WebTrader brokers deliver browser-based forex and CFD trading with no downloads, full cross-device access, and real-time execution. Top platforms integrate TradingView charts, 30+ technical indicators, advanced order types, and MT4 or MT5 synchronization, enabling traders to manage FX pairs, gold, indices, and stocks securely from any operating system.

Leading WebTrader platforms provide encrypted connections, cloud-based profile storage, and instant account recovery across desktop, tablet, and mobile. Top brokers for web trading:

| IC Markets | |||

| VT Markets | |||

| AvaTrade | |||

| 4 |  | XM Group | ||

| 5 |  | Exness | ||

| 6 |  | HFM | ||

| 7 |  | FxPro | ||

| 8 |  | FXGT |

Brokers with Web-Based Platforms Ranked by Trustpilot Ratings

Based on tens of thousands of verified Trustpilot reviews, leading WebTrader brokers demonstrate consistently high user satisfaction, with top platforms positioned in the upper rating tier and well-established providers maintaining solid mid-range scores.

Broker Name | Trustpilot Rating | Number of Reviews |

IC Markets | 49,951 | |

Exness | 25,861 | |

11,517 | ||

HFM | 2,821 | |

VT Markets | 2,067 | |

FXGT | 1,516 | |

866 | ||

XM Group | 2,839 |

WebTrader Forex Brokers’ Minimum Spreads

Leading WebTrader forex brokers offer ultra-competitive pricing with minimum spreads starting from 0.0 pips on major currency pairs, ensuring low trading costs and efficient execution.

Only a small number of platforms operate above this threshold, with spreads remaining below 1 pip, reflecting strong liquidity access and institutional-grade pricing conditions.

Broker Name | Min. Spread |

0.0 Pips | |

HFM | 0.0 Pips |

FxPro | 0.0 Pips |

Tickmill | 0.0 Pips |

0.0 Pips | |

Eightcap | 0.0 Pips |

Pepperstone | 0.0 Pips |

XM Group | 0.6 Pips |

Non-Trading Fees in WebTrader Brokers

Most WebTrader brokers eliminate deposit and withdrawal fees entirely, while inactivity charges typically range between $10 and $18 per month. Only a limited number apply funding costs of up to 1%, making fee-free account maintenance a major competitive advantage for active online traders.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Exness | No | No | No |

IUX | No | No | No |

IC Markets | No | No | No |

AvaTrade | No | No | $10/month |

No | No | Up to $10/month | |

No | No | $10/month | |

FOREX.com | No | No | $15/month |

IG | Up to 1% | No | $18/month |

WebTrader Forex Brokers’ Trading Instruments

Top WebTrader forex brokers provide extensive market access, offering from over 800 to more than 17,000 tradable instruments across the forex market, indices, commodities, stocks, ETFs, and cryptocurrencies.

This broad product coverage enables diversified portfolio construction, advanced multi-asset strategies, and continuous exposure to global financial markets.

Broker Name | Tradable Instruments |

IG | 17,000+ |

2,800+ | |

IC Markets | 2,200+ |

FxPro | 2,100+ |

AvaTrade | 1,250+ |

Pepperstone | 1,200+ |

1,000+ | |

Eightcap | 800+ |

Top 6 WebTrader Brokers

The Top 6 WebTrader forex brokers combine browser-based trading with deep liquidity, ultra-low spreads from 0.0 pips, access to 1,000+ instruments, advanced WebTrader terminals with MT4/MT5/TradingView synchronization, and strong global regulation.

These platforms deliver secure multi-device trading, fast execution, competitive pricing, and professional infrastructure for active traders worldwide.

IC Markets

IC Markets is a globally established multi-asset broker founded in 2007, serving traders with access to more than 2,100 stock CFDs and over 60 forex pairs. The broker supports 10 base currencies and requires a minimum deposit of $200, delivering professional-grade trading conditions.

Operating under ASIC, CySEC, and FSA regulation, IC Markets maintains strict financial standards, segregated client funds, and strong compliance systems. European clients benefit from investor protection coverage up to €20,000, while international clients may access leverage up to 1:500 across multiple asset classes.

