KCM Trade operates based on a dual-account model [ECN, STP] with a minimum initial deposit of $1,000. Offering leverage up to 1:400, this broker offers 3 trading platforms [MetaTrader 4, MetaTrader 5, proprietary] with more than 200 financial instruments.

The broker supports trading across 6 major asset classes, including 40+ Forex pairs, 2 Metals, 5 Commodities, 10+ Indices, 1,000+ Stocks, and 2 Cryptocurrency ETFs. Clients can choose from 3 platforms; MT4, MT5, and a proprietary platform.

KCM Trade Company Information & Regulation

KCM Trade, founded in 2016 as a liquidity provider, expanded its services to retail clients in 2019. The company is part of the larger KCM Group and is led by CEO Ryan Tsui.

Operating under the legal name Kohle Capital Markets Limited, KCM Trade is regulated by the Mauritius Financial Services Commission (FSC) under license number C117022600.

It is registered at The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, Ebene 72201, Republic of Mauritius.

The broker is reportedly capable of executing up to 5,000 orders per second with latency as low as 0.25 milliseconds.

Here are the regulatory details of the two KCM Trade branches:

Parameter | Kohle Capital Markets Limited | Kohle Capital Markets Pty Limited |

Regulation | Mauritius Financial Services Commission (FSC) | Australian Securities and Investments Commission (ASIC) |

Regulation Tier | Tier 5 | Tier 1 |

Country | Mauritius | Australia |

Investor Protection Fund / Compensation Scheme | N/A | N/A |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | 1:1000 | 1:30 |

Client Eligibility | Global clients (non-Australian) | Australian residents & clients interested in Australian services |

KCM Trade Broker Summary of Specifics

Giving you a quick overview of what the Forex broker offers, here's a summary table of key details:

Broker | KCM Trade |

Account Types | ECN, STP, Demo |

Regulating Authority | FSC Mauritius |

Based Currencies | USD, EUR |

Minimum Deposit | $1,000 |

Deposit Methods | Bank Transfers, Credit/Debit Cards, E-payment systems, Crypto |

Withdrawal Methods | Bank Transfers, Credit/Debit Cards, E-payment systems, Crypto |

Minimum Order | 0.01 Lots |

Maximum Leverage | 1:400 |

Investment Options | N/A |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Proprietary |

Markets | Forex, Commodities, Energies, Metals, Crypto ETFs, Indices, Stocks |

Spread | From 1.2 Pips |

Commission | None |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Economic Calendar, Signal Centre, AI Mentor |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | N/A |

PAMM Account | None |

Customer Support Ways | Email, Ticket, Phone Call, Live Chat |

Customer Support Hours | 24/5 |

Available Account Types & Comparison

KCM Trade offers two main account types [STP, ECN] for real trading, along with a demo account option for practice.

Actually, the company does not go into detail regarding these accounts; as mentioned, STP requires a $1,000 minimum deposit, while ECN has a higher initial funding.

Also, ECN accounts have various order execution types and lower spreads, along with advanced features and tools.

Benefits and Drawbacks of Working with KCM Trade

Every Forex broker comes with upsides and downsides. KCM Trade Advantages and Disadvantages:

Benefits | Drawbacks |

Offers Popular MT4 And MT5 Platforms | Limited Regulation Compared to Brokers With at least One Tier-1 license |

High Leverage Options Up to 1:400 | Relatively High Minimum Deposit |

Relatively Wide Range of Financial Assets | - |

KCM Trade Registration and Verification Tutorial

KCM Trade registration takes just a few minutes and gives you access to the MetaTrader 4 or MetaTrader 5 platforms. The process requires entering your personal details, selecting your platform, and verifying your email address via a PIN.

#1 Begin the Sign-Up Journey

Start by visiting the KCM Trade official site and clicking “Open Account” to initiate the registration.

