AvaTrade is a financial brokerage with 9 licenses from financial authorities [CBI, MiFID, FSA, ASIC, FSCA, BVI FSC, ADGM, CySEC, ISA]. Margin call and stop out levels are 25% and 10%, respectively, on this broker.

You will be required to deposit at least $100 for getting started with the brokerage; there are 6 payment options [credit/debit cards, bank wire transfers, Skrill, Neteller, WebMoney, PayPal.]

AvaTrade Broker Company Information & Regulation

AvaTrade is a globally regulated broker, licensed in major jurisdictions such as the Central Bank of Ireland, ASIC (Australia), FSCA (South Africa), FSA (Japan), and FSRA (Abu Dhabi). Its broad regulatory coverage reflects strong credibility and security for traders across the globe.

AvaTrade also adheres to MiFID II regulations in Europe and ensures the safety of client funds by maintaining segregated accounts.

AvaTrade regulatory status:

Ava Trade Markets Ltd | Ava Trade Middle East Ltd | ATrade Ltd | Ava Trade Japan K.K | Ava Capital Markets Pty | Ava Capital Markets Australia Pty Ltd | AVA Trade EU Ltd | DT Direct Investment Hub Ltd | Entity Parameters/Branches |

BVI FSC | ADGM | ISA | JFSA | FSCA | ASIC | CBI | CySec | Regulation |

3 | 2 | 2 | 1 | 2 | 1 | 1 | 1 | Regulation Tier |

British Virgin Islands, Tortola | United Arab Emirates, Dubai | Israel, Herzliya | Japan, Tokyo | South Africa | Sydney, Australia | Ireland, Dublin | Cyprus, Limassol | Country |

No | No | No | No | No | No | Up to €20,000 under ICF | Up to €20,000 under ICF | Investor Protection Fund/Compensation Scheme |

Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Segregated Funds |

Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Negative Balance Protection |

1:200 | 1:400 | 1:30 | 1:25 | 1:400 | 1:30 | 1:30 | 1:30 | Maximum Leverage |

Global | United Arab Emirates | Only Israel | Only Japan | Only South Africa | Only Australia | Ireland | Only EU/EEA Residents | Client Eligibility |

AvaTrade Summary of Specifications & Key Features

Let's take an overall look at the broker's key features and specifications. AvaTrade Key Features:

Broker | AvaTrade |

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Based Currencies | USD, EUR, CHF, GBP, JPY, AUD |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:400 |

Investment Options | Copy Trading, Referral Program |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

Markets | Forex, Metals, Stocks, Commodities, Indices, Crypto |

Spread | Depending on the Asset |

Commission | No Commission on Deposits/Withdrawals Inactivity Fees Overnight Fees |

Orders Execution | Instant |

Margin Call/Stop Out | 25%/10% |

Trading Features | Crypto and CFD Trading, Islamic Account |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Online Chat, Email, Phone Calls |

Customer Support Hours | 24/5 |

AvaTrade Account Types Specifics

AvaTrade offers multiple account types to suit different trader profiles:

- Standard Account: Suitable for most retail traders

- Professional Account: For experienced traders with better conditions

- Islamic Account: Swap-free accounts compliant with Sharia law

- Demo Account: Yes, available for practice

Pros and Cons

Let's weigh the advantages and disadvantages of trading with AvaTrade from a balanced perspective.AvaTrade advantages and disadvantages:

| Pros | Cons |

| Well-regulated by multiple authorities | Limited account types compared to some competitors |

| Wide range of trading instruments | - |

| Multiple trading platforms, including MT4/MT5 | - |

| Decent educational resources | - |

AvaTrade Broker Account Opening & Verification: Step-by-Step Guide

Signing up with this company is done in a few steps that will be discussed in this section. AvaTrade Registration:

#1 Access the AvaTrade Platform

Navigate to the official AvaTrade website and hit the “Create Account” button to begin.

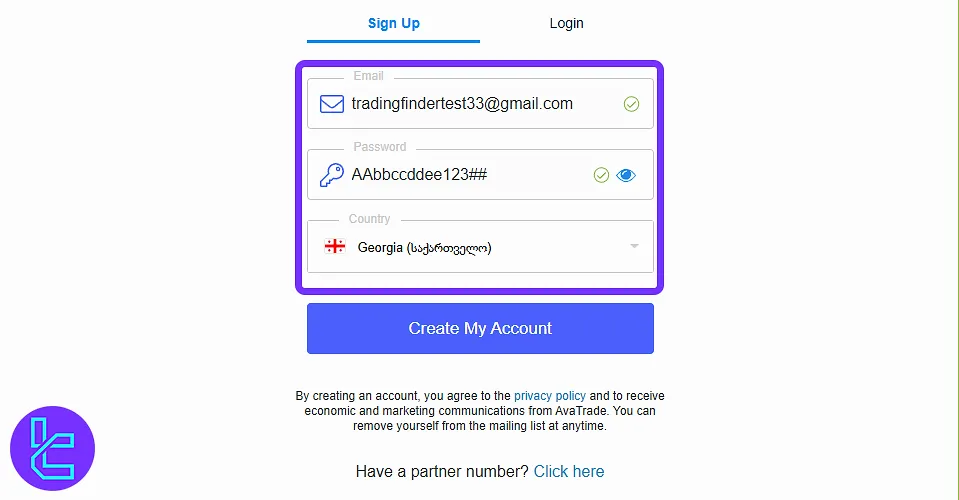

#2 Set Login Credentials

Input your email, define a secure password, and select your country of residence.

