Exclusive Markets offers 5 live accounts [Exclusive, Standard, Standard Plus, Cent, and Shares] for trading in financial markets. The broker is launched in 2018 and also provides PAMM accounts for passive income.

You can trade more than 5000 financial instruments with a maximum leverage of 1:4000 on this brokerage, regulated by the FSA in Seychelles.

Exclusive Markets Company Details and Regulating Authorities

This Forex broker is a relatively young player in the Forex arena, having been established in 2020. Here are some key information:

- Regulation: Financial Services Authority (FSA) in Seychelles, license number SD031

- Registered Address: Suite 18, Third Floor, Vairam Building, Providence, Mahé, Seychelles

- Legal Name: Exclusive Markets Ltd

Below is a concise summary table outlining the regulatory status, client protection policies, and operational scope of Exclusive Markets under its licensed entity:

Entity Parameters / Branches | Exclusive Markets Ltd |

Regulation | FSA Seychelles (No. SD031) |

Regulation Tier | Tier 3 |

Country | Seychelles |

Investor Protection Fund / Compensation Scheme | None |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:4000 |

Client Eligibility | Global (except restricted countries: U.S., Canada, Iran, North Korea, Belarus, Syria, etc.) |

Specifications and Parameters

Let's take a quick look at Exclusive Markets' offerings in the table below:

Broker | Exclusive Markets |

Account Types | Exclusive, Standard, Standard Plus, Shares |

Regulating Authorities | FSA |

Based Currencies | USD, EUR, GBP, JPY |

Minimum Deposit | $10 |

Deposit Methods | Payment Systems such as Skrill, Neteller, Fasapay, etc. |

Withdrawal Methods | Payment Systems such as Skrill, Neteller, Fasapay, etc. |

Minimum Order | 0.01 |

Maximum Leverage | 1:4000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Forex, Metals, Commodities, Stock Index, CFD Stocks, CFD Cryptos, Equities, CFD ETFs |

Spread | Depending on the Account Type |

Commission | Depending on the Account Type |

Orders Execution | Market (Direct Market Access for Shares Account) |

Margin Call/Stop Out | Varies Depending on the Account |

Trading Features | Economic Calendar, Glossary, VPS Hosting |

Affiliate Program | Yes |

Bonus & Promotions | Exclusive Trading Cashback, Partnership Rebate |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Live Chat, Email, Ticket, Phone Call |

Customer Support Hours | 24/7 |

Available Trading Accounts

The exchange offers 5 distinct account types, differentiating in minimum deposit, trading platforms, leverage, and more.

You will see a detailed comparison of these accounts in the table below:

Account Type | Exclusive | Standard | Standard Plus | Cent | Shares |

Base Currency | USD, EUR, GBP, JPY | USD, EUR, GBP, JPY | USD, EUR, GBP, JPY | USD Cents, EUR Cents, GBP Cents, JPY Cents | USD |

Min. Deposit | $2,000 | $500 | $1,000 | $10 | $5,000 |

Max. Leverage | 1:4000 (Dynamic) | 1:4000 (Dynamic) | 1:4000 (Dynamic) | 1:500 (Fixed) | 1:1 |

Stop Out Level | %50 | %20 | %50 | %20 | N/A |

Margin Call | %100 | %50 | %100 | %50 | %100 |

Trading Instruments | Forex, Metals, Indices, Commodities, Crypto, Stocks, ETFs | Forex, Metals, Indices, Commodities, Crypto, Stocks, ETFs | Forex, Metals, Indices, Commodities, Crypto, Stocks, ETFs | Forex, Metals | Stocks |

Swap Free Option | Yes | Yes | Yes | Yes | N/A |

Trading Platform | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT5 |

Negative Balance Protection | Yes | Yes | Yes | Yes | N/A |

Aside from these, a demo account is available for all traders on the broker.

Important Advantages and Disadvantages

This brokerage comes with 6 different account types, including a cent account, among other benefits, but it has its drawbacks, too. Let's investigate them in the table below:

Advantages | Disadvantages |

High Leverage Options Up to 1:4000 | Inactivity Fee is Charged by the Broker |

Decent Variety in Account Types | - |

Popular Trading Platform Choices | - |

Copy Trading and PAMM Options Available | - |

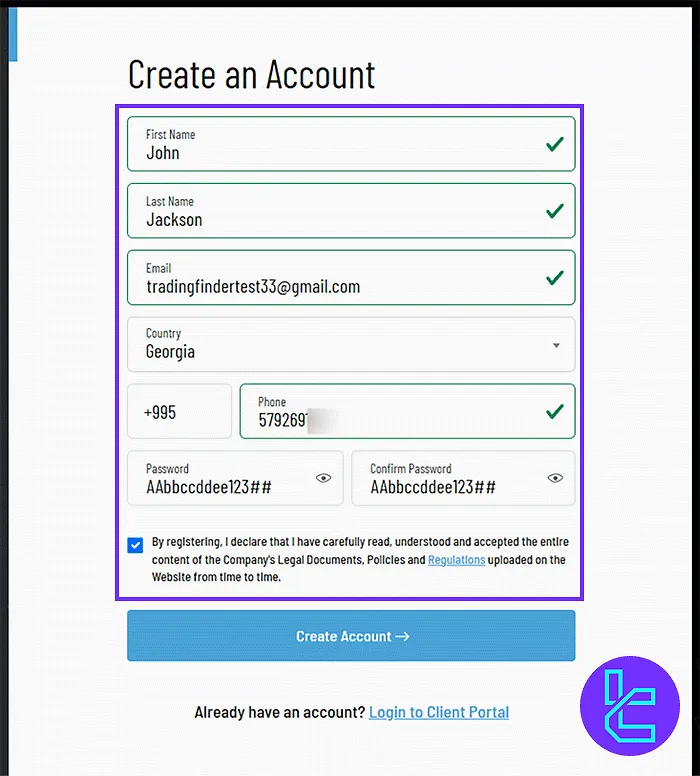

How to Sign Up and Verify Your Identity on Exclusive Markets

Creating an account with Exclusive Markets is a simple 5-step process, taking around 6 minutes. Once you’ve signed up, you’ll need to provide additional details for identity verification and full access to trading features.

