Perfect Money is an e-wallet payment system used by Forex brokers, among other kinds of companies and businesses. Operating since 2007, it enables transfers through various currencies, cryptocurrencies, and other forms of value, including gold.

In the ranking below, some of the best choices for Perfect Money clients are mentioned.

| Alpari | |||

| LiteFinance | |||

| Grand Capital | |||

| 4 |  | Exness | ||

| 5 |  | NordFX | ||

| 6 |  | AvaTrade | ||

| 7 |  | Deriv |

Trustpilot Scores for Perfect Money Brokers

The table in this section ranks the mentioned brokerages based on the user ratings submitted on the “Trustpilot” user review website.

Broker Name | Trustpilot Rating | Number of Reviews |

26,871 | ||

AvaTrade | 11,741 | |

NordFX | 81 | |

Deriv | 70,286 | |

LiteFinance | 475 | |

86 | ||

Alpari | 300 |

Perfect Money Brokers Based on Deposit/Withdrawal Fees

The table below demonstrates the fees for making a deposit or withdrawal through Perfect Money, charged by the broker itself.

Broker Name | Deposit Fee | Withdrawal Fee |

Exness | $0 | $0 |

AvaTrade | $0 | $0 |

$0 | $0 | |

VT Markets | $0 | $0 |

PU Prime | $0 | $0 |

$0 | $0 | |

NordFX | 0.5-1.99% | 0.5% |

Deposit/Withdrawal Time in Perfect Money

This section specifically focuses on the time required for a Perfect Money transaction to take place through a Forex broker.

Broker Name | Deposit Time | Withdrawal Time |

VT Markets | Instant | Up to 24 Hours |

FxGlory | Instant | 1-24 Hours |

Exness | Instant–30 Minutes | Instant-1 Day |

Alpari | Instant or Within Hours | Within 1 Business Day |

NordFX | Instant or up to 1 hour | Instant to 1 Business Day |

Deriv | 1 day | 1 day |

Within 24 Hours | 24–48 Hours |

Minimum Amount for Deposits/Withdrawals in Perfect Money Brokers

In an ascending order, the following table mentions the minimum deposit/withdrawal amount for each broker.

Broker Name | Min. Deposit | Min. Withdrawal |

FxGlory | $1 | $5 |

Deriv | $5 | $5 |

Exness | $10 | $1 |

$10 | $10 | |

$10 | Not Specified | |

VT Markets | $50 | $40 |

AvaTrade | $100 | Not Specified |

Top 5 Forex Brokers Accepting Perfect Money

Each of the following sections includes a short review of a recommended broker for Perfect Money users.

Exness

Founded in 2008 by Petr Valov and Igor Lychagov, Exness has grown into a global forex broker backed by a workforce of 2,100+ professionals across nearly 100 countries. The company reports monthly trading volumes exceeding $4 trillion, highlighting its strong presence in retail FX markets.

Exness operates as a multi-asset market maker, offering access to forex, indices, commodities, stocks, and cryptocurrencies. Traders can choose from five account types, including Standard, Pro, Raw Spread, and Zero, with spreads starting from 0.0 pips and commissions ranging between $0.2 and $3.5 per lot.

Regulation is one of Exness’s core strengths. The broker holds licenses from top-tier authorities such as the FCA (UK) and CySEC (EU), alongside FSCA, CMA, FSA, FSC, and CBCS. Client funds are segregated, negative balance protection is applied, and investor compensation can reach up to £85,000 under FSCS.

For funding, multiple Exness deposit and withdrawal methods, including Perfect Money, Skrill, Neteller, and bank cards, are available. With a minimum deposit of just $10, instant processing on most methods, and support for MT4, MT5, and proprietary platforms, Exness appeals to both beginners and advanced traders.

Broker Specifics

Account Types | Standard, Standard Cent, pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Deposit | $10 |

Deposit Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Withdrawal Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Maximum Leverage | Unlimited (Subject to account) |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Exness Pros & Cons

Before diving into the detailed comparison, it’s helpful to weigh the main advantages and drawbacks of trading with Exness, especially for traders seeking Perfect Money-supported forex brokers.

