According to our investigation, Kwakol Markets has ceased operations, and its website has been shut down. You can see the current status of its domain here:

Kwakol Markets offers commission-free trading on 1000+ instruments with leverage options of up to 1:1000. The broker was titled the Most Innovative Broker Africa in 2023.

Kwakol Markets: An Introduction to the Broker and Its Regulatory Status

Kwakol Markets (AU) PTY Ltd is a brokerage company registered in Victoria, Australia, and regulated by the country’s Securities and Investment Commission (ASIC).

Key features of Kwakol Markets:

- Micro lot trading (0.01 lots)

- Minimum deposit requirement of $1

- Leverage options of up to 1:1000

- More than 1000 trading instruments

Kwakol Markets Table of Specifications

The Forex Broker has implemented various measures to ensure client funds’ safety, including segregated accounts and negative balance protection.

Let’s take a quick look at what the company has to offer.

Broker | Kwakol Markets |

Account Types | Standard, ECN, Pro, Cent, No Swap, VIP |

Regulating Authorities | ASIC |

Based Currencies | USD |

Minimum Deposit | $1 |

Deposit Methods | Crypto, Bank Cards, Bank Transfer, Help2Pay, Match2Pay, Ozow, PayPal, Sticpay, UPI |

Withdrawal Methods | Crypto, Bank Cards, Bank Transfer, Help2Pay, Match2Pay, Ozow, PayPal, Sticpay, UPI |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | None |

Trading Platforms & Apps | MT5 |

Markets | Forex, Indices, Commodities, Crypto, Stocks, Synthetics |

Spread | From 0.0 pips |

Commission | Variable based on the account type |

Orders Execution | Market, STP |

Margin Call / Stop Out | N/A |

Trading Features | Mobile Trading, Economic Calendar, Profit/Loss Calculator, Currency Convertor, Micro Lot Trading |

Affiliate Program | Yes |

Bonus & Promotions | IB, Affiliate, Royalty |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat |

Customer Support Hours | 24/7 |

Account Types

The broker provides 6 account types, from ECN to Cent, with different commissions and entry barriers.

Features | Standard | ECN | Pro | Cent | No Swap | VIP |

Min Deposit | $1 | $100 | $1,000 | $1 | $1 | $10,000 |

Spread From (Pips) | 0.8 | 0.0 | 0.0 | 1.0 | 1.6 | 0.0 |

Commission | $0 | $4 | $5 | $0 | $0 | $2 |

Max Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:1000 |

Market Execution From | 0.1 s | 0.1 s | 0.1 s | 0.3 s | 0.3 s | 0.1 s |

Kwakol Markets Broker Pros & Cons

The company has various advantages; for example, it allows for EAs, hedging, and scalping. However, like any other broker, Kwakol Markets has downsides, too.

Pros | Cons |

Low minimum deposit of $1 | Non-responsive live chat feature |

High leverage options of up to 1:1000 | Geo-restrictions |

Wide range of trading instruments (1,000+) | Relatively new broker |

Advanced MT5 platform | No copy trading services |

The company was named The Most Innovative Broker Africa in 2023.

