AccentForex offers 3 asset classes with leverage options of up to 1:500 through the MT4 platform.

The broker provides various promotional programs, including a 40% depositbonus up to $4,000.

Company Information & Regulation Status

AccentForex (founded in 2010) is a straight-through processing (STP) and no-dealing desk (NDD) forex broker headquartered in Vanuatu.

The company is regulated by theVanuatu Financial Services Commission (VFSC), which provides specific oversight and protection for traders.

While AccentForex strives to provide a reliable and transparent trading environment, it's worth noting that the VFSC regulation may offer a different level of protection than top-tier regulators like the FCA or CySEC.

Entity Parameters/Branches | Accent Markets Group Inc. |

Regulation | VFSC |

Regulation Tier | Tier-3 |

Country | Vanuatu |

Investor Protection Fund / Compensation Scheme | No |

Segregated Funds | No |

Negative Balance Protection | N/A |

Maximum Leverage | 1:500 |

Client Eligibility | Most countries excluding United States, United Kingdom, Belarus, Russia and FATF blacklisted countries |

AccentForex’s Summary of Specifics

To give you a quick overview of the offers, here's a summary table of its key specifics:

Broker | AccentForex |

Account Types | Micro, Mini, PROFIT, STP |

Regulating Authorities | VFSC |

Based Currencies | USD, EUR |

Minimum Deposit | $50 / €50 |

Deposit Methods/ Withdrawal | Wire transfer, Visa, Master Card, Skrill, Neteller, Bitcoin, Ethereum, Tether |

Minimum Order | 0.01 |

Maximum Leverage | 1:500 |

Investment Options | YES |

Trading Platforms & Apps | МetaТrader 4 |

Markets | Futures, Currency pairs, Metals, CFDs on stocks, |

Spread | From 0.1 points |

Commission | variable |

Orders Execution | Market |

Margin Call/Stop Out | 60%/50% |

Trading Features | CopyTrading, Investment options |

Affiliate Program | Yes |

Bonus & Promotions | Yes (40%, 35%) |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Live Chat, Email |

Customer Support Hours | 24/5 |

AccentForex broker Types of Accounts

Like many Forex Brokers, AccentForex offers various account types to suit different trading styles:

Account | Min. Deposit | Leverage Up to |

Micro | $50 / €50 | 1:500 |

Mini | $100 / €100 | 1:200 |

PROFIT | $1000 / €1000 | 1:100 |

STP | $100 / €100 | 1:200 |

The broker also offers a Swap-Free Islamic Account:

- Available for all account types;

- No overnight swap charges;

- Compliant with Islamic finance principles.

Each account type is designed for specific trading needs, allowing traders to choose the one that best aligns with their experience, capital, and trading goals.

AccentForex Advantages and Disadvantages

To help you have a better idea of the broker, let's examine the pros and cons of trading with AccentForex:

Advantages | Disadvantages |

Competitive spreads | No top-tier regulations |

High leverage | Limited educational resources |

Multiple account types | Restriction in some countries |

Supports scalping and hedging strategies | - |

While AccentForex broker offers attractive trading conditions, potential clients should carefully weigh these pros and cons against their needs and risk tolerance.