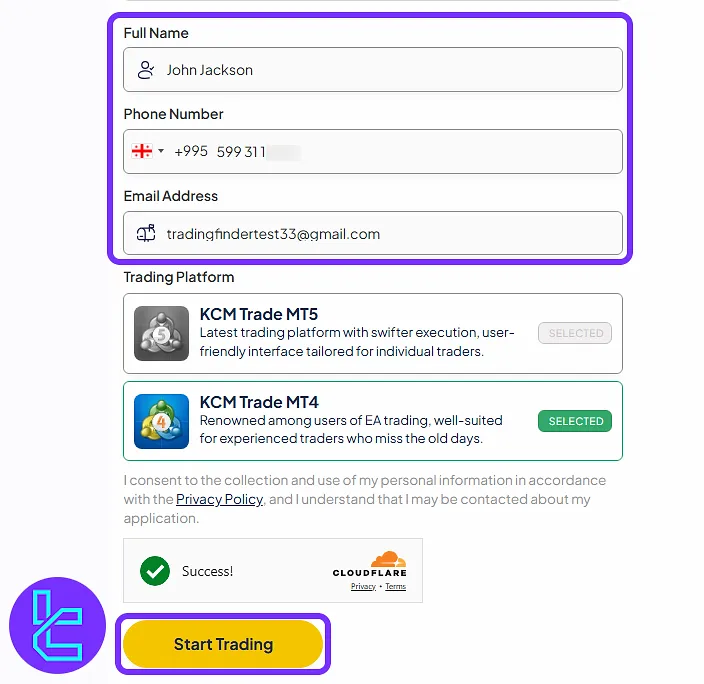

#2 Enter Personal Details

Provide your full name, mobile number, and email address. Choose your preferred trading terminal, KCM Trade MT4 or KCM Trade MT5.

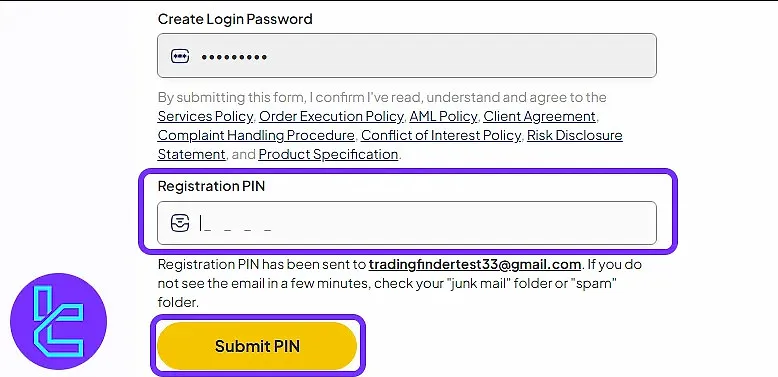

Then, proceed by creating a login password.

#3 Confirm Your Email

Check your inbox for a PIN from KCM Trade. Enter it in the platform’s verification form. Once submitted, you’re instantly redirected to your personal trading dashboard.

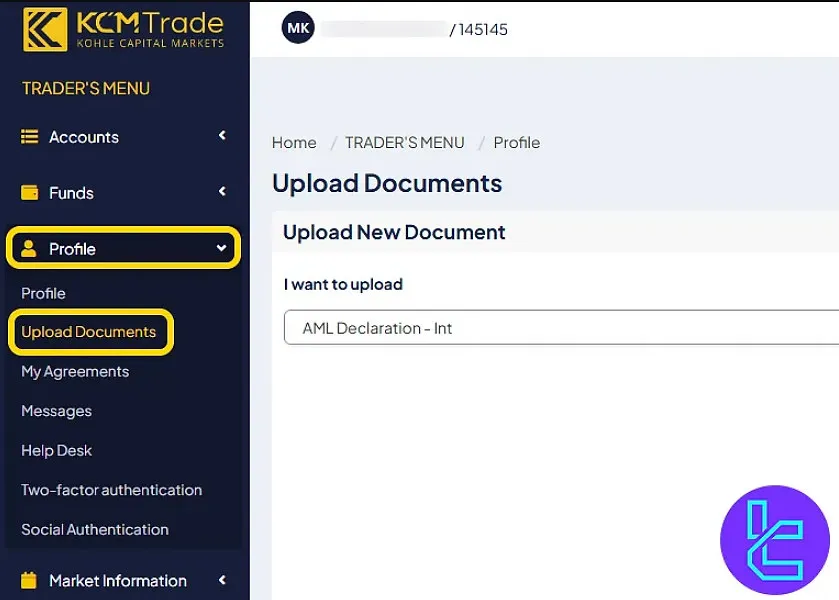

#4 KCM Trade Verification

Afterwards, go through the KCM verification process by completing theKYC (Know Your Customer).

Do this by uploading the required documents and waiting for the verification process to be completed.

Trading Platforms

KCM Trade offers 3 main trading platforms with applications available on various operating systems.