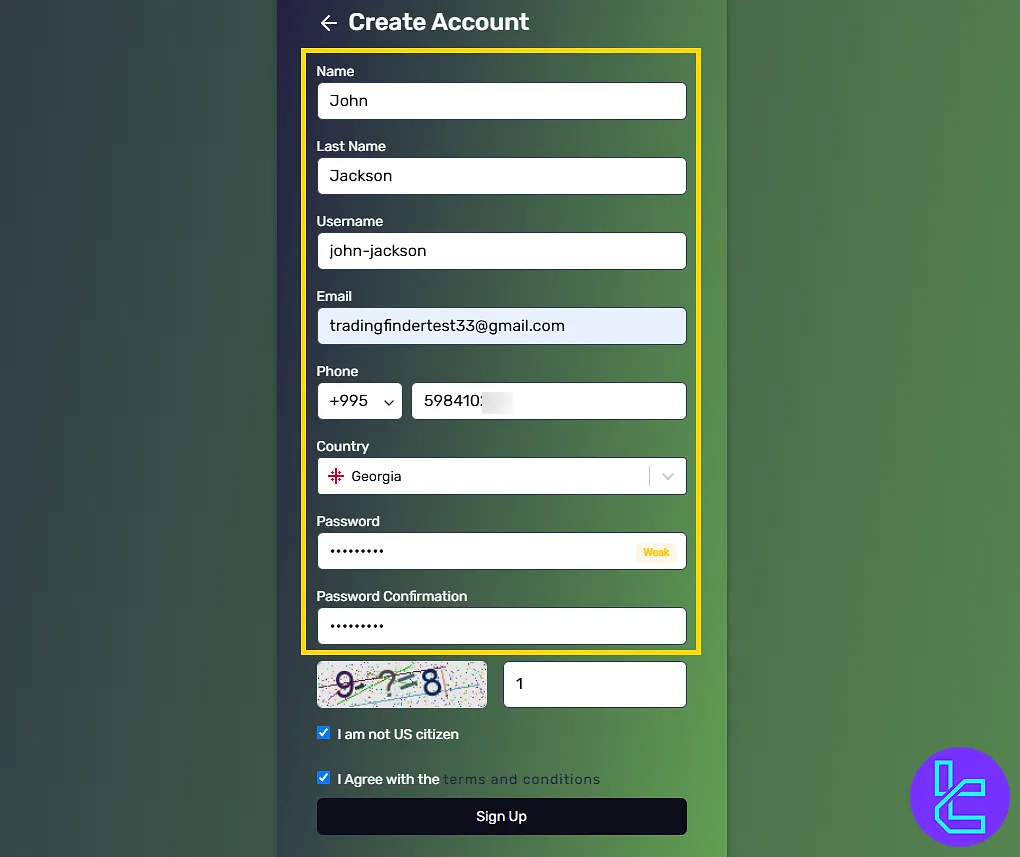

Registration and KYC Process

Kwakol Markets offers a simple, 3-step registration process designed to get traders started quickly with access to their personal dashboard.

The Kwakol Markets registration process is intuitive, mobile-friendly, and typically takes under five minutes.

#1 Begin Account Creation

Go to the Kwakol Markets website and click "Sign Up" or "Open an Account". This will redirect you to the registration form.

#2 Enter Personal Information

Fill out the form with the required details as mentioned below:

- First name

- Last name

- Username

- Mobile number

- Country of residence

Then, create a secure password.

Complete the security question, declare non-U.S. citizenship (if applicable), and agree to the terms.

#3 Activate Your Account

Check your inbox for an email from Kwakol Markets. Click "Activate Account" to confirm your email.

After confirmation, log in using your registered credentials to access the trading dashboard.

#4 Verify Your Identity

Upload valid identification (e.g., passport or national ID) and proof of address (e.g., utility bill or bank statement) for Kwakol Markets Verification and KYC compliance.

Kwakol Markets Apps and Platforms

The broker utilizes the robust MetaTrader 5 platform through partnership with MetaQuotes software company.

The Kwakol MT5 is available across various devices, including:

- MT5 Android

- MT5 iOS

- Desktop

TradingFinder has developed various advanced MT5 indicators that you can access for free.

Trading Fees Explained

The company implements a simple fee structure, mainly consisting of spreads and commissions, which vary based on the account type.

Account Type | Spreads From (Pips) | Commission (per lot) |

Standard | 0.8 | $0 |

ECN | 0.0 | $4 |

Pro | 0.0 | $5 |

Cent | 1.0 | $0 |

No Swap | 1.6 | $0 |

VIP | 0.0 | $2 |

Kwakol Markets Broker Payment Methods

The company has partnered with top-tier payment service providers to offer fast and smooth transactions, including:

Method | Min Deposit | Min Withdrawal |

Bank Card | $10 | $10 |

Bank Transfer | $1 | $10 |

Help2Pay | $10 | $10 |

Match2pay | $10 | $10 |

Ozow | $10 | $10 |

PayPal | $10 | $10 |

Sticpay | $10 | $10 |

UPI | $10 | $10 |

Crypto (USDT, LTC, BTC, and ETH) | $10 | $10 |

Is Copy Trading Available?

