Capital Street FX provides access to CFDs, futures market, and Options trading across 7 different asset classes, from Forex to Crypto, with spreads from 0.1 pips and leverage options of up to 1:10000 for a minimum deposit of up to $100.

Capital Street FX operates under the supervision of two regulatory authorities; the FSA of Saint Vincent and the Grenadines (SVG) and the FSC of Mauritius. It provides its services globally, except for certain restricted countries.

Capital Street FX; Introduction and Regulatory Status

Capital Street FX is a brand name of Capital Street Bancclear Corporation, registered in Saint Vincent and the Grenadines and under FSA license number 22064-IBC-2014. Key features of Capital Street FX:

- Regulated by the St Vincent & The Grenadines FSA

- Capital Street Intermarkets Limited (manager of the ECN and Prime accounts) is regulated by the Mauritius FSC (license number C112010690)

- Founded in 2008

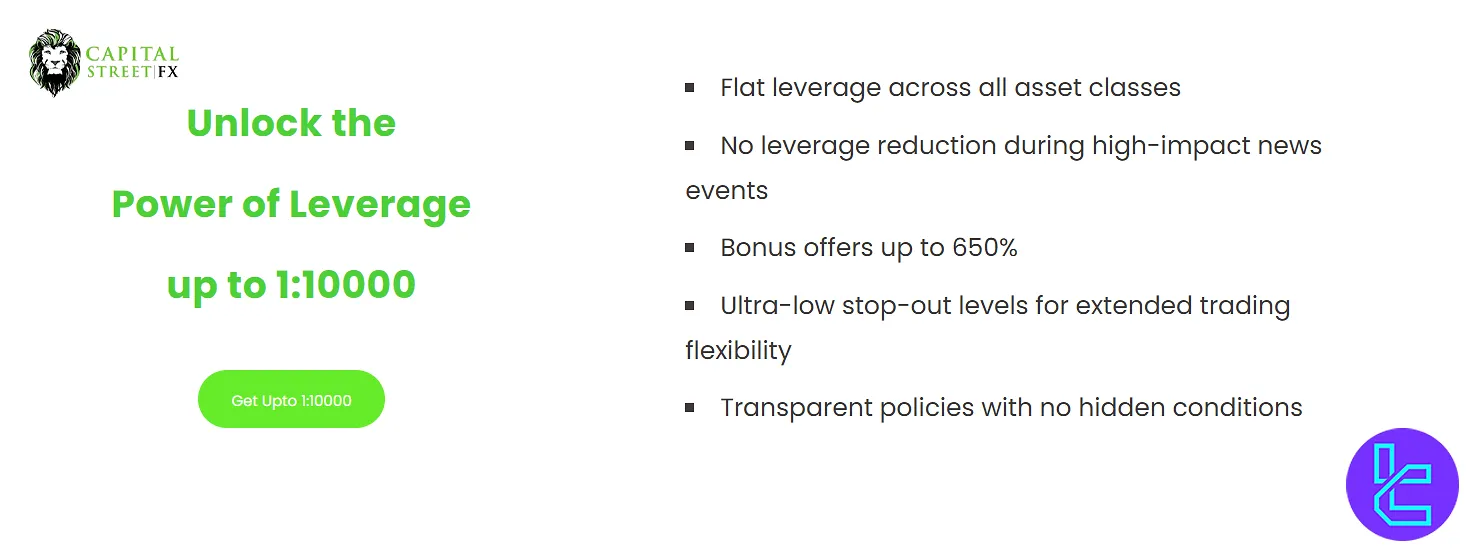

- Leverage up to 1:10000

- Spreads from 0.1 pips

- Up to 900% tradable bonus

- $100B monthly trading volume

- Serves 30,000 clients across 182 countries every day

- 1000+ markets

Entity Parameter / Branch | Capital Street Bancclear (SVG branch) | Capital Street Intermarkets (Mauritius branch) |

Regulation | FSA SVG, license 22064 BC 2014 | FSC Mauritius, license C112010690 |

Regulation Tier | Offshore | Offshore |

Country | Saint Vincent & Grenadines | Mauritius |

Investor Protection Fund / Compensation Scheme | None / not available | None / not available |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | 1:10000 (varies) | 1:10000 (varies) |

Client Eligibility | Global (except prohibited jurisdictions, e.g. U.S., North Korea) | Global (except prohibited jurisdictions, e.g. U.S., North Korea) |

Capital Street FX Broker Specific Details

The Forex broker offers pre-market, after-hours, and weekend trading on a comprehensivesuite of trading instruments with attractive conditions.

Let's dive into the nitty-gritty of what Capital Street FX brings to the table.

Broker | Capital Street FX |

Account Types | Basic, Classic, Professional, VIP |

Regulating Authorities | FSC, FSA |

Based Currencies | USD |

Minimum Deposit | $100 |

Deposit Methods | VISA/MasterCard, Crypto, GooglePay, ApplePay, SEPA, Volet, PerfectMoney, Bank Wire, Cash App, IMPS, Binance Pay, Faster Payments |

Withdrawal Methods | VISA/MasterCard, Crypto, GooglePay, ApplePay, SEPA, Volet, PerfectMoney, Bank Wire, Cash App, IMPS, Binance Pay, Faster Payments |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:10000 |

Investment Options | None |

Trading Platforms & Apps | Proprietary Desktop/Web/Mobile Platform |

Markets | Forex, Stock Index Futures, Commodities, Bonds, ETFs, Individual Equities, Crypto, Options |

Spread | From 0.1 pips |

Commission | N/A |

Orders Execution | Market, Instant |

Margin Call / Stop Out | 50% / 10% |

Trading Features | Trade Signals, Market Analysis, Economic Calendar, Options/Futures Trading |

Affiliate Program | Yes |

Bonus & Promotions | IB, 900% Tradable Bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Phone, Email, Ticket, Live Chat, WhatsApp, Skype |