MetaTrader 4 (MT4)

- Industry-standard platform known for its reliability and ease of use

- Customizable interface with multiple chart types and timeframes

- Access to Expert Advisors (EAs) for automated trading

Links:

MetaTrader 5 (MT5)

- More advanced version of MT4 with additional features

- Enhanced charting capabilities and analytical tools

- Improved backtesting capabilities for EAs

Links:

Proprietary

- User-friendly interface with essential trading tools

- Real-time quotes and charts

- Quick order execution

Links:

Spreads and Commissions

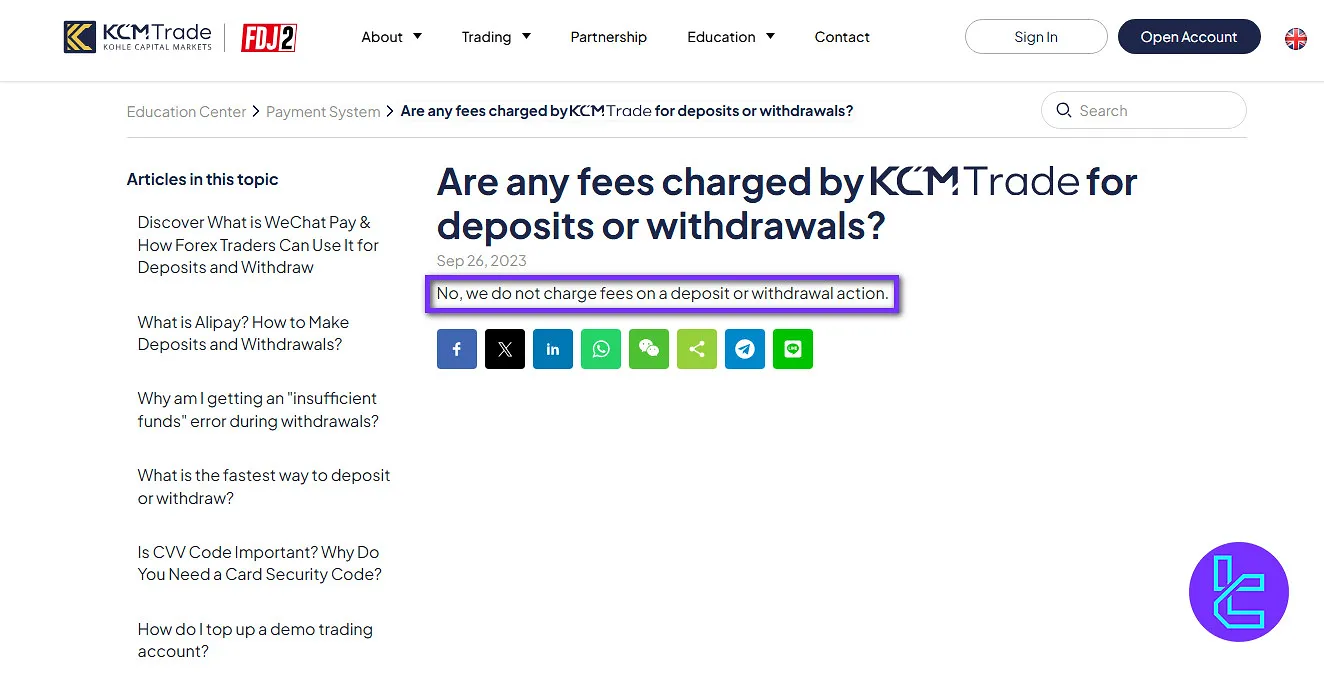

KCM Trade offers competitive spreads and a commission-free trading model. Based on the available data, spreads start from 1.2 pips, and there are no other types of fees for deposits/withdrawals and other operations.

Still, when compared to brokers like Eightcap or XM, its trading costs are relatively less competitive.

