Singapore hosts one of the top-tier financial authorities in the world, the Monetary Authority (MAS), established in 1971. In fact, MAS is the country’s central bank. According to the data officially released by the Monetary Authority, activity in Singapore’s foreign exchange market recorded a significant expansion in April 2025.

Based on our investigations and research around the regulation structure and relevant rules in Singapore, here’s a curated list for the country’s traders:

| Eightcap | |||

| Pepperstone | |||

| easyMarkets | |||

| 4 |  | IC Markets | ||

| 5 |  | Tickmill | ||

| 6 |  | Global Prime | ||

| 7 |  | FxPro | ||

| 8 |  | Fusion Markets |

Singapore Forex Brokers Ranking Based on Trustpilot Ratings

The following table outlines the average Trustpilot ratings submitted for each of the mentioned brokers:

Broker | Trustpilot Rating (out of 5) | Number of Reviews |

IC Markets | 4.8 ⭐ | 49,713 |

Fusion Markets | 4.8 ⭐ | 5,411 |

Global Prime | 4.7 ⭐ | 380 |

4.3 ⭐ | 3,190 | |

easyMarkets | 4.2 ⭐ | 1,771 |

4.1 ⭐ | 3,348 | |

FxPro | 3.8 ⭐ | 862 |

Tickmill | 3.6 ⭐ | 1,047 |

Forex Brokers with Lowest Spreads in Singapore

If you prioritize costs and fees when choosing a broker or trading ecosystem, the spread is one of the main parameters you should keep an eye on. This ranking includes some of the best choices in this regard.

Broker | Min. Spread |

Fusion Markets | 0 Pips |

FOREX.com | 0 Pips |

0 Pips | |

Swissquote | 0 Pips |

0 Pips | |

IronFX | 0 Pips |

Global Prime | 0 Pips |

easyMarkets | 0.2 Pips |

Best Brokers Based on Non-Trading Fees

Deposits/withdrawals, inactivity, etc. are some of the non-trading costs charged by brokers. The list below demonstrates these kinds of fees in select Forex brokerages.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

None | None | None | |

Forex.com | None | None | $15 Monthly |

FxPro | None | None | $15 Once, then $5 Monthly |

None | 10% Subject to Terms | Unclear | |

Swissquote | None | 2.9% or 10 EUR Subject to Terms | €15 per month for Accounta Above 10 EUR |

XM | None | None | $10 monthly |

IG | 1% for VISA and 0.5% for MasterCard | None | $18 per Month for Over 24 Months of Inactivity |

Plus500 | None | None | $10 per Month |

Tradable Instruments in Forex Brokers

A higher number of tradable assets of a broker means a higher possibility for investment diversification. Therefore, it's an important parameter to consider. Look at the table below for an overview.

Broker Name | Number of Instruments |

FOREX.com | 5.5K+ |

2.2K+ | |

Fx Pro | 2.1K+ |

Pepperstone | 1.2K+ |

Swissquote | 1.1K+ |

Eightcap | 800+ |

Axi | 190+ |

150+ |

Top 6 Forex Brokers for Singapore in Detail

Best brokerages for trading in the foreign exchange market should have reasonable costs, various account types, high-quality customer support, and other features and factors. Singapore-based traders should register with those Forex brokers that have licenses from the financial authorities in the country, such as the MAS.

We will dig into the details of the candidates for Forex trading in Singapore in the following sections.

Eightcap

Eightcap is an Australia-headquartered broker founded in 2009 in Melbourne, offering multi-asset CFD access across 6 markets - Forex, commodities, metals, crypto, indices, and shares - with 800+ symbols and leverage up to 1:500.

For Singapore-based traders, its regulatory mix stands out; ASIC and FCA support a strong compliance baseline, with additional coverage via CySEC and SCB, alongside segregated client funds and negative balance protection. Trading is offered via MT4, MT5, and a dedicated TradingView account, with a $100 minimum deposit and SGD available as a base currency.

If you are interested in testing this broker's services and features, go through our Eightcap registration tutorial, then open an account.

Costs are straightforward, Standard and TradingView accounts start from 1.0 pip, while the Raw account targets tighter pricing from 0 pips with round-turn commission. TradingFinder offers an Eightcap rebate program that can reduce costs for potential clients.

The broker adds practical tooling, Capitalise.ai, FlashTrader, and an AI-powered economic calendar, but does not provide copy trading or PAMM solutions.

