IC Trading offers multiple trading platforms, such as MetaTrader 4/5, c Trader, and Zulu, with leverage up to 1:500 and a minimum deposit requirement of just $200.

It provides a range of account types, including RAW Spread (MetaTrader), RAW Spread (cTrader), and Standard accounts, allowing traders to choose a setup that best fits their strategy.

It provides a range of account types, including RAW Spread (MetaTrader), RAW Spread (cTrader), and Standard accounts, allowing traders to choose a setup that best fits their strategy.

IC Trading Company Information & Regulation Status

IC Trading, operating under the IC Markets group, is a Mauritius-registered broker regulated by the Financial Services Commission (FSC).

The firm caters to experienced and cost-conscious traders by offering high leverage (up to 1:500), ultra-tight spreads, and access to advanced trading platforms such as MT4, MT5, and cTrader.

Using the table below, you can have a clear understanding of IC Trading’s regulation:

Entity Parameters/Branches | Capital Point Trading Ltd |

Regulation | Financial Services Commission (FSC) |

Regulation Tier | Tier 3 |

Country | Mauritius (Republic of Mauritius) |

Investor Protection Fund/Compensation Scheme | N/A |

Segregated Funds | N/A |

Negative Balance Protection | N/A |

Maximum Leverage | 1:500 |

Client Eligibility | Global except residents of restricted jurisdictions |

IC Trading Broker Summary of Specifics

To give you a clear picture of what IC offers, here's a concise summary of its key features:

Broker | IC Trading |

Account Types | RAW Spread (MetaTrader,cTrader), Standard |

Regulating Authorities | FSC |

Based Currencies | AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, CHF |

Minimum Deposit | $200 |

Deposit Methods | Credit/Debit cards, PayPal, Neteller, Wire Transfer, Broker to Broker |

Withdrawal Methods | Bank Wire, Credit/Debit cards |

Minimum Order | N/A |

Maximum Leverage | 1:500 |

Investment Options | N/A |

Platforms & Apps | MetaTrader 4/5, cTrader, Zulu |

Markets | Forex, Indices, Commodities, Bonds, Stock, Crypto, Futures |

Spread | From 0.0 |

Commission | From $3 |

Orders Execution | Market, pending orders |

Margin Call/Stop Out | N/A |

Trading Features | Copy Trading, Social Trading |

Affiliate Program | N/A |

Bonus & Promotions | N/A |

Islamic Account | Yes |

PAMM Account | Through Zulu |

Customer Support Ways | Live Chat, Help Center |

Customer Support Hours | 24/7 |

IC Trading's diverse offerings, regulatory compliance, and positive user reviews make it an attractive option for traders seeking a well-rounded trading experience.

IC Trading Forex Broker Account Types

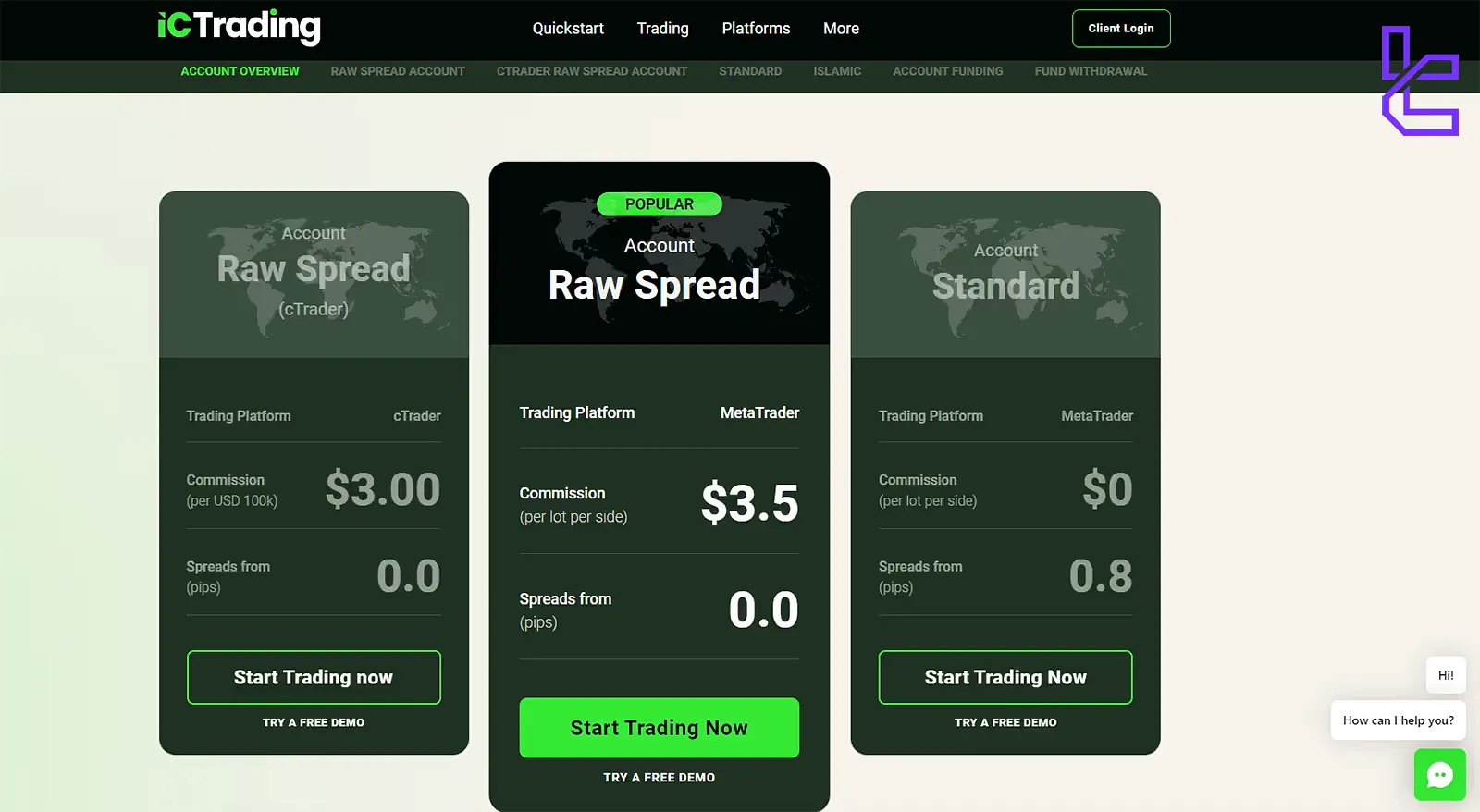

IC caters to various trading styles and preferences through its thoughtfully designed account types:

