HYCM verification involves 4 main steps, including completing a financial profile, providing proof of identity (POI), proof of address (POA), and reviewing the identification status.

The Forex broker will review your documents and activate your account within 1 business day.

Step-by-Step Guide for HYCM KYC

After completing HYCM registration, you can follow these steps to gain access to all trading features in the HYCM broker dashboard. HYCM verification:

- Access the “Verification” section and complete your financial profile;

- Upload valid identification documents;

- Provide proof of your residential address;

- Review identification status and wait for approval.

HYCM KYC requirements include:

Verification Requirement | Yes/No |

Full Name | No |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | Yes |

Phone Number Verification | No |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | Yes |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | Yes |

Restricted Countries | Yes |

#1 Access the “Verification” Section and Complete the Financial Profile

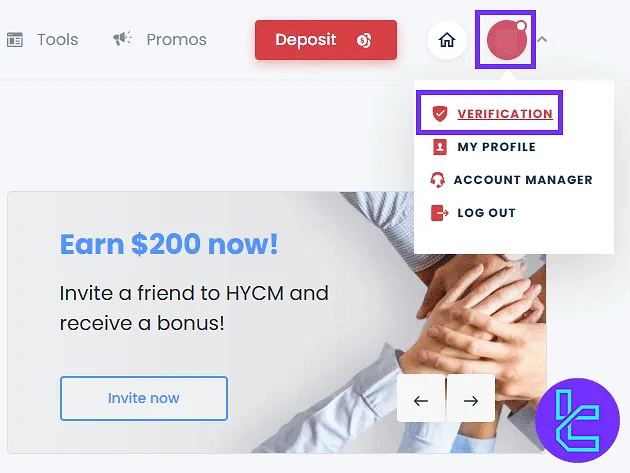

Begin by logging into the HYCM dashboard. Navigate to the "Profile" section and click "Verification" to start.

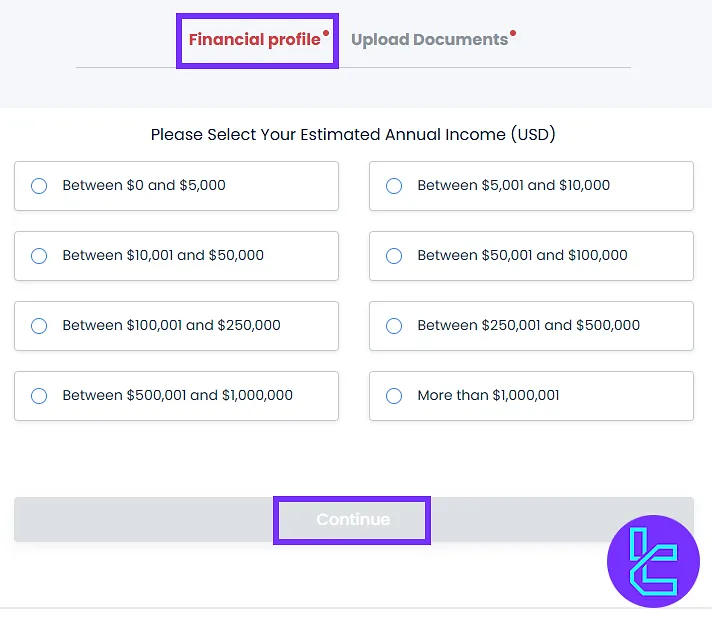

After entering the KYC section, you will be prompted to complete your "Financial profile". This step includes providing accurate information about your financial status and employment details.

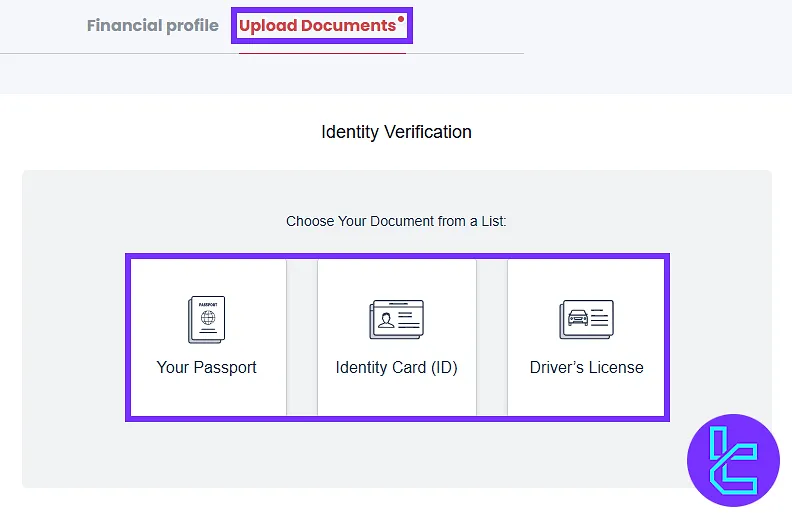

#2 Upload Valid Identification Documents

After submitting the financial profile, proceed to upload identification documents. Click "Upload Document" and select one of the following document types:

