IG broker enables traders to access 17,000+ instruments with 24-hour Indices and extended hours for US shares trading advantage. This broker has won 10+ industry awards, and over 381K traders use this broker's services.

Founded in 1974 in London,IG is a member of the FTSE 250 index (Footsie 250) and has offices in 17 countries. Today, the company operates under multiple top-tier financial regulators such as the FCA (UK), ASIC (Australia), and MAS (Singapore).

IG; Broker Introduction and Regulation

Founded in 1974 in London, IG pioneered spread betting and has become one of the industry's largest and most respected brokers.

IG International Limited is a member of IG Group and is regulated by the Bermuda Monetary Authority.

The company has sales offices in 17 countries across 5 continents and serves 381,000+ clients. IG Group is a constituent of the FTSE 250 index (Footsie 250) and regulated by multiple top-tier financial authorities, including:

- Australian Securities & Investment Commission (ASIC)

- United Kingdom Financial Conduct Authority (FCA)

- Japan Financial Services Agency (FSA)

- France The Autorité des Marchés Financiers (AMF)

- New Zealand Financial Markets Authority (FMA)

- Monetary Authority of Singapore (MAS)

- Dubai Financial Services Authority (DFSA)

- South African Financial Sector Conduct Authority (FSCA)

This multi-jurisdictional regulatory framework gives traders confidence in IG's operations and protects their investments. It also ensures the safety of client funds, adherence to industry standards, and the availability of dispute resolution mechanisms.

The broker offers different levels of client protection in some regions according to the regulating authority:

- In the U.K., FSCS coverage up to £85,000 and full fund segregation is provided;

- European clients are served with compensation of up to €20,000;

- Swiss clients enjoy 100,000 CHF in coverage.

IG also enforces negative balance protection for EU retail traders only, meaning clients can't lose more than their account balance on leveraged trades.

is an overview of all the details about the regulation of IG Broker:

Entity Parameters / Branches | IG Markets Ltd (UK) | IG Europe GmbH (EU) | IG Australia Pty Ltd (ASIC) | IG International Ltd (Bermuda) | IG Securities Ltd (Japan) | IG Singapore Pte Ltd (MAS) | IG Limited (Dubai) | IG Markets South Africa Ltd (FSCA) |

Regulation | Financial Conduct Authority (FCA) | AMF / BaFin | Australian Securities & Investments Commission (ASIC) | Bermuda Monetary Authority (BMA) | Japan Financial Services Agency (JFSA) | Monetary Authority of Singapore (MAS) | Dubai Financial Services Authority (DFSA) | Financial Sector Conduct Authority (FSCA) |

Regulation Tier | Tier-1 | Tier-1 | Tier-1 | Tier-3 | Tier-1 | Tier-1 | Tier-1 | Tier-2 |

Country / Region | United Kingdom | European Union (EEA) | Australia | Bermuda (Global clients) | Japan | Singapore | United Arab Emirates | South Africa |

Investor Protection Fund / Compensation Scheme | FSCS up to £85,000 | EU protection up to €20,000 | None (segregation only) | None | Local FSA protection | None (segregation only) | None | None |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes (retail only) | Yes (retail only) | No | No | No | No | No | No |

Maximum Leverage | 1:30 | 1:30 | 1:30 | 1:200 | 1:25 | 1:20 | 1:50 | 1:200 |

Client Eligibility | UK retail & pro | EU/EEA retail & pro | Australian retail & pro | Global clients outside top-tier regions | Japanese clients | Singaporean clients | Middle East clients | South African clients |

IG Broker Table of Specifications

To give you a clear picture of what IG offers, here's a comprehensive table of specifications.

Broker | IG |

Account Types | CFD |

Regulating Authorities | ASIC, FCA, FSA, AMF, FMA, MAS, DFSA, FSCA |

Based Currencies | USD, GBP, AUD, EUR, SGD, HKD |

Minimum Deposit | Unlimited |

Deposit Methods | Bank Transfer, Credit/Debit Cards |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards |

Minimum Order | $1 per trade for the first two weeks |

Maximum Leverage | 1:200 |

Investment Options | Trading signals, Algorithmic trading |

Trading Platforms & Apps | MT4, TradingView, L2 Dealer, ProRealTime, Proprietary Platform |

Markets | Forex, Indices, Shares, Commodities, Cryptocurrencies, Bonds, IPOs |

Spread | Variable based on the instruments |

Commission | $0.0 (except for Shares) |

Orders Execution | Market, Limit, Stop-Loss, Trailing Stops, Trigger, Guaranteed Stops |

Margin Call / Stop Out | N/A |

Trading Features | Academy, Signals, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Referral, Rebate |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone, WhatsApp |

Customer Support Hours | 24/6 |

IG Broker Account Types

IG forex broker offers only one trading account with extensive features. However, during registration, you can choose your preferred trading platform and the market model. Key features of the IG CFD Account:

Markets | 17,000+ |

Min Order Size | $1 per trade for the first two weeks |

Margin/Leverage | From 0.25% for forex, 5% for shares, and a margin factor for indices |

1:200 | |

Phone Trading | Yes |

Demo Account | Yes |

Min Deposit | No limit |

Why IG broker (Upside and Downside)

Tight spreads, low commissions, award-winning trading platforms, and segregated accounts are some of the advantages you’ll get by trading with IG.