Customer Support Hours | 24/7 |

Capital Street FX Account Types

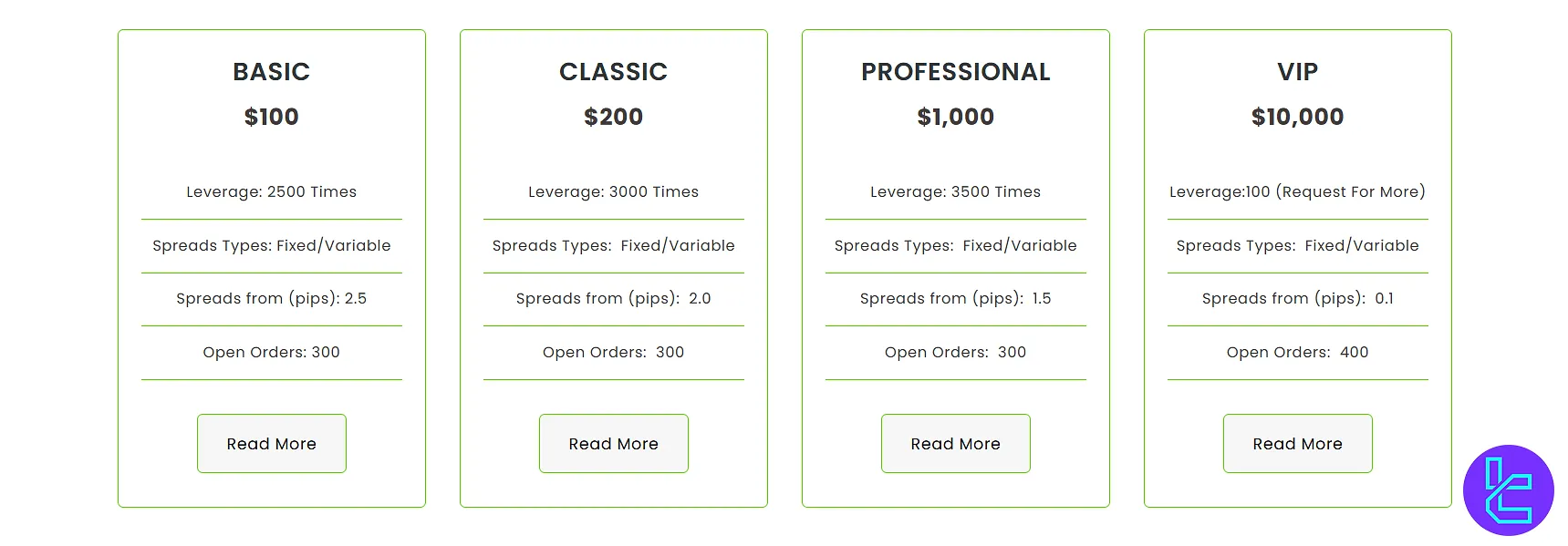

The company offers four main account types, including Basic, Classic, Professional, and VIP, to cater to different trader profiles and needs.

Features | Basic | Classic | Professional | VIP |

Base Currency | USD | |||

Min Deposit | $100 | $200 | $1,000 | $10,000 |

Spreads from (pips) | 2.5 | 2.0 | 1.5 | 0.1 |

Max Leverage | 1:2500 | 1:3000 | 1:3500 | 1:100 (with scaling option) |

Order Execution | STP/Market With Last Look | STP/Market With Last Look | STP/Market With Last Look | ECN/Market/No Last Look |

Margin Call | 50% | 50% | 50% | 50% |

Stop Out | 10% | 20% | 20% | 20% |

Capital Street FX offers some of the industry’s highest leverage limits, with maximum ratios reaching up to 1:10000.

However, the actual leverage varies depending on account type:

- Basic account: up to 1:2500

- Classic account: up to 1:3000

- Professional account: up to 1:3500

- VIP account: default 1:100 (can be increased upon request)

While such high leverage can amplify profits, it also significantly increases risk, especially for inexperienced traders.

The broker cautions users to fully understand leverage mechanics before trading.

Capital Street FX Broker Upsides and Downsides

The company boasts its tradable bonus offerings of up to 900% and generous leverage options up to 1:10000.

However, like any other broker, Capital Street FX also comes with some disadvantages.

Pros | Cons |

Wide selection of trading instruments | Lack of licensing from top-tier authorities |

No commission on FX trading | High entry barrier ($100) |

A comprehensive bonus program | Limited crypto assets |

Negative balance protection | Limited trading platform offerings |

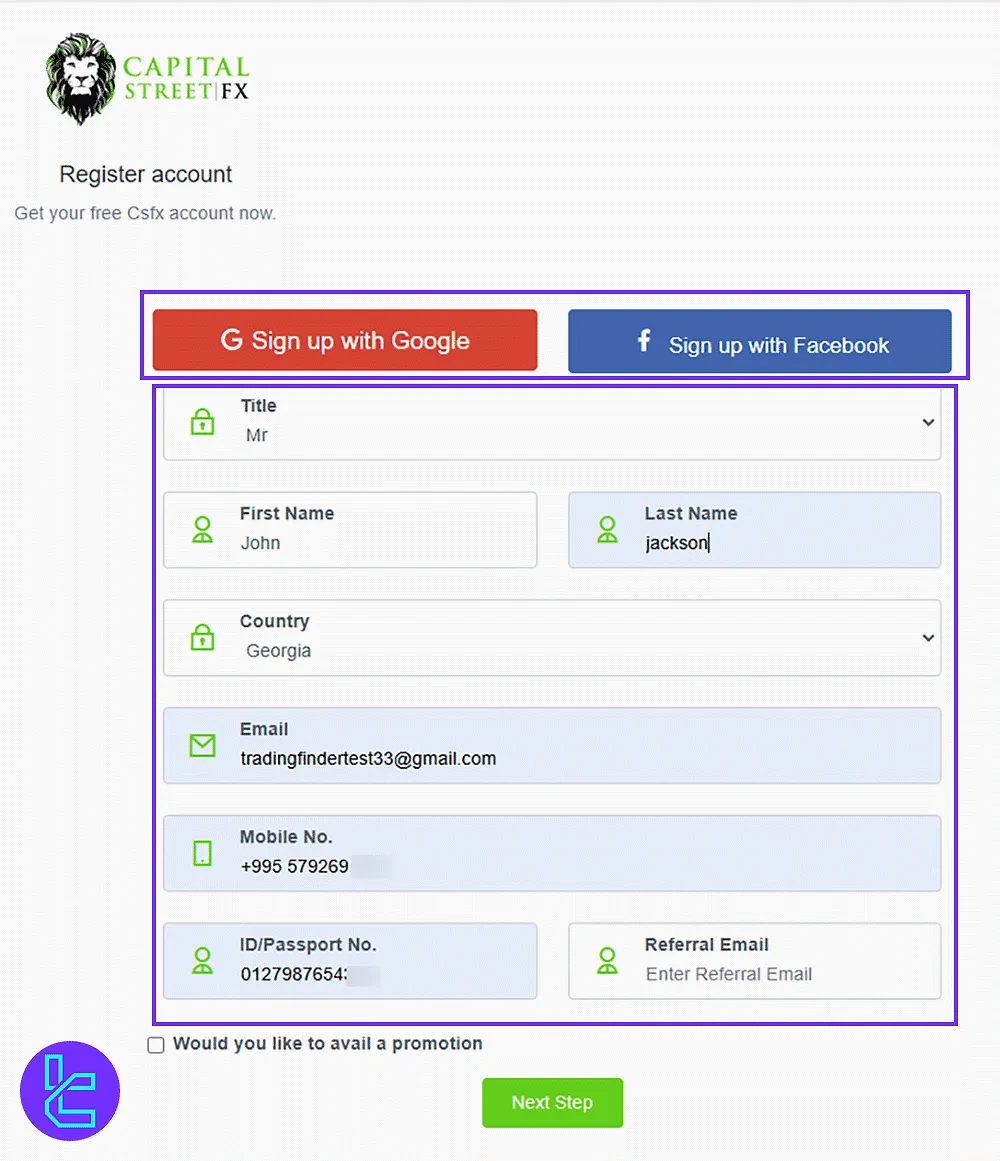

Registration and Verification on Capital Street FX

The company implements a robust Know Your Customer (KYC) and compliance policy to ensure the security and integrity of its platform.

Here's what you need to know about the Capital Street FX registration process:

#1 Access the Registration Portal

Go to the Capital Street FX website and click on the “Open Live Account” button. This will direct you to the secure signup form where registration begins.

#2 Input Personal & Contact Information

You can sign up using Google, Facebook, or by entering your full name, email, country, phone number, and passport or national ID. If you were referred, include the inviter’s email.