- Passport

- ID card

- Driver’s license

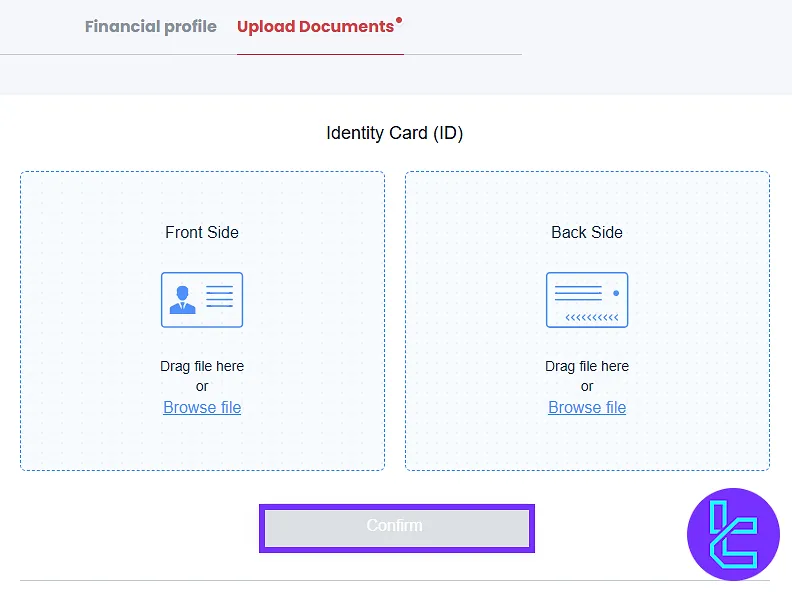

Once you have selected the document type, ensure both front and back sides are uploaded clearly, meeting HYCM’s requirements.

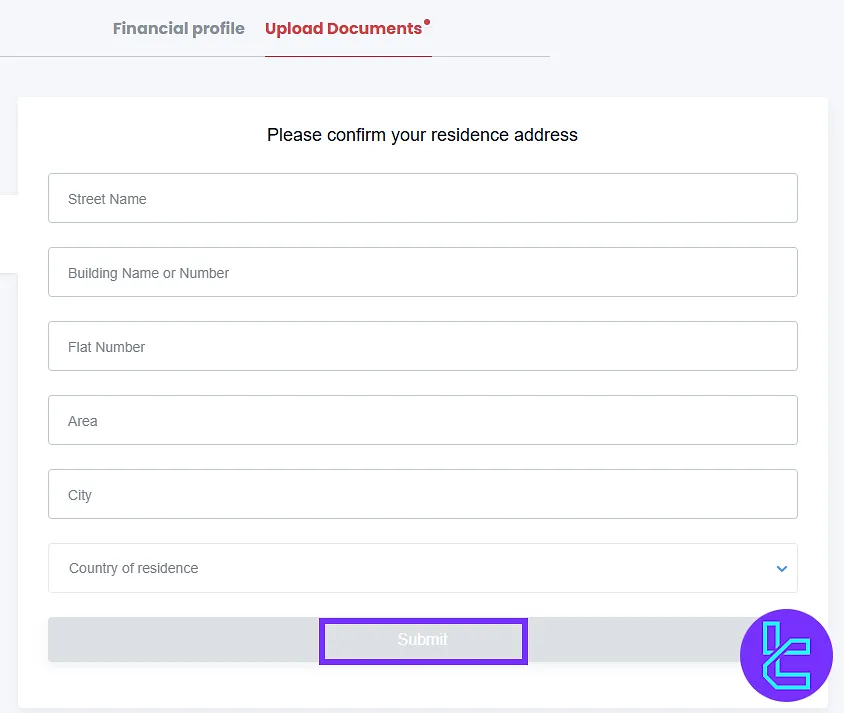

#3 Provide Proof of Residential Address

Next, enter your current residential address and click "Submit".

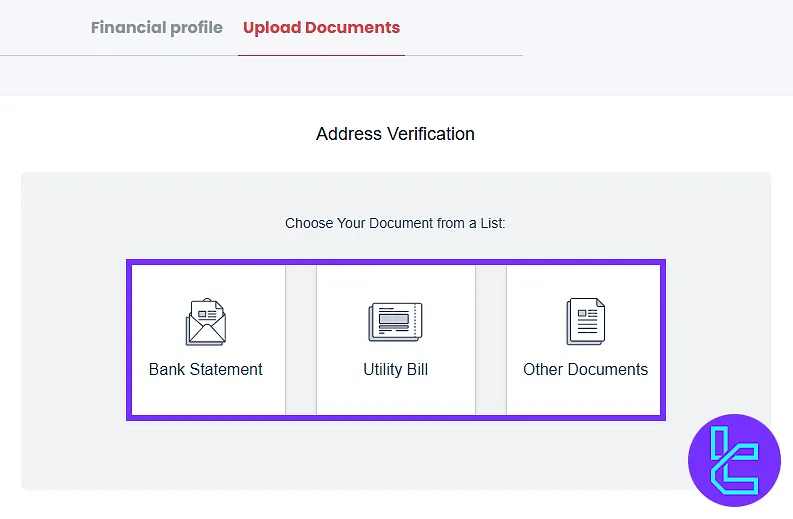

After submitting the address details, proceed to select the document type you wish to upload as proof of your residential address.