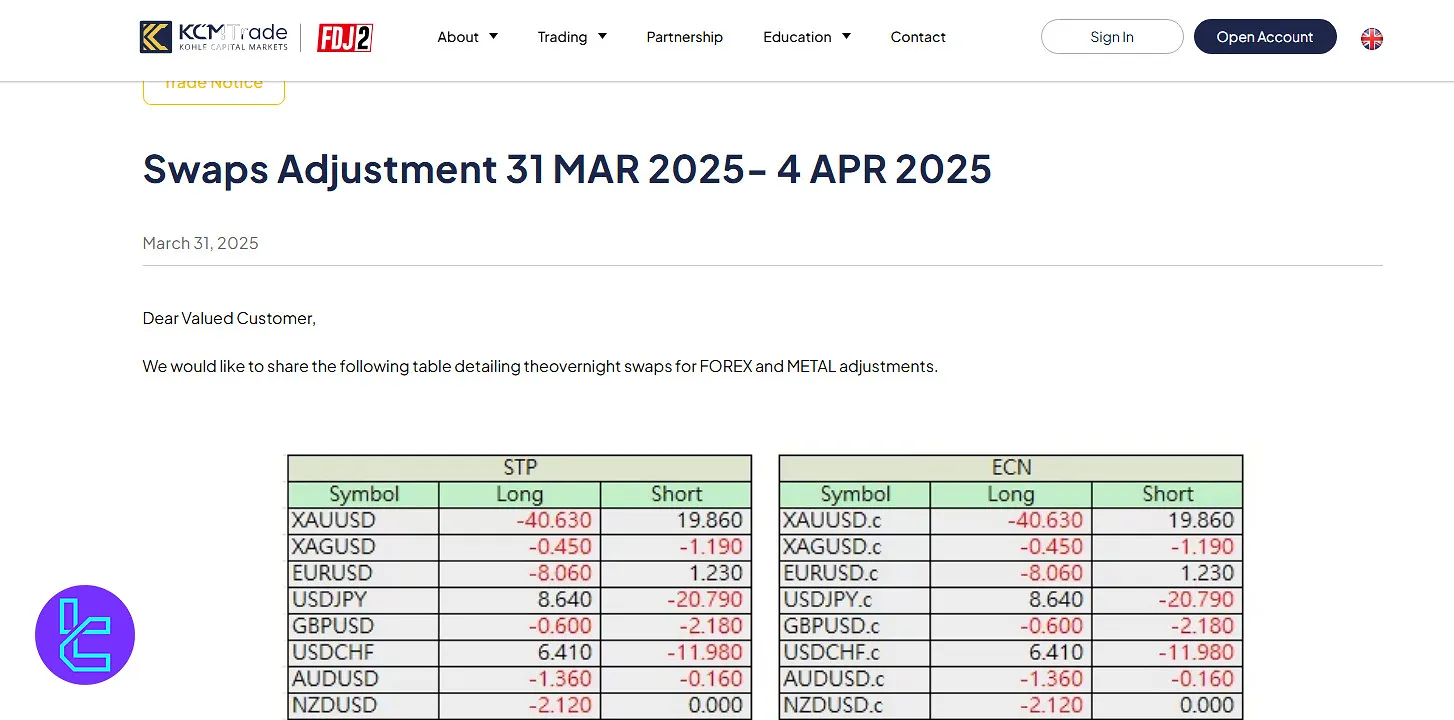

KCM Trade Swap Fees

Swap rates at KCM Trade are applied daily at 00:00 platform time. Traders should regularly review their open trading positions and maintain adequate margin to account for overnight swap costs.

The swap values are provided by liquidity providers (LP) and may occasionally contain discrepancies or omissions.

Any updates are automatically reflected on the trading platform. Forex and Metal swap rates are refreshed weekly according to Beijing time (GMT+8).

For detailed swap information, traders can refer to the Product Specifications section within the MT4 client terminal.

KCM Trade Non-Trading Fees

MT4 trading accounts at KCM Trade may be archived if they remain inactive for an extended period. Inactivity refers to real trading accounts with no executed trades over a prolonged timeframe.

Traders can request account reactivation by contacting KCM Trade’s customer support via email. There is no publicly available information regarding inactivity fees.

Additionally, KCM Trade does not impose charges for deposits or withdrawals, ensuring that account funding and withdrawals remain free of transaction fees.

KCM Trade Broker Funding/Withdrawal Options

The broker offers 6 options for depositing and withdrawing funds:

- Credit/Debit Cards: VISA, MasterCard

- Local Payment Systems: UnionPay, Thai QR Payment

- E-Wallets: American Express, PayPal

KCM Trade Deposit

Available options can vary by region, as the system automatically detects your location based on account details.

Since processing speeds differ across methods, it is not possible to single out one option as the fastest. When choosing a payment method, consider using the same method for both deposits and withdrawals to ensure consistent and efficient transaction times.

Most services advertise “instant” transactions, meaning the process starts immediately without manual intervention from financial specialists.

This does not necessarily imply immediate completion, but ensures that the transaction is initiated within seconds. Deposits and withdrawals can be performed 24/7, with all pending transactions typically finalized within 24 hours.

Here are the details of all deposit methods:

Deposit Method | How It Works | Processing Time |

Electronic Payment Systems (EPS) | Instant initiation of deposits through systems like UnionPay | Instant initiation; completion time may vary |

Bank Cards (Visa, Mastercard, JCB) | Enter card details (number, expiry, CVV, cardholder name) to fund the trading account | Instant initiation; may take up to 24 hours |

USDT (Digital Currency) | Deposit via the CRM Area by scanning the QR code or copying the wallet address from a third-party wallet | Depends on blockchain confirmations |

Mobile Banking Apps | Enter deposit details, generate QR code, scan or save for later completion | Varies by region |

Bank Cashiers (Paper Payment Slips) | Generate a PDF deposit slip after confirming the amount and method, print, and pay at the bank | Depends on bank processing |

Selecting the appropriate payment method is crucial for optimizing transaction efficiency. By choosing options that support quick processing for both deposits and withdrawals, traders can minimize delays and maintain smoother account management.

