AMEGA was titled the Most Innovative Broker in Africa2024. The broker offers commission-free trading across 6 asset classes, including Forex and Stocks, through MT5 and AMEGA Android app platforms.

Traders can also trade a wide range of instruments with a leverage of up to 1:1000 at AMEGA broker and cash out their profits via various methods, including Visa, MasterCard, Perfect Money, WebMoney, Neteller, Skrill, and crypto.

AMEGA (Company Introduction and Regulatory Status)

AMEGA Global Ltd is an investment company Founded in 2018 by the CEO Vadim Zhuravlev.

The company is licensed and registered in the Republic of Mauritius and has partner companies in the UK and the Republic of Cyprus. Key features of AMEGA:

- Authorized and regulated bythe Financial Services Commission (FSC) in Mauritius (License number: GB22200548)

- Low-cost trading with a minimum trade size of only $1

- 0% commission

- Fast execution (10ms)

- Leverage options up to 1:1000

- Unlimited cashback

Entity Parameters/Branches | Amega Global |

Regulation | Financial Services Commission (FSC) Mauritius |

Regulation Tier | 3 |

Country | Mauritius |

Investor Protection Fund/Compensation Scheme | No |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:1000 |

Client Eligibility | All countries except restricted jurisdictions (e.g., USA, Iran, N. Korea) |

AMEGA Broker Specifications

To give you a clear picture of what AMEGA offers, here's a table summarizing the company’s key specifications.

Broker | AMEGA |

Account Types | Mini, Scalper, Premium |

Regulating Authorities | FSC |

Based Currencies | USD |

Minimum Deposit | $20 |

Deposit Methods | Bank Cards, Wire Transfer, e-Wallets (Perfect Money, Neteller, Skrill), Crypto |

Withdrawal Methods | Bank Cards, Wire Transfer, e-Wallets (Perfect Money, Neteller, Skrill), Crypto |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | None |

Trading Platforms & Apps | MT4, MT5, WebTrader |

Markets | Forex, Stocks, Indices, Cryptocurrencies, Energy, Precious metals, Agricultural commodities |

Spread | From 1.0 pip |

Commission | $0 |

Orders Execution | Market |

Margin Call / Stop Out | 50% / 20% |

Trading Features | Trading Signals, Mobile Trading |

Affiliate Program | Yes |

Bonus & Promotions | Referral, Cashback |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Phone, Email, Ticket |

Customer Support Hours | 24/7 |

AMEGA Trading Account Offerings

This Forex broker offers multiple acccounts to cater to various traders and trading strategies:

- Mini Account: Designed for beginners or small-scale traders, this account requires a low minimum deposit of just $10. It offers spreads from 0.0 pips with no commissions

- Premium Account: A standard account with tighter spreads starting from 0.4 pips and zero commission, ideal for mid-level traders

- Scalper Account: Built for high-frequency traders, this account features raw spreads from 0.0 pips and no commissions

Additionally, Amega offers a Swap-Free (Islamic) account option for traders adhering to Sharia law. All accounts are commission-free and support MetaTrader 5.

AMEGA Broker Pros and Cons

Some benefits of trading with AMEGA include access to a dedicated mobile app, an award-winning platform, and leverage offerings of up to1:1000.

To help you make an informed decision, let's examine the advantages and disadvantages of trading with AMEGA.

Pros | Cons |

Wide range of trading instruments | Not regulated by tier-1 financial authorities |