#1 Begin Registration

Visit the Exclusive Markets homepage and click “Open an Account” to access the sign-up form.

#2 Enter Contact Information

Fill in the required fields:

- First and last name

- Email address

- Mobile number

- Country of residence

- Password

Agree to the terms and click “Create Account.”

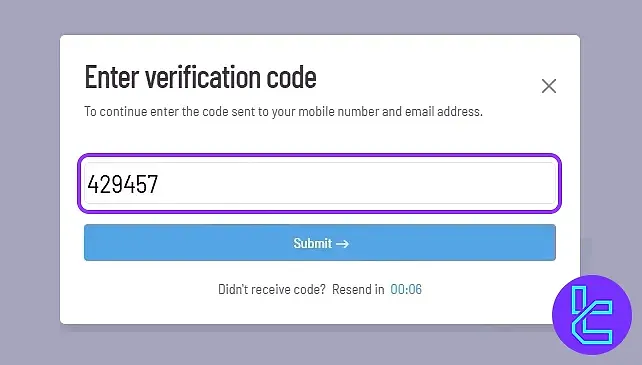

#3 Email & SMS Verification

Check your inbox and mobile for the verification code. Enter the code on the site to confirm your account.

#4 Provide Personal Details

Submit your information in the corresponding fields:

- Date of birth

- Full address and postal code

- Nationality

- Tax ID number

- Employment status

- ID card number

- Account type (Individual)

#5 Complete Legal & Financial Info

Answer questions about your income level, political exposure, and other required disclosures to finalize registration.

#6 Exclusive Markets Verification

After registration, log in to your dashboard and upload a valid ID/passport and proof of address to activate your account for full trading functionality.

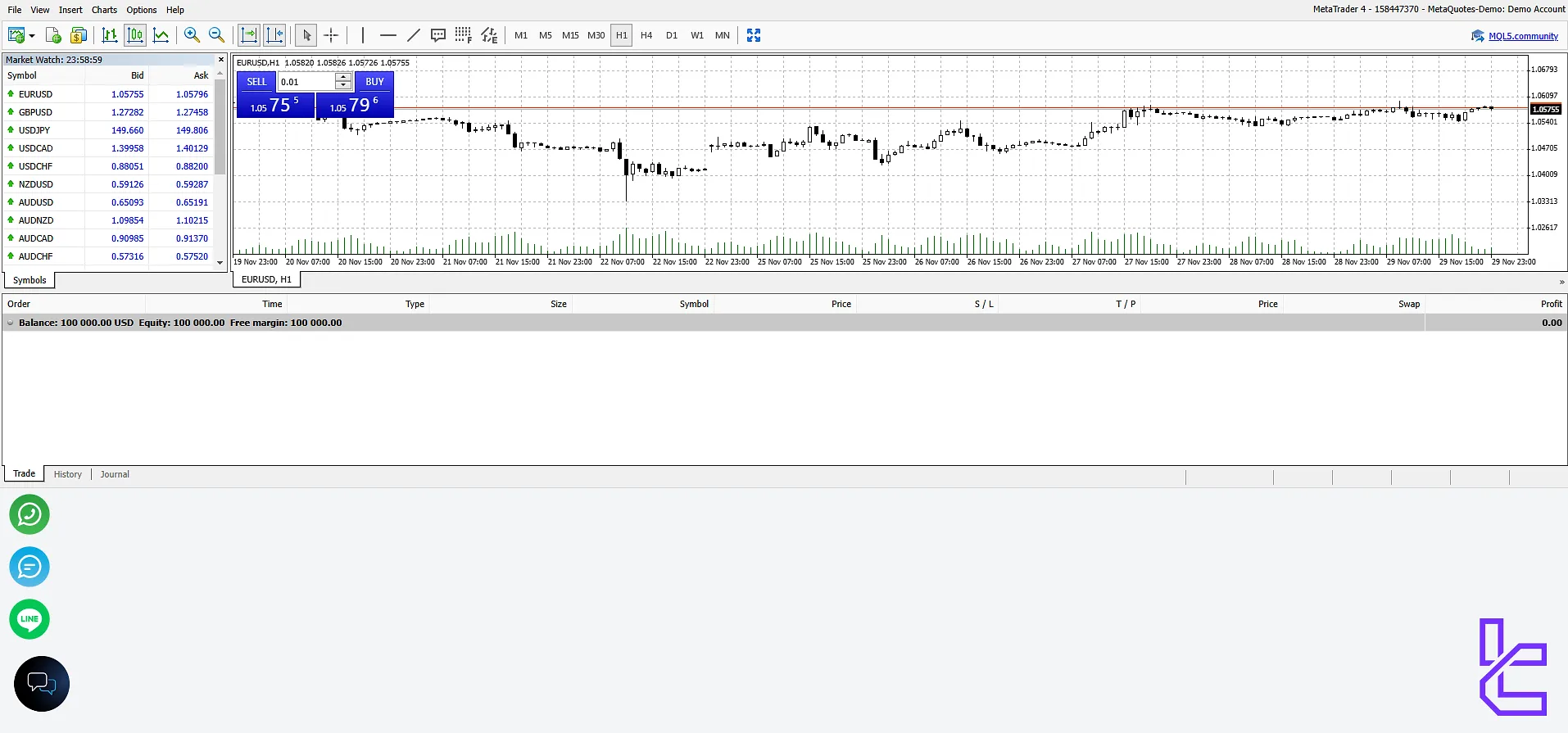

Trading Terminals and Platforms

Exclusive Markets takes a typical approach in the case of trading platforms, providing access to MetaTrader 4 and MetaTrader 5, two popular options among traders worldwide.