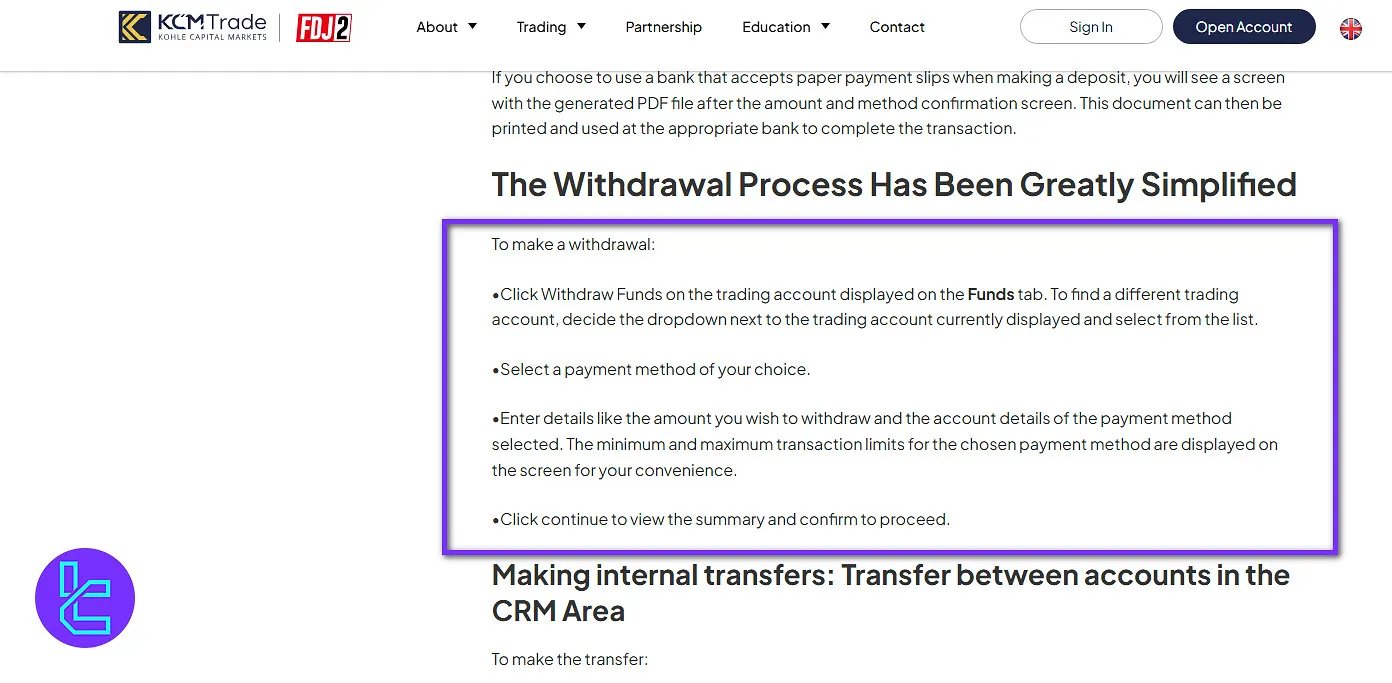

KCM Trade Withdrawal

KCM Trade offers a range of withdrawal options through the CRM Area, using the same payment methods available for deposits.

This ensures consistency and convenience for traders. Withdrawals are designed to be efficient, with no fees applied, and processing times vary depending on the chosen method and the client’s region.

Withdrawal Steps:

- Navigate to the Funds tab in the CRM Area;

- Select Withdraw Funds. To use a different trading account, pick from the dropdown menu;

- Choose a payment method from the available options;

- Enter the withdrawal amount and relevant account details. Minimum and maximum limits for each method are displayed on the screen;

- Review the summary and confirm the transaction to proceed.

Here are the details of each withdrawal method:

Method | How It Works | Processing Time |

Electronic Payment Systems (EPS) | Instant initiation of withdrawals through systems like UnionPay | Instant start; completion may vary |

Bank Cards (Visa, Mastercard, JCB) | Enter card number, expiry date, CVV, and cardholder name | Instant initiation; may take up to 24 hours |

USDT (Digital Currency) | Use CRM Area, Select Funds, Deposit Funds, and then USDT; scan QR code or copy wallet address from third-party wallet | Blockchain confirmation time applies |

Mobile Banking Apps | Enter deposit/withdrawal details, generate QR code, scan or save for later | Varies by region |

Bank Cashiers (Paper Payment Slips) | Generate PDF deposit slip after confirming amount and method, print, and pay at bank | Depends on bank processing |

Copy Trading and Other Available Investment Options

As of the latest information available, KCM Trade does not offer copy trading or different investment features. This means that traders cannot earn passive income via this broker.

KCM Trade does, however, offer a Signal Centre tool that offers trading signals and ideas which can help earning profits in a way.

