PayPal is a highly reputable and well-known payment intermediary and an e-wallet since 1999. Used by so many businesses and companies in the world, the platform is employed as a secure payment solution by a good number of Forex brokers.

| Eightcap | |||

| Pepperstone | |||

| Global Prime | |||

| 4 |  | City Index | ||

| 5 |  | Libertex | ||

| 6 |  | eToro | ||

| 7 |  | FP Markets |

Trustpilot Ratings in Best PayPal Brokers

This section ranks the mentioned Forex brokerages based on Trustpilot ratings from the highest to the lowest rating one.

Broker Name | Trustpilot Rating | Number of Reviews |

FP Markets | 9,850 | |

398 | ||

eToro | 30,252 | |

3,148 | ||

Eightcap | 3,392 | |

City Index | 396 | |

Libertex | 4,167 |

Forex Broker Fees Involved with PayPal

In some brokers, additional fee is charged beside the platform costs by the broker. These commissions are reviewed in the table below.

Broker Name | Deposit Fee | Withdrawal Fee |

FP Markets | 0 | 0 |

Global Prime | 0 | 0 |

FXCM | 0 | 0 |

Pepperstone | 0 | 0 |

0 | 0 | |

Fusion Markets | 0 | 0 |

Libertex | 0 | 0 |

PayPal Deposits/Withdrawals Time in Brokerages

The table in this section ranks Forex brokers based on the estimated duration of a PayPal transaction to take place in them.

Broker Name | Deposit Duration | Withdrawal Duration |

Instant | Instant | |

Global Prime | Instant | Instant |

Fusion Markets | Instant | Instant |

Instant | Instant | |

Eightcap | Instant | 1–5 Business Days |

Pepperstone | Instant–1 Business Day | Instant–1 Business Day |

FxPro | 10 Minutes - 1 Business Day | 10 Minutes - 1 Business Day |

PayPal Minimum Amounts in Forex Brokers

This list contains the minimum amounts required for making deposits and withdrawals through PayPal in select brokers.

Broker Name | Min. Deposit | Min. Withdrawal |

FxPro | 0 | 0 |

Eightcap | 0 | 0 |

Global Prime | $10 | $10 |

$50 | $30 | |

Pepperstone | $5 | $20 |

FXCM | $50 | Not Specified |

Deposit Not Available | £100 / $100 / €100 |

Top 5 Forex Brokers with PayPal Availability

Below, each of the best brokers with PayPal as a payment option will be introduced and reviewed in a couple of paragraphs.

FP Markets

FP Markets is a multi-regulated Forex and CFD broker founded in 2005, headquartered in Sydney. Operating under top-tier regulators such as ASIC and CySEC, the broker emphasizes regulatory transparency, segregated client funds, and negative balance protection across its global entities.

The broker provides access to over 10,000 tradable instruments, including Forex, stocks, indices, commodities, ETFs, metals, and cryptocurrencies. Traders can operate through MetaTrader 4, MetaTrader 5, and cTrader, enabling manual, algorithmic, and copy-trading strategies from a single account environment.

FP Markets offers two primary account types, Standard and RAW, both requiring a minimum deposit of $50. Spreads start from 1.0 pips on Standard accounts and from 0.0 pips on RAW accounts, with a $3 commission per lot. Professional leverage options can reach up to 1:500, depending on jurisdiction.

From a leadership perspective, the broker is guided by Craig Allison, Head of EMEA, whose background in financial law, governance, and strategic expansion supports FP Markets’ institutional-grade approach. The company has received multiple international awards for pricing efficiency, execution speed, and overall trading value.

If you are eager to learn about the other FP Markets deposit/withdrawal methods beside PayPal, visit the linked webpage.

Specifics and Features

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros & Cons

FP Markets combines deep liquidity, competitive pricing, and strong regulation, making it suitable for both active retail traders and professionals. However, certain limitations related to regional availability and platform ownership may influence broker selection.

Before opening an account through the FP Markets registration form, check out its benefits and drawbacks.