However, there are downsides to it as well.

Pros | Cons |

Wide range of markets and instruments | Occasional platform outages during high-volatility periods |

Robust regulatory framework | Limited cryptocurrency offerings |

Comprehensive educational resources | Lack of 24/7 support |

Strong reputation and long-standing presence in the industry | - |

IG broker Account opening and Verification

We must discuss the registration process in this IG broker review. To benefit from the company’s trading charts, signals, algorithmic trading, APIs, and many more, follow the stages below towards IG registration.

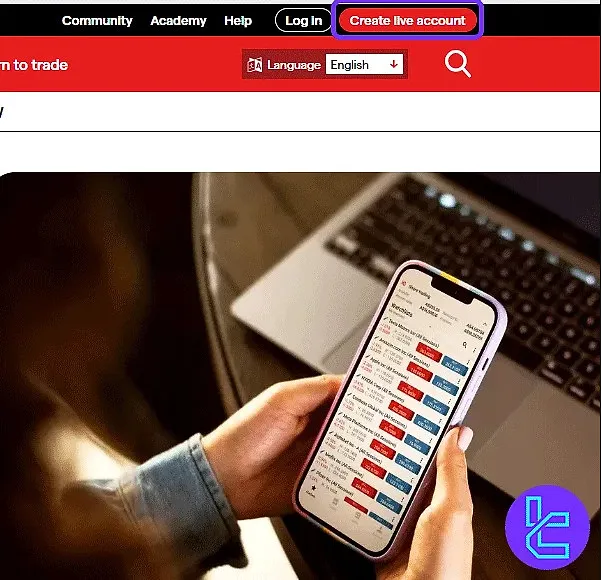

#1 Create an Account via IG.com

Head to the officialIG Markets website and hit "Create Live Account" to begin.

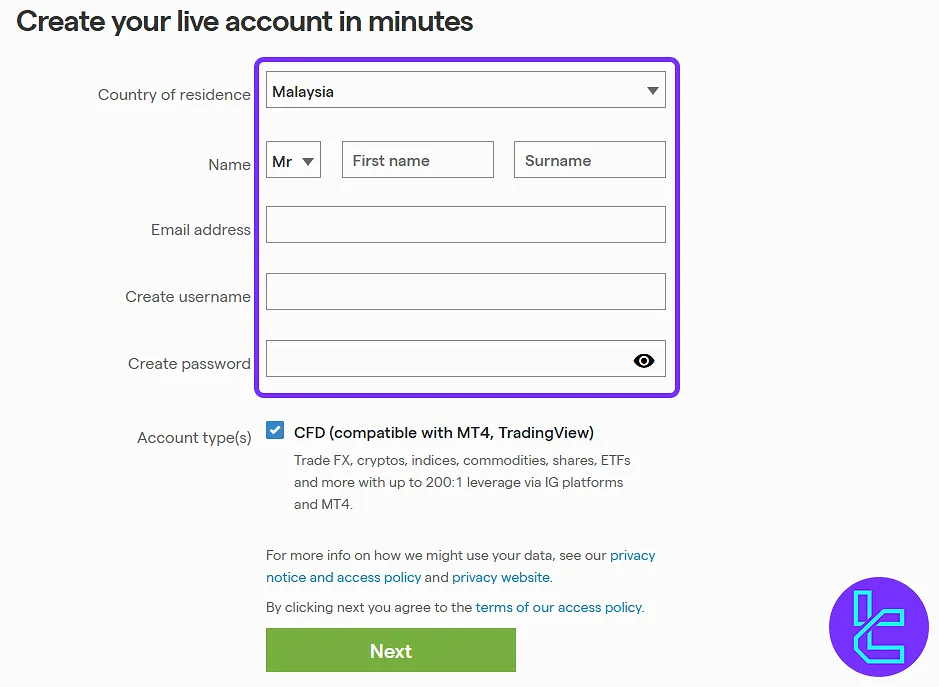

#2 Enter Personal and Account Preferences

Choose your country of residence from the list. Afterwards, please submit your full name and email address, and then set a password.

Select your desired account type for CFD trading on multiple asset classes.

