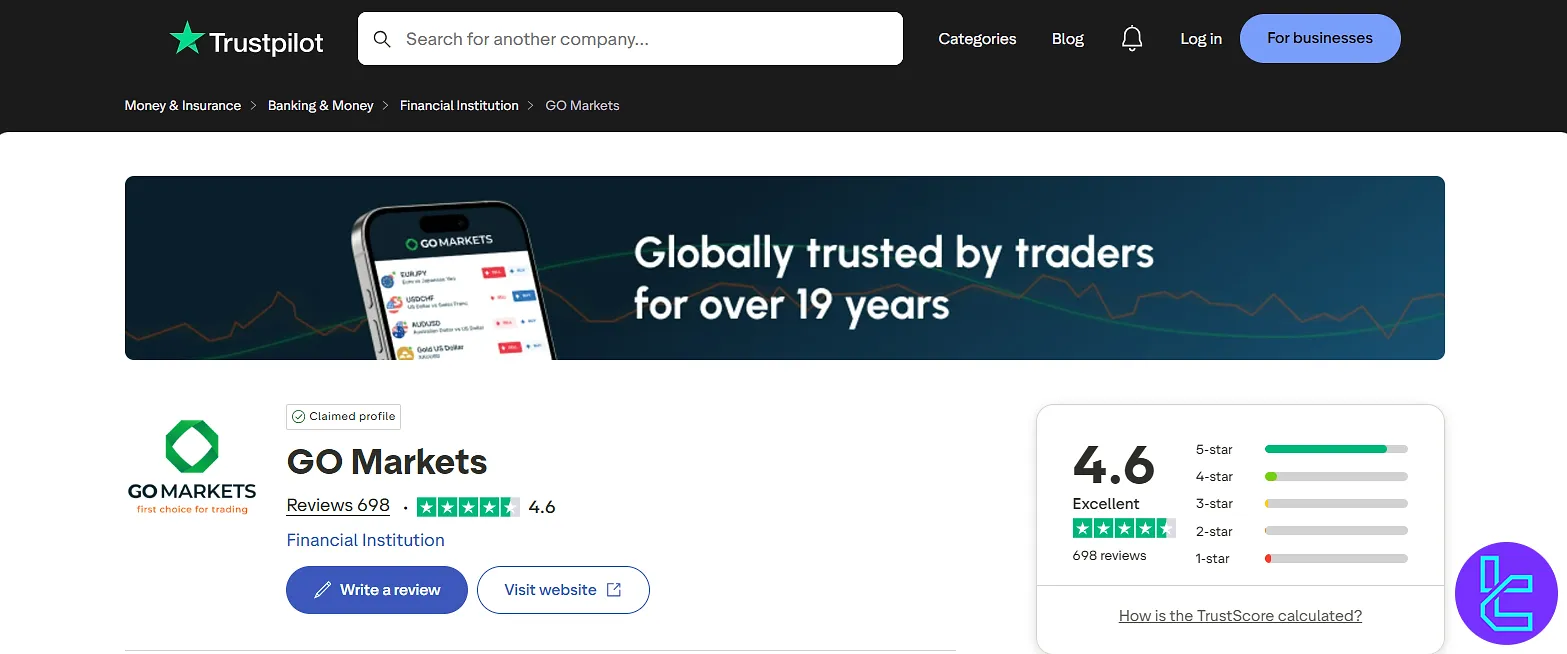

GO Markets, a financial broker with 2 account types [Standard, GO Plus+] in addition to a PAMM account, has received a 4.6/5 trust score on "Trustpilot."

With this broker, traders can trade currency pairs with 0 spreads and a $5 commission per round lot in a GO Plus+ account. Also, GO Markets has several regulations such as ASIC and CySEC.

Company Information & Regulation

GO Markets is a regulated CFD broker that has been serving traders since 2006, headquartered in Melbourne, Australia.

The company has built a solid reputation in the industry, focusing on providing clients with a superior trading experience through transparent pricing, fast execution, and reliable platforms.

Read the key information in the table below:

Entity Parameters / Branches | GO Markets Pty Ltd | GO Markets Ltd | GO Markets Pty Ltd (MU) | GO Markets International Ltd |

Regulation | ASIC | CySEC | FSC | FSA |

Regulation Tier | 1 | 1 | 3 | 3 |

Country | Australia | Cyprus (EU) | Mauritius | Seychelles |

Investor Protection Fund / Compensation Scheme | No | Up to EUR 20,000 under ICF | No | No |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:500 | 1:500 |

Client Eligibility | Australia residents only | EU residents only | Global (subject to local law) | Global / overseas (subject to restrictions) |

Summary of Key Specifics

This section will give a quick overview of GO Markets' important features. You can see it in the table below:

Broker | GO Markets |

Account Types | Standard, GO Plus+ |

Regulating Authorities | CySEC, FSC, ASIC, FSA |

Based Currencies | EUR, USD, PLN, GBP, AUD, CAD, SGD, HKD, CHF, NZD, etc. |

Minimum Deposit | 100 EUR |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-wallets |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-wallets |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, MT5, cTrader |

Markets | CFDs on Forex, Shares, Indices, Commodities, Crypto, Metals, ETFs, Treasury |

Spread | From Zero |

Commission | From Zero |

Orders Execution | Instant |

Margin Call/Stop Out | 80/50% |

Trading Features | Negative Balance Protection, Demo Account |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Phone Call, Live Chat, Email, Ticket |

Customer Support Hours | 24/7 |

GO Markets Trading Account Types

GO Markets offers two main account types, differentiating in spreads and commissions, which will be examined later in the article. GO Markets Accounts:

- GO Plus+: Designed for high-volume traders using Expert Advisors

- Standard: Suitable for both beginners and experienced traders

Table of Features:

Account Type | Go Plus+ | Standard |

Tradable Markets | Forex, Shares, Indices, and Commodities | |

Max. Leverage | 1:500 | |

EAs | Allowed | |

Scalping | Allowed | |

Min. Trade Size | 0.01 Lot | |

Also, a $50,000 demo account is available for traders with real-time spreads and no expiry, to practice without the risk of losing funds.