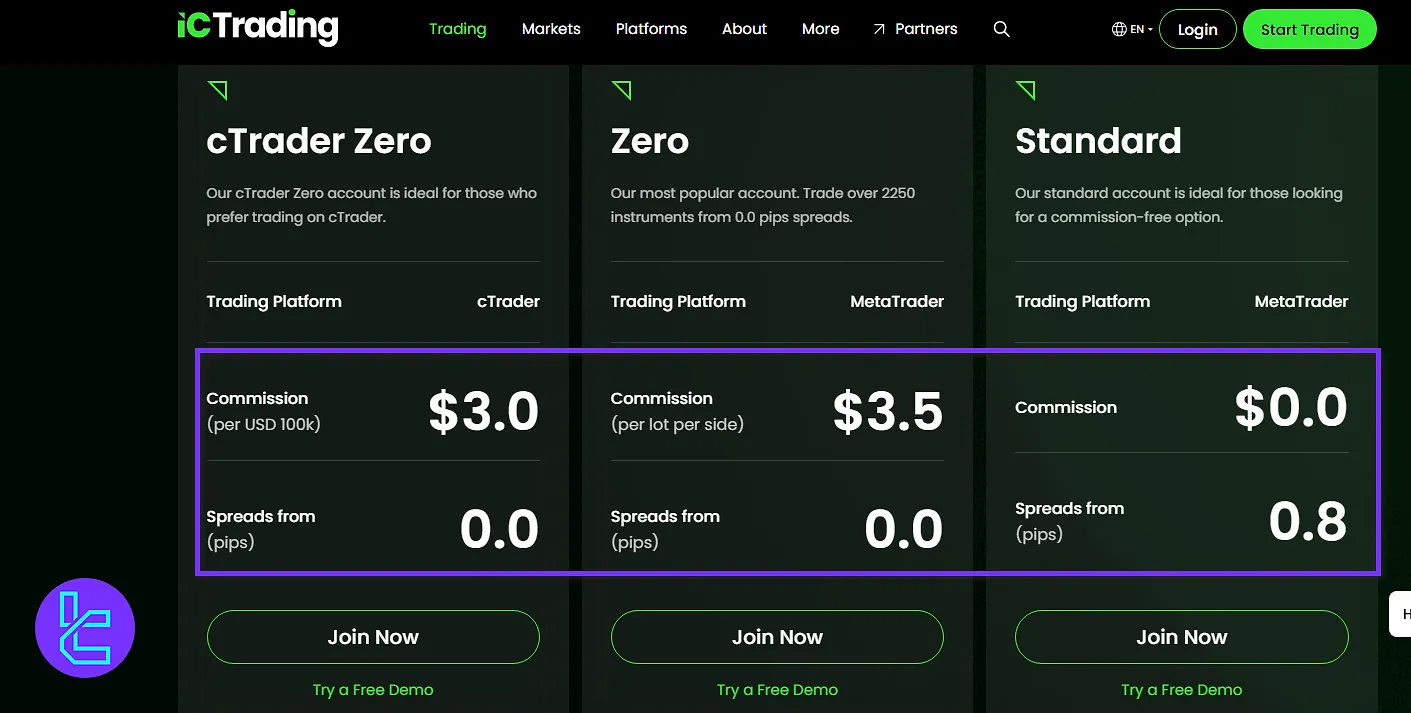

Raw Spread Account (cTrader)

- Trading platform: cTrader

- Ultra-low spreads, starting from 0.0 pip

- Small commission of $3.0 per $100,000 traded

Raw Spread Account (MetaTrader)

- Platform: MetaTrader

- Perfect for active traders and algorithmic trading enthusiasts

- Spreads from 0.0 pips

- Commission of $3.5 per lot

Standard Account (MetaTrader)

- Platform: MetaTrader

- Suited for discretionary traders

- No commissions

- Spreads from 0.8 pips

IC Trading Forex Broker Advantages and Disadvantages

As with any broker, IC has its own pros and cons. Let's break them down:

Advantages | Disadvantages |

Flexible Account Options | Limited Educational Resources |

Quick, Digital Account Opening Process | Regulated by a Less Stringent Authority (FSC of Mauritius) |

Industry-leading Spreads (as low as 0.0 pips on major pairs) | Limited Financial Transparency Compared to Top-Tier Regulated Brokers |

Ideal for Algorithmic and High-frequency Traders | - |

While IC Trading, compared to the other forex brokers, shines in areas crucial for experienced, price-sensitive traders, it may fall short for beginners seeking comprehensive educational resources.

IC Trading Broker Signing Up & Verification: Complete Guide

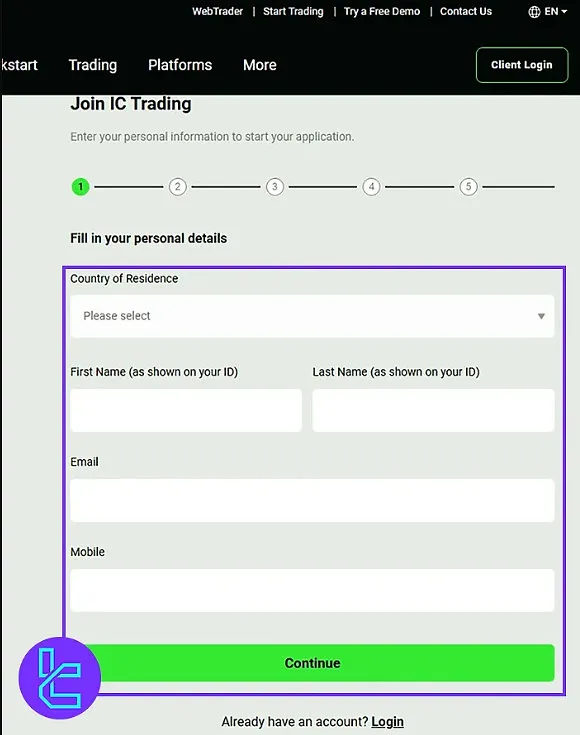

IC Trading registration is a fast and convenient process that typically takes under 10 minutes.

