AUS GLOBAL is a global forex broker regulated by 6 financial authorities worldwide [ASIC, CySEC, FSCA, FSC, FSA, SCA.] Also, it offers features such as an economic calendar, a PAMM account, and leverage up to 1:500.

The broker enables access to 4 main account types [Standard STP, ECN, CLA, VIP]. The minimum deposit for the first 3 is $50.

Company Specifications & Regulation Licenses

AUS GLOBAL is a multi-asset broker founded in 2003. Headquartered in the bustling city of Dubai, United Arab Emirates, this broker has established a global presence over the years. Company in Numbers:

- Over 100 employees;

- More than 150,000 customers;

- Over 20 offices across the globe in South Africa, Melbourne, Seychelles, and other regions.

What sets AUS Global apart is its impressive list of regulatory approvals. The broker is regulated by several prestigious financial authorities, including:

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Commission of Mauritius (FSC)

- Financial Services Authority of Saint Vincent and the Grenadines (FSA)

- Securities and Commodities Authority of the United Arab Emirates (SCA)

- Financial Sector Conduct Authority (FSCA) in South Africa

AUS Global, through its multiple regulatory licenses and branches across various regions of the world, has successfully delivered high-quality trading services to clients worldwide.

The details of these branches are presented in the table below:

Parameter | AUS Global UAE (SCA) | AUS Global AU (ASIC) | AUS Prime Europe (CySEC) | AUS Global ZA (FSCA) | AUS Global MU (FSC Mauritius) | AUS Markets / SVGFSA |

Regulation | SCA | ASIC | CySEC | FSCA | FSC Mauritius | SVGFSA |

Regulation Tier | Tier-2 | Tier-1 | Tier-1 / EU | Tier-2 | Tier-3 | Offshore |

Country | UAE | Australia | Cyprus | South Africa | Mauritius | St. Vincent & Grenadines |

Investor Protection / Compensation | None | None | ICF up to €20,000 | None | None | None |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:500 | 1:500 | 1:500 | 1:500 | 1:500 | 1:500 |

Client Eligibility | All countries except prohibited (e.g. US, Japan, Cuba) | All countries except prohibited (e.g. US, Japan, Cuba) | All countries except prohibited (e.g. US, Japan, Cuba) | All countries except prohibited (e.g. US, Japan, Cuba) | All countries except prohibited (e.g. US, Japan, Cuba) | All countries except prohibited (e.g. US, Japan, Cuba) |

While CySEC offers an investor compensation fund of up to €20,000, most other regulators associated with AUS GLOBAL, including ASIC and FSCA, focus on operational compliance and do not offer direct investor reimbursement schemes.

Summary Of Key Details

Financial brokers come with a suite of features and specifics that make them what they are. Let's have an overview of those specs for AUS GLOBAL:

Broker | AUS GLOBAL |

Account Types | STP Standard, ECN, CLA, VIP |

Regulating Authority | ASIC, CySEC, FSC, FSA, SCA, FSCA |

Based Currencies | USD, EUR, GBP, AUD, and more |

Minimum Deposit | $50 |

Deposit Methods | Bank Transfers, Credit/Debit Cards, GlobePayInc, TCPay |

Withdrawal Methods | Bank Transfers, UnionPay, Help2Pay, MyPay, OCC, and So On |

Minimum Order | 0.01 |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading, PAMM |

Trading Platforms & Apps | cTrader, MT4, MT5 |

Markets | Forex, Commodities, Indices, Stocks, Metals |

Spread | From 0.0 Pips |

Commission | Not Exactly Specified |

Orders Execution | Market |

Margin Call/Stop Out | Not Specified |

Trading Features | Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Phone Call, Ticket System |

Customer Support Hours | 24/7 |

Upsides and Downsides in Trading with AUS GLOBAL

Like any forex broker, this one comes with its own set of pros and cons. Let's examine them at a glance:

Upsides | Downsides |

Regulated by Multiple Top-Tier Authorities | Lack of Transparency in Fees |

Variety in Account Types | High Minimum Deposit for the VIP Account |

Large Number of +10,000 Trading Instruments | - |

Access to a PAMM Account | - |

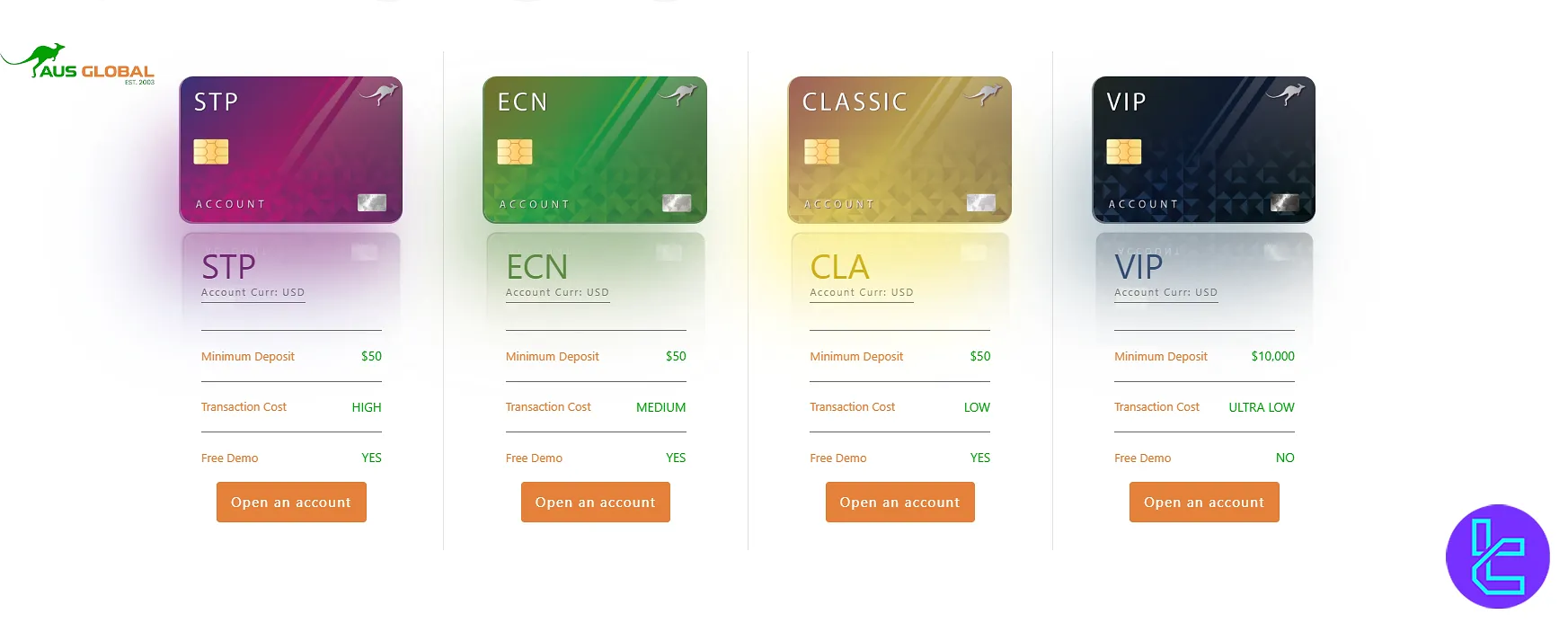

Trading Account Variety

AUS Global offers a diverse range of account types suitable for traders with various approaches. Let's break down the main accounts and compare them:

Account Type | STP Standard | ECN | CLA | VIP |

Currency | USD | |||

Min. Deposit | $50 | $10,000 | ||

Order Execution | Market | |||

Forced Liquidation Ratio | 30% | |||

Access to Expert Advisors | Yes | |||

Hedging | Yes | |||

Maximum Leverage | 1:500 | |||

Min. Order | 0.01 | |||

According to our investigation, the only difference between these accounts is the commission or transaction fee, which will be discussed later in this article.

Besides these live accounts, a demo account is also available for a trial without the risk of losing real funds.

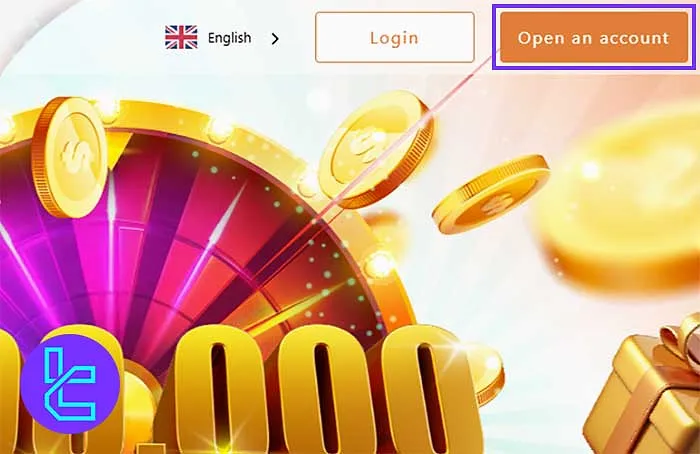

How to Register and Verify an Account on AUS

Creating a new trading account and verifying it with the AUS GLOBAL broker is easy. AUS GLOBAL registration:

#1 Access the Registration Page

Visit the AUS Global official website and click on “Open an Account” to start the process.