Pros and Cons of Trading with GO Markets

Every broker comes with its own benefits and drawbacks for trading. Here's a balanced overview of the pros and cons of GO Markets:

Cons | Pros |

Higher Minimum Deposit Compared To Some Competitors | Regulated By Reputable Authorities |

Limited Investment Options | Multiple Advanced Trading Platforms |

- | Comprehensive Educational Resources |

- | Negative Balance Protection |

- | Wide Range Of Tradable Instruments |

Account Registration and Authorization Guide

In this section, we will investigate the process of Go Markets registration as a tutorial. Opening a trading account withthis brokeris quick and streamlined, taking just a few minutes.

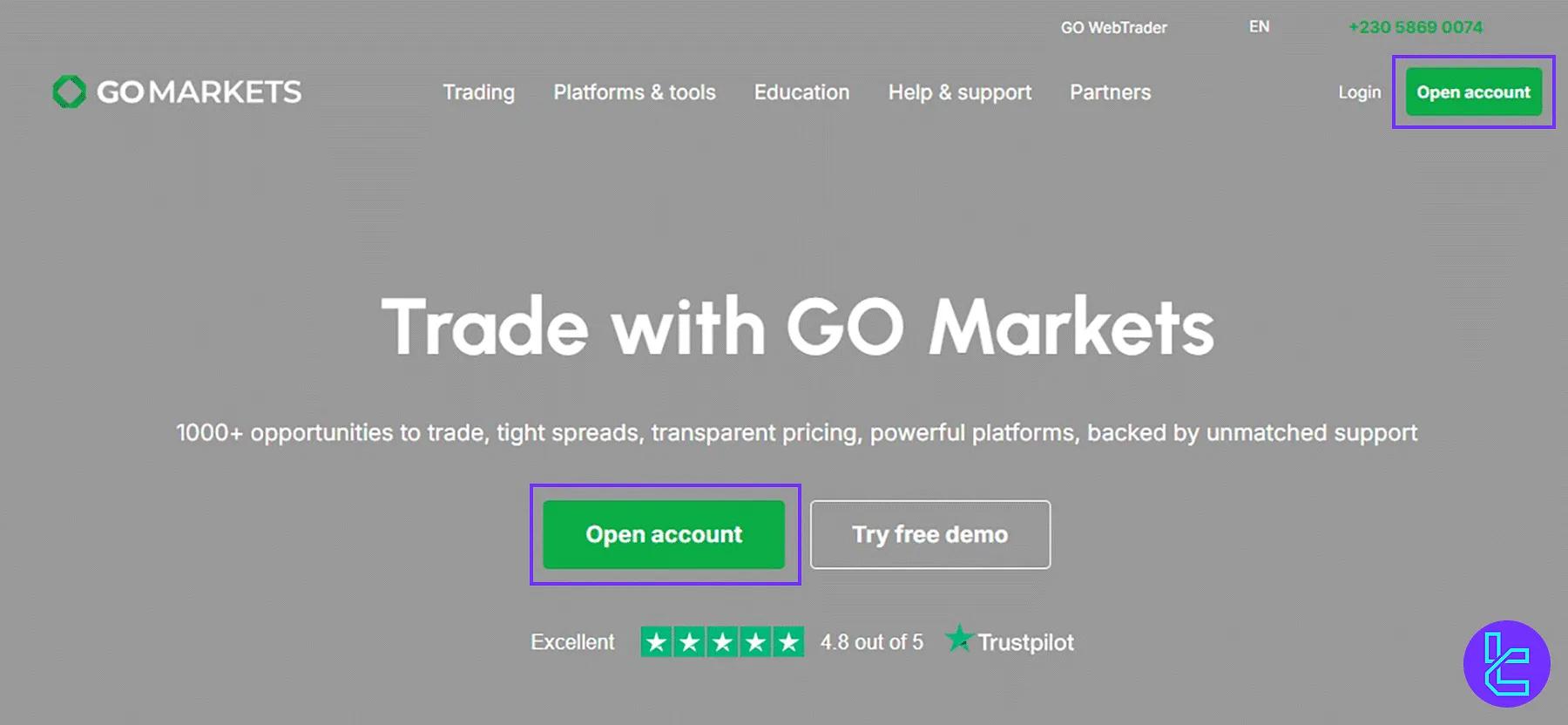

#1 Visit the Official Go Markets Signup Page

Click “Open Account” on the homepage to initiate your registration.

