InstaForex EU is a broker with 3 different investment options [MT5 Copy Trading, OYS Portfolios, Synthetic Assets]. It offers 6 main trading accounts [ECN, ECN Pro, and ECN VIP for MT4 and MT5].

There are 5 tradable markets [Forex, commodities, stocks, crypto, indices] available in this broker.

InstaForex EU is a broker with 3 different investment options, MT5 Copy Trading, OYS Portfolios, and Synthetic Assets.

InstaForex EU Company Information & Regulation

InstaForex EU's website, Instaforex.eu, is operated by INSTANT TRADING EU LTD, a company registered at Spetson 23A, Leda Court, Block B, B203, 4000, Mesa Geitonia, Limassol, Cyprus.

The company is a subsidiary of InstaForex and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 266/15.

As a MiFID II-compliant entity, InstaForex EU adheres to stringent investor protection rules, making it a reliable choice for traders within the European Economic Area.

The broker has also earned industry recognition with several international awards, including “Best Forex Broker in Central and Eastern Europe” and “Most Innovative Broker”.

Retail traders benefit from:

- Full segregation of client funds in European bank accounts

- Negative balance protection to ensure losses cannot exceed account deposits

- Participation in the Investor Compensation Fund (ICF), which covers eligible clients up to €20,000 in the event of company insolvency

Here are the full regulatory details of InstaForex EU:

Entity Parameters/Branches | Instant Trading EU Ltd |

Regulation | Cyprus Securities and Exchange Commission (CySEC) |

Regulation Tier | Tier 1 |

Country | Cyprus |

Investor Protection Fund/Compensation Scheme | Member of the ICF, covering eligible clients up to €20,000 in case of company insolvency |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:20 |

Client Eligibility | Available to retail and professional clients from EU and third countries |

Key Specifications and Features

Let's break down the notable specifics and features that make InstaForex EU a multi-asset brokerage:

Broker | InstaForex EU |

Account Types | MT5 ECN, MT5 ECN Pro, MT5 ECN VIP, MT4 ECN, MT4 ECN PRO MT4 ECN VIP, Demo |

Regulating Authorities | CySEC |

Based Currencies | EUR, USD, PLN, CZK, GBP |

Minimum Deposit | 200 EUR |

Deposit Methods | Credit/Debit Card, Skrill, Neteller, Bank Transfers |

Withdrawal Methods | Credit/Debit Card, Skrill, Neteller, Bank Transfers |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:30 for Retail 1:500 for Professional |

Investment Options | MT5 Copy trading, OYS Portfolios, Synthetic Assets |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Forex, Commodities, Stocks, Crypto, Indices |

Spread | Raw on MT5 Accounts Floating on MT4 Accounts |

Commission | Variable |

Orders Execution | Market |

Margin Call/Stop Out | Not Specified |

Trading Features | Economic Calendar, Forex Portal |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Email, Callback Request |

Customer Support Hours | 24/5 |

Account Types Specifics and Comparison

The brokerage offers a decent variety of 6 account types, plus a demo account to suit different trading needs and styles.

Let's compare the main account types:

Account Type | MT4 | MT5 | ||||

ECN | ECN Pro | ECN VIP | ECN | ECN Pro | ECN VIP | |

Deposit Currency | EUR, USD, PLN, CZK | EUR, USD, PLN, CZK, GBP | ||||

Min. Deposit (EUR or Equivalent) | 200 | 2,000 | 10,000 | 1,000 | 10,000 | 50,000 |

Trading Instruments | 260+ | 2,500+ | ||||

Order Execution | Market | |||||

Personal Account Manager | Yes | |||||

VPS Server | No | Yes | ||||

Leverage of up to 1:30 is available for retail clients and increases to 1:400 for professional traders, in compliance with EU regulations.

Benefits and Drawbacks

Like any broker, InstaForex EU has its strengths and weaknesses. Let's take an objective look at both:

Benefits | Drawbacks |

Large Number of Over 2,500 Trading Instruments | Relatively Low Leverage |

6 Trading Account Types | - |

Physical Presence in Multiple European Countries | - |

Strong Regulatory Oversight | - |

Account Creation and Verification: Quick Guide

Opening an account with InstaForex EU requires a standard identity verification and questionnaire process, ensuring compliance with KYC and MiFID II directives.