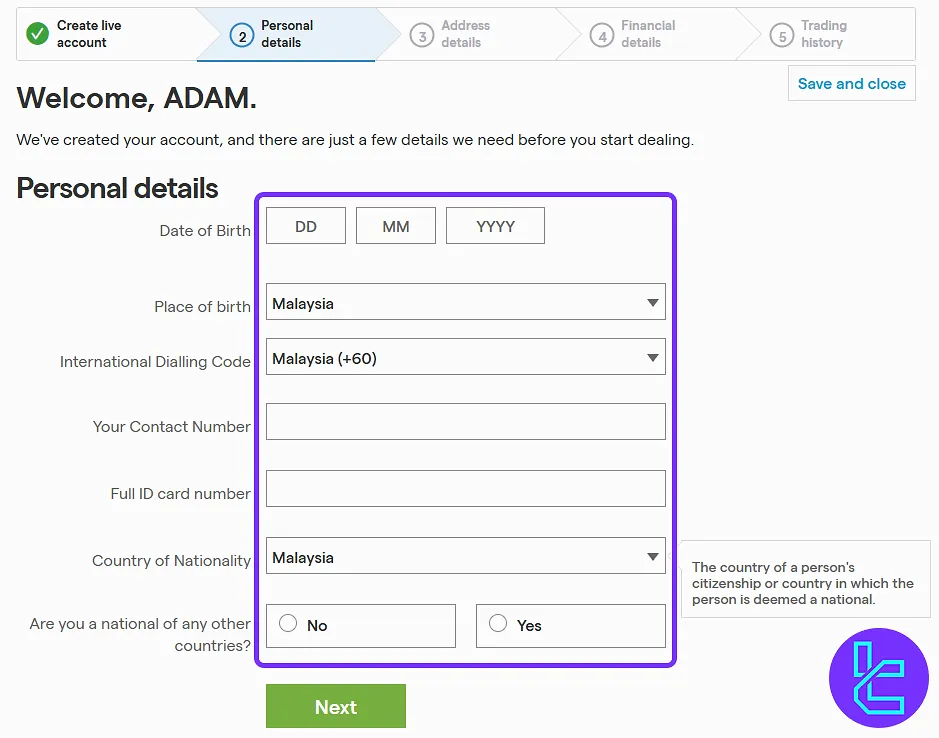

#3 Provide Identity and Contact Information

Include details mentioned here:

- Date/place of birth

- Phone number

- ID number

- Nationality

Note that multiple citizenships must be declared.

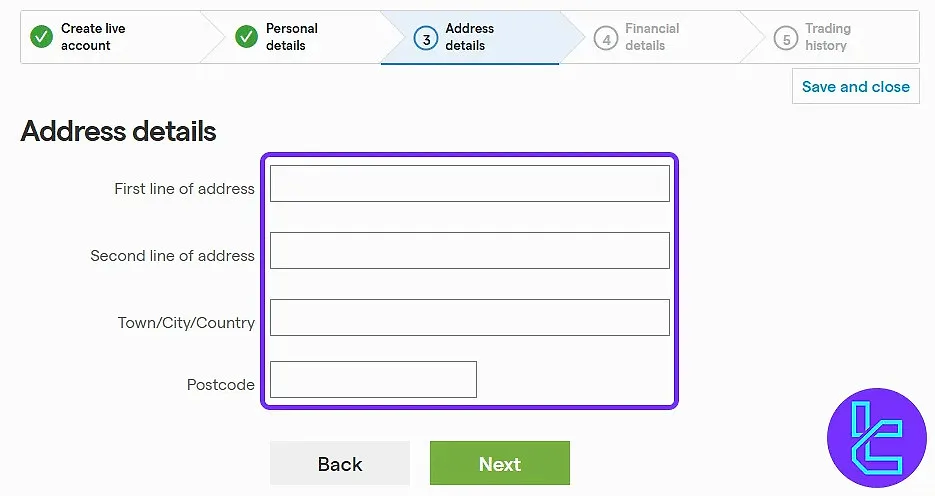

#4 Add Residential Address Details

Fill in your street address, city, and postal code to proceed with identity verification.

