Axi offers commission-free trading services on 5 asset classes, including Forex and Cryptocurrencies. It offers affiliates up to$1,000 CPA per referred client, and a 10% commission for sub-affiliates. The broker offers various eBooks, including “Hat Trick” and “Panic Over”.

Axi (Company Information and Regulation)

Axi, operating under the trading name of Solaris EMEA Ltd, has been a well-established player in the online trading sphere since 2007. Registered in Cyprus under the number HE376148, the broker has acquired licenses from multiple top-tier regulatory bodies, including:

- Cyprus Securities and Exchange Commission (CySEC), license number 433/23;

- Australian Securities & Investments Commission (ASIC), AFSL number 318232;

- England Financial Conduct Authority (FCA), Reference Number 509746;

- Dubai Financial Services Authority (DFSA).

Essentially, Axi's regulatory status serves as a seal of approval, assuring traders that they deal with a broker prioritizing compliance and client protection.

The regulatory structure of Axi is organized through multiple licensed entities across different jurisdictions, each with its own investor protection framework and leverage conditions. This table outlines the regulatory authorities, client eligibility, and operational scope for each branch:

Entity Parameters/Branches | Solaris EMEA Ltd | Axi Financial Services (UK) Limited | AxiCorp Financial Services Pty Ltd | AxiCorp Financial Services Pty Ltd | AxiCorp Financial Services Pty Ltd (DIFC Branch) | Solaris Services Ltd | AxiTrader Limited |

Regulation | CySEC | FCA | ASIC | FMA | DFSA | VFSC | FSA |

Regulation Tier | 1 | 1 | 1 | 1 | 2 | 3 | 2 |

Country | Limassol, Cyprus | London, United Kingdom | Sydney, Australia | New Zealand, Auckland | UAE, Dubai | Vanuatu, Port Vila | Saint Vincent and the Grenadines |

Investor Protection Fund/ Compensation Scheme | Up to €20,000 under ICF | Yes | No | No | No | No | Up to €20,000 under Financial Commission |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | 1:2000 | Yes | Yes | No | No | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:30 | 1:30 | 1:500 | 1:3000 | |

Client Eligibility | Only EU/EEA Residents | Only United Kingdom | Only Australia | New Zealand's financial markets | Dubai, UAE | Vanuatu | Global |

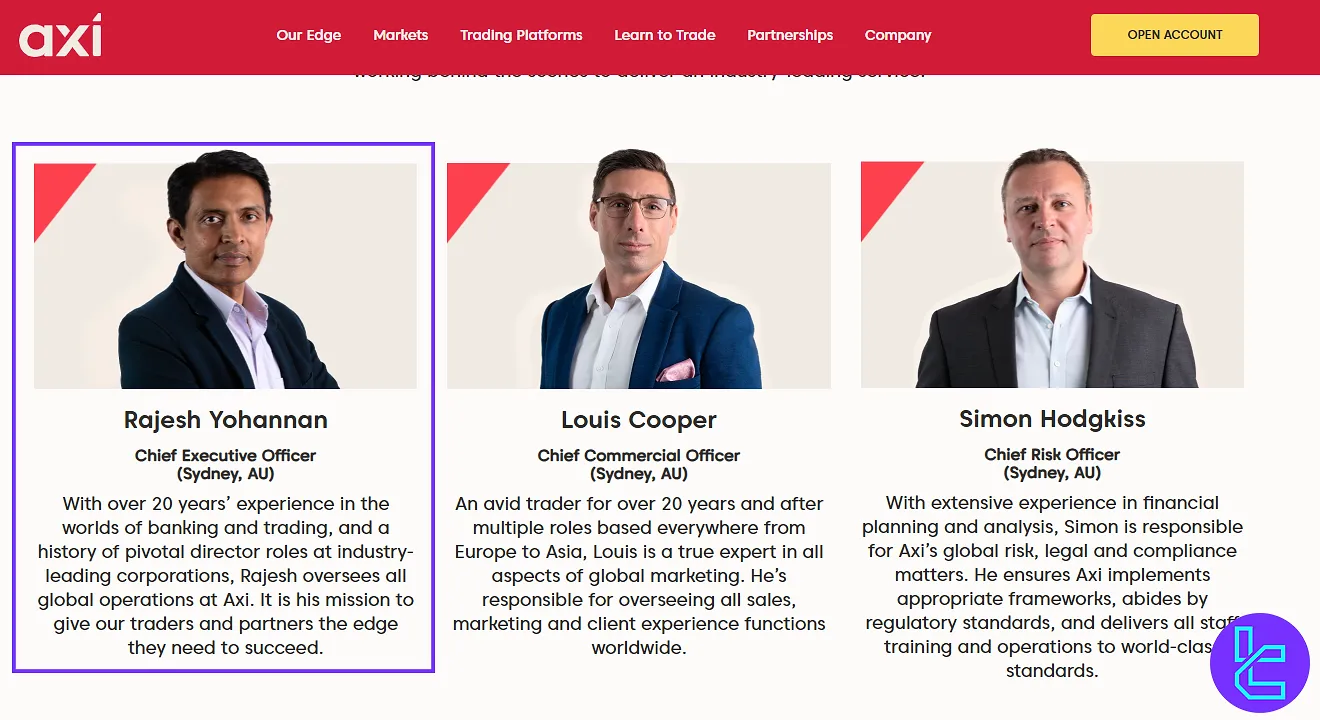

Rajesh Yohannan – Chief Executive Officer of Axi

Based in Sydney, Rajesh Yohannan brings more than two decades of experience in global banking and trading. Before joining Axi, he held senior director positions at several leading financial institutions.

