FXTM (Forex Time) offers spot, futures [1:3000 maximum leverage], and copy trading to more than 1M users. Forex Time Broker has received 45 awards for no other reason than features such as zero spreads, 1000+ tradable assets, and the Proprietary FXTM Trader App.

FXTM Company Information & Regulation

FXTM, established in 2011, has quickly become a major player in the global Forex and CFD trading landscape. Headquartered in Mauritius, FXTM has expanded its reach to serve clients in over 150 countries worldwide.

However, this company has only one regulation, which is the Financial Services Commission (FSC) of Mauritius.

In past years, ForexTime received regulations from the UK FCA, CySEC, Cyprus, and FSCA, South Africa, all of which have now expired. This company has performed poorly and inappropriately in this field because its only license is from an offshore regulator that is not very reliable.

The table in this section reviews and summarizes the brokerage's company specifics:

Entity Parameters/Branches | Exinity Limited |

Regulation | FSC |

Regulation Tier | 3 |

Country | Mauritius |

Investor Protection Fund / Compensation Scheme | N/A |

Segregated Funds | Yes |

Negative Balance Protection | N/A |

Maximum Leverage | 1:3000 |

Client Eligibility | International Clients (with Restrictions for Select Regions) |

Summary of Specifications

Let's take a closer look at what FXTM forex broker brings to the table and get to know this brokerage:

Broker | FXTM |

Account Types | Advantage, Stocks Advantage, Advantage Plus |

Regulating Authorities | FSC |

Based Currencies | USD/ EUR/ GBP |

Minimum Deposit | $200 |

Deposit Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Withdrawal Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:3000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, MT5, FXTM Trader App |

Markets | Forex, Stocks, Indices, Commodities, Cryptocurrency, Metals |

Spread | From 6 Cents in ADVANTAGE STOCKS, From 0.0 Pips in ADVANTAGE, From 1.5 Pips in ADVANTAGE PLUS |

Commission | Varies by Account |

Orders Execution | Market Execution |

Trading Features | Swap Free Account, 1:3000 Maximum Leverage, Copy Trading, Proprietary FXTM Trader App |

Affiliate Program | Yes |

Bonus & Promotions | Loyalty Program, Referral Program, Deposit Bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Email |

Customer Support Hours | 24/5 |

Restricted Countries | USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, Democratic People's Republic of Korea, Puerto Rico, Occupied Area of Cyprus, Quebec, Iraq, Syria, Cuba, Belarus, Myanmar |

FXTM stands out with its diverse range of trading instruments, competitive spreads, and high leverage options. The broker caters to both novice and experienced traders with its variety of account types and comprehensive educational resources.

