traders from most Portuguese speaking regions, including Portugal and Brazil, subject to local entity availability.

AvaTrade requires a minimum deposit of $100 and supports multiple base currencies such as USD, EUR, GBP, and AUD. Trading is offered across forex, stocks, indices, commodities, metals, and cryptocurrencies, with leverage ranging from 1:30 in EU regions up to 1:400 under non-EU entities. All trading costs are embedded in spreads, with no trading commissions.

The broker supports MetaTrader 4, MetaTrader 5, WebTrader, mobile apps, and AvaOptions. Copy trading is available through DupliTrade and AvaSocial, alongside Islamic and professional account structures. You can check out the AvaTrade dashboard article for a review of the broker’s interface.

Summary of Specifics

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros and Cons

Before opening an account through the AvaTrade registration, it’s essential to be aware of the positives and the negatives.

Pros | Cons |

Well-regulated by multiple authorities | Limited account types compared to some competitors |

Wide range of trading instruments | - |

Multiple trading platforms, including MT4/MT5 | - |

Decent educational resources | - |

Global Prime

Global Prime is an Australia-based forex and CFD broker founded in 2010 by Jeremy Kinstlinger. The broker operates under ASIC regulation for Australian clients and the VFSC license for international traders.

Client funds are held in segregated accounts with HSBC and National Australia Bank. Global Prime uses an agency-only execution model and provides post-trade execution receipts that display liquidity providers and fill details. It’s worth noting that TradingFinder enables discounts on the broker’s costs through Global Prime rebate program.

Global Prime offers access to more than 150 tradable instruments, including forex, indices, commodities, bonds, and crypto CFDs. Account types are limited to Standard and Raw, with raw spreads starting from 0.0 pips and a fixed commission on the Raw account.

There is no minimum deposit requirement, and leverage reaches up to 1:500 under the offshore entity and 1:30 for ASIC-regulated accounts.

Trading is conducted exclusively on MetaTrader 4. Additional services include Autochartist signals, ZuluTrade integration, VPS access, and fee-free deposits and withdrawals through more than 20 supported payment methods, including local options for Portuguese speaking regions such as Brazil. If you are interested, you may go through our Global Prime registration tutorial.

Table of Parameters

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | Unlimited |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros and Cons

This section provides a summary of the broker’s advantages and disadvantages.

Pros | Cons |

Regulated by reputable authorities (ASIC, VFSC) | MT4 is the only supported platform for now |

Competitive trading conditions with low spreads and fast execution | Relatively low maximum leverage (1:500) |

24/7 customer support | Lack of frequent trading bonuses or promotions |

Segregated client funds for enhanced security | - |

Pepperstone

Pepperstone is an Australia-founded forex and CFD broker established in 2010 and regulated by multiple tier-1 authorities, including ASIC, FCA, CySEC, BaFin, and DFSA. The broker reports average daily trading volumes of around $9.2 billion and serves more than 400,000 clients worldwide.

Client funds are held in segregated accounts, and negative balance protection applies across retail entities.

Pepperstone provides access to over 1,200 instruments across forex, indices, commodities, shares, ETFs, and cryptocurrencies. Trading is available through Standard and Razor accounts, with spreads starting from 0.0 pips on Razor and commission-based pricing.

There is no fixed minimum deposit, while leverage reaches up to 1:500 under offshore entities and 1:30 in EU and UK jurisdictions.

The broker supports MetaTrader 4, MetaTrader 5, cTrader, TradingView, and proprietary web and mobile platforms. Additional features include copy trading integrations, support for expert advisors, and ten supported base currencies, making Pepperstone suitable for traders across Portuguese speaking regions such as Portugal and Brazil.

Pepperstone Pros and Cons

Before Pepperstone registration, learn about the broker’s noteworthy benefits and drawbacks.

Pros | Cons |

Regulated by ASIC, CySEC, and other top-tier regulators | Limited access to demo account |

Extensive selection of tradable instruments across multiple asset classes | Limited leverage options |

Deep liquidity | No PAMM accounts |

Various options for trading platforms | Limited promotional offerings |

City Index

Founded in 1983 in London, City Index is a long-established Forex and CFD broker operating under the StoneX Group, a NASDAQ-listed financial services provider. With over four decades of activity, the broker has built a strong institutional background and global presence.