KCM Trade Financial Products & Symbols

The broker lists a decent range of 200+ tradable instruments across several asset classes:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts | Over 40 currency pairs | 50–70 currency pairs | 1:1000 |

Metals | CFDs on Gold and Silver | 2 | 2–5 instruments | 1:1000 |

Energies & Commodities | CFDs on Coffee, Oil, and other commodities | Around 5 instruments | 10–20 instruments | 1:100 |

Indices | CFDs on global equity indices (America, Europe, Asia) | 10+ indices | 10–20 indices | 1:100 |

Stocks | CFDs on individual international company stocks | Over 1000 stocks | 800–1200 stocks | 1:10 |

Cryptocurrency ETFs | ETFs on Bitcoin and Ethereum | 2 | 5 to 10 ETFs | 1:10 |

Available Bonuses and Promotional Offers

Per our investigations, when writing this article, KCM Trade does not offer any specific bonuses or promotions.

This is not uncommon among brokers regulated by top-tier authorities, but KCM is not one of them since it only has a license from Mauritius’s FSC.

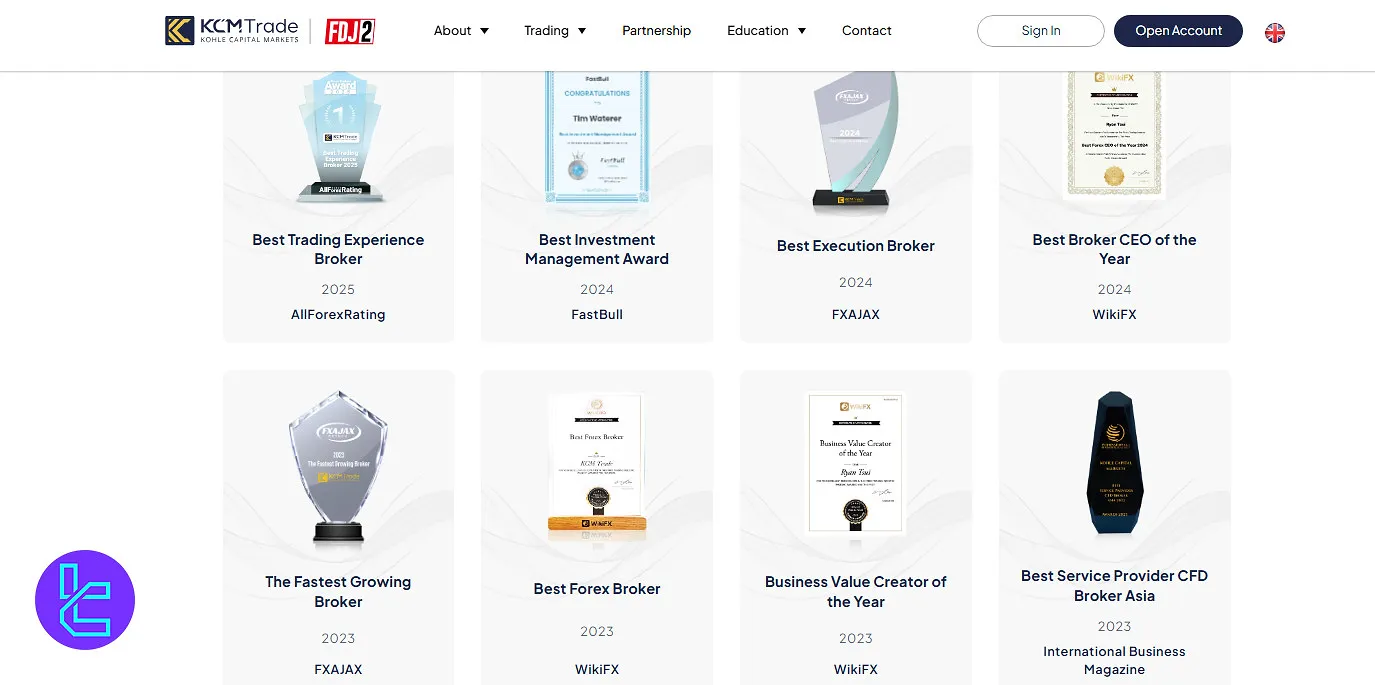

KCM Trade Awards

KCM Trade has been recognized multiple times for its performance and service quality within the financial trading industry. The broker’s achievements highlight its focus on efficient execution, client satisfaction, and innovation in trading services.

Recent Awards Include:

- Best Trading Experience Broker 2025, AllForexRating

- Best Investment Management Award 2024, FastBull

- Best Execution Broker 2024, FXAJAX

- Best Broker CEO of the Year 2024, WikiFX

- Fastest Growing Broker 2023, FXAJAX

- Best Forex Broker 2023, WikiFX

- Business Value Creator of the Year 2023, WikiFX

- Best Service Provider CFD Broker Asia 2023, International Business Magazine

KCM Trade awards reflect the broker’s consistent efforts to deliver high-quality trading conditions, advanced execution capabilities, and reliable investment management for its clients.