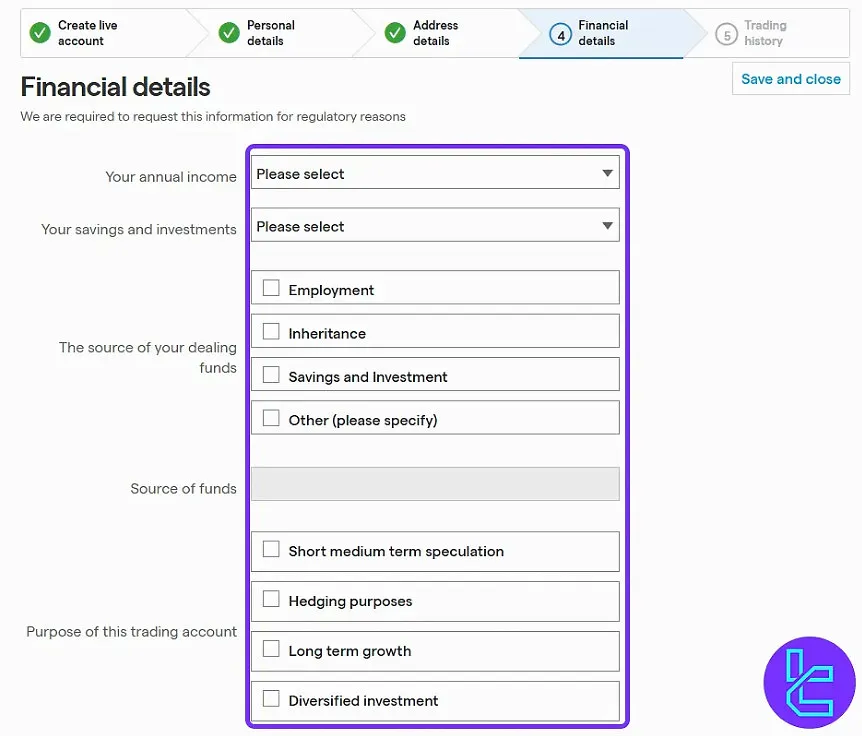

#5 Submit Financial Information

State these parameters based on facts about yourself:

- Income

- Employment status

- Fund source

- Trading goals

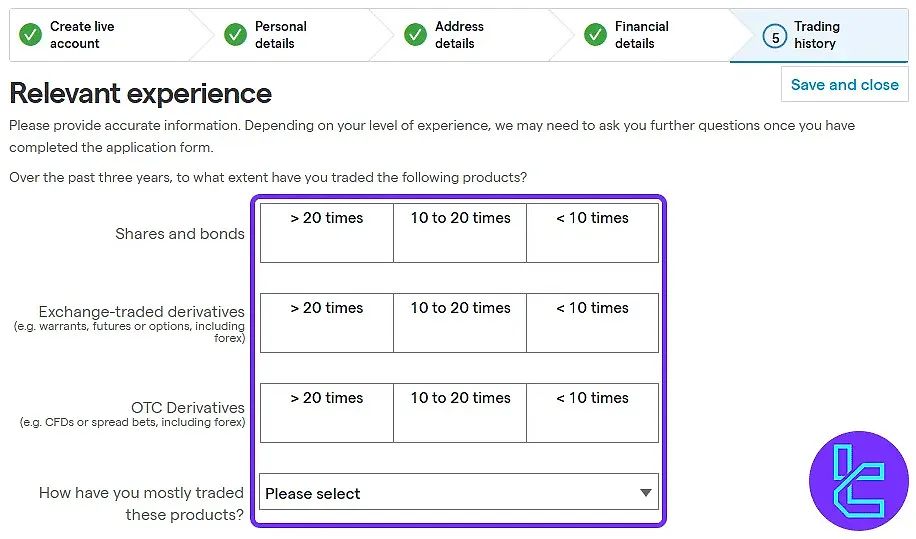

#6 Describe Your Trading Background

Answer questions regarding your experience with derivatives, stocks, OTC markets, and whether you hold any financial certifications.

#7 Accept Terms and Complete Sign-Up

Agree to IG’s terms and submit the form. After registration, upload your verification documents to activate your account and start trading.

IG Broker Trading Platforms

The company offers a full suite of trading platforms, from proprietary software to specialist platforms. Here’s a list of available trading platforms on IG.

- IG Android app

- IG iOS web app

- IG Web Trader

- MT4

- ProRealTime

- L2 Dealer

- TradingView

Almost all of the mentioned platforms are free to use, but they have requirements that you should meet, such as ProRealTime (at least 4 transactions per month) and L2Dealer (minimum $2,000 balance).

IG Broker Commission and Fees

The company offers competitive prices and fees. The rates for Futures and CFDs are variable. IG spreads on various markets:

Markets | Commissions | Spreads |

Indices | - | Floating from 1.0 pips |

Forex | - | Floating from 0.6 pips |

Commodities | - | Floating from 0.3 pips |

Crypto | - | Floating from 2.0 pips |

Shares | From 0.08% | - |

While IG's fees are generally competitive, it's important to consider all potential costs when planning your trading strategy. Some other potential fees on IG:

- Overnight Funding: Applied to positions held overnight, based on relevant interest rate benchmarks plus a small admin fee

- Guaranteed Stop Premiums: A small fee is charged if a guaranteed stop is triggered (e.g., 0.3% for share CFDs)

