FINAM provides 25+ Forex trading symbols [EURUSD, USDCHF, NZDCAD, GBPJPY, AUDNZD, EURAUD, and more] with a maximum leverage of 1:40 and a minimum order amount of 1,000 currency units. The company utilizes MetaTrader 4 as its only trading platform.

This broker also operates under the regulation of the Central Bank of Russia (CBR).

FINAM Company Information & Regulation

The company is part of the FINAM Group, which was founded in 1994. Operating under the legal name LLC FINAM FOREX, this broker is regulated by the Central Bank of the Russian Federation and has a website in the Russian language.

The broker's headquarter is located at Office 17, Building 2, 7 Nastasinsky Pereulok, Moscow, 127006, Russia.

Despite advantages like negative balance protection and advanced MetaTrader 4 trading platforms, FINAM has received criticism for its floating spreads (which may widen significantly during volatility), absence of a search function on its site, limited payment options, and lackluster support quality.

Regulatory safety is considered relatively low by industry standards, although its longevity and association with a major holding company lend it a degree of credibility.

Read the summary of the broker’s information below:

Entity Parameters / Branches | LLC FINAM FOREX |

Regulation | Central Bank of Russia (CBR) |

Regulation Tier | 3 |

Country | Russia |

Investor Protection Fund / Compensation Scheme | N/A |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:40 |

Client Eligibility | Russian residents only |

FINAM Summary Of Key Details

In this section, we will have a quick look at the company's main specifics as a Forex broker. Here's a table containing essential information:

Broker | FINAM |

Account Types | Standard, Demo |

Regulating Authority | CBR |

Based Currencies | USD, EUR, RUB |

Minimum Deposit | $5 |

Deposit Methods | E-payment Systems, Credit/Debit Cards, Wire Transfer |

Withdrawal Methods | E-payment Systems, Credit/Debit Cards, Wire Transfer |

Minimum Order | 1,000 Currency Units |

Maximum Leverage | 1:40 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, MT5, FinamTrade, Comon, Transaq, Quik, WebQUIK |

Markets | Forex |

Spread | Low Spreads |

Commission | None |

Orders Execution | Instant |

Margin Call / Stop Out | N/A |

Trading Features | None |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | None |

PAMM Account | None |

Customer Support Ways | Phone, Ticket |

Customer Support Hours | 24/7 |

Trading Accounts With Details

FINAM offers only 1 account type for its clients with a maximum leverage of 1:40, a minimum order amount of 1,000 currency units, and an initial deposit of $5.

The broker does not provide much detail about the account specifics on its website. Also, a demo account is offered for trading in a simulated environment.

Notable Benefits and Drawbacks

Let's evaluate the pros and cons of choosing FINAM as a broker for trading assets:

Benefits | Drawbacks |

Regulated by the Central Bank of Russia | Only Russian Federation Citizens Accepted |

24/7 Support | Only Forex Symbols Offered for Trading |

Various Funding Options | Lack of Enough Data on The Website |

FINAM Account Opening and Authorization

This brokerage platform is exclusively available to Russian citizens, and traders from other countries are not eligible to open accounts.

The registration process is minimal, leading directly into the account verification phase, which requires valid personal and legal documentation issued in Russia.

#1 Begin Account Creation

Head to the broker’s official website and click on “Открыть счет” (Open an Account). You'll be directed to the sign-up form.

#2 Fill in Your Details

Fill out the sign up form with the following information:

- Full name

- Email address

- Russian mobile number

After submission, your account is created.

#3 Proceed with Verification

Access your profile area and upload the required identification documents. You may also be asked to complete additional personal information fields to verify your eligibility.