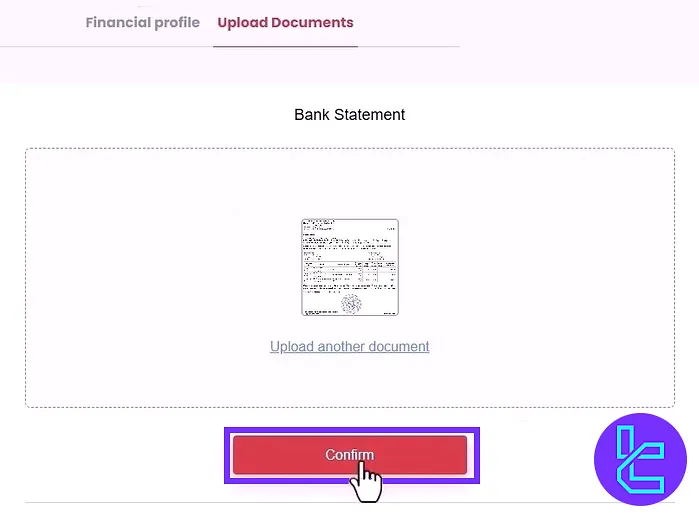

Available options are bank statements or utility bills, ensuring they display your full name, date, address and institution name.

Once selected, upload the document ensuring it is clear and meets HYCM’s stated criteria.

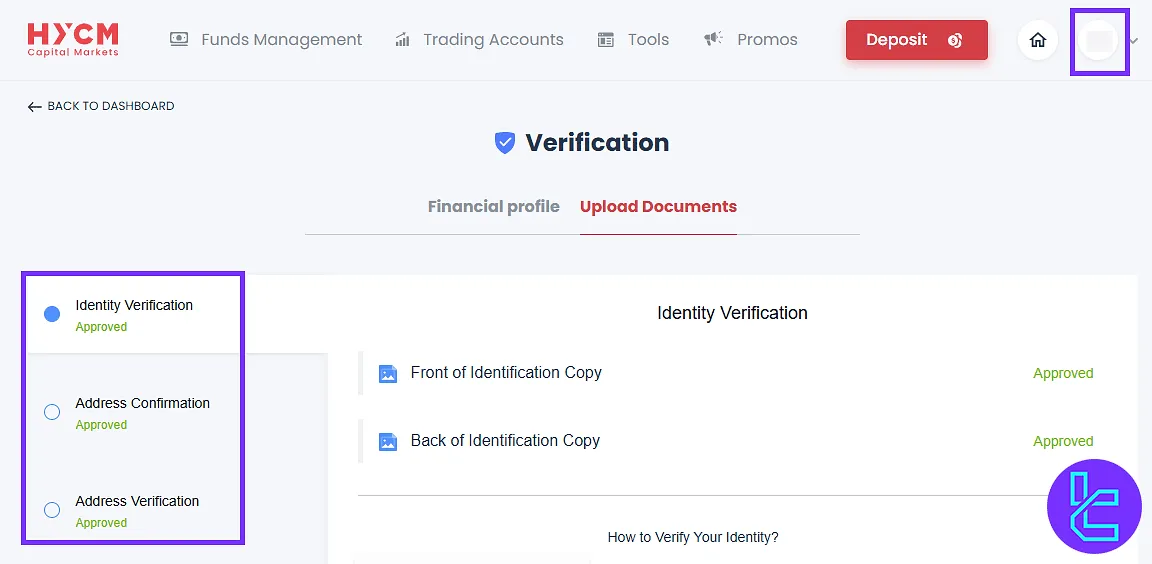

#4 Review Identification Status and Final Approval

Once all documents are uploaded, return to the "Account" section to check the status of the KYC process. HYCM typically reviews submissions within 1 business day.

The table below demonstrates the different requirements in the KYC process of HYCM and other brokers.

Verification Requirement | HYCM Broker | |||

Full Name | No | No | No | Yes |

Country of Residence | No | No | No | No |

Date of Birth Entry | No | No | No | Yes |

Phone Number Entry | No | No | No | No |

Residential Address Details | Yes | No | No | Yes |

Phone Number Verification | No | No | No | No |

Document Issuing Country | Yes | No | Yes | No |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | Yes | No | No | No |

Utility Bill (for POA) | Yes | Yes | No | No |

Bank Statement (for POA) | Yes | Yes | No | No |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | No | No | No |

Financial Status Questionnaire | No | Yes | No | Yes |

Trading Knowledge Questionnaire | Yes | No | No | No |

Restricted Countries | Yes | Yes | Yes | Yes |

TF Expert Suggestion

The HYCM verification process usually takes between 5 to 7 minutes. Accepted ID documents include passports, national ID cards, and driver’s licenses.

Now that your account has been verified, you can explore the available HYCM deposit and withdrawal methods to manage your account funds. More information is accessible on the HYCM tutorial page.