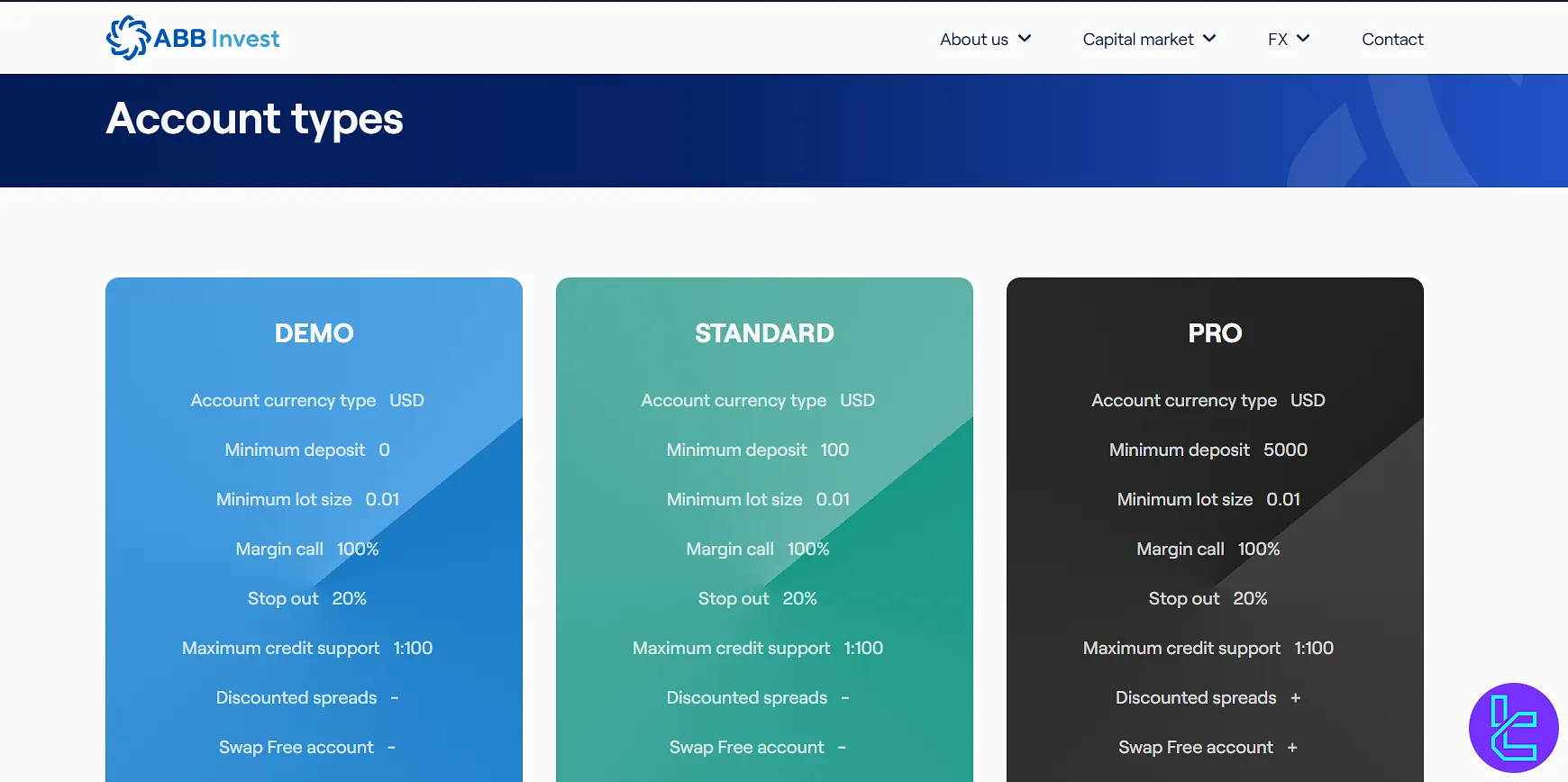

ABB Invest offers 2 real accounts [Standard, Pro] with$100 and $5,000 minimum deposit amounts, along with a demo account.

These accounts offer leverage up to 1:100 and operate based on USD. Muslims and other interested traders need to work with Pro for Islamic accounts.