IC Markets provides a full trading ecosystem including MetaTrader 4, MetaTrader 5, cTrader, and the WebTrader terminal, along with dedicated mobile apps.

Trading conditions feature spreads from 0.0 pips, average EUR/USD spreads of 0.1 pips, low commissions starting from $3 per lot, and cashbacks of up to $3 per lot via the IC Markets rebate program.

Traders gain exposure to forex, stocks, indices, bonds, commodities, and cryptocurrencies, with support for scalping, algorithmic trading, and copy trading through the WebTrader and cTrader environments. Advanced execution infrastructure ensures low latency and high reliability for active and professional traders.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

IC Markets Pros & Cons

Before choosing IC Markets, traders should carefully weigh the broker’s strengths and limitations to determine overall suitability for their trading objectives.

Pros | Cons |

Ultra-low spreads from 0.0 pips | $200 minimum deposit may limit beginners |

Strong regulation under ASIC, CySEC, and FSA | Leverage restrictions in the EU and Australia |

Advanced platforms, including WebTrader | Not available in several major countries |

2,100 plus tradable instruments | Some promotional programs no longer active |

AvaTrade

AvaTrade is a globally regulated online brokerage serving traders in more than 150 countries, operating under 9 regulatory licenses. The broker requires a minimum deposit of $100 and provides access to over 1,250 tradable instruments across forex, stocks, commodities, indices, cryptocurrencies, bonds, and options.

The company is licensed by major financial authorities, including ASIC, CySEC, CBI, FSCA, ISA, ADGM, and MiFID frameworks, offering strong client protection through segregated funds, negative balance protection, and leverage levels reaching up to 1:400 depending on region and regulatory jurisdiction.

AvaTrade dashboard supports a full professional trading environment featuring MetaTrader 4, MetaTrader 5, its proprietary WebTrader terminal, AvaOptions, and mobile applications for iOS and Android. Trading execution is instant, spreads are competitive, and margin call and stop out levels are set at 25% and 10%.

In addition to manual trading, AvaTrade provides copy trading solutions through DupliTrade and AvaSocial, enabling portfolio diversification and automated strategy execution. It also features 20% spread discounts through the AvaTrade rebate program.

The broker’s infrastructure supports active, institutional, and long-term traders seeking stability, regulatory depth, and multi-asset market access.

AvaTrade deposit and withdrawal methods include cards, bank transfers, PayPal, Skrill, Neteller, WebMoney, etc.

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros & Cons

Before choosing AvaTrade, traders should consider both the broker’s advantages and limitations in order to assess overall suitability for their trading style, capital size, and regulatory location.

Pros | Cons |

Strong global regulation with 9 licenses | No 24/7 customer support |

Wide selection of 1,250 plus instruments | Limited bonus availability by region |

Multiple platforms, including WebTrader | Inactivity fees for dormant accounts |

Integrated copy trading and options trading | No PAMM investment accounts available |

VT Markets

VT Markets is a multi-asset brokerage serving over 400,000 active traders and processing more than 30 million trades monthly across 1,000+ instruments.

VT Markets dashboard offers global market access through Forex, indices, commodities, shares, ETFs, bonds, and cryptocurrencies with a competitive execution infrastructure.

The company operates under regulation from ASIC, FSCA, and FSC Mauritius, providing a layered compliance framework for international clients. VT Markets supports multiple account structures, including Standard STP, RAW ECN, Cent STP, and Cent ECN, with a low minimum deposit of $50 and leverage up to 1:500.

VT Markets registration provides access to various platforms, including MetaTrader 4, MetaTrader 5, its proprietary WebTrader terminal (Webtrader+ powered by TradingView), and dedicated mobile applications.

Spreads begin from zero on ECN accounts, commissions start from zero on STP accounts, and execution follows market pricing with an 80% margin call and 50% stop out.

Beyond active trading, VT Markets offers integrated copy trading, PAMM investment solutions, VPS support, and loyalty programs, all available after completing the VT Markets verification procedure.

Its infrastructure accommodates both algorithmic and discretionary strategies, supported by fast execution, negative balance protection, and advanced analytical plugins for institutional-grade trading performance.