Here's a summary of Eightcap's specifics.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

The table below offers an overview of the advantages and disadvantages of the broker.

Pros | Cons |

Competitive Spreads | High minimum deposit |

Third-Party Platform Integration | Basic Educational Resources |

Strong Regulation | Platform Restrictions |

Pepperstone

Pepperstone is an Australia-founded Forex and CFD broker established in 2010, processing over $9.2B in daily trading volume across a global client base. The broker provides access to Forex, commodities, indices, shares, crypto, and ETFs, with leverage options up to 1:500 and order sizes ranging from 0.01 to 100 lots.

For traders in Singapore, Pepperstone stands out for its strong regulatory footprint under ASIC, FCA, CySEC, DFSA, and BaFin, combined with segregated client funds and negative balance protection.

10 base currencies are supported, including SGD, allowing efficient account management for regional traders. Trading is available via MT4, MT5, cTrader, TradingView, and Pepperstone’s proprietary platform. The Standard account offers spread-only pricing, while the Razor account delivers raw spreads from 0.0 pips with commission-based execution.

You can open an account with the broker through our Pepperstone registration tutorial.

With copy trading integrations, deep liquidity, and 24/7 support, Pepperstone is structured for active and technically focused traders rather than passive investors. Also, there is a Pepperstone rebate program offered by the TradingFinder that can increase your revenue.

The table below provides a summary of the specifics.

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Deposit | $1 |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Maximum Leverage | 1:30 in EU |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Pepperstone Pros and Cons

Look at the table here for an overview of the broker's pros and cons.

Pros | Cons |

Deep liquidity | Limited access to demo account |

Various options for trading platforms | - |

Extensive selection of tradable instruments across multiple asset classes | - |

Regulated by ASIC, CySEC and several top-tier regulators | - |

easyMarkets

easyMarkets is a Cyprus-based Forex and CFD broker offering commission-free trading with a low $25 minimum deposit, positioning itself as an accessible option for cost-conscious traders. The broker supports Forex, indices, metals, commodities, crypto, and stocks, with fixed and variable spread models and leverage reaching up to 1:2000 for eligible international clients.

easyMarkets has also earned industry recognition, including Best Forex/CFD Broker at the TradingView Awards 2023 and Leading Broker of the Year at Forex Expo Dubai 2024.

For Singapore-based traders, easyMarkets combines regulatory coverage under ASIC, CySEC, FSCA, FSA Seychelles, and FSC BVI with client safeguards such as segregated funds and negative balance protection.

Trading is available via MT4, MT5, TradingView, and a proprietary platform that includes unique risk management tools like dealCancellation, Freeze Rate, and free guaranteed stop loss.

With simple pricing, no commissions, and strong downside-protection features, easyMarkets is structured for traders who prioritize execution certainty and controlled risk over raw spreads or advanced passive investment products. You can learn how to open an account through our easyMarkets registration guide. The broker's specifications are summarized below:

Account Types | easyMarkets Web/App and TradingView, MT4, MT5 |

Regulating Authorities | CySEC, ASIC, FSA, FSC, FSCA |

Minimum Deposit | $25 |

Deposit Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Withdrawal Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, TradingView, Proprietary platform |

easyMarkets Pros and Cons

Finally, with this broker, here's the table of benefits and drawbacks.

Pros | Cons |

Regulated by multiple top-tier authorities | Limited range of tradable assets |

Trading Safety Features (No Slippage and Guaranteed Stop Loss) | No cryptocurrency deposits or withdrawals |

Fixed and variable spreads | Lack of 24/7 support |

No commissions or hidden fees | Geo-restrictions |

Multiple trading platforms (Proprietary, MT4, MT5, TradingView) | - |

Long-standing reputation (since 2001) | - |

IC Markets

IC Markets is an Australia-founded Forex and CFD broker established in 2007, widely recognized for its institutional-grade pricing and high-speed execution. The broker provides access to Forex, indices, commodities, bonds, crypto, and stocks, including more than 2,100 share CFDs, with leverage reaching up to 1:500 for eligible clients and a minimum deposit of $200.

For traders in Singapore, IC Markets combines a strong regulatory structure under ASIC, CySEC, and FSA Seychelles with practical safeguards such as segregated client funds and negative balance protection on regulated entities.

Ten base currencies are supported, including SGD, enabling efficient funding and account management.