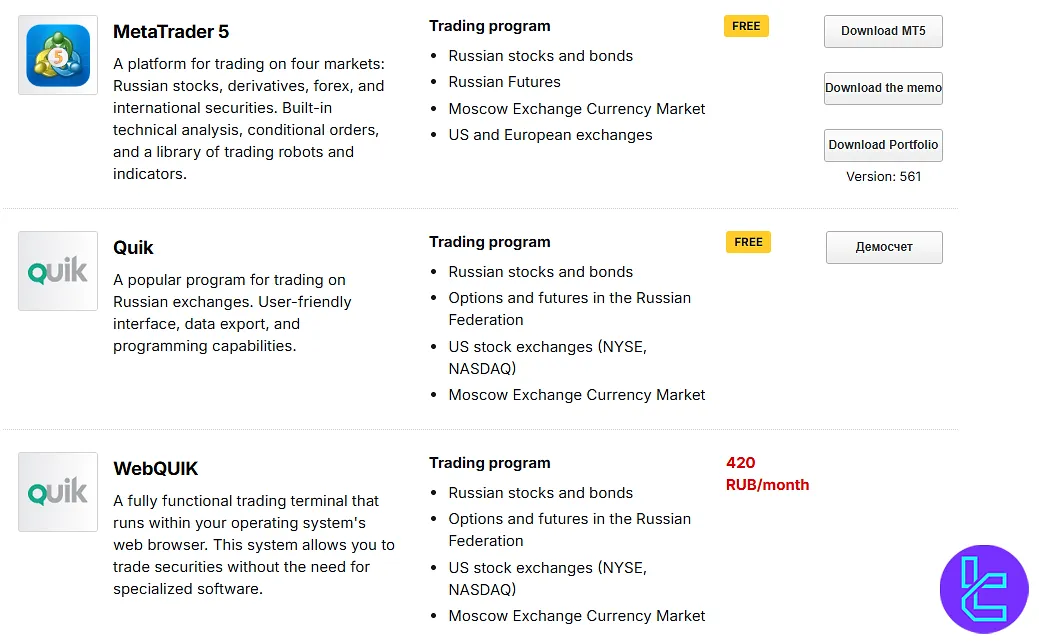

Trading Platforms Offered by FINAM

FINAM provides multiple trading terminals designed for both retail and professional investors.

These platforms are compatible with various operating systems and allow access to domestic and global financial markets.

Finam Trade

FINAM’s proprietary platform supports trading on the Moscow Exchange, St. Petersburg Exchange, and major international venues such as NYSE, NASDAQ, and LSE.

- Available for: Windows (desktop), Android, iOS/iPadOS, and Huawei (AppGallery);

- Markets: Russian and international stocks, bonds, futures, options, and Forex.

Transaq

A multi-market desktop terminal offering access to Russian equities, derivatives, and foreign securities. It provides built-in tools for technical analysis and real-time data from major exchanges and is Available for Windows (desktop).

MetaTrader 4 (MT4)

The standard terminal for Forex trading, featuring automated strategies, indicators, and charting tools. Available for:

- Windows

- Android

- iOS

MetaTrader 5 (MT5)

A newer generation multi-asset platform supporting trading on Russian, European, and U.S. exchanges, as well as derivatives and Forex. Available for:

- Windows

- Android

- iOS

QUIK

One of Russia’s most widely used trading systems, offering access to equities, futures, and currency markets with customizable modules and scripting options. It is Available for Windows (desktop).

WebQUIK

A browser-based version of QUIK that runs without installation, enabling full functionality through any modern web browser. This platform is Available for Web (cross-platform).

Comon (Autofollow)

An integrated service for Copy Trading, allowing users to automatically replicate the trades of professional investors directly within their FINAM account. Comon (Autofollow) is Available for Web (cross-platform).

Trading Spreads and Other Fees

According to our investigations on the broker's website and platform, FINAM does not provide any details about spreads. The website only states that there are "low spreads" and "no commissions".

There are no stated inactivity fees, but withdrawal charges may apply depending on the funding method and account level. Full transparency around the broker’s fee structure is limited, particularly for non-trading costs such as platform access or margin lending.