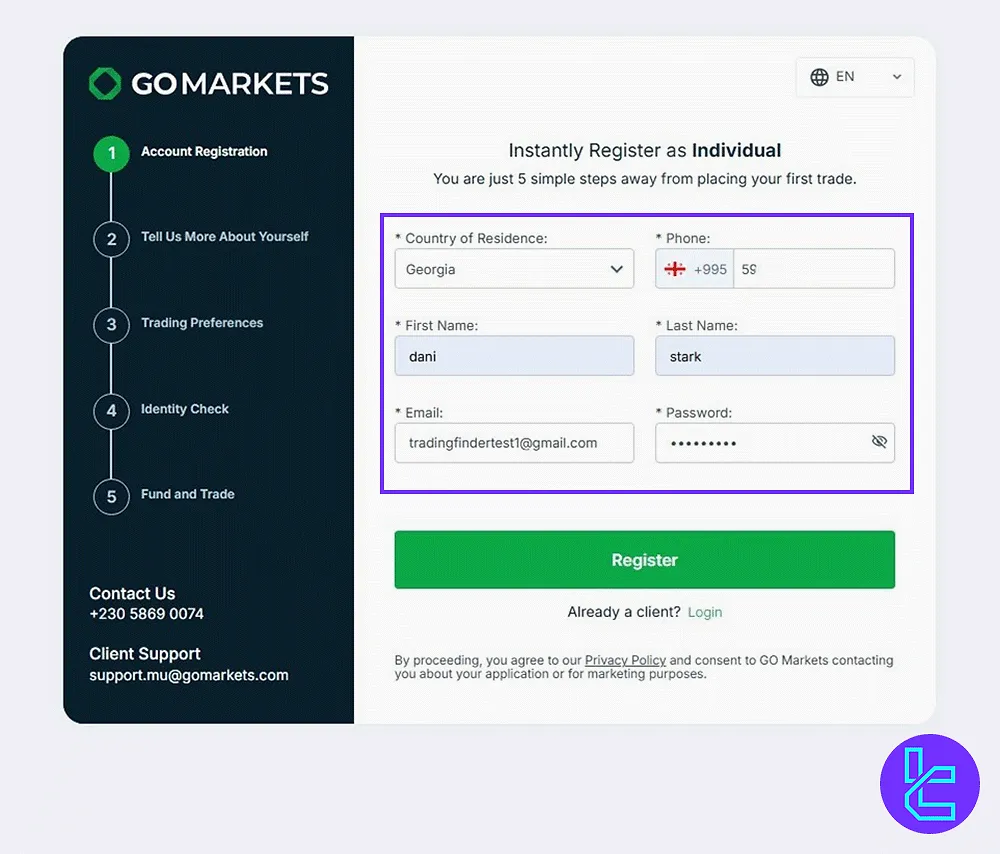

#2 Enter Basic Contact Details

Provide these data:

- Country

- Full name

- Phone number

Then, create a secure password.

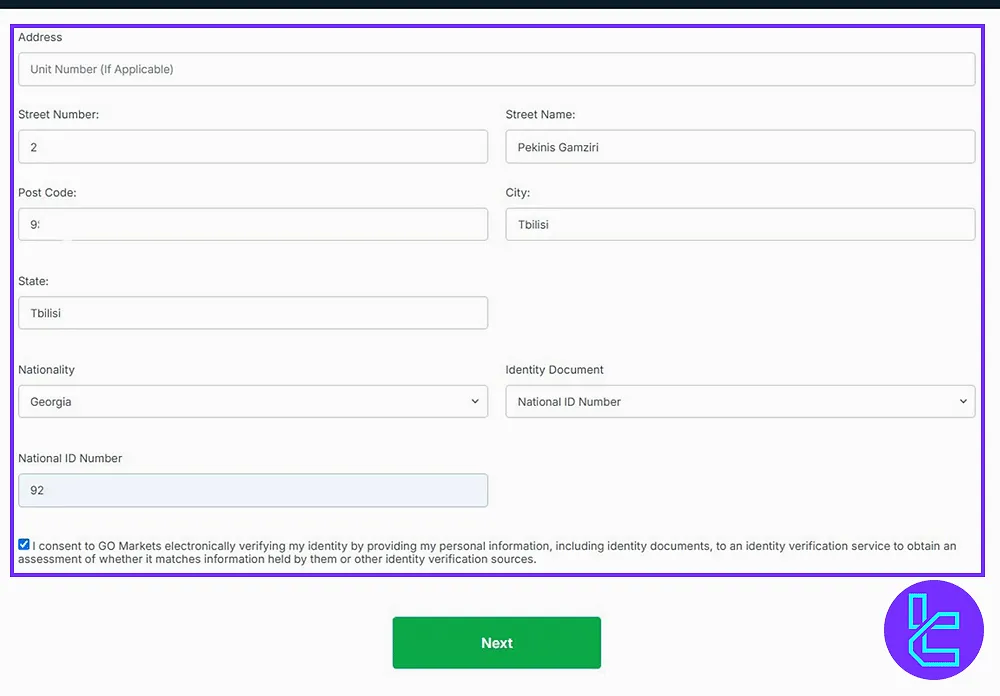

#3 Complete Identity Information

Add the required details, including:

- Residential address

- Nationality

- Date of birth

- Identity document number

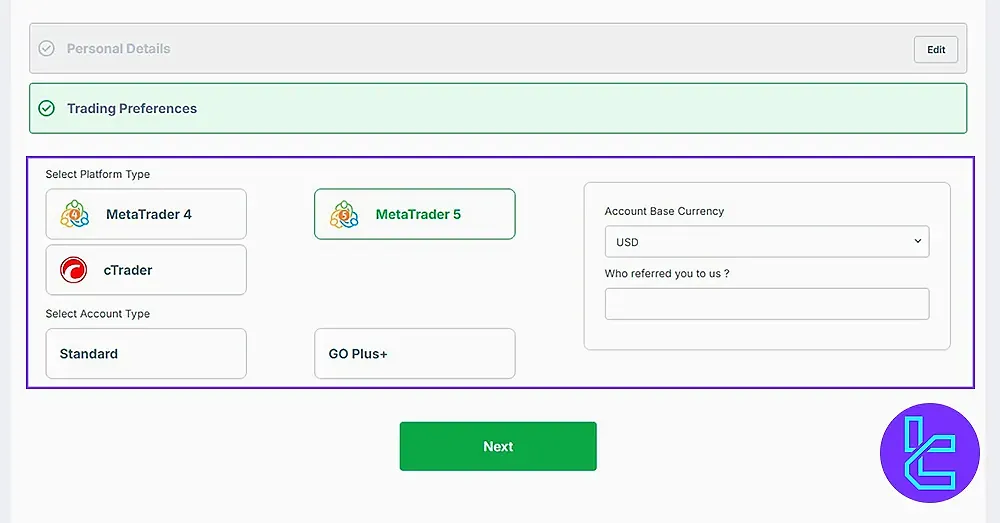

#4 Set Your Trading Preferences

Choose from one of the options for each of these:

- Trading platform

- Account type

- Preferred currency

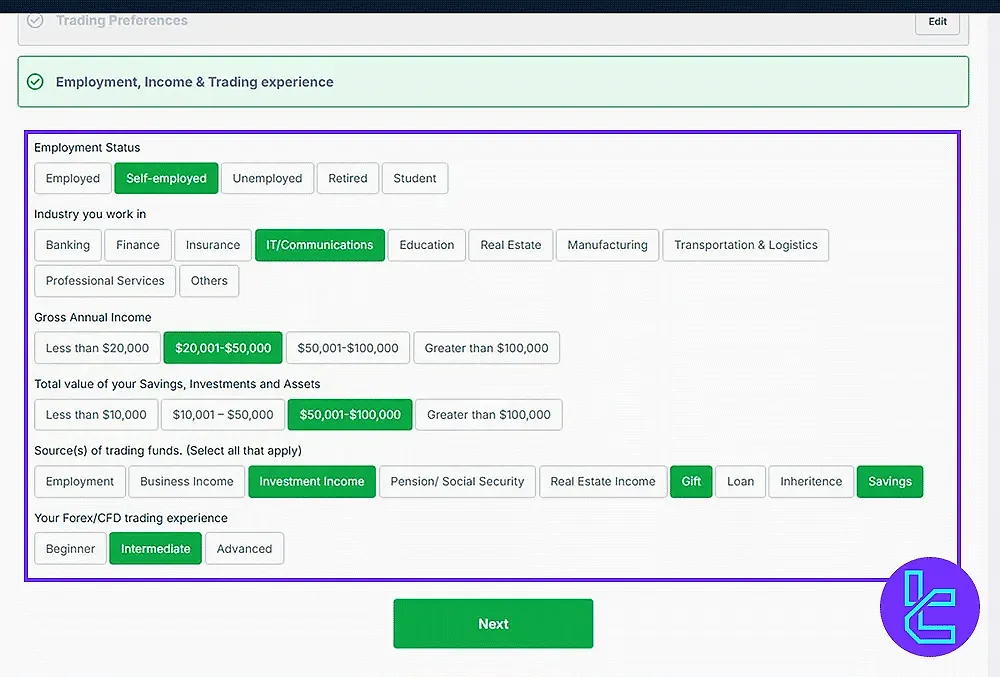

#5 Answer Regulatory Questions

Disclose your employment status, financial background, and source of funds as required.

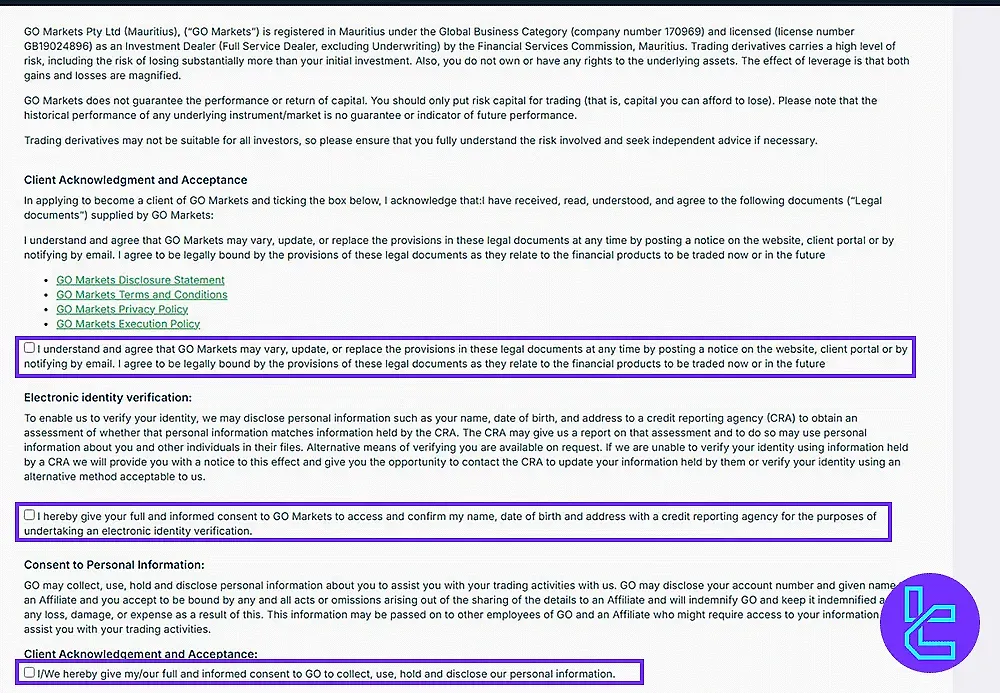

#6 Agree to the Terms

Review and accept the terms and conditions, then hit “Submit” to finalize.

#7 Verification

To verify your account, go to the profile section on the website and submit the required documents.