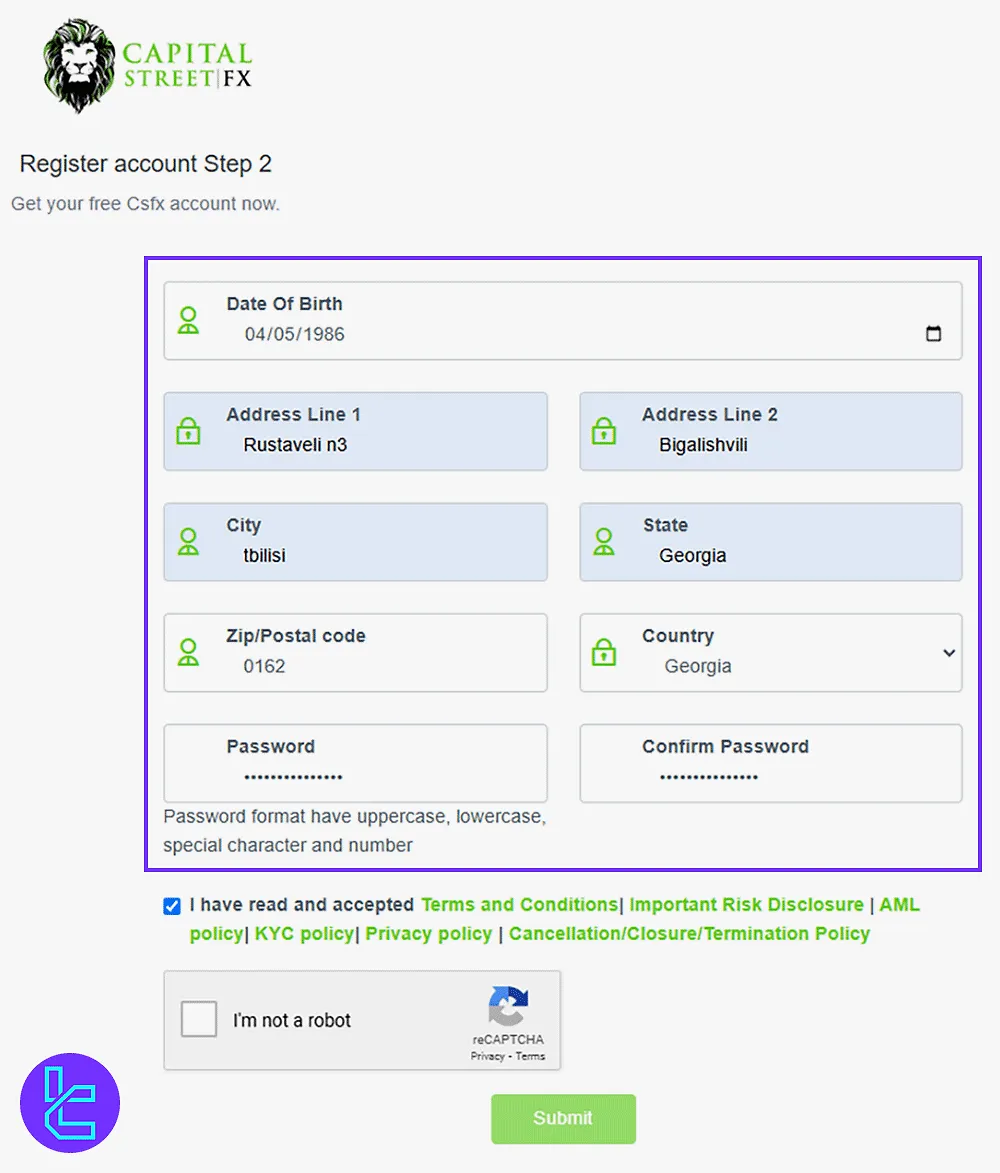

#3 Provide Residential Details & Secure the Account

Next, fill in your full address and date of birth, then create and confirm your password. Accept the platform’s terms of use and complete the captcha before submitting your form.

#4 Email Verification

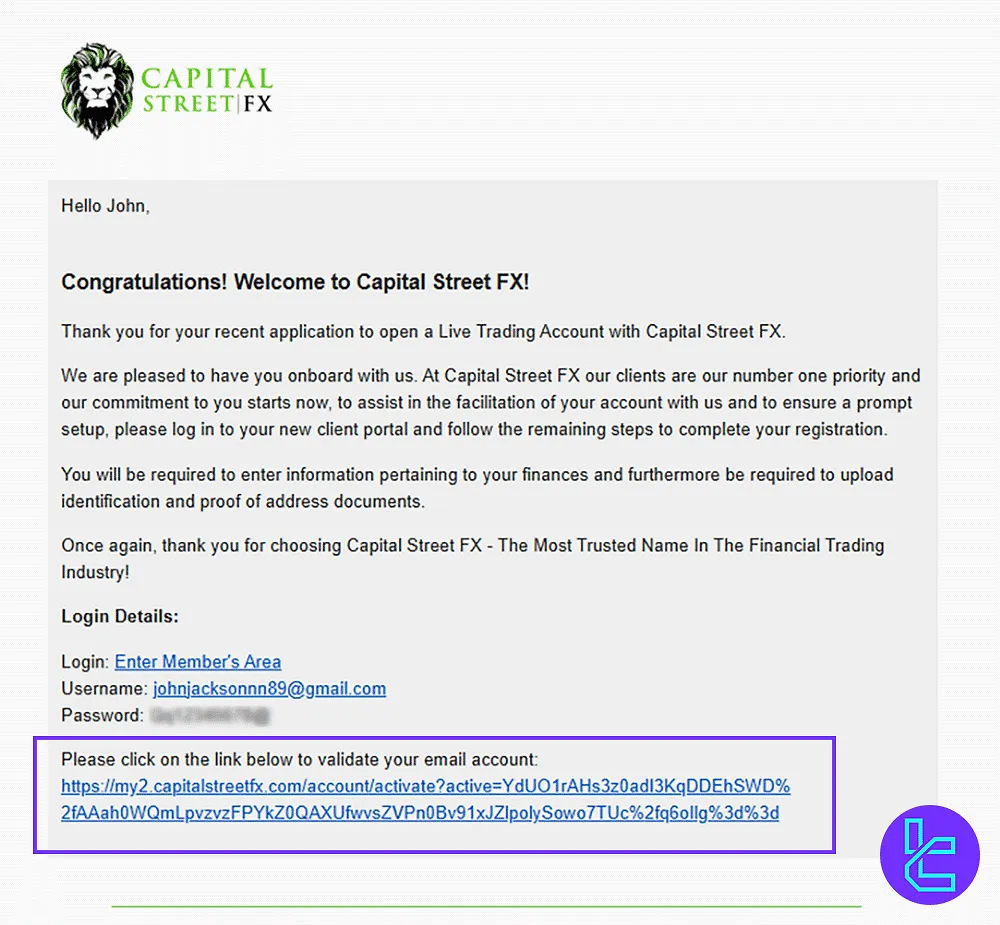

Check your inbox for a verification email from Capital Street FX. Click the confirmation link to activate your account.

Once verified, log in with your credentials to access your dashboard.