Pros | Cons |

Accepts Perfect Money with fast processing | No deposit or trading bonuses |

Strong regulation (FCA, CySEC, FSCA, CMA) | Limited educational depth for beginners |

Ultra-low spreads and flexible commission models | Some instruments restricted by region |

Unlimited leverage under specific conditions | Not available in several countries |

AvaTrade

AvaTrade is a globally regulated forex and CFD broker holding 9 regulatory licenses, including oversight from the Central Bank of Ireland, ASIC, CySEC, FSCA, and FSA Japan. This broad supervision framework positions AvaTrade among the most compliance-focused brokers in international markets.

The broker requires a minimum deposit of $100 and applies margin call and stop-out levels of 25% and 10%, respectively. Various AvaTrade deposit and withdrawal methods, including Perfect Money, bank wire transfers, cards, and popular e-wallets, are provided.

AvaTrade offers access to MT4, MT5, WebTrader, and mobile apps, covering forex, stocks, indices, commodities, and crypto CFDs. Client funds are held in segregated accounts, and negative balance protection is applied across all regulated entities to limit downside risk.

With availability in over 150 countries and leverage options reaching 1:400 under non-EU entities, AvaTrade balances regulatory safety with competitive trading conditions. Its long operational history and multi-jurisdiction presence add to its overall credibility. Check out the AvaTrade dashboard article to learn about the broker’s user interface.

Summary of Specifics

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros & Cons

The table below summarizes AvaTrade’s main pros and cons for traders interested in Perfect Money–supported forex brokers.

Pros | Cons |

Regulated by multiple top-tier authorities | Inactivity fees apply after prolonged non-use |

Supports Perfect Money and diverse payment methods | No PAMM or managed account services |

Negative balance protection across entities | Bonuses restricted by region |

MT4, MT5, WebTrader, and mobile apps available | Fixed spreads may be higher during volatile markets |

NordFX

Founded in 2008, NordFX is a global forex and CFD broker with over 16 years of market presence and 1.7+ million registered accounts across 190 countries. The broker focuses on cost-efficient trading conditions, flexible leverage, and broad market access for international traders.

NordFX offers MT4 and MT5 Pro & Zero accounts, with spreads starting from 0.0 pips, commissions from 0%, and leverage reaching 1:1000. A $10 minimum deposit makes the broker accessible, while Zero accounts cater to high-volume and scalping strategies.

Trading is conducted exclusively on MetaTrader 4 and MetaTrader 5, supporting Expert Advisors (EAs), automated strategies, advanced charting, and VPS integration. Available markets include Forex, Cryptocurrencies, Metals, Energies, Indices, and Stocks (CFDs).

For payment flexibility, NordFX supports Perfect Money, along with cards, bank wires, e-wallets, and crypto payments. Deposits are typically instant, withdrawals are processed within 24 hours, and most funding methods carry zero broker fees, making it attractive for Perfect Money users.

For more details on the payment solutions of the broker, visit our NordFX deposit and withdrawal review.

Table of Specifications

Account Types | MT4 Zero, MT4 Pro, MT5 Zero, MT5 Pro |

Regulating Authorities | Not regulated |

Minimum Deposit | $10 |

Deposit Methods | Bank wire transfer, Credit/debit cards, E-wallets, Cryptocurrencies |

Withdrawal Methods | Bank wire transfer, Credit/debit cards, E-wallets, Cryptocurrencies, Internal Transfer |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4 / MT5 |

NordFX Pros & Cons

Below is a balanced snapshot of NordFX’s main strengths and limitations, helping traders quickly assess whether it fits their risk profile and payment preferences.

Pros | Cons |

Leverage up to 1:1000 | No Tier-1 regulation |

Perfect Money supported | No investor compensation scheme |

Tight spreads from 0.0 pips | Limited proprietary platforms |

Multiple MT4/MT5 account types | Restricted in US, EU, Canada |

Deriv

Deriv is a global derivatives broker offering CFDs, Options, and Multipliers across five asset classes, including Forex and Cryptocurrencies. With floating spreads from 0.24 pips and zero commissions, it serves over 2.5 million users and executes more than 187 million trades monthly.

Formerly known as Binary.com, Deriv is part of the Regent Markets Group, founded in 1999. After rebranding in 2020, the broker expanded into leveraged CFD trading while maintaining a strong focus on accessibility, innovation, and low entry barriers, including a minimum deposit of just $5.