- Inactivity Fee: $18 per month after two years of inactivity

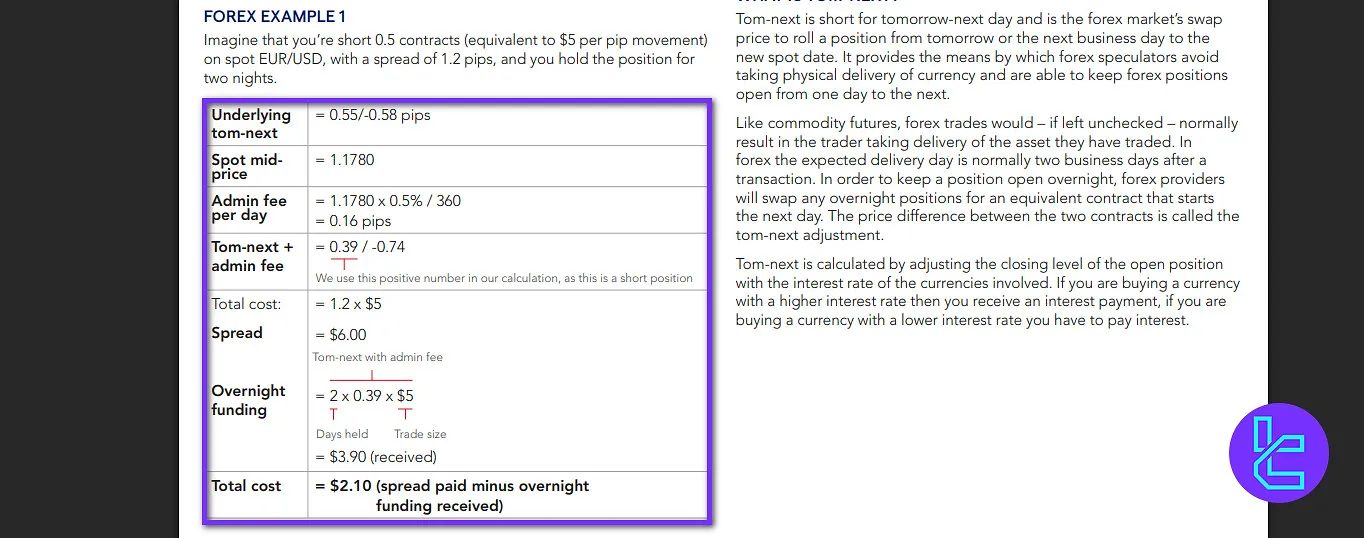

IG Broker Swap Fees

IG applies swap fees or overnight funding adjustments when positions stay open past 5 p.m. EST. These can be positive or negative, depending on the interest rate differential between the traded currencies.

Because forex trades follow a T+2 settlement, holding a position over Wednesday night triggers a three-day adjustment to include the weekend. Holidays in either currency also affect the calculation.

Formula:

The Tom-Next rate, quoted in pips, reflects the cost or credit of rolling a forex position to the next day. It adjusts for the interest rate gap between the two currencies. Traders receive interest when buying the higher-yielding currency and pay it when buying the lower-yielding one.

This mechanism lets IG clients maintain open positions overnight without physical currency delivery, while accounting for funding costs accurately.