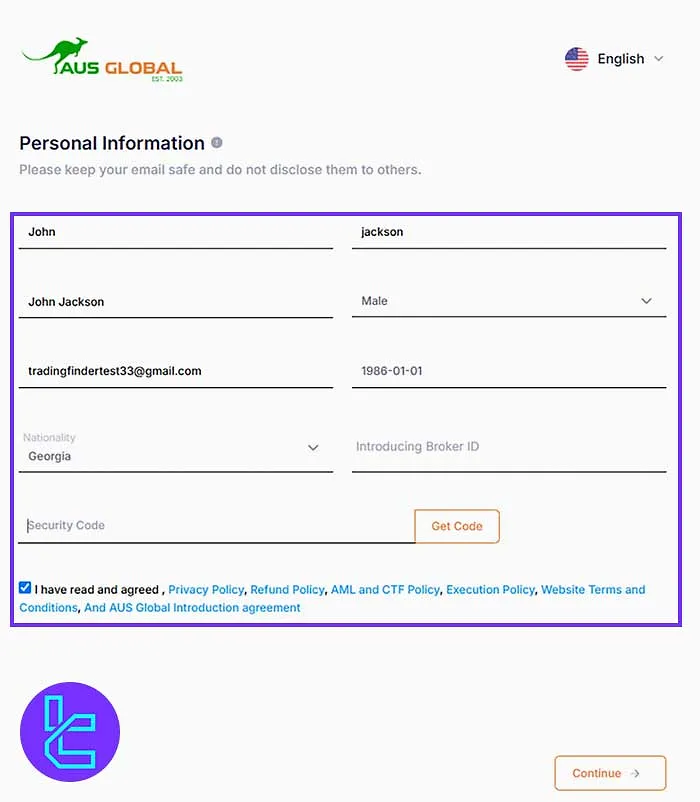

#2 Fill Out Personal Details

Provide your full name (Latin and local language), date of birth, nationality, gender, email, and optionally an IB ID.

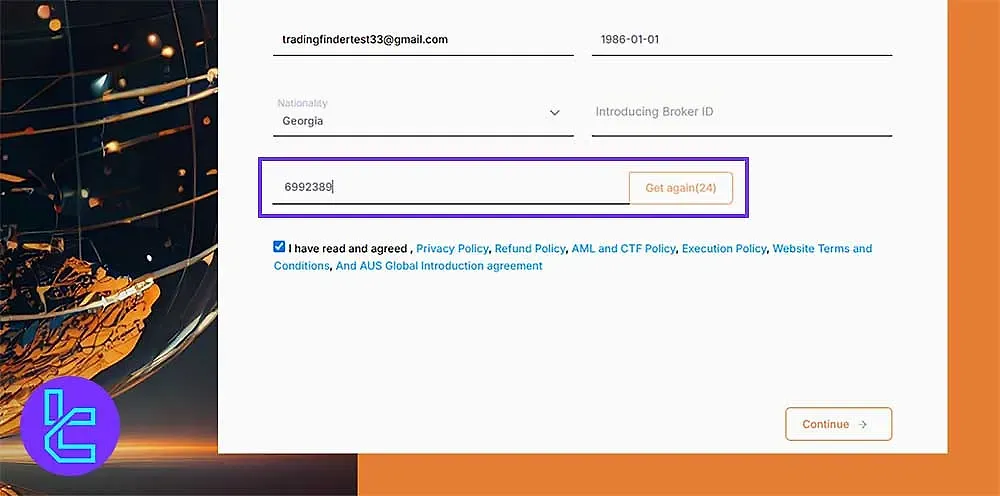

#3 Verify Your Email

Request a code, check your inbox for the AUS Global verification email, and input the code to confirm.

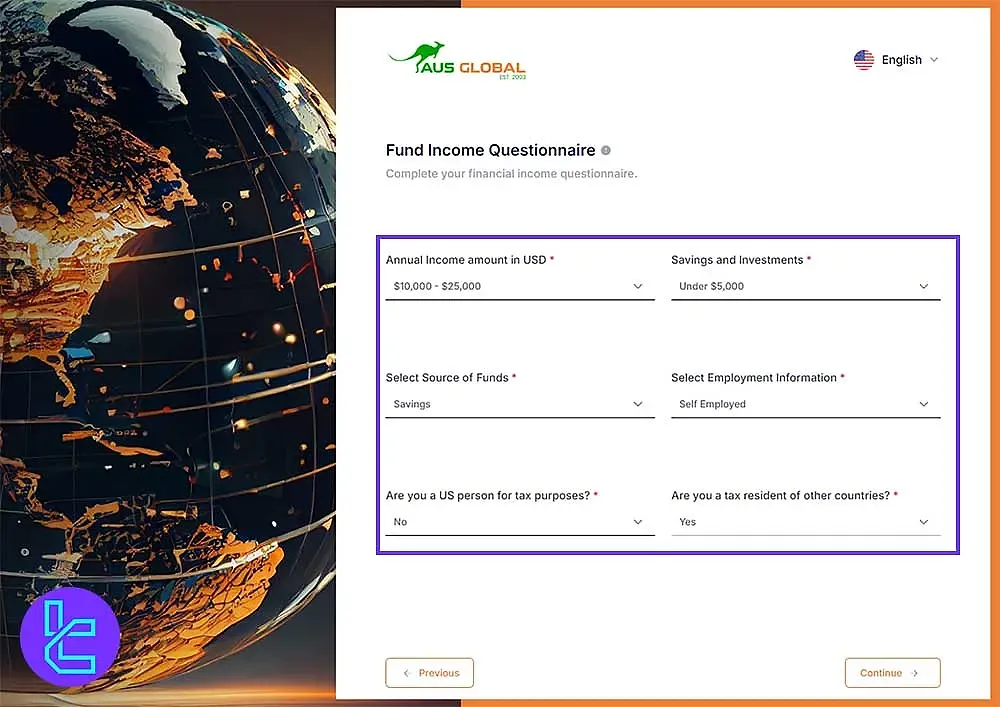

#4 Complete Financial Questionnaire

Answer required questions regarding income, employment, and source of funds to comply with regulatory requirements.