Deriv processes over $46 million in withdrawals each month and reports an average monthly trading volume exceeding $650 billion. Although it is not licensed by tier-1 regulators, it operates under multiple authorities such as the MFSA, Labuan FSA, VFSC, and BVI FSC, offering segregated funds and negative balance protection.

The broker supports MT5, cTrader, and its proprietary Deriv X platform, alongside copy trading and 24/7 customer support. With base currencies including USD, EUR, USDT, and BTC, Deriv is particularly popular among traders seeking flexible funding options like Perfect Money and other e-wallets. For details on them, check out the Deriv deposit and withdrawal article.

Table of Features and Parameters

Account Types | Standard, Financial, Swap-Free |

Regulating Authorities | MFSA, FSA, VFSC, BVI |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Crypto, Voucher, Deriv P2P |

Withdrawal Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Crypto, Voucher, Deriv P2P |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT5, cTrader, Deriv X |

Deriv Pros & Cons

Before going through with Deriv registration, it’s worth noting that this broker stands out for its low-cost trading model, broad payment method coverage, and innovative derivative products, while its regulatory structure and platform complexity may not suit every trader.

Pros | Cons |

Floating spreads from 0.24 pips with zero commission | No tier-1 regulators like FCA or ASIC |

Supports Perfect Money and multiple e-wallets | Complex interface for beginners |

Very low minimum deposit ($5) | No PAMM or MAM account services |

Multiple platforms (MT5, cTrader, Deriv X) | CFD risk disclosure above industry average |

LiteFinance

LiteFinance is a long-standing forex and CFD broker operating since July 2005, with over 3.01 million clients and an average $24 billion daily trading volume. Its global footprint spans 15 countries, supported by multilingual 24/5 customer service.

The broker offers leverage up to 1:1000 through its offshore entity and provides access to Forex, commodities, indices, and stock CFDs. LiteFinance supports MT4, MT5, cTrader, and a proprietary mobile app, covering both manual and mobile-first trading preferences.

If you are interested in LiteFinance deposit and withdrawal options beside Perfect Money, check out our article regarding the matter.

From a regulatory standpoint, LiteFinance operates under different entities. LiteForex (Europe) Ltd is regulated by CySEC with investor compensation up to €20,000, while LiteFinance Investment Limited is regulated by the Mauritius FSC, allowing higher leverage and broader global eligibility.

Account-wise, traders can choose between Classic (spread-based, no commission) and ECN (raw spreads from 0.0 pips with commissions). The broker is also known as the first provider of $1 Cent accounts, making it accessible to low-capital traders and strategy testers. Below is a summary of the broker’s parameters.

Account Types | CLASSIC, ECN |

Regulating Authorities | FSC |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, cTrader, Mobile App |

LiteFinance Pros & Cons

LiteFinance combines high leverage, ECN execution, and broad payment support including Perfect Money, making it a notable option in the “Best Perfect Money Forex Brokers” category. Below is a concise overview of its main strengths and limitations.

Pros | Cons |

High leverage up to 1:1000 | Offshore entity lacks investor compensation |

ECN accounts with raw spreads | Limited account type variety |

Supports Perfect Money and multiple e-wallets | No 24/7 customer support |

Copy trading and PAMM services available | Inactivity fee after 3 months |

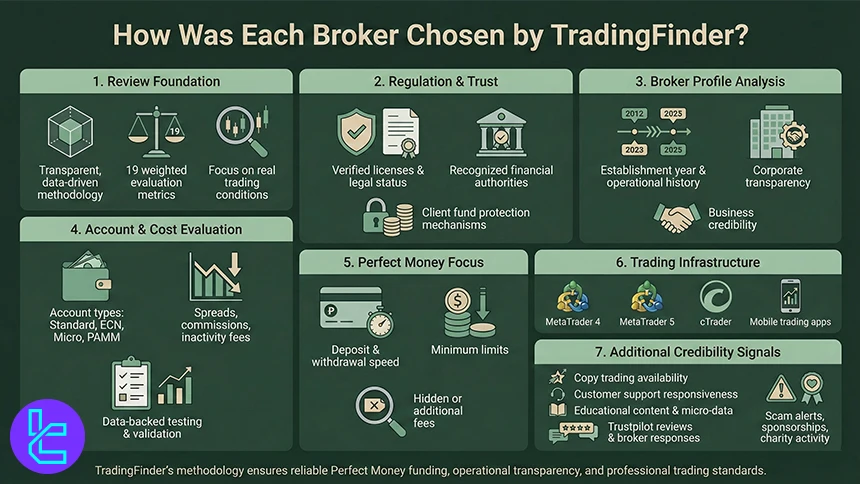

How was Each Broker Chosen by TradingFinder?

