CGS International provides commission-free Forex trading and access to US Stocks and ETFs with a fee of 20 SGD. The broker utilizes ViewPoint platform to offer up to 1:10 leverage on Equities CFDs.

CGSI was awarded the title of Best Domestic Broker in Singapore and Malaysia in the Finance Asia 2023 awards.

CGS International; Company Information and Regulation

CGS International Securities Pte. Ltd. (CGSI) provides leveraged instruments, investment banking, money management, and currency/commodities trading in more than 15 countries.

The broker operates under the umbrella of its parent company, China Galaxy Securities. Key features of CGS International:

- Over 15M clients (along with its parent organization)

- Registered in Singapore with Reg No. 200506890E

- Group CEO: Carol Fong

The CGSI Group is regulated by multiple financial authorities in various jurisdictions, including:

- Monetary Authority of Singapore (MAS)

- Securities and Futures Commission Hong Kong (SFC)

- Securities and Exchange Board of India (SEBI)

- Financial Services Authority (FSA) of Indonesia

- Securities Commission Malaysia (SCM)

- Financial Services Commission (FSC) and Financial Supervisory Service of South Korea

- Securities and Exchange Commission Thailand (SEC)

These regulatory entities highlight the broker’s extensive global presence and compliance framework.

The table below outlines the specific CGS International branches, their respective regulatory authorities, and key operational details for each jurisdiction.

Entity / Branch | CGS International Securities Singapore Pte. Ltd. | CGS International Securities Group Malaysia Sdn. Bhd. | PT CGS International Sekuritas Indonesia | CGS International Securities (Thailand) Co., Ltd. | CGS International Securities Hong Kong Limited | China Galaxy Securities Co Ltd | CGS International Securities India Private Limited | CGS International Securities Hong Kong Limited, Korea Branch | CGS International Securities UK Ltd. | CGS International Securities USA, Inc. | CGS International Securities Mauritius Ltd |

Regulation | MAS | SC | OJK / BAPPEBTI | SEC Thailand | SFC | CSRC | SEBI | FSC Korea | FCA | FINRA / SEC | FSC Mauritius |

Regulation Tier | Tier-1 | Tier-2 | Tier-3 | Tier-2 | Tier-1 | Tier-1 | Tier-2 | Tier-2 | Tier-1 | Tier-1 | Tier-3 |

Country | Singapore | Malaysia | Indonesia | Thailand | Hong Kong | China | India | South Korea | UK | USA | Mauritius |

Investor Protection / Compensation | Yes | Yes | Yes | Yes | Yes | No | No | No | Yes | Yes | No |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | Yes | Yes | N/A |

Maximum Leverage | 1:10 | N/A | 1:10 | N/A | N/A | N/A | N/A | N/A | 1:10 | 1:10 | 1:10 |

Client Eligibility | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) | All except prohibited countries (e.g., Iran and Congo) |

CGS International Broker Specific Features

CGSI has a presence across 15+ countries, including Singapore, England, the USA, and China. Let’s see what features the Forex Broker brings to the table.

Broker | CGS International |

Account Types | iCash, Margin, CFD |

Regulating Authorities | MAS, SFC, OJK / BAPPEBTI, SEBI, CSRC, FCA, FSA, FINRA, SC, FSC, SEC |

Based Currencies | USD, SGD, AUD, HKD, MYR, EUR, GBP |

Minimum Deposit | 100 SGD |

Deposit Methods | Bank Transfer, PayNow, Cheque |

Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:3.5 on Margin Fixed 3 to 7 on derivatives 10 on DMA Equities CFDs 5% on Forex |

Investment Options | Fixed Income Products, Wealth Management |

Trading Platforms & Apps | iTrade, Viewpoint, ProsperUs |

Markets | Equities, Leveraged Products, Futures, Bonds |

Spread | From 0.3 pips on Forex CFDs |

Commission | Variable based on the instrument |

Orders Execution | N/A |

Margin Call / Stop Out | N/A |

Trading Features | Trading Tools (e.g., iScreener, iFilter, Stock Filter), Mobile Trading |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Phone Call |