Swap Fee at FINAM

FINAM does not publish any specific swap or rollover rates on its official website. While the broker provides detailed information about trading and service commissions, overnight interest charges are omitted from public tariff documents.

Traders can only obtain exact swap conditions through their client agreements or by directly contacting FINAM’s support team.

Non-Trading Fees at FINAM

FINAM’s official tariff documents do not list any specific non-trading fees such as account maintenance or inactivity charges. The published tariffs focus solely on trading commissions and brokerage services, with no mention of additional service costs.

Deposit/Withdrawal Methods in FINAM Broker

This broker offers a list of common payment options that are often found in financial companies:

- Bank wire transfers

- Credit/debit cards (VISA, MasterCard, etc.)

- E-wallets (Skrill, FasaPay, WebMoney, YooMoney, and more)

Deposit Methods at FINAM

FINAM offers several deposit methods to help traders fund their accounts quickly and securely.

Clients can choose between traditional banking options, bank cards, or electronic payment systems depending on their preferences and account currency.

Here’s a quick overview of the main deposit options:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer (Russian) | RUB, USD, GBP, AUD, CHF, NZD | N/A | Free | 1–3 business days |

Credit/Debit Card | RUB, USD, GBP, AUD, CHF, NZD | N/A | Free | Instant to 1 business day |

E-Payments / e-wallets | RUB, USD, GBP, AUD, CHF, NZD | N/A | Free | Instant to few hours |

Withdrawal Methods at FINAM

FINAM allows withdrawals via bank transfers (especially in Russian rubles) with a processing period that typically spans up to two business days.

Below is a summary of the withdrawal methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer (Russian) | RUB, EUR etc. | N/A | Free | N/A |