#5 Verify Your Trading Account

To complete the Capital Street FX verification procedure, provide supporting documents, including:

- Proof of Identity: Passport or driving license

- Proof of Address: Utility bill or bank statement

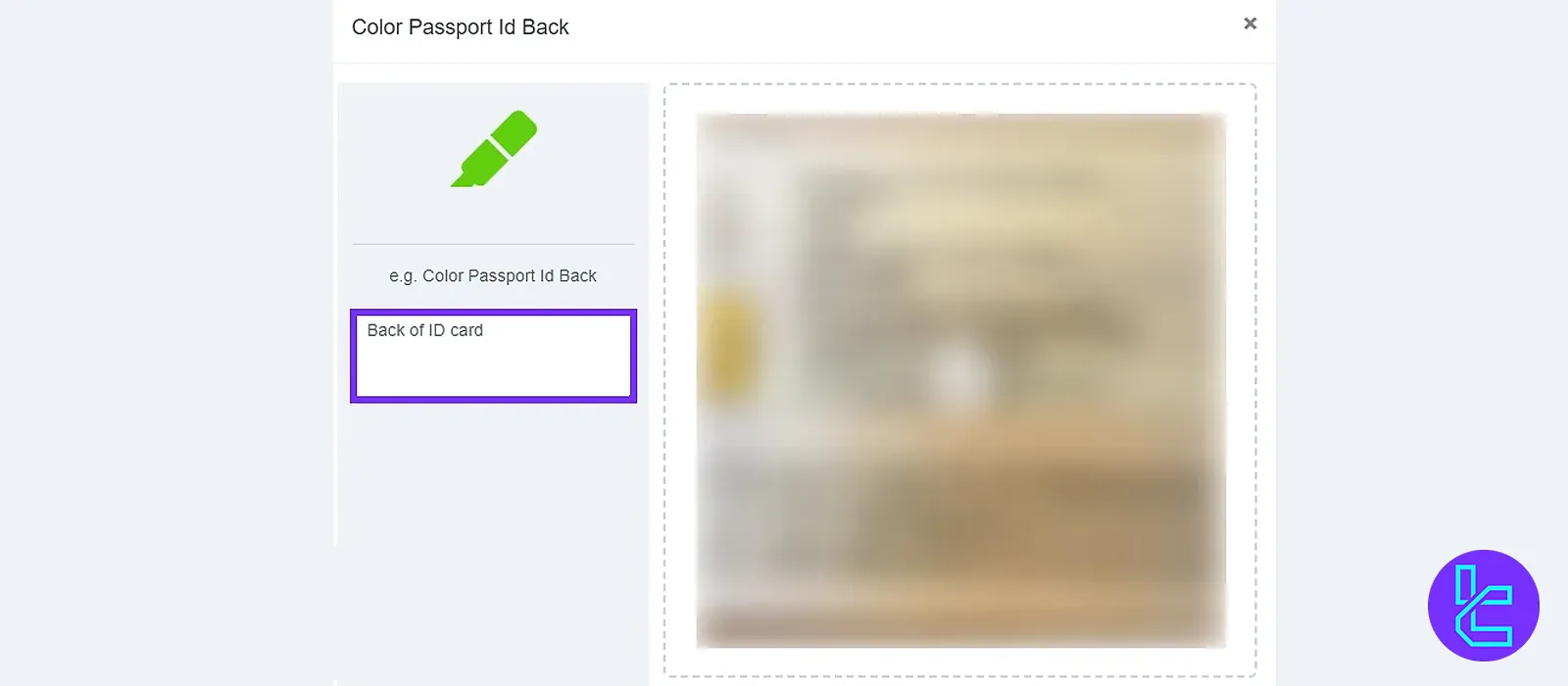

Capital Street FX Account Verification

Capital Street FX employs a structured three-step verification system designed to provide traders full access to the platform's trading features efficiently.

The process ensures compliance with regulatory standards while safeguarding user accounts.

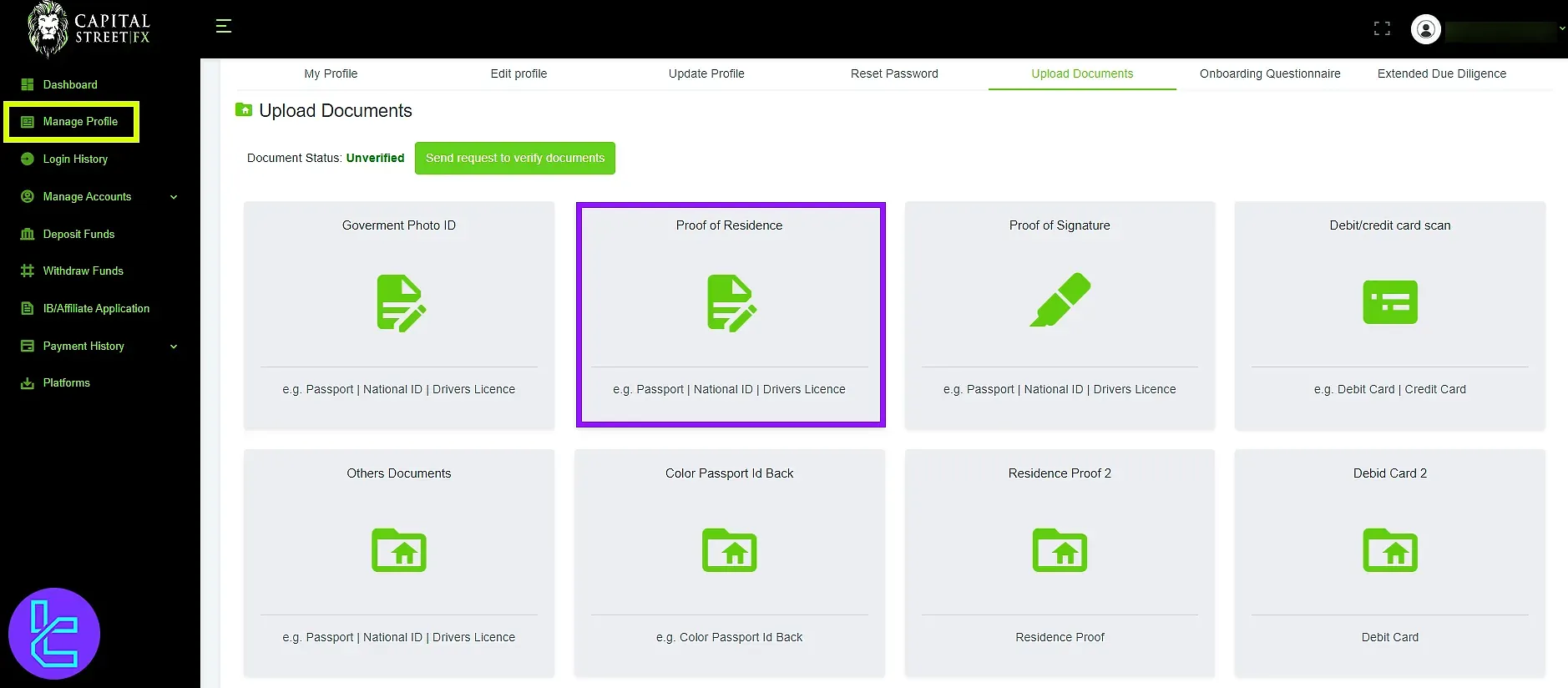

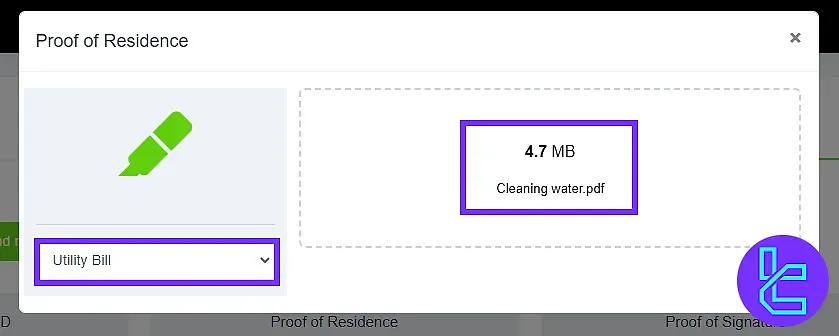

Step 1: Proof of Residence

To initiate verification, log into your Capital Street FX dashboard and navigate to the Manage Profile section. Under Upload Documents, select Proof of Residence.