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros & Cons

Traders should evaluate both the broker’s strengths and limitations to determine whether its structure, regulatory framework, and product range align with their trading objectives and risk profile.

Pros | Cons |

Advanced platforms, including WebTrader and TradingView tools | No 24/7 customer support |

Low minimum deposit starting from $50 | Restricted availability in several countries |

Over 1,000 tradable instruments across 7 markets | No excess loss insurance |

Integrated copy trading and PAMM services | Mixed public trust ratings |

FXGT

FXGT is a fast-growing multi-asset broker founded in 2019, offering ultra-flexible trading conditions with leverage up to 1:5000, a minimum deposit starting from just $5, and 0 percent stop-out protection.

The platform delivers access to more than 185 tradable instruments across forex, indices, metals, energies, stocks, cryptocurrencies, DeFi, and NFTs.

The broker operates under multiple regulatory authorities, including CySEC, FSCA, FSA, and VFSC, providing a diversified compliance framework. Client funds are fully segregated, negative balance protection is enabled across all entities, and institutional clients receive investor compensation protection of up to €20,000 under European regulation.

FXGT provides professional-grade trading through MetaTrader 4, MetaTrader 5, and its integrated WebTrader terminal, delivering high-speed execution, customizable workspaces, copy trading functionality, and advanced charting tools.

ECN Zero accounts offer spreads from 0 pips with commissions as low as $3 per side for FX pairs. Traders can select from five account types, including Mini, Standard+, Pro, ECN Zero, and Optimus, after completing the FXGT registration process.

With 24/7 multilingual support, extensive payment systems, FXGT rebate program (cashbacks of up to $4.5 per lot), and strong liquidity infrastructure, FXGT delivers a flexible and technology-driven trading ecosystem.

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

FXGT Pros and Cons

Before choosing FXGT, traders should carefully balance the broker’s competitive advantages with its structural limitations to ensure alignment with personal risk tolerance, regulatory location, and trading objectives.

Pros | Cons |

Extremely low entry barrier with $5 minimum deposit | Limited number of total tradable symbols |

Very high leverage up to 1:5000 | Not available to clients in many major regions |

Advanced platforms, including WebTrader and MT4/MT5 | Limited formal education resources |

ECN trading with raw spreads and low commissions | Relatively young broker with a shorter track record |

Exness

Exness is a globally established Forex and CFD broker founded in 2008, processing over $4 trillion in monthly trading volume and supported by more than 2,100 employees across nearly 100 countries. The broker provides deep liquidity, ultra-fast execution, and a professional trading infrastructure.

Operating under multiple top-tier regulators, including FCA, CySEC, FSCA, FSA, FSC, CMA, and CBCS, Exness delivers strong client protection with segregated funds, negative balance protection, and compensation coverage up to €20,000 or £85,000, depending on jurisdiction.

Maximum leverage reaches up to 1:2000, with special conditions allowing unlimited leverage.

Exness dashboard offers a complete trading ecosystem featuring MetaTrader 4, MetaTrader 5, Exness Trade mobile app, Exness Terminal, and its high-performance WebTrader terminal.

Trading conditions include spreads from 0.0 pips, commissions from $0.2 to $3.5, instant and market execution, stop-out levels as low as 0%, and the Exness rebate program with cashbacks of up to $112.5 per lot.

The broker supports diverse trading strategies through five account types, including Standard, Standard Cent, Pro, Zero, and Raw Spread, all available after completing the Exness registration process.

With copy trading, VPS services, swap-free options, advanced risk controls, and 24/7 multilingual support, Exness delivers one of the most scalable environments in global online trading.

Account Types | Standard, Standard Cent, pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Deposit | $10 |

Deposit Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Withdrawal Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Maximum Leverage | Unlimited |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Exness Pros and Cons

The table below provides a comprehensive overview of Exness' advantages and disadvantages.