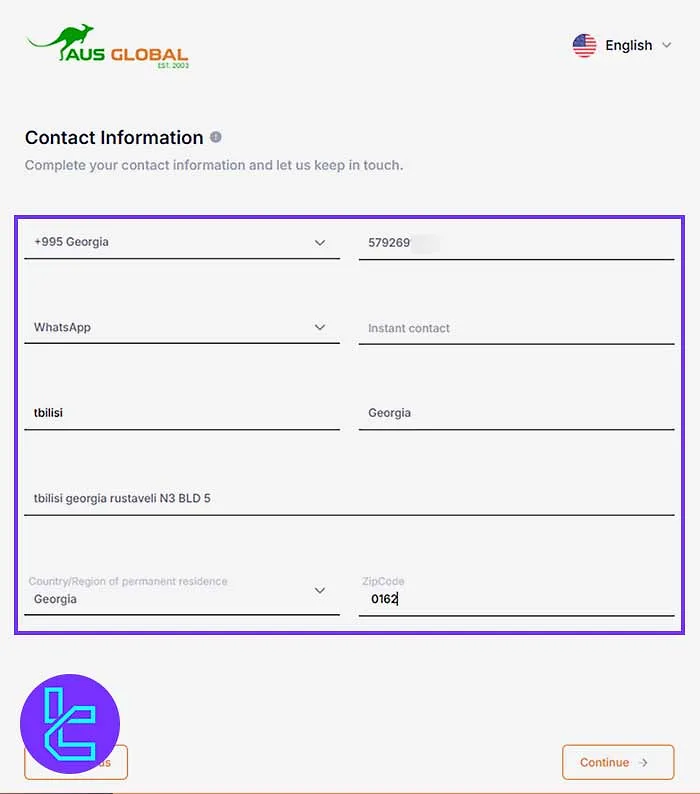

#5 Submit Contact Information

Enter your phone number, WhatsApp, residential address, city, zip code, and country to finalize the setup.

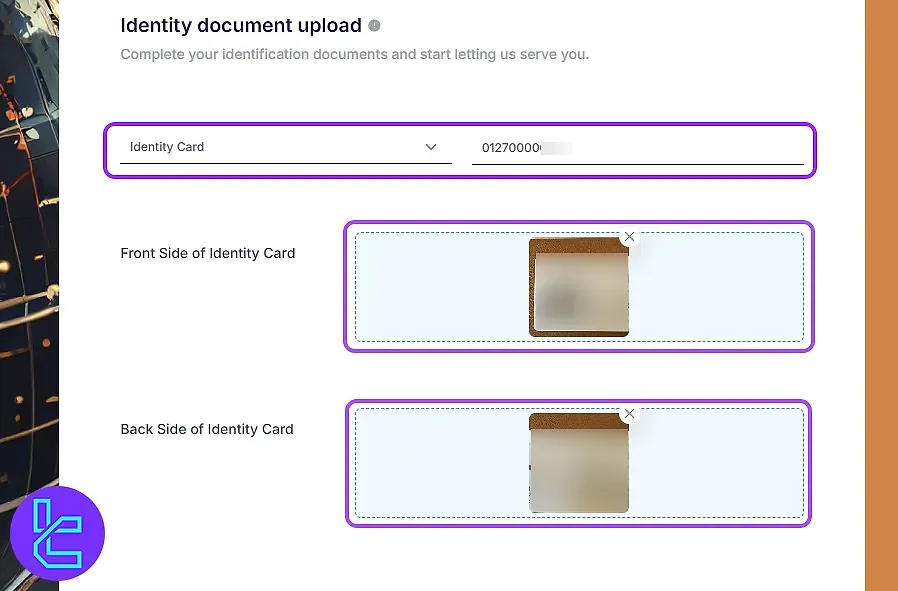

#6 AUS GLOBAL Identity Verification

The AUS GLOBAL verification is structured as a four-step procedure that can typically be completed in only a few minutes.

The purpose is to confirm client identity, ensure compliance with financial regulations, and enable secure access to trading services.

#1 Upload Identification

After completing the initial registration, users begin verification by submitting an identity document.

Acceptable forms include a passport, national ID card, driver’s license, or other government-issued documentation. Both front and back images, along with the document number, must be uploaded.