The broker doesn’t offer copy trading software for crypto or other markets, and its website doesn't mention social trading, PAMM, or MAM accounts.

The lack of such services is a potential letdown for investors seeking to earn passive income on their assets.

Kwakol Markets Broker Trading Assets

The company offers 1,000+ instruments across 6 asset classes, from Forex to Cryptocurrency. Kwakol Markets also provides:

- Stocks

- Commodities

- Indices

- Synthetics

- Crypto

- Forex

Partnership Program

Offering multiple partnership plans, including IB, affiliate, and loyalty, is one of the bright points in this Kwakol review.

- Introducing Broker (IB): Up to 60% or $15 per lot revenue share

- Affiliate: Up to $25 per referred client and up to $2,000 in commissions

- Loyalty: Premium prizes for partners, including a luxury super car, motorcycle, watch, and a $500 bonus

Customer Support Channels

The broker boasts 24/7 support through 2 main channels, including online chat and email.

However, in our queries, we couldn’t get an answer or even connect to an agent through the live chat feature.

support@kwakolmarke.com | |

Live Chat | Available on the official website |

Address | Mall 169, Adetokunbo Ademola Crescent, Wuse ll, Abuja, Nigeria |

Kwakol Markets Broker Geo-Restrictions

While the company aims to serve a global clientele, it's important to note that due to regulatory requirements, certain geo-restrictions apply. Restricted countries on Kwakol Markets:

- Bahamas

- Botswana

- Burma (Myanmar)