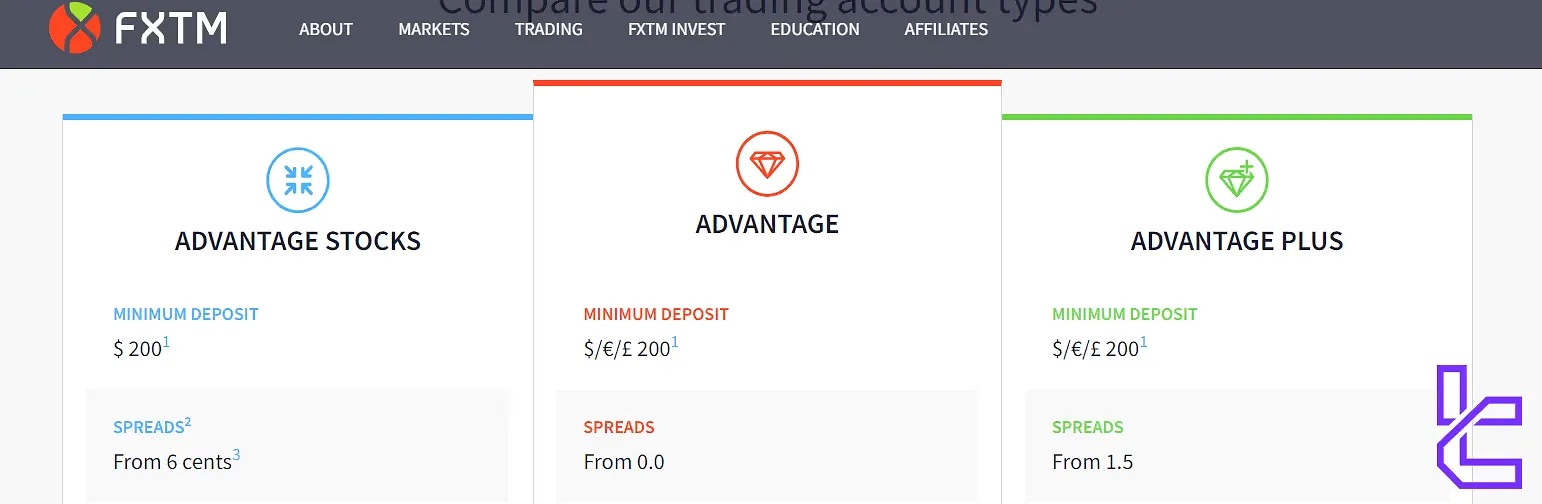

What are FXTM Account Types? Full Comparison

This broker offers 3 account types [ADVANTAGE STOCKS, ADVANTAGE, ADVANTAGE PLUS] to suit different trading styles and experience levels; FXTM Account Types:

Specifics | ADVANTAGE STOCKS | ADVANTAGE | ADVANTAGE PLUS |

Minimum Deposit | $200 | $200 | $200 |

Spreads | From 6 Cents | From 0.0 Pips | From 1.5 Pips |

Commissions | 0 | $3.5 per Lot for Forex 0.05% for Cryptocurrencies $0.02 for Stock CFDS | 0 |

Trading Instrument | Stocks | Forex Pairs, Metals, Indices, Commodity, Cryptocurrency, Stocks | Forex Pairs, Metals, Indices, Commodity, Cryptocurrency, Stocks |

Order Execution | Market Execution | Market Execution | Market Execution |

Base Currency | USD | USD/ EUR/ GBP | USD/ EUR/ GBP |

Max Leverage | 1:1 | 1:3000 | 1:3000 |

Margin Call | - | 80% | 80% |

Stop Out | - | 50% | 50% |

Swap Free | - | Yes | Yes |

All FXTM accounts can be converted to swap-free (Islamic) accounts upon request and benefit from fast execution speeds, especially under the Advantage structure.

FXTM Pros and Cons

Like any broker, FXTM has its strengths and weaknesses. Let's break them down to see what it got:

Advantages | Disadvantages |

Wide Range of Trading Instruments | Improper Performance in The Regulatory |

Competitive Spreads and Low Commissions | Limited Cryptocurrency Offerings |

Advanced Trading Platforms (MT4, MT5) | Higher Minimum Deposits in Comparison with Other Brokers |

Excellent Educational Resources | No US Clients Accepted |

Multiple Account Types to Suit Different Traders | - |

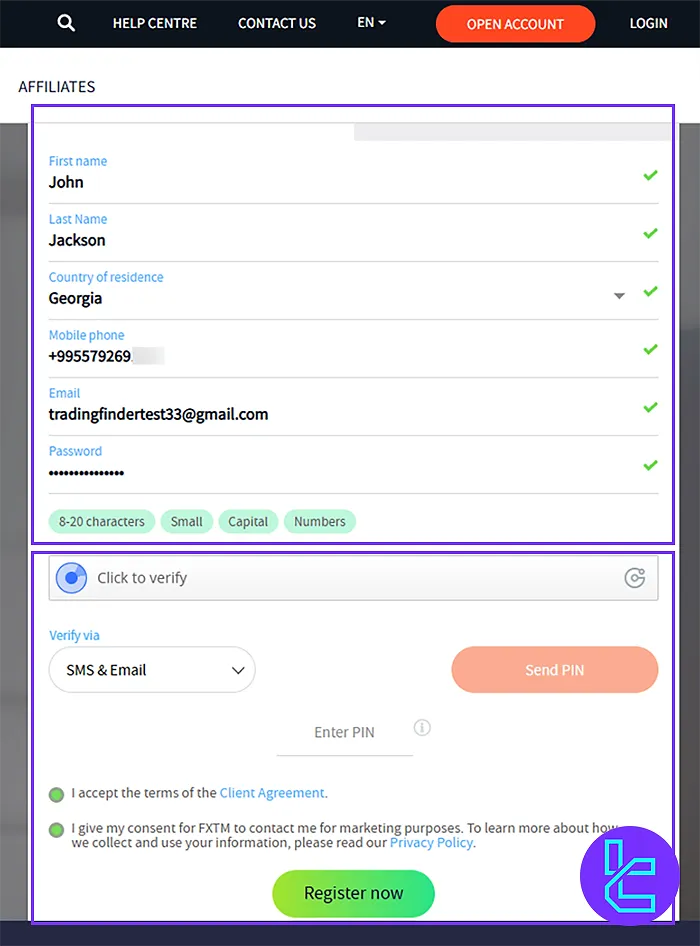

FXTM Broker Sign Up: Complete Tutorial for Traders

The FXTM Registration takes only a few minutes and offers flexible verification via email, SMS, or WhatsApp. The platform ensures a secure onboarding process for traders worldwide.