They both provide useful features like various timeframes, technical indicators & trading tools, and so on, but MT5 is more feature-rich. The applications are available on these operating systems:

- MT4:

- MT5:

Trading/Non-Trading Commissions

The broker has provided useful information regarding trading fees based on the account type. We will examine these numbers in the table below:

Account Type | Exclusive | Standard | Standard Plus | Cent | Shares |

Commission per Lot | $7 | Zero | Zero | Zero | From $0.03 per Stock |

Spread | From 0 Pips | From 1.6 Pips | From 0.8 Pips | From 1.6 Pips | Raw |

Based on our team's investigations, there are no costs for making deposits and withdrawals on the broker. However, an inactivity fee of $10 per month is charged by it.

Swap Fee at Exclusive Markets

Swap fees at Exclusive Markets are applied to all open CFD positions that remain overnight, with rates varying by instrument and trading direction. for example, a typical swap rate for EUR/USD may reach around 3.6 points on long positions.

For traders who wish to avoid these overnight financing costs, Exclusive Markets also offers swap-free or Islamic accounts under specific conditions. These accounts temporarily exempt certain instruments from overnight interest.

Here are some key highlights regarding swap and swap-free conditions at Exclusive Markets:

- Swap-free status applies only to eligible instruments listed in the broker’s internal appendix;

- The swap-free benefit is valid for the first 5 consecutive days that a position remains open;

- After the fifth day, standard swap charges automatically resume;

- Swap rates are published and updated regularly in the platform’s “Contract Specifications”;

- Swap fees are applied to both long and short CFD positions as part of the broker’s standard overnight financing policy.

Non-Trading Fees at Exclusive Markets

Exclusive Markets generally does not charge fees on most deposits or withdrawals, making funding and withdrawals cost-effective for active traders.

However, some payment channels and inactive accounts are subject to specific charges as stated in the broker’s official terms.

Below are the main non-trading fee details to consider:

- Deposits & withdrawals: 0 broker fee for most methods, though banks or payment processors may apply their own charges;

- Dormant / inactive account fee: $10 monthly after 3 months without trading or funding activity;

- Inactivity definition: No deposits, withdrawals, or trades for 90 consecutive days;

- Funding via Interpolitan: £30 fee applies to deposits below £8,500.

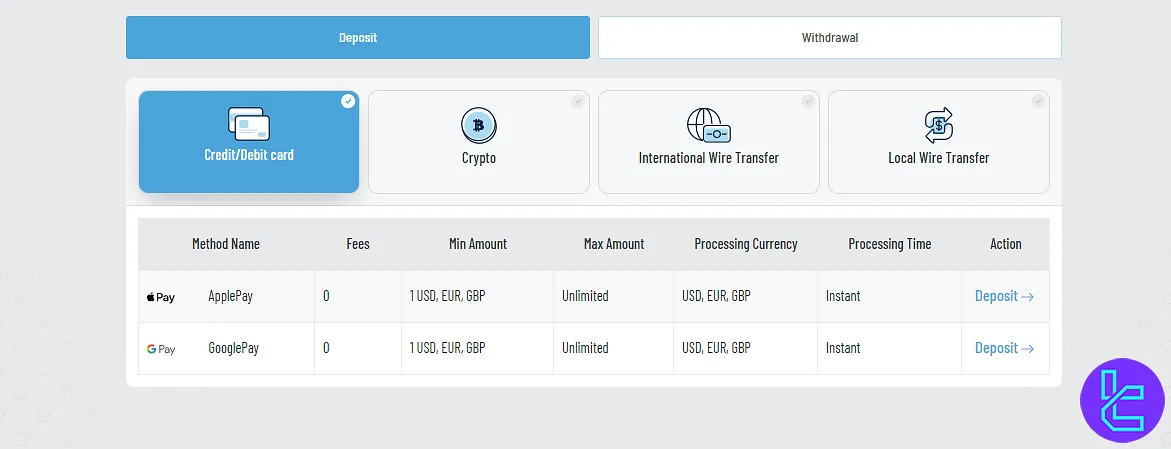

What Choices Do You Have for Deposits and Withdrawals on Exclusive Markets?

The brokerage offers a decent number of more than 10 payment options for both deposits and withdrawals. Here's a quick look:

- International and local wire transfer

- Crypto

- Credit and debit cards

- Neteller

- Skrill

- Apple Pay

- Google Pay

Deposit Methods at Exclusive Markets

Exclusive Markets supports a variety of deposit methods ranging from bank transfers to e-wallets and crypto, each with specific minimums and processing times to cater to global traders.

The broker emphasizes fast funding and no broker fees in many cases, though some local or less common methods may differ. Below is a table summarizing key deposit options and their parameters.

