FXCM registration takes under 15 minutes, requiring email, country, password, platform (e.g., MT4), trading currency, and personal details like insurance number, address, and mobile. The process ends with financial profiling and acceptance of FXCM’s terms and risk disclosure.

FXCM is a multi-regulated Forex broker with licenses from top-tier authorities such as FCA, ASIC, CySEC, ISA, and FSCA.

This broker offers 3 account types, including CFD, Active Trader, and Corporate accounts, with up to 1:1000 maximum leverage on MT4, TradeStation, and TradingView platforms.

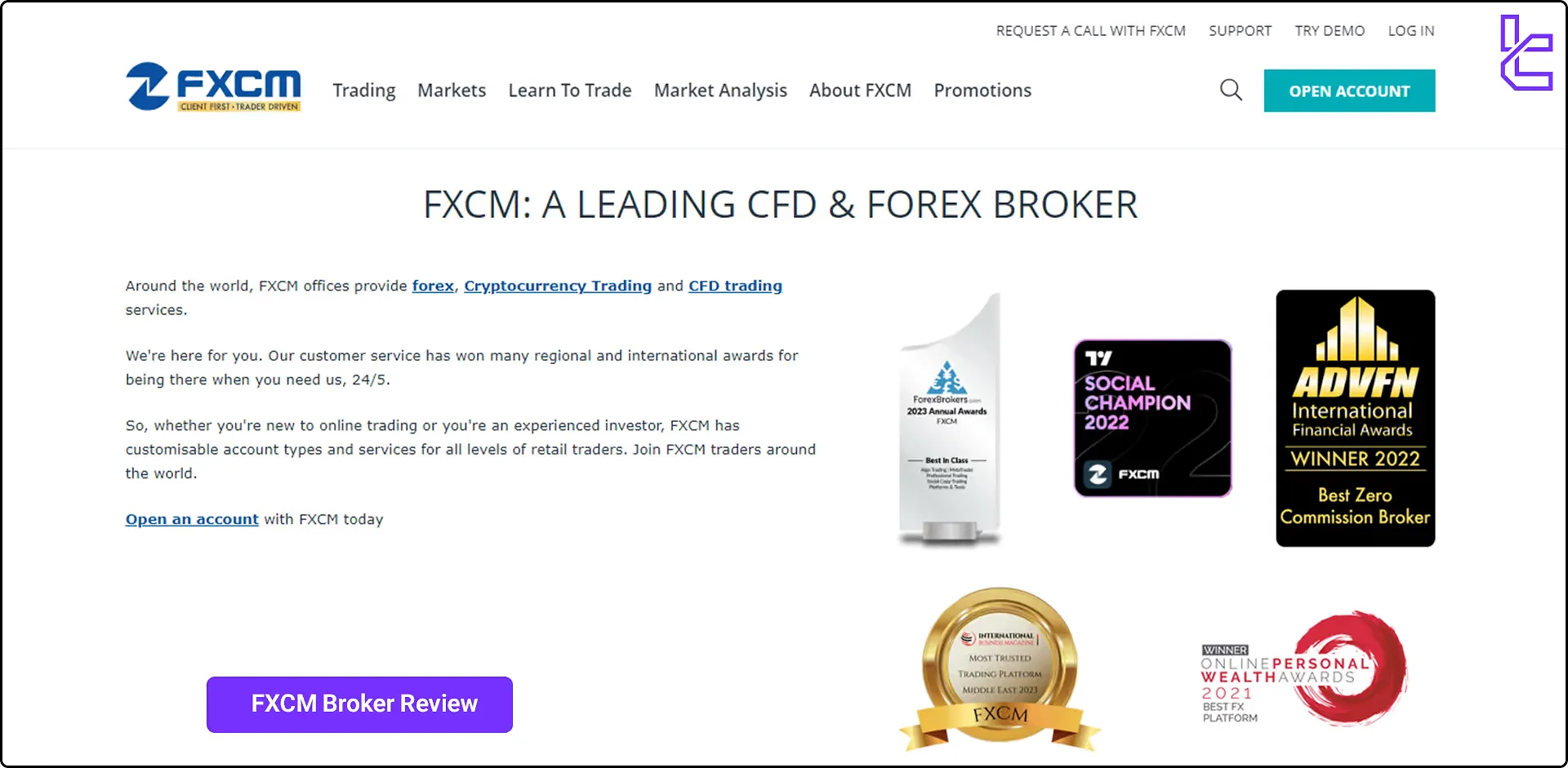

FXCM Company Information and Regulations

FXCM, short for Forex Capital Markets, has been a major player in the online Forex and CFD trading since 1999. With over two decades of experience, FXCM has weathered many storms in the volatile world of forex trading.

However, FXCM's journey hasn't been without its bumps:

- In 2017, the U.S. Commodity Futures Trading Commission(CFTC) slapped FXCM with a $7 million fine for fraudulent misrepresentation to customers and regulators. This led to FXCM withdrawing its CFTC registration, effectively ending its operations in the United States.

- The company has also faced regulatory actions from other authorities, including the UK Financial Conduct Authority(FCA) and the National Futures Association (NFA) in the US.

- In 2017, FXCM's parent company, FXCM Group, Inc., file for bankruptcy. Subsequently, Jefferies Financial Group (formerly Leucadia National Corporation) acquired FXCM.

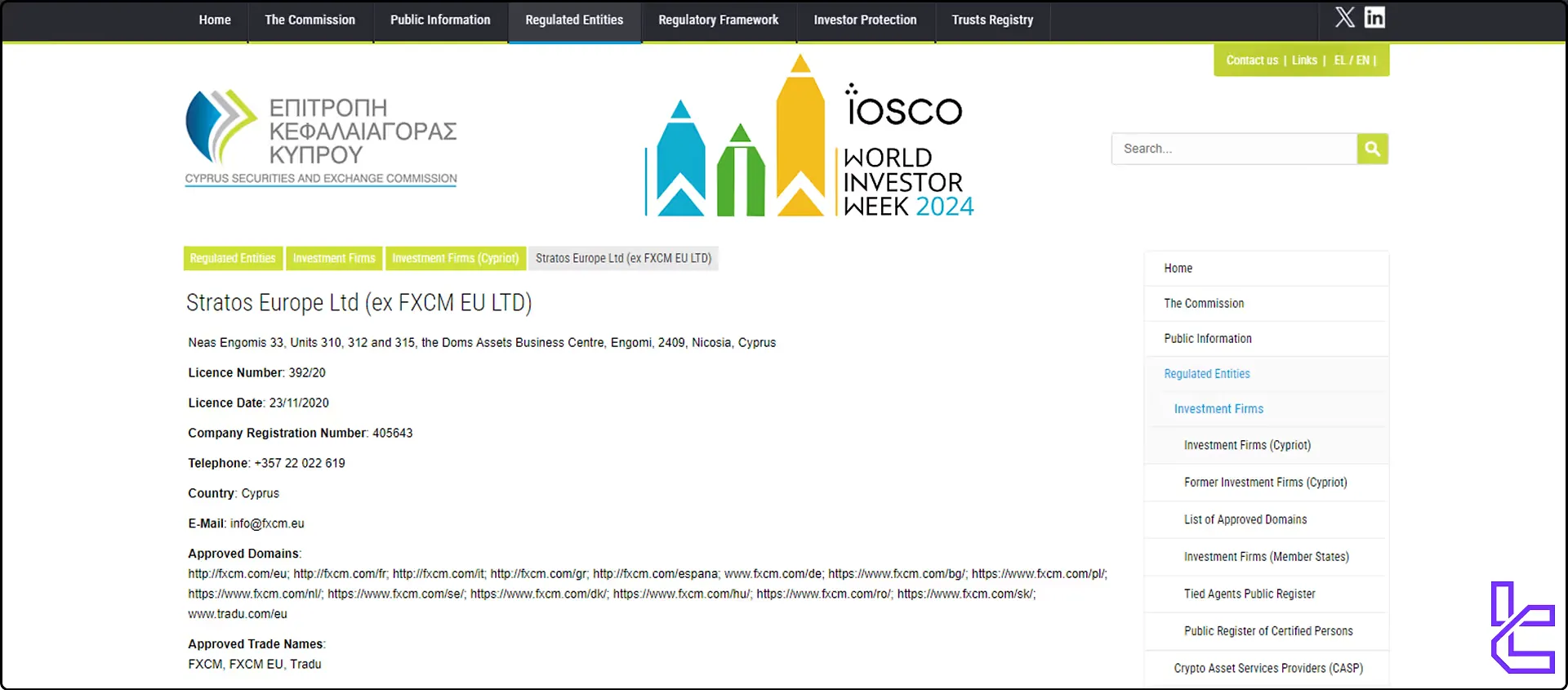

Despite these setbacks, the Forex broker has managed to maintain a strong global presence. The FXCM Group is currently regulated by several respected financial authorities:

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC) [license no. 392/20]

- Australian Securities and Investments Commission (ASIC)

- Financial Sector Conduct Authority (FSCA) in South Africa [no. No 46534]

- Israel Securities Authority (ISA)

FXCM ensures trader safety with the following security measures:

- Segregated Accounts: Client funds held separately under FCA & ASIC rules

- Negative Balance Protection: Prevents account balances from falling below zero

- Investor Compensation: Eligible clients covered up to £85,000 (UK)

- Regular Audits: Ensuring transparency and financial accountability

Entity Parameters/Branches | Stratos Markets Limited | Stratos Europe Limited (trading as "FXCM" or "FXCM EU") | Stratos Trading Pty. Limited (trading as "FXCM") | Stratos South Africa (Pty) Ltd | Stratos Light Limited |

Regulation | FCA | CySEC | ASIC | FSCA | ISA |

Regulation Tier | 1 | 1 | 1 | 2 | 2 |

Country | London, United Kingdom | Limassol, Cyprus | Sydney, Australia | South Africa | Herzliya, Israel |

Investor Protection Fund/ Compensation Scheme | Up to £85,000 Under FSCS | Up to €20,000 Under ICF | No | Up to €20,000 under Financial Commission | No |

Segregated Funds | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:2000 | 1:30 | 1:30 | 1:2000 | 1:30 |

Client Eligibility | Only United Kingdom | Only EU/EEA Residents | Only Australia | Only South Africa | Only Israel |

CEO of FXCM

Brendan Callan is the Global Chief Executive Officer of FXCM, headquartered in London, United Kingdom, overseeing operations across Europe, the Middle East, and Africa (EMEA). With a CB Rank of 52,145, he holds a leading role in one of the most recognized companies in the retail and institutional trading industry.

Callan has represented FXCM at major industry events, including speaking engagements at the Finance Magnates London Summit (FMLS 2022) and TradeON Summit 2020. His leadership connects FXCM to various financial sectors, from public finance companies generating over $1M in revenue to large-scale financial services firms with more than 500 employees.

In addition to his role at FXCM, Callan is noted for his thought leadership in trading and market trends, with appearances in media such as City A.M., where he discussed factors influencing the rise of retail traders in 2020.

Complete information about the CEO of FXCM broker is available on Brendan Callan’s LinkedIn profile.

FXCM Summary of Specifications

FXCM has established itself as a go-to platform for Forex and CFD trading enthusiasts.Here's a quick rundown of what FXCM brings to the table:

Broker | FXCM |

Account Types | CFD account, Active Trader account, Corporate account |

Regulating Authorities | FCA, ASIC, CySEC, ISA, FSCA |

Based Currencies | USD |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | Algo trading, copy trading |

Trading Platforms & Apps | MT4, TradingView, TradeStation |

Markets | Forex, indices, commodities, crypto, shares |

Spread | Floating from 0.2 pips |

Commission | No |

Orders Execution | Market |

Margin Call/Stop Out | 50% |

Trading Features | Demo account, Islamic account |

Affiliate Program | Yes |

Bonus & Promotions | Welcome bonus, cashback bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone, WhatsApp |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, Lebanon, USA, Sudan, and more |

FXCM Account Types Overview

FXCM offers a trio of account types designed to cater to different trading styles and experience levels:

Mini Account

- Perfect for beginners

- Low minimum deposit requirement ($50)

- Ideal for practicing and gaining experience

- Variable spreads from 0.2 pips

- 1:400 maximum leverage options

Standard Account

- Suited for more experienced traders

- Minimum Spread: 0.2 pips

- Maximum leverage: 1:30

- Margin call at 50%

Active Trader Account

- Tailored for high-volume traders

- Minimum deposit: $25,000

- Additional bonuses and cash rebates

- Maximum leverage: 1:30

This tiered approach allows traders to select an account that best aligns with their trading goals, risk tolerance, and capital availability.

You can also utilize a demo account to practice using $20,000 to $50,000 virtual fundswith 24/5 access to live market data.

FXCM Broker Strengths and Weaknesses

Like any Forex broker, FXCM has its strengths and weaknesses. Let's break them down:

Advantages | Disadvantages |

Over 20 years of experience in the forex industry | Bankruptcy record |

Diverse product range | $50 per year inactivity fee |

Regulated by top-tier authorities (FCA, ASIC, CySEC) | $40 withdrawal fee on bank transfers |

Multiple advanced trading platforms (Trading Station, MT4, TradingView) | - |

Active Trader discounts for frequent traders | - |

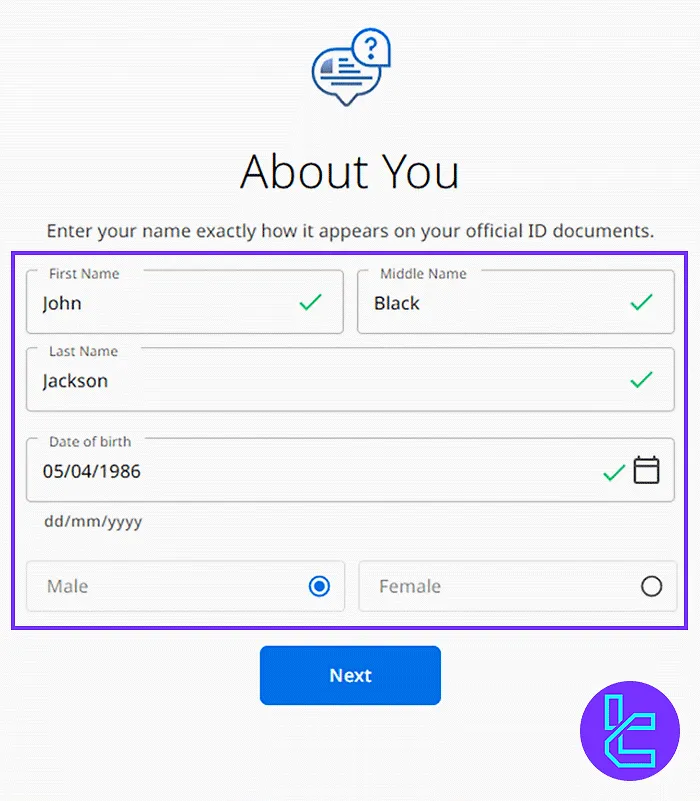

FXCM Registration & Verification Guide

#1 Start Registration

Go to FXCM’s official website and click Open Account to initiate the signup.

#2 Enter Basic Details

Select your country, input a valid email, and set a secure password.

#3 Choose Platform and Currency

Pick your trading platform (e.g., MT4) and your account currency.

#4 Provide Identity Details

Enter the following details:

- Full name

- Date of birth

- Residency

- Insurance number

#5 Address and Contact

Submit your residential address and mobile phone number for verification.

#6 Financial Profile

Define your employment status, industry, income, savings, trading goals, and knowledge level.

#7 Final Confirmation

Review and agree to FXCM’s Terms and Conditions to complete registration.