You can have lower costs through the TradingFinder IC Markets rebate program with discounts on spreads/commissions.

Trading is available via MT4, MT5, cTrader, and proprietary mobile platforms. The Standard account offers commission-free trading with spreads from 0.8 pips, while Raw Spread accounts deliver near-zero spreads with low per-lot commissions, making IC Markets particularly suitable for active, algorithmic, and scalping-focused traders. Here are the broker's specifics.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | Asic, CySEC, SCB, FSA, CMA |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards (Visa, MasterCard), Bank Wire Transfer, E-wallets (Skrill, Neteller, PayPal), Local and regional payment solutions |

Withdrawal Methods | Bank Cards, Bank Wire Transfer, E-wallets (Skrill, Neteller, PayPal) |

Maximum Leverage | Up to 1:500 (subject to trading conditions) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, cTrader Web, IC Markets Mobile |

Islamic Account | Yes (Swap-free accounts available on MT4, MT5, and cTrader) |

Customer Support Channels | Live Chat (24/7), Email, Phone Support |

IC Markets Pros and Cons

Consider the noteworthy pros and cons before making any decision.

Pros | Cons |

Competitive pricing with low average spreads | Offers limited leverage in Europe and offices regulated by ASIC and CySEC |

Wide range of trading platforms | Minimum deposit could be high for some traders |

Scalable execution for algorithmic traders | - |

Extensive market offering (2,250+ tradable symbols) | - |

Tickmill

Tickmill is a global Forex and CFD broker founded in 2014, serving more than 785,000 registered clients across 180+ countries and processing average monthly volumes above $129 billion. The broker offers access to Forex, indices, commodities, stocks, bonds, and crypto, with spreads from 0.0 pips and leverage reaching up to 1:300 on international accounts. You can check out our Tickmill registration guide if you are willing to open an account.

For traders in Singapore, Tickmill combines a multi-tier regulatory structure under FCA, CySEC, FSA, FSCA, and LFSA with client safeguards such as segregated funds and negative balance protection.

Accounts support six base currencies and require a $100 minimum deposit, keeping entry barriers relatively low.

Trading is conducted via MT4, MT5, web, and mobile platforms under a no-dealing-desk execution model. The Classic account features commission-free pricing, while the Raw account delivers institutional-style spreads with low per-lot commissions.

With social trading access and strong cost efficiency, Tickmill is well suited to active traders focused on execution quality rather than promotional extras. It's worth noting that TradingFinder offers a Tickmill rebate program for decreased trading costs.

For a summary of the broker's specifications, look at the table below.

Account Types | Classic, Raw |

Regulating Authorities | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Deposit | $100 |

Deposit Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Withdrawal Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Metatrader 4, MetaTrader 5, Metatrader Web, Mobile App |

Tickmill Pros and Cons

For a quick look at the broker's benefits and drawbacks, here's a table.

Pros | Cons |

Regulated In Multiple Top-Tier Jurisdictions | Low Variety On Account Types |

Advanced Trading Platforms For Futures And Options | Relatively Low Amount Of Forex Pairs |

| Educational Resources And Copy Trading Services | - |

Global Prime

Global Prime is an Australia-founded Forex and CFD broker established in 2010, offering access to 150+ instruments across Forex, indices, commodities, bonds, and crypto.

The broker provides raw pricing with spreads from 0.0 pips, fast execution from sub-10ms infrastructure, and no minimum deposit requirement, supporting both Standard and Raw account structures. You can use our Global Prime rebate program to minimize your trading fees.

For traders in Singapore, Global Prime operates under ASIC and VFSC oversight, with client funds held in segregated accounts at top-tier banks. Leverage reaches up to 1:500 for international clients, and SGD is supported as a base currency.

Trading is conducted via MT4, with upcoming expansion to TradingView and cTrader. Beyond core execution, the broker adds value through Autochartist signals, TradingView Premium access, and FT newspaper subscriptions. If you are interested in this broker, our guide on the Global Prime registration procedure can be useful.

With 24/7 support, commission-free funding, and a strong execution focus, this broker is positioned for traders who prioritize transparency, speed, and institutional-style market access over platform variety. Note that you need to go through the Global Prime verification to access all its features and services.

A summary of the broker's details are outlined here.

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | Unlimited |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros and Cons

This brokerage comes with its own set of advantages and disadvantages.