The procedure is digital, streamlined, and compatible with social logins, offering both convenience and regulatory integrity.

#1 Access the Platform

Visit the official InstaForex EU website and select “Open Trading Account”.

#2 Submit Basic Info

Fill in your name, residence country, email, and phone number, then enter the CAPTCHA and agree to the terms.

#3 Verify Contact Details

Enter the confirmation code sent to your phone or email. Alternatively, use a Google or Facebook account to proceed.

#4 Complete KYC

Answer the regulatory questionnaire, upload identification documents, and verify your account to activate full trading access.

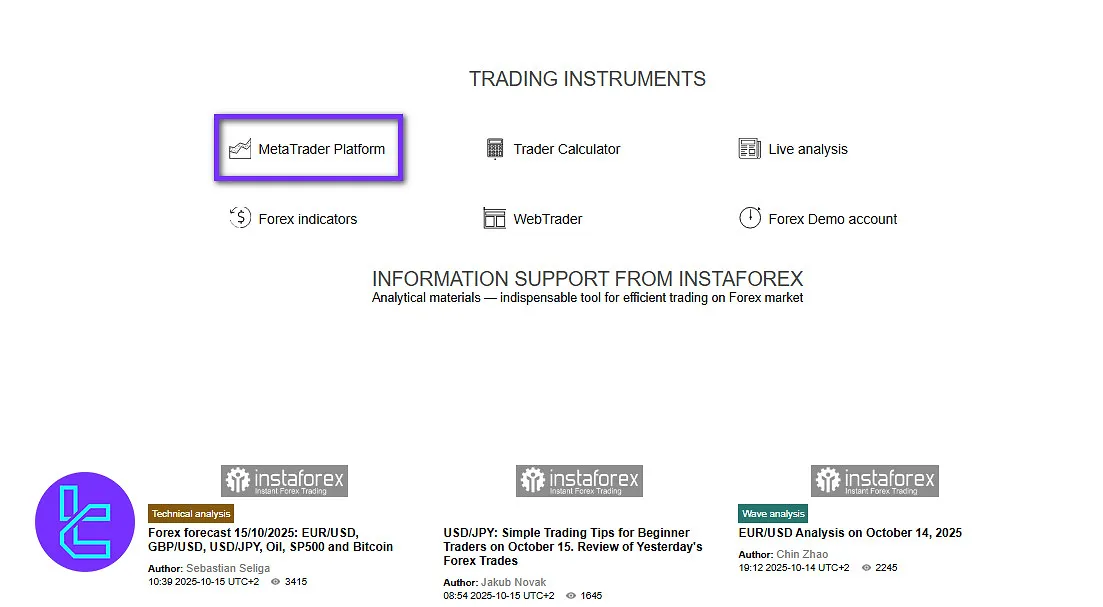

Trading Platforms and Terminals

InstaForex EU offers two of the most popular trading platforms in the forex industry to its clients: MetaTrader 4 and MetaTrader 5.

These terminals include every essential feature for trading in financial markets, such as charting tools, indicators, Expert Advisors, market depth, and more. Download or access these platforms via these:

MetaTrader 4:

- Windows

- MT4 Android

- MT4 iOS

- MT4 Web

- MacOS

MetaTrader 5:

- Windows

- MT5 Android

- MT5 iOS

- MT5 Web

- MacOS

Trading Spreads, Commissions, and Non-trading Fees

InstaForex EU offers competitive pricing across its account types. Let's take a look the trading costs in the table below:

Account Type | MT4 | MT5 | ||||

ECN | ECN Pro | ECN VIP | ECN | ECN Pro | ECN VIP | |

Spread | Floating | Raw | ||||

Commission | Variable | Variable Based on The Instrument | ||||

There are no deposit fees regardless of the method used; however, a withdrawal fee is charged on some payment options and account types.

Also, for accounts that are inactive for more than 6 months, a 5 EUR (or equivalent) monthly fee will be deducted from the client's account.

InstaForex EU Swap Fees

InstaForex EU applies standard industry fees, including spreads, commissions, and overnight financing costs known as Swaps or Rollovers.