Customer Support Hours | 8:30 am to 5:30 pm SGT (Mon - Fri) |

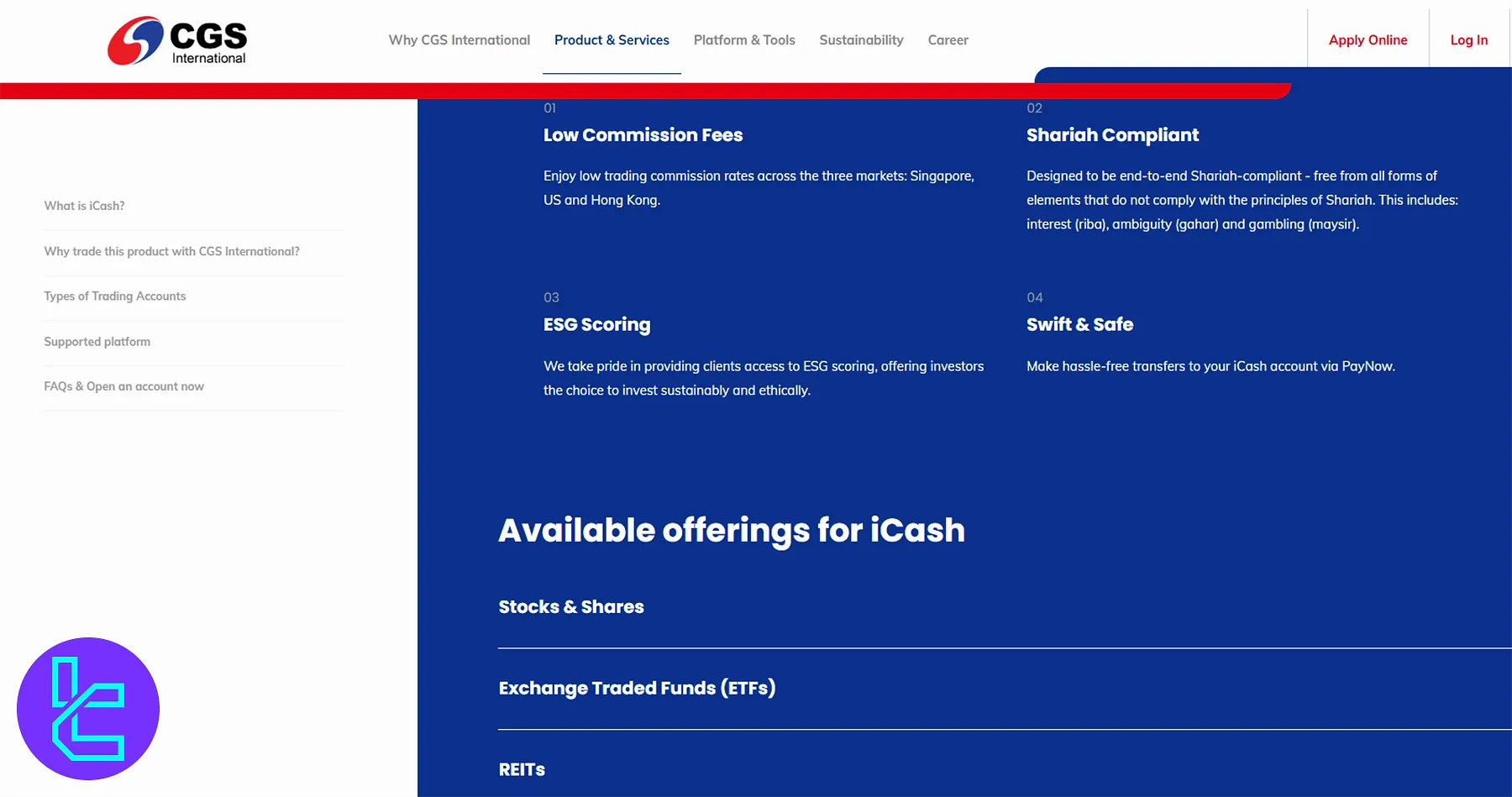

What Are the Account Offerings?

The broker offers various accounts for different products. It offers exclusive accounts for margin trading, securities, and CFD trading.

- iCash: Trade Shariah-compliant stocks with competitive commission rates across 5 major exchanges, including SGX, HKEX, NASDAQ, AMEX, and NYSE;

- Margin: Use leverage options of up to 1:3.5 to trade shares on SGX, BURSA, HKEX and US;

- CFD: Trade CFDs on Futures, DMA Equities, Cash Index, and FX with a minimum deposit requirement of 2,000 SGD.