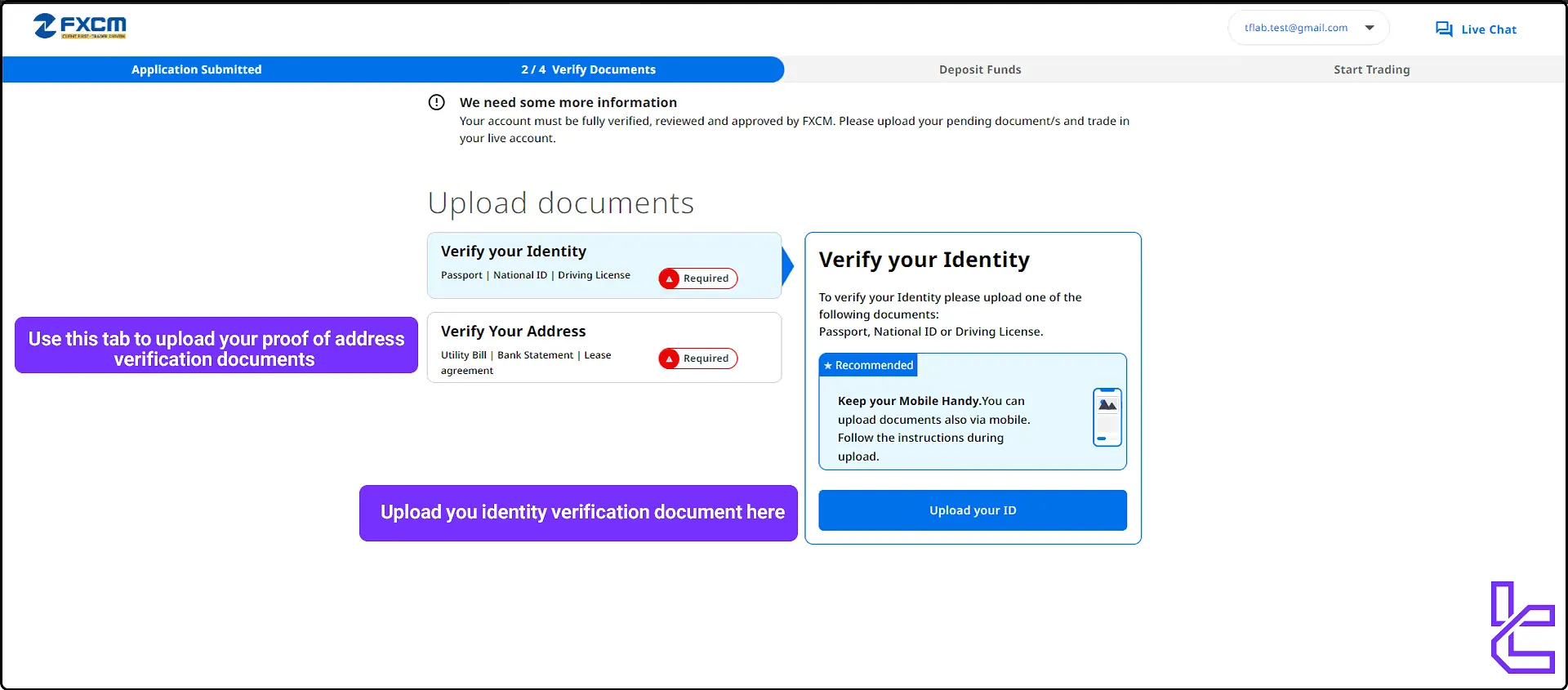

#8 Complete the KYC Procedure

To complete the FXCM verification process, upload supporting documents through the client dashboard, including:

- Identity verification documents: Passport, national ID, or driver’s license

- Proof of address documents: Utility bill, bank statement, or lease agreement

FXCM Broker Trading Platforms and Applications Review

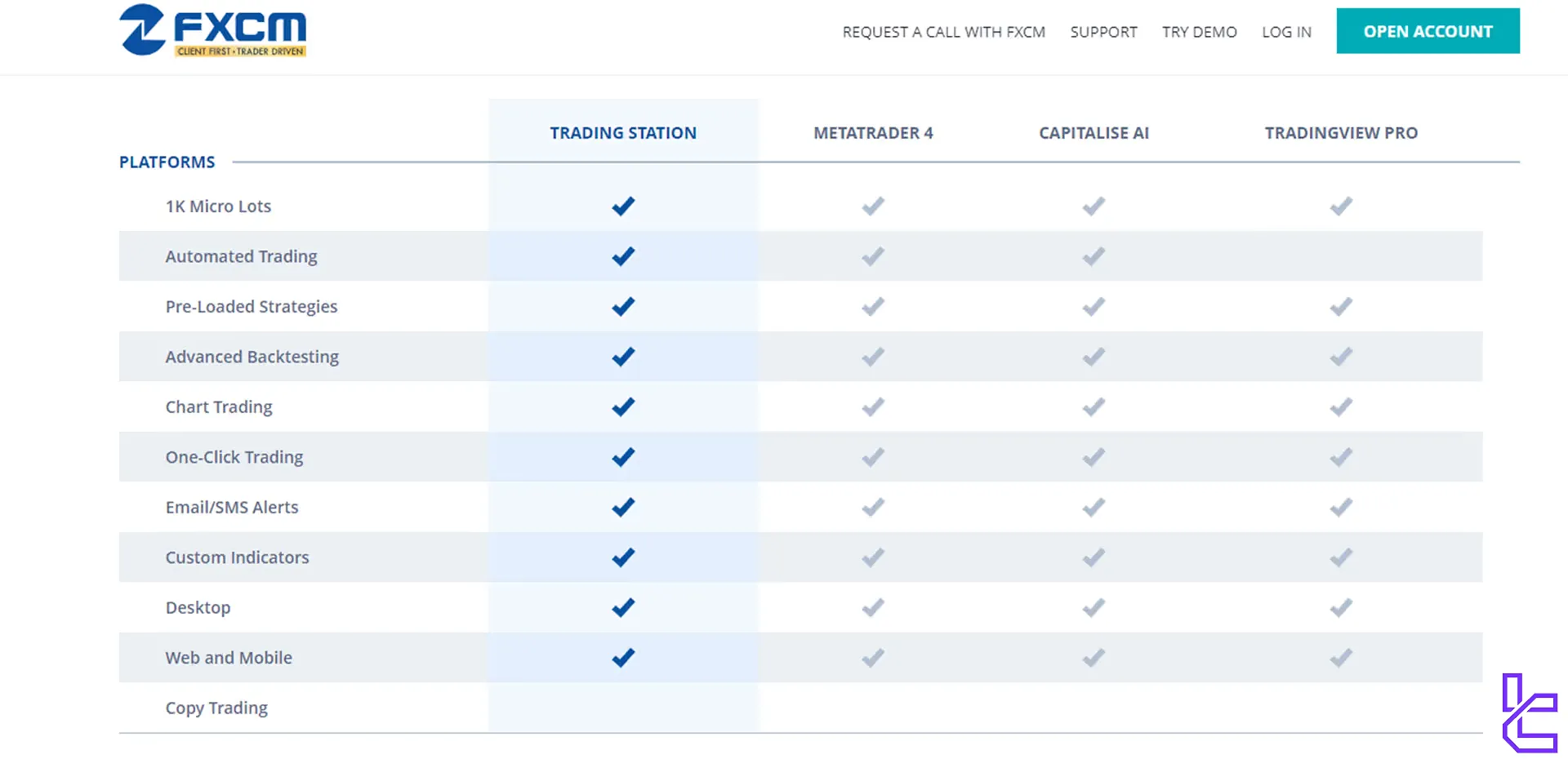

FXCM offers multiple trading platforms to suit different trading styles and preferences:

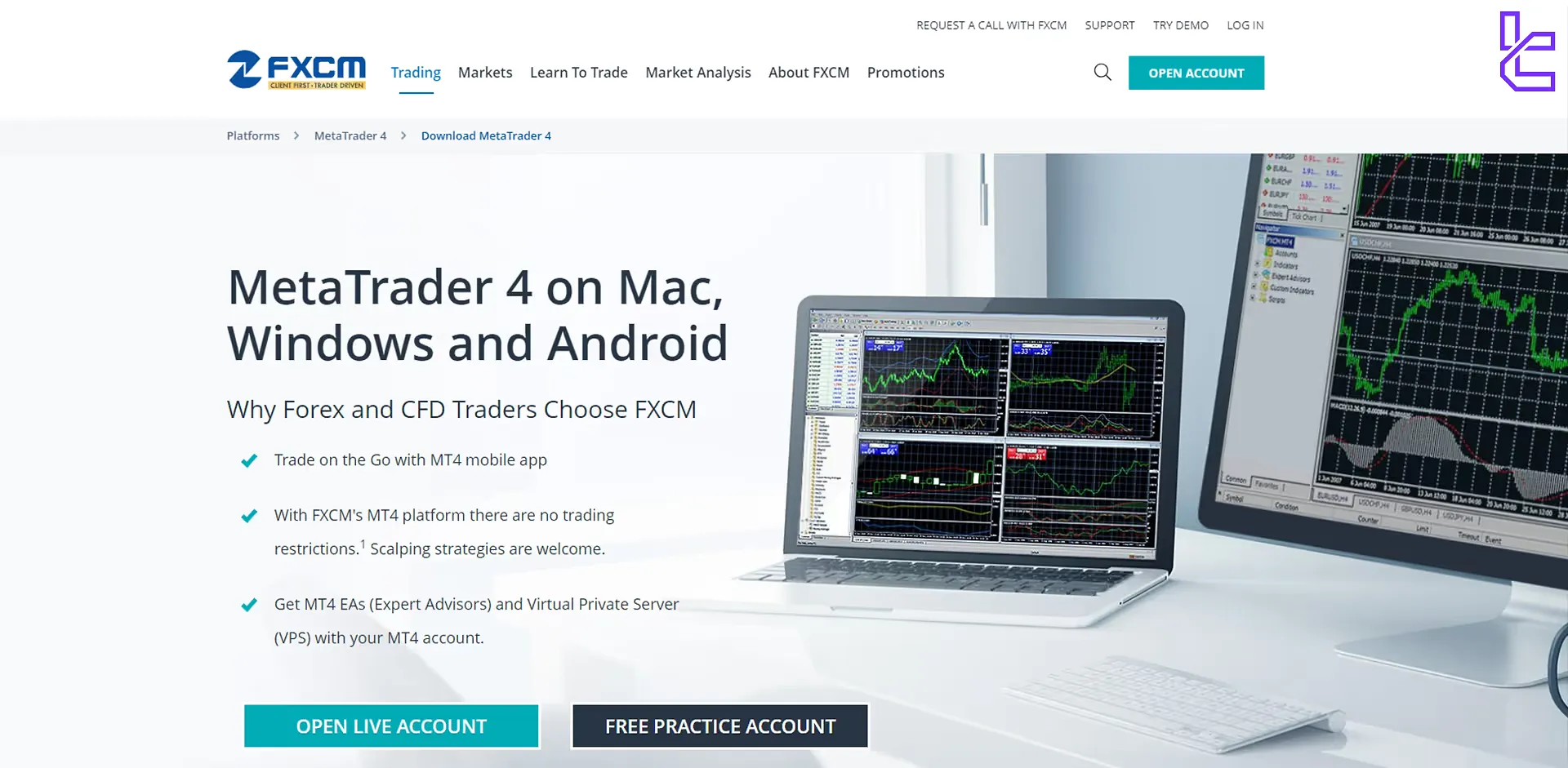

MetaTrader 4 (MT4)

MetaTrader 4 is the most well-known trading platform in the world. Key features of this platform:

- Industry-standard platform

- Advanced charting and analysis tools

- Supports automated trading and custom indicators

Links:

TradingFinder has developed a wide range of MT4 indicators that you can access for free.

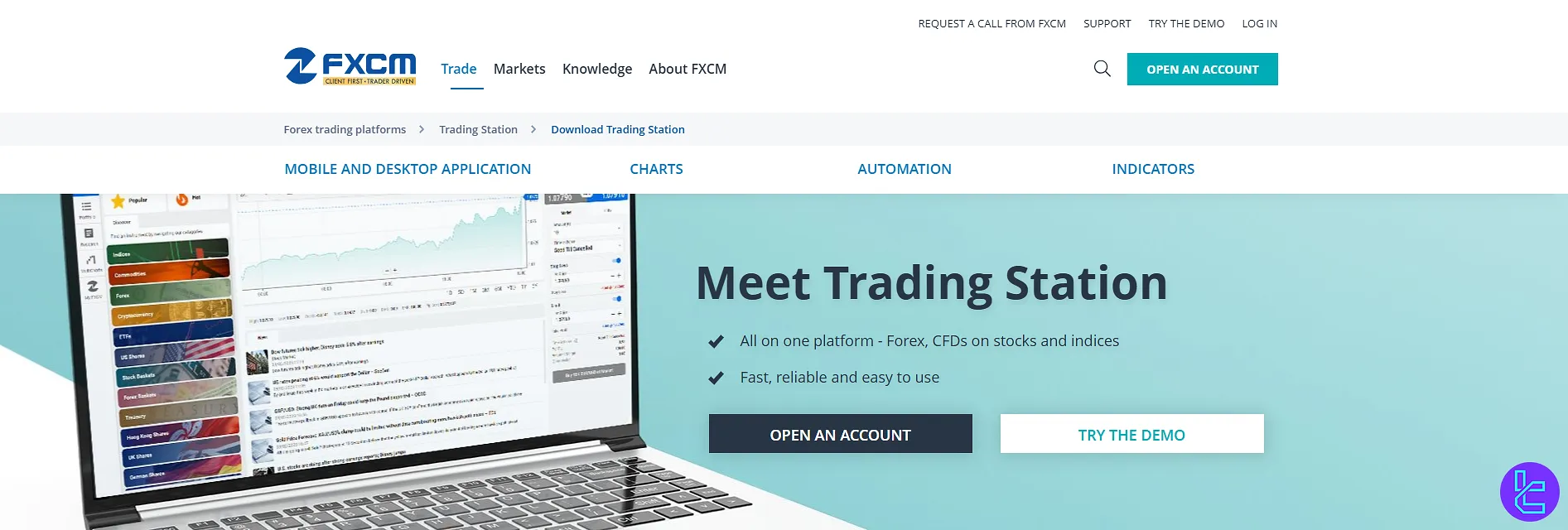

Trading Station

Trading Station is a powerful trading platform exclusive to FXCM broker. Key features of this platform:

- FXCM's proprietary platform

- User-friendly interface with advanced features

- Real-time news feeds and market analysis

- Available on browser, Android, and iOS

Links:

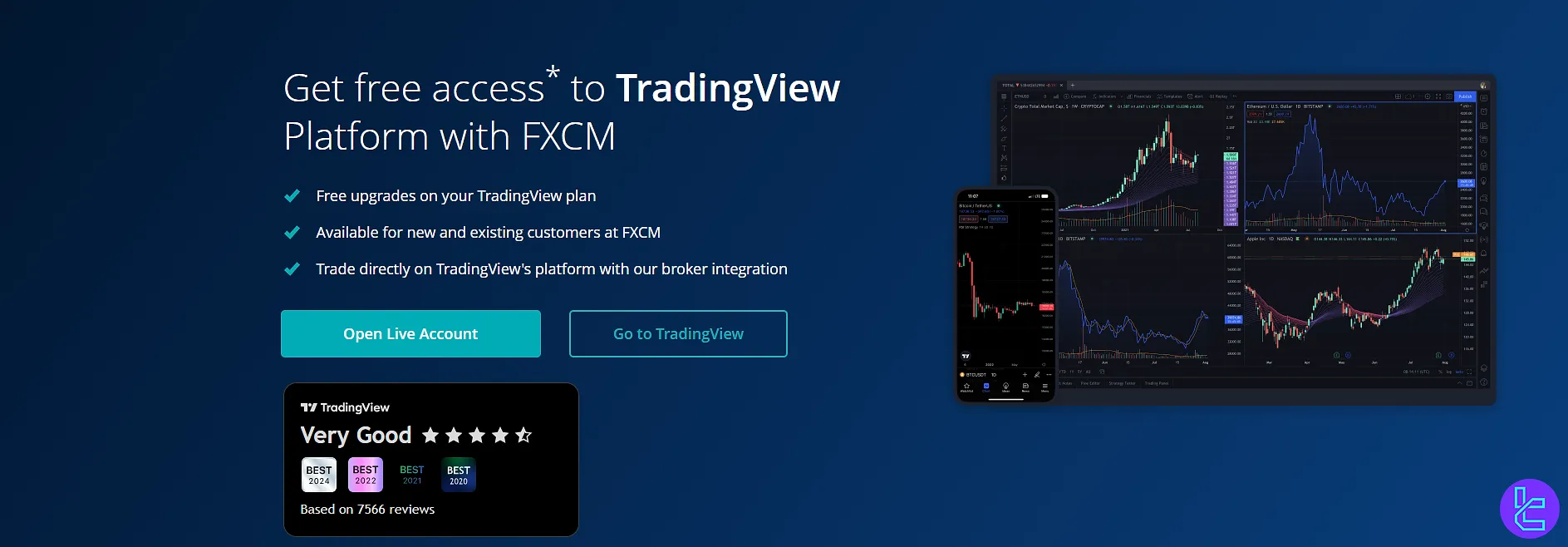

TradingView Pro

FXCM offers integration with the TradingView platform, allowing clients to trade directly and access plan upgrades at no additional cost.

FXCm allows full integration with the TradingView platform. main features of this platform include:

- Social trading features

- Extensive technical analysis tools

- A Wide variety of built-in indicators

You can use TradingFinder's custom TradingView indicators to access a wide range of technical tools.

Capitalize AI

Capitalize AI is the perfect platform for those who want to trade without involving human emotions. Main benefits of this platform:

- Innovative platform leveraging artificial intelligence

- Helps identify trading opportunities

- Automates strategy creation and backtesting

Spreads and Commissions in FXCM Broker

FXCM provides competitive spreads across its range of currency pairs and CFD instruments, aiming to keep trading costs low for various market participants.

FXCM offers competitive pricing structures, but they can vary depending on your account type and trading volume:

- Spreads from 0.2 pips on major pairs

- No commission on CFDs

FXCM other fees:

- Inactivity fee: $50 per year

- Currency conversion fee: 0.01%

- Deposit fee: $0

- Withdrawal fee: $0 (except for bank transfers)

Swap Fees

FXCM applies swap (rollover) fees on standard accounts when positions are held overnight. These charges, credited or debited, reflect interest rate differentials between the currencies or assets traded.

The broker also runs a No Rollover Campaign for selected instruments, removing overnight financing costs on certain CF Ds, such as Gold, Silver, and specific Index CFDs.

For traders following Islamic finance guidelines, FXCM offers swap-free accounts, replacing overnight interest with a fixed markup on spreads. Spread structures remain competitive across forex pairs and CF Ds, with additional volume-based discounts available for Active Traders.

FXCM Non-Trading Fees

FXCM applies an inactivity fee if an account remains unused for 12 consecutive months. The charge is the lower of 50 units in the account’s base currency or the remaining balance, with JPY-denominated accounts subject to a ¥5,000 fee. This fee is billed annually.

For withdrawals, there is no cost when using credit or debit cards; however, bank wire transfers incur a $40 fee. Certain account types, such as corporate, trust, or partnership accounts, may carry additional charges, including a one-time processing fee—often waived with a sufficiently large initial deposit.

FXCM does not impose deposit fees or account opening fees for individual trading accounts.

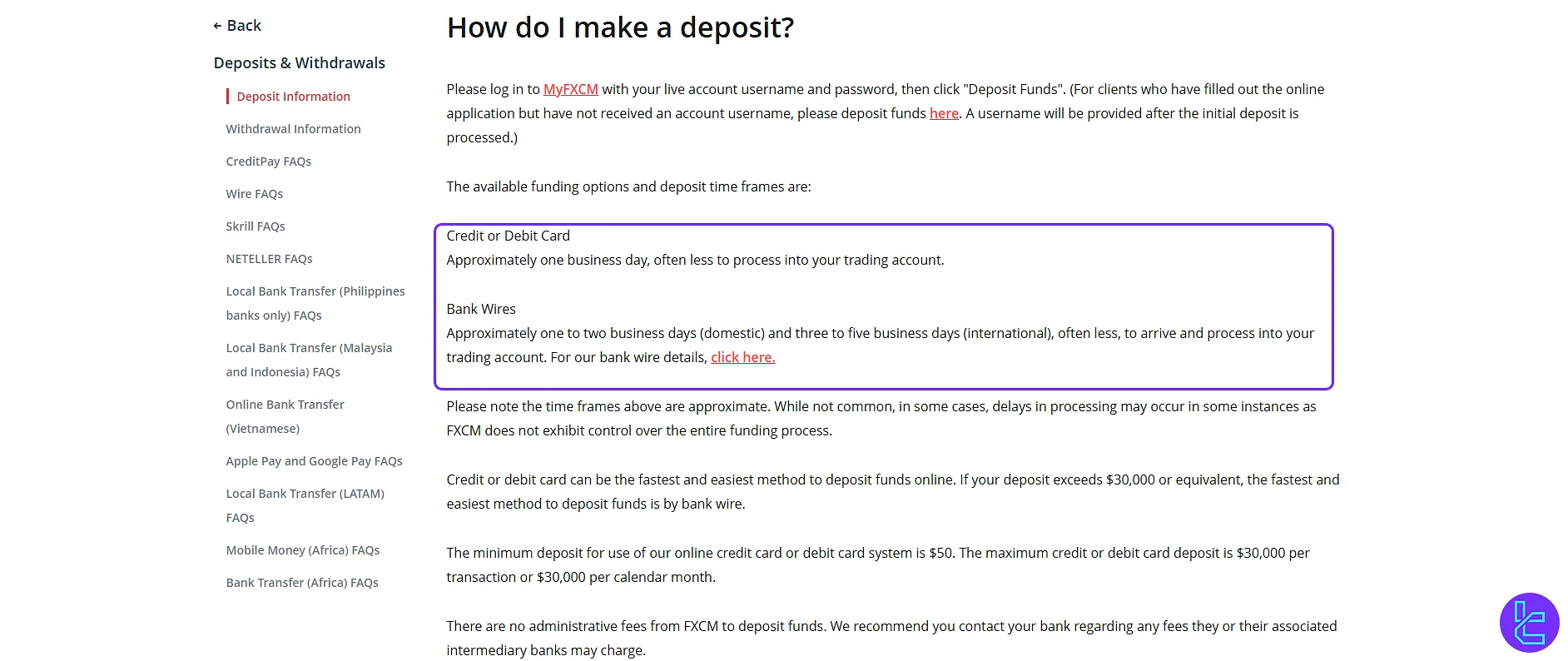

FXCM Deposit & Withdrawal Methods

FXCM offers a variety of options for funding your account and withdrawing your profits:

- Bank transfer

- Credit/Debit cards (Visa, MasterCard)

- E-wallets (Skrill, Neteller)

Key points to note:

- Minimum deposit:$50

- No deposit fee

- 40$ charge on bank wire withdrawals

- Withdrawals typically processed within 1-2 business days

FXCM Deposit

FXCM provides multiple funding options for secure and efficient deposits, including debit/credit cards, bank wire transfers, Google Pay, Skrill, Neteller, China Online Payment, and cryptocurrency.

Clients can access the MyFXCM portal with their live trading account credentials to manage account settings and initiate deposits.

Processing Times & Conditions:

Condition | Details |

Card Deposit | Typically available immediately, but may take up to 1 business day depending on third-party verification and transfer processes |

Third-Party Payments | Not accepted; deposits must come from an account in the trading account holder’s name |

Currency Conversion | Deposits in a currency different from the account denomination incur currency conversion fees per FXCM’s Rate Card |

FXCM also cautions users about the inherent risks of mobile trading and recommends testing the FXCM Mobile Trading Station before managing a live account via mobile devices.

