FXCess, headquartered in Bermuda with the legal name Notesco Limited, provides 2 account types [Classic, ECN] with a contract size of 1 lot. The ECN one allows trading without any spreads at a cost of $4.5 per lot.

The other account charges no commissions, but comes with variable spreads from 1.7 pips.

Company Key Information and Regulation Licenses

FXCess operates under the legal entity Notesco Ltd., registered in Bermuda, and is licensed by two offshore regulatory bodies:

- The Financial Services Authority (FSA) of Seychelles

- The Financial Services Commission (FSC) of the British Virgin Islands (BVI FSC)

Although FXCess is officially regulated, both entities are considered offshore Tier-3 regulators. These provide only basic investor protections and do not offer deposit insurance or compensation schemes.

While FXCess does apply negative balance protection, it lacks Tier-1 regulatory oversight, and its operational track record spans less than 8 years. Traders should weigh these factors when assessing the broker’s overall trustworthiness.

The table below goes through the company's entity details and specifics:

Entity Parameters/Branches | Notesco Ltd. | Notesco Ltd. |

Regulation | FSA | BVI FSC |

Regulation Tier | 3 | 3 |

Country | Seychelles | British Virgin Islands |

Investor Protection Fund / Compensation Scheme | Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Trading Leverage | Up to 1:1000 | Up to 1:1000 |

Client Eligibility | Global | Global |

Who is the FXCess CEO?

We conducted sufficient research and investigations to find any information about the broker's CEO; however, the identity of the person responsible for the company's policies and direction appears to be publicly unavailable.

Key Features and Important Specifics

To give you a quick overview of what FXCess offers, here's a summary table of its key features among forex brokers:

Broker | FXCess |

Account Types | Standard, Premium, VIP, ECN |

Regulating Authority | FSA, BVI FSC |

Based Currencies | USD, EUR, GBP, JPY, NGN |

Minimum Deposit | $10 |

Deposit Methods | Bank Wire Transfer, Credit/Debit Cards |

Withdrawal Methods | Bank Wire Transfer, Credit/Debit Cards |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | PMAM |

Trading Platforms & Apps | MetaTrader 4 |

Markets | Forex, Commodities, Shares, Indices, Metals, Futures |

Spread | Variable from 1.7 Pips on Classic Account None on ECN Account |

Commission | None on Classic Account $4.5 per Lot on ECN Account |

Orders Execution | Market |

Margin Call/Stop Out | 80%/50% |

Trading Features | Demo Account |

Affiliate Program | Yes |

Bonus & Promotions | Yes |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Ticket, Phone Call, Email |

Customer Support Hours | 24/5 |

Trading Accounts Overview

FXCess provides four distinct account types, each catering to a different segment of traders:

- Standard Account: Best suited for beginners, this account requires a minimum deposit of just $10 and offers spreads from 1.7 pips. It also supports Islamic (swap-free) trading

- Premium Account: A step up from the Standard, offering improved trading conditions, though it requires a higher deposit (exact amount not disclosed)

- VIP Account: Designed for experienced traders seeking personalized services and tighter spreads

- ECN Account: Built for active traders, this account offers raw spreads from 0.0 pips with a commission of $4.50 per side per lot

All account types are accessible via the MetaTrader 4 platform and support popular base currencies, including USD, EUR, GBP, JPY, and BTC. The minimum trade size across accounts is 0.01 lots. Margin calls occur at 80%, and stop-outs are triggered at 50%.

Advantages and Disadvantages

Like any broker, FXCess has its strengths and weaknesses. Here's a balanced view of what the broker offers:

Advantages | Disadvantages |

Flexible Leverage Options Up To 1:1000 | Limited Payment Methods (Only Wire Transfers And Bank Cards) |

Competitive Trading Conditions With Tight Spreads | No High-tier Regulating Bodies |