Pros | Cons |

Regulated by reputable authorities (ASIC, VFSC) | MT4 is the only supported platform for now |

Competitive trading conditions with low spreads and fast execution | Restricted access for traders from certain countries |

24/7 customer support | Relatively low maximum leverage (1:500) |

Segregated client funds for enhanced security | Lack of frequent trading bonuses or promotions |

What Are Our Evaluation Factors and Parameters?

Choosing the best Forex brokers in Singapore requires a structured, data-driven approach, as traders are placing real capital into fast-moving global markets.

At TradingFinder, broker evaluation is built around a transparent and objective framework designed to highlight platforms that deliver consistent value, reliability, and practical trading conditions for Singapore-based traders.

Our review process is based on 19 core data metrics that cover every critical aspect of a broker’s operations. We begin by verifying regulations and licenses, ensuring each broker operates under recognized financial authorities and applies safeguards that protect client funds.

A broker’s background is then assessed through its company profile, including establishment year, headquarters, and operational footprint, helping identify long-term stability.

Trading conditions play a central role in our analysis. We examine account type diversity, supported asset classes, and the range of tradable instruments, including Forex pairs, CFDs, indices, and other markets commonly accessed by traders in Singapore.

Cost efficiency is measured through detailed reviews of spreads, commissions, non-trading fees, and funding costs, using both published data and hands-on testing.

We also evaluate deposit and withdrawal methods, speed, and reliability, alongside the quality of trading platforms and mobile apps such as MetaTrader 4, MetaTrader 5, and cTrader. User experience is assessed by testing account opening, verification processes, and platform usability from start to finish.

Additional metrics include copy trading availability, educational resources, customer support responsiveness, Trustpilot scores, news updates, infographics, and broker responses to user issues or scam reports.

Is Forex Trading Legal in Singapore?

Forex trading is legal in Singapore and is widely practiced by both retail and professional traders. Singapore is considered one of the most established financial hubs in Asia, with a well-developed trading infrastructure and clear rules governing Forex and CFD activities.

Forex trading in Singapore is overseen by the Monetary Authority of Singapore (MAS), which sets standards for brokers offering leveraged trading products. Brokers that provide Forex services to Singapore-based traders must be properly licensed and comply with strict operational and financial requirements.

Key points about Forex trading legality in Singapore include:

- Legal for individuals and institutions: Both retail and professional traders are allowed to trade Forex through licensed brokers;

- Broker licensing matters: Only brokers regulated by MAS or recognized international authorities are permitted to legally offer Forex trading services in Singapore;

- Retail trader protections: While Singapore does not impose EU-style restrictions, brokers are required to follow strong risk disclosure and capital adequacy standards;

- Wide market access: Traders can access major and minor currency pairs, CFDs, indices, commodities, and other global markets through approved platforms.

Overall, Singapore offers a legally secure and globally connected environment for Forex trading. Choosing a properly regulated broker remains the most important factor for traders who want to operate safely and in line with local financial rules.

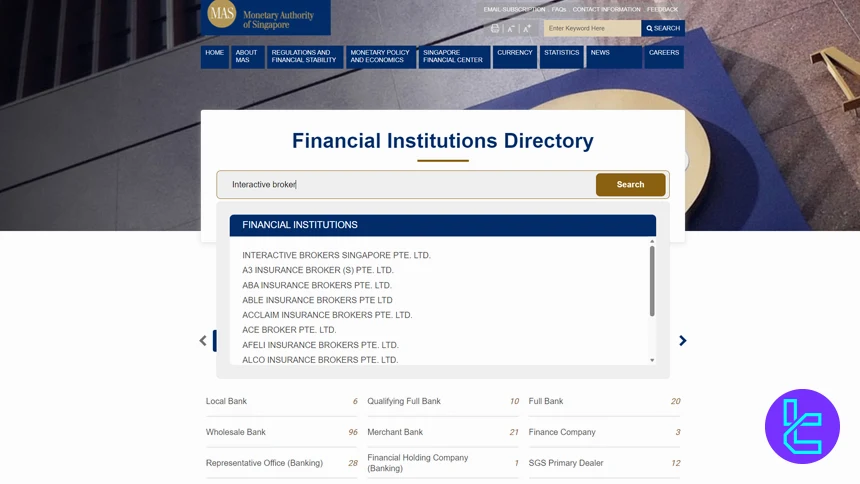

How Can I Verify Singapore Forex Brokers' Licenses?