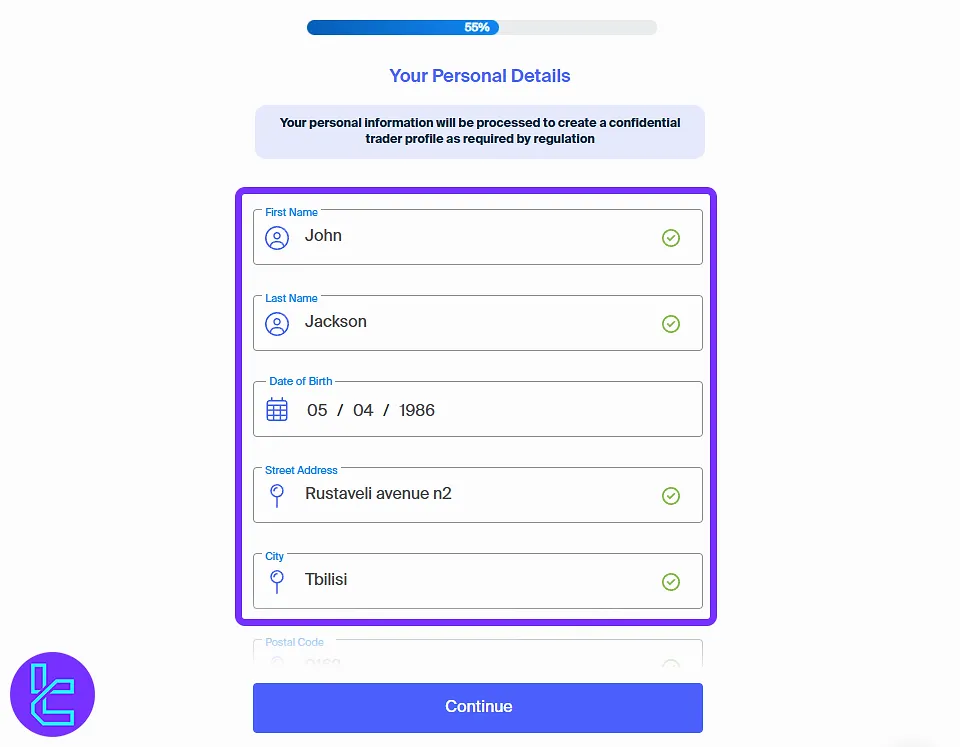

#3 Submit Personal Information

Provide your full name, birth date, phone number, and residential address, then select your base currency and desired trading platform.

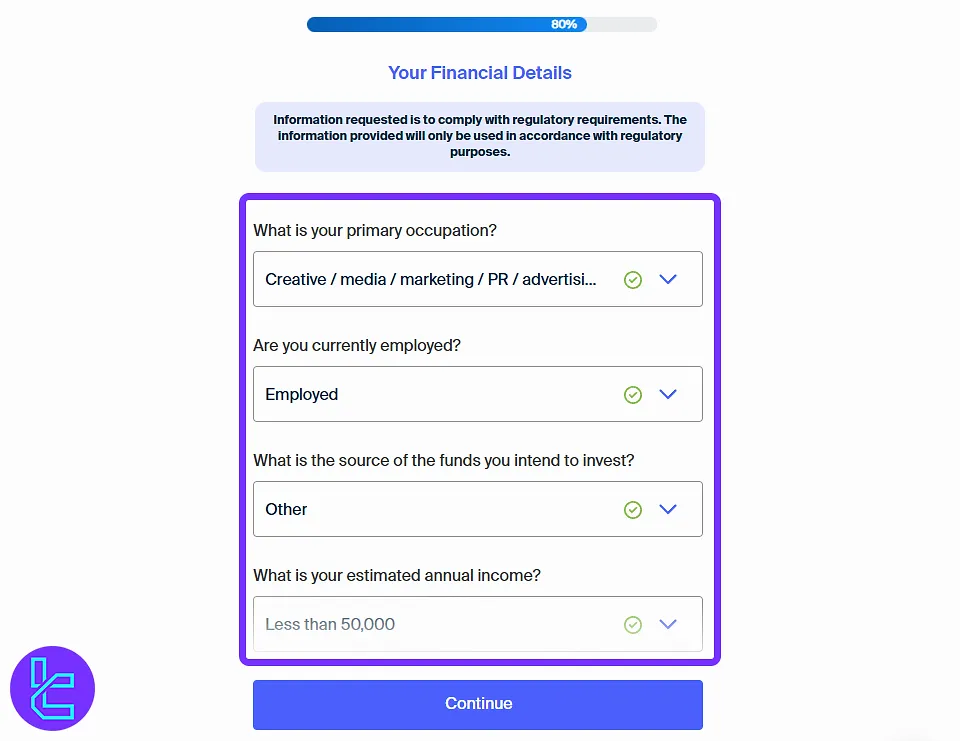

#4 Enter Financial Profile

Indicate your occupation, annual income estimate, net savings, and trading background to comply with KYC protocols.

