GTCFX provides Raw spreads from 0.0 pips for a minimum deposit of $3,000 through its ECN account. It offers access to Signal Center, Autochartist, and a 20% tradable bonus. The broker rewards its IBs with 70% cashbacks.

GTCFX operates through multiple branches and is regulated under various jurisdictions to ensure compliance with the laws of each country in which it provides services. ASIC, FCA, and FSCA are among the reputable regulatory authorities supervising this broker.

GTCFX (Company Information and Regulatory Status)

GTCFX is a well-established online trading platform prioritizing regulatory compliance and client security. With over 985,000 clients across more than 100 countries, the broker has built a strong reputation in the global financial market.

The company is licensed and regulated by multiple prestigious financial authorities, including:

Entity Parameters / Branches | GTC Financial Consultancy | GTC Global Trade Capital Co. Ltd | GTC Global Ltd | GTC Global (Australia) Pty Ltd | GTC Multi Trading DMCC | GTC Global South Africa (Pty) Ltd | Global Markets Group Ltd (UK) |

Regulation | SCA | VFSC | FSC | ASIC | SCA | FSCA | FCA |

Regulation Tier | N/A | N/A | N/A | 1 | N/A | 2 | 1 |

Country | UAE | Vanuatu | Mauritius | Australia | UAE | South Africa | United Kingdom |

Investor Protection Fund / Compensation Scheme | N/A | Financial Commission (€20,000) | Financial Commission (€20,000) | AFCA (AUD 542,500) | N/A | FSCA (up to ZAR 1,000,000) | FSCS (up to £85,000 per person) |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:100 | 1:2000 | 1:2000 | 1:30 | 1:100 | 1:100 | 1:30 |

Client Eligibility | UAE clients | Global (excl. restricted) | Global (excl. restricted) | Australia only | UAE clients | South Africa | UK & EEA clients |

GTCFX has received multiple awards, including “Best Liquidity Provider” and “Best STP Broker”, reflecting its strength in execution quality and institutional-grade infrastructure.

GTCFX Specific Features

GTC FX was founded in 2012 by Jack Zheng in Dubai. The Forex broker stands out from the competition with its impressive array of features designed to cater to novice and experienced traders.

Broker | GTCFX |

Account Types | Standard, Pro, ECN |

Regulating Authorities | ASIC, FCA, SCA, FSCM, VFSC, FSC |

Based Currencies | USD, JPY, CAD |

Minimum Deposit | $0 |

Deposit Methods | MasterCard, VISA, Bank Wire, GTCPay, Perfect Money, TCPay, My Fatoorah, Tether |

Withdrawal Methods | MasterCard, VISA, Bank Wire, GTCPay, Perfect Money, TCPay, My Fatoorah, Tether |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:2000 |

Investment Options | Copy Trading, PAMM |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, Stock CFDs, Equity Indices, Metals, Energies, Commodities |

Spread | Variable based on the account type |

Commission | $5 per lot on ECN account |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 20% |

Trading Features | Mobile Trading, Market Analysis, Signals |

Affiliate Program | Yes |

Bonus & Promotions | Referral, 20% Tradable Bonus |

Islamic Account | N/A |

PAMM Account | Yes |

Customer Support Ways | Phone, Email, Post Office Box, WhatsApp, Live Chat, Ticket |

Customer Support Hours | 24/7 |

GTCFX Account Offerings

The company offers three main account types, including Standard, Pro, and ECN, to cater to a diverse range of traders.

Features | Standard | Pro | ECN |

Min Deposit | $0 | $50 | $3,000 |

Leverage | 1:2000 | 1:2000 | 1:500 |

Avg. Spreads | 1.4 pips | 0.9 pips | Raw Spreads from 0.0 pips |

Commission | $0 | $0 | $5 per lot |

Extra Features | - | 80+ technical analysis tools | tier 1 liquidity with ECN technology, VPS |

GTCFX Broker Pros and Cons

To provide a balanced view, we must take a look at the advantages and disadvantages of trading with GTC FX.

Upsides | Downsides |

Wide range of trading instruments | Complex fee structure for some account types |

Tight spreads and high leverage | Limited educational resources for beginners |

Regulated by multiple reputable authorities | Geo-Restrictions |

Advanced trading platforms | Lack of cryptocurrency offerings |

GTCFX Registration and KYC Verification

Opening an account with GTC FX is a straightforward process, but it involves thorough Know Your Customer (KYC) and compliance procedures to ensure the security and integrity of the platform. GTCFX registration is explained in the following section.