Below is a summary of common funding method details:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Payment Asia | PHP, INR, PKR, ZAR, VND, IDR, BLR | 1 USD, EUR, GBP | 0 | Instant |

Beeteller | BRL | 1 USD, EUR, GBP | 0 | Instant |

Equals | USD, EUR, GBP | Unlimited | 0 | 1–5 Business Days |

Interpolitan | USD, EUR, GBP | Unlimited | 30 GBP for deposits under 8,500 GBP | 1–5 Business Days |

Openpayd | USD, EUR, GBP | Unlimited | 0 | 1–5 Business Days |

Apple Pay | USD, EUR, GBP | 1 USD, EUR, GBP | 0 | Instant |

Google Pay | USD, EUR, GBP | 1 USD, EUR, GBP | 0 | Instant |

Cryptocurrency (BinancePay, NACE) | BTC, USDT, ETH, others | Depends on crypto & method | 0 | Instant |

Exclusive Markets TRC20 Deposit

Funding an Exclusive Markets account with Tether (USDT) via the TRC20 (Tron) network is a straightforward process designed for speed, low fees, and transparency.

Exclusive Markets TRC20 Deposit supports instant crypto transactions and can be completed within minutes when all wallet details are entered correctly.

Below is the concise step-by-step outline of the USDT-TRC20 funding procedure:

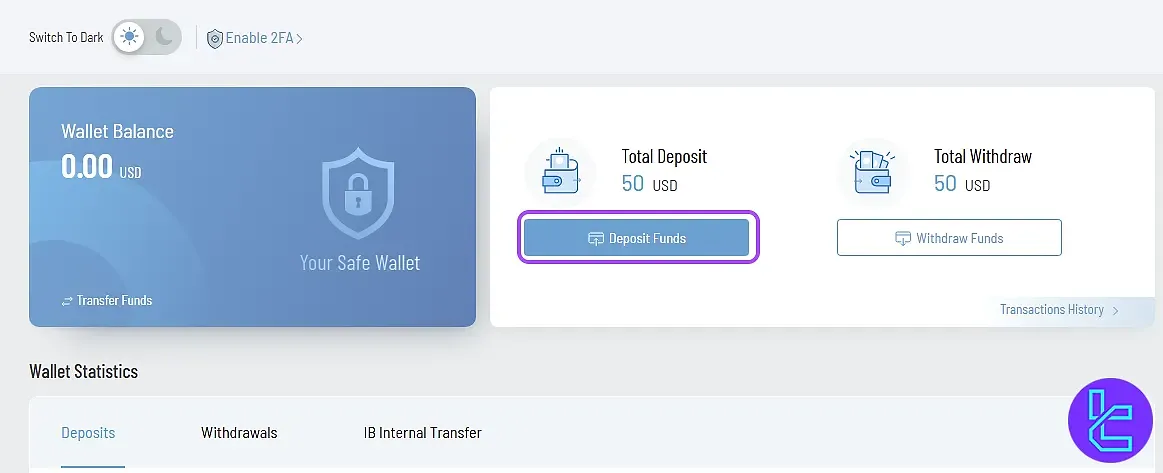

#1 Access the Deposit Section

Sign in to your Exclusive Markets client area and click “Deposit Funds” located at the top menu to initiate the top-up process.

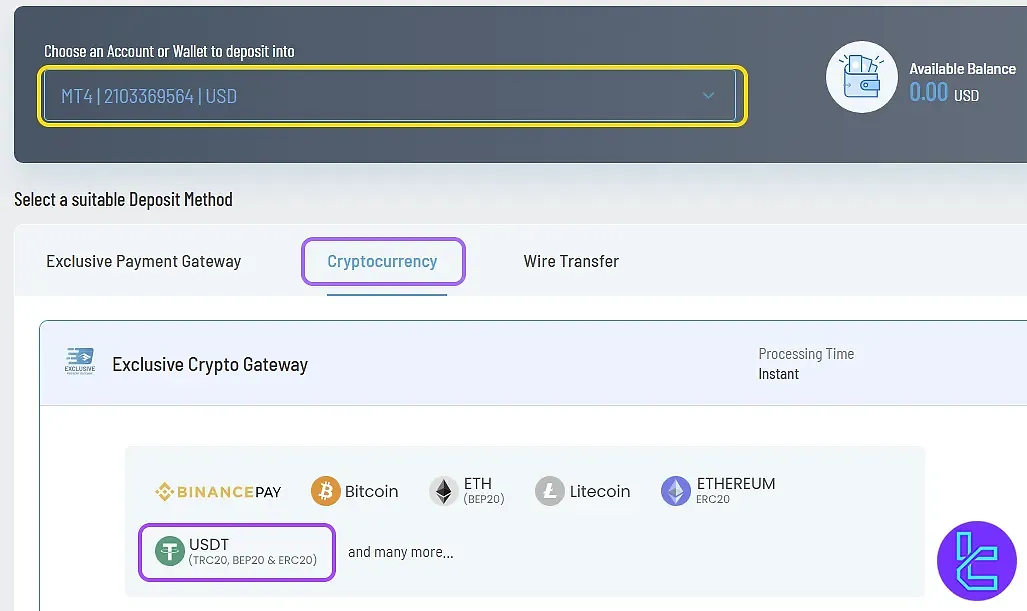

#2 Select Account and Network

Choose your preferred trading account, open the “Cryptocurrency” tab, and select USDT as your deposit asset.