+300 Tradable Assets | No 24/7 Support |

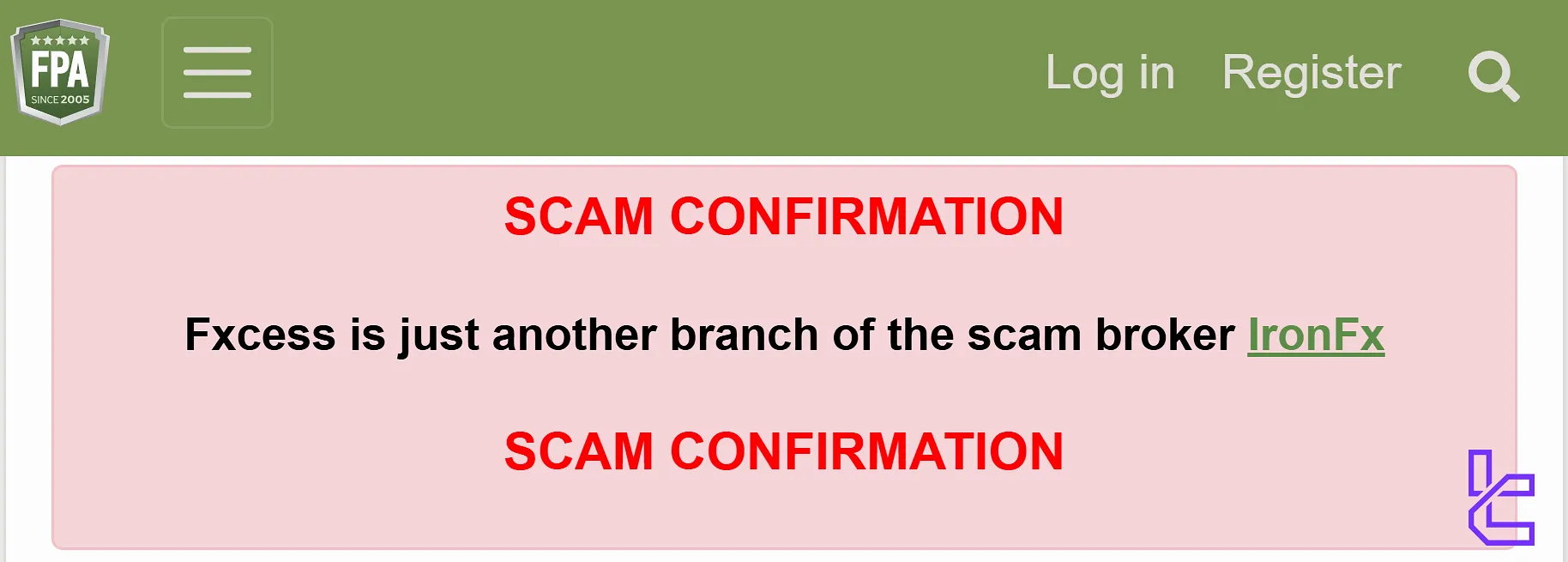

Proprietary PMAM (Personal Multi Account Manager) Feature | Confirmed As a Scam Broker by ForexPeaceArmy |

Sign Up and Verify Your Account on FXCess

Opening a new trading account with the FXCess broker is easy and beginner-friendly. FXCess registration:

#1 Access the FXCess Registration Portal

Visit the official FXCess website and click on “Open Account” to begin.

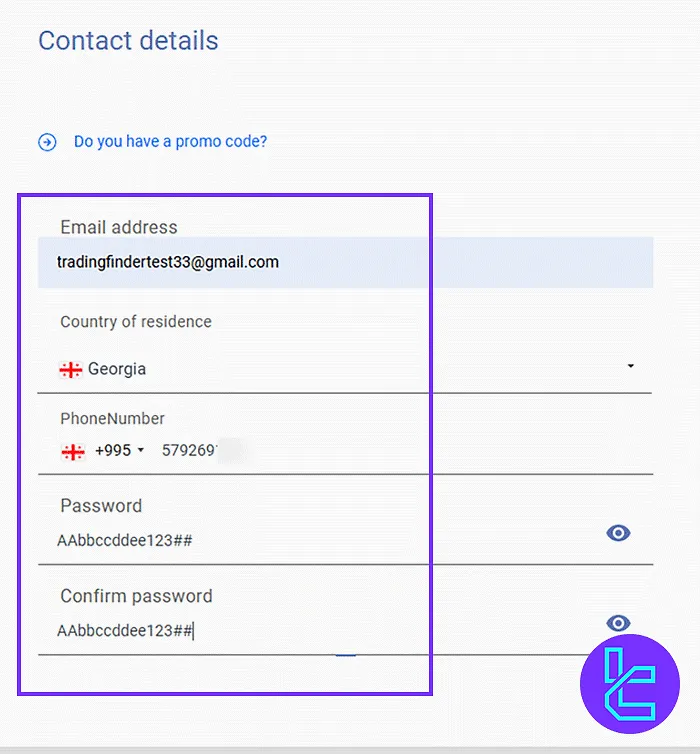

#2 Submit Basic Contact Details

Enter your email, country of residence, and phone number. Set a secure password using a mix of characters. If applicable, add a promo code.