Verifying a Singapore Forex broker’s license is an essential step to ensure you’re trading with a legitimate firm that meets financial standards and operates transparently.

Singapore’s market is well-established, and most reputable brokers are registered and authorized to offer Forex or CFD services under local regulations.

#1 Find the broker’s registered name or license number

Start by locating the broker’s legal company name or regulatory number, often displayed at the bottom of the broker’s website in the disclosure section.

#2 Visit the MAS Financial Institutions Directory

Use the official MAS directory to search for the broker by name or reference number. This directory lists all financial institutions authorized to operate in Singapore and the types of financial activities they are licensed for.

#3 Check the license details

Once you find the broker’s entry, verify that the license status is active and note the license type. For Forex and leveraged products, brokers typically hold a Capital Markets Services (CMS) license, which authorizes them to deal in capital markets products, including Forex contracts.

#4 Match contact information

Compare the broker’s official contact details (website, office address, email) with what’s listed in the MAS directory. A mismatch may signal an unauthorized or misleading claim.

#5 Look for regulatory disclosures

Licensed brokers often include a regulatory disclosure on their website footer specifying their MAS authorization and license number, which should match the information from MAS.

Everything About the Monetary Authority of Singapore

The Monetary Authority of Singapore is Singapore’s central bank and the main body responsible for overseeing financial markets, including Forex and CFD trading. Established in 1971, MAS operates with a dual role that combines central banking functions with financial regulation.

MAS is widely regarded as one of the most respected financial authorities in Asia due to its emphasis on market integrity, transparency, and risk management. Instead of focusing on restrictive oversight, the authority prioritizes long-term stability and responsible market participation.

In the Forex sector, MAS regulates brokers and financial institutions that offer leveraged trading products, ensuring they meet capital requirements, operational standards, and conduct rules before serving clients.

Beyond regulation, MAS plays a key role in shaping Singapore’s position as a global financial hub. It supports innovation in areas such as fintech, digital payments, and electronic trading infrastructure, while maintaining strict expectations around compliance and risk disclosure.

This balance has helped attract major international brokers and institutional participants to operate in Singapore.

For traders, MAS oversight translates into a trading environment where broker credibility, financial resilience, and transparent practices are central. While MAS does not actively manage individual trading outcomes, its regulatory framework helps reduce systemic risks and promotes confidence in the local Forex market.

The authority also publishes names and entities on an Investor Alert List page for traders to be warned about. However, it is stated on the website that the list is "not exhaustive".

As a result, Singapore remains one of the preferred jurisdictions in Asia for traders seeking access to global currency markets through well-established financial institutions.

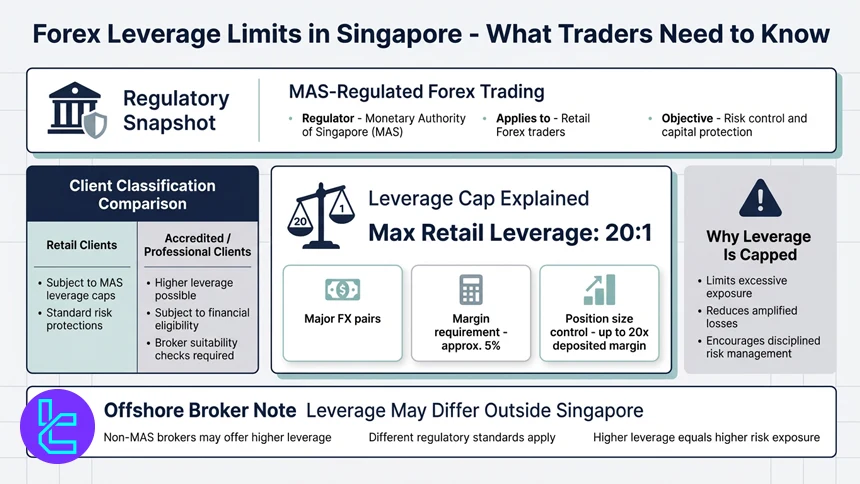

Is Leverage Capped for Forex Trading in Singapore?

Trading leverage for Forex in Singapore is generally capped for retail traders, but the specific limits depend on the broker and client classification. For traders using brokers regulated under the MAS, the maximum leverage available for standard retail Forex trading is around 20:1 for major currency pairs.