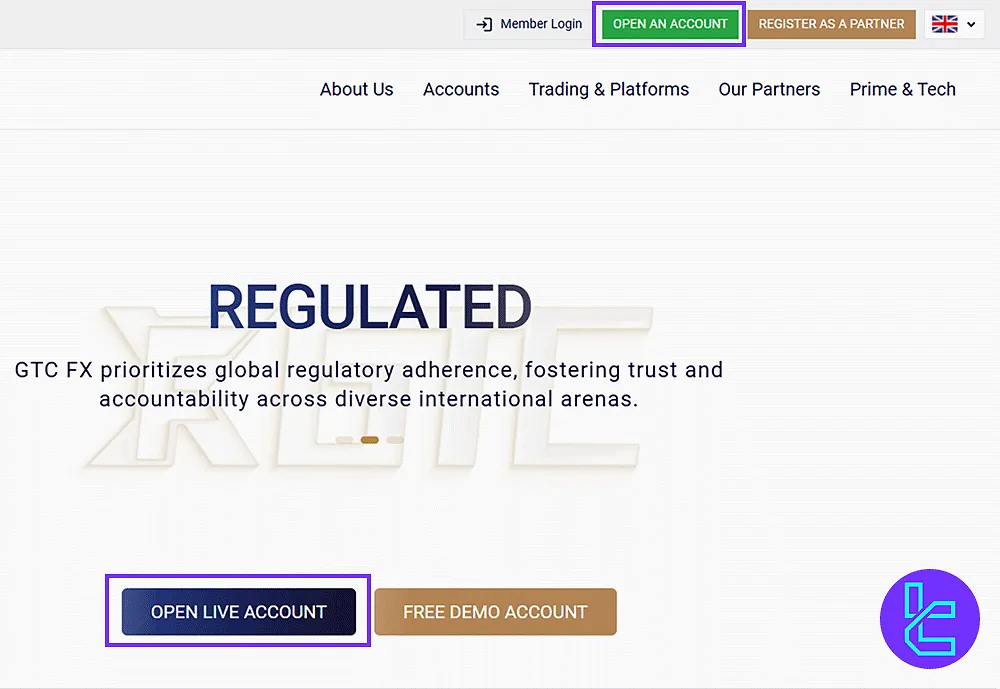

#1 Visit the GTCFX Registration Portal

Navigate to the broker’s official site and click on “Open an Account” to access the sign-up interface.

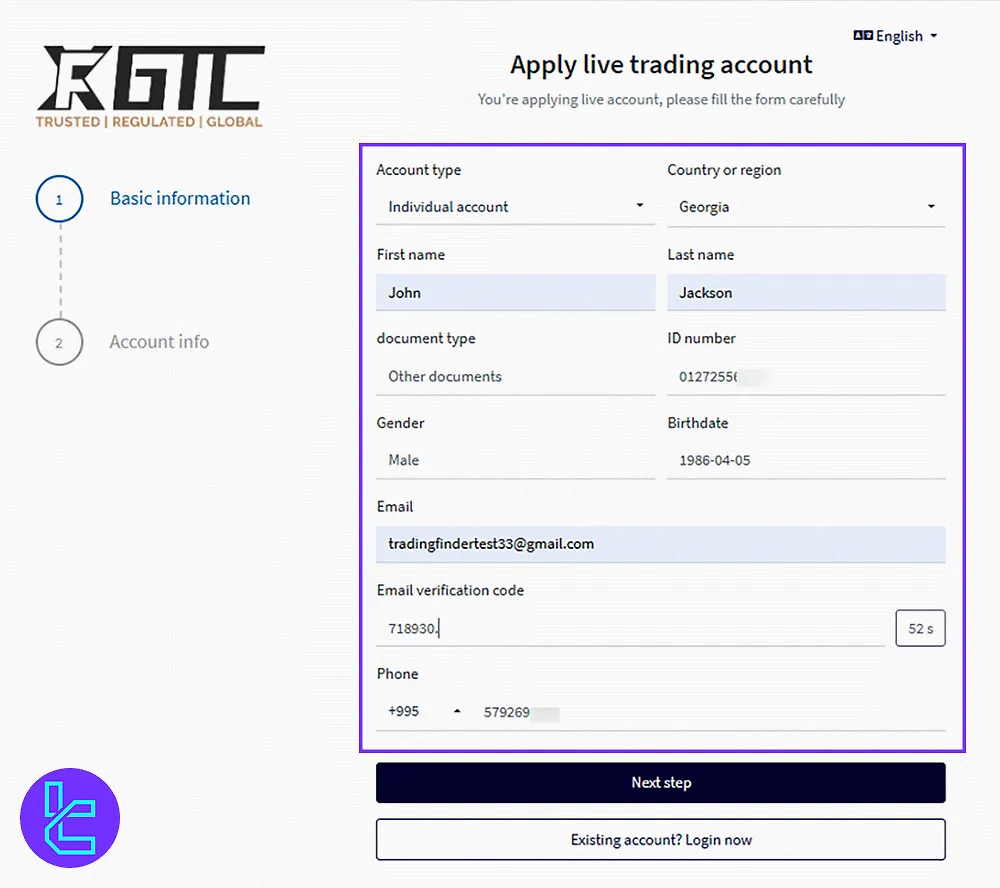

#2 Enter Personal Details

Fill out the registration form with required fields such as:

- First and last name

- Country of residence

- ID type (passport, ID card, etc.)