Traders can upload utility bills, bank statements, or other official documents confirming their address by dragging or selecting the corresponding file.

Step 2: Government-Issued Identification

Following address verification, proceed to submit a government-issued ID. Capital Street FX accepts:

- Passport

- National ID

- Driver’s License

Upload a clear, color copy of the chosen document. For passports or ID cards, the platform allows uploading both the front and back sides as required.

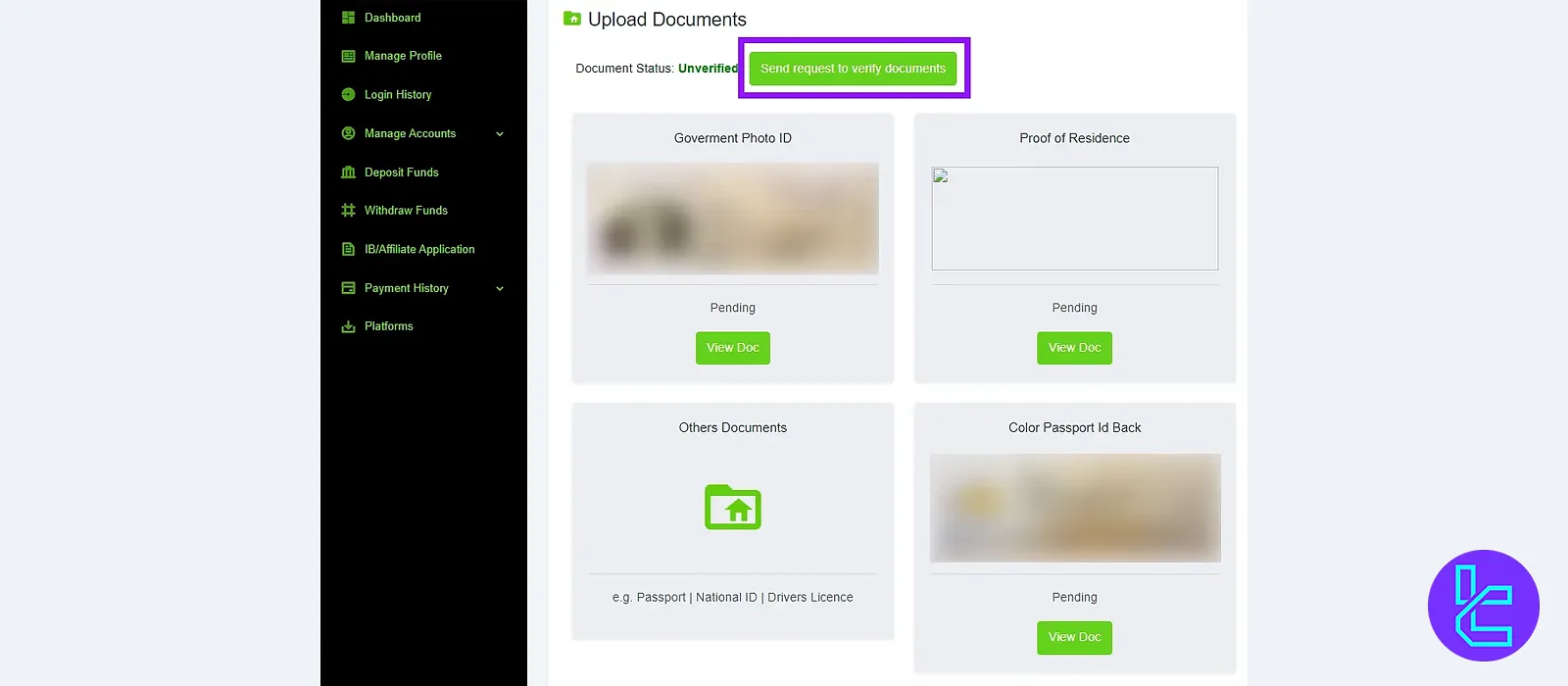

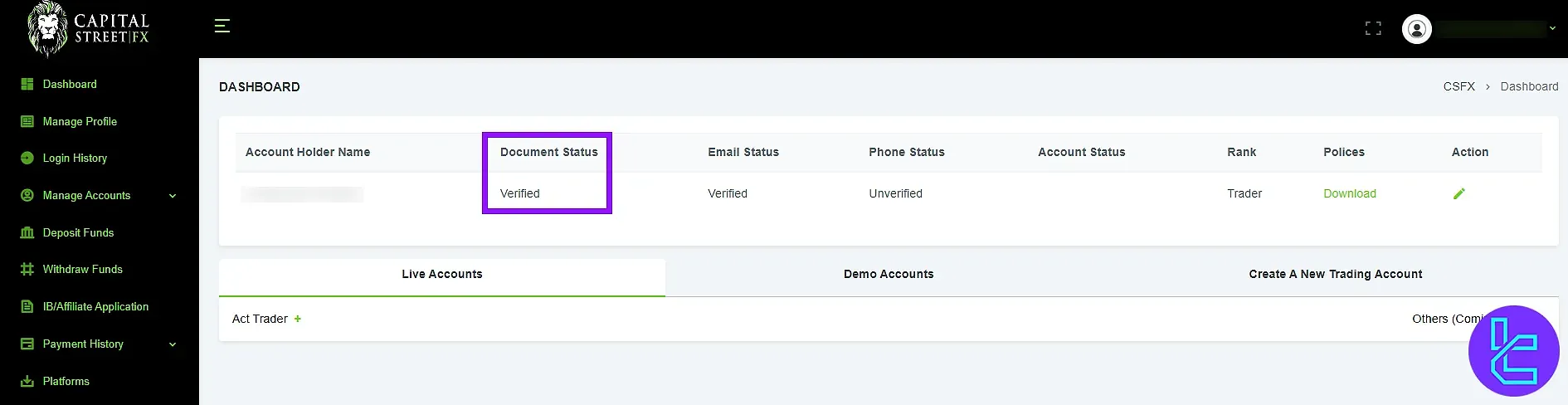

Step 3: KYC Submission and Status Monitoring

After all documents are uploaded, click Send Request to Verify Documents. The platform will process the submission, and users can check the verification status by returning to the dashboard.

Once approved, the Document Status section will display Verified, confirming that the account has full access to Capital Street FX trading features.