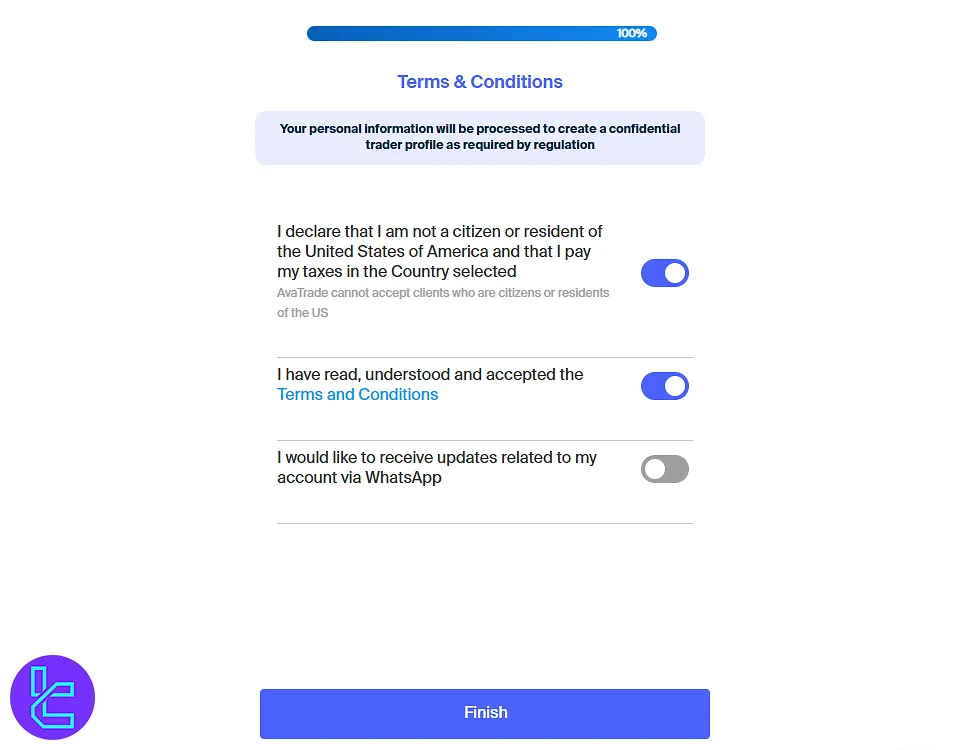

#5 Accept Regulatory Terms

Finalize registration by agreeing to AvaTrade’s terms and confirming non-U.S. tax status.

#6 Verify Your Trading Account

To start working with this broker's services, traders must complete the AvaTrade verification process by uploading the necessary identity and address documents. Fo detailed instructions, watch the video below.