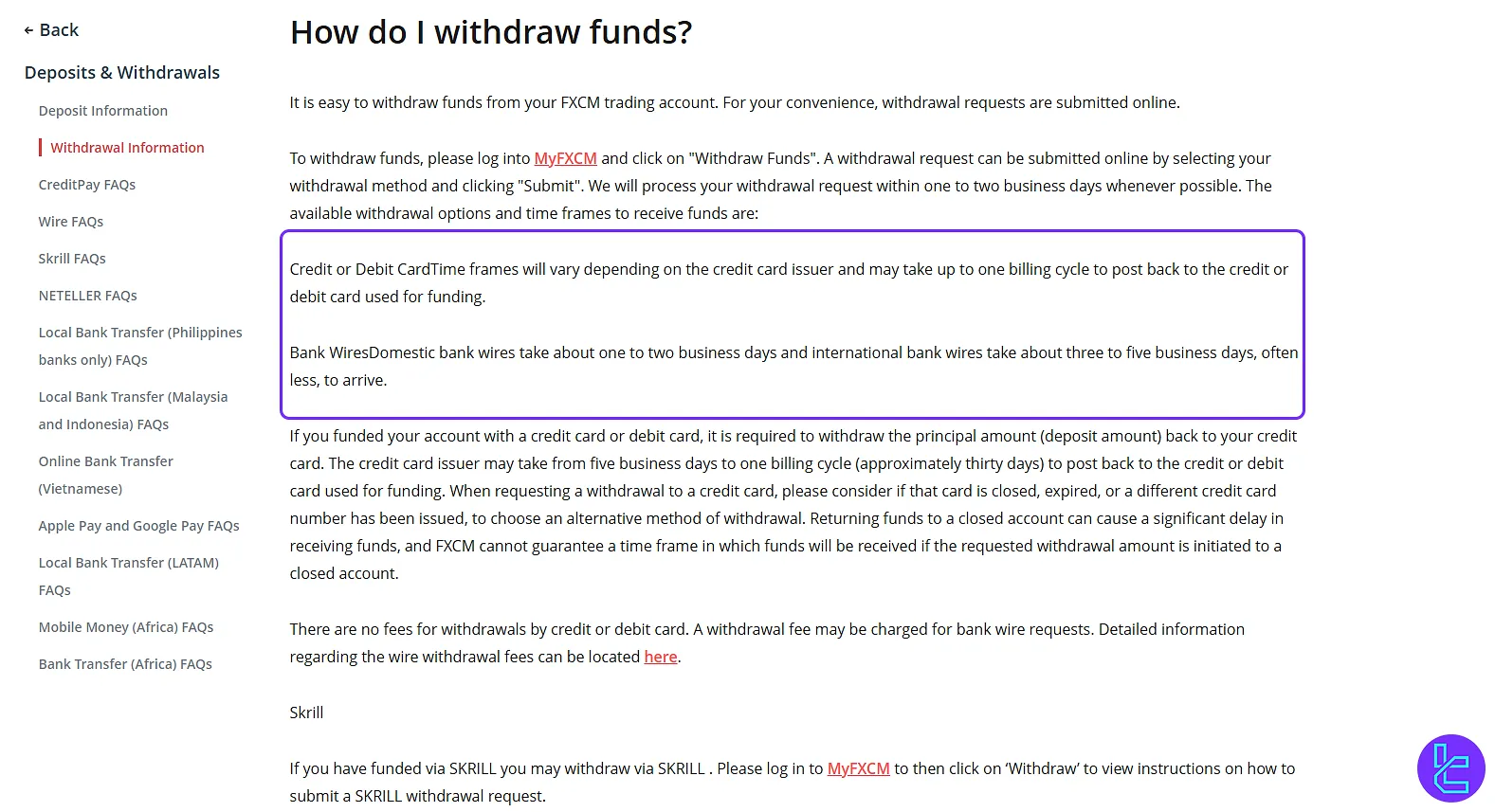

FXCM Withdrawal

To withdraw funds from an FXCM account, clients log in to MyFXCM, access the “Withdraw Funds” section, select a preferred withdrawal method, enter the withdrawal amount, and submit the request.

Withdrawals are generally processed within 1–2 business days.

Available Withdrawal Methods:

Withdrawal Method | Details |

Bank Transfer | Domestic wires: 1–2 business days; International wires: 3–5 business days |

Credit/Debit Card | Principal deposits may need to be returned to the same card used for funding |

Electronic Wallets | Options include PayPal, Neteller, and Skrill |

Important Notes:

- Currency Conversion Fees apply if the account currency differs from the withdrawal currency;

- Third-Party Payments are not allowed; withdrawals must be sent to an account in the same name as the FXCM trading account;

- External Fees may be charged by payment processors;

- Account Verification is required before any withdrawal can be processed.

Copy Trading & Investment Options Offered on FXCM Broker

FXCM provides several options for those interested in copy trading and passive investment:

Capitalize AI Algo Trading

- Uses artificial intelligence to create and optimize trading strategies

- Backtests strategies using historical data

- Automates trade execution based on AI-generated signals

Zulu Trade Copy Trading

- ZuluTrade copy trades of experienced traders

- Social trading

- Automated trade execution, allowing for hands-free portfolio management.

This option allows traders to diversify their approach, potentially benefiting from the power of AI. However, remember that past performance doesn't guarantee future results - always understand the risks involved in copy trading.

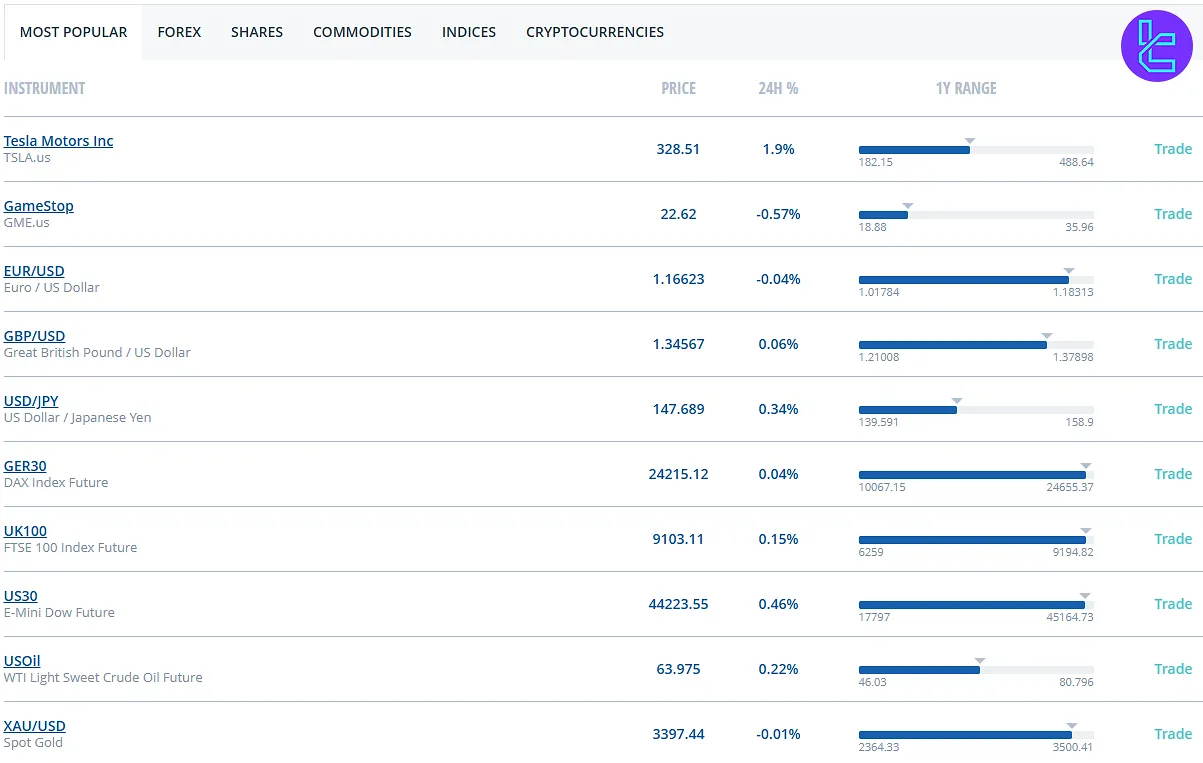

FXCM Tradable Markets and Instruments

FXCM offers a diverse range of tradable markets:

Category | Types of Instruments | Number of Symbols | Competitor Average |

Forex | Major, Minor, and Exotic pairs | ~40+ Pairs | Top Brokers Offer 100–240+ Forex Pairs |

Shares | Single-Share CFDs on Markets Across the US, UK, EU, Hong Kong, Australia | Not Publicly Specified | Some Brokers Offer Thousands of Stock CFDs |

Commodities | Metals (Gold, Silver), Energy (Oil, Natural Gas), Agricultural or others | ~10+ Instruments | Competitors Often offer 10–20 Commodity CFDs |

Cryptocurrencies | Crypto CFDs Such as BTC, ETH, LTC, XRP, ADA, AVAX, BNB, DOGE, DOT, EOS, KSM, LINK, SOL, XLM, XTZ (various pairings) | ~15+ Instruments | Average is 20–40+ Crypto CFDs Per Broker |

Indices | Index CFDs like US30, SPX500, UK100, GER30, NAS100, JPN225, AUS200 | ~10+ Indices | Competitors Average 10–15 Index CFDs |

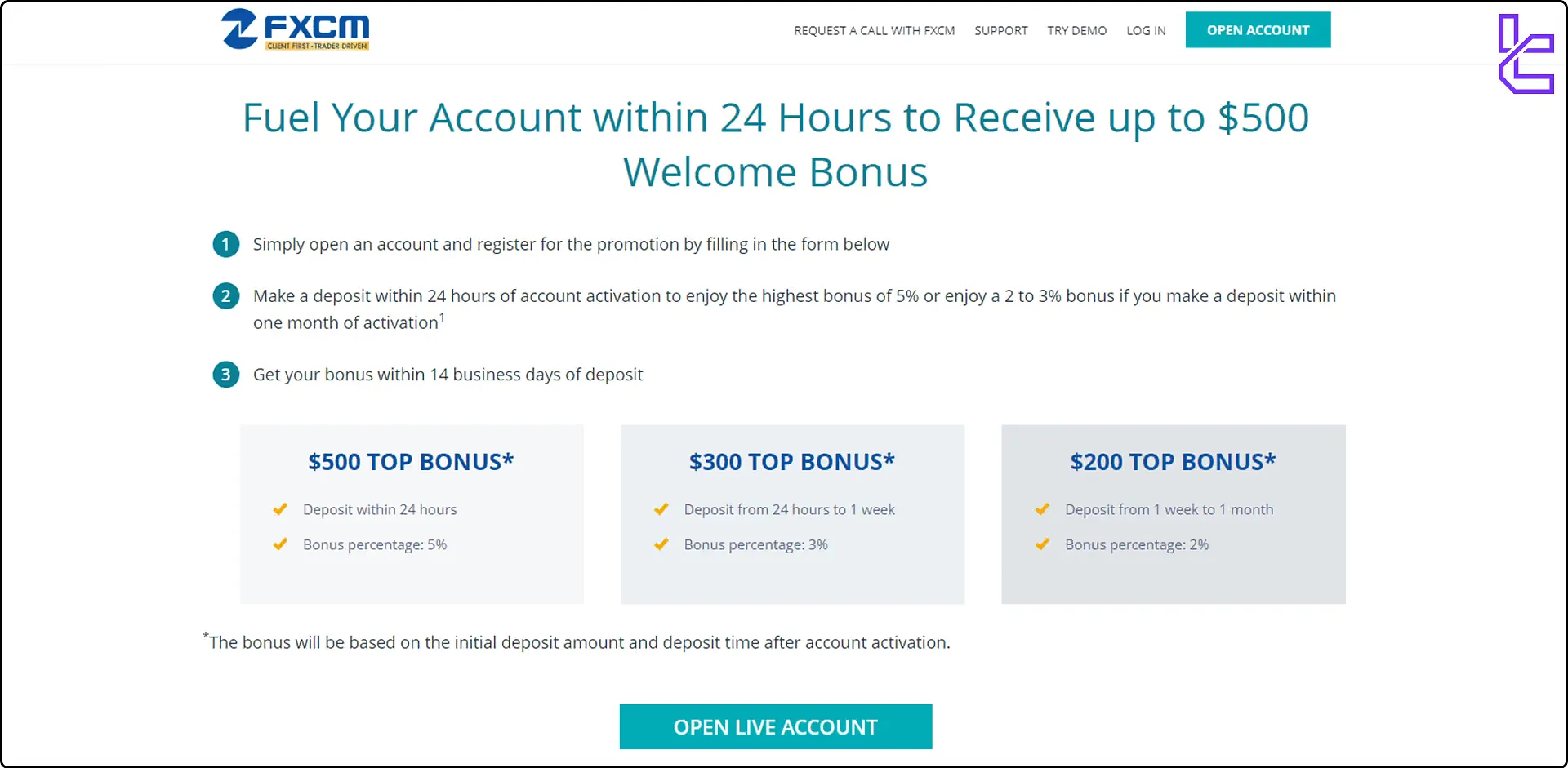

FXCM Broker Promotions and Bonuses

FXCM offers several incentives to attract and retain traders:

Welcome Bonus

FXCM offers a welcome bonus of up to $500 for traders who fund their accounts within the first 24hrs of their account registration.

Rebate Program

FXCM offers cashback bonus up to $10,000 for trading Gold in this broker. Based on your XAU trading volume, FXCM will reward you on a monthly basis.

Referral Program

Traders can earn up to $400 bonus by referring their friends to join the FXCM platform.

Remember, trading bonuses often come with specific terms and conditions. Always read the fine print and understand the requirements before participating in any promotional offers.