Today, he is responsible for overseeing Axi’s worldwide operations, driving the company’s strategic direction, and ensuring operational consistency across all regions.

For further details, you may visit the LinkedIn profile of Rajesh Yohannan.

Specifics of Axi Broker

Diving deeper into the ecosystem, we find a broker that's designed its offerings to cater to a diverse range of traders. Let's break down some of the key features that make Axi stand out in the crowded broker landscape.

Broker | Axi |

Account Types | Standard, Pro |

Regulating Authorities | ASIC, FCA, DFSA, CySEC |

Based Currencies | EUR, USD, PLN |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfer, Credit/Debit Cards |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | Trading signals, Copy Trading |

Trading Platforms & Apps | MT4, Axi CopyTrade |

Markets | Forex, Indices, Shares, Commodities, Cryptocurrencies |

Spread | Variable based on the account types |

Commission | Variable based on the account types |

Orders Execution | Market, Limit, Stop-Loss, Trailing Stops, Stop |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Signals, Economic Calendar, Copy Trading |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Chat Bot, Phone, WhatsApp, Ticket |

Customer Support Hours | 24/5 |

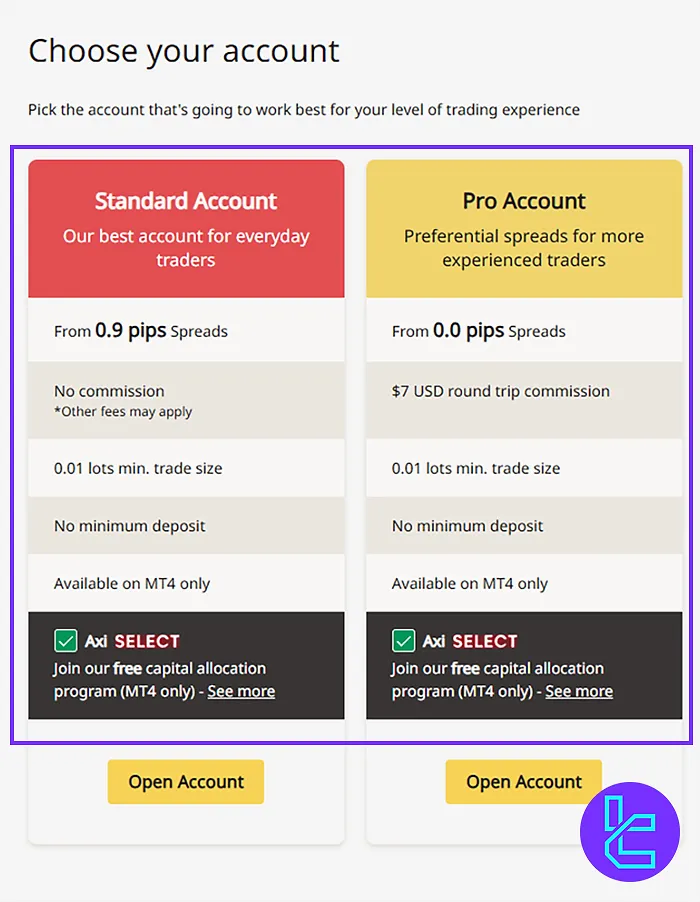

What Account Types Are Available on Axi Broker?

When it comes to account types, the broker keeps things refreshingly simple with two main options: ThePro and the Standard. Each caters to different trading styles and experience levels.

Axi provides traders with two primary account options tailored to different experience levels and trading styles:

- Standard Account: Designed for beginners and casual traders, this account features commission-free trading with slightly wider spreads. It's ideal for those seeking simplicity and zero upfront cost on trades.

- Pro Account: Built for experienced and high-volume traders, the Pro account offers ultra-tight spreads with a commission of $7 per round-turn per lot (i.e., $3.5 per side).

Both accounts require no mandatory minimum deposit, enabling users to start with any amount. However, Axi recommends a practical deposit of at least $50 to maintain effective trade management and margin coverage.

All account holders receive full access to MetaTrader 4, automated trading via Expert Advisors (EAs), and the complete range of available assets, ensuring parity in trading tools across account types.

Axi Pros & Cons

Every broker has its strengths and weaknesses, and this one is no exception. Let's take an honest look at what Axi brings to the table and where it might fall short.