High leverage up to 1:1000 | Relatively new broker |

No-commission trading | Limited account types |

Cashback program ($1 per lot) | Relatively high entry barrier ($20) |

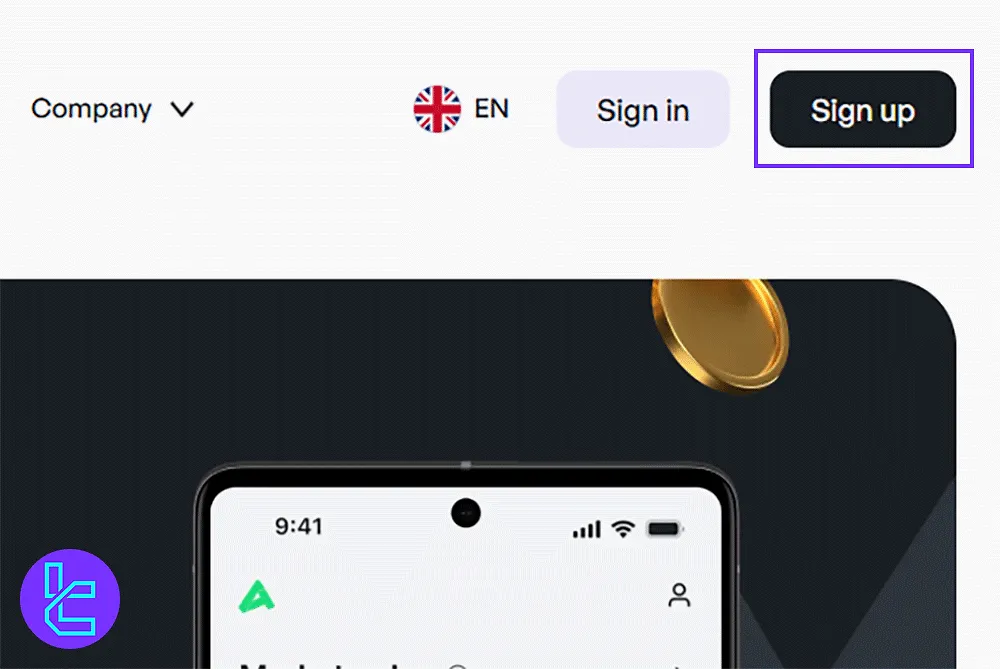

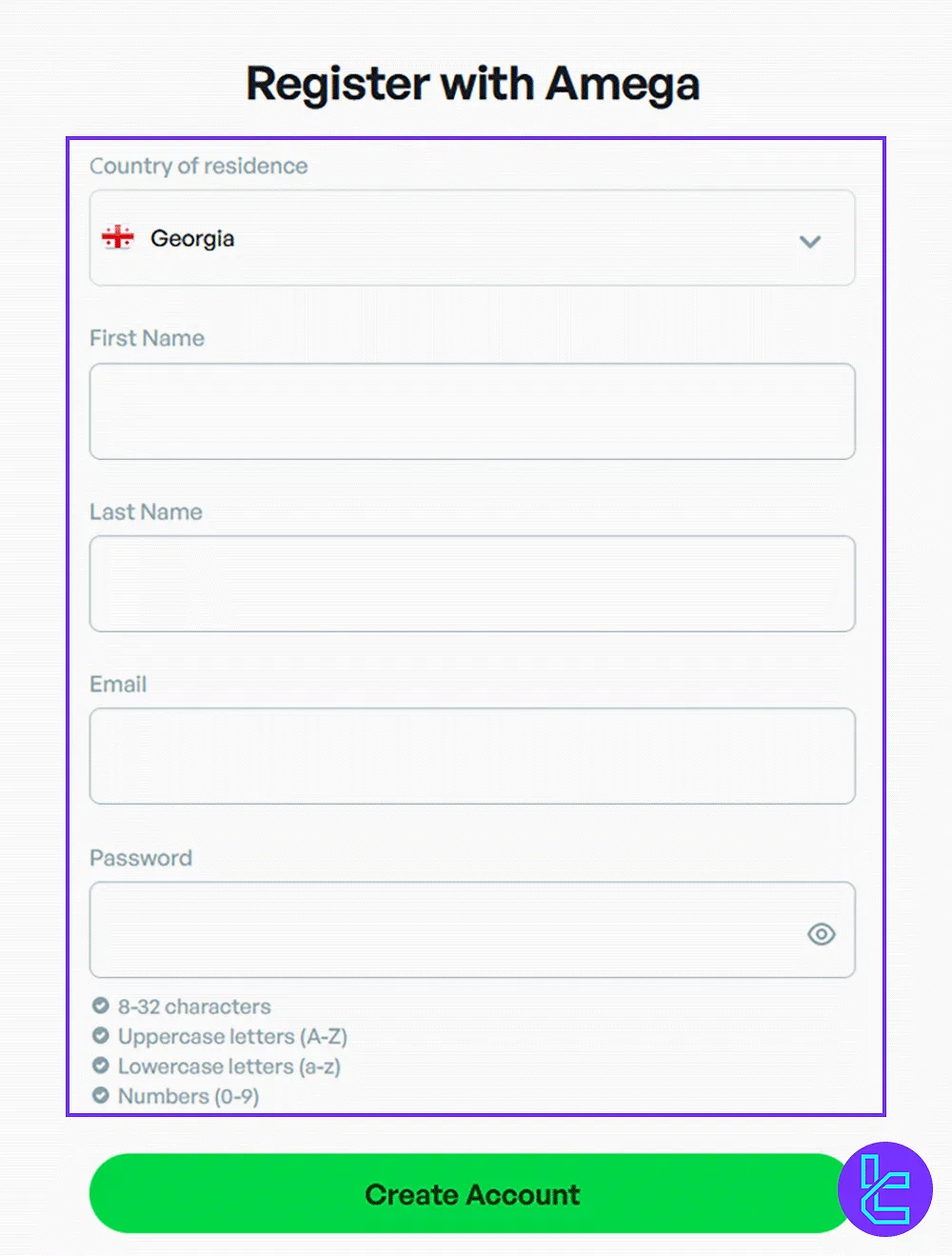

AMEGA Registration and KYC Verification

Creating a new trading account with AMEGA is easy and requires only three steps. AMEGA registration:

#1 Start Registration & Enter Personal Details

Visit Amega’s official site and click “Sign Up”. Fill in your country, full name, email, and set a secure password. Submit to create your account.

#2 Email & Profile Verification

Confirm your email via the link sent by Amega. Then, answer questions about your employment, income, tax residency, and any political exposure.

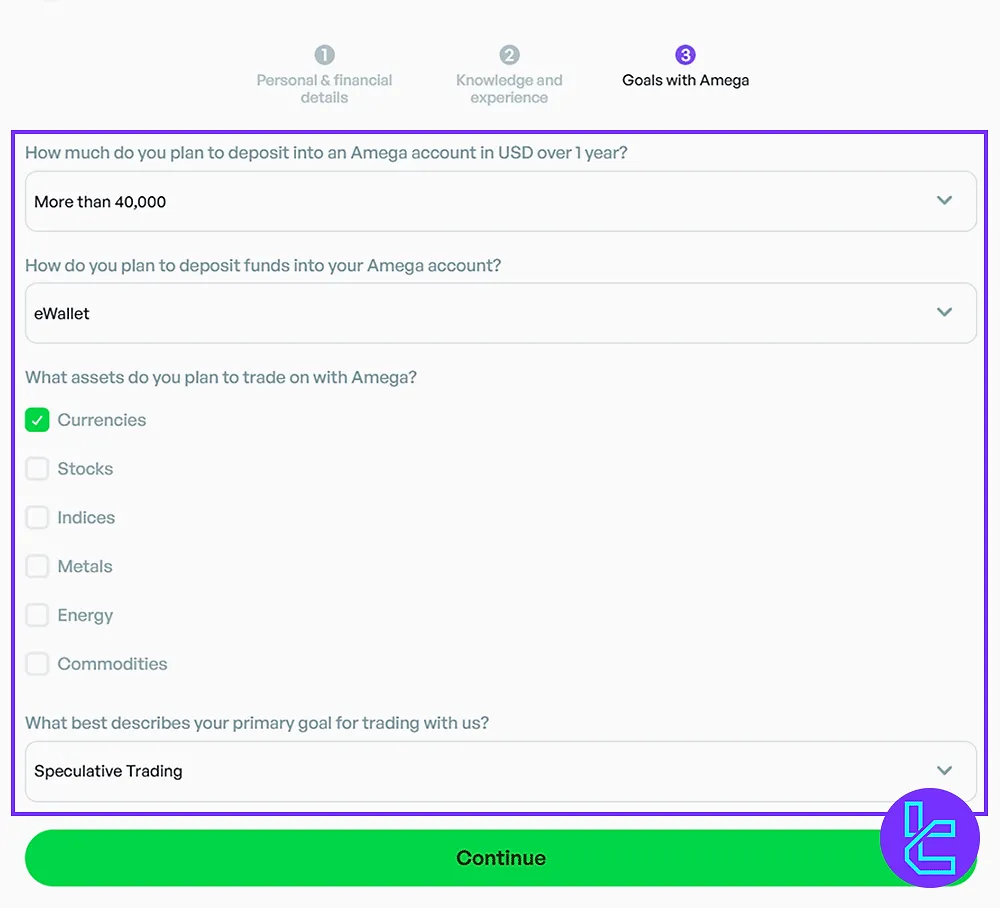

#3 Experience & Purpose Declaration

Provide your trading experience, financial knowledge, and specify your intended goal (e.g. investing or trading) to finalize registration.