The broker also provides Forex through its 3 account types with different leverage options, spreads, and initial deposit requirements, including:

Features | Mini | Classic | Accredited Investor |

Min Deposit | 100 SGD | 5,000 SGD | 10,000 SGD |

Spreads from | 0.3 pips | 0.7 pips | 0.7 pips |

Commission | $0 | $0 | $0 |

Leverage | 5% | 5% | 2% |

Min Order Size | 0.01 lots | 0.1 lots | 0.1 lots |

Max Order Size | 0.5 lots | Unlimited | Unlimited |

CGS International Upsides and Downsides

As with any financial service provider, CGSI comes with its own set of advantages and potential drawbacks.

Pros | Cons |

A wide range of trading instruments | Complex products for beginner traders |

Multiple account types | No support for popular platforms like TradingView |

Moderate entry barrier for Forex (SGD 100) | Limited services for regions other than ASEAN |

Strong regulatory framework (MAS) | Low leverage options (up to 5% on Forex) |

Overall, the broker positions itself as a reliable choice for clients within its core markets, while remaining less accessible for those seeking higher leverage or broader global coverage.

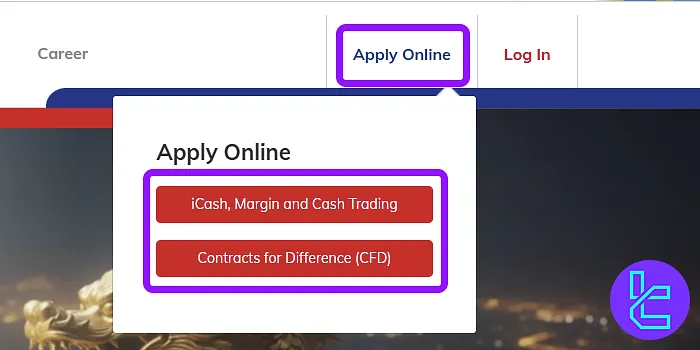

Account Opening and Verification

Opening a new account with CGS International is the first step in beginning to trade with this broker. CGS International registration:

#1 Start the Online Application

Head to the official CGS International website and select “Apply Online”. Choose your preferred account type, CFD or margin/cash, and proceed to the next step.