ABB Invest Company Information & Regulation

ABB Invest presents itself as a regional brokerage with an Azerbaijan-registered trading arm and an Indonesian regulatory claim. The company is reported to be regulated by Indonesia’s commodity regulator BAPPEBTI, while it also appears incorporated locally in Azerbaijan (office in Baku).

These mixed signals mean ABB Invest lacks oversight from Tier-1 authorities (FCA, ASIC, CySEC) and does not offer EU-style investor compensation or guaranteed negative-balance protection. Because of this, its regulatory profile is often classified as medium-to-high risk.

ABB Invest regulatory & company details:

Parameter / Branches / Entity | ABB Invest (BAPPEBTI-claimed) | ABB Invest (Azerbaijan / local CJSC) |

Regulation | BAPPEBTI | CJSC |

Regulation Tier | Tier-2 | Tier-3 |

Country / Jurisdiction | Indonesia | Azerbaijan |

Investor Protection Fund | No | No |

Segregated Funds | No | No |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | Up to 1:100 | Up to 1:100 |

Client Eligibility | Primarily Azerbaijan clients; wider access limited per registration form | Azerbaijan |

ABB Invest Key Specifications

We will have an overview of the Forex Broker details in the following table:

Broker | ABB Invest |

Account Types | Demo, Standard, Pro |

Regulating Authority | N/A |

Based Currencies | USD |

Minimum Deposit | $100 |

Deposit Methods | Bank Transfers |

Withdrawal Methods | Bank Transfers |

Minimum Order | 0.01 |

Maximum Leverage | 1:100 |

Investment Options | Copy Trading, Government Bonds, Corporate Bonds |

Trading Platforms & Apps | MetaTrader 4 |

Markets | Forex, Stocks, Metals, Commodities, Indices, Crypto |

Spread | N/A |

Commission | None |

Orders Execution | N/A |

Margin Call / Stop Out | 100% / 20% |

Trading Features | Economic Calendar, Calculator |

Affiliate Program | None |

Bonus & Promotions | None |

Islamic Account | Yes |

PAMM Account | None |

Customer Support Ways | Email, Ticket, Phone, Local Office |

Customer Support Hours | N/A |

Trading Account Details

ABB Invest offers 2 main account types with different specifics to its clients. Look at the table below:

Account Type | Standard | Pro |

Base Currency | USD | |

Min. Deposit | $100 | $5,000 |

Min. Lot Size | 0.01 | |

Margin Call / Stop Out | 100% / 20% | |

Max. Leverage | 1:100 | |

Swap-Free Account | No | Yes |

Also, a demo account is provided for practice trading.

Benefits and Drawbacks

The table below mentions ABB Invest’s most notable advantages and disadvantages:

Benefits | Drawbacks |

Relatively Low Minimum Deposit of $100 | Lacks Regulation |

MetaTrader 4 Platform Available | Above-Average Trading Costs |

Wide Range of Tradable Instruments | Limited Deposit and Withdrawal Options |

No Trading Commissions | - |

ABB Invest Account Opening and Verification

Getting started with this broker is different from the registration process in most other companies in the industry. Here's how to sign up:

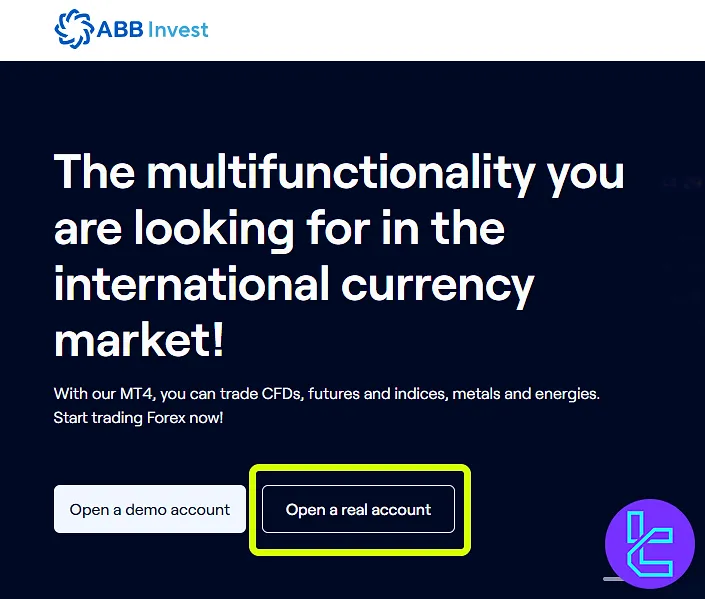

#1 Access the Sign Up Section of the ABB Invest Broker

First, search ABB Invest on your browser and find the official website. Once entered, click on the "Open a real account" button.