#1 Access the FXTM Registration Form

Visit the official website and click “Open Account” to launch the signup process.

#2 Enter Personal Details on FXTM

Fill in your first and last name, country, mobile number, email, and create a secure password (8–20 characters, including letters, numbers, and symbols).

#3 Verify Your Email in FXTM

Choose your preferred method (Email, SMS, or WhatsApp), request the PIN code, and enter it into the form. Once verified, check the terms box and click “Register Now”.

4# FXTM Verification

To complete the FXTM Verification process, access the KYC or Verification section from your profile, then upload the required documents, like a passport and proof of address, and wait for the approval.

What Platforms are Available on FXTM?

This broker supports the world's most popular trading platforms, MetaTrader 4 and 5. In addition to these two, it is also possible to trade on mobile with this broker's application, FXTM Trader App; Forex Time Trading Platforms:

- MetaTrader 4 (MT4): The industry-standard platform, known for its user-friendly interface and extensive customization options

- MetaTrader 5 (MT5): An advanced version of MT4, offering more timeframes, indicators, and the ability to trade a wider range of markets

- FXTM Trader App: FXTM's proprietary mobile app, allowing traders to manage their accounts and trade on the go

All platforms come with advanced charting tools, multiple order types, and the ability to automate trading strategies using Expert Advisors (EAs).

FXTM Forex Broker Spreads and Commissions Overview

FXTM offers competitive spreads and commissions across its account types; FXTM Spread and Fees:

Specifics | ADVANTAGE STOCKS | ADVANTAGE | ADVANTAGE PLUS |

Spreads | From 6 Cents | From 0.0 Pips | From 1.5 Pips |

FX Commission | 0 | $3.5 Per Lot | 0 |

Metals Commission | 0 | $25 Per Million Notional | 0 |

Indices Commission | 0 | $35 Per Million Notional | 0 |

Cryptocurrency Commission | 0 | 0.05% of Notional Value | 0 |

Stock Commission | 0 | $0.02 Per Side, $0.01 Minimum Commission | 0 |

These competitive rates, combined with fast execution speeds, make FXTM an attractive option for both casual and high-volume traders.

Swap Fees

A swap refers to the interest applied to positions held overnight, either as a cost or a credit, depending on the trade direction.

There are two categories: Swap Long (applied to buy trades) and Swap Short (applied to sell trades). These values, typically measured in pips per lot, differ by trading instrument. While this charge is retained by FXTM, it is generally maintained at a minimal level.

The brokerage has dedicated a section of its website to showing a table of the swap rates for each symbol. These might change instantly.

Non-Trading Commissions

FXTM applies certain non-trading costs, primarily related to inactive accounts. These fees are not tied to trading volume but can affect users with dormant accounts or those transferring funds out of the platform.

A recurring €10 / $10 / £10 fee (or the equivalent in NGN) is applied each month to any account holding a positive balance that has remained inactive for 90 consecutive days. This fee is automatically deducted either from the trading account or the FXTM Wallet, based on the currency setting.

Clients are alerted via email five days prior to the charge, with an additional reminder on the day the fee is processed.

Accounts with zero balances are exempt from inactivity fees.

What Deposit & Withdrawal Methods are on FXTM?

FXTM offers more than 10 deposit and withdrawal methods, including VISA and MasterCard. We will dig deeper in the topic in the following sections.

Deposit Options

FXTM supports a variety of funding methods, ensuring traders from different regions can top up their accounts with ease. Available options include cryptocurrencies, bank cards, bank transfers, and e-wallets such as Neteller, Skrill, and Perfect Money.

Additionally, local mobile and online banking services are supported based on geographic location.

All deposit methods are commission-free on the broker’s side, though external banking fees may apply depending on currency or local institutions.