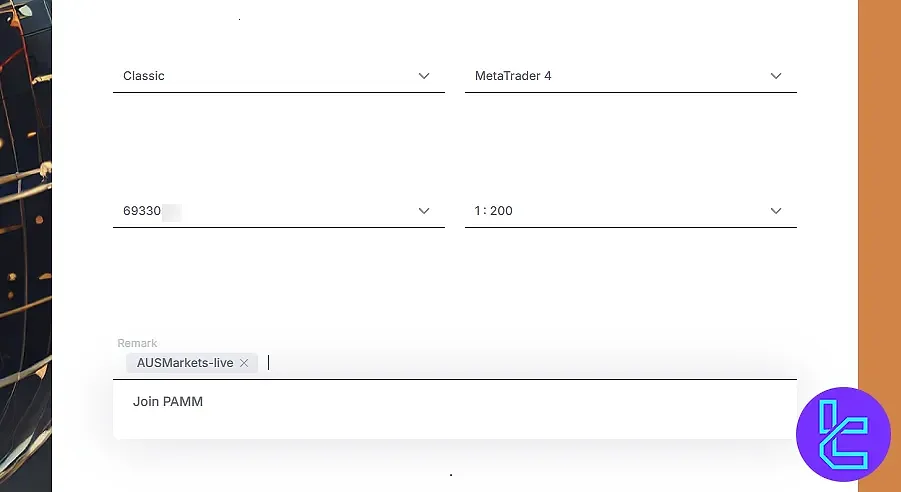

#2 Provide Trading Account Details

Applicants then specify their trading preferences. Required information covers account type (Standard or ECN), account number, chosen leverage, and selected platform (such as cTrader). These details help configure the account for trading activity.

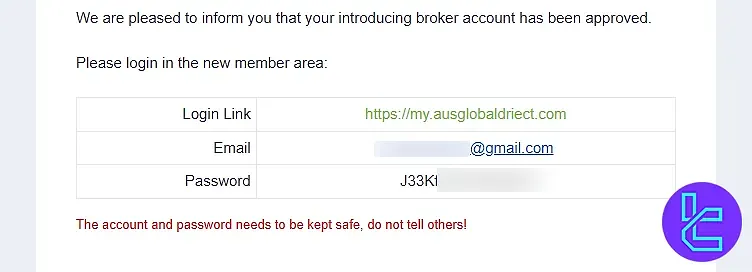

#3 Await Confirmation

Once documents are reviewed, AUS GLOBAL sends an approval email containing account credentials. At this stage, clients may log in using the verified details.