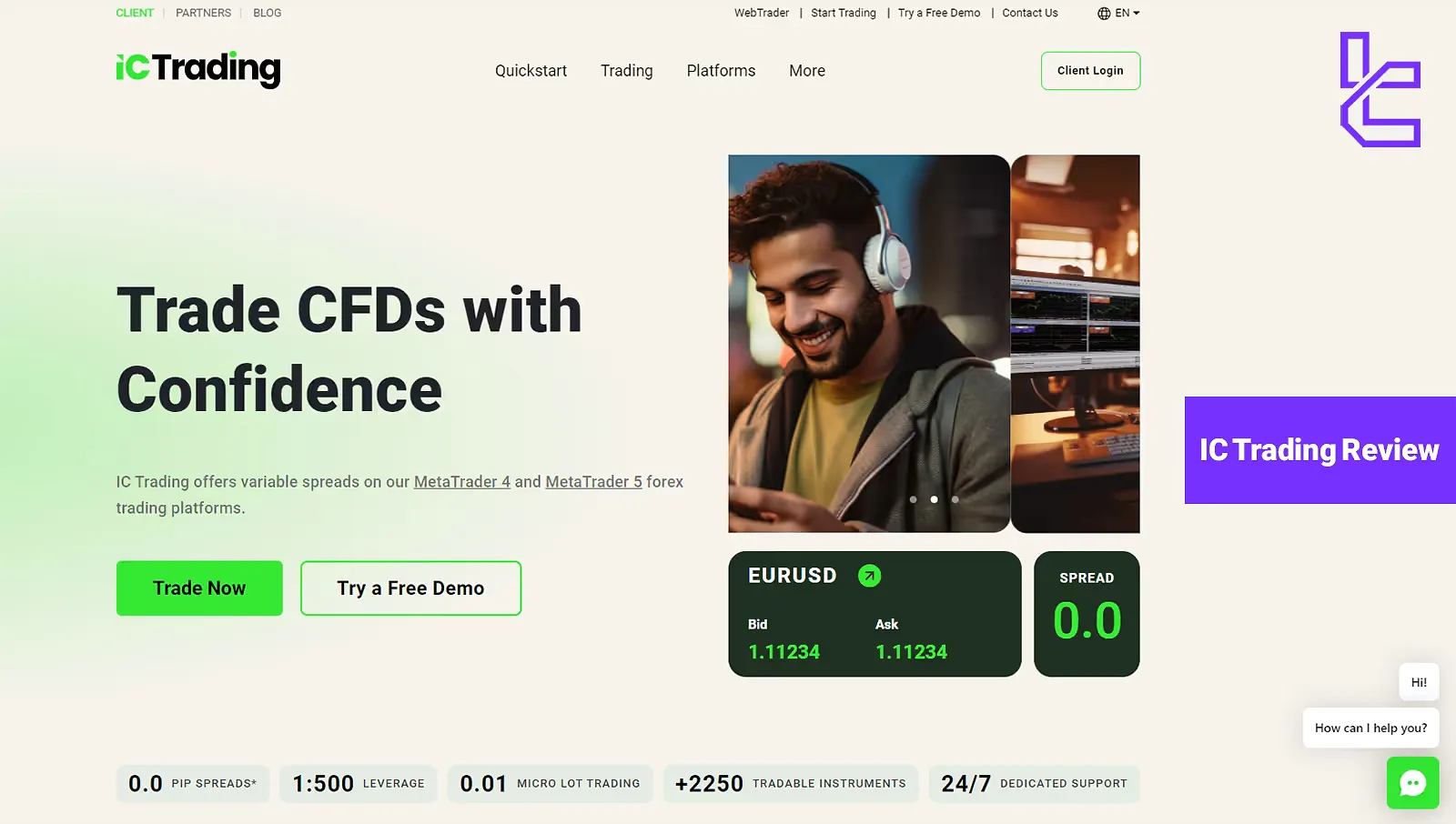

#1 Visit the IC Trading Website

Start by navigating to the broker’s homepage. On there, click on “Trade Now”.

#2 Submit Personal Details

Enter your personal details as mentioned below:

- First and last name

- Mobile number

- Country of residence

This initiates the registration.

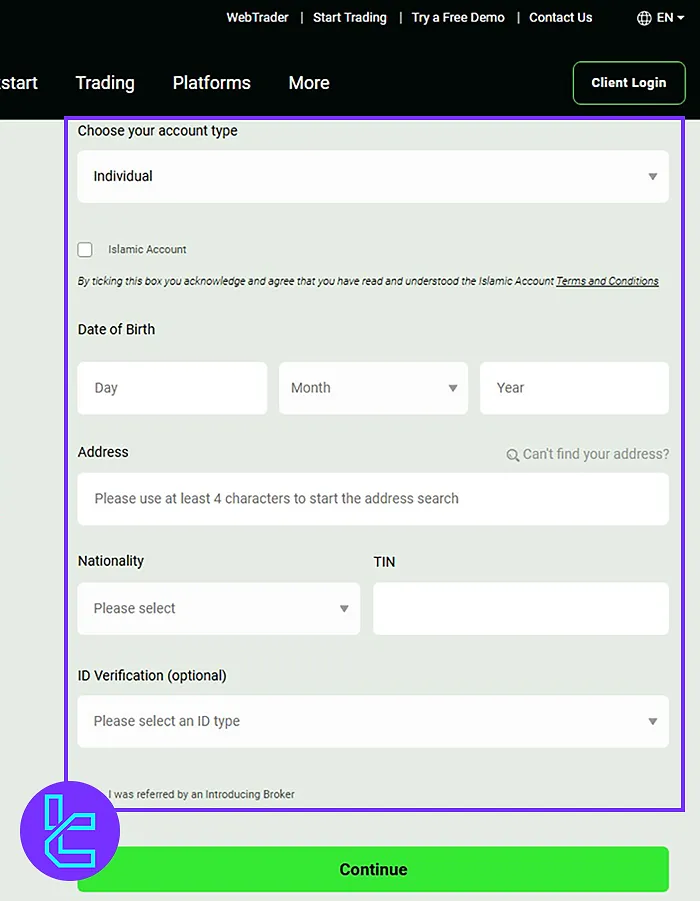

#3 Provide Financial and Identity Info

You’ll be asked to choose the account type, then input some information, including:

- Date of birth

- Address

- Nationality

- Tax identification number (TIN)

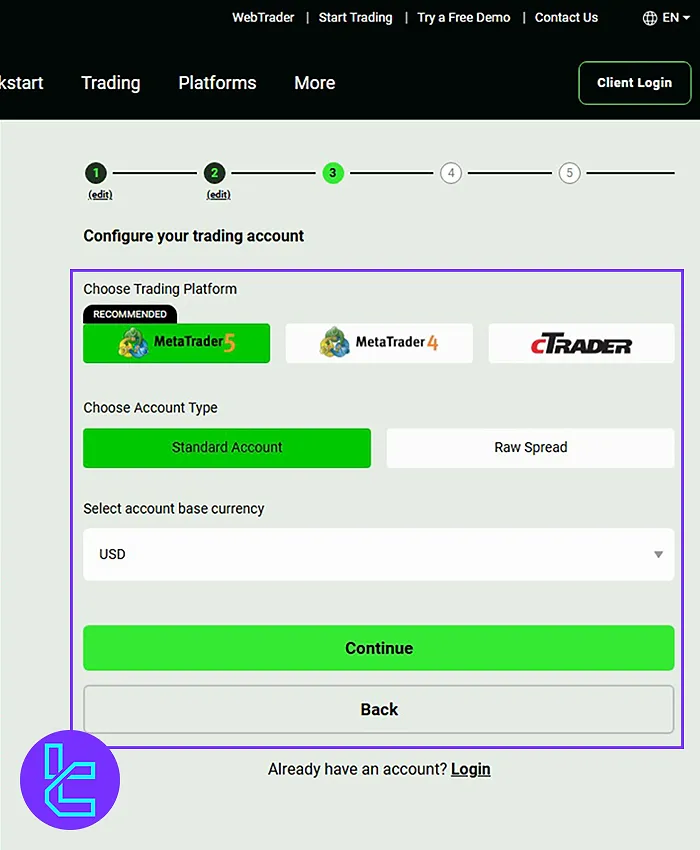

#4 Choose Platform and Currency

Select your trading platform (e.g., MetaTrader), account type (Standard or Raw Spread), and account base currency.

#5 Review and Confirm

Ensure all submitted data is accurate, as any mismatch could delay onboarding.

#6 Set Up Security Question

Add a custom security question and answer to enhance your account’s protection, then click "Submit" to complete the registration process.

#7 Verify Your Identity

Finally, provide proof of identity and proof of address to pass the KYC verification.

IC Trading Forex Broker Platforms

IC Trading offers a robust suite of platforms to cater to various trader preferences:

MetaTrader 4 (MT4)

- Industry-standard platform

- Extensive customization options

- Large marketplace for expert advisors (EAs)

Download Links:

MetaTrader 5 (MT5)

- Advanced version of MT4

- Enhanced charting capabilities

- more available markets, including stocks and futures

Download Links:

cTrader

- Modern, intuitive interface

- Advanced order types and risk management tools

- Built-in algorithmic trading capabilities

Download Links:

IC Trading Forex Broker Spreads and Commissions

IC prides itself on offering some of the most competitive pricing in the industry:

- Raw Spread accounts offer spreads starting from 0

- Variable spreads across all platforms (MT4, MT5, cTrader)

- Deep liquidity from over 25 providers

Commission structure:

- Raw Spread accounts: Small per-lot fee (e.g., $3.5 per standard lot on MetaTrader)

- Standard accounts: No commission, slightly wider spreads (0.8 pips)

IC Trading's transparent pricing model extends across major, minor, and exotic currency pairs and other instruments like commodities, indices, and bonds.

This combination of ultra-low spreads and reasonable commissions makes IC Trading particularly attractive for high-volume and high-frequency traders.