#4 Verify Your Account

To complete AMEGA verification and access full trading features on your account, you must provide the following information and documents:

- Proof of identity: ID card, passport, driver's license

- Proof of address: Utility bill or bank statement

AMEGA Trading Platforms

Amega offers access to the industry-standard MetaTrader 4 and MetaTrader 5 platforms, as well as WebTrader for browser-based trading.

Both MT4 and MT5 come equipped with core features such as:

- One-click execution

- Algorithmic trading via Expert Advisors (EAs)

- Integrated Autochartist and Trading Central

- Strategy builder for custom scripts

- Support for scalping strategies

While the platform suite meets most traders’ needs, Amega lacks proprietary software and does not support cTrader or TradingView integration.

The broker also offers mobile apps for Android and iOS, enabling full

AMEGA Broker Fee Structure

Amega operates as a commission-free broker, with all trading costs incorporated into the spread. Typical spreads vary by asset class and account type:

- Forex: Spreads start at 0.8 pips on GBP/USD and 1.0 pips on EUR/USD

- Indices: Around 1.5 pips on S&P 500 and 2.1 pips on FTSE 100

- Other instruments, like stocks and commodities, carry variable spreads based on market volatility

There are no additional trading commissions across any account type. However, traders should note the presence of a $5 monthly inactivity fee, which activates after 30 consecutive days of no trading activity.

Swap-Fee at Amega

At Amega, trades that remain open overnight incur a nightly rollover fee, or swap, which varies depending on the day of the week and the instrument being traded.

For clients who require a swap-free account for religious or other reasons, Amega offers swap-free accounts. These accounts are typically selectable at the time of account opening.

Non-Trading Fees at Amega

Non-trading fees at Amega are generally low. Usually, any additional costs you pay are mainly for third-party services or specific cases, such as account type changes or long periods of account inactivity.

- Deposits and Withdrawals: Amega charges no fees; third-party providers (Visa, Skrill, Neteller) may apply their own;

- Inactivity / Dormant Accounts: Accounts inactive for 180 days incur $5/month, continuing every 30 days until reactivated or closed;

- Currency Conversion: Small conversion fee may apply if deposit/withdrawal currency differs from account base;

- Account Upgrades / Modifications: Switching account types (e.g., to swap-free) or updating info is usually free.

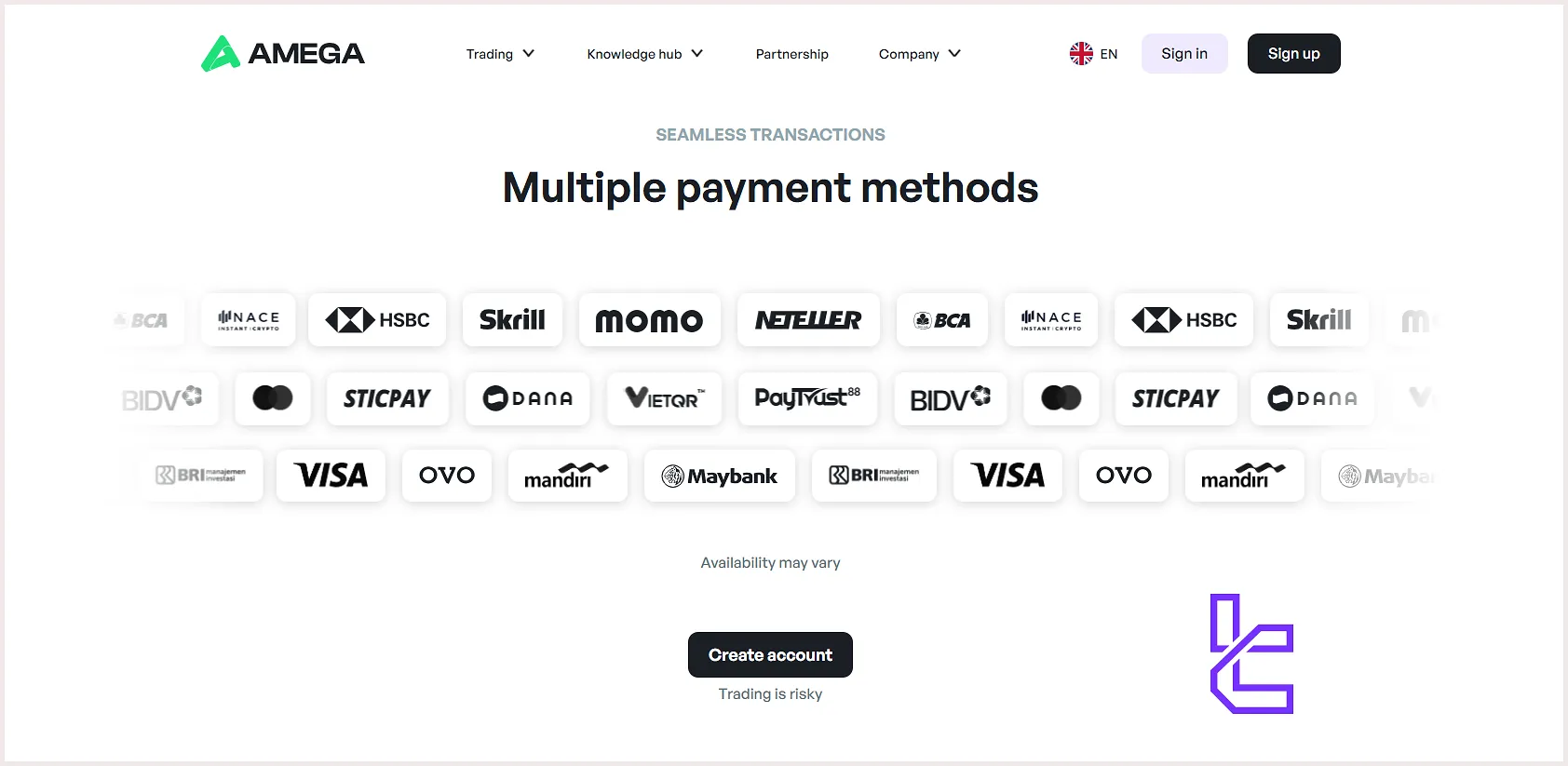

What Payment Methods Are Available on AMEGA?