Pros | Cons |

Regulated by top-tier authorities (ASIC, CySEC) | Not available to U.S. clients |

Spreads from 0.0 pips on RAW accounts | No proprietary trading platform |

Access to 10,000+ instruments | High leverage restricted in some regions |

Supports MT4, MT5, and cTrader | Educational content less extensive than some peers |

Global Prime

Global Prime is an Australia-founded forex and CFD broker (2010) associated with Jeremy Kinstlinger and later owned by Phil Horner (also linked to Fusion Markets). It offers access to 150+ instruments across Forex, indices, commodities, crypto CFDs, bonds, and US share CFDs.

The broker operates through multiple entities, including FMGP Trading Group Pty Ltd (ASIC) and an offshore arm regulated by VFSC. This structure creates different protection layers, such as investor compensation availability under the ASIC-regulated branch, depending on client residency and onboarding entity.

Global Prime positions its pricing around tight spreads, offering Raw spreads from 0.0 pips alongside a Standard account with spreads from 0.9 pips. Execution is promoted as ultra-fast (from 10ms), with trading available via MetaTrader 4 (MT4) and typical order types like Market, Limit, and Stop.

Additionally, a Global Prime rebate program is provided for discounts on trading fees. On the funding side, Global Prime supports 20+ payment methods and highlights commission-free deposits and withdrawals.

Account base currencies include USD, AUD, GBP, EUR, CAD, SGD, and JPY, while leverage can reach 1:500 under the VFSC entity (and up to 1:30 for ASIC retail, unless using “Pro Trading”).

If you are interested in the broker, go through our Global Prime registration page. The table below demonstrates the specifics.

Account Types | Standard, RAW |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | Unlimited |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros and Cons

To keep the evaluation balanced, the following table lists Global Prime’s core advantages and limitations, covering regulation depth, pricing structure, platform range, and regional eligibility differences.

Pros | Cons |

ASIC regulation via FMGP Trading Group Pty Ltd (tier-1 framework) | Platform choice is limited (MT4-centric) |

150+ tradable instruments across multiple CFD markets | Protection features vary by entity (e.g., NBP not uniform) |

Raw spreads from 0.0 pips with fast execution claims (from 10ms) | Leverage and margin rules differ by region/entity (can confuse comparisons) |

20+ funding methods with broker-stated fee-free deposits/withdrawals | Some countries are restricted, limiting global access |

eToro

Founded in January 2007, eToro Ltd is an Israel-based broker headquartered in TelAviv, built around social investing. The platform combines trading and investing across stocks, ETFs, commodities, indices, FX, and crypto, with a proprietary web/mobile terminal instead of third-party platforms.

eToro’s ecosystem centers on three investment options: CopyTrader, Smart Portfolios, and Crypto Staking. CopyTrader supports low-ticket entry (minimum $1 per copy relationship), while Smart Portfolios bundle thematic strategies. Staking is offered for selected assets such as ETH, SOL, ADA, and TRX.

Account access is structured into Personal, Professional, Corporate, and Islamic profiles, with a low $10 minimum deposit and base currencies including USD, EUR, and GBP. Funding options span PayPal, Skrill, Neteller, Trustly, cards, and bank transfer, with the available methods varying by region.

Regulation is multi-jurisdictional via entities such as eToro (UK) Ltd (FCA), eToro (Europe) Ltd (CySEC), and eToro AUS Capital Ltd (ASIC), alongside other branches (e.g., ADGM FSRA, Seychelles FSA, Gibraltar FSC/DLT provider, SEC/FINRA for the U.S.). Retail leverage is typically capped at 1:30, while eligible professionals can access up to 1:400. The table below summarizes the specifics.

Account Types | Personal, Professional, Corporate, Islamic |

Regulating Authorities | FCA, CySEC, MFSA, FSRA, ASIC, FSA, Gibraltar FSC |

Minimum Deposit | $10 |

Deposit Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Withdrawal Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | Proprietary App |

eToro Pros and Cons

This section breaks down eToro’s practical strengths and limitations, especially its social trading stack, multi-entity regulation, and broad market coverage, against common drawbacks like no MT4/MT5 and limited support channels. Check out this table before the eToro registration process.