Credit/Debit Card | RUB, EUR etc. | N/A | Free | N/A |

E-Payments / e-wallets | RUB, EUR etc. | N/A | Free | N/A |

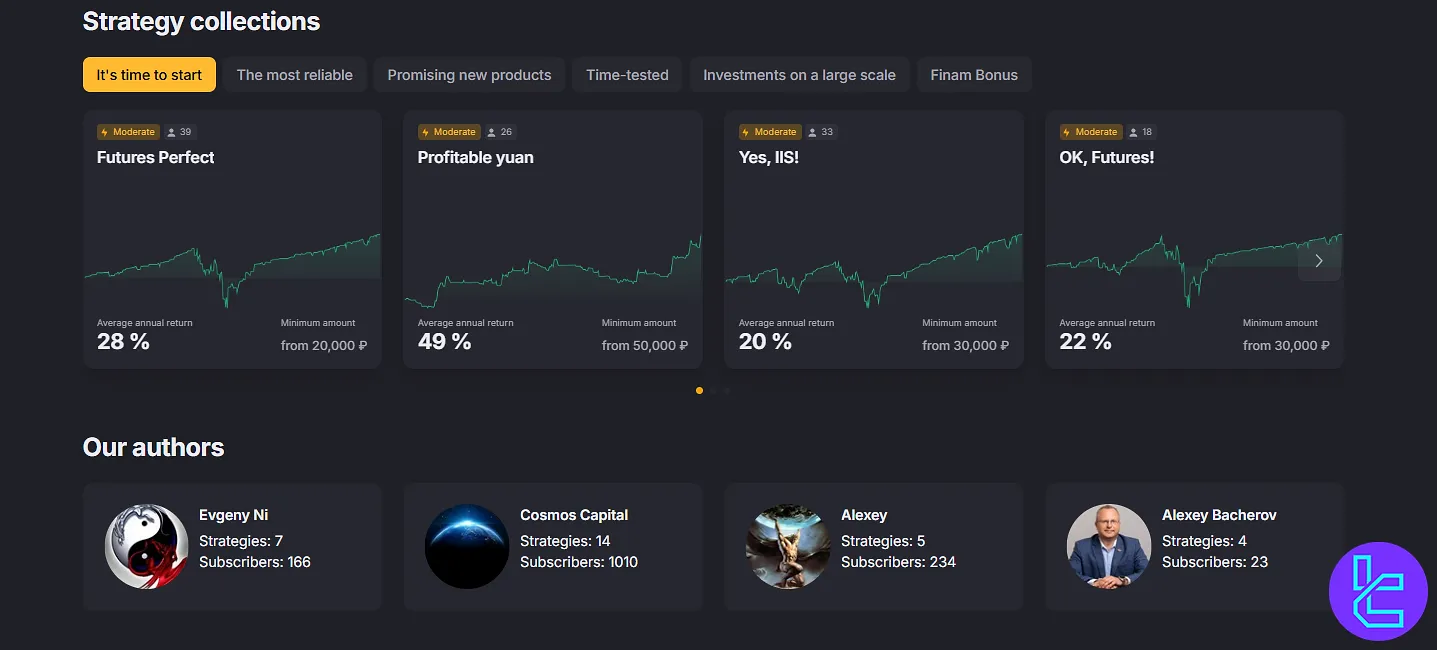

Are There Any Copy Trading or Other Investment Solutions in FINAM?

FINAM offers a Copy Trading service via its “Autofollow” feature, implemented through the Comon platform. Users can select strategies provided by other traders and automatically replicate their trades in real time.

All strategy providers must comply with the rules posted on the site before offering their strategies. The system is transparent; So users can view detailed performance metrics (returns, risk, history) before choosing whose trades to copy.