Support Channels and Schedule on KCM Trade

KCM Trade provides customer support through 4 channels:

- Email: cs@kcmtrade.com

- Live Chat: Available on the website and KCM LINE

- Phone: +23052970961

- Ticket: Submittable via the site

Based on the provided data, there is no around-the-clock in all-week support team; the schedule is 24/5.

KCM Trade Restricted Countries and Banned Regions

The broker, like many brokers, has restrictions on which countries it can offer services to. KCM Trade clearly states that it does not offer services to residents of:

- United States

- Canada

- Japan

- North Korea

- Iran

- Syria

- Sudan

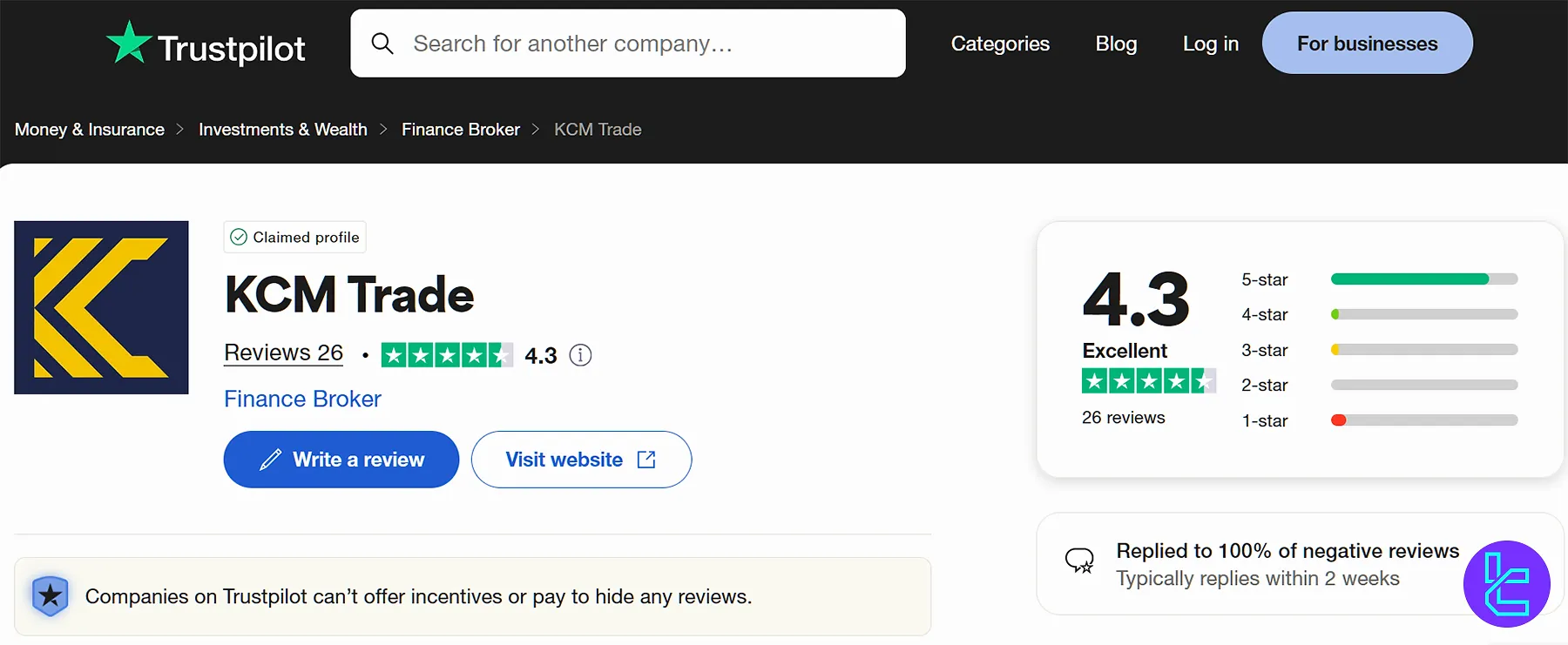

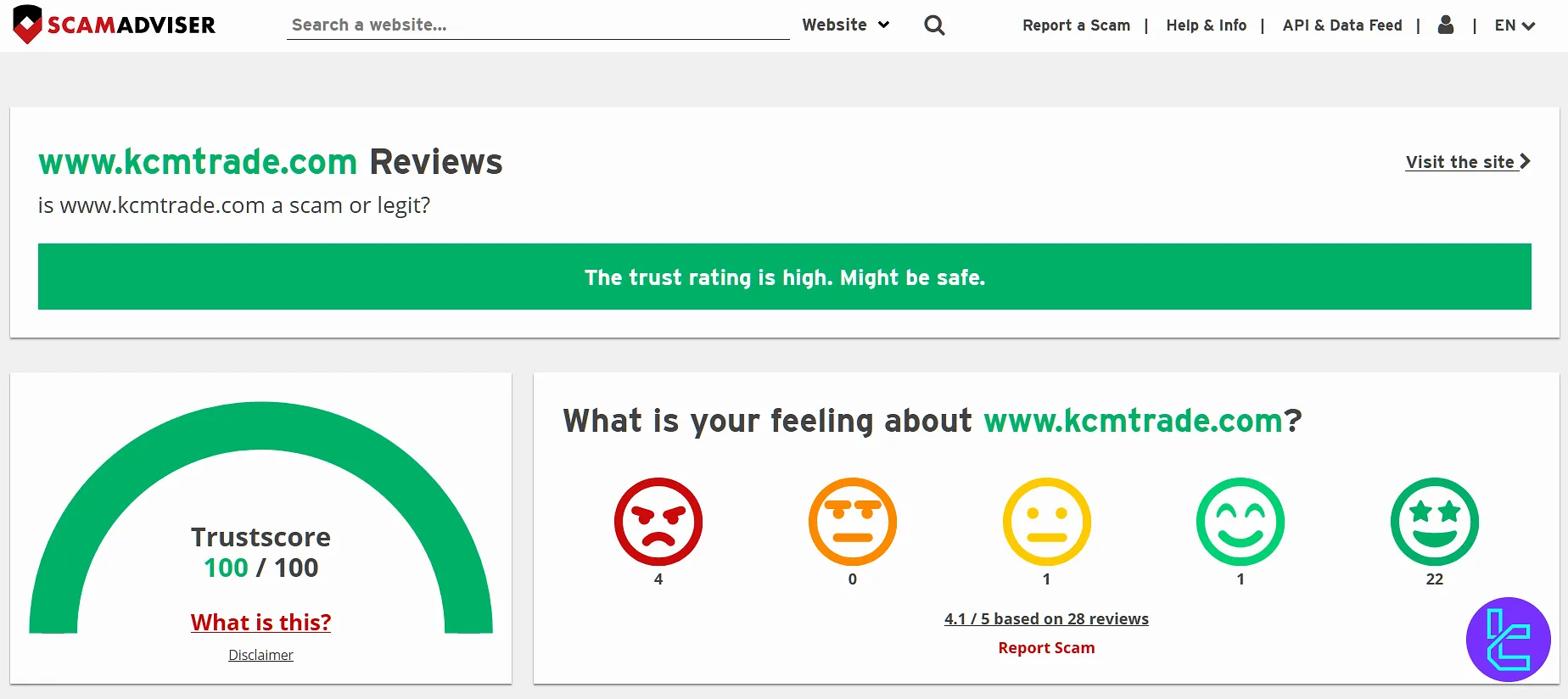

Which Trust Scores Have Been Given to KCM Trade?

KCM’s profiles on ScamAdviser and other reputable websites have received positive and acceptable reviews from various sources:

- Trustpilot: 4.3/5 based on 25+ reviews (80%+ 5-star scores)

- ScamAdviser: 100/100 trust score

On Trustpilot, more than 80% of the ratings are 5-star, and the company has replied to all negative reviews.

Educational Materials

Per our examinations of the website and its content, KCM Trade offers a limited set of educational resources to support traders:

- Help Center: Containing information about the broker and its platforms

- Webinars: Around trading and financial topics

- Market News: Events effective on financial markets covered

KCM Trade Compared to Its Peers

Get a more balanced perspective of the broker by checking out the table of comparison in this section:

Parameter | KCM Trade Broker | LiteForex Broker | Exness Broker | HFM Broker |

Regulation | FSC Mauritius | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | 1.2 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | None | From $0.0 | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $1,000 | $50 | $10 | From $0 |

Maximum Leverage | 1:400 | 1:30 | Unlimited | 1:2000 |

Trading Platforms | MetaTrader 4, MetaTrader 5, Proprietary | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | ECN, STP, Demo | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium |

Islamic Account | N/A | No | Yes | Yes |

Number of Tradable Assets | 200+ | N/A | 200+ | 1,000+ |

| Trade Execution | Market | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

KMC Trade, with a 24/5 support department available via 4 channels [live chat, phone call, email, ticket], offers trading features such as an economic calendar, a Signal Centre, and an AI Mentor.

This financial brokerage has received a 4.3/5 trust score from users on the Trustpilot website.