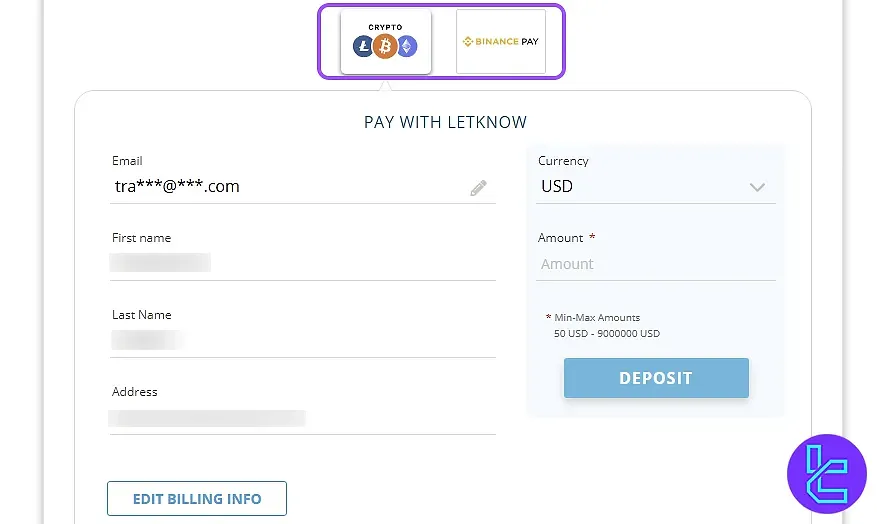

#3 Configure Payment Details

Now, follow these steps carefully:

- Click “Open Terminal” to select a wallet option such as Binance Pay or any other supported crypto wallet;

- Next, set your deposit currency to USD and enter the desired amount between $50 (minimum) and $9,000,000 (maximum).

Finally, choose USDT-TRC20 and click “Proceed” to generate your unique wallet address.

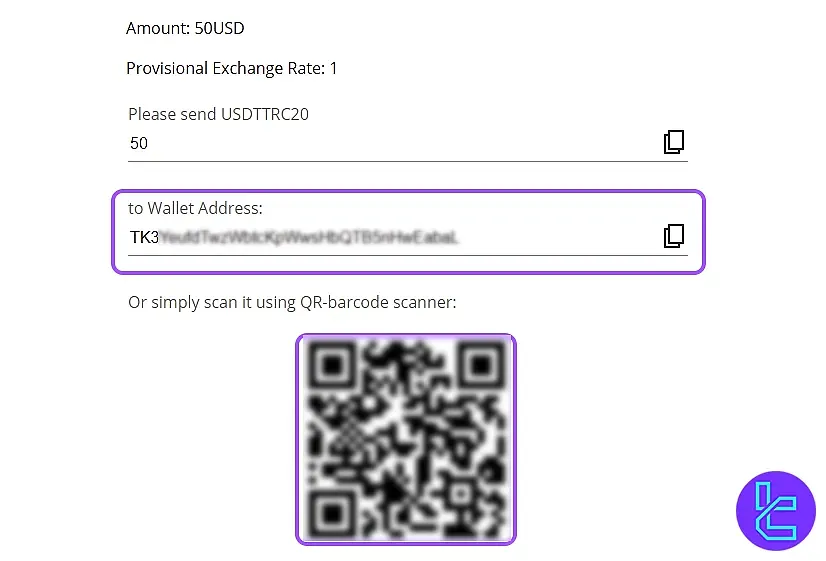

#4 Transfer via QR or Wallet Address

Scan the displayed QR code or copy the wallet address, then complete the transfer directly from your personal wallet to the provided TRC20 address.