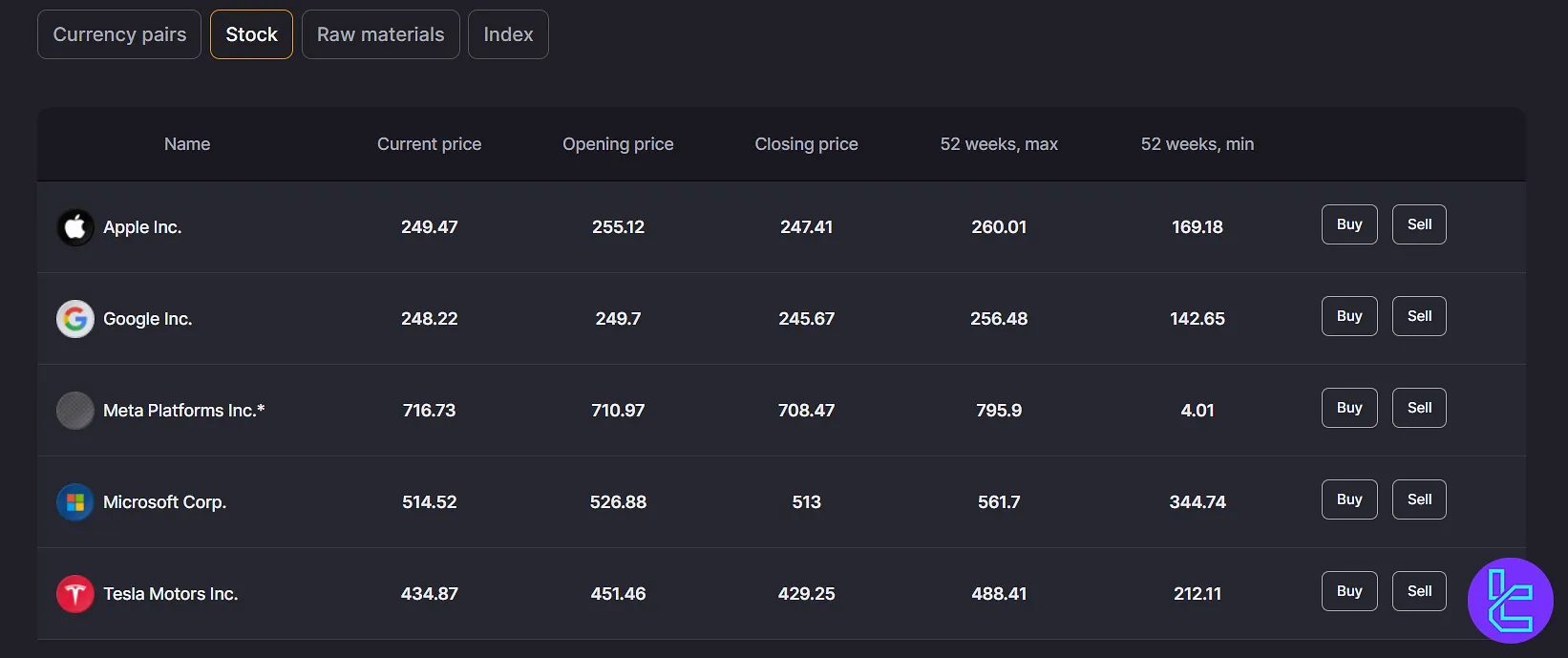

Available Trading Symbols

FINAM broker offers a variety of products and instruments in the Russian financial market as well as in the international market.

The list of these products and instruments is presented in the table below:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency pairs | 25+ | 50–100 | 1:40 |

Commodities | Precious metals, energy products | 30+ | 25–50 | 1:40 |

Indices | Stock indices | N/A | 20–50 | N/A |

Equities | Stocks (local and international) | N/A | 500–3000 | N/A |

Bonds | Government and corporate bonds | N/A | 5–20 | N/A |

ETFs | Exchange-Traded Funds | N/A | 30–100 | N/A |

Options | Financial options | N/A | 100–500 | N/A |

Cryptocurrency | Derivatives on BTC, ETH, SOL, etc. | 10+ | 5–30 | N/A |

FINAM provides access to a broad spectrum of investment opportunities, allowing traders to diversify their portfolios across multiple asset classes.

Bonuses and Promotions Offered by FINAM

As of our latest research, the discussed brokerage doesn't offer any no-deposit, welcome, or other types of bonuses.

While some traders might see this as a disadvantage, it's worth noting that having promotional offers is not a fundamental aspect of financial brokers.