The broker reserves the right to adjust the size or rate of fees at its discretion, with all changes published publicly in accordance with company procedures.

Swap points are either credited or debited from a trader’s account when positions remain open overnight, reflecting the interest rate differential between currencies or the financing cost of the underlying asset.

The daily swap value is calculated using the following formula:

where F(1) is the weekly forward rate considering time and deposit rates, and F(0) is the spot rate of the given instrument.

As InstaForex EU operates under a market maker model, no upper cap applies to the mark-up embedded in swap points or spreads. Negative swap values represent a trading cost borne by the client.

If significant differences arise between the broker’s swap rates and prevailing market conditions, InstaForex EU may correct or adjust past or future swap charges to ensure fair alignment with market prices.

Open positions that extend beyond the rollover date are automatically transferred to the next contract period. The rollover adjustment, a one-time debit or credit, is applied to reflect price movement between the expiring and new contracts.

InstaForex EU Non-Trading Fees

InstaForex EU applies several non-trading charges designed to cover administrative costs and ensure regulatory compliance.

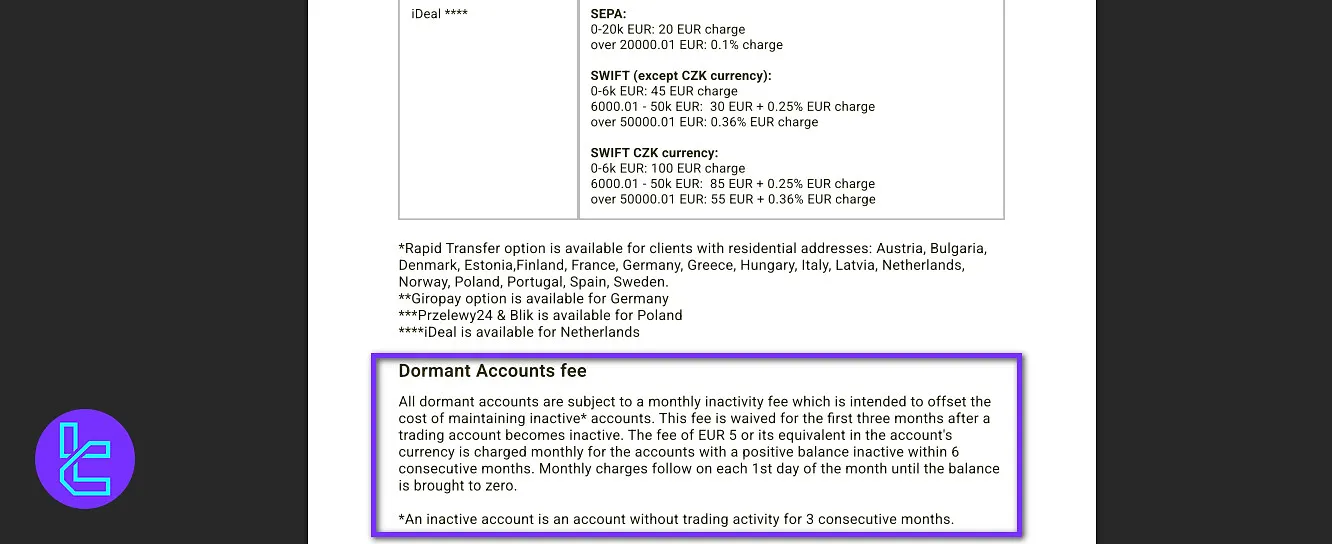

Dormant Account Policy

Trading accounts that remain inactive, meaning no trading activity for three consecutive months, are classified as dormant.

After this initial three-month grace period, a monthly inactivity fee of €5 (or its equivalent in another currency) is applied to accounts with a positive balance that remain unused for six consecutive months.

The charge recurs on the first day of each month until the account balance reaches zero.