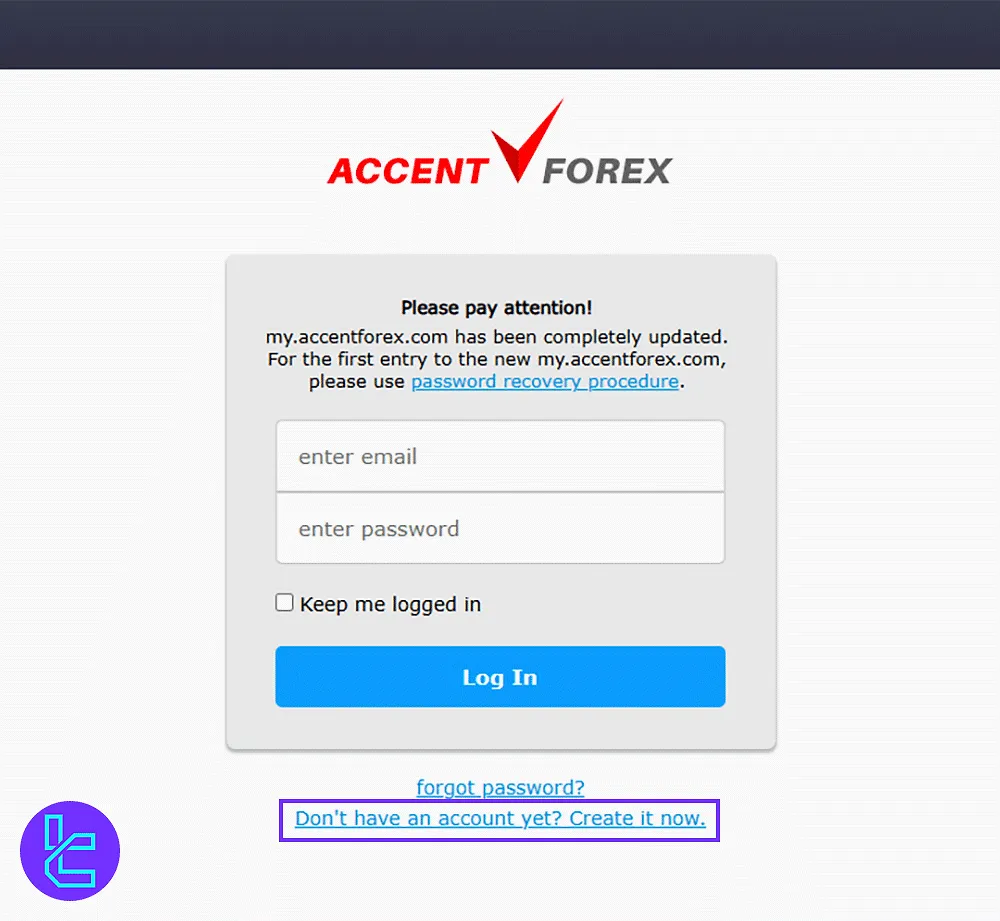

Signing Up & Verification Process

To benefit from the broker's services, traders must open an account with the AccentForex broker. Here's the Accent Forex registration process.

#1 Access the Signup Page on the AccentForex Website

Navigate to the official Accent Forex website. Click on "Open Account" or choose the “Don’t have an account yet?” link to initiate registration.

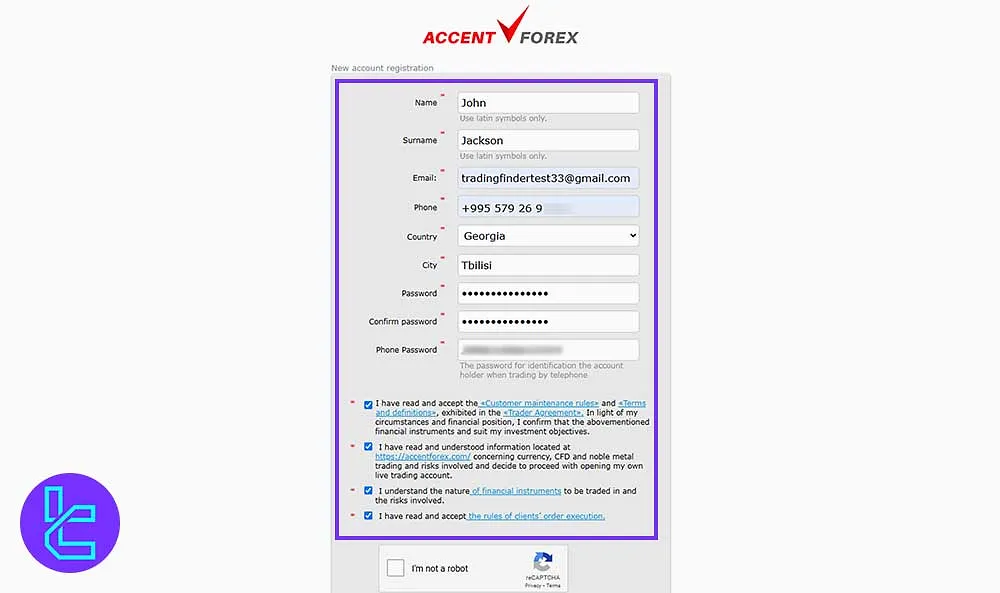

#2 Provide the Necessary Details in the Signup Form

Fill in your full name, email, mobile number, country, and city. Set a strong primary password (use a mix of uppercase, lowercase, numbers, and symbols) and a separate transaction password for deposits and withdrawals.