City Index provides access to more than 13,500 tradable markets, covering Forex, indices, shares, commodities, bonds, and crypto CFDs. The broker serves 1M+ traders worldwide, supporting portfolio diversification through multi-asset exposure and flexible position sizing across global financial markets.

Regulation is a core strength of City Index. The broker is licensed by tier-1 authorities including the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), and Monetary Authority of Singapore (MAS), ensuring strict compliance, segregated client funds, and retail negative balance protection.

Trading is available via MetaTrader 4, a proprietary web platform, mobile apps, and TradingView integration. City Index offers commission-free trading, floating spreads from 0.5 points, minimum deposits from $150, and leverage up to 1:1000, depending on jurisdiction and client classification.

City Index pros and cons

The following section outlines key advantages and potential limitations to help traders assess overall suitability.

Pros | Cons |

Tier-1 regulation by FCA, ASIC, and MAS | No Islamic (swap-free) account |

13,500+ markets across multiple asset classes | Inactivity fee on dormant accounts |

Commission-free trading with competitive spreads | Limited copy or social trading features |

MT4 and TradingView integration | Higher fees on stock CFD trading |

eToro

Founded in 2007 in Tel Aviv, eToro is a multi-asset broker best known for pioneering social investing. Operating under eToro Ltd, the company serves millions of users globally with a strong focus on community-driven and long-term investing solutions.

eToro offers access to 6,000+ tradable assets across stocks, ETFs, Forex, indices, commodities, and cryptocurrencies. Its investment ecosystem includes CopyTrader, Smart Portfolios, and crypto staking, enabling both active trading and passive portfolio-based strategies from a single account.

Regulation is handled through multiple entities, with licenses from tier-1 and tier-2 authorities such as the Financial Conduct Authority (UK), Cyprus Securities and Exchange Commission, Australian Securities and Investments Commission, and Financial Services Regulatory Authority, providing regional investor protections.

All trading is conducted via eToro’s proprietary web and mobile platform, with minimum deposits starting from $10. While leverage is capped at 1:30 for retail clients, professional accounts may access leverage up to 1:400, depending on jurisdiction and eligibility.

For a detailed guide on opening an account, you may check out our eToro registration article.

eToro Pros and Cons

The following table summarizes eToro’s key pros and cons, outlining where the broker excels and where limitations may impact certain trading styles.

Pros | Cons |

Industry-leading social trading features | No MT4 or MT5 platform support |

CopyTrader, Smart Portfolios, and crypto staking | Fixed $5 withdrawal fee |

Low minimum deposit and beginner-friendly platform | No phone-based customer support |

Regulated across multiple major jurisdictions | Higher CFD spreads compared to ECN brokers |

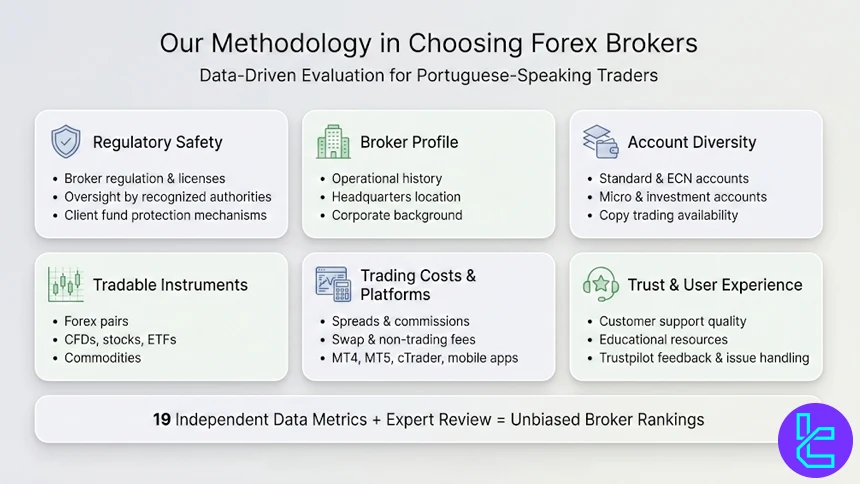

Our Methodology in Choosing the Forex Brokers

Choosing the best Forex brokers in the Portuguese-speaking area requires a structured, transparent, and data-driven evaluation process. At TradingFinder, broker reviews are built on a comprehensive methodology designed to reflect the real conditions traders face when committing capital to global financial markets.