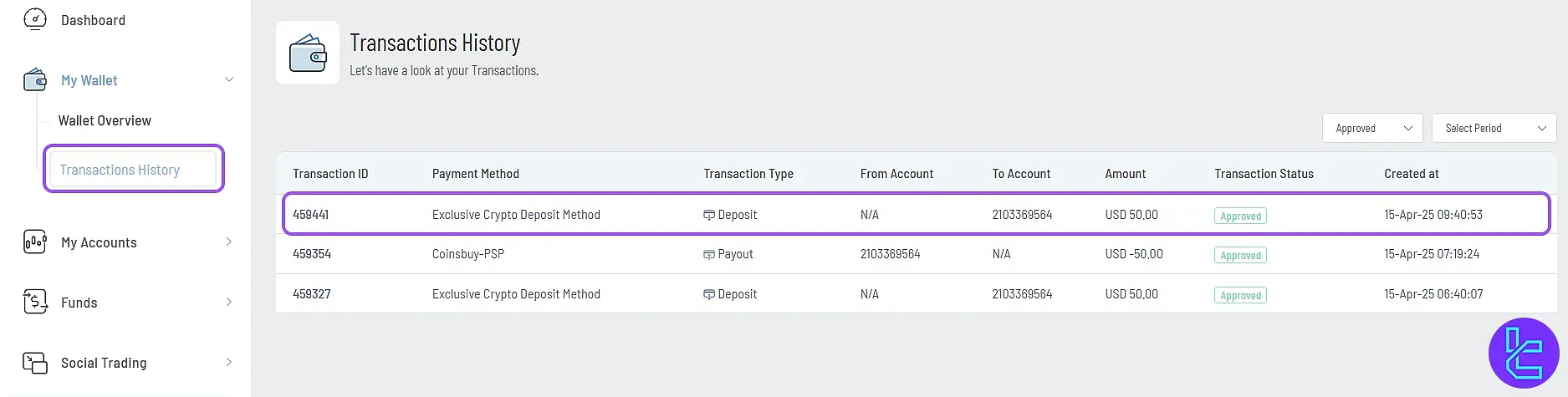

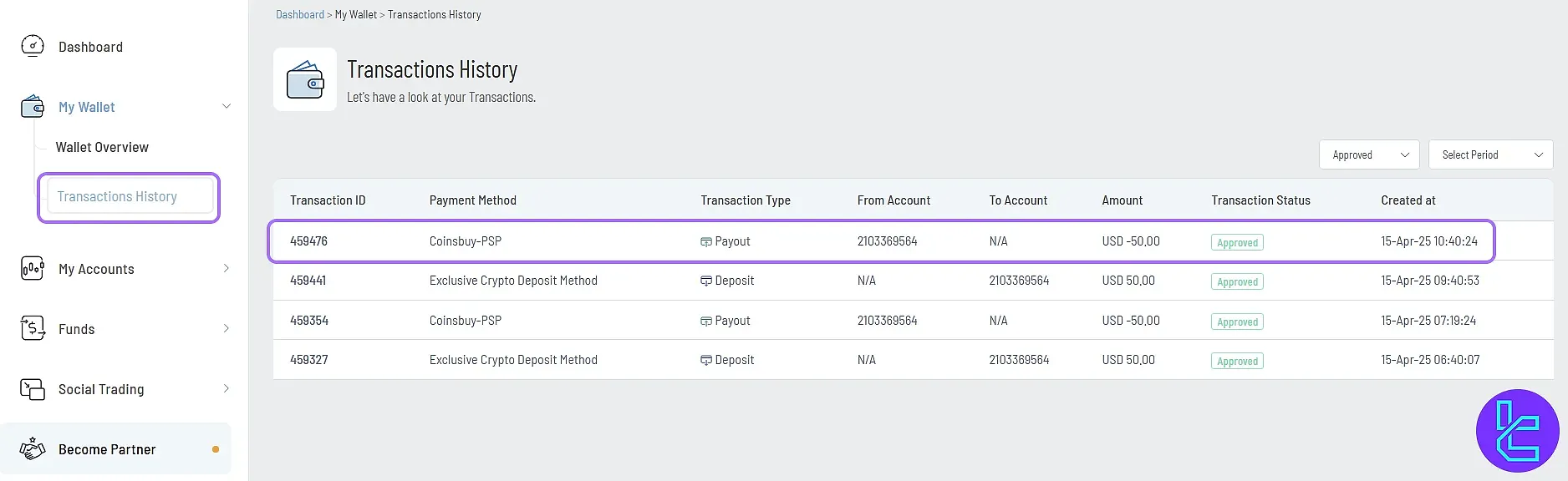

#5 Confirm Deposit Status

Navigate to “My Wallet” then “Transaction History” and verify that the transaction appears as successful once the blockchain confirmation is complete.

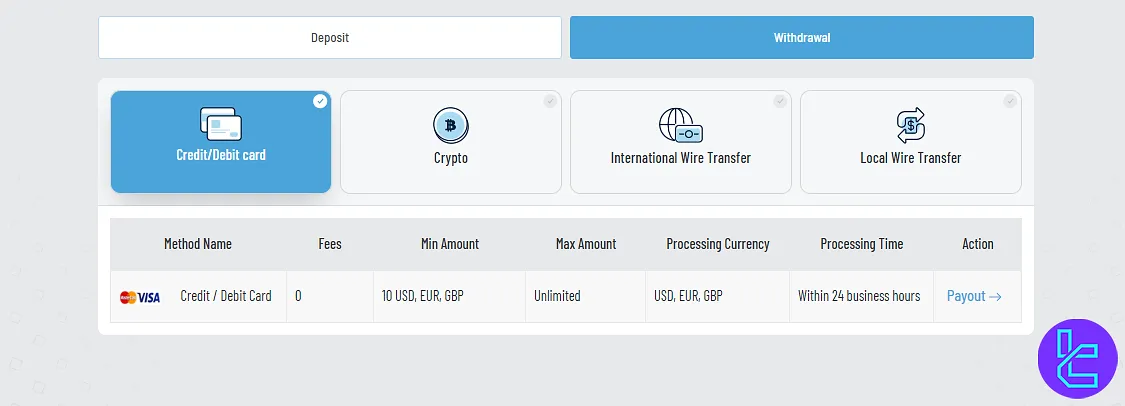

Withdrawal Methods at Exclusive Markets

Exclusive Markets mandates that withdrawals always follow a “return-to-source” rule, meaning funds are normally sent back via the same channel used for deposit; except in cases where the original payment method is unavailable for withdrawals.

All withdrawal requests are processed within 24 hours, though the final delivery time depends on the payment method (e.g. bank wire may take multiple business days). Withdrawal is only allowed after full client verification and matching the original funding method.

Below is a comparative table of their withdrawal options and conditions:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Credit / Debit Card | USD, EUR, GBP | 10 USD / EUR / GBP | 0 | Within 24 business hours |

Crypto | BTC, ETH, USDT (ERC20, BEP20, TRC20), USDC, LTC, and more | 50 USD / EUR / GBP | 0 | Within 24 business hours |

International Wire Transfer | USD, EUR, GBP | 50 USD / EUR / GBP | 0 | Within 24 business hours |

Local Wire Transfer | ARS, BDT, BRL, CLP, CNY, CRC, USD, INR, IDR, KES, MYR, MXN, NGN, PKR, PHP, ZAR, THB, UYU, VND | 15 USD / EUR / GBP | 0 | Within 24 business hours |

Exclusive Markets TRC20 Withdrawal

Withdrawing funds from Exclusive Markets using USDT on the Tron (TRC20) network allows traders to transfer assets quickly while keeping transaction costs minimal, typically under $1.