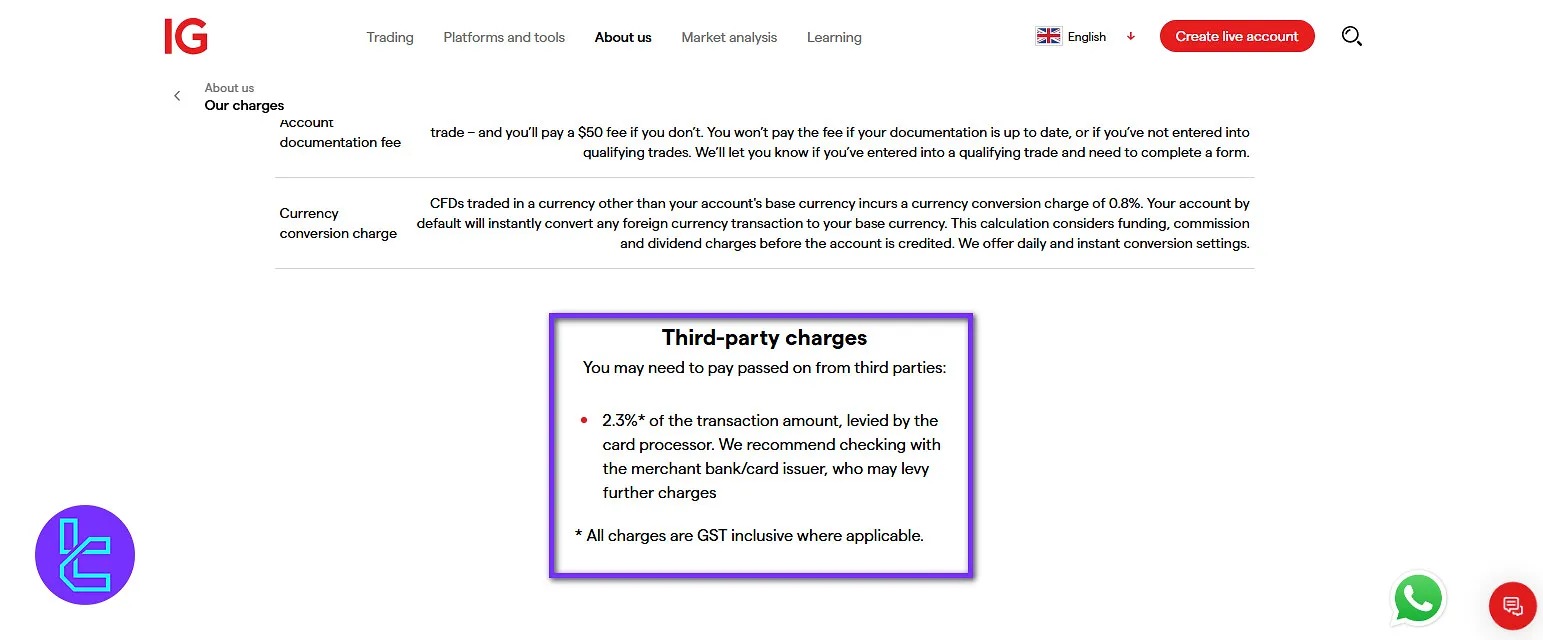

IG Broker Non-Trading Fees

Opening an account with IG Broker is free of charge. However, an inactivity fee of $18 per month applies if an account remains unused for 24 consecutive months.

In addition, traders may incur third-party costs that IG passes on directly, such as a 2.3% card processing fee applied by payment providers.

Extra charges may also be imposed by the merchant bank or card issuer, depending on their individual policies.

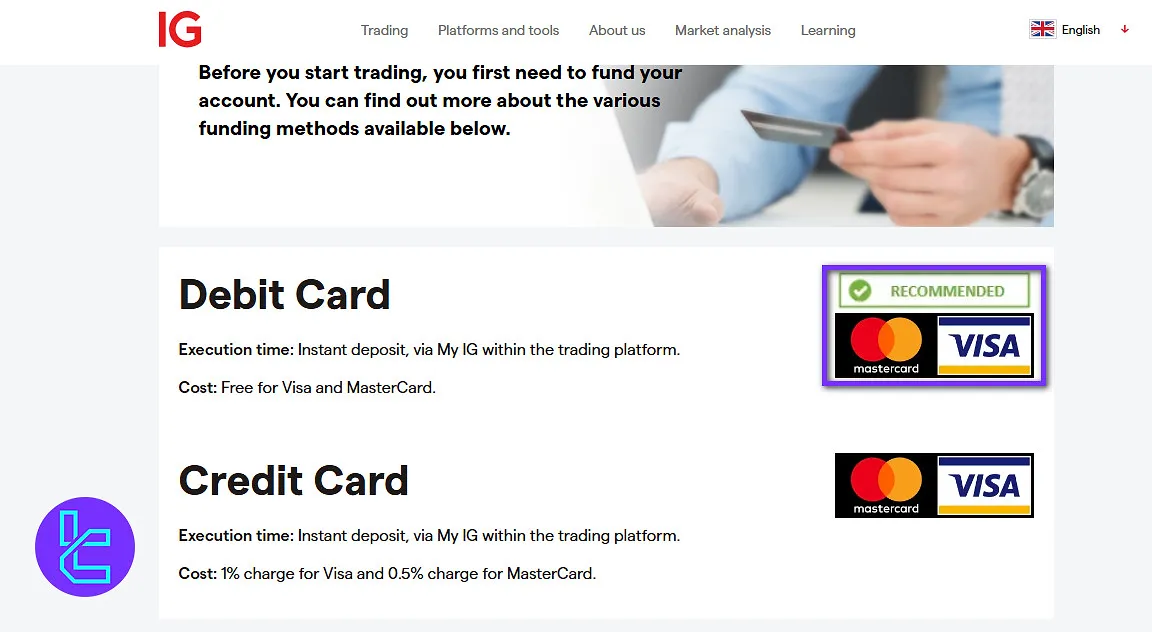

IG Broker Payment Methods

When it comes to the payment methods, there is not much to discuss in this IG broker review. The company offers only two central payment systems, including bank transfer and Credit/Debit cards.