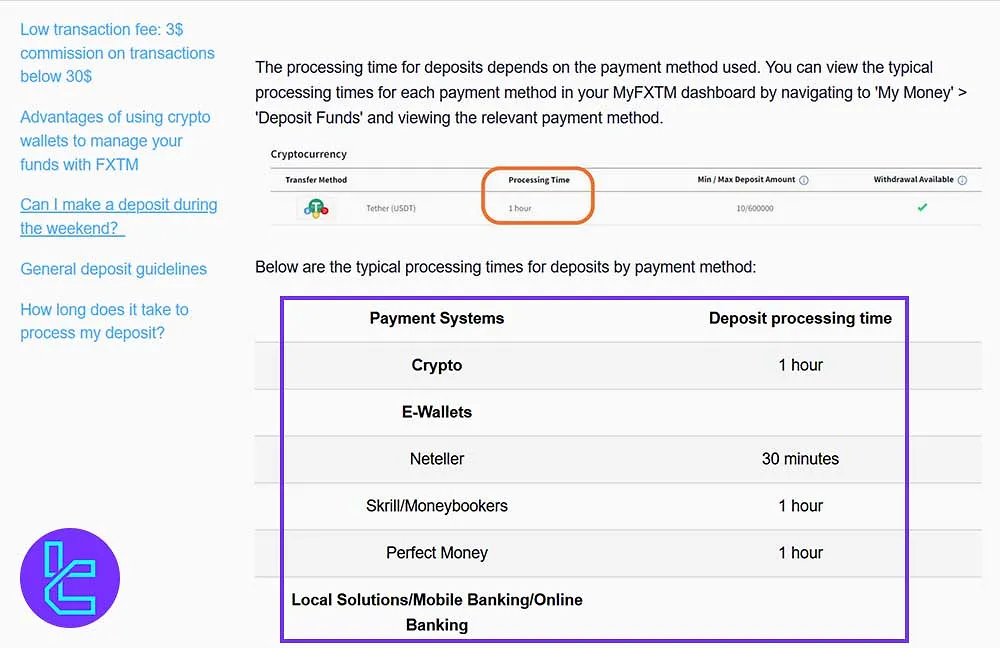

Processing times vary by method:

- Crypto and Skrill: up to 1 hour

- Neteller: Approx. 30 minutes

- Perfect Money: About an hour

- Bank wire: typically 3–5 business days

- Local/mobile banking: 30 minutes to 1 business day

There are no minimum or maximum limits imposed by FXTM, offering flexibility for both small and high-volume traders.

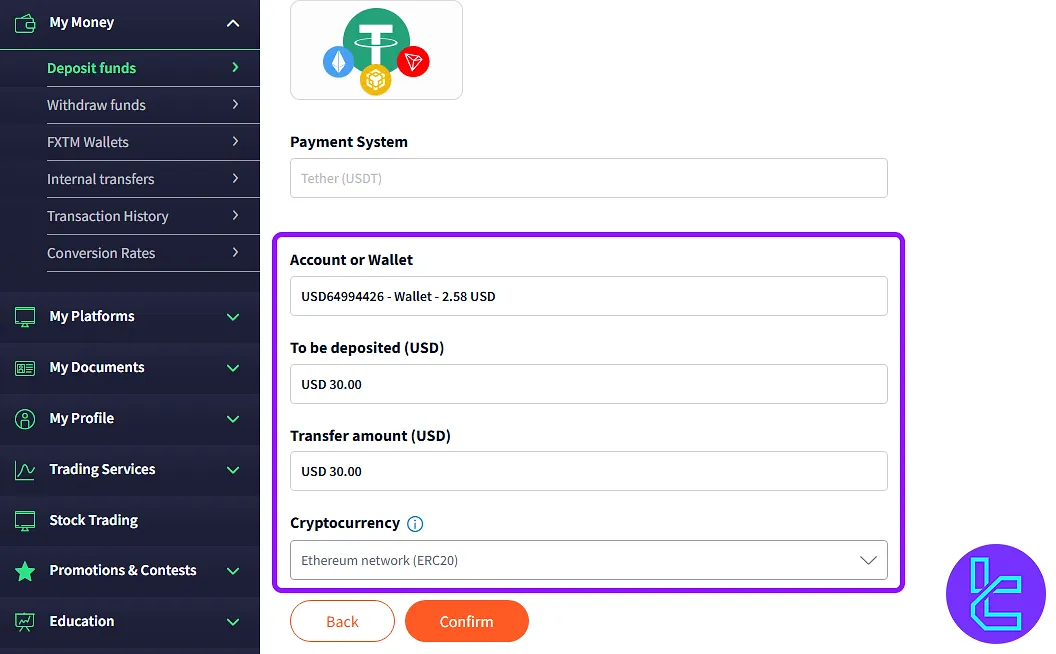

ERC20 Deposit

FXTM ERC20 deposit via USDT is available using any compatible crypto wallet. The minimum deposit is $30, and the broker charges no fees for this method.

Steps to deposit USDT (ERC-20) into FXTM:

- Access the dashboard, go to “My Money”, then “Deposit Funds”;

- Choose your trading account, set USDT as currency, and enter the amount;

Provide the required data for making a deposit on FXTM - Select the ERC-20 network under Tether;

- Confirm transaction details and submit the request;

- Scan the QR code or copy the wallet address to complete the transfer;

- Monitor progress via Transaction History under “My Money”.

Once submitted, transactions cannot be canceled, so ensure accuracy when entering wallet details. FXTM also supports ERC20 deposits via its mobile app on both iOS and Android.