The primary Amega deposit and withdrawal methods include Bank Card, e-wallet, and crypto.

While the broker charges no fees for funding and payouts, carriers may charge their own rates.

- Bank Cards: Visa and MasterCard

- E-Wallets: Perfect Money, Skrill, Neteller, and SticPay

- Bank Transfers: Wire transfers and local bank transfers (availability may vary by country)

- Cryptocurrencies: Bitcoin, Ethereum, and other major cryptocurrencies (through crypto-to-fiat conversion)

- Mobile Money: Available in Africa

- QR Code Payments: Available in Vietnam and Thailand

Deposit Methods at Amega

Amega provides multiple funding solutions designed for traders across different regions.

Clients can choose from international bank cards, wire transfers, e-wallets such as Neteller, Skrill, and SticPay, as well as crypto-fiat gateways.

In addition, certain localized payment options are available in selected markets, particularly in Africa and East Asia.

You can find a detailed breakdown of the available deposit channels, their fees and processing times in the tables below:

Deposit Method | Minimum Amount | Deposit Fee | Funding Time |

Bank Cards | Varies by region | Possible bank/card fees | Within minutes after confirmation |

Bank Transfer | Varies by region | Bank fees may apply | Up to few business days |

Neteller | No minimum (broker side) | 0% (broker), PSP fees possible | Within minutes |

Skrill | No minimum (broker side) | 0% (broker), PSP fees possible | Within minutes |

Stic Pay | No minimum (broker side) | 0% (broker), PSP fees possible | Within minutes |

Crypto-Fiat | Network dependent | 0% (broker) | Within minutes (after blockchain confirmation) |

Amega TRC20 Deposit

Funding an Amega account with TRC20 USDT is a fast and straightforward process, allowing traders to deposit a minimum of $20 without delays or verification requirements.

The AMEGA USDT TRC20 deposit option is fully managed from the trader’s Amega dashboard, ensuring secure and instant fund transfers.

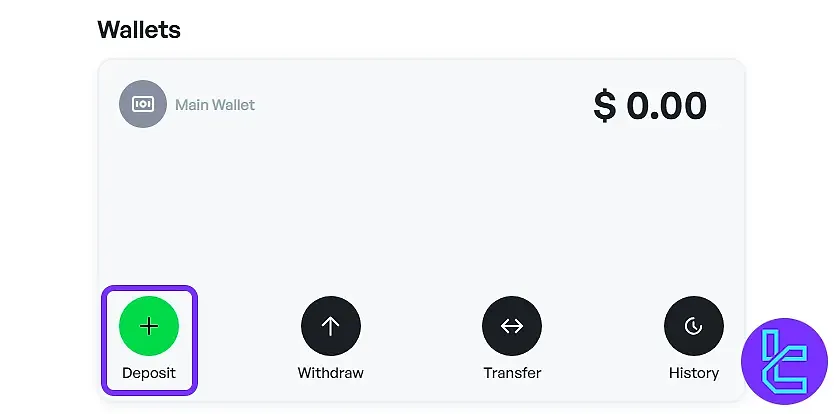

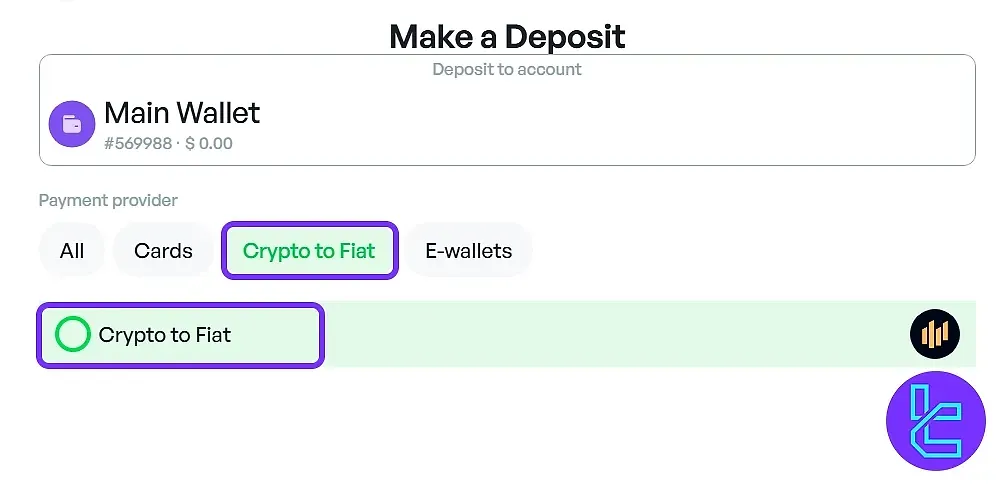

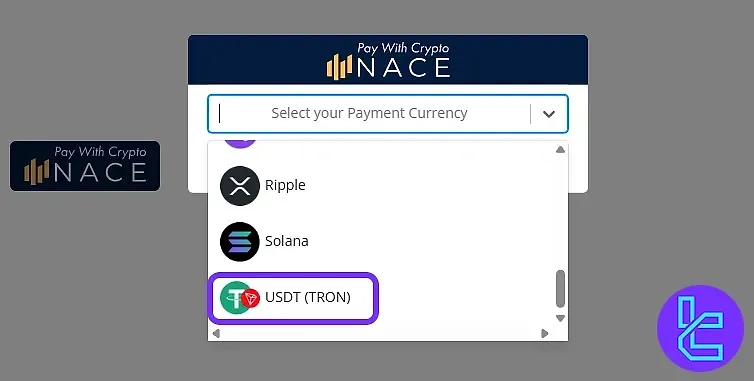

#1 Access Funding and Select Crypto

Log in to your Amega account and navigate to the “Deposit” section.

Among the available funding options, choose “Crypto to Fiat” to initiate a TRC20-based transaction.

This selection enables seamless USDT (TRON) transfers from your wallet to your trading account.