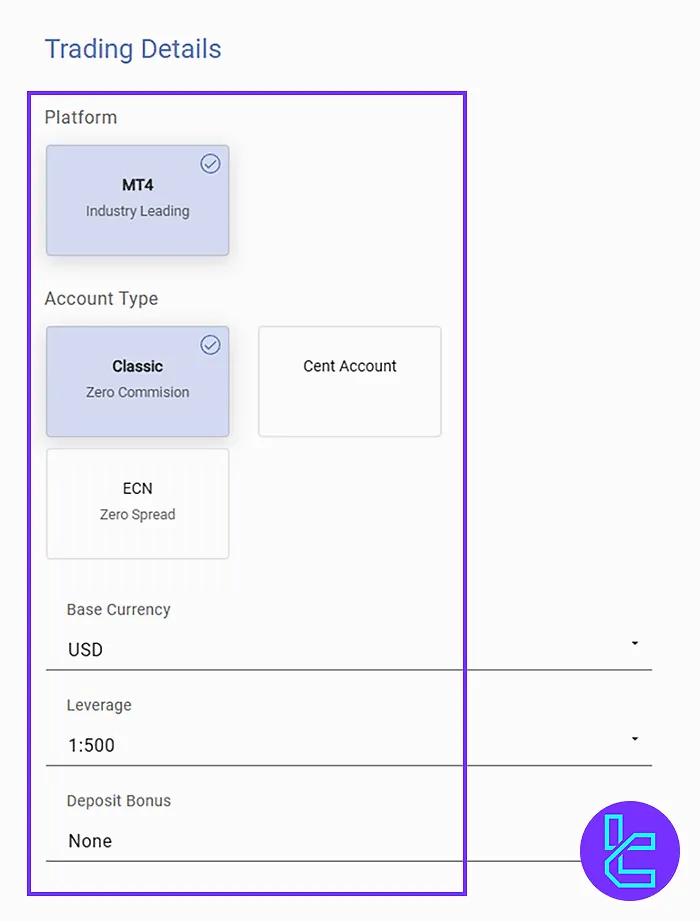

#3 Configure Trading Preferences

Choose your trading platform, account type, desired leverage, and preferred account currency. Optionally, activate a bonus offer.

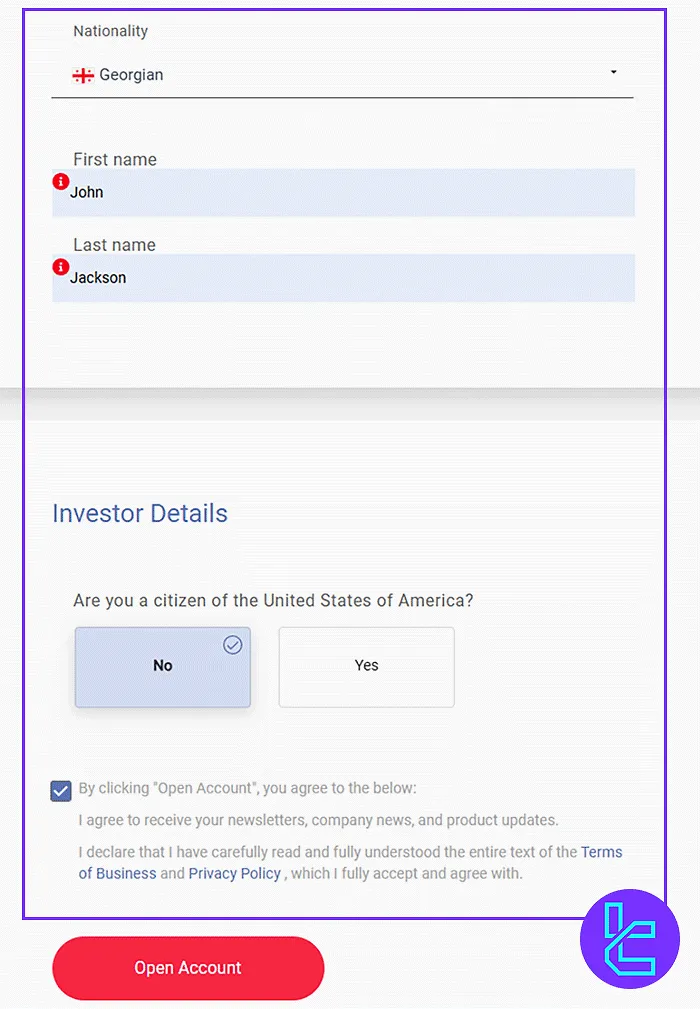

#4 Provide Personal & Regulatory Details

Complete your profile with your full name, nationality, and citizenship status. Accept the terms and conditions, then submit your application.

#5 Access the KYC Section

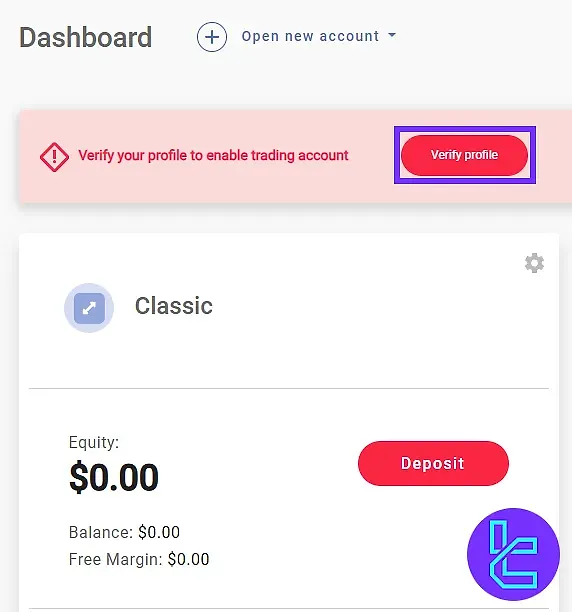

ّFor FXCess verification, log in to your FXCess dashboard and select the "Verify Profile" option to begin the verification.