Trading Platforms Available on GO Markets

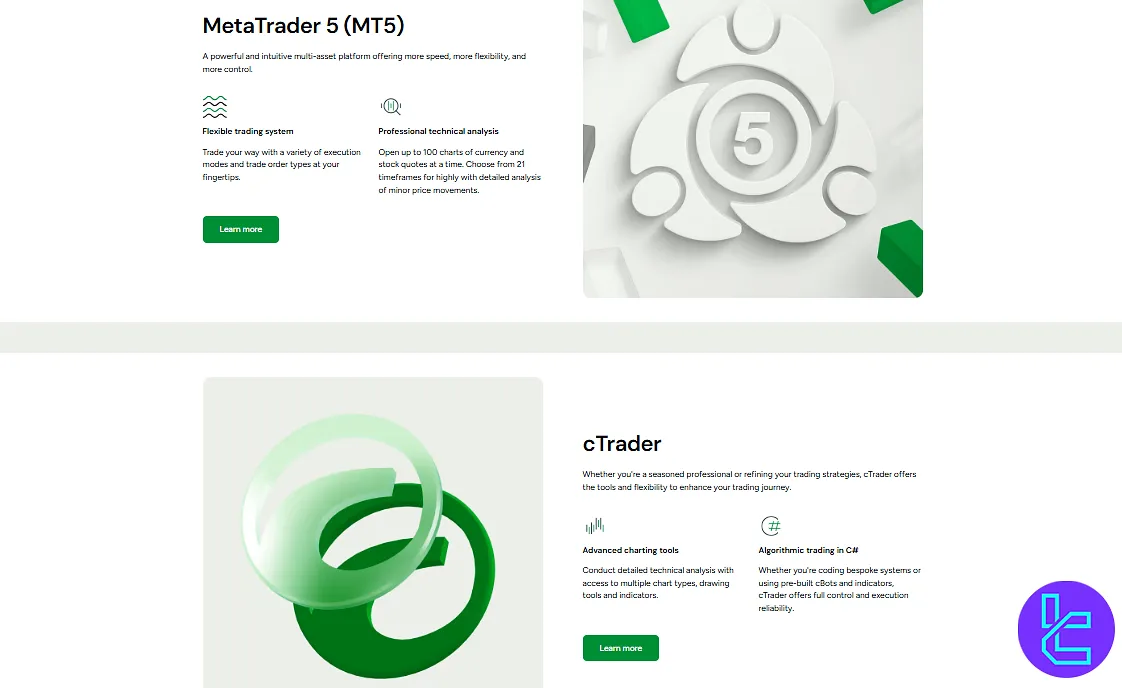

GO Markets offers a versatile range of trading platforms to suit both beginners and professional traders. MetaTrader 4 (MT4) provides simplicity and wide adoption, MetaTrader 5 (MT5) adds algorithmic trading features, and cTrader delivers a modern, intuitive interface.

Additionally, GO WebTrader allows trading directly from any browser, ensuring seamless access across devices.

In this section, we will have an overview of each platform:

- MetaTrader 4 (MT4): A popular platform evolved by the broker for its clients

- MetaTrader 5 (MT5): A newer version of MT4 with algorithmic trading possibilities

- cTrader: A robust platform with an attractive, user-friendly interface

- GO WebTrader: Web-based versions of MT4 and MT5 accessible from any browser

In the table below, you will find links to each platform for different operating systems and devices:

Operating System | Android | iOS |

MetaTrader 4 | ||

MetaTrader 5 | ||

cTrader |

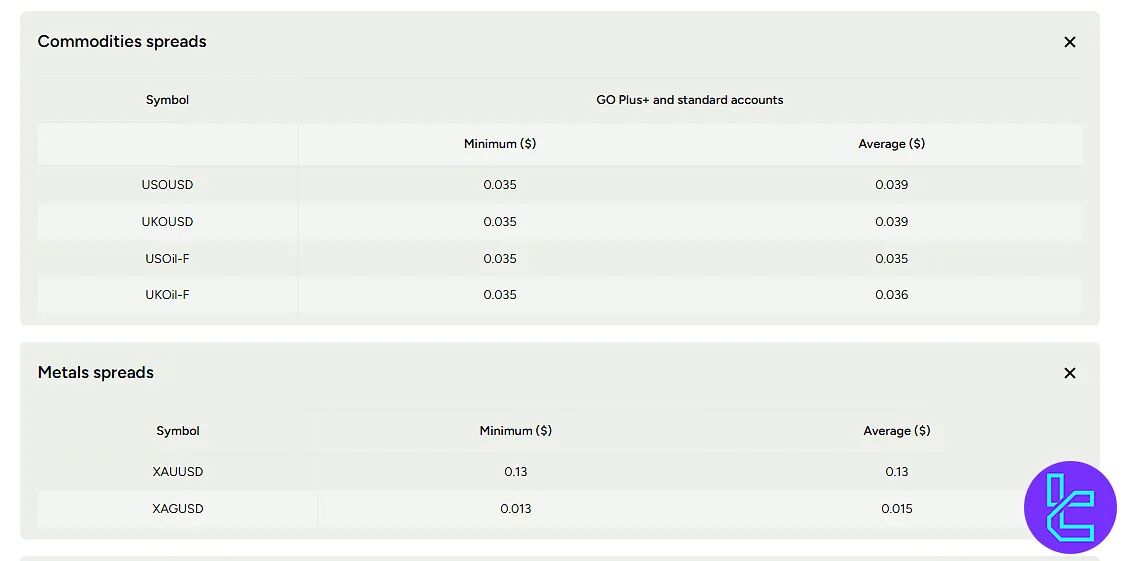

Spreads and Fees

GO Markets provides a trading environment with competitive pricing across its account types. Spreads and Trading Commissions:

Account Type | Spreads | Fees |

GO Plus+ | From 0.0 Pips | $5 per Round Lot on Forex |

Standard | From 0.8 Pips | Zero |

GO Markets uses a variable spread model, which means spreads can widen during volatile market conditions. However, their pricing remains competitive compared to industry averages.

There are no fees besides those on trading. In other words, no inactivity, deposit, or withdrawal costs exist when working with the broker.

For high-frequency or automated traders, GO Markets also provides free VPS hosting, provided the trader completes at least 10 standard lots of FX or gold trading per month (5 round-turn lots). Otherwise, the VPS costs $25/month.