Pros | Cons |

Extremely high liquidity and fast execution | Educational content less extensive than some competitors |

Strong global regulation across major jurisdictions | Certain instruments unavailable on some account types |

Advanced platforms, including WebTrader and MT4/MT5 | Restricted access in several countries |

Low trading costs with tight spreads and commissions | No traditional trading bonuses available |

XM Group

XM Group is a globally recognized Forex and CFD broker founded in 2009, serving over 15 million clients and executing nearly 14 million trades per day. The broker offers access to more than 1,400 instruments, including 55 plus currency pairs and over 1,200 stock CFDs.

The company operates under multiple international regulatory bodies such as CySEC, FSCA, DFSA, FSC Belize, FSC Mauritius, and FSA Seychelles, delivering a structured compliance framework.

XM provides negative balance protection, guaranteed order execution up to 50 lots, and leverage reaching 1:1000 for qualified accounts.

XM delivers trading services through MetaTrader 4, MetaTrader 5, the proprietary XM mobile app, and a high-performance WebTrader terminal for browser-based execution. Trading conditions include spreads from 0.6 pips, commission-free trading on most accounts, and 24/7 multilingual customer support.

The broker supports diverse trading profiles with account types including Standard, Ultra Low, and Shares, alongside Islamic and demo accounts. Integrated copy trading features, loyalty programs, and extensive educational resources position XM as a comprehensive trading ecosystem for both new and professional traders.

Account Types | Standard, Ultra Low, Shares |

Regulating Authorities | FSC Belize, CySEC Cyprus, FSCA South Africa, DFSA Dubai, FSC Mauritius, FSA Seychelles |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

XM Group Pros and Cons

Traders should carefully assess the broker’s strengths and limitations to ensure the platform aligns with their trading objectives, capital requirements, and regulatory preferences.

Pros | Cons |

Very low minimum deposit from $5 | An inactivity fee charged on dormant accounts |

Strong global regulatory coverage | Restricted in several major countries |

Wide selection of 1,400 plus instruments | No dedicated PAMM investment accounts |

Advanced platforms, including WebTrader | Mixed public trust ratings |

What Is WebTrader?

WebTrader is a browser-based trading terminal that enables live trading without installing software. It runs entirely through the web using an encrypted cloud architecture and offers full account access from any device, including desktop, tablet, and mobile.

Modern WebTrader platforms mirror desktop terminals by supporting advanced charting, technical indicators, pending orders, stop-loss, take-profit, and real-time execution. Most brokers integrate WebTrader with MT4/MT5 servers, ensuring seamless synchronization.

- Real-time price streaming

- Charting & technical indicators

- Order execution & management

- Account synchronization

- Cross-device access

What Factors Should I Consider to Select the Best WebTrader Broker?

A top WebTrader broker must combine strong regulation, stable execution, competitive pricing, and platform reliability. Regulatory oversight from bodies such as FCA, ASIC, CySEC, FSCA ensures capital protection, while infrastructure quality determines execution speed, slippage control, and uptime.

Beyond licensing, traders should examine spreads, commissions, leverage limits, supported instruments, funding methods, data security, and availability of advanced charting. A broker offering WebTrader + MT4/MT5 with cloud synchronization significantly enhances trading continuity across devices.

- Regulation quality and jurisdiction coverage

- Trading costs: spreads, commissions, swap structure

- WebTrader feature set and execution model

- Asset coverage and liquidity depth

- Deposit/withdrawal reliability

- Customer support accessibility

- Platform security and data encryption

Key Advantages of WebTrader

WebTrader removes installation barriers while delivering professional trading features. Its cloud-based design allows traders to instantly log in from any location, eliminating dependency on operating systems or hardware configuration.

Additional benefits include rapid deployment, automatic updates, lower resource consumption, and enhanced security via encrypted web protocols. Many platforms integrate TradingView charting, enabling institutional-grade analysis directly in the browser.

- No installation or downloads

- Full platform synchronization

- High-level charting & indicators

- Encrypted cloud security

- Immediate access from any device

WebTrader Platform Costs and Pricing

Most WebTrader terminals are free with brokerage accounts. Costs arise from spreads, commissions, swaps, and execution models, not platform access. ECN brokers may offer spreads from 0.0 pips with per-lot commissions.

Professional pricing models vary based on asset class, liquidity, and jurisdiction. Many brokers provide both commission-free accounts and RAW spread accounts accessible through WebTrader.