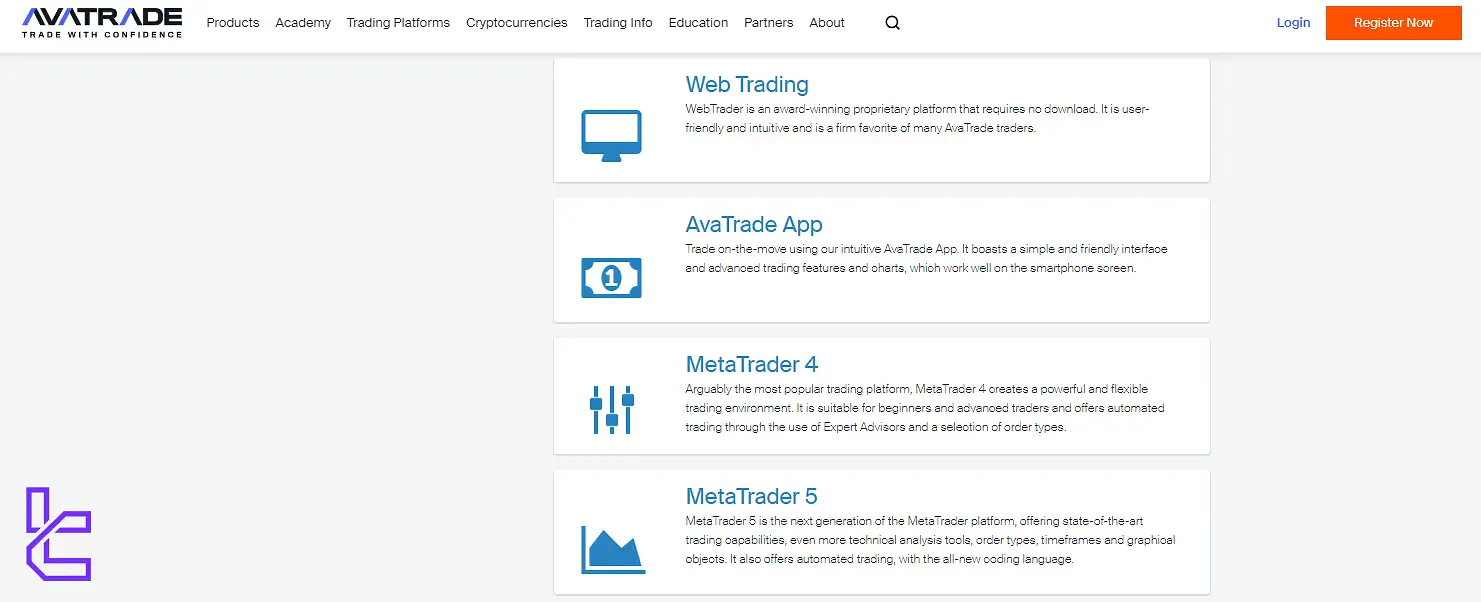

AvaTrade Trading Platforms and Applications Specifics

The broker offers a variety of trading applications to provide several features for traders. AvaTrade Apps:

- MetaTrader 4 (MT4): The industry-standard platform known for its vast range of charting tools and trading capabilities

- MetaTrader 5 (MT5): An advanced version of MT4 with more features and newer user interface

- AvaTrade WebTrader: A proprietary web-based platform that requires no download, offering a user-friendly interface and essential trading tools

- Mobile App: A mobile trading app available for iOS and Android devices, allowing traders to manage their accounts on the go

- AvaOptions: A specialized platform for options trading, featuring advanced risk management tools

AvaTrade Spreads and Commissions on Trading & Other Activities

AvaTrade does not charge trading commissions and instead earns from fixed spreads, which are typically competitive.

Swap Fees

Overnight interest rates are indicative and may vary. For MT4 FX, Gold, and Silver trades, the charges or credits for the weekend period are applied in advance, specifically on Wednesday.

In contrast, non-FX instruments on MT4 (excluding Gold and Silver) are settled earlier, with weekend interest adjustments processed on Friday. If you are interested in lowering your trading costs, we suggest checking the AvaTrade rebate page on our website.