#2 Specify Amount and Complete Transfer

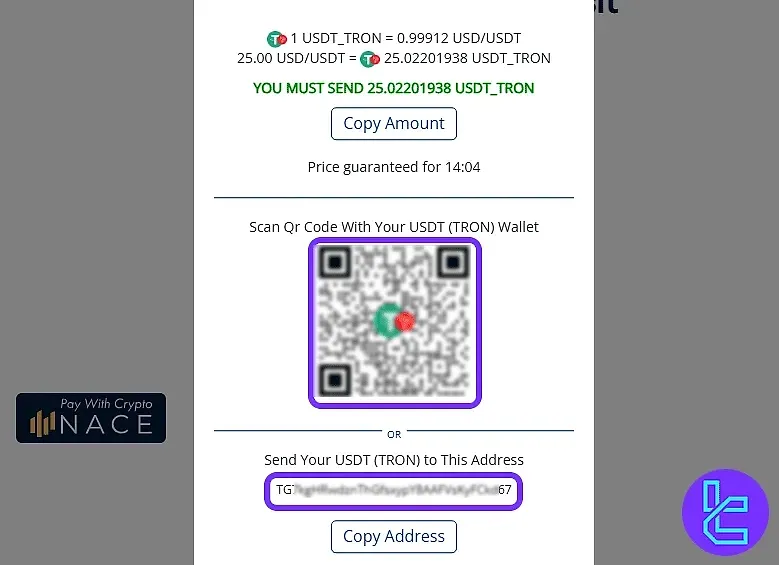

First, enter the desired deposit amount, which must be at least $20.

Next, select USDT (TRON) as your preferred payment method.

Copy the wallet address provided or scan the QR code with your crypto wallet, then send the funds. Ensure the exact amount is transferred to avoid discrepancies.

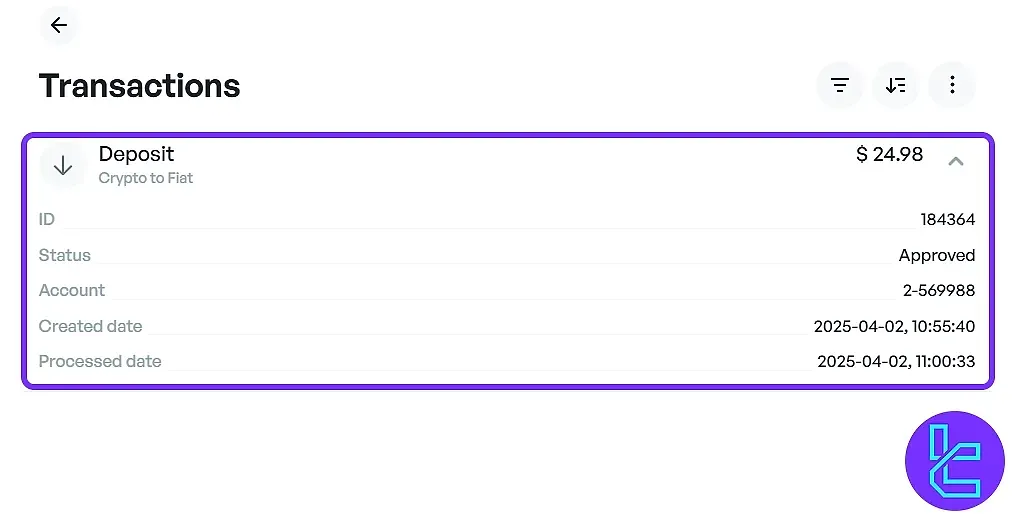

#3 Verify Transaction in History

After sending the TRC20 payment, return to the dashboard and open the History tab to confirm that the deposit has been recorded.

The transaction will appear almost instantly, reflecting in your Main Wallet.

Withdrawal Methods at Amega

The withdrawal infrastructure mirrors the deposit channels, covering cards, bank transfers, crypto payments, and e-wallets.

Local payment methods may vary depending on the client’s residency and regulatory environment.

You can find a detailed breakdown of the available Withdrawal channels, their fees and processing times in the tables below:

Withdrawal Method | Minimum Amount | Withdrawal Fee | Processing Time |

Bank Cards | Varies by region | 0% (broker) – card issuer may charge | Faster than bank transfers (typically 1–3 business days) |

Bank Transfer | Varies by region | 0% (broker) – bank fees may apply | Up to 7 business days |

Neteller | No minimum (broker side) | 0% (broker), PSP fees possible | Within minutes to a few hours |

Skrill | No minimum (broker side) | 0% (broker), PSP fees possible | Within minutes to a few hours |

Stic Pay | No minimum (broker side) | 0% (broker), PSP fees possible | Within minutes to a few hours |

Crypto-Fiat | Network dependent | 0% (broker) – network fee applies | Within minutes (after blockchain confirmation) |