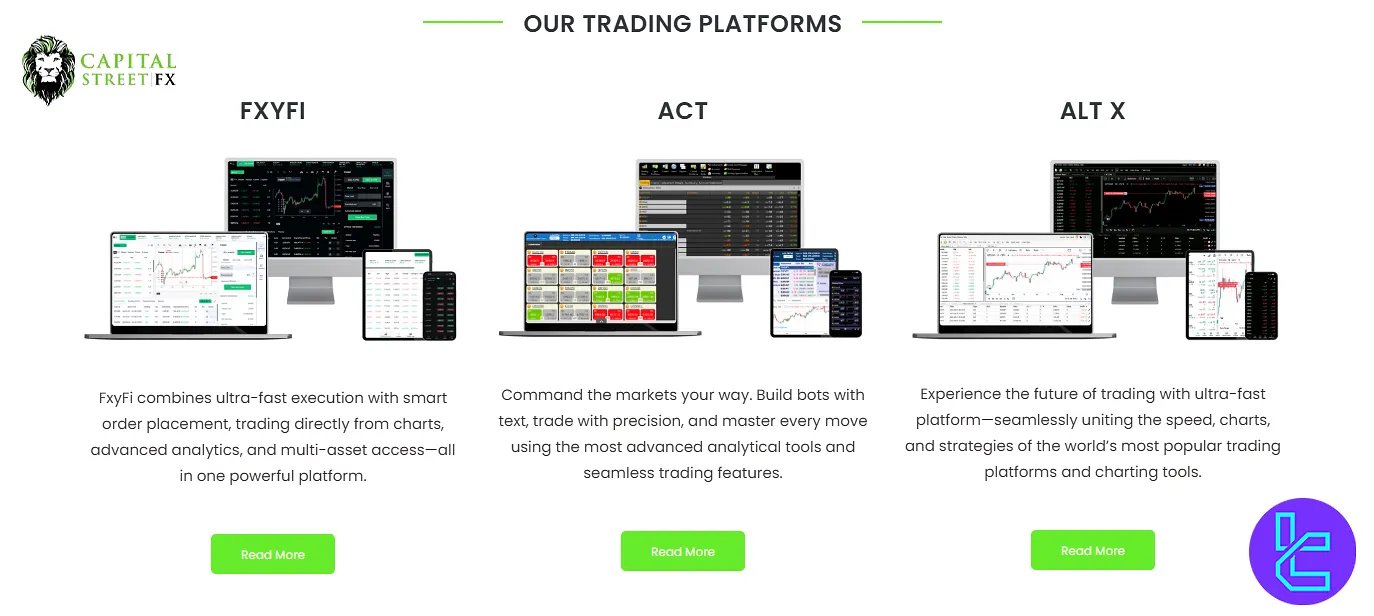

Capital Street FX Platform Offerings

The lack of popular and advanced platforms like TradingView and MetaTrader is a major letdown in this Capital Street FX review.

However, the broker offers a comprehensive proprietary trading solution, “Capital Trader”, in various versions, including:

Capital Street FX Trading Costs

While the company offers tight spreads of 0.1 pips, it lacks transparency regarding trading commissions. Commission data is only available for the Forex market.

Account Type | Spreads From (Pips) | Commission for FX Pairs |

Basic | 2.5 | $0 |

Classic | 2.0 | $0 |

Professional | 1.5 | $0 |

VIP | 0.1 | $15 |

Swap Fee at Capital Street FX

Overnight financing charges, also known as swap fees or rollover costs, are part of trading at Capital Street FX.

These charges vary by asset class including Forex pairs, commodities and indices and are determined through the broker’s Swap/COC calculator rather than a universal flat rate.

Key considerations:

- No fixed table of rates is published; traders must calculate fees for each position individually;

- Swap-free (Islamic) accounts are available, with the exception of ECN accounts;

- The broker’s policies prohibit swap or rollover arbitrage, categorizing it as abusive trading behavior;

- Because swap values are dynamic and instrument-specific, reliance on the calculator is essential before holding trades overnight.

Non-Trading Fees at Capital Street FX

At Capital Street FX, traders may face non-trading fees separate from spreads, swaps, or commissions. These typically relate to funding transactions, account management, and banking services, and can vary depending on payment method or user activity.

Key points on non-trading fees:

- Deposits: No broker fees for most methods, though banks or electronic payment providers may apply charges;

- Withdrawals: Fees vary by method, including fixed charges for Advcash, percentage-based deductions for Perfect Money or Visa/Mastercard, and higher flat rates for wire transfers;

- Inactivity: If an account remains inactive for at least one year or has a balance of USD 50 or less, a dormant fee (up to USD 50) may be applied and the account could be closed;

- Minimum deposit: Around USD 50, with no additional broker charge.

Capital Street FX Broker Payment Options

The company provides a wide array of payment options, from e-Wallets to crypto, to cater to its global client base.

Method | Deposit Fee | Withdrawal Fee |

VISA/MasterCard | 0 | 5.5% per side |

Bank Wire | 0 | $50 – $100 per transfer |

Apple Pay/Google Pay | 0 | 3% per side |

PerfectMoney | 0 | 3% per side |

Crypto (BTC, ETH, USDT, USDC) | 0 | 3% per side |

Binance Pay | 0 | 3% per side |

SEPA | 0 | €35 per €1000 |

Deposit Methods at Capital Street FX

Capital Street FX offers a variety of deposit methods for funding trading accounts, including bank cards, e-wallets, bank transfers, and cryptocurrencies.

These options are generally sufficient to meet most traders’ needs. Detailed information about each deposit method is provided in the table below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Visa/ MasterCard | USD | USD 50 | 0 | Instant |

Bank Wire | USD | USD 50 | 0 | 3–7 Business Days |

Perfect Money | USD | USD 50 | 0 | Instant |

Adv Cash | USD | USD 50 | 0 | Instant |

Apple Pay | USD | USD 50 | 0 | Instant |

Faster Payments | USD | USD 50 | 0 | Instant |

Binance Pay | USD / Crypto | USD 50 | 0 | Instant |

SEPA | USD | USD 50 | 0 | Instant |

Crypto (General) | BTC / ETH / USDT / USDC / Altcoins | USD 50 | 0 | Instant |

Bitcoin | BTC | USD 50 | 0 | Instant |

Ethereum | ETH | USD 50 | 0 | Instant |

Tether (USDT) | USDT | USD 50 | 0 | Instant |

USD Coin (USDC) | USDC | USD 50 | 0 | Instant |

Altcoins | Various | USD 50 | 0 | Instant |

Withdrawal Methods at Capital Street FX

Capital Street FX offers a variety of withdrawal methods, including bank wire transfers, e-wallets and cryptocurrencies. The processing time for withdrawals varies depending on the chosen method.