Pros | Cons |

Regulated by reputable authorities | Low leverage options on retail accounts |

Competitive spreads starting from 0.0 pips | Limited payment options |

Low minimum deposit requirement | Limited trading platform offerings |

Diverse trading tools | - |

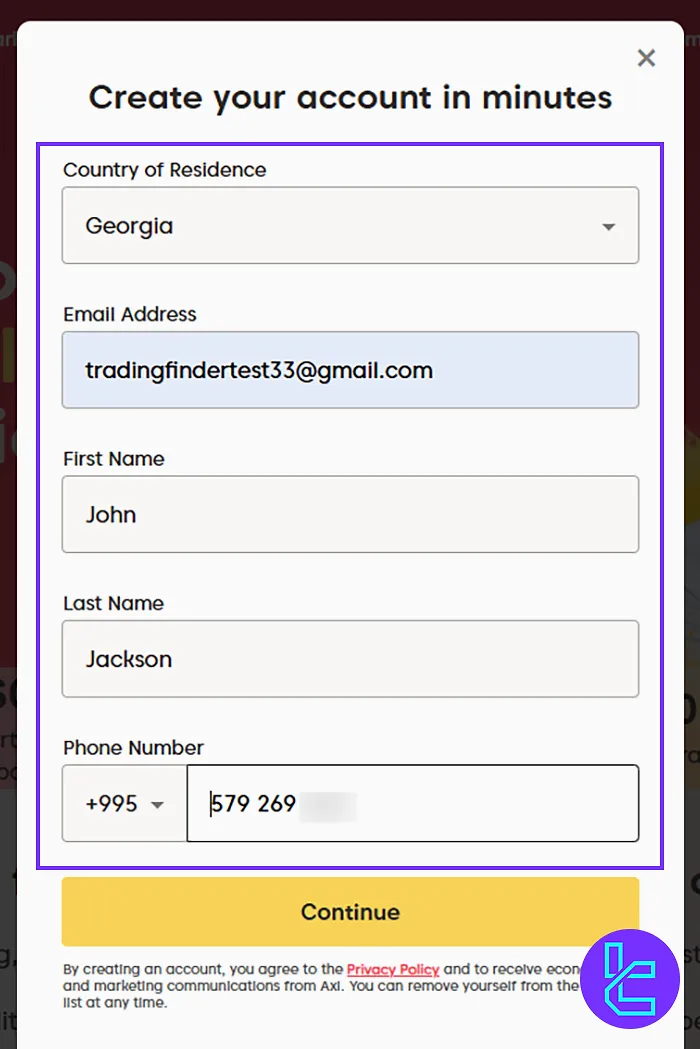

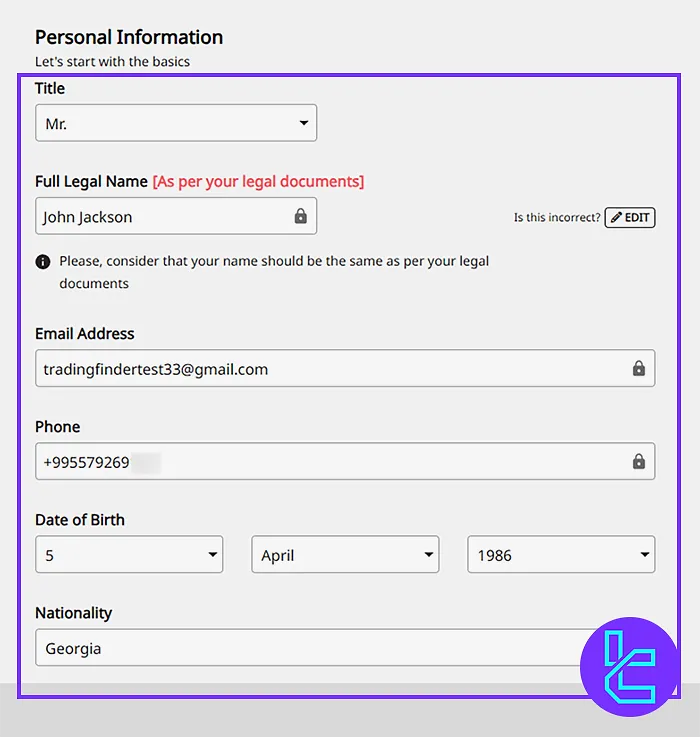

Axi Registration and Verification

Creating a new account with Axi broker is easy, even for beginner traders. Axi registration:

#1 Begin Your Application

Visit the Axi website and click on "Open Account". Enter your email, full name, mobile number, and select your country of residence.

#2 Set Account Preferences

Choose your account type, trading currency, platform, and leverage, all tailored to your trading strategy.

#3 Verify Identity & Provide Financial Information

Submit your personal information, including:

- Date of birth

- Nationality

- Address

- Employment status

Disclose basic income and investment profile.

#4 Accept Terms & Register

Review and agree to the terms and conditions. Click "Submit" to complete the process and receive your login details via email.

Once registered, you must provide proof of identity and proof of address documents to complete the Axi verification process to access all Axi dashboard features.

Axi Broker Trading Platforms

Regarding trading platforms, the company has put all its eggs in one sturdy basket: MetaTrader 4 (MT4). This decision to focus on one trading solution might seem limiting initially, but there's a method to this madness.

MT4 is arguably the most popular trading platform in the Forex world, renowned for its robust features and user-friendly interface. It’s accessible across various devices and operating systems, including:

- Windows

- macOS

- iOS

- Android

- Axi MetaTrader4 Webtrader

Axi Fee Structure (Commission and Spread)

Axi follows a clear and competitive pricing model across its account types:

- Standard Account: Commission-free trading with spreads starting at 0.9 pips, ideal for traders preferring simplicity and zero transaction costs;

- Pro Account: Access to raw spreads from 0.0 pips with a $7 commission per round-turn per standard lot (equivalent to $3.5 per side) designed for cost-sensitive and active traders.

Beyond trading costs, Axi distinguishes itself with zero deposit and withdrawal fees across all payment methods. While Axi does not impose fees for fund transfers, users should note that intermediary banks or payment providers might charge service fees independently.

Additionally, Axi maintains a zero-inactivity fee policy and avoids all hidden costs, reinforcing its commitment to full transparency in pricing.

If you're interested in reducing your trading costs by earning Axi rebates, we recommend checking TradingFinder's IB services.