- ID number

- Gender, and date of birth

#3 Verify Contact Information

Enter your email address and mobile number. Retrieve the code sent to your inbox and input it into the platform for verification.

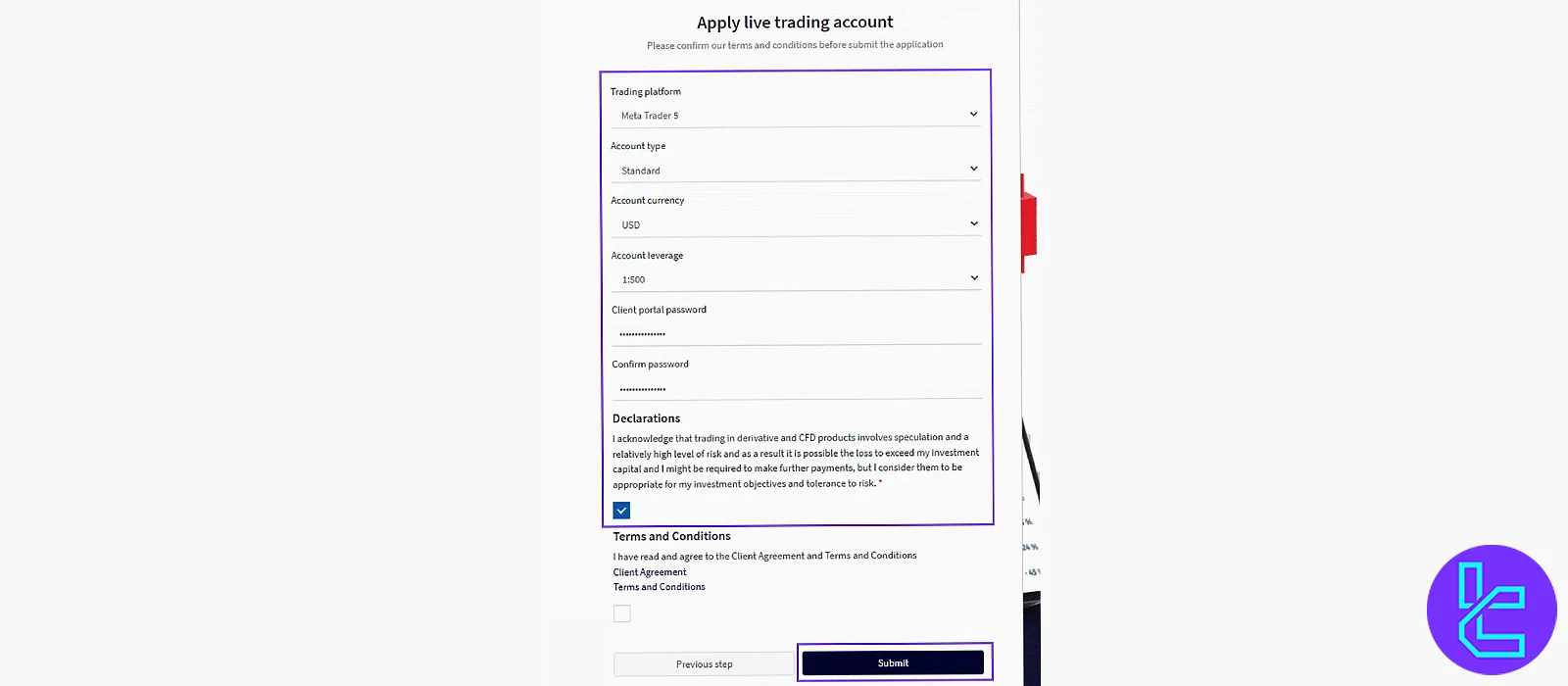

#4 Set Trading Parameters

Customize your trading experience:

- Choose your trading platform, account type, base currency, and leverage

- Set and confirm a strong password (including upper/lowercase letters, numbers, and symbols)

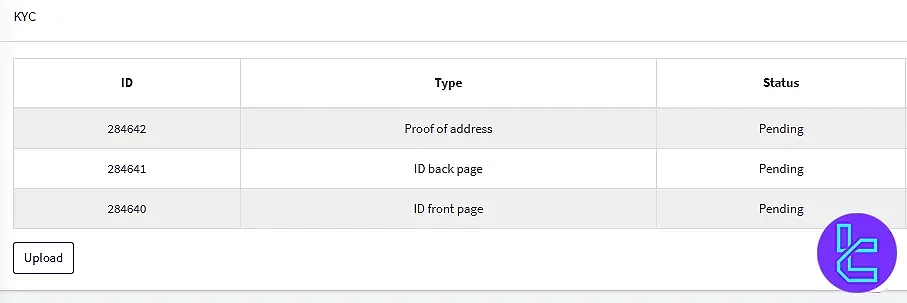

#5 GTCFX Account Verification

Follow these five steps to complete the account verification process with GTCFX.