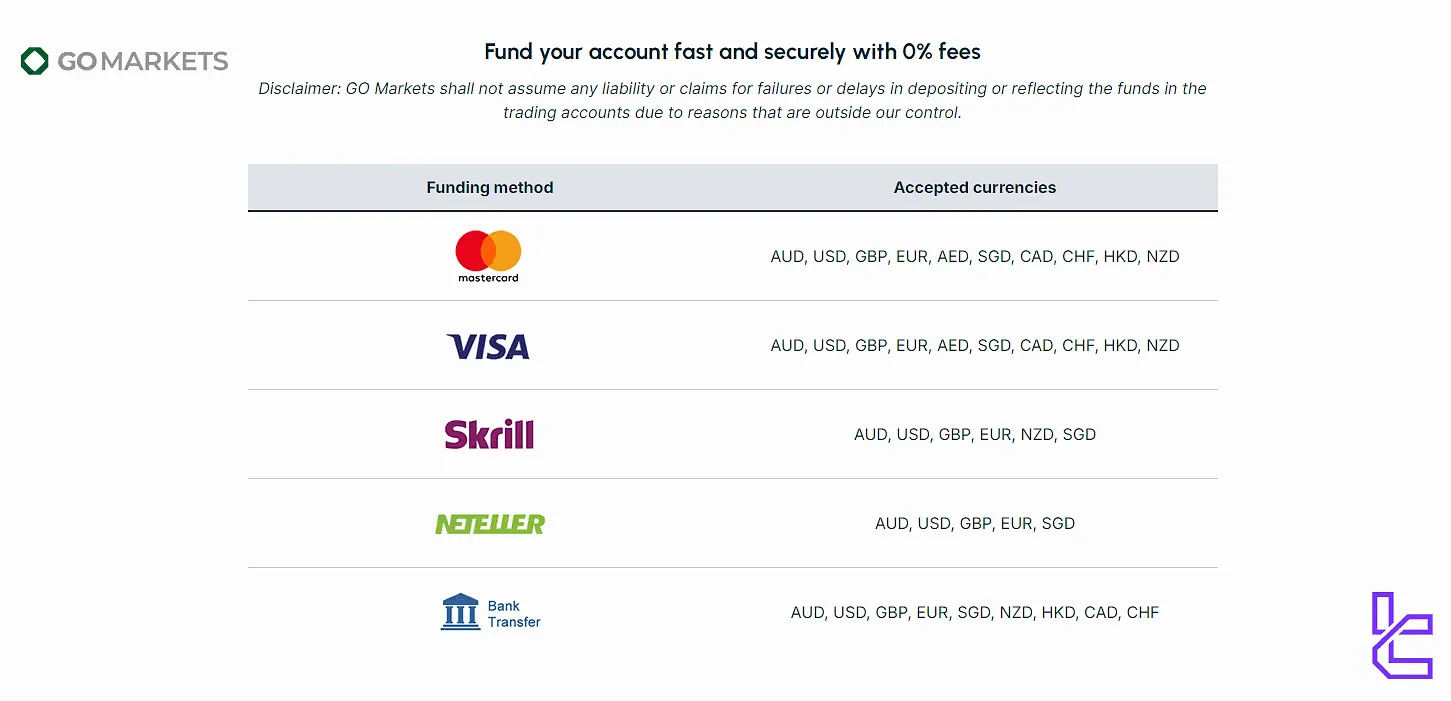

Which Methods Are Available for Deposit & Withdrawal on GO Markets?

This broker provides various options for funding and withdrawing from your trading account. Choose one that best fits your region and preferences:

- Credit/Debit Cards (Visa, Mastercard)

- Bank Transfer

- E-wallets (Neteller, Skrill)

Deposit Methods at GO Markets

When funding a trading account at GO Markets, multiple methods are available which all are with zero internal deposit fees, and processing times ranging from instant to a few business days depending on the method.

The broker clearly lists the accepted currencies and typical processing times for each method.

Here’s how the main deposit methods compare:

Deposit Method | Currency | Deposit Fee | Funding Time |

Mastercard / Visa | AUD, USD, GBP, EUR, NZD, SGD, CAD, CHF, HKD | 0% | Up to 1 hour |

E-Wallets (Skrill, Neteller) | AUD, USD, GBP, EUR, NZD, SGD | 0% | 1–2 hours |

Bank Transfer | AUD, USD, GBP, EUR, SGD, NZD, HKD, CAD, CHF | 0% | 1–2 business days |

BPAY | AUD | 0% | 1–2 business days |

Pay Pal | AUD, USD | 0% | Instant |

Withdrawal Methods at GO Markets

When withdrawing funds from GO Markets, the broker states there are no internal withdrawal fees applied by the firm, yet it emphasizes that third-party bank or intermediary charges may still apply for cross-border transfers.

The withdrawal processing is tied to the original deposit method and the same-day cut-off for domestic requests optimizes speed.

Below is a breakdown of typical withdrawal methods and their terms:

Withdrawal Method | Currency Accepted | Withdrawal Fee | Funding Time |

Bank Wire Transfer | AUD, USD, GBP, EUR, SGD, NZD, HKD, CAD, CHF | $0 internal (third-party may apply) | 3–5 business days |

Credit/Debit Card | AUD, USD, GBP, EUR, AED, SGD, CAD, CHF, NZD | $0 internal (provider may charge) | Up to 24 hours |

E-Wallets (Skrill, Neteller) | AUD, USD, GBP, EUR, NZD, SGD | $0 internal (provider fees possible) | Up to 24 hours |

Pay Pal | AUD, USD | $0 internal (provider fees possible) | N/A |

BPAY | AUD | $0 internal (provider fees possible) | N/A |

Copy Trading & Investment Options

Investment methods have become so popular as ways to earn passive income in financial markets. GO Markets offers copy trading and PAMM accounts for traders. These options allow clients to earn money with the help of professional and experienced traders.