Available Withdrawal Solutions

FXTM allows withdrawals through the same channels used for deposits, including cryptocurrencies, e-wallets, credit/debit cards, bank wire, and local payment systems

Withdrawal fees differ by method:

- E-wallets: Free

- Cards: $3 / €2 / £2

- Bank wire: $30

- Local methods: Fee varies by provider

Processing times range based on the system:

- Cards: 3–10 business days

- Bank wire: 3–5 business days

- E-wallets: Within 1 business day

- Local payments: Time varies by region

FXTM sets withdrawal limits for specific options:

- Cards: Minimum $5, maximum $15,000 (USD/EUR)

- Crypto and e-wallets: No specific limits apply

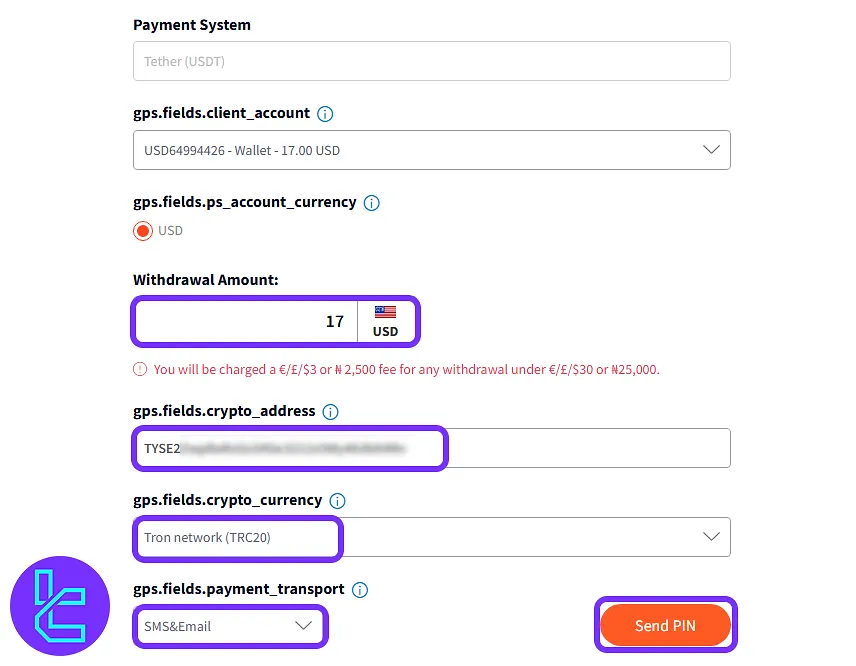

TRC20 Withdrawal

FXTM TRC20 withdrawal on FXTM is quick and efficient. This method allows users to transfer funds to a Tron-compatible wallet with minimal steps and secure PIN confirmation.

Steps to withdraw via TRC20:

- Go to “My Money”, select your account, and click “Withdraw”;

- Fill out the form: enter the amount, paste your USDT TRC20 address, choose the TRC20 network, and request your PIN code (via SMS or email);

Fill in the form fields as shown in the screenshot - Confirm the code and submit the transaction.

To track the status, check the Transaction History section. No documents are required, but a $3 fee applies if withdrawing less than $30. This method is supported on both desktop and mobile platforms.