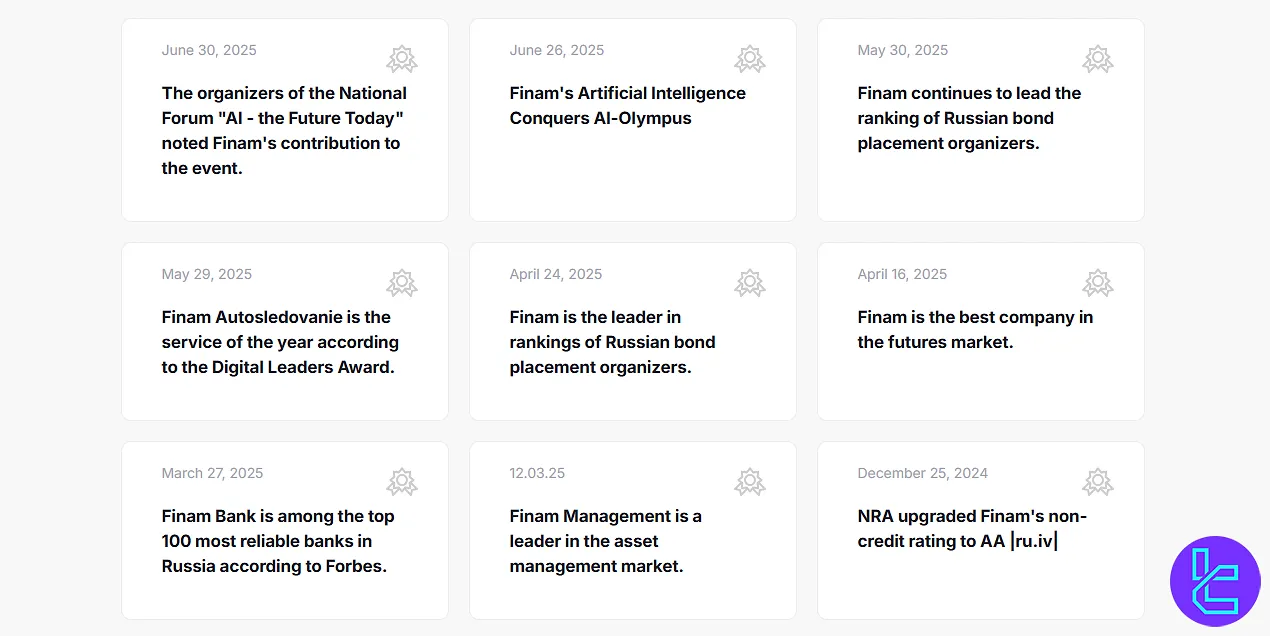

FINAM Broker Awards

FINAM has been recognized with numerous prestigious awards, underscoring its commitment to excellence in the financial services industry.

These accolades highlight the company's dedication to providing top-tier trading services and innovative solutions to its clients.

Here are some of the notable FINAM awards:

- Financial Olympus Best Broker of the Year (2023)

- Best Online Broker (2022)

- The Financial Pearl of Russia (2021)

- Top Brokerage Company (2020)

- Leader in Investment Products (2019)

- Best Educational Platform in Finance FINAM Znaniya (2018)

Customer Support Open Hours and Contact Channels

FINAM offers 24/7 customer support via these contact channels:

- Phone Call: +7 (495) 796-90-24

- Ticket: Submittable via the official website

Also, the company has physical offices in many cities across Russia, including Moscow, Saratov, Tula, Tolyatti, Tver, etc.

Customer support reviews are mixed. While some users report timely responses, others cite delays and lack of helpfulness. There is no dedicated support for non-Russian speakers, making the service less accessible to a global audience.

FINAM Restricted Countries

Based on the data provided by the website in its registration form, only "adult citizens of the Russian Federation who are not individual entrepreneurs" can open an account with the discussed broker.

Therefore, traders from other countries are not eligible to trade on this brokerage.