Pros | Cons |

CopyTrader + Smart Portfolios built into one proprietary ecosystem | No MT4/MT5 support |

Multi-jurisdiction regulation (e.g., FCA, CySEC, ASIC, ADGM FSRA) | No phone-call customer support option (primarily chat/ticket/email) |

Broad market access (including 6,000+ stocks plus ETFs, FX, indices, commodities, crypto) | Non-trading costs can add up (e.g., $10 monthly inactivity after 12 months; conversion fees) |

Low entry thresholds (e.g., $10 minimum deposit; $1 minimum copy allocation) | Platform-only execution may not fit MT-based automation/EA workflows |

Pepperstone

Pepperstone is a global forex and CFD broker founded in Melbourne in 2010. Today, it processes over $9.2 billion in daily trading volume for more than 400,000 active clients, reflecting its strong institutional-grade infrastructure and global reach.

The broker supports 10 base currencies, including USD, EUR, GBP, and JPY, and allows position sizes from 0.01 to 100 lots. With leverage up to 1:500 (jurisdiction-dependent), Pepperstone appeals to both retail and professional traders seeking flexible risk management.

Pepperstone operates under a multi-entity regulatory structure, supervised by top-tier authorities such as ASIC, FCA, CySEC, BaFin, and DFSA. Client funds are held in segregated accounts, with negative balance protection applied across supported regions.

From a trading standpoint, Pepperstone offers Standard and Razor accounts, spreads from 0.0 pips, and access to MT4, MT5, cTrader, TradingView, and a proprietary platform. Markets include Forex, indices, commodities, crypto, shares, and ETFs, covering over 1,200 instruments. As a benefit, a Pepperstone rebate program is available to reduce trading fees.

Specifics and Details

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Deposit | $1 |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Pepperstone Pros and Cons

The following table highlights Pepperstone’s key advantages and drawbacks.

Pros | Cons |

Multi-regulated by top-tier authorities (ASIC, FCA, CySEC) | No PAMM or managed account solutions |

Ultra-low spreads with Razor account (from 0.0 pips) | No trading bonuses or promotions |

Broad platform support (MT4, MT5, cTrader, TradingView) | Demo account access is limited |

Deep liquidity and fast order execution | Restricted availability in several countries |

Eightcap

Eightcap is an Australian CFD broker founded in 2009 in Melbourne, offering access to 6 markets, Forex, commodities, metals, crypto, indices, and shares, with a listed maximum leverage of 1:500. The broker supports MT4, MT5, and TradingView, targeting both traditional and chart-centric workflows.

Regulation is a core part of Eightcap’s structure, with licenses across multiple jurisdictions: ASIC, FCA, CySEC, and SCB. Entity coverage includes Eightcap Pty Ltd (ASIC), Eightcap Group Ltd (FCA), Eightcap EU Ltd (CySEC), and Eightcap Global Limited (SCB), with segregated funds and negative balance protection noted.

Account options include Standard, Raw, and TradingView (plus a Demo). Standard and TradingView accounts start from 1.0 pip, while the Raw account lists spreads from 0.0 pips with a $7 round-turn commission per standard lot. The minimum deposit is $100, with 80% margin call and 50% stop-out levels. To open an account, you can go through our Eightcap registration guide.

Eightcap also adds specialist tools aimed at execution and automation: Capitalise.ai (code-free strategy automation), FlashTrader (fast order placement and position sizing), and an AI-powered economic calendar that highlights historical impact and sentiment across 1,000+ macro events. Support is available 24/5 via live chat, phone, and email.

Summary of Parameters

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

Eightcap’s strengths and limitations become clearer when its regulation, platform stack, costs (Raw vs Standard), and trading tools are weighed against factors like minimum deposit level, education depth, and the lack of copy-trading or PAMM-style investing, which are covered in the Pros & Cons below.