Method | Min Deposit | Min Withdrawal | Commission |

Credit/Debit Cards | $50 | $150 | 1% charge for Visa and 0.5% charge for MasterCard. |

Bank Transfer | Unlimited | $150 | - |

IG Broker Deposit

Deposits with IG Broker can be made through debit cards, credit cards, or bank transfers. Visa and MasterCard debit card payments are processed instantly via the My IG platform with no additional fees.

Credit card deposits are also instant, but a 1% charge applies to Visa and 0.5% to MasterCard. Bank transfers usually take up to three business days and are free of charge.

Here are the details of each deposit method:

Deposit Method | Deposit Fee | Execution Time |

Debit Cards | Free for Visa and MasterCard | Instant deposit |

Credit Cards | 1% charge for Visa and 0.5% charge for MasterCard | Instant deposit |

Bank Transfer | Free | Up to 3 business days |

IG Broker Withdrawal

Withdrawal methods are the same as deposit methods. The minimum amount of withdrawal is $150, and the maximum is $25000 per day for cards.

There is no maximum limit for Bank transfers.

Here are the details of withdrawal methods:

Withdrawal Method | Withdrawal Fee | Processing Time |

Credit/ Debit Cards | Free (third-party fees may apply) | 2-5 working days |

Bank Transfer | Free (third-party fees may apply) | within 24 hours |

Copy Trading and Growth Plans on IG

While the brokerage company doesn’t provide an automated Copy Trading system, you can use the “Signals” menu on the platform for social trading. Monitor the market signals and strategies provided in the platform and copy them to open positions.

In addition, you can use the Algorithmic trading feature and APIs to automate your trades and earn profits without opening or closing positions yourself. Other than these, there are no specific investment plans on IG Markets.

Available Markets on IG

The broker offers an impressive range of markets with 17,000+ financial instruments to trade.

Here are the different categories:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | CFDs on major, minor, and exotic currency pairs | Over 80 currency pairs | 50–70 currency pairs | 1:200 |

Indices | CFDs on global indices including US, EU, and Asian markets | Around 30+ major indices | 10–20 indices | 1:200 |

Commodities | CFDs on metals, energy, and agricultural products | Approximately 25 instruments | 10–20 instruments | N/A |

Shares CFDs | CFDs on global equities across US, UK, EU, and APAC markets | Over 13,000 shares | 800–1200 | 1:20 |

Cryptocurrencies | CFDs on major and alternative digital assets | About 10+ crypto pairs | 5–15 crypto instruments | N/A |

Options | CFDs and derivatives on forex, indices, and commodities options | Wide range of contracts | Limited availability among competitors | N/A |

Bonds & Interest Rates | CFDs on global bond markets and rate instruments | Several major bonds and rates | Few brokers offer this category | N/A |

ETFs | CFDs on exchange-traded funds from global markets | Hundreds of ETFs | 100–300 ETFs | N/A |

IPOs & Sectors | Access to new listings and thematic sector baskets | Regular new IPOs and sector CFDs | Rarely offered by competitors | N/A |

IG Bonus Offerings

Bonus and promotional plans are indeed among the most attractive topics in this IG broker review. The company’s main promotional programs are referrals and a rebate system.

- Refer a Friend: Earn up to$10,000 in a tiered system;

- Rebate: Receive rewards for your loyalty as cashback on your trading volume.

Don't what if forex rebate? Read the Forex Rebate article on TradingFinder to learn about earning indirect income from trading and the best brokers that offer it.