This means you can control a position up to 20 times your invested margin, which reflects a margin requirement of about 5%.

This cap aims to help traders manage risk by reducing exposure to highly leveraged positions that can amplify losses as well as gains. Accredited or professional clients who meet higher financial thresholds (such as significant assets or income) may be able to access higher leverage levels, depending on the broker’s policies and MAS’s suitability checks.

It’s important to note that leverage practices can vary between brokers, especially if they are licensed outside Singapore. International brokers not bound by MAS caps may offer higher leverage ratios, but trading with them involves different regulatory environments and risk profiles that traders should understand before opening an account.

Do Forex Brokers in Singapore Have Negative Balance Protection?

Whether Forex brokers in Singapore offer negative balance protection depends on the broker rather than being a universal requirement imposed by the MAS. Unlike some regulatory regimes that mandate the protection for all retail trading accounts, MAS does not explicitly require brokers to provide it as a standard condition of licensing.

Negative balance protection is a risk-management feature that prevents a trader’s account from going below zero in extreme market conditions.

With this protection in place, you can only lose up to the amount you have deposited, and any losses beyond that are absorbed by the broker.

In practice:

- Some MAS-regulated brokers do offer the safeguard to retail clients: Many of the major brokerages active in Singapore provide this protection as part of their risk tools, particularly for non-professional accounts;

- Professional accounts may not include negative balance protection: Similar to other markets, brokers often exclude negative balance protection for professional or high-net-worth clients;

- Offering negative balance protection can be a competitive advantage: Because MAS does not make negative balance protection mandatory, brokers that do include it often highlight this feature to attract traders who want that additional layer of safety.

Because negative balance protection is not automatic for every broker in Singapore, traders should review the terms and conditions carefully before opening an account. Confirm directly with the broker whether negative balance protection applies to the specific account type you plan to use.

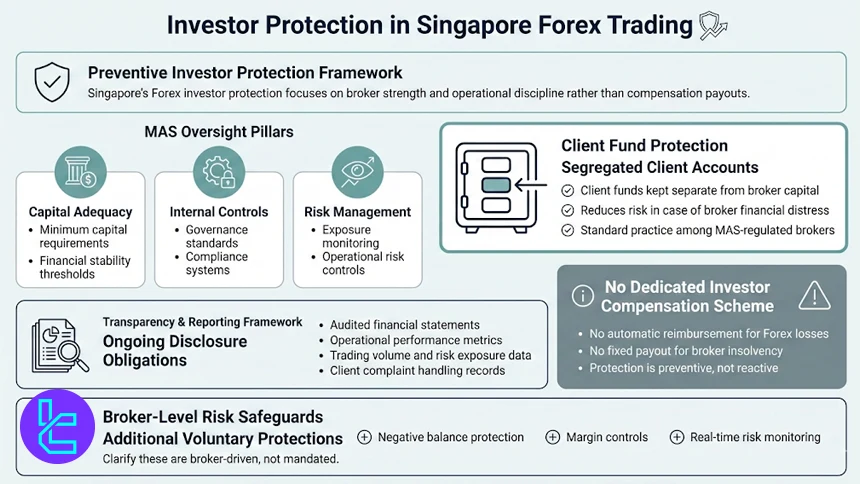

Investor Protection Schemes in Singapore Forex Trading

Investor protection in Singapore Forex trading is primarily built around broker credibility, financial strength, and operational standards rather than formal compensation schemes.

Brokers operating under the oversight of the Monetary Authority of Singapore are required to meet strict requirements related to capital adequacy, internal controls, and risk management.

A key element of investor protection in Singapore is the use of segregated client accounts. Reputable Forex brokers keep client funds separate from their own operating capital, which helps safeguard trader balances if the broker faces financial difficulties.

Also, forex brokers operating in Singapore function under a structured disclosure framework that requires ongoing communication with the monetary authority.

These reporting obligations extend beyond basic licensing requirements and cover detailed submissions related to audited financial statements, operational performance indicators, trading volumes, and risk exposure metrics.

In addition, brokers are expected to maintain transparent records of client-related data, including complaint handling procedures and resolution outcomes. This information allows MAS to continuously assess the broker’s financial soundness, internal controls, and conduct standards within the Forex and CFD markets.

Unlike some European jurisdictions, Singapore does not operate a dedicated investor compensation fund that automatically reimburses Forex trading losses or broker insolvencies.