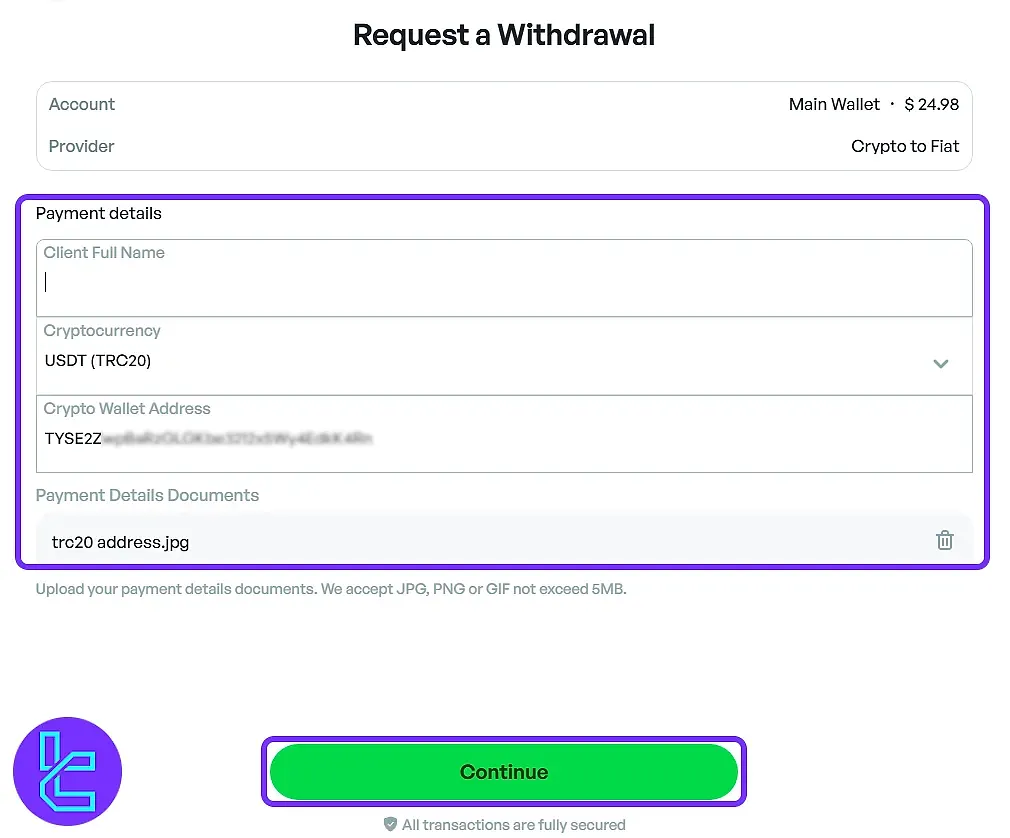

Amega TRC20 Withdrawal

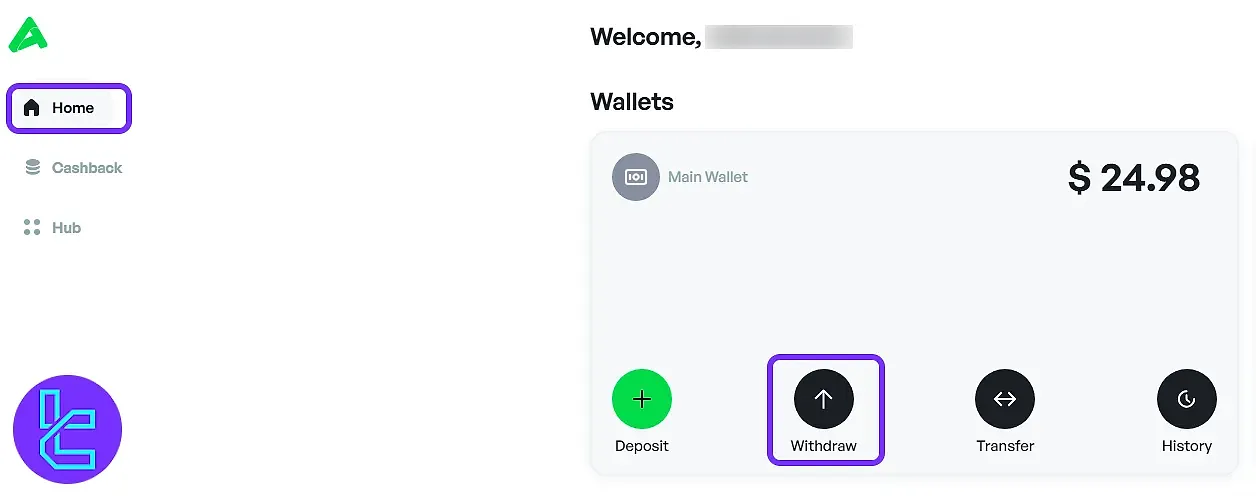

AMEGA USDT TRC20 withdrawal is a simple three-step process. Traders can request a minimum payout of $10, with processing times typically up to 2 business days.

#1 Access Withdrawal Section and Select Method

Log in to your Amega dashboard and click the Withdraw button.

Choose “Crypto to Fiat” as your withdrawal method to initiate a TRC20 transaction. This ensures your funds are routed correctly to your crypto wallet.

#2 Enter Wallet Information and Submit Request

Complete the payout form by providing:

- Wallet name or ID

- TRC20 network selection

- Wallet address

- A screenshot confirming your wallet address

After entering this information, input the withdrawal amount (minimum $10) and submit the request. This step finalizes the cash-out initiation on Amega’s platform.

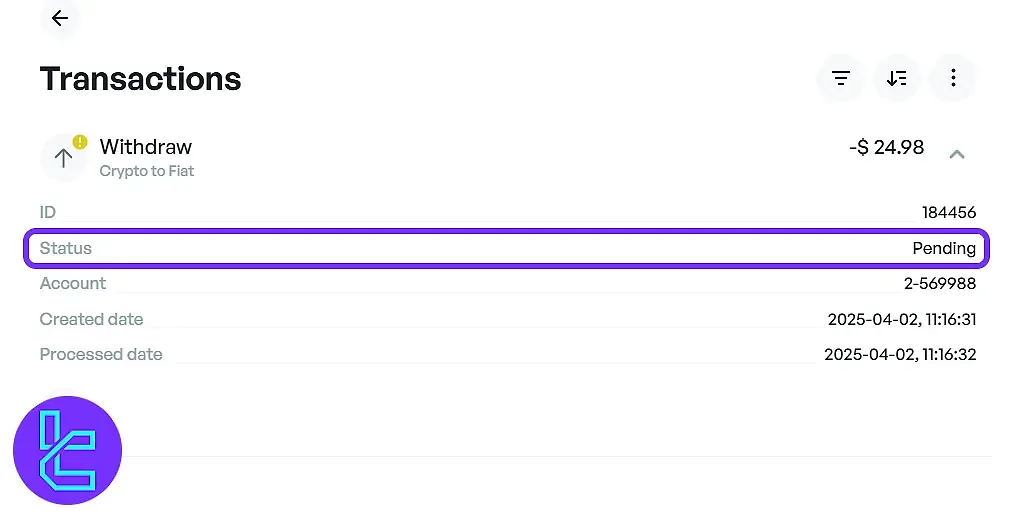

#3 Monitor Transaction Status

Return to the History tab on your dashboard to track your withdrawal. TRC20 payout requests are processed by Amega within 2 business days, and the status will update once the transaction is completed.

Ig you want to cash out funds using one of the best available methods on this broker, check the Amega Tether TRC20 withdrawal guide.

Does AMEGA Offer Copy Trading and Investment Plans?

As of the latest information, AMEGA does not offer copy trading services or pre-packaged investment plans.

However, they have removed all restrictions regarding trading strategies, including Hedging, Scalping, Copy trading, and EAs.