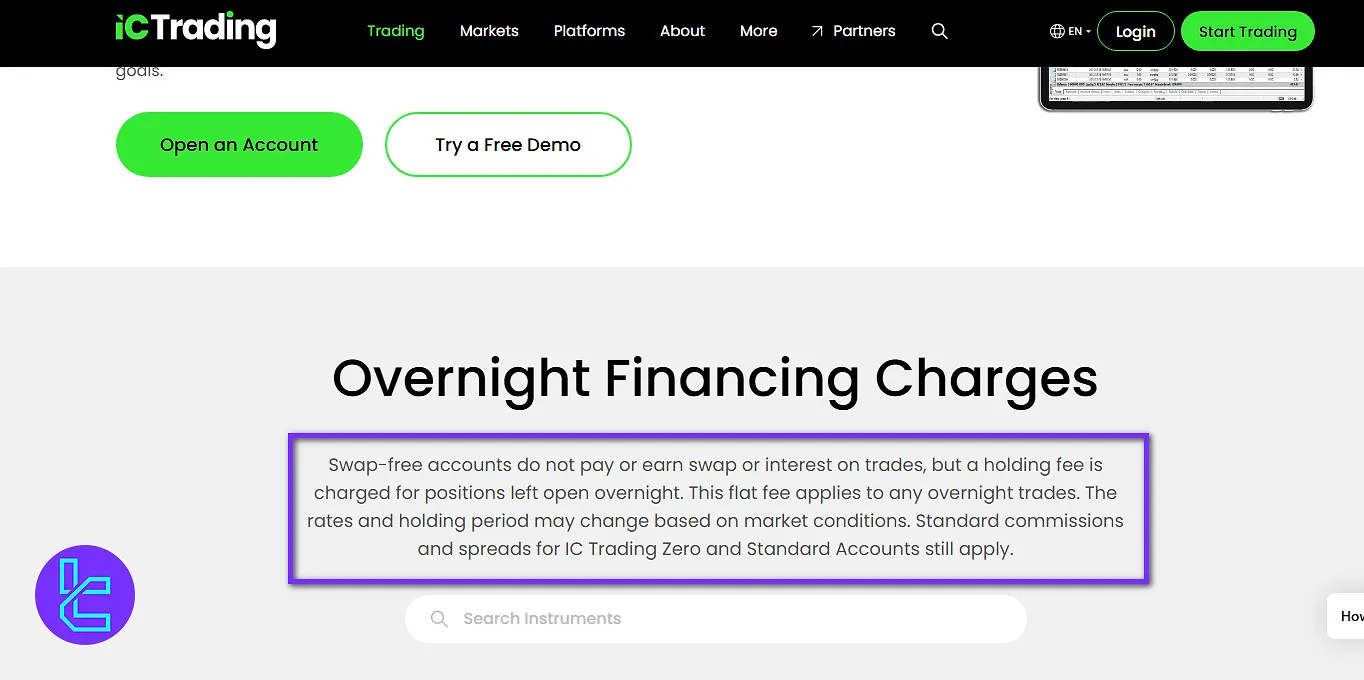

IC Trading Swap Fees

Swap fees, also known as overnight financing or rollover charges, are costs applied when a trader keeps a leveraged position open beyond the trading day.

At IC Trading, these fees vary depending on the trading instrument, position size, and prevailing interbank interest rates.

IC Trading does not publicly disclose detailed information about its specific swap fee structure. However, it offers a swap-free (Islamic) account.

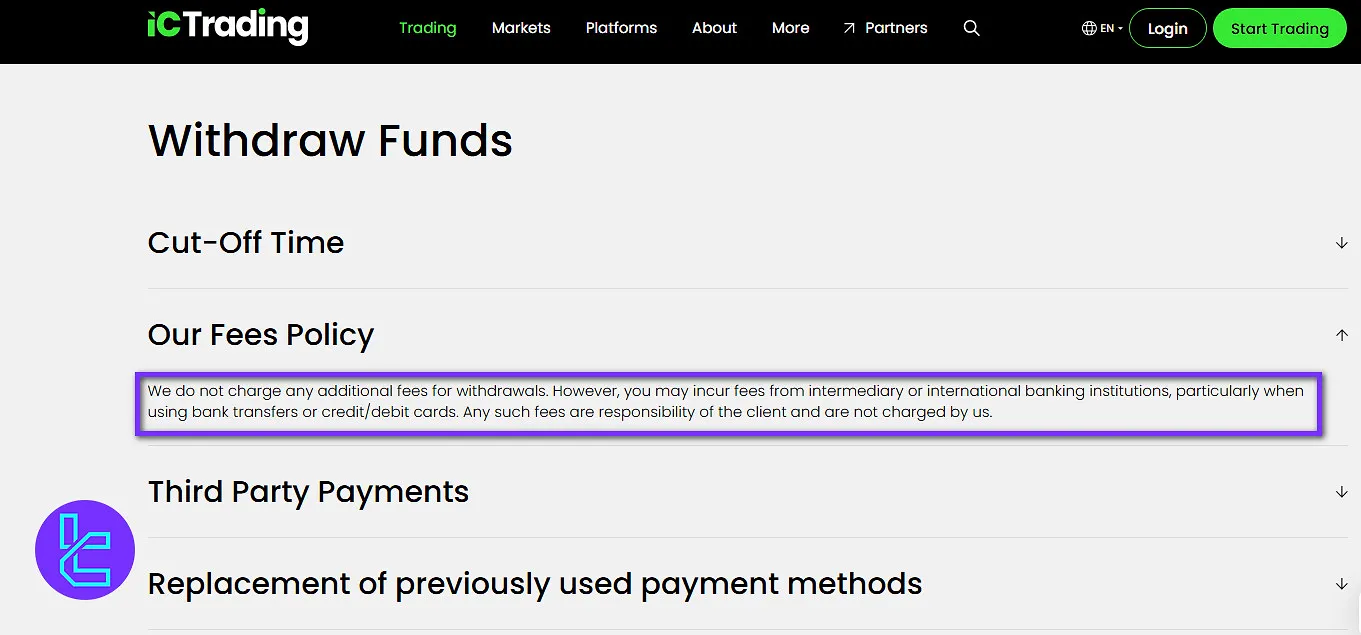

IC Trading Non-Trading Fees

The broker’s website does not specify whether it applies inactivity fees, deposit or withdrawal commissions, or account management costs.

According to IC Trading, no additional fees are charged by the broker for withdrawals.

However, traders should be aware that fees may still apply when transactions involve intermediary or international banking institutions, especially in the case of bank transfers or credit/debit card payments.

Deposit & Withdrawal in IC

IC Trading offers a wide array of funding options to accommodate traders from various regions:

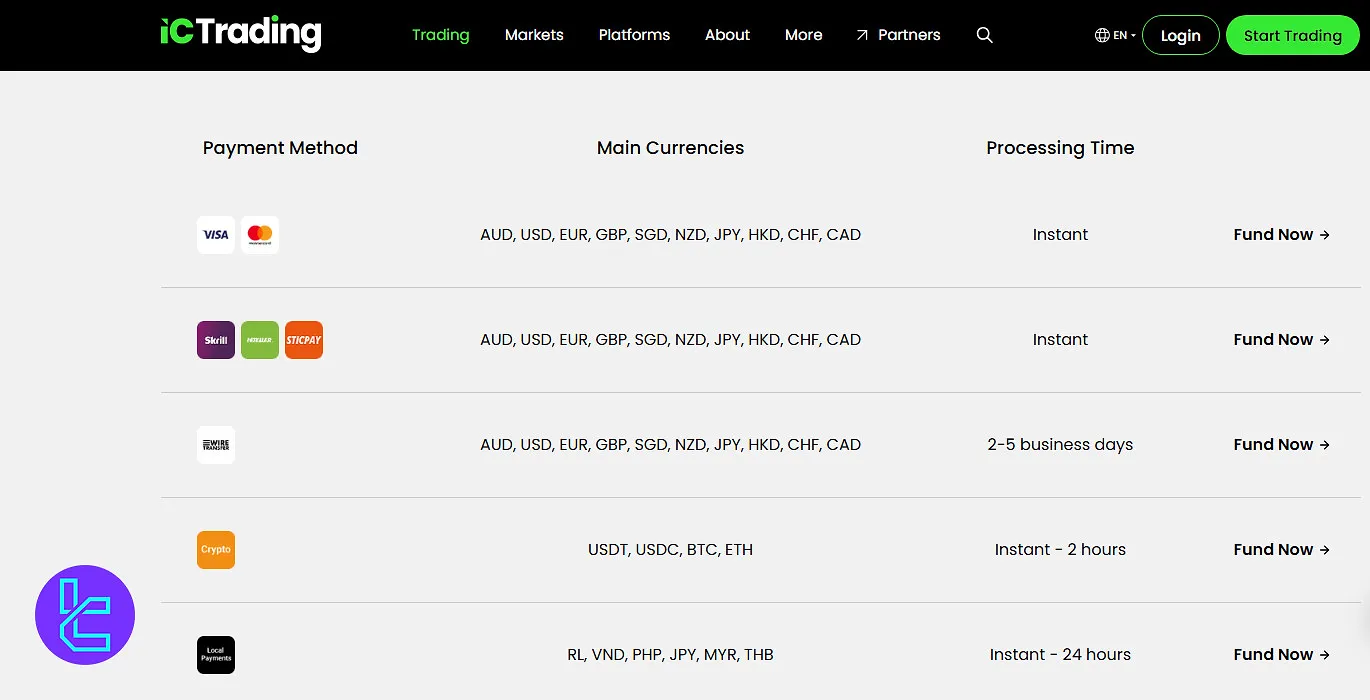

Deposit Methods

IC Trading offers various secure ways to deposit funds into your account. Here are the available options for making deposits:

Deposit Method | Main Currencies | Processing Time |

Credit/Debit Cards | AUD, USD, EUR, GBP, SGD, NZD, JPY, HKD, CHF, CAD | Instant |

E-Wallets | AUD, USD, EUR, GBP, SGD, NZD, JPY, HKD, CHF, CAD | Instant |

Wire Transfer | AUD, USD, EUR, GBP, SGD, NZD, JPY, HKD, CHF, CAD | 2 to 5 business days |

Crypto | USDT, USDC, BTC, ETH | Instant – 2 Hours |

Local Payments | RL, VND, PHP, JPY, MYR, THB | Instant – 24 Hours |

Note that all deposits must come from an account in the client's name. Processing times vary depending on the chosen method.

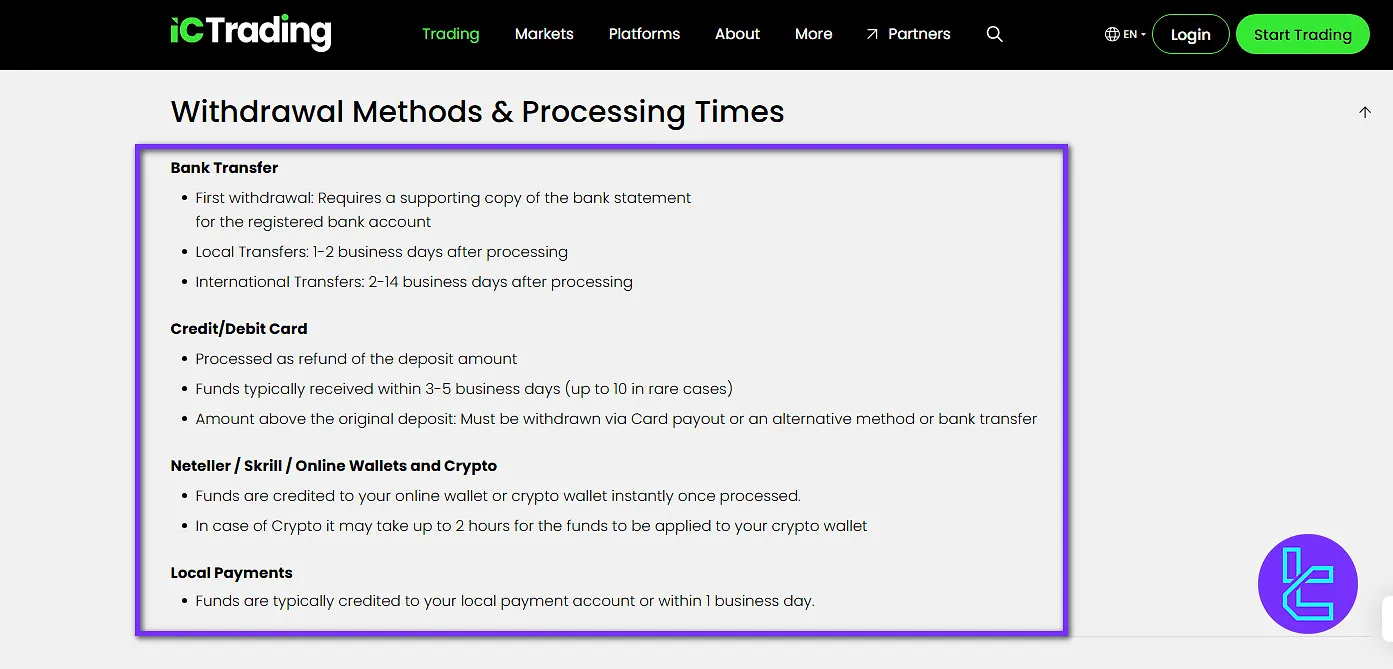

Withdrawal Methods

IC Trading provides 4 different withdrawal methods to its users. Here are the details:

Withdrawal Method | Withdrawal Fees | Processing Time |

Credit/Debit Cards | $0 (Bank fees may apply) | 3 to 5 business days |

E-Wallets | $0 | Instant |

Crypto | $0 | Up to 2 Hours |

Local Payments | $0 (Bank fees may apply) | 1 business day |

Note: Credit/Debit card withdrawals are processed as a refund of the deposit amount. If the amount is more than the original deposit, it must be withdrawn via card payout or another method.