Does WebTrader Support Custom Indicators?

Most modern WebTrader platforms support custom indicators, particularly when connected to MT4/MT5 servers or enhanced by TradingView integration. Traders can load proprietary scripts, templates, and saved chart layouts.

However, some web-only proprietary terminals restrict indicator customization compared to desktop terminals. Compatibility depends on broker infrastructure and WebTrader architecture.

How To Access a WebTrader Terminal

Access requires only broker login credentials. After registration, traders open the broker’s website, select WebTrader, authenticate, and begin trading instantly without downloads.

This access model enables rapid execution from office computers, public terminals, or mobile browsers while preserving full account control.

- Register trading account

- Verify identity

- Log in via broker website

- Launch WebTrader

- Begin trading

Does WebTrader Support VPS Trading and Auto Trading?

WebTrader itself does not host Expert Advisors, but it integrates with broker-provided VPS services. Traders deploy automated strategies on MT4 or MT5 running on VPS servers while monitoring performance, managing risk, and controlling positions through WebTrader from any browser.

This hybrid structure combines automation reliability with browser-based flexibility. Professional traders benefit from uninterrupted algorithm execution on VPS infrastructure while retaining real-time management through WebTrader’s responsive interface.

Connecting WebTrader to Your Broker

WebTrader connects directly to broker trading servers using encrypted HTTPS protocols and proprietary trading bridges. All trade data, execution instructions, account balances, and historical records synchronize instantly across WebTrader, desktop, and mobile terminals in real time.

This unified infrastructure ensures execution accuracy and consistency regardless of the access device. Traders benefit from seamless continuity, allowing uninterrupted position management and reliable risk monitoring across all platforms.

Do WebTraders Support Historical Data for Back-Testing Strategies?

WebTrader platforms provide extensive historical price data for technical analysis, strategy evaluation, and market replay. Traders can analyze multiple timeframes, apply indicators, and visually test trading concepts directly in the browser environment without external software dependencies.

However, full algorithmic back-testing execution remains a function of desktop terminals. WebTrader complements this process by supporting strategy preparation, validation, and performance review across synchronized trading accounts.

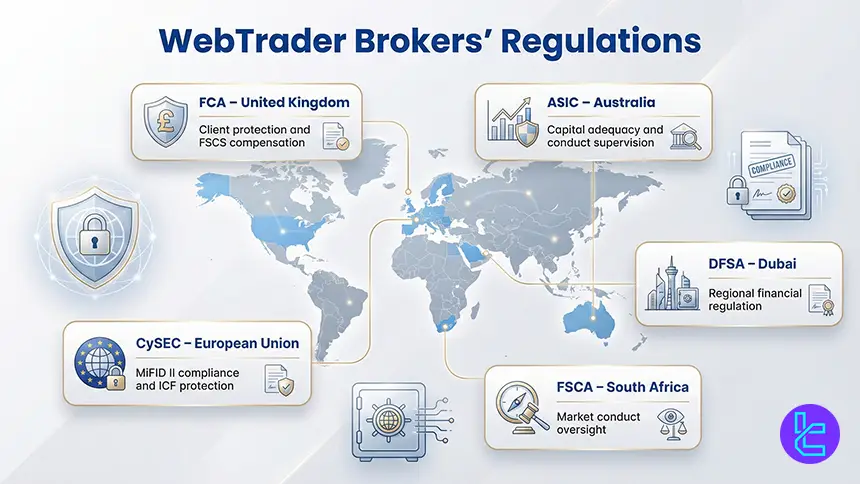

WebTrader Brokers' Regulations

Strong regulatory frameworks form the foundation of reliable WebTrader brokers. High-tier regulators enforce strict financial standards, ensure client fund segregation, mandate negative balance protection, and operate investor compensation schemes that safeguard traders from broker insolvency.