Also note that withdrawal fees may apply, and the specific fees depend on the chosen withdrawal method. For a detailed overview of each withdrawal method, refer to the table below:

Withdrawal Method | Currency | Withdrawal Fee | Processing Time |

Visa/ MasterCard | USD | 5.5% per side | 3–5 Business Days |

Bank Wire | USD | $50 – $100 per transfer | 3–7 Business Days |

Perfect Money | EUR | 3% per side | Instant |

Adv Cash | USD | 4% per side | Instant |

Apple Pay | USD | 3% per side | Instant |

Faster Payments | USD | 4% per side | Instant |

Binance Pay | USD / Crypto | 3% per side | Instant |

SEPA | USD | EUR 35 per 1000 EUR | Instant |

Crypto (General) | BTC / ETH / USDT / USDC / Altcoins | 3% per side | Instant |

Bitcoin | BTC | 3% per side | Instant |

Ethereum | ETH | 3% per side | Instant |

Tether (USDT) | USDT | 3% per side | Instant |

USD Coin (USDC) | USDC | 3% per side | Instant |

Altcoins | Various | 3% per side | Instant |

Copy Trading and Investment Plans on Capital Street FX

It's important to note that Capital Street FX does not currently offer copy trading services or specific investment plans.

This distinguishes them from some other brokers in the market who provide these features.

Capital Street FX Trading Assets

We must discuss the available markets in this Capital Street FX review.

The company offers 1000+ financial instruments, catering to traders with varying interests and strategies.

Here are all the markets you can trade at Capital Street FX:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency Pairs | 60+ | 70–150 | 1:10000 | |

Indices | Stock Indices (e.g., S&P 500, NASDAQ) | 20+ | 10–20 | N/A |

Commodities | Gold, Silver, Crude Oil, Natural Gas | 20 | 5–15 | N/A |

Bitcoin, Ethereum, USDT, USDC, Binance Coin | 10+ | 5–15 | N/A | |

Stocks | Individual Equities (e.g., Tesla, Apple) | 200+ | 50–100 | N/A |

ETFs | Exchange-Traded Funds | 20+ | 20–50 | N/A |

Bonds | Government & Corporate Bonds | 5–10 | 5–15 | N/A |

Options | Options on Stocks and Indices | 10+ | 10–20 | 1:1 |

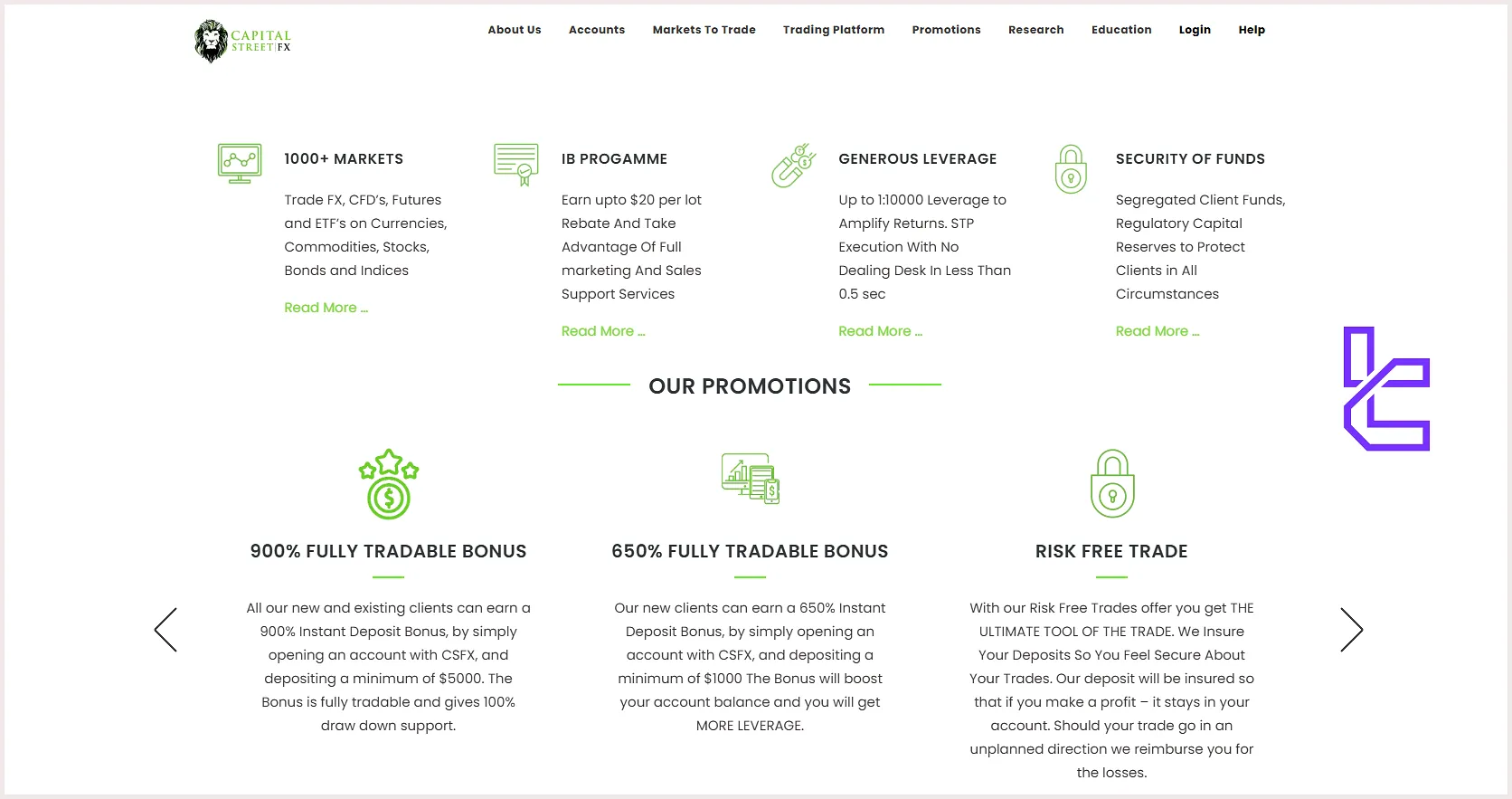

Capital Street FX Bonus and Promotional Plans

CSFX is known for its generous promotional offers, including a comprehensive deposit bonus plan and a partnership program.

- Deposit Bonus: 150% - 900% tradable extra funds on each deposit ($100 or more)

- IB: Up to $20 per traded lot by your referred clients

While bonuses can be attractive, they should not be the primary factor in choosing a broker. Consider the overall trading conditions, platform quality, and regulatory status when deciding.

Capital Street FX Awards

Capital Street FX has been recognized for its excellence in the financial services industry.

Notably, in 2019, the company received the “Excellence Award as Best Full-Service Investment Dealer” from Wealth & Finance Magazine.