Begin the ABB Invest registration process by clicking on the "Open a real account" button.

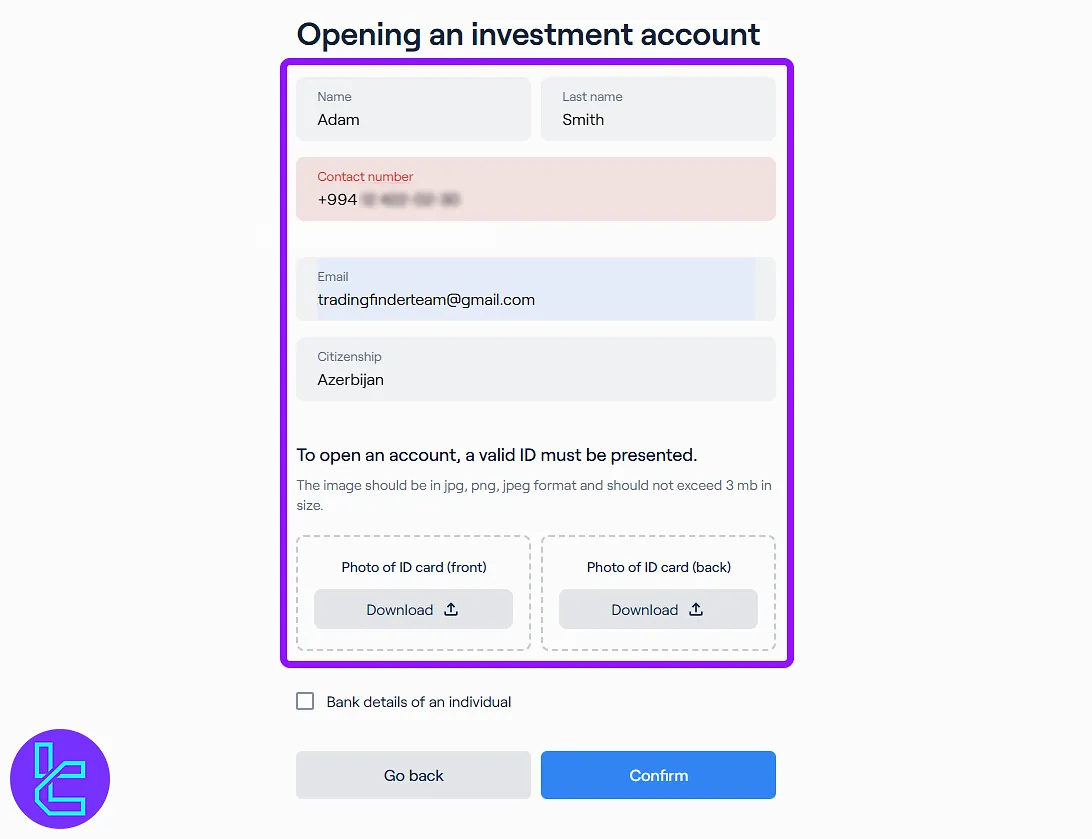

#2 Complete the Registration Form with Personal Details

Now, click the "Survey" button to access the signup page. Then, provide the following details:

- First and last name

- Contact number

- Email address

- Citizenship

Now, you must upload the front and back images of your ID card to verify your account in ABB Invest.

You will be contacted within 2 business days and will be invited to the company's office to sign the contract.

Trading Platforms Offered by ABB-Invest

This broker offers the industry-standard MetaTrader 4 (MT4) platform, known for its reliability and powerful features:

- Trading tools and technical indicators

- Copy trading feature

- Customizable workspace to suit individual trading styles

You can download or access the terminal on your PC or mobile devices via these links:

Spreads and Costs Overview

ABB Invest offers floating Spreads across account types, with standard accounts typically wider (EUR/USD around 1.4–2.0 pips reported) and a discounted “Pro/Ultra” option noted but not fully published.