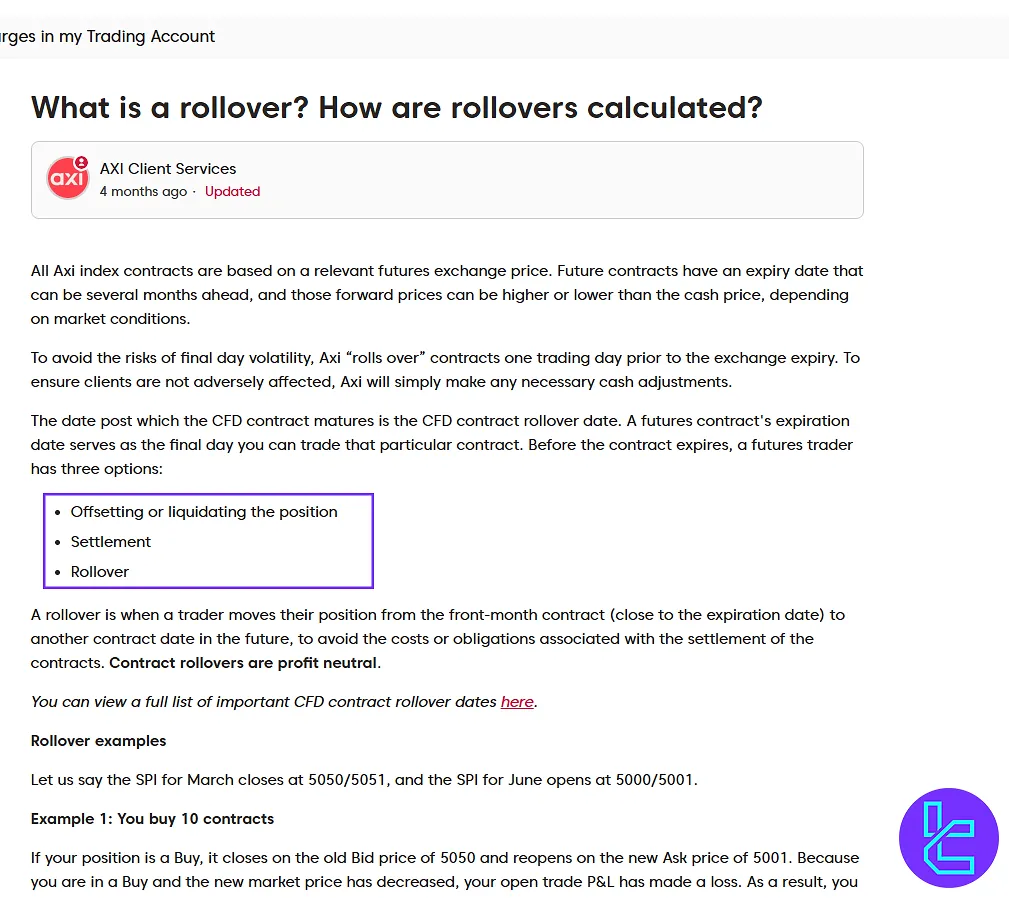

Swap Fees

Financing charges are applied to all open positions in FX Margin Contracts, Bullion Spot CFDs, and Cash CFDs. These charges are calculated at the close of each business day and appear in the “Swap” field on MT4 and MT5 while the position remains open. The adjustment is credited or debited to the client account when the trade is closed.

The broker applies swaps once per day, generally within 30 seconds before 5:00 p.m. New York time. For currency pairs, a triple swap is applied on either Wednesday or Thursday to reflect the weekend settlement rollover. The exact day for each pair is listed in the Product Schedule.

While short-term public holidays are not normally factored into swap calculations, extended holiday periods—such as Lunar New Year or Golden Week—may result in adjustments.

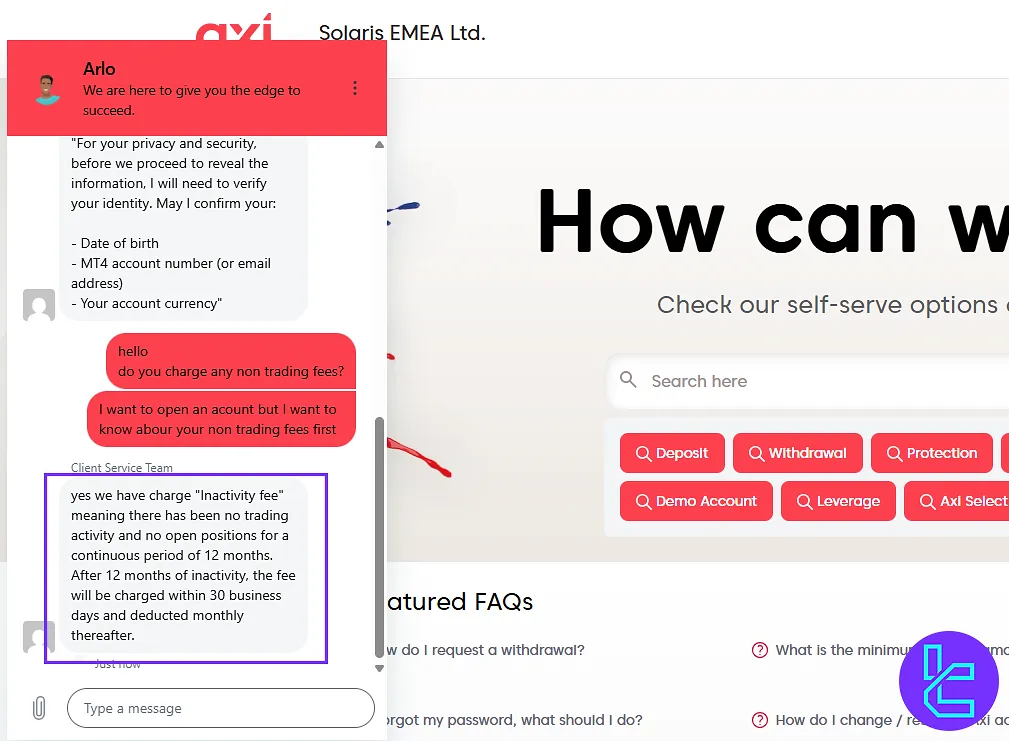

Non Trading Fees

Axi applies several non-trading fees, though not in the form of account maintenance costs. According to Axi’s official information, traders may face an inactivity fee and, in some cases, additional administrative charges.