GTCFX Verification:

- Select the “Unverified” option to initiate verification;

- Provide your personal details;

- Complete your investment profile;

- Upload identification and address verification documents;

- Press “Submit” and wait for the approval response.

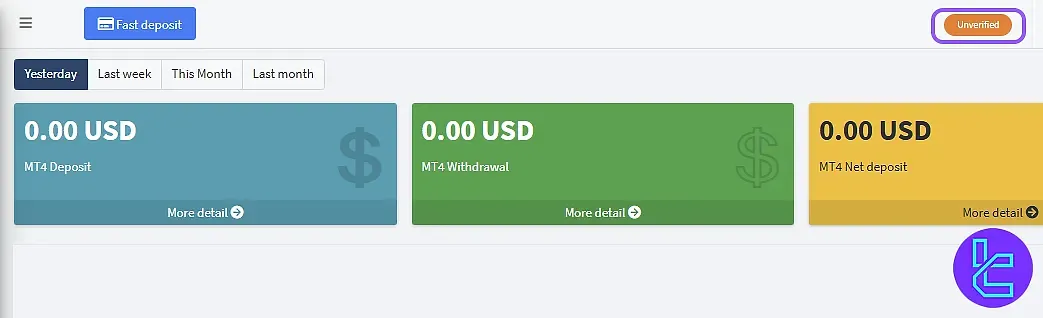

#1 Click “Unverified” to Begin Verification

To start, access your GTCFX profile and:

- Log in to your account;

- Click on the “Unverified” button to trigger the verification workflow.

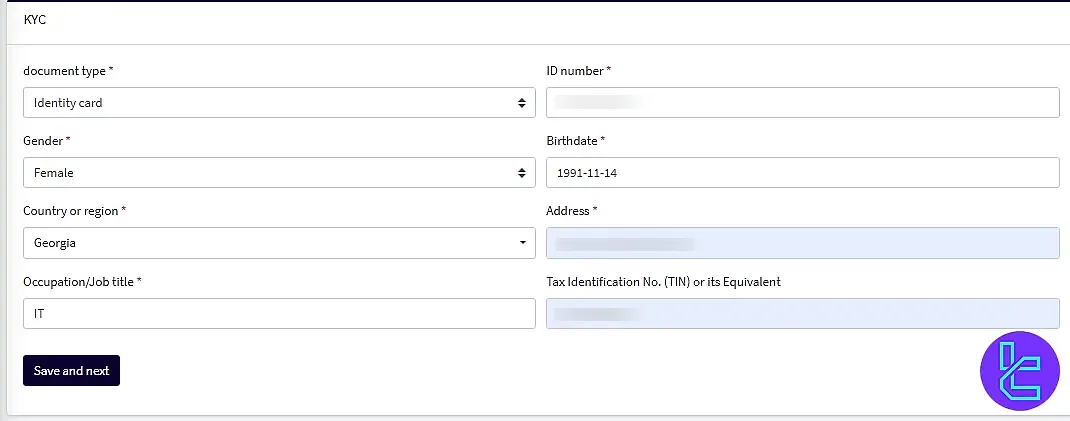

#2 Complete Personal Information

Enter the required personal information accurately, including:

- Document Type

- ID Number

- Gender

- Country/Region

- Address (must match proof of address)

- Date of Birth

- Job Title

- Tax Number (if applicable)

Ensure all data aligns with your official documents to prevent processing delays.

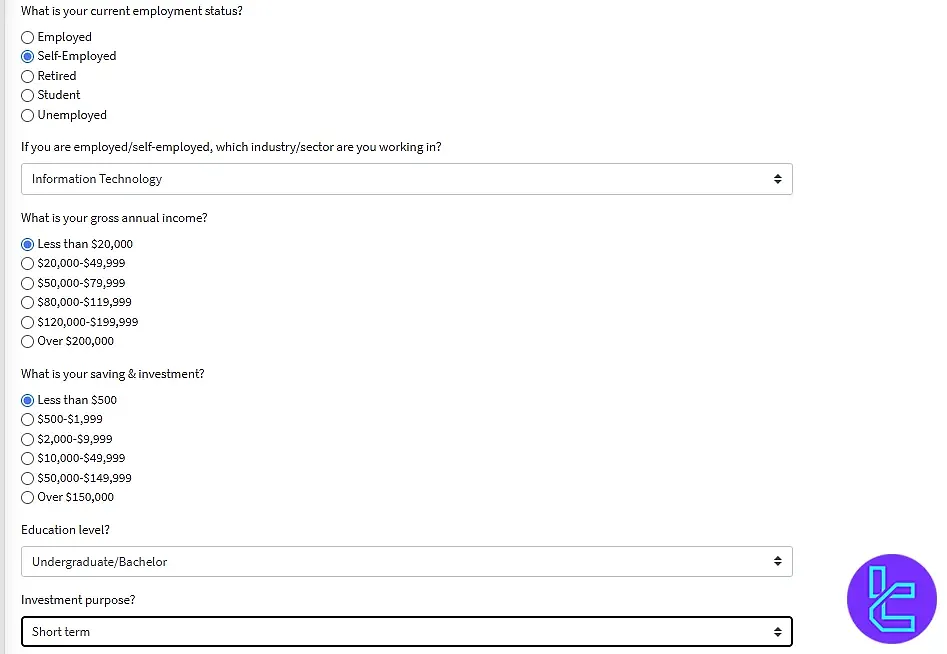

#3 Submit Investment Profile

Provide employment and financial background, specifying:

- Employment Status (Employed, Self-Employed, Unemployed, Retired, Student)

- Annual Income (estimated yearly range)

- Source of Funds (Salary, Investments, Inheritance, Other)

- Total Assets (approximate financial holdings)

- Investment Experience Level (Beginner, Intermediate, Advanced)

#4 Upload Verification Documents

Supply high-quality scans or photos of the following:

- Identification (passport, driver’s license, or national ID) showing both front and back;

- Proof of address (bank statement or utility bill issued within the last three months).

Verify that your uploads meet GTCFX quality standards to avoid rejection.

#5 Submit and Await Confirmation

Once all details are provided:

- Click “Submit” to send your verification request;

- The review process usually completes within a few minutes; after which you will receive confirmation.

GTCFX Trading Platforms

GTC FX offerstwo powerful trading platforms to cater to different trader preferences: MetaTrader 4 and MetaTrader 5.

MetaTrader 4 (MT4)

- MT4 Android

- MT4 iOS

- Desktop

MetaTrader 5 (MT5)

- MT5 Android

- MT5 iOS

- Desktop

Accessing the robust MT4 and MT5 indicators is one of the advantages of trading with GTCFX.

GTCFX Fee Structure

The broker takes a simple approach to fees and commissions. It offers trading with tight spreads and zero commissions (except for the ECN account).

Account Type | Spreads from (Pips) | Commission (per standard lot) |

Standard | 1.4 | $0 |

Pro | 0.9 | $0 |

ECN | 0.0 | $5 |

Regarding other costs, deposits and withdrawals are free across all methods and currencies. However, traders should note that a $5 monthly inactivity fee applies to dormant accounts.

Swap Fee at GTCFX

GTCFX applies swap fees dynamically based on market conditions, asset type, and account category. Swaps are calculated daily and automatically applied to open positions at 00:00 platform time.

Rates are published weekly and vary across Forex, Metals, Energies, Indices, and Cryptocurrencies.

Here are some of the most relevant details from the broker’s official information:

- Swap rates are updated every Monday and displayed transparently in the trading platform;

- Overnight swaps for major FX pairs typically range between −1.5 to +0.8 points depending on direction and liquidity;

- Swap fees differ across assets; for instance, AUDCAD (Long +2.50 / Short −5.05), and AUDCHF (Long +4.86 / Short −7.87);

- Swap-free / Islamic accounts are available upon request and exempt from overnight interest fees.

Non-Trading Fees at GTCFX

GTCFX applies certain non-trading fees that are separate from spreads and commissions, covering account maintenance, withdrawals, and inactivity. These charges are calculated transparently and vary depending on account type and currency used.

Traders are notified in advance of all applicable fees to ensure clarity and fairness.

To highlight the most important details:

- Inactivity fee: $5 per month after 6 months of inactivity on the account;

- Withdrawal fee: Varies by method; for wire transfers, typically $25 per transaction;

- Deposit fee: No fees for most methods; some local bank transfers may incur small charges;

- Currency conversion fee: Applied at 0.5% of transaction if account currency differs from deposit/withdrawal currency;

- Account upgrade/maintenance: Some premium account services may carry a fixed monthly service fee, as per account terms.

GTCFX Broker Payment Options

Payment options are among the most important topics in all of the GTCFX reviews. Providing a wide range of deposit/withdrawal methods ensures that traders from across the globe can easily make transactions. Here’s a list of GTC FX offerings.

- MasterCard

- VISA

- Bank Wire

- GTCPay

- PerfectMoney

- TCPay

- My Fatoorah

- USDT

Note that while the minimum deposit amount for all the methods mentioned above is $10, you can deposit as low as $1 via USDT.

Deposit Methods at GTCFX

GTCFX offers a variety of deposit methods to cater to the diverse needs of its clients. These methods are designed to provide secure, fast, and convenient funding options.

The broker accepts deposits in multiple currencies, ensuring flexibility for traders worldwide.