The broker advertises no trading commissions, though a deposit fee of about 0.5% and mixed reports on withdrawal charges have been mentioned.

For precise live values, traders should confirm with ABB Invest’s official terms or customer support.

Key Spreads & Cost Items:

Account Type | Spreads (typical) | Commission | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Standard | EUR/USD ~1.4–2.0 pips | None | ~0.5% | Varies | No |

Pro / Ultra | Discounted spreads | None | ~0.5% | Varies | No |

Swap Fees

Overnight swap (long/short) is applied per instrument and reflects interest-rate differentials. These values change daily and are visible in the MT4 platform.

Non-Trading Fees

Non-trading costs include the reported deposit fee (around 0.5%) and inconsistent withdrawal charges, with some users noting higher costs. It is recommended to confirm the exact fees with ABB Invest support before funding an account.

Deposit and Withdrawal Methods

ABB Invest primarily uses bank-based funding and payout routes. Clients can fund accounts via local ABB Bank transfers or cash deposits at ABB Bank branches, while international clients use SWIFT transfers; reviewers report a $100 minimum deposit for live accounts.

Cards and e-wallets (Skrill, Neteller, etc.) are not accepted by ABB Invest, and cryptocurrency deposits/withdrawals are not listed as standard options.

Processing times and any correspondent fees vary by channel and the beneficiary bank, so confirm final details with ABB Invest support before sending funds.

Deposit Options

Below is a quick reference table of ABB Invest’s commonly reported deposit channels and minimums:

Option | Accepted Currencies | Min. Deposit |

Local Bank Transfer (ABB Bank) | AZN, USD | $100 |

International SWIFT Transfer | USD, EUR, other major currencies | $100 |

Cash at ABB Bank Branch | AZN, USD | $100 |

Withdrawal Solutions

Below is a quick reference table of ABB Invest’s commonly reported withdrawal channels, times and fees:

Withdrawal Solution | Processing Time | Withdrawal Fee |

Local Bank Transfer (ABB Bank) | 1 business day to 3 business days | No fee reported (may vary by bank) |

International SWIFT Transfer | 3–5 business days | Correspondent bank fees may apply |

Cash Pickup at ABB Branch | Same business day to 1 business day | No fee reported |

Copy Trading and Investment Services

ABB Invest provides several investment options beyond standard trading:

- Copy trading via MT4 platform

- Access to government bonds

- Corporate bond investments available

Tradable Markets & Symbols

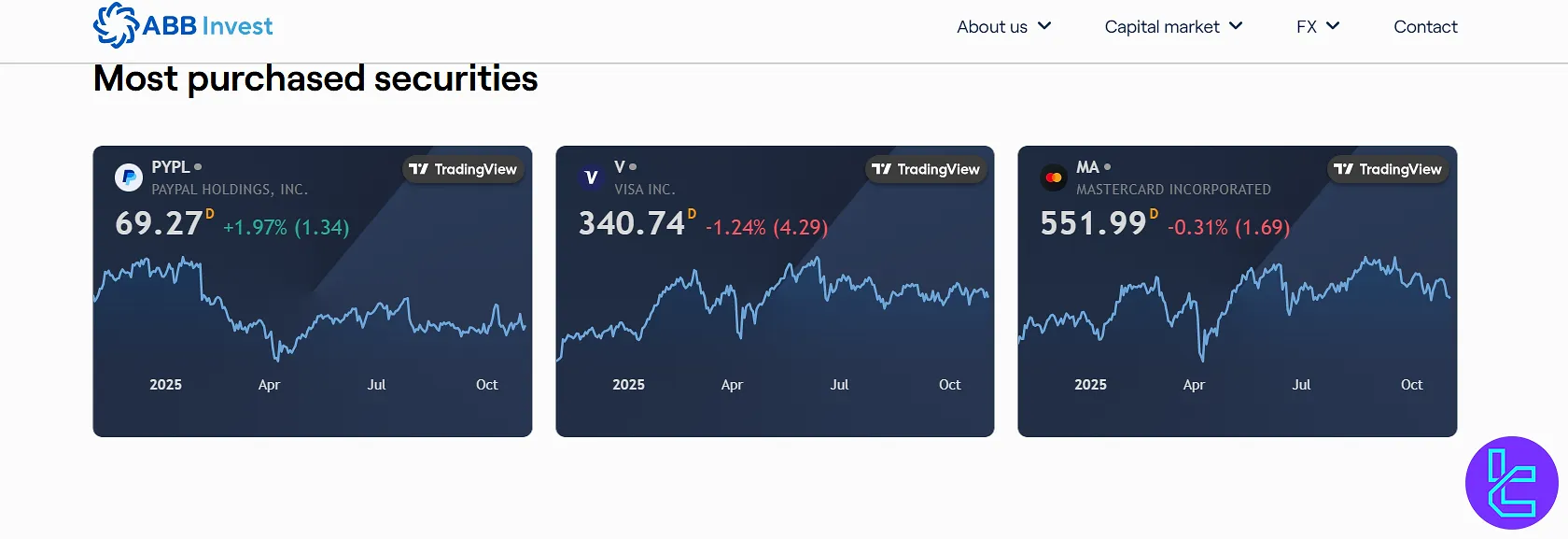

ABB Invest provides access to a multi-asset lineup, allowing traders to diversify across Forex, Commodities, Indices, Shares, and Cryptocurrencies.

The Forex section covers major, minor, and exotic pairs, while commodities include metals like gold and silver alongside energies such as oil.

Index CFDs extend to popular benchmarks including the US30, DE40, and UK100, giving exposure to regional and global economies. ABB Invest also offers CFDs on international stocks, plus a growing list of cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Leverage availability varies by asset class, with higher levels on Forex and lower ratios for cryptos and shares, reflecting industry norms.

ABB Invest tradable asset classes and key details:

Asset Class | Type of Instruments | Number of Symbols | Max. Leverage | Competitor Average |

Forex | Major, Minor & Exotic Currency Pairs | 40+ Pairs | Up to 1:100 | 50–70 Pairs |

Commodities | Metals (Gold, Silver), Energies (Oil, Gas) | Around 10 Instruments | Up to 1:50 | 10–20 Instruments |

Indices | Global Indices (US30, DE40, UK100, EUR50, more) | 10–12 Indices | Up to 1:50 | 10–20 Indices |

Shares | CFDs on Popular International Stocks | 200+ Global Stocks | Up to 1:20 | 800–1200 Stocks |

Cryptocurrencies | CFDs on Bitcoin, Ethereum, Litecoin, others | 15+ Coins | Up to 1:10 | 30–50 Coins |

ABB Invest Broker Bonuses

At the time of writing, this company does not offer any specific bonuses or promotions. However, we will update this page if case of any changes in the future.

ABB Invest Awards

Currently, ABB Invest has not been granted any awards or formal recognitions within the financial industry. There is no public record of the company receiving honors from trading associations or independent review bodies.

Its standing in the market is primarily based on user experience and operational consistency rather than official distinctions.