Exclusive Markets TRC20 Withdrawal method ensures fast blockchain confirmations and direct crypto transfers to your personal wallet.

To complete a TRC20 payout, follow the steps outlined below:

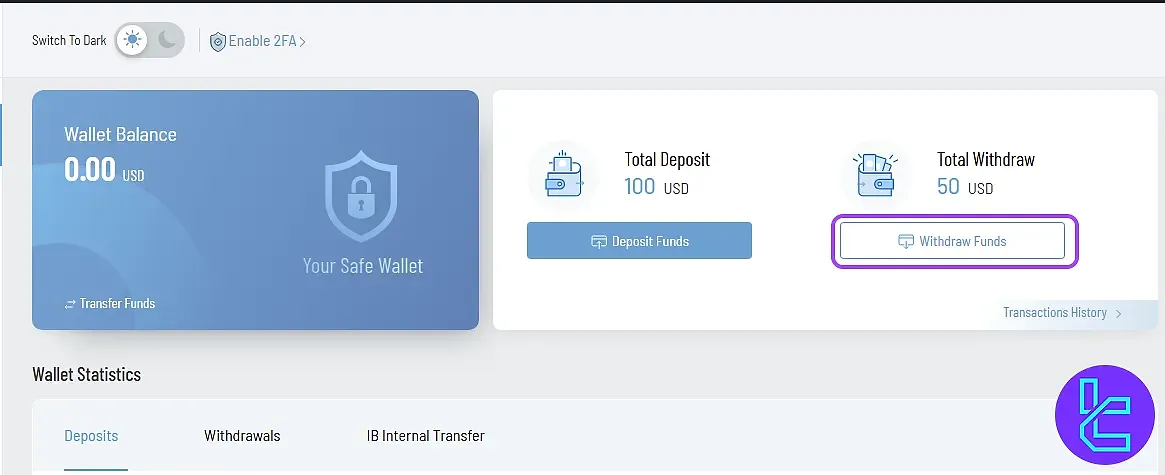

#1 Access the Withdrawal Dashboard

Log into your Exclusive Markets account and click “Withdraw Funds” located at the top of your dashboard.

#2 Select Account and Enter TRC20 Withdrawal Details

Follow these sub-steps to prepare your payout:

- Choose the trading account from which you want to withdraw funds. Select “Crypto”, pick USDT, and confirm TRC20 as the network;

- Paste your TRC20 wallet address into the designated field;

- Enter the withdrawal amount (minimum $50);

- Finally click “Proceed to Payout”.

#3 Email Code Verification

A verification code will be sent to your registered email. Retrieve the code, enter it into the platform, and click “Submit” to authenticate the withdrawal request.

#4 Monitor Withdrawal Status

Go to “My Wallet” then “Transaction History” to track the payout. The request will initially show as “Pending” and is usually completed within one business hour.

As stated on the official website, deposits are typically processed instantly, while withdrawals can take up to 24 business hours.

Investment Features and Social Trading Options

For those who prefer a more hands-off approach or want to learn from experienced traders, Exclusive Markets offers:

- Copy Trading: Allows you to automatically follow the trades and strategies of successful traders, without constant monitoring;

- PAMM (Percentage Allocation Management Module): Invest in professional money managers who trade on your behalf.

Trading Symbols and Instruments

Exclusive Markets offers a diverse range of more than 5,000 tradable symbols across 8 markets, including:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex / Currencies | Currency pairs (Majors, Minors, Exotics) | ~60+ pairs | 50–100 | 1:4000 |

Metals / Precious | Spot metals (Gold, Silver, etc.) | ~2+ | 5–20 | 1:4000 |

Commodities / Energy | Oil, natural gas, and other commodities | ~10+ | 10–30 | N/A |

Indices | Global indices (AUS200, US500, etc.) | ~13+ | 20–50 | 1:400 |

CFD Stocks | Contracts for Difference on global company shares | ~90+ | 100–200+ | N/A |

Equities | Direct equities trading (non-CFD instruments) | ~3000+ | 500–3000 | N/A |

CFD Cryptocurrencies | Cryptocurrencies (BTC, ETH, USDT, etc.) | ~20+ | 10–50 | N/A |

ETFs / CFD ETFs | Exchange-Traded Funds | ~40+ | 20–100 | N/A |

Traders can execute trades with a maximum leverage of 1:4000, depending on their strategy and risk tolerance. However, this leverage applies to Forex and metals markets, while it is lower for other instruments.

Bonuses and Promotions on Exclusive Markets Broker

The broker currently offers two bonuses and promotions; one is a deposit bonus and the other is rebate. We will quickly review them in the list below:

- Rebate on Partnership: Earn rebates by referring new clients to the broker;

- Exclusive Trading Cashback: Earn up to $500 cashback and get rewarded for every trade.

We will update this page in case of any changes in promotional offers of the brokerage.

Exclusive Markets Awards

Exclusive Markets has earned a distinguished reputation in global finance, consistently recognized for its transparency, innovation, and service excellence.

Exclusive Markets Awards reflect its strong performance across trading technology, client support, and partnership programs. Each recognition highlights its continuous growth and leadership within the financial industry.