As a result, protection relies more on preventive measures than post-event compensation. This places greater importance on choosing well-capitalized brokers with a strong operating history and transparent disclosures.

In addition, many brokers serving Singapore-based traders voluntarily offer risk-limiting features such as negative balance protection, margin controls, and real-time risk monitoring, even when these are not legally required.

Do Singapore Forex Traders Have to Pay Taxes?

In Singapore, the tax treatment of Forex trading profits is primarily determined by guidance from the Inland Revenue Authority of Singapore (IRAS). As Singapore does not levy a capital gains tax, most retail Forex traders who trade on a personal and non-commercial basis do not pay tax on their trading profits.

In these cases, Forex gains are generally viewed as investment returns rather than taxable income under Singapore’s tax system.

That said, IRAS assesses Forex trading on a case-by-case basis, focusing on the nature and intent of the activity. When trading is frequent, highly structured, and conducted with the purpose of generating regular income, IRAS may classify it as a business activity.

Under this classification, Forex profits can fall under taxable income, subject to Singapore’s progressive income tax rates. Factors such as trading volume, holding periods, reliance on trading as a primary income source, and the presence of a professional setup are commonly considered in this assessment.

Loss treatment also follows this distinction. Losses from personal investment trading are typically not deductible, while losses arising from a recognized trading business may be deductible against other taxable income, subject to IRAS rules.

Importantly, trading through international or offshore Forex brokers does not, by itself, create a tax obligation. IRAS focuses on the trader’s behavior and income structure rather than the broker’s jurisdiction.

Overall, Singapore remains a tax-efficient location for Forex traders, particularly individuals trading on a non-professional basis. Traders with high-frequency strategies or full-time trading operations often consult tax professionals to ensure their reporting aligns with IRAS guidelines.

Forex Trading in Singapore Compared to Other Countries

Forex trading in Singapore operates within a highly structured and credibility-focused regulatory environment. Compared with EU jurisdictions and emerging markets, Singapore emphasizes broker capital strength, disclosure standards, and risk controls rather than statutory compensation schemes.

The table below compares Singapore’s forex trading conditions with selected regions, highlighting differences in regulation, leverage limits, investor protection, broker access, and tax treatment.

Comparison Factor | Singapore | |||

Primary Regulator | Monetary Authority of Singapore (MAS) | Federal Financial | Autorité des Marchés Financiers (AMF) | Financial Sector Conduct Authority (FSCA) |

Regulatory Framework | National framework under MAS (non-EU) | EU-wide MiFID II and ESMA compliance | EU-wide MiFID II and ESMA compliance | National regulation under FSCA (non-EU) |

Retail Leverage Cap (Forex Majors) | 1:20 | 1:30 | 1:30 | Not strictly capped; higher leverage common |

Investor Protection Level | High (prudential & conduct-based) | Very high | Very high | High |

Negative Balance Protection | Not mandatory; applied by many brokers | Mandatory | Mandatory | Commonly applied by brokers |

Client Fund Segregation | Mandatory under MAS rules | Mandatory | Mandatory | Required under FSCA rules |

Broker Transparency Requirements | Strict disclosure, capital, and reporting standards | Strict EU disclosure rules | Strict EU disclosure rules | Strong conduct and disclosure standards |

Broker Availability | MAS-licensed local and global brokers | Broad access via EU passporting | Broad EU access via passporting | Mix of FSCA-licensed and international brokers |

Access to International Brokers | High (regional financial hub) | High (EU passporting) | High (EU passporting) | High (global brokers target ZA market) |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, proprietary platforms |

Maximum Loss Protection | Entity-dependent | Cannot lose more than deposit | Cannot lose more than deposit | Often applied but entity-dependent |

Tax Treatment of Forex Profits | Taxable as income depending on activity (IRAS rules) | Capital gains tax with limited loss offsets | Flat tax (PFU) or progressive option | Taxed as income or capital gains |

Conclusion

Singapore, as a major financial hub in the world, is an attractive region for many traders in the world because of the taxation benefits and stringent supervision by the MAS.

IG, Interactive Brokers, Saxo, and FOREX.com are some of the best Forex brokers in Singapore with regulatory licenses from the MAS and high-quality trading services.

Each of the brokers are weighted based on important factors and parameters, including commissions, regulatory licenses, account types, etc., as illustrated in our Forex methodology framework.