CMC Markets UK is a leading broker with over 1 million customers in 4 continents. This broker is listed on the London Stock Exchange (LSE) and has offices in various countries, including Australia, Canada, Spain, Norway, Poland, and many more.

CMC Markets allow traders to trade on Spread Betting, CFD Trading, andFX Active accounts with a maximum leverage of1:500.

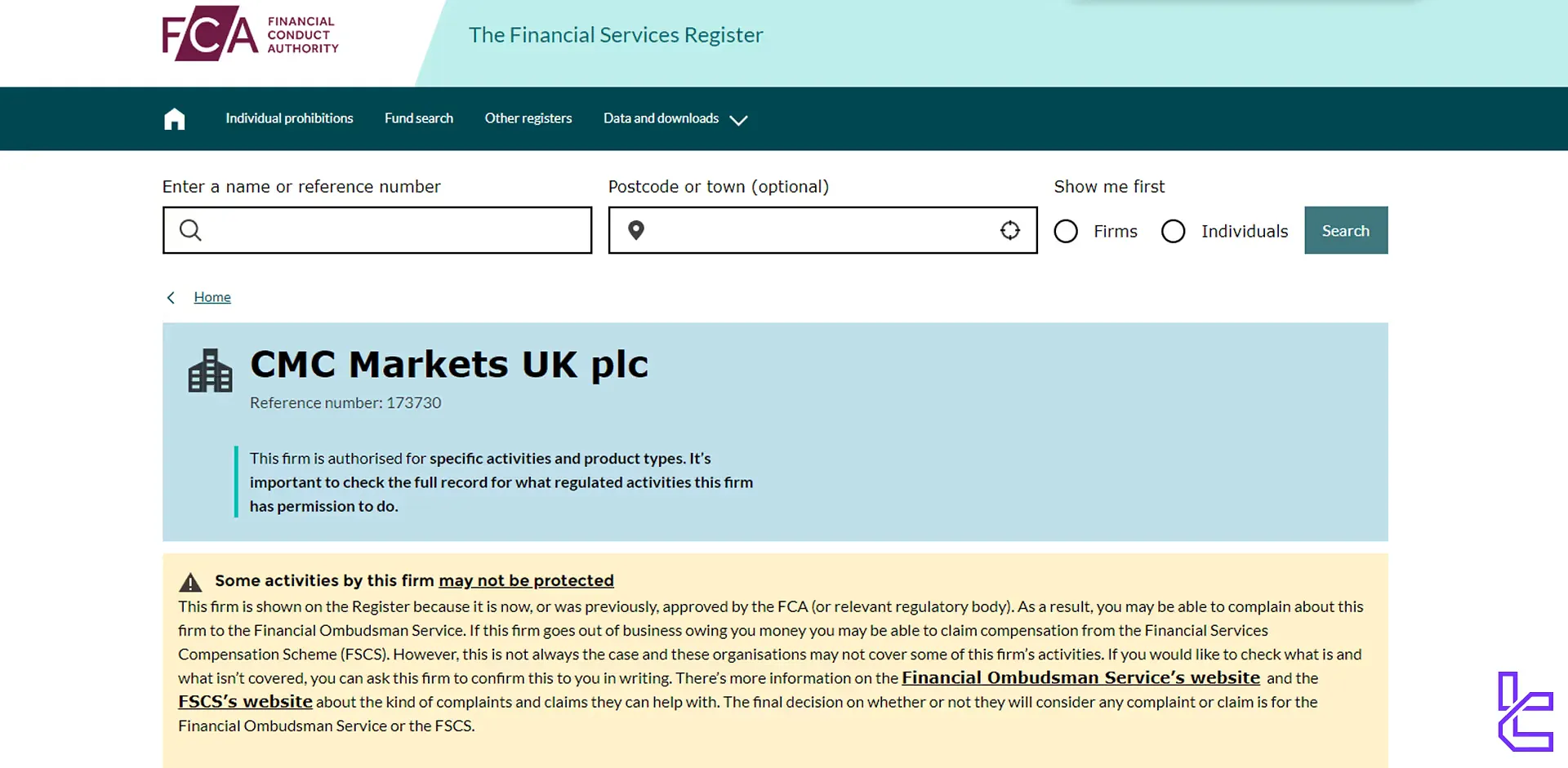

CMC Markets Company Information & Regulation Overview

CMC Markets has built a strong reputation over its 30+ years in the financial industry.

The company's commitment to regulatory compliance and client protection is evident in its multiple licenses from top-tier financial authorities worldwide:

- Financial Conduct Authority (FCA) in the UK (registration no. 173730)

- Cyprus Investment and Securities Commission (CySEC) in Cyprus

- Federal Financial Supervisory Authority (BaFIN) in Germany (license no. 154814)

- Australian Securities and Investments Commission (ASIC) in Australia

- Financial Markets Authority (FMA) in New Zealand

- Monetary Authority of Singapore (MAS) in Singapore

- Dubai Financial Services Authority (DFSA) in Dubai (license number F002740)

- National Financial Regulatory Administration (NFRA) in China

- Financial Market Authority Austria

- CMC Markets Germany GmbH Filial Oslo

Below is a table where you can see the most important information about the different branches of CMC Markets:

Entity Parameters/Branches | CMC Markets UK Plc / CMC Spreadbet Plc | CMC Markets Asia Pacific Pty Ltd | CMC Markets Singapore Pte Ltd | CMC Markets Germany GmbH | CMC Markets NZ Ltd | CMC Markets Middle East Ltd |

Regulation | FCA | ASIC | MAS | BaFin | FMA | DFSA |

Regulation Tier | Tier-1 | Tier-1 | Tier-1 | Tier-1 | Tier-1 | Tier-1 |

Country | UK | Australia | Singapore | Germany | New Zealand | UAE |

Investor Protection Fund/Compensation Scheme | FSCS up to £85k | None | None | EdW up to €20k (90%) | None | N/A |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | N/A |

Maximum Leverage | 1:30 | 1:30 | 1:30 | 1:30 | 1:500 | 1:30 |

Client Eligibility | All countries except banned (e.g. USA, NK) | All except banned (e.g. USA, Iran) | All except banned (e.g. USA, Cuba) | All except banned (e.g. USA, Russia) | All except banned (e.g. USA, Belarus) | All except banned (e.g. USA, Syria) |

CMC Markets Broker Summary of Specifications

This Forex broker offers a comprehensive suite of trading products and services, catering to both novice and experienced traders. Here's a summary of the key specifics:

Broker | CMC Markets |

Account Types | Spread Betting, CFD Trading, FX Active |

Regulating Authorities | FCA, ASIC, CySEC, DFSA, NFRA, FMA, BaFIN |

Based Currencies | GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD |

Minimum Deposit | $0 |

Deposit Methods | Visa/MasterCard, Bank wired, Online Banking |

Withdrawal Methods | Visa/MasterCard, Bank wired, Online Banking |

Minimum Order | N/A |

Maximum Leverage | 1:500 |

Investment Options | No |

Trading Platforms & Apps | MT4, Next Generation web trading platform |

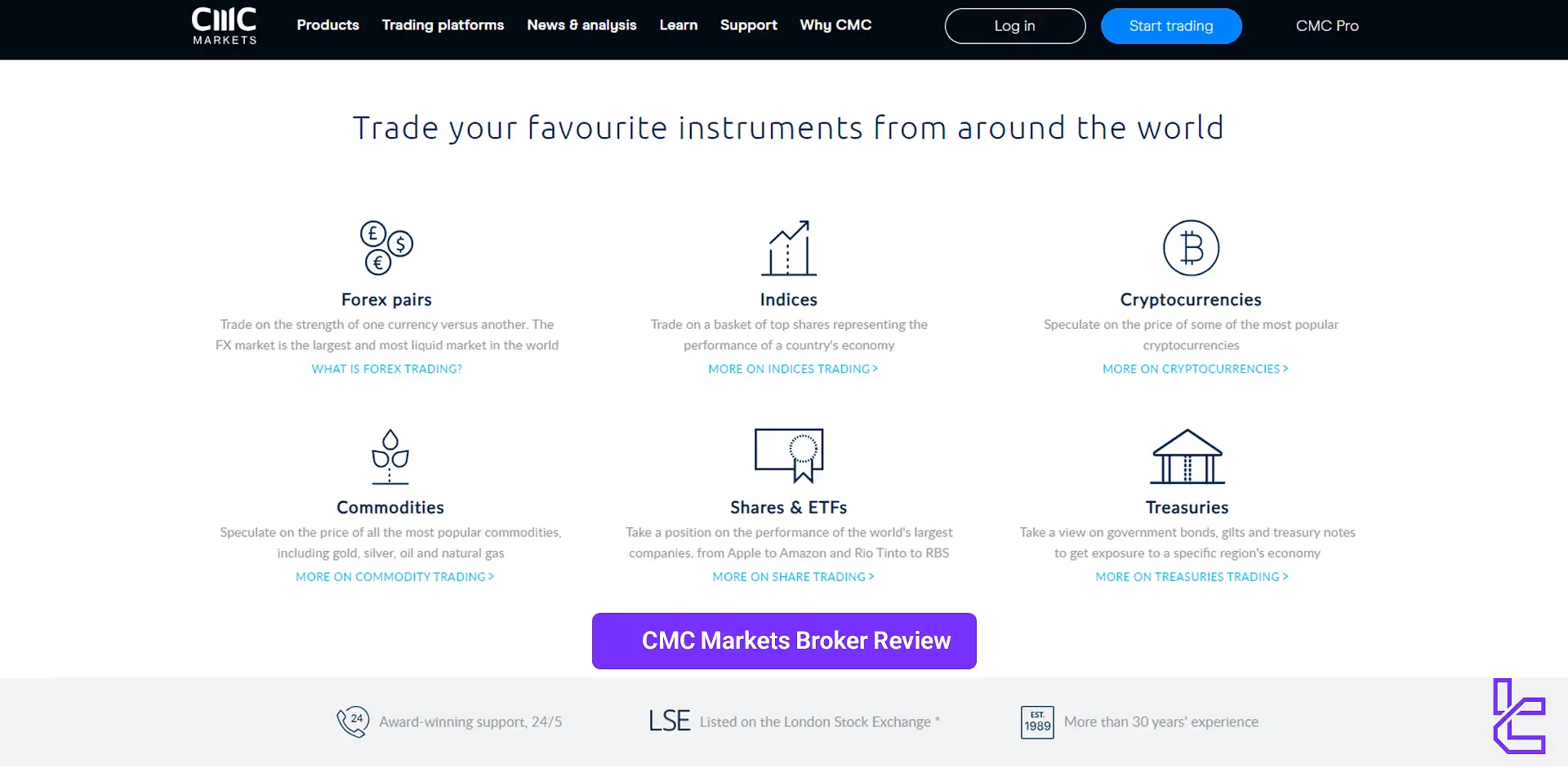

Markets | Forex, indices, commodities, crypto, shares, ETFs, Treasuries |

Spread | Floating from 0.0 pips |

Commission | From $10 on shares |

Orders Execution | Market |

Margin Call/Stop Out | 80%/50% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus, cashback bonus |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | Monday to Friday from 8am to 8pm |

Restricted Countries | Iran, Brazil, Yemen, Argentina, USA and more |

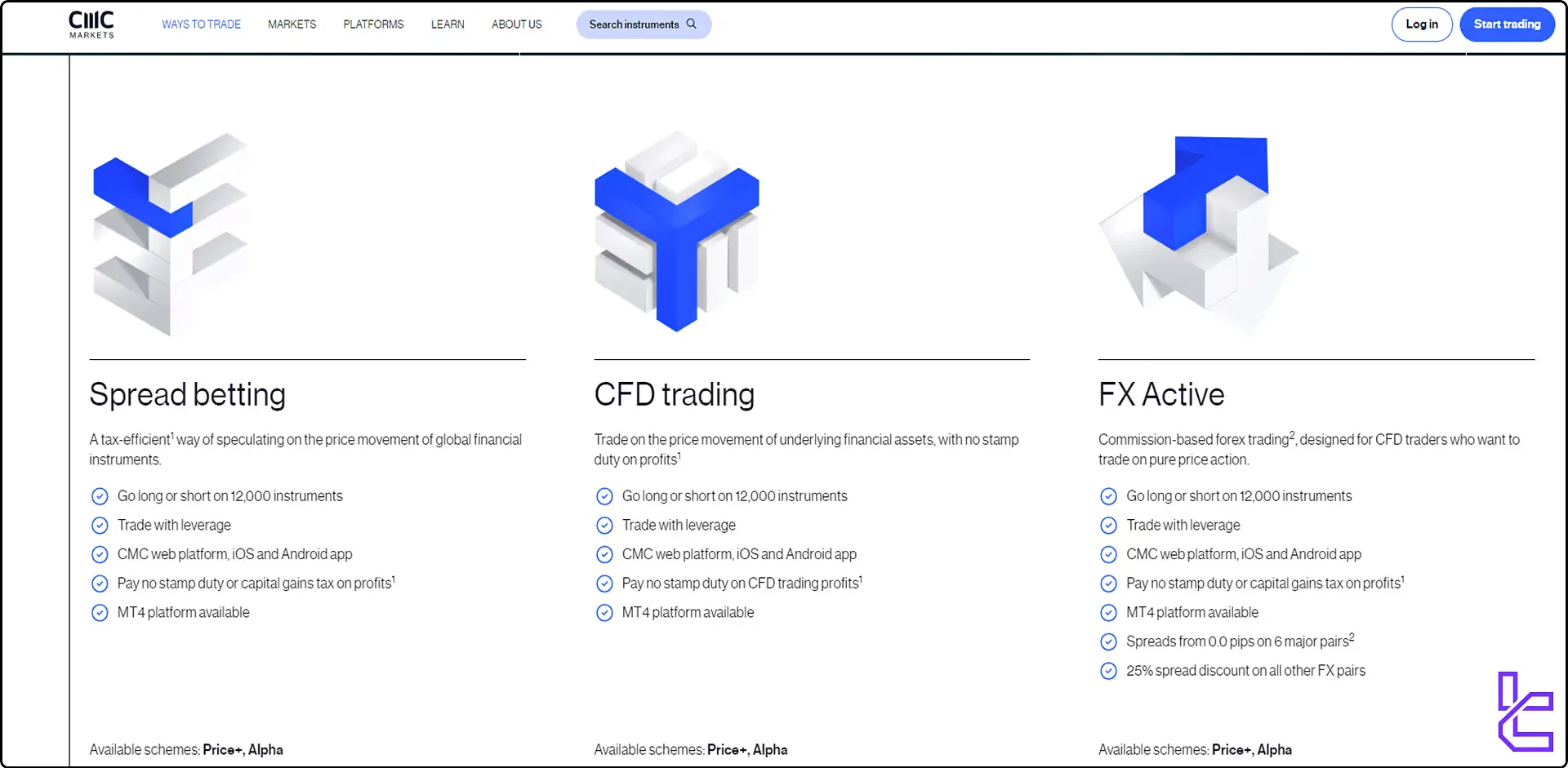

CMC Markets Accounts

CMC Markets offers 3 main account types to cater to different trading styles and preferences:

Account types | Spread Betting | CFD Trading Account | FX Active Account |

Minimum deposit | $0 | $0 | $0 |

Maximum leverage (retail clients) | 1:30 | 1:30 | 1:30 |

Spreads | Floating from 0.0 pips | Floating from 0.0 pips | Floating from 0.0 pips |

Commission | No | Yes (only for shares trading) | Yes (only for shares trading) |

Instruments | Forex, indices, commodities, shares, treasuries | Forex, indices, commodities, shares, treasuries | Forex, indices, commodities, shares, treasuries |

All account types provide access to CMC Markets' proprietary Next Generation platform, mobile apps, and MetaTrader 4.

It is also worth mentioning that CMC Markets offers demo accounts for beginner traders.

CMC Markets Advantages and Disadvantages

Let’s review the benefits and drawbacks of trading with CMC Markets:

Advantages | Disadvantages |

Wide range of tradable instruments (over 12,000) | Limited withdrawal and deposit methods |

Established broker with strong regulatory oversight | High shares trading fees |

Low-cost Forex and CFD trading | - |

Excellent user experience across platforms and tools | - |

CMC Markets Broker Account Opening

The account opening process on CMC Markets is user-friendly and takes no time to complete. CMC Markets registration:

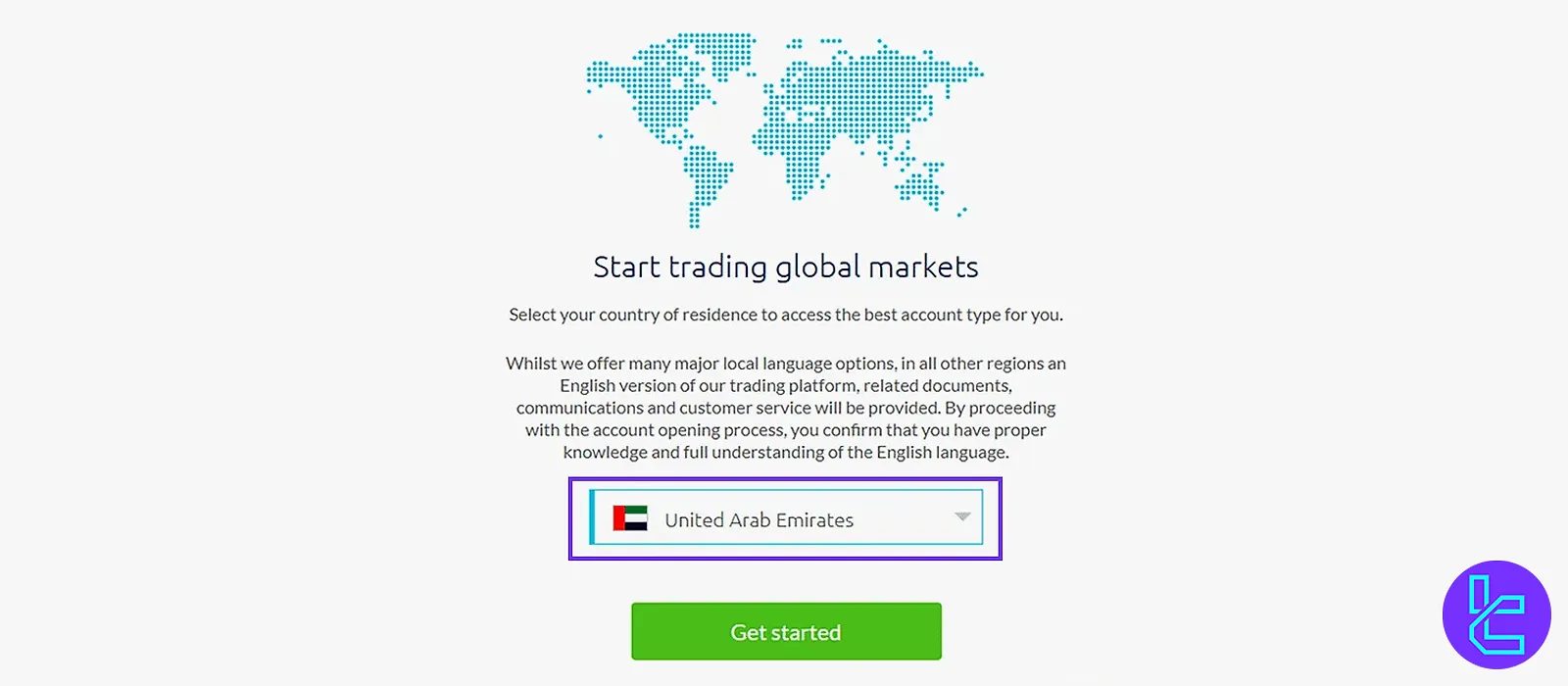

#1 Access the CMC Markets Registration Page

Start by navigating to the official CMC Markets website and locate the registration section. First Click Open an Account or “Start Trading”.