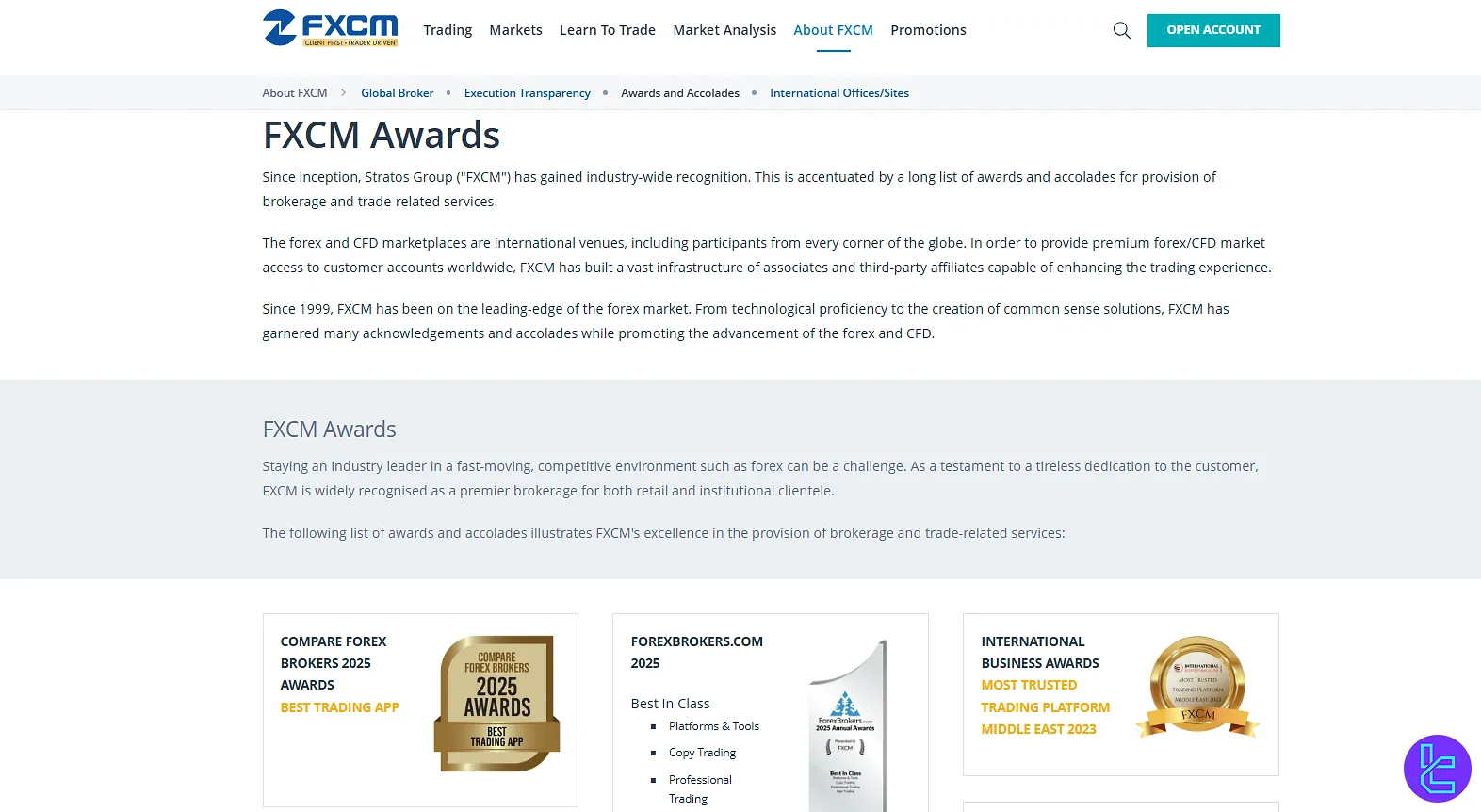

FXCM Industry Awards and Recognitions

FXCM has earned a series of industry awards acknowledging its performance in forex and CFD trading, platform innovation, and client support.

2022 Highlights:

- Ultimate Fintech Awards: Broker of the Year

- Global Forex Awards: Best Forex Trading Platform – MENA

- ADVFN International Financial Awards: Best Zero Commission Broker

2021 Highlights:

- Ultimate Fintech Awards: Broker of the Year, Best Customer Service

- ADVFN International Financial Awards: Best Zero Commission Broker

- Shares Awards: Best Forex Trading Platform

- Online Personal Wealth Awards: Best FX Platform

- Global Forex Awards: Best Forex Mobile Trading Platform – Global

Other Notable Achievements:

- ForexBrokers.com: 4.5/5 Stars Overall Review (2020)

- Shares Awards: Best Trading Tools and Research (2020)

- Personal Wealth: Best Trading Tools (2020)

- FXStreet: Best Sell-Side Analysis Contributor (DailyFX) (2013)

- UK Forex Awards: Best Forex Trading Automation (2015)

- Money AM: Best Online FX Provider (2013), Best Online FX Broker (2010)

- Inc. 500 List: Four-time honoree for fastest-growing U.S. companies

These recognitions span over a decade, reflecting FXCM’s sustained presence in the industry and its capabilities across platform technology, market analysis, and customer support.

Full details regarding FXCM’s awards are available on the broker’s official page.

FXCM Broker Customer Support

It’s time to go through customer support in our FXCM review. This broker provides comprehensive support through multiple channels:

- Live Chat: Available 24/5 for quick queries

- Email: info@fxcmmarkets.com

- Phone: 00 1 646-253-1401

- WhatsApp: +44 7537 432259

Support is offered in multiple languages to cater to FXCM's global client base, and it is active 24/5. FXCM also maintains an extensive FAQ section and knowledge base on their website for self-help options.

FXCM Restricted Countries

While FXCM operates globally, regulatory restrictions mean it can't offer services in all countries. Notable restrictions include:

- Asia: North Korea, South Korea, Singapore, Iran, Syria, Afghanistan, Turkey

- Africa: Liberia, Sudan, Zaire, Zimbabwe, Burundi, Ivory Coast, Central African Republic

- Europe: Russian Federation, Ukraine, Belarus

- South America: Cuba, Vanuatu

- North America: USA

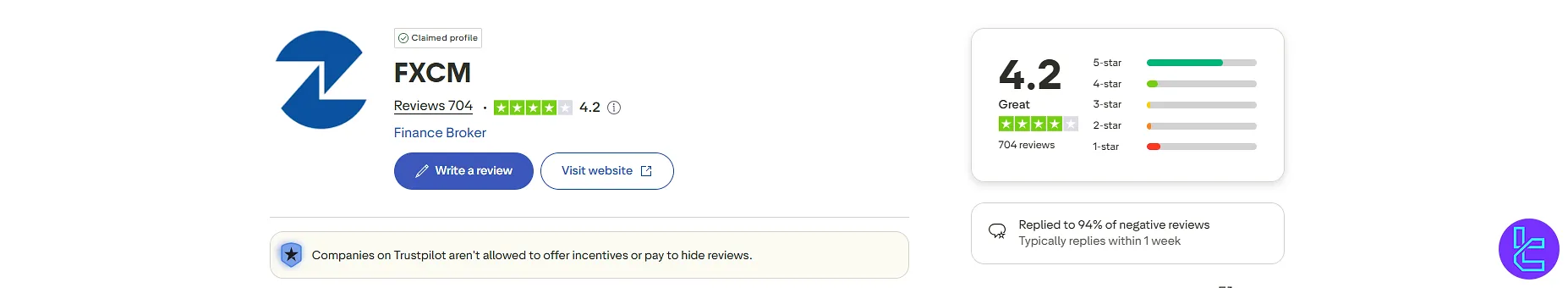

FXCM Reviews and Trust Scores

The FXCM Trustpilot profile has garnered mixed reviews from traders over the years, with a score of 4.2 out of 5.

It's important to note that online reviews can be subjective. While they provide valuable insights, they should be considered alongside other factors like regulation, trading conditions, and personal experience.

FXCM Broker Education

FXCM offers a robust educational section to help traders of all levels improve their skills:

- Trading Guides: Comprehensive resources on forex basics, technical analysis, and trading strategies

- Video Tutorials: Visual learning aids covering platform usage and trading concepts

- Webinars: Live and recorded sessions with FXCM experts

- Trading Signals: Daily analysis and trade ideas

The education section is freely accessible, even for non-account holders. You can also check TradingFinder's Forex education section for additional resources.

FXCM Compared to Other Brokers

Let's compare FXCM features and services with those of other brokers:

Parameter | FXCM Broker | FXGT Broker | Pepperstone Broker | Moneta Markets Broker |

Regulation | FCA, ASIC, CySEC, ISA, FSCA | VFSC, CySEC, FSA, FSCA | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC | FSCA, FSRA |

Minimum Spread | From 0.2 Pips | From 0.0 Pips | From 0.0 pips | From 0.0 pips |

Commission | $0.0 | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $50 | $5 | $1 | $50 |

Maximum Leverage | 1:1000 | 1:5000 | 1:500 | 1:1000 |

Trading Platforms | MT4, TradingView, TradeStation | MT4, MT5 | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 | MT4, MT5, Pro Trader, App Trader |

Account Types | CFD account, Active Trader account, Corporate account | Standard+, ECN Zero, Mini Optimus, Pro | Standard, Razor | Direct, Prime, Ultra |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 13,000 | N/A | 1200+ | 1000+ |

Trade Execution | Market | Market | Instant | Market |

TF Expert Suggestion

FXCM offers a low-cost trading experience, with floating spreads from 0.2 pips and no commissions on CFDs in 5 markets.

Despite that, the broker's $50 inactivity fee, $40 commission on bank withdrawals, and history of bankruptcy are important facts traders must consider about this broker.