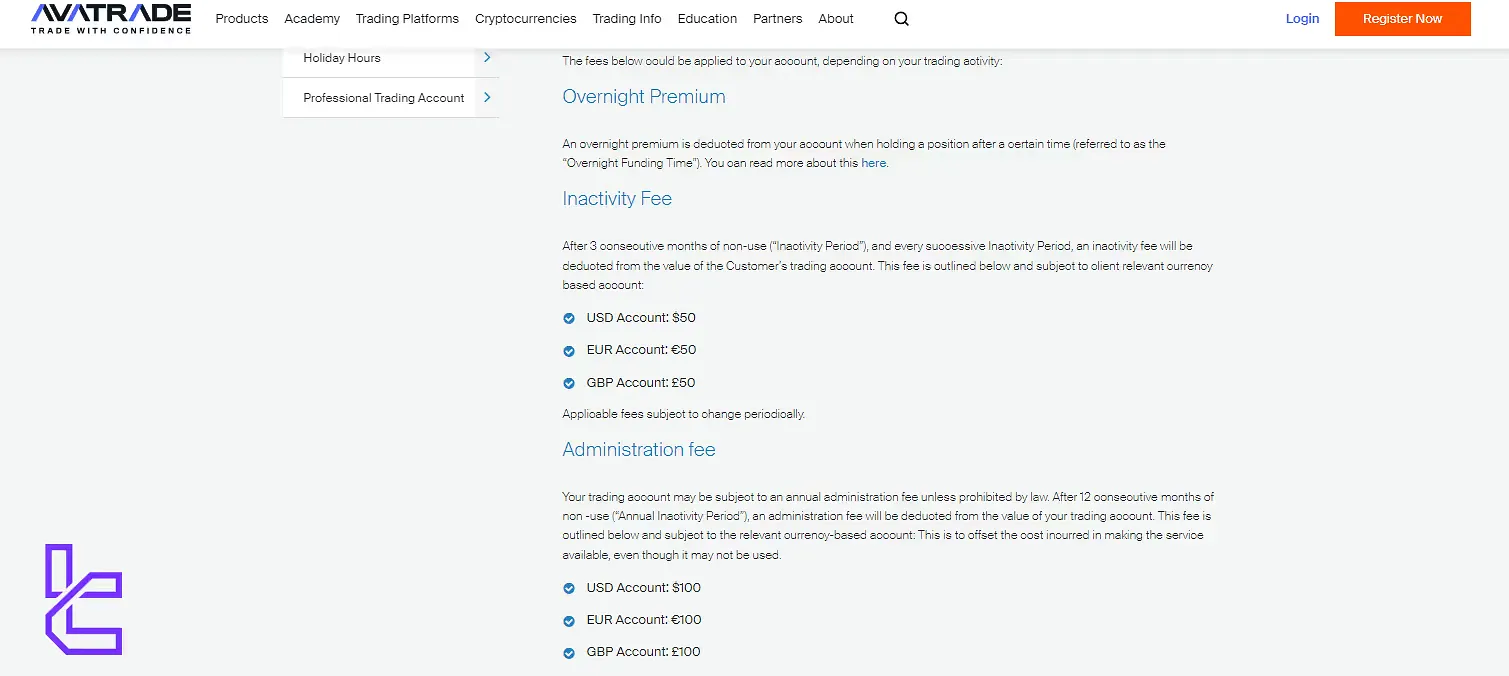

Non-Trading Fees

AvaTrade applies certain non-trading charges primarily linked to account inactivity. If no trading activity occurs for two consecutive months, and the account balance remains below $2,000, a $10 monthly inactivity fee (or its equivalent) is deducted.

For prolonged inactivity, an additional $100 annual administration fee is imposed after 12 consecutive months without any user engagement. Regarding transaction-related fees, deposits and withdrawals are typically free of charge, and no separate account maintenance fees are reported.

These conditions highlight a cost structure that penalizes long-term inactivity but maintains minimal barriers for active users.

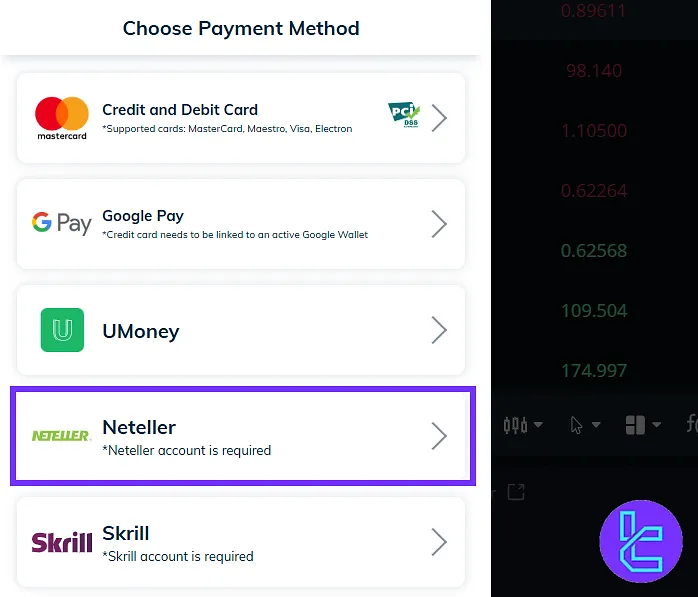

AvaTrade Deposit & Withdrawal Methods

This broker provides a bunch of payment options for deposits and withdrawals. In the list below, we will have an overview of the methods:

- Credit/Debit Cards

- Bank Wire Transfer

- E-wallets (Skrill, Neteller, WebMoney)

- PayPal (in select countries)

- Apple Pay and Google Pay (Not available to all regions)

AvaTrade requires a minimum deposit of $100 to open a standard trading account. To learn about the details of each transaction method, we suggest reading the AvaTrade deposit and withdrawal methods article.

AvaTrade Deposit

AvaTrade supports a range of deposit methods, including cards, e-wallets, and wire transfers. While card and e-wallet payments are processed almost instantly, wire transfers may take several days. AvaTrade charges no deposit fees, though third-party provider fees may apply.

Method | Processing Time | Fees | Minimum Deposit |

Credit/Debit Cards | Instant (1 day max for first-time deposit) | No broker fee; card fees may apply | $100 or equivalent |

E-wallets (Skrill, etc.) | Within 24 hours | Depends on provider | $100 or equivalent |

Wire Transfers | 3–7 business days | Bank fees may apply | $500 or equivalent |

AvaTrade Neteller Deposit

To fund your account using the AvaTrade Neteller deposit method, log into your trading dashboard and access the Deposit section. Select Neteller from the list of payment options, enter the transaction amount (between $100 and $20,000) along with the email linked to your Neteller account, and proceed to the next step.

You’ll be redirected to Neteller’s secure login page, where you must authenticate the payment using your credentials. After confirming the transaction, choose your preferred verification method, SMS or email, and enter the code received. Once confirmed, the funds will be instantly credited to your AvaTrade trading account with no extra fees applied by the broker.

AvaTrade Withdrawal

Withdrawals on AvaTrade are processed securely, with timelines depending on the method used. While the broker imposes no withdrawal fees, bank or e-wallet providers might. For security, the first withdrawal must match the deposit method.