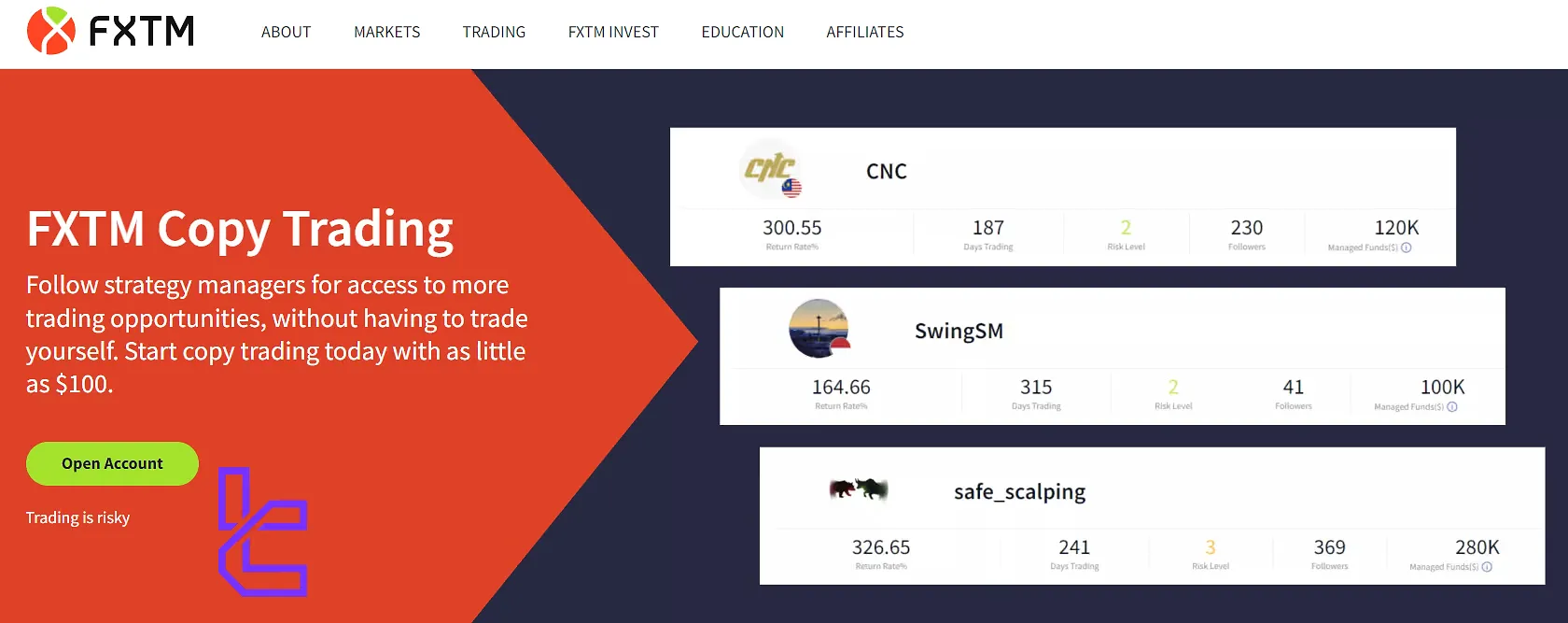

Copy Trading & Investment Options

FXTM offers a robust copy trading program called FXTM Invest. This allows less experienced traders to automatically copy the trades of successful strategy managers. FXTM Copy Trade Features:

- Low minimum investment ($100)

- Ability to follow multiple strategy managers

- Real-time tracking of strategy performance

- Flexible allocation of funds

This program provides an excellent opportunity for beginners to learn from experienced traders while potentially earning returns.

What Instruments and Assets are Tradable on FXTM?

More than 1000 assets and 6 Markets are tradable on FXTM.

FXTM Instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Standard, Micro, Ultra Low accounts | Over 50 currency pairs | 50–70 currency pairs | 1:3000 |

Stocks | CFDs on shares from major global markets (e.g., Facebook, Apple, Alibaba) | Over 1000 global stocks | 800–1200 | 1:25 |

Indices | CFDs on major global indices (e.g., Dow Jones) | Around 14 indices | 10–20 indices | 1:1000 |

Commodities | CFDs on crude oil, Brent oil, natural gas, and more | Around 15 instruments | 10–20 instruments | 1:500 |

Cryptocurrencies | CFDs on major cryptos such as Bitcoin, Ethereum, and others | Multiple major cryptocurrencies | Not specified | 1:1000 |

Metals | CFDs on precious metals (e.g., Gold and Silver) | Gold, Silver | Not specified | Not Specified |

This wide selection allows traders to diversify their portfolios and take advantage of opportunities across different markets.

FXTM Forex Broker Bonuses

While FXTM occasionally offers promotions, they focus more on providing value through competitive trading conditions and excellent service rather than flashy bonuses. Current promotions include:

- Loyalty Program: Earn points for trading activity, which can be exchanged for trading credit

- Referral Program: Earn rewards for referring new clients to FXTM

- Deposit Bonus: $30 deposit bonus is considered for all traders

Always check the terms and conditions of any promotion before participating.