Our analysts apply 19 independent data metrics to assess each broker from multiple angles. The process starts with regulations and licenses, verifying oversight by recognized authorities and the existence of client-fund protection mechanisms. A detailed broker profile is then examined, including operational history, headquarters, and corporate background.

Accountdiversity is another core factor. Brokers are evaluated based on the availability of standard, ECN, micro, and investment or copy-trading accounts, allowing traders with different risk profiles and strategies to find suitable conditions.

Equal attention is given to the range of tradable instruments, covering forex pairs, CFDs, stocks, ETFs, and commodities, which is particularly important for diversified portfolios.

Cost transparency plays a critical role. TradingFinder reviews spreads, commissions, swap rates, deposit and withdrawal fees, and inactivity charges using both published data and live testing. Platform accessibility is also assessed, including support for MetaTrader 4, MetaTrader 5, cTrader, and mobile trading apps.

Beyond trading conditions, the methodology incorporates customer support quality, educational resources, office presence, Trustpilot feedback, and the broker’s responsiveness to user issues or scam reports. By combining quantitative metrics with expert judgment, TradingFinder delivers balanced, unbiased broker rankings tailored to Portuguese-speaking traders.

How Can I Verify if a Broker Is Regulated for the Portuguese-Speaking Area?

Verifying a broker’s regulatory status is a critical step for traders in Portuguese-speaking regions such as Portugal and Brazil. The most reliable approach is to check the official register of the relevant financial authority rather than relying solely on claims made on a broker’s website.

For brokers targeting Portugal, regulation is typically overseen by the Securities Market Commission (CMVM). Traders can search the CMVM database to confirm whether the broker is authorized to provide investment or forex-related services.

In Brazil, supervision falls under Comissão de Valores Mobiliários (CVM), where licensing status and permitted activities are publicly disclosed.

Many brokers operating in Portuguese-speaking markets are regulated internationally. In such cases, verification should be done through well-known global regulators such as the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchanges Commission. Always match the broker’s legal entity name and license number with the regulator’s official database.

As a final step, ensure that the regulated entity actually applies to your account type and country of residence. This confirms whether investor protections, leverage rules, and dispute mechanisms are legally enforceable for traders in the Portuguese-speaking area.

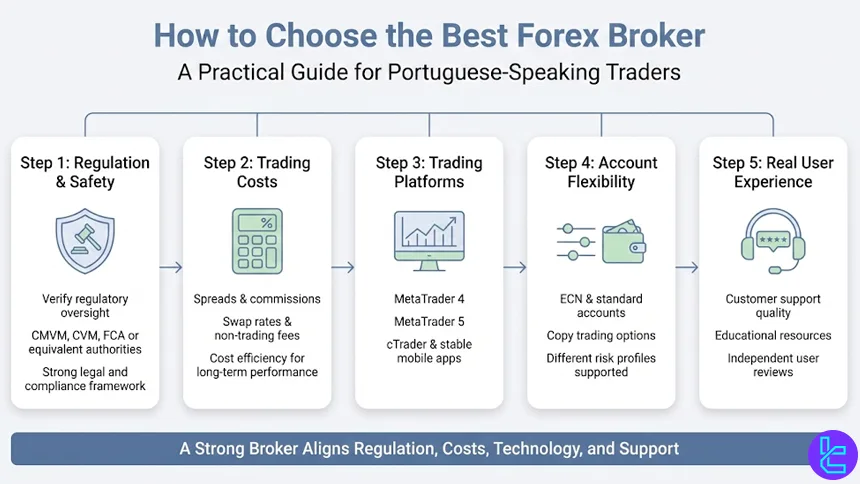

How Can I Choose the Best Forex Broker for Trading from Portuguese Speaking Area?

Choosing the best forex broker for traders in the Portuguese-speaking area requires aligning regulation, trading conditions, and platform reliability with individual trading goals. The first and most important step is confirming regulatory oversight.

Brokers authorized by respected regulators such as the CMVM, CVM, or internationally recognized authorities like the FCA provide a stronger legal and compliance framework.

Next, traders should assess cost efficiency, including spreads, commissions, swap rates, and non-trading fees. Even small pricing differences can significantly affect long-term performance, especially for active or high-frequency strategies. Equally important is access to robust trading infrastructure, such as MetaTrader 4, MetaTrader 5, or cTrader, alongside stable mobile apps.