Confirm your credentials, agree to the platform's terms, verify you're not a robot, and hit "Send".

Once completed, proceed to AccentForex verification to access the broker's full range oftrading features and platforms.

The video below provides detailed information about the KYC process and required documents.

#3 AccentForex Account Verification

AccentForex implements a 3-step KYC procedure to confirm user identity and enable full access to deposits, withdrawals, and trading features.

Clients must submit proof of identity (POI) and proof of address (POA) documents for AccentForex Account Verification:

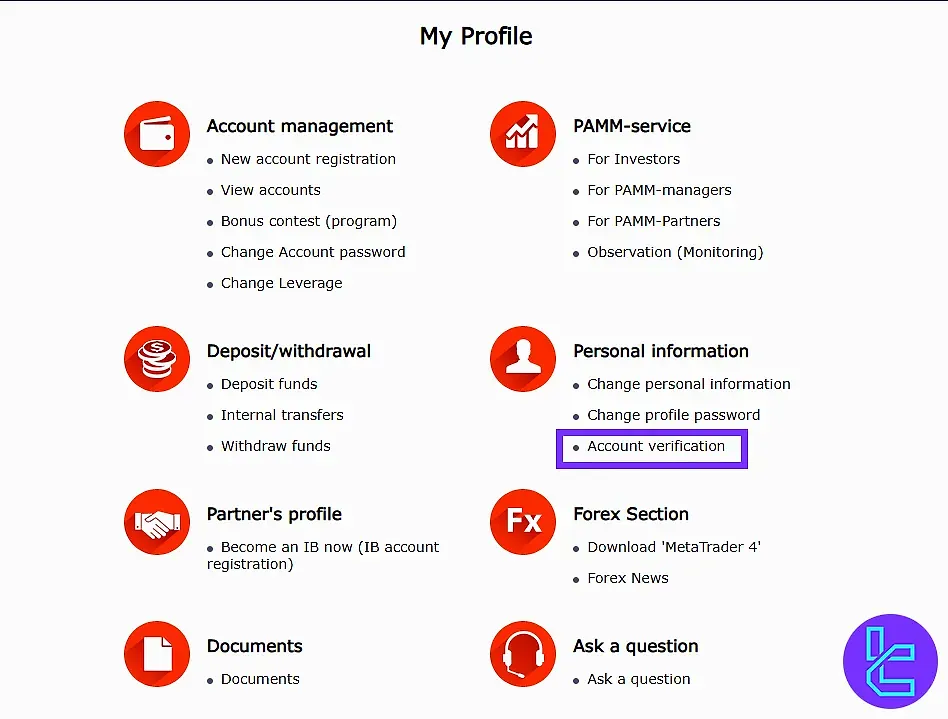

#4 Access the KYC Section

Log in to the dashboard, navigate to My Profile, and select Account Verification.