The inactivity fee is set at $/€10 per month. It becomes effective if an account shows no trading activity for 12 consecutive months, with the first deduction made within 30 business days and continuing monthly thereafter. Accounts that remain inactive for two years with a zero balance are subject to closure.

Other possible charges include transaction-related costs. While Axi itself does not impose deposit or withdrawal fees for amounts under $50,000 per month, third-party providers such as banks or payment processors may apply their own fees. Administrative costs can also be charged if specific account services are requested.

For cryptocurrency deposits, users are responsible for paying blockchain mining fees. In addition, swap-free accounts may still incur holding charges if positions are kept open for extended periods. Standard leveraged positions can also generate overnight funding fees (swap rates) depending on the instrument traded.

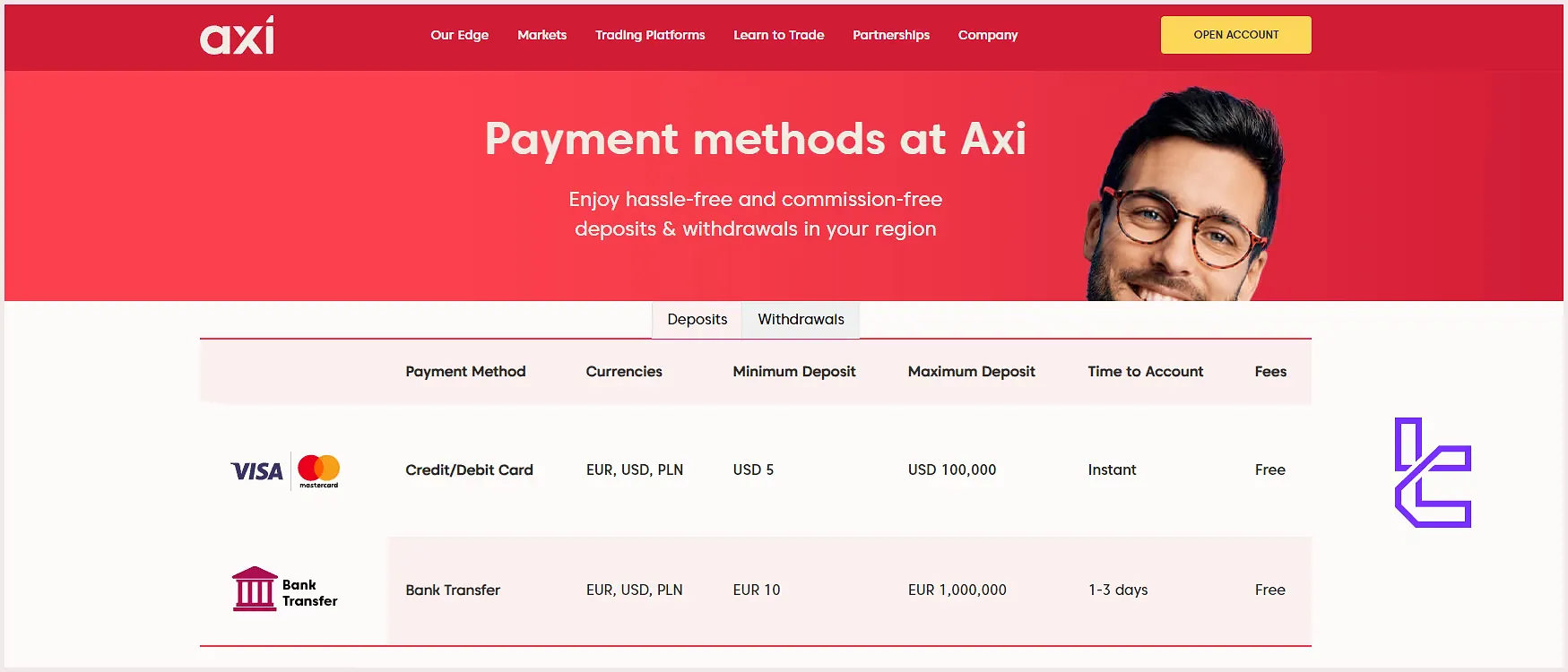

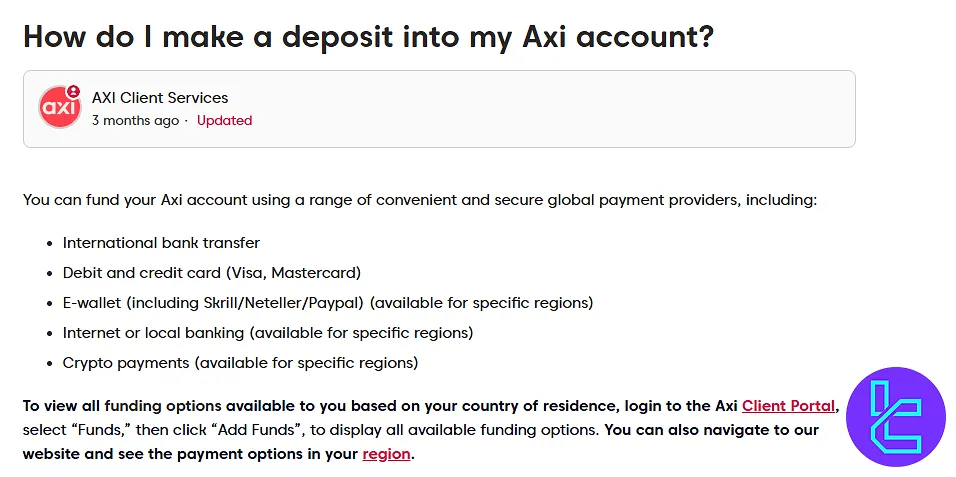

Available Payment Methods on Axi Broker

The company offers two main options for funding and payouts to cater to the diverse needs of its global client base.