Account flexibility is another decisive factor. The availability of ECN, standard, or copy trading accounts allows traders with different risk profiles to operate under suitable conditions. Finally, evaluating customer support quality, educational resources, localized services, and independent user reviews helps filter out brokers that may look competitive on paper but underperform in real trading environments.

Is Forex Trading Legal in Portuguese-Speaking Countries?

Forex trading is generally legal across Portuguese-speaking countries, but the regulatory framework and level of oversight vary significantly from one jurisdiction to another. Understanding these differences is essential for traders to ensure compliance and adequate investor protection.

In Portugal, forex and CFD trading are legal when conducted through brokers supervised by the CMVM or by firms licensed in other European Union states under MiFID rules. This framework allows Portuguese residents to trade legally with EU-regulated brokers while benefiting from standardized investor protection measures.

In Brazil, the situation is more restrictive. The CVM does not formally license retail forex brokers for local operations. As a result, many Brazilian traders access the forex market through international brokers regulated abroad, which is not explicitly illegal but operates in a regulatory gray area. Traders should therefore be cautious and prioritize brokers with strong global regulation.

Other Portuguese-speaking regions, such as Angola and Mozambique, typically allow forex trading through offshore brokers, although local regulatory supervision may be limited or undefined.

Overall, while forex trading is not prohibited in Portuguese-speaking countries, the legality depends on the broker’s regulatory status and jurisdiction, making proper verification a critical step before opening an account.

Do Forex Brokers in the Portuguese-Speaking Area Offer Negative Balance Protection?

Negative Balance Protection is a critical risk-control mechanism that ensures traders cannot lose more than the funds deposited in their trading accounts. In Portuguese-speaking regions, the availability of this protection depends primarily on the broker’s regulatory framework, not on the trader’s nationality or residence.

Key considerations include:

- European Union–regulated brokers: Brokers operating under EU regulations and accessible to traders in Portugal, supervised by authorities such as the CMVM, are required to provide Negative Balance Protection for retail clients;

- International regulators serving Portuguese traders: Brokers licensed by the FCA or the CySEC must enforce Negative Balance Protection for retail forex accounts, even when serving clients outside their home countries;

- Brazil and other non-EU Portuguese-speaking markets: Since the CVM does not directly regulate retail forex brokers, many traders rely on offshore brokers where Negative Balance Protection is typically offered as a contractual policy;

- Account classification matters: Professional or high-leverage accounts may not benefit from Negative Balance Protection, even when the broker itself is regulated in the EU.

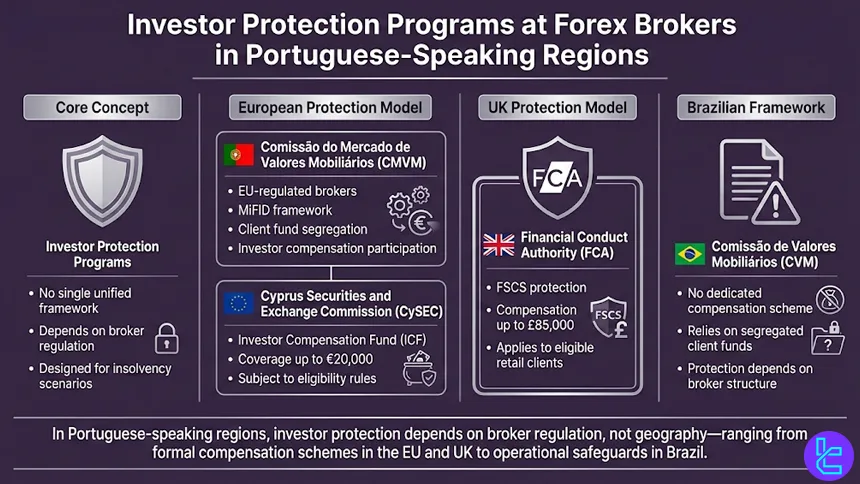

Are There Any Investor Protection Programs Enforced in Portuguese Speaking Area Forex Brokers?

Investor protection programs for forex traders in Portuguese-speaking regions are not applied under a single unified framework. Instead, they are determined by the regulatory authority governing the broker, rather than by the trader’s language or country alone. These mechanisms are primarily designed to protect client funds in situations such as broker insolvency or regulatory failure.