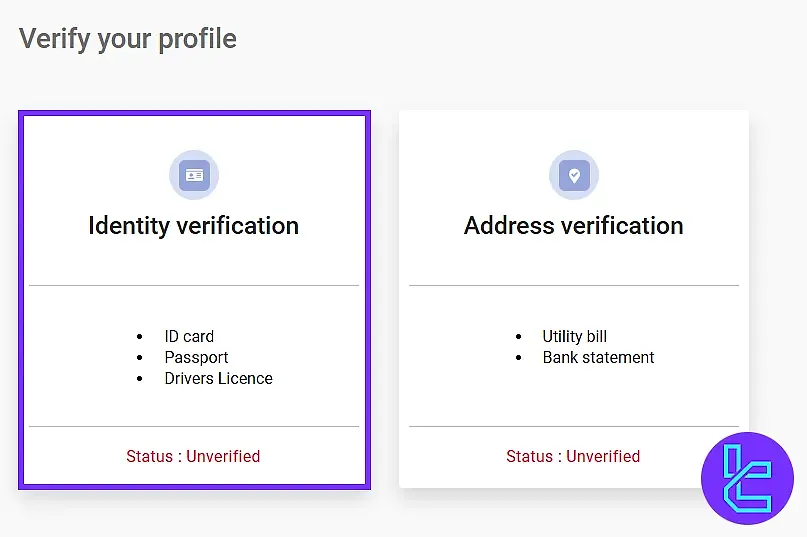

#6 Upload Identity Confirmation Documents

Upload a clear image of a valid identity document (National ID card, passport, or driver's license) after filling in personal details like your name and date of birth.

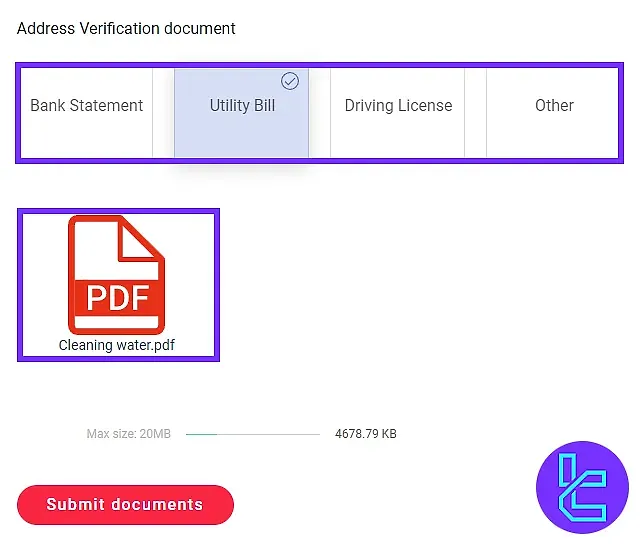

#7 Provide Proof of Address

Submit a document for address verification, such as a utility bill or bank statement, ensuring it’s recent (within 3-6 months).