Below are some of the most notable achievements:

- Best Partners Program 2024

- Top Trusted Financial Institution 2024

- Most Trusted Forex Broker Global 2024

- Best FX Broker Global 2024

- Best Customer Support Global 2024

- Leading Multi-Asset Broker 2022

How and When to Contact Support

The brokerage provides 24/7 customer support through 4 main channels:

- Live Chat: Available directly on their website, LINE, and WhatsApp

- Email: support@exclusivemarkets.com

- Phone: +44 20 8097 6094

- Ticket: On the "Contact Us" section of the website

Countries Restricted from Exclusive Markets' Services

While the broker accepts clients from many countries, they do have restrictions because of regulations and sanctions. Unfortunately, traders from the following countries are not accepted:

- Belarus

- Canada

- Cuba

- Islamic Republic of Iran

- Myanmar

- North Korea

- Russia

- South Sudan

- Syria

- United States

Trust Scores and Performance Evaluations

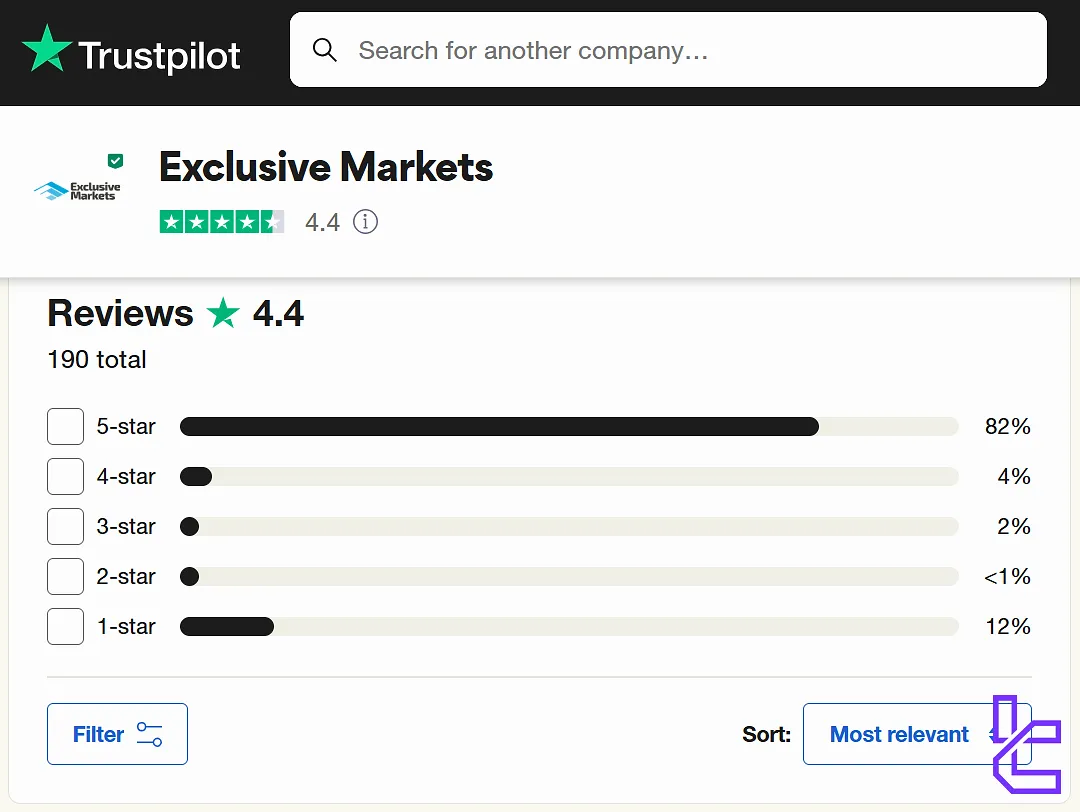

Users submit their trust scores on reputable websites, and Exclusive Markets Trustpilot ,which shows a strong reputation among forex brokers: Here are the Trustpilot and ForexPeace Army score details about the broker:

- Trustpilot: 4.4/5 stars with 190 reviews (82% 5-star)

- ForexPeaceArmy: 1.9/5 stars (Only 3 scores)

Education Section

This broker provides educational resources in 4 main forms on its website. You will find these via the "Education" tab in the header:

- Articles: Strategies, trading styles, basic & advanced concepts, and so on

- Forex Glossary: Important terms and words with their definitions and explanations

- Market News: Price analysis, news pieces, and more

- Videos: Various trading topics on the YouTube channel

This educational variety is available for both beginner and professional traders, allowing them to continuously improve their skills and generate income from the financial markets.

Exclusive Markets Comparison Table

Here is a quick overview of the differences between Exclusive Markets and some of the well-known brokers; Exclusive Markets Comparison:

Parameter | Exclusive Markets Broker | XM Broker | LiteForex Broker | FXGlory Broker |

Regulation | FSA | ASIC, FSC, DFSA, CySEC | CySEC | No |

Minimum Spread | 0 Pips | From 0.6 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $0 | $0 (except on Shares account) | From $0.0 | $0 |

Minimum Deposit | $10 | $5 | $50 | $1 |

Maximum Leverage | 1:4000 | 1:1000 | 1:30 | 1:3000 |

Trading Platforms | MetaTrader 4, MetaTrader 5 | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | MetaTrader 4, MetaTrader 5 |

Account Types | Exclusive, Standard, Standard Plus, Shares | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | No | Yes |

Number of Tradable Assets | 5,000+ | 1,400+ | N/A | 45 |

Trade Execution | Market (Direct Market Access for Shares Account) | Market, Instant | Market | Market, Instant |

Conclusion And Final Words

Exclusive Markets offers Exclusive trading cashback, Forex Glossary, VPS hosting, and other tools together with benefits such as more than 10 payment options and access to a Cent account.

The broker has achieved a 4.4/5 score with 190 reviews on the Trustpilot platform. The minimum deposit is $10 on the Cent account.