AMEGA Broker Financial Instruments

The company offers a diverse range of financial instruments, allowing traders to access multiple markets through a single account.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, Minor, Exotic Pairs | 100+ | 60–80 pairs | 1:1000 |

Indices | Global indices (ASX200, CAC40, DAX40, SPX500, NASDAQ, Dow Jones, etc.) | 10 | 15–20 | 1:100 |

Precious Metals | Gold, Silver, Palladium, Platinum against USD | 4 | 5–6 | 1:100 |

Energies | Natural Gas, Brent, WTI | 3 | 5–6 | 1:100 |

Stocks (CFDs) | Global shares (Apple, Google, Netflix, Amazon, Boeing, eBay, Alphabet, etc.) | 100+ | 200–300 | 1:10 |

Cryptocurrencies | Popular cryptos (Bitcoin, Ethereum, Dogecoin, etc.) | 30+ | 20–25 | 1:10 |

These instruments cover various asset classes, providing traders with flexibility to diversify their strategies and manage risk more effectively.

Cryptocurrency CFDs are available through Amega Markets LLC, the broker’s unregulated offshore entity.

While the overall instrument list is broad enough for most retail traders, it remains more limited than that of multi-asset brokers with ETF, bond, or options access.

Bonus Offerings

Promotions are among the most attractive topics of the AMEGA review.

While the broker doesn’t offer traditional bonuses like deposit and welcome gifts, it has a comprehensive partnership program alongside a rebate plan.

- Cashback: $1 cashback per lot traded with no limitations

- Affiliate: A CPA (up to $600 per active referred client) and RS ($20 per lot) based commission structure for referring new clients

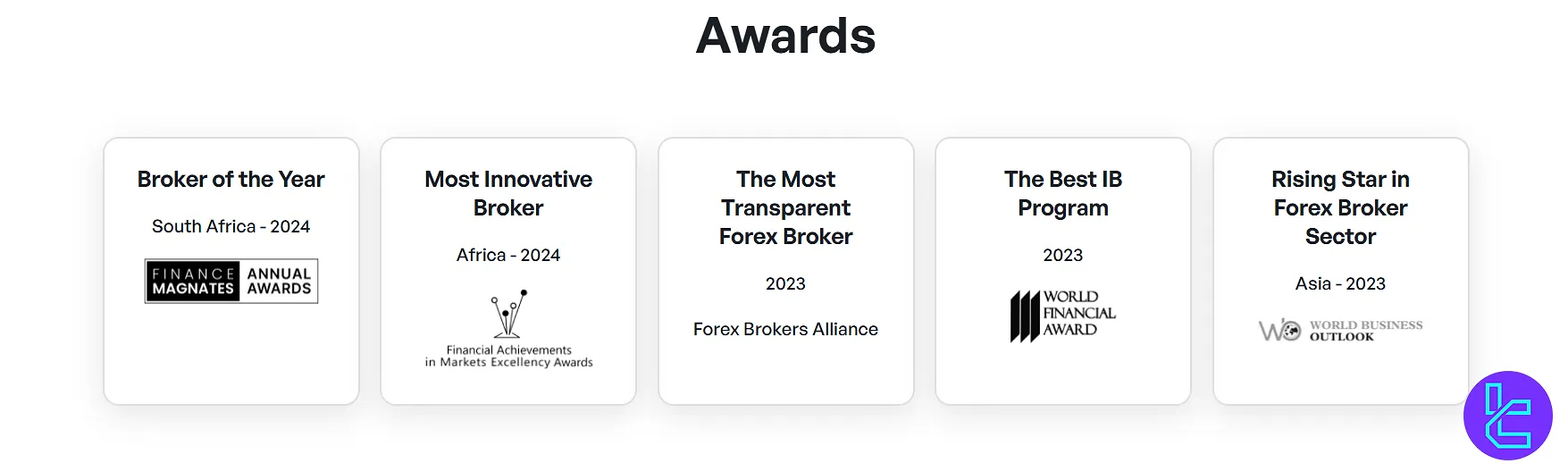

Amega Awards and Industry Recognition

So far, Amega has managed to win multiple industry awards, such as Broker of the Year 2024 in South Africa and Most Innovative Broker 2024 in Africa.

These recognitions highlight the broker’s commitment to innovation, transparency, and attractive Introducing Broker (IB) programs that support both retail and institutional traders worldwide.

Below is a full list of Amega’s recent awards:

- Broker of the Year – South Africa, 2024

- Most Innovative Broker – Africa, 2024

- The Most Transparent Forex Broker – Forex Brokers Alliance, 2023

- The Best IB Program – 2023

- Rising Star in Forex Broker Sector – Asia, 2023

How to Reach AMEGA Customer Support

The company boasts its 24/7 customer support, which is available in over 10 languages. While AMEGA claims that it has live chat support, the option isn’t available on its website.