At TradingFinder, selecting the best forex brokers that accept Perfect Money is guided by a transparent, data-driven review methodology designed to protect traders and improve decision-making quality. Entrusting capital to a broker requires more than surface-level checks, which is why our evaluation framework is built on 19 carefully weighted metrics that directly impact real trading conditions.

Our process starts with regulations and licenses, verifying each broker’s legal status under recognized financial authorities and confirming the existence of client fund protection mechanisms.

We then assess core broker information, including establishment year, operational history, and corporate transparency. Account diversity is another key factor, as access to Standard, ECN, Micro, or PAMM accounts allows traders to align broker offerings with their risk profile and strategy.

Given the focus on Perfect Money transfers, we place special emphasis on deposit and withdrawal conditions, including processing speed, minimum limits, and hidden fees.

These are analyzed alongside commissions, spreads, and inactivity charges, using both published data and hands-on testing. Platform availability is equally important, with support for MetaTrader 4, MetaTrader 5, cTrader, and mobile apps being thoroughly reviewed.

Beyond trading mechanics, our analysts evaluate copy trading options, customer support responsiveness, educational resources, and the quality of micro-data and infographics provided. We also consider Trustpilot scores, broker responses to user issues, scam alerts, and even sponsorship or charitable activities, as these reflect long-term credibility.

Backed by experienced market analysts, TradingFinder’s methodology ensures that every broker listed offers reliable Perfect Money funding, operational transparency, and a trading environment aligned with professional standards.

What is Perfect Money?

Perfect Money is an online payment platform widely used by forex traders for funding and withdrawing from trading accounts, especially with international and offshore brokers. Launched in 2007, Perfect Money allows users to hold balances in multiple currencies, including USD, EUR, and gold-backed units, making it flexible for cross-border trading activities.

For forex traders, Perfect Money functions as an e-wallet, meaning deposits and withdrawals are processed without direct involvement of banks or card networks. Transactions are typically fast, often completed within minutes, which is a key advantage for traders who need quick access to capital.

Many brokers that support Perfect Money also offer lower minimum deposits and fewer geographic restrictions compared to traditional banking methods.

Another notable feature is Perfect Money’s privacy-oriented structure. While account verification exists, it is generally less restrictive than bank transfers or credit cards, making it popular in regions with limited access to international banking. However, this also means traders must pay close attention to broker regulation and security.

In the forex market, Perfect Money is mainly valued for speed, accessibility, and independence from banks, making it a practical payment method for traders seeking flexible fund management.

What Are the Advantages and Disadvantages of Using Perfect Money in Forex Brokers?

Perfect Money is widely used in forex trading due to its fast processing, low entry barriers, and accessibility in regions with limited banking options. However, its limited regulatory oversight and narrower broker acceptance mean traders must carefully balance convenience with security when choosing this payment method.

Advantages | Disadvantages |

Near-instant deposits and withdrawals with most forex brokers | Limited acceptance among top-tier, strictly regulated brokers |

Low minimum deposit requirements compared to bank transfers | Weaker consumer protection compared to cards or bank wires |

Accessible in countries with restricted banking systems | Higher fees when exchanging or funding via third-party exchangers |

No dependency on banks or card networks | Fewer dispute or chargeback options |

Simple account setup and multi-currency balances | Greater exposure to unregulated or offshore brokers |

Do Users Have to Pay for Perfect Money Transactions?

Yes, users generally pay fees when using Perfect Money, and these costs depend on the transaction type and account status. Perfect Money applies internal transfer fees, which are typically lower for verified accounts and higher for unverified ones.

In addition, fees may apply when funding a Perfect Money account or withdrawing funds through third-party exchangers, which often include their own service margins and exchange rate spreads.