Capital Street FX Support Channels

The broker provides multiple support channels to ensure traders can get assistance whenever needed in their preferred languages.

support@capitalstreetfx.com | |

Phone | +370 650 04197 |

+370 650 04197 | |

Skype (Partners) | csfx.affiliates.support |

Live Chat | Accessible on the website |

Ticket | Through the “Contact Us” page |

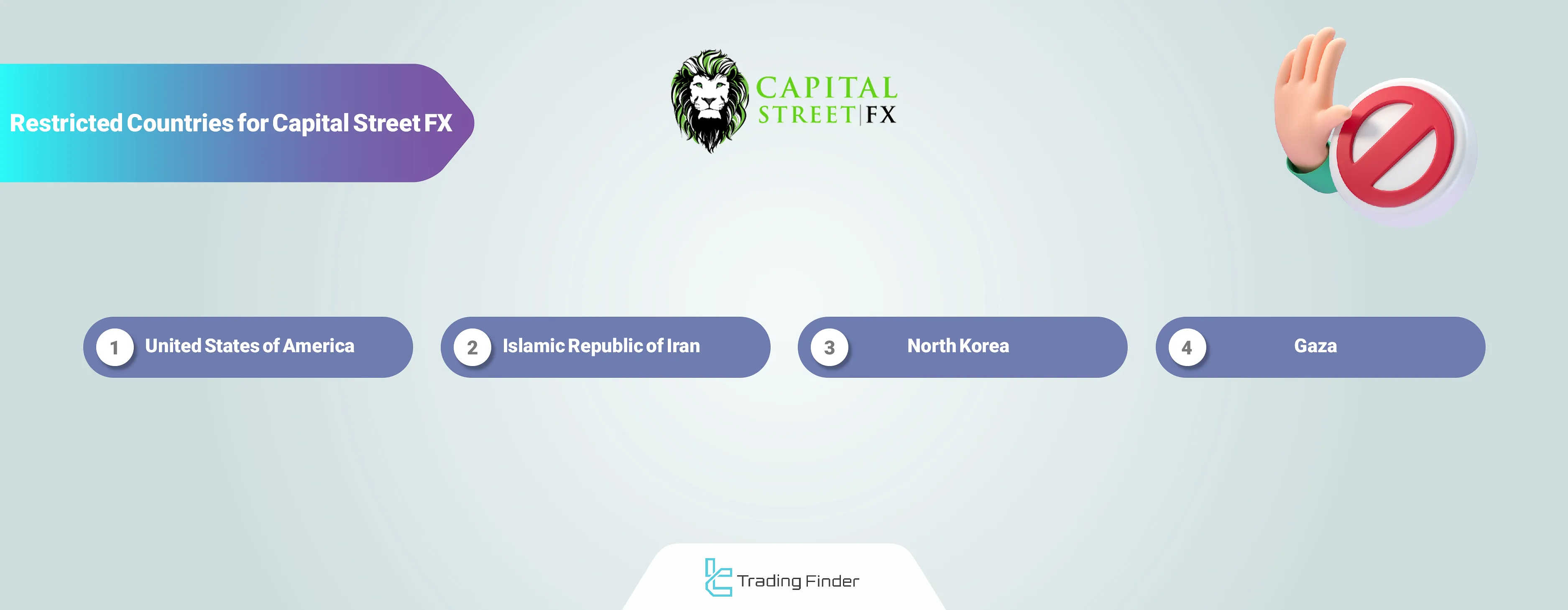

Capital Street FX Broker Geo-Restrictions

While the company strives to serve a global clientele, it’s obligated to implement some restrictions in providing services to certain regions, including:

- United States of America

- North Korea

- Iran

- Gaza

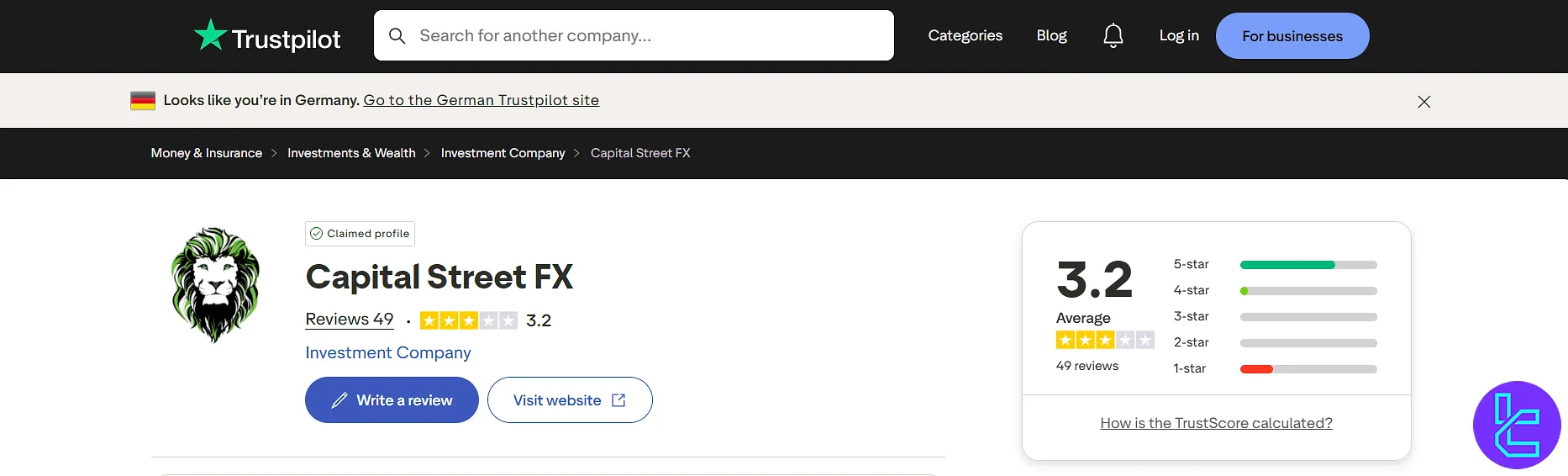

Capital Street FX Reviews and Ratings

Trust Score is a key factor when evaluating Capital Street FX, as it reflects user experiences and the overall reliability of the broker.

Analyzing feedback on established review platforms offers valuable insight into the company’s performance and client satisfaction.

Capital Street FX broker has received a rating of 3.2 based on 49 reviews on TrustPilot

Capital Street FX broker has received a rating of 3.2 based on 49 reviews on TrustPilotThe detailed trust metrics from major review sites are summarized in the table below:

3.9 out of 5.0 based on 42 comments | |

Forex Peace Army | 2.7 out of 5.0 based on 21 ratings |

Capital Street FX Educational Materials

CSFX takes a thorough approach to traders’ knowledge by offering two types of resources: Research and Education.

These two sections combined cover a wide range of subjects, including:

- Financial announcements

- Economic calendar

- Daily market reports

- Signals

- Beginners guide

- Glossary

- Tutorials

TradingFinder also offers a wide range of learning materials through the Forex education section.

Capital Street FX Comparison Table

Let's compare Capital Street FX to other Forex brokers.

Parameters | Capital Street FX Broker | |||

Regulation | FSC, FSA | No | CySEC, DFSA, FCA, FSCA, FSA | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0.1 pips | From 0.1 Pips | From 0.0 Pips | From 0.6 Pips |

Commission | N/A | $0 | From $0 | $0 (except on Shares account) |

Minimum Deposit | $100 | $1 | From $0 | $5 |

Maximum Leverage | 1:10000 | 1:3000 | 1:2000 | 1:1000 |

Trading Platforms | Proprietary Desktop/Web/Mobile Platform | MetaTrader 4, MetaTrader 5 | MT4, MT5, Mobile App | MT4, MT5, Mobile App |

Account Types | Basic, Classic, Professional, VIP | Standard, Premium, VIP, CIP | Cent, Zero, Pro, Premium | Micro, Standard, Ultra Low, Shares |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1000+ | 45 | 1,000+ | 1400+ |

Trade Execution | Market, Instant | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

Conclusion and Final Words

Capital Street FX provides 1000+ trading instruments with no commissions for Forex pairs via the Capital Trader platform.

The broker offers 4 account types with stop-out levels of up to 20%. CSFX has a TrustPilot score of 3.9.