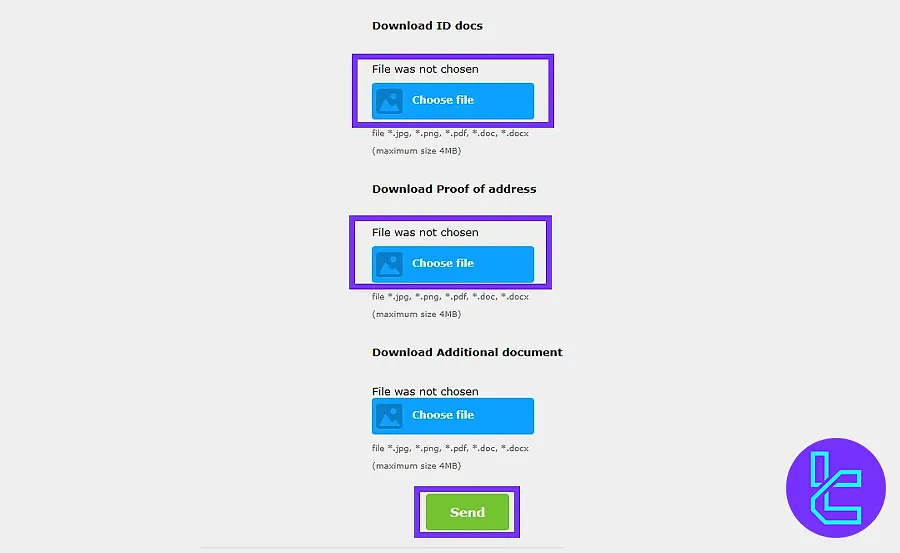

#5 Upload Documents

Provide front and back images of a national ID, passport, or driver’s license, along with proof of address such as a bank statement or utility bill. Additional documents can be uploaded if required, then submit the files.

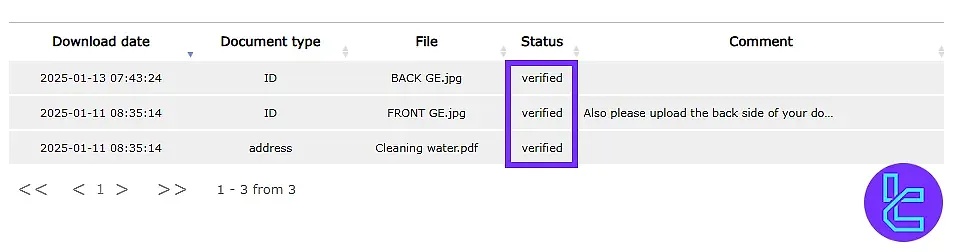

#6 Check Status

Revisit the Account Verification area to monitor approval progress and confirm KYC completion.

This process ensures regulatory compliance and secures full trading capabilities for verified users.