These services allow traders to follow and copy the strategies of successful traders, making it possible for less experienced investors to potentially benefit from the expertise of others.

Go Markets Rebate

Traders affiliated with TradingFinder IB can earn cashback on Go Markets for trading several key markets, including Forex, metals, indices, and oil.

Rebates vary by account type and are accessible across all standard accounts, including Standard and Go Plus, while specialized rates apply for accounts registered under the SVG entity.

For more information, check out the GO Markets rebate page.

Tradable Instruments & Symbols on GO Markets

This broker offers a vast range of choices in CFDs on tradable instruments, which is an advantage for diversifying your portfolio. GO Markets Tradable Assets:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex CFDs | Major, minor & exotic currency pairs | ~40–60 pairs | ~50–100 pairs |

Share CFDs | Global equities (ASX, NYSE, NASDAQ, HKEX) | ~1,000+ symbols | ~300–500 stocks |

Index CFDs | Global cash & futures indices | ~30–50 indices | ~50–70 indices |

Commodity & Metals CFDs | Gold, oil, wheat, silver, and other commodities | ~20–30 instruments | ~20–40 instruments |

Cryptocurrency CFDs | Bitcoin, Ethereum, Litecoin, and other cryptos | ~14 symbols | ~10–20 instruments |

Bonds & ETF CFDs | Global government bonds and diversified ETFs | ~5 bond CFDs + ~50 ETFs | Varies |

These instruments provide a wide range of trading opportunities for both short-term and long-term strategies. Traders can diversify across multiple asset classes while accessing competitive leverage depending on the account type and jurisdiction.

Bonuses and Promotions

According to the latest investigations, GO Marketsdoes not offer bonuses or promotions for new or existing clients. This is in line with regulatory requirements in many jurisdictions, which restrict or prohibit the use of trading bonuses.

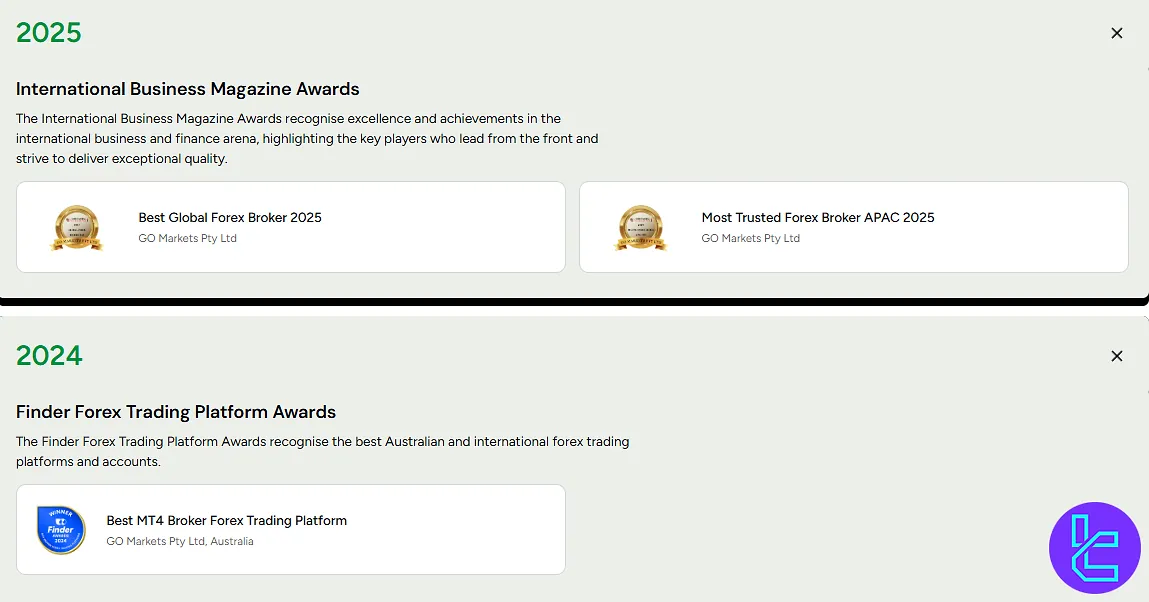

GO Markets Awards

GO Markets has garnered numerous prestigious accolades, underscoring its commitment to excellence in the trading industry.

GO Markets awards reflect the broker's dedication to providing top-tier services and innovative solutions to traders worldwide.

Here are some of the notable awards received:

- Best Global Forex Broker 2025

- Most Trusted Forex Broker APAC 2025

- Best MT4 Broker Forex Trading Platform 2024

- Best Global Forex Broker, Asia 2024

How and When to Contact Support on GO Markets

Support services are an essential factor to consider when choosing a broker. GO Markets answers to the clients' inquiries via common methods:

- Live Chat: Available from the official website

- Email: support.mu@gomarkets.com

- Phone: +230 5869 0074

- Support Ticket: Through the website

GO Markets states that the support department offers its services 24/7.

Which Countries Are in the GO Markets' Restriction List?

GO Markets, like many international brokers, has restrictions on accepting clients from certain countries due to regulatory and compliance reasons. While the exact list of restricted countries may change over time, it generally includes:

- United States

- New Zealand

- Afghanistan

- Iran

- Iraq

- Lebanon

- North Korea

- Some European Union countries (due to specific local regulations)

Traders should always check the most up-to-date information on the GO Markets website or contact customer support for clarification. Residents of restricted countries are typically unable to open live trading accounts with the broker.