Pros | Cons |

Multi-regulated structure (ASIC, FCA, CySEC, SCB) with segregated funds and negative balance protection | No investment features (no copy trading, PAMM, or passive-income programs) |

Strong platform coverage: MT4, MT5, TradingView | Educational hub is useful but comparatively basic (limited advanced learning features) |

Competitive pricing on Raw account (from 0.0 pips + commission model) | Inactivity fee may apply after 3 months (monthly fee listed as 10 EUR/GBP/USD) |

Extra trading utilities: Capitalise.ai, FlashTrader, AI-powered economic calendar | Crypto is offered as CFDs only; UK retail clients face crypto CFD restrictions |

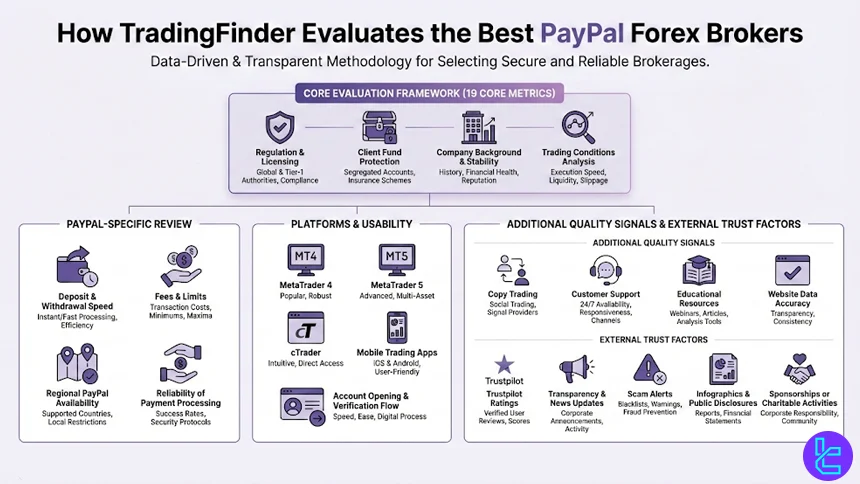

What Factors Did We Consider in Curating the Best PayPal Brokers?

Selecting the Best Forex Brokers with PayPal requires more than comparing spreads or payment speed. At TradingFinder, brokers are evaluated through a transparent, data-driven review methodology designed to reflect real trading conditions and long-term reliability. Our goal is to identify PayPal forex brokers that combine regulatory strength, fair costs, and a seamless trading experience.

Each broker is assessed using19 core metrics that directly affect traders’ capital safety and performance. The evaluation starts with regulation and licensing, ensuring brokers operate under recognized authorities and apply client-fund protection measures. We then analyze company background, including founding year, headquarters, and global presence, to gauge operational stability and credibility.

A key focus is account type diversity, covering standard, ECN, micro, and managed accounts, alongside the range of tradable instruments such as forex pairs, CFDs, indices, stocks, and ETFs.

For PayPal-supported brokers, deposits and withdrawals receive extra scrutiny, examining processing speed, fees, limits, and PayPal availability across regions. Trading costs are carefully reviewed through spreads, commissions, and non-trading fees, including inactivity charges.

Our analysts also test trading platforms and apps, prioritizing support for MetaTrader 4, MetaTrader 5, cTrader, and stable mobile platforms. The account opening and verification process is evaluated step-by-step to ensure efficiency and usability.

Additional factors include copy trading options, customer support responsiveness, educational resources, micro-level website data, and broker responses to user issues.

Finally, external signals such as Trustpilot scores, transparency in news and updates, infographics, scam alerts, and even sponsorship or charitable activities are factored into the final ranking.

What is PayPal?

PayPal is a global digital payment platform designed to make online and in-store transactions faster, safer, and more flexible. With a single account, users can pay for goods and services, send and receive money internationally, manage balances, and access additional financial tools; all without repeatedly entering card or bank details.

Getting started with PayPal is straightforward. Users create an account using an email address and phone number, then link a bank account or card to fund their PayPal balance. Once set up, payments can be made directly from the balance, linked cards, or banks through the PayPal app or supported websites.

For users who prefer card-based spending, PayPal also offers a “PayPal Debit Card”, allowing payments online and in physical stores while tracking transactions in real time.

Beyond payments, PayPal includes features such as cash-back offers, Buy Now, Pay Later options, and peer-to-peer transfers. Money can be sent quickly to individuals in over 110 countries using just a name, email, or phone number, making it a popular solution for both personal and international transfers.

Funds received are typically available immediately in the PayPal balance and can be used for shopping, bill payments, donations, or bank withdrawals.