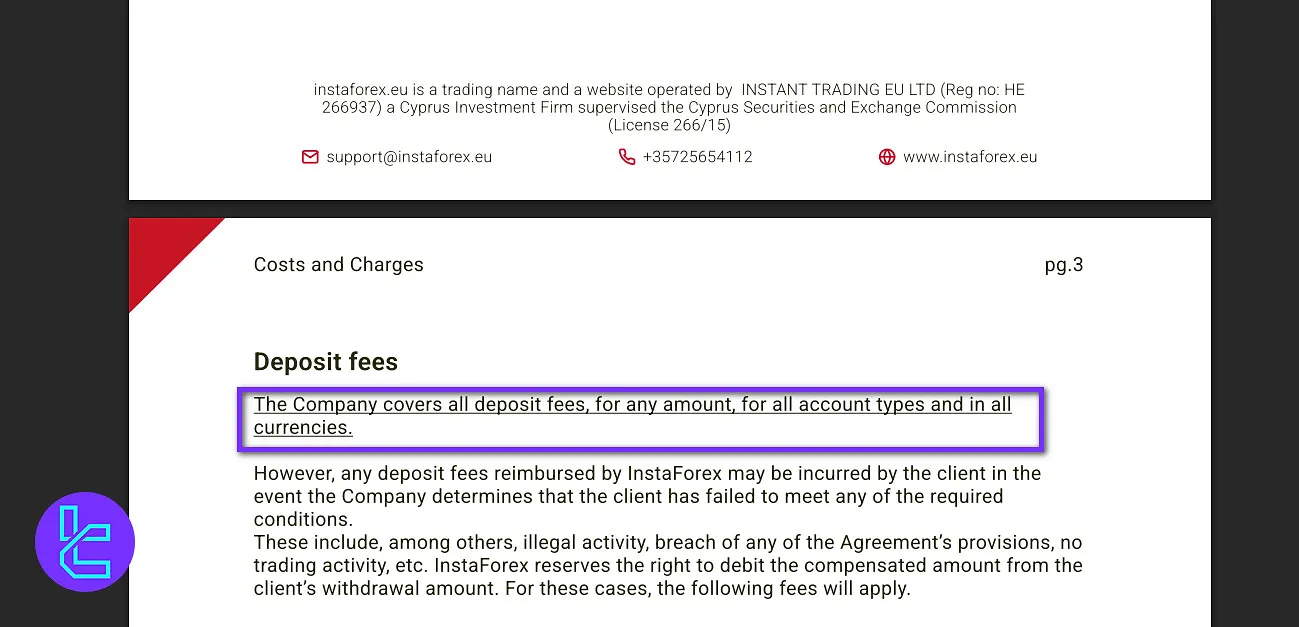

Deposit and Withdrawal Fees

The company covers all deposit fees across all account types, currencies, and deposit amounts.

However, if an account is later found to violate the platform’s terms, such as engaging in unlawful activity, breaching the client agreement, or showing no trading activity, InstaForex EU reserves the right to reclaim reimbursed deposit costs by deducting the amount from future withdrawals.

Clients maintaining a balance of €10,000 or more (or its equivalent in another currency) are entitled to one free withdrawal every 30 calendar days, regardless of the account type.

For bank transfers, withdrawal fees vary according to the chosen method and transaction amount:

- SEPA transfers: €20 fee for amounts up to €20,000; 0.1% charge for larger transactions;

- SWIFT transfers (non-CZK): from €45 for small amounts to 0.36% for large transfers;

- SWIFT transfers (CZK currency): start at €100 for smaller withdrawals, decreasing in flat fees but adding a percentage-based charge for larger sums.

For Neteller, a 2% fee applies (minimum $1), while Skrill transactions incur a 1% fee, with an additional 2.99% currency conversion charge if the wallet currency differs from EUR.

Deposit and Withdrawal Options

InstaForex EU offers six payment methods for both deposits and withdrawals. We will mention these options in the list below:

- Credit/Debit Cards: VISA and MasterCard

- E-wallets: Skrill, Neteller

- Bank Transfers: SEPA, SWIFT

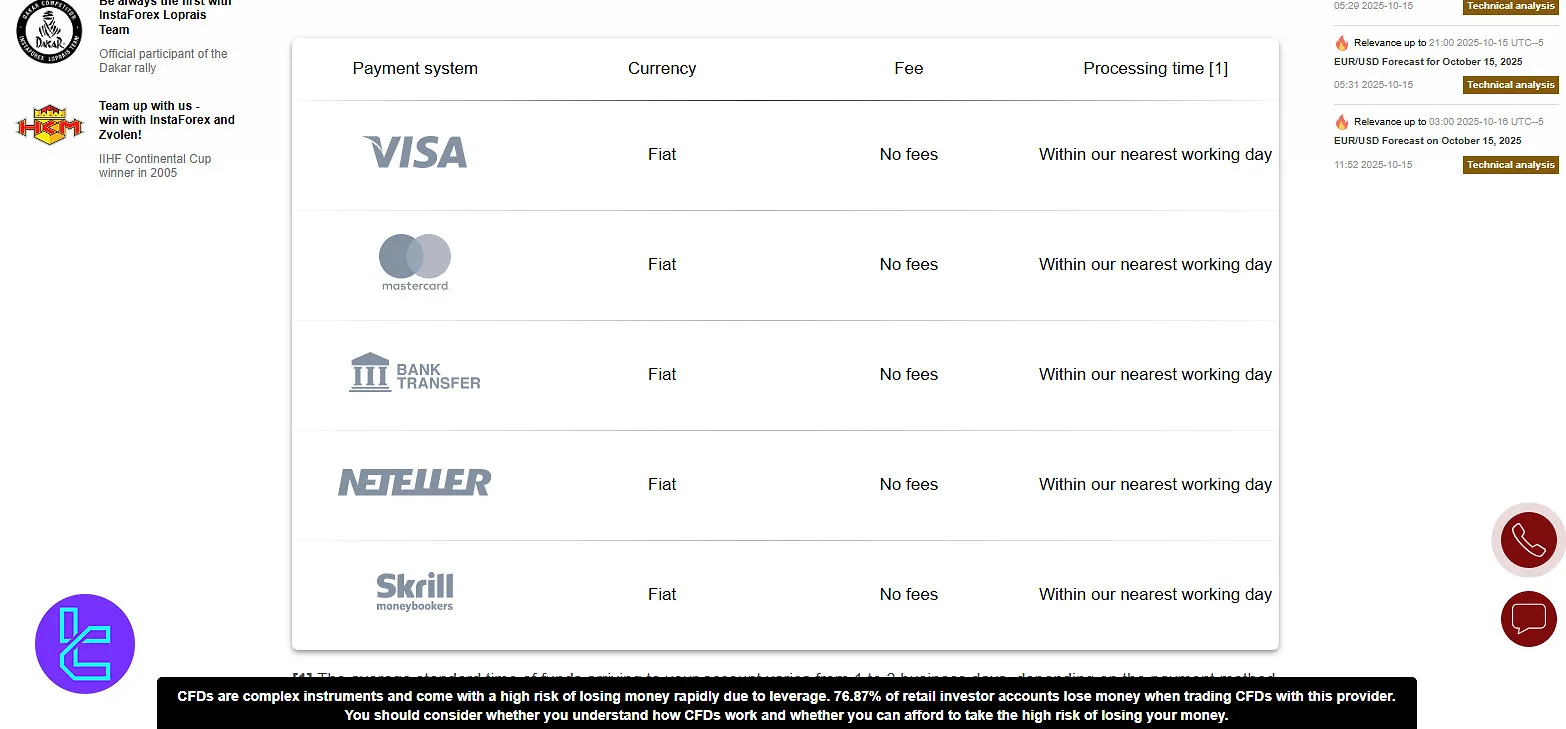

InstaForex EU Deposit

Depositing funds into an InstaForex EU account is a straightforward process, with an average completion time of around 20 minutes and 25 seconds under normal conditions.

The broker accepts deposits through major fiat payment systems, including Visa, MasterCard, bank transfers, Neteller, and Skrill.

All supported options are fee-free, and transactions are typically processed within the broker’s next working day.

While deposits are executed promptly, the actual time for funds to appear in a client’s account may vary depending on the chosen method, generally between 1 and 3 business days, though some cases can extend up to 10 business days due to intermediary bank procedures.