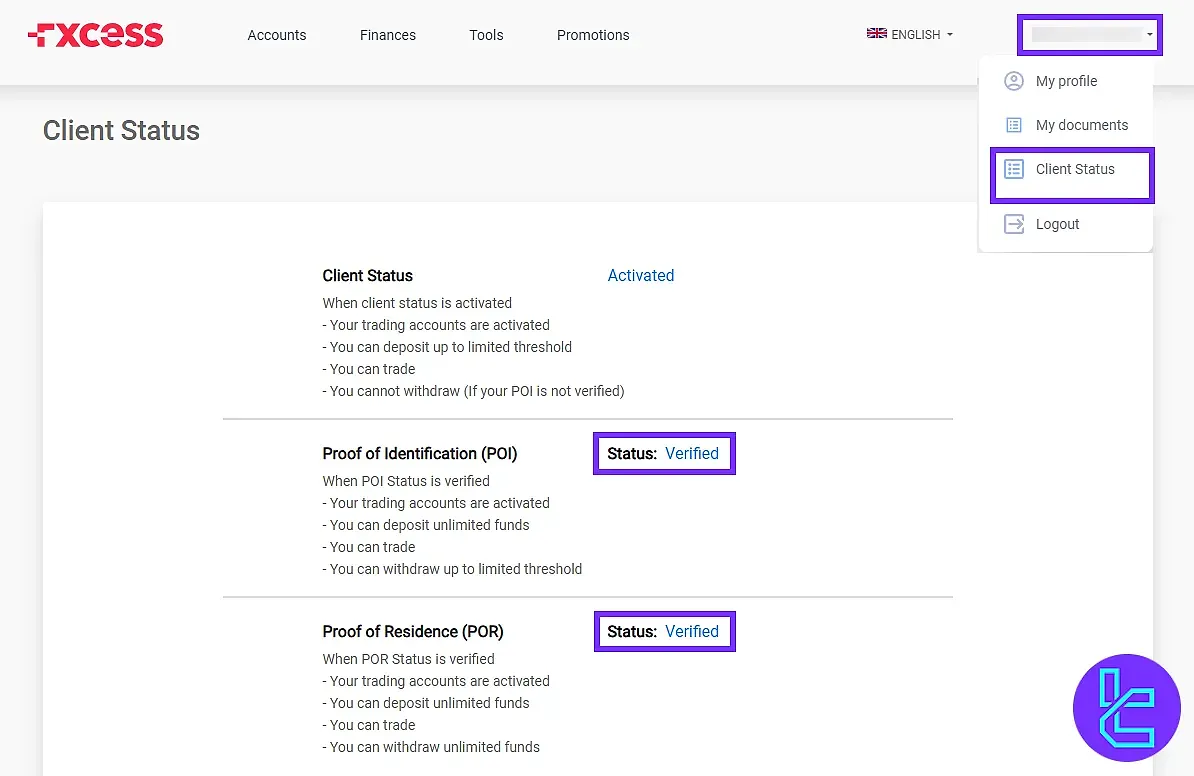

#8 Check Authentication Status

Once documents are uploaded, go to the "Client Status" section to track the approval of your verification.

Trading Platforms and Facilities

FXCess primarily offers the industry-leading MetaTrader 4 (MT4) platform for forex and CFD trading. MT4 is renowned for its powerful features and user-friendly interface, making it suitable for both novice and experienced traders.

The lack of variety in available trading software could be a drawback for some traders.

Trading Spreads and Overall Costs

FXCess applies a cost structure that varies by account type, offering low overall trading and non-trading fees:

- Standard Account: Commission-free trading with floating spreads starting at 1.7 pips. Designed for entry-level traders, this account integrates transaction costs directly into the spread;

- ECN Account: Offers institutional-grade pricing with raw spreads from 0.0 pips and a commission of $4.50 per lot per side. Real-market average spreads include 0.08 pips on EUR/USD and 0.235 pips on GBP/USD.

Non-trading fees are minimal. FXCess does not charge for deposits, withdrawals, or inactivity. This competitive fee model makes it particularly attractive to high-frequency and long-term traders alike, especially on the ECN account.

Swap Fees

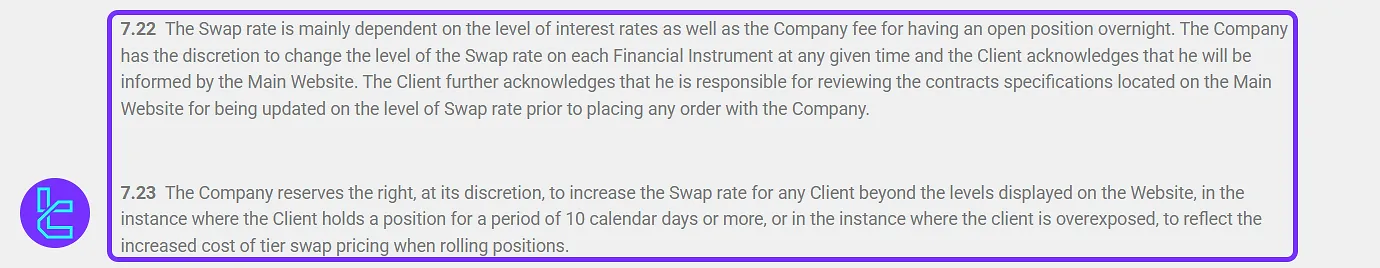

The Swap rate applied to open positions is influenced by two primary factors: prevailing interest rates and the broker’s own overnight holding fee. It is important to note that the Company retains full discretion to adjust the Swap rate for any Financial Instrument at any time.

All changes are communicated via the Main Website, and traders are expected to consult the contract specifications regularly to stay informed before executing any trades.

Moreover, the Company may impose higher Swap charges on a Client if certain conditions apply — such as maintaining an open position for 10 consecutive calendar days or having an overexposed account.

This adjustment reflects the additional cost associated with tiered swap pricing during prolonged rollovers.

Non-Trading Fees

In accordance with the Company’s operational policies, clients are advised of the following administrative fee conditions.