Deposits

To fund an Axi trading account, traders can go to the Deposit section inside their Personal Area (PA), choose a preferred payment method, fill in the required details such as deposit amount and account selection, and confirm the request once the summary is correct.

Axi provides two account types with different funding thresholds and trading conditions:

Axi Account Type | Minimum Deposit | Spreads From | Minimum Trade Size | Available Products |

Standard Trading Account | $0 USD | From 0.4 pips | 0.01 lots | 140+ Forex pairs, Metals CFDs |

Elite Trading Account | $25,000 USD | From 0.0 pips | 0.01 lots | 140+ Forex pairs, Metals CFDs |

The Standard Account is accessible with no minimum deposit, making it suitable for new traders, while the Elite Account is designed for professionals seeking raw spreads and advanced trading conditions.

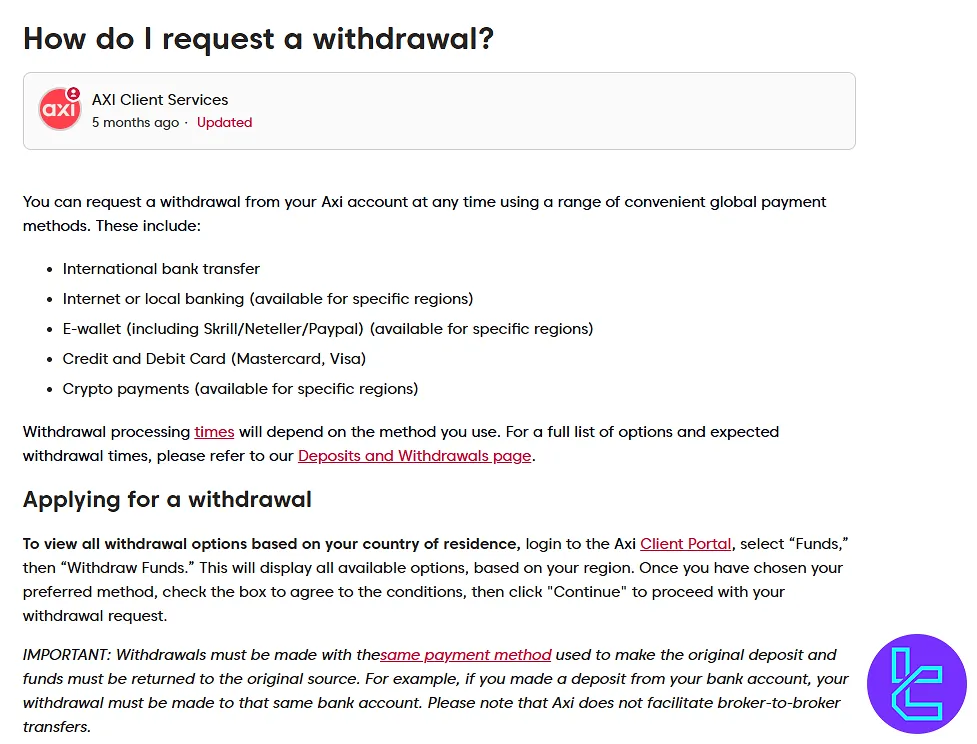

Withdrawals

Traders with an Axi account can request withdrawals at any time, using a variety of international and regional payment channels. The method chosen determines the processing time and availability, depending on your country of residence.

Available Withdrawal Methods:

Method | Details | Availability |

International Bank Transfer | Direct transfer to your bank account | Global |

Local/Internet Banking | Online or regional banking networks | Region-specific |

E-Wallets (Skrill, Neteller, PayPal) | Fast electronic transfer | Region-specific |

Credit/Debit Cards (Visa, Mastercard) | Linked directly to your trading account | Global |

Cryptocurrency Payments | Crypto-based withdrawals | Region-specific |

How to Apply for a Withdrawal

1. Log in to the Axi Client Portal ;

2. Navigate to Funds, Withdraw Funds ;

3. The platform will display the available options for your country;

4. Choose your preferred method, agree to the conditions, and select Continue .

Important Rule: Withdrawals must be made using the same method as the original deposit. Funds are always returned to the original funding source (e.g., if deposited via a bank account, they will be withdrawn to that same account). Broker-to-broker transfers are not supported.

Axi enhances its platform offering through a suite of premium tools and plugins:

- Autochartist: Offers real-time technical pattern recognition to help identify high-probability trade setups;

- PsyQuation: AnAI-powered performance analytics platform that helps traders optimize risk, strategy, and behavioral patterns;

- Trading Central: Institutional-grade analytics with actionable market insights and expert commentary;

- Axi Copy Trading: A standalone mobile app (powered by Pelican) that allows clients to mirror trades from professional traders in real-time. Available for both iOS and Android.