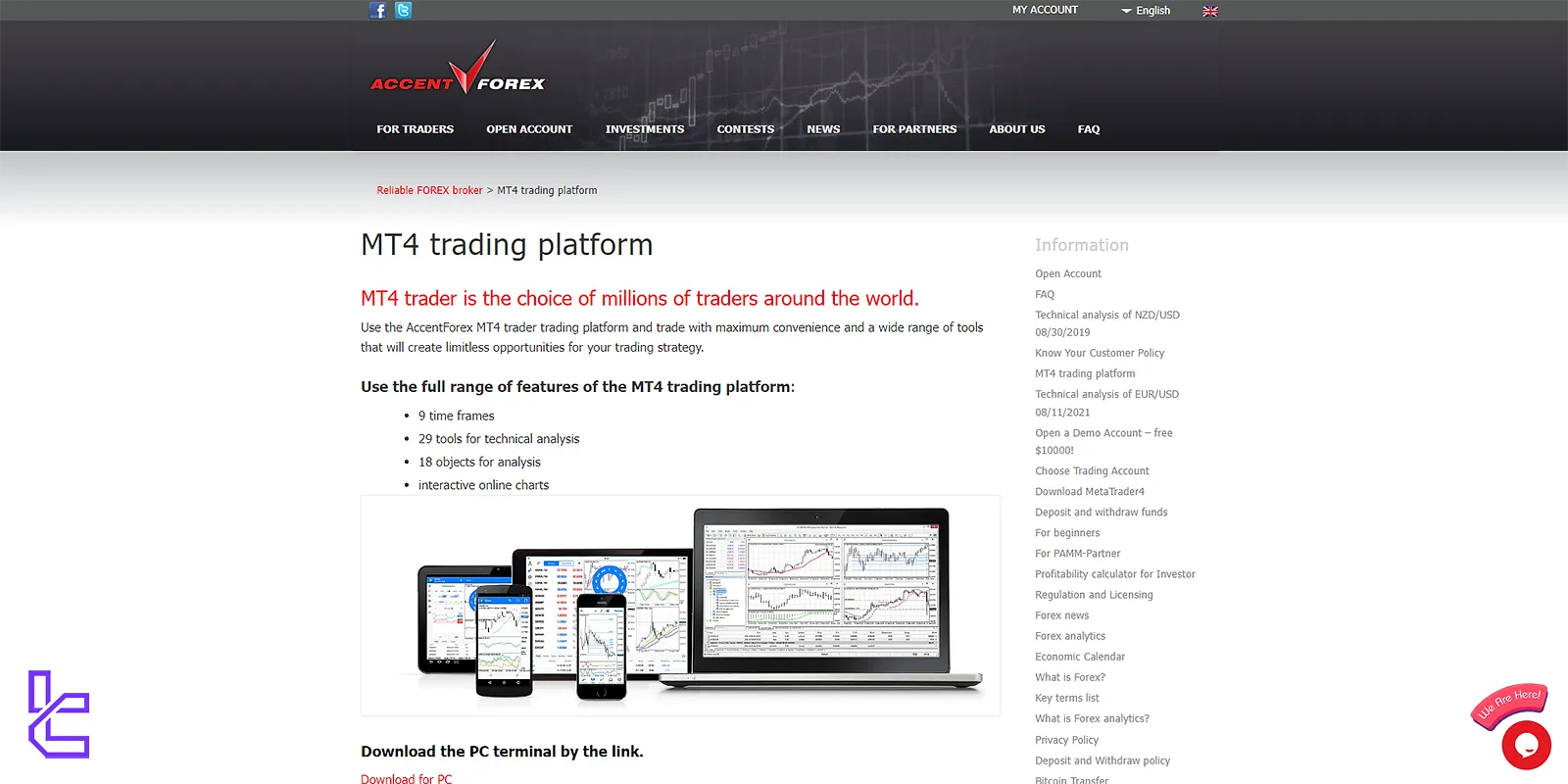

Trading Platforms on Accent Forex

AccentForex primarily offers the MetaTrader 4 (MT4) trading platform, renowned for its reliability, user-friendly interface, and powerful features. Here's an overview of the MT4 platform as offered by AccentForex:

- Expert Advisors (EAs) for automated trading;

- One-click trading and customizable interface;

- Access your account from any browser without downloading software;

- Real-time quotes and live charts;

- Available for iOS and Android devices;

- Push notifications for important market events.

While AccentForex focuses on providing a robust MT4 experience, it's worth noting that they don't offer the newer MetaTrader 5 platform or proprietary platforms as some other brokers do.

However, MT4's capabilities are sufficient for executing various trading strategies effectively for most traders.

Spreads and Commission Structure

AccentForex is known for offering competitive spreads, especially on their STP accounts. Here's a breakdown of the spreads and commissions across different account types:

Account | Spreads From |

Micro | 2 pips |

Mini | 0.5 points |

PROFIT | 0.5 points |

STP | 0.1 points |

It's important to note that spreads vary depending on market conditions and liquidity. During major economic events or periods of high volatility, spreads may widen.

Swap Fees in AccentForex

AccentForex applies swap fees for overnight positions, calculated based on the interest rate differential between currencies.

These fees can either increase (positive) or decrease (negative) a trader’s balance.

Traders who cannot engage in swaps due to religious reasons can open swap-free (Islamic) accounts, in line with Sharia law, or check specific swap rates for each currency pair via the broker’s website or client support.

Key Points About Swap-Free Accounts:

- Purpose: Designed for traders restricted from using swaps for religious reasons;

- Available Account Types: STP, Micro, Mini and Profit;

- Trading Conditions: Identical to standard accounts, except swaps are not applied;

- Overnight Positions: No swaps charged or removed at midnight, regardless of order volume or currency;

- Profit/Loss Impact: Determined solely by market price movements, allowing long-term positions;

How to Open:

- New Clients: Register a live account and send a request via support@accentforexmail.com;

- Existing Clients: Contact the Support Center through Live Chat or other convenient channels to convert the account.

- Requirements: Acceptance of AccentForex’s terms and regulations is necessary.

Non-trading Fees in AccentForex

AccentForex charges non-trading fees only for services not directly related to executing trades.

These fees include inactivity charges for dormant accounts, deposit and withdrawal fees for bank transfers or e-wallets, and occasional administrative or account maintenance costs.

Key Points:

- Card Withdrawals: An additional 5.9% fee applies if funds are withdrawn without prior trading activity;

- Credit Card Deposits/Withdrawals:

- Deposit fee is 5.1% + 0.5 EUR/USD;

- For deposits of $1,000 or more, AccentForex compensates the commission;

- Clients who deposit via card can withdraw funds via Bank Wire, subject to bank transfer fees.