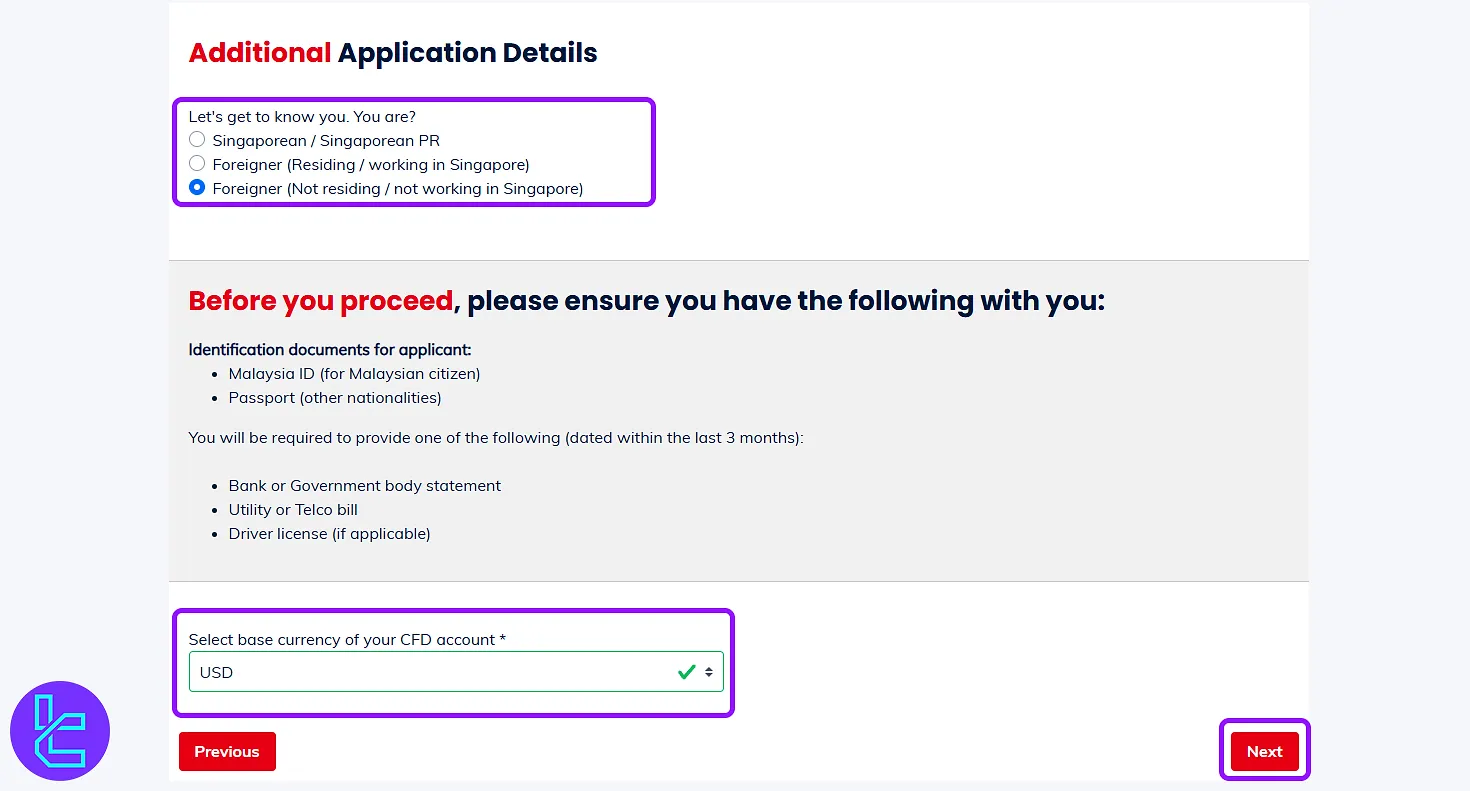

#2 Provide Residency and Currency Details

Specify your country of residence. Singapore-based users must enter their national details, while others should select “Foreigner (Not Residing).” Then, choose your account’s base currency before moving forward.

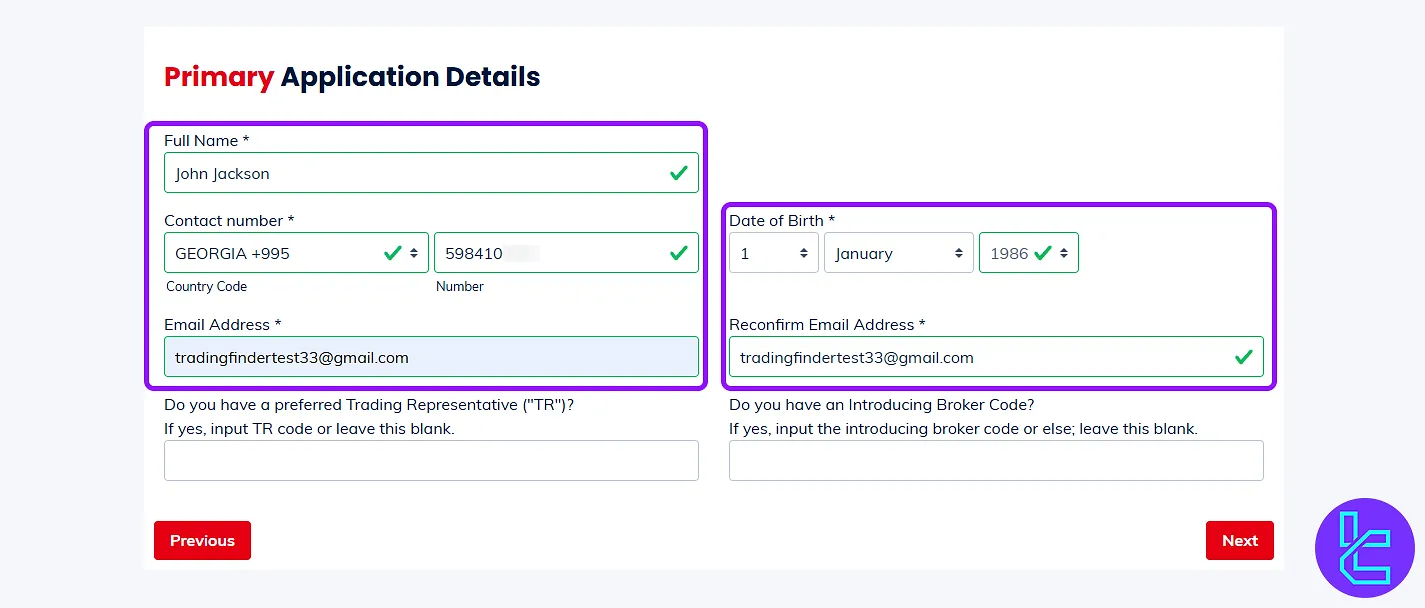

#3 Fill in Your Personal Information

Complete the application form with your full name, date of birth, email, and mobile number. You may also enter an IB Code (optional). If you don’t have one, contact TradingFinder support for assistance.