Here is an overview of all the deposit methods available on InstaForex EU:

Payment System | Currency Type | Deposit Fee | Processing Time (Broker) | Average Arrival Time |

Visa | Fiat | No fees | Within the next working day | 1–3 business days |

Master Card | Fiat | No fees | Within the next working day | 1–3 business days |

Bank Transfer | Fiat | No fees | Within the next working day | 1–3 business days (up to 10 in rare cases) |

Neteller | Fiat | No fees | Within the next working day | 1–3 business days |

Skrill | Fiat | No fees | Within the next working day | 1–3 business days |

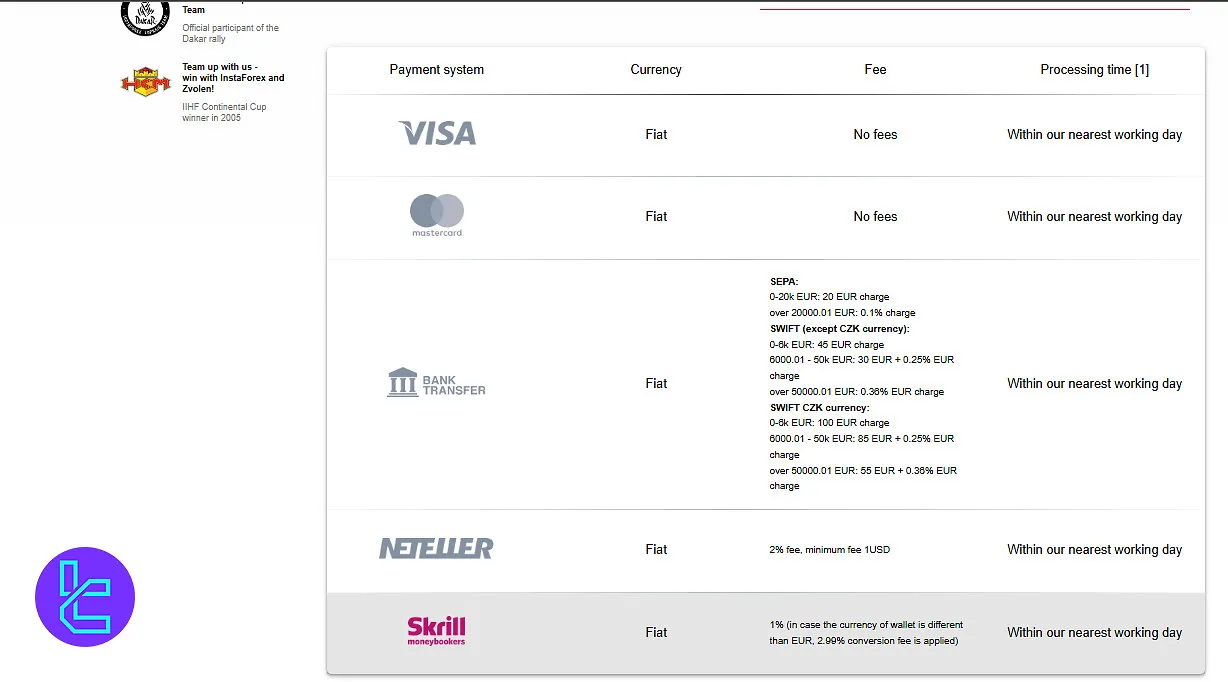

InstaForex EU Withdrawal

Withdrawals through InstaForex EU are handled efficiently, with an average processing time of under four hours once the request is submitted.

The broker supports multiple fiat payment systems, including Visa, MasterCard, bank transfers, Neteller, and Skrill, offering flexible options for traders across the European Economic Area (EEA).

All card-based withdrawals (Visa, MasterCard) are free of charge, and transactions are processed within the broker’s next working day.

The actual arrival time depends on the financial institution involved and generally ranges from 1 to 3 business days, although certain transfers may take up to 10 business days.

Here are the full details of InstaForex EU’s withdrawal methods:

Payment System | Currency Type | Fee Structure | Processing Time (Broker) | Average Arrival Time |

Visa | Fiat | No fees | Within the next working day | 1–3 business days |

Master Card | Fiat | No fees | Within the next working day | 1–3 business days |

Bank Transfer – SEPA | Fiat | €20 (≤€20,000); 0.1% (>€20,000) | Within the next working day | 1–3 business days (up to 10) |

Bank Transfer – SWIFT (non-CZK) | Fiat | €45 (≤€6,000); €30 + 0.25% (€6,000.01–€50,000); 0.36% (>€50,000) | Within the next working day | 1–3 business days (up to 10) |