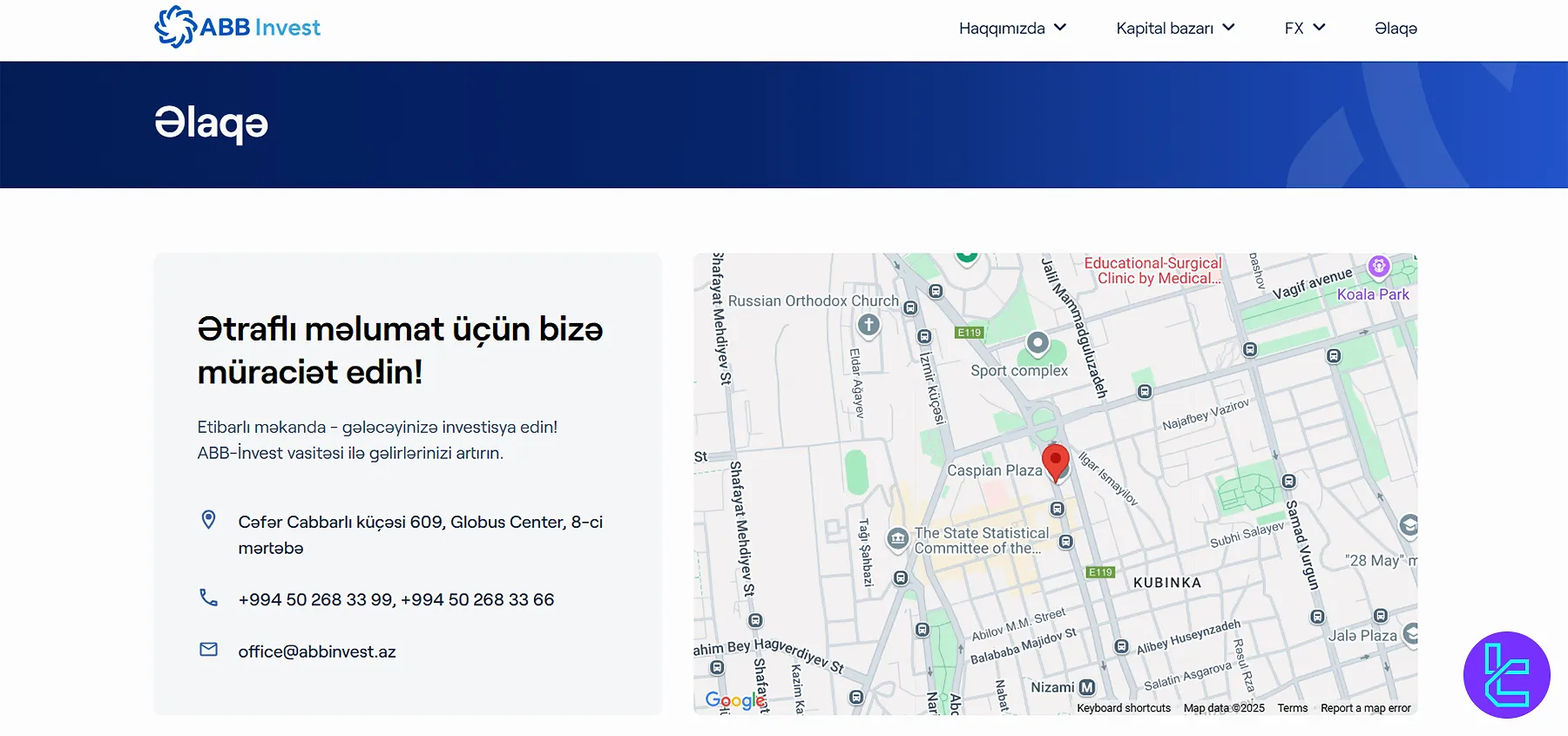

Customer Support Channels and Hours

ABB Invest provides 4 ways to get in touch with their support team:

- Email: office@abbinvest.az

- Phone: +994 50 268 33 99 in addition to a "request callback" form

- Ticket: Submittable via the website

- Local Office: 8th Floor, Globus Center, 609 Jafar Jabbarli Street

Strangely, the broker's websitedoes not mention any schedules for its support department. Many users have complained about low-quality customer service in this broker.

ABB Invest Restricted Countries

The broker does not provide any lists outlining banned countries, but per our examinations on the registration form of the website, it accepts clients only from Azerbaijan. Therefore, all other countries are restricted.