Security is a core component of PayPal’s ecosystem. Transactions are encrypted, and eligible purchases may be covered by PayPal Purchase Protection, adding an extra layer of confidence.

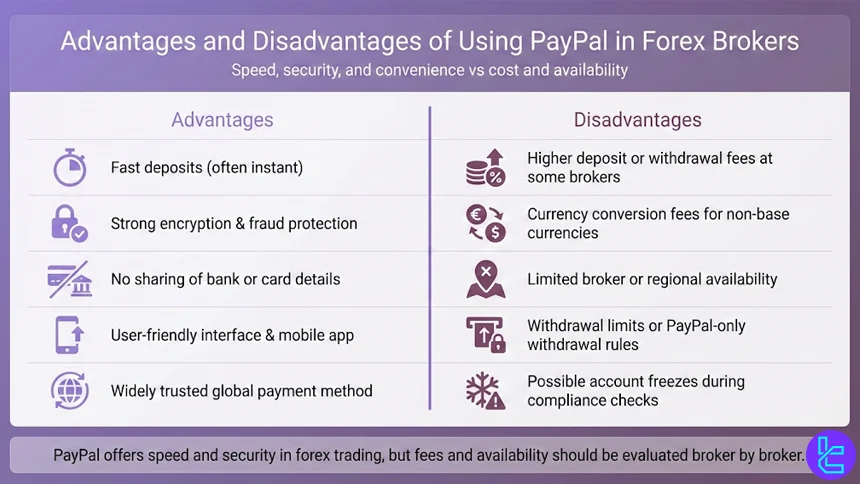

What Are the Advantages and Disadvantages of Using PayPal in Forex Brokers?

Using PayPal with forex brokers offers a balance between speed, security, and convenience. PayPal is widely favored for fast deposits and strong buyer protection, but it may also introduce higher fees and limited broker availability compared to bank transfers or cards.

Advantages | Disadvantages |

Fast deposits, often processed instantly | Higher deposit or withdrawal fees at some brokers |

Strong security with encryption and fraud protection | Currency conversion fees when trading non-base currencies |

No need to share bank or card details with brokers | Not supported by all forex brokers or regions |

User-friendly interface and mobile app | Withdrawal limits or PayPal-only withdrawal restrictions |

Widely trusted global payment method | Account freezes possible during compliance checks |

Learning about a broker’s pros and cons helps users make a better judgement of them.

PayPal Fees for User Transactions

PayPal applies transaction-based fees that vary depending on the payment method, checkout type, and whether the payment is processed online or in person.

While many of these rates are designed for merchants, they indirectly affect forex traders through broker-side costs, deposit fees, or minimum transaction thresholds. Below is a structured overview of PayPal’s main fee categories.

Online Payment Processing Fees:

- Card payments (Visa, MasterCard, AmEx, Discover): 2.89% + $0.29 per transaction

- PayPal & Venmo payments: 3.49% + $0.49 per transaction

- PayPal Pay Later: 4.99% + $0.49 per transaction

Checkout & Digital Payments:

- PayPal Checkout (cards): 2.99% + $0.49 per transaction

- Expanded Checkout (cards, Apple Pay, Google Pay, etc.): 2.89% + $0.29 per transaction

In-Person & POS Transactions:

- Card present / Tap to Pay / QR code: 2.29% + $0.09 per transaction

- Card keyed-in: 3.49% + $0.09 per transaction

Invoicing & Manual Payments:

- Invoices (PayPal & Venmo): 3.49% + $0.49 per transaction

- Invoices (Pay Later): 4.99% + $0.49 per transaction

- Invoices (cards & Apple Pay): 2.99% + $0.49 per transaction

- Virtual Terminal (manual card entry): 3.39% + $0.29 per transaction

Is PayPal Safe to Use for Forex Traders?

As stated in the previous sections of this article, this electronic wallet is one of the most reputable payment solutions in various industries, and it is widely known and used on a daily basis. Therefore, it is not impossible to consider it a trustworthy platform.

PayPal has mentioned on its website that they encrypt users’ transaction to keep the financial information private.

Also, they state that they do not share user’s full financial details. Furthermore, the company has an early fraud detection initiative to alert users in case of any suspicious or unusual transactions and activity.