#4 Verify Your Account

As a multi-regulated broker, CGS International requires all traders to upload proof of identity (POI) and proof of address (POA) documents to comply with KYC and AML laws.

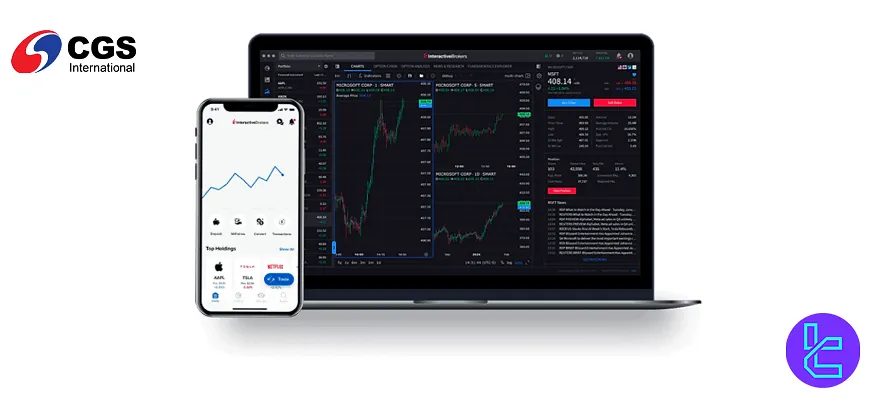

CGS International Platforms

The broker offers 3 sophisticated online trading platforms designed to cater to the diverse needs of individual investors.

While iTrade and ProsperUs are among their offerings, the Viewpoint platform stands out as a particularly robust solution.

Fees and Commissions Explained

CGS-CIMB Securities offers a transparent but rather complex fee system across its various asset classes, including:

Asset Type | Fees |

US Stocks & ETFs | 20 SGD |

SG Stocks & ETFs | 25 SGD |

CFD Stocks & ETFs | As low as 0.20% |

CFD Forex | Spreads as low as 0.3 pips |

CFD Bonds | As low as 20% |

Non-Trading Fees at CGS International

Non-trading fees at CGS International cover costs for services outside of order execution, such as account maintenance and custody. Some of the most relevant charges include:

- Custody Fee: Waived until 30 September 2025; thereafter 0.25–10 bps per annum depending on AUM, min SGD 2, max SGD 12,500 per quarter;

- Inactivity Fee: Not explicitly listed; typically, subject to account terms;

- Settlement Instruction Fee (SGX): SGD 0.35 per instruction;

- GST on commissions and fees: 9% applied where applicable.

CGS International Broker Funding & Withdrawal

CGS International, as a leading integrated financial services provider in Asia, offers a range of funding and withdrawal options to cater to its diverse global client base, including:

- Bank Transfer

- PayNow

- Cheque

Deposit Methods at CGS International

CGS International supports a variety of deposit/funding channels to accommodate different client preferences and jurisdictions.

These methods aim to cover bank wire transfers, local instant payment options (e.g. PayNow in Singapore) and traditional options like cheque or electronic payments.

However, the coverage and terms depend on your country of residence and the base currency of your trading account.