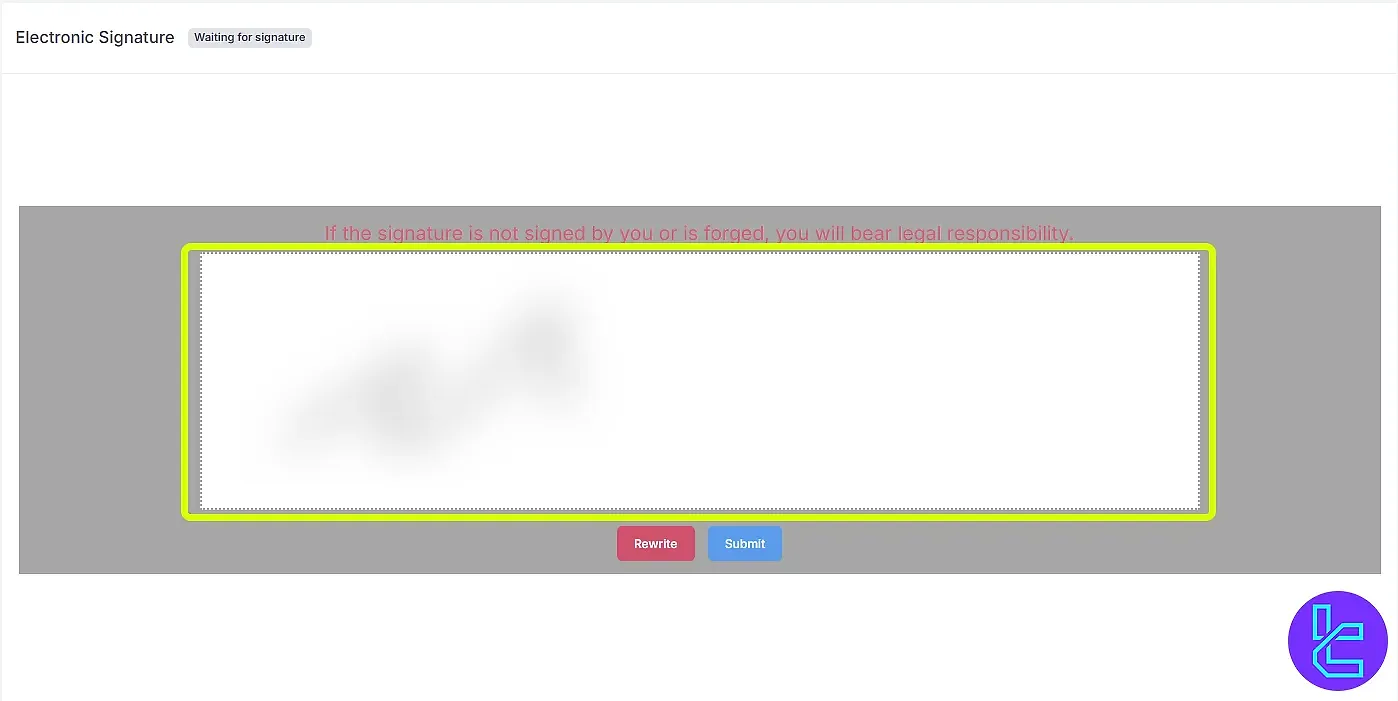

#4 Submit a Digital Signature

The final step involves adding an electronic signature within the client portal. Using a mouse or touchpad, the applicant signs digitally and submits the form, completing the KYC process.

Trading Platforms and Facilities

AUS GLOBAL provides a flexible multi-platform trading environment by supporting the industry’s top three platforms:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

Each platform is available on desktop, web, and mobile (iOS/Android), allowing for seamless cross-device trading.

Users benefit from advanced charting, built-in technical indicators, custom order types, and automated trading via Expert Advisors (EAs).

What Are The Spreads And Trading Commissions?

AUS GLOBAL offers competitive spreads and a tiered commission model depending on the account type:

- Standard Account: EUR/USD spreads typically range between 1.5 and 1.9 pips, with no separate commission; the cost is embedded in the spread

- ECN Account: Offers raw spreads averaging 0.2 pips on EUR/USD, with a commission of $3.5 per standard lot traded

- VIP Account: Designed for professional traders, spreads begin at0.2 pips with ultra-low commission fees

Compared to industry peers, the ECN and VIP accounts offer better cost efficiency, while the Standard STP account may carry above-average trading expenses. Non-trading fees are highly favorable:

- No deposit or withdrawal fees

- No inactivity fee

This transparent and cost-efficient fee model is particularly beneficial for active traders seeking long-term cost savings.

Swap Fee at AUS Global

AUS Global charges an overnight interest (rollover) for holding positions beyond the trading day, and the rate depends on whether your position is long or short as well as the instrument type.

Key points:

- The overnight interest is applied at 21:00 GMT+0 from Monday to Friday;

- Example: Holding EUR/USD overnight, long may incur −0.86 USD, short may yield +0.03 USD (for 1 lot);

- Interest is charged even when markets are closed (weekends). i.e., if a position is held past Wednesday close, triple interest may apply;

- AUS Global does not offer islamic accounts.

Non-Trading Fees at AUS Global

At AUS Global, non-trading fees are generally minimal and mostly depend on the type of account and payment method.

The broker does not charge standard fees for deposits, withdrawals or account inactivity, highlighting a relatively fee‑friendly structure for clients.

Key points:

- Deposit fee: None, excluding possible intermediary or bank costs;

- Withdrawal fee: None, although bank or payment-processor fees may still apply;

- Inactivity fee: None; dormant accounts are not charged;

- Other non-trading fees: No transfer fees are reported.

Funding Methods and Withdrawal Options

AUS offers a range of deposit and withdrawal methods to cater to traders from various regions. Let's examine these options in the next sections.

Note that the availability of these methods may vary depending on your location.

Deposit Methods at AUS Global

US Global offers a variety of deposit methods to cater to its global clientele. Clients can fund their accounts using local bank transfers, major credit and debit cards, e-Wallet and international wire transfers.

These options are designed to provide flexibility and convenience, supporting multiple currencies and ensuring swift processing times.

For detailed information on each deposit method, refer to the table below:

Deposit Method | Currency | Minimum Amount (USD) | Deposit Fee | Funding Time |

TC Pay | USD/IRR | 50 | 0 | Instant |

Hyper Pay | USD | 50 | 0 | Instant |

KORA | NGN | 50 | 0 | Instant |

EX Link | CNY | 470 | 0 | Instant |

My Pay | CNY/THB/IDR/VND/INR | 50 / 600 (INR) | 0 | Instant |

Chip Pay | CNY/THB | 150 / 50 (THB) | 0 | Instant |

ChipPay (Scan code) | CNY | 150 | 0 | Instant |

N Pay | CNY | 470 | 0 | Instant |

Easy Pay | CNY | 470 | 0 | Instant |

MyPay (支) | CNY | 1,500 | 0 | Instant |

Help2Pay | MYR/THB/IDR/PHP | 50 | 0 | Instant |

Cheezee Pay | INR | 50 | 0 | Instant |

Pay Me | VND | 50 | 0 | Instant |

Payment Asia | VND/MYR/PHP | 50 | 0 | Instant |

International Wire Transfer | USD/AED | 200 | 0 | About 2-5 working days |

Withdrawal Methods at AUS Global

AUS Global offers a variety of withdrawal methods to ensure clients can access their funds conveniently.

These methods include local bank transfers, major credit and debit cards, e-Wallet and international wire transfers.