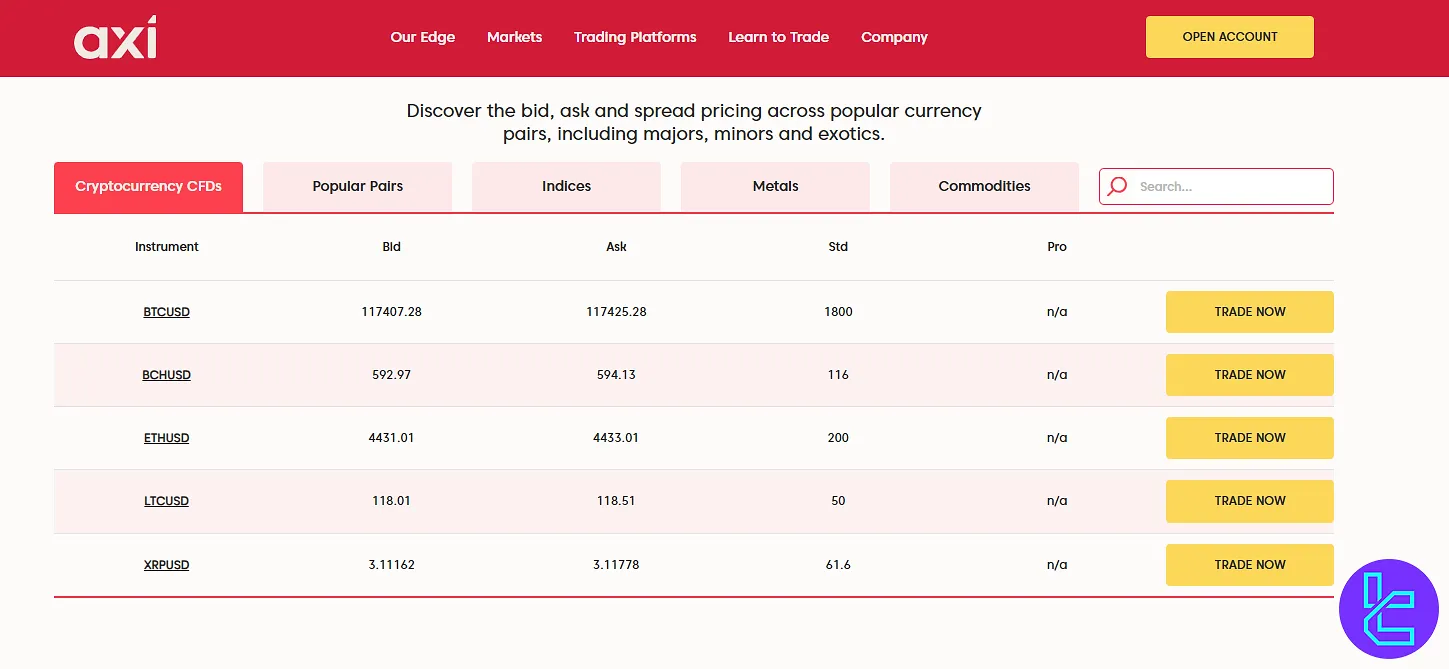

Available Markets on Axi broker

The company offers a diverse range of markets for traders to explore, catering to various trading preferences and strategies.

The table compares Axi’s range of tradable instruments against industry averages, highlighting differences in coverage across forex, cryptocurrencies, indices, commodities, and shares. It shows where Axi provides competitive breadth and where its offering is more limited relative to competitors.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | Currency Pairs | 70+ | 60 | 1:500 |

Cryptocurrency | CFDs on Crypto | 11 | 20 | 1:200 |

Indices | Global Indices CFDs | 30+ | 25 | 1:200 |

Commodities | Metals & Energies | 30+ | 20 | 1:200 |

Shares | Stock CFDs | 50+ (US, UK, EU, AU) | 1,000+ | 1:20 |

Axi Broker Bonus Offerings

In an industry where sign-up bonuses and promotional offers are commonplace, Axi takes a different approach. The broker offers no traditional bonus programs or welcome incentives for new traders, due to regulatory compliance.

However, there is an Affiliate program in place that enables individuals to earn commissions by referring new clients to the broker. Key features of Axi referral:

- Up to $1000 CPA for each qualified client introduced;

- A 10% commission on sub-affiliate earnings for Master Affiliates;

- Marketing materials and support to help affiliates promote the broker effectively;

- Real-time tracking of referrals and earnings.