Here is a summary of deposit methods as documented via CGS’s support materials:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer / Wire | Account currency (e.g. SGD, USD) | ~S$100 (or equivalent) | Usually Free | 1–3 business days |

PayNow (Singapore) | SGD | No fixed minimum | Free | Same day / Next day |

Cheque / EPS | Local currency | N/A | Free | Clearing time applies |

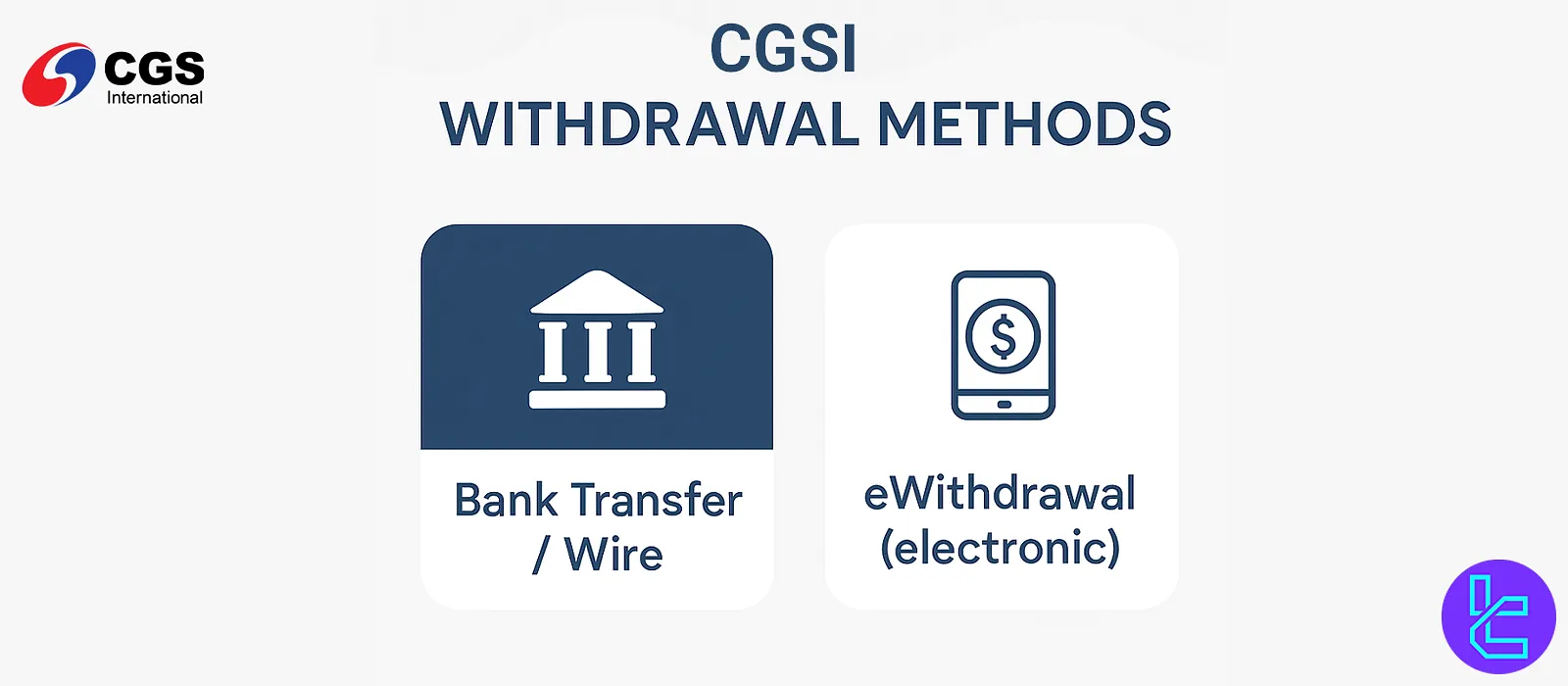

Withdrawal Methods at CGS International

Withdrawal options depend heavily on the country (e.g. CGS Malaysia) and client eligibility.

While traditional bank wire is common, some regional branches offer electronic withdrawal to local bank accounts under certain conditions.

Here is a summary of Withdrawal methods:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time / Notes |

Bank Transfer / Wire | Account base currency (e.g. SGD, USD, MYR, etc.) | Varies by region | Possible bank charges / internal fees | Typically 1–3 business days |

eWithdrawal (electronic) | Local currency only (e.g. MYR in Malaysia) | RM 1 | Usually no explicit fee (CGS MY claims zero handling fee) | If request made before 2:30 pm on trading day |

Investment and Growth Plans

While the broker doesn’t offer copy trading or social trading services, it provides access to a wide range of fixed-income products and instruments, such as:

- Stocks and Shares

- Bonds

- ETFs (Fullgoal Vietnam 30 Sector Cap and Fullgoal CSI 1000)

The broker also offers wealth management and investment consultation on various products, including:

- Global Equities

- Investment Funds

- Structured Products

CGS International Financial Markets

The wide range of trading and investment products is one of the biggest strength points in this CGS International review.