When used with forex brokers, Perfect Money deposits are often fee-free on the broker’s side, but traders should always check for minimum deposit limits or indirect costs. Overall, while Perfect Money is not entirely free, its transaction costs are usually predictable and transparent, making it a manageable option for active forex traders.

Can Forex Traders Trust Perfect Money for Funding Operations?

Forex traders can trust Perfect Money for funding operations, provided it is used with reputable and well-regulated brokers. Perfect Money has been operating for many years and employs core security features such as encrypted transactions, account authentication, and activity monitoring to reduce unauthorized access.

However, trust in Perfect Money should be viewed in context. Unlike bank cards or wire transfers, Perfect Money does not operate under major international financial regulators.

As a result, user protection mechanisms such as chargebacks or dispute resolution are limited. This places greater responsibility on traders to carefully select brokers with strong regulatory oversight and transparent fund-handling policies.

From a practical standpoint, Perfect Money is widely trusted in regions where access to global banking is restricted. Its fast processing times and independence from banks make it appealing for frequent deposits and withdrawals.

According to evaluations by TradingFinder, risks related to Perfect Money are significantly reduced when traders use it exclusively with brokers that have verified licenses, segregated client funds, and a solid reputation.

In short, Perfect Money itself is a stable payment tool, but trader safety ultimately depends on the broker, not just the payment method.

What Should I Do if My Funds Do Not Appear After Making a Transaction Through Perfect Money?

If your funds do not appear after using Perfect Money, the issue is not usually serious. To resolve it efficiently, go through these instructions:

- Check the transaction status in your Perfect Money account to confirm that the payment was completed successfully and not pending or canceled;

- Verify transaction details, including the wallet ID, amount, and reference number, to ensure they match the information provided by the forex broker;

- Allow sufficient processing time, as some brokers manually review Perfect Money deposits or withdrawals, especially outside business hours;

- Review the broker’s funding rules, such as minimum deposit limits or required internal transfer confirmations;

- Contact the broker’s customer support and provide the transaction ID, screenshots, and time of payment for faster tracking;

- Reach out to Perfect Money support if the broker confirms non-receipt but the transaction shows as completed;

- Check your account verification status, as unverified accounts may face delays or additional checks.

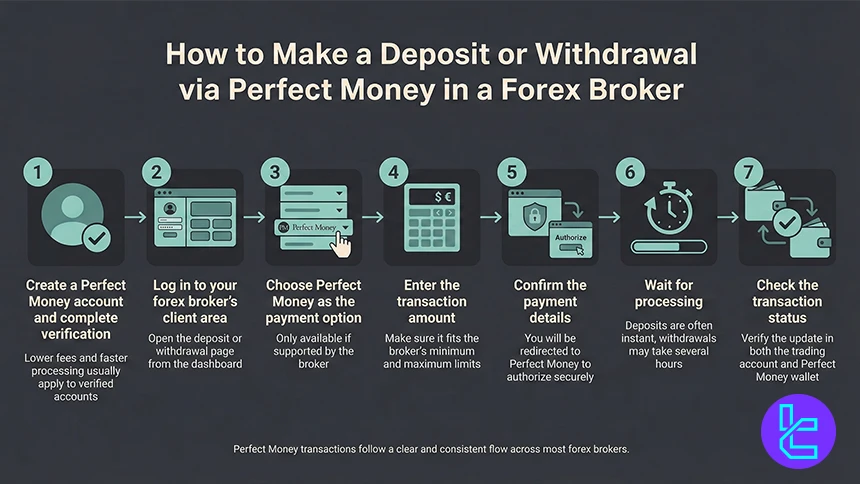

How to Make a Deposit/Withdrawal via Perfect Money in a Forex Broker

Using Perfect Money to fund or withdraw from a forex trading account is usually straightforward. While the exact steps may vary slightly between brokers, the standard process is as follows:

- Create and verify a Perfect Money account: Open an account on the Perfect Money platform and complete verification if required to reduce transaction fees and delays;

- Log in to your forex broker’s client area: Access the broker dashboard and navigate to the “Deposit” or “Withdrawal” section;

- Select Perfect Money as the payment method: Choose “Perfect Money” from the list of available funding options supported by the broker.