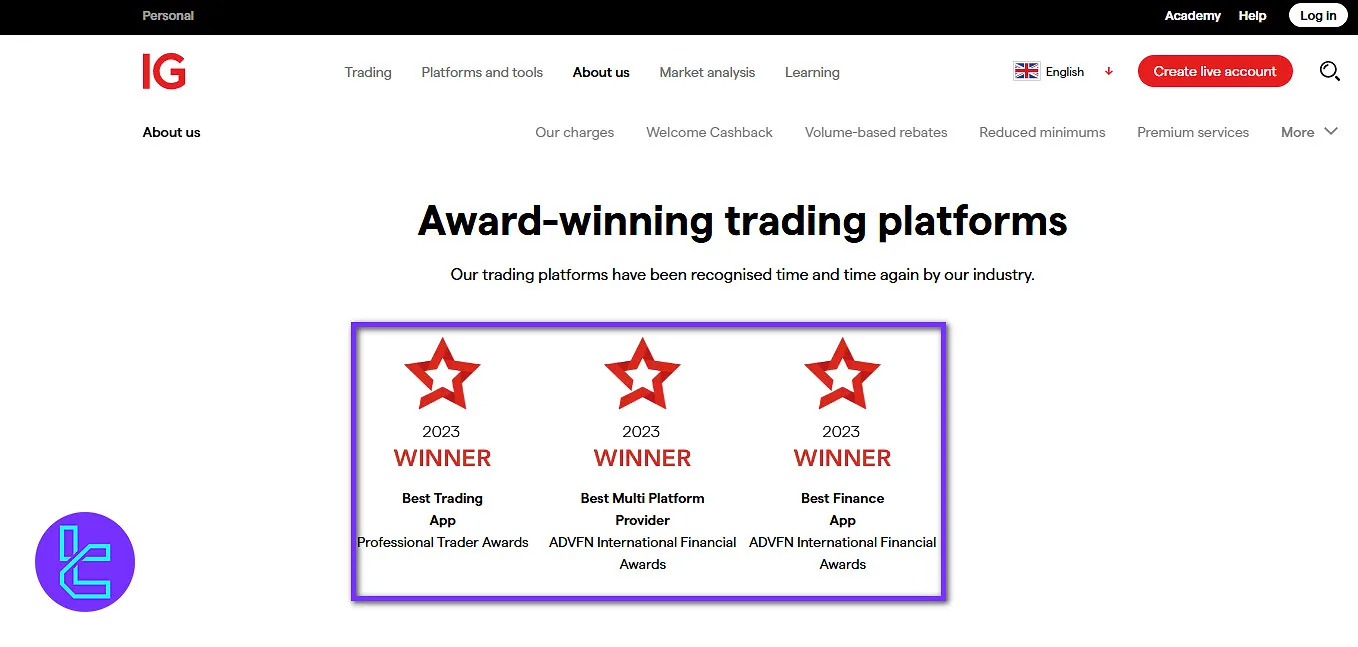

IG Broker Awards

IG Broker has consistently earned recognition within the financial industry for the quality and innovation of its trading technology. The company’s platforms have received multiple honors, including:

- Best Trading App: Professional Trader Awards

- Best Multi-Platform Provider: ADVFN International Financial Awards

- Best Finance App: ADVFN International Financial Awards

These IG Broker awards highlight its ongoing focus on platform performance, accessibility, and user experience across different trading environments.

How to reach IG Customer Support

The broker’s customer support is available 24/6 through various channels, including live chat, WhatsApp chat, and other methods.

sales.en@ig.com | |

Phone | +44 (20) 7633 5430 |

Live Chat | Through the official website |

Scan the QR code on the “Contact Us” page |

Restricted Countries on IG broker

The Company doesn't offer services in certain countries due to regulatory restrictions. These include:

- United States

- Iran

- Cuba

- Sudan

- Syria

- North Korea

Note that residents of the United States can use the IG Group’s services through its US branch, tastyfx. However, the services might be limited compared to those the international branch provides.

IG Markets User Satisfaction (Trust Score)

One of the most important topics in this IG broker review is the trust score. The broker has received mixed comments and scores from users and experts.

3.7 out of 5 based on 7,089 reviews | |

Forex Peace Army | 1.8 out of 5 based on 174 comments |

Investopedia | 4.7 out of 5 |

IG Educational Materials

The broker offers comprehensive educational content through the “Learn to trade” section on its website. This menu gives you access to various education and information resources, including:

- IG Academy: Online courses covering various forex education topics

- Webinars: Regular sessions on market analysis and trading strategies

- Trading guides: In-depth articles on trading concepts and techniques

- News and analysis: Daily market updates and expert insights

Table of Comparison

The table in this section evaluates IG's performance compared to three of the top global brokers:

Parameter | IG Broker | Exness Broker | HFM Broker | Errante Broker |

Regulation | ASIC, FCA, FSA, AMF, FMA, MAS, DFSA, FSCA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | CySEC, FSA |

Minimum Spread | Variable Based on the Instrument | From 0.0 Pips | From 0.0 Pips | From 0.0 pips |

Commission | $0.0 (except for Shares) | From $0.2 to USD 3.5 | From $0 | From $0.0 |

Minimum Deposit | Unlimited | $10 | From $0 | $50 |

Maximum Leverage | 1:200 | Unlimited | 1:2000 | 1:1000 |

Trading Platforms | MT4, TradingView, L2 Dealer, ProRealTime, Proprietary Platform | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | Metatrader 4, Metatrader 5, cTrader, Mobile App |

Account Types | CFD | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Premium, VIP, Tailor Made |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 17,000+ | 200+ | 1,000+ | 150+ |

Trade Execution | Market, Limit, Stop-Loss, Trailing Stops, Trigger, Guaranteed Stops | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market |

Conclusion and Final Words

1$ minimum deposit, 1:200 maximum leverage, 8 regulations and $0 commission (except for shares) are some of the features of IG broker.

This broker offer signals, economic calendar and rebate to all traders and has only 1 account type called "CFD." But it has disadvantages such as limited cryptocurrencies to trade and lack of 24/7 support.