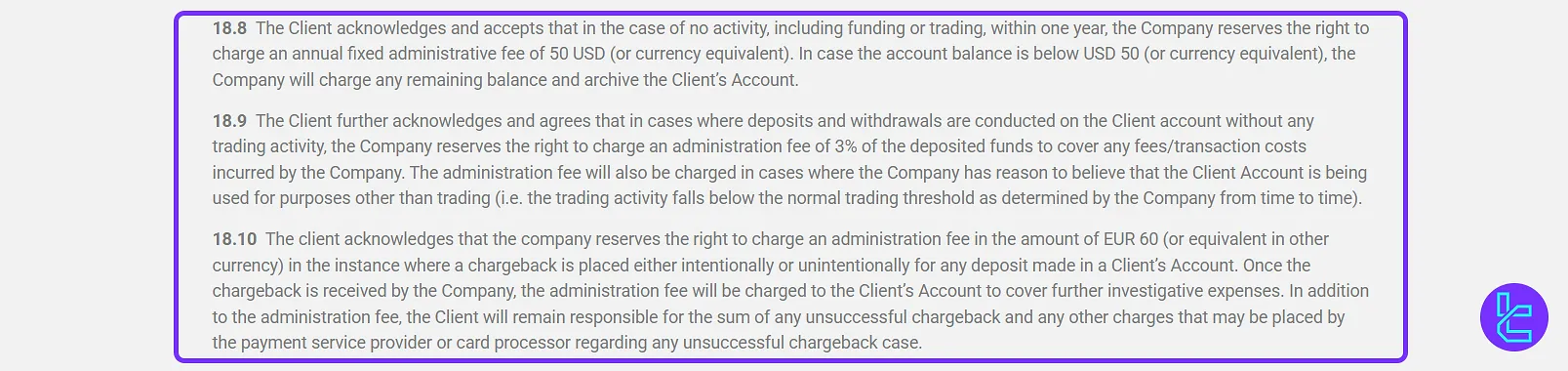

Inactive Accounts

Should a trading account remain dormant for 12 consecutive months—without any deposits or trading activity—a fixed annual maintenance fee of $50 (or its currency equivalent) may be applied.

If the balance falls below this threshold, the entire remaining amount may be deducted, and the account will be archived accordingly.

Non-Trading Transactions

If a client deposits or withdraws funds without engaging in any trading activity, the Company reserves the right to apply a 3% administrative charge on the deposited amount.

This also applies where transactional patterns indicate non-trading usage, such as activity below the platform’s defined trading threshold.

Chargeback Handling

In instances where a chargeback is initiated—whether mistakenly or deliberately—a flat fee of €60 (or an equivalent amount in another currency) will be imposed to cover investigation and administrative costs.

The client will additionally remain liable for the reversed transaction amount, as well as any associated processing fees levied by financial intermediaries or card issuers.