Method | Processing Time | Fees |

Credit/Debit Cards | 24–48 hours | No |

E-wallets (Skrill, etc.) | 24–48 hours | No |

Wire Transfers | Up to 10 Business Days | No (bank fees may apply) |

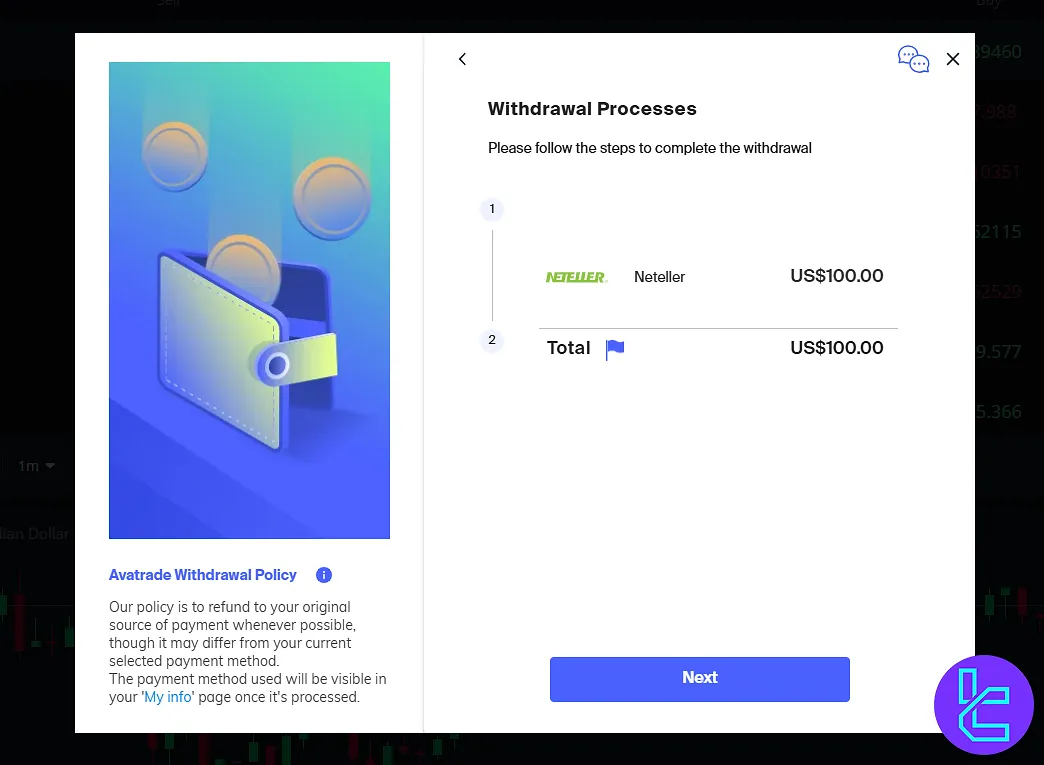

AvaTrade Neteller Withdrawal

To withdraw funds from your AvaTrade account using Neteller, log into your dashboard and go to the Payments section, then select the Withdrawal option. Choose the trading account from which you'd like to transfer funds, enter your desired cash-out amount, and proceed.

On the next screen, pick the AvaTrade Neteller withdrawal method.

Your registered Neteller account details will be auto-filled for confirmation. Make sure all information is accurate before submitting the request. Once processed, the transaction will be visible in your Transaction History tab.

No fees are charged by AvaTrade, and payouts typically clear within 24 hours, provided your Neteller account is already verified.

Copy Trading & Investment Options Offered on AvaTrade

This broker pays enough attention to copy trading services, providing 2 platforms specifically used for this goal. AvaTrade Copy Trading Platforms:

- DupliTrade: An automated trading platform integrated with AvaTrade, featuring Strategy providers with proven track records, real-time performance monitoring, and risk management tools;

- AvaSocial: This app is designed by AvaTrade to let users copy trades from experienced traders and interact with them in real time.

Also, this brokerage provides an affiliate program that allows you to earn passive income by inviting friends.