In addition to Futures markets andSecurities across 10+ global exchanges, including Bursa Malaysia, SGX, HKEX, SET, IDX, NYSE, NASDAQ, NYSEMKT LLC, SZSE, and SSE, the broker offers access to a wide range of leveraged products, as shown in the table below:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Equities | Stocks, ETFs, REITs | N/A | 2,000–3,000 |

CFDs | Futures, DMA Equities, Cash Index, FX | N/A | 1,500–2,500 |

Forex | Currency pairs | N/A | 50–100 |

Fixed Income | Bonds, Notes | N/A | 500–1,000 |

Commodities | Futures on commodities | N/A | 200–500 |

Structured Products | Derivatives, Warrants, Synthetics | N/A | 300–700 |

ELN enables clients to purchase shares of selected companies at a discount rate lower than market price.

CGS International Awards and Accolades

Throughout its history, this broker has achieved recognition through numerous CGS International awards.

These awards are reflecting its commitment to excellence in financial services, customer satisfaction and innovation across the Asia-Pacific region.

Below are some of the recent awards CGS International has garnered:

- Best Broker in Singapore (2022) Recognized for outstanding brokerage services in Singapore;

- Biggest Social Impact International (2022) Honored for significant contributions to social initiatives;

- Most Innovative Use of Technology International (2022) Awarded for cutting-edge technological advancements in financial services;

- Company of Good (2024) Recognized for corporate social responsibility and community involvement.

CGS International Partnership Program

The broker’s official website doesn't specifically mention a partnership program for affiliates or IBs.

However, upon creating a trading account, you’ll be asked to enter an IB code (optional). Therefore, the broker must offer an Introduction Broker service.

For detailed information about the program, please contact the support team.

Customer Support

While CGS-CIMB provides a hotline and email for support, it truly lacks a live chat feature. Here’s a quick look at the broker’s contact details:

clientservices.sg@cgsi.com | |

Tel | +65 6538 9889 |

Fax | +65 6225 1228 |

Address | 10 Marina Boulevard, #09-01 Marina Bay Financial Centre Tower 2, Singapore 018983 |

The broker’s operating Hours are from 8:30 am to 5:30 pm SGT on weekdays (excluding weekends and public holidays).

CGS International Restricted Countries

While CGSI offers its services to a wide range of clients, there are certain restrictions in place regarding the countries and jurisdictions from which they accept clients, including:

- Sudan

- Iran

- North Korea

- Yemen

- Congo

Potential clients should directly contact the company or check their website for the most up-to-date information on country restrictions.

CGS International User Satisfaction

CGSI doesn’t have a profile on reputable review websites like Trustpilot and REVIEWS.io. However, the CGSI Google Reviews profile has 12 comments, resulting in a total score of 3.7 out of 5.

CGS International Educational Materials

The broker has a vast research department exploring opportunities across various markets, from Equities to CFDS.

While CGSI doesn’t provide educational materials on its website, it operates more face-to-face. The company has hosted many regional educational events, such as:

- Financial literacy for the deaf community in Indonesia

- Young Happy Financial Literacy for 62,000 elderly

- PastiPaham Investasi educational series for youths

CGS International Vs Other Forex Brokers

Let's compare some of the most important aspects of trading with CGS International with other Forex brokers.

Parameters | CGS International Broker | |||

Regulation | MAS, SFC, SEBI, FSA, SC, FSC, SEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | From 0.3 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0 | From $0.2 to 3.5 USD | From $0 | From $0 |

Minimum Deposit | 100 SGD | $10 | $100 | From $0 |

Maximum Leverage | 1:10 | Unlimited | 1:500 | 1:2000 |

Trading Platforms | iTrade, Viewpoint, ProsperUs | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, Mobile App |

Account Types | iCash, Margin, CFD | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite | Cent, Zero, Pro, Premium |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 3100+ | 200+ | 2100+ | 1,000+ |

Trade Execution | N/A | Market, Instant | Market, Pending | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

CGS International provides access to 30+ markets, including Bonds with a minimum investment requirement of 100,000 SGD and Forex with an initial deposit requirement of 100 SGD.

CGS International broker operates in 15+ countries, including Singapore and the USA, and it has a trust score of 3.7 on Google Reviews.