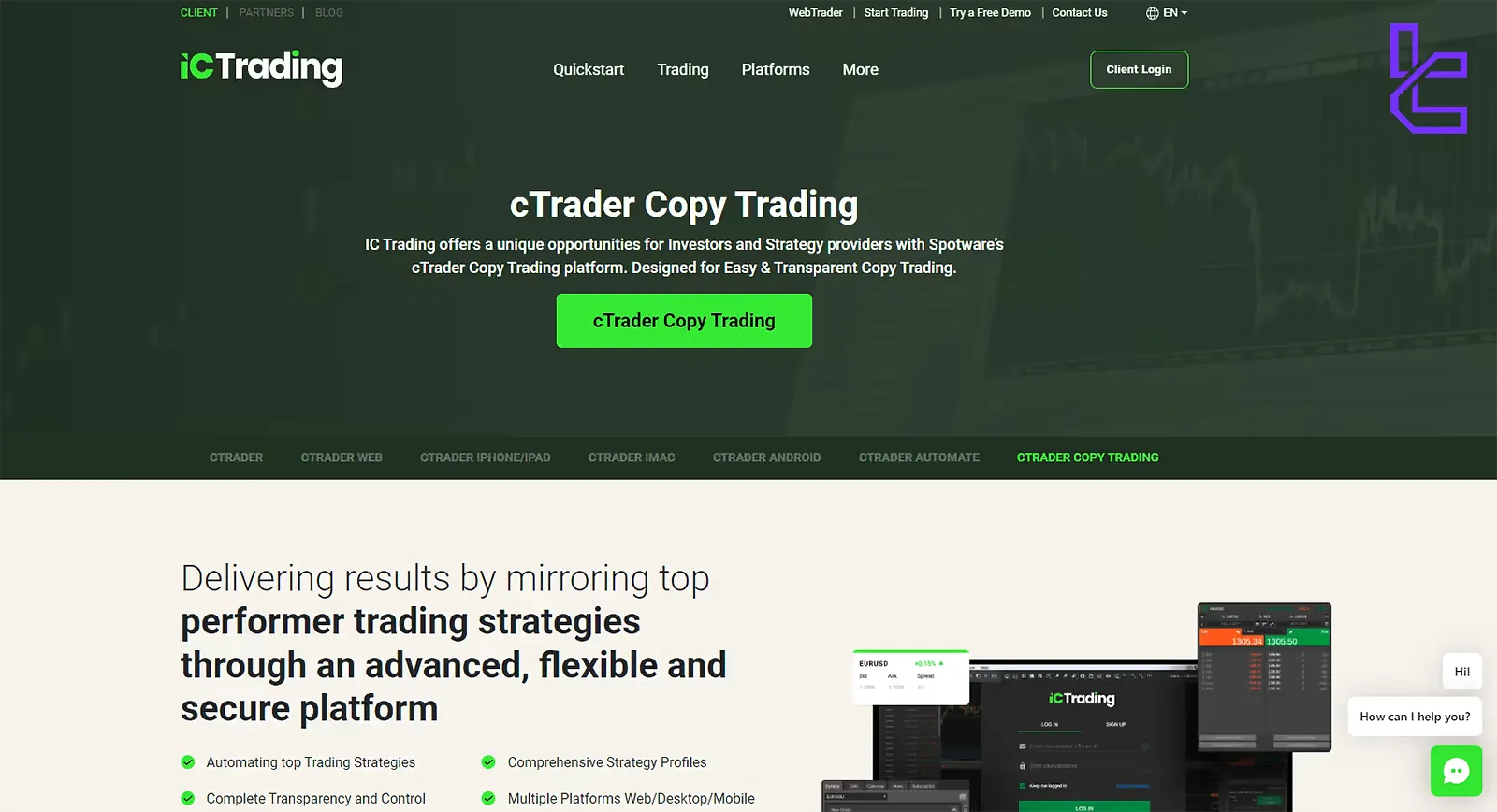

Copy Trading & Investment Options Offered on IC Trading

IC Trading offers copy trading services through the cTrader. This allows clients to automatically replicate the trades of other investors or professional traders.

This feature is ideal for those seeking passive investment opportunities, as it enables them to benefit from the expertise of experienced traders.

Additionally, it provides flexibility and convenience, allowing users to manage their investments with ease while still having the option to develop and implement their own trading strategies.

IC Trading Tradable Markets & Symbols

IC Trading offers an extensive range of tradable instruments across multiple asset classes:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex | Major, minor, and exotic pairs available across Standard, Pro, and ECN accounts | Over 60 currency pairs | 50–70 currency pairs |

Stocks | CFDs on shares from major global exchanges via MT5 platform | Over 1,000 global stocks | 800–1,200 stocks |

Commodities | CFDs on metals and energy products (gold, silver, oil, etc.) | Around 15 instruments | 10–20 instruments |

Indices | CFDs on major global indices such as S&P 500, NASDAQ, DAX, FTSE, and others | Around 10 indices | 10–20 indices |

Bonds | Government and corporate bonds available for trading | Over 5 bonds | 5–10 bonds |

Cryptocurrencies | Major crypto pairs (e.g., BTC/USD, ETH/USD) | Around 10 major pairs | 8–15 pairs |

This diverse offering allows traders to access a wide range of global markets from a single platform, facilitating portfolio diversification and the ability to capitalize on various market conditions.

IC Trading Bonuses and Promotions

IC Trading appears not to provide any bonuses or promotions at the moment. This means clients won’t encounter sign-up bonuses, deposit bonuses, or other promotional rewards that some brokers offer.

IC Trading Rebate

Traders using IC Trading can earn rebates and cashbacks through the TradingFinder IB program, which reduces spreads (up to $1.25) and commissions (over 21%) on Forex, metals, indices, and cryptocurrencies for Standard, Raw Spread, and cTrader Raw accounts.