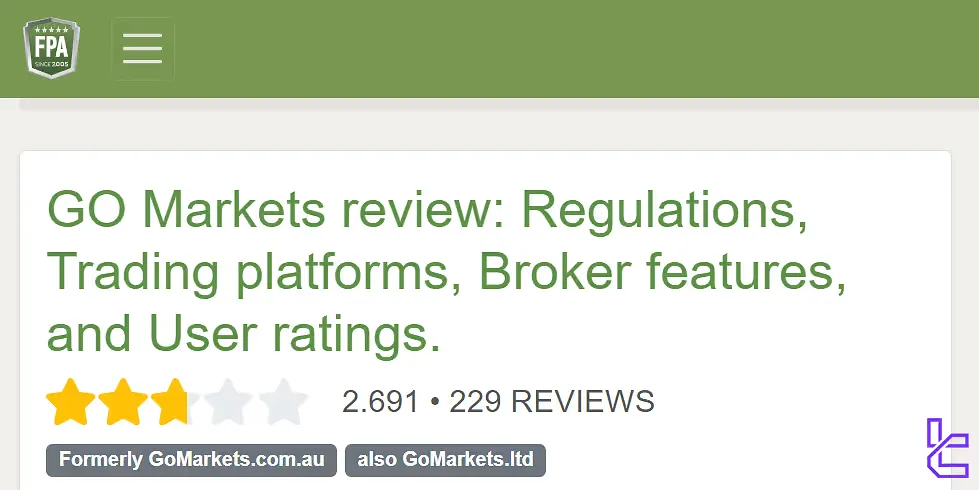

Trust Scores on Reputable Websites

GO Markets has received mixed reviews across various platforms, including REVIEWS.io. Let's have a look at these ratings:

- GO Markets Trustpilot: 4.6/5, based on over 500 reviews

- ForexPeaceArmy: 2.7 out of 5 with more than 220 ratings

- GO Markets REVIEWS.io: 3.6/5, over 30 scores

Overall, GO Markets maintains a positive reputation, with higher-than-average scores on major review platforms. The rating discrepancy highlights the importance of considering multiple sources when evaluating a broker.

Potential traders should weigh these reviews alongside their own research and experience with the broker's demo account.

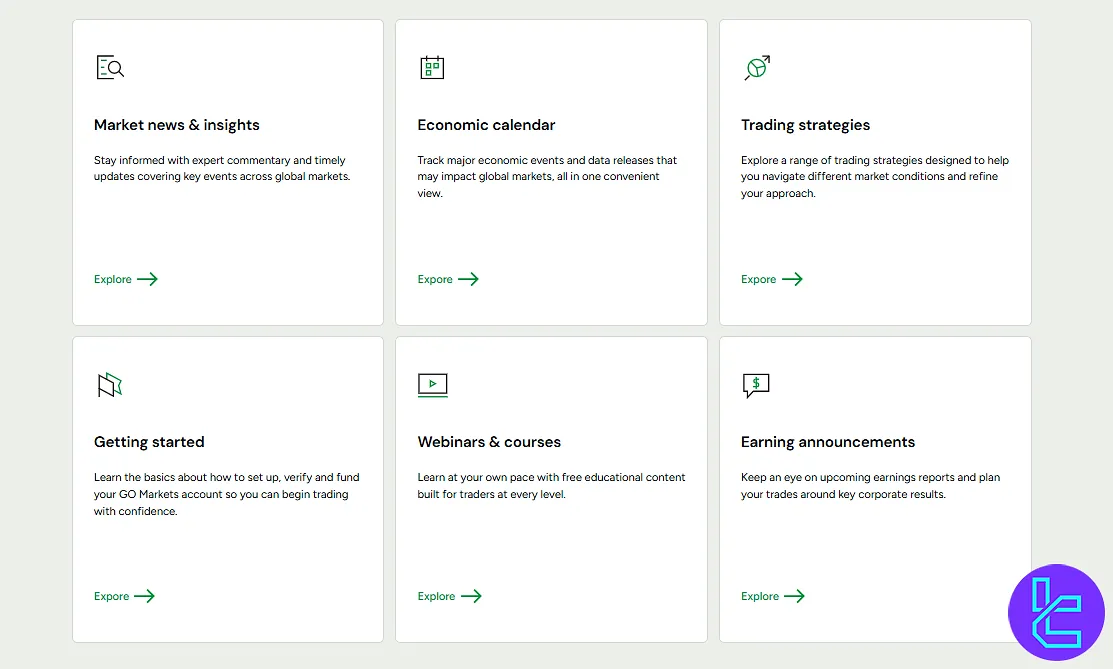

Educational Resources and Content

GO Markets offers a complete and useful suite of educational resources to help traders improve at all levels. It offers an "Education Hub" section, including:

- News & Analysis

- Inner Circle Webinars

- Trading Strategies

- Introduction to Forex

Also, the website provides earnings announcements in addition to an Economic Calendar for clients. All the educational resources on the website are accessible for free.

GO Markets Compared to Top Brokers

The table below compares the discussed broker with other players in the Forex market:

Parameter | GO Markets Broker | |||

Regulation | CySEC, FSC | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB | Standard, Standard Cent, pro, Raw Spread, Zero |

Minimum Spread | 0 Pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | From Zero | Average $1.5 | From Zero | From $0.2 |

Minimum Deposit | 100 EUR | $200 | $100 | $10 |

Maximum Leverage | 1:500 | 1:500 | 1:500 | Unlimited |

Trading Platforms | MT4, MT5, cTrader | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard, GO Plus+ | Standard, Raw Spread, Islamic | Standard, Pro, Raw+, Elite | Standard, Standard Cent, pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 500+ | 2,250+ | 270+ | 230+ |

| Trade Execution | Instant | Market | Market, Instant | Market, Instant |

Conclusion and final words

GO Markets is a financial company regulated by 2 authorities [CySEC, FSC (Mauritius)] and a score of 3.6/5 on "REVIEWS.io" from +30 user ratings.

The broker offers CFDs on 8 asset categories [Forex, Shares, Indices, Commodities, Crypto, Metals, ETFs, Treasury.]