Then choose your country and select “Get Started” to begin the signup process.

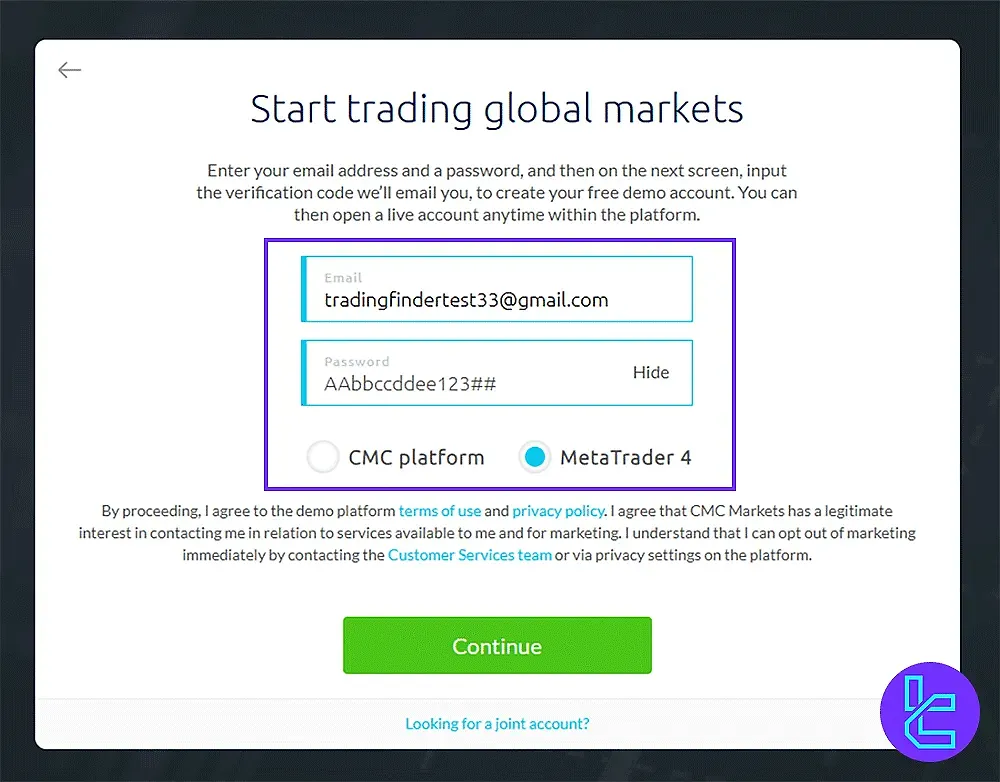

#2 Provide Email and Create a Secure Password

Enter a valid email address and set a strong password containing uppercase and lowercase letters, numbers, and special characters.

Select your preferred trading platform and click “Continue” to move forward.

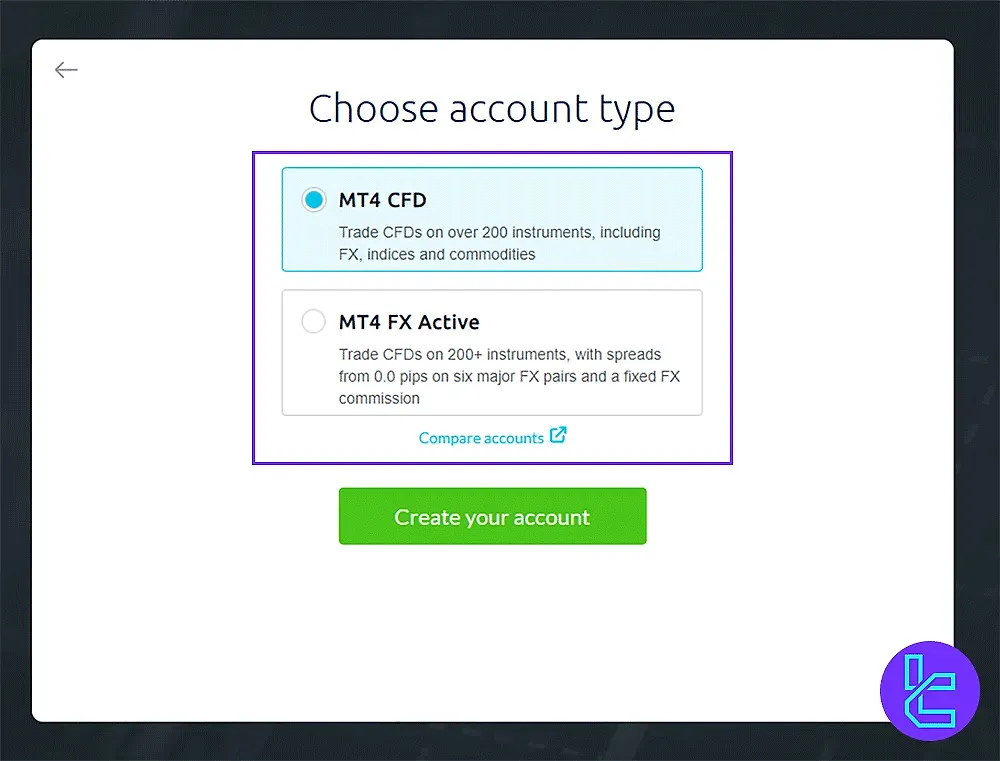

#3 Choose an Account Type

Pick the account type that aligns with your trading preferences, such as MT4 CFD or MT4 FX Active, then click Create Your Account to proceed.

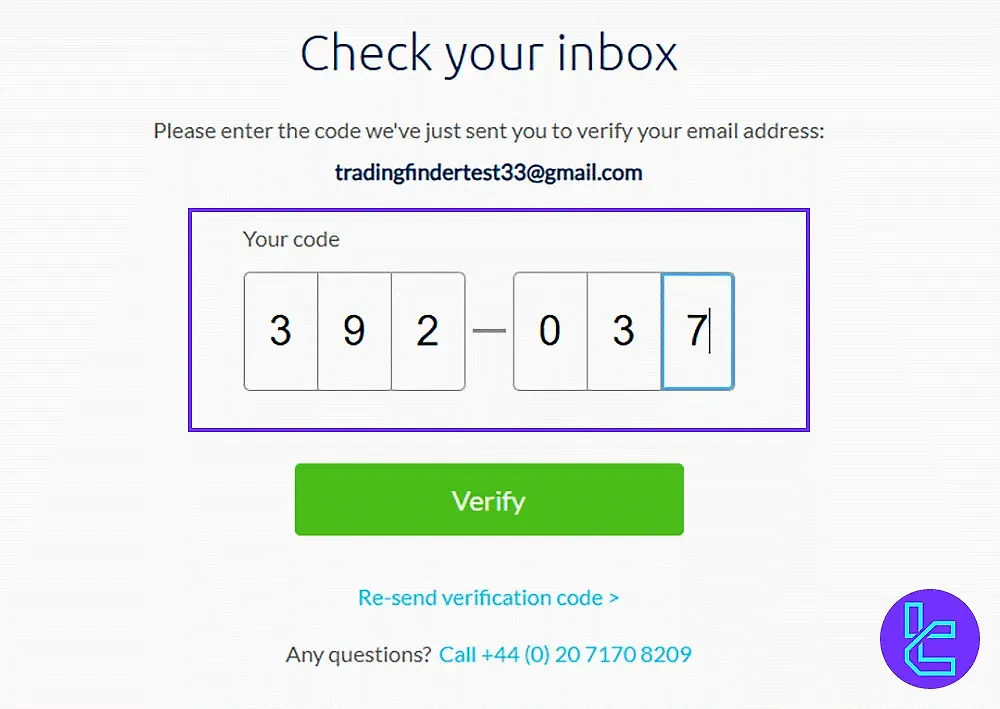

#4 Verify Your Email

A 6-digit verification code will be sent to your email. Enter this code in the designated field and click Verify to confirm your email address.

#5 Log in to Your CMC Markets Account

Once your email is verified, click Login Now to access your account. Initially, the account will operate in demo mode.