Processing times and fees may vary depending on the chosen method and the client's location.

For detailed information on each withdrawal method, refer to the table below:

Withdrawal Method | Currency | Minimum Amount (USD) | Withdrawal Fee | Processing Time |

Union Pay | CNY | 40 | 0 | About 2 working days |

International Wire Transfer | USD/AED | 200 | 0 | About 5 working days |

Help2Pay | MYR/THB/IDR/PHP | 40 | 0 | About 1 working day |

My Pay | THB/IDR/VND/INR | 40 | 0 | About 1 working day |

Chill Pay | THB | 40 | 0 | About 1 working day |

Pay Me | VND | 20 | 0 | About 1 working day |

Cheezee Pay | INR | 40 | 0 | About 1 working day |

TC Pay | USD | 40 | 0 | About 1 working day |

Hyper Pay | AED | 40 | 0 | About 7–15 working days |

KORA | NGN | 40 | 0 | About 7–15 working days |

Payment Asia | MYR/VND | 40 | 0 | About 1 working day |

Payment Asia | PHP | 50 | 0 | About 1 working day |

AUS Global Payment details

The broker allows deposits in more than a dozen base currencies, including USD, EUR, GBP, AUD, CNY, JPY, and others, helping clients avoid conversion fees.

- Minimum deposit: $50 for Standard, STP, ECN, and CLA accounts; $10,000 for VIP

- Minimum withdrawal: $40 (varies by method)

- Fees: No withdrawal fees; most deposits are free except MyPay (4% fee)

- Processing times: Instant deposits (for most methods); withdrawals are typically completed within 1 business day

This flexible payment structure ensures fast, low-cost transfers across borders, with broad currency compatibility.

Does AUS GLOBAL Provide Any Investment Services?

One of the most popular investment methods for earning passive income via brokerages is the copy trading tool.

AUS offers this option, allowing traders to replicate the trades of successful investors without spending any time on strategies and analysis through "Social Trading" services.

Additionally, a PAMM account is available for clients to manage their money in a single account. There are no account limits for PAMM, and the deposit amount is unlimited, too.

Trading Instruments and Markets

AUS does a great job in tradable products, offering over 10,000 symbols across 5 markets. Here's an overview at these assets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency Pairs | 60+ | 50–70 | 1:500 |

Commodities | Energy, Agricultural Products | 15+ | 10–20 | 1:500 |

Indices | Stock Indices, ETF, Futures | 10+ | 5–15 | 1:100 |

Stocks | US & EU Stocks | 300+ | 200–300 | 1:20 |

Metals | Precious Metals (Gold, Silver, etc.) | 5+ | 5–10 | 1:400 |

These instruments give traders access to both global and regional markets with flexible leverage options. The wide range of symbols ensures plenty of choice for different strategies and trading styles.

Are There Any Available Bonuses?

At the time of writing, we couldn't find any information about active bonuses or promotions offered by AUS GLOBAL.

It's worth noting that many regulated brokers, especially those under strict regulatory bodies like ASIC, often have limitations on offering trading bonuses.

Always read the terms and conditions carefully if you come across any promotional offers, as they often come with specific trading volume requirements or other restrictions.

AUS Global Awards and Recognitions

AUS Global has received various prestigious awards from the beginning of its operations in 2012 up to the present.

The broker has been acknowledged for categories such as “Most Trusted Forex Broker” and “Best Forex Broker IB Program”, highlighting its strong reputation and service quality.

Below is a list of some of the latest awards received by AUS Global:

- Most Trusted Forex Broker 2024 BrokersView Middle East Ceremony, Dubai

- Best Forex Broker IB Program 2024 Forex Traders Summit, Dubai

- Best Trading Spread 2024 BrokersView Middle East Ceremony, Dubai

- Best Customer Service Broker 2024 Summit Oman

- Best Trading Platform 2024 Summit South Africa

- Top Trusted Broker 2023 MEFM Awards, Dubai

Support Contact Methods and Active Hours

Customer support is a crucial aspect of any forex broker's service. AUS offers several ways to get in touch:

- Ticket System: Access through the "Contact Us" page of the website

- Live Chat: Available on the website

- Phone Call: Through 4 different phone numbers, including +44 203 769 9740, +65 3138 8011, +852 3853 1090, +61 73 106 8871

- Email: support@ausglobaluk.com

The brokerage does not directly provide any information about the support department's working schedule, but based on our investigations, it provides 24/7 customer service.

Restricted Countries and Regions

Due to regulatory constraints, AUS Global may not be able to offer its services in certain countries. The list includes, but is not limited to:

- North Korea

- United States

- Belgium

- Cuba

- Syria

- Afghanistan

- Japan

If you're unsure about your eligibility to open an account with AUS Global, it's best to contact their customer support or check their terms of service for the most up-to-date information.

Trust Scores; Is AUS GLOBAL Trustworthy?