Awards

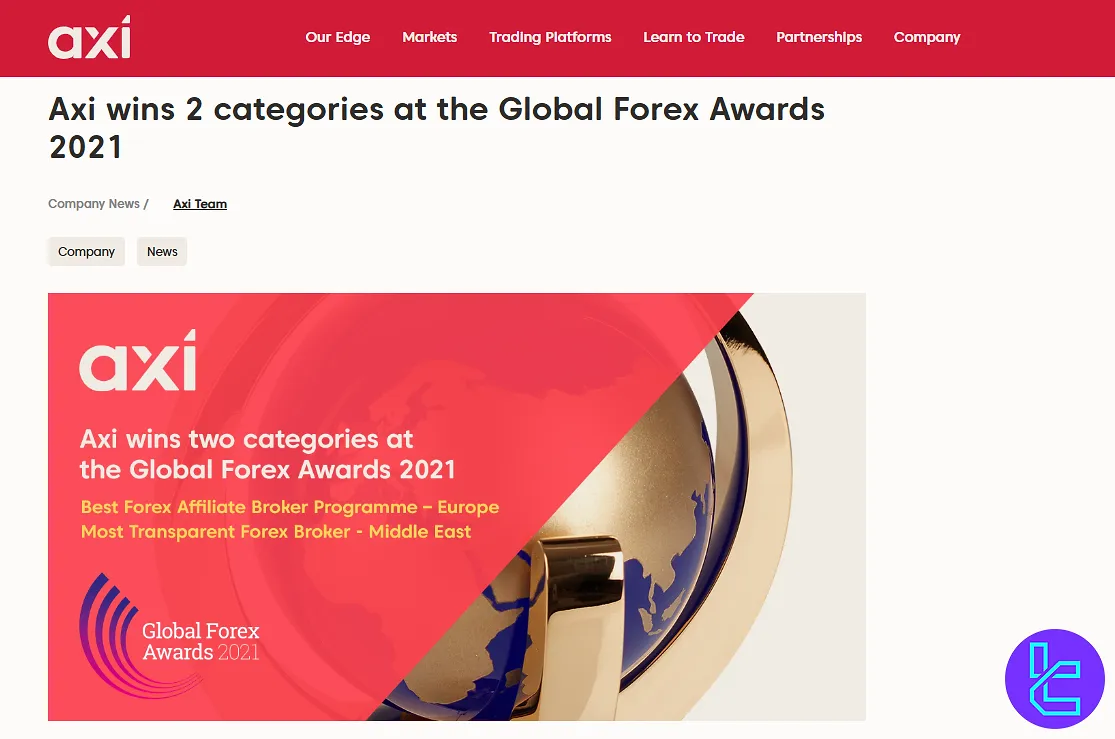

The Global Forex Awards 2021 highlighted leading companies in online trading, with Axi receiving recognition in two categories: Best Forex Affiliate Broker Programme (Europe) and Most Transparent Forex Broker (Middle East).

Now in its fourth year, the event acknowledges forex and CFD businesses that advance retail trading services through innovation. According to Louis Cooper, Chief Commercial Officer at Axi, the recognition comes after a year marked by significant challenges in the industry, during which the company adapted its operations and strengthened its global presence.

These achievements add to Axi’s earlier distinctions, such as Best MT4 Forex Broker, Best Forex Broker Europe, Best Forex Broker Middle East, and Best EMEA Region Broker. Unlike many industry prizes, the Global Forex Awards are determined by public voting, with over 31,000 votes from more than 4,000 participants recorded in 2021.

Holiston Media, the organizer of the awards, emphasized that the winners represent the highest standards of retail forex trading worldwide.

For full details, you can visit the Axi Awards Page where the broker lists all recognitions.

Axi Broker Customer Support

Quality customer support is crucial in online trading, and Axi understands this well. The broker offers a comprehensive multilingual support system to assist traders at various journey stages 24/5 via several channels, including:

service.eu@axi.com | |

Phone | +61 2 9965 5830 |

Chat Bot | Available on the official website |

Live Chat | Make a request to the chat bot |

Ticket | Use the "Contact Us" page |

Axi Geo-Restrictions

As a global broker, Axi serves clients from many countries around the world. However, like all financial service providers, they are subject to certain geo-restrictions based on regulatory requirements and business decisions. Restricted countries on Axi:

- United States of America

- Ontario, Canada

- Iran

- Israel

- Libya

- Syria

- Cuba

- Belgium

Axi Trust Scores

One of the most important topics in this Axi broker review is trust score. User satisfaction is paramount in online trading, and the company has made significant strides in establishing itself as a reputable broker.

User satisfaction is paramount in online trading, and the company has made significant strides in establishing itself as a reputable broker.

4.2 out of 5 based on 2,064 reviews | |

Forex Peace Army | 2.8 out of 5 based on 157 reviews |

Reviews.io | 2.4 out of 5 based on 13 reviews |

Does Axi Broker Provide Educational Materials?

Education is a crucial component of successful trading, and Axi doesn’t perform very well in this regard. The broker offers a five-part forex trader eBooks series that covers various subjects, including:

- Forex

- MT4

- Indicators

- Price Action Playbook

- Trading Strategies

There are also other free ebooks among the broker’s offerings with some attractive titles, including:

- 7 Lessons for Understanding Forex Market Types

- 13 Exclusive Pro Tips for Using Chart Setups

- Hat Trick! 3 Easy Entry and Exit Strategies

- 3 Ways to Achieve Your Objectives with Position Sizing and System Monitoring

- Panic Over, 3 Rescues for When Your System Stops Working

How Axi Compares to Other Brokers

To determine whether Axi is the right broker for you, refer to the table provided below.

Parameters | Axi Broker | AvaTrade Broker | Tickmill Broker | FxGrow Broker |

Regulation | ASIC, FCA, DFSA, CySEC | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FCA, CySEC, LFSA, FSCA | CySec, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC |

Minimum Spread | 0.9 Pips | Depending on the Asset | 0.0 Pips | 0.00001 pips |

Commission | $0 | No Commission on Deposits/Withdrawals Inactivity Fees Overnight Fees | $0 | $8 for FX |

Minimum Deposit | $5 | $100 | $100 | $100 |

Maximum Leverage | 1:30 | 1:400 | 1:1000 | 1:300 |

Trading Platforms | MetaTrader 4, Axi Copy Trade | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MetaTrader 5 |

Account Types | Standard, Pro | Retail, Professional, Islamic, Demo | Classic, Raw | ECN, ECN Plus, ECN VIP, Demo |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 280+ | 1250+ | 600+ | 160+ |

Trade Execution | Market, Limit, Stop-Loss, Trailing Stops, Stop | Instant | Market | Market |

Conclusion and Final Words

Axi provides access to leverage options of 1:30 and spreads from 0.0 pips with a minimum deposit of $5. While the broker has a TrustPilot score of 4.2 and a strong regulatory status (ASIC, FCA, DFSA, and CySEC), it can’t provide services in the United States of America.