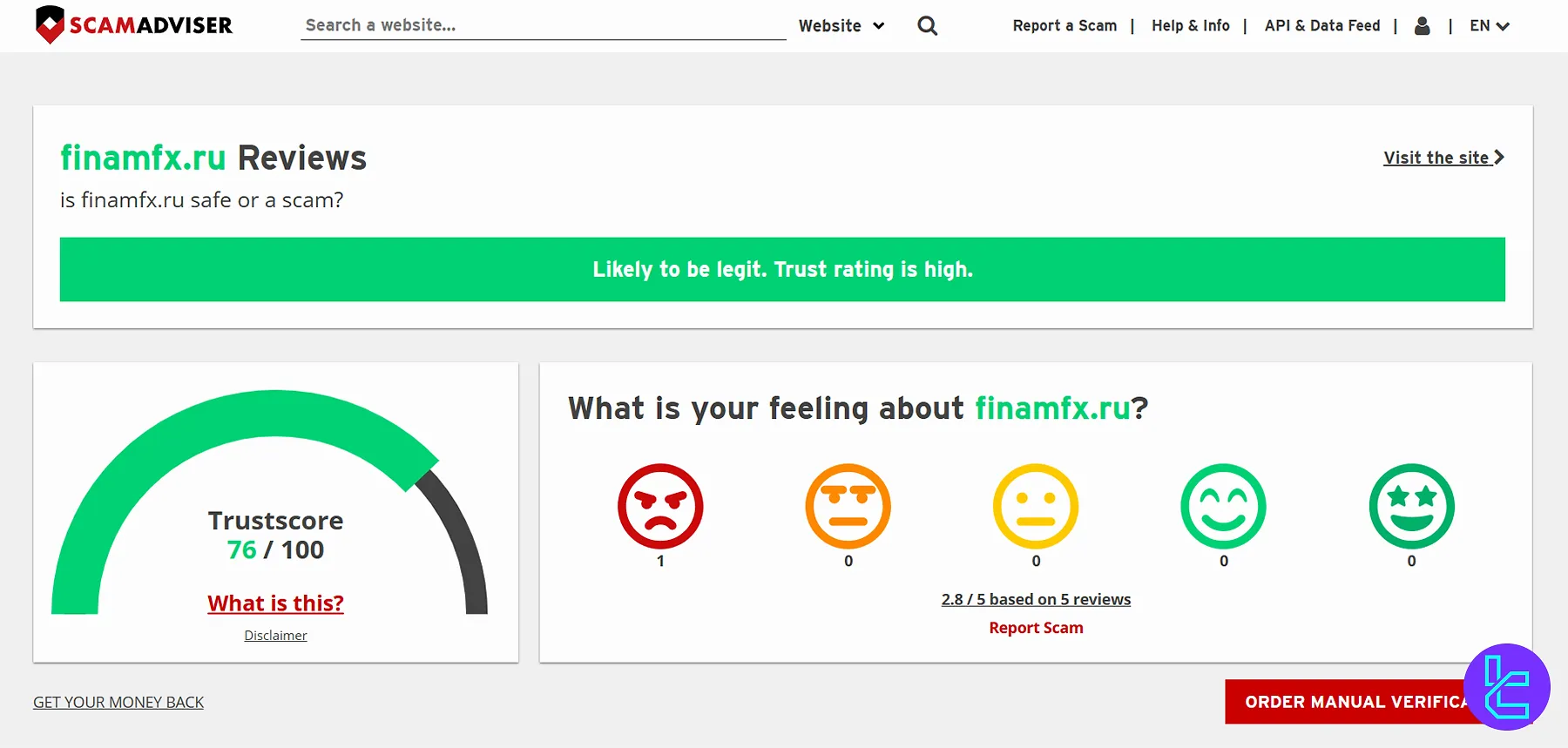

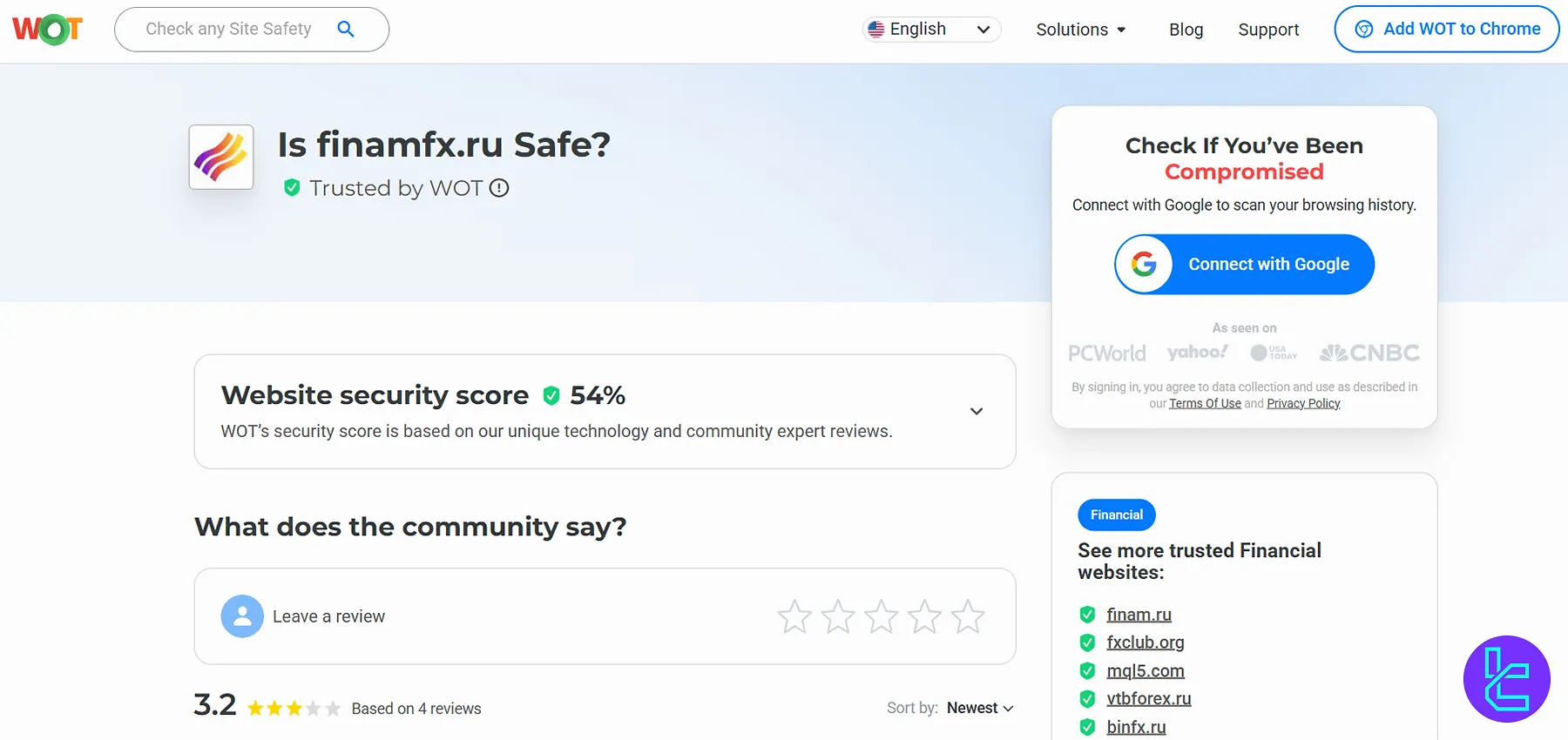

Trust Evaluations and User Scores on FINAM

The broker hasn’t received many reviews and ratings on sources across the internet. However, FINAM's page on ScamAdviser shows a trust score of 76/100, described as "likely to be legit".

Besides, this company has a 3.2/5 user score on MyWOT, based on only 4 reviews.

Education Content

FINAM offers a comprehensive educational platform called "Finam Znaniya" (Finam Knowledge). This resource provides:

- Webinars

- Regional seminars

- Trading courses

- Market analysis

- Trading strategies

Furthermore, a section dedicated to articles is also available on the brokerage's website, providing technical and fundamental analysis.

You can also check TradingFinder's Forex education section for additional learning materials.

FINAM vs Other Brokers

The table below provides a comprehensive comparison between FINAM and popular forex brokers:

Parameter | FINAM Broker | AMarkets Broker | FXTM Broker | Fusion Markets Broker |

Regulation | CBR | FSA, FSC, Misa, FinaCom | FSC | ASIC, VFSC |

Minimum Spread | N/A | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | $0 | From $0.0 | Variable | From $0.0 |

Minimum Deposit | $5 | $100 | $200 | $0 |

Maximum Leverage | 1:40 | 1:3000 | 1:3000 | 1:500 |

Trading Platforms | MT4 | MetaTrade 4, MetaTrade 5, Mobile App | MT4, MT5, FXTM Trader App | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Account Types | Standard, Demo | Standard, ECN, Fixed, Crypto, Demo | Advantage, Stocks Advantage, Advantage Plus | Zero, Classic, Swap-Free |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 25+ | 550+ | 1000+ | 250+ |

Trade Execution | Instant | Instant, Market | Market, Instant | Market, Instant |

Conclusion And Final Words

FINAM, offering 24/7 support services via phone call and ticket system, enables payments through 10+ methods [VISA, MasterCard, Skrill, FasaPay, WebMoney, YooMoney, and more]. The broker has received a 76/100 Trustscore from ScamAdviser.