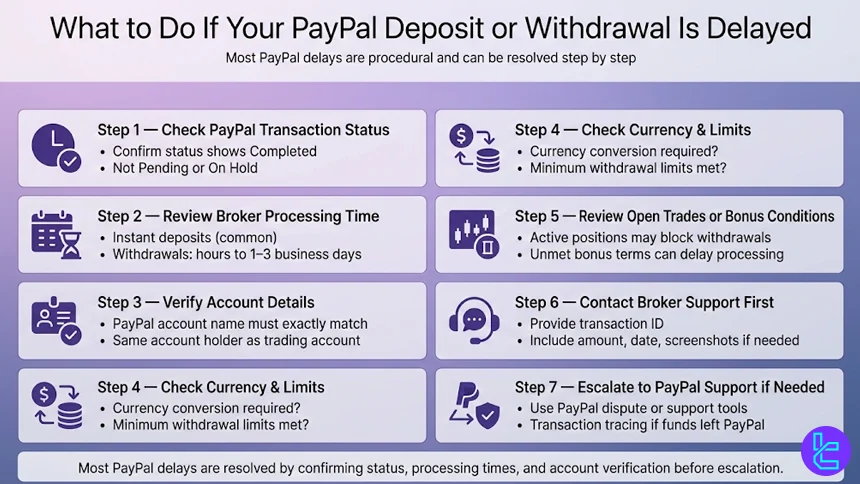

What Should I Do if My Money Does Not Appear After a PayPal Deposit/Withdrawal?

If a PayPal transaction is delayed with a forex broker, the issue is usually procedural rather than permanent.

When using PayPal, deposits are often instant, while withdrawals may require additional verification or internal processing by the broker.

Follow these instructions to resolve the issue efficiently.

- Check transaction status in PayPal: Confirm the payment shows as “Completed” (not Pending or On Hold);

- Review broker processing times: Some brokers process PayPal withdrawals within hours, others within 1–3 business days;

- Verify account details: Ensure the PayPal account name matches the trading account holder’s name exactly;

- Check currency conversion or minimum limits: Delays can occur if conversion is required or limits are not met;

- Confirm no open positions or bonus conditions: Active trades or unmet bonus terms may block withdrawals;

- Contact broker support first: Provide transaction ID, amount, date, and screenshots if needed;

- Escalate to PayPal support if necessary: If funds left PayPal but were not credited, PayPal can trace the transaction.

How to Deposit/Withdraw Funds to/from Brokers via PayPal

PayPal is designed to create a convenient and simple interface for users with all levels of experience to make their transactions. To fund your trading account in a Forex broker quickly, follow the steps mentioned below.

- Create an Account: Sign up with the payment solution using your email address or another credential per requirements, then go through the identity verifications to access all features and options;

- Log in to the broker’s user dashboard: Go to the brokerage’s website or application, then access the client area to find and select the “Deposit” or “Fund” option;

- Choose “PayPal” as the payment intermediary: From the list of payment platforms, select the desired one to make your transaction through it;

- Specify the amount and the currency of your deposit: In the related sections, enter the amount you want to deposit. Also, choose the currency accordingly;

- Authorize the transaction: After confirming the amount and currency, you’ll be redirected to the PayPal website or application to approve the payment;

Eventually, your payment will go through and the funds will appear in your broker’s trading account. The duration is subject to the brokerage.

If you want to withdraw funds from your broker, the process is almost totally similar. The only main difference is that you should choose the “withdraw” option in the step #2.