The following table summarizes the available deposit methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR | $30 | None | 1-3 business days |

Credit/Debit Card (VISA/MasterCard) | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR | $30 | None | Instant to a few hours |

E-Wallets / Digital Payment Systems (Perfect Money, My Fatoorah, etc.) | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR | $30 | None | Instant |

Cryptocurrency (USDT) | USDT, BTC etc. | $30 | None | Typically instant after confirmation |

Apple Pay / Google Pay | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR | $30 | None | N/A |

Withdrawal Methods at GTCFX

Withdrawals at GTCFX are handled with the same precision and transparency as deposits, ensuring traders have reliable access to their funds.

All requests must be submitted through the secure MyGTC portal, and the broker enforces strict name-matching policies to prevent third-party transfers.

According to GTCFX’s official withdrawal policy, processing times and potential intermediary charges vary depending on the chosen method.

The supported withdrawal methods can be summarized as follows:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR | $1 | $25 | 3-5 business days |

Credit/Debit Card (VISA/MasterCard) | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR | $1 | N/A | 5-7 business days |

E-Wallets / Digital Payment Systems (Perfect Money, My Fatoorah, etc.) | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR | $1 | N/A | Instant |

Cryptocurrency (USDT) | USDT, BTC etc. | $1 | N/A | 1-2 days |

Apple Pay / Google Pay | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR | $1 | N/A | N/A |

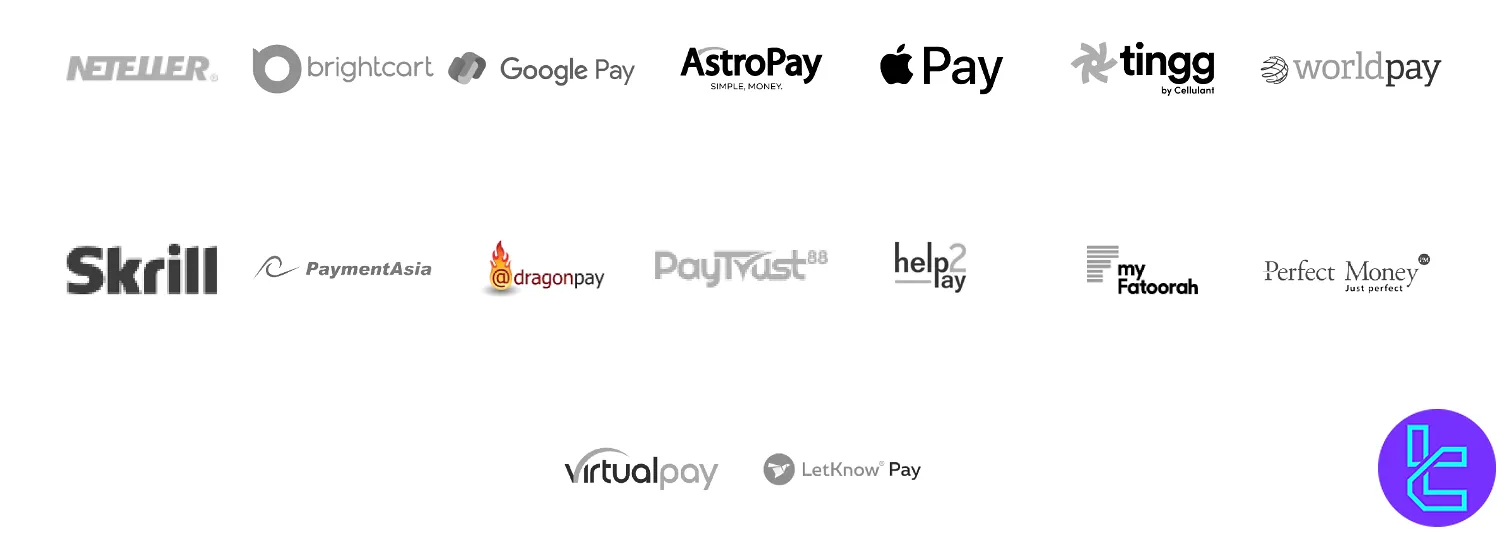

Does GTCFX Offer Copy Trading or Investment Plans?

GTC FX provides several options for traders looking to automate their trading or invest in managed accounts.

- Copy Trading: Follow and automatically copy trades of successful traders with customizable risk levels;

- PAMM (Percentage Allocation Management Module): Invest in professionally managed accounts;

- MAM (Multi-Account Manager): It's suitable for money managers and institutional clients to manage multiple client accounts simultaneously.

Available Trading Assets on GTCFX Broker

GTC FX offers a diverse range of trading assets to cater to various trading preferences.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex CFDs | Currency Pairs | N/A | 50-100 | 1:2000 |

Energies CFDs | Oil, Gas, Brent, WTI | N/A | 5-10 | 1:500 |

Commodities CFDs | Agricultural & Soft Commodities | N/A | 5-10 | 1:400 |

Equity Indices CFDs | Major Global Indices | N/A | 15-30 | 1:125 |

Metals CFDs | Gold, Silver, Platinum, Palladium | N/A | 2-5 | 1:2000 |

This breakdown highlights where GTCFX provides the deepest market coverage, the most competitive leverage, and which instruments are most suitable for both high-risk and conservative strategies.