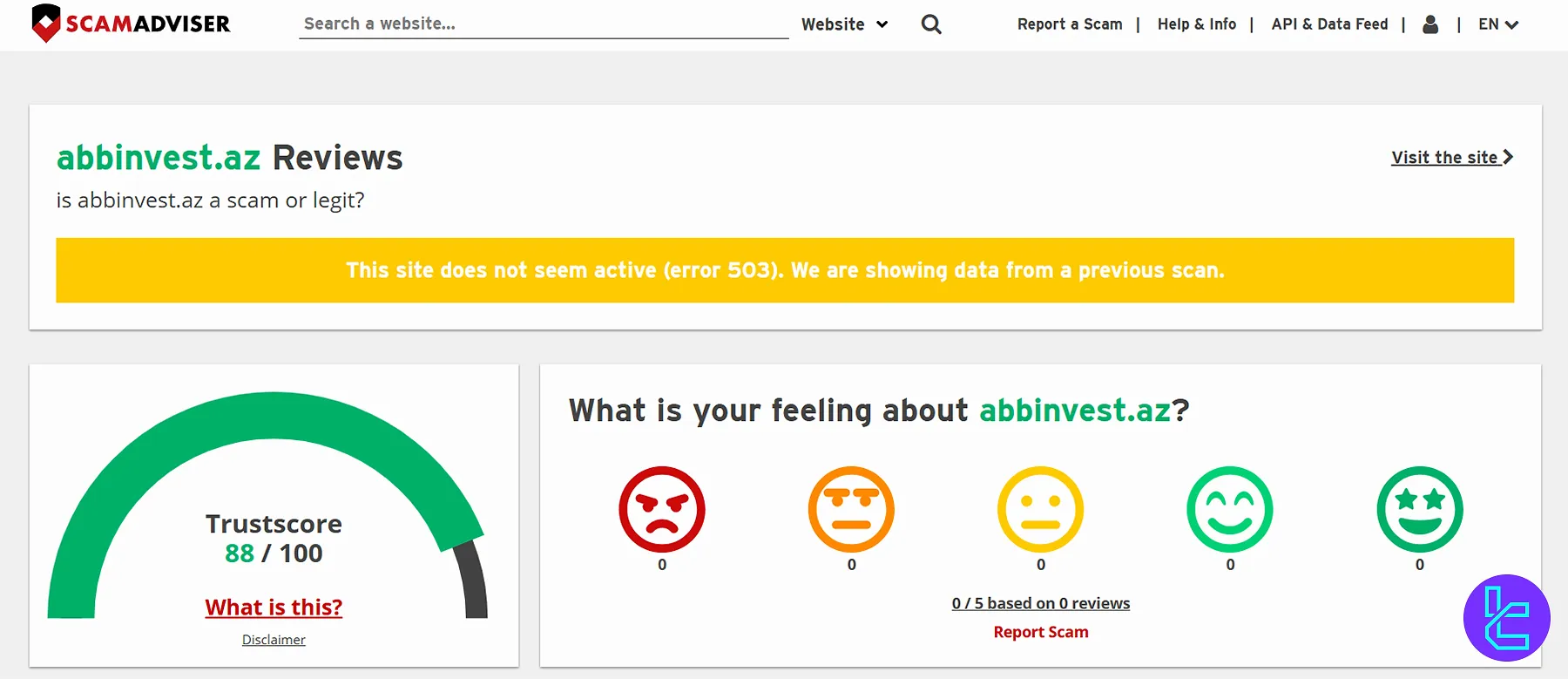

Trust Evaluations

ABB Invest's profile on "ScamAdviser" shows a high Trustscore of 88/100 given by the website itself.

However, there are no other ratings and reviews submitted for this company across the internet. It could be a drawback since it shows a low popularity and small client base.

Education Content on ABB-Invest

ABB Invest's educational offerings are limited compared to some larger brokers. This company mainly releases news articles on local and global events in addition to webpages containing information about the brokerage and its platforms, rather than trading strategies and concepts.

ABB Invest Comparison with Well-Known Forex Brokers

The table below provides a detailed comparison of the key features of ABB Invest compared to other Forex brokers.

Parameters | ABB Invest Broker | |||

Regulation | Not Specified | ASIC, VFSC | FSC | No |

Minimum Spread | Not Specified | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | $0 | $0 | $0 | $0 |

Minimum Deposit | $100 | $0 | $200 | $1 |

Maximum Leverage | 1:100 | 1:500 | 1:3000 | 1:3000 |

Trading Platforms | MetaTrader 4 | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MetaTrader 4, MetaTrader 5, FXTM Trader App | MetaTrader 4, MetaTrader 5 |

Account Types | Demo, Standard, Pro | Zero, Classic | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 500+ | 250+ | 1000+ | 45 |

Trade Execution | Not Specified | Market, Limit, Stop, Trailing Stop, Take Profit | Market | Market, Instant |

Conclusion and Final Words

ABB Invest, with MetaTrader 4 as its platform and 500+ trading instruments, has a margin call level of 100% for its clients.

This broker, providing 4 support channels [phone, email, ticket, office] has obtained a Trustscore of 88/100 from the ScamAdviser website.