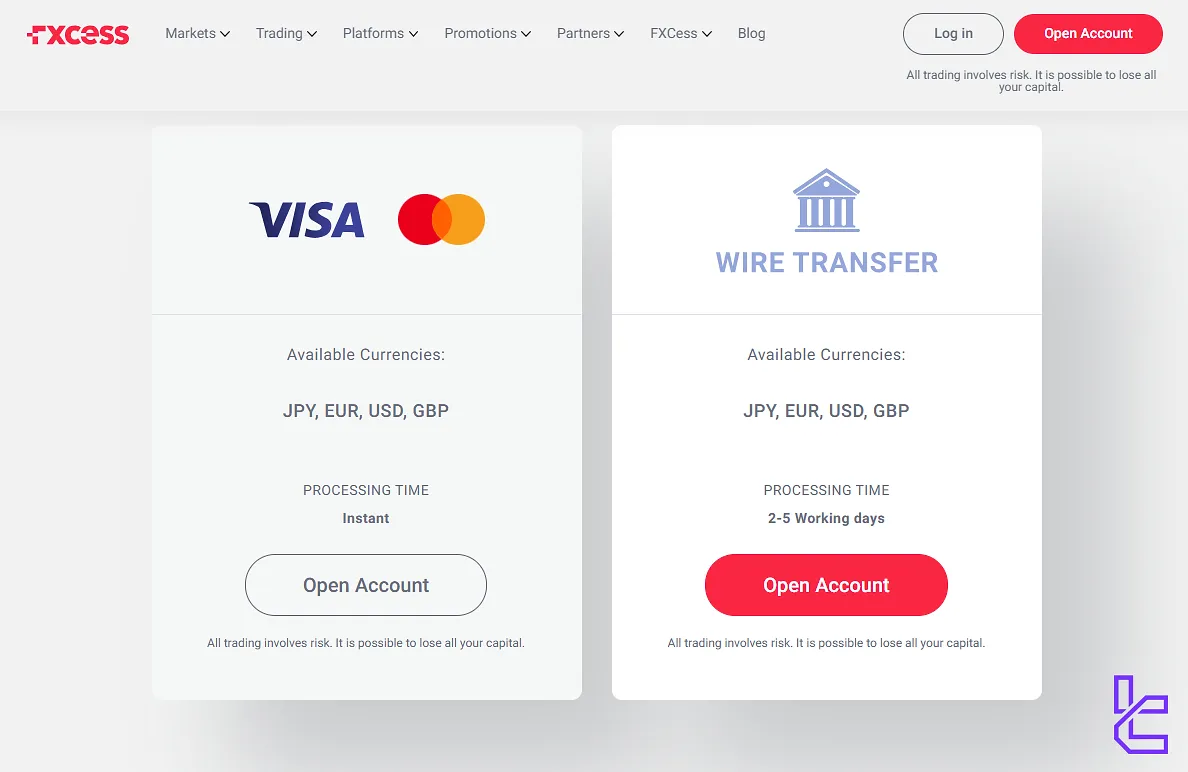

Available Funding Methods on FXCess Broker

FXCess offers a limited set of funding methods that support traditional payment solutions. All transactions benefit from zero deposit and withdrawal fees. The minimum deposit requirement is $10, while the minimum withdrawal amount is $100.

Deposit Options

The brokerage offers a total of only three choices for making deposits on the platform.

The table below demonstrates the options:

| Payment Method | Accepted Currency |

| VISA | USD, EUR, JPY, GBP |

| MasterCard | USD, EUR, JPY, GBP |

| Bank Transfers | USD, EUR, JPY, GBP |

Withdrawal Solutions

The methods for funding the account and withdrawals are the same. The table in this section provides more details:

| Withdrawal Method | Processing Time |

| VISA | Instant |

| MasterCard | Instant |

| Bank Transfers | 2-5 Business Days |

Copy Trading Options and Investment Programs

The broker offers a Multi-Account Manager (MAM) service, which allows professional traders to manage multiple client accounts simultaneously. This feature is particularly useful for money managers and institutional clients.

While FXCess doesn't offer a traditional copy trading service like some other brokers, its MAM solution provides a way for less experienced traders to benefit from the expertise of professional traders. This brokerage offers this solution on a Personal Multi-Account Manager (PMAM) platform.

What Are The Trading Instruments and Available Symbols on FXCess?

This firm offers a wide range of tradable instruments in a long list across multiple asset types:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Standard, Micro, Ultra Low Accounts | Over 80 Currency Pairs (e.g., EUR/USD, GBP/USD) | 50–70 Currency Pairs | |

Metals | Gold, Silver, etc. | 2–5 Instruments (Gold, Silver, etc.) | 5–10 Instruments |

Indices | UK 100, Wall Street, Germany 10, and More | Around 10 Indices | 10–20 Indices |

Commodities | US Crude Oil, Brent Crude Oil, Coffee, Sugar, etc. | 10–15 Instruments | 10–20 Instruments |

Shares/Stocks | Popular companies like Apple, Google, Meta, and Microsoft | Over 500 Global Stocks | 800–1200 Stocks |

Futures Contracts on Available Symbols | Various Available Symbols | N/A |

With over 300 instruments available, FXCess provides ample opportunities for portfolio diversification and access to global financial markets.

Bonuses and Promotional Offers

This brokerage offers an attractive Introducing Broker (IB) Reward Program, allowing IBs to earn cash rewards for referring new active clients. The program includes:

- Monthly rewards up to $5,000

- Tiered reward levels from Bronze to Master

- Rewards based on referrals' net money inflow and traded lots

In addition to the IB program, FXCess offers deposit bonuses such as:

- 100% Sharing Bonus

- 40% Power Bonus

- Credit Bonus

These promotions are subject to terms and conditions, and traders should carefully review these before participating.

Support Services: Channels and Active Hours

Support is crucial in a financial firm and should be seriously considered. FXCess provides its customer services through various channels:

- Email: support@fxcess.com

- Live Chat: Accessible through the website

- Phone Call: +44 203 150 1111

- Ticket Submission System: In the "Contact Us" page of the website

The support team is available 24/5 and does not work on weekends. This is a drawback since some of the competitors provide 24/7 support.

What Countries Do Not Have Access to FXCess Services?

While FXCess aims to serve a global client base, there are restrictions on services in certain jurisdictions due to regulations and international sanctions. Based on the official list provided by the company, residents of these regions are prohibited from signing up with the broker:

- United States

- Iran

- Cuba

- Sudan

- Syria

- North Korea

Trust Scores and Evaluations

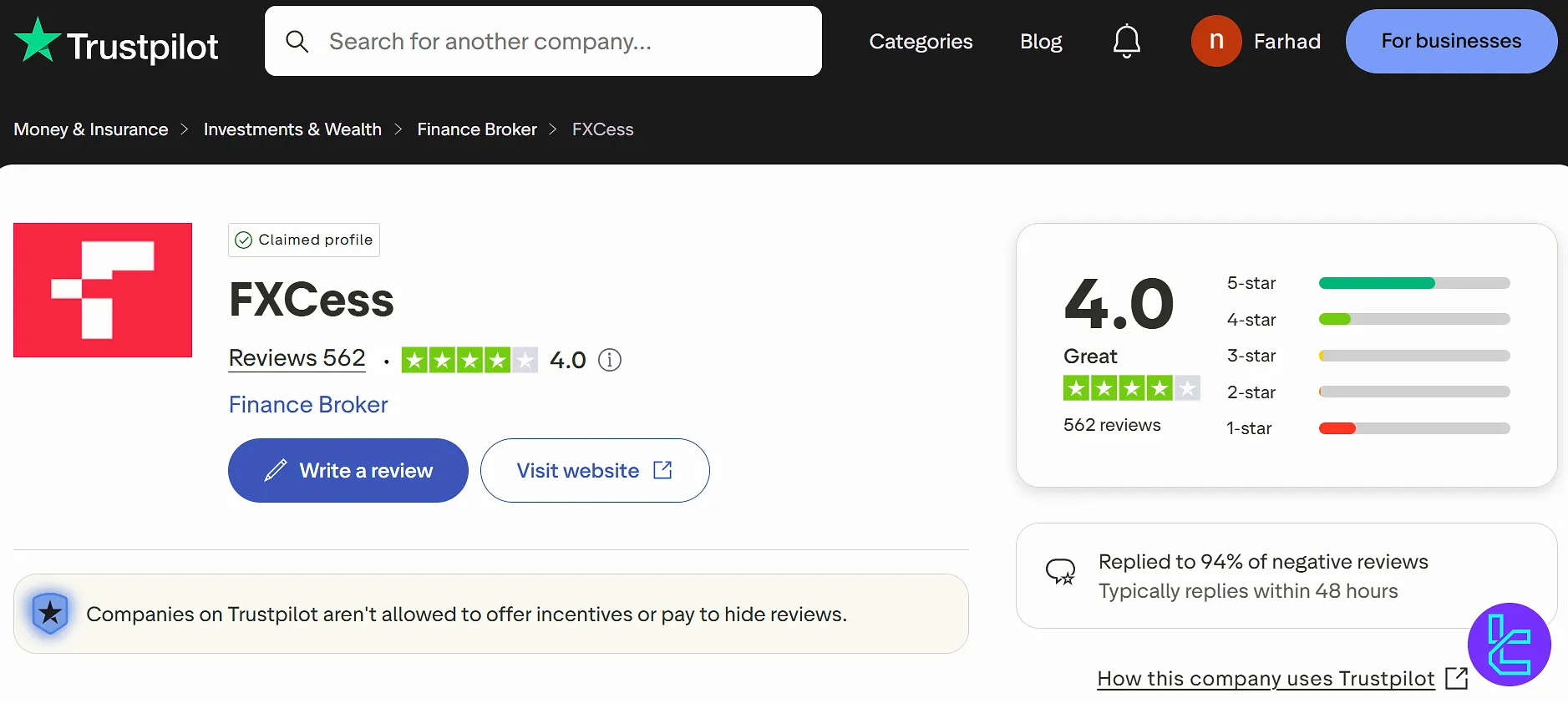

FXCess has received above-average reviews from traders across various platforms. However, on ForexPeaceArmy, it has received a scam notice, which will be discussed below:

- FXCess Trustpilot: 4/5, more than 560 reviews

- REVIEWS.io: 4.5/5, over 100 ratings

- FXCess ForexPeaceArmy: Scam notice allegedly related to the scam broker IronFX

While the claim made by FPA does not necessarily mean that FXCess is a scam company, traders should exercise extreme caution and conduct thorough research before making any deposits.

Education Content Offered by FXCess

This broker provides mediocre resources for educational matters. To be more precise, the website consists of a "Blog" page with articles in these topics:

- Market insights and analysis

- Risk management

- Trading concepts

- Trading platform

Moreover, there is an FAQ section on the website with questions and corresponding answers. No search option is available on this page.

FXCess in Comparison with Other Forex Brokers

To better understand the pros and cons of trading with the FXCess, let's compare it to other Famous Forex Brokers.

Parameters | FXCess Broker | |||

Regulation | FSA, BVI FSC | FSA, CySEC, ASIC | No | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | From 1.7 Pips | From 0.0 Pips | From 0.1 Pips | From 0.0 Pips |

Commission | From $0 | From $3 | $0 | From $0.2 to USD 3.5 |

Minimum Deposit | $10 | $200 | $1 | $10 |

Maximum Leverage | 1:1000 | 1:500 | 1:3000 | Unlimited |

Trading Platforms | MetaTrader 4 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MetaTrader 4, MetaTrader 5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard, Premium, VIP, ECN | Standard, Raw Spread, Islamic | Standard, Premium, VIP, CIP | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 300+ | 2,250+ | 45 | 200+ |

Trade Execution | Market | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

FXCess provides 24/5 support with 4 contact channels [email, live chat, phone call, ticket.] The company has received an average score of 4.5/5 based on over 100 user ratings on REVIEWS.io. Furthermore, its trust score on the Trustpilot website is 4/5, with more than 560 reviews.