GTCFX Bonus Offerings

Promotion is the most attractive topic in all GTCFX reviews. The broker offers seasonal bonuses and promotional programs, such as a deposit bonus, affiliate, and IB.

- 20% Tradable Bonus: available till October 31, 2024, only after verifying your account and making a deposit

- Affiliate: Available in 80+ countries with CPA commissions up to $1850

- IB: Up to 70% rebates

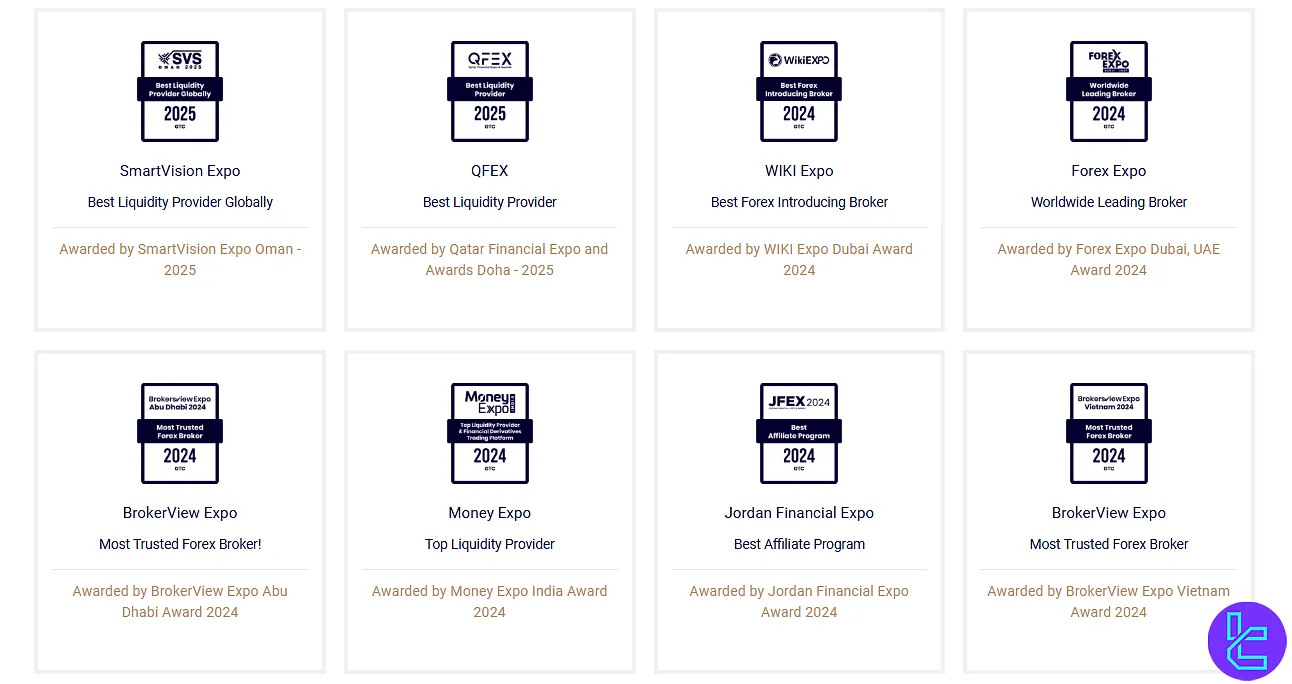

GTCFX Awards

The GTCFX awards section reflects how the broker has continually received recognition across the global trading industry for performance, innovation and client-centered services.

It highlights how GTCFX’s efforts to lead in fintech, execution speed and educational support are acknowledged.

Below are some of the standout accolades that tie directly into this recognition:

- Best Liquidity Provider Globally 2025

- Best Liquidity Provider 2025

- Best Forex Introducing Broker 2024

- Worldwide Leading Broker 2024

- Most Trusted Forex Broker 2024

- Top Liquidity Provider 2024

GTCFX Broker Support Channels

The company offers comprehensive 24/7 multilingual customer support through various channels, including:

support@gtcfx.com | |

Phone | +971 800 667788 |

Post Office Box | 393526 |

Address | Business Center 1, M Floor, Meydan Hotel, Nad Al Sheba, Dubai, United Arab Emirates |

https://api.whatsapp.com/send?phone=971800667788 | |

Live Chat | Accessible through the “Contact Us” page |

Ticket | Available on the “Contact Us” page |

Red Flag Countries on GTCFX

GTC FX, like many regulated brokers, cannot provide services to residents of certain countries due to regulatory restrictions or high-risk designations.