- Internal Transfers: No fees are charged for transfers between accounts (e.g., Money Box to Trading Account and vice versa);

- Deposits: AccentForex does not charge deposit commissions, although banks or payment systems may apply their own fees.

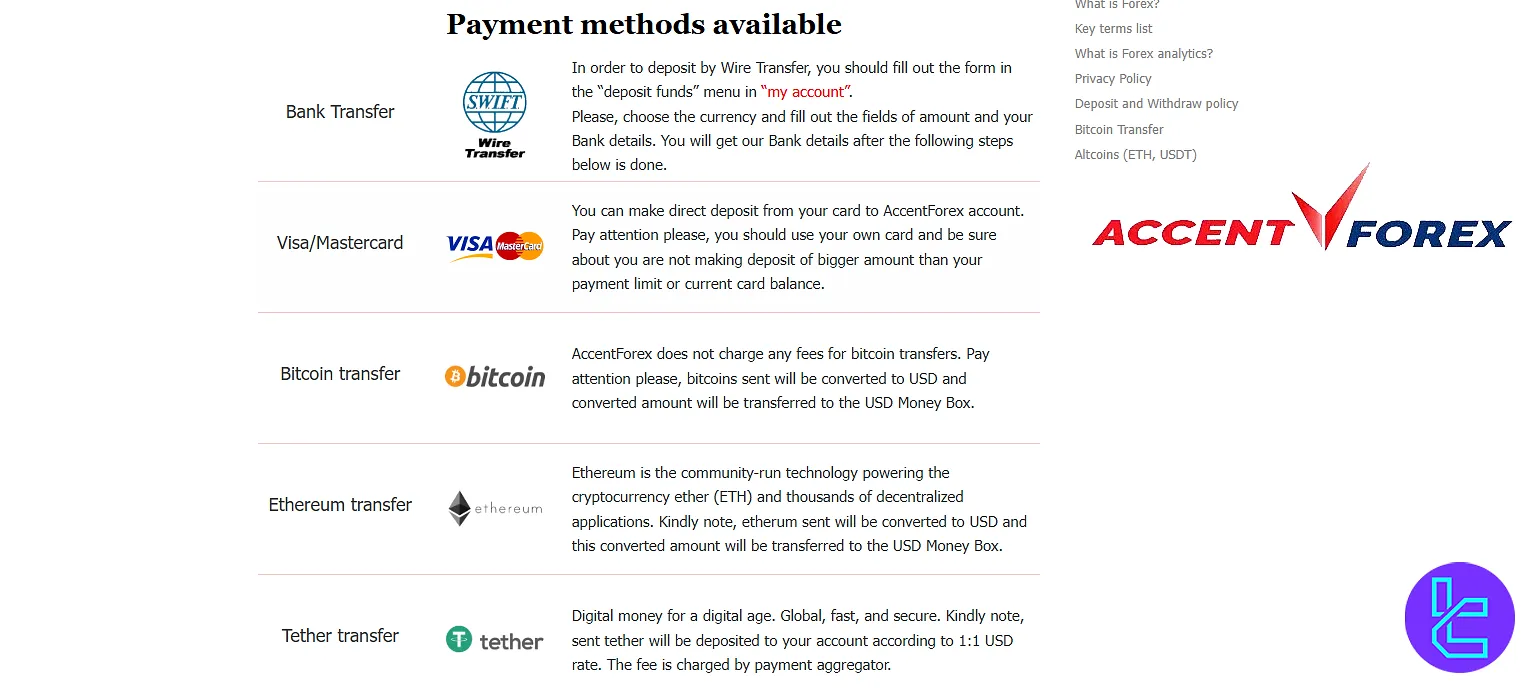

Deposit & Withdrawal Methods

AccentForex offers a variety of deposit and withdrawal methods to cater to traders from different regions:

Deposit/Withdrawal | Fees for deposit | Fees for Withdrawal |

Bank Wire Transfer | bank fees | 0.5% |

Credit/Debit Cards | 5.1% + 0.5 USD | bank fees |

Skrill | 7% | 1% |

Neteller | 7% | 2% |

BTC | Best Price | Best Price |

ETH | Best Price | Best Price |

USDT | Best Price | Best Price |

The minimum deposit at AccentForex starts at $50 for the Micro account. A $100 deposit is required for Mini and STP accounts, while the Profit account demands a minimum of $1000.