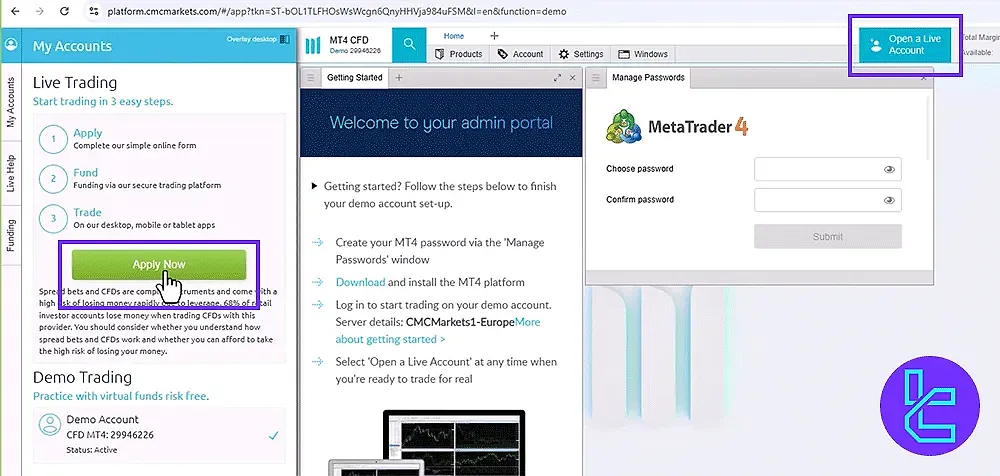

#6 Upgrade to a Live Account

To start live trading, select Open a Live Account and click “Apply Now”.

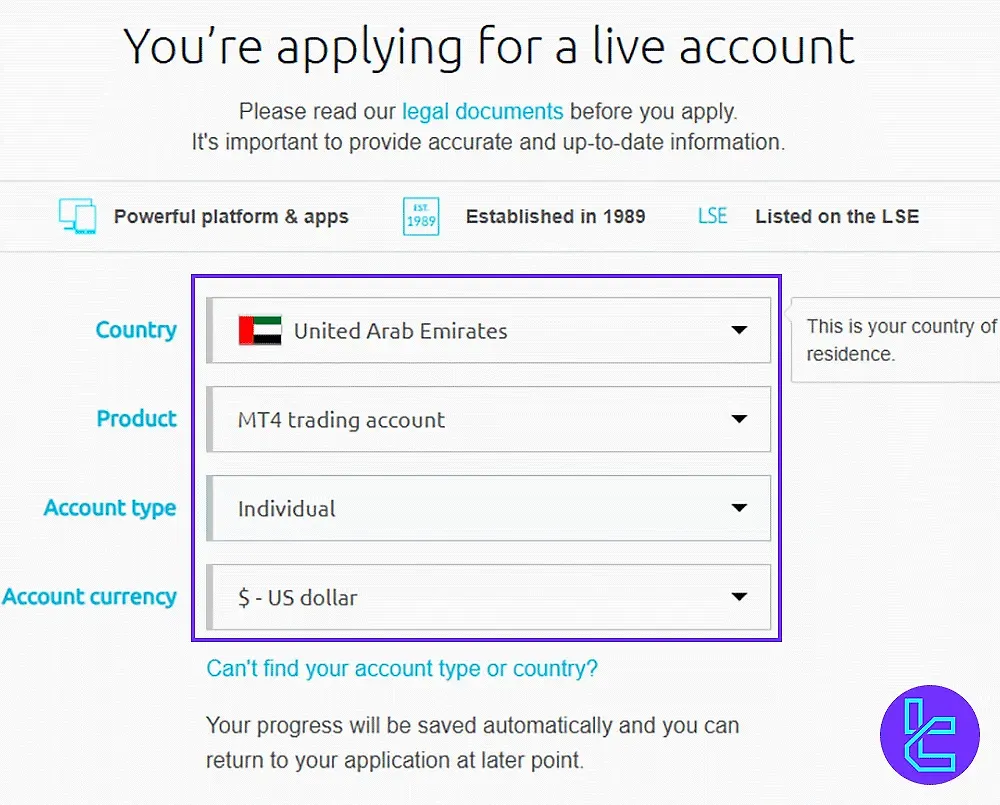

#7 Configure Live Account Settings

Choose your country, trading platform, account type, and preferred base currency. Click Next to continue.

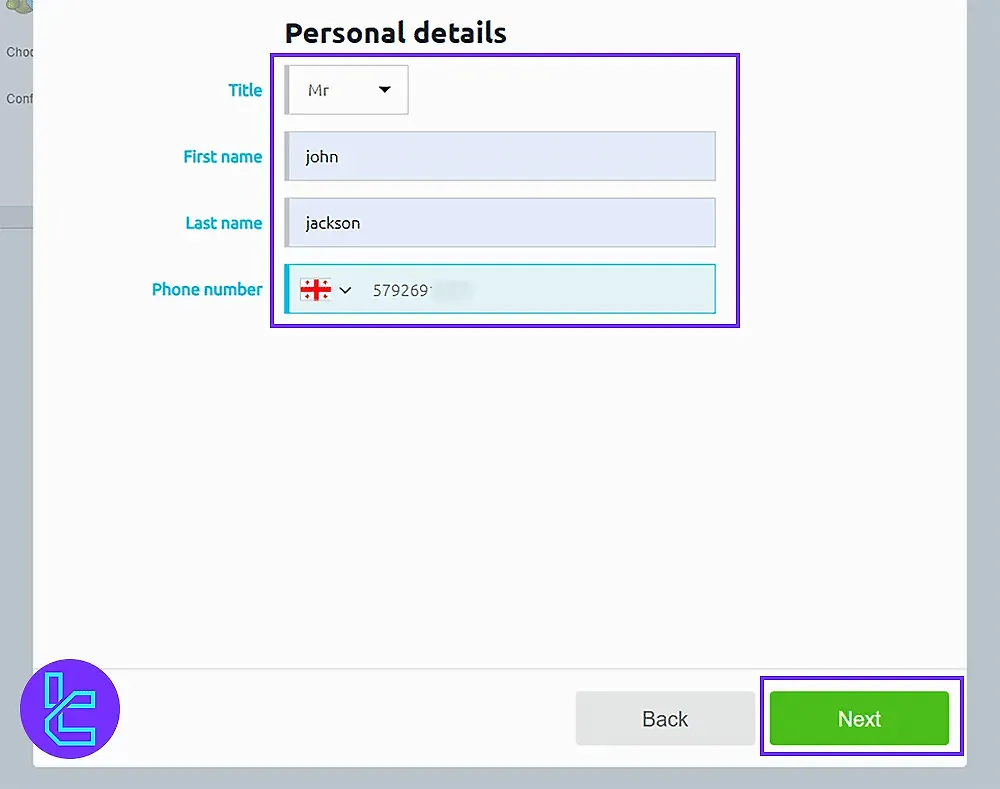

#8 Enter Personal Information

Provide your title, last name, and mobile number, then proceed by clicking “Next”.

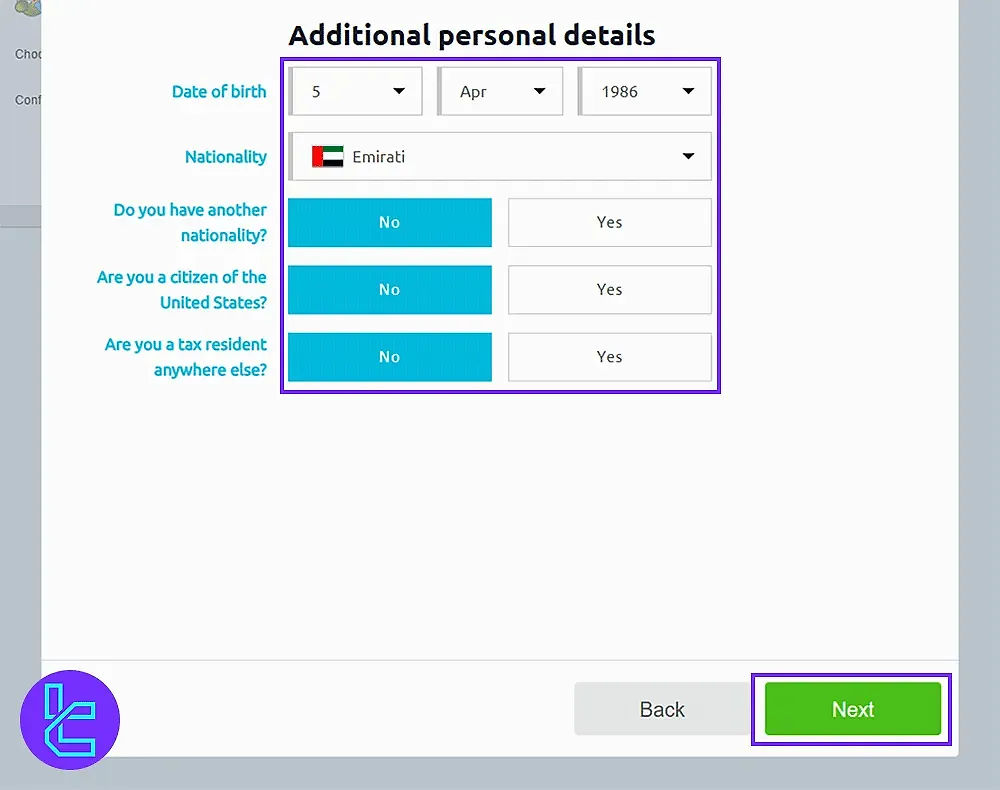

#9 Add Nationality and Tax Details

Submit your date of birth, nationality, any additional citizenships, U.S. tax status, and other relevant tax information. Click Next to advance.