Bank Transfer – SWIFT (CZK) | Fiat | €100 (≤€6,000); €85 + 0.25% (€6,000.01–€50,000); €55 + 0.36% (>€50,000) | Within the next working day | 1–3 business days (up to 10) |

Neteller | Fiat | 2% (min $1) | Within the next working day | 1–3 business days |

Skrill | Fiat | 1% (+2.99% conversion fee if non-EUR wallet) | Within the next working day | 1–3 business days |

Copy Trading and Other Investment Features in InstaForex EU Broker

Investment options are ways to earn passive income in a financial company. The discussed broker offers 3 of these choices to traders:

- MT5 Copy Trading: Automatically copy the signals provided by successful traders

- OYS Portfolios: Invest in pre-built portfolios managed by professionals

- Synthetic Assets: Earn dividends on synthetic shares in the broker

Which Markets and Instruments Are Available?

InstaForex EU does a good job in this regard, offering a large number of over 2,500 tradable instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, Minor, and Exotic Currency Pairs | 55 Currency Pairs | 50–70 Currency Pairs | 1:20 |

Stocks | CFDs on Global Shares (available via MT5 platform) | Over 1,000 Stocks | 800–1,200 Stocks | 1:5 |

Commodities | CFDs on Precious Metals, Energy, and Agricultural Assets | Around 15 Instruments | 10–20 Instruments | 1:10 |

Indices | CFDs on Global Stock Indices | Around 14 Indices | 10–20 Indices | 1:20 |

Cryptocurrencies | CFDs on Digital Assets including BTC, ETH, LTC, ADA, and others | 10+ Major Cryptocurrencies | 8–15 Cryptocurrencies | 1:2 |

Are There Any Bonuses and Promotions?

Based on our investigations, at the time of writing this article, InstaForex EU does not offer traditional deposit or non-deposit bonuses, in compliance with EU regulations.

This approach is the same as that of many other brokers regulated by CySEC.

InstaForex EU Awards

InstaForex EU continues to strengthen its reputation as a trusted and forward-thinking broker through consistent recognition at major international financial events.

Each award reflects the company’s dedication to technological advancement, transparency, and trader-focused innovation.

Recent Awards & Achievements include:

- Most Innovative Mobile Trading Application - Forex Traders Summit Dubai 2025: Honored for developing a next-generation mobile platform that enhances accessibility and trading efficiency;

- Forex Broker of the Year Money Expo Abu Dhabi 2025: Recognized for delivering outstanding trading conditions, automation tools, and client-oriented services;

- Best Trading Technology Forex Expo Dubai 2024: Awarded for cutting-edge platform upgrades, faster execution, and advanced risk management features;

- Best Mobile App Forex Traders Summit Dubai 2024: Celebrated for a user-friendly mobile app exceeding one million downloads and maintaining strong client trust.

These InstaForex EU awards highlight the broker’s ongoing commitment to creating smarter, faster, and more intuitive trading solutions.

Support Contact Options and Open Hours

InstaForex EU provides a useful set of options for support, providing 4 channels:

- Phone: +35725654112 and other numbers in several countries

- Email: support@instaforex.eu

- Live Chat: Accessible via the website, WhatsApp, and Facebook Messenger

- Callback Request: Option to request a call from the support team on the website

Support is available 24/5 for the Cyprus head office, with varying hours for branch offices in Poland, Slovakia, Czech Republic, Hungary, and Bulgaria.

InstaForex EU Broker List Of Restricted Countries

While InstaForex is a global brand, InstaForex EU (operated by Instant Trading EU Ltd) specifically caters to clients within the European Union and those from several other specific countries. They do not serve residents of the USA or other regions, including but not limited to:

- Cuba

- North Korea

- Iran

- Iraq

- Saudi Arabia

- Sudan

- Afghanistan

- Pakistan

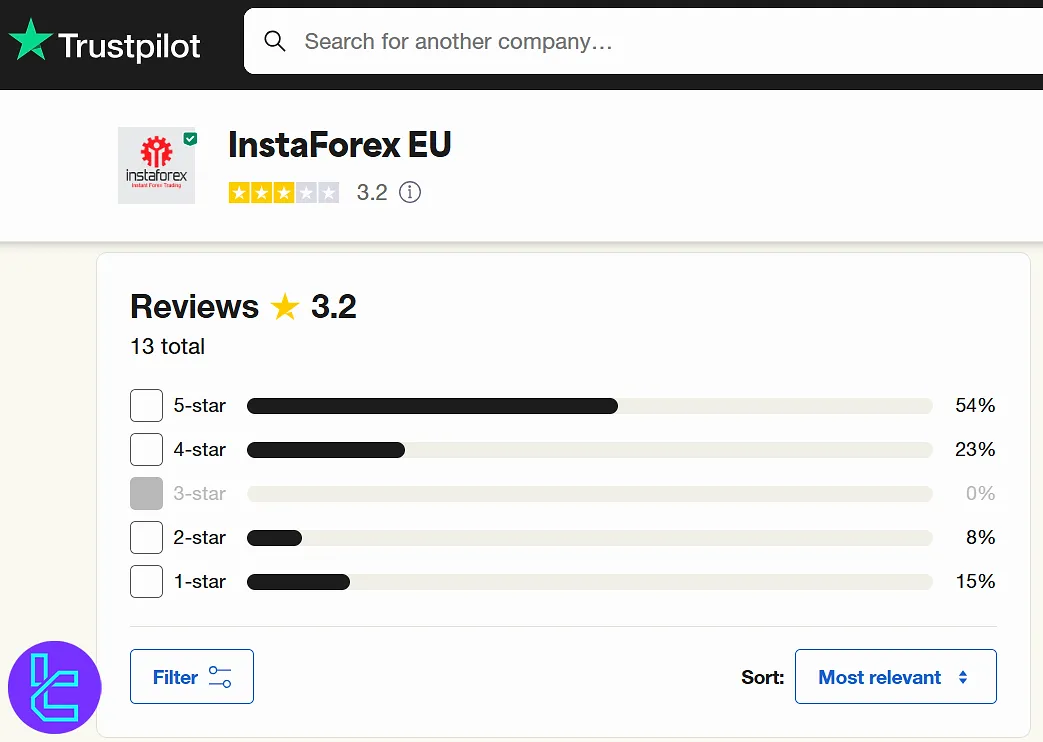

Trust Scores and User Ratings

Sources like Trustpilot and ScamAdviser are reliable platforms for evaluating the trust score of financial companies.

InstaForex EU has received mixed reviews from traders:

- Trustpilot: 3.2/5 based on more than 10 reviews

- InstaForex EU ScamAdviser: Trustscore of 5/100, with +20 user reviews averaging 2.2/5

Overall, the number of reviews are too low to be taken into account.

Educational Resources and Materials

InstaForex EU attempts to provide an essential level of education to its clients by offering articles covering trading concepts and guides. Also, there is a glossary of trading terms in addition to analytics, forecasts, and trading plans.

All in all, these resources are useful and can help beginners get started in the industry.

How Does InstaForex EU Perform Compared to Its Peers?

Here's a table comparing the European branch of InstaForex to its competitors:

Parameter | InstaForex EU Broker | HFM Broker | FxPro Broker | Fusion Markets Broker |

Regulation | CySEC | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | ASIC, VFSC |

Minimum Spread | 0.0 Pips | 0.0 Pips | 0.0 Pips | From 0.0 pips |

Commission | Variable | From Zero | From $0 | From $0.0 |

Minimum Deposit | 200 EUR | From $0 | $100 | $0 |

Maximum Leverage | 1:30 for Retail 1:500 for Professional | 1:2000 | 1:500 | 1:500 |

Trading Platforms | MetaTrader 4, MetaTrader 5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Account Types | MT5 ECN, MT5 ECN Pro, MT5 ECN VIP, MT4 ECN, MT4 ECN PRO MT4 ECN VIP, Demo | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Zero, Classic, Swap-Free |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 2,500+ | 1,000+ | 2100+ | 250+ |

| Trade Execution | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Conclusion and Final Words

InstaForex EU requires a minimum amount of 200 EUR (or equivalent) for the initial deposit and charges a monthly inactivity fee of 5 EUR after an inactive period of 6 months for an account.

The broker has received a trust score of 2.2/5, based on more than 20 user reviews on the ScamAdviser website.