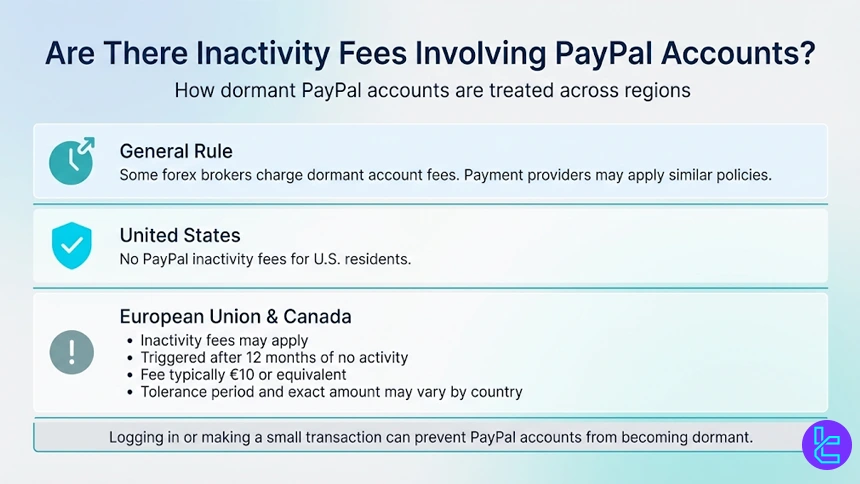

Are There Inactivity Fees Involving PayPal Accounts?

Some Forex brokers charge dormant accounts with specific fees after a certain period of inactivity. It is the same with payment providers. Regarding PayPal, there are no inactivity costs for account holders residing in the United States.

However, a fee is charged for those residing in certain countries in the European Union and Canada. While the amount and the toleration might be different, the cost is mainly 10 EUR or equivalent for accounts dormant for at least 12 months.

Are There Specific Regulatory Requirements for PayPal Forex Brokers?

Yes, there are clear regulatory and compliance requirements that a forex broker must meet to integrate PayPal as a payment method. PayPal operates as a regulated financial institution and only partners with brokers that hold valid licenses from recognized regulatory authorities.

This typically includes oversight from bodies such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or comparable regulators in the EU and other jurisdictions.

In addition to holding a brokerage license, forex brokers must comply with strict AML (Anti-Money Laundering) and KYC (Know Your Customer) standards. PayPal requires full transparency in client identity verification, transaction monitoring, and fund flow tracking.

Brokers are also expected to maintain segregated client accounts and follow dispute-resolution procedures aligned with PayPal’s buyer and seller protection policies.

Another important factor is operational risk management. PayPal evaluates brokers based on chargeback ratios, fraud history, and complaint levels. Brokers with repeated payment disputes or unresolved user issues may lose PayPal access, regardless of their trading conditions.

This is why PayPal is more commonly available with well-established, regulated forex brokers rather than offshore or lightly regulated entities.

From a trader’s perspective, the presence of PayPal can act as an indirect credibility signal, but it should never replace proper regulatory checks.

How Does PayPal Compare to Other Broker Payment Methods?

Forex brokers accept funds through various methods and gateways beside PayPal, such as Skrill, Neteller, Webmoney, etc. The table below draws a comparison between the popular payment solutions employed by brokerages.

Parameter | PayPal | Skrill | Neteller | WebMoney |

Broker Acceptance | Moderate; fewer Forex brokers support it | Widely accepted by Forex brokers | Widely accepted, similar to Skrill | Limited; region-specific |

Deposit Speed | Instant to same day | Instant to a few minutes | Instant | Instant |

Withdrawal Speed | Fast, bank withdrawals may take longer | Same day to 24 hours | Same day to 24 hours | Instant to same day |

Transaction Fees | Moderate to high in some cases | Low to moderate; broker-dependent | Low to moderate | Generally low |

Supported Currencies | 25+ fiat currencies | 40+ fiat currencies | Multiple fiat currencies | Digital WM units (WMZ, WME, etc.) |

Security & Compliance | High consumer protection, strong fraud control | Strong KYC, FCA-regulated provider | Strong KYC under Paysafe Group | Strong authentication, passport system |

Typical Forex Deposit Limits | Often higher minimums and limits | Low minimums; broker-defined caps | Low minimums; flexible limits | Low minimums; depends on WM type |

Regional Availability | Global but broker-limited | Global, strong in EU & Asia | Global, strong in Forex-friendly regions | Strong in Eastern Europe & CIS |

Conclusion

PayPal is a convenient and well-known e-wallet in various industries, and is employed by strictly regulated Forex brokers. While it might not be employed by many brokerages, some of the best ones offer it, including the FP Markets, Global Prime, eToro, and Pepperstone. We curated the list of best PayPal brokers based on 19 metrics.

If you are curious about the details of our evaluation framework, visit the Forex Methodology page.