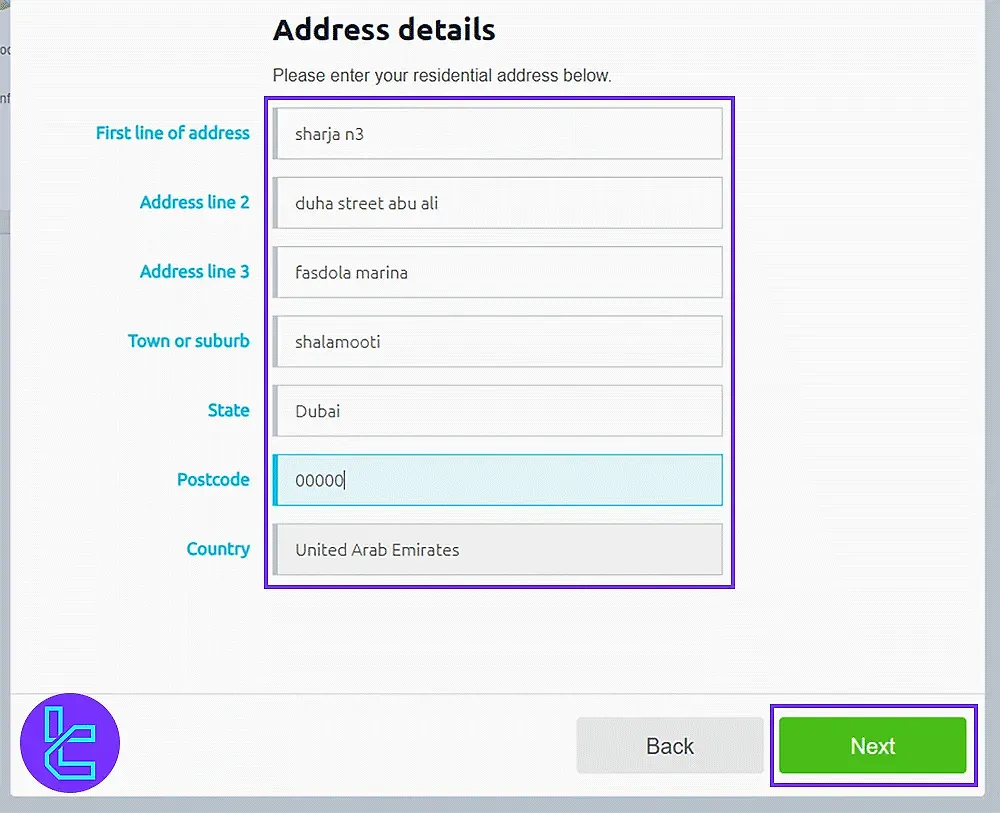

#10 Provide Residential Address

Enter your full address along with the postal code and continue to the next step.

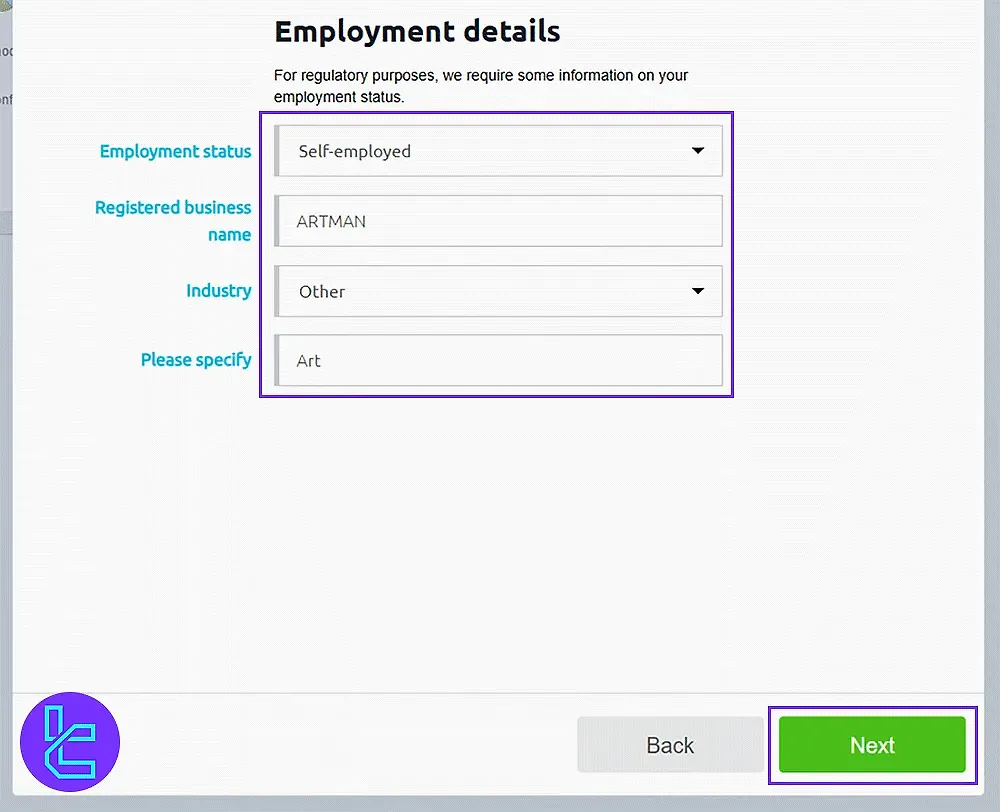

#11 Enter Employment Information

Fill in your current employment status and any additional financial details requested, then click Next.

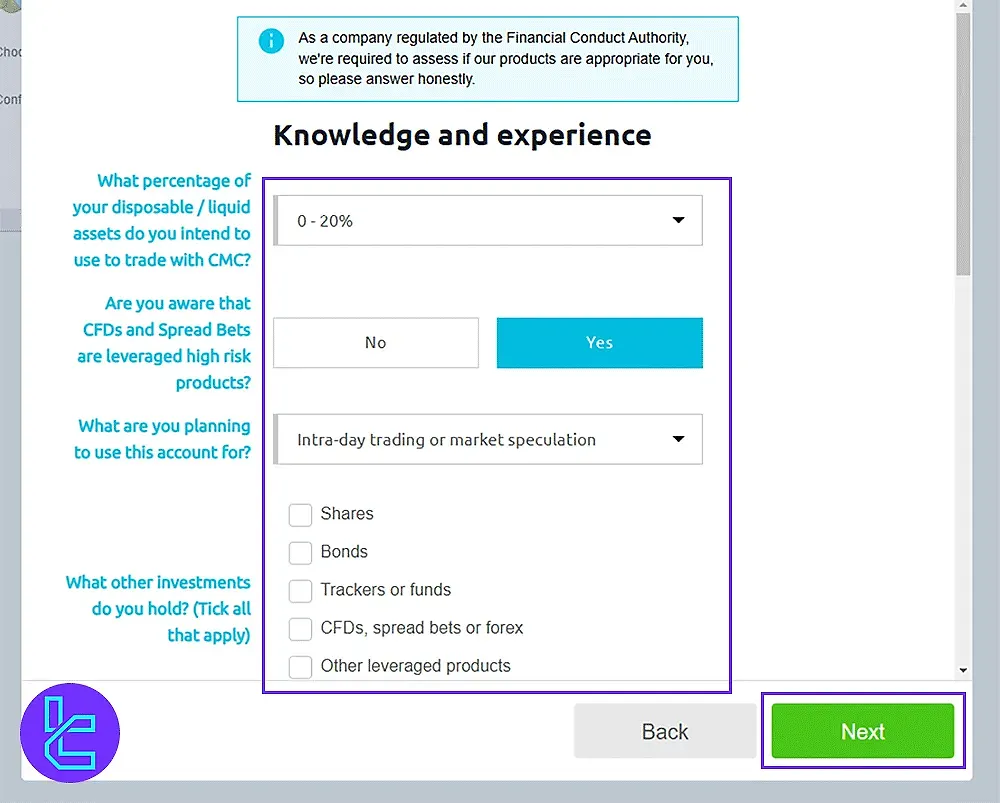

#12 Submit Financial and Trading Experience

Provide your financial background, including annual income and savings, and detail your prior trading experience. Click Next to submit this information.