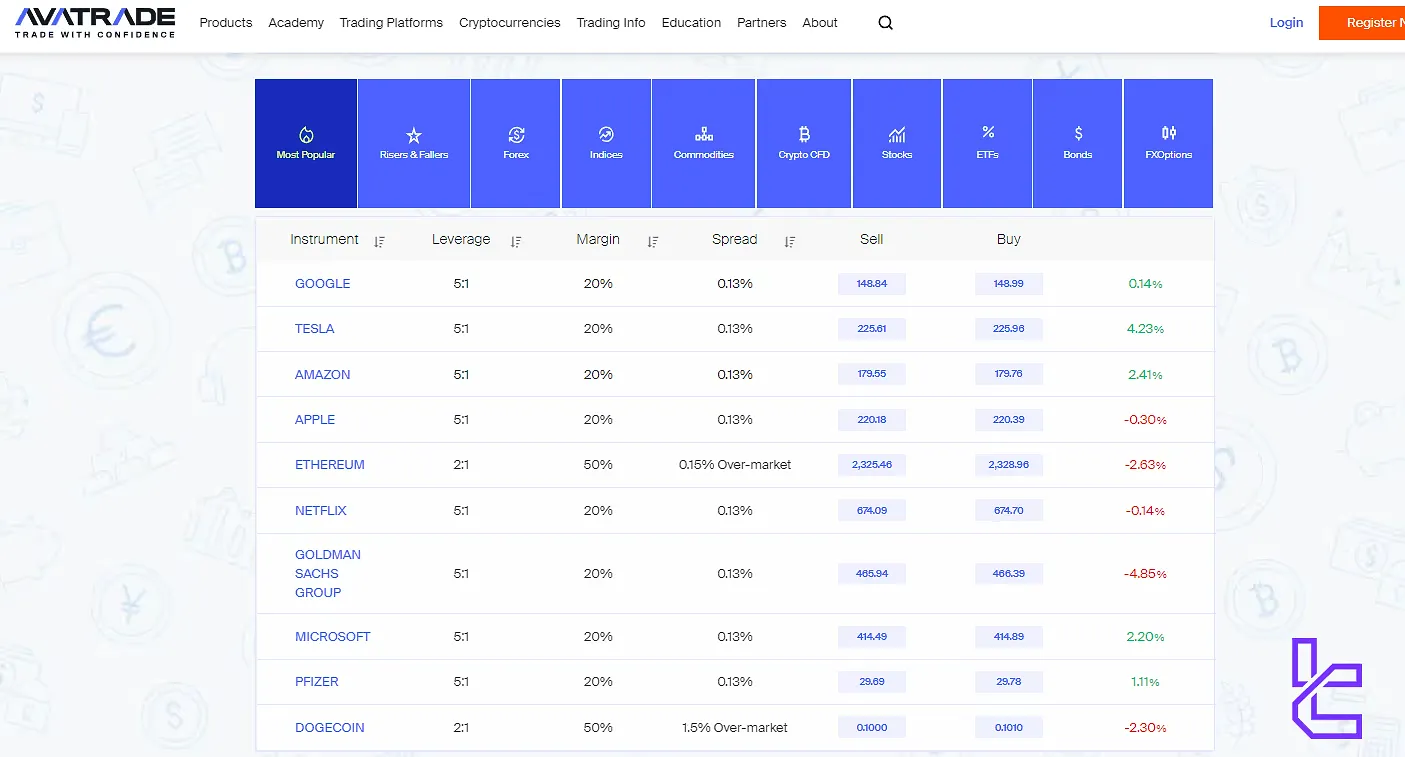

Which Tradable Markets & Symbols are Available on AvaTrade?

AvaTrade offers a diverse range of over 1250 instruments from various asset classes. List of tradable assets on AvaTrade:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | CFDs on currency pairs (majors, minors & exotics) | 60+ Forex pairs | 50–70 currency pairs | 1:500 |

Stocks & ETFs | CFDs on individual shares & ETFs | Over 250 to 1,000 CFDs | 800–1,200 global stocks | 1:100 |

Commodities & Metals | CFD trading on precious metals, energies & agricultural softs | 20 commodity instruments | 10–20 instruments | 1:500 |

Indices | CFDs on major stock indices (e.g. S&P 500, NASDAQ, DOW) | Over 250 to 1,000 CFDs | 10–20 indices | 1:200 |

Cryptocurrencies | CFDs on major crypto pairs (BTC/USD, ETH/USD, XRP, LTC, etc.) | +20 Crypto pairs | Varies (often 5–15) | 1:20 |

Bonds & Options | Government bond CFDs; FX options via AvaOptions | Bonds & Options included in instrument mix | N/A | Not Specified |

Does AvaTrade Currently Offer Any Bonuses and Promotions?

Based on our investigations on the website and official resources, the broker offers bonuses, but they are not available to all users, and it depends on your region and jurisdiction.

AvaTrade Awards

AvaTrade has received over 100 international awards that reflect its ongoing role in the online trading industry. In 2024, the broker was named "Best Trading Experience" by Finance Derivatives and also secured the "Best Mobile Trading App" title from World Business Outlook. In 2023, International Business Magazine awarded AvaTrade the "Most Trusted Broker", while World Business Outlook recognized it for "Best Affiliate Program – Global".

Going further back, Global Brands Magazine honored AvaTrade in 2021 with "Best Forex Broker – UAE" and "Best Trading App – Global". These distinctions have acknowledged various aspects of AvaTrade’s services, from user experience and platform performance to its affiliate infrastructure. To see the full list of AvaTrade awards, we suggest checking its official website.

AvaTrade Support: Does It Offer 24/7 Services?

The company provides comprehensive customer support, though not on a 24/7 basis. AvaTrade Customer Support:

- 24/5 customer service via live chat, email, and phone

- Support available in 14 languages

- Knowledgeable and responsive agents

While the lack of 24/7 support may be a drawback for some traders, the brokerage's support team is generally praised for its helpfulness during operating hours.