Stocks, commodities, bonds, futures, and ETFs are not covered. The rebate amount depends on account type, trading volume, and asset, with specific rates for each instrument, and can be calculated using a Forex rebate calculator.

To participate in the IC Trading Rebate, new traders must open an account via TradingFinder’s exclusive link, while existing accounts linked to another referrer cannot be transferred.

IC Trading Broker Support team

IC Trading aims to provide comprehensive support to its clients through 2 main channels:

- Live chat: Accessible via the website

- Help center: A section on the official site

- Phone: +230 215 8013

- Email: support@ictrading.com

While IC Trading strives to offer robust support, some users have reported issues with response times and availability.

As with any broker, it is advisable to test the support channels before committing to a live account.

IC Trading Broker List of Restricted Countries

It is not explicitly stated whether the IC Trading broker maintains a specific list of restricted countries where clients are prohibited from trading.

We will update this page in case of any changes.

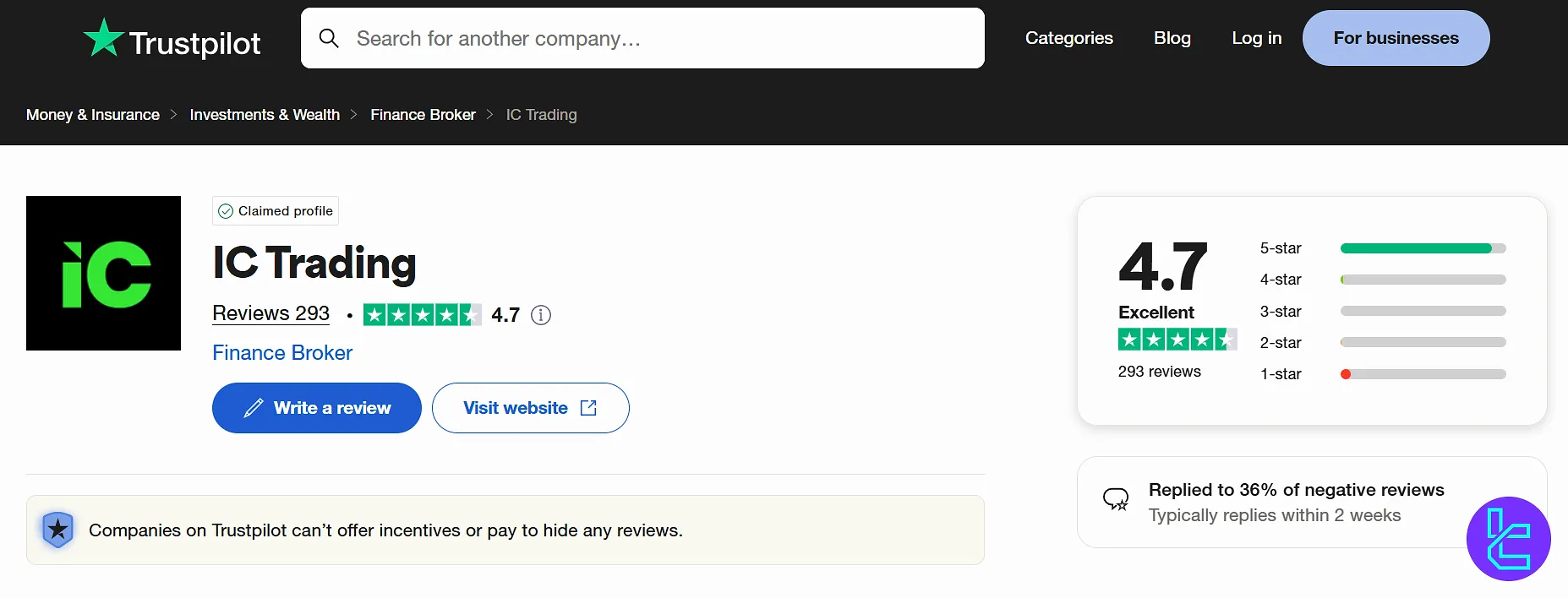

IC Trading Broker Trust Scores & Reviews

The broker has received mostly positive reviews from users and various online sources. IC Trading Trust Scores:

- IC trading Trustpilot: 4.7 out of 5 with over 293 user reviews

- ScamAdviser: 100/100 Trustscore

Education on IC Trading Broker

IC Trading falls short in providing educational resources, which can be a disadvantage for traders, particularly beginners aiming to improve their knowledge and skills.

The broker lacks a comprehensive array of educational materials, such as in-depth tutorials, webinars, and extensive market analysis that are typically offered by other brokers.

This shortfall can make it difficult for new traders to get up to speed and for seasoned traders to stay updated on advanced trading strategies and market trends.

Although IC Trading offers some basic educational content, it does not measure up to the robust educational platforms provided by industry leaders.

IC Trading Against Other Brokers

Look at the table below for a comprehensive comparison between IC Trading and other brokerages:

Parameter | IC Trading Broker | AvaTrade Broker | Tickmill Broker | FxGrow Broker |

Regulation | FSC | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FCA, CySEC, LFSA, FSCA | CySEC, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC |

Minimum Spread | 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.00001 pips |

Commission | From $3 | $0 | From $0.0 | $8 |

Minimum Deposit | $200 | $100 | $100 | $100 |

Maximum Leverage | 1:500 | 1:400 | 1:1000 | 1:300 |

Trading Platforms | MetaTrader 4/5, cTrader, Zulu | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App | MetaTrader 5 |

Account Types | RAW Spread (MetaTrader,cTrader), Standard | Standard, Demo, Professional | Classic, Raw | ECN, ECN Plus, ECN VIP, Demo |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 1250+ | 620+ | 120+ |

Trade Execution | Market, Pending Orders | Instant | Market | Market |

Conclusion and Final Words

IC Trading ensures the security of client funds by holding them in segregated accounts.

The commission on RAW Spread accounts is $3.5 per lot (MetaTrader) and $3 per $100,000 traded (cTrader), while Standard accounts have no commissions.

With a Trustpilot rating of 4.7, the broker enjoys positive feedback for its trading conditions and platform offerings. However, its regulation by the FSC Mauritius (a less stringent regulatory body) may concern some traders.