These entry thresholds accommodate traders with varying levels of experience and capital.

AccentForex Deposit

AccentForex supports funding via bank transfer, Visa/MasterCard, Bitcoin, Ethereum, and Tether, with most deposits processed within minutes to several hours.

Bank and card transactions may involve additional banking fees, while crypto transfers are converted to USD before crediting. Deposits above $1000 by card have fees compensated under the broker’s loyalty program.

Read more details in the table below:

Deposit methods | Minimum amount | Deposit fee | Funding time |

Bank Wire Transfer | 55 USD/EUR | Bank fees | 3 – 5 bank days |

Visa/Master Cards | Not Specified | 5.1% + 0.5 USD(EUR) (Free ≥ 1000 USD(EUR)) | Within 5 minutes |

Bitcoin | Not Specified | Aggregator fee | Within several hours |

Ethereum | Not Specified | Aggregator fee | Within several hours |

Tether | Not Specified | Aggregator fee | Within several hours |

AccentForex Withdraw

Withdrawals are requested through the client portal and processed within 7 business days, depending on the method. Bank and card transfers may incur intermediary fees, while crypto withdrawals depend on aggregator costs.

An extra 5.9% fee applies if funds are withdrawn without trading activity. AccentForex enforces strict AML rules, allowing transfers only between the broker and the verified account holder.

Read more details in the table below:

Withdraw methods | Minimum amount | Withdraw fee | Funding time |

Bank Wire Transfer | 10 USD/EUR | 0.5% | Up to 7 bank days |

Visa/Master Cards | Not Specified | Bank fees | Up to 7 bank days |

Bitcoin | Not Specified | Aggregator fee | 24 business hours |

Ethereum | Not Specified | Aggregator fee | 24 business hours |

Copy Trading & Investment Options Offered on Accent

AccentForex broker offers several investment options for traders who want to diversify their strategies or benefit from the expertise of professional traders:

Considerations:

- Past performance doesn't guarantee future results;

- Carefully review the track record and risk level of PAMM managers before investing;

- Understand the fee structure associated with PAMM accounts;

- Be aware of the risks involved in copy trading and PAMM investments.

Tradable Markets & Symbols Overview

AccentForex provides access to diverse financial instruments, allowing traders to diversify their portfolios across different asset classes:

Some useful details in this area can be found in the table below:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency Pairs | 60 | 60-80 | 1:500 |

Metals | Gold, Silver, Palladium | 3 | 2-3 | 1:500 |

Stocks | CFD on Shares | N/A | 100+ | N/A |

Future | Commodities | 13 | 15-20 | N/A |

By offering a wide range of tradable instruments, AccentForex allows traders to take advantage of various market opportunities and create diversified trading strategies.

Bonus Offerings and Promotions

AccentForex offers bonuses and promotions to attract new clients and reward existing ones.

Here's an overview of the current offers:

Bonus Type | Eligibility | Bonus Details | Max Bonus Amount | Conditions |

40% Deposit Bonus | New clients | 40% bonus on initial deposits | $4,000 | Minimum deposit and trading volume requirements |

35% Cash Bonus | Existing clients | 35% bonus on deposits of $300 or more | Fully tradable | Must request "Cash Bonus + 35%" upon deposit; trading volume requirements for withdrawal |

The broker also offers an IB Program:

- Earn commissions by referring new clients to AccentForex;

- Up to 90% commission;

- No restrictions on the duration or number of trades to earn commissions.

While these bonuses can provide extra trading capital, it's crucial to remember that trading carries inherent risks.

Traders should not base their decision to join AccentForex solely on promotional offers. Consider the broker's overall trading conditions, regulation, and reputation when choosing.

AccentForex Awards

AccentForex has not received any officially recognized global or industry awards. While the broker offers features like MT4 access, swap-free accounts, and competitive spreads, there is no evidence of accolades from established financial organizations.

AccentForex’s Support Channels

AccentForex provides customer support through various channels like email to assist traders with queries and concerns.

This broker provides customer support 24 hours a day on business days (Monday to Friday).

- Live Chat

- Phone: +678 23 043

- Email: support@accentforex

The support team is available 24/5.