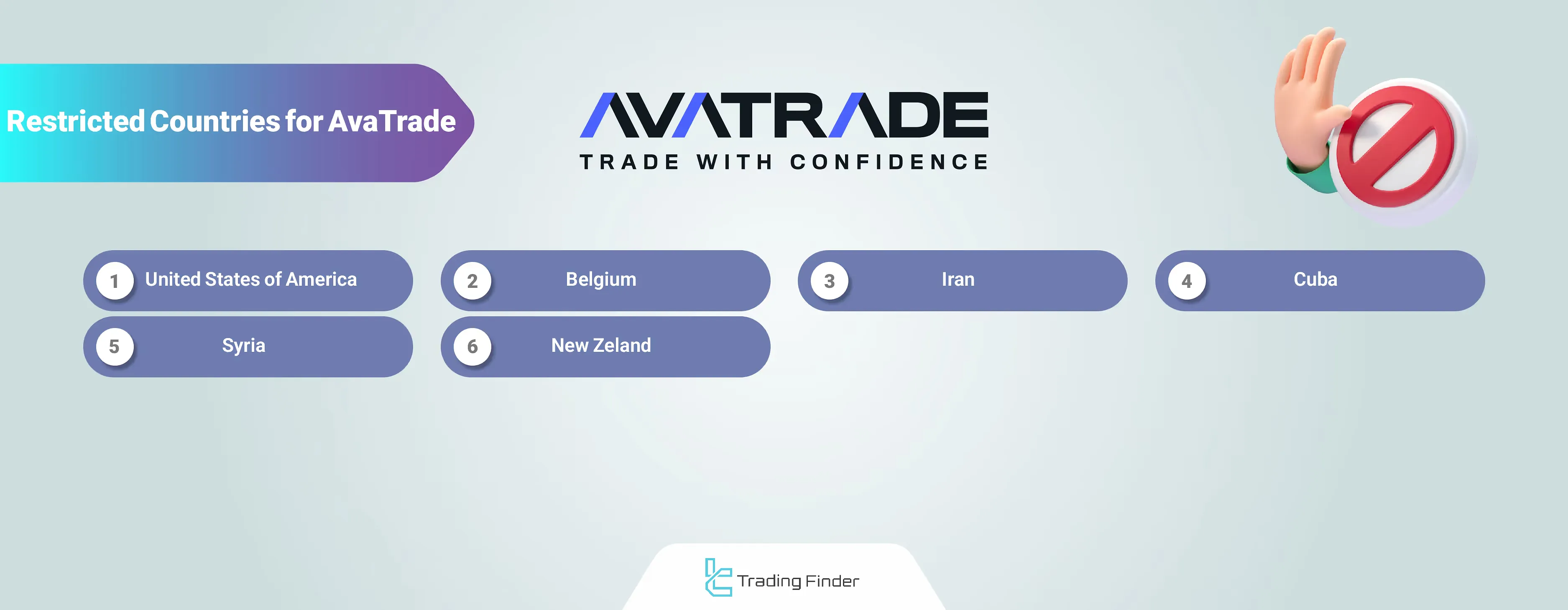

List of Countries Banned from AvaTrade's Services

The company serves traders in over 150 countries but is restricted in several jurisdictions:

- United States

- Belgium

- Iran

- Cuba

- Syria

- New Zealand

Always check the most up-to-date list on the broker's website, as restrictions can change based on regulatory requirements.

AvaTrade Broker Trust Scores & Reviews

The brokerage generally receives positive reviews from users and industry experts; AvaTrade's Trustpilot score is 4.5 out of 5, based on over 8,000 reviews. Overall, AvaTrade scores well in trust and reliability, with a high average rating on various websites.

AvaTrade Education Section Overview

The website of the broker offers a robust educational suite for traders of all levels. It includes:

- Trading guides and tutorials

- Video lessons on various trading topics

- Live webinars hosted by market experts

- Economic calendar and market analysis

These resources demonstrate the broker's commitment to trader education and development.

AvaTrader Comparison with Other Forex Brokers

The table below compares the most important features of trading with AvaTrade to those of other well-known Forex brokers.

Parameters | AvaTrade Broker | |||

Regulation | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | ASIC, VFSC | FSC | FSA, FSC, Misa, FinaCom |

Minimum Spread | 0.0 Pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | $0 | $0 | $0 | $0 |

Minimum Deposit | $100 | $0 | $200 | $100 |

Maximum Leverage | 1:400 | 1:500 | 1:3000 | 1:3000 |

Trading Platforms | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MetaTrader 4, MetaTrader 5, FXTM Trader App | MetaTrade 4, MetaTrade 5, Mobile App |

Account Types | Standard, Demo, Professional | Zero, Classic | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Standard, ECN, Fixed, Crypto |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1250+ | 250+ | 1000+ | 700+ |

Trade Execution | Instant | Market, Limit, Stop, Trailing Stop, Take Profit | Market | Market, Instant |

Conclusion and Final Words

AvaTrade is a multi-asset brokerage with a 4.5/5 trust score on the "Trustpilot" website. You have 3 options [live chat, email, phone call] for contacting the support department in the mentioned company, which is available 24/5. Besides that, AvaTrade support is available in 14 languages.