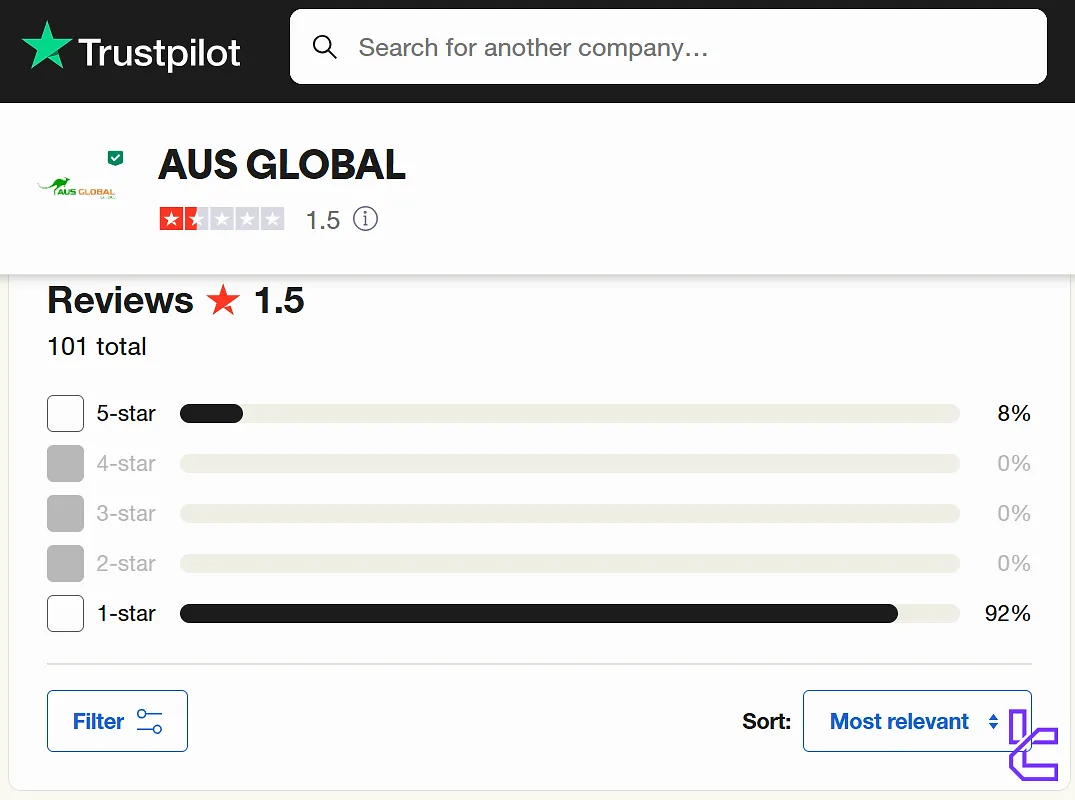

Trust scores and user reviews on websites like Trustpilot, REVIEWS.io, and ForexPeaceArmy can provide a valuable image of a broker's reputation. Unfortunately, AUS's scores on popular review platforms are concerning:

- Trustpilot: 1.5/5 stars, based on more than 100 reviews

- ForexPeaceArmy: Rated 1 out of 5, with only 4 ratings

The majority of reviews (+90% 1-star on Trustpilot) are negative, with users reporting issues such as sudden account closures and unexplained profit deductions; some of them call it out as a scam company.

Despite the strong regulatory status, the overwhelmingly negative sentiment raises serious concerns about the broker's reliability and trustworthiness.

Education Content

Educational resources can be very helpful for traders, especially beginners, but they are not a necessary part of a broker's services. AUS GLOBAL provides limited materials for educational purposes:

- Trading tools

- Video tutorials

- Help center with FAQs

These are all dedicated to the broker and its services; therefore, no educational resources for trading concepts, strategies, and analysis are provided.

Comparing AUS Global and Other Forex Brokers

Let's review the pros and cons of trading with AUS Global compared to other well-known Forex brokers.

Parameters | AUS GLOBAL Broker | |||

Regulation | ASIC, CySEC, FSC, FSA, SCA, FSCA | No | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FSA, CySEC, ASIC |

Minimum Spread | From 0.0 Pips | From 0.1 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | Not Exactly Specified | $0 | From $0.2 to USD 3.5 | From $3 |

Minimum Deposit | $50 | $1 | $10 | $200 |

Maximum Leverage | 1:500 | 1:3000 | Unlimited | 1:500 |

Trading Platforms | cTrader, MT4, MT5 | MetaTrader 4, MetaTrader 5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | STP Standard, ECN, CLA, VIP | Standard, Premium, VIP, CIP | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Raw Spread, Islamic |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 10,000+ | 45 | 200+ | 2,250+ |

Trade Execution | Market | Market, Instant | Market, Instant | Market |

Conclusion And Final Words

AUS GLOBAL provides the trading of over 10,000 symbols across 5 markets [Forex, Commodities, Indices, Stocks, Metals] with a maximum leverage of 1:500.

The broker has received a 1.5/5 trust score on the Trustpilot website, and a 1/5 rating on ForexPeaceArmy.