List of Restricted Countries

AccentForex restricts clients from several regions, including:

- United States of America

- United Kingdom

- Citizens of the Russian Federation

- Citizens of Belarus

- FATF blacklisted countries

Traders from these areas are not eligible to register or trade with the broker. It's important for potential clients to check whether their country is permitted, as restrictions are based on regulatory compliance and international financial laws.

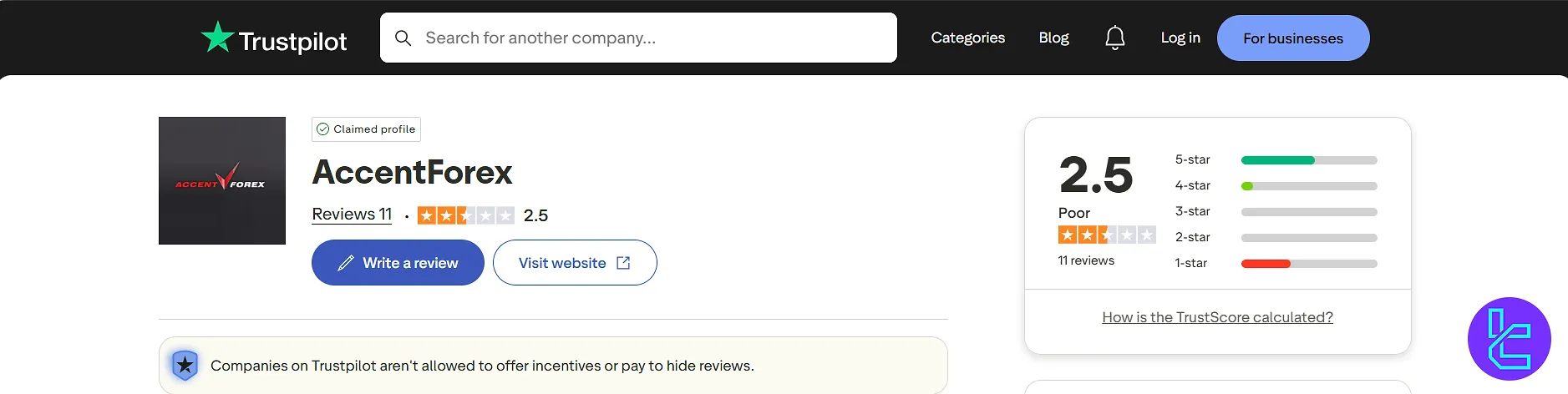

AccentForex Broker Trust Scores & Reviews

AccentForex holds a solid trust score of 2.5 out of 5 on the Trustpilot Reviews, indicating overall positive feedback from its users:

Positive reviews | Negative reviews |

broker’s reliability | Manipulated gains on PAMM accounts |

Excellent customer service | - |

Fair trading conditions | - |

Traders generally appreciate its competitive spreads, execution, and the variety of trading instruments offered.

Education on AccentForex Broker

AccentForex provides valuable educational content, including a dedicated news section andforex analytics to help traders make better decisions.

The news section offers up-to-date market insights, while the forex analytics deliver technical and fundamental analysis to guide trading strategies.

This resource is particularly helpful for traders looking to enhance their market understanding.

AccentForex Comparison with Other Forex Brokers

The table below compares AccentForex features with those of other famous brokers.

Parameters | AccentForex Broker | |||

Regulation | VFSC | ASIC, VFSC | FSA, FSC, Misa, FinaCom | No |

Minimum Spread | 0.1 Points | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | Variable | $0 | $0 | $0 |

Minimum Deposit | $50 | $0 | $100 | $1 |

Maximum Leverage | 1:500 | 1:500 | 1:3000 | 1:3000 |

Trading Platforms | MetaTrader 4 | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Micro, Mini, PROFIT, STP | Zero, Classic | Standard, ECN, Fixed, Crypto | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 140+ | 250+ | 700+ | 45 |

Trade Execution | Market | Market, Limit, Stop, Trailing Stop, Take Profit | Market, Instant | Market, Instant |

Conclusion and final words

AccentForex offers CFDs and Futures trading services for a minimum deposit of $50. The broker offers a 35% Cash bonus for deposits above $300. It has a score of 3.9 onTrustPilot, and doesn't accept US clients.