- The United States

- Russia

- Afghanistan

- Angola

- Bahamas

- Botswana

- Myanmar

- Cote d’Ivoire (Ivory Coast)

- Crimea and Sevastopol

- Cuba

- Democratic Republic of Congo

- Liberia

- Ghana

- Iran

- Iraq

- Mongolia

- North Korea

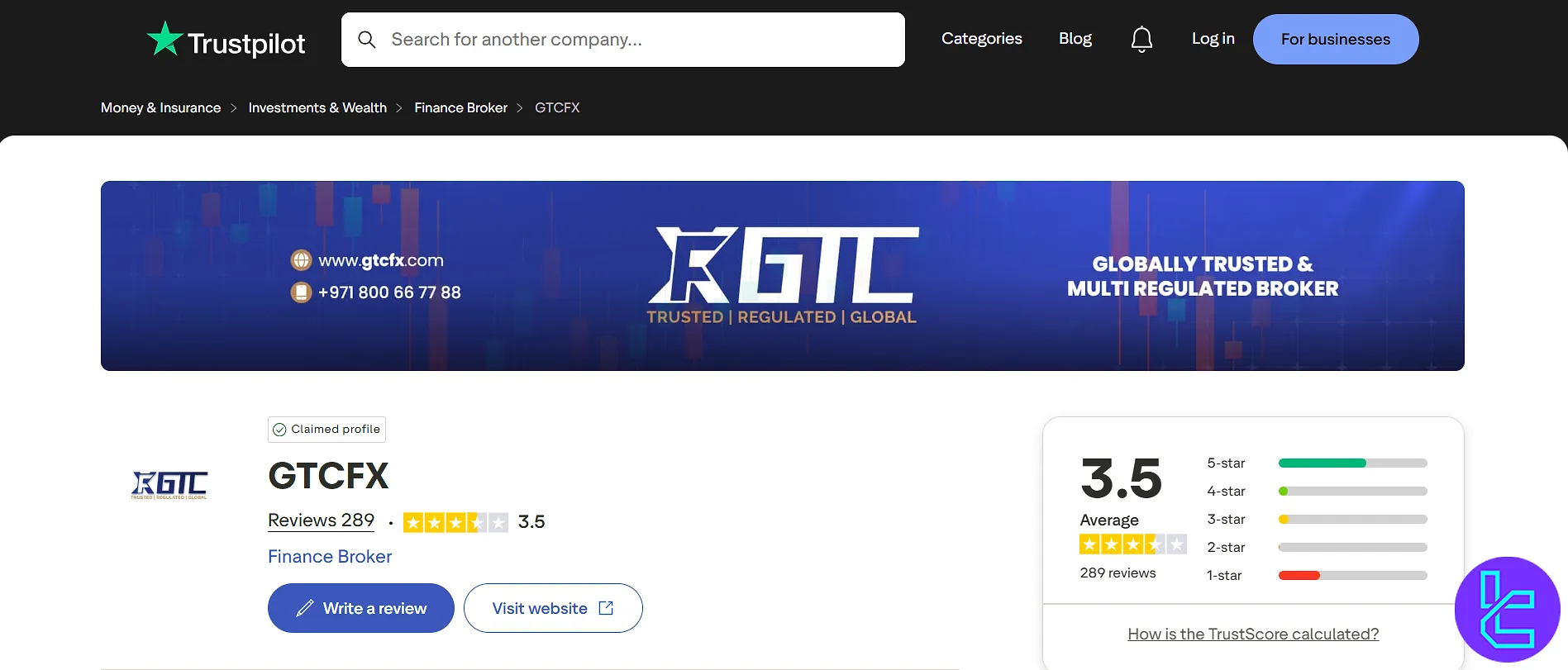

GTCFX Reviews and Trust Scores

User satisfaction is one of the most important topics in all GTCFX reviews. The company has garnered good scores across various platforms, especially TrustPilot.

There are 201 reviews on GTC FX TrustPilot profile rating the broker 3.5 out of 5.0; a normal score.

GTCFX Broker Educational Materials

While the company doesn’t offer an exclusive Forex education section on its website, it offers a range of trading tools to help traders elevate their skills.

- Market Analysis: Daily and weekly market reports

- Trading Signals: Real-time trading ideas and recommendations

- Economic Calendar: Up-to-date economic events and their potential market impact

- Glossary: An extensive list of trading terms and definitions

GTCFX Compared to Other Brokers

This section evaluates the broker's offerings and features in comparison to its peers:

Parameter | GTCFX Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | ASIC, FCA, SCA, FSCM, VFSC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | Variable Based on the Account Type | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $5 per lot on an ECN Account | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | None | $10 | From $0 | $100 |

Maximum Leverage | 1:2000 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | MetaTrader 4, MetaTrader 5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Standard, Pro, ECN | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 27,000+ | 200+ | 1,000+ | 2100+ |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Conclusion and Final Words

GTCFX provides access to 27,000+ trading instruments across 6 different asset classes, including Forexand Stocks. The broker offers 3 main account types with leverage options of up to 1:2000 through the robust MT4/5 platforms.

GTCFX broker is regulated by multiple entities, including SCA, FSCM, and VFSC, and has a great rating of 3.5 on TrustPilot.