High-Tier Regulators

- FCA UK: Client protection and FSCS compensation

- ASIC Australia: Capital adequacy and conduct supervision

- CySEC EU: MiFID II compliance and ICF protection

- FSCA South Africa: Market conduct oversight

- DFSA Dubai: Regional financial regulation

Non-Trading Services on WebTrader Brokers

Beyond trading execution, leading WebTrader brokers provide extensive non-trading services such as economic calendars, market research portals, sentiment tools, copy trading networks, portfolio analytics, and education hubs. These tools strengthen decision-making and support professional risk management.

Advanced brokers also provide API access, trading signals, institutional analytics, and proprietary risk dashboards. Together, these services create a complete trading ecosystem that extends well beyond simple order execution.

Trading Markets Supported by WebTrader Brokers

WebTrader brokers typically provide multi-asset access to Forex, CFD contracts, indices, stocks, commodities, cryptocurrencies, ETFs, and bonds. This broad coverage allows traders to construct diversified portfolios and manage risk across global markets within a single browser-based environment.

Institutional-grade liquidity enables tight spreads, deep order books, and stable execution even during high volatility. Market depth and asset availability remain critical differentiators among top WebTrader brokers.

Do WebTrader Brokers Offer Proprietary Platforms Too?

Most professional brokers complement WebTrader with proprietary desktop and mobile platforms that feature specialized execution engines, proprietary analytics, and enhanced risk management tools. These proprietary platforms often integrate seamlessly with WebTrader, maintaining synchronized trading environments.

This hybrid platform ecosystem allows traders to combine deep analysis on desktop systems with the convenience of WebTrader for mobile and remote access, maximizing flexibility and control.

WebTraders Compared to Popular Trading Platforms

WebTrader offers unmatched accessibility and device independence compared to traditional desktop platforms such as MT4 and MT5. While desktop platforms retain advantages in algorithm development and deep back-testing, WebTrader surpasses them in mobility, instant access, and infrastructure efficiency.

Comparison Parameter | WebTrader | cTrader | ||

Primary Use Case | Instant market access | ECN Forex & CFD trading | Multi-asset trading | Forex & CFD trading |

Tradable Assets | Forex, stocks, crypto, futures, CFDs, bonds | Forex, indices, commodities, crypto (CFDs) | Forex, stocks, indices, commodities, crypto | Mainly Forex, CFDs |

Order Types | Market & Limit (broker-dependent), alerts-based execution | Market, Limit, Stop, Stop Limit, Market Range, Trailing Stop | Market, Buy/Sell Limit, Buy/Sell Stop, Buy/Sell Stop Limit, Trailing Stop | Market, Buy/Sell Limit, Buy/Sell Stop, Trailing Stop |

Algorithmic Trading | Limited | Yes (cAlgo / C#) | Yes (MQL5 EAs) | Yes (MQL4 EAs) |

Chart Types | Depends on the broker | Candlestick, Bar, Line, Heikin Ashi, Renko | Candlestick, Bar, Line | Candlestick, Bar, Line |

Strategy Backtesting | Limited | Tick-accurate backtesting | Multi-threaded | Single-threaded |

Social / Community Features | Depends on the broker | Limited (copy trading via cTrader Copy) | No | No |

Platform Access | Browsers | Desktop, Web, Mobile | Desktop, Web, Mobile | Desktop, Web, Mobile |

Typical User Profile | Multi-asset traders | ECN-focused & professional traders | Advanced multi-asset traders | Algorithmic & retail Forex traders |

Price | Typically free | Free platform (broker-provided) | Free platform (broker-provided) | Free platform (broker-provided) |

Conclusion and Expert Suggestions

WebTrader platforms now power professional online trading with browser-based execution, ultra-low spreads from 0.0 pips, multi-asset access exceeding 17,000 instruments, and advanced synchronization across MT4, MT5, mobile, and desktop terminals.

Best WebTrader brokers combine deep liquidity, strong regulation, institutional execution, and encrypted cloud architecture for seamless multi-device trading. Modern WebTrader ecosystems integrate TradingView charting, 30+ indicators, copy trading networks, VPS connectivity, and multi-asset exposure.

Broker rankings in this guide are built using the TradingFinder Forex methodology, a structured evaluation framework that measures execution quality, regulatory depth, pricing efficiency, platform stability, market coverage, and real trading performance to identify the strongest WebTrader brokers for every trading profile.