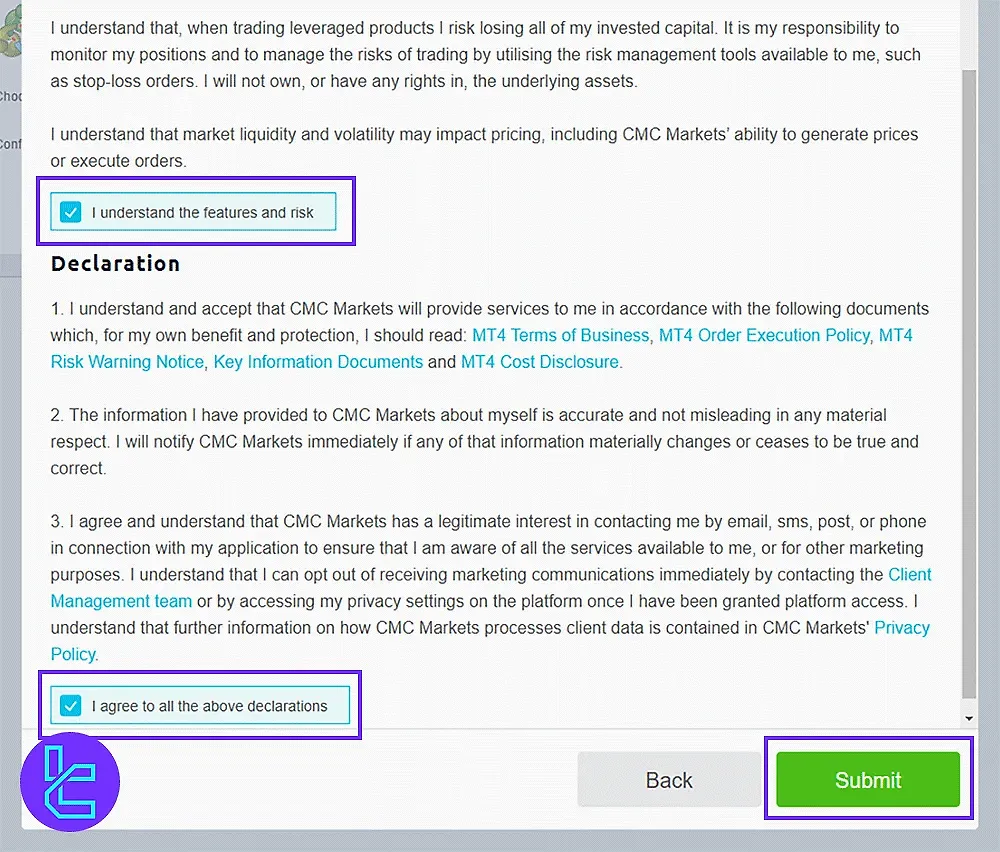

#13 Accept Terms and Complete Registration

Carefully review CMC Markets’ terms and conditions. Check the acceptance box and click Submit to finalize your registration.

CMC Markets Verification

CMC Markets verification requires both proof of identity (such as a passport, driver's license, or ID card) and proof of address (such as a bank statement or utility bill).

The broker will review your documents and verify your account in 1-2 days.

CMC Markets Trading Platforms

CMC Markets offers a range of trading platforms, including MetaTrader 4, to suit different preferences:

Next Generation Platform (web-based)

- Intuitive interface with advanced charting tools

- Customizable workspace and module linking

- Real-time news and market analysis

- 115 technical analysis indicators, 70 chart patterns, and 12 chart types

MetaTrader 4 (MT4)

- Industry-standard platform for Forex and CFD trading

- Advanced charting, technical analysis, and trading tools

- Support for automated trading (Expert Advisors)

- Available for desktop and mobile

Mobile Trading App

- Available for iOS and Android devices

- Full trading functionality on the go

- Real-time price alerts and notifications

Links:

CMC Markets Costs (Spreads and Commissions)

CMC Markets offers competitive pricing for Forex trading, with all costs incorporated into tight spreads.

For major currency pairs such as EUR/USD, the spread is typically around 0.6 pips, and no separate commissions are charged for Forex CFDs.

However, stock CFD trading is significantly more expensive. A flat commission of $0.02 per share applies, with a minimum charge of $10 per trade, notably higher than industry averages. For instance, trading Apple CFDs incurs a $10.1 fee.

CMC Markets' other fees:

- Inactivity fee: £10 monthly, if there is no trading activity for one year

- Deposit withdrawal fee: No

- Currency Conversion fee: 0.05%

Swap Fee at CMC Markets

CMC Markets UK applies overnight holding costs (swap/rollover) on CFD and spread-bet positions held past 5 pm New York time.

Holding cost is charged (or credited) daily depending on trade direction (long vs short) and underlying interest / interbank rate differentials.

Key points about swap fees:

- For share CFDs: fee = underlying interbank (risk-free) rate ± 0.0082%;

- For indices: fee = index interbank rate ± 0.0082%;

- For FX CFDs: Cost is based on tom-next rate + 0.5% (for buys) or tom-next rate –5% (for sells) annually, converted to daily;

- There is no swap free account offered in the UK branch; overnight rates are mandatory for positions held past cutoff.

Non-Trading Fee at CMC Markets

CMC Markets UK imposes minimal non-trading fees; most account maintenance or transaction costs (deposit/withdrawal) are waived.

However, clients may incur fees under specific conditions like market data subscriptions or inactivity.

Key points about non-trading fees:

- Deposits: No fee for depositing funds into UK accounts;

- Withdrawals: CMC does not charge internal withdrawal fees (but third-party bank charges may apply);

- Inactivity Fee: If no trading activity for 12 continuous months, a £10 monthly fee may apply.

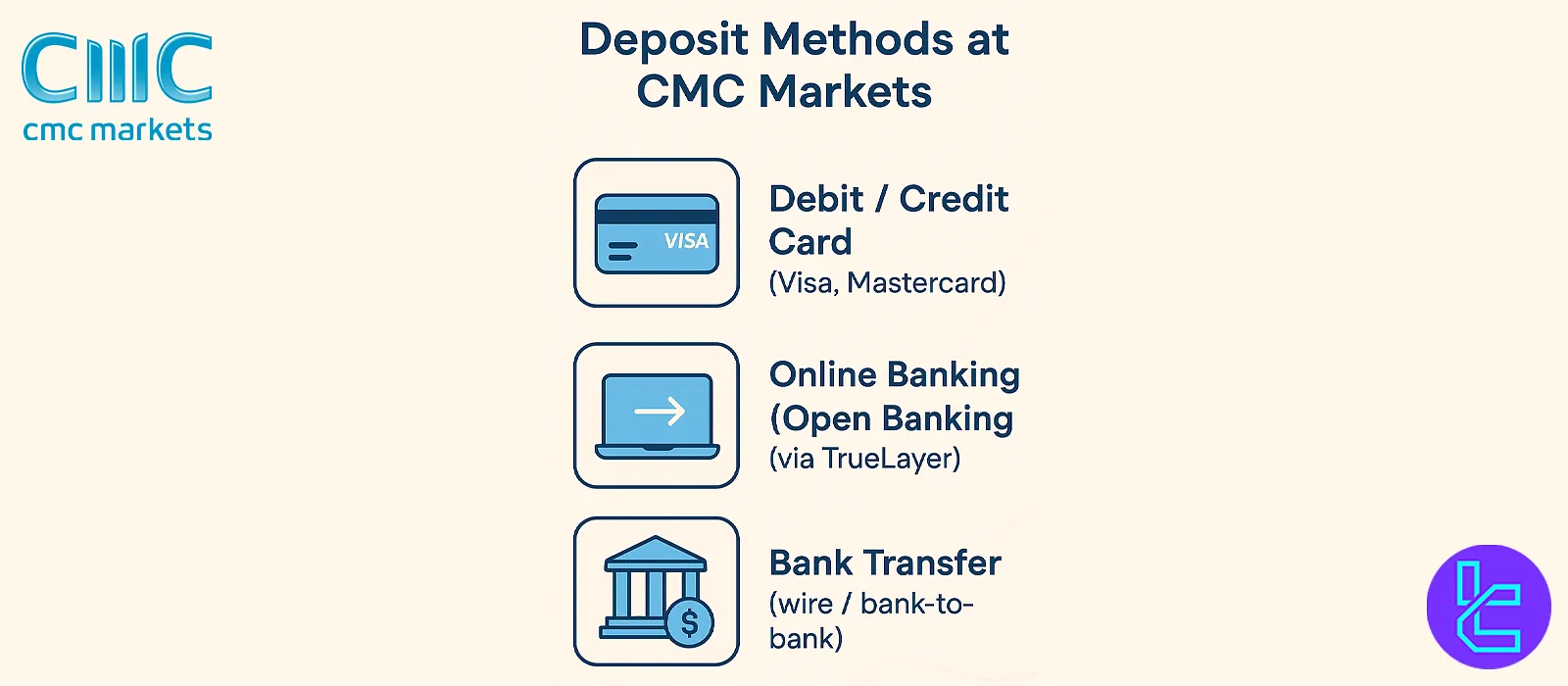

CMC Markets Broker Deposit & Withdrawal

CMC Markets offers several funding options:

- Credit/Debit Cards: Instant deposits

- Bank Transfer: 1-3 business days processing time

- Online Banking: Available in selected countries

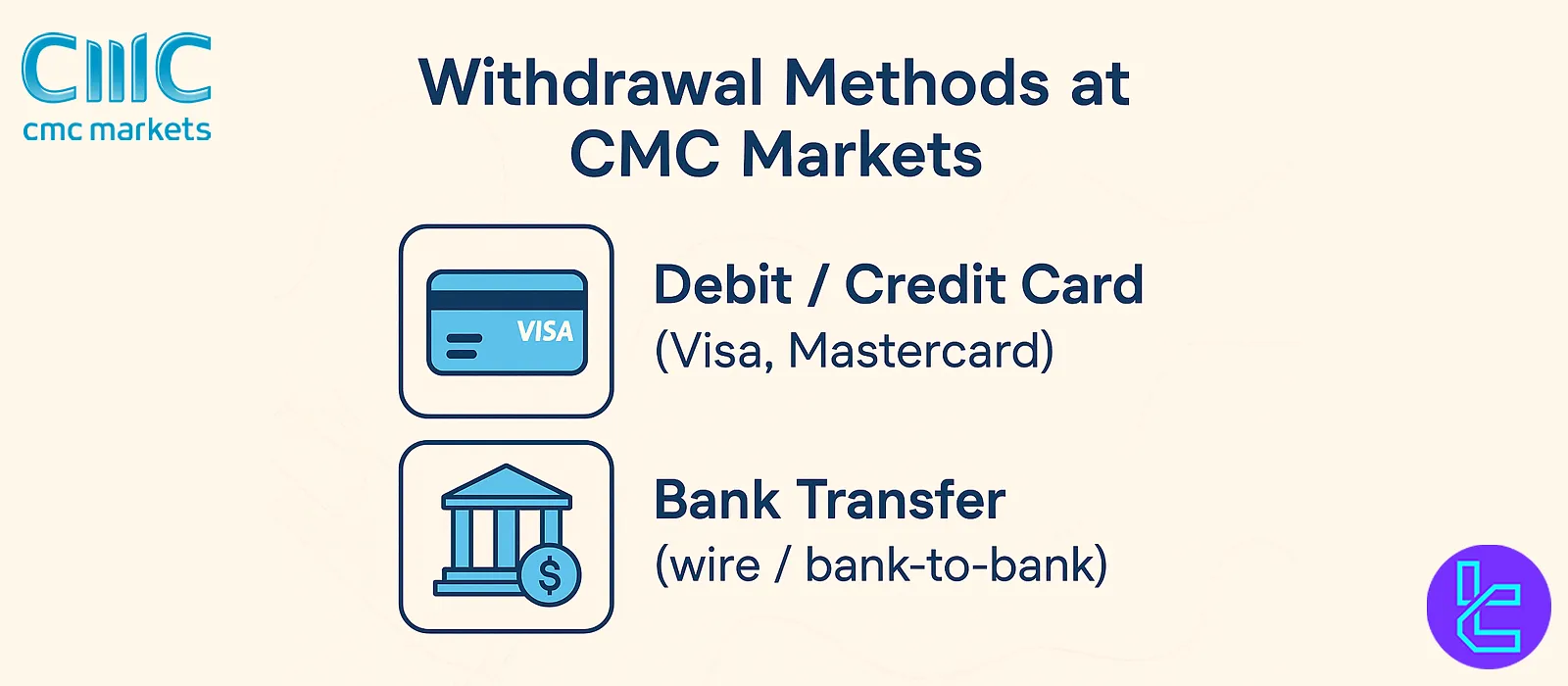

Withdrawals can take up to 5 business days. CMC Markets doesn't charge fees for deposits or withdrawals, but your bank may apply charges. Important notes about funding and payouts:

- There is no minimum deposit required to open a CMC Markets account;

- You can deposit as little money as you wish, and there are no deposit fees for bank transfers;

- Withdrawals to a registered bank account have no limit;

- Withdrawals to a card are limited to $40,000 or its equivalent in your account currency within a 24-hour period;

- Withdrawal limits for cards may also be influenced by the amount deposited with that card in the last 12 months.

CMC Markets Deposit Methods

CMC Markets UK offers three primary deposit options for clients including debit/credit cards (Visa and Mastercard), online banking via TrueLayer, and traditional bank transfers.

All funding methods are free of CMC charges, support GBP and other account currencies, and provide fast or instant processing depending on the bank.

For detailed comparison, please refer to the table below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Debit / Credit Card (Visa, Mastercard) | GBP (or account currency) | £0 | £0 (no fee by CMC) | Instant (subject to bank/card issuer) |

Online Banking / Open Banking (via TrueLayer) | GBP | £0 | £0 | Instant or as soon as bank clears |

Bank Transfer (wire / bank-to-bank) | GBP | £0 | £0 (plus any bank wire charges) | 1–2 business days |

CMC Markets Withdrawal Methods

CMC Markets UK provides withdrawals through debit/credit cards and bank transfers, ensuring quick access to funds with no internal withdrawal fees.

Processing times depend on the method and bank, with same‑day processing possible if requests are submitted before the cut-off.

For full method comparison, see the table below:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Debit / Credit Card | GBP (or account currency) | No explicit minimum | £0 (no internal fee) | Varies by card issuer (some within hours, others up to 5 working days) |

Bank Transfer | GBP | No explicit minimum | £0 (unless international charges apply) | 1–2 UK bank working days (3–5 days for international banks) |

CMC Markets Broker Copy Trading & Investment Options

CMC Markets doesn't offer a dedicated copy trading or social trading platform.

However, for those interested in copy trading, CMC Markets' integration with MetaTrader 4 allows the use of third-party copy trading services compatible with MT4.

Tradable Markets & Symbols in CMC Markets

CMC Markets offers an impressive range of tradable instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency Pairs | 330+ | 200+ | 1:500 |

Indices | Stock Indices | 90+ | 80+ | 1:200 |

Commodities | Cash & Forward | 100+ | 80+ | 1:100 |

Shares | Global Equities | 10,000+ | 8,000+ | 1:20 |

ETFs | Exchange-Traded Funds | 1,000+ | 800+ | 1:20 |

Treasuries | Bonds | 50+ | 40+ | 1:100 |

Digital Assets | 11+ | 10+ | 1:2 | |

Share Baskets | Thematic baskets of related stocks | 50+ | 30+ | 1:20 |

This diverse offering allows traders to diversify their portfolios and take advantage of opportunities across multiple markets.

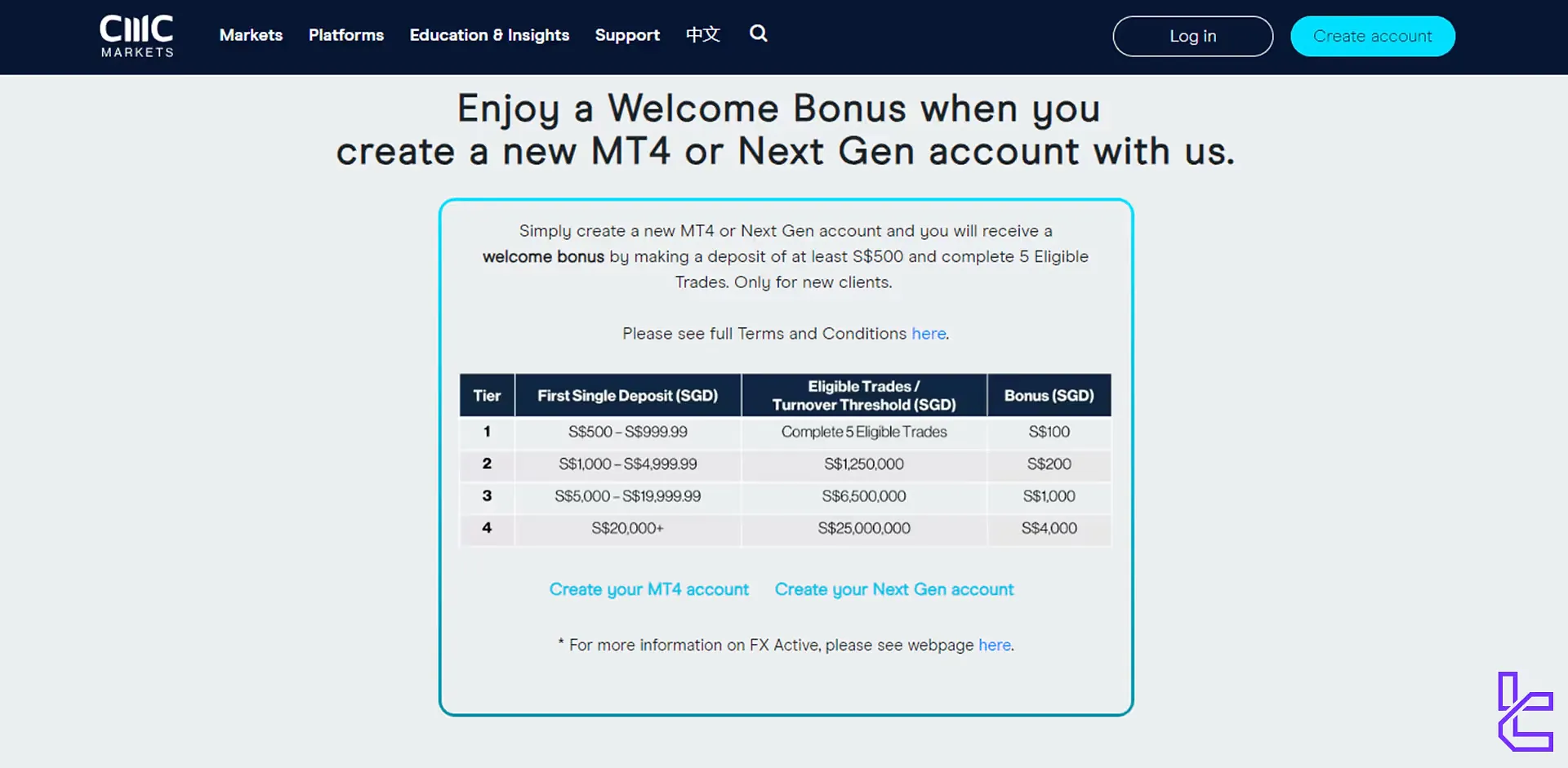

CMC Markets Bonuses and Promotional Programs

CMC Markets occasionally offers promotions, including:

- Refer a friend bonus: Both referrer and friend can receive a bonus (e.g., S$150 in Singapore)

- Welcome Bonus: Earn up to $4,000 on your first single deposit

It's important to note that promotions may vary by region and are subject to change. Always check the current offers on the CMC Markets website for your location.