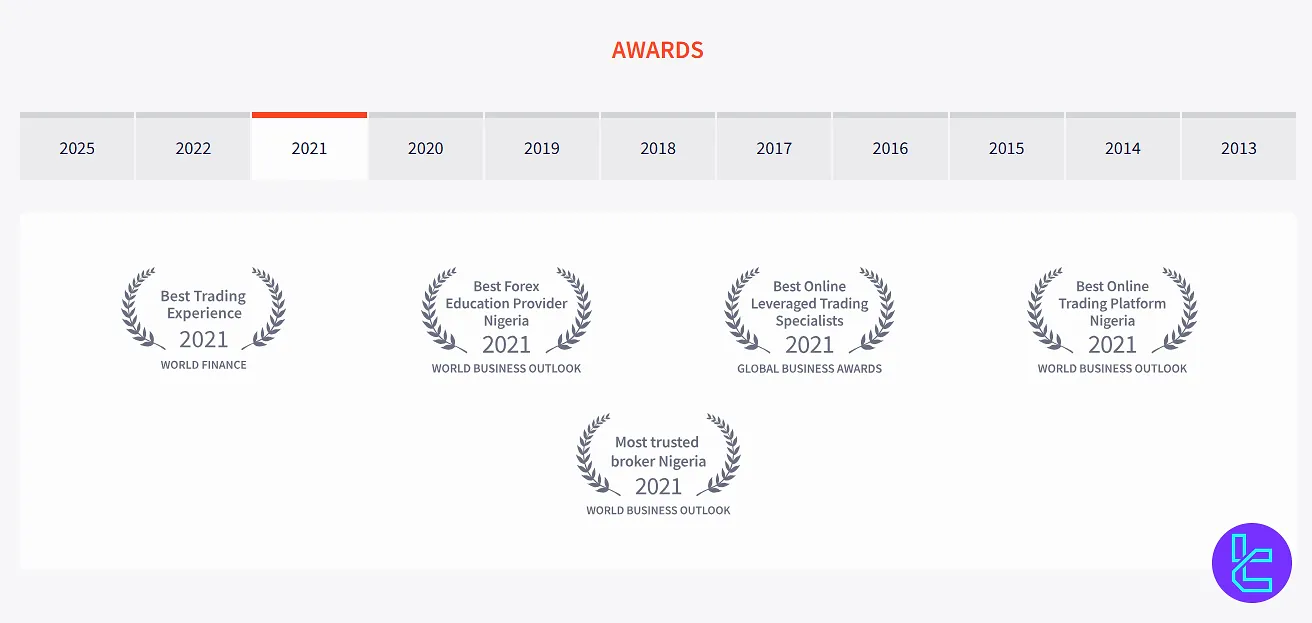

FXTM Awards

Having received over 45 awards, the broker has a relatively high reputation in the Forex industry. The company has awards listed on its website from 2013 to 2025. FXTM Awards Overview:

- Best Trading Experience 2021, World Finance

- Best Online Leveraged Trading Specialists 2021, Global Business Awards

- Best Investment Broker 2019, World Finance Awards

- Forex Broker of the Year 2017, Global Investor MENA Awards

- Most Promising Forex Broker 2015, CNForex

- Best Forex Newcomer 2013, World Finance

Support

At FXTM Review, we found that 24/7 support is not available; However, Forex Time's experts are available 24 hours a day from Monday to Friday. FXTM support:

- 24/5 support via live chat, email, and phone

- Support available in multiple languages

- Extensive FAQ section and help center

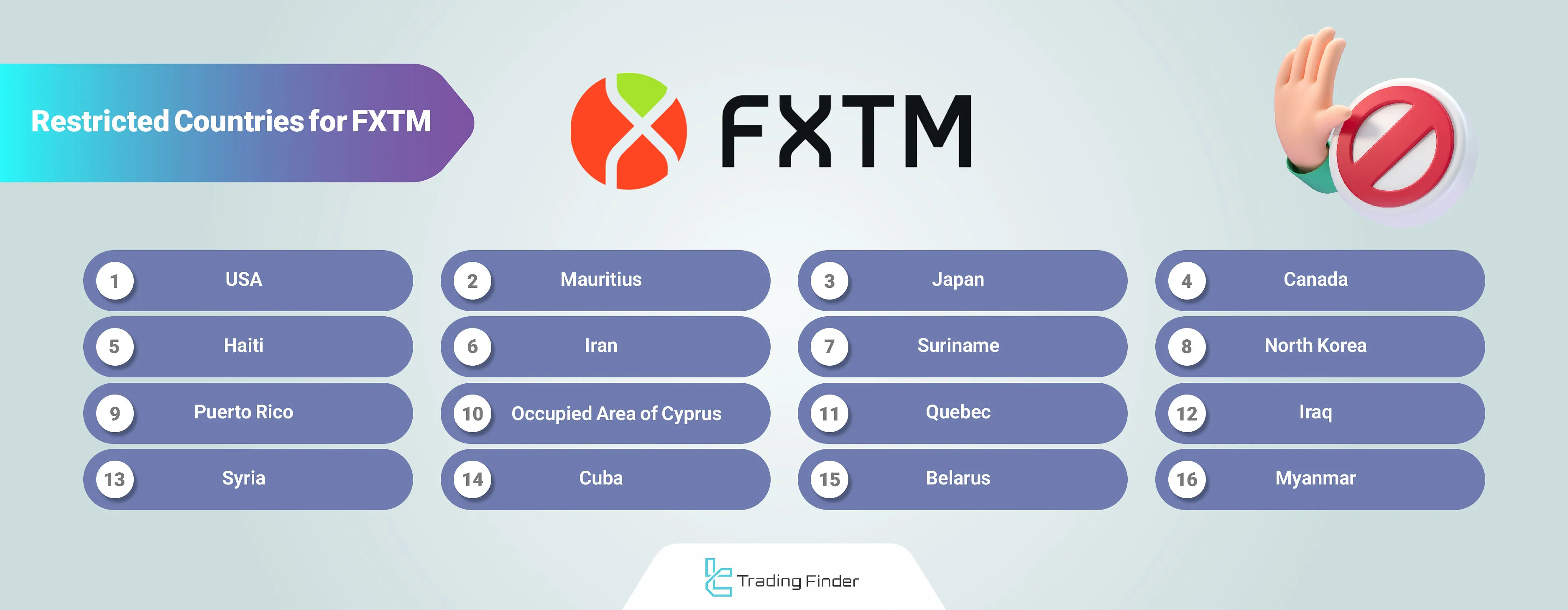

What Countries are Restricted from FXTM Services?

Due to regulatory restrictions, FXTM cannot accept clients from certain countries, including:

- USA

- Mauritius

- Japan

- Canada

- Haiti

- Iran

- Suriname

- North Korea

- Puerto Rico

- Occupied Area of Cyprus

- Quebec

- Iraq

- Syria

- Cuba

- Belarus

Always check the most up-to-date information on FXTM's website for the current list of restricted countries.

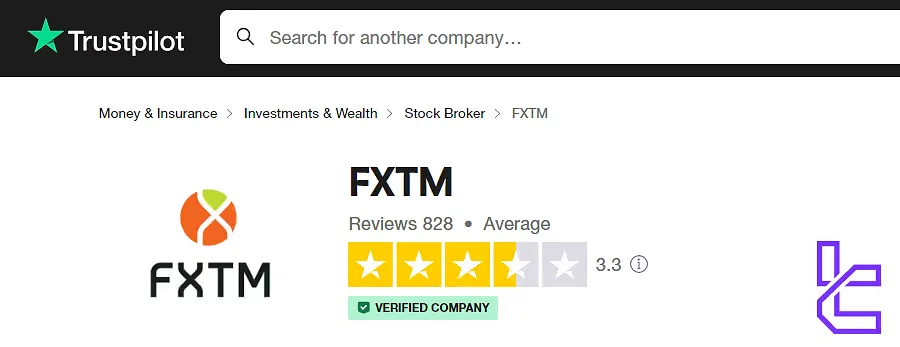

Trust Scores & Reviews

FXTM has garnered positive reviews from traders and industry experts alike:

- Trustpilot: 3.3/5 from over 800+ reviews

- ForexPeaceArmy: 2.1/5

These average scores on Trustpilot and FXTM FroexPeaceArmy reflect the broker's advantages and disadvantages that need to be addressed.

Educational Resources on FXTM Broker

FXTM excels in its educational offerings and names it “KNOWLEDGE HUB”; in this section, Forex Time Broker provides:

- Comprehensive video tutorials

- Regular webinars on various trading topics

- E-books and articles covering trading strategies and market analysis

- Demo accounts for risk-free practice

These resources make FXTM an excellent choice for traders looking to improve their skills and knowledge.

FXTM in Comparison with Others

Let's compare the FXTM features with those of other brokers; FXTM Comparison:

Parameter | FXTM Broker | |||

Regulation | FSC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB | FSA, CySEC, ASIC |

Minimum Spread | 0.0 Pips | 0.0 Pips | Varies based on Account | 0.0 Pips |

Commission | Variable | From $0.2 to USD 3.5 | Varies based on Account | Average $1.5 |

Minimum Deposit | $200 | $10 | $100 | $200 |

Maximum Leverage | 1:3000 | Unlimited (Subject to account) | 1:500 | 1:500 |

Trading Platforms | MT4, MT5, FXTM Trader App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | Advantage, Stocks Advantage, Advantage Plus | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite | Standard, Raw Spread, Islamic |

Islamic Account | Yes | Yes | Yes | Yes |

Currency Pairs | 62 | Over 100 | 200 | 861 |

Number of Tradable Assets | Over 1000 | 500+ | Not specified | Not specified |

Trade Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market |

Trading Finder Conclusion and final words

FXTM offers three account types [ADVANTAGE STOCKS, ADVANTAGE, ADVANTAGE PLUS] with $0 commission and supports more than 10 payment methods. Besides these, it offers copy trading, $30 deposit bonus, and comprehensive educational resources. But on the other hand, Forex Time has $200 minimum deposit and no US clients are welcome in this broker.