- Cambodia

- Democratic Republic of Congo

- Cuba

- Ethiopia

- Ghana

- Iran

- Iraq

- Japan

- Lebanon

- Libya

- Malta

- North Korea

- Pakistan

- Panama

- Republic of the Congo

- Somalia

- Sri Lanka

- Sudan

- Syria

- Trinidad and Tobago

- Tunisia

- Vietnam

- Yemen

- Zimbabwe

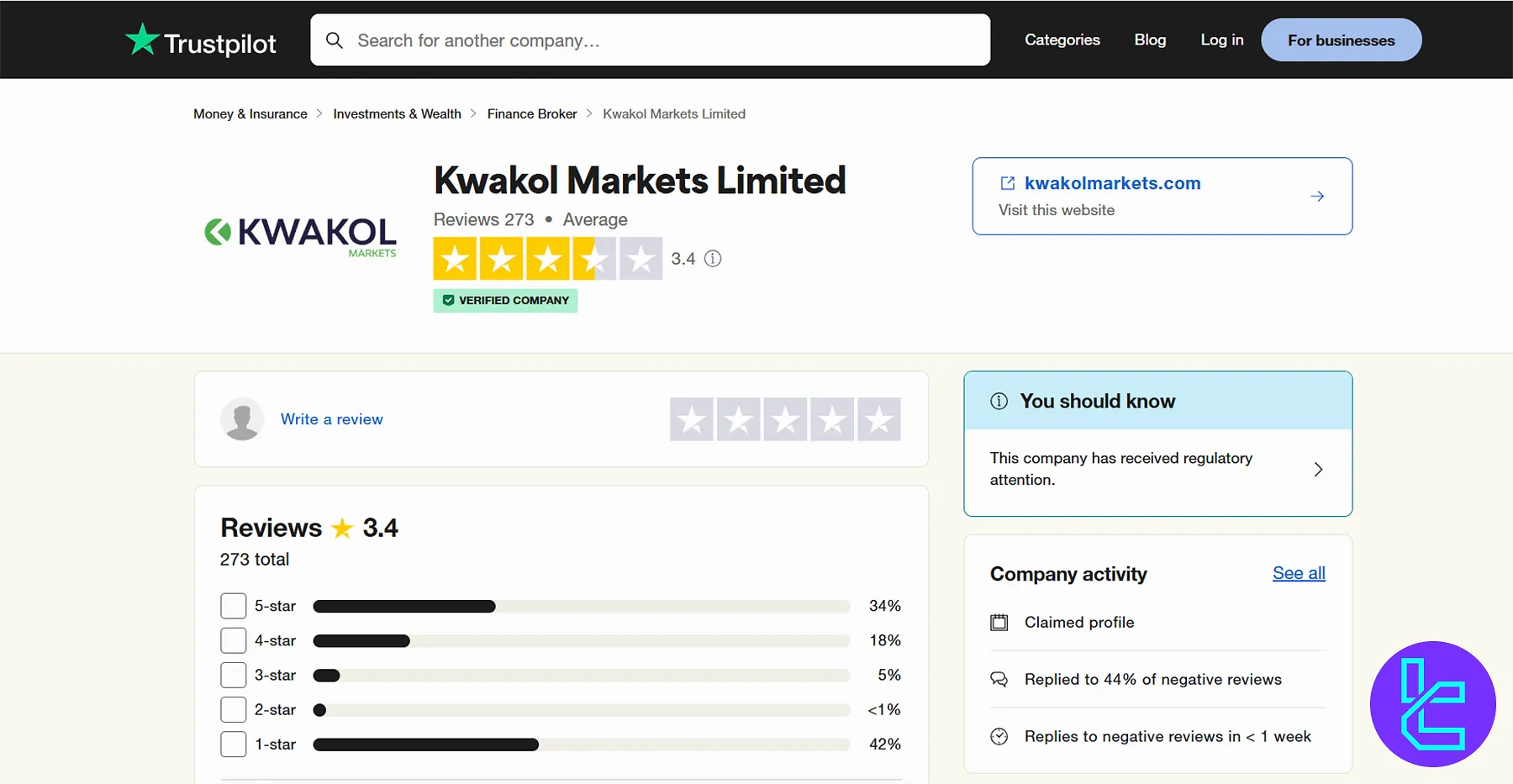

Trust Score and User Ratings

Kwakol Markets reviews on reputable websites like TrustPilot, Forex Peace Army, and Reviews.io don’t paint a good picture.

3.4/5 based on 273 comments | |

Forex Peace Army | Not officially rated (two 1-star reviews) |

Reviews.io | 1.1/5 based on 14 ratings |

While 52% of user comments on The broker’s TrustPilot profile are positive (4-star and 5-star), less than 43% of them are negative (1-star and 2-star).

Education and Academy

The broker provides trading signals on its Telegram channel alongside a vast amount of educational materials, including:

- Trading courses

- Free lessons

- News

- eBooks

Comparison Between Kwakol Markets and Competitors

The table in this section evaluates Kwakol Markets in comparison to top brokers:

Parameter | Kwakol Markets Broker | AMarkets Broker | FXTM Broker | Fusion Markets Broker |

Regulation | ASIC | FSA, FSC, Misa, FinaCom | FSC | ASIC, VFSC |

Minimum Spread | 0.0 Pips | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | Variable based on the account type | From $0.0 | Variable | From $0.0 |

Minimum Deposit | $1 | $100 | $200 | $0 |

Maximum Leverage | 1:1000 | 1:3000 | 1:3000 | 1:500 |

Trading Platforms | MT5 | MetaTrade 4, MetaTrade 5, Mobile App | MT4, MT5, FXTM Trader App | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Account Types | Standard, ECN, Pro, Cent, No Swap, VIP | Standard, ECN, Fixed, Crypto, Demo | Advantage, Stocks Advantage, Advantage Plus | Zero, Classic, Swap-Free |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1,000+ | 550+ | 1000+ | 250+ |

| Trade Execution | Market, STP | Instant, Market | Market, Instant | Market, Instant |

Conclusion and Final Words

Kwakol Markets provides access to CFD products across 6 asset classes, including Forex and Synthetics. The company offers trading services through its 6 account types (e.g., Cent, and ECN) with a minimum deposit requirement of $1.

Mixed user reviews (TrustPilot score of 3.4), restrictions in certain countries like Cambodia and Tunisia, and a non-responsive live chat support are the biggest weaknesses in this Kwakol Markets review.