In Portugal, brokers authorized under European Union regulations and supervised by the CMVM operate within the MiFID framework. This structure requires strict client fund segregation and, in many cases, participation in investor compensation schemes that provide limited financial coverage if a broker becomes insolvent.

Portuguese traders using EU-regulated brokers therefore benefit from standardized investor safeguards.

For brokers regulated in the United Kingdom, oversight by the Financial Conduct Authority brings additional protection through the Financial Services Compensation Scheme. Under this program, eligible retail clients may receive compensation of up to £85,000 if a regulated broker fails. Similarly, brokers licensed by the Cyprus Securities and Exchange Commission participate in the Investor Compensation Fund, which can cover losses up to €20,000 per client, subject to specific conditions.

In contrast, Brazil follows a different approach. The CVM does not enforce a dedicated investor compensation scheme for retail forex trading. As a result, Brazilian traders using international brokers typically rely on operational safeguards such as segregated client accounts rather than formal compensation programs.

Do Forex Traders in Portuguese Speaking Area Have to Pay Taxes?

Forex taxation in the Portuguese-speaking area depends on local tax laws, residency status, and how trading income is classified. There is no single tax rule applied across all Portuguese-speaking countries, making it essential for traders to understand country-specific obligations.

In Portugal, forex trading profits are generally considered investment income. Retail traders may be subject to capital gains tax or personal income tax, depending on whether trading is classified as occasional investing or habitual activity.

While some capital income in Portugal may benefit from favorable tax treatment, active forex trading is usually taxable and must be declared to the Portuguese tax authority. Using brokers regulated under the CMVM does not remove the obligation to report profits.

In Brazil, forex trading profits are taxable under personal income tax rules. Brazilian residents are required to self-report gains, including profits earned through offshore brokers, to the Receita Federal.

Although many Brazilian traders use international brokers regulated outside the country, tax liability is determined by residency, not by the broker’s location. Oversight of securities-related activities falls under the CVM, while taxation is enforced separately by tax authorities.

In other Portuguese-speaking countries such as Angola or Mozambique, taxation rules are less clearly defined and may vary based on income source and trading frequency. In these cases, professional tax advice is strongly recommended.

Forex Brokers in Portuguese Speaking Area Compared to Other Countries

Forex trading conditions in Portuguese-speaking regions are shaped mainly by European Union regulations in Portugal, while traders in other global markets operate under very different legal and supervisory structures.

Compared with countries such as Russia, Thailand, and Vietnam, the Portuguese-speaking area generally offers stronger investor protection, clearer leverage limits, and standardized broker oversight through EU frameworks.

The table below highlights how regulation, leverage, client protection, and broker access in the Portugal market compare with selected non-EU jurisdictions.

Comparison Factor | Portuguese Speaking Area | |||

Primary Regulator | CMVM (Portugal) under ESMA & MiFID II | Central Bank of Russia (CBR) | SEC Thailand & Bank of Thailand | No dedicated forex regulator; SBV oversees currency flow |

Regulatory Framework | EU-wide MiFID II compliance | National regulation + offshore access | National oversight; no retail forex licensing | No domestic retail forex framework |

Retail Leverage Cap (Forex Majors) | 1:30 (EU rules) | 1:50 (CBR-licensed) | Not formally capped; broker-dependent | Not capped locally; broker-dependent |

Investor Protection Level | Very high (EU standards) | Moderate to high | Moderate | Low to moderate |

Negative Balance Protection | Mandatory | Not explicitly mandated | Broker-dependent | Broker-dependent |

Client Fund Segregation | Mandatory | Mandatory for licensed dealers | Depends on broker | Depends on broker |

Broker Availability | Broad EU & international brokers | Local + international brokers | Mainly international brokers | Offshore international brokers |

Access to International Brokers | High (EU passporting) | High | High | High |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

Maximum Loss Protection | Cannot lose more than deposit | Entity-dependent | Broker-dependent | Broker-dependent |

Tax Treatment of Forex Profits | Taxable (capital gains or income) | Taxable income | Taxable personal income | Interpreted as personal income |

Conclusion

Among Portuguese-speaking countries, Portugal has, most likely, the most stringent regulatory framework, under the supervision of the CMVM, following the MiFID II rules.

If you are a trader living in the Portuguese-speaking area, select Forex brokers such as Fusion Markets, AvaTrade, and Global Prime are the best options you can find.

To learn about the way we chose each broker, check out our Forex methodology page.