support@amegafx.com | |

Phone Call | +230 5297 0273 |

Ticket | Accessible on the “Contact Us” page |

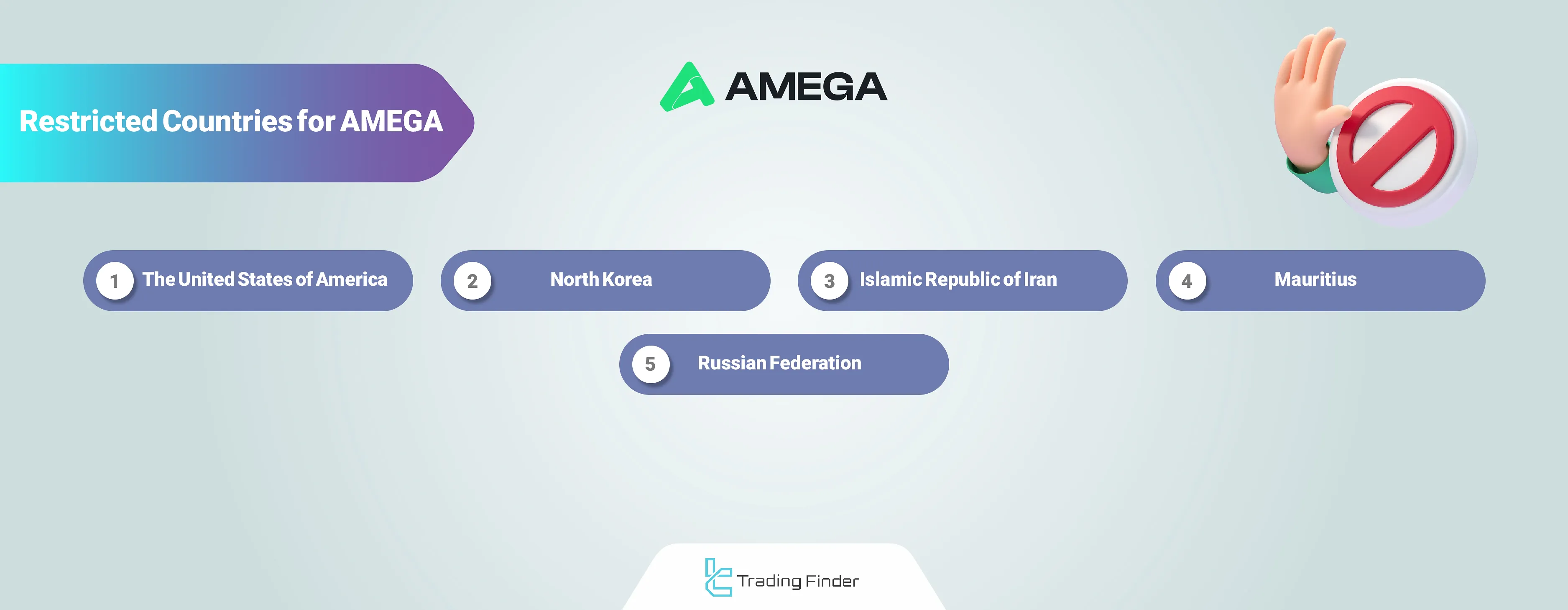

Red Flag Countries on AMEGA

The company has restrictions on providing services to residents of certain countries due to regulatory requirements or geopolitical considerations. Prohibited countries on AMEGA broker:

- The United States of America

- North Korea

- Iran

- Mauritius

- Russian Federation

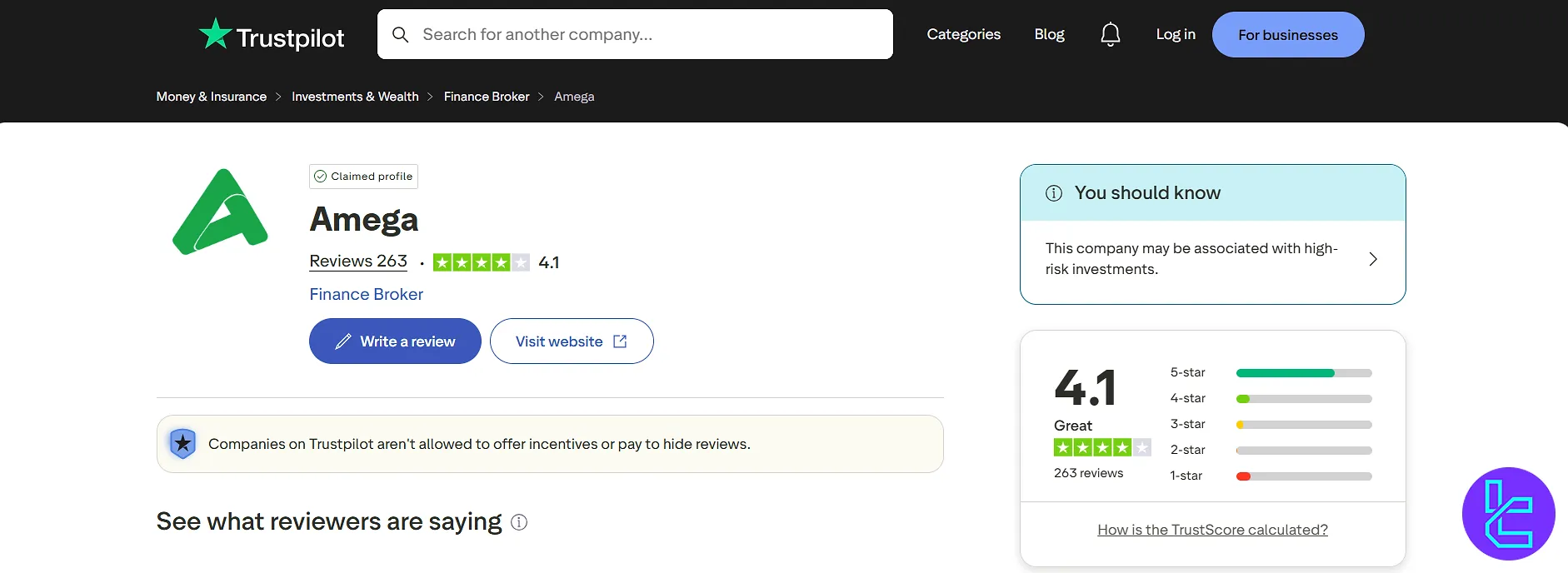

AMEGA Trust Scores

User satisfaction is the most important topic in this AMEGA review. Trust scores and user reviews can provide valuable insights into a broker's reputation and performance.

4.1 out of 5.0 based on 160 reviews | |

Forex Peace Army | 2.1 out of 5.0 based on 48 ratings |

Does AMEGA Broker Provide Educational Resources?

The company understands the importance of traders’ education and attempts to empower them by providing educational resources suitable for beginners and professionals through its Knowledge Hub.

- Trading Strategies

- Indicators Tutorials

- Chart Analysis

- Trading Glossary

AMEGA Broker in Comparison with Other Brokers

To better understand the quality of services in the Amega broker, we suggest checking the comparison table below:

Parameters | AMEGA Broker | |||

Regulation | FSC | FSA, CySEC, ASIC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 1.0 Pip | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | From $3 | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $20 | $200 | $10 | $100 |

Maximum Leverage | 1:1000 | 1:500 | Unlimited | 1:500 |

Trading Platforms | MT4, MT5, WebTrader | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Mini, Scalper, Premium | Standard, Raw Spread, Islamic | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 2800+ | 2,250+ | 200+ | 2100+ |

Trade Execution | Market | Market | Market, Instant | Market, Pending |

Conclusion and Final Words

AMEGA allows for Forex trading (and 5 other asset classes) with a minimum trade size of $1. It supports Crypto, PerfectMoney, and Neteller payments.

An unlimited rebate program with $1 cashback per traded lot and a great TrustPilot score of 4.1 are the main strengths in this AMEGA review.