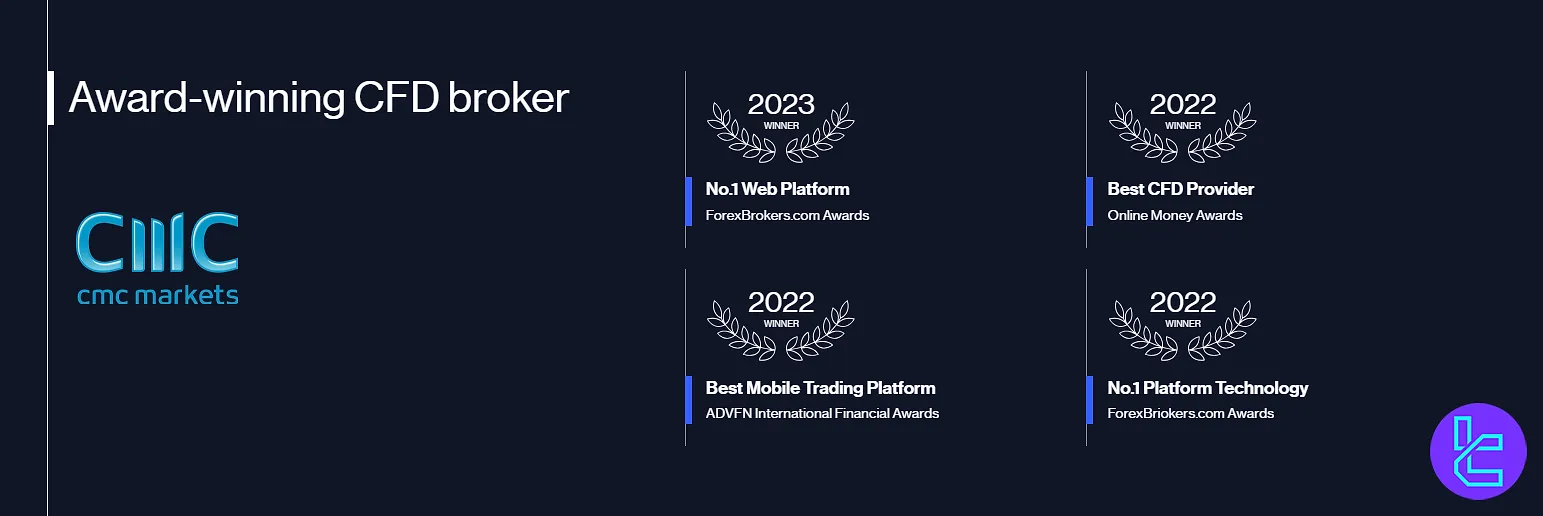

CMC Markets Awards

CMC Markets has been recognized with numerous industry accolades, underscoring its commitment to delivering exceptional trading services and innovative platforms.

CMC Markets awards reflect the company's dedication to enhancing the trading experience for its clients.

Here are significant awards CMC Markets has received:

- Best Mobile Trading Platform ADVFN International Financial Awards 2025

- Best Spread Betting & CFD Education Tools ADVFN International Financial Awards 2025

- 1 for Commissions & Fees ForexBrokers.com Awards 2025

- 1 Most Currency Pairs ForexBrokers.com Awards 2025

- Best Forex Broker Good Money Guide Awards 2023

- Best CFD Provider of the Year Shares Awards 2020

CMC Markets Support Channels

CMC Markets provides comprehensive customer support:

- Phone: +49 (0) 69 22 22 440 44

- Email: eusupport@cmcmarkets.com

- Live Chat: Available on the website during business hours

- FAQ Section: Extensive self-help resources

The quality of CMC Markets' customer support is generally well-regarded, with knowledgeable staff providing prompt and effective assistance.

They are adept at addressing both technical issues and trading-related queries, ensuring a smooth user experience. Clients often praise the team's professionalism and accessibility across multiple communication channels.

CMC Markets Restricted Countries and Regions

CMC Markets does not accept clients from certain countries due to regulatory restrictions. These include:

- United States

- Yemen

- Argentina

- Brazil

- Ukraine

- Belarus

- Iran

- Yemen

- North Korea

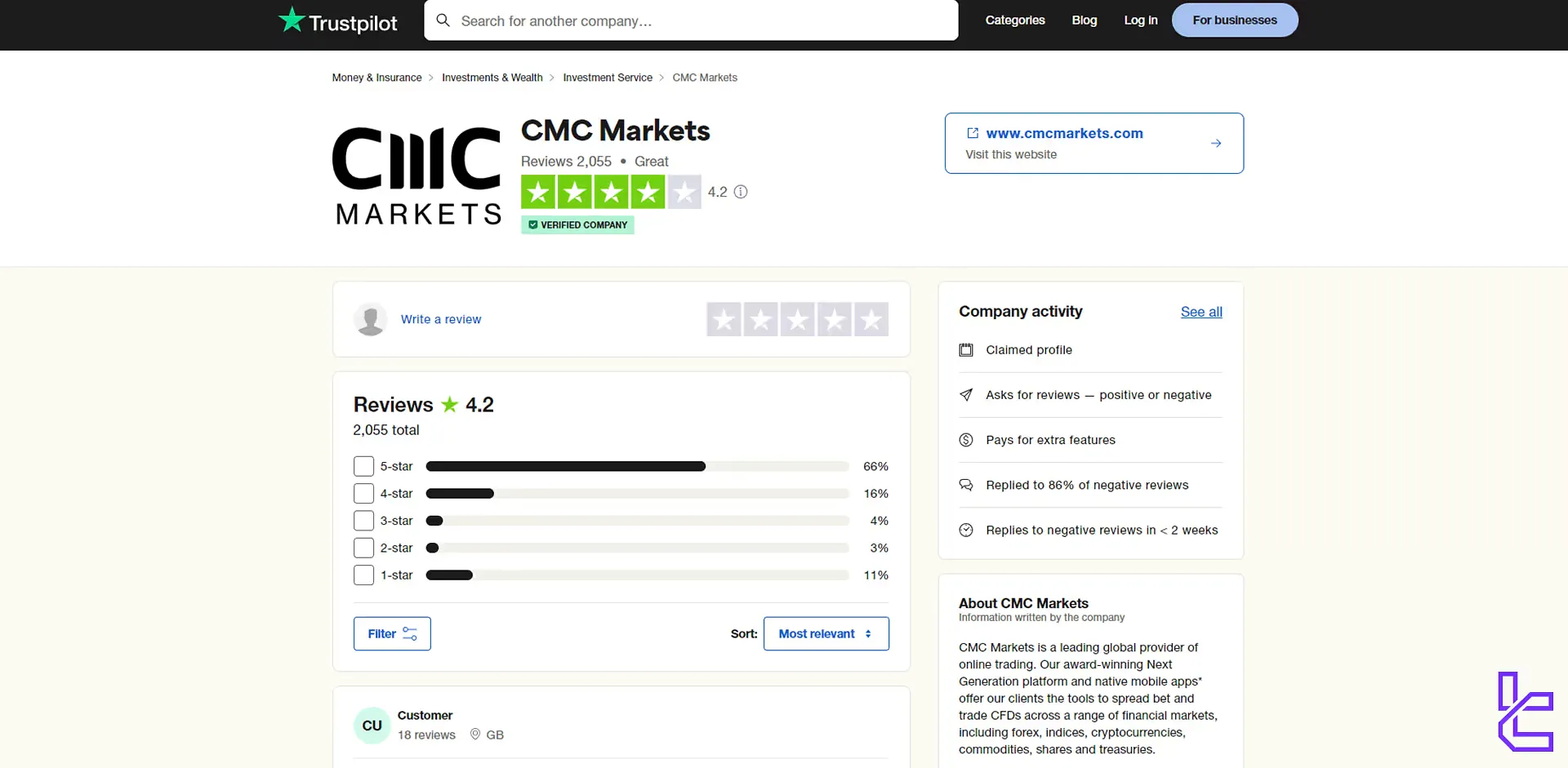

CMC Markets Broker Trust Scores

CMC Markets has generally positive reviews across various platforms. This broker has a 4.2/5 stars based on over 2000 reviews on the CMC Markets Trustpilot website.

The broker's commitment to addressing client concerns and maintaining transparency contributes to its overall positive reputation in the industry.

CMC Markets Educational Resources

CMC Markets offers a comprehensive education center:

- Platform Guides: Detailed tutorials on using the Next Generation and MT4 platforms

- Trading Library: Articles covering trading basics, strategies, and market analysis

- Webinars: Regular live sessions on various trading topics

- Market Analysis: Daily insights and commentary from CMC Markets analysts

CMC Markets in Comparison with Other Brokers

The table below helps you understand the pros and cons of trading with CMC Markets compared to other Forex brokers.

Parameters | CMC Markets Broker | |||

Regulation | FCA, ASIC, CySEC, DFSA, NFRA, FMA, BaFIN | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.6 Pips |

Commission | From $10 on shares | From $0.2 to USD 3.5 | From $3 | $0 (except on Shares account) |

Minimum Deposit | $0 | $10 | $200 | $5 |

Maximum Leverage | 1:500 | 1:Unlimited | 1:500 | 1:1000 |

Trading Platforms | MetaTrader 4, Next Generation Web Trading Platform | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App |

Account Types | Spread Betting, CFD Trading, FX Active | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 12000+ | 200+ | 2,250+ | 1400+ |

Trade Execution | Market | Market, Instant | Market | Market, Instant |

TF Expert Suggestion

CMC Markets provides low-cost trading services (spreads from 0.0 pips and no commission on various instruments except stocks) with a $0 minimum deposit barrier, which is perfect for newcomers.

However, the high shares trading fees ($10) and limited withdrawal methods with high processing times (up to 3 days) might make it unsuitable for some traders.