- Enter the transaction amount: Specify the deposit or withdrawal amount, ensuring it meets the broker’s minimum and maximum limits;

- Confirm payment details: You will be redirected to Perfect Money to log in and authorize the transaction securely;

- Wait for processing confirmation: Deposits are often credited instantly or within minutes, while withdrawals may require broker approval and can take several hours;

- Track the transaction status: Monitor both your Perfect Money account and trading balance to confirm completion.

Does Perfect Money Charge Any Inactivity Fees?

Perfect Money does not charge inactivity or dormancy fees for accounts that remain unused over time. Users can keep their Perfect Money wallets open without making transactions for extended periods without facing penalties or balance reductions.

However, while Perfect Money itself does not impose inactivity charges, traders should be aware that forex brokers may apply their own inactivity fees on dormant trading accounts, regardless of the payment method used.

These broker-side fees are unrelated to Perfect Money and are usually outlined in the broker’s terms and conditions. As a result, traders should clearly distinguish between wallet inactivity and trading account inactivity when managing their funds.

Are Perfect Money Forex Brokers Regulated by High-Tier Financial Authorities?

Forex brokers that accept Perfect Money are not automatically unregulated, but regulation largely depends on the broker’s jurisdiction, not the payment method itself.

In practice, many top-tier regulated brokers under authorities such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or Cyprus Securities and Exchange Commission (CySEC) tend to limit or avoid Perfect Money due to strict AML and payment compliance rules.

As a result, Perfect Money is more commonly supported by offshore or mid-tier regulated brokers, operating under jurisdictions such as IFSC, FSA (Seychelles), or similar regulatory frameworks.

These regulators still impose licensing, reporting, and operational requirements, but they generally allow more flexibility in payment methods compared to Tier-1 authorities.

That said, regulation quality should be assessed independently of the funding option. Some Perfect Money brokers maintain solid compliance standards, segregate client funds, and apply internal risk controls, even without Tier-1 licenses.

The key is verifying the broker’s legal entity, license number, and fund-protection structure rather than relying solely on brand claims.

In summary, while most Perfect Money forex brokers are not regulated by the highest-tier authorities, a number of them still operate within recognized regulatory frameworks. Traders should prioritize transparent regulation, fund segregation, and operational history when choosing a Perfect Money broker.

Perfect Money Compared to Other Payment Solutions in Forex Brokers

Perfect Money is widely used by Forex traders who prioritize fast processing, low minimum deposits, and access in regions where traditional banking is limited.

Compared to Bank Wire, Credit Cards, and PayPal, it offers near-instant transfers and fewer entry barriers, but usually with weaker consumer protection and lower acceptance among top-tier regulated brokers.

The table below highlights how Perfect Money stacks up against these popular payment solutions across key parameters relevant to Forex trading, including speed, fees, security, and broker support.

Parameter | Perfect Money | Bank Wire Transfer | Credit Card | PayPal |

Broker Acceptance | Moderate; common with offshore & mid-tier brokers | Widely accepted by regulated brokers | Widely accepted by most brokers | Moderate; fewer Forex brokers support it |

Deposit Speed | Instant to minutes | 1–5 business days | Instant to a few minutes | Instant to same day |

Withdrawal Speed | Instant to 24 hours | 1–5 business days | 1–5 business days | Instant to 1–5 business days |

Transaction Fees | Low to moderate; PM & exchanger fees may apply | Often higher; bank & intermediary fees | Low to moderate; issuer/broker-dependent | Moderate to high in some cases |

Supported Currencies | USD, EUR, gold-backed units | Depends on bank & broker base currencies | Depends on card & broker | 25+ fiat currencies |

Security & Compliance | Basic KYC; limited consumer protection | Very high; bank-level AML/KYC | High; chargebacks & fraud protection | High consumer protection & fraud control |

Typical Forex Deposit Limits | Low minimums; broker-defined caps | High limits; ideal for large transfers | Medium limits; broker-defined | Often higher minimums & limits |

Regional Availability | Strong in Asia, Africa, CIS | Global | Global | Global but broker-limited |

Conclusion

Perfect Money is a niche payment method in specific regions and mostly employed by international or offshore brokers. Exness, AvaTrade, NordFX, and Deriv are some of the best options offering PM with a high reputation among traders.

To learn about the way we chose each broker and the important factors in the process, check out our Forex methodology (https://tradingfinder.com/forex-methodology/) page.